THE VOICE OF 7-ELEVEN FRANCHISEES 2023 ISSUE 3 Second Quarter 2023 Affiliate & Board Of Directors Meeting Summary Page 44

Partnering To Address A Dwindling Labor Pool & Legislative Issues Overcoming Our Labor Obstacles Importance Of Engaging In Legislative Matters Franchisee Turnover Setting Up SSI/NRI In RIS 1.0 CFA Day 2023 CMN Hospitals And Mental And Behavioral Health Bracing For Mandatory Anti-Smoking Signs Fire Prevention & Emergency Preparedness 2023 Mid-Year Legislative Review

Tackling External Challenges

©2023 7-Eleven, Inc. 7-ELEVEN, 7REWARDS, SLURPEE, SPEEDWAY, Moving S Design, and SPEEDY REWARDS are trademarks of 7-Eleven, Inc. and Speedway LLC. ©2023 The Coca-Cola Company. ©2023 RIOT GAMES, INC. NOW AVAILABLE AT YOUR LOCAL

RICE KRISPIES TREATS ® TREAT YOURSELF.

RICE KRISPIES TREATS ® TREAT YOURSELF.

PROMO OFFER: 2 for $3.00 08/02 thru 09/05

PROMO OFFER: 2 for $3.00 08/02 thru 09/05

Rice Krispies Treats® Mega Size Bar Original – SLIN 303863

Rice Krispies Treats® Mega Size Bar Double Chocolatey Chunk – SLIN 303821

Rice Krispies Treats® Mega Size Bar Original – SLIN 303863

Rice Krispies Treats® Mega Size Bar Double Chocolatey Chunk – SLIN 303821

2023 ISSUE 3 AVANTI 3

®, TM, © 2023

NA Co.

Kellogg

VITA COCO’S BIGGEST & BOLDEST DRINK YET Tropical. Flavorful . Refrescante. UNIT UPC SLIN 248472 WITH PULP UNIT UPC SLIN 248463

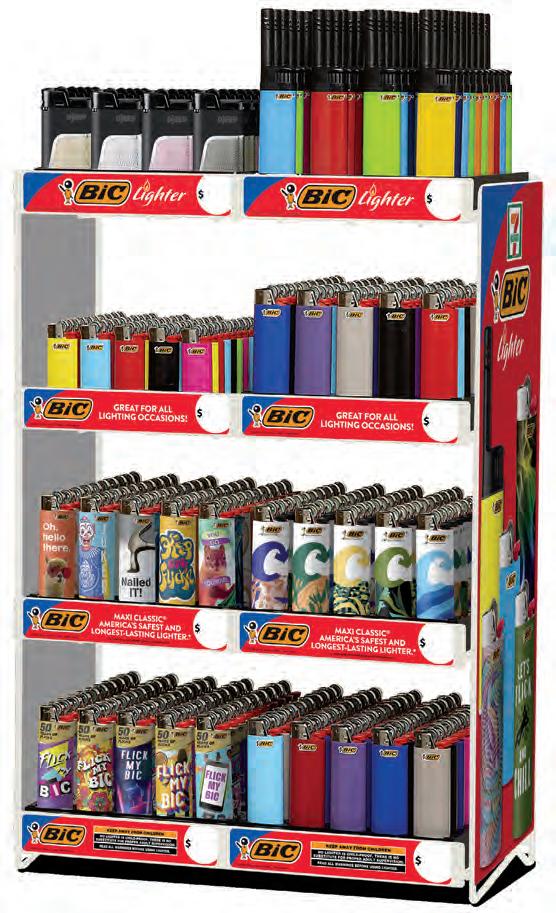

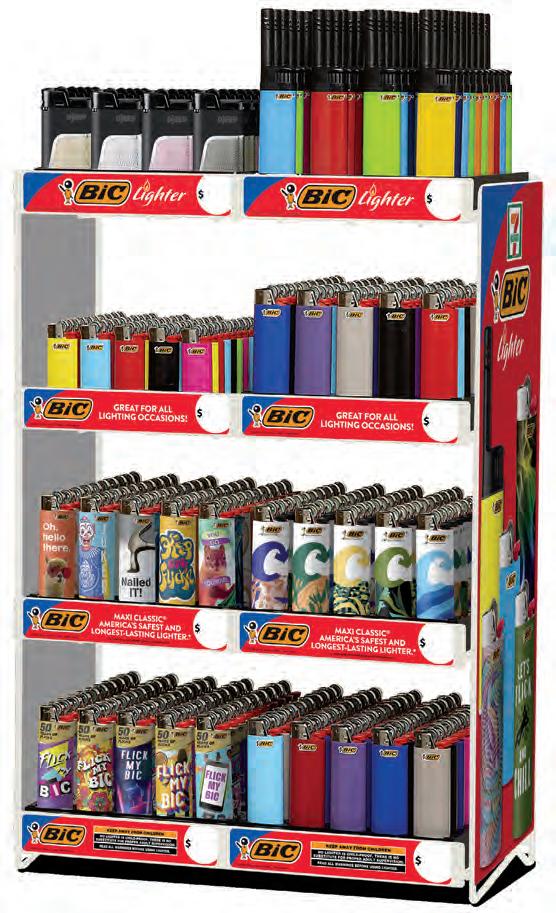

LIGHT UP YOUR SALES Made with 55% recycled metals and 30% carbon offset† Long-lasting quality and long-lasting style Perfect for candles, grills and so much more! A more eco-friendly lighter* THE ULTIMATE LIGHTER © 2023 BIC USA Inc., Shelton CT 06484. †by investing in climate projects *vs. BIC Classic Lighter BIC® Ecolutions 50ct Tray SLIN 323606 DJEEP Bold 24ct Tray SLIN 322487 BIC® EZ Reach 40ct Tray SLIN 324353

Be bold robust &

© 2023 McLane Company, Inc. All rights reserved. Sometimes you need a fresh cup of get it done. At McLane, we partner with retailers of all sizes to make sure they start every day fully stocked and ready to take on their bold business goals. Learn more at mclaneco.com

ESSENTIAL ENERGY *CELSIUS® helps maintain the body’s regular metabolic function. CELSIUS® alone does not produce weight loss in the absence of a healthy diet and moderate exercise. So, whether you walk the dog or work out at the gym, make CELSIUS® part of your daily regimen. **In the energy category, in both units and $, IRI data L4WKS VS YA ending 05/28/23 CELSIUS GREEN APPLE CHERRY OASIS VIBE IN $ SALES YTD SINCE 1/9 LAUNCH (IRI YTD ENDING 6/4/23)** FIRST ORDER DATE $4.7M 6/5/23 L4WS ENDING IN 5/28/23 $ SALES +73% PROJECTED TO DELIVER THE NEXT 52WKS $180M NON•CARBONATED PEACH MANGO GREEN TEA SLIN 241399 SPARKLING PEACH VIBE SLIN 241805 SPARKLING TROPICAL VIBE SLIN 243457 SPARKLING GRAPE RUSH SLIN 243462 SPARKLING FUJI APPLE PEAR SLIN 243474 NON•CARBONATED RASPBERRY AÇAI GREEN TEA SLIN 243475 SPARKLING WATERMELON SLIN 243550 SPARKLING KIWI GUAVA SLIN 243549 SPARKLING ORANGE SLIN 243551 8 89392 02143 1 SPARKLING MANGO PASSIONFRUIT SLIN 246340 8 89392 02141 7 SPARKLING ARTIC VIBE SLIN 240321 SPARKLING STRAWBERRY LEMONADE SLIN 240323 SPARKLING COLA SLIN 248418 8939200086 8 3 SPARKLING GREEN APPLE CHERRY SLIN 245409 8939200090 8 0 SPARKLING WILD BERRY SLIN 247099 SPARKLING OASIS VIBE SLIN 247165 SPARKLING STRAWBERRY GUAVA SLIN 244074 8939200075 8 7 SPARKLING LEMON LIME SLIN 245445 8939200059 8 7 SPARKLING FANTASY VIBE SLIN 245549 SPARKLING ORANGE SLIN 245687 SPARKLING TROPICAL VIBE SLIN 245673 8 89392 01049 7 SPARKLING MANGO PASSIONFRUIT SLIN 245828

By Sukhi Sandhu, NCASEF Chairman

By Sukhi Sandhu, NCASEF Chairman

By Joe Rossi, NCASEF Executive Vice Chair

By Eric Karp, Esq., General Counsel To NCASEF

By Joe Rossi, NCASEF Executive Vice Chair

By Eric Karp, Esq., General Counsel To NCASEF

By Jawad Ursani, Secretary, FOA Of Southern California

By Nisar Siddiqui, Vice President, Midwest FOA

By Jawad Ursani, Secretary, FOA Of Southern California

By Nisar Siddiqui, Vice President, Midwest FOA

By Ali Haider, Michigan FOA President; Board Member Small Business Association of Michigan

By Ali Haider, Michigan FOA President; Board Member Small Business Association of Michigan

By John Harp, CSP, ARM—Risk Engineering Consultant, Mitsui Sumitomo Insurance Group

By Thomas Bunting, Senior Manager External Engagement, Reynolds Marketing Services Company

By John Harp, CSP, ARM—Risk Engineering Consultant, Mitsui Sumitomo Insurance Group

By Thomas Bunting, Senior Manager External Engagement, Reynolds Marketing Services Company

2023 ISSUE 3 AVANTI 9

is published by the National Coalition of Associations of 7-Eleven Franchisees for all independent franchisees, store managers and interested parties. National Coalition offices are located at 3645 Mitchell Road, Suite B, Ceres, CA 95307. For membership information, call 855-444-7711 or e-mail nationaloffice@ncasef.com. The views and opinions expressed in the articles and columns published in AVANTI Magazine are those of the authors and do not necessarily reflect the official policy or position of the National Coalition of Associations of 7-Eleven Franchisees, its officers or its Board of Directors.

AVANTI

Contents

Our Labor Recruitment & Retention Obstacles

THE VOICE OF 7-ELEVEN FRANCHISEES

Overcoming

The Importance Of Engaging In Legislative Matters

Turnover

Franchisee

Up SSI/NRI In RIS 1.0

Setting

CFA Day 2023—Empowering Franchisees In Washington, D.C.

Children’s Miracle Network Hospitals And Mental And Behavioral Health

Children’s Miracle Network Hospitals Bracing For The Impact Of Mandatory Anti-Smoking Signs

By

Fire Prevention & Emergency Preparedness—Are You Ready?

2023 Mid-Year Legislative Review

Member News............10 Bits & Pieces..........49 Legislative Update.......48 SEI News...................61 Vendor Focus....66 FOA Board Meetings.....68 FOA Events.....................70 DEPARTMENTS Central Florida FOA Mixes Compassion With Business EVFOA Hosts Meet & Greet With NCASEF Officers Franchisees & Vendors Tee Up For CMN Hospitals Sun & Sales At The San Diego FOA Trade Show Keystone FOA’s Debut Trade Show Draws Accolades Joe Saraceno FOA Rallies Members To Tackle Challenges Midwest FOA Charity Golf Event NCASEF’s Impact At Children’s National Hospital Generosity At The 2023 FOAC Charity Golf Tournament California FOAs Unite For Trade Show & Charity Golf Camaraderie & Philanthropy Highlight EVFOA Events Great Products & Deals At The SF/MB FOA Trade Show 31 15 19 25 29 42 38 17 54 THE VOICE OF 7-ELEVEN FRANCHISEES Making Tomorrow Better Than Today Labor Remains One Of Our Biggest Issues How Franchisee-Friendly Changes To California Law May Affect You Workers’ Compensation Insurance Questions & Answers The Bridge Is Getting Built Your Donations Go A Long Way 14 THE VOICE OF 7-ELEVEN FRANCHISEES Sharing The Same Goal Working Together Benefits All Stakeholders Brand Unity At Its Finest A Healthy Relationship Benefits Everyone Restrictions On Competition In Your Franchise Agreement Thank You, NCASEF! New Year, New Proposals In The Nicotine Category 2nd Quarter Board Directors Meeting Summary Page 44 39 59 34 THE VOICE OF 7-ELEVEN FRANCHISEES 2023 ISSUE The Spring 2023 Affiliate Member Directory Page 43 7-Eleven’s Winning Trifecta Franchisees, SEI, and Vendors Synergy Fuel Success Unlocking Success Through Collaboration The Benefits Of Joining Your Local 7-Eleven FOA Thoughts While Shaving How Children’s Hospitals Are Improving Access To Healthcare Joining A Small Business Association Will Give Your FOA Added Perks Crime And Assault Prevention: An Update For 2023 33 60 64 65 67 21 35 43

C-Store Industry Booms Post-Pandemic

In 2022, the U.S. convenience store industry experienced a significant surge in sales, rebounding strongly as the country returned to regular routines and shopping habits, reported Convenience Store News. Convenience stores saw record sales of $814 billion, a 23 percent increase compared to the previous year, according to the 2023 Convenience Store News Industry Report. The revitalization of commuting and shopping behaviors contributed heavily to this growth, as did a 30 percent increase in motor fuel sales, which brought the industry’s 2022 fuel revenue to $538.7 billion.

Despite inflationary pressures, in-store sales reached a new high of $275.3 billion, an increase of 6.6 percent from the previous year. This surge was influenced not only by higher product prices, but also by a 1.5-percent increase in store count, primarily driven by single-store operators. Overall industry gross profits saw a boost of 3.3 percent, with in-store

stores saw record sales of $814 billion in 2022, a 23 percent increase compared to the previous year.”

gross profits outpacing those from motor fuel. The foodservice category emerged as a key player, driving in-store gross profits to total $73.35 billion, while fuel profits amounted to $50.61 billion.

7-Eleven Tops CSP’s C-Store List

7-Eleven has once again taken the #1 spot on CSP’s Top 202 Convenience Stores list, which ranks the largest c-store chains in the industry based on store count. With 13,000 locations, 7-Eleven has nearly double the number of stores than Alimentation Couche-Tard (#2 with 7,103 stores) and five times more than Casey’s General Stores, which ranked #3 with 2,422 units. Rounding up the top five are EG America at #4 with 1,750 stores, and Murphy USA at #5 with 1,669.

Mastercard Ordered To Stop Blocking Rivals

The U.S. Federal Trade Commission (FTC) recently finalized a consent order to address charges against Mastercard, alleging that the financial services company employed illegal tactics to compel merchants to route debit card payments exclusively through its own network, reported the Westchester & continued on page 12

The National Coalition Office

The strength of an independent trade association lies in its ability to promote, protect and advance the best interests of its members, something no single member or advisory group can achieve. The independent trade association can create a better understanding between its members and those with whom it deals. National Coalition offices are located in Ceres, California.

3645 Mitchell Road Suite B Ceres, CA 95307 855-444-7711

nationaloffice@ncasef.com

NATIONAL COALITION OF ASSOCIATIONS OF 7-ELEVEN FRANCHISEES

NATIONAL OFFICERS & STAFF

Sukhi Sandhu NATIONAL CHAIRMAN 855-444-7711 • sukhi.sandhu@ncasef.com

Joe Rossi

EXECUTIVE VICE CHAIRMAN 312-501-4337 • joer@ncasef.com

Rajneesh Singh VICE CHAIRMAN 214-208-6116 • rjn_singh@yahoo.com

Teeto Shirajee VICE CHAIRMAN 954-242-8595 • teeto.shirajee@yahoo.com

Nick Bhullar VICE CHAIRMAN 626-255-8555 • bhullar711@yahoo.com

Romy Singh TREASURER 757-506-5926 • romys@ncasef.com

Shawn Howard VENDOR RELATIONS ADMINISTRATOR 855-444-7711 • shawnh@ncasef.com

Eric H. Karp, Esq. GENERAL COUNSEL 617-423-7250 • ekarp@wkwrlaw.com

John Riggio MEETING/TRADE SHOW COORDINATOR 262-394-5518 • johnr@jrplanners.com

John Santiago MANAGING EDITOR 267-994-4144 • avantimag@ncasef.com

April J. Key GRAPHIC DESIGNER lirpayek@gmail.com

The Voice of 7-Eleven Franchisees 2023 ISSUE 3

©2023 National Coalition of Associations of 7-Eleven Franchisees

Avanti Magazine is the registered trademark of The National Coalition of Associations of 7-Eleven Franchisees.

10 AVANTI 2023 ISSUE 3 Member News

“Convenience

SMIRNOFF ICE IS THE LARGEST FMB 6PK BRAND WITH >60% OF THE SEGMENT2

SMIRNOFF ICE IS THE LARGEST FMB 6PK BRAND WITH >60% OF THE SEGMENT2

Eleven scan 126 weeks ending 5/14/23

1. Mintel RTD Alcoholic Beverages, US 2021 1. 7-Eleven Enterprise Scan 4 weeks ending 5/28/23. 2. 7-Eleven scan 126 weeks ending 5/14/23 SLIN: 105485 SLIN: 106451 SLIN: 101352 SLIN: 101482 SLIN: 107642 SLIN: 107762 SLIN: 101804 SLIN: 104755

Smirnoff Ice

12pks +505%!1

continued from page 10

Fairfield Counties Business Journals. As per the FTC’s directive, Mastercard is now obligated to share the necessary customer account information with rival networks to facilitate the processing of debit payments, effectively overturning its purported strategy of barring merchants from utilizing competing networks to handle specific ecommerce debit payments.

The FTC asserted that Mastercard’s practices contravened the 2010 Dodd-Frank Act’s Durbin Amendment and its associated rule, Regulation II, which mandates banks to facilitate at least two unrelated networks for every debit card. Mastercard was accused of breaching this law by implementing policies that ostensibly obstructed merchants from directing ecommerce transactions through alternative payment card networks using Mastercard-affiliated debit cards stored in

e-wallets. Despite the consent order, no financial penalties against Mastercard were disclosed, nor was there a requirement for the company to acknowledge its alleged missteps.

SEI Leaders Among The 2023 Top Women In Convenience

Convenience Store News’ 2023 Top Women in Convenience (TWIC) class, comprising 87 established and emerging female leaders in the convenience store industry, has recognized two women from 7-Eleven, Inc. Among the honorees are Treasa Bowers, Senior Vice President of Human Resources, who was recognized as a Woman of the Year for her exceptional impact on the success and direction of SEI, as well as her positive impact on the convenience store industry as a whole.

The Mentors category, acknowledging women who have made an extraordinary impact on the careers of their colleagues, honors SEI’s Jennifer Goschke, Vice President

continued on next page

Member News

Better informed. Better advised. Better protected. When it comes to your business, you can’t

a

on peace

Discover Aon’s tailored and exclusive programs for 7-Eleven franchisees Contact us today for your insurance needs!

put

price

of mind

“The FTC has finalized a consent order to address charges against Mastercard, alleging that it employed illegal tactics to force merchants to route debit card payments exclusively through its own network.”

& Country Leader, Global Solution Center. The honorees were chosen based on their innovative initiatives, financial and strategic accomplishments, problem-solving acumen, exceptional performance, mentoring efforts, charitable participation, and other notable attributes. All winners will be recognized in the August issue of Convenience Store News and at an awards ceremony at the 2023 NACS Show in Atlanta.

Proposed Bill Would Save Retailers $15 Billion A Year

The Merchants Payments Coalition (MPC) recently welcomed a new estimate showing that passage of the Credit Card Competition Act would save merchants and

continued from previous page

their customers at least $15 billion a year. Payments consulting firm CMSPI last year estimated that the Credit Card Competition Act would save merchants and consumers at least $11 billion a year, based on prepandemic 2019 credit card spending. As the bill was reintroduced in early June, CMSPI revised its estimate based on the latest figures and now says the savings would “conservatively” amount to $15 billion.

The legislation would require banks with at least $100 billion in assets to enable cards they issue to be processed over at least two unaffiliated networks—Visa

or Mastercard plus a competitor like NYCE, Star or Shazam. Banks would decide which networks to enable, but merchants would then choose which to use on individual transactions, meaning networks would have to compete over fees, security and service.

In addition to lowering fees, the bill would improve security. Independent networks have less fraud than Visa and Mastercard’s

“A new CMSPI estimate shows that passage of the Credit Card Competition Act would save merchants and their customers at least $15 billion a year.”

continued on page 49

News

Member

Your only worry should be your business It’s simple. It’s reliable. It’s Aon AON has provided Insurance for 7-Eleven’s stores for 25+ years, offering: Contact us for any insurance questions: 847 629 4711 support.7eleven@aondigital.com www.aondigital.com/en-us/7eleven Guaranteed coverage, servicing and satisfaction. Comprehensive coverage from the nation’s leading carriers. Direct access to our team of licensed advisors. Guaranteed acceptance into the Aon program (no cancellation of coverage due to past claims).

Central Florida FOA Mixes Compassion With Business

The Central Florida FOA had a memorable start to May, as they pulled off a series of successful events, each centered on giving back to the community and fostering better business relationships. It kicked off with the sold-out Charity Golf event on May 3 at the Orange County National Golf Center and Lodge in Winter Garden, Florida. With 149 golfers putting their skills to test on the greens, they didn’t just enjoy a day of golf but also rallied to raise funds for two significant causes. The event saw a tremendous wave of generosity, with a total of $20,000 being raised—$10,000 each for Children’s

Miracle Network Hospitals and Swim Across America.

As the excitement settled from the golf event, the focus shifted to the Central Florida FOA Trade Show on May 4. Taking place at the DoubleTree by Hilton Hotel Orlando at SeaWorld in Orlando, Florida, the event was a vibrant showcase of business potential. The trade show floor was teeming with exhibiting vendors, each one eager to display their latest products and deals. The event served as an excellent platform for vendors and franchisees to connect and explore business-building partnerships.

But the week of activities wasn’t complete without another demonstration of commitment to charity. On May 6, Central Florida FOA President Fari Ishani stepped away from his “business suit” and into his swimsuit to participate in a Swim Across America event in Saint Pete, Florida. Showing impressive resilience, he swam a mile across the ocean, and in doing so, raised an additional $5,000 for the charity. The weeklong activities underscored the Central Florida FOA’s dedication to combining the worlds of business and philanthropy, making an impact in more ways than one.

14 AVANTI 2023 ISSUE 3

Overcoming Our Labor Recruitment & Retention Obstacles

BY SUKHI SANDHU,

In an increasingly competitive labor market, the battle for reliable employees is growing fierce. The stakes are high, with a constant surge in the employment rate and heightened competition for quality labor. This is especially significant for our stores, where maintaining a consistent and reliable workforce is pivotal to our bottom lines.

Every time an employee leaves, it costs us money and disrupts the workflow. The cost of turnover includes training new employees, dealing with potential errors made by inexperienced staff, and the need for double coverage during the hiring process. This not only impacts our finances, but also the overall efficiency of our operations.

To address this issue, we must first understand the employment rates and the difficulties in recruiting quality employees. The market is saturated with competitors who offer attractive benefits and wages that can be challenging for us to match. For example, Buc-ee’s, a popular convenience store chain, offers impressive hourly rates and various other incentives for their workers. To combat the allure of such competitors, we need to make our positions appealing and create a sense of pride in working for our brand.

I can assure you that the NCASEF officers and Board members have not

been sitting idly by—we are taking a proactive approach to tackle our labor recruitment and retention challenges. We have been working with SEI as they develop and introduce the new selfcheckout system, which can alleviate some of the workload on our sales associates. By simplifying operations and reducing the burden on our employees, we hope to improve their overall experience and job satisfaction. These discussions were initiated during a CEO Roundtable, where the need to address labor retention was recognized. Furthermore, we have signed on with Paradox, an artificial intelligence talent recruitment company, to streamline the hiring process. By using their AI assistant, Olivia, we can automate preinterview screenings and simplify the entire recruitment process. This not only saves time, but also ensures a personalized candidate experience. Additionally, Paradox offers electronic onboarding, further simplifying administrative tasks and reducing the time it takes to integrate new employees. This service is available at a reasonable monthly cost for franchisees, and it provides an efficient talent acquisition

solution.

In our efforts to attract and retain employees, we are also exploring healthcare benefits through Dafanie Financial Group. This allows franchisees to provide their employees with comprehensive health insurance plans that may include vision coverage, dental insurance, life insurance, and disability insurance. Offering such benefits will not only help us retain employees, but also enhance their overall well-being.

Another partnership we have established is with T-Mobile. Through this collaboration, franchisees and their employees can access affordable phone services and even receive free smartphones, which will save them money on their monthly bills. Additionally, T-Mobile offers multiple sensor solutions that include temperature monitoring for refrigerators and freezers; energy monitoring; and smart waste bin sensors that would help make our store operations more efficient.

We are also working with Payality, a payroll processing company, to allow stores to fund their employees’ payrolls

2023 ISSUE 3 AVANTI 15

continued on page 17

NCASEF CHAIRMAN

“The market is saturated with competitors who offer attractive benefits and wages that can be challenging for us to match.”

“I can assure you that the NCASEF officers and Board members have not been sitting idly by—we are taking a proactive approach to tackle our labor recruitment and retention challenges.”

“Looking at industry trends, we find that many convenience store retailers are implementing measures to improve employee retention.”

Overcoming Our Labor Recruitment & Retention Obstacles

continued from page 15

that many convenience store retailers are implementing measures to improve employee retention. According to a recent survey, pay raises, flexible scheduling, and employee recognition programs are commonly adopted strategies. Furthermore, offering improved training, additional paid time off, and enticing benefits like health insurance and vacation time have also yielded positive results. These efforts have led to a significant decrease in short-term employee turnover, reflecting the positive effects of improved wages and working conditions.

such as morale, job complexity, and work environment also play significant roles. Therefore, we’re investing in tools and benefits to make the everyday lives of our franchisees and sales associates easier.

directly from their open account, similar to ADP. This is not only a step towards simplifying the payroll process but also ensures the accuracy of payroll expenses reflected in financial reports.

Looking at industry trends, we find

We’re exploring all avenues to recruit quality personnel and provide them with competitive benefits so that they stay longer with us. We understand that employee retention isn’t only about offering competitive pay rates. Factors

EVFOA Hosts Meet & Greet NCASEF Officers

The Eastern Virginia FOA hosted a Meet & Greet event with NCASEF officers on May 10, 2023, at the Waterford Event Center in Springfield, Virginia. The event included NCASEF Chairman Sukhi Sandhu and EVFOA President and NCASEF Treasurer Romy Singh. Attendees seized the opportunity to voice their ongoing concerns, fostering an atmosphere of transparency and shared purpose. The occasion was not all business, however, as attendees were also treated to a delicious lunch, striking a delightful balance between important discussions and casual socializing.

These facts point to our unwavering dedication to overcoming our current labor recruitment and retention obstacles, and creating a vibrant and sustainable work environment in our stores. As we look to the future, we will continue to adapt and innovate in our ongoing mission to foster a productive, beneficial, and fulfilling workplace for our valued employees.

2023 ISSUE 3 AVANTI 17

SANDHU CAN BE REACHED AT

SUKHI

855-444-7711 or sukhi.sandhu@ncasef.com

“We’re exploring all avenues to recruit quality personnel and provide them with competitive benefits so that they stay longer with us.”

Hang Bags are the largest pack type by dollars making up over 41% of sales and driving 32% of all dollar growth in Non-Chocolate

18 AVANTI 2023 ISSUE 3

With 5oz Sour Punch Peg

SLIN 144991 CM 491403 UIN 323987 SLIN 141523 CM 490991 UIN 323967 SLIN 140442 CM 491595 UIN 323977 SLIN 142436 CM 491404 UIN 323887 SLIN 145690 CM 491596 UIN 446887

July 18th

Bags

Source: IRI CUSTOM MARKET ADVANTAGE: Total US IRI Conv L52 WE 3.26.23

The Importance Of Engaging In Legislative Matters

BY

Managing a convenience store is about more than ensuring shelves are stocked and customers are served. It’s also about actively participating in the

accumulate to a significant cost, eating into our margins, so we must advocate for lower fees or at least a reevaluation of the fee structures to better align with the realities of our stores.

The debate around minimum wage increases is multifaceted. While we all want our employees to earn a livable wage, steep increases can place an enormous burden on small businesses like ours. We should campaign for sensible, incremental increases that balance the need for fair wages with the economic realities of operating a small business.

voice, advocating on behalf of all 7-Eleven franchisees.

legislative landscape at both the local and national levels. Our operations can be significantly affected by changes in legislation, such as tobacco flavor bans, credit card swipe fees, minimum wage increases, and modifications to labor laws. Therefore, it is crucial for us as franchisees to voice our concerns and advocate for our interests.

Tobacco sales form a substantial part of our revenue, so the implementation of tobacco flavor bans could impact our financial health. Many customers visit our stores looking for tobacco products, and losing them would also affect secondary sales because these customers usually buy other items along with their packs of cigarettes, like gum, energy drinks, or coffee. So it’s in our interest to oppose such legislation, not by denying the health impacts of tobacco, but by advocating for balanced regulations that consider the potential economic fallout.

Credit card swipe fees are another critical area where we must take a stance. As convenience stores, we often process numerous small transactions daily, each subject to a swipe fee. These fees can

The same applies to labor laws. Legislative changes, such as those related to overtime or sick leave, could significantly increase our operational costs. Again, while we want fair treatment for our employees, it’s essential that these laws consider the viability of small businesses.

We need to be active participants in these bodies, understanding proposed legislation, discussing potential impacts, and agreeing on a collective response. It is through these organizations that we can lobby local and national lawmakers, submit testimonials, and work with industry groups to influence legislative outcomes.

Another powerful tool at our disposal is the relationships we build within our communities. As local business owners, we can engage with local stakeholders, including customers, other businesses, and community leaders. We can leverage these relationships to rally support for our cause, reminding them that the success of our stores contributes to the health of the local economy.

Changes in legislation can significantly impact our operations, profitability, and even our ability to serve our communities. So we need to stand up, voice our concerns, and fight for our interests. By doing so, we can help shape a regulatory environment that considers our needs, ensuring the continued success of our stores and the entire 7-Eleven network.

So, how do we, as franchisees, make our voices heard? A significant part of this battle is fought through our local FOAs and the National Coalition. These organizations serve as our collective

2023 ISSUE 3 AVANTI 19 JOE ROSSI CAN BE REACHED AT 312-501-4337 or joer@ncasef.com

“Our operations can be significantly affected by changes in legislation, such as tobacco flavor bans, credit card swipe fees, minimum wage increases, and modifications to labor laws.”

“Changes in legislation can significantly impact our operations, profitability, and even our ability to serve our communities.”

JOE ROSSI, NCASEF EXECUTIVE VICE CHAIR

“A significant part of this battle is fought through our local FOAs and the National Coalition. These organizations serve as our collective voice, advocating on behalf of all 7-Eleven franchisees.”

NICOTI NE POUCHES WARNING: This product contains nicotine. Nicotine is an addictive chemical. NICOTI NE POUCHES WARNING: This product contains nicotine. Nicotine is an addictive chemical. ZYN.COM/REWARDS ZYN.COM/REWARDS WARNING: This product contains nicotine. Nicotine is an addictive chemical. ZYN.COM/REWARDS ZYN.COM/REWARDS WARNING: This product contains nicotine. Nicotine is an addictive chemical. ZYN.COM/REWARDS ZYN.COM/REWARDS WARNING: This product contains nicotine. Nicotine is an addictive chemical. You know what’s best for your business. Don’t miss the opportunity for more profit and customer satisfaction with ZYN 5-can rolls. STOCK UP STACK UP

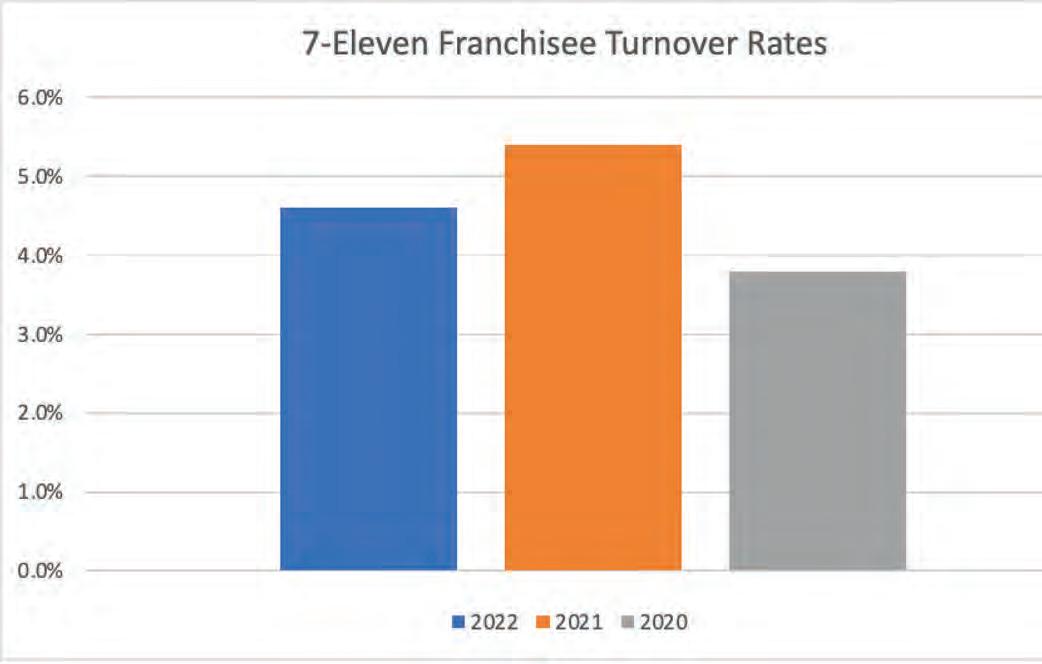

Franchisee Turnover

BY ERIC H. KARP, ESQ., GENERAL COUNSEL TO NCASEF

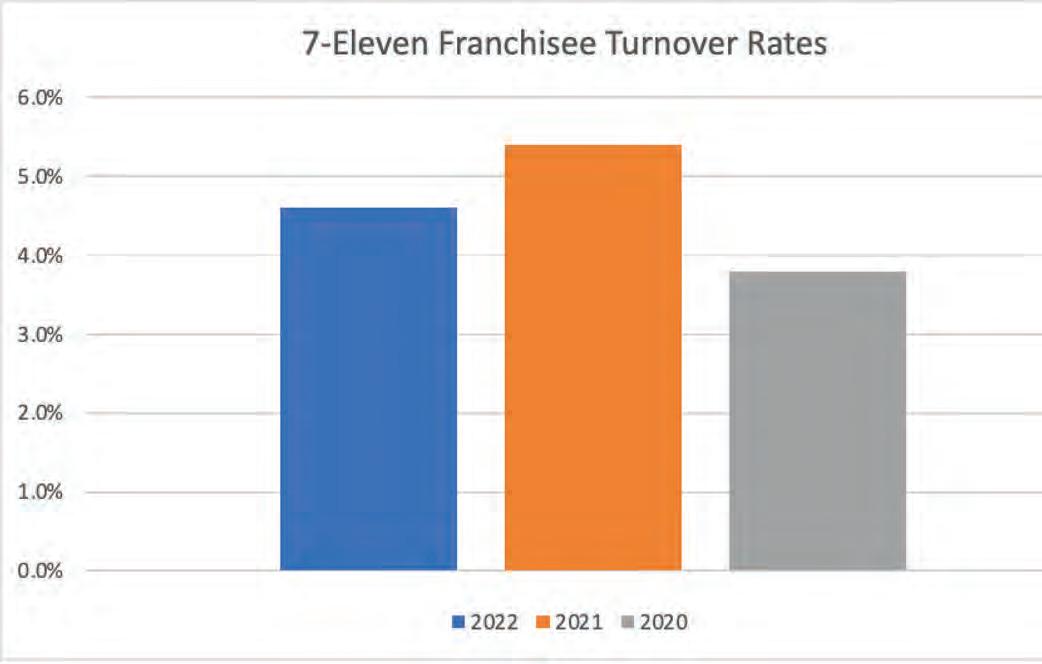

The United States Federal Trade Commission Franchise Rule requires all franchise companies to annually disclose not only the number of franchised locations they have, but a variety of other data regarding increases or decreases in the number of franchised locations and the reasons for those changes.

One of the reasons for this required disclosure is to allow a prospective franchisee to gauge whether the franchisee community is growing or shrinking and in either case, attempt to understand why.

One way of summarizing this data is to estimate the extent to which the franchised locations in the system are turning over, that is to say, changing hands or status, in and if so, how. In my work with the National Coalition and other franchisee associations, I have developed my own definition of turnover, which consists of the following:

(Terminations + Non-renewals + Reacquisitions by the Franchisor + Abandonments of locations) / (total franchised locations at the start of the year + total franchised locations at the end of the year/2).

All of the information necessary to make these calculations can be found in Item 20 of each Franchise Disclosure Document issued by 7-Eleven, Inc. One of our roles as General Counsel is to be a repository of important documents in the system. As such, we maintain a library of Franchise Disclosure Documents going

back nearly 20 years.

Transfers are sales of franchised locations from one franchisee to another franchisee. These transactions can sometimes be the result of distress or bad news, such as the death or incapacity of a franchisee, or good news in the sense that a franchisee has reached the stage where he or she wants to retire or engage in other activities. The number of transfers in this system also includes those situations where 7-Eleven gives a franchisee who has received a termination notice a period of time to attempt to sell the location rather than having it terminated. (Termination notices can often be avoided by curing a default and staying in compliance with the franchise agreement and its operating standards.) Nevertheless, when such a sale is concluded, it is treated as a transfer rather than as a termination. This is one

of the reasons, as you will see, that the number of terminations in the 7-Eleven system has historically been low. On the other hand, over the past five years there have been nearly 1,200 transfers. It is also the reason that we don’t count this statistic in the turnover rates, because we cannot determine how many of the transfers were good news and how many of the transfers were bad news events.

Before we take a look at turnover rate in the 7-Eleven system, let’s define our terms:

• Terminations. This is an event where the franchisor chooses to terminate the franchise agreement and require the franchisee to leave the business without compensation. As stated, these events are typically quite rare in the system. In fact, over the last 10 years there have been only 26 terminations.

• Non-renewals. If the franchisee completes the term of the franchise agreement, it expires by its own terms and the franchisee elects not to renew and sign a new franchise agreement and thus exit the system, this is treated as a non-renewal. This is the rarest of events in the 7-Eleven System, having occurred only twice in the last 17 years.

• Reacquisition. If the franchisor chooses to purchase the location

2023 ISSUE 3 AVANTI 21 continued on page 23

“These transactions can sometimes be the result of distress or bad news, such as the death or incapacity of a franchisee, or good news in the sense that a franchisee has reached the stage where he or she wants to retire or engage in other activities.”

“One way of summarizing this data is to estimate the extent to which the franchised locations in the system are turning over—that is to say, changing hands or status—and if so, how.”

Franchisee Turnover

continued from page 21

the 50 states of the United States. Our analysis started with 2006, when there were 3,525 franchised locations at the start of the year, to 2022 when there were 7,280 such

in the 7-Eleven system, ending with 2022, summarized on the chart below, averaging 4.5 percent. For perspective, the average turnover rate for the three years ended 2012 was 1.9 percent.

from the franchisee, this is treated as a reacquisition. It may result from a simple business decision by 7-Eleven or in some instances a pathway to the resolution of a dispute between franchisee and franchisor. Over the past 10 years more than 1,700 locations have been bought back by 7-Eleven.

• Abandonments. If the franchisee simply walks away from the location, including those instances where the franchisees exercise her or his right to terminate the franchise agreement, this is treated as a catchall for locations where the franchisee is no longer the operator, but it is not the result of a termination, a nonrenewal, or a reacquisition. Over the past 10 years, these abandonments have averaged about 75 locations per year.

• Total Franchised Locations. This data can be found in Chart 1 of item 20 of each FDD which discloses the total number of franchised stores in the system at the start and the end of each of the last three complete calendar years. For the purposes of this disclosure and the calculation of the turnover rate, we count only events and locations within

locations at the end of that year, meaning that over that period, the number of franchised locations had doubled.

We analyzed turnover rates in the 7-Eleven system going back 17 years. That detailed study will be included in the presentation that I will make at this year’s Convention and Trade Show in Las Vegas. But for the purpose of this article, I would like to look at just the turnover rates over the last three years

It occurs to us that many franchisees will not find these numbers surprising given the material number of franchised locations that have changed hands in recent years. The reasons for these events are myriad and complex and we will continue to investigate and bring you our findings.

Our continuing role is to research and report on information that we believe will be of interest to every franchisee in the system. We hope that this information is useful.

2023 ISSUE 3 AVANTI 23 ERIC H. KARP CAN BE REACHED AT 617-423-7250 or ekarp@wkwrlaw.com

“For the purposes of this disclosure and the calculation of the turnover rate, we count only events and locations within the 50 states of the United States.”

“The reasons for these events are myriad and complex and we will continue to investigate and bring you our findings.”

SOUR PATCH KIDS Watermelon SOUR PATCH KIDS Flavor at 7-Eleven Blue Raspberry is #3 5 TRIDENT brand awareness in the gum category 4 SOUR PATCH KIDS AND SWEDISH FISH ARE ARTIFICIALLY FLAVORED Sources: 1. Nielsen xAOC + C NCC $ Consumption, L52 as of 2/16/22 2. NPD Beverage Consumption by Generational Groups 1/26/22 3. Buzzback Mondelez SOUR PATCH KIDS Flavor Screen & TURF, 7/21/21 4. Nielsen Total US xAOC+Conv Dollar sales %Chg Sour Patch Kids and SPK WatermelonL52 weeks ending 1/1/22 5. Nielsen US Total C-Store peg bag by flavor profile YTD 7/30/22 © Mondelēz International group SOUR PATCH KIDS Lemonade Fest 8 oz. SLIN# 142708 SWEDISH FISH Blue Raspberry Lemonade 8 oz. SLIN# 142676 SLIN# 521587 40 Pieces SLIN# 546587 FULLY FUNDED PROMO IN P6 8 OZ. 2/$6 2/ 8 OZ. Lemonade over-indexes with GEN Z vs Total (167 Index) and grew 0.4 pts last year2 LEMONADE FLAVORS PROVIDE THE MOST INCREMENTAL REACH VS THE EXISTING PORTFOLIO1 BLUE RASPBERRY LEMONADE HAS A STRONG APPEAL WITH TEENS & YOUNG ADULTS3 GET THE FLAVOR OF BIG SALES! FULLY FUNDED PROMO IN P5/P6 BOTTLES 2/$850 2/ BOTTLES

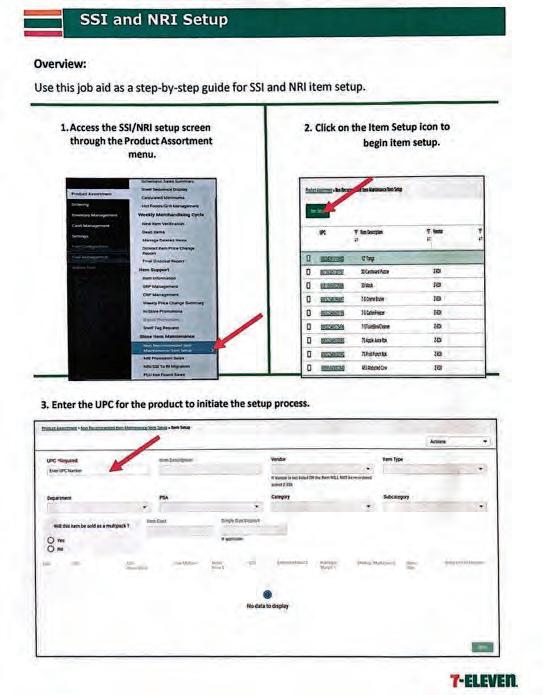

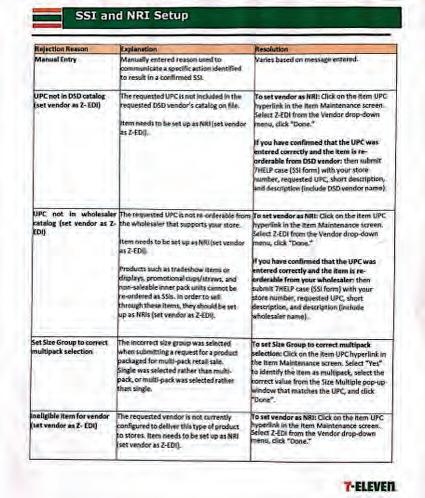

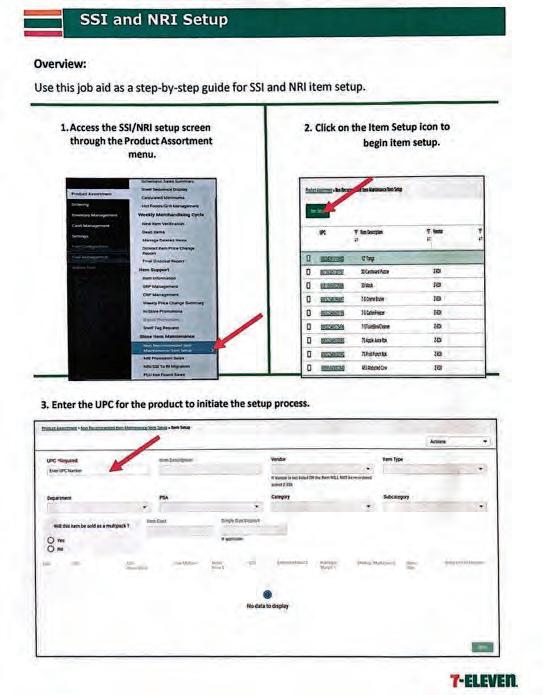

Setting Up SSI/NRI In RIS 1.0

BY JAWAD URSANI, SECRETARY, FOA OF SOUTHERN CALIFORNIA

Retailer Initiative (RI) is 7-Eleven’s strategy for providing customers with what they want through item-by-item management at each store. The product assortment in our industry is enormous, and being able to narrow it down to fit our footprint is what drives sales and profits. 7-Eleven’s merchandising team does a great job bringing products that fit our customers’ needs, but opportunity still exists to fine tune our store’s product mix. We as independent contractors can bring selected PSA category items to offer our customers and increase our sales and profits.

an SSI setup, keep in mind that you plan to reorder from the system and will keep it as your permanent assortment.

Non-Recommended Item (NRI): NRIs are items that are not electronically ordered and come from nonrecommended vendors. Seasonal items or in/out items are typically set up as NRI.

We have been asked by many vendors and franchisees how to properly set up SSI/NRI in our RIS 1.0 system. I will walk you step-by-step through the process.

1. Access the SSI/NRI setup screen through the Product Assortment menu.

2. Click on the Item Setup icon to begin item setup.

3. Enter/scan the UPC for the product to initiate the setup process.

4. Enter item description.

of the SSI is that it will receive full system support as a Recommended Item.

We can do this by adding SSI and NRI items to our store inventory. As you may be aware, we identify all items in our system as Recommended items, SSI items or NRI items. So, what is the difference between the three?

Recommended Item: Items that are sold in 7-Eleven stores across the nation. These items are electronically ordered from the system on a regular basis.

Store Supported Item (SSI): An SSI is a non-recommended item from a recommended vendor. When requesting

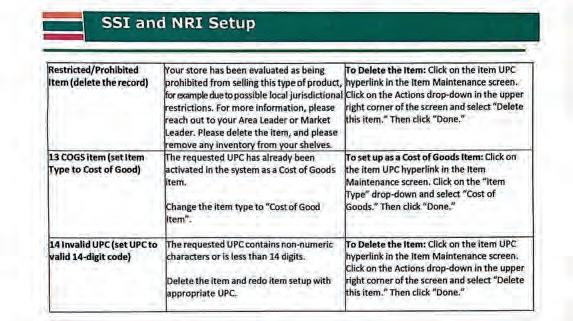

5. Select the vendor. THIS IS A CRITICAL STEP! If the product is provided by a non-recommended vendor, then pick the “Z-EDI” option. This will make the product a Non-Recommended Item (NRI). NOTE: NRIs are not supported by the ordering functionality through the system. If the item is provided by a recommended vendor and you would like to make the item a permanent part of your assortment so you can reorder the product, then select the vendor from the drop-down picklist. This will make the item a Store Supported Item (SSI). A key benefit

6. Select the item type from the dropdown. For sellable goods, use the “retail” option.

7. Select the PSA, Category, and Subcategory for the item (this is important for ordering purposes).

8. Select whether the item is a multipack. Items such as beer and cigarettes are commonly sold in multipacks, all

2023 ISSUE 3 AVANTI 25

“We can do this by adding SSI and NRI items to our store inventory.”

continued on page 27

“7-Eleven’s merchandising team does a great job bringing products that fit our customers’ needs, but opportunity still exists to fine tune our store’s product mix.”

Setting Up SSI/NRI In RIS 1.0

others select “NO.”

9. Enter the item cost. If the item includes a bottle deposit, that also needs to be entered.

10. Enter the retail price and the LDU (lowest deliverable unit) for the item.

11. Select the retail unit of measure from the drop-down menu. This information is typically found on the item label.

12. Once finished, hit the “DONE” button on the right side of the screen to complete the item setup.

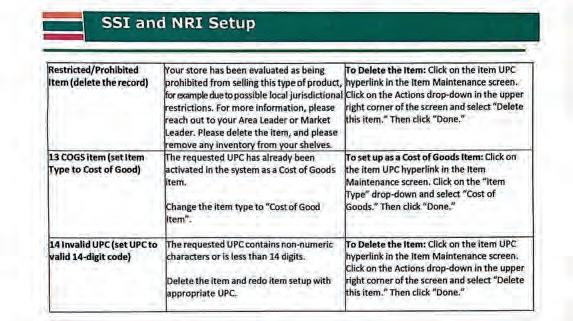

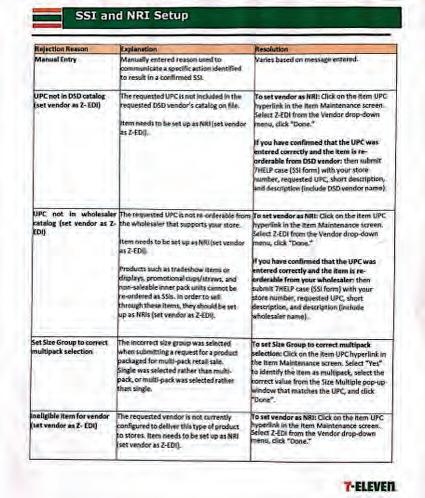

“UPC not in DSD catalog.” “Set Size Group to Correct Multipack Selection,” “Ineligible item for vendor,” and “Future Recommended Item.”

SSI requests pending completion due to exceptions can be identified in the “SSI Approval Date” column. If further

Congratulations, the setup process is complete.

NOTE: If the item was set up as an NRI, no further action is required. The item will ring up at the register and be tracked on the ABC report.

SSIs will need to be approved by SEI/ IT team before it can be ordered through the system. To track the status of the SSI request, click on Product Assortment on the Non-Recommended Item Maintenance/Item Set Up Screen.

If your request is rejected, a reason code will be provided for your reference and investigation. This can be displayed for each item by hovering over the BLUE “information” icon in the “Rejection Reason” column.

NOTE: a rejected item cannot be set up as an SSI unless it is modified and resubmitted. Common reasons for SSI rejections include “invalid UPC,”

action is needed on the item to compete, an “Attention” icon will appear next to the Approval Date. Click on the “Edit” icon and make the appropriate changes.

As mentioned in the beginning of the article, Retailer Initiative (RI) is 7-Eleven’s strategy for providing customers with what they want through item-by-item management at each store. SSI/NRI when properly screened for safety and quality can bring additional sales and profits to each store. At NCASEF, we will continue to bring value to our vendors partners, franchisees and SEI by working together to make 7-Eleven the first choice for all of our customer’s needs.

2023 ISSUE 3 AVANTI 27 JAWAD URSANI CAN BE REACHED AT 310-503-0749 or jsursani@yahoo.com

“SSI/NRI when properly screened for safety and quality can bring additional sales and profits to each store.”

“SSIs will need to be approved by SEI/IT team before it can be ordered through the system.”

CFA Day 2023—Empowering Franchisees In Washington, D.C.

VICE PRESIDENT, MIDWEST FOA

Administration, deliver a presentation on the SBA’s role during the COVID-19 pandemic. His insights provided valuable guidance on accessing resources and support for small businesses during uncertain times.

CFA Day also allowed us to connect with federal legislators who are supportive of small businesses and are aware of the unique challenges faced by franchisees. Rep. Beth Van Duyne (RTX-24) highlighted the crucial role that small businesses, including 7-Eleven, play in providing convenience to communities. During the Congressional Reception, we had the opportunity to hear from Rep. Josh Gottheimer (D-NJ5), who discussed his position on small business issues and emphasized the importance of addressing the concerns of franchisees.

One of the highlights of CFA Day was the opportunity to advocate for the issues that small businesses, including franchisees, currently face. Our team made visits to the offices of three Congress members to raise awareness and discuss these issues: Rep. Pete Stauber (R-MN08), Rep. John James (R-MI-10), and

Rep. Hillary Scholten (D-MI-03). We focused on three key issues:

• L abor Shortage and Guest Worker Program: As small businesses recover from the impact of the pandemic in an inflationary economy, we emphasized the need for a seasonal temporary worker program to fully staff our businesses and facilitate growth.

• Asylum Seeker Work Authorization: We proposed a more orderly asylum application process that would provide businesses with muchneeded labor while ensuring a fair and regulated system.

• Credit Card Swipe Fees: The dominance of Visa and Mastercard in the credit card network market has imposed crushing fees on small businesses. We advocated for increased competition in this field to help reduce swipe fees, ultimately resulting in lower costs for our customers.

CFA Day not only provided valuable insights into legislative issues specific to franchising, but also facilitated networking opportunities with franchisees from over 20 different brands. This collaborative environment allowed us to share experiences, exchange ideas, and strengthen our collective voice as franchisees.

2023 ISSUE 3 AVANTI 29

NISAR SIDDIQUI CAN BE REACHED AT 248-703-0947 or nisarsid1@yahoo.com

“CFA Day provided a platform for engaging dialogue with esteemed guest speakers who shed light on crucial topics relevant to franchisee businesses.”

Children’s Miracle Network Hospitals And Mental And Behavioral Health

BY CHILDREN’S MIRACLE NETWORK HOSPITALS

At Children’s Miracle Network Hospitals, we believe that kids need help now. We are unrelenting in our desire to ensure every child has a healthy future, and that includes mental and behavioral health.

hospitals, whether standalone or part of a broader health system, offer some mental health service, resource, and/or community benefit.

• 90 percent of U.S.-based member hospitals offer clinical services in mental health, behavioral health, psychiatry, or psychology.

One-hundred percent of U.S.-based member hospitals offer some mental health service, resource, or community benefit. These vary from clinical care and telehealth to school-based care and community education. While the pandemic certainly accelerated and magnified an existing crisis, the demand for youth mental health services was happening beforehand—and experts predict the need for services to grow.

Kids can’t wait. Without additional support, member children’s hospitals wouldn’t be able to meet critical needs like mental and behavioral health services for patients and families in their communities. We play a critical role in that process with unrestricted funding. Changing kids’ health means not only providing access to best-inclass health services and treatments, but also addressing some of the social determinants of health that cause and exacerbate the health challenges kids and families face. When you support Children’s Miracle Network Hospitals, you do both—creating a healthier, happier future for families and communities for years to come.

• 100 percent of U.S.-based member

• 90 percent of U.S.-based member hospitals are also integrating mental health services into primary and/or emergency care.

• 72 percent of U.S.-based member hospitals offer mental health telehealth services, many of which were implemented in response to the COVID-19 pandemic to continue services to patients and remain in place as a service today.

Member hospitals address the most challenging health issues of today and prevent and prepare for those to come.

Children’s Wisconsin’s mental and behavioral health services are for kids from 6 months to 18 years old. The pediatric mental and behavioral health team is made up of experts in child and adolescent psychiatry, counseling, pediatric psychology, neuropsychology, and psychotherapy. The team can diagnose and treat a wide range of mental health, behavior and psychiatric problems.

Golisano Children’s Hospital at the University of Rochester Medical Center’s

most pressing need is to create an urgent care center, within the next year on the URMC campus, to provide emergency assessments and interventions, community-wide coordination of youth family crisis services, and the development of innovative best practices for crisis intervention. This center will provide critical services for all youth and schools in the community as the hospital’s crisis management strategic plan for the region unfolds.

Member hospitals pioneer research and treatments—such as those related to managing mental and emotional health issues and physical ones—that transform how we care for children.

Kids need help now. Incidence rates for mental and behavioral health disorders were already rising before the onset of the COVID-19 pandemic with shortages in providers to meet this growing need. The pandemic magnified and multiplied the incidence rates and needs for child and adolescent mental health services. Experts predict the need for mental health treatment and services only to continue to grow post-pandemic.

Change Kids’ Health. Change the Future.

Children’s Miracle Network Hospitals raises unrestricted funds for 170 children’s hospitals across the U.S. and Canada to help fulfill their most urgent needs. We make all of this possible at the local level. When someone donates

continued on page 33

“Changing kids’ health means not only providing access to best-in-class health services and treatments, but also addressing some of the social determinants of health that cause and exacerbate the health challenges kids and families face.”

2023 ISSUE 3 AVANTI 31

“One-hundred percent of U.S.-based member hospitals offer some mental health service, resource, or community benefit.”

VIBE SIZED

Big profits come in small packages.

ORIGINAL DIAMONDS

GREEN GRAPE

GREEN GRAPE

Children’s Miracle Network Hospitals And Mental And Behavioral Health

continued from page 31

through a business or fundraiser in their community, the donation goes directly to their local member hospital.

But we have our sights set even higher, because we know that when we improve treatments and facilities, we can address the most challenging health issues of today while preventing and preparing for those to come tomorrow. When we fund pioneering research at children’s hospitals, we transform how we care for children not just in their youth, but throughout their lives.

Use the following steps to get more involved with Children’s Miracle Network Hospitals and your local member hospital:

1. Contact your local hospital representative. Need help getting connected? Email Kate (KBurgess@ CMNHospitals.Org) with your FOA name.

2. Invite your local hospital representative to present at an upcoming Board or Member meeting.

3. Schedule a hospital tour with your local hospital representative. Please note, this is subject to COVID-19, RSV, and flu-season protocols.

4. Host a charitable event for Children’s Miracle Network Hospitals. Invite your local hospital and allow them space to showcase the power of your partnership. Local member hospitals may be able to support your event through the following:

• Hosting a pre-event presentation: During pre-event meetings, local hospital representatives can share information about your local member hospital and the impact your charitable event will have on patients and families. This is a great way to build more familiarity around our partnership before your charitable event.

• Inviting a patient family to the event: Your local hospital representative can invite a patient ambassador to share their story and the impact of your local member hospital.

Franchisees & Vendors Tee Up For CMN Hospitals

It was a bright and warm day when NCASEF Board members, franchisees, and vendor partners took to the links at the Grand Reserve Golf Club in Rio Grande, Puerto Rico on May 15—prior to the Affiliate and Board of Directors meetings—to raise funds for Children’s Miracle Network Hospitals. The golf event raised $5,711 for NCASEF’s charity of choice, and all of the proceeds will benefit Valley Children’s Hospital in Madera, California. A special thanks to our golf sponsors: Fairlife Core Power, Hostess, and Celsius.

• Hosting a CMN Hospitals informational table: Have a table near check-in where participants can learn more about Children’s Miracle Network Hospitals and the impact your local member hospital makes in your community. Your local hospital representative can staff this table and bring informational materials.

• Welcoming remarks or words of gratitude: Your local hospital representative can share a few brief remarks to thank vendors and franchisees for supporting Children’s Miracle Network Hospitals. These remarks can be made at any point during the event, but we see great success at the start of your event or during the check presentation.

We are grateful for the many ways FOAs support and interact with their local member hospitals. For additional information or ideas, please contact Kate (KBurgess@CMNHospitals.Org).

2023 ISSUE 3 AVANTI 33

Sun & Sales At The San Diego FOA Trade Show

The San Diego FOA Trade Show was a summer celebration bringing together franchisees and vendors for a festive event. Held June 22 at the Four Points by Sheraton’s Skies Lounge & Patio in San Diego, the theme was “Hello Summer,” marking the summer kickoff. Attendees enjoyed exclusive vendor deals and exciting raffle prizes, and the atmosphere was flavored with authentic Mexican cuisine from Sabor Mexican Grill & Taqueria’s taco cart.

Numerous well-known vendors participated, including Black Rifle Coffee, So. Cal Shades, Heineken USA, Bubbies Mochi, Splash Bev Group, and many others spanning from beverage companies like Pepsi, Monster Energy, Coca-Cola, and Happy Dad Hard Seltzer to services such as Barbot Insurance and the San Diego Sheriff Department. The event served as an excellent platform for franchisees to network, explore new products and services, and enjoy the summer spirit.

34 AVANTI 2023 ISSUE 3

Bracing For The Impact Of Mandatory Anti-Smoking Signs

BY ALI HAIDER, MICHIGAN FOA PRESIDENT; BOARD MEMBER SMALL BUSINESS ASSOCIATION OF MICHIGAN

As a 7-Eleven franchisee, I am bracing myself for the impact of a recent order issued by the U.S. Justice Department. This new directive requires retail locations nationwide that have merchandising agreements with certain cigarette companies—a group that includes 7-Eleven stores—to display signs warning of the health effects of smoking. The warnings are striking and meant to capture the attention of our customers, and feature statements such as “Smoking cigarettes causes numerous diseases and on average 1,200 American deaths every day” and “The nicotine in cigarettes is highly addictive, and cigarettes have been designed to create and sustain addiction.”

This order went into effect on July 1st, and between then and September 30, 2023 a third-party company called Footprint is visiting our stores to place the required signage on or near the back bar, and on an exterior facing window. We’ve been told by SEI that the anti-smoking signs must remain in place until June 30, 2025. We’ve also been informed by our franchisor that between October 1, 2023 and June 30, 2025 our stores will be periodically visited by an independent third-party auditor who will check to make sure the signs are up until the end date.

There’s a sense of trepidation among us, the affected retailers, because the

responsibility falls upon us to ensure these signs remain displayed at all times. Should a sign go missing—be it due to a disgruntled customer, an accident, or any other reason—we must order a replacement promptly. However, during the time it takes for a new sign to arrive and be installed, we remain at risk of incurring penalties should an audit occur. Even more concerning, a series of these incidents could lead to the cancellation of our tobacco licenses. It’s disconcerting to think that an angry customer annoyed by the anti-smoking signs could remove them and put us in jeopardy.

One of my other concerns is how our smoking customers will perceive these signs. The warnings may come across as aggressive, potentially driving customers away. They might view this as a move against smokers by our store, not understanding that it’s a federal mandate. Unfortunately, not every customer will be aware that the signs are mandated by the Department of Justice and are not a policy of our individual store or 7-Eleven, Inc.

Even more frustrating is that not all retail locations are required to display these signs, only about 200,000 that have merchandising agreements with Altria, R.J. Reynolds or ITG brands. If a customer decides they dislike the warning signs in our 7-Eleven, they might choose to frequent another store across the street that isn’t required to post the same signs. One of my locations in Perry, Michigan, for example, is the only store required to display these warnings. If my smoking customers decide to boycott my store due

to the signs, I stand to lose significant revenue. The potential loss of customers due to this misunderstanding could hit us hard.

To make matters more complex, cigarettes are one of our “basket makers.” When people come in to buy cigarettes, they often pick up other items as well: a soda, a lighter, some food, or even a pack of gum. The loss of a cigarette sale doesn’t just mean the loss of that singular sale; it means the loss of the entire basket of items a customer might have otherwise purchased.

Despite these daunting challenges, there doesn’t seem to be any plan among the affected retailers to confront the Department of Justice about making exceptions when signs are removed or destroyed. Since July 1st, we are expected to have these signs on display at all times. It’s a hard truth we have to face.

This measure, while aiming to discourage smoking and inform the public about its dangers, inadvertently places a heavy burden on us, the retailers. Not only could it affect our sales, but it also threatens our peace of mind. Imagine the thought of someone throwing a drink at the signs or even hurling a rock through our glass door in protest. For now, all we can do is maintain our signs, prepare for potential audits, and watch the customer reactions closely.

2023 ISSUE 3 AVANTI 35

ALI HAIDER CAN BE REACHED AT 517-219-5288 or aliokemos@gmail.com

“There’s a sense of trepidation among us, the affected retailers, because the responsibility falls upon us to ensure these signs remain displayed at all times.”

WIN WITH THE TOTAL CONSTELLATION BRANDS SINGLES OFFERINGS 101107 Corona Extra 24oz Bottle 100002 Corona Extra 24oz CN 104874 Corona Premier 24oz CN 102291 Pacifico 24oz CN 102637 Pacifico 32oz Bottle 102559 Corona Familiar 24oz CN 102559 Corona Familiar 32oz Bottle 102444 Victoria24oz CN (available Sept 2022) 000000 Victoria 32oz Bottle 105661 Modelo Oro 24oz CN 105709 Modelo Chelada Sandia Picante 24oz CN 105596 Modelo Chelada Pina Picante 24oz CN 104108 Modelo Especial Chelada 24oz CN 105851 Modelo Chelada Mango Chile 24oz CN 107457 Modelo Chelada Naranja Picosa 24oz CN 101040 Modelo Chelada Limon & Sal 24oz CN SLIN Drink responsibly. . Beer and flavored beer . Imported by Crown Imports, Chicago, IL. Corona Premier Per 12 fl. oz. serving average analysis: Calories: 90, Carbohydrates: 2.6 grams, Protein: 0.7 grams, Fat: 0.0 grams Modelo Oro Per 12 fl. oz. serving average analysis: Calories: 90, Carbohydrates: 3.0 grams, Protein: 0.6 grams, Fat: 0.0 grams

Relax responsibly ® . Corona Extra® Beer. Imported by Crown Imports, Chicago, IL Drink responsibly. Modelo Especial® Beer. Imported by Crown Imports, Chicago, IL. 101446 CORONA EXTRA 18PK 12Z BT 105414 MODELO ESPECIAL 24PK 12Z BT 100643 CORONITA 24PK 7Z 104743 MODELITO ESPECIAL 24PK 7Z BTL SLIN *Source: Week ending 4/30/23, C-Shopper for 7-E/Speedway and scan data for PDI.

Keystone FOA’s Debut Trade Show Draws Accolades

Philadelphia, Pennsylvania became the center of 7-Eleven business activity on May 31, 2023, as Rivers Casino Philadelphia hosted the inaugural Keystone FOA Trade Show. The event turned out to be a huge success, with 55 exhibiting vendors participating and 280 franchisee attendees, who keenly engaged with the exhibitors. The trade show managed to attract highprofile figures within the 7-Eleven network, including NCASEF Chairman Sukhi Sandhu, NCASEF Treasurer Romy Singh, and presidents and vice presidents from the Chicagoland (Jaimin Pandya and Hitesh Doshi), Metro New Jersey (Hari Patel and Mital Patel), and Michigan (Ali Haider) FOAs.

The SEI Franchising team (Brian Demcher, Charles Canella, and John Nolan) and Accounting Department (Clint Gay and team) also made their presence felt, as did representatives from SEI’s IHM (Justin Syzmaniak and Michelle McKee).

SEI Market Manager Kate Nawara was also in attendance, and took the opportunity to congratulate the Keystone FOA team’s Executive team—including Sukhie Thind, Dev Patel, Balwinder Singh, and Chirag Banker—on their triumphant debut. The occasion also caught the attention of state representatives Danilo Burgos and Pat

Gallagher,

Besides the business engagements and networking, the event also celebrated the contributions of key individuals in the franchisee community. Special awards were given out, recognizing the extraordinary leadership of Sukhi Sandu and Romy Singh. The Visionary Support Award was given to Jaimin Pandya, Hitesh Doshi, Hari Patel, and Ali Haider.

However, the event wasn’t all business. Attendees enjoyed a lavish spread of lunch, appetizers, and cocktails, and the excitement was kept high with a raffle, offering cash prizes totaling $8,000.

Demonstrating its commitment to social causes, the Keystone FOA made donations to the Children’s Miracle Network Hospital and the Philadelphia Police Department. After the trade show, the feedback was overwhelmingly positive, with attendees and vendors describing it as a grand event and expressing satisfaction with the return on their investment. This successful debut encapsulated the mission statement of Keystone FOA President Sukhie Thind: to drive profitability, foster growth, and ensure the franchisee’s voice is not only heard but valued.

38 AVANTI 2023 ISSUE 3

who attended the event, lauding Sukhie Thind for his vision and leadership.

FIRE PREVENTION & EMERGENCY PREPAREDNESS—ARE YOU READY?

BY JOHN HARP, CSP, ARM—RISK ENGINEERING CONSULTANT MITSUI SUMITOMO INSURANCE GROUP

Many events can disrupt your business and interrupt cash flow, damage property, or injure people. Whether it’s an employee victimized by an assault, a customer slip and fall, a theft, a fire, or a natural disaster, there can be costly consequences without proper planning. Fire or natural disasters can be one of the costliest in maintaining business continuity, and in many cases business survival.

Fortunately, with a good risk management strategy and property conservation, you can minimize the impact of an event or reduce the downtime. As an essential business, especially during natural disasters, it’s important to continue providing drink, food, and fuel to your customers.

Two of the essential questions to ask are; what could interrupt the continuity of store operations and how could someone be injured? We can separate these into three areas:

1. Fire—This could be a fire starting inside the store, a car at the fuel pump, another store in your building, an intentional act, or from wildfires.

2. Power—Power loss could be shortterm from a car hitting a power pole or longer if it’s weather-related.

3. Weather—This is the most common source of business interruption. Whether it’s a hurricane, tornado, flooding, heavy snow, or hail, the damage could close your store.

The answer to reducing the chances of disruption, damage, downtime, and

injuries is risk assessment, prevention, and planning. These are the most important elements in keeping your employees and customers safe, and your store up and running.

FIRE

According to a National Fire Protection Association fire department analysis, grocery/convenience stores have the highest frequency of fires among all retail establishments. Studies show the #1 cause is electrical or lightning.

Common causes and what to look for:

• Circuit Breaker Panel—keep clear and properly maintained.

• Water Heater—clearance from combustibles.

• Extension Cords—keep to a minimum or not at all, and in good condition.

• Roller Grill and Ovens—properly maintained and cords in good condition.

• Fire Extinguishers—inspected and serviced annually.

• Fuel Pumps—equipment in good condition and emergency shut-off is easily accessible, and the sign is visible.

• Old boxes, debris, and dumpsters away from the building’s exterior.

• Propane storage cage secure and away from the building, if possible.

• No smoking near fuel, propane, or outside storage is strictly enforced.

• Trees and large bushes away from the building and not over the roof.

Apps for IOS and Android:

WeatherBug • Emergency: Alerts

FEMA • Shelter Finder

Know Your Plan

POWER OUTAGE

This could be an entire area or a local situation from a transformer problem, a damaged pole, or a lightning strike. There aren’t many prevention techniques, but this should be part of your emergency plan. Utility companies will prioritize restoration for certain essential operations like hospitals and grocery/convenience stores. Until power is restored consider a few precautions/preparations:

• Call your utility company if it’s a local outage.

• Keep extra flashlights with fresh batteries.

• Add a surge protector to sensitive equipment and replace it every few years.

• Consider a plan to process customer purchases with cash or manual credit card transactions.

• Determine your most sensitive perishables and how long health codes allow before they have to be discarded.

• Move what you can into the vault then keep the doors closed.

• Understand what happens to the safe, registers and prepare to secure all valuables, including lottery tickets and cigarettes.

• Label your circuit breakers so you know which ones to leave on if the store

2023 ISSUE 3 AVANTI 39

continued on page 41

“Fire or natural disasters can be one of the costliest in maintaining business continuity, and in many cases business survival.”

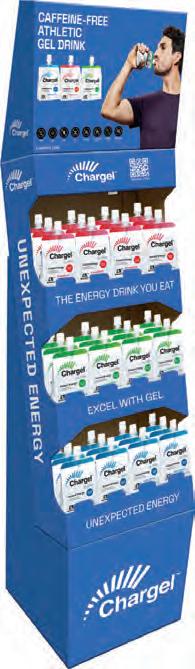

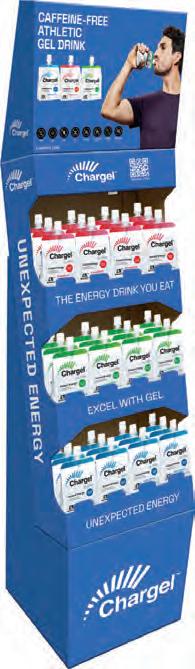

SEND ORDERS TO: Raymond Gates 518-812-4478 rgates@morinaga-america.com THE ENERGY DRINK YOU CAN EAT! Strawberry, Green Apple, & White Grape Chargel shipper 648377 Mclane code for Chargel Shipper STOCK UP TODAY!! Buy one Peg Get one for $1 9/6-11/2 STOCK UP TODAY!! 72ct Peg Bag Shipper McLane UIN: 458707 Peg Bags SLINs 18ct Original 141280 18ct Tropical 144316 18ct Berry 142418 18ct Fantasy Mix 143865 72ct Bites Dump Bin McLane UIN: 648797 McLane Bites SLINs 141607 105ct Stick Pack Wire Rack McLane UIN: 412777 Stick Packs SLINs Green Apple 1.76oz 140553 Strawberry 1.76oz 140560 Grape 1.76oz 141442 Mango 1.76oz 141449 Watermelon 1.76oz 141865 P7 PROMO! P7 PROMO!

Fire Prevention & Emergency Preparedness—Are You Ready?

continued from page 29

is evacuated.

• Anticipate what happens to any building alarms, panic alarms, and phone systems.

• Know how your fuel pumps will react and if there’s a transfer switch.

• Have safety cones to direct traffic and people.

• Unplug or prepare equipment for an orderly restart once power resumes.

• Consider access to a portable generator (never used indoors!). Rent or contract for an on-call unit.

WEATHER

This is the most likely source of disruption or damage to your store, and can happen any time of year or in any part of the country. The weather is changing and storms are more frequent and furious.

Know Your Disaster Seasons

Hurricane:

• Bring in items that may be a hazard during high winds.

• Secure doors and windows, and shut down all non-essential equipment.

• Find a safe place for valuables and important documents.

Flood:

• Know your flood risk (FEMA flood maps will show your risk and flood zone).

• Consider access to tarps to cover equipment and sandbags for the doors.

Earthquake:

• Ensure displays and shelves are secure and bottles or heavy items are on lower shelves.

• Make sure everyone knows how to “Drop, Cover and Hold On.” Know the safe spots in the store.

Tornado:

• Consider there is little time to react— keep a weather alert radio and look for danger signs like dark, greenish sky, large hail, or a loud roar.

Activate Your Plan Ahead of the Threat

• Maintain a weather alert radio or app for your mobile device.

• Make sure employees know what to do before a disaster is imminent.

• Take steps to secure the building, equipment, and inventory depending on the type of threat.

RESOURCES

• Move to the center of the store away from any windows. The restroom is a good spot.

Other items to prepare for an emergency:

• Keep an emergency kit with flashlights, tape, batteries, masks, gloves, blankets, and more (see resources below).

After the Disaster:

https://www.sba.gov/business-guide/manage-your-business/prepare-emergencies

https://www.ready.gov/

https://www.convenience.org/Topics/Operations/Disaster-Preparedness/Emergency-Planning-and-Job-Aid (NACS website with planning guides and training)

https://www.nixle.com/ (Local public safety text alerts)

• Stay in communication with the authorities and employees so they know when it is safe.

• Inspect the facilities and determine if they are safe and what damage occurred. Take photos.

• Call your insurance company and SEI.

• Review your plan; what worked, what needs improvement.

Summary

No matter what the weather or emergency might be, success in preventing injuries and minimizing damage, and downtime is through being prepared. Be ready to protect your employees, customers, and your business. There’s no way to know exactly if or when a disaster might strike and, in some cases, there may be little you can do, but preparing will give you the best chance to be safe and have your store ready to reopen.

Insurance is critical to your business’s recovery and resilience. It’s important to annually review your property and business insurance program with your agent or broker.

If you need assistance with your emergency planning, or inspection checklists to complete your own assessment, contact your agent, broker, or insurance carrier. (MSIG clients can request a survey at my contact information below.)

JOHN HARP CAN BE REACHED AT 908-604-2951 or jharp@msigusa.com

2023 ISSUE 3 AVANTI 41

“Weather is the most likely source of disruption or damage to your store, and can happen any time of year or in any part of the country.”

Joe Saraceno FOA Rallies Members To Tackle Challenges

The Joe Saraceno Franchise Owners Association is dedicated to fostering unity and employing a logical and methodical approach in addressing crucial matters affecting franchisees. COVID presented many challenges for franchisees and left many feeling exhausted and worn out. But guess what? Franchisees are tough and resilient. They rallied together from all corners of Southern California, reinvigorated and ready to take on the pressing issues that affect our stores’ operations and profitability. Recognizing that their collective strength lies in their extensive knowledge of store operations,

community that works as a cohesive team to overcome operational challenges and boost profits. Recently, the FOA organized discussions on best practices for reviewing reports such as DMRs, understanding accounting updates, and optimizing net profit margins. The Joe Saraceno FOA looks forward to continuing its collaboration with members and with SEI to gain deeper insights into pertinent issues and will continue to share key learnings that will empower franchisees to run their operations effectively. The FOA is excited to continue to prioritize the optimization of store operations, so that there may be a positive impact on the success of its

—Harnek Thiara, Joe Saraceno FOA President

IT’S ONLY WORTH IT IF YOU ENJOY IT ENJOY RESPONSIBLY © 2023 Anheuser-Busch, Michelob Ultra® Light Beer, St. Louis, MO [95 calories, 2.6g carbs, 0.6g protein and 0.0g fat, per 12 oz.] 25 oz. can SLIN# 101517 12pk bottles SLIN# 101290 HEAD FOR THE MOUNTAINS 25 oz. can SLIN# 100088 12pk cans SLIN# 100038 30pk cans SLIN# 101437 UP 12.3% YTD VS LY 8 OUT OF 10 OF THE TOP CORE PLUS PACKAGES BELONG TO MICHELOB ULTRA® 12/12C TOP PACKAGE. UP 18.7% L52W TO LY. #5 BRAND IN $ SALES FOR TOTAL 7-ELEVEN BUSCH LIGHT® SINGLE CAN UP 67.2% IN $ SALES YTD 12/12C UP 23.4% $ YTD VS LY AND TREND IS ACCELERATING. UP 7% TO $ TREND L52 WEEKS UP 10.7% YTD TO LY FOR TOTAL BRAND #2 GROWING VALUE BRAND YTD Source: TTL 7E YTD WE 5/28/2023 and TTL 7E latest 52W ending 5/28/2023 ENJOY RESPONSIBLY © 2023 Anheuser-Busch, Busch Light ® Beer, St. Louis, MO #1 CORE PLUS BRAND IN $ SALES. 30/12C 1_30072_BSCHMUL_Avanti_HalfPageAd_FNL.pdf 1 6/15/23 2:10 PM

2023 MID-YEAR LEGISLATIVE REVIEW

BY THOMAS BUNTING Senior Manager External Engagement, Reynolds Marketing Services Company

At the half-way point of 2023, many state legislatures have adjourned sessions, and here’s an overview of the status compared to the beginning of the year.

Several states introduced hostile proposals to ban flavored tobacco, limit nicotine content in vapor products, and impose higher excise taxes and environmental product restrictions. However, a majority of these threats were defeated in states such as Washington, Indiana, Nevada, Ohio, Texas, Alaska, Vermont, New York, New Mexico, Minnesota, Hawaii, Georgia, Idaho, Iowa, Kansas, Mississippi, New Hampshire, Tennessee, Utah, Virginia, West Virginia, Wyoming, and Maryland. Only four states—Hawaii, New York, Louisiana, and Nebraska—raised excise taxes on some tobacco products.

In California, following a statewide flavor ban in 2022, legislators introduced the first-of-its-kind Tobacco Free Generation legislation. The bill, AB 935, originally aimed to ban sales of all tobacco products in the state to anyone born on or after January 1, 2007, beginning January 1, 2028. However, after engaging in efforts to mitigate the proposal, AB 935 was amended to focus on enforcing the existing flavor ban.

While efforts were made to defeat harmful legislation, there were also opportunities to support favorable laws. South Carolina successfully established statewide preemption on tobacco products, preventing local governments from imposing taxes or banning certain products. This major victory benefits the industry and businesses in the state.

At the federal level, a few key developments are expected for the rest of

rulemaking process before it could take effect.

In addition to these administrative rules, the FDA has begun taking action against illicit disposable vapor products, including by issuing import alerts and warning letters to retailers and distributors. Enforcement efforts are being ramped up, as the FDA feels pressure to act against these illegal products.

2023. First, starting on October 1, 2023, specific “corrective statements” provided by cigarette manufacturers must be displayed at retail for 21 months, as part of the Department of Justice Corrective Signs Settlement. Second, the FDA is expected to release its final rule banning menthol cigarettes later this year, which will provide further clarity on the rule’s effective date. Third, the FDA is expected to publish a proposed low nicotine cigarette rule for comment in December 2023, beginning a multi-step, multi-year

Looking ahead, it is anticipated that 2024 will bring increased legislative threats at the federal, state, and local levels. Despite these challenges, the industry can fight back to protect its interests by engaging with elected officials. To participate in advocacy efforts, you can join Own it Voice it by signing up through their trade partners survey at www.ownitvoiceit.com/tradepartners-survey.

2023 ISSUE 3 AVANTI 43

“While efforts were made to defeat harmful legislation, there were also opportunities to support favorable laws.”

“Looking ahead, it is anticipated that 2024 will bring increased legislative threats at the federal, state, and local levels.”

“Several states introduced hostile proposals to ban flavored tobacco, limit nicotine content in vapor products, and impose higher excise taxes and environmental product restrictions.”

Full Agendas At

NCASEF’s Second Quarter Meetings Addresses

The picturesque city of San Juan, Puerto Rico served as the backdrop to NCASEF’s second quarter Affiliate Member and Board of Directors meetings. Taking place from May 1618 at the Marriott Resort and Stellaris Casino, the meetings were filled with productive discussions and informative presentations. The week commenced with a charity golf tournament on May 15 at the Grand Reserve Golf Club in Río Grande, which raised $5,711 for Children’s Miracle Network Hospitals, NCASEF’s charity of choice.

At the outset of the Affiliate Member meeting on May 16, Chairman Sukhi Sandhu and Executive Vice Chairman Joe Rossi expressed their gratitude to attendees, and asked vendors to provide feedback and suggestions on

how to enhance future Affiliate Member meetings.