10

Austin South Asian | March 2020

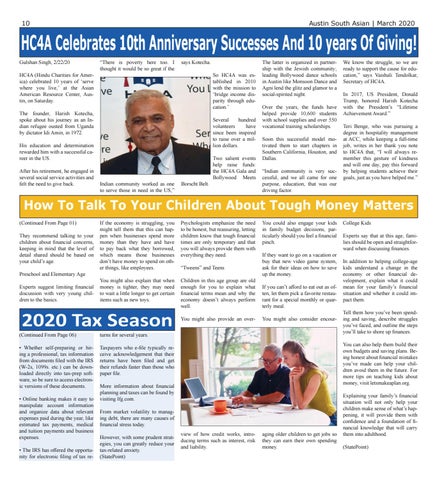

HC4A Celebrates 10th Anniversary Successes And 10 years Of Giving! Gulshan Singh, 2/22/20 HC4A (Hindu Charities for America) celebrated 10 years of ‘serve where you live,’ at the Asian American Resource Center, Austin, on Saturday.

“There is poverty here too. I thought it would be so great if the

says Kotecha. So HC4A was established in 2010 with the mission to ‘bridge income disparity through education.’

The founder, Harish Kotecha, spoke about his journey as an Indian refugee ousted from Uganda by dictator Idi Amin, in 1972.

Several hundred volunteers have since been inspired to raise over a million dollars.

His education and determination rewarded him with a successful career in the US. After his retirement, he engaged in several social service activities and felt the need to give back.

Indian community worked as one to serve those in need in the US,”

Borscht Belt.

Two salient events help raise funds: the HC4A Gala and Bollywood Meets

The latter is organized in partnership with the Jewish community; leading Bollywood dance schools in Austin like Monsoon Dance and Agni lend the glitz and glamor to a social-spirited night. Over the years, the funds have helped provide 10,600 students with school supplies and over 550 vocational training scholarships. Soon this successful model motivated them to start chapters in Southern California, Houston, and Dallas. “Indian community is very successful, and we all came for one purpose, education, that was our driving factor.

We know the struggle, so we are ready to support the cause for education,” says Vaishali Tendolkar, Secretary of HC4A. In 2017, US President, Donald Trump, honored Harish Kotecha with the President’s “Lifetime Achievement Award.” Teri Benge, who was pursuing a degree in hospitality management at ACC, while keeping a full-time job, writes in her thank you note to HC4A that, “I will always remember this gesture of kindness and will one day, pay this forward by helping students achieve their goals, just as you have helped me.”

How To Talk To Your Children About Tough Money Matters (Continued From Page 01) They recommend talking to your children about financial concerns, keeping in mind that the level of detail shared should be based on your child’s age. Preschool and Elementary Age Experts suggest limiting financial discussion with very young children to the basics.

If the economy is struggling, you might tell them that this can happen when businesses spend more money than they have and have to pay back what they borrowed, which means those businesses don’t have money to spend on other things, like employees.

Psychologists emphasize the need to be honest, but reassuring, letting children know that tough financial times are only temporary and that you will always provide them with everything they need.

You might also explain that when money is tighter, they may need to wait a little longer to get certain items such as new toys.

Children in this age group are old enough for you to explain what financial terms mean and why the economy doesn’t always perform well.

2020 Tax Season

(Continued From Page 06)

turns for several years.

• Whether self-preparing or hiring a professional, tax information from documents filed with the IRS (W-2s, 1099s. etc.) can be downloaded directly into tax-prep software, so be sure to access electronic versions of these documents.

Taxpayers who e-file typically receive acknowledgement that their returns have been filed and get their refunds faster than those who paper file.

• Online banking makes it easy to manipulate account information and organize data about relevant expenses paid during the year, like estimated tax payments, medical and tuition payments and business expenses. • The IRS has offered the opportunity for electronic filing of tax re-

“Tweens” and Teens

You might also provide an over-

You could also engage your kids in family budget decisions, particularly should you feel a financial pinch. If they want to go on a vacation or buy that new video game system, ask for their ideas on how to save up the money. If you can’t afford to eat out as often, let them pick a favorite restaurant for a special monthly or quarterly meal. You might also consider encour-

Experts say that at this age, families should be open and straightforward when discussing finances. In addition to helping college-age kids understand a change in the economy or other financial development, explain what it could mean for your family’s financial situation and whether it could impact them. Tell them how you’ve been spending and saving, describe struggles you’ve faced, and outline the steps you’ll take to shore up finances. You can also help them build their own budgets and saving plans. Being honest about financial mistakes you’ve made can help your children avoid them in the future. For more tips on teaching kids about money, visit letsmakeaplan.org.

More information about financial planning and taxes can be found by visiting lfg.com. From market volatility to managing debt, there are many causes of financial stress today. However, with some prudent strategies, you can greatly reduce your tax-related anxiety. (StatePoint)

College Kids

view of how credit works, introducing terms such as interest, risk and liability.

aging older children to get jobs so they can earn their own spending money.

Explaining your family’s financial situation will not only help your children make sense of what’s happening, it will provide them with confidence and a foundation of financial knowledge that will carry them into adulthood. (StatePoint)