Editor’s note

As anticipated in the previous editorial, this issue of Aboutcamp BtoB is particularly focused on the Australian market. We attended the Melbourne fair and visited one of the most organized, integrated and successful companies Down Under: Jayco Australia. We are confident that our readers will find interesting insights in this extensive report, including some suppliers who might be interested in expanding into this vibrant market.

Unfortunately, there is no good news from the USA, where the recreational vehicle industry has experienced a significant downturn in the first quarter of 2023, with March seeing a sharp decline in total RV shipments: -50.8% compared to the previous year. This downward trend reflects the challenges faced by the industry, including inflationary pressures and economic uncertainty. To date, total RV shipments have declined by -54.3% in 2023. Despite the challenging market conditions, the RV industry in North America remains resilient and is focused on adapting to the changing needs of consumers. Towable RVs have been hit the hardest, experiencing a decline of 53.7% in shipments compared to the same period last year, while motorhomes witnessed a relatively smaller decline of 20.2%.

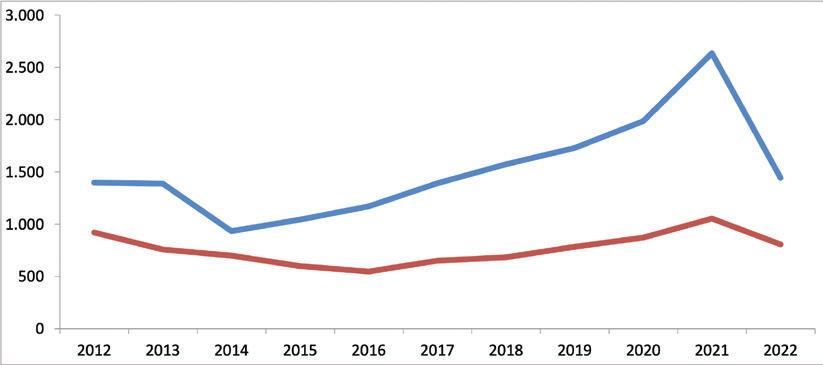

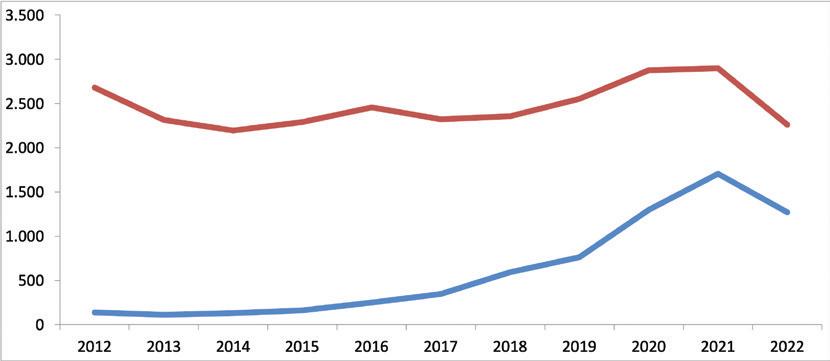

On the other hand, Europe is faring better. Data from ECF (European Caravan Federation) for the first quarter indicated a slight decline compared to the same period in 2022, more pronounced for the caravan sector (-13.5%) while motorhomes have held relatively steady (-3.9%). Germany is performing very well, remaining an extraordinary market with even an increase for the total number of recreational vehicles registered

Contents

Interviews

• 42 Gerry Ryan Jayco Australia

Columns

• 58 AL-KO

System-relevant carriers

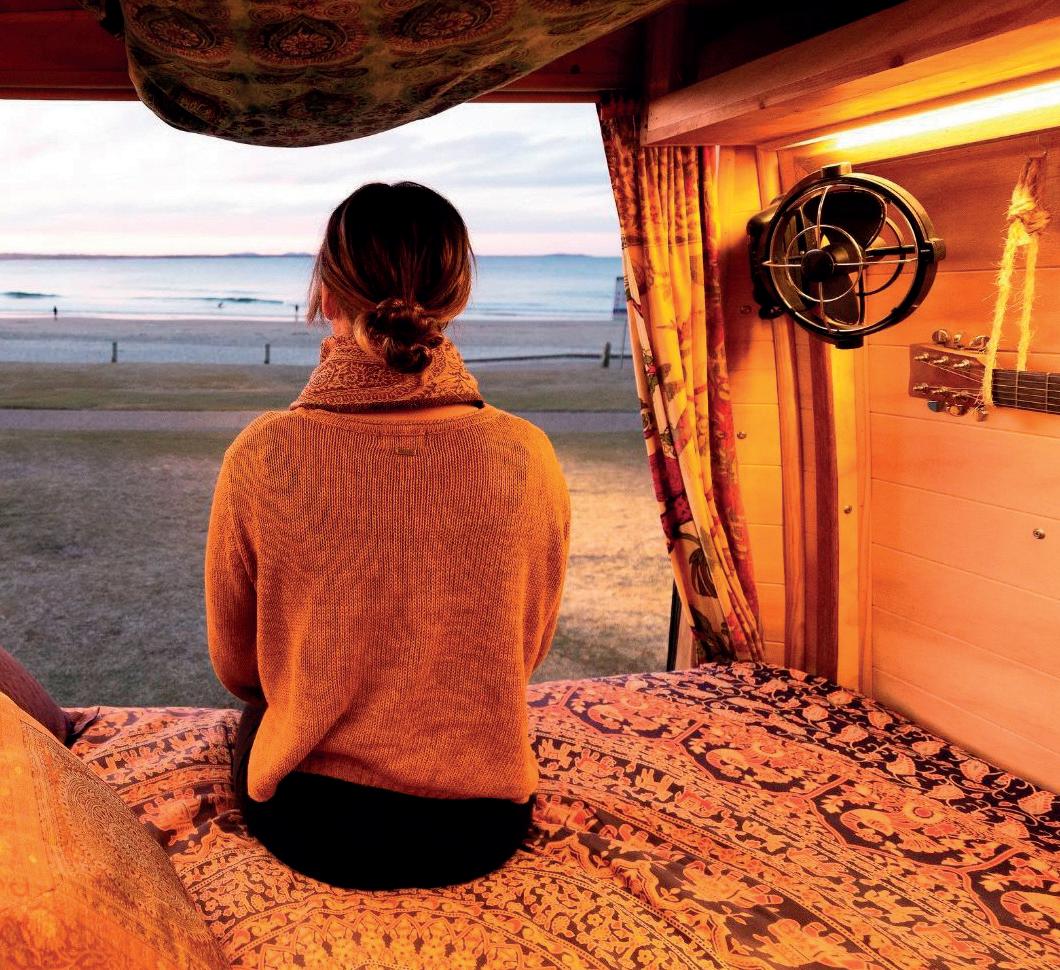

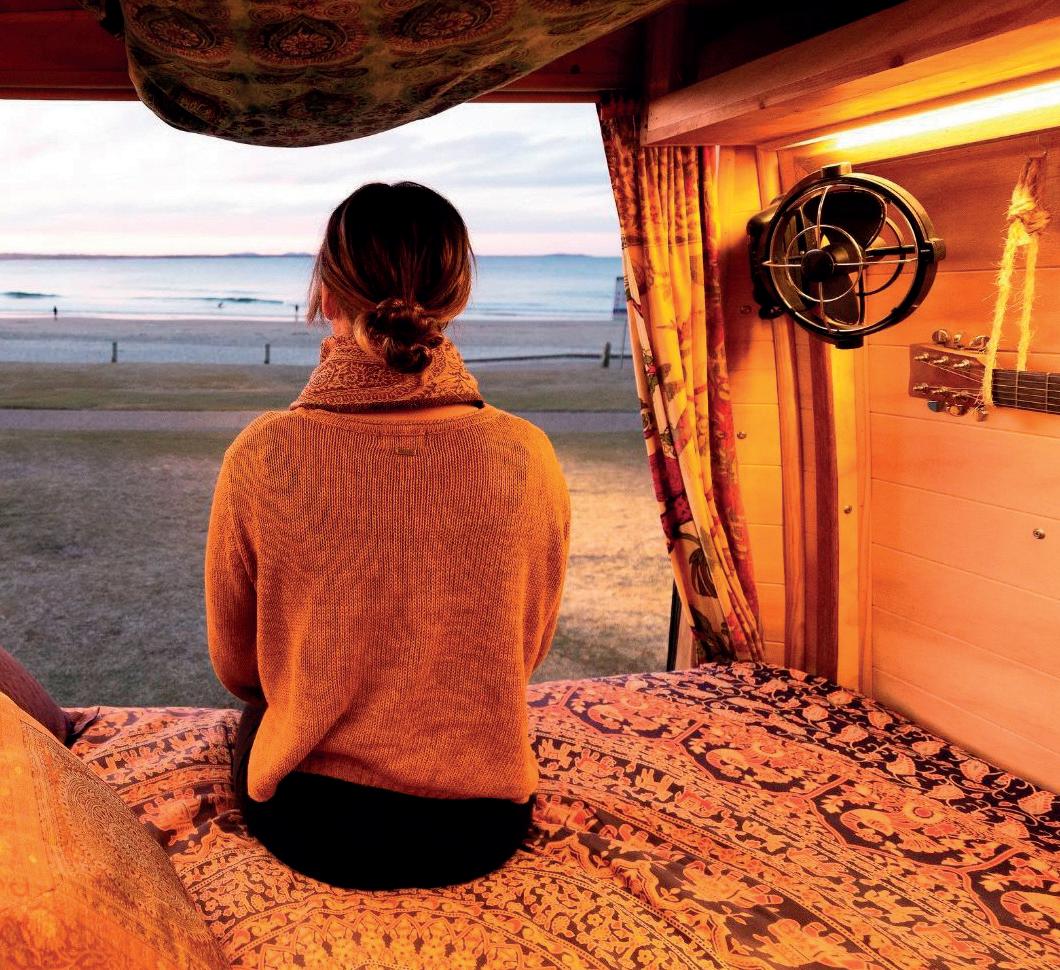

• 60 SEEKR by Caframo

Fan ventilation

• 62 Indel B

Great little fridge

• 64 Vetroresina

High quality, low weight

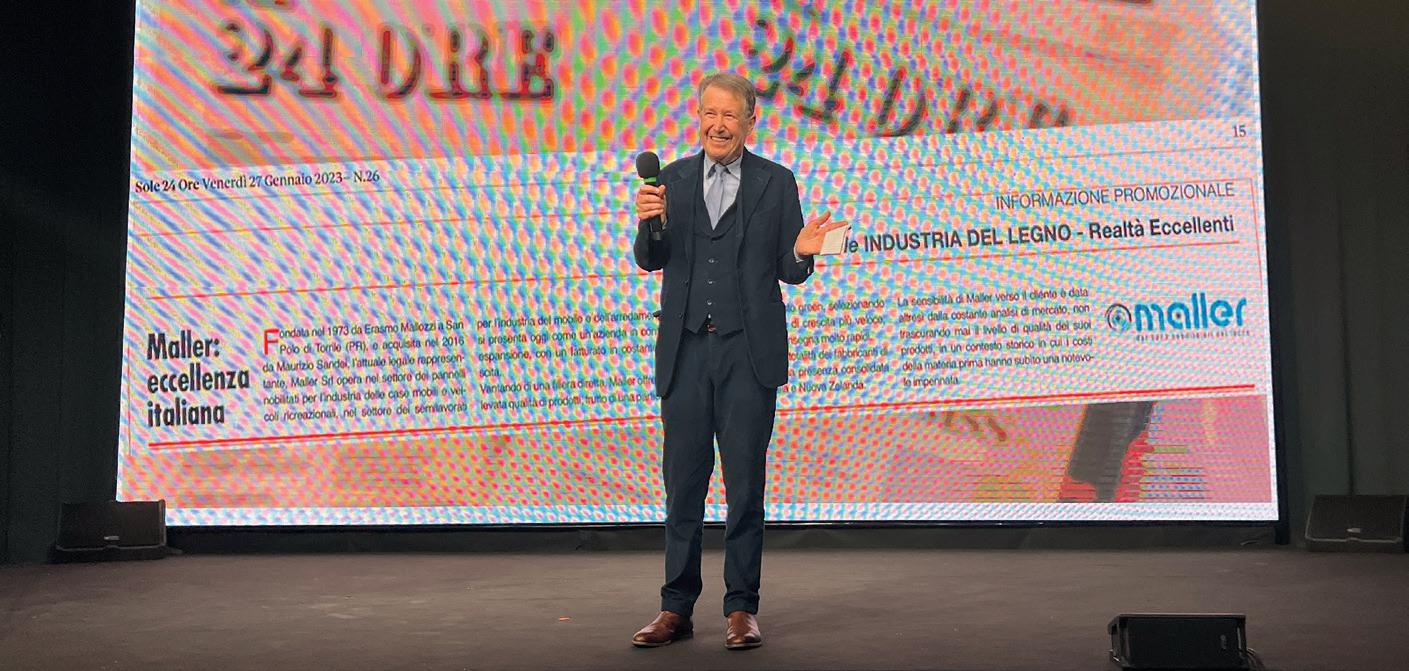

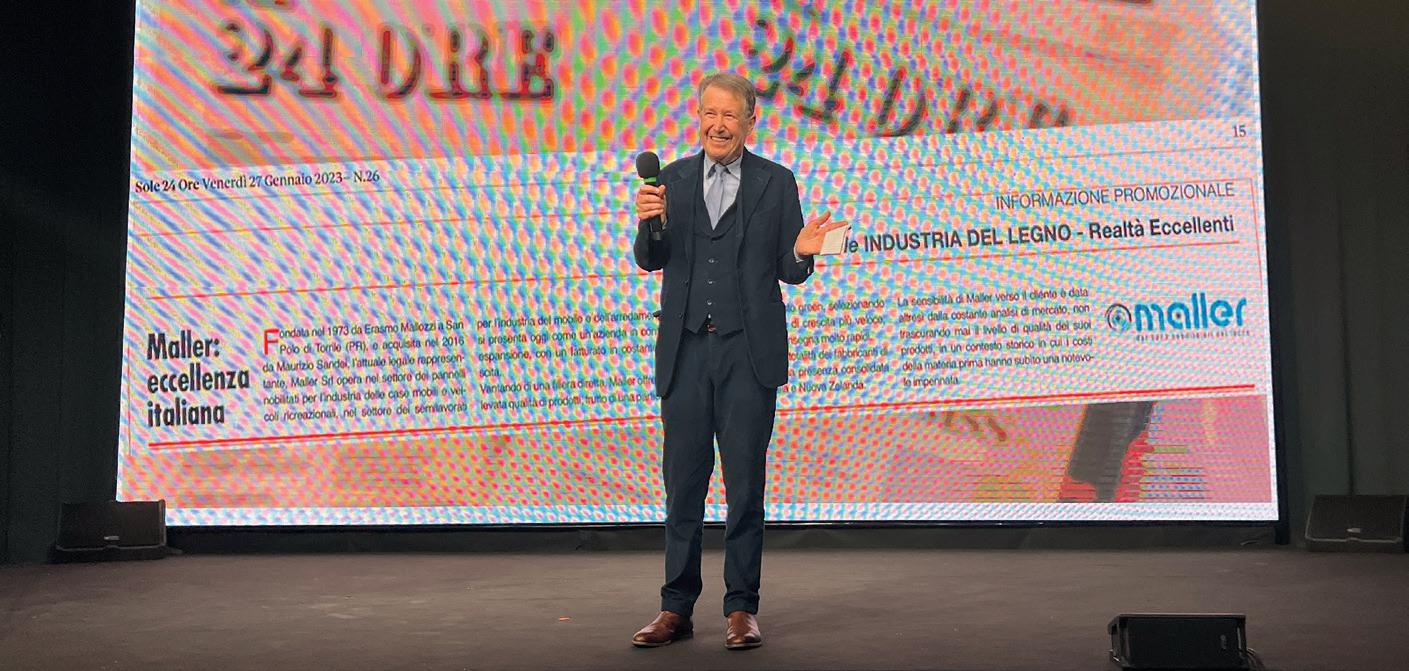

• 66 Maller

Celebrating 50 years

• 70 Teleco

Telair EcoEnergy Lithium

(+3.1). The United Kingdom, Belgium, and the Netherlands are also holding up well, with negative declines only in single digits, while the markets of France (-11.1%), Spain (-13.9%), and Italy (-15.1%) are declining more significantly. The negative trend is becoming concerning, however, for Scandinavian countries, with Denmark (-24.8%) and Sweden (-35.2%) leading the way, along with Switzerland (-27.7%) and Austria (-30%). As usual, every year we publish the market report for the last 10 years for each European country. The analysis of the Australian market data compared to European data reveals intriguing insights that shed light on the similarities and differences between these two regions. Moreover, you can also discover fascinating insights into products, technologies, and interviews with key market players.

As you delve into these pages, our team is tirelessly crafting the upcoming August issue, which previews the Düsseldorf Trade Fair. This edition promises to be an extraordinary compilation, brimming with exclusive previews of what exhibitors from the Technology & Components sector will unveil at this unique German show. Prepare yourself for an immersive experience that will showcase the latest innovations, inspiring industry professionals, and provide an invaluable glimpse into the future of the market.

Antonio Mazzucchelli

• 46 Philip Kahm Westfalia

• 50 Jarod Lippert Lippert

• 54 Anthony Wollschlager Airxcel

Report

• 22 Victorian Supershow 2023

Seventy years of Melbourne Supershow

• 72 LAM

Automotive quality

• 74 Whale

Heat Air products

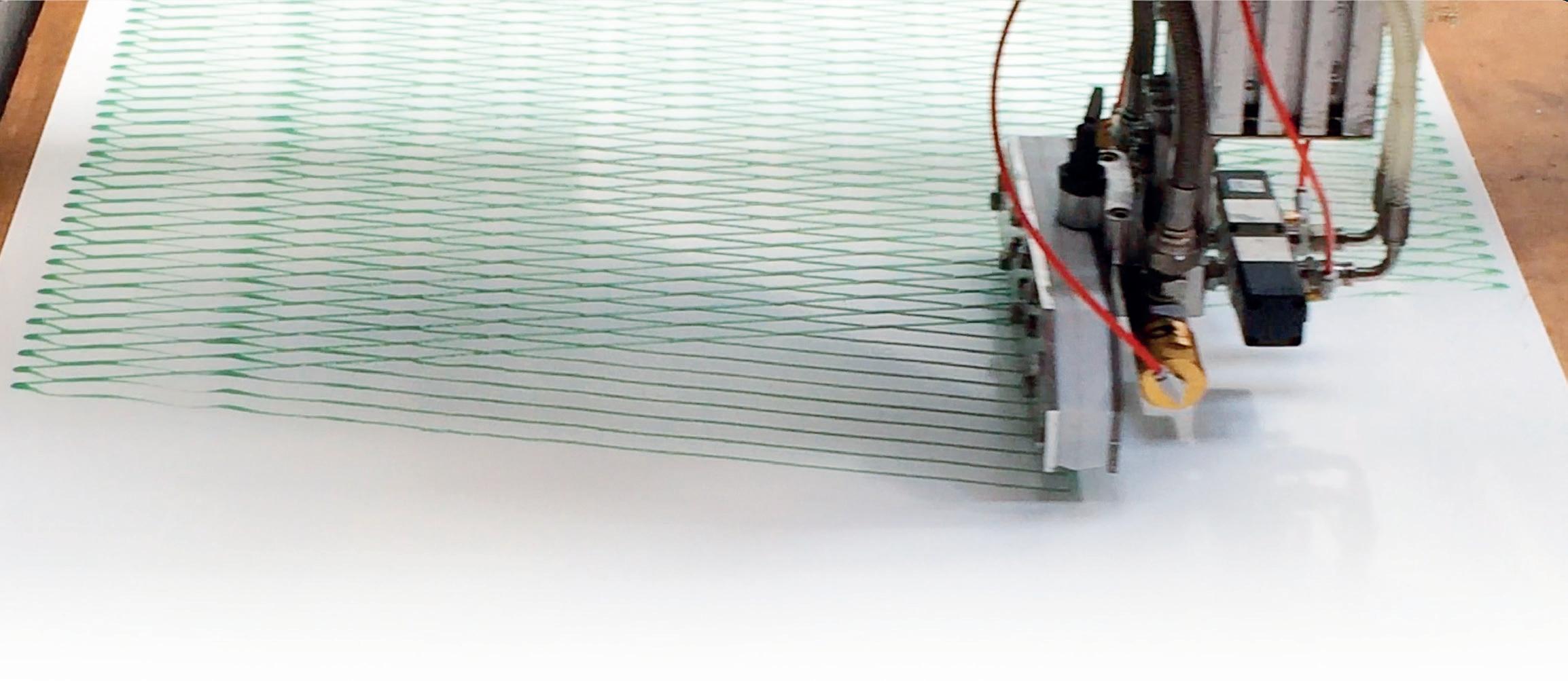

• 76 H.B. Fuller - Apollo

Fast-tack technology

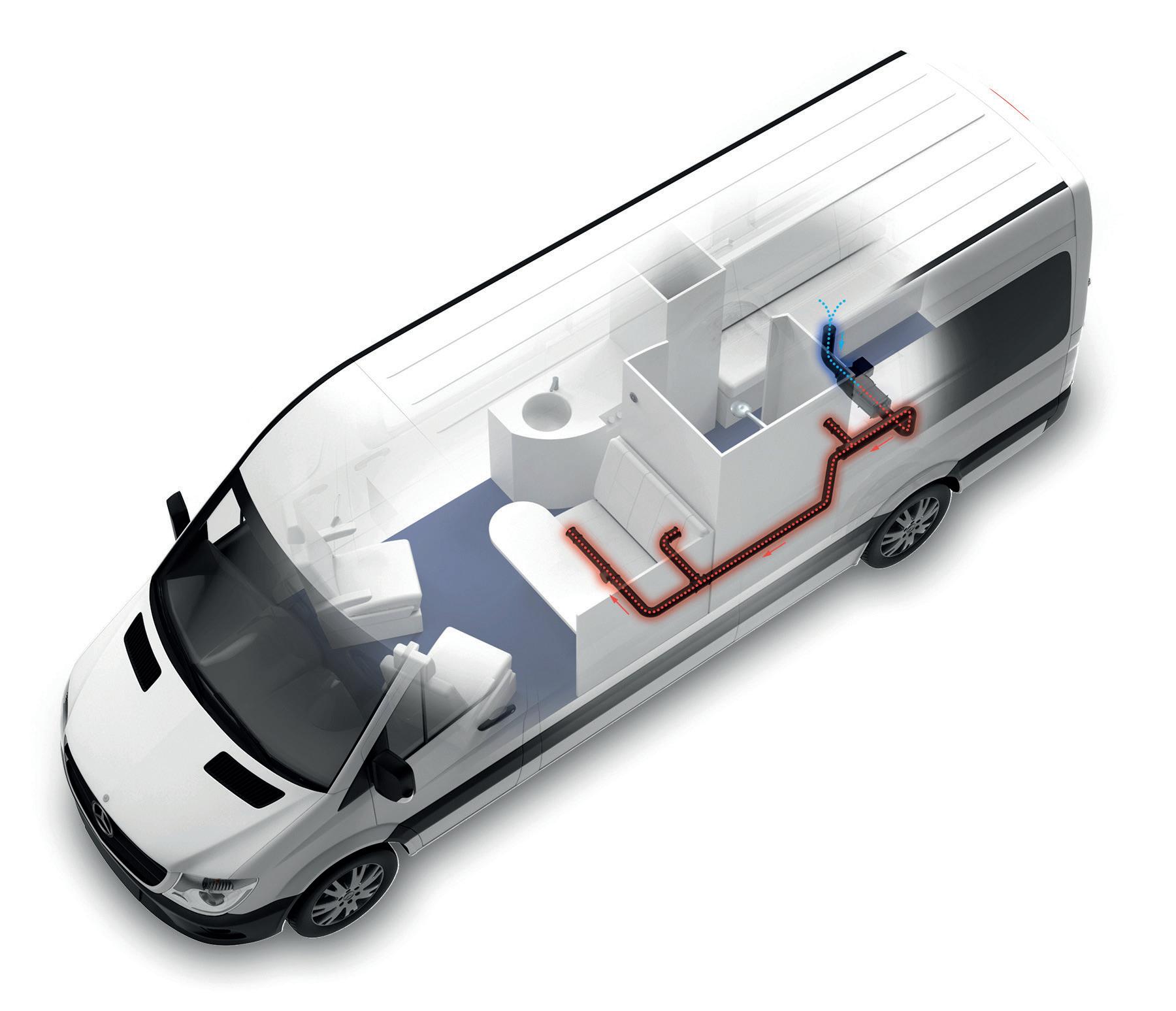

• 78 Wallas-Marin Oy

Winter’s heroes

• 80 Bartolacci design

Playing with light

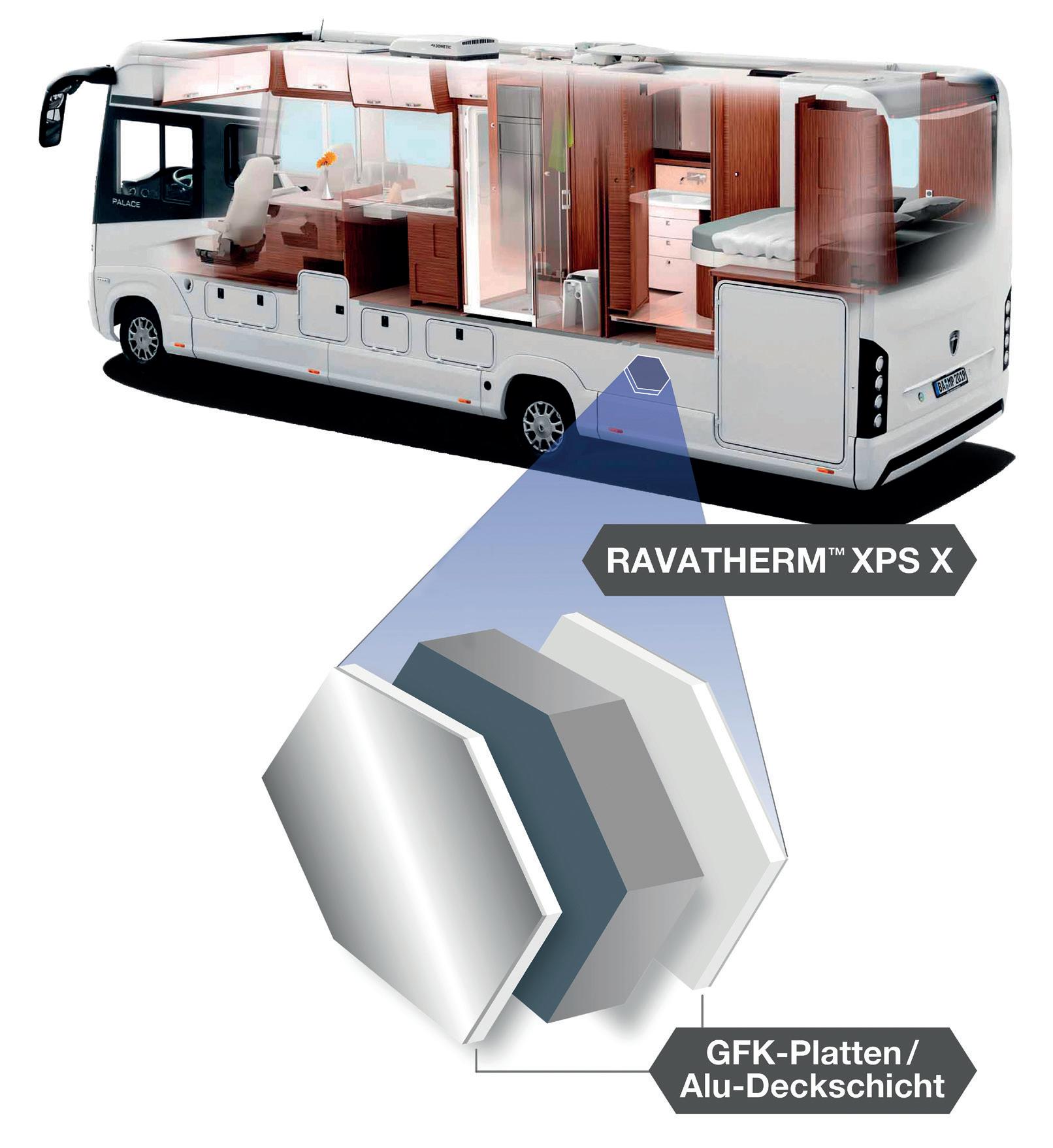

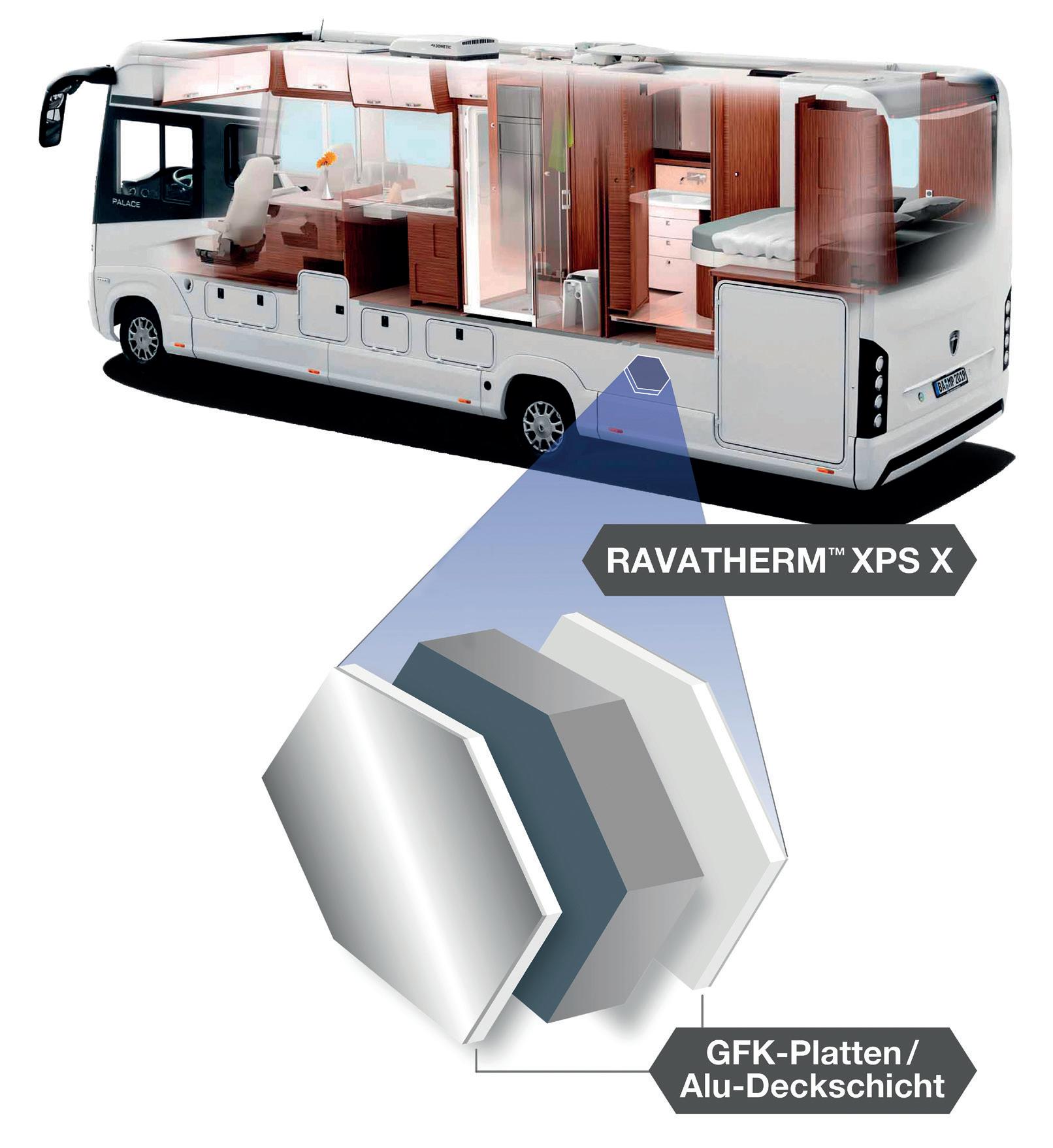

• 82 Ravago Building Solutions Performance enhancement

Focus

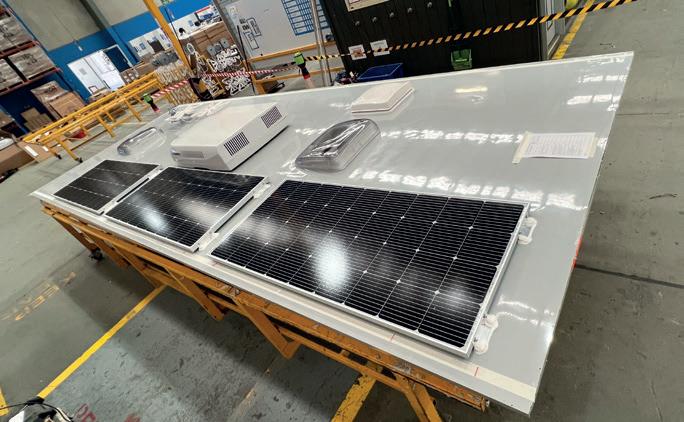

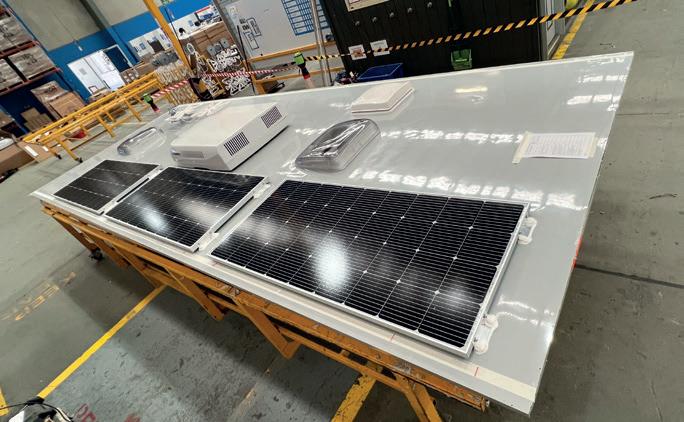

• 36 Jayco Australia

Impressive production facilities

Market

• 84 European RV registrations

Market shows signs of slowing down

T estimonials

• 88 Insights from the industry

News from the world

• 94 North America

3 Issue 39 MAY/JUNE/JULY 2023

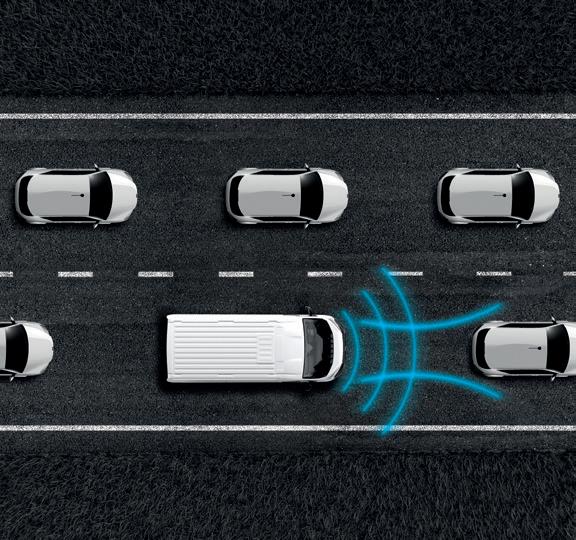

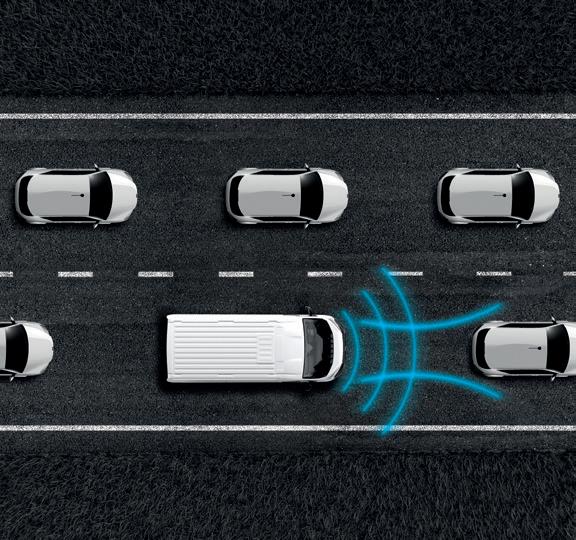

DUCATO. DISCOVER THE NEXT LEVEL.

DUCATO WITH LAST GENERATION AUTONOMOUS DRIVING

LET YOURSELF BE DRIVEN

Straight to destination with Lane Centering, Traffic Jam Assists with Automatic Stop&Go and Adaptive Cruise Control. Let Ducato, with its last generation safety features, take the strain off you, reduce the risk of accidents and improve passengers’ protection. Put your holidays into the safest hands ever; choose a motorhome based on Fiat Professional Ducato.

This communication shows model-specific features and contents that can be chosen by motorhome manufacturers. Trim levels and the optional equipment may vary due to specific version, market or legal requirements.

fiatcamper.com

Photograph location: Asciano –Tuscany Crete Senesi

Positive vibe at annual ECF meeting in The Netherlands

The European Caravan Federation (ECF) organized their 45th Annual General Meeting and their 28th Meeting of the European Leisure Vehicle Industry in the Dutch city of Utrecht last May 12. Although 2022 was a though year for the industry because of the challenges in the supply chain, there was a positive vibe among the 140 attendees. Hosted by the Dutch caravanning industry association KCI a variety of speakers from across Europe -and even from the United States- presented their view on the current and future camping landscape. During the General Meeting ECF made clear that the supply chain problems that arose in recent years started to fade away in Q1 of 2023

Editorial

Editor in Chief: Antonio Mazzucchelli direttore@aboutcamp.eu

Art director: Federico Cavina

Editorial team: Renato Antonini

John Rawlings - Terry Owen - Enrico Bona

Steve Fennell - Paolo Galvani - Giorgio Carpi

Peter Hirtschulz - Andrea Cattaneo

Bartek Radzimski - Irene Viergever

Web team: Maurizio Fontana - Gabriel Lopez

Advertising

Sales International: direzione@fuorimedia.com

Sales Italy: Giampaolo Adriano +39 338 9801370 adriano@fuorimedia.com

Web edition

Print edition

and production figures are now clearly up, to pre-covid levels. For manufacturers of motorhomes and caravans sustainability is a big topic, especially with regard to the upcoming Euro7 emissions standard and the uprise of alternative fuels. ECF board members elaborated on those issues and on their efforts to influence EU decision making, on these topics as well as on the proposed rise of the maximum weight for motorhomes to 4,250 kilograms for holders of the B driving license. Troy James (senior VP at Thor Industries) and Alexander Leopold (CEO at Thor-owned Erwin Hymer Group) took the audience along into all of the differences between the US and European caravanning and RV market. Alexander Wottrich, co-CEO at Truma Group and grandson of the company’s founder, shared his views on technical innovations. KCI board member and Thetford marketing manager Norbert van Noesel presented the promotional efforts of the Dutch industry association on promoting camping, followed by trend researcher Adjied Bakas, who also was on stage last time around in Utrecht, ten years ago. University professor Carlo van de Weijer gave his view on sustainable recreational mobility and Stan Stolwerk, director of NKC, the Dutch association of over 65,000 motorhome ownersm takes a prominent role towards sustainability and co-operation with manufacturers and other suppliers.

The full report will be published in the next issue of Aboutcamp BtoB. Don’t miss it!

Would you like to receive the print edition of Aboutcamp BtoB? It is free of charge!

Aboutcamp BtoB helps professionals in the caravan/RV and leisure industry around the world keep up to date with all the latest business news and market trends in this sector. It’s the most well informed source of B2B information in the caravan industry, with a unique global perspective and an international team of correspondents delivering daily news online at www.AboutcampBtoB.eu, a bi-monthly e-newsletter, and a high quality print magazine delivered (free) in Europe, the United States, Australia, New Zealand, South Africa, Japan, China, Korea, Argentina, Brazil, Chile. The Aboutcamp BtoB magazine is published four times a year with features including exclusive interviews with senior management from the industry, reviews of the major exhibitions around the world, and reports about the latest market trends, plus in-depth profiles of OEM suppliers who specifically manufacture components for this sector. With all the recent acquisitions, new technological developments and more and more consumers buying leisure vehicles around the world, Aboutcamp BtoB is essential reading for everyone working in any business related to the caravan industry. While so many flock to the internet, and have an inbox full of emails, Aboutcamp BtoB decided to print a paper magazine so that it gets more noticed, read, appreciated and discussed; so, we wish you happy reading!

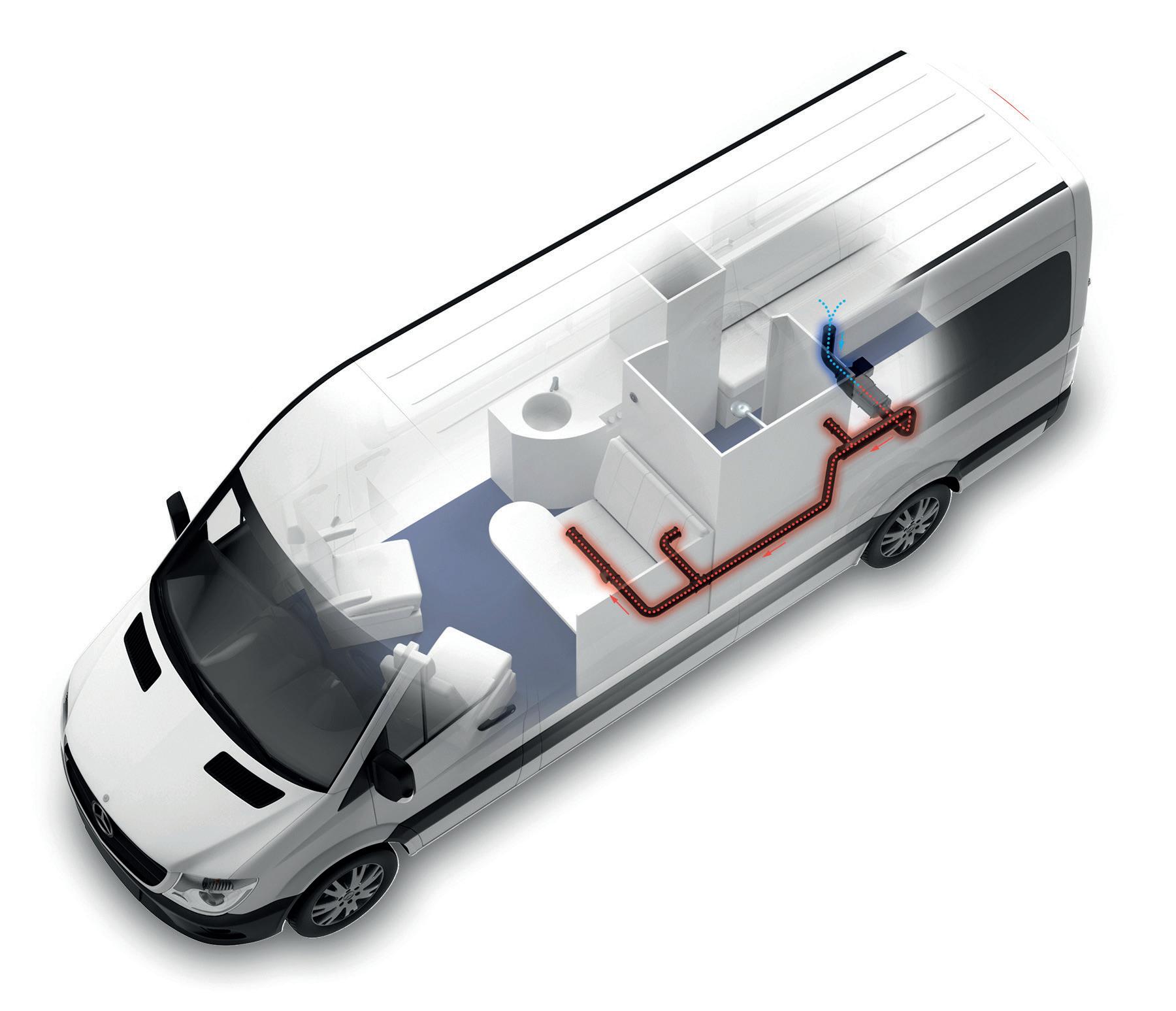

Subscribe on www.aboutcampbtob.eu

Aboutcamp BtoB is also a website updated daily with news and information dedicated to RV builders and OEM producers. The website is supported by a professional newsletter sent monthly to the professionals in the RV sector. We also strengthened our presence on LinkedIn, where we manage the business page of the magazine but also the group “Caravanning Professional” which allows us to develop direct and informal relationships with decision-makers in the RV industry.

On our website is possible to read online the print edition of all Aboutcamp BtoB issues at: www.aboutcampbtob.eu/read-the-magazines

Headquarters

Fuori Media srl

Viale Campania 33 - 20133 Milan – Italy

Ph +39 0258437051

E-mail: redazione@aboutcamp.eu

Internet: www.aboutcampbtob.eu

Registered with the Milan Court on 22 Dec. 2016 at No.310.

Subscription ROC 26927

6

N ews

Your plan. Our project. Together by tecnoform.com tecnoform_of cial

Carthago opens new Malibu van plant in Slovenia

The Carthago Group held an inauguration ceremony at its new plant in Ormož, Slovenia which will manufacture its Malibu Van range. This is Carthago’s second plant in Slovenia (in addition to its plant at Odranci) and represents a total investment of 50 million Euros, with 300 jobs expected to be created by the end of next year. This shows that Carthago is continuing to expand, even during times of political and economic uncertainty.

The guest list at the inauguration ceremony included the Slovenian President Nataša Pirc Musar and Matjaž Han, the Minister for Economy, Tourism and Sport, which indicates

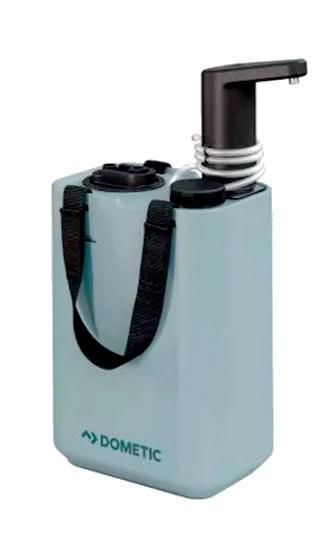

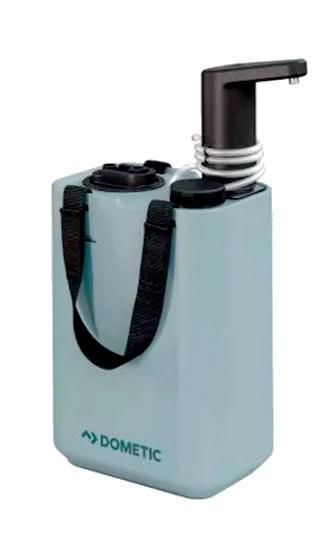

Dometic wins ISPO AWARD 2023

Dometic has won an ISPO AWARD for its GO Hydration Water Faucet and matching Water Jug which provides a universal smart water supply solution for outdoor adventures thanks to its water-saving rechargeable electric faucet and space-saving jug.

The ISPO Award jury said the following about the Dometic Hydration Water Faucet: “A small invention with big benefits. The Hydration Water Faucet is as easy to use as it sounds, just press the button and the exact amount of water you need is dispensed. Undoubtably, this was a key factor in our AWARD decision. For outdoor adventurers looking to go further and stay out longer, this is a worthwhile purchase.”

The innovative Hydration Water Faucet is part of Dometic’s GO collection of products designed to be easily stowed, packed, combined and transported. Practical and robust products including a table, chairs and stackable storage boxes.

the importance of the Carthago Group in Slovenia and the strategically important connection between the German motorhome manufacturer and its locations in the country. They were accompanied by Danijel Vrbnjak, the Mayor of Ormož, plus the management of Slovenian company Carthago d.o.o, and the entire management of the Carthago Group, including founder and owner Karl-Heinz Schuler.

Karl-Heinz Schuler emphasised the close relationship between the locations in Germany and Slovenia in his speech:

“In addition to our headquarters in Aulendorf/Upper Swabia, the plants in Odranci and now in Ormož constitute a supporting and indispensable pillar of the Carthago Group. Without the foothold in Slovenia, the Carthago Group wouldn’t be what it is today: one of Europe’s most successful manufacturers of premium category motorhomes.”

The new, highly specialised and state-of-the-art plant in Ormož in the north east of Slovenia has been built on a green field site covering an area of approximately 100,000 square metres. The manufacturing facilities include a joinery, a pre-assembly facility and an assembly facility, as well as logistics.

The new plant will have an annual capacity of about 3,000 Malibu Vans. Approximately 180 people will be employed in Ormož when production starts. This number is expected to increase to about 300 employees by the end of the first full year of production in 2024.

Caravan industry in Germany records stronger first quarter in 2023 than previous year

The association for the caravan industry in Germany (the CIVD), says that in the first quarter of 2023, the industry recorded a total of 23,770 new registrations of leisure vehicles, exceeding the previous year’s result by around 3.1 percent. It says that the continued interest in caravan and motorhome travel and the improved availability of vehicles is making the industry optimistic for the caravanning year 2023 at the start of the season. This is the second-best result ever for this period. New registrations of motor caravans rose by 5.7 percent to 18,479 units while the caravan segment recorded a decline compared with the previous year, with 5,291 new registrations (-5.1 percent). These results are an initial indicator that motor caravan production is recovering from the challenges of the previous year. The enthusiasm of Germans for caravanning as a form of holidaying continues to be strong, while high demand for rental vehicles indicates that interest among newcomers also remains high. Therefore, these positive developments are encouraging for the caravanning industry in Germany which is starting the caravanning year 2023 with optimism after a very challenging

2022. Supply shortages were particularly noticeable in motor caravans production last year, as the division suffered from an acute shortage of vehicle chassis. Demand for new motor caravans far exceeded supply on the market. The latest new registration figures therefore give cause for optimism for the remainder of the year: with 18,479 new registrations in the first quarter, the division exceeded the previous year’s level by 5.7 percent. Numerous manufacturers are now focusing on a broader range of brands for their base vehicles, which has improved the supply situation for vehicle chassis compared with the previous year. Caravan production benefited from the lack of vehicle chassis for motor caravans in 2022: manufacturers producing both vehicle types used their open production capacities to build more caravans. Accordingly, the division not only closed 2022 with an increase in production, but also recorded rising new registration figures in the autumn and winter. Many of the new caravans were exported. In the first quarter of 2023, the caravan sector, with a total of 5,291 new registrations, was around 5.1 percent below the result for the same period of the previous year.

8 N ews

Erwin Hymer Group signs agreement for 6,000 Volkswagen Crafter vans

The Erwin Hymer Goup has concluded an agreement with Volkswagen Commercial Vehicles (VWCV) for 6,000 Crafter panel vans as the base vehicles for EHG brand camper vans. The agreement was signed by Alexander Leopold, CEO Erwin Hymer Group, and Lars Krause, Member of the Brand Board of Management responsible for Sales and Marketing at VWCV. The vehicles will be delivered to the Erwin Hymer Group from 2024.

Volkswagen Commercial Vehicles is a leading manufacturer of light commercial vehicles and a brand of Volkswagen Group. The Erwin Hymer Group is the European subsidiary of Thor Industries, the world’s largest manufacturer of recreational vehicles. At the signing of the contract, Lars Krause announced: “We are delighted to have gained the Erwin Hymer Group

as a new partner that will offer its own camping solutions using our vehicles as the basis. We see the Crafter panel van as a benchmark in its class. It offers

In recent years, caravans and campervans have become a lifestyle topic that inspire people across all age groups. Young target groups and families in particular appreciate the flexibility and everyday usability of compact camper vans. This development is also reflected in the number of vehicle registrations. In 2020, campervans recorded a 44 per cent share in motorhome registrations in Europe. This increased to 50 per cent in 2021 and grew once more to 54 per cent in 2022.

plenty of space and great flexibility for a wide range of solutions and is a first step in our collaboration. We are also looking forward to discussing further projects for other vehicles, such as the Crafter chassis and T6.1 successor.”

Alexander Leopold: “With the Crafter as a base vehicle, we are in an even better position to meet the strong demand for powerful and compact camper vans. In addition, we can very well imagine joint projects with our partner Volkswagen Commercial Vehicles in areas such as alternative drive systems, for example.”

9 aboutcamp_issue_39_UK_VC 210x148.indd 1 11.04.23 10:20

CIVD update on EU Commission B-licence policy

For several years, the caravaning industry has been campaigning for the expansion of the B-licence policy #Führerscheins to 4.25 tonnes. The European Caravan Federation (ECF) is actively involved in the deliberations of the EU commission and is an important point of contact for decision-makers in Brussels. The concerns of the caravanning industry are therefore heard at EU level. On 1 March, the EU Commission published its draft for the 4th driving licence policy #Führerscheinrichtlinie. The draft also takes up the extension of the B driving licence, but limits this to vehicles with alternative drives. From the point of view of the caravanning industry, the CIVD has the view that this restriction is not expedient and must be revised, because the existing fleet must be urgently considered and the expansion to 4.25 tons for all vehicles must be possible.

Thetford launches new website

Thetford has launched a new website that is easier to use for both consumers and commercial users. Market research showed that there were two different types of visitors to the Thetford website: those with a service demand who typically query how a product works, how to maintain a product or how to fix a product, and those with a commercial need.

Wendy Dujardin, Services Manager at Thetford: “Not every end-user is aware of their product model. In the past they had trouble finding the right one and therefore finding the right answer to their questions. A service wizard now supports our customers, leading them to all relevant documentation per product series, all in one place. This will help our end users to become far more self supporting in case of service questions.” The renewed website also offers a more inspirational commercial journey. Norbert van Noesel, Marketing Manager at Thetford said: “Although Thetford offers no direct sales to end-users, we like to guide our customers to have the best RV and camping experience and find the right products to support this experience. This is more than just showing products, it’s about bringing people in an inspirational environment. Our new approach from areas of use, supported by lifestyle photography, creates a refreshing visual design.” The new website can be experienced at www.thetford.com.

LCI Industries first quarter 2023 report

LCI Industries (“Lippert”) has reported first quarter 2023 results which show that in its RV OEM business channel, net sales were $400.1 million in the first quarter, down 62% year-over-year, driven by a nearly 55% decline in North American wholesale shipments for the quarter compared to same quarter in 2022.

“Despite wholesale RV declines, revenue and content per unit are substantially above pre-COVID levels. By leveraging our strong R&D capabilities, we are aggressively working to expand market share through product innovations to meet consumer demand for high-quality, sophisticated content,” commented Jason Lippert, LCI Industries’ President and Chief Executive Officer.

Lippert’s content per North American travel trailer and fifth-wheel RVs for the twelve months ended March 31, 2023, increased 21% year-over-year to $5,881. Its continued execution of a diversification strategy meant that North American RV OEM net sales were now less

than 48% of total net sales for 12 months ended March 31, 2023. Consolidated net sales for the first quarter of 2023 were $973.3 million, a decrease of 41 percent from 2022 first quarter net sales of $1.6 billion. Net income in the first quarter of

2023 was $7.3 million, or $0.29 per diluted share, compared to net income of $196.2 million, or $7.71 per diluted share, in the first quarter of 2022. EBITDA in the first quarter of 2023 was $52.5 million, compared to EBITDA of $301.5 million in the first quarter of 2022. Additional information regarding EBITDA, as well as a reconciliation of this non-GAAP

financial measure to the most directly comparable GAAP financial measure of net income, is provided in the “Supplementary Information – Reconciliation of Non-GAAP Measures” section below. The decrease in year-over-year net sales for the first quarter of 2023 was primarily driven by decreased North American RV wholesale shipments and decreased selling prices which are indexed to select commodities, partially offset by acquisitions. Net sales from acquisitions completed in the twelve months ended March 31, 2023 contributed approximately $28.5 million in the first quarter of 2023. The Company’s average product content per travel trailer and fifth-wheel RV for the twelve months ended March 31, 2023, increased $1,027 to $5,881, compared to $4,854 for the twelve months ended March 31, 2022. The content increase in towables was primarily a result of organic growth, including pricing and new product introductions, market share gains, and acquisitions.

10

N ews

Close to you since 1962

We stand right in the middle of every project realization.

HIGH QUALITY GRP FOR RECREATIONAL VEHICLES.

www.flatlaminates.com

Dimatec with Nova Leisure to expand in UK

Dimatec, a global manufacturer of instrumentation, accessories and spare parts for the RV sector, in particular in the field of on-board and external lighting for campers and caravans, has announced an important new partnership with Nova Leisure, a distributor of caravan and motorhome equipment in the UK market. This new alliance will bring benefits to customers in terms of availability of materials and in after-sales service and technical assistance.

“The United Kingdom has a very solid internal market, with its own needs, in which we have already been successfully present for many years,” said, Alexander Vohwinkel, Export Manager of Dimatec: “Nova Leisure represents for us a strategic partner in this sector, with a great experience both technically and of the needs of its specific market. We are confident that this synergy will be an immediate advantage for customers and will give impetus to further consolidation of both companies in the UK market”.

AMA revenues up for third consecutive year: +24% in 2022

AMA closed the 2022 financial year with €289 million in consolidated revenues, up for the third consecutive year, and +24% compared to the previous year. UniCredit and Crédit Agricole Italia, together with SACE, are supporting the growth strategies of the Emilia-based company. With 18 production units, 15 distribution branches and four sales offices in which 1,650 people work in synergy, the Group aims to expand its product range with a view to long-term sustainable development, respecting the environment and future generations.

Unicredit and Crèdit Agricole Italia have supported the company by disbursing two six-year loans, for a total of €20 million , resources that will enhance the production units and accelerate the growth in size of the Group. Both operations saw the intervention of SACE with the SupportItalia guarantee and for the financing of UniCredit, and also of CDP.

12 N ews

HALL 13 BOOTH D14

Trigano acquires Alonso dealer group and Abalain

Trigano has entered into exclusive negotiations for the acquisition of almost 100% of the capital of the companies Loisirs Evasion, Loisirs 40, Loisirs 47 and ATC 64 (Alonso group). It is also acquiring 100% of the capital of the companies Bretagne Camping-Cars, Bretagne Camping-Cars Quimper, SO.DI.CA. and Britways Car (Abalain group) – motorhome distributor in Brittany. Alonso group is a motorhome distributor in south-western France, it employs around 40 people and achieved a total turnover of around €30M in 2022 from its four sales outlets. Given the level of Trigano’s sales to these companies, the contribution to consolidated sales resulting from this acquisition would be around €25 million. These acquisitions are fully in line with Trigano’s development strategy through external growth. The integration of Alonso group would complete the territorial coverage of the Libertium network, which already consists of 50 outlets in France.

New marketing manager at Lippert Europe

Francesca Tompetrini has a new role as Marketing Manager Caravanning and Rail at Lippert Europe with responsibility for the marketing team and reporting to the Vice President of Sales Caravanning EMEA, Lorenzo Manni. Francesca has a Degree in Communication and started her career at Lippert in 2017.

“Francesca has always had a great passion for Communication and Marketing area, expressing professionalism and ability to manage projects in the Caravanning and Railway sectors, as well as the constant desire to grow and improve,” says Lorenzo Manni. “We are sure that in her new role she will contribute to achieving Lippert’s growth and sales objectives and to increasingly promote and develop strategic communication and brand identity and awareness.”

13

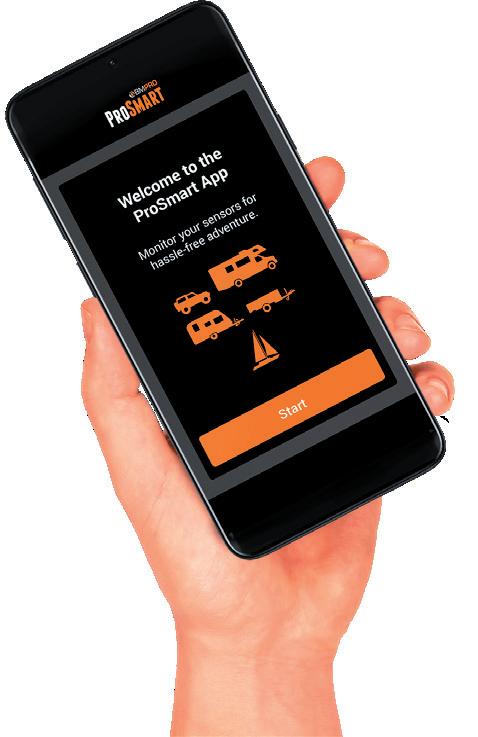

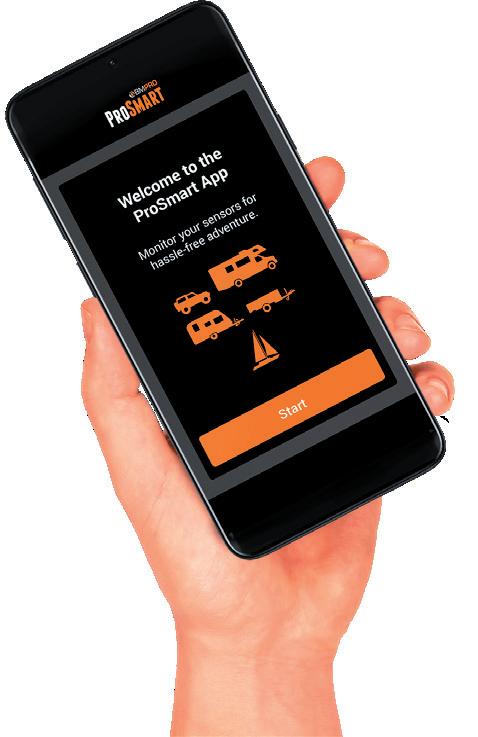

ProSmart MONITOR YOUR ADVENTURES TEAM BMPRO .COM

Dometic’s first quarter 2023 report says market conditions were ‘extremely challenging’

Net sales were SEK 7,289 m (7,518); a decrease of -3%, of which -13% was organic growth. Operating profit (EBITA) before items affecting comparability was SEK 847 m (1,114), corresponding to a margin of 11.6% (14.8%). Items affecting comparability were SEK -26 m (-159). Profit (loss) for the quarter was SEK 334 m (494). Operating profit (EBITA) was SEK 821 m (955), corresponding to a margin of 11.3% (12.7%). Operating profit (EBIT) was SEK 667 m (812), corresponding to a margin of 9.2% (10.8%). Comment on Dometic’s first quarter 2023 results by Juan Vargues President and CEO: “The first quarter result 2023, with a solid double-digit EBITA margin despite extremely challenging market conditions and macroeconomic uncertainty, shows how our strategic initiatives are transforming Dometic into a more diversified and resilient company. RV industry production in the US declined by 54 percent year to date, while high retailer inventory levels continued to affect our Service & Aftermarket business globally. In this environment, net sales for the quarter reached SEK 7,289 m (7,518) and both the Marine and Global segments reported organic net sales growth. For the Group, organic net sales declined by 13 percent. Service & Aftermarket organic net sales declined by 19 percent, a sequential improvement compared with the fourth quarter of 2022. We expect a

continued gradual improvement over the coming quarters. Operating cash flow improved significantly to SEK 294 m (-398), supported primarily by sequentially reduced inventories. EBITA before items affecting comparability was SEK 847 m (1,114), corresponding to a margin of 11.6 percent (14.8). The decline was attributable to the EMEA and Americas segments, while the margin improved in the APAC, Marine and Global segments.

site in Hungary, continued to have an adverse impact on the EMEA result. We are taking additional measures to improve the results in EMEA and Americas, and expect to see gradual improvements in 2023. The global restructuring programs announced in 2019 and 2022 are continuing at high pace, and today there are 14 percent fewer FTEs (full-time equivalents) in the company than a year ago. At the same time we are increasing our investments in product development and in strategic structural growth areas such as Mobile Power Solutions and Mobile Cooling.”

The margin for the Americas segment continued to be negatively impacted by significantly lower net sales in both RV OEM and Service & Aftermarket. The sales mix, with a lower share of Service & Aftermarket net sales, also had a negative effect on the margin for the EMEA segment. In addition, extraordinary logistics-related costs and inefficiencies in manufacturing linked to the factory transfer from Germany to our existing

“We are optimistic about the long-term trends in the Mobile Living industry, however it is difficult to predict how the current macroeconomic situation will impact the business in the short term. We anticipate a gradual recovery in demand in Service & Aftermarket over the coming quarters, and continued stable development in the Distribution sales channel. In the OEM sales channel we foresee a gradual weakened demand over the coming quarters, with the exception of RV Americas where we expect to see a stabilization in demand by the end of the year. In this environment we will continue to drive our strategic agenda to deliver on our targets, while at the same time remaining agile to quickly respond to short-term market trends.”

Caravan Salon Düsseldorf 2023 set to be highlight of the year for the caravan industry

The Caravan Salon Düsseldorf 2023 (25 August to 3 September) has already received more enquiries from potential exhibitors compared to last year and is set to be the highlight of the year for the caravan industry.

This leading caravanning trade fair occupies 16 halls at the Düsseldorf Messe, plus outside display areas, and is when the sector presents its new products and innovations for the future, and also sets standards for the quality and diversity of the products on display.

“We are very satisfied with the registrations received so far. Requests from national and international exhibitors have increased again against the previous year and we

have already had to set up waiting lists in many segments. Caravan Salon is the highlight of the year for visitors and exhibitors and undisputedly THE meeting point for the entire industry with guests from all continents. It is and will be the showcase for innovations because in Düsseldorf the trends and innovations of the coming season and beyond are presented,” says Caravan Salon Director Stefan Koschke. In addition, there is a great entertainment and information programme that is perfectly oriented towards mobile leisure. The popular “StarterWelt”, the Special “Abenteuer Selbstausbau/Adventure

14 N ews

DIY”, the “Travel & Nature connected” stage, the Dream Tours cinema plus many other attractions are all part of the inviting line-up at Düsseldorf Exhibition Centre. The ranges are rounded off by accompanying high-quality side events for the caravanning industry.

Bailey of Bristol with Ford Pro for its first campervan conversion

The UK caravan and motorhome manufacturer, Bailey of Bristol (Bailey) has announced it will be introducing its first van conversion in October this year. It will be based on the Ford Transit and called Endeavour. It is also working on a concept van conversion based on the all-electric Ford E-Transit. Bailey became an official Ford Pro Converter in August 2022, following its first collaboration with Ford for its best-selling Adamo coachbuilt motorhome range in 2020. The success of the Adamo model has lead Ford to become Bailey’s leading base vehicle supplier. Members of the Bailey Product Development Team recently presented its first pre-production Endeavour model to the Ford Pro Special Vehicle Team for evaluation at Ford UK headquarters in Dunton, Essex.

WEVC eCV1 3.5T electric van starts real-world testing

The British-designed and built WATT eCV1 prototype 3.5 tonne light commercial vehicle from the Watt Electric Vehicle Company (WEVC) has started an intensive real-world testing programme. Designed for production of up to 5,000 vehicles per annum, the innovative and highly flexible vehicle is suitable for a wide range of electric commercial vehicle designs and specialist vehicle converters. WEVC signed a MoU with electric commercial vehicle specialist, ETRUX, earlier this year who has designed and built a body for the WATT eCV1 3.5 tonne cab and chassis unit. The next step is for WEVC’s electric vehicle platform technology to be adapted by ETRUX into a range of offerings for the commercial vehicle market. It could also suit a conversion to a recreational vehicle. The vehicle uses WEVC’s PACES architecture, a sophisticated and cost-effective modular electric vehicle platform designed to support commercial vehicle manufacturers, specialist vehicle converters and fleet operators in the transition to an electric future.

15

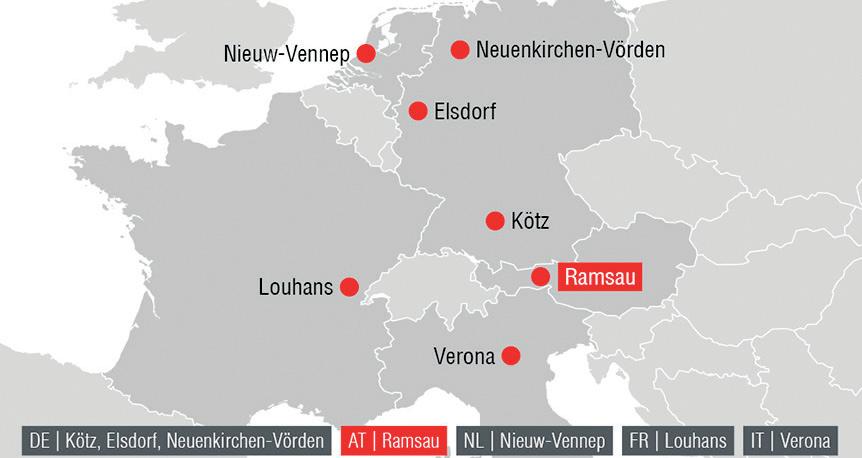

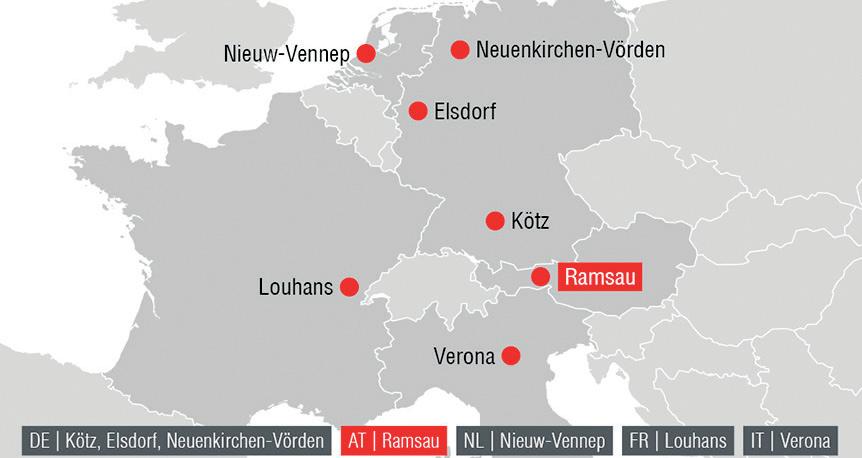

AL-KO Vehicle Technology adds seventh Customer Centre to its European network

AL-KO VT has expanded its European customer centre network with the addition of a customer centre in Ramsau in Austria. This joins the group of six other centres in Germany, the Netherlands, France and Italy. “The newly opened customer centre in Ramsau in the Zillertal valley in Austria is another step towards even greater customer proximity and is a first-class addition to AL-KO VT’s closeknit service network in Europe,” says Günther Schöllenberger, Managing Di-

rector at the Ramsau site. “Our caravanning customers can now have their vehicles retrofitted with high-quality accessories in a great holiday area. Due to its optimal geographical location on the north-south axis, the Ramsau Customer Centre is also ideal for a stopover during a holiday trip.”

Vitus Gredler, Head of the Customer Centre Ramsau, adds: “Particularly when it comes to advice-intensive topics such as caravan payload increase, choosing the right rear carrier or configuring a suitable air suspension, caravanning customers can meet seasoned workshop professionals with a wealth of relevant experience. Owners of caravans and motorhomes, light commercial vehicles and car trailers will find themselves in good hands at the Ramsau Customer Centre.”

Scott Hunter: Head of Operations at BMPRO US Division

BMPRO, the RV power and control management company, has announced the promotion of Scott Hunter to the position of Head of Operations at its US Division. BMPRO says that Scott’s experience, accomplishments and dedication to the company’s growth and success make him the ideal candidate for this role. Scott has been part of the BMPRO team for several years, and his leadership skills have helped drive the company’s continued growth and success. His experience in the RV industry has been invaluable, with a lifetime of exposure to the industry through their father’s involvement.

16 N ews

FIAT Professional celebrates 25th anniversary of Ducato in Brazil with fourth generation model

To celebrate the important milestone of the 25th anniversary of the Ducato in Brazil, and more than 15 years of leadership in this segment in Brazil, FIAT Professional a further step towards its consolidation in the South American market with the launch of the brand’s most popular light commercial vehicle, the fourth generation of the Ducato. In 2022, the total van market in Brazil reached 64,000

registrations, with FIAT Professional achieving a 37% market share, an absolute leader in the segment. The new Ducato, that has sold over 130,000 units since 1998, reaffirms its leadership by focusing on technology and connectivity, and also by refreshing its design and overall interior appearance. In Brazil, the new Ducato is exclusively equipped with the 2.2 Turbo Diesel engine with 140 hp and 340 Nm, developed with an optimized weight, greater efficiency, and lower emissions. FIAT Professional is present in over 230 sales and after-sales points throughout the national territory. With a 100% coverage of the van market, the brand boasts a specialized personnel and priority service, which is fundamental for those who use the vehicle as a work tool.

REV Group appoints new President and CEO

The REV Group, Inc. has appointed Mark Skonieczny as President and Chief Executive Officer, effective immediately. Previously, Mark Skonieczny had served as Interim CEO and Chief Financial Officer. Mark Skonieczny joined the Company’s Board in January 2023 and will continue to serve as a Director. The company has initiated a comprehensive search for a new CFO. Prior to joining REV Group, Mark Skonieczny held positions as Vice President and Corporate Controller of Adient PLC and spent 17 years at Johnson Controls in a variety of financial roles.

17 www.ofolux.it We are certified IATF 16949:2016 Your reliable partner for Lighting Systems A new milestone in Automotive Quality System requirements

Knaus Tabbert starts 2023 financial year with a record first quarter

The significantly improved availability of chassis in the first quarter of 2023 has helped the Knaus Tabbert Group achieve another quarterly revenue record of EUR 8.368 million in the first three months (previous year: EUR 222.3 million). This corresponds to an increase of 65.8% compared to the same period of the previous year. The reason for this significant increase in sales is Knaus’ changed chassis purchasing strategy. Since the second half of 2022, Knaus Tabbert no longer produces motorhomes and camper vans on just one chassis (Stellantis) but now uses five different chassis (Stellantis, MAN, VW Commercial Vehicles, Mercedes and Ford). As in the fourth quarter of 2022, the better chassis availability has lead to an improved product mix. “In 2022, we set the course for the future. The significant increase in person-

nel capacities, investments in innovative products and state-of-the-art manufacturing technologies and, in particular, the decision to diversify chassis to now five suppliers have been increasingly having an impact since the fourth quarter of 2022. Our product portfolio inspires our dealers and customers alike: with our premium brand KNAUS, we are the mar-

Adria Supersonic wins Red Dot design award

The new Adria Supersonic integrated motorhome range from Adria Mobil has

won the prestigious Red Dot design award 2023. The new Supersonic won a distinction in the Product Design category. This follows recent other international awards including the German Design Award 2023 for excellent product design. The new Supersonic range, launched at the Caravan Salon Dusseldorf in September 2022, is Adria’s pinnacle range of integrated motorhomes built on the Mercedes-Benz Sprinter base vehicle.

ket leader for new registrations of fullfledged motorhomes and camper vans not only in Germany but throughout Europe for the first time!” comments Wolfgang Speck, CEO at Knaus Tabbert AG. The significantly higher share of motorhomes and camper vans of 53% (previous year: 28%) of the total portfolio, coupled with a significantly higher average price compared to caravans, led to the significant increase in sales revenue.

The Management Board of Knaus Tabbert AG is optimistic about the 2023 financial year. On the basis of the order backlog, the changed chassis purchasing strategy and the resulting positive product mix effects, it expects the Group to achieve strong sales growth compared to the previous year before the effects of price increases. Price increases compared to dealers of the Knaus Tabbert Group are planned in the 2023 financial year in a range of 6–8%. The prerequisite for this, however, is an easing of the supply chains and consequently the planned availability of components and other materials, in accordance with the carefully considered planning premises. This forecast is also based on the assumption that the global economic and industry-specific conditions, especially with regard to the further course of the Ukraine conflict, will not deteriorate significantly compared to planning.

NEXTGEN hydrogen-powered concept campervan offers 500 km range

A hydrogen-powered NEXTGEN zero emission campervan study, developed by First Hydrogen Corp and global mobility experts, EDAG, could offer a range of 500 km. The concept is based on First Hydrogen’s new hydrogen-powered light commercial vehicle. The camper is designed to be used on various surfaces thanks to the combination of off-road components such as all-terrain tyres, auxiliary lighting and wheel arch flares. Inside, the futuristic camper will have spacious living areas with all kinds of electrical appliances that can be used without a power connection thanks to its fuel cell that generates electricity. Fuel cell electric vehicles (FCEVs) can cover larger ranges and manage heavier payloads loads than equivalent battery

electric vehicles (BEVs); attributes that are attractive for the recreational vehicle market. RVs travel long distances, often into the wilderness away from refuelling or charging infrastructure, making long range especially appealing. Refuelling a FCEV takes mere minutes, approximately the same amount of time as a petrol or diesel vehicle, whereas recharging electric vehicles can take hours, which inhibits the freedom that van life demands. Additionally, in the same way that delivery vans might need to run refrigeration units and emergency vehicles power medical equipment; recreational vehicles run auxiliary loads such as cookers and water boilers, applications suited to FCEVs. BEVs require more battery cells to power these loads, adding to overall

vehicle weight, depleting the vehicles’ energy more quickly. First Hydrogen is successfully starting 12-18-month-long commercial vehicle trials with its Generation I fuel cell LCV. In collaboration with the UK Aggregated Hydrogen Freight Consortium (AHFC), road trials are commencing with award-winning fleet management company, Rivus.

18 N ews

Our UK correspondent completes Bailey of Bristol’s Sahara Challenge

The Aboutcamp B2B UK correspondent, John Rawlings, has travelled over 2,735 miles to Morocco and back to the UK during a Sahara Challenge media road trip hosted by the UK caravan and motorhome manufacturer, Bailey of Bristol. The objective of the Sahara Challenge is to put Bailey caravans and motorhomes to real-life tests, generate media coverage, inspire people to try new destinations, and show the joys and benefits of travelling with your own leisure vehicle. This follows previous road trips to above the Arctic Circle in Finland (in winter) and to Istanbul in Turkey, as well as a

coast to coast trip across Australia. Various media and industry guests were invited to take part in different sections of the trip, including Nick Lomas, Director General of the Caravan and Motorhome Club, Martin Fitzpatrick, Joint Managing Director of Truma UK, plus Nick Howard and Simon Howard, the Managing Director and Marketing Director of Bailey of Bristol (respectively).

The guests used two Bailey Phoenix caravans towed by Ford MS-RT Rangers and a Ford Transit-based Bailey Adamo 75-4T motorhome.

From the official start in Sagres in Portugal (where the previous attempt had to be abandoned at the start of the pandemic in March 2020), the team crossed from Algeciras in Spain to Tanger Med in Morocco, and then travelled to Casablanca and Marrakech, and over the Atlas Mountains to camp in the Sahara Desert near M’hamid. The return leg of the journey took the team back over the Atlas Mountains to Fes and Chef-

chaouen, then back into Spain to take the Brittany Ferries crossing back to the UK from Bilbao.

“I was lucky enough to be asked to organise the trip,” said John Rawlings, “so did the full itinerary and am glad to say that everything went according to plan and all vehicles returned safely to the Bristol in the UK. Morocco surpassed all my expectations, but the highlight for me was camping in the Sahara Desert. That’s a caravanning memory I’ll always remember”.

19

MAN reports strong Q1 performance with increased sales and revenue

The commercial vehicle manufacturer, MAN, has started the current financial year 2023 with an operating profit of €197 million (compared to previous year period: €55 million; adjusted €57 million) or an operating margin of 5.8%. After production losses due

to the Russian attack on Ukraine last year, sales for the first three months of 2023 increased by 41% to 27,333 units, compared to 19,325 new vehicles in the previous year’s first quarter. In total, 19,655 (14,355) trucks, 917 (707) buses, and 6,761 (4,263) vans have been sold to customers this year so far. MAN Truck & Bus achieved sales of €3.4 billion, which was 34% higher than the previous year’s level (€2.5 billion). This growth is mainly due to increased sales of new vehicles and vehicle services. “After an extremely difficult year with production downtime lasting several weeks, disruptions to supply chains, and high financial charges, including from rising energy and raw material prices,

Ford unveils All-Electric E-Tourneo Courier

Ford has revealed its all-new E-Tourneo Courier, a fiveseat multi-activity vehicle with a distinctive SUV-inspired design and a refined all-electric driveline. It is one of ten all-electric vehicles Ford has committed to offering in Europe by 2024. Ford is investing $50 billion globally through 2026 to achieve a targeted run rate of more than 2 million all-electric vehicles by the end of that year. The all-electric E-Tourneo Courier will arrive in 2024 for customers across Europe. E-Tourneo Courier was developed from the ground up to deliver a spacious and practical design in a manoeuvrable and compact package. The all-electric multi-activity vehicle features a “digiboard” instrument panel that features a full digital instrument cluster and SYNC 4 infotainment controlled via the large 12-inch touchscreen. The fully connected cabin features wireless Android Auto and Apple CarPlay integration, as well as a phone charging pad to stay connected on the go. The vehicle offers both 11kW AC and 100kW DC charging options, and charge management is made easier with Ford’s end-to-end home charging solution, handy app, and scheduling capability to take advantage of cheaper energy tariffs where available. A typical 7kW overnight domestic charge from 10-100 per cent takes 7.8 hours. Ford software and the BlueOval Charge Network, which is one of the largest in Europe and set to include 500,000 chargers by 2024, also facilitate public charging.

we succeeded in getting MAN back on track thanks to major efforts. The measures taken in recent years to improve earnings, some of which were incisive, are now bearing fruit and are also reflected in the Company’s earnings. A great success! In order to achieve our targets for the current fiscal year, we will now do everything in our power to continue this positive trend,” says Inka Koljonen, the MAN Truck & Bus SE Executive Board member responsible for Finance, IT and Legal. At the same time, however, she points to the uncertainties that still exist, resulting among other things from the economic consequences of the Ukraine war and the Corona pandemic.

MORELO expands production facility to meet growing demand

MORELO, the premium motorhome brand from the Knaus Tabbert group, is expanding its production facility in Schlüsselfeld by building a new workshop so it can increase production to meet the growing demand for its vehicles. At the same time, the number of employees will also increase sharply, from the current 450 to around 550 employees.

“With the factory expansion, we are taking the next big step into the future,” says Robert Crispens, Managing Director of MORELO Reisemobile GmbH. “The new Plant 2 as well as the significant expansion of Plant 1 and the exhibition area for our vehicles – all this is the basis for being able to continue to grow under our own steam and at the same time to implement the first class wishes of our customers even better, more individually and faster can.”

Due to the continuous growth, the Upper Franconians have now almost reached their capacity limits. Therefore, a new stage in the company’s history is confidently heralded and an additional factory building is built, which will contain a fully-fledged, state-of-the-art production line. The new Plant 2 in the north of the MORELO company premises, which is within sight of the A3, will include a state-of-the-art production line, a second panel production, design and development including prototype construction, a warehouse, a canteen and a second employee car park for approx. 100 cars.

20 N ews

New Pop-up roof solutions

• high level comfort

• side guards in high quality canvas

• cutting-edge design, accurate construction

• robust and easy to operate lifting mechanism

• resistant structure, semi-rigid or soft internal lining

• RTM/Foamed resin for a sensible weight reduction

• interior lining in LWRT in the upper part of the cabin

• LWRT technology for construction and finishing parts, inner and outer

21

AUTOMOTIVE TECHNOLOGIES IN THE RV INDUSTRY

LWRT technology for your next innovative project

Ama Composites is the reliable partner for designing and building any element of an RV - inner & outer - always with a view to cost and weight saving

Seventy years of Melbourne Supershow

Melbourne Showgrounds welcomed back the biggest Caravan and Camping Show in Australia earlier this year for the 70th Anniversary edition. The 2023 Victorian Caravan, Camping & Touring Supershow was held from Wednesday 22nd of February and conducted on Sunday 26th of February. Almost 48 thousand consumers visited the pet friendly event, which is a record number for a 5-day Supershow in Australia

The Victorian Supershow is one of four Caravan Shows organised by Caravan Industry Victoria, featuring more than 215 exhibitors and spanning across 100,000 square metres of exhibition space. Daniel Sahlberg, CEO of Caravan Industry Victoria: “Off the back of huge demand, the question is where the industry will realign too. Our focus with our caravan shows and everything we do is to keep the caravan industry at the forefront of consumers’ minds with constant education and training on how to use the products. And with the global financial impact we are promoting that you can do more with a

caravan or RV and it’s more affordable.” This year’s theme was “Start Here, Go Anywhere”, which has been the main message for all market ing and promotions. New for this special anniversary edition were the RV Master Stage and Adventure Zone. The RV Master Stage welcomed over 30 live interactive sessions from caravanning and camping experts. For those who were not able to attend the show in person, these sessions were streamed live

on the Caravan Industry Victoria Social Media channels. The Adventure Zone, located on the campground food court, hosted a large number of demonstrations on offroad driving, weight, towing and much more.

Celebrating over 70 years in manufacturing, Truma (part of Leisure-Tec Australia) was again the major partner for the 2023 Victorian Caravan, Camping & Touring Supershow. Supporting partners were AL-KO and BMPRO.

22

Words Irene Viergever

R eport Melbourne - Victorian Supershow 2023

Daniel Sahlberg

History

The first annual Victorian Caravan Show was held over three days in September and October of 1954, at the Wirth’s Circus site in Melbourne. The organisation, formed by leading caravan makers of Australia, got together to start promoting the caravan lifestyle and its products in Victoria. A newspaper article from 1954 to encourage people to visit the caravan show reads: “All caravans offer big advantages over tents and camping - in weather protection, comfort and convenience. Some of the luxe models may even be better equipped and more comfortable than your own home”. A total of 22 exhibitors showcased their products and over 10,000 people visited that first Caravan Show in 1954.

After that premiere in 1954, the Victorian Caravan Show moved locations a number of times. The Passport of Freedom competition has been a beloved tradition at caravan shows since its debut. Being the 70th anniversary edition, Caravan Industry Victoria went all out for the 2023 prize pack: the major prize this year was a $70,000 Jayco Starcraft Bush Pack caravan. In addition, 70 other prizes were included in the prize pack, increasing the total value to a historic high of $100,000.

23

The 2023 Victorian Caravan, Camping and Touring Supershow commenced with the official opening on Wednesday morning. A number of VIPs, exhibitors and key players from within the Australian Caravan Industry joined presenter and radio broadcaster David Mann for a morning of industry announcements, product launches and 70th anniversary celebrations. David Mann: “You are all in business, I won’t hide the fact it has been a difficult three years. But this industry has made a lot of people very happy, particularly in the mental health and wellbeing space. They got out, got fresh air with like-minded people and had a terrific time”.

First keynote speaker of the opening event was President of Caravan Industry

Victoria Nat Schiavello. Nat took the opportunity to express his gratitude and support to everyone attending. Nat: “Collectively we create, operate and pro mote the best industry in Australia. [...] I am proud to be part of this industry and to see the vast majority of our members and industry products continue to evolve”.

Chief Executive Officer of Caravan Industry Victoria Daniel Sahlberg took the stage for a number of announcements and industry updates, including the lat-

est stats on Caravan manufacturing. Over the COVID-19 years, Victoria has seen a 35% industry growth and the state’s Caravan industry is now responsible for 93% of towable manufacturing in Australia. The Victorian RV industry is worth over AU$3 billion, providing jobs to over 10,000 direct employees. This number of jobs has doubled from 11 years ago when the industry was worth AU$1.1 billion. Daniel: “It is quite amazing; Victoria is the heartland of caravan manufacturing here in Australia. Caravan manufacturing came across from Adelaide in the 1930s and since the mid 2000s Victoria alone has 120 to 130 Recreational Vehicle manufacturers, mainly based north of Melbourne.”

Caravan Industry Victoria has 246 trade members, including manufacturers, suppliers, dealerships, retailers and service companies. On top of that there are a number of caravan parks and affiliates with a membership. During this year’s Supershow the association announced a number of member support initiatives, including a Weight Inspection Program, Membership Benefit Program and the roll out of the RV Master Manufacturers Accreditation Program.

Weight Inspection Program

Weight is a big issue for both cars and recreational vehicles in Australia as more and more accessories are being fitted in the aftermarket. For the last three years, Caravan Industry Victoria has been working closely with VIC Roads to gather data from manufacturers and dealerships regarding this issue. As part of the Caravan Industry Victoria’s strategy to better educate the industry and consumers, the Weight Inspection Program is designed to help consumers to understand weight with the goal to increase driver safety whilst travelling on the roads. During the inspection days, organised in conjunction with WIM Technologies, consumers can have the weight of their RV measured and corrected for free.

Membership Benefits Program

The Membership Benefits Program offers all Victorian members and their staff discounts to a range of mainstream items, including IT, flights, accommodation, fuel, shopping and entertainment. Signing up for this benefit program results in an average annual saving of $1400 per person.

RV Master Manufacturers Program

The RV Master Manufacturers Program, designed to raise industry standards, launched two years back and is now

24 R eport Melbourne - Victorian Supershow 2023

Nat Schiavello

Nat Schiavello, Daniel Sahlberg and Stuart Lamont

ready to be rolled out in Victoria. The program covers five key areas, being Business Systems, Quality, Human Resources, Regulatory Compliance and Customer Service. Like RVMAP, participants will be subject to annual audits to maintain their ‘RV Master’ status.

Stuart Lamont, CEO of Caravan Industry Association of Australia highlighted the importance of vehicle quality in Australia, as Australians love to explore parts of their country that are not as easily accessible. Areas you would not think of taking your car, Australian RV owners expect their caravan, camper trailer or motorhome to be able to go. Stuart: “We have some of the most stunning places in the world. Australians love to get out of the cities and travel terrain for which caravans and camper trailers probably aren’t traditionally used to. Caravans and camper trailers need to be built in

such a way to accommodate that consumer demand”. For this reason, Caravan Industry Association of Australia (CIAA) has been at the forefront of lobbying and advocating for tougher laws around supplying caravans and camper trailers to the Australian market. On 1 July 2023, the Road Vehicle Standards Act 2018 (RVSA) will finally come into full effect after a transition period was extended a further 12 months leading into last year’s federal election.

Over COVID-19, Caravan Industry Association of Australia supported their members with a number of initiatives and campaigns, including Camp At Home Heroes and Travel Your Road. Now that Australians are allowed to travel again, the National Body continues to inspire people on a National level to explore the country in an RV. On a state level, Caravan Industry Association of Australia and Caravan Industry Victoria

work closely together on a number of initiatives, including compliance merchandise, access to Australian standards and educational sessions. On top of that, Caravan Industry Victoria subsidised 50% of the registration fees for one employee per current financial business member who attended this year’s CIAA National Conference.

The next event organised by Caravan Industry Victoria is the 2023 Caravan Industry Victoria Trade Expo, held mid-July at the Hyatt Place Melbourne in Essendon Fields. This one-day Trade Exhibition is an Industry only event to network, do business and to see the latest products and services from suppliers and manufacturers. Several key speakers will discuss important topics within the Australian caravan industry, including compliance, RVSA and ACCC. AboutCamp BtoB had the pleasure to explore 100,000 square metres of exhibition space during this year’s Victorian Caravan, Camping and Touring Supershow, meeting exhibitors and learning more about the Australian trends and market.

25

Stuart Lamont

R eport Melbourne - Victorian Supershow 2023

Jayco

Founded in 1975 by Gerry Ryan, the iconic Jayco has grown to be the biggest caravan manufacturer in Australia. In fact, Jayco is the largest vehicle manufacturer in the Southern Hemisphere. The Jayco stand at this year’s

Supershow, located in the Grand Pavilion, was impressive as always and showcased Jayco’s full range, including caravans, motorhomes, camper trailers, pop-tops and campervans. Jayco considers “Australian Made” to be essential

to its values and success and therefore all Jayco RVs are manufactured at the Jayco

Jayco All terrain

Although campervans are not as in demand as towables in Australia, the Jayco All-Terrain Campervan is getting more and more popular due to the off-road capabilities. The All Terrain Campervan is

built on a sturdy Mercedes-Benz Sprinter 4x4 chassis, which provides exceptional stability and traction. This luxury model looks compact and can be driven with a normal licence, however it has a lot of internal features, including a separate

shower and toilet, decent size kitchen and large fridge. In addition to its offroad capabilities, the Jayco All-Terrain campervan is also equipped with safety features such as airbags, electronic stability control, and a rearview camera.

Jayco Silverline

Jayco Conquest

Jayco Australia brought their first motorhome to market in 2004. Since then, a range of on road and off-road motorhomes have been launched. The current Jayco Motorhome range consists of the Conquest and Optimum series, with the Conquest being the more economical option. The Jayco Conquest motorhome is available on the Renault Master platform, Mercedes Sprinter cab chassis and the Fiat Ducato – AL-KO chassis. AboutCamp BtoB had a look inside the 25ft Conquest motorhome built on the Fiat Ducato – AL-KO chassis. This motorhome has a large slideout area, which accommodates both the dinette and the bed. The full ensuite is located at the back of the motorhome and includes a separate toilet and shower. This roomy motorhome can still be driven on a normal drivers licence here in Australia.

Jayco’s Caravan range consists of four models, the Starcraft, Journey, All Terrain and Silverline. The top of the range Silverline is Jayco’s most luxurious option and comes in a Touring and Outback version, with the main difference being the suspension. The Touring features a lower ride height that enables greater fuel efficiency, coupled with Jayco engineered JTECH 2.0 suspension. The Outback comes with JTECH 2.0 independent suspension, off-road electric brake magnets, higher ground clearance, protective side aluminium checker plates and 200W solar panel and regulator. Both the Touring and Outback are available in four different floor plans, with the 21ft-3 being the most

26

Jayco-All-Terrain-MS-ft

Jayco-Silverline-24-ft

Jayco-Conquest-FA-25-3

factory in Dandenong.

Dometic

As with many businesses, COVID-19 has interrupted the flow of new development, products, and business focus – Dometic is no exception. As we exit the dark days of the pandemic, Dometic continues to adapt and develop the product offering to meet the evolving market. Managing Director Trent Rowe: “Getting closer to consumers is a recent focus for us. Being closer to consumers and really understanding the different types of consumers across Caravanning & Camping is very important. A common misconception is that Dometic is only focussing on the aftermarket and retail. That’s not entirely true as the RV industry is still a major focus for us – hence our acquisition of Enerdrive in 2021. With 28,000 RVs built locally and over 20,000 imported RVs, that’s almost 50,000 opportunities where you can see a Dometic and/or Enerdrive product fitted somewhere.”

popular option. Being Jayco’s flagship model, all Jayco Silverlines come with a range of luxurious key features, including air conditioning, washing machine, 216L Dometic absorption fridge, Truma ducted gas heating, continuous gas hot water system and Shurflo 12v water pump. All Silverlines come with a slide out. The Jayco Silverline sleeps up to four people and is mainly popular under the older demographics.

Everything Caravan and Camping

Established in 2014 by Matt and Paula Sutton, Everything Caravan and Camping is a community-driven resource for those who share the love of adventure, travel, camaraderie and road trips. With over 380K members, ECC is one of the largest Facebook communities for caravanning enthusiasts in the Southern Hemi sphere. When Leisiu-

re-Tec Australia acquired the platform early 2022, they expanded with the Everything Caravan and Camping marketplace. This one-stopshop for everything caravanning and camping is developed with marketplace software and technology that allows sellers to create digital shop fronts on the ECC website. Almost 5000 products are currently listed on the ECC Marketplace, sold by 44 different sellers.

27

Trent Rowe

Karl Vassallo

R eport Melbourne - Victorian Supershow 2023

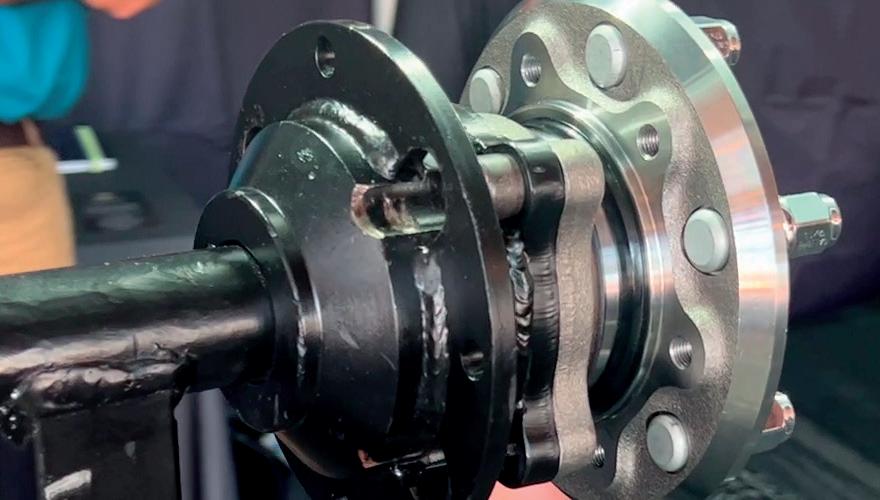

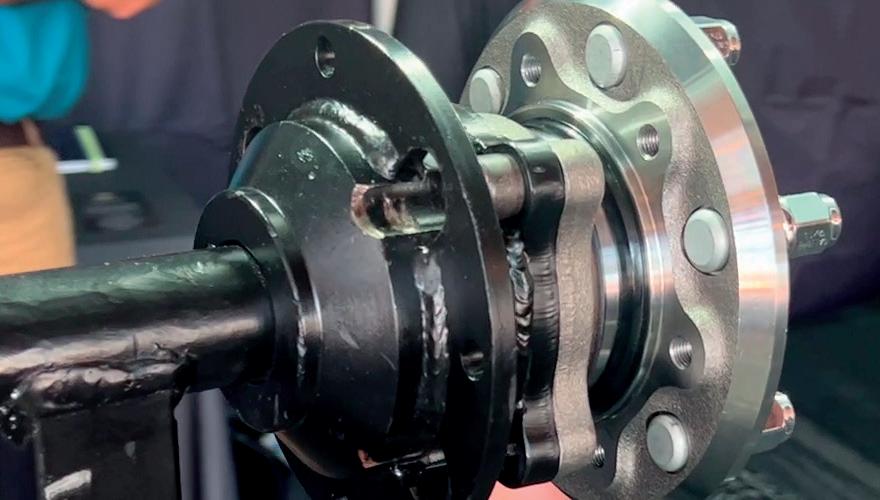

Spartan Innovations

New to the RV Industry and Melbourne Supershow is Spartan Innovations, a Queensland based com pany that has been around for only three years. They set the bar and expectations high by announcing the arrival of a new product for the RV Industry during the Official Show Launch. A product that, according to founders Bill Seawright and Alex Muzic, will revolutionise the trailer industry. Spartan Innovation’s new trailer hub system will get rid of the stub axle of any trailer system completely and their combined trailer hubs and axles will eliminate anything that can go wrong with stub axles. And if they do break, it is only a 10 minute job to have the full system replaced. The Spartan Trailer Hub System will last for approximately 225.000 kilometres on a 2.5ton axle and is rated up to 2.75ton. AboutCamp BtoB caught up with co-founder Bill Seawright a few weeks after the show to get the latest news on Spartan Innovations and the new trailer hub system. Bill told us there is a lot of interest from end users who are looking at upgrading their current system. The product will be released to market in June this year and the team is currently having conversations with a number of key players within the trailer industry, including RV manufacturers, suspension manufacturers and RV Service Centra. Next is the launch of their heavy-duty system, which will be rated at 4ton.

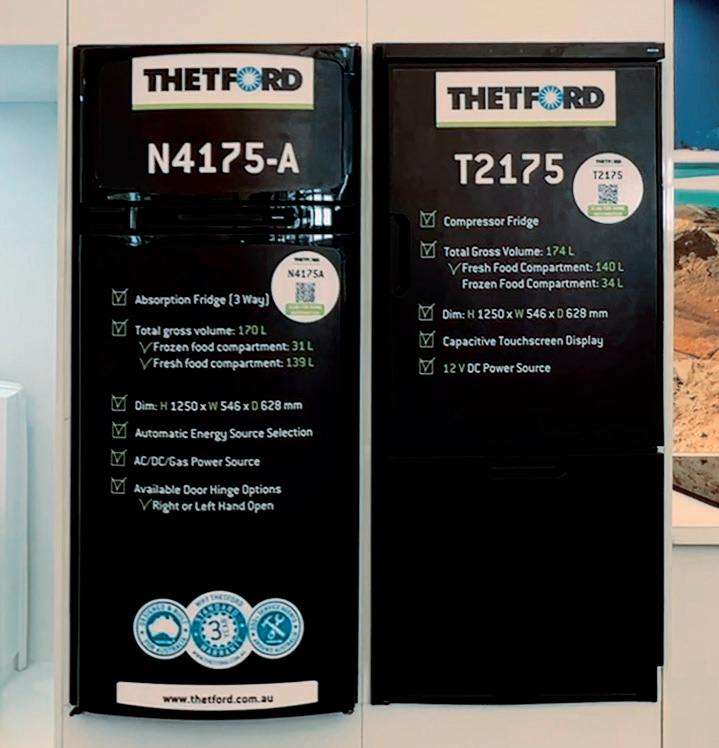

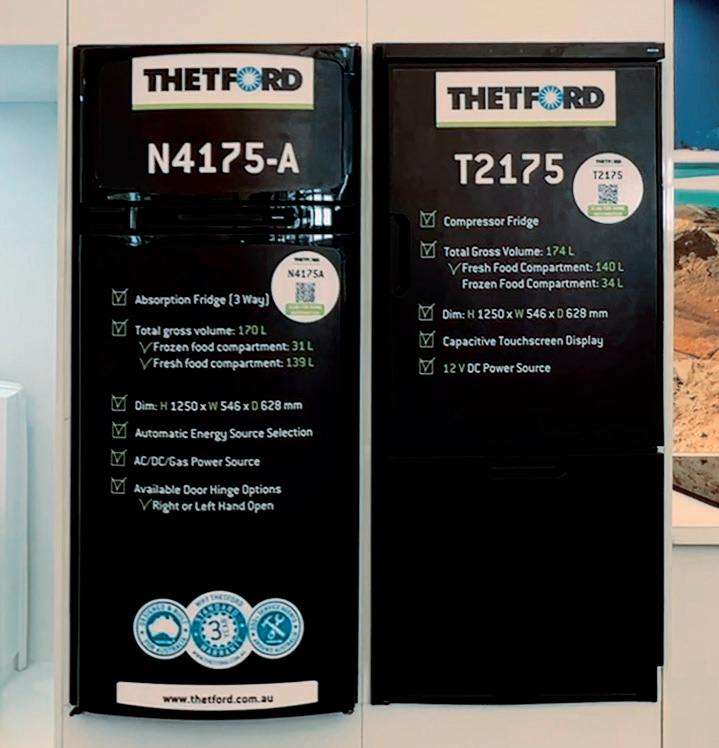

Thetford

Thetford Australia always seems to amaze the crowd with their inviting, colourful and wellstaffed exhibition stand at the Melbourne Supershow. Customer Service is one of the key strengths at Thetford in Australia and there is a constant flow of consumers entering the stand to ask (technical) questions about the products. Predominantly known for their sanitation solutions, Thetford now has high market shares in all their main categories. Director Daniel Dunn: “We see quite a large trend towards electrification. We released a new range of compressor fridges in recent times, and we are seeing a huge increase in our sales of compressor fridges and electric cook-

ing solutions.” Thetford offers a range of Absorption and Compressor fridges that fit in the same cut-out, to meet the needs of the Australian manufacturers to easily change between compressor and absorption models. “Within the range of cooking appliances, we see a similar trend with both gas, induction and dual fuel options.” Daniel Dunn said.

28

Bill Seawright

Daniel Dunn

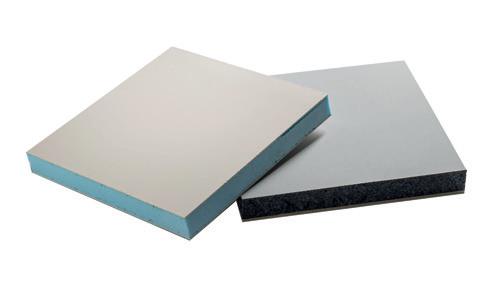

Crusader Caravans

Crusader Caravans is one of the top five caravan manufacturers in Australia and the winner of two Caravan Industry Victoria Manufacturer of the Year Awards over the last years. In July 2022, Crusader Caravans moved to a new purpose-built factory in Epping Victoria. The new factory is five times larger than the previous manufacturing facility, reflecting the rapid growth of the Crusader Caravans brand. With this move, Crusader changed from a traditional meranti timber frame into a full composite caravan range, which makes Crusader Caravans the first volume manufacturer that went fully composite. The most popular model, the CRV Gladiator, was launched in the middle of COVID and solely sold online for a number of months while showrooms were closed due to lockdown. Now that Australia opened up again Crusader Caravans is doing better than ever.

Avida

Proudly Australian made since 1965, Avida is the leading manufacturer of Motorhomes in Australia. We caught up with Billy Falconer, Sales and Marketing Manager, to learn more about the market and Avida products. Motorhomes represent 5% of the total Australian RV production, which is very low compared to for example Europe. Billy explains: “What we see is that when people go through the cycle of life and hit the age of 65,

they are more likely to buy a motorhome, whereas caravans are popular under all age demographics including young couples and families’’. Although most people know Avida from their motorhomes, the company expanded into caravans and camper trailers in 2013. Their most recent addition is the Avida Diversion campervan, built on the latest Mercedes Benz Sprinter. It comes with a number of unique features, including an electric roll out bed and larger fridge than most campervans.

29

Avida-Diversion

Avida-Esperance

Crusader-Gladiator-Force

Crusader-Musketeer-Treville

R eport Melbourne - Victorian Supershow 2023

Retreat Caravan

Retreat Caravans, based and manufactured in Victoria Australia, was the first Australian caravan manufacturer that went fully electric. The ERV model is now one of Retreat Caravans most popular models and AboutCamp BtoB had the pleasure to learn more about this oneof-a-kind caravan and the people behind it. Going fully electric all starts with the construction of the caravan, General Manager Tilly Rexhepi explains: “Back in 2019 we came out with the concept of an all-electric caravan. Retreats industry leading RXP wall construction is basically a full composite shell including flooring, walls and roof. Because it is fully composite it will keep the caravan cool when it is hot outside and warm when it is cold outside. This forms the perfect base for an electric caravan”

Everything within the Retreat ERV is powered by the 14.3 kW chassis integrated DCX battery system from OzXCorp. Unlike other manufacturers that might install several batteries under the bed, Retreat Caravans mount theirs directly underneath the caravan. For extra protection, the battery has a 50mm crush resistance zone and is completely waterproof and dustproof. Furthermore, the ERV includes a 5,000-watt smart inverter and up to 2400 Watt of commercial grade solar panels on the roof, which allows the user to run all electric appliances at the same time. One of the benefits people like most about this ERV is the safety feature, as there is no gas involved. This includes the barbeque on the outside of the Caravan, which is an electric Weber.

The inside of the Retreat ERV is just as unique as the outside, as the air conditioning is mount-

ed under the bed instead of on the roof. Tilly: “Because we use the roof as real estate for solar panels, our air conditioner and heater are under the bed. Due to the full composite construction, the warm or cool air will stay inside the caravan as soon as you close the doors” . The ERV further includes a 240V induction cooker, conventional microwave oven and large Thetford compressor fridge.

The fully offroad ERV comes in a number of different lay-outs and is fast becoming one of the most popular models in the Retreat Caravan range. For caravanners that do not want to go fully electrical, Retreat Caravans created the Retreat Daydream. This semi-electrical caravan is powered by a 7.1kW battery system, which is integrated in the chassis as well.

Tilly: “Going electric is undoubtedly the future of Australian caravanning and we are glad to be the innovators that launched the first full electric caravan in 2019. There are other manufacturers that have adopted this technology, however Retreat Caravans is ahead of everybody else as we already validated the system in the field.”

30

Use the QR-code to watch our video report on the Victorian Caravan, Camping & Touring Supershow on the FuoriMedia Aboutcamp BtoB YouTube channel.

Tilly Rexhepi

BMPRO

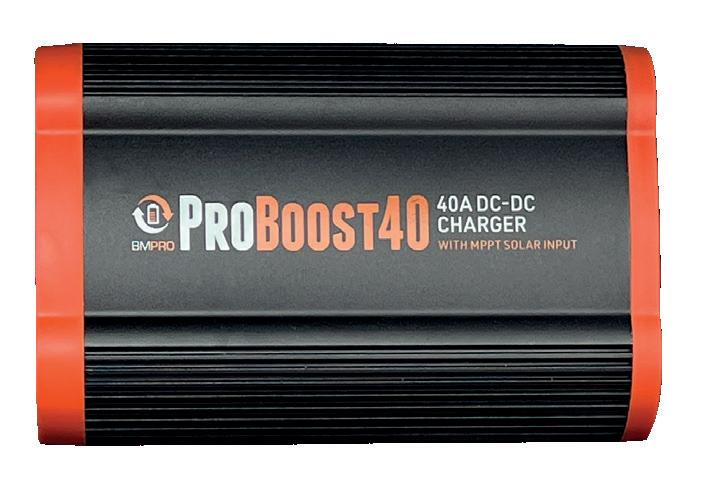

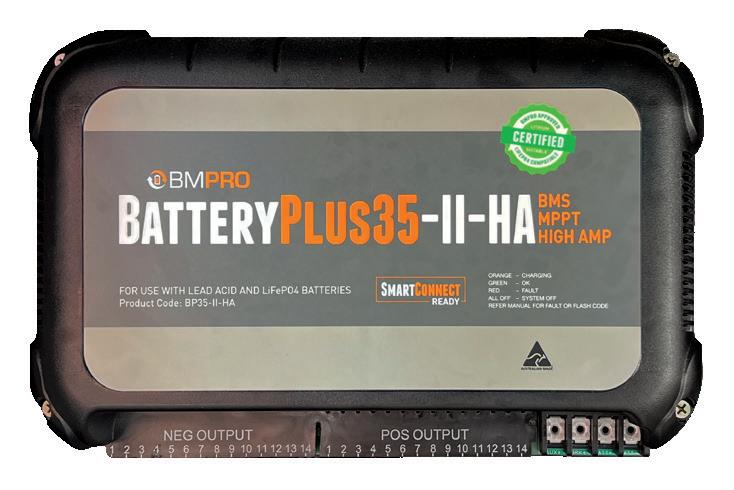

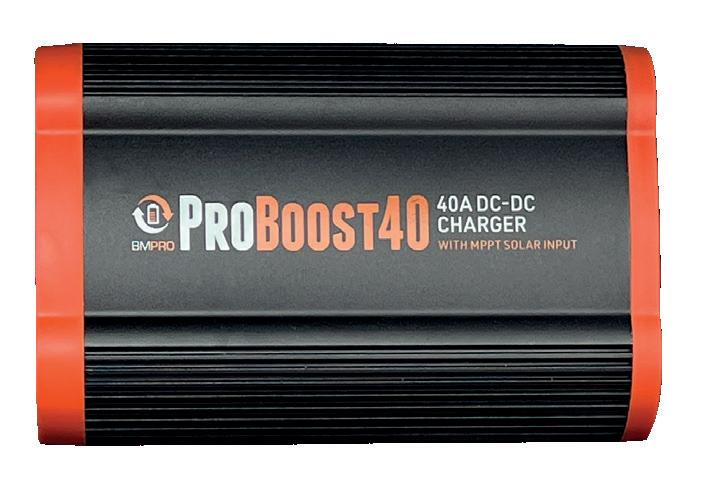

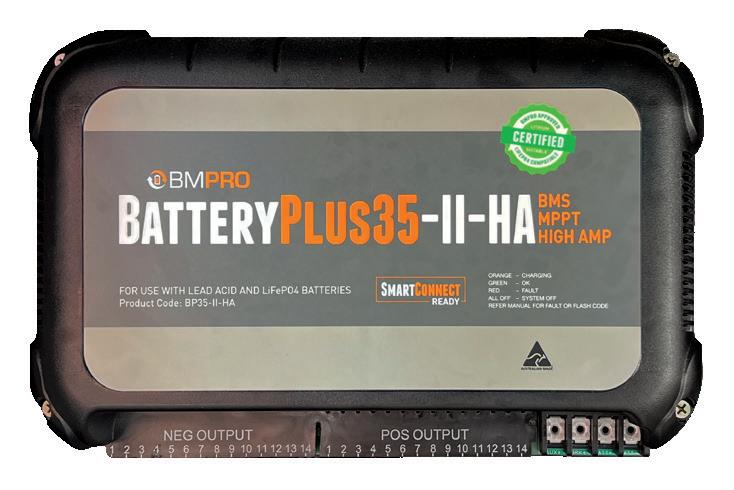

Being the major supplier of Power Management Systems and Smart RV Systems in Australia, BMPRO has been the Heartbeat of the Australian RV for over 15 years. In fact, about half of the RVs manufacturers in Australia use some form of BMPRO. Latest for this innovative power solution supplier is the recently launched ProBoost: a range of DC-DC chargers for both the Caravan and 4x4 Markets. ProBoost features an in-built MPPT solar regulator and blends both solar and auxiliary inputs to ensure there is always a consistent charge to the battery.

Global Heritage

A company to watch out for is brand new supplier to the industry Global Heritage. Although you may not have heard the name Global Heritage before, owner Brad Slater is exceptionally well known in the RV Industry, inside and outside Australia. Global Heritage did not have their own stand at the 2023 Melbourne Supershow, nevertheless their products were on display at a number of RV Manufacturers. One of these manufacturers is Masterpiece Caravans, where AboutCamp BtoB caught up with Nicolas Chevalier, Head of Product Innovation. Global Heritage has the aim to create the most durable and sustainable products on the market, without losing focus on the ease of use for the end user and the visual appearance. The

Global Heritage awning range on display at the VIC Supershow demonstrates how these principles translate into a product: cast aluminium frame, heavier weight fabric and details that stand out for ease of use. The experienced team at Global Heritage is working on an extended range of products for both the RV and Outdoor Markets. We will keep you up to date on any news regarding this promising brand.

31

Louise Bayliss

Nicolas Chevalier

R eport Melbourne - Victorian Supershow 2023

MDC is one of the leading camper trailer manufacturers in Australia. Camper trailers are growing in popularity every year, mostly due to the Australian climate and the fact that Australians love spending quality time outside. MDC’s camper trail-

Apollo Motorhome Holidays

Founded in 1985, Apollo Motorhome Holidays is the largest privately owned recreational vehicle operator in the world. Since 2014, Apollo RV Sales has been the exclusive importer and distributor of Adria Mobil in Australia. Soon after this partnership, a significant licensing agreement was established with Winnebago Industries to produce and promote the globally recognized brand in Australia. Coromal and Windsor Caravans are iconic Australian brands which Apollo adopted in recent years and all production is now done under the Apollo Motorhome Holidays brand.

ers are all about outdoor living and the slide-out kitchens and outdoor storage are some of MDC’s key features that suit this market really well. The most popular MDC model is the XTT, which was recently brought to North America. Next to the wide variety of camper trailers, MDC manufactures a full range of caravans and hybrids for both the Australian and US market.

32

MDC

MDC_XT16HR

MDC-ROBSON-XTT

Coromal-SoulSeeker-196

Winnebago-Iluka

Established in 1966 and originally known for their timber products, NCE has developed into a leading supplier of various components for the RV industry in both Australia and New Zealand. NCE is the sole distributor for a number of Australian and overseas manufacturers, including CAN,

Cruisemaster

Gree and Puretec. Plus, they developed a full range of NCE products over the years, including appliances for bathroom and kitchen. Often without realising it, most Australian caravanners have a NCE product inside their RV as NCE supplies to nearly all caravan manufacturers Down Under. The centrepiece of this year’s NCE stand was the DCX power supply system from OzXCorp. Being the distributor for OzXCorp in Australia and New Zealand, there was a lot of interest in this chassis mountable battery system. A number of leading RV manufacturers already adopted the DCX system, both in Australia and more recently in North America.

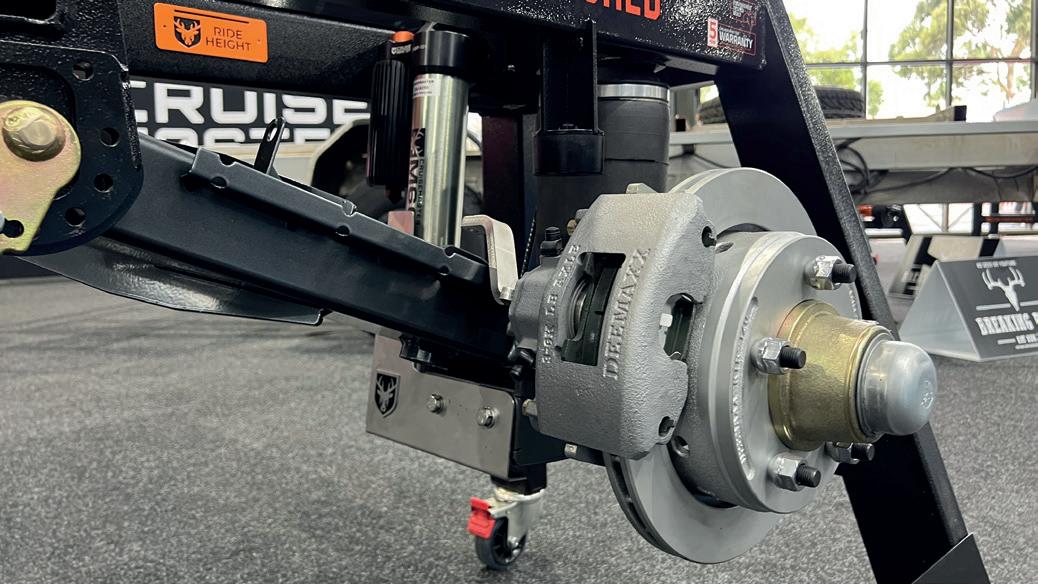

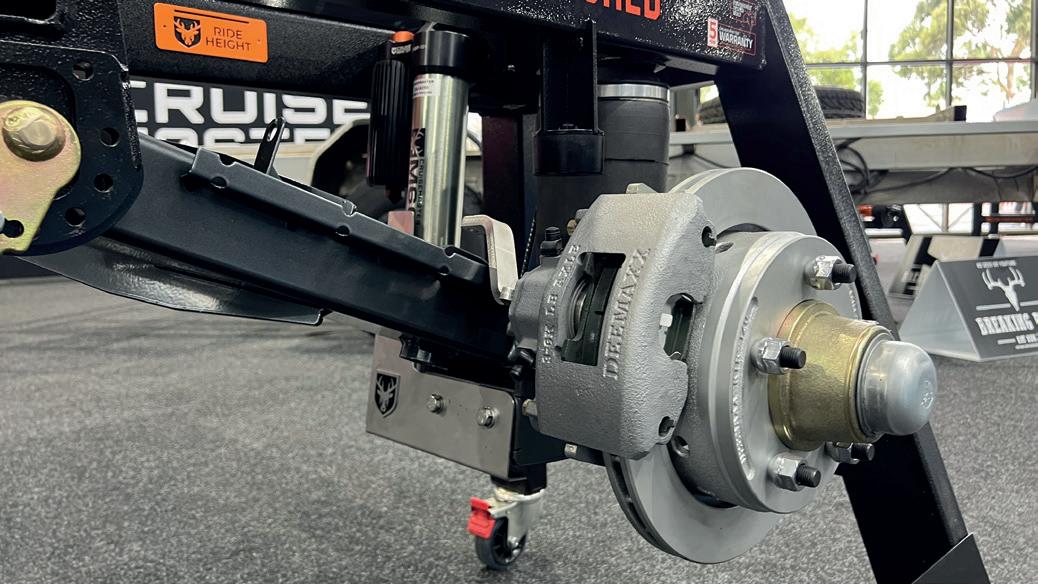

Established in 2005 under the name Vehicle Components and rebranded in 2018, Cruisemaster has grown to become a trusted name in the Australian caravanning industry. Cruisemaster offers a range of high-quality products, including inde pendent suspension, airbag suspension and shock absorber systems. As well as other accessories and upgrades to improve the performance and safety of caravans and trailers. What really sets Cruisemaster apart is their product testing in remote areas of Australia, which is performed during a yearly R.A.T Run.

33

NCE

Jared Pearson

Josh Sippel

Australia vs Europe: a possible comparison?

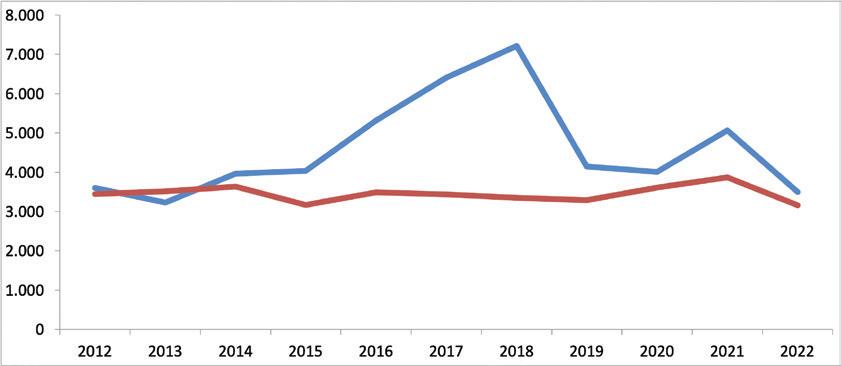

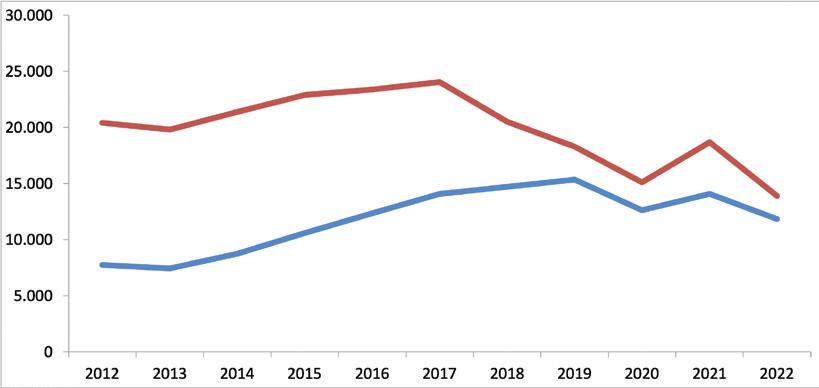

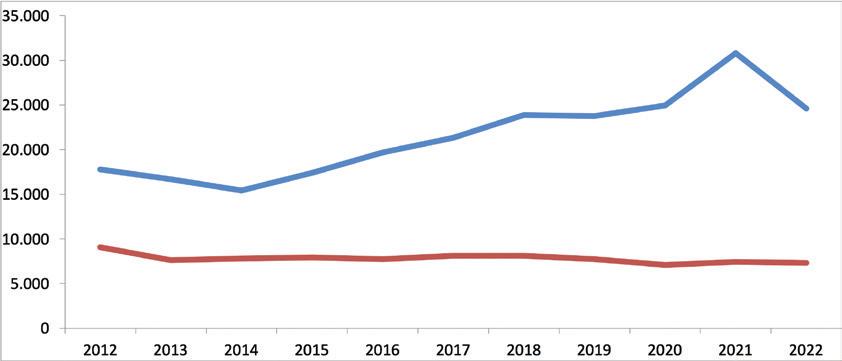

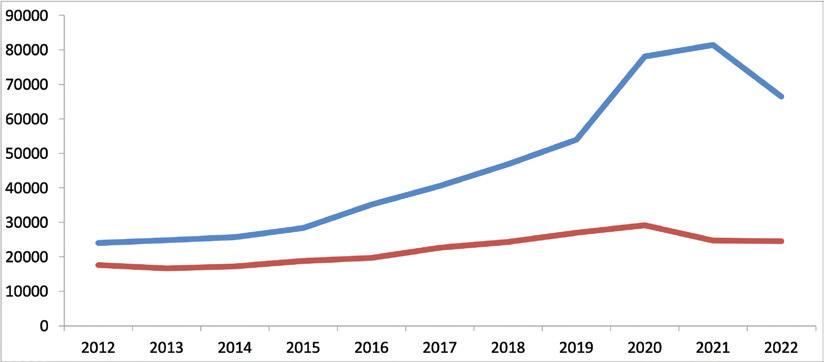

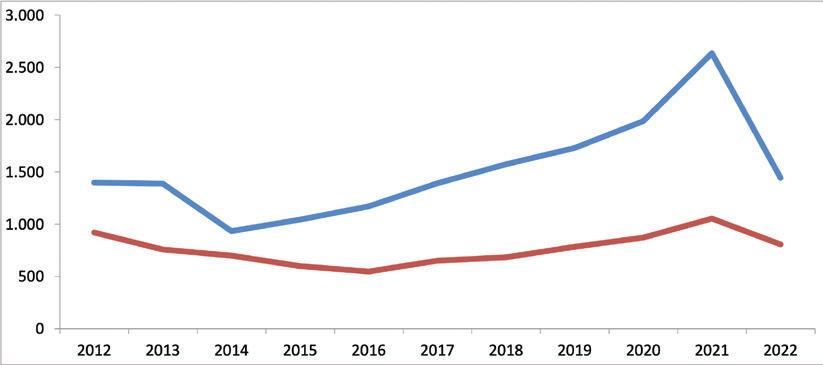

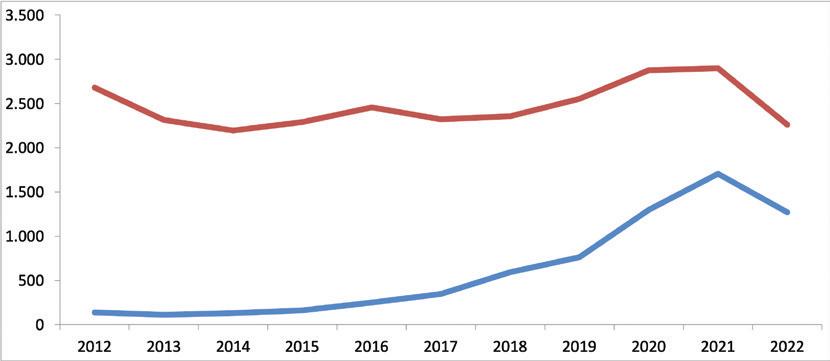

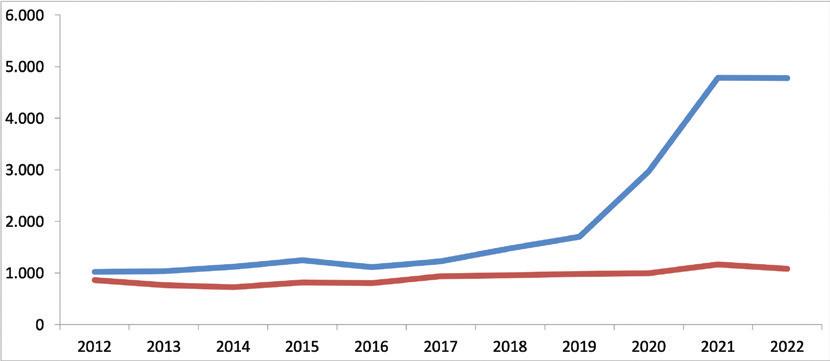

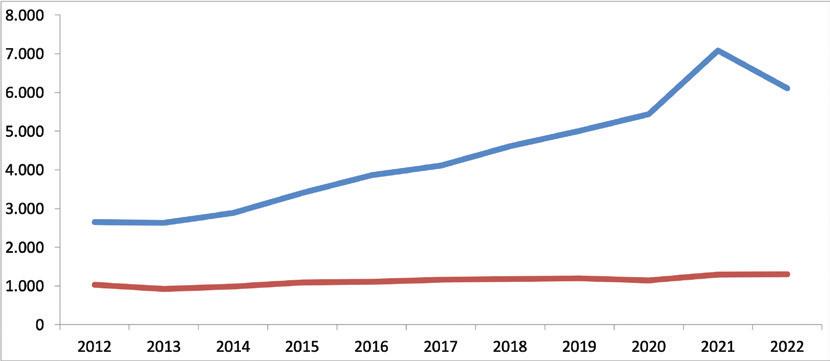

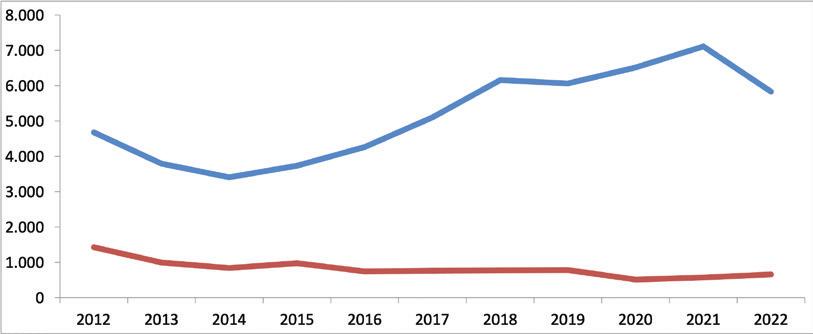

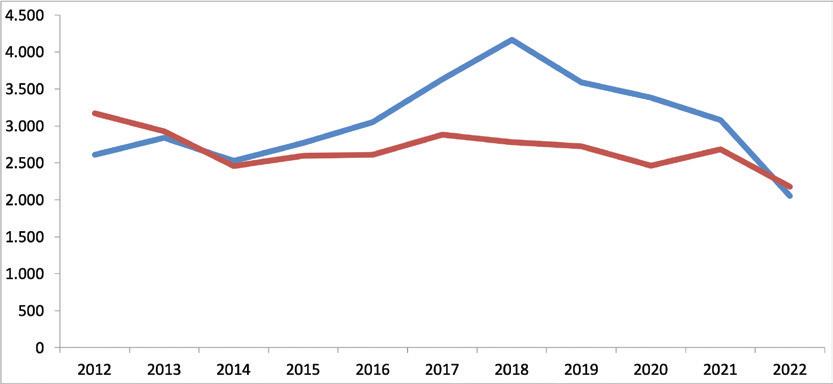

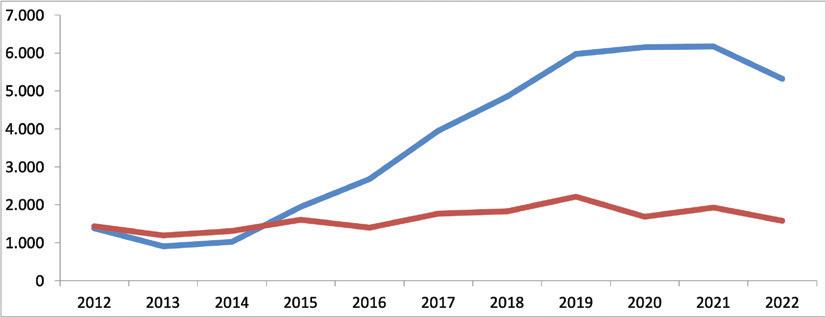

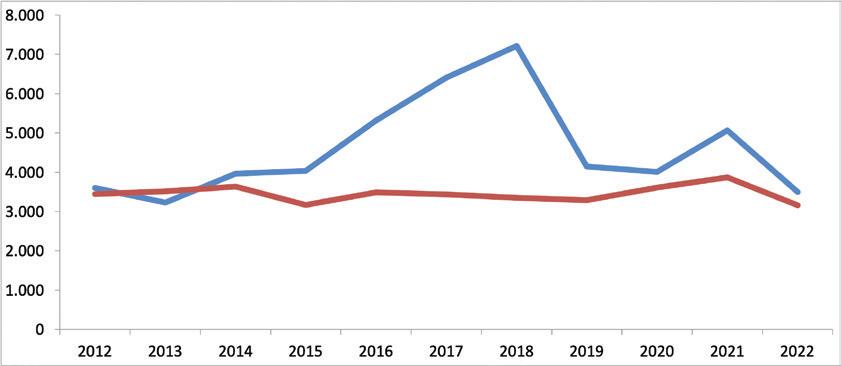

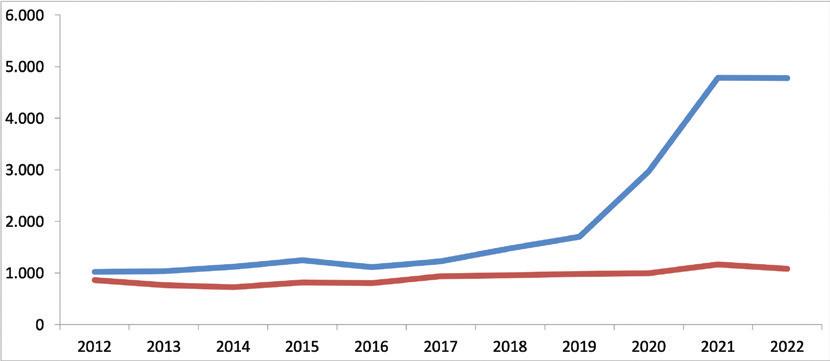

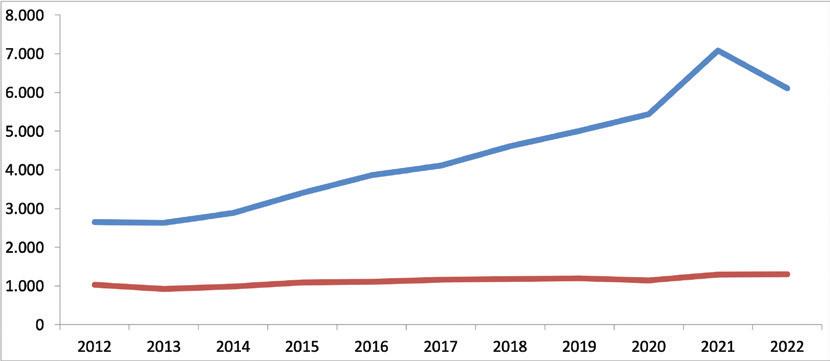

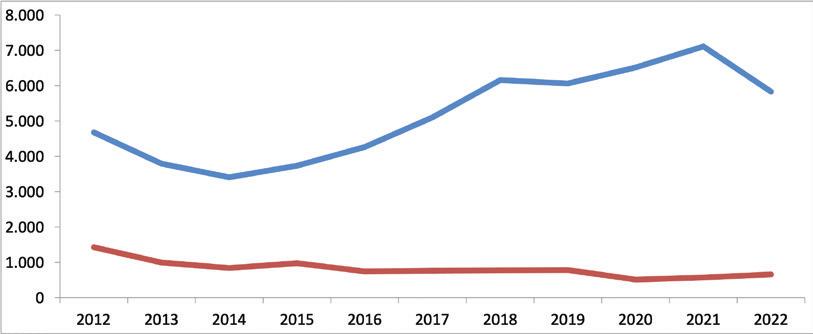

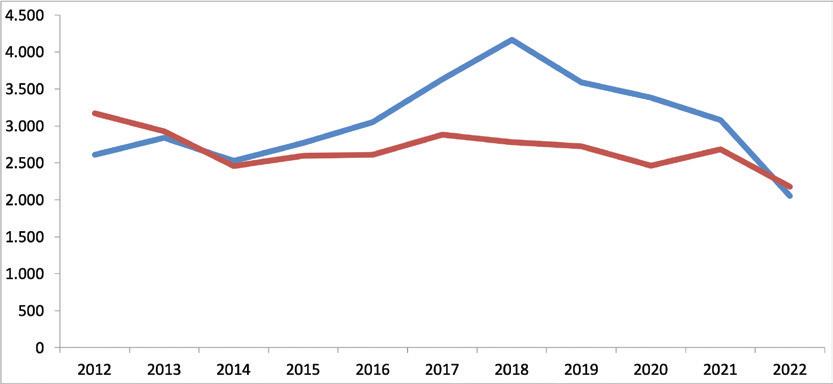

In the RV sector, Australia is experiencing a very special situation, both for the production and sale of vehicles, and for tourism. A comparison with some European countries may be useful (all data refer to 2022)

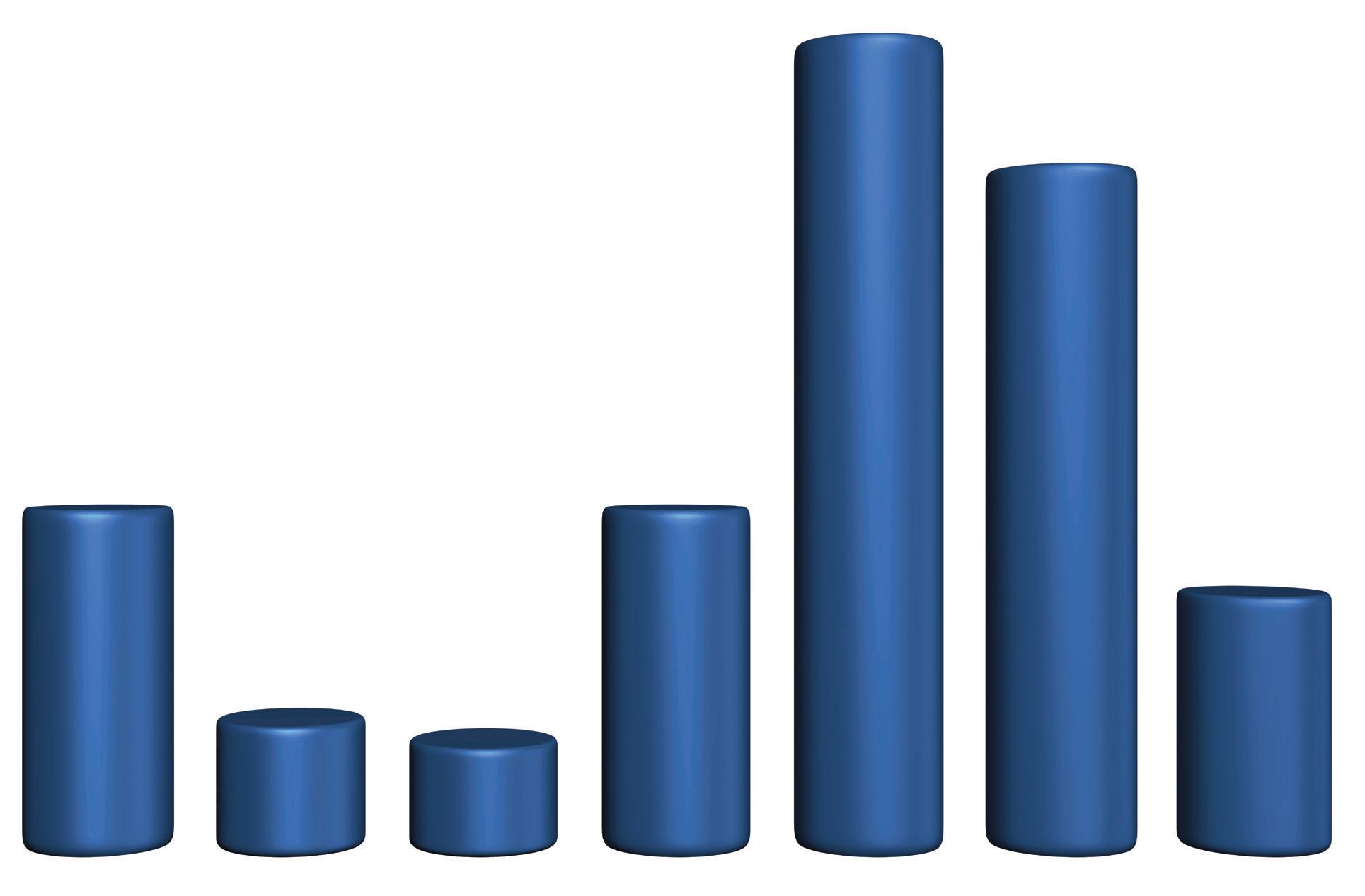

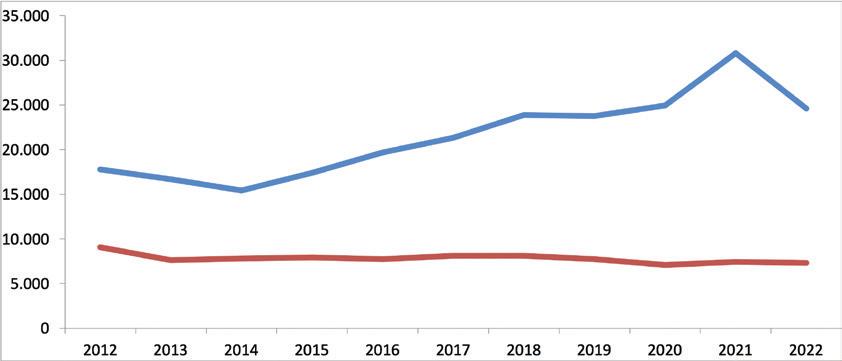

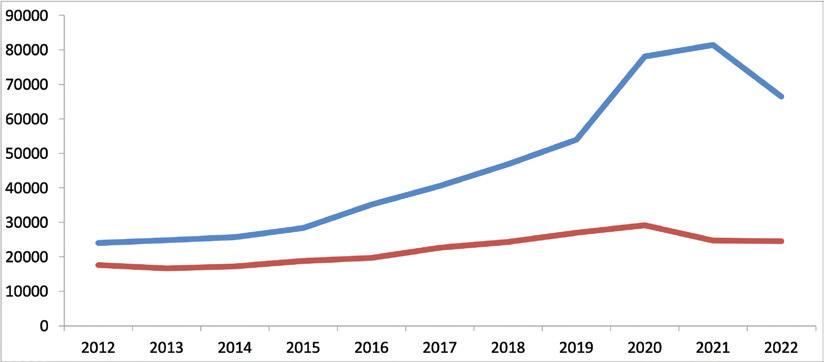

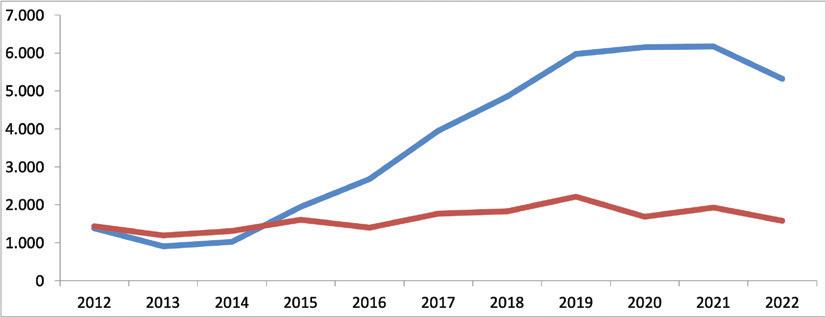

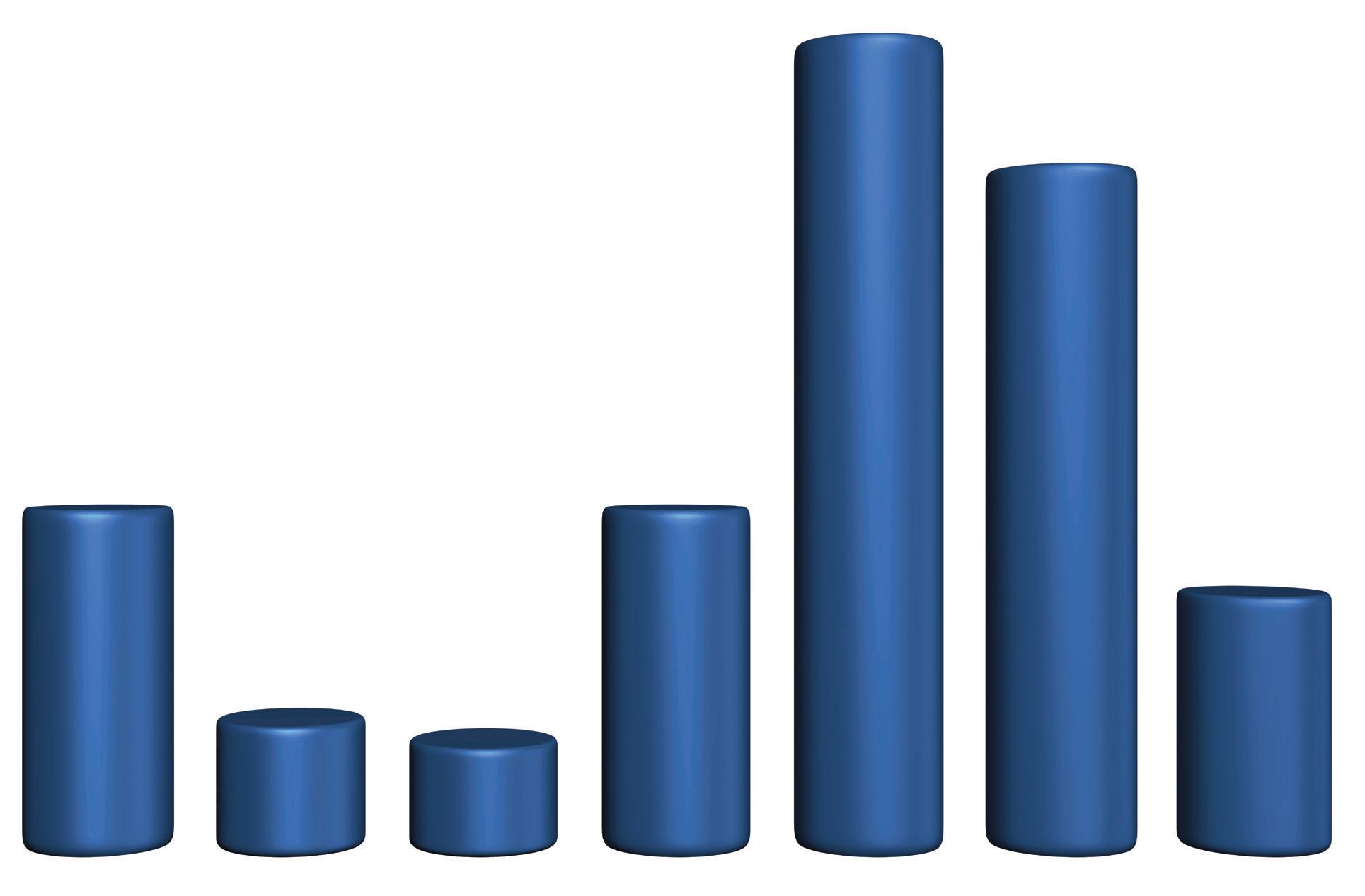

New RV registrations: Australia and European countries

In 2021, the Australian market demonstrated that it had fully overcome the difficult period of the pandemic by growing sales since 2020. This trend continued in 2022, for both production (+ 17%) and imports (+ 37%).

Attendance at recent trade fairs

After the pandemic, trade fairs in Europe are back at full power, with excellent attendance by the public. As always, the Caravan Salon in Düsseldorf dominates the international scene, with the number of visitors in 2022 exceeding 235,000 people. The Victorian Caravan, Camping & Touring Supershow, the biggest show in Australia held in February 2023, was visited by nearly 48,000 consumers.

34 F acts and figures RV INDUSTRY

48,529 estimated 31,941 6,487 6,662 10,206 25,707 90,985 Australia France 6,902 Spain Italy Germany Sweden Netherlands UK 235,000 110,000 104,521 91,000 Düsseldorf, Germany Parma, Italy Birmingham, UK Paris, France

Salon de Vehicules de Loisirs

Motorhome&Caravan Show

Salone del Camper Caravan Salon

48,000 Melbourne,

Australia Supershow

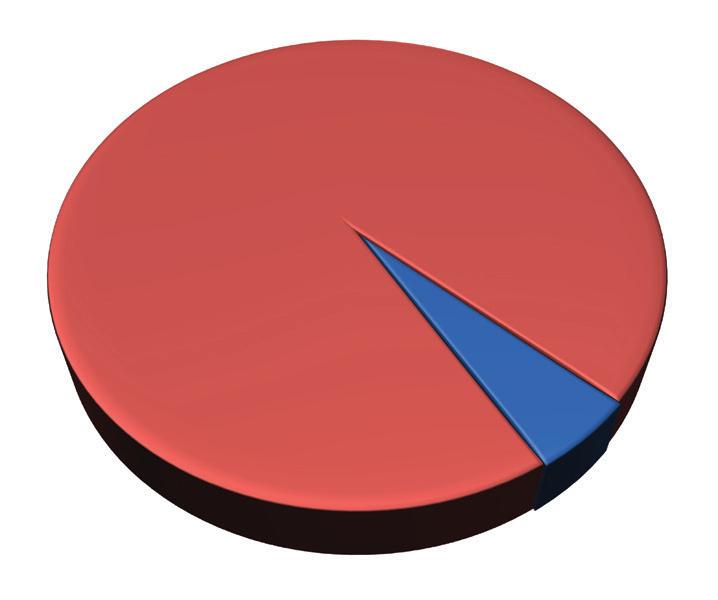

96% towables/ caravans

RVs in use per 1,000 people: Australia and European countries

The number of RVs in use in Australia is very high at 30 vehicles per 1,000 inhabitants. A comparison with Europe shows that such a high figure only exists in a few countries, such as Sweden and the Netherlands (whose populations is similar to that of Australia).

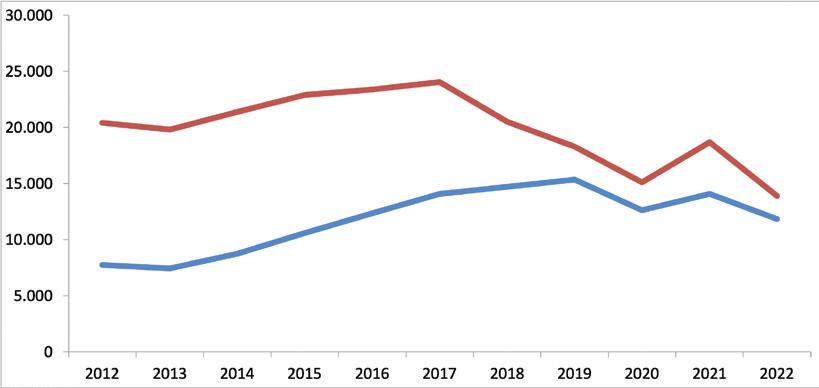

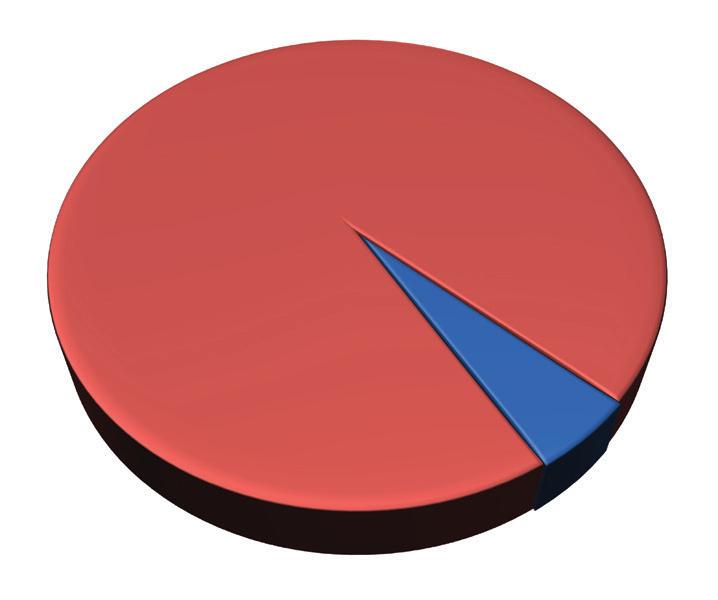

Manufacturing of RVs: comparison between Australia and Germany

58% motorhomes/campervans

4% motorhomes/ campervans

Australia total RVs 28,031

42% towables/caravans

Germany total RVs 129,288