INDUSTRY U P DAT E S

B A N K I N G S U R V E Y A N A LY Z E S

Agricultural

Lending A

national survey of nearly 500 loan officers, managers and executives offers a deep dive into attitudes among agricultural lenders regarding farm liquidity, income and leverage as well as the impact of tariffs and trade, COVID-19 and the weather.

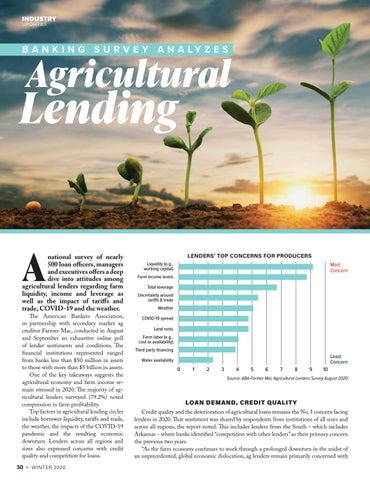

The American Bankers Association, in partnership with secondary market ag creditor Farmer Mac, conducted in August and September an exhaustive online poll of lender sentiments and conditions. The financial institutions represented ranged from banks less than $50 million in assets to those with more than $5 billion in assets. One of the key takeaways suggests the agricultural economy and farm income remain stressed in 2020. The majority of agricultural lenders surveyed (79.2%) noted compression in farm profitability. Top factors in agricultural lending circles include borrower liquidity, tariffs and trade, the weather, the impacts of the COVID-19 pandemic and the resulting economic downturn. Lenders across all regions and sizes also expressed concerns with credit quality and competition for loans.

30

•

WINTER 2020

LENDERS’ TOP CONCERNS FOR PRODUCERS Liquidity (e.g., working capital)

Most Concern

Farm income levels Total leverage Uncertainty around tariffs & trade Weather COVID-19 spread Land rents Farm labor (e.g., cost or availability) Third party financing Water availability

0

1

2

3

4

5

6

7

8

9

10

Least Concern

Source: ABA-Farmer Mac Agricultural Lenders Survey August 2020

LOAN DEMAND, CREDIT QUALIT Y Credit quality and the deterioration of agricultural loans remains the No. 1 concern facing lenders in 2020. That sentiment was shared by respondents from institutions of all sizes and across all regions, the report noted. This includes lenders from the South - which includes Arkansas - where banks identified “competition with other lenders” as their primary concern the previous two years. “As the farm economy continues to work through a prolonged downturn in the midst of an unprecedented, global economic dislocation, ag lenders remain primarily concerned with