Unlocking Success Through Collaboration

The Benefits Of Joining Your Local 7-Eleven FOA

Thoughts While Shaving

How Children’s Hospitals Are Improving Access To Healthcare

Joining A Small Business Association Will Give Your FOA Added Perks

Crime And Assault Prevention: An Update For 2023

THE VOICE OF 7-ELEVEN FRANCHISEES 2023 ISSUE 2

Franchisees,

Vendors

The Spring 2023 Affiliate Member Directory Page 43 7-Eleven’s Winning Trifecta

SEI, and

Synergy Fuel Success

©2023 7-Eleven, Inc. 7-ELEVEN, 7REWARDS, SLURPEE, SPEEDWAY, Moving S Design, and SPEEDY REWARDS are trademarks of 7-Eleven, Inc. and Speedway LLC. © 2023 The Coca-Cola Company. “Sprite” is a registered trademark of The Coca-Cola Company. SPRITE ® LYMONADE LEGACY AVAILABLE MAY TH

79% Love or Like Lemonade1 Of All Customers Highly Incremental Current Portfolio EXCITING SHAPES & FLAVORS INSIDE! 86% AMERICANS LOVE STRAWBERRY FLAVOR2 81% AMERICANS LOVE WATERMELON FLAVOR2 ARTIFICIALLY FLAVORED Sources: 1. MenuTrends - Datassential 2. Datassentials Flavor Trends - Total USA - March 2020 © Mondelēz International group March POG Updates in April Additions SOUR PATCH KIDS Lemonade 8 oz. SLIN# 142708 SWEDISH FISH Blue Raspberry Lemonade 8 oz. SLIN# 142676 SWEDISH FISH & Friends 8 oz. SLIN# 144258 FULLY FUNDED PROMO IN P3 8 OZ. 2/$6 2/ 8 OZ.

VITA COCO’S BIGGEST & BOLDEST DRINK YET Tropical. Flavorful . Refrescante. UNIT UPC SLIN 248472 WITH PULP UNIT UPC SLIN 248463

NEW LOOK HITTING SHELVES NOW!

FLAVOR YOUR SUMMER! FMB 12pks +168% at 7-Eleven! 1

ALWAYS ENJOY RESPONSIBLY © 2023 Stella Artois® Beer, Brewed in the U.S.A., Stella Artois,® St. Louis, MO IT’S ONLY WORTH IT IF YOU ENJOY IT 25 oz. can SLIN# 102613 12pk bottles SLIN# 102172 6pk bottles SLIN# 100255 ENJOY RESPONSIBLY © 2023 Anheuser-Busch, Michelob Ultra® Light Beer, St. Louis, MO [95 calories, 2.6g carbs, 0.6g protein and 0.0g fat, per 12 oz.] 25 oz. can SLIN# 101517 6pk bottles SLIN# 100034 12pk bottles SLIN# 101290 18pk cans SLIN# 100138 Start with a STELLA Michelob Ultra® is currently the #4 brand in $ Sales YTD

Michelob Ultra® is up +13% in $ YTD vs Modelo up 11% in $ YTD, making Michelob Ultra® the fastest growing brand. +13% +20% Michelob Ultra® Single 25 oz. CN is up 20% in $ Source: IRI YTD WE 3/26 Projected TTL 7E 779,065 UNITS

IN ALL OF 2022! • UP 12% YTD VS LY IN $ SALES • UP 5% YTD VS LY IN UNIT AND VOLUME SALES Source: YTD WE 4/02/2023 TTL 7E. THAT COULD FILL UP 8 SWIMMING POOLS OR A JUNIOR OLYMPIC SIZE SWIMMING POOL • STELLA 25 OZ. CAN WAS UP 457% IN $ IN 2022 VS. 2021 Source: Rolling 52 WKS ending 1/1/2023 TTL 7E. STELLA 25 OZ. CAN

№4 BRAND

SOLD

2023 ISSUE 2 AVANTI 7

Mahalo for enjoying responsibly. © 2023 Kona Brewing Co., Big Wave® Golden Ale, Cartersville, GA, Fort Collins, CO, Fair eld, CA, Portland, OR, Portsmouth, NH, Merrimack, NH ENJOY RESPONSIBLY © 2023 Goose Island® Beer Co., Tropical Beer Hug,® India Pale Ale, Chicago, IL and Fort Collins, CO ENJOY RESPONSIBLY © 2023 Anheuser-Busch, Busch Light ® Beer, St. Louis, MO 19.2 oz. can SLIN# 100003 25 oz. can SLIN# 103825 6pk bottles SLIN# 109563 12pk cans SLIN# 105299 Easy-drinking island flavor that is smooth and refreshing. The perfect reminder to take a breath & enjoy the moment. BUSCH LIGHT ® IS UP +10% IN $ YTD AND IS THE #1 GROWING VALUE BRAND THE BEST SELLING PACKAGE IS THE 30/12 CN AND IS UP 9% IN $ BEST GROWING TOP PACKAGE IS THE 12/12CN AND IS UP 10% IN $ BUSCH LIGH T ® IS THE # 2 VALUE BRAND IN $ SALES #1 +9% Up 3% in $ YTD +3% Kona Big Wave® 12/12cn is up 49% in dollar sales and 48% in Unit Sales Source: IRI YTD WE 3/26 Projected TTL 7E +49% Goose Island® is up 80% in $ YTD +80% Tropical Beer Hug® Single is up 174% in $ YTD and the #2 Growing Craft Single! Source: IRI YTD WE 3/26 Projected TTL 7E +174% 9.9% ABV Source: IRI YTD WE 3/26 Projected TTL 7E 25 oz. can SLIN# 100088 12pk cans SLIN# 100038 30pk cans SLIN# 101437

HEAD FOR THE MOUNTAINS

Sukhi Sandhu, NCASEF

Sukhi Sandhu, NCASEF

Joe Rossi, NCASEF Executive Vice Chair

By Eric Karp, Esq., General Counsel To NCASEFp

Joe Rossi, NCASEF Executive Vice Chair

By Eric Karp, Esq., General Counsel To NCASEFp

2023 ISSUE 2 AVANTI 9 AVANTI is published by the National Coalition of Associations of 7-Eleven Franchisees for all independent franchisees, store managers and interested parties. National Coalition offices are located at 3645 Mitchell Road, Suite B, Ceres, CA 95307. For membership information, call 855-444-7711 or e-mail nationaloffice@ncasef.com. The views and opinions expressed in the articles and columns published in AVANTI Magazine are those of the authors and do not necessarily reflect the official policy or position of the National Coalition of Associations of 7-Eleven Franchisees, its officers or its Board of Directors. THE VOICE OF 7-ELEVEN FRANCHISEES Contents Brand Unity At Its Finest By

The Benefits Of Joining Your Local 7-Eleven FOA

Thoughts While Shaving

Chairman

By

How Children’s Hospitals Are Improving Access To Healthcare! By Children’s Miracle Network Hospitals Crime And Assault Prevention: An Update For 2023

Engineering Consultant, Mitsui

Insurance Group Joining A Small Business Association Will Give Your FOA Added Perks By

President; Board Member Small Business Association of Michigan Member News............10 Bits & Pieces..........49 Legislative Update.......48 SEI News...................65 Vendor Focus.....70 FOA Board Meetings.....76 FOA Events.....................78 DEPARTMENTS Building Stronger Ties With Their Community NCASEF Charity Golf Tournament Raises Funds For CMN Hospitals Great Products & Deals Showcased at Midwest FOA Trade Show Brain-Freezing Fun At Michigan FOA Stores On ‘Bring Your Own Cup Day’ Central Texas & Keystone FOAs Join NCASEF Michigan Franchisee Donates Water To Local Police Detroit FOA Trade Show Is A Hit With Franchisees & Vendors 29 15 19 21 25 NCASEF 47th Annual Convention & Trade Show Caesars Palace • Las Vegas, NV July 30-August 2, 2023 51 42 27 67 Save The Date! THE VOICE OF 7-ELEVEN FRANCHISEES September/October 2022 Overcoming System Obstacles To Improve Profitability Communication & Teamwork Are Key Working On The Challenges Support Durbin’s Efforts To Lower Swipe Fees A Decrease In Gross Profit On Merchandise Change Kids’ Health. Change The Future. Reduce Harm On Nicotine Products The Value Of A Self-Inspection Program THE VOICE OF 7-ELEVEN FRANCHISEES Making Tomorrow Better Than Today Labor Remains One Of Our Biggest Issues How Franchisee-Friendly Changes To California Law May Affect You Workers’ Compensation Insurance Questions & Answers The Bridge Is Getting Built Your Donations Go A Long Way 16 THE VOICE OF 7-ELEVEN FRANCHISEES 2023 ISSUE Sharing The Same Goal Working Together Benefits All Stakeholders Brand Unity At Its Finest A Healthy Relationship Benefits Everyone Restrictions On Competition In Your Franchise Agreement Thank You, NCASEF! New Year, New Proposals In The Nicotine Category 1st Quarter Board Directors Meeting Summary Page 36 Spring 2023 Affiliate Member Directory Page 43 33 73 35

By John Harp, CSP, ARM—Risk

Sumitomo

Ali Haider, Michigan FOA

Seven & I Reports FiscalYear Net Profit Increase

Seven & i Holdings Co. announced that fiscal-year ended February 28 net profit rose 33 percent to 280.98 billion yen ($2.14 billion) thanks to greater earnings from its international convenience store business and despite weakness in its superstore operations, reported Market Screener. Fourth-quarter net profit was Y46.27 billion and fiscal-year revenue increased 35 percent from a year earlier to Y11.811 trillion, while fourth-quarter revenue was Y2.988 trillion.

ended February 28 net profit rose 33 percent thanks to greater earnings from its international c-store business.”

Seven & i said the fiscal-year operatig profit for its international convenience store business rose 81percent to Y289.70 billion and that of its domestic convenience store business rose 3.9 percent to Y232.03 billion, while profit from its superstore business dropped 36 percent to Y12.11 billion.

C-Store Sales Hit Record Highs In 2022

Convenience stores saw record sales inside their stores as shopping behaviors continue to return to pre-pandemic levels, reported NACS Daily. According to the NACS State of the Industry data for 2022, total convenience industry sales were $906.1 billion, of which $302.8 were from in-store sales, which accounted for 33.4 percent of industry sales. Overall, in-store sales increased 9.0 percent in 2022. Packaged beverages, other tobacco products, salty snacks, candy and packaged sweet snacks all had double-digit sales growth year-over-year. The average basket increased 4.9 percent to $7.52.

NATIONAL COALITION OF ASSOCIATIONS OF 7-ELEVEN FRANCHISEES

NATIONAL OFFICERS & STAFF

Sukhi Sandhu

NATIONAL CHAIRMAN

855-444-7711 • sukhi.sandhu@ncasef.com

Joe Rossi

EXECUTIVE VICE CHAIRMAN

312-501-4337 • joer@ncasef.com

Rajneesh Singh

VICE CHAIRMAN

214-208-6116 • rjn_singh@yahoo.com

Teeto Shirajee

VICE CHAIRMAN 954-242-8595 • teeto.shirajee@yahoo.com

Nick Bhullar VICE CHAIRMAN 626-255-8555 • bhullar711@yahoo.com

Romy Singh TREASURER 757-506-5926 • romys@ncasef.com

Shawn Howard VENDOR RELATIONS ADMINISTRATOR 855-444-7711 • shawnh@ncasef.com

Eric H. Karp, Esq. GENERAL COUNSEL 617-423-7250 • ekarp@wkwrlaw.com

John Riggio MEETING/TRADE SHOW COORDINATOR 262-394-5518 • johnr@jrplanners.com

The National Coalition Office

The strength of an independent trade association lies in its ability to promote, protect and advance the best interests of its members, something no single member or advisory group can achieve. The independent trade association can create a better understanding between its members and those with whom it deals. National Coalition offices are located in Ceres, California.

3645 Mitchell Road Suite B Ceres, CA 95307 855-444-7711

nationaloffice@ncasef.com

John Santiago MANAGING EDITOR 267-994-4144 • avantimag@ncasef.com

April J. Key GRAPHIC DESIGNER lirpayek@gmail.com

The Voice of 7-Eleven Franchisees 2023 ISSUE 2

©2023 National Coalition of Associations of 7-Eleven Franchisees

Avanti Magazine is the registered trademark of The National Coalition of Associations of 7-Eleven Franchisees.

10 AVANTI 2023 ISSUE 2 Member News

“Seven & i reported fiscal-year

contact your Swisher Representative, call 800.874.9720 or visit Swisher.com

Please

BRANDY

IRISH CREAM PEACH

continued from page 10

increase in the convenience industry store count to reach 150,174 stores; inflationary pressures pushing prices higher in 2022; and the continued growth of foodservice and industry operators’ continued focus on providing restaurant-quality food. Overall, foodservice sales represented 25.6 percent of average, monthly in-store sales and 36.1 percent of in-store gross margin.

Despite positive sales growth, direct store operating expenses (DSOE) climbed, putting pressure on retailers. Credit card swipe fees at an industry level have increased 82 percent between 2020 and 2022 and now stand at $19.5 billion. Labor costs also increased in 2022—average wages increased 9.1 percent for full-time and 12.6 percent for part-time employees to $14.33 per hour and $14.02 per hour, respectively.

7-Eleven Foodservice Provider To Build New Plant

Warabeya Nichiyo Holdings, a Japanese producer of ready-to-eat food, will spend $81.5 million to build its third plant in the U.S., intended to supply meals for 7-Eleven convenience stores, reported Nikkei Asia

The plant, expected to open in December 2024, will be constructed in Ohio and will be the company’s biggest production center in the country at roughly 13,000 square meters of floor space. The new factory will produce bread and light meals, supplying approximately 2,500 7-Eleven and Speedway stores throughout the Midwest.

7-Eleven recently selected Warabeya’s American subsidiary as a partner to upgrade its fresh food business. In 2017, Warabeya

The of In is H

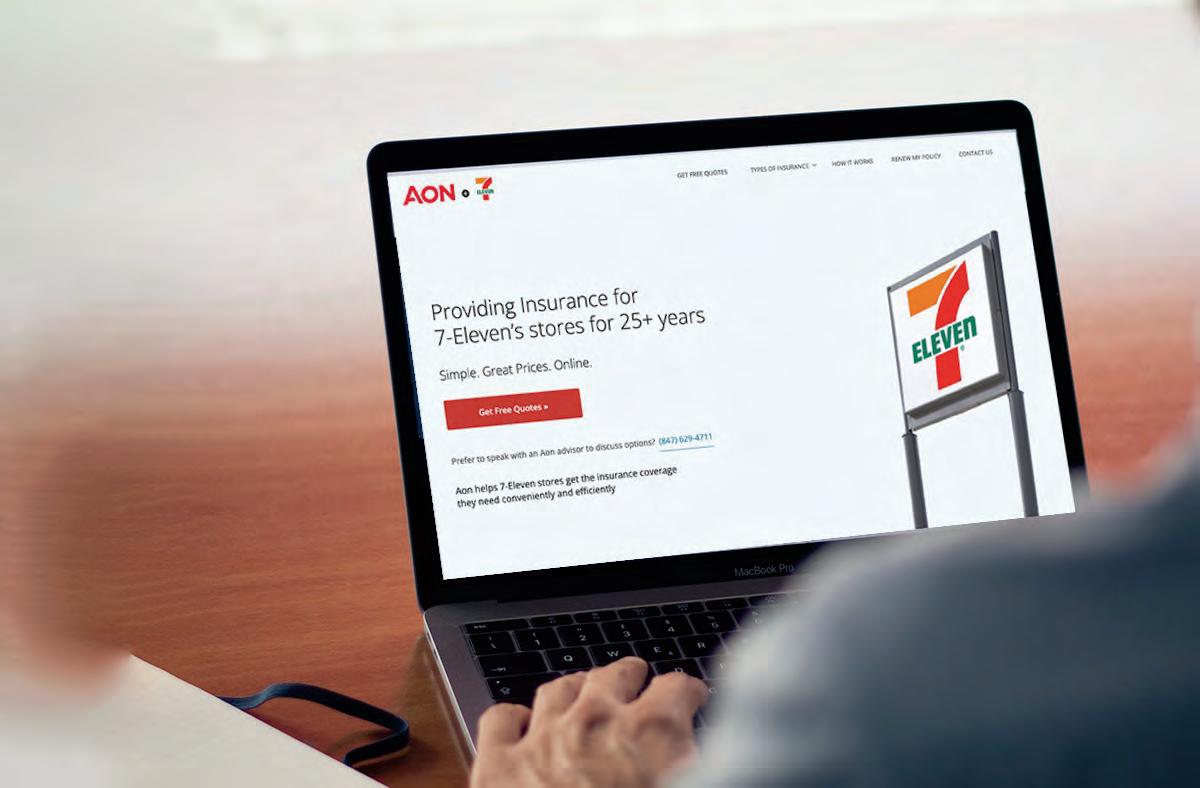

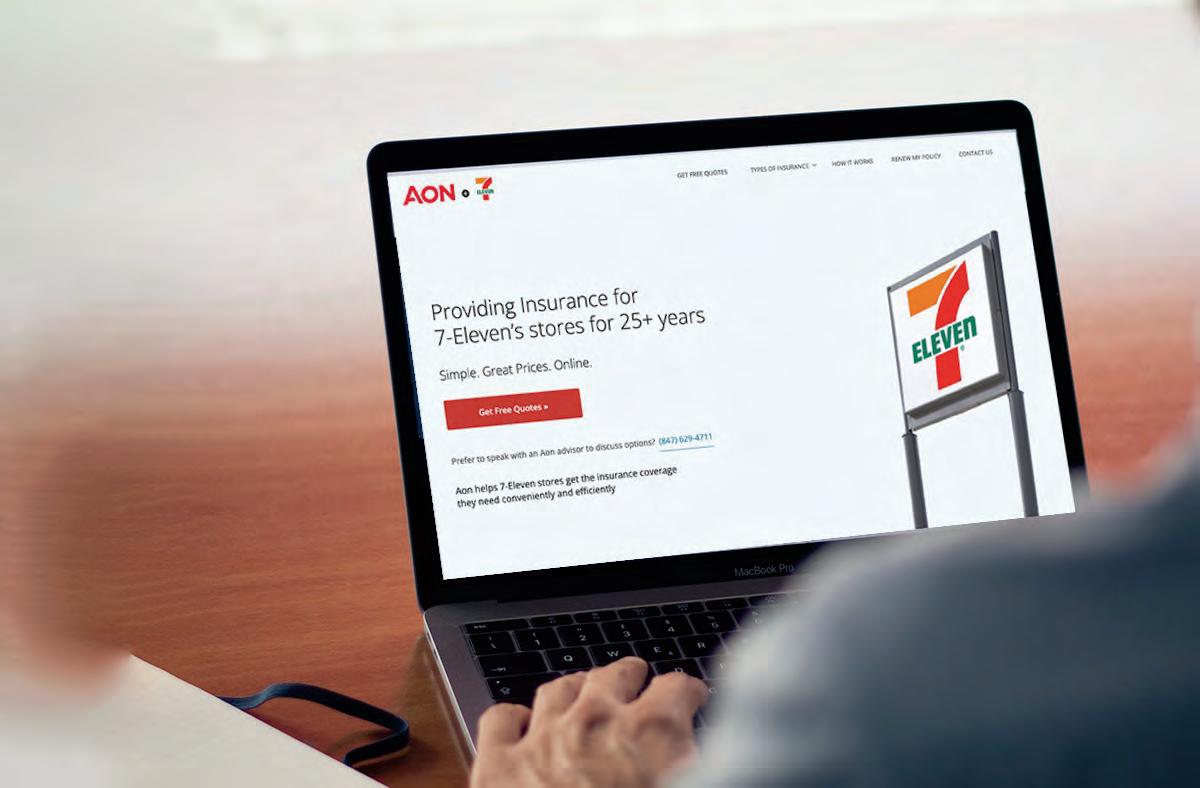

7-Eleven Franchisee Insurance Program

opened its first U.S. plant in Texas, where its American operations are based. The company is building its second factory in Virginia, slated to launch later this year.

C-Store Beer Sales Beat Other Outlets

In the first three months of 2023, convenience stores and gas stations outperformed other types of outlets like supermarkets and liquor stores when it comes to how much beer is sold, a continuation of trends from last year, reported Good Beer Hunting. According to scan data from National Retail Solutions, collected from more than 20,000 independent stores operating its point of sale system:

• Total beer volume—which includes

continued on next page

2023 ISSUE 2 Member News

aondigital.com/en-us/7eleven/

flavored malt beverages (FMBs) and ciders—was up +5.3 percent in c-stores and gas stations January 1 - March 15 when compared to the same time period last year.

• That’s well above an increase of +1.4 percent for total beer across all stores in the NRS data set.

• Craft beer has fared even better in c-stores and gas stations, up nearly +9 percent in volume year-to-date, compared to being up +5 percent across all types of stores.

Member News

continued from previous page

Store Brands Continue Double-Digit Growth

Sales of store brands continue to grow at a double-digit rate, according to nationwide data provided to the Private Label Manufacturers Association (PLMA) by Circana. During the first quarter of 2023, store brands grew by 10.3 percent in dollar volume, almost double the growth of national brands at 5.6 percent. Store brands also saw increases in both dollar and unit market share compared to the same period in 2022, with dollar share rising to 19.1 percent and unit share increasing to 20.8 percent, vs Q1 of last year when the numbers were 18.5 percent for dollars and 20.3 percent for units. Store brands fared significantly better

than national brands in unit sales as well, decreasing by only 1 percent compared to the 3.9 percent decline for national brands. Among the 17 food and non-food departments tracked by Circana, 15 saw increased store brand dollar sales, with double-digit gainers in Beverages, Bakery, General Food, Refrigerated, Floral, Deli Prepared, and Health Care. Deli Cheese, General Merchandise, Beauty, Frozen, Produce, Deli Meat, and Liquor also saw an increase in store brand sales, while only Tobacco and Meat saw a decrease.

MPC Calls For Action As Swipe Fees Rise Again

The Merchants Payments Coalition (MPC)

continued on page 49

SIMPLE. AFFORDABLE. ONLINE.

We don’t just sell insurance. Our programs are specifically created for the 7-Eleven franchise.

As your dedicated insurance partner, we understand the risks and requirements of operating a 7-Eleven franchise.

Exclusive program for 7-Eleven franchisees

Guaranteed coverage regardless of claims history

Manage certificates of insurance online, 24/7

Concierge support to answer any questions

or call (847) 629-4711

more at aondigital.com/en-us/7eleven/

Learn

“Beer sales at c-stores and gas stations increased 5.3 percent in the first quarter of 2023.”

McLane UINMFG#RETAIL UPCCASE UPC 20041757026114 20041757026091 20041757019369 041757026103 041757026080 041757019358 459498 459522 453198 642177 642167 844605 MINI BABYBEL ORIGINAL SNACK CHEESE SINGLES, 30ct MINI BABYBEL LIGHT SNACK CHEESE SINGLES, 30ct MINI BABYBEL WHITE CHEDDAR SNACK CHEESE SINGLES, 30ct PRODUCT DESCRIPTION Limit 3 cases per franchise location (up to $44.01 total value). Valid only for product codes/SKUs listed on this offer. Promotion period is March 27, 2023 – May 31, 2023. Only licensed franchise operators physically located in the United States qualify for this offer. Offer invalid for resale, cash/carry, club store and grocery. Any other use constitutes fraud. Bel Brands USA has final decision on the interpretation of the terms and conditions of this program and reserves the right to cancel this program at any time. Void where prohibited. Virtual Show Dates 3/27-5/31/23 RETAILER DEAL Maximum value of $44.01 SHIP DATES 4/30-7/18/23 Babybel is the #1 Branded Snack Cheese¹ 1IRI Unify POS - US Food - L52 and L4 we 4/17/22 NEW CODES NEW CODES

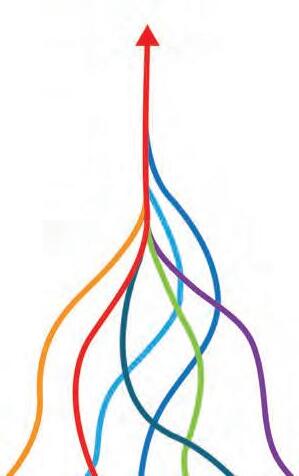

Unlocking Success Through Collaboration

BY

As a 7-Eleven franchisee in California, I’ve experienced first-hand the challenges that our stores have faced due to the recent tobacco flavor bans in our state. The impact on our traffic count has been significant, as these bans not only affected our cigarette and tobacco sales, but also the sales of other products that customers would typically buy along with their tobacco purchases, like gums and energy drinks. The current dire economic climate, coupled with the recent cut in the extra pandemic SNAP/ EBT benefits, has further strained our business. But through adversity, we’ve discovered that collaboration is the key to overcoming obstacles and driving success.

When the tobacco flavor ban started having a negative impact on California stores, SEI’s operations and merchandising teams put their heads together to come up with a plan to counteract the declining foot traffic.

Their solution was the “California Traffic Driver” initiative, which went above and beyond a regular sales plan promotion. SEI’s Zone operations team, with the help of the Dallas merchandising team, approached manufacturers and fresh food commissaries to put together an aggressive, funded program for our stores.

The initiative’s primary objective was to increase foot traffic through special promotions, without sacrificing gross profit percentages. SEI’s teams worked with the manufacturers to get the best possible cost of goods, enabling our stores to offer the promotions at the value retail price to our customers. This collaborative effort was further strengthened by the alignment of all California FOA leadership and franchisees—ensuring that the promotions would be executed effectively and maximized to their full potential.

The results have been nothing short of astronomical. The success of the California Traffic Driver initiative has caught the attention of other manufacturers, and many more are now inquiring about joining. The initiative’s success not only helped 7-Eleven stores in California with increased foot traffic, but also boosted the unit turns for the manufacturers who had experienced collateral damage from the tobacco flavor ban.

Additionally, the promotions were supported by eye-catching window signs, point-of-purchase displays, banners, and digital marketing through the 7-Eleven app and loyalty programs. This cohesive advertising strategy ensured that the promotions were impossible to miss,

driving more customers to our stores. I can’t help but think about the potential of expanding this successful program to the national level in the future. With

2023 ISSUE 2 AVANTI 15

continued on page 17

SUKHI SANDHU, NCASEF CHAIRMAN

“Through adversity, we’ve discovered that collaboration is the key to overcoming obstacles and driving success.”

“SEI’s teams worked with the manufacturers to get the best possible cost of goods, enabling our stores to offer the promotions at the value retail price to our customers.”

“The initiative’s primary objective was to increase foot traffic through special promotions, without sacrificing gross profit percentages.”

Building Stronger Ties With Their Community

NCASEF Chairman Sukhi Sandhu recently participated in two local events that have a positive impact on the community his stores serve. The first was the annual 10K With A Cop organized by Project Blue in Downtown Modesto on March 12. Mr. Sandhu and his team have participated in this event every year since 2017. Along with his son, 7-Eleven team, and their families, they helped distribute water, bananas, and nutrition bars to over 700 runners and 1,000 community residents. They also donated $2,500 to Project Blue.

Project Blue and 10K With A Cop aim to build trust and safety in inner-city communities through youth programs that strengthen relationships between community members and law enforcement, helping launch children into successful futures.

Detective Sean Dodge, Modesto Police Department Chief Brandon Gillespie, and Modesto Mayor Sue Zwahlen attended the event and expressed appreciation for Mr. Sandhu’s participation and sponsorship. Many community members and law enforcement agencies from various counties and cities thanked him and his team for their efforts and invited them to participate in future events.

Earlier this year, Mr. Sandhu and his store team also lent their support to a local school event by donating pizzas, water, and chips for Tuolumne Elementary School’s February Dance Bash for 6th-8th graders, with about 150 students and faculty in attendance. Mr. Sandhu and his team have consistently given back to this school for the past 15 years, emphasizing the importance of education for children. Additionally, they donated $2,000 for transportation and $2,925 for entrance fees for 8th-grade students attending the Six Flags school trip.

In appreciation for all the support they have given the Tuolumne Elementary School, the school invited Mr. Sandhu and his 7-Eleven team to attend its STEAM Building Ribbon Cutting on April 19 and asked Mr. Sandhu to be the guest speaker at the school’s firstever 8th-grade graduation on May 24.

16 AVANTI 2023 ISSUE 2

Unlocking Success Through Collaboration

continued from page 15

all 7-Eleven partners working together, imagine the incredible results we could achieve. It’s time for us to learn from the California Traffic Driver initiative and apply the same collaborative mindset

across the board.

The success of the California Traffic Driver initiative sends a clear message to all 7-Eleven stakeholders: when we

work together towards a common goal, we can achieve remarkable results. Manufacturers, suppliers, franchisees, and SEI all played a crucial role in overcoming the challenges posed by the California tobacco flavor ban and other headwinds. And although there remain kinks in our system that need to be ironed out, the California Traffic Driver initiative is exemplary of what can be accomplished when we all lock arms and focus on driving business success. Let this example inspire us to continue working together, strengthening our partnerships, and striving for even greater accomplishments in the future.

SUKHI SANDHU CAN BE REACHED AT 855-444-7711 or sukhi.sandhu@ncasef.com

Avanti Is Your Magazine

Avanti Magazine was created in 1981 by franchisees, for franchisees. It represents your voice within the 7-Eleven universe and requires your participation to remain relevant to the ideas, information, and knowledge floating about the franchisee community. You can contribute to the success of Avanti Magazine by submitting any of the following:

> Articles on any 7-Eleven topic that may be of interest to other franchisees.

> Your FOA events and Board meeting calendars.

> FOA event photos with a short description (who, what, where, when, and why).

> Store or community event photos with captions.

> Any combination of the above.

Please send your submissions to avantimag@ncasef.com.

As former National Coalition Chairman Bill Schuessler famously said, “None of us is as great as all of us together, so let’s stay tightly knit together.”

2023 ISSUE 2 AVANTI 17

“Let this example inspire us to continue working together, forging new partnerships, and striving for even greater accomplishments in the future.”

“Manufacturers, suppliers, franchisees, and SEI all played a crucial role in overcoming the challenges posed by the California tobacco flavor ban and other headwinds.”

The Benefits Of Joining Your Local 7-Eleven FOA

BY

In our fast-paced and competitive industry, it is vital to seek support and resources to maintain a thriving enterprise. As a 7-Eleven franchisee, joining your local Franchise Owners Association (FOA) can provide numerous benefits that will contribute to the growth and success of your store. I cannot emphasize enough the importance of being part of such an organization.

This network of fellow franchise owners cultivates a collaborative environment that encourages mutual growth and success. By leveraging the collective knowledge and experience of your peers, you can overcome obstacles and develop innovative solutions to your individual challenges. After all, there is a power in numbers that allows us to get things done.

One of the primary benefits is access to a wealth of educational resources. As an FOA member, you become part of, not only a local, but a national network that connects you with valuable information from both the National Coalition and SEI. You will also have access to vendor resources and new items before even SEI becomes aware of them, which make FOA-member stores the first to carry the latest innovations from our vendor partners. This knowledge offers a clear roadmap for conducting your business and addressing systemic issues that may arise. The educational opportunities provided by your local FOA ensure that you are equipped with the latest insights and best practices to help you navigate our ever-evolving 7-Eleven business.

Another advantage is the sense of camaraderie and support within the community. Local FOAs function as a fraternity, where members can rely on one another for guidance and assistance.

The relationship between the FOA and local municipalities is another significant benefit. Being part of a unified group gives you a stronger voice when dealing with ordinances and other regulatory matters. This collective strength ensures that your concerns are heard and addressed, enabling you to focus on running your store more efficiently and profitably.

Furthermore, FOA events such as trade shows, charity golf outings, and holiday parties provide exceptional networking opportunities. These gatherings allow you to connect with other franchisees and our vendor partners to share ideas and experiences, and establish lasting business relationships. The friendships formed through these events contribute to the overall sense of belonging and solidarity within the 7-Eleven franchisee community.

If you are a 7-Eleven franchisee and have not yet joined your local FOA, I highly recommend looking into it. The easiest way to find your local FOA is by visiting the National Coalition website. The process of joining is straightforward—just scan the QR code included with this article that takes you to 7-Help and follow the instructions outlined in the sidebar. The benefits gained from being an FOA member far

outweigh the initial investment of time and effort. As a member, you will not only gain access to crucial resources and support, but you will also become a part of a community that cares about your success as much as their own.

How To Join An FOA

1. Open or download the 7-Help Store Mobile App, or scan the QR code provided.

2. In the search bar, type FOA

3. Go to Accounting/Accounts Payable FOA/PAC (requesting to join or be removed from an FOA).

4. Enter current FOA (if none, leave blank).

5. Enter name of FOA you would like to join.

6. Enter dues amount (paid monthly on 48a).

7. Type in that you are requesting to join the FOA in the short description.

8. Copy and paste the same (or retype) in long description.

9. Press SUBMIT on right side and you’re all set!

2023 ISSUE 2 AVANTI 19 JOE ROSSI CAN BE REACHED AT 312-501-4337 or joer@ncasef.com

“As a 7-Eleven franchisee, joining your local FOA can provide numerous benefits that will contribute to the growth and success of your store.”

“Local FOAs function as a fraternity, where members can rely on one another for guidance and assistance.”

JOE ROSSI, NCASEF EXECUTIVE VICE CHAIR

Scan this QR code to be taken to 7-Help.

Thoughts While Shaving

BY ERIC H. KARP, ESQ., GENERAL COUNSEL TO NCASEF

In this message, I pay homage to the late and great Boston Globe sports columnist and editor Ernie Roberts, the progenitor of “Thoughts While Shaving.” As a teenager, I very much looked forward to his columns on the left-hand side of the first page of the sports section, because they contained relatively short stories about a variety of different subjects related to the Boston sports scene, at a time when the perennial NBA Champion Boston Celtics made the news, while our other sports teams languished.

36 percent in 2007 and last exceeded 35 percent in 2012.

Retail CPG

SEI’s parent correctly summarized the financial results of SEI for 2022 as follows:

• “A decrease in gross profit on merchandise was outweighed by growth in gross profit on fuel, leading to a year-on-year increase in the overall gross profit margin factor.”

So it is with 7-Eleven and it’s publicly held parent company, Seven & i. The past several weeks have seen news and public disclosures on a variety of fronts which have the potential to affect U.S. franchisees on both a long-term and short-term basis.

Merchandise Gross Profit

Merchandise gross profit for SEI stores for calendar year 2022 was 34 percent, down from 34.2 percent the year before. In fact, this is the lowest merchandise gross profit reported since at least 2006, the first year that this statistic was disclosed. Merchandise gross profit was

These numbers are blended, which is to say that they include both company owned and franchised stores. SEI last published merchandise gross profit for franchised stores in 2018, following a nearly 1 percent decline in franchisee merchandise gross margin from 2012 to 2018. Previous public disclosures by SEI’s parent company suggested that the merchandise gross profit in the acquired Speedway stores was lower, which may have been reducing the systemwide average. But there has been more than enough time for the company to adjust and take advantage of the opportunity.

SEI often and correctly points out that sharing gross profit aligns the interests of franchisees and the franchisor. But declining gross profit, together with the increase of SEI’s share of that net profit as reflected in the so-called 2019 form of franchise agreement, should be of concern because it undermines the gains reflected in same-store sales increases.

• “Strong growth in operating income through increased fuel GP led by historical CPG and accelerated fresh food and PB sales.”

That “historical CPG” is illustrated by the following, which demonstrates that fuel margin has more than doubled since 2015. And as every franchisee knows, unlike merchandise gross profit, franchisees do not share in this bounty, but rather receive a fixed commission of 1.5 cents per gallon. For perspective, in 2015 and 2016, franchisees received approximately 7.5 percent of the retail gross margin; by 2022, that percentage was more than cut in half to 3.5 percent.

2023 ISSUE 2 AVANTI 21 continued on page 23

“The past several weeks have seen news and public disclosures on a variety of fronts which have the potential to affect U.S. franchisees on both a longterm and short-term basis.”

“SEI last published merchandise gross profit for franchised stores in 2018, following a nearly 1 percent decline in franchisee merchandise gross margin from 2012 to 2018.”

Restrictions On Competition In Your Franchise Agreement

continued from page 21

SEI’s total gross profit from the fuel segment of its business increased by more than $1.8 billion in 2022, or 46 percent over the previous year. The extent to which SEI is at least as much a gasoline retailer as it is a merchandise retailer is shown by the fact that in 2022, more than 78 percent of its revenue came from the sale of gasoline and just 4 percent from franchisees.

Electric Vehicles

Given the heavy reliance of SEI on gasoline revenue and profit, illustrated most prominently by its acquisition of the Sunoco and Speedway chains, we are concerned about the long-term prospects for gasoline powered automobiles.

According to InsideEVs.com:

• “Out of 1.24 million new light vehicles registered in January 2023, some 87,708, or 7.1 percent were allelectric. That’s a 74 percent increase year-over-year and a noticeable change, compared to a 4.3 percent share in January 2022. The 7.1 percent share is also a step change from 5.6 percent in the 12 months of 2022.”

• “It’s clear that the battery electric vehicle (BEV) segment is booming, partially through organic growth and partially through the Inflation Reduction Act of 2022 (IRA), which brought back the $7,500 federal tax credit eligibility for Tesla and General Motors.”

• “Another reason why the market surged is price cuts introduced by

some of the manufacturers (Tesla was one of them).”

Fortune Business Insights projects that the sale of electric vehicles will experience more than a 25 percent compound annual growth rate through 2028, at which point sales will reach more than $138 billion. Bloomberg reports on projections that EVs will account for 50 percent of all new vehicle sales by 2030. And the federal government has recently proposed new measures to change the way mileage standards are computed for electric vehicles as a way of spurring sales and incentivizing manufacturers to produce lower cost electric vehicles.

ValueAct

This activist investor firm continues to put pressure on the management of the parent company of SEI. It holds a 4.4 percent stake and has been pressuring for change. In the run up to the annual shareholders meeting scheduled for May 25, ValueAct is pushing for a spinoff of the convenience store business into a standalone publicly held company or a sale of the entire company. It is also seeking to replace four board members. ValueAct has recruited two other institutional investors to its cause, Artisan Partners and Dalton Investments.

“A rational and experienced board of directors would understand their fiduciary duty and spin off the Seven Eleven business to existing shareholders,” said James Rosenwald, chief investment

“ValueAct is pushing for a spinoff of the convenience store business into a standalone publicly held company or a sale of the entire company.”

officer of Dalton Investments. “The market would likely value the new spin off at more than the entire company today.”

As I have noted before, these investors are not quarrelling with the financial performance of the convenience store business. Rather, they believe that the other segments of the conglomerate are dragging down the value of the company and hence its stock price, which has perennially underperformed its peers and the market as a whole. I bring these matters to your attention because these investors hold large stakes and are very persistent. And any major change in the corporate structure of the parent company could have important consequences for every franchisee in the United States.

Conclusion

With apologies to Ernie Roberts, these four matters may seem disparate and unconnected, but they are all closely interrelated because each one of them has the potential to materially impact the profitability and value of every franchised location in the country. It is for this reason that the National Coalition strives to be fully informed by monitoring all publicly available information and keeping its franchisee constituents in the know.

2023 ISSUE 2 AVANTI 23 ERIC H. KARP CAN BE REACHED AT 617-423-7250 or ekarp@wkwrlaw.com

“SEI’s total gross profit from the fuel segment of its business increased by more than $1.8 billion in 2022, or 46 percent over the previous year.”

JACK LINK'S® DORITOS® SPICY SWEET CHILI FLAVORED JERKY 2.65 OUNCES JACK LINK'S® DORITOS® SPICY SWEET CHILI FLAVORED MEAT STICK 0.92 OUNCES JACK LINK'S® ORIGINAL STEAK BITES 1.75 OUNCES JACK LINK'S® FLAMIN’ HOT® ORIGINAL FLAVORED JERKY 2.65 OUNCES JACK LINK'S® TERIYAKI STEAK BITES 1.75 OUNCES JACK LINK'S® FLAMIN’ HOT® ORIGINAL FLAVORED MEAT STICK 0.92 OUNCES Jack Link’s® and its logo are registered trademarks of Link Snacks, Inc. Frito-Lay® and its brands are registered trademarks of Frito-Lay North America, Inc Fully Funded Promos and 40% + Margins. Now available on 7Rewards.

How Children’s Hospitals Are Improving Access To Healthcare

BY

Children’s Miracle Network Hospitals (CMN Hospitals) is committed to ensuring every child receives the best possible care, and that includes access to the services and expertise they need to flourish. Addressing accessibility is more than a matter of removing barriers—it’s fundamental to ensuring children and communities are healthy and able to reach their full potential.

community care clinics in rural and urban settings that reach underserved and vulnerable populations; and mobile, pop-up, and school-based clinics, which take healthcare to where their patients are, reducing or eliminating their need to miss work or choose between lost income and healthcare.

through a business or fundraiser in their community, the donation goes directly to their local member hospital.

Many families still struggle to find care for their children, due to factors like the inability to find health practitioners or discounted care, as well as struggles of their own, such as financial instability, unreliable transportation, prohibitive work schedules, high distance to treatment facilities, language barriers, limited access to technology, and low health literacy. Member children’s hospitals rely on our unrestricted funding, which benefits the member hospital where it is donated. These funds can support things like accessibility programs that will best suit their patients and communities.

These include language services for thse for whom English is not their first language, or for those who are deaf or hearing impaired; social workers who help with transportation and other logistical needs; and telehealth services that ensure patients are able to be seen in a timely manner. These also include

Providing these services is not a given— it necessitates substantial resources and staffing that go well beyond the core functions of a hospital. When you support CMN Hospitals you do both, thus creating a healthier, happier future for families and communities for years to come.

Further Your Involvement With Your Local Children’s Miracle Network Hospital

Children’s Miracle Network Hospitals raises unrestricted funds for 170 children’s hospitals across the U.S. and Canada to help fulfill their most urgent needs. We make all of this possible at the local level. When someone donates

But we have our sights set even higher, because we know that when we improve treatments and facilities, we can address the most challenging health issues of today while preventing and preparing for those to come tomorrow. When we fund pioneering research at children’s hospitals, we transform how we care for children not just in their youth, but throughout their lives.

Use the following steps to get more involved with Children’s Miracle Network Hospitals and your local member hospital:

1. Contact your local hospital representative. Need help getting connected? Email Kate Burgess (KBurgess@CMNHospitals.Org) with your FOA name.

2. Invite your local hospital representative to present at an upcoming FOA Board or Member meeting.

2023 ISSUE 2 AVANTI 25

CHILDREN’S MIRACLE NETWORK HOSPITALS

“Member children’s hospitals rely on our unrestricted funding, which benefits the member hospital where it is donated.”

continued on page 27

“Providing these services is not a given—it necessitates substantial resources and staffing that go well beyond the core functions of a hospital.”

“Children’s Miracle Network Hospitals raises unrestricted funds for 170 children’s hospitals across the U.S. and Canada to help fulfill their most urgent needs.”

How Children’s Hospitals Are Improving Access To Healthcare

continued from page 25

3. Schedule a hospital tour with your local hospital representative. Please note, this is subject to COVID-19, RSV, and flu-season protocols.

4. Host a charitable event for Children’s Miracle Network Hospitals. Invite your local hospital and allow them space to showcase the power of your partnership. Local member hospitals may be able to support your event through the following:

learn more about Children’s Miracle Network Hospitals and the impact your local member hospital makes in your community. Your local hospital representative can staff this table and bring informational materials.

d. Welcoming remarks or words of gratitude: Your local hospital representative can share a few brief remarks to thank vendors and franchisees for supporting Children’s

Miracle Network Hospitals. These remarks can be made at any point during the event, but we see great success at the start of your event or during the check presentation. We are grateful for the many ways FOAs support and interact with their local member hospitals. For additional information or ideas, please contact Kate (KBurgess@CMNHospitals.Org).

NCASEF Charity Golf Tournament Raises Funds For CMN Hospitals

The sun was shining and the weather was warm as franchisees and vendors took to the greens at the TPC Louisiana in New Orleans on March 7 to participate in the NCASEF Charity Golf Tournament benefitting Children’s Miracle Network Hospitals. The event took place the day before the Affiliate Members and Board of Directors meetings, and raised $5,711 for NCASEF’s charity of choice.

a. Hosting a pre-event presentation: During pre-event meetings, local hospital representatives can share information about your local member hospital and the impact your charitable event will have on patients and families. This is a great way to build more familiarity around our partnership before your charitable event.

b. Inviting a patient family to the event: Your local hospital representative can invite a patient ambassador to share their story and the impact of your local member hospital.

c. Hosting a CMN Hospitals informational table: Have a table near check-in where participants can

2023 ISSUE 2 AVANTI 27

“When we fund pioneering research at children’s hospitals, we transform how we care for children not just in their youth, but throughout their lives.”

THREE SUCCESSFUL SBT PROGRAMS DRIVE REVENUE

TO NEW HEIGHTS!

women across the convenience store market. Whether for style or function, these patriotic items are perfect for a summer weekend BBQ, festival or concert!

Rolling display comes pre-loaded and can be installed in under 10 minutes! The impressive selection includes 1,200 bracelets per display comprised of 25 different bracelet designs. These stylish bracelets are great for the buyer and as gifts, increasing opportunities for multiple and repeat purchases!

Retail: $2.99 or recommended retailer promotion of 4 for $10.00

Quantity: 1,200 units

UPC: 87994200194

Display Dimensions: 78” H x 12” W x 12” D

Target program duration is 6 months with no replenishment

Available as a floor display or a power wing, the Sticker program is loaded with UV and weather resistant vinyl stickers that are trendy and feature high demand sticker designs. Stickers are die-cut to the specific design shape and made with multiple layers of laminate to prevent fading. The adhesive is re-positionable or multi-use. Customize items like laptops, water bottles, and more!

Retail: Large stickers $5.99, Small $3.99

SPINNING FLOOR DISPLAY

UPC: 6087076808 • Quantity: 648 pcs

Display Dimensions: 74”

UPC:

Display

H

15” W

15” D

WING INSERT DISPLAY

x

x

POWER

60870768088 • Quantity: 300 pcs

W

D

Dimensions: 56” H x 14”

x 2”

TO ORDER, CONTACT: Jack Claiborne, National Account Manager 7-Eleven Mobile: 407-412-8563 • Hotline: 844-377-4711 • E-mail: jack.claiborne@srpcompanies.com SHOW YOUR PATRIOTIC SPIRIT FUN DESIGNS APPEAL TO EVERYONE & STICK ANYWHERE TOP SELLING WOVEN BRACELETS DRIVE WEEKLY SALES

Bandanas $4.49 • Straw Hats $29.99 Caps $16.99 • Sunglasses $12.99 & $19.99 Quantity: 78 pcs UPC: 608707025113 Display Dimensions: 70” H x 13.5” W x 14.25” D INCREASE YOUR SALES UP TO per store per turn $124122 AMERICANA SHIPPER INCREASE YOUR SALES UP TO per store per turn $91440 FRIENDSHIP BRACELET FLOOR SHIPPER INCREASE YOUR SALES UP TO per store per turn $325536 VINYL

SPINNING DISPLAY

Retail:

STICKER

CRIME AND ASSAULT PREVENTION: AN UPDATE FOR 2023

BY JOHN HARP, CSP, ARM—RISK ENGINEERING CONSULTANT MITSUI SUMITOMO INSURANCE GROUP

As 2023 takes shape with continuing labor challenges and increasing costs— but stability in the economy—there is a continuing risk of injuries resulting from crime, robbery, and assaults.

of claims in 2021 (pandemic influence) declined and continues to show improvement, including the first three months of 2023.

Key Prevention Tips

Is your store prepared for crime and assault prevention through physical controls like quality high resolution surveillance, fencing, landscaping, and general clean appearance?

Are your windows free of large displays that can obstruct vision from inside and out?

As seen in the chart below, the MSIG/ Franchisee workers’ compensation experience shows high costs but a continuing decline in the number of assault-related claims. Costs tend to increase over time, but when the number of claims declines, costs usually follow.

Background—Crime and Assaults

A recently released FBI report shows violent crime increased in 2020, but leveled off in 2021. The data shows that convenience stores are the #4 location for violent crimes after residential, streets/ alleys/sidewalks, and parking garages.

MSIG provides workers’ compensation insurance for almost 4,000 U.S. franchised stores. Since 2017, there have been 374 assault-type claims for a current cost of $21,761,257. The number

Claim Examples:

• Employee got into an altercation with a customer over a fountain drink. The employee was stabbed in the back. Current costs are $399.

• Cashier was shot by customer, possibly unprovoked. Current costs are $178,300.

• Employee shot after refusing customer sale. Current costs are $531,019.

• The assailant stole five packs of cigarettes and then stabbed the employee. Current costs are $329,552.

The most serious injuries in the last 10 years occur from two basic causes. 1. The employee was unable to effectively de-escalate the situation 2. Leaving the counter or store to chase. “Nothing good ever happens if an employee leaves the store.”

A notable trend starting in 2022 is the lower number of claims where the employee left the store or confronted a customer. Recently, what appears to be purely crime-motivated offenders are the root cause and the employee is not contributing to the situation.

Primary Factors Contributing To Store

Are store displays low enough to maintain good visibility?

Did you know assaults or robberies do not always occur after midnight?

Can you support two employees at night? This can lessen the crime risk or severity of injuries.

Do you sell items that may draw less than desiriable customers?

Are your employees trained, tested and ready if a shoplifting event escalates or someone enters the store demanding money or cigarettes?

Have you communicated concerns or issues to SEI Asset Protection or Store Support?

Crime

• Hours—Studies vary on this issue, but the later hours see the most crime.

• Untrained or ill-prepared employee.

• Store Layout—Limited visibility from inside the store and from the outside looking in.

• Escape route for the offender. The easier it is to escape outside to the sides or back of the store.

• Location—Free-standing stores are

2023 ISSUE 2 AVANTI 29

60 69 73 73 49 45 5 $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 0 10 20 30 40 50 60 70 80 2017 2018 2019 2020 2021 2022 2023 Count and Cost of MSIG Assault Claims Count Cost 3 mos.

continued on page 31

“As patience is lower, effective de-escalation can be the difference between life and death.”

$26.2M

$ SALES, UP +85% VS YAD**

#1

IN UNIT SALES GROWTH, CONTRIBUTING 4.5M UNITS VS YA +75%**

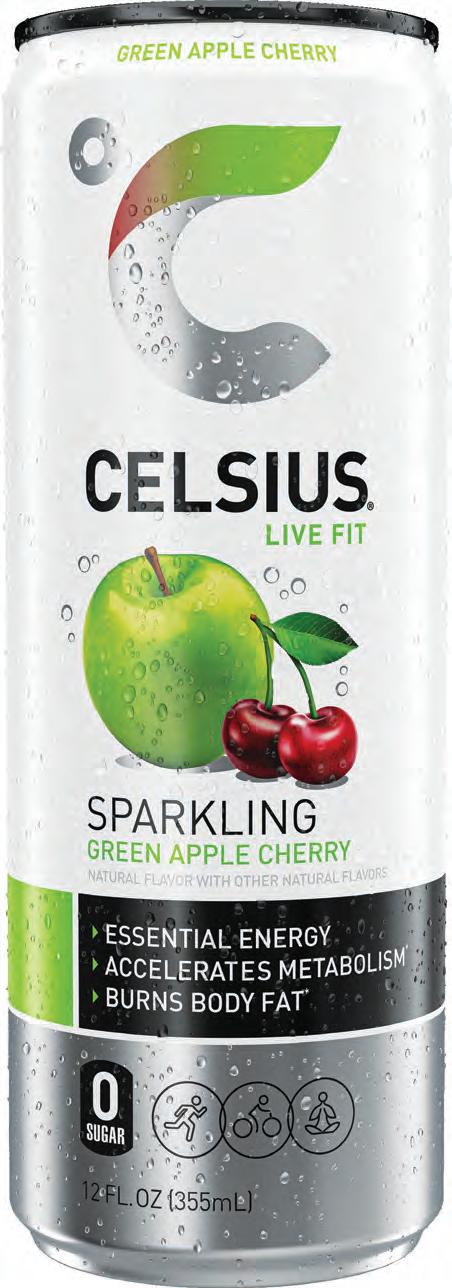

GREEN APPLE CHERRY

$1.4M

IN $ SALES YTD**

#2

GROWTH DRIVING SKU**

30 AVANTI 2023 ISSUE 2 ESSENTIAL ENERGY *CELSIUS® helps maintain the body’s regular metabolic function. CELSIUS® alone does not produce weight loss in the absence of a healthy diet and moderate exercise. So, whether you walk the dog or work out at the gym, make CELSIUS® part of your daily regimen. **in the energy category, in both units and $, IRI YTD ending 3.12.23 Total 7E Enterprise, latest L4W

CELSIUS

Crime And Assault Prevention: An Update For 2023

continued from page 29

more vulnerable than strip mall locations.

De-Escalation Tips

Tempers can flare over demand for cigarettes or questioning a customer’s ID. As patience is lower, effective de-escalation can be the difference between life and death.

A few tips for your employees in dealing with a difficult customer:

• Listen. Let the person vent their frustration by actively listening.

• Do what they say. Sometimes this is the best and only option.

• Remain calm. But refrain from telling the customer to remain calm (this makes most people angrier).

• C ontrol your body language. Show your concern and do not reach for anything.

• Find a solution. Talk about how to fix the situation with facts.

• Keep yourself and others safe. Do

After A Robbery Or Assault

• Lock the doors and call 911.

• Find any witnesses and get their information.

• Call the SEI Hotline! But remember, they cannot process a workers’ compensation claim!

• Preserve any evidence of the crime, including video—take pictures.

• Contact MSIG, your workers’ compensation company, or your broker within 24 hours, even if there are no visible injuries.

not leave the store or register area. What Else Can You Do?

Look at your store with fresh eyes and an open mind! Ask an expert for their advice! Consider the following:

1. Customer Service. Ensure your employees make eye contact and greet the customer.

2. Cleanliness. A clean store inside and out shows customers and possible assailants there is a high level of care.

3. Employee training including Operation Alert. Follow up with frequent reminders, especially for new employees.

4. Limit outside activities after dark. Employees should not take out the trash after midnight.

5. Make sure employees know how and when to use the panic alarm.

6. Cash limit in registers should be strongly enforced. If a robber succeeds in getting excess cash, you are a likely target again.

7. Cigarettes are a valuable target item. Limit these and other target items in the register area of the store. Secure them in a cage in the backroom and minimize inventory.

8. Keep the office door closed or locked

to limit the temptation from a would-be criminal seeing cigarettes or cash.

9. Encourage the police to stop in for coffee or drinks and park in your lot after hours. Work with law enforcement to understand criminal or gang activity in your neighborhood.

10. Perform a security/violence prevention audit using information from OSHA at this site: https://www.osha. gov/Publications/osha3153.pdf or request a Safety-Security Store audit from MSIG or your insurance company.

“The number of assault claims has decreased in the last 18 months through a focused effort on store conditions, training and owner diligence.”

Summary—The Good News!

The number of assault claims has decreased in the last 18 months through a focused effort on store conditions, training and owner diligence. The mission in minimizing crime and employee injuries is never over. Keep it going!

MSIG, your insurance company, or your broker can help you audit your store, and develop practical and effective strategies to protect your employees from violent crime.

JOHN HARP CAN BE REACHED AT 908-604-2951 or jharp@msigusa.com

2023 ISSUE 2 AVANTI 31

“Cigarettes are a valuable target item. Limit these and other target items in the register area of the store. Secure them in a cage in the backroom and minimize inventory.”

103495_0921 Clip and save for reference. MAXIMIZE SALES MAXIMIZE SALES MAXIMIZE SALES MAXIMIZE SALES MAXIMIZE SALES BECOME YOUR GUESTS’ DESTINATION FOR GIFT CARDS Make sure your display is FULL of gift cards from all categories to increase sales Need more inventory? Email us at 7ElevenAutoReplen@incomm.com for FREE inventory/delivery! If you are a victim of a phone scam, have questions or need help, please contact us: 7-Eleven Asset Protection Hotline (800) 555-2620 InComm Fraud Department (866) 362-9035 or FraudDepartment@incomm.com

Joining A Small Business Association Will Give Your FOA Added Perks

BY ALI HAIDER, MICHIGAN FOA PRESIDENT; BOARD MEMBER SMALL BUSINESS ASSOCIATION OF MICHIGAN

As a 7-Eleven franchisee, I can attest to the numerous benefits and resources that being a member of a Franchise Owners Association (FOA) has to offer. However, I believe there is another important step that FOAs can take to further enhance their value and support for their members: joining a local business association. These organizations can provide additional benefits and services that franchisees may not have easy access to for themselves and their employees, like health insurance and retirement plans.

Take, for example, the Small Business Association of Michigan (SBAM), an organization that represents over 34,000 small businesses. I first became involved with SBAM as a member and soon realized that the benefits they offered could be a game-changer for our FOA. By joining SBAM, our FOA was able to secure a range of services offered by the organization for our members and their employees, including health insurance through Blue Cross and Blue Shield with dental and vision coverage, life and disability insurance, and pooled employer retirement plans.

The best part is that our FOA is registered as a strategic partner with SBAM so we are able to take advantage of the aforementioned benefits. Furthermore, the Michigan FOA pays the annual premium membership fee of $249 for our members, which is a significant saving for them. Another key highlight of this partnership is the inventory insurance. As franchisees, this is one of our most significant expenses, and we’ve been struggling to find affordable options. Inventory insurance costs can vary from $300 to $600 a month, and with high crime rates in some areas, it’s challenging to find a suitable policy. SBAM’s partnership allows us to access better inventory insurance options based on our zip code and store complaints, which can save a considerable amount.

Our members were excited and eager for the services to start. As far as I know, we are the first FOA to provide these benefits to our members via a partnership with a small business association. Franchisees deserve access to these benefits just as much as any other small business owner.

I strongly encourage other FOA leaders to explore similar business associations in your area and consider joining them as strategic partners to reap the benefits they can offer to your members. The larger your FOA, the easier it would be to gain a higher-tier membership platform.

“I strongly encourage other FOA leaders to explore similar business associations in your area and consider joining them as strategic partners to reap the benefits they can offer to your members.”

Brian Calley, the former Lieutenant Governor Michigan and the President and CEO of SBAM, came to our most recent trade show and announced the benefits of our partnership with SBAM.

By doing so, FOAs can enhance their support for their franchisees, providing them with valuable resources and services that can help them grow and thrive in an increasingly competitive business landscape. As the experience of the Michigan FOA demonstrates, this approach can lead to significant cost savings and additional benefits for franchisees, ultimately contributing to the overall success of your FOA members. Please feel free to contact me if you have any questions.

2023 ISSUE 2 AVANTI 33

“By joining SBAM, our FOA was able to secure a range of services offered by the organization for our members and their employees.”

“I believe there is another important step that FOAs can take to further enhance their value and support for their members: joining a local business association.”

ALI HAIDER CAN BE REACHED AT 517-219-5288 or aliokemos@gmail.com

CELEBRATING ONE BILLION IN RETAIL REVENUE Stock your shelves with proven moneymakers. ZYN is the first and only nicotine pouch to break one billion in retail sales. Increase your bottom line with America’s #1 nicotine pouch. FOR TRADE PURPOSES ONLY. | Source: IRI Total US Multi-Outlet, YTD Ending 11-06-22. | ©2023 Swedish Match North America LLC Call 800-367-3677 or contact your Swedish Match Rep to learn more.

Great Products & Deals Showcased At Midwest FOA Trade Show

The Midwest Franchise Owners Association (MWFOA) hosted our Spring Trade Show on April 4 at the Chicago Schaumburg Marriott. We started the day off with wicked weather, but it did not stop the show. Our Trade Show Committee members—Rick Boone, Bob Rinaldi, Joe Rossi, and Jigar Shah—brought in over 40 vendor partners to showcase summer deals and new items. With over 150 stores representing Illinois, Indiana and Michigan, franchisees were able to speak with vendor partners, build relationships, and find new brands to carry in their stores. We are thankful to our resident DJ and franchisee, Ankit Shah, for mixing some tunes while franchisees and store managers visited booths to take advantage of deals. Thank you to our SEI area leaders and field operations teams, along with SEI Senior Director of Franchisee Relations and Engagement Bruce Maples and SEI Senior Manager of Franchise Support Jim Bayci, for attending. We are looking forward to our upcoming Charity Golf Outing and many more events throughout the year. If you’re interested in particiapting, please be sure to email office@midwestfoa.com for more details.

—Güliz Sönmez, Midwest FOA

—Güliz Sönmez, Midwest FOA

2023 ISSUE 2 AVANTI 35

First Quarter Affiliate & Board Meeting

Collaboration and cooperation were the mindset in The Big Easy as NCASEF Board members, franchisees, vendor partners, and SEI guests met at the Westin New Orleans in Louisiana, March 8-10, to participate in the 2023 first quarter Affiliate and Board of Directors meetings. Topics of discussion included store safety, 24-hour operation, the gasoline commission, accounting, the gross profit split, labor issues, and much more.

A day prior to the meeting, a charity golf tournament was held at the TPC Louisiana benefitting Children’s Miracle Network Hospitals. Franchisees and vendors spent a pleasant day networking and having fun on the golf course while raising funds for a worthy cause.

The Affiliate meeting commenced

with NCASEF Chairman Sukhi Sandhu explaining to the assembled vendors that NCASEF is dedicated to establishing a strong and productive relationship with them. As such, he announced that the Affiliate meetings will now be held three times a year, along with the charity golf tournament benefiting CMN Hospitals the day before the meetings. He also thanked the vendors for attending the meeting and participating in the charity golf event.

Kate Burgess of CMN Hospitals presented a recap of the fundraising efforts for the organization, revealing that a total of $242,207 was raised by NCASEF and FOAs in 2022. Vendor Relations and Merchandising Committee Chair Jivtesh Gill followed with a discussion about the benefits of

36 AVANTI 2023 ISSUE 2

Addresses Industry Challenges

being a vendor partner with NCASEF, emphasizing the National Coalition’s unique role in bringing together franchisees, SEI, and vendors to improve business for all parties.

Later that morning, four breakout workshops for Board members and vendors were organized. The groups consisted of Brokers and Wholesalers, Service Providers, Beverage Vendors, and Food Service and DSD Vendors, and each group discussed specific challenges and potential solutions relevant to their respective sectors.

The Brokers & Wholesalers group addressed issues with re-orders and requested FOA event schedules ahead of time for better planning. Service Providers discussed insurance options and safety measures to retain employees

and reduce risky behavior. Beverage Vendors talked about ordering, accounting, and delivery problems, while Food Service & DSD Vendors explored delivery issues and the need for diverse deals at various events.

In the afternoon, SEI guests Raj Kapoor (Senior Vice President, Fresh Food and Proprietary Beverages), Bruce Maples (Senior Director, Franchisee Relations and Engagement), and Randy Quinn (Senior Vice President, Franchise Operations) joined the meeting, with Kapoor stressing the importance of more Affiliate meetings to address the challenges posed by the current economic climate. Factors such as pandemics, supply chain issues, the war in Ukraine, and recession concerns were discussed, along with their impact on

continued on page 38

2023 ISSUE 2 AVANTI 37

7-Eleven. Kapoor also highlighted the importance of vendor partnerships and innovation to ensure store shelves remain stocked, and the development of the new commissary in Virginia and regional distribution centers. Randy Quinn and Raj Kapoor then answered questions from vendors and franchisees. The Affiliate meeting capped off with a tabletop trade show featuring 30 exhibiting vendors showcasing their exciting new products and offering great deals.

On the first day of the Board meeting, Chairman Sukhi Sandhu welcomed the group, recapped the Affiliate meeting, and encouraged Board members to help grow the Affiliate Member Program. Executive Vice Chairman Joe Rossi also mentioned that he had received several suggestions for future meeting locations from Board members and vendors, and will be looking into them with Events Coordinator John Riggio.

SEI Senior Vice President of Franchise Operations Randy Quinn and the other SEI guests then took the proverbial stage. They included Dennis Phelps—Vice President, Item Master; Chethan Makam—Vice President, Merchandising Technology; Scott Albert—Vice President, Product Management-Digital & Delivery; Guyton Gagliardi—Senior Director, Merchandise Accounting & Assistant Controller; Bruce Maples—Senior Director, Franchisee Relations & Engagement; Davina Stevens—Director, Analytics & Audits-Asset Protection; and John Evans—Director, Accounting.

Randy Quinn explained his vision for franchise operations, his goals as vice president, and his approach to solving issues. He emphasized partnership and support and sharing of best practices, and spoke about store simplification rollouts. Chethan Makam explained that SEI now has a Merchandise Tech Taskforce working 24/7 to resolve technology issues, and Dennis Phelps explained the process for escalating issues to the Merchandise Tech Taskforce. The SEI team then spent some time answering questions from Board members covering a range of topics, including the gross profit split, franchisee income, store labor issues, slow ISP connections, digital promotions, Item Master, custom retail pricing, and non-merchandise accounting.

Throughout the meeting vendor presentations were made by Botanic Tonics, Altria, Pepsico, Anheuser-Busch, and NJOY. Several committee reports were also presented, such as Logistics/Simplification, By-Laws, Facility Maintenance, and Convention & Entertainment. The By-Laws Committee presented proposed amendments to certain wording in the NCASEF bylaws, as well as a proposal to change the serving

38 AVANTI 2023 ISSUE 2

continued from page 37

terms for NCASEF officers from three two-year terms to two three-year terms. After some discussion, a motion was made to accept the proposed amendments and the motion passed unanimously.

Also during the meeting, the Board reviewed the Keystone FOA’s NCASEF membership application. After extensive discussion, the Chairman tabled the decision for the following day. Representatives of the Central Texas FOA presented their case for reinstatement into NCASEF and were granted conditional approval by the Board until they satisfy certain conditions by specific dates.

The following day’s Board meeting opened with discussion on the Keystone FOA’s membership application, which was ultimately accepted. Afterwards Chairman Sukhi Sandhu addressed certain agenda items, beginning with nominating Vice Chair Teeto Shirajee as Executive Secretary, which the Board approved. Board members were asked to provide updated lists of officers and designated meeting attendees, and to ensure their FOAs were registered as not-for-profit organizations with their respective Secretary of State. A vote was taken to change the bylaws, making signing the Conflict of Interest clause a one-time requirement for each sitting Board member.

Vendor presentations were given by Blue Triton Brands, Bubbies Ice Cream, and Morinaga. The treasury report, presented by Romy Singh, was approved. General Counsel Eric Karp discussed SEI’s revenue, store closures, the situation involving ValueAct and Seven & i, California’s new franchise law, and provided a brief update on the misclassification lawsuits.

Committee reports were made by Accounting & Finance, Government Affairs/Community Relations, Vendor Relations/ Merchandising, Membership, and Store Profitability/Fuel. These reports covered various topics such as inventory management, labor shortage legislation, vendor relationships, FOA membership numbers, and store profitability solutions. Board members then tackled additional items, including credit card processing fees, store safety issues, and gasoline commissions. Chairman Sukhi Sandhu highlighted the importance of committee work and announced the addition of a Tobacco/Legislative Education Committee, while also combining the Membership and By-Laws Committees.

The next Affiliate and Board of Directors meeting will be held May 15-18 at the Marriott Resort San Juan and Stellaris Casino in Puerto Rico.

2023 ISSUE 2 AVANTI 39

105767 Fresca 8pk 18pk 12oz Can Fresca Mixed Variety 8 Pack 12oz Can 12oz Can Please enjoy responsibly. ©2022 The Coca-Cola Company. "Fresca" and "Fresca Mixed" are trademarks of the Coca-Cola Company. Fresca™ Mixed Tequila Paloma, Tequila with natural flavor, certified colors, and artificial sweeteners, 5% alc/vol, Per 12 fl. oz. average analysis: calories 100, carbohydrates 1.6g, protein 0g, fat 0g; and Fresca™ Mixed Vodka Spritz, Vodka with natural flavor and artificial sweeteners, 5% alc/vol, Per 12 fl. oz. average analysis: calories 100, carbohydrates 1.3g, protein 0g, fat 0g, frescamixed.com

WIN WITH THE TOTAL CONSTELLATION BRANDS SINGLES OFFERINGS 101107 Corona Extra 24oz Bottle 100002 Corona Extra 24oz CN 104874 Corona Premier 24oz CN 102291 Pacifico 24oz CN 102637 Pacifico 32oz Bottle 102559 Corona Familiar 24oz CN 102559 Corona Familiar 32oz Bottle 102444 Victoria24oz CN (available Sept 2022) 000000 Victoria 32oz Bottle 105661 Modelo Oro 24oz CN 105709 Modelo Chelada Sandia Picante 24oz CN 105596 Modelo Chelada Pina Picante 24oz CN 104108 Modelo Especial Chelada 24oz CN 105851 Modelo Chelada Mango Chile 24oz CN 107457 Modelo Chelada Naranja Picosa 24oz CN 101040 Modelo Chelada Limon & Sal 24oz CN SLIN Drink responsibly. . Beer and flavored beer . Imported by Crown Imports, Chicago, IL.

Brain-Freezing Fun At Michigan FOA Stores On ‘Bring Your Own Cup Day’

Franchisee members of the Michigan FOA welcomed Slurpee-lovers to their stores on April 29 to take part in “Bring Your Own Cup Day.” Children and adults of all ages showed up to fill their containers with their favorite Slurpee flavors for just $1.99. And many were creative with their choices of containers— from gallon jugs and coffee urns to small waste baskets and large cooking pots—some literally walked away with as much Slurpee as they could carry.

42 AVANTI 2023 ISSUE 2

The Spring 2023 AFFILIATE MEMBER DIRECTORY

Franchisees: Call or email the representatives below if you have questions for them or simply want to speak to a representative from their company. Please note: This directory is current as of April 27, 2023.

5-Hour Energy

Brad Margheim

14150 Colt Chase Road

Frisco TX 75035

972-948-2481

bmargheim@fivehour.com

Abbott Nutrition

James Spencer

10115 Kingshyre Way

Tampa FL 33647

813-295-3163

james.spencer@abbott.com

Accel Entertainment

Teresa Radtke

140 Tower Drive Burr Ridge IL 60527

630-280-6119

teresar@accelentertainment.com

Acosta Sales & Mktg

Rene Chumbley

605 Promontory Drive Keller TX 76248

817-475-4710

rchumbley@acosta.com

Altria Group Distribution

Erin Haby

2600 Network Blvd., Ste 200 Frisco, TX 75034

830-931-5516

Erin.A.Haby@pmusa.com

Anheuser-Busch, Inc.

John Crerand

225 East John Carpenter Way Irving, TX 75062

908-930-9674

john.crerand@anheuser-busch. com

Aon Risk Services

Tonya Rosales

5005 LBJ Freeway, Suite 1400 Dallas TX 75244

214-989-2349

972-757-3322

214-989-2304

tonya.rosales@aon.com

Atkinson-Crawford

Sales Co.

Butch Henderson

11999 Plano Road, Suite 110 Dallas TX 75243

972-234-0947

972-979-9845

bhenderson@acsales.com

Atmosphere TV

Bianca Gosser

416 Congress Ave. Austin, TX 78701 512-729-5176

bianca.gosser@atmosphere.tv

Bang Energy

Anayansi Ramirez

1600 North Park Dr Weston FL 33326

786-390-2043

anayansi.ramirez@bangenergy.com

Barbot Insurance Services

John Barbot

9001 Grossmont Blvd #711 La Mesa CA 91941

619-337-0290

619-609-1882

619-337-2703

jcbarbot@barbotins.com

Beam Suntory

Jay Hornback

1104 Keighly Crossing Dardenne Prairie, MO 63368 314-368-7429

jay.hornback@beamsuntory.com

BeatBox Beverages

Craig Ritcheson

1023 Springdale Rd #11F Austin TX 78721 805-823-5959

craig@beatboxbeverages.com

BIC USA

Joe Tesauro One Bic Way, Suite 1 Shelton CT 06484 609-651-6046

joe.tesauro@bicworld.com

Bimbo Bakeries/ Barcel USA

Ryan Barrios

11407 N. Weidner Rd San Antonio, TX 78233 210-452-6258

Ryan.Barrios@grupobimbo.com

Blue Triton Brands

Erik Dube

900 Long Ridge Road Stamford, CT 06902 203-241-2653

edward.dube@bluetriton.com

Bon Appetit

Mike Kawas

4525 District Blvd. Vernon CA 90058 913-708-5526

m.kawas@bonappetitbakery.com

Bonya

Joseph Burke PO Box 924 Rye, NY 10580 914-313-6905

josephmburke@gmail.com

Botanic Tonics LLC

Chris Elebesunu 501 West Avenue, Unit 1203 Austin, TX 78701 937-248-3285

celebesunu@botanictonics.com

Bubbies Ice Cream

Emily Notrica

101 N. 1st Ave., Ste. 1725 Phoenix, AZ 85003 480-393-3007 626-627-9424

emily.notrica@bubbiesicecream.co

Bucked Up

Bryan Mazur 2600 Queen Margaret Drive Lewisville, TX 75056 214-226-8192

bryan.mazur@greatpointbrands.co

Bug Juice International

Richard Hunsberger

5520 Wisdom Court Waco TX 76708 214-914-5531

rhunsberger@bugjuice.com

2023 ISSUE 2 AVANTI 43 2023

AFFILIATE MEMBERS

continued from page 44

2023 AFFILIATE MEMBERS

continued from page 43

CAB Enterprises—

Electrolit

Kaitlin Pierce

2700 Post Oak Blvd. Floor 21 Houston, TX 77056

817-333-4196

kaitlinopierce@outlook.com

Campbell’s Snacks

Sabrina Crum

1617 Funny Cide Drive

Waxhaw NC 28173

704-748-3530

sabrina_crum@campbells.com

Canarchy Craft Brewery

Jeff Kataoka

12 Walnut Bay Court Sacramento CA 95831

916-320-4288

jeffk@canarchy.beer

Celsius

Erich Kleeman

2424 N Federal Hwy, Ste 208 Boca Raton, FL 33431

830-456-1738

ekleeman@celsius.com

CENTR Brands

Josh Rosinsky

300-2318 Oak St

Vancouver BC V6H 4J1

646-345-5913

jrosinsky@findyourcentr.com

Coca-Cola

Myrna Hawkins

5800 Granite Pkwy, Suite #900

Plano TX 75024 214-244-9485

mbarronhawkins@coca-cola.com

Congo Brands

Jimmy Gutierrez

7692 Alderwood Ave.

Eastvale, CA 92880

714-604-7039

jgutierrez@congobrands.com

Constellation Brands

Tonya Huff

10110 Robin Hill Lane Dallas TX 75238

469-585-5937

tonya.huff@cbrands.com

Core-Mark International

Rich Haen

1415 W Diehl Rd. Suite 300N Naperville, IL 60563 630-536-3719 937-367-4100

rich.haen@pfgc.com

Country Archer

Adam Vick

1055 E. Cooley Ave. San Bernardino, CA 92408 704-213-2130

a.vick@countryarcher.com

Dafanie Financial

Harris May 850 Pacific Street, 1162 Stamford, CT 06902

203-666-5560 203-536-2069

harris.may@coloniallifesales.com

Danone North America

Rachel Federico 12002 Airport Way Broomfield, CO 80021 303-550-7815

rachel.federico@danone.com

Dreyer’s Grand

Ice Cream

Chip Vineyard 1202 Lakewood Drive McKinney, TX 75072 214-534-5721

chip.vineyard@us.Froneri.com

Ecolab

David Read

116 Dory Ln Stansbury Park UT 84074 413-265-5054

david.read@ecolab.com

Fairlife LLC

Jason Tomlinson

1001 W. Adams Street Chicago IL 60607 740-403-0885

jasont@fairlife.com

Ferrara Candy

Taylor Condon

404 W. Harrison St., Suite 650 Chicago IL 60607 248-877-1847

Taylor.Devine@ferrarausa.com

FIFCO USA

Rodney Norrell

19 Tradewinds Dr. Galveston, TX 77554 409-651-4188 rodney.norrell@fifco.com

Fiji Water

Patrick Haas 11444 W. Olympic Blvd. Suite 210 Los Angeles CA 90064 856-426-2775

patrick.haas@fijiwater.com

Firestone Walker Brewing Co.

Patrick Butler 5161 E Rosewood St. Tucson, AZ 85711 631-965-1939

pbutler@firestonebeer.com

FunkAway

Scott Wood 2401 West 69th Street Mission Hills, KS 66208 773-319-3839

swood@p2mbrands.com

Geloso Beverage Group

Andrew Donohue 683 Westray Drive Westerville, OH 43081 740-317-8251

adonohue@gelosobev.com

Glanbia Performance

Nutrition/Amino Energy

Adam Friday 3500 Lacey Rd., Suite 1200 Downers Grove IL 60515 561-353-8563

adamfriday@glanbia.com

Golden Rates Insurance Agency

Raj Malhi 5025 El Camino Ave. Carmichael, CA 95608 888-819-8384

530-329-4600

raj@goldenratesinsurance.com

Grecian Delight

Kronos Foods

Eliot Kaufman 1 Kronos Drive Glendale Heights, IL 60139 224-300-8241

ekaufman@kronosfoodscorp.com

Green Team Worldwide

Environmental Group

Miglena Minkova 65 Triangle Blvd Carlstadt NJ 07072 973-420-4634

miglena.minkova@greenteamworldwide.com

Happy Dad Hard Seltzer

Sam Shahidi

3011 S Croddy Way Santa Ana, CA 92704 949-370-4000

sam@happydad.com

Heineken USA

Zack Stefanik 222 W Las Colinas Blvd, 1675E Irving, TX 75039 845-391-1760

zstefanik@heinekenusa.com

Hershey Company

Samantha Priest

19 East Chocolate Ave Hershey PA 17033 774-641-3600

sepriest@hersheys.com

44 AVANTI 2023 ISSUE 2

continued on next page

Hostess Brands

Jackie Lawing

9030 County Road 2432

Terrell TX 75160

940-368-4413

972-638-7523

jlawing@hostessbrands.com

HTWO Hydrogen Water

David J Brooks

6339 Charlotte Pike

Nashville, TN 37209

615-961-2300

brooks@industrialsalescorp.com

Impact Sales & Marketing

Diane Drew

1851 Windmill Run

Wimberley TX 78676

512-847-3284

512-563-3947

512-847-7284

ddrew@impact-sales.net

Included Health

Nancy Brock

13230 Ballantyne Corporate Pl.

# 1608

Charlotte, NC 28277

508-630-6162

nancy.brock@includedhealth.com

In Motion Design

Amir Norouzi

7314 Madison Street Paramount CA 90723

562-537-6898

anorouzi@in-motion-design.com

ITG Brands

Michael Espino

11601 Plano Road, Suite 112 Dallas, TX 75243

662-420-4134

michael.espino@itgbrands.com

Johnsonville Sausage

Eugene Rech

PO Box 906

Sheboygan Falls WI 53085

920-453-6960

920-918-9102

920-453-2221

grech@johnsonville.com

JUUL Labs

Lisa Lee

560 20th Street San Francisco CA 94123

706-570-0206

lisa.lee@juul.com

Kellogg’s

Christina Quintana

One Kellogg Square Battle Creek MI 49016

331-703-4511

Christina.Quintana@kellogg.com

Kenny’s Candy and Confections

Stephen Ornell 109 Lakeside Drive Perham MN 56573 972-977-2446

sornell@klnfamilybrands.com

Keurig Dr Pepper

Tom Nawa

5301 Legacy Drive Plano TX 75024 214-212-1232

tom.nawa@kdrp.com

Koia

Linnea Solbrook 5190 Shaw Lane Denton TX 76208 214-843-7012

linnea@drinkkoia.com

LifeMade Products

Colt Bearden 6375 Lansdale Road Fort Worth TX 76116 817-538-8693

Colt.Bearden@lifemadeproducts.com

Liquid Death

Rachel Ridenour

3898 Van Ness Lane Dallas TX 75220

214-558-2482

Rachel@liquiddeath.com

Mad Tasty

Daniel Kelly

4041 Macarthur Blvd, Suite 170

Newport Beach CA 92660

941-527-5749

dankelly@madtasty.com

Mars Wrigley

George Dugan

11404 Maggiore Drive Austin, TX 78739

713-299-1235

george.dugan@effem.com

McLane Company Inc.

Nick Bullard

4747 McLane Parkway Temple TX 76504 414-704-9392

nick.bullard@mclaneco.com

MegaMex Foods/ Hormel—Don Miguel

Todd Ginley

110 Claremont Dr. Ovilla, TX 75154 972-670-8875

twginley@mmxfoods.com