THE EDITOR

New thinking on big questions

Every single feed additive or animal health company I speak to thinks of themselves as science-driven, with a particular dedication to innovation.

While this is admirable, it left me with a bit of a conundrum when I was charged with putting together a magazine on new innovation in the animal nutrition and health space. If everybody has new innovation they want to talk about, how do I decide what to cover?

The starting point, I decided, would be the challenges facing the animal production industry. There is certainly no shortage of those. For one thing, everyone is concerned about the supply chain: conventional wars and trade wars, pandemics and droughts, strikes and labour shortages — all these have managed to disrupt international commerce, shipping, and agriculture in just a few years, affecting nearly everyone. Animal health concerns are also topof-mind: the industry must perpetually maintain its defences against contagious and destructive pathogens and lessen its dependence on antibiotics to avoid contributing to antimicrobial resistance. And of course, looming over all are environmental emergencies such as climate change and resource scarcity, issues where consumers and regulators are increasingly demanding action and accountability.

The industry’s challenges provided me with a framework to organise the different ideas. Once that organising principle was in place, though, I still had to decide what innovations to feature. What I tried

to do was collect a variety of technologies you might not have heard of, or might not yet understand the importance of. Several months back, a spin-off from a waste management company was pitching an idea to recycle phosphates from wastewater and thus reduce Europe’s dependence on imported phosphates. It was interesting at the time. A few weeks later, Russia’s invasion of Ukraine abruptly upset the supply chain for agricultural inputs including phosphates. And suddenly, that interesting idea looked a lot more urgent.

This was a dramatic illustration of why blue-sky innovation is essential. Because you just don’t always know what’s going to come at you.

Besides this example (discussed on page 9), this issue seeks to shine a spotlight on other potentially transformative ideas. Can we make essential gut health additives without relying on the volatile petrochemical and palm-oil markets? Can we reduce our use of fishmeal without increasing our dependence on fossil fuels? Can animal vaccines be made safer to administer and more accessible? How can we control pathogens without provoking the development of antimicrobial resistance? What’s being done to help one of the most effective methane mitigating feed additives yet identified actually make it into cattle diets?

Of course, the selection of technologies covered here is by no means exhaustive. Still, I hope this issue of the Feedinfo Review can help connect a few problem solvers with a wider ecosystem in need of such solutions.

INNOVATE FOR LIFE

Expert and innovative solutions for our customers to contribute to the development of sustainable animal farming.

We, miXscience, believe in the development of sustainable animal farming, economically efficient, respectful of the welfare and health of the animals, playing an active role in the protection of our environment and producing food of high sanitary and nutritional quality.

Throughout the world, we work with our customers in the livestock sector every day to provide them with answers to these many challenges.

Global context

GRAINS BEING EXPORTED OVER THE BLACK SEA

One of the most significant developments in the quarter was the deal brokered by Turkey and the UN wherein warring parties Russia and Ukraine allowed for the reopening of Black Sea ports for agricultural exports. Over the first two months following its signature in late July, it helped nearly 5 million tonnes of grain to be shipped out of Ukraine and onto the hungry global markets, lowering food prices.

RUSSIA PRESSURING EUROPE ON GAS, AFFECTING MULTIPLE INDUSTRIES

Still, the Russia-Ukraine War continues to affect the agricultural sector, particularly because of its impacts on the supply of natural gas to Europe. This has already had knock-on effects on the supply of various inputs throughout the value chain. For example, it has shut fertiliser production across the continent, which has affected the supply of industrial CO2 (used in stunning animals and packaging meat, and made as a byproduct of fertiliser production) and feed phosphates. Going forward, there are fears about what a worsening of Europe’s energy crisis could mean for feed additives manufacturers; see page 18-19 for further discussion of this situation.

VIETNAM RESUMES ASF VACCINE PILOT

Initial deployment of the world’s first vaccine against African Swine Fever was halted in August over concerns about concerns about the deaths of vaccinated pigs. However, it is now being reported that the mortality was due to those operations failing to respect the rules surrounding the use of the vaccine, administering it to pigs which should not have received it because of their age, or using incorrect doses. It is understood the country is now resuming the use of the new vaccine, which was developed by NAVETCO with the ASF-G-Δl177L technology licensed from USDA.

EMISSIONS CEILINGS CAP IRISH AGRICULTURE’S CO2 GENERATION

The end of July saw the Irish government announce greenhouse gas reduction targets for various sectors, and the agricultural sector finds itself obliged to reduce its CO2 footprint by 25% of

2018 levels by 2030. “Crucially, the changes for agriculture will be voluntary,” states the announcement, which also promises “generous financial incentives in return with an additional financial package in Budget 2023.”

DUTCH FARMERS PROTEST LIMITATIONS ON LIVESTOCK PRODUCTION

Elsewhere in northwest Europe, Dutch farmers staged several protests over the summer, pushing back against nitrogen emissions targets which will require a reduction in the number of animals the country raises. They argue that Dutch farmers are among the most efficient and cleanest in the world, and that a reduction here would be met with an expansion in other countries where livestock production is more polluting. Meanwhile, others argue that farming is among the sectors which emit the most nitrogen into the environment, and that the country has already surpassed what it is legally allowed to emit under EU law.

LOW WATER LEVELS AFFECT RIVER SHIPPING

In the US and Europe, major arteries used by the agricultural industry to ship feed ingredients and additives have been pressured by drought. Those dependent on the Mississippi have had to deal with draft restrictions requiring their ships to be lighter, curbs on the number of vessels, and narrowed or closed passages, while vessels on the Rhine have sailed largely empty at some parts of this summer because of low water levels, and shippers have also seen many vessels move to the Danube to help shift grain out of Ukraine before that country’s Black Sea ports were operational again.

SOME PORK PRODUCERS SETTLE IN US PRICE-FIXING CASES

JBS SA may pay USD 20 million and Smithfield Foods USD 75 million to resolve lawsuits brought by consumers, according to preliminary settlements accepted in the month of September. Litigation around the behaviour of other pork industry actors such as Hormel and Tyson Foods was ongoing in the second half of September, according to news sources such as the Associated Press and Reuters.

ADISSEO LAUNCHES NEW LIQUID METHIONINE PRODUCTION IN CHINA

Adisseo’s new liquid methionine plant in Nanjing (the BANC2 project) has begun commercial production following the conclusion of its testing phase. The plant, which started up in August, has a nameplate capacity of 180,000 tonnes/year

LITHUANIAN FEED PHOSPHATE PRODUCTION: ON AGAIN, OFF AGAIN

Lithuanian feed phosphates manufacturer Lifosa, a subsidiary of EuroChem, restarted operations in early August after a four-month hiatus while the company adapted to the sanctions that had been put on EuroChem’s owner. However, by mid-September, Lifosa was set to stop operations once more as expensive natural gas shut down its suppliers of important inputs such as ammonia.

MOSAIC’S FEED PHOSPHATE OPERATIONS AFFECTED BY HURRICANE

The Mosaic Company has said that its North American phosphates operations, located in Florida, were negatively impacted by Hurricane Ian. According to early assessments, phosphate production could be down by approximately 200,000250,000 tonnes, split roughly evenly between Q3 and Q4 2022.

BASF TO EXPAND VITAMIN A POWDER FORMULATION CAPACITIES

BASF announced in late July plans to expand its vitamin A formulation capacities in Ludwigshafen. The new facility, which will be fully integrated into vitamin production at the site, will support and further expand the production of vitamin A powder products for the animal nutrition industry. Start-up is planned for mid-2023 and will “stepwise increase BASF’s vitamin A powder formulation capacities in line with the increased vitamin A acetate production capacity,” the company said.

GARDEN GROUP OPENS VITAMIN D3 PROJECT

Garden Group began operations at its backward-integrated vitamin D3 project located at the Jinxi Technology Park, Jinhua, Zhejiang province in mid-September. It is understood that total investment in the project amounted to CNY 10.3 billion (USD 1.46 billion).

VITAMIN E PLANT REOPENS AFTER LONGER-THANEXPECTED MAINTENANCE

DSM completed maintenance work at its vitamin E 50% plant in Sisseln, Switzerland, in the week commencing 19 September. The plant did not restart at the end of August as planned and had been operating at reduced rates.

KEXING LOOKS TO EXPAND PRODUCTION OF ADDITIVES INCLUDING VITAMINS

Kexing Biochem is applying for environmental permissions to expand its production of additives for feed, food, and dietary supplements. Biotin, vitamin A, beta-carotene, canthaxanthin/ cantharidin, astaxanthin, and vitamin E are among the products to be made at the expanded plant, located in Dongzhou Industrial Zone, Fuyang, Hangzhou.

HONGDA INVESTMENTS WILL INCREASE THE PRODUCTION OF AMINO ACIDS

Hongda Biotech has announced plans to increase the production of valine, leucine, isoleucine, and other feed and food additives at its site in Yishui County, Shandong. It is understood this will be done by compressing the production time of vitamin K2, freeing up the facilities to make other products.

BIO-BASED CARBOXYLIC ACID PRODUCTION OPENS IN FRANCE

AFYREN NEOXY, an industrial-scale plant for the production of biobased carboxylic acids from sugar beet co-products, opened in late September in France. It is expected to reach 16,000 tonnes in production capacity by 2024. Among its products are feed-grade natural butyric acid.

CJ’S BIO-METHIONINE PLANT EXPERIENCES FIRE

A fire at CJ Bio’s L-methionine plant in Kerteh, Malaysia, broke out on 21 July, and was reportedly extinguished on the same day. The company confirmed that the plant returned to normal operations from mid-September after repairs were completed.

RUSSIA’S ARNIKA RAMPING UP PRODUCTION OF FEED ADDITIVES

Russian feed additive supplier Arnika LLC has reportedly ramped up production in Vladivostok, taking advantage of the lack of imported products in the domestic market. Last year, Arnika launched a production cluster in the Nadezhdinskaya Advanced Development Zone to make lysine HCl, valine, and tryptophan, as well as certain vitamins. In 2022, Arnika plans to produce 10,000 tonnes, the company said. Moreover, at the end of 2022, Arnika also expects to launch a feed probiotics plant, as part of a division designed to produce approximately 4,000 tonnes/year of probiotics, protein concentrates, and antibiotics.

OCP GROUP TAKES STAKE IN FEED PHOSPHATES COMPANY

Morocco’s OCP Group signed an agreement in late September to acquire 50% of feed phosphates supplier GlobalFeed from Fertinagro Biotech, a Spanish fertilizers producer. GlobalFeed operates production units located in Huelva, Spain with a capacity of 200,000 tonnes/year of phosphate-based products and 30,000 tonnes/year of iron sulphate.

PHOSPHEA ACQUIRES BRAZIL’S SPO

Phosphea acquired SPO Indústria e Comércio LTDA , a Brazilian company with a 100,000 tonne/year feed phosphate production unit located in Santa Catarina state, this September.

AB LINAS AGRO DIVESTING RUSSIAN AND BELARUSSIAN PREMIX AND FEED COMPANIES

AB Linas Agro announced in late August that it would be selling two Russian companies acquired 13 months ago as part of KG Group - OOO VitOMEK (Moscow) and OOO VitOMEK (Tver), as well as IOOO Belfidagro, registered in Belarus, to unnamed companies registered in Russia. VitOMEK and Belfidagro are premix producers and feed suppliers.

DECHRA PHARMACEUTICALS BUYS ANIMAL HEALTH COMPANY

Dechra Pharmaceuticals acquired Med-Pharmex, a Californiabased veterinary pharmaceutical manufacturer, for USD 260 million, providing further product scale to its operations in the US.

MITSUI TAKES STAKE IN BRAZILIAN ANIMAL HEALTH COMPANY

Mitsui has agreed to acquire a 29.44% stake in animal health firm Ouro Fino Saúde Animal Participações S.A. (Ouro Fino)Brazil’s fourth largest animal health company. The Japanese conglomerate says it will “pursue synergies with its wide-ranging business assets and global networks.” Among Mitsui’s potentially related assets are animal nutrition company Novus International, Inc. and several divisions around the world making agricultural inputs such as fertiliser.

ABOITIZ EXITING SRI LANKAN FEED BUSINESS

Aboitiz Equity Ventures (AEV) of the Philippines is divesting its feeds business in Sri Lanka, Gold Coin Feed Mills (Lanka) Limited (GCFL), to New Anthoney’s Farms (PVT) Ltd. AEV said “The exit from Sri Lanka is aligned with the Aboitiz Group’s direction to grow its animal feeds business in other parts of the Southeast Asia and China markets.”

FORFARMERS UK AND 2AGRICULTURE AGREE TO MERGER

ForFarmers UK and 2Agriculture have agreed to merge their businesses into a joint venture. The share split will be 50.1% for ForFarmers UK and 49.9% for 2Agriculture. With 3 million tonnes of compound feed per year, the joint venture will provide both companies a balanced feed portfolio across species.

CARR’S SELLING AGRICULTURE SUPPLY DIVISION, INCLUDING FEED MILLING

Carr’s in the UK has entered a conditional agreement to divest its agricultural supplies division, Carr’s Billington Agriculture, to Edward Billington and Son Limited for up to GBP 44.5 million. The division includes its feed milling activities.

DABEINONG CANCELS ACQUISITION OF ZHENGBANG’S FEED FACILITIES

Beijing Dabeinong Biotechnology Co. Ltd. (Dabeinong), an agricultural biotechnology company, announced that it has cancelled the acquisition of eight feed production facilities owned by leading pig producer Jiangxi Zhengbang Technology Co. Ltd.’s (Zhengbang), and is suing Zhengbang for CNY 500 million (around USD 70 million) over an alleged breach of contract. The deal was first announced in March of this year.

SANDERSON FARMS ACQUISITION COMPLETED

Cargill and Continental Grain finalised their USD 4.5 billion acquisition of Sanderson Farms, the third-largest US poultry company. Continental Grain owns Wayne Farms, another major actor in US poultry, and the deal thus needed to navigate antitrust concerns.

MAZZOLENI BUYS FEED ADDITIVES

DISTRIBUTOR SIVAM

Italian animal nutrition firm Mazzoleni SpA has reached an agreement to acquire Società Italiana Veterinaria Agricola Milano SpA (Sivam), a supplier of feed supplements to over 8,000 customers across the country. Sivam has over 200 collaborators and its turnover in 2021 was EUR 46 million.

MAURI BUYS FEED ADDITIVES DISTRIBUTOR AUSPAC

AusPac Ingredients Pty Ltd, an Australian and New Zealand distributor of feed additives, has been acquired by MAURI, a division of George Weston Foods of the Associated British Foods group. AusPac Ingredients will be joining MAURI’s Weston Animal Nutrition business.

Don’t step into the trap

We can help you avoid traps by providing evidence that 65 units of MetAMINO® will achieve comparable performance* to 100 units of MHA-FA.

Change to MetAMINO®, take the savings and benefit from additional advantages.

Trust in science. Trust 65.

Download the MetAMINO® ATLAS 2022 with scientific trials here: www.metamino.com

*For

or

How to make supply chains more robust and sustainable?

Replacing production processes based on petrochemicals or oleochemicals with fermentation to make feed additives – ChainCraft

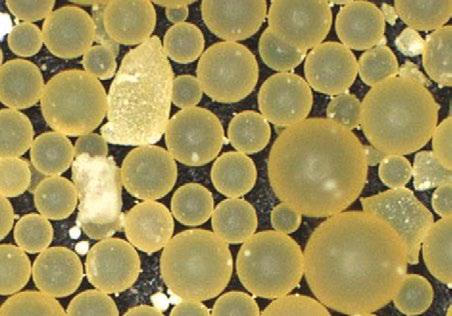

As the industry has moved away from the use of antimicrobials, many have turned to short- and medium-chain fatty acids as an alternative to help regulate the microbiome and maintain good gut health. However, these feed additives are currently made from either petrochemicals or palm oil. Now, a spin-off from Wageningen University in the Netherlands has found a way to ferment organic residues into a feed-grade product containing C6 caproic acid and C4 butyric acid.

According to Niels Van Stralen, Director and Co-founder of ChainCraft, this move to fermentation-based production has various environmental advantages. First, it has a lower carbon footprint and less energy-intensive production process; second, it provides a higher-value application for a low-grade waste stream.

Beyond that, it also has the advantage of being less dependent on the same volatile feedstocks as the traditional production process, meaning that events such as a ban on palm oil exports would not cause a supply chain shock. Moreover, a fermentationbased process also makes small-scale production of these products economically feasible, and makes it possible to locate production outside of large, centralized chemical production

complexes, which is a win for both sustainability and supply chain robustness. “We can produce these chemicals locally. We are producing them in Amsterdam instead of in Malaysia or Indonesia.”

Finally, and perhaps most excitingly, the company claims it can offer this more sustainable product at a competitive price to traditionally-manufactured feed grade fatty acids, meaning that this will not be an innovation limited to niche applications, but should be accessible to all.

ChainCraft has already begun marketing its product, made in its 2,000 tonne per year facility in Amsterdam. The company is looking to begin construction on a facility about 10 times larger in 2024, and expects to bring this online in late 2025.

A BROADER VIEW:

The advantages that fermentationbased production processes can provide are being explored in other feed additive categories as well. DSM has recently announced a breakthrough in fermenting vitamin A, although the initial application for this technology will be in cosmetics rather than in animal nutrition. Meanwhile, CJ Cheiljedang has been making bio-methionine since 2015, the only producer of this amino acid to use a fermentation-based production process.

Single-cell proteins from fossil-fuel-free carbon – Gas2Feed

Demands for feed proteins such as soy and fishmeal have put strains on the world’s oceans and forests. Norway’s Gas2Feed seeks to replace those with a single-cell protein made from exotic microbes naturally found in geothermal hot springs, microbes which produce their biomass from hydrogen, oxygen, and CO2. According to Dr. Vukasin Draganovic, Business Development Director, the resulting ingredient has a lower CO2 footprint than other aqua feed proteins such as soy protein concentrate or fishmeal.

While the concept of using single-cell protein in animal feed is not new, Gas2Feed’s process is distinctive in terms of where it sources its inputs. First, the CO2. The company has novel plans to capture some of this from the biological emissions of the RAS fish farms it is partnered with. “Fish exhale CO2 as we do. We’re working together with an institute in Trondheim in Norway called SINTEF, and looking at ways to extract the CO2 and use it in the protein production.”

Bringing circular economy principles to the phosphates market – EasyMining

Mineral phosphates are essential for both crop production and animal nutrition, and they are a finite resource. Swedish firm EasyMining has a process for closing the nutrient cycle, recycling these precious materials from municipal waste and making them available for agriculture once more.

According to Dr. Sara Stiernström, Product and Market Developer for EasyMining, this involves incinerating municipal waste biosolids to produce a mineral concentrate free of microbiological or other organic contaminants, and then applying a proprietary “Ash2Phos” process to recover precipitated calcium phosphate with a lower heavy metal content than that of phosphates derived from mineral deposits.

Beyond being “cleaner” in the sense of contaminants, recycling phosphates from waste in this way has many virtues. Phosphates emissions into the environment can cause eutrophication, disrupting the natural ecological balance; EasyMining’s concept thus extracts a valuable product from an ecologically problematic waste stream. Moreover, not only are Earth’s mineral phosphate resources finite, but they are also unevenly distributed. Recycling phosphates from waste locally would mean that places without natural endowments of rock phosphate could become less dependent on imports from the few countries which produce and export these products. It would also reduce the greenhouse gasses emitted in the

Agriculture

Society

Production Industry

Ash2®Phos Phosphorus Recovery

Plant

long-distance transport of these ingredients. EasyMining is planning plants in Germany and Sweden, which are expected to start up in 2024 and 2025. Both will process some 30,000 tonnes of ash per year into 15,000 tonnes per year of dry precipitated calcium phosphate. Longer term, Stiernström believes the company may look to license the process.

A BROADER VIEW:

Unfortunately, animal nutrition products obtained from wastewater cannot be used in the EU, regardless of the processing they have undergone to ensure the safety and quality of the final product. Therefore, barring any change to this regulation, EasyMining’s home market (and a key livestock producing region without natural phosphate resources of its own) is currently off limits. Stiernström calls for animal feed companies to add their voices to the call to authorise recycled phosphates use as the EU pushes forward on other circular economy plans for the agriculture industry. “We cannot do this alone…this is not something one company can change,” she says.

If that does not cover the process’s requirements, Draganovic says Gas2Feed will source CO2 using a direct air capture concept, rather than using emissions captured from an industrial source and purified. “You could get the CO2 from industrial waste gasses…that would be the easy target, relatively easy to get, and these bacteria can also tolerate a certain level of impurities. But this is not our intention; we would like to get a kind of biogenic CO2.” he asserts. Beyond the CO2, the other two inputs, hydrogen and oxygen, will be derived from splitting water, using electrolysis technology from Gas2Feed sister company HydrogenPro

Founded in 2020, the Norwegian startup is in the process of extending its small pilot plant in Risavika to reach 1,500l of production capacity in 2023. Beyond that, Gas2Feed has its eyes on a demo plant, followed by a 20,000-tonne commercial-scale plant planned tentatively for 2026.

A BROADER VIEW:

While Gas2Feed is pre-commercial at this point, other single-cell protein concepts are being manufactured and sold into the feed industry. To cite just two examples: Calysseo, a joint venture between Adisseo and Calysta, announced this June that commissioning and start-up activities have commenced at its first industrial-scale facility in Chongqing, China; meanwhile, Unibio began supplying commercial customers with its single-cell protein late last year.

By Shannon Behary, senior editorEmploying monoglycerides & organic acids for more comprehensive swine and poultry gut health support

Organic acids and their derivatives can play an important role in gastrointestinal health in swine and poultry, and new information about their effects is being uncovered. Their antimicrobial and anti-inflammatory activity is valuable for farmers in the absence of antibiotic growth promoters and in supporting a reduction in use of antibiotics for all purposes.

As Eastman’s Segment Marketing Manager for Animal Nutrition, Joao Barroso, explained to Feedinfo during a recent catch-up, the glycerol monoesters of these acids, or monoglycerides, have many benefits compared to free organic acids, including a higher potency against bacteria and pH-independent activity that can deliver their beneficial effects further down the GI (gastrointestinal) tract. Therefore, Eastman believes they should form part of an effective gut health strategy.

Below, Mr. Barroso and Luke Barnard, Eastman’s European Team Lead for Application Development and Technical Services, share the company’s ambitions for monoglycerides and organic acids in monogastric nutrition and talk us through the supporting science.

[Feedinfo] How is Eastman approaching the concept of gut health in animal nutrition differently than other players? What sets the company apart?

[Joao Barroso] We strongly believe organic acids and organic acid derivatives play a critical role in gut health and are focusing on providing robust solutions with these products. We have developed proprietary blends of organic acids and esterified organic acids to exploit the synergies between the different components and maximise the effect in the animal, focusing on key industry challenges such as weaning diarrhoea. We also have blends with plant bio-actives that provide additional benefits for specific needs.

We have a sophisticated production facility in Ávila, Spain, and significant formulation expertise, enabling us to offer great flexibility in

the end application of our products. This allows us to further finetune our proven formulations and concepts to specific customer needs, both in solid and liquid forms, through feed and via drinking water applications.

We are focusing our investment on developing an in-depth understanding of the mode of action of our products. Using our network of research collaborations as well as in-house expertise we have been able to explore interesting parameters, from gene expression to histology, inflammation and stress markers and microbiology.

Furthermore, Eastman is vertically integrated, thus assuring security of supply in a marketplace full of uncertainty.

[Feedinfo] So, what should a robust organic acid strategy look like, and why should monoglycerides form part of this?

[Luke Barnard] Everything begins with the quality of the ingredients, good formulation strategy and excellent management. Once this is in place, organic acids can help, starting with ensuring raw material hygiene. This use of organic acid blends is prevalent in the market, and our Eastman AcitraTM and KeitexTM product lines are popular solutions here.

Inside the animal, organic acids are an effective way to acidify and tackle microbial challenges in the early part of the GI tract. To elicit their protective effect, they need to be in their undissociated form: this is where the pKA (dissociation constant) is lower than the pH of the environment. For most organic acids this only occurs in the acidic parts of the GI tract (i.e., in the early part). This is a fundamental step to reduce bacterial load of the feed and reduce the pH to help the animal digest nutrients, such as proteins.

Further down the GI tract, where the pH is higher, organic acids will be in their dissociated form, where their activity will be reduced. Monoglycerides are glycerol monoesters of organic acids, meaning that a glycerol molecule is covalently bound to an organic acid. As a result, no dissociation occurs, and they are not dependent on pH for their activity, meaning the monoglycerides can elicit their activity further into the GI tract. This chemical structure also means that monoglycerides interact directly with the cell membrane of bacterial cells which is different to the mode of action of organic acids. For the medium chain fatty acids, we see that the monoglycerides are more effective

microbial modulators compared to straight organic acids as evidenced by differences in the minimum inhibitory concentration (MIC) values between organic acids and monoglycerides.

Monoglycerides of different organic acids are present in the market and are proven to have many beneficial effects inside the animal, from microbial inhibition to managing the stress response of the animal, depending on the organic acid monoglyceride used.

By utilising monoglycerides and organic acids simultaneously we can have beneficial effects throughout the GI tract of the animal. The synergies between these different molecules have been harnessed in our Eastman Entero-Nova™ product line.

[Feedinfo] However, not all monoglycerides are created equal. What should be kept in mind when considering their application in formulations?

[Luke Barnard] As alluded to earlier, different monoglycerides have different effects. This depends on the chain length of the organic acid that has been esterified. Typically, we see differences in the activity of the short-chain monoglycerides and mediumchain monoglycerides. Monobutyrin is a special case, with interesting effects on stress markers and inflammatory markers documented in our own research.

Even within the medium chain fatty acid esters, when looking at the MIC values of monoglycerides of different chain lengths (C6-C10 vs. C12) different effects on gram-positive vs. gram-negative bacteria can be seen, with C6-C10 monoglycerides having greater impact on gram-negative and C12 having greater impact on gram-positive strains. This is thought to be due to the way the different monoglyceride chain lengths interact with the different bacterial membranes.

It is important to look at combinations of monoesters for maximum benefit. This is corroborated by a study by Batovska et. al. (2009) demonstrating the synergy between different monoglycerides on minimum inhibitory concentrations of different bacteria. There is still so much to discover about the effects of monoglycerides, which is what makes the field so exciting. However, with what we have already discovered we have been able to build some proprietary blends (Eastman Entero-NovaTM product line) which have been shown to be effective at supporting the growth of production animals.

[Feedinfo] A healthy gut can result in improved animal performance. What findings can you share with us on the impact that the inclusion of monoglycerides can have on performance indicators, like feed conversion or weight gain?

[Luke Barnard] Several published studies have demonstrated the power of monoglycerides on microbial management, as well as the benefits in managing inflammation and stress responses. As expected, these benefits also translate into improved animal performance. What is perhaps even more impressive is how the application of monoglycerides can maintain performance in the absence of compounds that have been historically common in animal diets, such as antibiotics and zinc oxide.

In one trial published by Zißler et al. (2017), it was shown that there was no significant difference between weaning pigs supplemented with zinc oxide and colistin and those supplemented with a proprietary blend of monoglycerides (Eastman Entero-NovaTM Bond 400) on either body weight gain or feed conversion ratio.

As pressure increases on producers to find new ways of feeding animals without the “old tools”, monoglycerides and their combinations are emerging as an interesting part of the solution.

[Feedinfo] With the acquisition of 3F, you now have one of the broadest ranges of monoglycerides and of organic acids. How are you helping customers navigate these portfolios successfully?

[Joao Barroso] Our wide range of available monoglycerides represent a major cornerstone of our offering. This broader selection allows us to really help our customers address their specific challenges and achieve their goals.

Our approach places the customer at the centre of our offering and considers their distinct set of needs, feeding strategies and limitations.

So, whether it is to tackle pathogen pressure or to improve general gut health, our dedicated technical service team can formulate the concept that best fits a customer’s individual challenges by combining various organic acid derivatives with different modes of action.

We believe monoglycerides and organic acids can play a critical role in every swine and poultry producer’s gut health toolbox.

Published in association with Eastman

How to creatively protect animals against pathogens?

Skipping the injections and producing vaccines in corn

instead — Mazen Animal Health

Vaccinating animals is one of the most important tools in the fight against disease. It is also really hard. Sows weighing upward of a 100 kg try and escape injections. Needles break. People get hurt. And it requires not only trained personnel, but also careful biosecurity precautions to ensure outsiders are not bringing other problematic pathogens in, as well as a cold chain to ensure the vaccine remains potent.

To simplify the process and make it more widely accessible, US-based Mazen Animal Health is pursuing a novel way to deploy vaccines — developing corn which is genetically engineered to express the protein which triggers the animal’s immune response.

Dr. Jennifer Filbey, CEO of Mazen Animal Health, draws a comparison to a vaccine which might be more familiar: the mRNA vaccine against COVID. “[The COVID vaccine] injects RNA that tells the body to make a protein, which the body then develops antibodies against. [Our subunit vaccine] is ... dosing that protein [directly], and then the animal generates antibodies against that foreign protein. But instead of injecting it, we are, through biotech, putting it in the corn seed.”

After the corn is grown, it is devitalised, or ground up, so that it cannot reproduce outside of the controlled conditions of official production. Filbey explains that the final vaccine will be “highly regulated, [with] release specs that it has to meet every time” monitored by the US Center for Veterinary Biologics to ensure that the protein was adequately expressed in each harvest. That vaccine-bearing corn would then be deployed in feed over three days, so that even animals who might get muscled out at the feed trough on some occasions would still be reached.

PEDV and coccidiosis

Mazen’s first target for this technology is porcine epidemic diarrhoea virus, PEDv. “We’ve been able to show a statistical difference in the survival of newborn pigs between vaccinated sows and control sows,” asserts Filbey.

PEDv made sense as a starting point for a number of reasons, she claims. First was the market opportunity: this is a disease in need of a better solution, in Mazen’s estimation. Second was the technical argument; the company’s scientific founder, Dr. John Howard, had already done work on this technology in another virus of the same family — transmissible gastroenteritis virus, or TGEV. According to Filbey, the company is currently setting up safety and larger-scale efficacy studies (800 sows) for its PEDv vaccine. “We’ve run several studies and we’ve never seen safety issues. So, once we complete our efficacy study, we’re confident that we will move forward to licensure.” This could mean that corn-based vaccines could be licensed for use in the US in a little over a year: “conservatively, we’re saying the very beginning of 2024.”

Meanwhile, Mazen is in an earlier stage of applying this technology to coccidiosis, getting ready to start a second proof of concept study after promising first results. Coccidiosis is another disease with a large market opportunity, particularly in the US, where ionophores are classed as an antibiotic and thus must be rejected by antibiotic-free producers. Moreover, says Filbey, Mazen’s technology is multivalent; of the half dozen or so different Eimeria species which cause coccidiosis, Mazen is looking to address three of them with its vaccine.

A BROADER VIEW:

When it comes to deploying elsewhere, she says this is absolutely a priority of the company. “Right now, the plan would not be to grow [our corn] outside the US…this is where our IP is, and that will be highly controlled. But once it’s devitalised, ground up, it’s no problem to ship it, and so we do plan to go global with this.”

Indeed, it is in parts of the world without the level of animal health infrastructure found in the US that a non-refrigerated, easyto-deploy vaccine could be most impactful. “There are pockets of the world where cold-chain injectables just are not a possibility. And now we have a room temperature, stable vaccine that can be fed. And so the opportunity there to help in areas where vaccines aren’t possible today is very exciting.”

Disarming E. coli to reduce the risk of postweaning diarrhoea in piglets — Bactolife

Antibodies are critical elements of the immune system’s reaction to bacterial pathogens. Certain types of antibodies bind to what are called virulence factors — the toxins or adhesion points through which a pathogen causes an infection.

“Bacteria in the gut produces a toxin, and the toxins bind to one of the receptors in our gut. That’s how you get inflammation, that’s why you get a stomachache. That’s why you get diarrhoea. That’s why you feel bad. And that’s a physical interaction,” explains Dr. Sandra Wingaard Thrane, cofounder and CSO of Danish company Bactolife

Bactolife’s idea is to interrupt that interaction using a sort of stripped-down version of an antibody, which they call a “Binding Protein”. First identified in camelids, these singledomain antibodies have the advantage of being more stable than the larger versions found in other mammals such as pigs or humans — stable enough to be deployed as feed additives in animal agriculture.

“We go in and find something that blocks [the virulence factors] so that a disease-causing pathogen cannot cause disease but will act more like a normal commensal bacterium.”

Notably, a Binding Protein doesn’t kill the bacteria — instead, it can be thought of more like disarming bacteria, rendering them less able to cause disease. This is important, because it is the killing of bacteria that creates an evolutionary pressure favouring the development of antimicrobial resistance. Bactolife’s solution, Ablacto+, is therefore intended as an alternative to other feed additives to help piglets through the weaning stage, where use of antibiotics or zinc oxide is common.

Thrane says Ablacto+ is currently focusing on enterotoxigenic E. coli. “There are different types of them, of course, but they have some common denominators, and that’s where we try to look.”

“Rather than say we target a specific pathogen, I would say we target a specific virulence factor… different bacteria can produce the same type of toxins.”

Establishing that a virulence factor is a problematic source of infection is the starting point. “Then we have a standardised method of finding Binding Proteins that bind and block exactly that virulence factor,” she explains.

Indeed, given that these types of Binding Proteins are a naturally-occurring feature of the immune system of camelids, one option is to see what nature suggests. “You can immunise a [camelid] with an antigen of interest, with the virulence factor you want to target, then you can take out a very small blood sample.”

At the moment, Ablacto+ is still under team and its partners work to establish that it can have a meaningful impact on postweaning diarrhoea in nursery piglets across a variety of different production environments. “We need to show that it has an effect for a producer to want to invest,” acknowledges Thrane.

“We are right now in large scale trials, testing the benefits of the potential product, Ablacto+, and once we have that clear, we’ll begin the regulatory process here in the EU. So, we are looking at a timeline that is three to four years [before the product might be brought to market], depending on the regulatory environment,” she says.

A BROADER VIEW:

Piglets aren’t the only ones who suffer from diarrhoea. An estimated 760,000 children die each year from gut infections, according to a press release from August which revealed that the Gates Foundation had invested USD 5 million to accelerate the impact of Bactolife’s binding protein technology. While Bactolife is indeed actively exploring applications in human health, it also remains committed to the animal health market as more than just a side business. “[We’re] convinced animal health is very important to us. It is a big market; there is a big need for solutions like ours.”

“Now with the ban on zinc [oxide], I think everybody is very acutely aware that there’s a need for some new thinking.”

NEW THINKING ON BIG QUESTIONS | ANIMAL HEALTH

If binding proteins (discussed on page 13) can be thought of as disarming bacteria, quorum quenching is like jamming their communication network.

In simplified terms, bacteria emit chemicals to determine how dense their own species’ population is. Interfering with that chemical message — preventing bacteria from being able to synthesise or receive it, or degrading or modifying the signal itself — can prevent the bacteria from realising that they have the numbers necessary to engage in certain behaviours such as the creation of biofilms or toxins.

A Bacillus-specific lipopeptide called fengycin competitively binds to the signal receptor of a bacterial

This concept is known as quorum quenching, quorum sensing inhibition, or signalling interference (technically the terms are subtly different based on what part of the signalling process they seek to interrupt, but are often used interchangeably these days).

According to Dr. Grant Tan, who did a Ph.D on quorum quenching in wastewater and who is now applying that knowledge to animal pathogens as part of the R&D team at Kemin Animal Nutrition and Health, the concept came out of plant agriculture in the early 2000’s. By the end of the decade, it was being explored in animal science, starting in aquaculture, which was looking to counter pathogens such as Aeromonas and Vibrio.

It is clear that we are still in the early days of applying the signalling interference concept to land animals. Dr. Tan says that Bacillus subtilis PB6 is effective against the oligopeptide-based quorum sensing systems in gram-positive bacteria Staphylococcus aureus and Clostridium perfringens. Specifically, a Bacillus specific lipopeptide called fengycin competitively binds to the signal receptor, shutting down the bacterial communication and rendering the bacteria harmless to the host.

Beyond this solution, Dr. Tan believes that there might be a few other products in the animal nutrition market using molecules for which a quorum-quenching effect has been demonstrated in vitro, but warns that demonstrating this in vivo is another thing. “They can degrade some types of signals, but how does this eventually relate, physiologically, to [what we see] in the animal?” he queries.

Meanwhile, even on the fundamental research side, there remains a lot of unanswered questions. “Some quorum-sensing

Quorum quenching is like jamming the communication network of pathogenic bacteria.

and rendering the bacteria harmless to the host.

systems may be shared across species, including with beneficial probiotics,” Dr. Tan warns. “What might be the impact of a broadspectrum quorum-quenching product on non-target bacterial species, on the microbiota and the host in general over the animal production period?”

While important to understand and adapt to, this might not be a blocking point for the technology. “Most pathogens use one or more quorum sensing systems to control virulence expression. It is important to understand which quorum sensing systems are physiologically relevant in the context of disease development and progression,” he explains. This, he says, could potentially allow a solution to be tailored to a specific pathogen and a specific quorum-sensing system which is not shared with other bacteria.

However, we must also be vigilant to the potential for bacteria to evolve in response to quorum quenching solutions. Of course, the original idea was that by containing the virulence of bacteria, rather than killing them outright as antibiotics do, quorum quenching products would be much less likely to encourage the development of resistance. Still, says Dr. Tan, “despite the low probability of quorum quenching resistance build-up, given the low selective pressure, resistance does occur and has been documented. The potential for resistance to quorum quenching agents to emerge in the animal host remains poorly understood and requires further research.”

Although we still have much to learn, quorum quenching remains a promising topic. “With the growing understanding of how quorum sensing may work in a highly complex intestinal microbiome and their physiological roles and impacts on disease development, I believe we will be seeing more specific, potent, and promising quorum quenching-based products launched in coming years.” Dr. Tan suggests that beyond deploying them as a preventative measure, the industry might eventually even look into their use as a therapeutic or para-therapeutic treatment.

By Shannon Behary, senior editor

Preventing bacteria from identifying their population density and becoming virulent — Quorum quenching

How precision feeding is moving ruminant feed formulation forward

Improving the use of technology in animal agriculture has never been more important. With farmers facing rising costs due to factors like inflation and geopolitical issues, maximising the use of animal feed is something that all those involved in animal husbandry are focusing on. Precision feeding is a field that can heavily contribute to this and Lallemand Animal Nutrition is investing in this area to better support its customer base and improve income over feed cost through utilisation of its solutions.

Feedinfo sat down with Aurélien Piron, Technical Manager for Ruminants, and Angel Aguilar, Director of Employee Training and Development for Ruminant Feed Additives at Lallemand to gain their views on advancements in this area, why this field is particularly important for ruminants, what is next for their business in this exciting discipline and how they are using this work to better support their customers.

[Feedinfo] To start, can you explain how precision feeding can better support nutritionists and livestock producers?

[Angel Aguilar] Precision feeding is a forwardthinking concept that aims to precisely adjust the ration to the animal’s requirements, monitoring each animal and considering its precise needs at a specific moment. This is possible thanks to the development of sensor technology and the accurate livestock models available today.

Knowing how each animal can react differently to the same ration is a powerful tool to allow nutritionists and producers to provide the right amount of each nutrient to every animal. Giving nutritionists more flexibility to choose the correct ingredients and amounts for formulation helps to improve performance, reduces waste, and increases income over feed costs (IOFC).

[Feedinfo] Why is it so important to utilise precision feeding in the field of ruminant nutrition specifically?

[Angel Aguilar] Ruminants have a unique capacity to digest fibre (including cellulose) and to transform raw materials that cannot be used to feed humans into food products like milk or meat. Since the ruminant digestive system has this exceptional ability to degrade and ferment fibre through rumen microbial activity, the fibre components provided in the ration represent a significant amount of available energy for the animal. One of the key objectives for ruminant nutritionists when formulating rations is to maximise fibre digestibility to extract more energy from the fibrous components of the feed, leading to improved feed efficiency and IOFC.

When compared to monogastric species, precision feeding is newer and less advanced in ruminant feeding programs, so it is important to consider this new concept in animal husbandry strategies. Farm managers and nutritionists have to make decisions daily which are crucial for farmprofitability, choices like: “should I harvest this field of corn as silage, or should I sell it as grain?” Now being able to precisely measure feed intake (and thus feed efficiency) helps them to make the correct decision based on precise data. Today we can say that ruminant nutrition is finally catching up thanks to the progress in farm equipment including sensors and robotics.

[Feedinfo] Tell us about the work you have done in this area at Lallemand? How have you gone about making your research usable in a formulation and farming setting?

[Aurélien Piron] We are committed to provide the most advanced support to our customers. An example of the tools we provide to the field specifically dedicated to precision feeding is our ruminant live yeast Saccharomyces cerevisiae CMCN I -1077 (LEVUCELL SC).

For this product we have already invested in a lot in research to understand its mechanisms of action through more than 100 scientific publications over the 25 years since this strain was discovered in partnership with INRAE in France.

However, research does not stop at understanding the mode of action and the benefits within animal production. Other research is focused on the ability to quantify the effect of the supplement on fibre degradation in multiple type of forages that can be found all over the world. Based on this in vivo database which includes over 350 forage types, Lallemand Animal Nutrition works with independent third parties to develop formulation and nutrition software that are able to predict the effect of the supplementation of the live yeast into the ration on different parameters. These include rumen pH, improvement in milk production and IOFC. This accuracy of prediction has been and is constantly being challenged by new research on animal performance.

To explain this further, a software supplier once told me that now with our live yeast we are not only qualifying its effects, but we are able to quantify them, which makes a huge difference but also requires important and continuous R&D investment. In other words, if our customers share with us their diet composition and the quality of ingredients such as forage, the program will tell them the response of using Saccharomyces cerevisiae CNCM I1077 live yeast. This is significant, as now nutritionists can openly discuss with farm managers how the additive will best fit his or her strategy.

[Feedinfo] Can you explain more about how these sorts of tools benefit the farmer and wider industry?

[Aurélien Piron] Nutritionists are challenged today to make sure the decisions they take are the safest in terms of both animal performance and economics. Now we can predict the effect of an additive on animal performance for each specific diet conditions (in terms of both composition and ingredient quality). This will enable nutritionists to use additives like our live yeast as tools to fit to the farm manager’s objectives in terms of production and of course farm profitability. Addressing questions like “should I make more milk or should I adjust my diet composition to increase my IOFC?” is really a game changer during conditions of high price volatility. On top of this, giving nutritionists and producers the opportunity to switch from one source of nutrients to another without compromising on feed efficiency helps support greater flexibility and economic resilience. We are working with leading software companies and support the integration of our models into our partners’ own software. Nutritionists can contact their Lallemand representative for more information.

[Feedinfo] What are some of the advances you and your team are seeing in precision livestock farming?

[Aurélien Piron] Today, farms have access to huge amounts of information in real time that can help them detect a performance deviation much earlier than before. The earlier they take decisions in terms of animal management, the lower their loss in terms of

animal performance, cow health and farm profit. With the development of intelligent sensor systems, producers and nutritionists are able to predict dry matter intake and follow individual cow behaviour, providing the ability to measure, treat and analyse this data which leads to better management of the overall herd. In the field of ruminants, the next step in this ongoing technological development is the further use of artificial intelligence to monitor the herd and individual cows, to meet their needs each day.

[Feedinfo] What are the next steps for Lallemand and your work around precision feeding?

[Aurélien Piron] We are working hard to support nutritionists, premixers and feedmills in this new field. Our expertise enables us to help achieve the farm’s goals by selecting the right data and strategies and the LEVUCELL SC sub-model is just one example of this. By adding meaning and value into NDFd data, we help to achieve greater feed efficiency and better rumen health which means more milk from a healthier cow.

[Angel Aguilar] We also are highly involved in understanding how animal behaviour can be analysed to depict critical rumen efficiency. Our ultimate goal is working with partners to define how that information can be used in their daily work, so we are looking for opportunities to combine sensor data of cow behaviour and rumen health. We have the expertise tracking the cow’s rumen health, pH fluctuations in real time, and microbiota analysis, so this information could be used in future to help predict rumen health, as well as individual cow eating and resting behaviour.

We can further use this information to better understand the impact on the animal behaviour and overall animal welfare. For example, with robotic systems, cows can be fed individually with supplement by the robot machine. This allows us to “precisionfeed” these cows, and add a specific supplement aligned with the individual needs of the cow. The goal is to be able to document and understand the impact of this feeding system on the individual cow health, behaviour, and overall performance. Exciting opportunities lie ahead in this innovative field.

“...if our customers share with us their diet composition and the quality of ingredients such as forage, the program will tell them the response of using Saccharomyces cerevisiae CNCM I1077 live yeast.”

PIRONAngel Aguilar

Winter is coming: Europe’s feed additive producers brace for energy crisis impacts

At the end of September, Sweden found a new leak in one of the two Nord Stream pipelines connecting Russia to the EU, making it the fourth leak discovered in one week across the two pipelines.

The 1,200km Nord Stream 1 pipeline had been transporting Russian gas into Europe since 2011 until the geopolitical disruptions that began earlier this year. Meanwhile, its twin, Nord Stream 2, was first announced in 2015. Construction was completed in 2021, but the pipeline was not yet operational, waiting on final approval from German regulators. Russia’s invasion of Ukraine in early 2022 ensured it never received that approval.

The leaks, whose origin are still under investigation, represent the latest development in a six-month saga wherein Moscow has largely denied using energy as a political weapon, but has found excuses to throttle the supply of gas to its EU neighbours.

Since February, the EU has imposed a number of sanction packages on Russia, including on its energy industry.

In May, Gazprom closed a key pipeline which runs through Belarus and Poland and delivers gas to Germany and other European nations. Then, in June, it cut gas deliveries through Nord Stream 1 by 75%, from 170m cubic metres of gas a day to roughly 40m cubic metres. This was followed by another shutdown of Nord Stream 1 for 10 days, citing the need for maintenance

When Russia announced its intention to restrict supply in July, within a day it had pushed up the wholesale price of gas in Europe by 10%

The ongoing reduction in Russian gas exports to Europe since the summer has sent global prices soaring.

Germany, Europe’s largest economy and one heavily dependent on Russian gas, has been replenishing its gas stocks more quickly than expected despite drastic Russian supply cuts, and should meet an October target early, the government reported at the end of August.

Gas continues to be injected into storage. Germany’s gas storage was 90.41% full at the end of September, according to the country’s federal gazette Bundesanzeiger. However, to avert the risk of energy shortages, Berlin set a series of goals to build gas stocks up to reach 95% of capacity by November.

POTENTIAL IMPACT ON FEED PRODUCTION

Germany houses a key feed additives production site: the BASF chemicals site in Ludwigshafen. Feed additive market sources have said that the gas supply situation is not currently affecting BASF’s production of vitamins A or E.

Still, the issues around gas supply in Europe will likely have an impact on the feed additive industry.

A huge chunk of global methionine capacity is located in Europe: Evonik’s plant in Antwerp, Belgium, and Adisseo’s plants in Commentry and Roussillon in France, as well as in Burgos, Spain.

Production of methionine in Europe is a chemical process, as opposed to fermentation, which is used to make most other amino acids, such as lysine. Natural gas is a very important input for methionine production.

Feed additive market sources have said that the gas supply situation is not currently affecting BASF’s production of vitamins A or E.Approximately 3-5% of the natural gas produced globally is utilised for ammonia production, and the latter is one of the key raw materials for methionine. So soaring gas prices — or gas shortages — will likely affect production of methionine.

Natural gas is also a source of energy, and production of feed additives such as vitamins is very energy-intensive. Therefore, concerns over energy supply could potentially affect other key vitamin production sites in Europe. Beyond BASF in Ludwigshafen (vitamins A and E), there is also DSM in Sisseln, Switzerland (vitamins A and E), and Adisseo in Commentry (vitamin A).

SEEKING SOLUTIONS

BASF is preparing to replace natural gas with other sources of energy at its production sites, according to their Q2 financial results report in July, as Europe is set to reduce gas consumption this winter.

BASF’s natural gas demand in Europe reached 48 TWh in 2021, with the Ludwigshafen site consuming 37 TWh.

According to Feedinfo’s Supply & Demand Pro analytics service, the Ludwigshafen site has nameplate capacities of 5,600 tonnes/ year for vitamin A 1000 and 16,000 tonnes/year for vitamin E oil. This represents around 25% and 13% of total global capacity for feed-grade vitamin A and E respectively. BASF recently announced that it will expand vitamin A capacity at Ludwigshafen from mid-2023.

“Where technically feasible, preparations to substitute natural gas (e.g., by fuel oil) are progressing well and technical optimizations are in place … continued operation at the Ludwigshafen site is ensured down to 50% of BASF’s maximum natural gas demand,” the company said in its financial results.

PRODUCERS’ VIEWS

“We are continuing to closely monitor the supply of natural gas in Europe … As you know, Evonik’s methionine supply is produced in three global hubs in Antwerp, Belgium, Mobile, USA and Singapore. This spread of production facilities worldwide reduces

the risk of supply disruptions,” a spokesperson for Evonik told Feedinfo in July.

“Nevertheless, we have to state that we are unable to judge the full impact that a further cut in gas supply from Russia would have on the global and European gas markets.”

The German government’s decision in June to trigger level 2 of the national emergency plan to manage gas supplies had no immediate impact on Evonik’s supply, the company said.

DSM, another major European vitamins producer, says it has been working on gas supply risks for some time, and has multi-faceted continuation plans in place.

“Fortunately, many of our plants are in countries that are less dependent on Russian gas, or, as in Sisseln, Switzerland, one of our sites for Vitamin A and E production, less dependent because they’re already using renewables such as biomass for a portion of power and heat generation. At other sites, like our Grenzach, Germany, Vitamin B6 plant, we can switch to heating oil instead of natural gas in case of reduced availability”, said Joerg von Allmen, DSM’s Vice President for Fat Soluble Vitamins & Carotenoids.

Another leading European manufacturer told Feedinfo that it has long-term gas contracts in place and an international set-up which will allow the company to keep producing and delivering product.

“We are confident that we will be able to deliver on expected volumes and targets, and be able to deliver to customers,” the company said, noting that the current situation is having a significant impact on its energy costs and on margins.

“We are focused on protecting our margins in the mid-term. We already took actions to address this in H1 and further actions can be anticipated in H2,” the company said. “But it is difficult to imagine how volatile costs will be in the future and to evaluate how markets will evolve.”

FEED ADDITIVE PRICE IMPACT

Prices for key vitamins such as A and E, as well as methionine, were stable to weaker during the summer and have remained so in September. Since the gas crisis would mostly affect the winter, Q4 is the period to watch, but early offers for Q4 have been slightly lower than current spot prices, so it looks like — for now — the potential supply cuts are not priced in. This might be because of low demand for feed in general, or it might be too early to judge the impact should gas supply cuts from Russia continue this winter.

Many sellers are lowering their prices, trying to move old stock. But some acknowledge that with the current economic dynamics, some suppliers could take any news as an opportunity to increase their prices.

Europe has been aiming to reduce its reliance on Russian gas for some time now – particularly certain countries in eastern Europe that have been implementing the changes needed to diversify their energy sources. Russia’s invasion of Ukraine and the resulting geopolitical turmoil have only strengthened the continent’s determination to improve its energy security.

By Karolina Zagrodna, Senior Analyst

Cost-effective SBM-free broiler production possible with right additive mix

Complex supply chains, as well as concerns about greenhouse gas emissions and land use changes, are driving interest in alternative raw materials in broiler diets. Yet, although partial replacement of soybean meal (SBM) has been achieved with ingredients such as rapeseed and sunflower seed meal, total replacement has generally meant a drop in performance and a significant rise in costs. Until now.

At the annual meeting of the Poultry Science Association in Texas this summer, Danisco Animal Nutrition & Health presented the results of an intriguing proof of concept study. This research investigated how enzymes and gut health solutions could be used to mitigate the negative impacts of alternative raw materials in diets free-from SBM and oil and, crucially, achieve a cost and performance comparable or very close to traditional diets. Today, Principal Scientist Dr. Yueming Dersjant-Li shares more about these findings and what’s next for the concept.

[Feedinfo] Nutritionally, the disadvantages of alternative feed ingredients can be broken down into a few different categories. Can you explain them? How can each be addressed with feed additive use?

[Dr. Yueming Dersjant-Li] Using alternative protein ingredients, such as rapeseed meal or sunflower meal, does have potential limitations. It can, for example, increase dietary crude fiber content which in turn reduces nutrient digestion. Or it can result in a rise in undigested crude protein or amino acids (AA) content, causing the over-growth of microbiota, especially non-beneficial bacteria. It may also contain antinutritional factors that could damage animal health.

That’s why we are taking a strategic approach to each issue. In practice, this means:

• investigating how to optimise the use of xylanase and betaglucanase (XB) to improve non-starch polysaccharide (NSP) and fiber digestion,

• applying protease to increase AA digestion, and

• enhancing gut health with betaine or probiotics in addition to these enzymes.

[Feedinfo] Can you give a quick overview of the proof of concept study? How many animals were involved? How many different alternative diets did you study? How did those diets differ from the control diet? Which additives were included in both the experimental diets and control? How did you analyse the raw materials before formulation?

[Dr. Yueming Dersjant-Li] In this study we used a total of 2,574 Ross 308 male broilers, with 22 birds × 13 floor pens per dietary treatment. We tested nine treatments in total; one commercially relevant SBM-based diet (control supplemented with Axtra® PHY GOLD phytase and Danisco® Xylanase) and eight alternative diets formulated without SBM and soy oil.

The eight SBM-free diets were designed in a 2x4 factorial arrangement, with two levels of crude protein and four diets with different combinations of enzymes and other additives. The 4 diets included: 1) Danisco® Xylanase alone at the same dose as in SBM control; 2) xylanase and beta-glucanase (Axtra® XB); 3) Axtra® XB + Betafin® natural betaine; and 4) Axtra® XB + Enviva® PRO probiotic. All alternative diets contained Axtra® PRO protease. All were fed as ad lib pelleted diets in four phases; starter (1-10 days), grower (10-21 days), finisher 1 (21-35 days), and finisher 2 (35-42 days). All diets including SBM control were supplemented with 2,000, 1500 and 1000 FTU/kg Axtra® PHY GOLD phytase in starter, grower and finishers phases respectively.

Our data analysis focused on answering two key questions. Firstly, what is the effect of the different CP levels and enzyme/feed additive combinations on bird BWG and FCR at each growth phase — and which is the most effective strategy?

“These preliminary results are the first to suggest that SBM could be completely replaced without significantly compromising performance.” DR. YUEMING DERSJANT-LI

And secondly, is it possible to maintain performance and achieve economic equivalence in 100% soy-free diets?

[Feedinfo] The most interesting alternative diet had no soya ingredients and a lower crude protein level overall. Can you talk about its significance?

[Dr. Yueming Dersjant-Li] We observed that reducing protein levels by 2% to 1.5% (from starter to finisher) significantly improved performance compared to normal protein diets across the alternative diets analysed, excluding the SBM control treatment. When formulating the low crude protein diet, we maintained levels of the most critical essential AA and also considered the balance between essential and non-essential AA. This meant more synthetic AA was included to meet the digestible AA requirement. We believe this approach will help to further reduce undigested crude protein and nitrogen emissions, thereby improving both gut health and feed efficacy.

[Feedinfo] How well did these alternative diets perform compared to the control diets with soy, and how well did they perform on overall performance objectives?

[Dr. Yueming Dersjant-Li] Their performance relates to the specific enzyme/feed additive combination used. For example, application of probiotics in addition to NSPase enzymes (on top of protease) outperformed the NSPase-alone treatments (xylanase or the combination of xylanase and beta-glucanase). However, the best performing alternative treatment was low CP, supplemented with XB enzymes and probiotics on top of protease. It reached 98.3% for 42-day BW (3,082 g vs 3,136 g) and 99% for 1-42 days FCR (1.61 vs 1.60), compared to the breeder performance objectives (Figure 1). This compares well with the SBM treatment, which achieved 3,256 g BW and 1.57 FCR at 42 days.

and improved nutrient absorption — all of which helps to improve animal performance.

[Feedinfo] How did the alternative diets compare in terms of cost? How did you calculate this?

[Dr. Yueming Dersjant-Li] We observed that the alternative SBM-free diets (low CP with xylanase and beta-glucanase, protease and probiotics) maintained the feed cost/kg BWG versus SBM-based control diets (P>0.05). These calculations were based on the accumulated feed cost of each phase and final BWG for each treatment, enabling us to test the statistical differences. (Figure 2).

[Feedinfo] You have characterized this as a proof-ofconcept study. What follow-up research does Danisco Animal Nutrition & Health have planned? And will you be seeking to publish the initial research?

[Dr. Yueming Dersjant-Li] These preliminary results are the first to suggest that SBM could be completely replaced without significantly compromising performance. We are in the process of publishing this study in a scientifically peer-reviewed journal to make the full details available for all who want to partly or fully replace soybean meal. We plan to use these insights to perform further studies to determine the optimal enzymes/feed additives combination to mitigate the negative effects of using alternative ingredients in broiler diets.

[Feedinfo] Why is this kind of enquiry important to Danisco Animal Nutrition & Health? Given that the nutritional profile and costs of alternative ingredients is so variable, according to location and other circumstances, how does research like this add customer value?

[Feedinfo] So, adding probiotics on top of NSPase enzymes further improved performance. Can you explain why?

[Dr. Yueming Dersjant-Li] It has a positive synergistic effect, optimising nutrient digestibility and reducing undigested substrates, while also modulating gut microflora to promote beneficial gut bacteria. Better gut health means reduced challenge

[Dr. Yueming Dersjant-Li] Our customers are very clear that the adoption of new concepts and practices needs to be supported by reliable data generated under practical conditions. We also know that our customers will test and validate the new concept in their own conditions. As a leading specialty ingredient supplier to the feed industry, we understand its importance and continue to invest in driving science through well-run animal studies designed to demonstrate benefits. That’s why we are the partner of choice for customers interested in new concepts formulated to address current challenges, such as improving sustainability through greater use of locally sourced raw materials.

Published in association with Danisco Animal Nutrition

Will supply or demand evolutions make phosphates into niche ingredients?

Evolutions in demand

Therefore, it’s fair to say that a better option would be to reduce the use of phosphates and look for alternatives. In that respect, phytase can help by lowering inclusion levels in feed and application rates on crops with the help of precision farming techniques.

We hear from the field that consumption has been heavily reduced, and soon feed phosphates may become niche products in certain applications – pig feed, for instance. But can we see this in the statistics?

To answer this question, Praxed* looked to the UK. As there are no official statistics on detailed consumption of feed phosphates in the country, we used trade statistics to calculate the net consumption of phosphates compared to feed production levels.

During the last 20 years, the UK has been through several crises, from the BSE (bovine spongiform encephalopathy) crisis in 1992 to the Covid-19 pandemic in 2020.

Mineral phosphate availability

According to the US Geological Survey (USGS), global reserves of phosphate rock amount to more than 300 billion tonnes. In addition, phosphorous is one of the most abundant elements and is found everywhere. So what’s the problem then?

The issue is not in finding phosphate rock but in finding phosphate ore containing high phosphate levels and in the form of bone phosphate of lime.

Most industrial phosphate production uses high-grade phosphate rock. Unfortunately, these high-grade deposits are not found in many places. Morocco owns about 70% of the known reserves. Among rock producers, quality varies greatly, from pure volcanic rock found in Finland or Russia to radioactive sedimentary deposits containing high levels of heavy metals.

According to the USGS, five countries control 85% of the world’s phosphate rock reserves: Morocco (70%), China (5%), Egypt (4%), Algeria (3%), and Syria (3%). In terms of the annual supply of phosphate rock, just four countries were responsible for 72% of global production in 2021: China (39%), Morocco (17%), the US (10%), and Russia (6%)

Today, technology to extract the phosphorous from low-grade deposits is expensive or not scalable. Though this might change in the coming years, for the time being, the world is reliant on smaller resources than one might think.

Moreover, existing technologies used to produce phosphates are far from being environmentally friendly. Problems include emissions of sulphur oxides into the air, mine tailing, and eutrophication.

Nonetheless, feed production shows a positive trend and is growing, especially in poultry, where we see robust growth. The UK is still far from being self-sufficient in meat production, but efforts are being made to reach self-sufficiency in poultry. Moreover, even pig production is now growing after a previous decline.

There is also clearly increased consumption of minerals in the country. However, looking at feed phosphate net imports, we see the opposite trend, with a significant drop after 2008 and, ever since, stagnant demand. Relative to other feed consumption, we see that the use of feed phosphate is declining. This illustrates well what we often hear when talking to nutritionists: phosphate consumption has been reduced.

Now, one might ask: will the war in Ukraine trigger another reduction in demand? Today it is hard to say; factors other than the price also affect demand. For example, there is a seasonality factor. And most recently, outbreaks of avian flu and African Swine Fever (ASF) have seriously impacted feed consumption. Finally, one can’t ignore the global economic slowdown, inflation, and the impact on meat consumption.

Assessing feed phosphate demand elasticity is still possible. If the price goes up, consumption should decrease, and if the price goes down, it should increase unless substitutes exist. However, this is not the case for the feed phosphate market.

Feed phosphate production is one of the branches of the fertilizer industry. But fertilizer producers seem to overlook one crucial fact about animal nutrition: feed producers are constantly looking for substitutes to reduce costs, optimise performance and mitigate their environmental impact.

Phytase producers previously promoted their products by using the simple argument that phosphate resources were depleting and should be spared. However, the end of feed phosphates is probably not close at hand.

Analysing the UK market again and looking for a correlation between price and demand, we see that after the historical high phosphate prices in 2008, phosphate inclusion levels fell by 0.3-0.5%.

Later, even when prices decreased to low levels, volumes stagnated. Looking at the relative level of feed phosphate use to minerals consumption, we see declining demand at a time when prices were low compared to today.

The combination of demand destruction and tight supply, with fears of product shortages lately due to the war in Ukraine and sanctions on Russia, has forced the feed industry to reconsider its use of feed phosphates. As a result, Praxed expects to see a decline in consumption of feed phosphates, lower inclusion levels, and higher use of substitutes.

When looking outside Europe, we come to the same conclusion. For example, research in China shows a revision of the minimum

VIEWS ON THE

inclusion levels for feed phosphate and the promotion of phytase, with two goals in mind: lowering costs and improving the environment.

Since China revised the minimum inclusion levels for feed phosphates and began promoting phytase in 2017, consumption of feed phosphates has declined by the equivalent of 1 million tonnes of MCP, according to the consultancy Praxed.

In spite of this landscape for demand, phosphate producers are still looking to expand output as if feed phosphate demand will continuously grow along with food consumption and the global population, instead of adapting production to market needs.

Guillaume Milochau is Economic Intelligence Consultant of agricultural commodities, chemicals, and energy for Praxed.

All views are his own.

Bioiberica ready to help nucleotide application in piglet and broiler nutrition take off

It’s been more than 15 years since Spain’s Bioiberica introduced its range of nucleotides, Nucleoforce, to the animal nutrition and health sectors.

Over the years the range has found great acceptance in aquaculture, and the company is now looking to repeat that success in livestock animals, particularly in piglets and broilers.