ACRE:

An Update on Rural Lending

UNDERSTANDING

THE PRESIDENT

Acts on Debanking

ACRE:

An Update on Rural Lending

UNDERSTANDING

THE PRESIDENT

Acts on Debanking

ARKANSAS BANKERS ASSOCIATION STAFF

President/CEO

Lorrie Trogden

VP/Controller

Carla Brinkley

VP/Professional Development

Kami T. Coleman

Membership & Business Development Associate

Brad Keating

Office Manager

Peggy Hooper

Administrative

Support Specialist

Abi Johnson

EDITORIAL STAFF

Editor Roby Brock

Creative Director / Designer Ashlee Nobel Lee Lee Arts + Design

Contributing Writers

Michael E. Borden, Ian Bryan, Joel D. Feinberg, Trent Flemin, Jim Fuchs, Tim Griffin, French Hill, Kristin Lee, Michael D. Lewis, Susannah Marshall, Lisa H. Miller, David I. Monteiro, Rob Nichols, David E. Teitelbaum, Alexa Poletto, and Thomas G. Ward.

The Arkansas Banker (ISSN 004-1726) is published quarterly by the Arkansas Bankers Association, 1220 West Third Street, Little Rock, AR 72201. Phone: 501.376.3741. Periodical postage paid at Little Rock, AR. Postmaster: Send address changes to Arkansas Bankers Association, 1220 West Third Street, Little Rock, AR 72201. Subscription to The Arkansas Banker magazine is included in the membership fees to the Arkansas Bankers Association. Cover price is $5.95 each. Annual subscription rates are $40.00 for members and $60.00 for non-members.

Federal tax law prohibits the deduction of lobbying expenses for federal incomes tax purposes. Organizations like ABA, which assess member dues, are required by law to notify their members of the portion of their dues attributable to lobbing/and therefore non-deductible on your federal tax return. For the year 2024, it is estimated that 9.91% of your dues will be attributable to lobbing as defined by the IRS. Contributions to ABA are not charitable contributions, however, they may be deductible as a legitimate business expense.

Chairman’s Column Washington Update

Commissioner's Column Ascending Bankers

The President aims to protect conservatives from discrimination.

The latest from D.C. on helping farm lenders.

Tax Provisions for Rural & Agricultural Loans

What you need to know.

Customer Data

Be confident that your data is in good shape.

Regulated Payment

Stablecoins

What is it and who can issue?

New Fraud Task Force

Find out how you can help.

Financial Innovation

The integration of digital assets into global payment systems.

Bank Management Seminar Recap

Banking leaders convened in Branson, MO at this annual event.

Congrats to Graduates

Arkansas bankers who graduated from prestigious schools of banking and Supervisor Boot Camp.

NEWS & MOVES

Lorrie Trogden | President & CEO | Arkansas Bankers Association

There are a variety of things going on around the ABA and in Washington, and our Q3 magazine takes a deeper dive into several of those with in-depth articles.

In his column, Chairman Chris Gosnell covers the issues we talked about in midSeptember with our federal delegation, regulatory agencies and the White House Office of Public Engagement. I was lucky enough to get to stay an extra day to attend Governor Micki Bowman’s swearing in as the Vice-Chairman of Supervision at the Federal Reserve.

Chairman French Hill has been hard at work as the head of the House Financial Services Committee, passing over 80 bills out of committee. He told us that he would like to package the banking and housing bills together to take to the floor for a vote this fall – perhaps late October. It will then be up to the Senate to get them to the finish line.

We all know that the GENIUS Act passed and is now law, and the CLARITY Act passed the House, but now what? The Senate has not taken up the CLARITY Act but has released a draft text of its own market structure bill. As you’ll see in Chris’ column, there are loopholes in GENIUS that need to be fixed. Those currently are not included in the Senate draft text and we will continue to lobby about what needs to be fixed. If the Senate passes its own bill, the two bills will have to go to a conference committee to hash out a final bill, or the House can take up the Senate’s bill.

The Association is hard at work finding education and any other resources we can offer to help you create your strategy around digital assets.

Congressman Hill indicated there will likely be a conference. In the meantime, regulatory agencies are tasked with creating new regulation to implement the GENIUS Act. The Association is hard at work finding education and any other resources we can offer to help you create your strategy around digital assets.

Congressman Hill also indicated there are two important House committee hearings on the horizon this fall about the deposit insurance fund and about fraud. These are both needed, and we asked him to be sure and include telecoms, social media companies and the USPS as witnesses in the fraud hearing. It should not and cannot be a problem that banks are left to manage on our own.

Chris Gosnell, Chairman Farmers Bank & Trust Company, Magnolia

Jason Tennant, Chairman-Elect CS Bank, Eureka Springs

Jeff Lynch, Vice Chairman Eagle Bank & Trust Company, Little Rock

Jay Wisener, Treasurer First National Bankers Bank, Little Rock

Lorrie Trogden, President & CEO

Arkansas Bankers Association, Little Rock

We are still short of this year’s state and federal PAC goals, so please consider holding your own 13th Board Meeting and having your bank and its holding company participate in our state PAC.

Speaking of fraud, the ABA has created a new Security/Technology Section and a community forum for your bankers to utilize. If they are in that job role in our database, they have been added to the Section and should be receiving community forum posts in their email. If they need to be added, please let us know – it is so very important that we are able to quickly share with one another when something happens. The most recent posts have been about the rash of ATM jackpotting going around Arkansas.

I appreciate all of you that have allowed me to visit you for 13th Board Meetings. It makes all the difference for our federal PAC and allows me the opportunity to share with you and your board our important advocacy work and other hot button items. We are still short of this year’s state and federal PAC goals, so please consider holding your own 13th Board Meeting and having your bank and its holding company participate in our state PAC. Your contributions are what help win races for candidates that are friends of banking.

I’ll end with what I heard a speaker say in a conference recently that moved me – “My dad took every opportunity to talk to us about what a great country we live in.” The veterans that you see profiled in this issue are just a couple of the folks who make this country great, and we are so thankful for their service. I decided that I need to do a better job talking about how great our country is, and this is my start. God bless the great state of Arkansas and God bless America!

Lorrie Trogden, President & CEO

Chip Blanchard, Russellville

Keith Bowles, Bentonville

Ian Bryan, Russellville

Robin Hackett, Greenbrier

Heather Jones, Little Rock

Rob Lance, Jonesboro

Katherine Mitchell, White Hall

John Olaimey, Little Rock

Calvin Puryear, Dumas

Randy Rawls, Warren

Lori Ross, Arkadelphia

Brent Taylor, Van Buren

Rob S. Tiffee, Little Rock

Mark Wilson, Jacksonville

Ron Witherspoon, Little Rock

Jim Youngblood, McGehee

Ijoined other Arkansas bankers in Washington, D.C., for our Fall Fly-In. This event was an opportunity to discuss what matters to Arkansas banks, our customers, and the farmers and businesses that support our communities.

We had the chance to meet with every member of our delegation: Senators Tom Cotton and John Boozman staff, along with Representatives French Hill, Bruce Westerman, Rick Crawford, and Steve Womack. Each discussion focused on similar issues—protecting Arkansas’ economy, addressing fraud, updating deposit insurance, and staying ahead of digital assets to prevent an uneven playing field.

After last week’s Senate Banking Committee hearing, deposit insurance is a hot topic in DC. Senators Hagerty and Alsobrooks recently introduced an amendment, the “Hagerty amendment,” with the goal of having it added onto NDAA legislation. While it will not be added to the NDAA, the Senators have indicated they will run a standalone bill. Bill text has not been released to date, and while we have no official comments until reading the bill, we can all agree that modernization is needed. We emphasized that reform needs to create stability and fairness, enabling community banks to protect their customers without being sidelined by the system.

Arkansas farmers face significant stress. Input costs are rising, commodity markets are unstable, and weather patterns are increasingly erratic. Much of these discussions went towards the necessity for quick action to assist farmers, as most growers have used all their cash on hand as well as depleted the equity they held on their balance sheets. Very few cash flows have a positive margin even with the ARC/PLC payments figured into the equation, which is why we advocated for a “bridge” payment for 2025 to get

farmers to the fall of 2026 at which time the export markets pick up. Until this occurs, subsidy payments will be necessary because cash flows on crop prices alone do not work in the current agriculture economy.

“Americans are under attack” was the message to the Arkansas delegates as well as the OCC, Fed, FDIC and Treasury. Fraud is draining resources from banks and customers. Scams and non-card payment fraud have reached record levels, and current regulations often hinder more than they help by requiring resources for low risk “check the box” tasks and not preventative and educational efforts. We need Congress to enhance important tools, including:

• Real-time fraud alert systems that can prevent losses

• Improved clarity on data sharing under Section 314(b)

• A true risk-based approach to BSA/ AML that minimizes paperwork and focuses on real threats

Also, there should be a hearing that includes large telecommunication companies, social media, and even the US Post Office. After all, these companies know who is sending the phishing text messages and emails as well as how to stop them.

Scams and non-card payment fraud have reached record levels, and current regulations often hinder more than they help...

The rise of digital assets, particularly stablecoins, presents both risks and opportunities. Big tech and fintech companies are pushing for national bank charters through the OCC, without the same regulations that community banks face. We asked for:

• A consistent regulatory framework that addresses gaps and protects consumers

• Regulations that prevent digital asset firms from selectively choosing rules

• Maintaining state authority and the dual banking system

Arkansas banks can innovate, but we can’t compete if regulators allow nonbanks to operate without oversight.

Advocacy is most effective when it is direct and as Arkansans, we are fortunate to have our representatives who are in positions to make long-lasting positive impact for Arkansas and the United States.

I’m thankful to the Arkansas Bankers Association for leading this effort and to FHLBank Dallas and Forvis Mazars for their sponsorship support. As we left D.C., I was reminded that we must continue to speak up — loudly and clearly - for Arkansas banking and the communities we serve.

WEDNESDAY 9 A.M. – 4 P.M.

Turn numbers into knowledge! During this session, we’ll discuss some of the key elements in the underwriting process for Commercial Lending. Through analyzing the customer’s tax return and financial statements we can learn to assess their capacity to repay the loan and whether the risks associated with the request comply with the bank’s tolerance.

INSTRUCTOR: Adam Trower

LOCATION: ABA Professional Development Center, 1220 W. 3rd St., Little Rock, AR

THURSDAY 9 A.M. – 4 P.M. LOAN

This popular training event is designed to provide lending knowledge and administrative effectiveness of one of the most important positions in a community bank’s lending staff – the loan assistant/loan processor. All of the objectives of this program are directed at increasing the performance effectiveness of these individuals.

INSTRUCTOR: Adam Trower

LOCATION: ABA Professional Development Center, 1220 W. 3rd St., Little Rock, AR

16 21 22

THURSDAY 9 A.M. – 4 P.M.

Managing risk is the #1 priority for all financial institutions, starting at the new account desk. If a criminal cannot open a bank account, they cannot negotiate a stolen check, embezzle from their employer, or steal from your organization. Welltrained new account personnel and universal bankers are the first lines of defense. The 200+ page detailed manual, included in the registration and customized to your state law, has become an invaluable resource for banks.

INSTRUCTOR: Matt Dickinson

LOCATION: ABA Professional Development Center, 1220 W. 3rd St., Little Rock, AR

TUESDAY 5 P.M. –WEDNESDAY 3 P.M.

This conference offers a unique educational experience focused on banking industry trends, leadership development skills, and peer networking opportunities. The Ascending Bankers Section of Arkansas works to engage, connect, and empower banking professionals from around Arkansas to shape and lead the future of the financial industry. Get access to top industry thought leaders and grow your network. Share ideas with your peers and get strategies for solving your challenges. Get answers to professional problems that you can put into action. Gain insight to help you influence positive change within your organization.

LOCATION:

Clinton Presidential Center, Little Rock

28

TUESDAY 9 A.M. – 4 P.M.

This program builds upon the base knowledge, duties, and responsibilities of board members. Board duties also include a role in the development and maintenance of Asset Quality, monitoring the health and performance of the loan portfolio, and a sound relationship with regulatory authorities. Note: You do not have to complete Bank Directors Workshop part I to attend part II.

INSTRUCTOR: David Kemp

LOCATION: ABA Professional Development Center, 1220 W. 3rd St., Little Rock, AR

29 30

WEDNESDAY 9 A.M. –THURSDAY 4 P.M.

This two-day program is designed to provide lenders and analyst the tools required to understand and use financial information provided by borrowers. Good loan officers are able to provide value-added information that allows their borrowers to make better business decisions.

INSTRUCTOR: David Kemp

LOCATION: ABA Professional Development Center, 1220 W. 3rd St., Little Rock, AR

29

WEDNESDAY 10 A.M. – 3 P.M. CPE DE MAYO:

Join the professionals from Crowe LLP as they discuss the latest accounting, financial reporting, and tax updates.

INSTRUCTOR: Crowe LLP

LOCATION: ABA Professional Development Center, 1220 W. 3rd St., Little Rock, AR

FOR MORE INFORMATION ABOUT ABA TRAINING & EVENTS, AND TO REGISTER, LOG ON TO

MONDAYS 10 A.M. – 12 P.M. SUCCESSION PLANNING WORKSHOP SERIES

This two-part virtual workshop series (held on November 3 & 17) is designed to help community banks establish a robust succession planning process. Participants will learn how to create a comprehensive succession plan, conduct talent assessments to identify skills gaps, and develop personalized development plans for their successors, focusing on leadership, management, and technical skills. Note: This workshop is presented in conjunction with the Iowa Bankers Association.

INSTRUCTOR: Marci Malzahn

LOCATION: Virtual

WEDNESDAY 9 A.M. – 4 P.M.

Bank security officers are challenged each day to be aware of the perils affecting their banks, while also modifying the policies, procedures, and practices to prevent losses. As we confront increasing threats worldwide, it has become more essential than ever for you and your security team to ensure your bank’s security program can address today’s wide range of physical and virtual threats. This conference will provide you with an opportunity to learn from industry experts, network with colleagues, and visit with exhibitors to see and experience the latest in products and services. Note: The Security Conference has replaced the Security track at our Mega Conference. This is now a stand-alone annual event.

LOCATION: ABA Professional Development Center, 1220 W. 3rd St., Little Rock, AR

THURSDAY 9 A.M. – 4 P.M.

Technology and innovation have been transforming financial services since long before artificial intelligence and iPhones, and your role as an IT professional is everchanging. This event is designed to provide support as you keep on top of technology trends, navigate the business of banking, and build your bank’s technology strategy. This conference will provide you with an opportunity to learn from industry experts, network with IT colleagues, and visit with exhibitors to see and experience the latest in products and services.

LOCATION: ABA Professional Development Center, 1220 W. 3rd St., Little Rock, AR

MONDAY 9 A.M. –FRIDAY 5 P.M.

The ABA Commercial Lending School prepares commercial lenders who have not been exposed to formal commercial lending education or lenders who want to broaden their commercial lending knowledge. This school is an intensive, one-week course that exposes students to the major issues commercial lenders face. Eleven different instructional modules throughout the week along with group case study work will address multiple topics and are taught and led by top-notch banking veterans who will give you plenty of opportunity to ask questions, share concerns, and learn from the best! Please note: This school assumes a working knowledge of commercial lending.

INSTRUCTOR: Ron Rushing & Tom Wiley

LOCATION: ABA Professional Development Center 1220 W. 3rd St., Little Rock, AR

Live events are subject to a virtual learning environment. For more information, contact the ABA at (501) 376-3741 or Kami Coleman at kami.coleman@arkbankers.org.

Rob Nichols | President and CEO | American Bankers Association

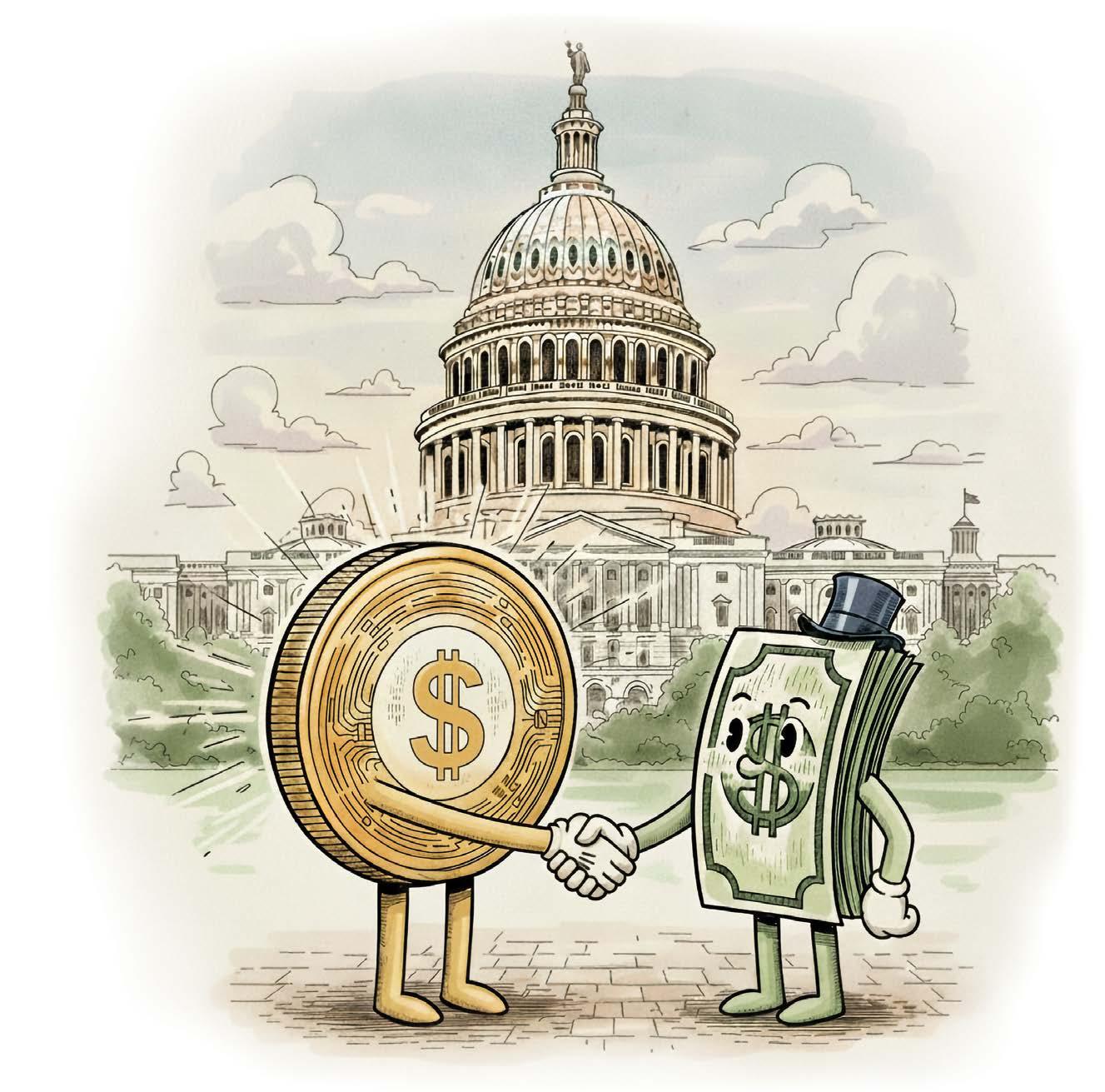

Earlier this summer, President Trump signed into law the Genuis Act, a long-awaited bill that will kickstart the development of a new regulatory framework for stablecoins in the U.S.

Stablecoins like Tether, Circle and others currently have a market cap of about US $275 billion—a relatively small fraction of the total money supply in the U.S. Nonetheless, interest in stablecoins has grown rapidly in recent months.

In simplest terms, stablecoins are digital assets that are designed to maintain a stable value over time, and that are pegged to a reference asset like the U.S. dollar on a one-to-one basis. They can function as both a store of value and a means of payment, and there are several potential use cases that are starting to emerge, from cross-border payments to integration into smart contracts.

ABA has been closely following the conversations around the future of stablecoins, and we were engaged on behalf of our members as lawmakers debated and refined the Genius Act prior to its passage. Our input, which included feedback from bankers and our state association alliance partners, helped shape a better legislative outcome for the banking industry, though as with most pieces of legislation there remain areas we’d like to see improved.

Among our top priorities was ensuring that banks are not disintermediated by stablecoins issuers incentivizing customers to hold their money in the form of stablecoins instead of bank deposits. We also advocated for a framework that would ensure that America’s banks have the freedom to participate in the stablecoin ecosystem if they choose.

“With the Genius Act now law, bank and credit union subsidiaries, along with national trusts and nonbanks can apply to become stablecoin issuers.”

With the Genius Act now law, bank and credit union subsidiaries, along with national trusts and nonbanks can apply to become stablecoin issuers, but lawmakers included a key exclusion for non-financial public companies to maintain an important firewall between banking and commerce—a principle ABA has long supported.

The law also includes several key prohibitions applied to payment stablecoin issuers that ABA supports, including those preventing pledging of stablecoin reserves; paying interest or yield to holders of payment stablecoins; and the misrepresentation of insured status of payment stablecoins, among other things. As I write this, we are actively engaged on the Hill trying to strengthen some of these provisions through separate but related digital asset legislation focused on market structure.

“Among our top priorities was ensuring that banks are not disintermediated by stablecoins issuers incentivizing customers to hold their money in the form of stablecoins instead of bank deposits.”

The Genius Act places rulemaking authority in the hands of the banking agencies, which means that banker engagement will continue to be critical in the months ahead as these rules are crafted, as more than a dozen rulemakings are expected related to this new law. ABA is continuing to engage through its Digital Assets Working Group—a banker driven advisory panel that convenes ABA members from across the country, led by our Office of Innovation. We have also made a comprehensive suite of resources—including a full summary of the Genius Act and associated rulemakings—available for our members at aba.com/stablecoin. More than 2,100 bankers participated in a recent ABA webinar on the topic.

As we work to shape the future of stablecoin regulation, ABA remains committed to helping banks responsibly meet customer demand for digital assets, including stablecoins and other cryptocurrencies, while mitigating the risks that these emerging products and technologies may pose to consumers and the broader financial system. Our goal will always be a fair and level playing field on which banks and other financial service providers can compete.

Email Rob at nichols@aba.com

In my column last quarter, I wanted to more fully introduce the readers to the topic of stablecoins. Fast forward to today, this topic has gained momentum, and we now have a more substantive basis for discussing digital assets and the financial services industry, including the commercial banking sector, specifically focusing discussions on stablecoins. On July 18, 2025, President Trump signed into law the “Guiding and Establishing National Innovation for U.S. Stablecoins Act” or more commonly known as the “GENIUS Act.” This law creates a comprehensive and federal regulatory framework for payment stablecoins in this country and paves the way for the United States to more holistically enter the global digital asset market. The legislation passed through both the U.S. Senate and the U.S. House of Representatives with comfortable margins signaling notable bipartisan engagement and support for the proposal. The GENIUS Act became law the day after it passed the House of Representatives. What does the GENIUS Act do? Generally, the Act:

• Defines which state and federal entities, including a subsidiary of an insured depository institution and credit unions, may be a permitted stablecoin issuer. Permitted stablecoin issuers may also include uninsured national banks, a federal nonbank entity and certain state issuers.

• Identifies primary regulators for permitted stablecoin issuers.

• Bars permitted stablecoin issuers from paying interest.

• Places some limitations on permitted activities of payment stablecoin issuers.

• Requires issuers to maintain reserves on a 1:1 basis.

• Includes requirements for BSA/AML standards.

• Provides that stablecoins are not FDIC insured.

• Imposes regulatory requirements regarding capital, liquidity and risk management among other supervisory functions.

The rulemaking process is beginning and additional work on the application of the law will occur in the coming months. The Act takes effect the earlier of 18 months after enactment and 120 days after the primary federal payment stablecoin regulators issue any final regulations implementing the Act.

In addition to the stablecoin vote on July 17, 2025, the House also successfully passed two other digital asset related bills which now await action by the Senate. The first of these two bills is the “Digital Asset Market Clarity Act” also known as the “Clarity Act.” The

I strongly encourage bankers and others in the financial services industry to stay abreast of developments in relation to the Clarity Act.

Clarity Act also received bipartisan support with a strong majority voting in favor of the bill. The Clarity Act is commonly known as the “market structure” legislation which would further Congress’ work on creating a digital asset framework and provide a clear determination for digital asset authorities by the Commodity Futures Trading Commission and the Securities and Exchange Commission. The second bill passed by the House is the “Anti-CBDC Surveillance State Act.” CBDC stands for central bank digital currency. You may recall that during the most recent Arkansas legislative session, lawmakers in our state also passed CBDC legislation now known as Act 50 of 2025 which ensures that the definition of money does not include CBDC according to Arkansas law.

As with the stablecoin legislation, I strongly encourage bankers and others in the financial services industry to stay abreast of developments in relation to the Clarity Act. After the August recess, the U.S. Senate will continue their work on their version of market structure legislation, the Responsible Financial Innovation Act of 2025. Combined, these legislative actions have and will continue to build the regulatory foundation for the next generation of financial innovation and advancement in digital assets. With more than $250 billion in stablecoins in existence today, we must be prepared to fully create, implement and embrace a solid foundation for industry adoption and regulatory oversight for this activity. As I mentioned last quarter, we may not see a rapid shift by consumers and bank customers as it relates to stablecoins, but we must all be prepared to appropriately address this next chapter in financial services. As I meet with Arkansas bankers, I will inquire about what you are seeing or hearing in relation to customer interest in stablecoins and I will work to continue the conversation by providing additional information and engagement on this very important topic.

minutes with...

Brandon Knowlton

AVP/Consumer & Mortgage Loan

Officer

Southern Bancorp | Helena-West Helena and Jonesboro

“ I am 35 years old,

born and raised in West Helena, AR.

I

am responsible for providing services to customers seeking consumer loans, all types of real estate loans, and commercial loans.”

Q. HOW DID YOU GET STARTED IN BANKING?

A.

I got started in banking during my college internship. It was my first real exposure to the banking industry. I didn’t originally plan on going into banking, but during that internship I found myself really drawn to the work – especially the way it combined analytical thinking with real-world financial impact.

Q. WHAT’S THE DIFFERENCE BETWEEN A BOSS AND A LEADER?

A.

The difference between a boss and a leader comes down to approach. A boss gives directions and focuses on authority, while a leader inspires, supports, and works alongside their colleagues.

Q. WHAT PIECE OF ADVICE DO YOU WISH YOU HAD KNOWN WHEN YOU STARTED YOUR CAREER?

A. Looking back, I wish I had known just how important relationships are in banking. At first, I thought success would come mostly from technical knowledge and numbers, but I quickly realized that building trust with customers and colleagues is just as critical. If I had focused on that earlier, I would have accelerated my growth even more.

Q. WHAT ADVICE DO YOU HAVE FOR YOUNG BANKERS STARTING THEIR CAREERS?

A. I would tell young bankers to be patient and stay curious. Banking is a career where the more you learn, the more value you bring. Don’t be afraid to ask questions, seek out mentors, and take on challenges.

Q. WHAT IS THE BEST ADVICE YOU EVER RECEIVED?

A. The best advice I ever received was, “Don’t be afraid to ask questions – it’s how you grow.” Learning to ask, listen, and learn has made me a stronger banker.

Q. WHAT IS THE BEST PART OF BEING A HOMETOWN BANKER?

A. The best part of being a hometown banker is the personal connection you build within the community. You know your customers personally, build trust and relationships, and support local growth.

Q. WHAT TIME DO YOU GET UP IN THE MORNING?

A. 5:00 a.m.

Q. COFFEE, TEA, OR SODA?

A. Black coffee, no sugar, no cream.

Ian Bryan | Chairman | Ascending Bankers Section

In a profession known for precision, performance, and progression, it’s easy to fall into the mindset that banking success is a solo climb. But as anyone who’s weathered the complexities of today’s industry can tell you—no one ascends alone. That’s where the power of peer networks comes in. As emerging leaders in banking, we’re operating in an era defined by complexity, rapid change, and growing interdependence. The days of isolated career advancement are behind us. In their place is a new model: collective leadership.

“Peer relationships give us what no seminar or leadership book can: lived, unfiltered experience from those walking beside us.”

When we surround ourselves with a strong network of peers— people at similar stages in their careers, facing similar challenges—we create a system of shared learning, mutual support, and real-time feedback. Peer relationships give us what no seminar or leadership book can: lived, unfiltered experience from those walking beside us.

At the Ascending Bankers Section, we see this every day. Whether it’s during roundtable discussions, informal mentorships, or community initiatives, we witness young professionals finding both insight and inspiration in each other’s stories. Someone might share how they navigated their first compliance audit, or how they handled the pressure of their first loan committee meeting. These aren’t just conversations, they’re accelerators for growth.

Collective leadership also means widening the lens. Peer networks naturally encourage more diverse perspectives. They push us to consider different leadership styles, communication approaches, and problem-solving strategies. This isn’t just good for our personal development, it’s good for our institutions. Teams led by collaborative, well-rounded leaders are better equipped to adapt, innovate, and connect with the communities we serve.

Importantly, peer networks are also a buffer against burnout. The challenges of banking, especially early in your career, can feel isolating. But having a trusted group to turn to, even just to vent or exchange advice, can make all the difference in staying motivated and resilient.

So, what does it take to build a strong peer network? First, show up. Attend events, volunteer for committees, or simply reach out to someone whose perspective you respect. Second, give as much as you get. The most powerful connections are based on mutual investment. And third, be authentic. We grow more when we bring our full selves into the room—questions, mistakes, and all.

What’s also exciting is that peer networks often serve as springboards to broader leadership opportunities. Many of the most visible leaders in banking today began by taking on small committee roles, sharing their perspectives in young professional forums, or collaborating with peers on passion projects. These small steps build confidence, credibility, and visibility—all critical as we continue to grow.

At the Ascending Bankers Section, we’re not just investing in individual careers, we’re building the foundation for a more inclusive, dynamic, and forward-thinking banking industry. We’re proud to offer platforms where young professionals can not only network but truly lead. And we’re just getting started.

As Chairman, I’ve seen the incredible momentum that comes when driven individuals come together—not just to climb, but to lift each other up along the way. That’s the spirit we’re cultivating: one where leadership isn’t about being the loudest voice but about creating space for every voice.

Let’s keep building that space. Let’s keep ascending—together.

E. Teitelbaum

Joel D. Feinberg

Thomas G. Ward

David I. Monteiro

Lisa H. Miller

Michael E. Borden

Michael D. Lewis

Kristin Lee

On August 7, 2025, President Donald Trump signed an executive order titled “Guaranteeing Fair Banking for All Americans,” directing federal agencies to combat “debanking” — the denial or termination of financial services based on political views, religious beliefs, or industry affiliation.

The executive order expands on numerous recent federal and state initiatives targeting debanking — including the joint U.S. Department of Justice (DOJ)/Commonwealth of Virginia Equal Access to Banking Task Force, two recent bills introduced in the U.S. Senate, and actions by the federal financial regulators to remove “reputation risk” as a supervisory consideration.

This Update examines the executive order, the existing debanking initiatives, and the implications for financial institutions navigating the second Trump administration’s increasingly high-stakes regulatory landscape. Notably, the executive order requires federal regulators to review past practices within 120 days, making attention to the executive order implications a priority for regulated institutions.

President Trump’s fair-banking executive order is designed to ensure that federal regulators do not promote policies and practices that allow financial institutions to deny or restrict services based on political beliefs, religious beliefs, or lawful business activities, ensuring fair access to banking for all Americans.

Section 1 of the executive order provides context for the Trump administration’s concerns, including that “[s]ome financial institutions participated in Government-directed surveillance programs targeting persons participating in activities and causes commonly associated with conservatism and the political right following the events that occurred at or near the United States Capitol on January 6, 2021.” According to the order, Americans may not be denied access to financial services based on constitutionally or statutorily protected beliefs, and “[b]anking decisions must instead be made on the basis of individualized, objective, and risk-based analyses.”

The executive order goes on to define “politicized or unlawful debanking” as restricting or modifying access to financial services “on the basis of the customer’s or potential customer’s political or religious beliefs, or on the basis of the customer’s or potential customer’s lawful business activities that the financial service provider disagrees with or disfavors for political reasons.”

The implementation of the order falls primarily to the Secretary of the Treasury and the federal banking regulators, which are defined to include the Small Business Administration (SBA) and federal member agencies of the Financial Stability Oversight Council with supervisory authority over banks, savings associations, or credit unions.

Key provisions of the executive order:

Guidance Withdrawal and Reform. Section 4(a) directs federal banking regulators to remove reputation risk and other equivalent concepts that enable politicized or unlawful debanking from all guidance documents, examination manuals, and other materials within 180 days.

SBA Requirements. Section 4(b) requires the SBA to notify lenders that participate in its loan guarantee programs of the applicable requirements of the executive order within 60 days. These institutions must then, within 120 days, identify and attempt to reinstate former clients and former applicants that were denied services or payment processing due to politicized debanking in violation of SBA requirements and notify affected parties of their renewed eligibility.

• Within 120 days, per Section 5(b), regulators must identify financial institutions with “past or current, formal or informal, policies or practices that require, encourage, or by David

Strategic Development. Section 5(a) directs the Secretary of the Treasury to develop within 180 days “a comprehensive strategy for further measures to combat politicized or unlawful debanking activities of financial regulators and financial institutions across the Federal Government, including consideration of legislative or regulatory options to eliminate such debanking.”

Retroactive Review and Enforcement. Sections 5(b) and (c) requires federal banking regulators to review financial institutions for past or current policies encouraging politicized or unlawful debanking and take remedial actions. Specifically:

Alexa Poletto

otherwise influence such financial institution to engage in politicized or unlawful debanking and to take appropriate remedial action,” including levying fines, issuing consent decrees, or imposing other disciplinary measures for violations of applicable law.

• Within 180 days, per Section 5(c), regulators must review supervisory and complaint data to identify institutions that engaged in unlawful debanking based on religion and, if appropriate, refer such matters to the Attorney General “for an appropriate civil action” if the institution “is unable to obtain compliance within the meaning of 15 U.S.C. 1691 and 1691e(g)” under the Equal Credit Opportunity Act (ECOA).

The White House fact sheet accompanying the executive order identifies digital-asset firms as having been targets of unfair debanking practices. To that end, the fact sheet notes that “President Trump has already ended Operation Chokepoint 2.0 once and for all by working to end regulatory efforts that deny banking services to the digital assets industry.”

The fair-banking executive order builds on the recently announced DOJ/Virginia Equal Access to Banking Task Force, announced on April 28, 2025, by U.S. Attorney Erik S. Siebert of the Eastern District of Virginia, Assistant Attorney General Harmeet K. Dhillon of the DOJ Civil Rights Division, and Virginia Attorney General Jason Miyares.

The Virginia Equal Access Task Force was formed to investigate debanking — when banks refuse customers access to credit and other financial services based on impermissible factors under current federal and state law. The task force determines whether allegations warrant government enforcement action or criminal prosecution and works with federal financial regulatory agencies to “bring the full power of the federal government to bear on this important issue.”

While explicitly focused on “allegations of debanking actions taken against Virginians,” the task force accepts nationwide complaints through the Civil Rights Division’s portal and coordinates with federal regulators — positioning it as a potential model for broader DOJ enforcement efforts.

Since President Trump’s second inauguration, Congress has pursued complementary anti-debanking legislation. Republican Sen. Kevin Cramer of North Dakota reintroduced the Fair Access to Banking Act in February, which would penalize financial institutions that deny services to creditworthy customers engaged in lawful businesses. The following month, Senate Banking Committee Chairman Tim Scott, Republican of South Carolina, introduced the Financial Integrity and Regulation Management (FIRM) Act to eliminate reputational risk from bank supervision.

The Fair Access to Banking Act, as characterized by Sen. Cramer, builds on the original Fair Access Rule from President Trump’s first administration, which required financial institutions to make individual risk assessments rather than broad decisions regarding entire industries. The Biden administration paused the rule’s implementation in early 2021, but Sen. Cramer’s legislation would establish these protections permanently.

The FIRM Act would statutorily eliminate “reputational risk” as a supervisory measure by removing all references from safety and soundness determinations, prohibiting federal banking agencies from promulgating new rules using reputation risk, and requiring agencies to report to Congress on their elimination of reputation risk from supervisory frameworks. Chairman Scott characterized the FIRM Act as addressing the “weaponization of federal banking agencies,” stating that “federal regulators have abused reputation risk by carrying out a political agenda against federally legal businesses.”

Both bills have received endorsements from financial industry groups including the American Bankers

Association, Bank Policy Institute, and Financial Services Forum as well as organizations representing potentially affected industries such as the Blockchain Association and National Shooting Sports Foundation.

Following Sen. Scott’s introduction of the FIRM Act, federal banking regulators began eliminating reputation risk from supervision. The OCC acted first on March 20, 2025, with Acting Comptroller Rodney E. Hood directing examiners to focus on measurable, objective risk categories — credit, operational, compliance, and strategic risk — rather than subjective notions of reputation risk. In an April 8, 2025, speech, FDIC Acting Chairman Travis Hill stated that the FDIC is working on a rulemaking that would “prohibit FDIC supervisors from (1) criticizing or taking adverse action against institutions on the basis of reputational risk and (2) requiring, instructing, or encouraging institutions to close, modify, or refrain from offering accounts on the basis of political, social, cultural, or religious views.” On June 23, 2025, the Federal Reserve Board announced that reputational risk will no longer be a component of examination programs in its supervision of banks. The fair-banking executive order now mandates this practice across all federal banking regulators.

Multiple states have also enacted legislation addressing debanking concerns. Tennessee enacted a fair access law on April 22, 2024, prohibiting financial institutions and insurers from denying services based on political views, religious beliefs, or any factor that is not a quantitative, impartial, and risk-based standard. Florida expanded its fair access law in May 2024, extending coverage to out-of-state financial institutions doing business in Florida and establishing a customer complaint process with the state’s Office of Financial Regulation. Similar legislation has been introduced in nine additional states: Arizona, Georgia, Idaho, Indiana, Iowa, Kentucky, Louisiana, South Dakota, and South Carolina, demonstrating growing momentum for state-level fair access protections.

Texas and West Virginia have taken a different approach, using state contracting power to combat

industry-specific debanking. Rather than mandating fair access directly, these states restrict government business with financial institutions that deny services to disfavored sectors. Texas Government Code Chapter 2274 prohibits state contracts with companies that discriminate against firearm and ammunition industries, while Chapter 809 requires state divestment from financial companies that boycott energy companies. West Virginia Code § 12-1C-1 et seq. similarly restricts state business with financial institutions that boycott fossil fuel companies.

The timelines in the fair-banking executive order are short. Within 120 days, regulators must identify financial institutions with “past or current, formal or informal, policies or practices that require, encourage, or otherwise influence such financial institution to engage in politicized or unlawful debanking and to take appropriate remedial action,” including levying fines, issuing consent decrees, or imposing other disciplinary measures for violations of applicable law. That means regulators will be calling imminently.

In assessing what steps to take in response, financial institutions should be particularly mindful of two things that the fair-banking executive order does not do. First, the order does not create new legal grounds for action; it implicitly acknowledges that the banking agencies and DOJ, in scrutinizing banks’ choices, will likely be constrained to enforcing three key statutes: ECOA, Section 5 of the Federal Trade Commission Act (FTC Act), and Section 1031 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Second, the executive order does not excuse banks’ compliance with other laws — such as the anti-money-laundering (AML) and countering the financing of terrorism provisions of the Bank Secrecy Act (BSA) and USA PATRIOT ACT, identity theft prevention provisions of the Fair and Accurate Credit Transactions Act, and sanctions law — or safety and soundness principles.

• ECOA has limited application, though its prohibition is clear when the law does apply. The statute prohibits discrimination in lending — including commercial lending — but (1) only in connection with a credit transaction and (2) only on a defined list of prohibited bases. Of the grounds for “unlawful debanking” discussed in the executive order, only religion appears in ECOA’s statutory prohibitions. ECOA does not protect “political affiliation” and “lawful business activity” described in the executive order, nor does it reach deposit accounts.

• Unfair, Deceptive, or Abusive Acts or Practices Laws, including Section 5 of the FTC Act and Section 1031 of the Dodd-Frank Act, are framed more broadly but do offer useful legal parameters and precedent for anticipating how bank regulators are likely to evaluate debanking — other than religious discrimination in credit — for potential enforcement.

The unfairness doctrine, with decades of precedent under the FTC Act, is particularly instructive. An act or practice must cause substantial injury to consumers that is not reasonably avoidable by consumers themselves and that is not outweighed by countervailing benefits to consumers or competition. Depending

The timelines in the fair-banking executive order are short. Within 120 days ... That means regulators will be calling imminently.

Conduct internal audits of past account closures or adverse actions to identify potential debanking issues before regulatory examinations begin.

on the circumstances, account closures are often involuntary, unilateral actions; the analysis thus shifts to the question of whether there is substantial injury or a sufficient countervailing benefit to consumers or competition generally — that is, a cost-benefit balancing of the practice taken as a whole.

Relying on “unfairness” in this context is, notably, the same approach that the CFPB took with respect to account suspensions in enforcement actions against several large banks under the previous administration. The angle of attack may be different, but the legal analysis is the same.

With that in mind, financial institutions should therefore consider the following in the near term:

• Review of Policies, Procedures, and Governance. Review current and legacy policies or procedures that reference (or previously referenced) reputation risk or equivalent concepts to determine whether they will withstand regulatory scrutiny. Clear policies, procedures, and standards for determining when to close or refuse an account that are tied to goals with public benefits will assist in demonstrating the “countervailing benefit” of the bank’s approach to account closures. Whenever possible, consider tying account closure standards to other regulatory obligations and objective, regulation-driven policies — such as the institution’s AML policy, identity theft prevention plan, elder and vulnerable persons policy, credit policy, or fraud risk management policy. Assess whether existing governance processes and controls are sufficient to minimize ad hoc determinations and conform decisions to policies.

• Documentation Requirements. Ensure that appropriate documentation is created and maintained for account termination decisions to demonstrate individualized, objective, and risk-based analyses. Examiners should be able to follow account closure decisions and understand the link between a particular decision and the bank’s policies.

• Reinstatement Processes. For institutions participating in SBA programs, establish procedures to review previously denied clients for potential reinstatement.

• Internal Audit of Past Account Closures. Conduct internal audits of past account closures or adverse actions to identify potential debanking issues before regulatory examinations begin.

• Religious Discrimination Review. Implement systems to identify and prevent religious-based discrimination in banking services, focusing in particular on credit products. Consider what products or business lines present a risk of religious discrimination in commercial lending.

• BSA/AML Compliance. Ensure that legitimate AML and sanctions compliance activities are clearly distinguished from prohibited discriminatory practices. Document specific suspicious activity indicators and ensure that decisions are based on actual risk factors rather than customer categories or affiliations. Exercise caution that policy changes to address the fair-banking executive order do not inadvertently undermine the bank’s AML program.

• Training Programs. Update compliance and front-line staff training to reflect the new requirements and prohibited considerations.

The fair-banking executive order represents the culmination of mounting federal and state efforts to combat debanking, building on the DOJ-Virginia Task Force, congressional bills, and regulators’ voluntary elimination of reputation risk. The executive order’s retroactive review provisions and enforcement mechanisms — including potential fines, consent decrees, and DOJ referrals — signal a new era of scrutiny for banking decisions. Financial institutions must now balance heightened fair access obligations with legitimate BSA/AML compliance, all while preparing for Treasury’s forthcoming comprehensive strategy. With federal regulators mandated to review past practices within 120 days, the financial services industry faces an urgent compliance imperative.

by Roby Brock

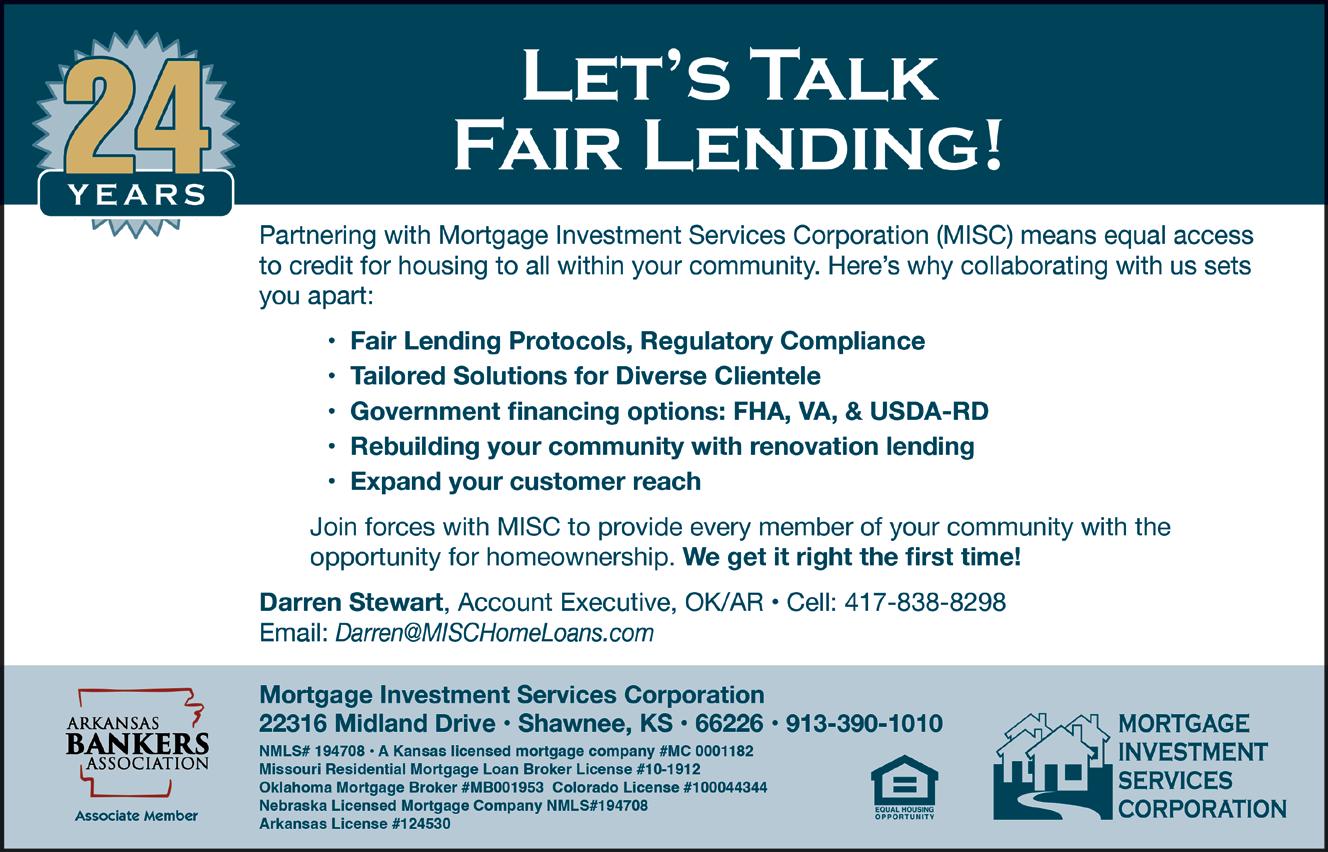

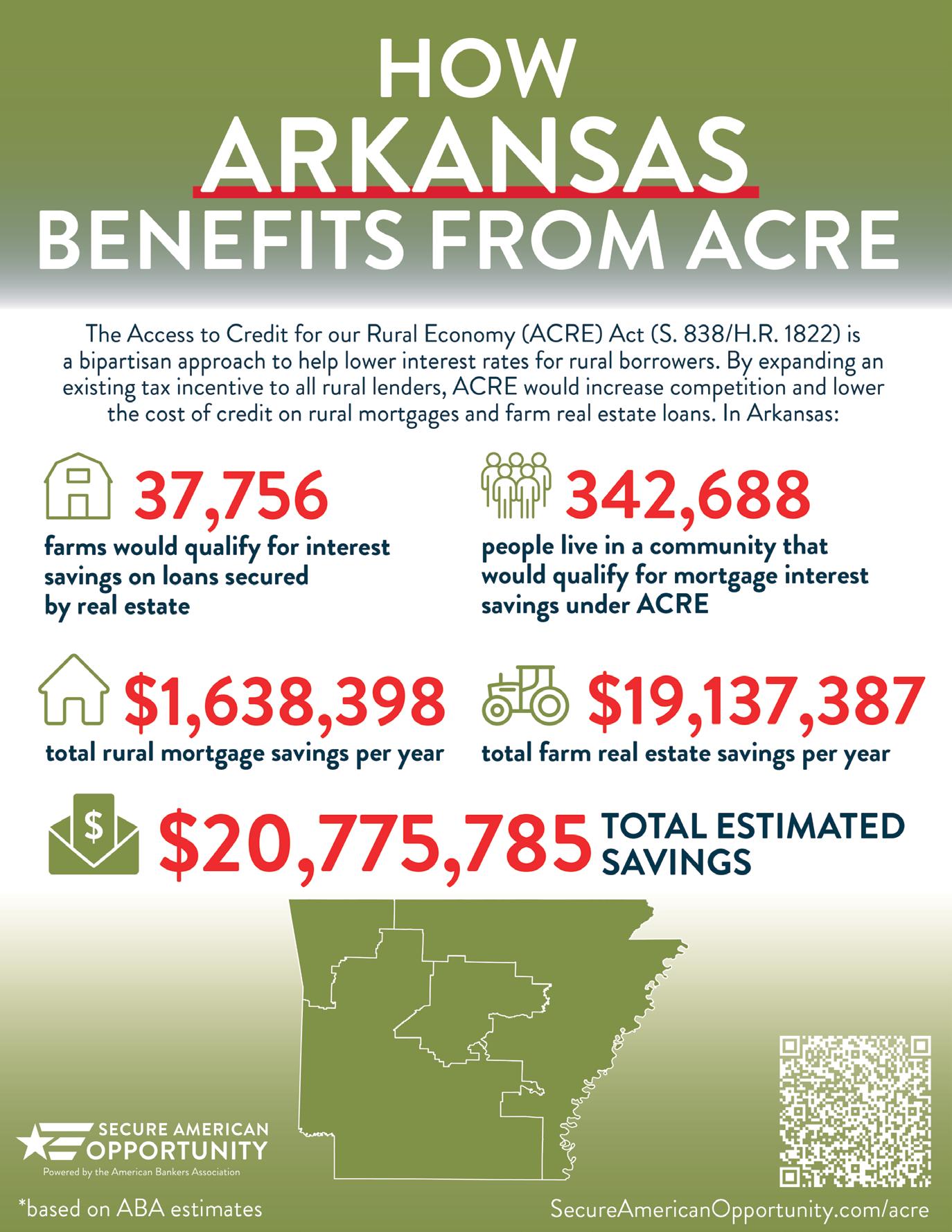

With agricultural producers and bankers on the cusp of a major collapse, a growing number of supporters are advocating for passage of the Access to Credit for our Rural Economy (ACRE) Act of 2025.

The ACRE Act is bipartisan with lead sponsors Senators Jerry Moran (R-KS) and Angus King (I-ME) and Representatives Randy Feenstra (R-IA) and Don Davis (D-NC).

This bill aims to lower interest rates on agricultural real estate and rural home loans by amending the Internal Revenue Code to exempt the earned interest from taxation for qualified lenders, such as community banks. The legislation has received backing from the American Bankers Association (ABA) and the Independent Community Bankers of America (ICBA), who believe it will stimulate rural economies.

In short, the ACRE Act excludes from gross income the interest received by a qualified lender on newly originated loans secured by farm real estate, forestry, fisheries and aquaculture facilities. Additionally, ACRE would exclude from gross income the interest received by a qualified lender on home mortgage loans that do not exceed $750,000 in rural communities of no more than 2,500 people.

The hardships facing farmers and rural communities have been well-chronicled in recent months. High input costs, low commodity prices, lost markets due to trade and tariff deals, the lack of a Farm Bill, and weather-related disasters have combined to waylay farmers in conditions not seen since the 1980’s. Subsequently, bank lenders to farmers and in rural Arkansas are in a precarious predicament holding millions of dollars of loans and having to pause to evaluate prospects for next year’s crops.

“There is a true disaster looming on the horizon,” warns Andrew Grobmyer, executive director of the Agricultural Council of Arkansas, a group representing a vast diversity of farmers and those who support the industry.

One in three or more farms in Arkansas could be shuttered by next spring if the federal government doesn’t provide some type of supplemental assistance to farmers this fall, said Joe Mencer, president of the Agricultural Council of Arkansas.

Another compelling argument for passing the ACRE Act centers around benefits for younger farmers and ranchers. New generation farmers don’t have the capital access, business history, or relationships that older farmers do with bankers. This makes it difficult to loan to a younger generation, but that age group is critical to the future of ag and rural America.

The ACRE Act hopes to remedy this conundrum by lowering costs for acquiring land. ACRE will reduce interest payments, which increases the cash flow from their operation, reduces the need for off-farm income and helps young producers build equity.

The 2025 ACRE proposal in Congress will also lower the costs of mortgages that do not exceed $750,000 in communities of no more than 2,500 people. Current interest rates for rural mortgages are averaging 6.9%. ACRE is estimated to lower those interest rates between 50 and 100 basis points for new interest rates between 5.9%-6.4%.

Kansas and Wisconsin are two states that recently passed a state-level equivalent of ACRE. The Kansas law implemented a lending structure that is delivering rates 50 basis points lower than those prior to its passage. It also provided a state income tax break on farm mortgage loans and some rural home loans. Its language ensures the

One in three or more farms in Arkansas could be shuttered by next spring...

In

short, the ACRE Act excludes from gross income the interest received by a qualified lender on newly originated loans secured by farm real estate, forestry, fisheries and aquaculture facilities.

tax treatment only applies to new originations. It passed in 2021 on the heels of the pandemic and its ensuing relief packages.

In 2023, Wisconsin enacted state-level legislation offering a 100% state tax exemption on the income earned from commercial and agricultural loans of $5 million or less.

The One Big Beautiful Bill (OBBB) passed earlier this year actually had two provisions related to previous ACRE Act proposals.

The OBBB maintained the current Section 199A deduction rate of 20% for Subchapter (Sub) S banks and made the deduction permanent. Failure to extend the 20% deduction rate for Sub S banks would have created chaos for many banks.

The OBBB also provided banks with a permanent 25% deduction for interest income derived from qualified agricultural real estate loans.

The Internal Revenue Service will have to draft guidance for the policy.

U.S. Rep. French Hill, R-Little Rock, hopes to see passage of the ACRE Act this year, but as of this writing, he was deeply embroiled in the federal government shutdown debate. Still, Hill said the provisions passed earlier this year in the OBBB will be helpful to farmers and rural lenders.

“A provision similar to the ACRE Act was included in the budget reconciliation bill signed by President Trump. It will enhance the competitiveness of commercial banks making farm related loans,” Hill said.

According to an analysis of the pending federal bill, ACRE would expand access to affordable rural mortgages to more than 30 million people in 17,000 rural communities across the country. ACRE would also deliver approximately $1.18 billion worth of annual interest expense savings to farmers and ranchers and improve competition in ag real estate markets.

by Kathy Herbig and Kasey Pittman

On July 4, 2025, President Trump signed P.L. 119-21, commonly referred to as the “One Big Beautiful Bill Act,” a sweeping legislative package that includes wide-ranging reforms affecting infrastructure, tax policy and economic development.

Of particular interest to financial institutions and agricultural stakeholders is Section 70435 of the bill (new Internal Revenue Code Section 139L), which introduces a federal income tax exclusion for a portion of interest received on certain loans secured by rural or agricultural real property.

This provision aims to reduce borrowing costs for rural communities and incentivize greater private investment in agricultural development and rural infrastructure.

The inclusion of Section 70435 signals a federal push to:

• Stimulate investment in rural America by encouraging lenders to offer more competitive financing options for agricultural and rural development projects.

• Lower the cost of capital for rural and farming communities, helping preserve family farms and support food security initiatives.

• Encourage participation by the financial services industry, including banks and insurance companies, in underserved rural markets.

If implemented effectively, this provision could benefit rural lending markets by increasing the availability of affordable credit and contributing to broader economic stimulation in agricultural regions.

Learn more about the requirements for Section 70435 and how it could impact you and your business:

For taxable years ending after the date of enactment (July 4, 2025), 25% of interest income received by a qualified lender on qualifying loans secured by rural or agricultural real estate will be excluded from gross income of that financial institution for federal tax purposes.

The legislation provides that the excluded interest income will be treated as tax-exempt income, and 25% of the qualified real estate loan adjusted basis will be included in the bank’s calculation of the amount of interest expense deduction disallowed.

financial institutions that originate qualifying loans will be able to exclude 25% of interest income from taxable income.

With the recent increase in cost of funds, this disallowance will reduce the overall benefit to the bank for this interest income exclusion. Insurance companies are subject to a 25% proration rate on tax-exempt income, which reduces the deduction for losses incurred.

Qualifying lenders include:

• Any bank or savings association with deposits insured under the Federal Deposit Insurance Act: Including certain entities wholly owned, directly or indirectly, by a company that is treated as a bank holding company under Section 8 of the International Banking Act of 1978

• Any state- or federally regulated insurance company: Including certain entities defined in the legislation owned by an insurance holding company

• Federal Agricultural Mortgage Corporation (Farmer Mac): Only as it relates to interest received on a qualified real estate loan secured by real estate substantially used for production of one or more agricultural products

If the loan is made after July 4, 2025 (the date of enactment of the legislation), it could qualify for this exclusion. However, it must be secured by rural or agricultural real estate, or a leasehold mortgage (with a status as a lien) on rural or agricultural real estate. Refinancings will not be treated as qualifying to the extent the proceeds are used to refinance (or in a series of refinancings) an original loan made before the enactment date.

In order to qualify as rural or agricultural real estate, the parcel must be located in a state or a possession of the United States and be:

• Any real property that is substantially used for the production of one or more agricultural products,

• Any real property which is substantially used in the trade or business of fishing or seafood processing, and

• Any aquaculture facility (as defined in the legislation)

• Tax Benefits: Qualifying financial institutions that originate qualifying loans will be able to exclude 25% of interest income — net of the associated interest expense disallowance — from taxable income, which reduces both tax liability and tax expense, creating a benefit to their net income through the lower effective tax rate.

• Loan Pricing Opportunities: With favorable tax treatment, lenders may be able to offer more competitive interest rates on qualifying loans, supporting the rural and agricultural communities served by community banks.

• Operational Readiness: Lenders should begin evaluating their loan portfolios and internal systems to:

º Identify qualifying loan products

º Implement documentation processes for qualified loan interest income and exclusion of certain refinancing proceeds

º Ensure lender awareness of eligibility criteria and impacts to loan rates

• Strategic Implications: This provision creates a tax incentive to financial institutions that lend to the agricultural and fishing industries, aiming to stimulate investment and economic activity in those sectors. Mission-driven lenders that are considered qualified lenders may be particularly wellpositioned to benefit.

Lenders are encouraged to consult legal and tax advisors to understand how Section 70435 may affect their institution. Steps to consider:

• Review rural and agricultural lending activity for potential eligibility.

• Assess operational changes needed to ensure compliance and information needed to report the tax benefit.

• Evaluate the financial and strategic upside of creating or expanding agriculture-focused loan programs.

If your institution has any questions about Section 70435 (new IRC Section 139L) or any other provisions of the new tax legislative package, Cherry Bekaert’s dedicated Financial Institutions practice is here to support you as a trusted advisor. Our team brings deep industry insight and technical experience to help you navigate the evolving tax landscape with confidence.

In addition, our Tax Policy group is closely monitoring developments at the federal, state and local levels to ensure you stay informed about emerging opportunities and potential impacts on your organization.

Now is the time to assess how these changes could affect your lending strategies, tax planning and long-term growth. Reach out to explore how we can help you turn policy into opportunity.

by Trent Fleming

Iwant to address a fundamental matter that will impact many of your current and future technology projects, from core conversions to implementing AI and Machine Learning: the quality of your customer data. The concept of leveraging your data is not a new one. I’ve often spoken about the “gold mine” of customer information that exists in your files. Today’s fast moving and competitive environment makes it increasingly important that you put a strategic focus on data analytics.

Before your efforts to analyze and leverage data can be successful, you must be confident that your data is in good shape. Clean, accurate data files allow you to be confident when using your data for improving internal productivity, enhancing customer service, and creating effective marketing campaigns.

Over the years your bank has been in existence, numerous factors have combined to degrade data quality. Manual processes, manual conversions, automated conversions, and yes, poor and inconsistent data entry practices. I know that you may feel this is an overwhelming task. Effectively tackling this project will pay dividends in many ways, for years to come. Thus, it is a worthwhile effort.

Let’s get started. The first step is to draft and enact a data strategy that will guide you in controlling the quality of data that flows into your system. While this is not a comprehensive list, here are some key concepts that should be addressed:

1. CUSTOMER INPUT - Which systems allow direct customer input? Online applications and account opening? Mobile and Internet apps that allow customers to enter or update data (phone, email, etc.) How is this information evaluated and managed before it reaches your core?

2. EMPLOYEE INPUT - Create guidelines (and provide training) on entering data for both existing and new customers. These guidelines are critical to addressing how to style accounts involving complicated personal names or consistently styling business accounts so there is a predictable structure to how you treat industries, religious organizations, or non-profits.

3. THIRD PARTY SYSTEMS INPUT - Perhaps you’ve been frustrated that your core provider has rigid standards for allowing third party or “fintech” solutions to read and write data from your core. This is protection that you should expect. Your core provider is tasked with accurately posting transactions, securing your data, and providing reporting across many channels. You want them to carefully control the integrity and accuracy of data from other providers so that your bank’s data standards are kept high.

In each case, there are likely software configuration capabilities that will allow you to codify and thus control how data is entered and quality checked. Leveraging your technology to enforce policies and procedures is a win. Make sure you are using these features.

Over the years your bank has been in existence, numerous factors have combined to degrade data quality.

While the above will assist you in improving the quality of data that is input to your system, there remains the matter of cleaning up what you have right now.

In my experience, the most common problem is that you have multiple records for the same customer. This can result in a fragmented or distorted view of the customer’s relationship and makes you likely to make mistakes about serving that customer. Using your basic reporting capabilities, try to identify instances where you have such duplication.

Break it out by branch and ensure that employees who are knowledgeable about your customers take their time to review reports and make corrections. You may have this issue with business customers as well as consumers. Remember that the findings from these corrective efforts may be useful in fine tuning your policies and procedures to prevent repeat performances of errors that got you here in the first place.

Once these semi-manual processes have been undertaken, it is time to look for additional automation help. I already mentioned software configuration that can be used to control the data entry process. Beyond that, it is likely that your core vendor has software designed to help you identify additional data errors that are more complex than simple naming conventions. Going forward, this is an area where I expect AI and Machine Learning to have impact, by searching more thoroughly and accurately correcting data in much less time than humans could accomplish it. Still, testing and auditing results is a best practice, no matter how much you trust the technology.

Hear more from Trent at the ABA Technology Conference NOV. 6TH

Another best practice is to use points of customer contact to ensure that your information remains accurate. Notice if you call your local utility company, they will often ask to verify your phone number or email address. While this is to some extent used to validate your identity, it is also an excellent way to keep contact information updated. Questions like “is this still the best phone number to reach you on?” or “are you still using this email address?” are simple enough and help in keeping information up to date.

The focus here is simple: initiate and perpetuate efforts to maintain an accurate database of your customer information to improve service to your customers and enhance your efforts to do more business with them.

Trent Fleming serves as a trusted advisor to financial institutions, helping community banks make good decisions on matters of strategy, management, and technology. His practice includes core vendor evaluation and negotiations, and strategic planning. For more info: trent@trentfleming.com.

by Jim Fuchs

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act was signed into law June 18, establishing a regulatory framework for the issuance and transaction of payment stablecoins in the U.S. The law goes into effect 18 months after enactment (December 2026) or 120 days after the Federal Reserve Board (FRB), the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corp. (FDIC) and the National Credit Union Administration (NCUA) issue final regulations, whichever is earlier.

Each month, issuers are required to publish the composition of their reserves on their website ... and publish their procedures and fee schedule for purchasing and redeeming stablecoins.

A payment stablecoin is defined as a digital asset issued on a public blockchain designed for payment and settlement purposes. Stablecoins are not securities or commodities. Authorized issuers of payment stablecoins are required to redeem them for a fixed amount of money and must maintain the stability of each coin’s value by holding an appropriate level of highly liquid assets, or reserves, against them. It is this feature that gives stablecoins their name.

The GENIUS Act specifies how the stable value, or peg, of an issued stablecoin must be maintained. Issuers are required to hold assets (reserves) on at least a one-to-one basis against the value of the coins issued. In short, if an issuer issues $1 in stablecoin, they must hold at least $1 in acceptable liquid assets against that coin. Acceptable assets include:

• U.S. currency, deposits held at insured depository institutions

• U.S. Treasury securities with a remaining maturity of no more than 93 days, and

• Other liquid federal governmentissued financial instruments, including government money market funds.

The GENIUS Act gives federal regulators authority to approve additional types of reserves not specified in the law. Approved reserves also may be issued in tokenized form.

Any entity that wishes to issue a payment stablecoin is required to receive approval from a federal banking or credit union regulator. For banks, thrifts and credit unions, this means either the OCC, the Federal Reserve, the FDIC or the NCUA are required to give approval. An uninsured bank, such as a national trust bank, and federal branches of foreign banks, must receive approval from the OCC. States also may approve certain entities to

become authorized issuers if the state’s regulatory framework is “substantially similar” to the framework developed by federal banking regulators. The GENIUS Act establishes a Stablecoin Certification Review Committee (SCRC), chaired by the U.S. Treasury Secretary and composed of the chair of the FDIC and the chair of the Board of Governors of the Federal Reserve System, to review and approve state-level regulatory frameworks. States are required to submit certification requests on an annual basis to the SCRC for recertification. Additionally, if a state-approved stablecoin issuer issues more than $10 billion in payment stablecoins, it is required to transition to the federal regulatory framework within one year of crossing the $10 billion threshold. That entity would then be jointly supervised by their home state and a federal banking regulator.

The GENIUS Act generally assumes that issuers of payment stablecoins will be institutions engaged in banking and other financial activities. However, the law does allow U.S. and non-U.S. companies not engaged in one or more financial activity to legally issue stablecoins if they receive a unanimous vote from the SCRC. The SCRC is required to evaluate several factors, including risks to financial stability, and to the safety and soundness of the banking system, in making its determination.

Approved stablecoin issuers are generally limited to four main activities: issuing stablecoins, redeeming stablecoins, managing reserves, and providing custodial or safekeeping services.

The GENIUS Act prohibits issuers from paying stablecoin holders yield or interest on their coins. Issuers also are prohibited from requiring a customer to purchase other products or services as a condition for issuing a stablecoin to that customer (also known as tying).

Each month, issuers are required to publish the composition of their reserves on their website. They also are required to publish their procedures and fee schedule for purchasing and redeeming stablecoins. All reports attesting to the state of an issuer’s reserves must be certified by the CEO and CFO of the issuing institution and must be examined monthly by a registered public accounting firm. Issuers with $50 billion or more in total stablecoin issuance must prepare annual audited financial statements.

The GENIUS Act requires each federal banking regulator to issue regulations to implement the act within one year of passage. This includes establishing a regulatory framework, implementing capital, liquidity and risk management requirements and developing diversification standards for the reserve assets backing an issuer’s stablecoins.

In addition, there are numerous other rulemakings due within one year of the GENIUS Act, which also requires federal stablecoin regulators and the Treasury Secretary to issue several reports—some within one year of enactment and others on an ongoing basis.

To learn more about banking regulation, read the St. Louis Fed’s “Supervising our Nation’s Financial Institutions” series.

Jim Fuchs is a vice president in the Supervision, Credit and Learning Division at the Federal Reserve Bank of St. Louis. The views expressed are those of the author and do not necessarily reflect those of the St. Louis Fed or the Federal Reserve System.

by Tim Griffin

Earlier this year, I formed a Financial Fraud Task Force that includes the Arkansas Bankers Association, the Arkansas Credit Union Association, and other stakeholders working in banking and finance. This approach utilizes the successful model we’ve built to address other types of crime, such as organized retail crime and human trafficking.

Our Financial Fraud Task Force, which is led by my office’s Consumer Protection Division, meets quarterly. The meetings are an opportunity for the industries that are most impacted by these types of crimes to share information and intelligence with my office. Input from the private sector better equips us to track down perpetrators of financial fraud and bring them to justice.

And we don’t just listen; the meetings are a two-way street. My office keeps tabs on what is happening around the country when it comes to fighting and preventing financial fraud, and we share these valuable insights and resources with our partners in the industries.

As we gain understanding about emerging scams through the relationships we’re building in the banking industry, we can more nimbly alert consumers of telltale signs of these scams and provide tips to avoid them. My office regularly issues consumer alerts for Arkansans, warning them about scams and equipping them with information on how to protect themselves and report bad actors.

Fraud can be reported to my office directly by calling (501) 682-2007, by emailing consumer@arkansasag.gov, or by completing the online complaint form at https://arkansasag.gov/file-a-complaint/.

If we want to be successful in combating the financial fraud being committed against Arkansans, we will be far more effective together than alone. As members of the banking industry, you can help ...

I believe in the power of collaboration and cooperation. If we want to be successful in combating the financial fraud being committed against Arkansans, we will be far more effective together than alone.

As members of the banking industry, you can help us in a couple of ways. My office stands ready to assist when you or one of your customers falls victim to a scam. Fraud can be reported to my office directly by calling (501) 682-2007, by emailing consumer@arkansasag.gov, or by completing the online complaint form at https:// arkansasag.gov/file-a-complaint/.

Second, you can report trends in fraudulent activity through your bank’s leadership to the Arkansas Bankers Association. This information helps us educate consumers and identify potential connections between criminal activity in different parts of the state.

For our task force to be successful, we need the buy-in of a wide range of partners across Arkansas. As we tackle this extremely important issue with this new approach, please utilize us as a resource, and join in our commitment to root out scammers and protect consumers.

by U.S. Rep. French Hill, R-Little Rock

In a world where speed and efficiency are paramount, the integration of digital assets into global payment systems is revolutionizing and reshaping how value moves. As Chairman of the House Committee on Financial Services and former longtime community banker in Arkansas, I have seen firsthand how innovation fuels economic growth, specifically the transformative potential digital assets hold for our financial landscape. Throughout my time in Congress, my work in the financial services space has focused on harnessing that potential to foster innovation in the banking sector and maintain U.S. economic leadership across the globe.

Congress has a responsibility to ensure there is a regulatory framework for digital assets that promotes innovation while safeguarding American consumers and our nation’s financial system. Digital assets, including cryptocurrencies and stablecoins, offer another innovative payment rail that can facilitate faster and cheaper transactions, making them a valuable tool for both consumers and businesses.

This year alone, the Committee passed multiple bills on digital assets that are essential to ensuring the United States remains a leader in the global financial system. President Trump has already signed one of those bills into law – the Guiding and Establishing National Innovation for