LINE CARD

Fire code enforcement affecting installers

CANASA and CFAA respond to queries about the Ontario Fire Code and its more stringent interpretation

By Ellen Cools

Recently, Patrick Straw, executive director of the Canadian Security Association, sent an email to CANASA regional council chairs regarding an incident where the fire department removed a Greater Toronto Area (GTA) member’s technicians from a jobsite. The technicians had been changing smoke sensors on a standard wired alarm system.

According to Straw, “The fire department happened to come in to do a fire inspection and advised the end user and the alarm technician that this work could only be done by a certified fire technician.”

SP&T News reached out to Peter Hallinan, executive director at the Canadian Fire Alarm Association (CFAA), via email to clarify how the Ontario Fire Code (OFC) applies to alarm installers.

While the Ontario Fire Code has not changed recently — the fire departments are still operating under the 2007 version — Hallinan says, “The Code is constantly being reviewed and revised with updates, amendments and supplements.”

The Ontario Fire Marshall (OFM) publishes any changes in advance and are available on the OFM website, he adds.

Ontario Fire Code requirements

According to Hallinan, “the change that has prompted this discussion has been in place for a number of years.”

However, now there is greater enforcement by the local Authorities Having Jurisdiction (AHJs).

As such, Hallinan says that the CANASA member’s technicians were removed from the job because “the AHJ felt they did not meet the requirements laid out … in the Code or the

Technical Guideline.”

“There has been a greater emphasis on enforcement of the Code in the past few years, along with stronger educational opportunities for Fire Prevention Officers and a greater willingness by the Crown to prosecute offenders [and] additional and higher fines for non-compliance to the OFC,” explains Hallinan.

Division C, Subsection 1.2.2 of the OFC identifies the requirements for persons who maintain or perform annual tests on interconnected smoke alarm systems. This refers to any type of smoke alarm that is wired together.

“In subsection 1.2.2.2 (1), it states that a person who performs the work on these systems ‘must have successfully completed a program or course acceptable to the Fire Marshal.’ To date, the only two courses identified as acceptable to the Fire Marshal are Certified Fire Alarm Electricians licensed by the ECAO [Electrical Contractors Association of Ontario] or Registered Fire Alarm Technicians in good standing with the CFAA,” Hallinan elaborates.

The penalty for working on these systems without completing the required courses is determined by the local AHJ and varies from jurisdiction to jurisdiction, he adds.

“In most cases,” says Hallinan, “the technician would be asked to leave the site and the owner directed to engage properly trained and qualified staff to perform or re-perform the inspection.”

In an interview with SP&T, Straw said he does not know how many CANASA members have the required certifications. “I know that we have several fully certified fire companies that are members of CANASA, but a huge amount of them are members of the Canadian Fire Alarm Association because a lot of the fire alarm [work] is done by electricians,” he explains.

Exceptions

However, the issue is not as simple as it might sound. Some interconnected smoke alarms don’t require these certifications. The occupancies that do require them are identified in Division B of the OFC, section 6.3.2.6.

This section “applies to interconnected smoke alarm systems in all residential occupancies and care occupancies, except in individual dwelling units and in Buildings regulated by

section 9.8.”

This means, “residential houses, which are all required to have interconnected smoke detectors, do not need to be checked by a licensed or registered technician,” explains Hallinan.

Moreover, the OFM has identified some fire protection systems in use in Ontario today that do not have identified qualification criteria for work on these systems.

Consequently, the OFM has published a technical guideline, OFM-TG-03-2000, “Qualification For Service Company Personnel,” which explains who can work on the system and the parameters local AHJs can use to determine if a person or company is qualified, Hallinan explains.

As a result of this ambiguity, Straw says CANASA’s concern would be if a member is working in a building that doesn’t require smoke detectors, but recommends installing them, “there shouldn’t be any reason why that can’t happen, if it’s not a fire code requirement.”

In his seven months as executive director, Straw says this is the only incident he has been made aware of where a member has complained.

“Frankly,” he says, “it might have just been a misunderstanding.”

Staying informed

So how can installers ensure that they are always in compliance with the OFC?

Hallinan recommends subscribing to the OFM’s e-bulletins and checking the CFAA’s website, which lists the criteria for working on systems. The CFAA also publishes and discusses proposed changes and those coming into effect via email and in the Journal.

“Going forward, both Patrick Straw and I are committed to a line of communication and finding mutual ways to work together,” Hallinan adds.

Additionally, Straw is in regular communication with AHJs, the CFAA and ULC “on any technical issues which require clarification,” and has met with several 911 centres in Ontario.

While AHJs often communicate with CANASA about procedure changes, CANASA also reaches out to them to ask for information. “Most of them reply because it’s really helpful for them if they can communicate [information] back to our members.”

Patrick Straw, CANASA

Peter Hallinan, CFAA

Honeywell gives a name to impending home business spin-off

Honeywell recently announced that “Resideo” will be the new name of its home products portfolio and ADI distribution business.

Honeywell first announced the corporate spin-off last year — it is expected to be completed by the end of 2018.

The company said it will license its brand to Resideo under a longterm agreement covering its home comfort, security hardware and software solutions for all channels.

Honeywell Homes (the business that will become Resideo) in a statement.

“The home is the biggest investment most of us will ever make — the place where we create a lifetime of memories,” said Mike Nefkens, president and CEO,

Dealer Spotlight

Because the home is a centrepiece of our lives, we expect it to be secure, comfortable and safe at all times. Resideo builds on Honeywell’s strength in providing the world’s best solutions to help people to live more productive, comfortable and safer lives. And because smart home choices can be truly overwhelming, our mission is to provide consumers with integrated, simple solutions for today’s connected home.”

“Through its iconic brand and unparalleled presence in the home and low-voltage product distribution markets, Resideo will have

an enviable position from its first day,” added Roger Fradin, chairman of the board, Resideo. Fradin was announced as chairman earlier this year.

According to Honeywell, its network of partners and customers for home products includes more than 110,000 contractors. “As an independent company, Resideo will support their growth by investing in sales and technical training, improving channel partner marketing and related programs to enhance their ability to meet the needs of homeowners,” stated Honeywell.

Bob Hoevenaars, owner, Alarmtech Security Systems, London, Ont.

SP&T News: What side of your business is showing the most growth? Is it residential, commercial, a mix of both?

Bob Hoevenaars: It’s a bit of both, probably hedging a little bit more towards the commercial side of things, but we’re doing a lot more cameras and stuff on both sides, residential and commercial.

SP&T: What new technology are you embracing?

BH: We’re embracing connectivity on the security side of things, allowing our clients to have remote access and receive notifications in multiple ways on events and control of their system. And we’re doing that across the board — residentially and commercially.

On the commercial side, we find that business owners really appreciate knowing their alarm system has been armed or knowing the time and who disarmed their alarm system. So in that case, they’ll really feel quite a bit of comfort, over and above what we used to be able to offer in the past. On the residential side, people just really like the cool idea of being able to be in touch with their home.

SP&T: So what impact (if any) is DIY or MIY having on your business?

BH: At this point and time I don’t think it has a lot of impact on my business yet. There’s still a lot of people out there who want and need a personal consultation. We just did a system the other day and there are 70 zones in this one person’s house — obviously they’re not going to DIY something like that.

But on the smaller end of things, I do think it’s coming, it’s going to grow, and we’re looking at ways to be able to embrace that opportunity when it starts becoming more mainstream.

SP&T: Are the kinds of questions your customers are asking different than five or 10 years ago?

BH: Five or 10 years ago it was all, “Can you come out and do a quote for a security system?” and we would go out to the site. One of the biggest things we were really trying to enhance the system with is, “You should be adding fire protection and maybe carbon monoxide and make your alarm system do a little bit more for you.”

But now they might be saying we need

The home products network also includes 3,000-plus distributors and 1,200 OEMs (original equipment manufacturers), retailers and online merchants. After the spin-off, Honeywell estimates the new company will already have approximately 30 million installed sensors generating more than 250 billion data transmissions annually.

ADI Global Distribution has more than 200 physical locations across 20 countries.

ADI will retain its name and operate as a free-standing distribution business of Resideo.

an alarm system and a camera. It almost always is, “We need this and a camera.”

SP&T: With Amazon and Google in the mix, how is that affecting the traditional alarm market?

BH: We do have people wanting to have Alexa in part of their system. At this point and time, we’re using it more as an enhancement rather than a replacement. But we struggled with the market for many, many years, where 20 per cent of the people got involved in security, and I believe that this is kind of opening the doors to higher and higher numbers.

SP&T: Is the industry as a whole moving the needle on home alarm market penetration rates (currently stuck around 20 or 25 per cent)?

BH: I think they will be helping move that needle. I think that the 20, 25 [per cent] might grow to 30, 35 [per cent], and if we keep working at it and providing what the end user is looking for, then we can become a decent portion of that 60 per cent middle portion of the market.

Mike Nefkens, Resideo

LINE CARD

Alarm Guard expands into the U.S.

Alarm Guard, a Torontobased Master Dealer for ADT in Canada, is expand ing its operation into the U.S.

The company was started by Mike Chaudhary, founder and president, in 2003 and has grown to a cross-Canada presence.

The company’s success “gave us the confidence that now is the right time to explore opportunities in the bigger market. With a 35 million population, we can grow up to a certain level, but that process will be a little slow.”

The first stop for Chaudhary & co. is Atlanta, Ga. — Alarm Guard opened its first U.S. office there in May and has started recruiting dealers.

have a couple of dealers under our belt, so we’ve signed them and they’re going to start working with our program,” explains Chaudhary.

expects that proportion to change in Atlanta, particularly with the recent growth of its corporate sector.

Chaudhary is planning to expand Alarm Guard’s U.S. presence quickly and will move into the Florida market as soon as July.

“I think it’s a good time for Canadians to show that we can not only survive, we can thrive in the U.S. market too,” he says.

Changing market

“We are going to grow our business with corporate sales in Georgia as well as dealer partners. We already

Alarm Guard’s overall business is split 80/20 between residential and commercial, but Chaudhary

ADT has undergone many corporate changes over the years — it was taken private through a US$6.9 billion buyout from Apollo Global Management in 2016 and went public again less than two years later. Ownership changes have no appreciable impact on the dealer business, says Chaudhary. But the alarm market itself has shifted over

time, particularly with the arrival of the cablecos, he says. “We’re losing some customers to the low-hanging fruit. They’re not worried about service levels; they’re worried about bottom-line pricing. We cannot win all the customers. But the people who really need [security], we definitely educate them about the new smart home lifestyles rather than about intrusion.”

Chaudhary adds that interactive services through Alarm.com and ADT’s Pulse have ramped up significantly. “That’s a big game changer for us.”

He also sees relative newcomers like Amazon and Google carving out their own space in the home security market but “there will always be room” for more traditional monitored security providers.

— Neil Sutton

Tips for securing your home during the holidays IHS: voice-operated alarms to grow

The holiday season may be the perfect getaway for the family, but unfortunately, it can leave homes untended and a potential target for thieves.

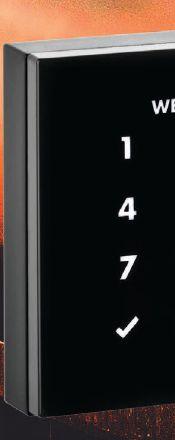

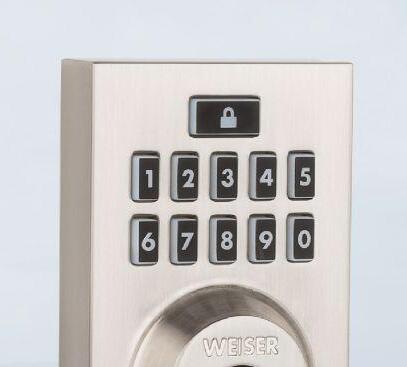

“In Canada, a break-in happens every 90 seconds,” says Steve Kolobaric of Weiser. “It is especially important to know how to protect ourselves and our valuables during times when our homes are most vulnerable.”

Weiser’s tips for home protection this season include:

1. Be wary of social media. Posting photos when you’re away on your vacation or visiting with Grandma may advertise the fact that you’re not home. Save photo uploads for when you’re back safe and sound.

2. Lock your doors. This may seem obvious, yet almost 50 per cent of burglaries occur when

a door is simply left unlocked. All doors should have a reliable lockset and working deadbolt.

3. Ask a trusted neighbour to check in from time to time. This is especially useful if you are away for an extended period. But do not use the “hide-akey” approach. Most criminals know exactly where to look.

4. Hide your valuables. A safe is a great way to protect your valuables. And ensure that items like laptops, cameras and other expensive equipment are away from windows and out of sight.

5. Set an electronic timer for lights. This helps maintain regular lighting patterns and is more effective than leaving one light on all the time.

“Make sure that the only person breaking and entering into your home this season is Santa Claus,” adds Kolobaric.

According to recent IHS market data, 92 per cent of intruder alarm systems sold globally in 2017 were operated via fob or keypad. This number is expected to decline to 81 per cent by 2022. The share of voice-operated alarm systems is expected to increase at a compound annual growth rate of seven per cent from 2017 through 2022.

IHS stated that: “Home assistants developed by Amazon, Google and others are changing how consumers interact with connected home devices, including intruder alarms. More alarm systems now offer a voice-command option, allowing users to use Alexa and other smart assistants to arm and disarm their alarm systems.”

With increased familiarity with IoT technology and voice-enabled devices, alarm

systems that rely on traditional technology to communicate will decline, according to IHS.

Voice interaction also: makes device operation quicker and easier; does not require a device like a fob; allows the alarm to be set at a distance from the security system (such as from the bedroom).

Current drawbacks to the adoption of voice-based systems, include: non-tech-savvy users may struggle with the interface; reliance on WiFi connectivity; privacy concerns (such as where voice samples are stored or smart devices actively listening to users conversations).

The research note concludes: “Installers will need to focus on changing these perceptions, by explaining how smart devices can simplify interactions with the intruder alarm systems.”

Monitoring firms assess the move to verified response

Wave of new alarm response programs from police agencies spreads across Canada

By Ellen Cools

John Slater, CEO of Commissionaires

Northern Alberta, which provides monitoring services, says the Alberta RCMP’s new alarm response policy “makes imminent sense.”

According to the policy, which came into effect on July 13, the organization no longer responds to one-hit alarms. They received 15,500 one-hit alarms last year, which used about 8,000 human resource hours, the CBC reports.

“We don’t want to waste highly paid, highly trained police officers running around because the vast majority of incidents are because either systems aren’t well designed or maintained or because the owners of the properties [don’t] do what’s expected of them,” explains Slater.

The Alberta RCMP is not alone in changing its alarm response policy. On Sept. 10, the Toronto Police Service (TPS) implemented a verified response policy for burglar alarms.

These changes are part of a larger national trend of police services transitioning to verified response to reduce the number of resources sent to false alarms.

Patrick Straw, executive director of the Canadian Security Association (CANASA), says that Ontario police services in Kingston, London, and the Niagara region have all recently implemented a verified alarm response policy.

“It’s been spreading across Canada,” he elaborates. “It’s also pretty common now in the United States.”

With regards to the new TPS policy, “I think everybody kind of knew that this was coming,” he says.

In fact, the TPS gave the alarm monitoring community advanced warning of its intentions in 2015, at CANASA’s request, Straw explains.

According to a memo from Toronto Chief of Police Mark Saunders, “The deferral [from 2015] was for the benefit of the alarm industry and its clients in order to make the necessary contractual and business practice changes.”

Toronto Police’s new policy

The new TPS policy defines verified response as: “The requirement of validation that criminal activity is occurring/has taken place OR there is imminent threat to personal safety PRIOR to requesting a police response.”

The TPS “will no longer respond to alarms solely on the request of alarm monitoring stations,” the memo clarifies. The policy only applies to burglar alarm activations, which can be verified through audio devices, video devices, eyewitnesses and multiple zone activation.

There are 142 monitoring stations and 2,513 alarm companies registered with the Toronto Police, says Sandra Buckler, Toronto Police Service’s strategic communications advisor. Before the policy came into effect, the service contacted representatives of these registered monitoring stations and spoke with CANASA, she explains.

So why did the TPS move to verified response?

In 2016, the TPS found that 97 per cent of alarms activated were false, says Buckler. Until Sept. 10, the service sent a two-person car for each alarm call and operated under a fee-based policy for false alarms, she adds. But increasing the fee did not reduce the number of false alarms.

“In 2010, the false alarm fee was increased from $83.50 to $130, but the alarm events reported to us remained around 23,000 and 97 per cent of those were false,” she shares as an example.

Buckler believes the new policy will help Toronto Police achieve one of its strategic goals: “to be where the public needs us the most.”

Verified response will ensure police officers are responding to calls requiring immediate attention, instead of false alarms, Buckler explains.

Industry response

But how do the changes in Toronto and Alberta impact the monitoring community?

“It makes sense,” says Shawn O’Leary, president and CEO of Toronto-based SafeTech Alarms. “It just means that the operators have

to be a little more vigilant and understand [how alarms work].”

Consequently SafeTech, an installing company that acquired a monitoring station a few years ago, focuses on educating its operators.

“I think the gap is that operators don’t really understand the devices themselves and necessarily the technology behind the devices,” O’Leary explains.

Kelly Hine, vice-president of business development and operations at Edmonton-based Orion Monitoring, says the company is not negatively impacted by Alberta RCMP’s new policy.

“I think it’s very important that [the police] understand that there are companies out there that do live video monitoring and that we’re there to support them.”

— Kelly Hine, Orion Monitoring

Instead, it “allows us to help our customers and it makes it easier for our dealers’ customers to transition into this new protocol.”

Hine adds that she hasn’t heard of any problems in the wake of these changes, remarking that the monitoring community in Alberta, as in Ontario, knew they were coming.

Like Hine, Slater believes video verification is “the way to go.”

Moreover, his company has a mobile patrol business that checks clients’ doors and verifies alarms. The requirement for verification means that such services will be in higher demand, so the new policy is positive in that regard, he says.

Ultimately, Hine believes the transition to verified alarm response will not only reduce the number of false alarms, but also improve the industry’s relationship with police, especially if more monitoring companies move to video verification.

“I think it’s very important that [the police] understand that there are companies out there that do live video monitoring and that we’re there to support them,” she explains.

“When the burglar alarm has been verified, it will give [officers] what they need to know when they go into a situation — that there is criminal activity or there is something quite suspicious,” Buckler agrees.

“We have had minimal feedback [from the monitoring community] that ranges from asking questions about live video surveillance and how it relates to the alarm policy to the timing of the change,” she adds. “Overall, there is support for reducing false alarm calls.”

Toronto Police Chief Mark Saunders

John Slater, Commissionaires Northern Alberta

LINE CARD

Anixter unifies branding

Anixter recently confirmed that it is retiring the Tri-Ed Distribution and Clark brands and moving forward with Anixter as the leading name.

The news was announced by James Rothstein, senior vice-president, global security solutions, during an ISC West press conference (ISC West was held in Las Vegas, April 11-13). Customers and partners were notified of the change earlier this year.

The transition began in January and is well underway. All Tri-Ed and Clark branches are now on the Anixter platform. Collectively, the company operates approximately 80 branches across the U.S. and Canada.

In a presentation to media, Rothstein described Anixter as a “true global partner with a local touch,” noting that the company has access to 600,000 products.

Anixter acquired Tri-Ed Distribution,

then an independent company, in 2014, and Clark Security Products in 2010.

Pat Comunale, president, global security solutions, said last year that those acquisitions had opened Anixter up to a more holistic view of the security market — particularly since Anixter traditionally catered to the enterprise market and Tri-Ed to the mid-tier.

Comunale has since retired from that role, with Rothstein stepping in to lead

Anixter’s security division.

Additional changes to senior management include the retirement of CEO Bob Eck in June. Bill Galvin, currently president and chief operating officer, will assume the role of CEO.

In a company statement announcing his retirement, Eck said, “During my 28 years at Anixter the company has gone through an incredible amount of change and I am proud of what our people have accomplished during that time. The company is well positioned for the future...”

Eck will continue to serve on the company’s board of directors after his retirement. Another recent appointment includes Bill Geary, who is now serving in the role of executive vice-president, network and security solutions.

— Neil Sutton

James Rothstein, Anixter Bob Eck, Anixter

LESSONS LEARNED

DBy Victor Harding

DIY and MIY: Opportunity and threat

There is a huge untapped market for home security. This may be the answer that has eluded our industry

IY means Do It Yourself and MIY means Monitor It Yourself.

If you are like me you have heard these two terms a lot over the last two or three years in our industry. Will these trends account for any meaningful piece of the pie? Should dealers be looking at them? If you are an existing alarm dealer, how do you set yourself up to handle DIY or MIY?

Truthfully, I did not pay that much attention to this discussion until I had lunch with my old friend Gordon. Gordon is in his 50s. He’s not really a “techie” or “do it yourself” guy, but he is an “early adopter” as far as technology is concerned.

Gordon recently went out to Best Buy, with no coaching, no calls to any security company, and bought and installed a DIY “security” system complete with hub, motion detectors, cameras, lock and light control and CO detectors. Gordon lives in a condo so it is fair to say that his motivation was as much about convenience as it was about security. He wanted to be able to control his lights and locks through his cell phone. The scary thing to me was he never thought about calling a security alarm dealer. He simply went to Best Buy, a place he instinctively knew would have what he was looking for. And he was right. Because we are all in the security industry, perhaps we mistakenly assume that Gordon would call one of us.

It is not like the customer service reps at Best Buy knew as much about motion detectors as a typical alarm dealer. But that did not seem to matter. Gordon said the kit was self explanatory and remarkably easy to install.

There are those who will say that Gordon is not really getting a full security system. But for him, this was more than enough. My fear is that for many people in single family dwellings, they will think the same way. They will think these systems can give them 80 per cent of what a professional system can give them — and it will probably be at less than half the price of a professionally installed system.

So let’s look at this event again. Gordon is clearly not a millennial. He does live in a multiunit building, so that reduces his security needs somewhat. Although he bought what we would call “security” equipment, he was looking for convenience as well.

Based on what I know of him, Gordon would

never have thought of going to a security dealer to get what he wanted — too slow, way too expensive and unnecessary, and he does not know the name of a security dealer anyway.

You ask, what about monitoring? A security dealer would surely have tried to push monitoring on Gordon. But Gordon is functioning with MIY and quite happy having all signals come directly only to his smart phone.

He can call the police or fire department if he sees something very definitely wrong in his condo. He has been around enough to hear about his friends having to deal with false alarms, the hassle and the potential fines. He may even know that in a city like Toronto, police reaction to an alarm is very slow without verified response. In fact it was when Gordon leaned across the lunch table and said to me that based on his experience, he would be seriously worried about the future of the monitoring business that I really took note.

Aside from what Gordon thinks about all this, here is what I think. Based on the small amount of research I have done, I think DIY and MIY are definitely here to stay in some form or other. I think they are capitalizing on our whole digital, interactive, Wi-Fi-enabled, smart phone dominated world and giving customers a lot of convenience and some security at a much reduced cost. It is possible these new DIY systems have the potential to take the smart home penetration rate from its current 20 per cent level for monitored systems to 50 per cent and above over the

next five to 10 years. Just look at the names that are in this market now, and only in the last two to three years: Honeywell, ADT-Samsung, Google Nest, Ring, Amazon, Kwikset, Vivint, Apple and Best Buy to list some of the bigger names. I have never seen so many new names offering what we have to call a “security” product since I joined the industry 25 years ago. They cannot all be wrong. You can bet these big companies have not entered this DIY market to try to steal part of the 20 per cent penetration of monitored security systems. They want part of the other 80. How far will this DIY/MIY trend spread? For sure it is attacking the traditional alarm market for residential systems including condo and apartment owners like my friend Gordon. And yes, I think it will make it more difficult for alarm dealers to sell first-time home buyers on a professionally installed system.

What about existing monitored accounts and the potential for new ones? Is monitoring in danger? Let’s put it this way. DIY and MIY are going to make it tougher to get professional monitoring accepted in certain situations. Certainly if I was an alarm dealer, I would be watching my monthly monitoring rates. To me, these new interactive systems being sold by the high volume alarm dealers at a rate of $50/month are at risk in the future.

Victor Harding is the principal of Harding Security Services (victor@hardingsecurity.ca).

MILLENNIALS MARKETING TO

Monitored systems and DIY are starting to merge as providers look to cater to a generation investing in home security

By Ellen Cools

For years, residential penetration rates for home security have been stuck around 20-25 per cent.

But this is potentially changing as more millennials are looking for home security — not necessarily through professionally installed systems, but through do it yourself (DIY) and monitor it yourself (MIY). And some key players in the industry have started to notice this trend.

In February, reports surfaced that Amazon had acquired smart door-

bell company Ring for just over US$1 billion. Google also announced that it was rolling Nest into its hardware team.

More recently, Leviton announced a partnership with the Works with Nest program, and MONI Smart Security — now rebranded as Brink’s Home Security — announced it is providing professional monitoring services for Nest Secure.

Evidently, the connected home market is taking off, and millennials are a factor in this tranformation.

According to Dina Abdelrazik, a research analyst at Parks Associates, 34 per cent of millennials (defined as those born between 1982 and 1998) have a security system.

Fourteen per cent have a self-installed security system, and three per cent have a self-monitored system. In comparison, only six per cent of all U.S. broadband households have a DIY system and two per cent have a MIY system.

“Security adoption is highest among young, affluent and educated consumers with children at home,” she adds. “Security providers looking to penetrate this key demographic may turn to DIY solutions as a method of expanding their customer pool.”

The challenge, then, is how to market to millennials and other population segments that have never had a home security system before, while also capitalizing on the push for DIY and MIY.

Comfort and control

The first step to successfully doing that is to understand why millennials are proponents of DIY and connected home security.

“The millennials of today approach things very differently,” says Ivan Spector, president of The Monitoring Association. “In many cases, they have nice things that others want that need protection. Obviously, they are app adopters, and want technology to make life work.”

“They’re not just following suit and saying, ‘Well, my parents had a traditional security system; it protected us while I was growing up and it worked great for me,’” adds Greg Rhoades, director of marketing for Leviton’s Energy Management Controls & Automation (EMC&A) division. “They’re taking a look and saying…‘If my house is all lit up at night, if my doors are all locked, if my garage door shuts behind me, that’s a pretty secure property right there.’”

Generally, millennials want comfort and control over their safety and security, adds Rhoades, and they have several avenues through which they can feel safe and comfortable, whether via a hub solution or connected smart devices.

With connected home security systems, “the homeowner is gaining control over it,” he adds, which he believes is a priority for millennials.

“[Millennials are] certainly very security conscious and they want to make sure that what they’ve secured for themselves and what they continue to grow stays theirs and stays protected,” he concludes.

A definite disruption

With the influx of DIY and MIY products in the market, and the increasing demand for these solutions, “there’s a definite disruption right now,” says Tom Leonard, vice-president of marketing and product management for Leviton’s EMC&A division.

Leonard believes that new security customers, such as millennials, are redefining what security means to them.

“Folks in the millennial demographic are far more apt to take a stab at [installation] themselves, or to take action due to their higher technical

“Folks in the millennial demographic are far more apt to take a stab at [installation] themselves.”

— Tom Leonard, Leviton

propensity than many other generations,” Leonard adds.

Consequently, Leviton’s smart Wi-Fi products “have really seemed to resonate well with millennials because now [they have] the ability to use their smart device at that point to turn on the various lights in their home and interact with their home remotely.”

This has been “an entry point” to pursue a deeper understanding of what automation in safety and security means to them, he adds.

As such, Leviton highlights the customers’ needs: their desire for comfort and control over the traditional understanding of security.

The company anticipates DIY will be “a point of market growth because it’s going to open up monitored systems and expand the reach of what was traditionally available, and ultimately build a larger base of customers,” he explains.

Google and Amazon’s entry into the space suggests their prediction is correct.

Spector believes this “is a barometer of technology adoption and the new economy. They will disrupt the sales chain that many have grown comfortable with and used to. But they are not looking at the ‘traditional’ market…They are looking long and hard at the 75 per cent that have remained very infertile to security systems.

“Companies that offer low or no cost systems with a monitoring component had better sit up and notice,” he adds.

Their entry also presents an opportunity, says Leonard.

“Our belief is that it’s an overall benefit to have Google and Amazon joining the security realm because it brings a heightened awareness and brings attention to the whole spectrum of products,” he explains.

Jeff Gardner, CEO of MONI Security Systems, agrees, noting that Google’s Nest product has “really taken DIY to the next level,” because it is easy to install, easy to use, and Google already has 2.5 million embedded customers who are using their products, he says.

“It’s not just about security, it’s about really engaging the customer in a way that makes their life easier; it still affords them the protection for their family and the property they’re looking for, but there’s so much more,” he elaborates. “And I think Google really brought it into play.”

Moreover, Amazon has brought an additional opportunity with voice command.

“I think voice is going to really play a big role in the future in terms of simplifying the user interface,” says Gardner. “A lot of customers are still perplexed by the complexity of the Internet of Things, and the more you can use voice technology to simplify that, I think the better off we’re going to be.”

Rhoades believes the industry is beginning to capitalize on this trend.

ADT, for example, recently began leveraging some of the partners of Samsung SmartThings, “to make their system more approachable, more affordable and more in line with what consumers are really looking for these days, and that’s ultimate connectivity, not just security and safety,” he says.

Connecting the dots

However, Gardner argues not everyone is reacting fast enough to these changes.

“I’d like to think that we’re being a lot more open minded at MONI. We want to be a part of the disruption than be the disrupted,” he says. “That’s why we’ve been involved in DIY for a couple of years, but there are many traditional players in our space that don’t do either [DIY or MIY].”

Leviton offers integration with Nest’s product line-up as part of its home automation suite.

So what have MONI and Leviton done to adjust their marketing strategy?

Both companies recently partnered with Nest, and say this is a move to attract millennials and other groups that have never had a home security system before.

Gardner says the company has built an interface with Nest “so customers that are buying the Nest product at Best Buy or Home Depot or Lowes can really activate professional monitoring and install their system without any human intervention.”

While Nest products can be MIY, MONI believes there are shortcomings since the system is not connected to a monitoring station that can alert first responders.

“We’ve been really trying to work with Nest to make that more apparent in a different way, not just in digital marketing or television advertising, but at the point of sell in Best Buy,” he explains.

The product itself describes the benefits of professional monitoring, which Gardner says benefits both MONI and Nest.

Meanwhile, Leviton’s partnership with Nest highlights the ease of connectivity.

A homeowner can install Nest devices via the Nest app and install Leviton devices via their app, Rhoades explains. Then within the Leviton app, they can “connect the dots,” integrating Leviton devices with motion detectors,

cameras, etc.

“It’s a mechanism to go after the safety and security concerns that we all [have], and to connect these pieces and parts and ultimately make it more seamless for the end user,” he says.

Strategic marketing

Additionally, MONI recently rebranded to Brink’s Home Security, principally to improve their marketing efficiency and brand awareness.

“I think the Brink’s brand is going to allow us to be a more credible alternative, especially if we can modernize [it] by offering DIY with that,” Gardner explains.

The company has also adopted a marketing strategy specific to millennials, focusing on simplifying their offering on the DIY side, particularly with digital and mobile ecommerce.

According to Gardner, millennials prefer to shop online with little human interaction. Consequently, mobile ecommerce presents a largely untapped opportunity for MONI, as 60-70 per cent of people prefer to do business on their phone, says Gardner.

In contrast, Leviton’s marketing strategy toward millennials has focused more on raising awareness through education.

Leviton has taken a dedicated approach to understanding how the DIY and MIY customers’ needs differ from the professional customers’, explains Leonard.

“The future is now, and if the traditional companies do not step up they will be left far behind.”

— Ivan Spector,TMA

“If we see a knowledge gap appearing in comments, reviews, in our interactions, we daily assess it and determine how we can best meet them,” he says.

For example, the company provides direct one-to-one outreach to customers who have questions, updates product pages with more detail and delivers instructional video content on their YouTube page when they see demand from customers.

An insatiable appetite

The rise of DIY solutions in the past year, as evidenced by MONI and Leviton’s partnerships with Nest, signifies the push towards this market and end users’ desire for this “seamless” experience.

In fact, says Spector, “there is an insatiable appetite for lifestyle enhancing systems.”

“If I would have said 10 years ago that we would be the gateway into homes for wireless locks, audio/video doorbells, controllable thermostats … that you have all of these technological marvels — not only at the tip of your smartphone but voice controlled — you would have thought I had watched one too many episodes of the Jetsons,” he adds.

“But the future is now, and if the traditional companies do not step up they will be left far behind.”

Consequently, “your supplier relationships are important, your alarm association is important, and the information bearers can keep you in the game,” he says.

Additionally, Gardner and Rhoads believe it is key that the industry continues to evolve its thinking about the customer and assist the end user, whether by simplifying product offerings or education.

“The biggest opportunity is to open up our thinking about the broader opportunity of safety and security,” adds Leonard.

The needs and definitions of these customers are a little different, [but] their ability to incorporate the value of safety and security is still there, and likely going to increase the opportunity for our products and services,” he says. “It’s a very exciting time.”

OFFICE HOME MEETS WHEN

Advances

in video games, cell phones, televisions and more will disrupt commercial security. Learn how you can adapt to be successful

By Joe Young

At home today, your virtual assistant can notify you of today’s weather, top news stories, traffic conditions and the time it will take to get to your first appointment. The assistant opens your blinds, turns on the kitchen lights, sets your thermostat, and plays your morning music playlist throughout the house. You can see the driveway camera on your TV to check if it snowed. When you leave for the day, it sets the daytime temperature of the house, turns off the lights, turns off the TV, disarms the alarm, unlocks the front door, and opens the garage door. As you leave, the front door automatically locks, the alarm is armed and the garage door shuts.

“The critical driver of disruption is the speed at which consumers or businesses adopt a new product or service.”

While this sounds like a state-of-the-art, expensive home automation set-up, it’s the complete opposite. This experience can be built with a simple DIY Apple Home Kit setup with devices purchased at the local electronics store for less than $800.00, and best of all, the Apple Home Kit software is

free. This seamless experience is controlled by your voice. People are living this life now

When you arrive at your client’s office, it’s like a step back in time. The front door is propped open because everyone forgets their badges at home. In the reception area, there is no receptionist or intercom. A sign asks you to sign the paper visitor logbook and call your host using the lobby phone. When your host arrives, he hands you a badge that has access to all doors throughout the building 24/7. The conference room he brings you to is 10 degrees colder than the rest of the office. Your host leaves and tries to find the thermostat that controls the room, but can’t figure out which one it is.

The next generation of employees are going to expect that they have the same connected experience in the office as at home. And the next generation of Corporate Security Officers will make that a reality. What does this mean for integrators and manufacturers?

Disruptive Technology

The critical driver of disruption is the speed at which consumers or businesses adopt a new product or service. The perfect storm of emerging technology, new business models to distribute it quickly, and subsequent exponential adoption means that organizations must become more agile and be able to respond and anticipate.

As emerging technologies spread into boardrooms, it is not just the technologies themselves that are disruptive; it’s the scaling and adoption of those technologies that are also vulnerable. Artificial intelligence, advanced robotics, augmented reality, Internet of Things and virtual reality have been around since the early 2000’s. What we see now versus then is that our business model enablers have evolved to drive the technology through a business, making the impact of technology truly disruptive on a large scale.

Business model enablers such as Cloud services, miniaturization of sensors, low cost computing, application programming interfaces, crowdfunding, open source and Freemium mean we now have access to the funding, platforms,

processing power, software and data to turn the technology into useful, scalable solutions.

The combination of new technologies, together with these new business model enablers, is resulting in significant change in the adoption rates of new technology enabled companies, products, and services. Technology companies are crossing over into different areas, and getting the right technology at a cheaper price is becoming easier.

“PC usage is down and app usage has soared. Understanding ‘user experience’ is the secret sauce to success.”

The New Normal

People are consuming things differently today. Users want the same content, but in a different way. For example, cable TV users are shifting to streaming. Virtual assistants are the norm at home. How soon until they control security? PC usage is down and app usage has soared. Understanding “user experience” is the secret sauce to success.

The DIY trend tempts the above average user to want to install their own solution. In our “I want it now” culture, integrators and manufacturers need to be nimble and responsive by using the tools end users are accustomed to in their daily lives. In the home automation space, if you have an issue, you can instantly call, find web support, chat, email, voice, etc., and remotely resolve issues. Integrators and manufacturers need to harness the disruptive technology to provide the instant support end users experience in their every day lives.

Internet of Things is one of the biggest disruptors that integrators and manufacturers can use to their advantage. With the ability to self-configure and create automation, end users

can self-customize. Adding devices is simple, and everything is connected. Savvy end users do not want to call a technician every time they want to make a change to their system. End users are taking more control. As the commercial security industry evolves, it is imperative to leverage the trends to bring greater value to customers.

To keep up with the user demand and provide a secure data environment for customers, the industry needs to increase cyber capabilities. End users are increasingly looking for technology with open architecture to meet their desire to self-customize quickly. In the security or commercial space, customers frequently worry about security breaches, and end-to-end encryption must be used for everything along with opt-in models.

Tips to Succeed

In two to five years, what we see today in the consumer space will be the norm. Manufacturers need to balance their core offerings and figure out how to be disruptive.

Bringing innovation to your customers will require you to invest in a diverse team to lead your innovation and technology vision. Hiring talented individuals who live technical lives at home will help your culture change when they bring their experience to work. You must understand generational differences and work to provide a common ground. If you are able, budget for a lab and provide technology allowances for a select team to use technology at home to understand the experience. Leverage everyone in the organization for their thoughts, ideas and experiences.

Listen to and embrace feedback. Create channel communities and hold voice of the customer events to learn what your customers need and want. These events will teach you not only what your customers need, but where you need to get smarter as an organization.

Build systems that are native to the mobile operating system. Be sensitive to privacy issues, and apply encryption to secure your solutions. At the end of the day, it’s all about the user experience.

As commercial technology evolves to the consumer level, you will need to find ways to provide value to end users. Make yourself available to your customer, listen to their needs, and sell value. Use knowledge to become your customer’s trusted advisor. Understand the connected experience and know what your customer will want sooner rather than later. Sell value, not widgets, and sell systems that connect to each other. Creating a vision in partnership with your clients will help you both set up a road map to a future-proof security solution, and will create a relationship that will last for years.

Joe Young is the Senior Director, Cloud & Enterprise Solutions, G4S Secure Integration (www.g4s.ca). Young originally presented this information as a webinar for SP&T News. The webinar is archived and available at www.sptnews.ca.

CONNECTED HEALTH SOLUTIONS ARE ON THE RISE

Physically active baby boomers, now in their 60s, are creating the need for more

mobile

health-care

options

By John Carpenter

Everyone is familiar with the traditional PERS (Personal Emergency Response) device that sits on a counter, plugs into a phone line, and features one large red button that is pressed in the event of an emergency.

While these traditional PERS devices are still being sold today, a new wave of modern mobile PERS (mPERS) solutions is taking the connected health industry by storm, meeting the demands of a far more active generation of seniors while offering significant new revenue opportunities for security dealers.

A new generation of active customers

Historically, PERS has been a somewhat limited category of security sales, since the average

age of the device buyer is around 81-years old. Traditional PERS devices are stationary; they only work within the home and not outside of it. And, once purchased, the devices are used for an average of 18 months — eliminating the opportunity for any potential meaningful recurring revenue for security dealers.

“New solutions are able to upload information into a cloud-based service.”

Fortunately, mPERS is changing the game completely, targeting seniors that are more youthful and more active, and therefore need a solution that is well-adapted to users on-thego. As the baby-boomer generation approaches their mid-60s, they are more engaged with sports, exercise, work, and travel than any other

generation in history.

So, why would active and healthy seniors need an mPERS device? Even though the new generation of seniors is mobile, the reality is that one out of every three people over the age of 65 will experience a fall that requires medical attention. And, once they have fallen, they are three times more likely to fall again.

That’s why the market is looking for a modern mobile solution –– and it’s a need that security dealers can capitalize on right now.

Technology is expanding the customer base

Today’s mPERS devices are equipped with advanced technology that relays critical information to more stakeholders than ever before, greatly expanding a security professional’s potential customer base.

Most notably, new solutions are able to upload information into a cloud-based service that makes a wide range of information accessible to concerned family members. This development is simultaneously keeping seniors safe, while also allowing security dealers to use a subscription-based model for recurring revenue generation.

The information that is acquired by an mPERS device and then uploaded to the cloud

is getting increasingly more detailed, which entices more and more family members to subscribe. For example, one of the biggest innovations in the mPERS industry today is detailed fall detection. Historically, most PERS devices include an accelerometer, which can determine whether or not someone has fallen. Today’s solutions include a magnetometer and a gyroscope, which measures specific details of the fall and the twist motion.

A modern mPERS device can send the fall data to the cloud service, where it is compared automatically to 3,000 different fall types, then matched and identified. Therefore, mPERS devices can tell the difference between a fall from the chair, an accidental drop of the device to the floor, and a heart attack.

These developments allow family members to get more involved in the monitoring process. It also opens up an entirely new customer base in addition to the user.

Currently, 70 per cent of these devices are purchased by family members and care givers. Therefore it is important to provide them with services to keep them involved with their loved ones and their device. With cloud-based services, such as the Numera EverThere, families can login on their mobile device and check the status of their senior family member’s device. They can set personalized notifications. For example, they can configure the system to send

them a ping if the device has been inactive for 24 hours, or if the battery is low and needs to be charged.

Dealers can sell more solutions to more family members because there are more solutions that directly cater to families, as opposed to just the individual users. More potential customers equates to more potential sales.

New market opportunities

In addition to selling to family members, security dealers can begin targeting health professionals — a new commercial market that can benefit from cloud-based service mPERS solutions.

mPERS devices equipped with Bluetooth functionality help to connect medical devices directly to health-care agencies or hospitals that seek to monitor chronically ill patients. mPERS devices can monitor a user’s vitals, such as blood pressure, and automatically upload these results to medical professionals through the unit, opening up an entirely new market of health professionals for potential sales.

Other commercial markets will also begin adopting mPERS solutions. For example, the lone worker market is a primary industry that could greatly benefit from the ability to equip remote employees with an mPERS device. This includes oil, gas and mining industries as well as sales, delivery or driving services.

In the next few years, these advancing technologies will only keep adding new customer markets. We expect to see even more technological developments similar to that within the smart home industry, including voice commands and voice recognition, that make devices more personalized and easier to control.

Security dealers don’t need to wait to capitalize on the opportunity to sell more to more potential customers. The technology is here — so, what are you waiting for?

John Carpenter is the vice-president of channel engagement at Nortek Security & Control (www.nortekcontrol.com).

Using products like the Numera EverThere platform, families can check in on senior relatives.

PLEASE, WON’T YOU STAY FOR A WHILE?

Keeping customers and managing attrition is one of the cornerstones of any successful business that relies on recurring monthly revenue.

By Ellen Cools

For alarm dealers and monitoring centres, attrition is part of life. But is your attrition really as low as you think?

With the advent of do-it-yourself (DIY) systems and higher customer expectations, understanding and managing attrition is more important than ever before.

But a number of companies still don’t have a good understanding of their attrition, the reasons behind it, and how to earn customer loyalty.

Look in a mirror

In fact, John Brady, president of TRG Associates, based in Old Saybrook, Conn., shares that,

in his experience, the entrepreneur who started the alarm company almost always says his attrition is low.

“What we almost invariably find is it’s a lot higher than he understands, because he’s so busy growing the business for new customers and new sales, and most guys don’t have reporting systems that give them monthly information and monthly attrition tracking,” he says.

Given this, companies should “look in a mirror,” to find out what’s causing attrition. Attrition should be measured based on two metrics: gross attrition and net attrition, Brady says.

Bob Harris, president of The Attrition Busters in West Hill, Calif., agrees. “The formula for gross attrition is how many accounts you start with at the beginning of the month and how many have cancelled by the end of the month,”

Harris explains. “Net attrition has to do with how many accounts did you lose at the beginning of the month minus how many accounts did you add during the same period of time?”

However, there is another important factor companies should be aware of, he says.

“There’s an account creation multiple, which means that it costs money to generate a new account, whereas it doesn’t cost money to keep one that you already have,” he explains.

“So a lot of mistakes are being made between gross and net attrition. People think if they … lose 10 accounts and they add 10 accounts, that they’re in the same place they started in. But they’ve lost.”

For example, Harris says that in Quebec, his data shows that it’s approximately a 36 times account creation multiple, meaning it’s 36 multiplied by every dollar to generate a new account.

“So if the account creation multiple is 36 times and you get a new $25 a month customer, that’s $300 a year. But what’s 25 times 36? It’s a lot more than a year, even two years’ revenue.”

Brady adds that attrition should be measured

based on recurring monthly revenue (RMR), rather than the number of customers. “You measure based on RMR and you measure on a monthly basis, and then each month, you annualize to see what your gross attrition rate is, and then you track your reasons,” he explains.

Understanding the roadmap

Tracking the reasons behind attrition is the first step to better understanding attrition.

Alarm dealers need to know more than “‘Hey, I have seven per cent attrition.’ You’ve got to know the reasons for the losses,” Brady says. “Because if you don’t know the reasons for the losses, it’s really hard to manage what you’re doing wrong.”

Many companies say they track the reasons, but often they offer customers the option of choosing ‘other’ in a survey.

“What do you do with ‘other’? How do I manage ‘other’?” asks Brady.

While it is difficult getting unhappy customers to share why they are cancelling their contracts, he says the management team “really have to be come in-tune with unhappy customers.” He recommends they ask customers why they are leaving so they can learn from their mistakes.

“The reasons give you the roadmap to managing to lower your attrition,” he adds.

“If you don’t know the reasons for the losses, it’s really hard to manage what you’re doing wrong.”

— John Brady,TRGAssociates

And there are a range of reasons, including loss to competition and poor service on calls.

To address the problem of poor service, Brady suggests companies look at their “go backs.”

“Look at all the times that a service tech went to see Mrs. Smith and she probably took off [time] from work…and you don’t show up on time or you don’t show up at all, or you show up and you do a little work, but you don’t have all the right parts, so you have to come back.” Mrs. Smith won’t be happy.

“So we track go backs, because go backs are endemic; they create unhappy customers,” he explains.

Poor service can also be measured by looking at the turnaround time — the time between when a customer calls with a problem and when the company fixes it.

If the quickest a company can fix a client’s system is a few days, then they are in trouble, he adds.

Additionally, moves is a big driver of attrition, since customers may move out of a company’s

“Our industry as a whole has become so lethargic in the way we communicate and how we add value to the professional services we do.”

— Bob Harris,The Attrition Busters

geographic market. But they can also be an opportunity.

“A good management team will tell you not only how many move-outs they had, but how many re-signs they got,” Brady explains. “Think of the re-sign as two different things. I can either resign the same customer in the new home, or I can get a two-for-one. I can sign the existing customer in the new home and I can sign the new homeowner in the old home.”

“It’s [all about] the management team and what they do about re-signs, follow up,” he continues. “Because think about it — who’s really your customer? Long term, the home is your customer.”

Finally, the most important factor driving attrition is “the perception of value that people receive or don’t receive. It’s the experience-based perception of value they get based on the money they invest,” Harris says.

The best way to engage customers and stop attrition is to “shore up the front-end of an all-out team approach to engage our customers and make the customer really believe that they’re not paying us enough for the services that we’re providing them. And when you do that effectively, it makes it really, really hard for them to dump you.”

“We’re falling short”

But as customer expectations have become higher

“I would say the challenge has never been higher, and our strategy to combat that has been to go above and beyond with service.”

— Virgil Reed, Reed Security

over the years, “How we communicate, what we communicate, specifically, and what do we do in terms of education… has changed dramatically, and frankly we fell short, or we’re falling short still on doing that,” Harris says.

In his experience, countless alarm companies have lost a customer to a competitor for a service they already provide, simply because they didn’t communicate properly.

Reaching out to customers outside of renewing contracts, collecting payments, or service calls is a simple way to earn customer loyalty, Brady adds.

He suggests that companies pick a few customers a week to call and check up on. When he tells entrepreneurs to do this, “they all look at me like I’ve got four heads,” he says.

But “there’s just a lot of different places where a customer can discern poor service…and if you’re really looking carefully, you can tell that they might be getting unhappy.”

Harris also believes lack of communication plays a role in losing customers to DIY.

“One of the primary ways to really persuade people from DIY is the monitoring component. You’re on an airplane, you’re in a meeting, there’s a fire at your house — there’s no possible way that you can respond as quickly as a professionally monitored service can,” he explains.

Additionally, he says, a professionally monitored service would only cost clients approximately one dollar a day.

But the industry is not explaining this to customers.

“Our industry as a whole has become so lethargic in the way we communicate and how we add value to the professional services we do,” he shares.

“What we’ve done is we’ve done the opposite, we’ve gone cheap, especially in Canada! … [Instead of focusing] on value and service and relationships, we’re competing on product and price, and it’s totally backwards.”

Dealing with problem customers

These communication problems are exacerbated further by higher customer expectations.

“I believe [higher expectations are] due to having a smart phone, instant access to the internet, and consumers, including us, are used to getting whatever we want now. And so that’s been the number one challenge of adapting our business to today’s consumer and their high expectations,” says Virgil Reed, president of Reed Security & Dealer Program, based in Saskatoon, Sask.

With such high expectations, some customers can become a drain on a company, especially if they require several service calls.

When it comes to dealing with these customers, Reed says if they become belligerent, it may be time to let them go.

“There are times where the expectations are so high that you do have to actually agree to [say] ‘We can’t make you happy, we’re happy to cancel your contract and you can shop around elsewhere,’” he explains.

Sometimes customers do cancel their contracts, and other times this changes the tone of the conversation, and they can work together to come up with a solution, he adds.

“I would say the challenge has never been higher, and our strategy to combat that has been to go above and beyond with service, including adding more to our support desk, more staffing, more hours, more resources, and trying to create a better experience for that client base.”

Harris adds that when it comes to problem customers, “you need to turn that customer into a profitable customer, otherwise it’s a huge drain on your financial position.”

To identify these customers before they become problematic, Brady suggests that companies watch for signs of unhappiness, such as a sudden stop in payments or lack of system activity.

Many alarm dealers don’t pay attention to accounts with no activity and don’t want to reach out to those customers if they are still paying, he shares.

But the problem with that is “there’s a good chance that someone like Vivint …they’re going to come knocking on doors.”

Greater awareness

However, not all alarm dealers are falling short managing attrition and communicating with customers.

“I think the management teams in general

have gotten far more aware of the importance of understanding the metric and understanding the dynamics of it,” says Brady.

Additionally, more companies are taking attrition seriously.

“We’ve got a lot of smaller clients and they do a monthly report, they use our template …and they track the reasons and they really do something about it,” he says.

In fact, Reed Security does just that.

“We look at gross attrition, we track our data, we do monthly reports on what our attrition is and we pay attention to it quite heavily,” Reed shares.

“Proactively educating our customers is our best strategy,” he adds.

The company writes educational articles on their blog and shares them via social media, particularly Facebook, and through their email database, he explains.

Reed Security especially focuses on communicating and educating customers during the “summer door-knocking programs.”

“As soon as May hits, I’m always going to send a proactive email to our client database and we will educate [them]…Some years it’s been ‘Beware of door-to-door sales people,’ and then we’ll share articles that we find online,” Reed says.

This year, he took a slightly different approach, writing an article from the perspective of a fictitious door-to-door salesperson who was sharing his secrets and tactics.

“Boy, did we get a lot of attention on that one, as far as our customers sharing various stories, on social media in particular,” he says. “It’s the best awareness that we’ve ever come up with. To this point, I don’t think we’ve had a single cancellation relating to door-to-door this season.”

On top of education, Reed agrees with Brady and Harris.

“You have to make sure that those customers feel like they’re valued, and you have to actually stay in communication with them,” he says. “You can’t just sit back and relax and be on cruise control — you have to take an active approach with your customer experience and that’s really what we’ve done.”

To learn more about how alarm and security dealers can get ahead in the market and manage their attrition, check out our six-part video series with Bob Harris, “Selling Points” as well as our interview with John Brady, who was a featured speaker at Security Summit Canada. Both are available at www.sptnews.ca.

Smart phones for credentials and access control: The under-30 crowd is ready to replace smart cards with smart phones

A family affair: Many security businesses in Canada are passed through generations from parents to children. Passing along the knowledge and business acumen is a vital part of that process, whether it’s industry savvy or a customer focused attitude

Millennials are probably the most scrutinized age cohort since Generation X — arguably much more so, given their close association with the rise of the Internet and reputation for being mobile savvy.

This issue’s feature story, Marketing to Millennials, references a definition of the age group as those born between 1982 and 1998 — a significantly broad time span that roughly equates to the rise of the personal computer and the early days of the Internet.

This is not the first time SP&T News has taken a look at how this generation is transforming security through its technology preferences and habits. In 2011, an article by Ingersoll Rand’s Raj Venkat, while

Generation next

not expressly about millennials, explored the impending use of mobile devices as identification and access control devices. “The under 30 crowd is tech savvy,” he wrote. “This younger generation has only one question when it comes to using smart cards and biometrics in the commercial world: why aren’t smart cards and biometrics used beyond campus?”

Just two years ago, SP&T ran an article on hybrid security systems that take advantage of DIY and self-monitoring, but bring the dealer into the equation. The premise is the dealer would sell this equipment to the end user who would install it and monitor it themselves — with an option in some cases for third-party monitoring on-demand.

Keith Jentoff spoke of a hybrid alarm product/service called DragonFly, which was offered by Honeywell. “DragonFly is chasing the millennials, the 20-somethings, who are going to Amazon.com and Best Buy to purchase cameras,” he said. “They’re not looking at a professionally installed alarm system. So we’re trying to bring them into the RMR ecosystem where they normally wouldn’t be.”

Another important aspect of security and millennials is the industry itself — specifically the people it employs. As the cohort ages and enters the work force, there are of course new additions to the security industry as well. SP&T News has featured several articles and roundtables over the

Americans don’t feel totally safe in their homes, says survey: People, particularly millennials, no longer live life on a rigid schedule, and the lack of consistency can leave consumers wondering about their homes when on the road. (from www.sptnews.ca).

Putting the pieces together: “Our security solutions will continue to evolve and adapt to meet the needs of our clients. I am confident that future generations of security professionals will look back with pride at our time in this vital industry.” (Richard McMullen, FCi)

years that ask questions (and offer some answers) about what it takes to entice new graduates to join security and the types of skillsets they bring with them.

Back in 2010, Steve Bocking, then of Genetec, wrote that a new generation of control room operators had adapted to the complexity presented by alarm systems that integrate intrusion, video and access control, shedding the image of control rooms as static environments.

In the April 2018 issue of SP&T, industry veteran Brian St.Onge noted that new ideas and are being explored in security as young people enter the profession. Moreover, he noted, they will have answers to problems “that we don’t even know exist yet.”

RESIDENTIAL ACCESS SOLUTIONS

HOW DOES INCORPORATING ACCESS CONTROL HELP YOU?

Increase RMR

Increase system usage

Increase customer retention

Provide the total security solution Innovative Security

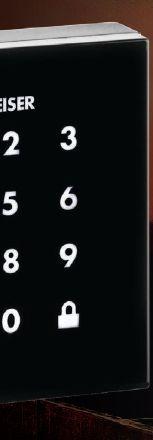

There are many drivers for why incorporating connected locksets into your customers’ total security solution will provide otherwise unseen benefits. Whether interested in safety & security, remote access control or everyday convenience, Weiser provides the products that give your customers the solutions they are looking for.

• Full 128-Bit Encryption Security

• Motorized Deadbolt - enables true remote locking & unlocking

• SmartKey Security™

Easy Integration

• Wireless Protocol

• Replaces Existing Deadbolt with just a screwdriver

• 4 AA Batteries (no hard wiring) - batteries last for approximately 1 year

Satin Nickel Iron Black Satin Nickel

Product Previews Home Automation

Electronic deadbolt

Kwikset

The SmartCode 888 touchpad electronic deadbolt can be included in virtually every smarthome or security package. Featuring an all-metal design and traditional styling, it is designed to integrate with most Z-Wave smart home systems. With complete remote locking/unlocking via smartphones and tablets, as well as total home control, it features Kwikset’s patented SmartKey Security, which protects against advanced break-in techniques and allows homeowners to re-key the lock in seconds, the company says.

www.kwikset.com

Touchscreen display

NAPCO Security Technologies

iBridge Touch is an advanced, neutral-colour, décor-friendly, wall-mounted touchscreen that controls security and/or video and smart automation (IoT services). Available in hardwire or wireless models, this slim-profile, high-res 7” full colour touchscreen is responsive with a high-speed, quad-core processor, matching the iBridge Smart App for mobile services. iBridge Touch has an intuitive graphical icon-based user interface, built-in voice prompts, onscreen MMS/SMS notifications, and offers one-touch security for arm, disarm, stay & away. www.napcosecurity.com

Water leak detector

Nortek Security & Control

The 2GIG Water Leak Detector provides dual-source protection against water leaks and flooding. The detector is a notification sensor, designed to give homeowners important information in advance of events. The patent-pending 2GIG Water Leak Detector alerts the homeowner of a leak before costly water damage or flooding has a chance to occur. The sensor, when placed under a water source, will send notifications to a homeowner’s smartphone or security panel if it detects either drips or pooled water. Transmitting wirelessly at 345MHz and compatible with 2GIG and Honeywell systems, the unit requires no tools to install. www.nortekcontrol.com

Subwoofers

Legrand

Available in 8-, 10- and 12-inch models, Nuvo powered subwoofers are designed to offer versatility to integrate with almost any audio system for the delivery of high performance bass. The new powered subwoofers each feature a front-mounted woofer in a cabinet constructed of durable MDF for distortion-free bass response and are also compatible with an optional wireless kit (NV-SUBTXRX) that includes one transmitter and one receiver for installation flexibility in single room installations.

www.legrand.ca

Smart panel partitioning Nortek Security & Control

Smart Areas partitioning for the 2GIG GC3 security panel is available immediately to every GC3 system – even installed systems – via the new v3.2 firmware release, with no added hardware modules required. According to the company, with Smart Areas, the GC3 is the first wireless self-contained partitioning panel in the marketplace, including an interface, controller, wireless transceiver, and communicator in one package. The GC3 provides the ability to arm and disarm up to four partitions independently. For example, a household with a pool can keep the sensor at the gate to the pool area armed at all times, even when the rest of the home is disarmed.

www.2gig.com/smart-areas

Water monitor

Reliance Worldwide Corporation

Reliance Worldwide Corporation’s Streamlabs Smart Home Water Monitor provides early leak detection notification and real-time data about water consumption habits. Streamlabs helps protect against water damage. Users can customize alerts and configure settings using a smartphone app to enable monitoring of plumbing systems remotely. The ability to use the app enables monitoring of plumbing systems from almost any location. The monitor won a SIA 2018 New Product Showcase Award at ISC West in Las Vegas, Nev., earlier this year.

www.streamlabswater.com

Garage door openers

Overhead Door

OHD Anywhere has been fully integrated into Overhead Door Legacy 920 garage door openers, allowing homeowners to monitor and control their garage door remotely via an Apple iPhone or Android phone or device. With OHD Anywhere, users can check if their garage door is open, closed or if there are any changes to the door position. They can also open the door for delivery, maintenance professionals or friends without an access password. It also keeps a log of all uses of the garage door. Legacy 920 openers gives users the option to choose between a chain unit or a belt operated unit. www.overheaddoor.com

In-wall speakers

Leviton