OUR COORDINATOR

Prof. Madhavi Garikaparthi (Coordinator-Student Activities,) Associate Professor (Marketing & Strategy)

IBS Hyderabad

Prof. Madhavi Garikaparthi (Coordinator-Student Activities,) Associate Professor (Marketing & Strategy)

IBS Hyderabad

OUR MENTORS

Prof. Dr. Vaibhav Shekhar Associate Professor (Marketing & Strategy)

IBS Hyderabad

Prof. Dr. Saravanan D Assistant Professor (IT & Operations)

IBS Hyderabad

Prof. Dr. Vaibhav Shekhar Associate Professor (Marketing & Strategy)

IBS Hyderabad

Prof. Dr. Saravanan D Assistant Professor (IT & Operations)

IBS Hyderabad

CONTENTS

Acknowledgement

Editor’s note

Then vs. now: The Progressive Dissent

Brain Bytes

Evolution of Behavioral finance

Crossword

Then vs. Now: Data Storage

Photo Gallery Evolution of Payment Gateways

Did you know?

ACKNOWLEDGEMENT

We IBS Analytics Club would like to express our sincere gratitude to ICFAI Business School Hyderabad for providing us with an amazing platform to put forward our magazine. As a team, we are highly obliged in taking this opportunity to convey our sincere regard to Prof. Madhavi Gankaparthi Ma’am (coordinator – of student Activities and Associate Professor, Department of Marketing & Strategy) for her constant support and encouragement throughout. We are also grateful to Prof Dr. Manish Gupta Sir (Assistant Professor, Department of HR) and Prof. Dr. Vaibhav Shekhar Sir (Associate Professor, Department of Marketing and strategy), and Prof. Saravanan Sir (Assistant Professor, Department of IT and Operations) for their immense support and guidance towards the launch of the magazine.

Lastly, we would also like to thank each and every member of our club for working hard with utmost diligence and perfection and supporting each other throughout the course of this magazine.

IBS Analytics Club, IBS Hyderabad, a Constituent of IFHE, Deemed University,

EDITOR'S NOTE

Dear Readers,

The Editorial vertical of IBS Analytics Club is proud to present, Analyzia Volume 5.0 Issue 1! The theme of the issue is ‘Then vs. Now’ , which will take you through the journey, looking back in time along the past few decades, that have seen dramatic changes in the world as we know it.

We present the articles ranging from data storage to behavioral finance penned by our enthusiastic team members, drawing parallels between what was and what is; more precisely, how it was and how it is.

With this new volume, we have introduced a variety of new sections to keep our digital readers engrossed, abreast and intrigued! This includes brain teasers to tickle the grey cells as well as, fun facts, putting analytics into purview. Moreover, a photo gallery accompanies the pages, to let a sense of belongingness pose as nostalgia.

At IBS Analytics Club, we believe in building a network of nurturing connections. Hence, we welcome your constructive feedback on the magazine, in general or specific. Feel free to reach us at: ibsanalytics.editorials@gmail.com

We hope you enjoy reading as much as we enjoyed making it for you!

THE PROGRESSIVE DISSENT

Long before the time, when industrialization penetrated deep within the core of the national building to become closely embedded in daily life, it faced ire. Ire from the world of art

Why is it so significant? Of a time when H.G. Wells was busy building a road map for a possible future, and the cosmos had already become the talk of the town, much against the Church, which, when sensed threat from Galileo, chose to make him blinded for life, the soaring industries had started the mindless exploitation of the population looking for even meager amounts, to survive, God forbid, they know not. It is during these difficult times, that writers, poets, and theatrical artists took it upon themselves to speak of the harsh conditions to which the workers were subjected. The popular works became accessible to the elite class, and thus started a long journey for justice. Justice for the mute, silently working in the dark and murky corners without being allowed breaks or leaves, even bare conversations between each other.

The essay tries to understand these champions of human causes, whose works echo human misery, turned black in smoke. The poison that was consumed, day in and day out to produce goods for a class, which couldn't imagine what it might have taken to get them the priced commodities.

Published in 1854, Hard Times by Charles Dickens is considered an early criticism on the Industrial Revolution. Along the lines, is David Copperfield, by the same author, which recounts the life of David Copperfield and how he had to face hardships as a child with the rise of industries. Both stories are set in imaginary cities, synonymous with flourishing lifestyles and shift of people from the rural belt to urban setups in search of better livelihood. But this search, hits rock bottom, a tragedy that Dickens laments of, as dreaming eyes get filled with smoke. No wonder, social writings of the times grew multifold, as modernization came face to face against traditions, inside the households.

Popular nature poet, William Wordsworth, in his poem, London, published in 1794, uses midnight streets as a metaphor to draw a gloomy picture of people trapped in sorrow, as in the lines:

I wander thro' each charter’d street, Near where the charter’d Thames does flow.

And mark every face I meet Marks of weakness, marks of woe

Readers of Wordsworth claim that while the Industrial Revolution was at its peak, he didn't unanimously turn a critic but rather opposed how nature is exploited for the benefit of a few. Being a nature poet, deeply ingrained with the pristine quality of nature to nourish lives, while he stays put with this quality being affected, he doesn't shy away from being influenced by modernity and celebrating the tag of being a progressive writer.

While I have tried to lay down an introduction to the world of literature that chose to voice concerns against growing factories, hapless workers, and poor-quality of workplaces, the literature is continuously growing.

The policies which made the lower rung of the society suffer under capitalists who claimed to elevate the society to become reliant on massproduced products and whatnot, this limited to examining two popular littérateurs and their works. William Blake, John Keats, T.S. Eliot, and Percy Shelly, among others, spearheaded the new generation’s thoughts underlying the honeycomb of hollow yet attractive promises of the future.

In conclusion: While still, the industrial revolution became a symbol of mass production, that ushered the world towards innovation, the voices of dissent, forced government and industrialists to rethink the impact. The Social Contact didn't really allow them to disregard the contrasting viewpoints, and more than anything shrugged them off.

Sayak Chatterjee

BRAIN BYTES

If you burn all of the data created in just one day onto DVDs, you could stack them on top of each other and reach the moon – twice!

A user of the internet today would need 181 million years to download all the data from the internet.

EVOLUTION OF BEHAVIORAL FINANCE

“Human nature is complex. Even if we do have inclinations toward violence, we also have an inclination to empathy, to cooperation, to self-control.” -Steven Pinker

Every investor can safely say that investing in stocks elicits a wide range of emotions, from the agony of seeing your investment lose value to the joy of seeing your investment rise higher and higher, and these emotions can result in mistakes and misjudgments. Behavioral finance tells us how these emotions and psychological and cognitive elements affect their investment choices. Multiple studies have stated that humans make completely irrational decisions. Behavioral finance can help explain this gap between expected and actual efficient, rational investor behavior. It encompasses behavioral economics, psychology, and microeconomic theory insights. In economics, the mideighteenth century is regarded as the start of the classical period.

John Stuart Mill coined the term "economic man" or "homo economics" in 1844

It describes a person who acts rationally on complete knowledge out of self-interest and a desire for wealth, attempting to maximize his economic well-being provided the limitations he faces. He proposed three underlying assumptions:

Perfect rationality, Perfect self-interest, and Perfect information.

These assumptions served as the foundation for the traditional financial framework.

Academic finance is another name for standard finance. Modern Portfolio Theory, for example, arose in the 1950s and early 1960s. Following that, it gained widespread acceptance in academia According to this theory, investors are entirely rational decisionmaking entities. The theory also accepted that stock prices always reflected the most up-to-date information about fundamental values and that prices changed only in response to sound and sensible information Using rational expectations, 1970s finance models linked speculative asset prices to economic fundamentals.

As a result, finance was linked to the entire economy. The standard finance was based on the following four foundations:

Investors are rational Markets are efficient Investors should design their portfolios according to the rules of Mean-Portfolio Theory

Expected returns are a function of risk, and risk alone.

These foundations are based on the theories given by Merton Miller, Franco Modigliani, Eugene Fama, Harry Markowitz, William Sharpe, etc. For a long time, these theories were accepted and regarded as an explanation for investor and market behavior But now, many researchers have found that these theories are not complied with in the actual market. They have begun to recognize that these theories are based on how market participants should behave rather than how they actually behave. This resulted in the emergence of behavioral finance, which takes into account investors' irrationalities and biases.

CONCLUSION:

Behavioral finance is not restricted to specific asset classes. It applies to all types of investments. It impacts the individual investor and the entire market at the micro and macro levels

At the micro-level, behavioral finance theories are derived by comparing the assumptions of rational behavior in classical theories to the imperfect behavior displayed by market participants. At the Macro-level, behavioral finance contests and refutes two significant financial theories. The efficient market hypothesis and Harry Markowitz's portfolio theory are two examples of such theories.

A common misconception is that behavioral finance only applies to stocks and bonds. However, behavioral finance will be relevant whenever humans attempt to make investment decisions.

For years, experts have been studying the field of behavioral finance It has given new insights that have the potential to change the way we participate in markets and better understand consumers. Understanding the psychological makeup of consumers and investors can help you spot investment opportunities and avoid mistakes

K.Mrunalini Rao

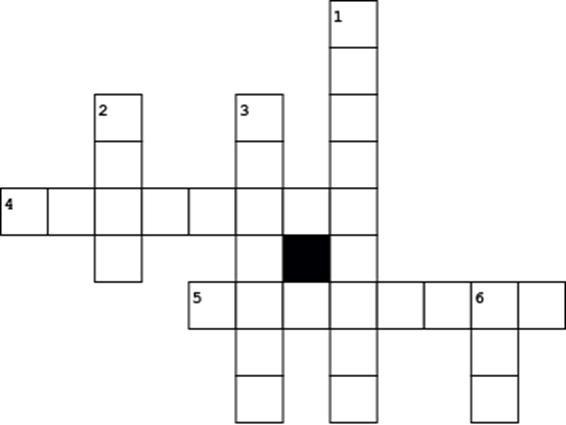

CROSSWORD DOWN ACROSS

1.The more you take, the more you leave behind. What am I?

2 What belongs to you, but other people use it more than you?

3.What's 3/7 chicken, 2/3 cat, and 2/4 goat?

6.I am something people love or hate. I change people’s appearances and thoughts. If a person takes care of them self, I will go up even higher. To some people I will fool them To others I am a mystery. Some people might want to try and hide me but I will show. No matter how hard people try I will Never go down. What am I?

4. You have me today, Tomorrow you'll have more; As your time passes, I'm not easy to store; I don't take up space, But I'm only in one place; I am what you saw, but not what you see. What am I?

5. No matter how little or how much you use me, you change me every month. What am I?

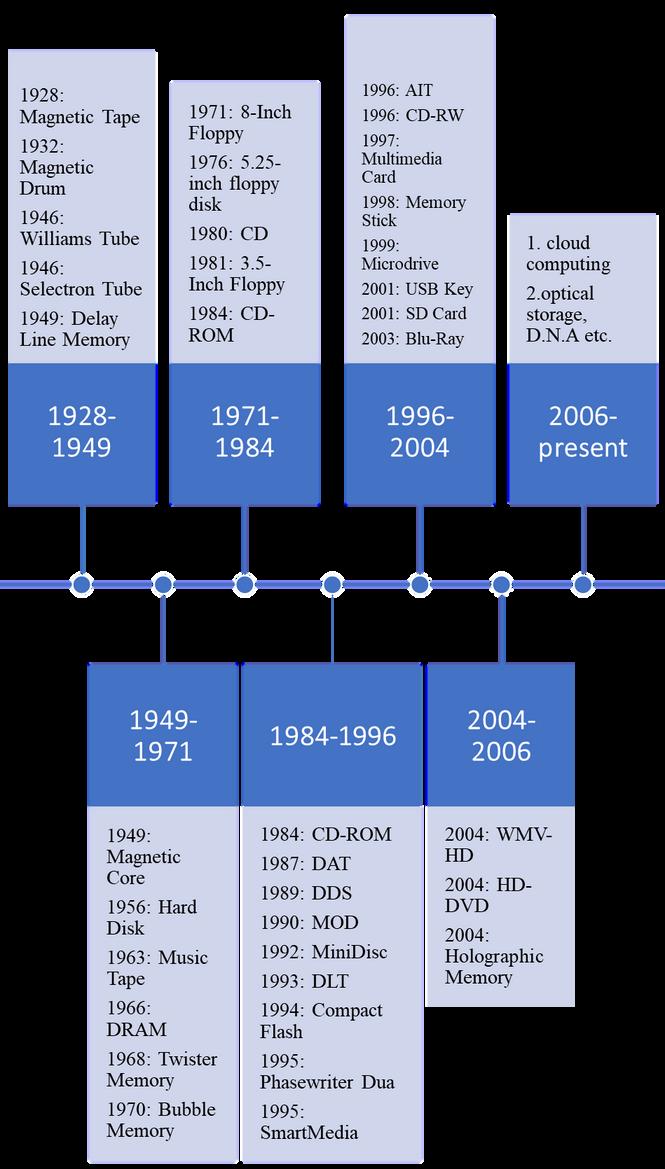

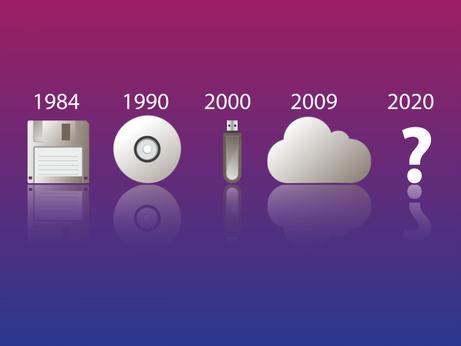

THEN VS NOW: DATA STORAGE

Data can be stored using various methods to carry out an infinite number of tasks. Data manipulation occurs when you keep paper in a filing cabinet, copy files to a disc, or enter data on a hard drive The ability to create, distribute, and destroy data is also constantly evolving in the digital world we live in today.

Have you ever wondered how we moved from storing files in the cabinet to storing files on a cloud server? The data storage journey is fantastic and unique, from a roomsize storage unit for a few kilobytes (kB) of data to a handheld hard disk for a terabyte of data.

It started in 1928 when Fritz Pflueger created the magnetic tape technique for data storage. Magnetic wire recording serves as the foundation for Pflueger’s invention. A magnetic coating that can record audio and video makes up the tape.

After this, a ray of advancement kept falling in the data storage industry. The field of data storage has always

been brain-boggling. If we look at the table, it is evident that every time, a new and peculiar invention has been made in this industry, revolutionizing people's thinking and perspective of data With every advancement, the capacity of these technologies has increased in the amount of which they store data, process it, analyze it, and draw inferences from it. If we look at the early 80s or 90s, the race was only about how much more data we could store in a single device, but now the whole game is changing. It is not only about the storage of data but also about analyzing it and drawing inferences from it.

Let’s take an example from earlier when we used to listen to songs either on our phone’s memory or through CDs or DVDs but now, with the advent of apps like Amazon Music, Spotify, etc., we not only listen to songs that we have saved in the app but also to the ones these apps suggest us which is an excellent example of how data storage has changed over time. Earlier, we needed to buy SD cards or CDs or, if

we go way back in time, audio cassettes, but now it’s just an app of a few MB which consists of terabytes of data disposable for us.

Because there is less air resistance when these drives utilize helium instead of air, it requires less power to spin the discs. The technology is still costly However, probably, these high-performance drives will only become more accessible and affordable possibly even inexpensive enough for consumer usage.

Up until now, we have seen a comparison of Then v/s Now of data storage. Since there are so many advancements in this industry today, the definition of data storage has changed phenomenally. Is there any room for future growth? Well, you will be surprised to know that this field will still evolve to another different level instead of humungous advancement and changes. Here are 6 data storage technologies showing us a glimpse of this field in the future.

Helium Drives

Hard drives filled with helium instead of air are undoubtedly pushing the limits of their storage capacity. Such data storage technology is produced by several firms, including Western Digital, which recently unveiled the first 10TB hard disc. Additionally, Seagate unveiled an 8TB air-filled hard disc

Shingled Magnetic Recording (SMR)

The tracks are compressed closer together with SMR technology. Higher areal densities are, as a result, attained, and the paths overlap like shingles on a roof. More data may be written in the same place because of this Now, it cuts the drive tracks, or in other words, shingles, when new data is written. Data can be easily read in a trimmed way without affecting data integrity or reliability. Additionally, SMR can make use of the conventional reader and writer components.

D.N.A

Is it challenging to imagine biological molecules being used in data storage technologies? DNA is the new storage technology of the future, even though it sounds the oddest.

Various other types of digital data might be stored in the same molecules that hold biological information. In 2012, Harvard researchers discovered a way to encode DNA using digital data, including JavaScript software, eleven JPEG photos, and a 53,400-word HTML book.

Regarding storage density, DNA has an astounding 2.2 petabytes per gram. This implies that the whole world's data might fit on a DNA hard drive the size of a teaspoon! In addition to taking up less room, DNA is perfect for long-term preservation.

DNA requires a long time to read or write, and the technology is currently too costly to be widely used. According to New Scientist, the cost to encode 83 kilobytes in recent research was £1000 (about USD 1,500). Scientists encode information into synthetic DNA and add it to bacteria, which sounds like a sci-fi tale Not to add that DNA may one day serve as the ultimate perpetual drive.

Large Memory Servers NVRAM

The first to introduce non-volatile random-access memory was Intel (NVRAM)

These memories are magical because they can maintain data across several power cycles without batteries. NVRAM is substantially quicker than SSDs or discs since it is connected to the server's memory bus. NVRAM may however, be accessed as either memory bytes or 4K storage blocks, which is rare in SSDs. You benefit from optimal compatibility and performance as a consequence.

Rack Scale Design

Rack scale design (RSD), another revolutionary idea in data storage technology that Intel has been advocating for years, has already been introduced to the market and is expected to make more advancements RSD is the solution if you're seeking explanations for the divergent rates of technological advancement in storage, CPU, GPUs, and networks.

Additionally, the RSD idea is straightforward. It may be seen as a single rack containing a highbandwidth, low-latency connection, together with CPU, storage, memory, and GPUs. Any mix of computers, memory and storage needed by a specific application may be customized using software and virtual servers RSD may be viewed as a highly configurable private cloud as a result.

5D Optical Storage

5D optical storage, using lasers to engrave terabytes of data onto small glass discs, might revolutionize data storage, be freezing storage, or even be biomolecular! Academics are developing this kind of digital data storage at the University of Southampton in the UK. Interestingly, this kind of data storage may endure for billions of years. In addition, they have developed a femtosecond laser-based recording and retrieval mechanism.

They want to replace magnetic tape. Therefore, they chose quartz glass because of its extraordinary durability and suitability for data centers (it can withstand calamities like solar flares or fires). Additionally, this storage option may store five-dimensional data in layers comprising the conventional three dimensions. Recording the imprinted structures’ size and orientation achieves five degrees of freedom for data storage

Consequently, 5D Optical storage has thermal stability of up to 1800 degrees Fahrenheit and can store hundreds of gigabytes per disc. Microsoft has taken notice of the study because it can use the glass's 5D optical storage.

CONCLUSION

This era of technology is data-centric. Today, nearly 4.5 billion computers are in use, the majority of which are portable The development of IoT is also something that will happen in the future. Furthermore, data will be the top priority for governance and technology for financial and legal reasons.

The latest data storage technologies should always be kept in mind because any company's data is its key competitive advantage. New analytical techniques can enhance the value that correctly kept data can provide. Fortunately, data storage is more affordable than ever and will stay that way

Darshit Sharma

Verticals- Matrix and Events

Darshit Sharma

Verticals- Matrix and Events

PHOTO GALLERY

Analyst 5.0 & 6.0

On the occasion of Guest lecture by Subhash Kakarla dated 30 Aug 2022

Up Next :

Top: Analyst 5.0 at 6.0 Introductory event

Bottom: Analyst 5.0 photoshoot by Nazaria

BID ADIEU

(Batch of 2023)

EVOLUTION OF PAYMENTS METHODS

When you go out, how do you prefer to pay? Perhaps we used to carry cash before the pandemic, but you know we prefer contactless payments over cash. If this is the case, you are not alone. According to a PAYMENTS and Visa study, the pandemic has only accelerated the modernization and digitalization of payment processes, with 80% of U.S. survey respondents claiming that they adopted new payment experiences and contactless payments due to a belief that cash could lead to COVID-19 exposure.

We've come a long way since 700 B C in China when we first began carrying physical currency in the form of coins and paper money. While paper checks first appeared in Holland in the 1500s, the evolution and variety of payment systems really took off in the late twentieth century with the introduction of debit and credit cards Fast forward to today, when there are numerous ways to process financial transactions, ranging from smart terminals to mobile payments. Buying and paying for things is a part of our daily lives these days, and we do now and then. But how did we get to where we are today?

Here is a rundown of the major milestones:

Barter: Evidence of a barter system dates back to the Neolithic, with the emergence of the agricultural/livestock society (probably before 7000 BC). The exchange of material goods or services for other goods or services is known as barter

Coins: They appeared first between 680 to 560 BC in what is now Turkey. Because barter sometimes posed difficulties for transactions, and certain forms of payment were perishable, they could not be accumulated, the use of coins increased As a result, coins made of precious metals appeared. The most practical shape was chosen: a circle.

Paper money and banknotes: Their purpose was to replace coins because they were carrying large amounts of coins was inconvenient Banknotes were first used in China in the 7th century, but their use was not made official until 812. It's worth remembering that until the 1970s, every banknote issued by a country's government had to be backed by a certain amount of gold.

Checks and bills of exchange: Bills of exchange date back to the 12th century in Italy. This document guaranteed that the debtor would pay the creditor or another person named in the commercial document. Cheques, on the other hand, date back to the 18th century and are associated with the English Crown.

Cards: The first credit card appeared in 1914, when Western Union created a loyalty card for its most affluent customers, granting them access to a line of credit with no surcharges. However, banks did not offer cards as a payment option until 1958. The first card was later known as Visa.

Digital payments: When the Internet and the World Wide Web system were introduced in 1990, goods and services began to be sold via this new communication channel. The company Peapod was a pioneer, offering the ability to buy groceries from home using a computer Following the recent disrupted digital revolution and the introduction of new technologies, it is now possible to pay by mobile phone or digital watch.

This gave birth to the idea of crypto currency. David Chaum pioneered the use of DigiCash and eCash to create a currency. However, Satoshi Nakamoto was the creator of first Cryptocurrency, Bitcoin, until 2009.

CONCLUSION

Money is and has been an integral part of our lives .Over the period of time evolution of money has transformed our lives in every possible way From exchanging goods with goods to making digital payment we have come a long way. New Age mode of payments are contact less payments .Contactless Payment has overtaken our lives in every aspect. No matter where we go we prefer digital payments as it is feasible option and refrain from holding cash The pandemic is one of the sole in charge of bringing revolution in the payment industry. It has transformed the functioning of money. Even though pandemic is almost over, people will find it easier to pay using alternative payment methods like SEPA, Sofort, PayPal, AliPay, and others Usage of paper notes and currency has declined with usage of Digital Payments to certain extent.

Cryptocurrencies: In 1998, Wei Dai proposed the creation of a decentralized type of currency using cryptography as a means of control.

DID YOU KNOW?

Facebook users on an average send 31.25 million messages and view 2.77 million videos every minute

An AI-generated text prediction model was trained to write a Harry Potter novel

HIGHLIGHTS : 2022

Union Budget: Key Takeaways

1. PM GatiShakti: PM's purview of the seven engines for economic transformation, seamless multimodal connectivity, and logistical effectiveness will all be included in the GatiShakti National Master Plan.

2 Inclusive Growth; The main areas of attention for inclusive development are listed below.

• In 2022–2023, 3.8 crore families would be served through Har Ghar, Nal Se Jal.

• 80 lakh homes will be finished under the PM Awas Yojana in 2022–2023.

• For the development of lagging blocks in aspirational districts, see Aspirational Blocks Programme.

• Digital Payments: Scheduled Commercial Banks will establish 75 Digital Banking Units in 75 districts. 100% of post offices will transition to the core banking system.

3.

4. Investment Financing RBI's introduction of the Digital Rupee beginning in 2022–2023

5. Capital spending is increased in the next fiscal year by 35.4% to Rs 7.5 lakh crore, or 2.9% of GDP, to encourage private investment and start a "virtuous cycle of investment."

6. Atomic energy makes for 1.9% of all Capex, followed by telecommunications (7 2%), defense (20 3%), transfer to states (14 9%), police (1 4%), housing and urban affairs (3 6%), railroads (18 3%), and road transport and highways (25.0%).

States will be permitted a budget deficit of 4% of GSDP for 2022–2023, of which 0.5% will be conditioned on improvements to the electricity sector.

Climate Action, Sunrise Opportunities, Energy Transition, and Productivity Enhancement & InvestmentJanuary to March:

• T+1 Stock Settlement begins on Indian stock markets.

• In February, the amount of UPI transactions fell to Rs 8.27 lakh crore.

• RBI prohibits Paytm Payments Bank from accepting new clients and orders the business to do IT audits.

• Paytm introduces "Payment Analytics" to assist SMEs in making fact-based choices.

• India's foreign exchange reserves decline by $9.64 billion, the most in two years.

• Cabinet Approves World Bank-Assisted Program for MSMEs Worth Rs. 6,062 Crore

• To encourage innovation and entrepreneurship, KidEx, NITI Aayog, and Atal Innovation Mission work together

April To June:

• Mastercard and Nexo Launch the World's First "Crypto-Backed" Payment Card RBI Starts SDF to Increase the Effective Policy Rate

• In accordance with section 47 A (1) (c) of the Banking Regulation Act of 1949 read with sections 46 (4) I and 51 (1), the RBI fines the Bank of Maharashtra Rs. 1.12 crore (the Act)

• The IMF estimates that India's general budget deficit for FY23 would be 9.9% of GDP.

• Shaktikanta Das, governor of the RBI, announced an increase in the benchmark interest rate of 40 basis points to 4.40 percent.

• For both new and existing clients, private sector lender HDFC Bank has introduced a 30-minute "Xpress Car Loans" program The loan money would be credited to the dealers' accounts in 30 minutes for purchases up to Rs 20 lakh.

• Roughly 20% of the non-performing assets (NPAs) of banks that National Asset Reconstruction Co. Ltd. (NARCL) was supposed to take over in two tranches were resolved.

• To build a branch in Gujarat International Financial Tech City, MUFG Bank received the required approvals from the International Financial Services Centre Authority in India and the Financial Services Agency in Japan (GIFT City).

• The real GDP growth for FY22-23 is kept at 7.2% as the RBI hikes the repo rate by 50 basis points to 4.90%.

• The trade deficit in India now stands at $24.29 billion in May.

July to September:

• ICICI Bank, HDFC Bank, and SBI each buy 9.54% of Perfios Account Aggregation Services.

• According to NPCI data, UPI-enabled digital transactions stayed over Rs 10 lakh crore in June for the second consecutive month.

• After receiving $100 million in investment, fintech company OneCard becomes India's 104th unicorn.

• In order to finance India's PM Ayushman Bharat plan and private investment to spur economic growth, the World Bank has granted loans worth $1.75 billion.

• According to the most recent information provided by the RBI, India's foreign exchange reserves decreased by $7 5 billion to $572 7 billion during the week ending July 15.

• For July 2022, merchandise exports totaled 36.27 billion dollars, up from 35.51 billion dollars in July 2021, a rise of 2 14%

• 14 million debit and credit cards have been tokenized on PhonePe, the largest financial platform in India, in order to lower the risk of fraud and protect client card information. September 30, 2022, is the deadline.

• According to a statement from the Finance Ministry, the total gross GST income received in August 2022 was Rs 1,43,612 crore, an increase of 28% over the same month the previous year

• As of September 24, 2022, the Fund of Funds for Startups, established by Prime Minister Shri Narendra Modi as part of the Startup India program, has contributed Rs. 7,385 crores to 88 alternative investment funds In turn, these AIFs contributed Rs 11,206 crores to 720 startups.

• Gautam Adani briefly overtakes Bill Gates as the second-richest person in the world.

October to December:

• HDFC Bank announced the release of the SmartHub Vyapar Merchant app, payments, and banking solution for small and medium-sized enterprises. • LIC and the Central Government will sell their 60.72% ownership in IDBI Bank. The software was created in collaboration with Mintoak Innovations India, a merchant SaaS platform

• The National Highways Infra Trust (NHAI) would provide NCDs with a 25-year return of 8.05%.

• The Center permits MSMEs to make use of non-tax benefits for three years following categorization. Adani Ports and 12 other companies sign a non-disclosure agreement to gain access to data on the Unified Logistics Interface Platform.

• The increased fertilizer subsidy totaling Rs 51,875 crore has been authorized by the Centre for the rabi or winter planting season, which spans from October 2022 to March 2023.

RIDDLES

1) When John was six years old, he hammered a nail into his favourite tree to mark his height Ten years later at age sixteen, John returned to see how much higher the nail was. If the tree grew by five centimetres each year, how much higher would the nail be?

2) There is a clothing store in Bartlesville. The owner has devised his own method of pricing items. A vest costs $20, socks cost $25, a tie costs $15 and a blouse costs $30. Using the method, how much would a pair of underwear cost?

3) Something very extraordinary happened on the 6th of May, 1978 at 12:34 a m What was it?

4) Can you name three consecutive days without using the words Monday, Tuesday, Wednesday, Thursday, Friday, Saturday, or Sunday?

5) : What comes once in a minute, twice in a moment, but never in a thousand years?

6) 81 x 9 = 801. What must you do to make the this equation true?

CLUB BYTE

IBS Analytics Club personifies the term ‘analytics’ as well as how we interact with data in real life. The club has 7 verticals namely, Matrix, Digital, Marketing, Networking & PR, Events, Operations and Editorial. They work in synergy to conduct activities year-round that represent our philosophy, ‘Data to Decision’. We collaborate in leveraging data to conduct research in various sectors while also organizing entertaining and interesting events.

The club’s activities begin with a rigorous drive for ‘Analyst 6 0’ i e , the junior batch which is followed by an exciting event planned only by the junior batch ‘Vishlelshan’ which is centered around analytics. Through the year, members of the club are encouraged to grow holistically and collaboratively. Matrix, the club’s research vertical, works with the Marketing vertical to create the weekend bulletin in which, members conduct research on a firm and forecast its performance based on their findings. The Editorial team collaborates with the Marketing team on a regular basis to create posters for all major festivals and national holidays. The Events and the Operations teams collaborate to organize numerous events to a successful climax.

The club’s signature event ‘Trikona’, which was organized in November 2022 this year, is aclaimed for its analytically driven premise. The Matrix vertical is wellnoted for its Management Discussion event. The club also organizes guest lectures by industry experts, to ensure that adequate exposure in various fields is provided and knowledge is shared in abundance

The club’s persistent efforts to support college activities have paid off and it will continue to present entertaining and thought-provoking events in the future.

PLACEMENT BYTES

Placements in IBS Hyderabad generally start in September with zero week till February of the same academic calendar. Companies from various and different sectors participate in the process offering decent position and pay scale for freshers and work ex-students. The usual process goes through Resume shortlisting, Aptitude test, Group Discussion, Personal Interview, and lastly HR interview. To get the best seat one must prepare herself/himself from the start I.e preparing your resume according to the Job description and aligning the thought process with the requirements of the profile. Just Remember it's not about what you know, it's about what the interviewer wants to hear from you. Preparing your interview answers in the line with JD will help a lot.MBA as a curriculum is very diversified, it prepares you from the core and that should be reflected in your interview, at last, Healthy Confidence is what going is to take you ahead. Ps: Develop a habit of reading.

Placement at IBS this year was amazing. Compare to last year, average CTC has increased and majority of students got placed within first 3 months of placement. Many new companies have joined IBS for recruitment purpose such as Barclays. Coming to MBA, it was a very good experience at IBS Hyderabad. We could get knowledge from any institution, but practical application of knowledge into real world through case studies is provided by only IBS in India. Even faculties are ready to help students to excel in their respective domain, other than for the academic curriculum. So yes, doing MBA from IBS Hyderabad was a very good decision and I’m feeling proud to be part of such a great institution.

There was this talk by Mr. Anirudh Tara, Director and Partner at BCG that I came across where he highlighted the disproportionate impact that a relatively small team of consultants can have on a much larger firm’s bottom line, or their operational efficiency for that matter. That thought is something that enthralls me. I have always wanted to be a part of the financial consultancy sector and getting placed in KPMG in the risk division was a dream come true. I focused on the basics of corporate finance, accountancy and bits and parts of valuation while preparing for my interviews. KPMG India had a 3 rounds. The first two of which were completely technical. The third was an interview with the partner of the firm which was a mix HR and technical.

Starting my Marketing Career with the 3rd largest Private Sector Bank in India is a significant accomplishment for me. And it was quiet unpredictable for me to get placed in Axis Bank as I never thought that being a core marketing student I will be working in a Banking Sector All this started with preparing for the placement by brushing up all the marketing concepts which helped me a lot in cracking various rounds of the placement process. The placement process for Axis Bank consist of two steps the first round was Resume Shortlisting followed by Interview. The interview round was mostly focused on Internship and understanding of the banking sector. Overall it was a great experience for me

MBAs need to be more rational, practical and observational at IBSH. We have to understand frameworks, there implementation and what can be a game changer in the longer run. Placements are doing fairly good. The impact of a good batch can change the numbers for better.

MBA is not a about assignments and grades, it values consistency, initiative as you embark yourself on a 2 year rollercoaster journey to achieve your goals and on the way making new friends and connections to help you do so.

THANKS TO OUR VALUED TEAM MEMBERS!

Priyanshu Goyal

Bhargavi Siram

Vishal Verma

Prakriti Das

Ekansh Dhingra

Shivani Sharma

Sayak Chatterjee

Jagnoor

Siddardha

Naincy

Nivedita Gokul

Special thanks to our seniors!

Parisha Sharma

Nivedita Paul Rohit Kundu Rupsa Pal

Send your feedback articles to IBS Hyderabad, The ICFAI Foundation for Higher Education (Declared as Deemed University U/s 3 of the UGC Act 1956) Donthanapally, Shankarpally, Road, Hyderabad-501203.

Feel free to write back at: editorial.ibsanalytics@gmail.com

Frequency of the Magazine

This magazine is biannual and published twice a year, with support from IBS Hyderabad, a Constituent of IFHE, and Deemed to be University

Disclaimer

The views expressed by the contributors represent their personal views and not necessarily the views of their organization. All efforts are made to ensure that the published information is correct. The organization is not responsible for any errors caused due to oversight or otherwise.

Copyright

All rights reserved. No part of this publication may be reproduced or copied in any form by any means without prior written permission.

Publisher

Student Club IBS Analytics, IBS Hyderabad, a Constituent of IFHE, Deemed University.