A bright future for the African commercial aviation industry Revival of the digital passenger

Female wings in African airspace

Passion to create a sustainable future

Another set of crossroads

Report of

study on: Airlines taxes and charges in Africa

AFRAA AFRICANAIRLIN ES ASSOCIATION ASSOCIATIONDESCOMPAGN ES AERIENNESAFRICAINES AFRAA’s Panafrican Journal on Air Transport, Issue No. 53 : May-July 2023

AFRAA’s Panafrican Journal on Air Transport, Issue No. 51 : May – July 2021

African-skies

AFRAA

TH

AVIATION STAKEHOLDERS

CONVENTION

7-9 May 2023 | Addis

Ababa, Ethiopia

Changing the African Aviation Narrative

AFRAA and Ethiopian Airlines will stage the 11th Aviation Stakeholders Convention from 07-09 May 2023 at the Ethiopian Skylight Hotel in Addis Ababa – Ethiopia.

The Aviation Stakeholders Convention (ASC) is an initiative of AFRAA to bring together aviation ecosystem stakeholders under one roof with the view to foster dialogue, build sustainable networks, create a competitive environment for business and improve the aviation value chain in the continent.

Now in its 11th year, the discussions at the event will evolve on the main theme: “Changing the African Aviation Narrative” best practices and information on win-win supplier-customer relationships.

Sponsorship and Exhibition Opportunities: The Convention provides excellent marketing and visibility opportunities through sponsorship and exhibition. Join us for brand visibility and the opportunity to do business with the over 500 African Aviation top decision makers and leaders.

For more information, please contact

Maureen Kahonge

Senior Manager Business Development & Communications: African Airlines Association (AFRAA)

Tel: +254 725500470

mkahonge@afraa.org

www.afraa.org

Lt Me n Ehoi h

Cuty f 13 Mnh f Snhn!

Drive the tide for the African airline industry

Looking back from the 1930’s since the earliest African airlines took flight, the industry has navigated different tides while continuously playing an essential contribution to the economic development of the African continent. Regrettably, what has remained unchanged over the past four decades is the modest size of Africa’s air transport industry, which has been at less than 3% share of the world air traffic and remained far from maturity. This contrasts with Africa’s growth potential being among the fastest rates compared to those of the matured air transport markets.

The call to action to change could not come at a better time. The COVID-19 crisis was an impetus to the entire air transport ecosystem to rethink the business to remain agile and far-sighted to ensure that African economies can continue to reap the benefits of aviation. As the industry recovery trajectory picks up from the COVID-19 crisis, currently at 93% of 2019 traffic levels, the focus is to be more efficient and sustainable. The seeds to achieve this change were planted at the first-ever African aviation laboratory organised by the industry and hosted by AFRAA in 2022 to develop roadmaps for the sustainability of the African air transport sector. The overall objective of the Laboratory was to address the root cause of challenges

facing the air transport industry in Africa and develop relevant solutions to revamp the sector.

A year after the Lab, the roadmaps of the five projects are on course. For instance, the AFI Free Routing Airspace has the Project Management Team (PMT) engaged in preparatory works towards the Free Routing Airspace trial implementation of selected routes within Africa. The objective is sustainable flight operations through flying as direct as possible within Africa to reduce operational costs and carbon emissions.

The 11th Aviation Stakeholders Convention, scheduled to take place from 7-9 May 2023, is deliberately aligned on this storyline for change. The Convention, proudly being hosted by Ethiopian Airlines under the patronage of the Government of Ethiopia, will be held under the theme: “Changing the African Aviation Narrative”. Air transport industry stakeholders will converge to deliberate on strategies to enhance efficiencies, create synergies, develop intra-Africa connectivity, and ensure business continuity that will redefine the narrative of the African air transport industry. Change is essential. A sustainable, interconnected and affordable air transport in Africa can be realised through change. “What’s dangerous, as Jeff Bezos quoted, is not to evolve.”

Mr. Abdérahmane Berthé AFRAA Secretary General

FOREWORD

FOREWORD 1

A sustainable, interconnected and affordable air transport in Africa.

Another set of crossroads

The latest crossroad is probably the last opportunity in a reset world, can the continent make the right turn?

17

Revival of the digital passenger

Reviving digital customer experience remains key to overcome the challenges of the modern airline world and pave the way towards a successful and sustainable future.

Female wings in African airspace

The biggest challenge for women in African aviation is accessing the opportunities available to them.

04

A bright future for the African commercial aviation industry

Despite the headwinds airlines face, we see a bright future for the African commercial aviation industry, with growing demand across the continent.

A successful partnership

A successful NDC partnership is one where travel partners engage positively with an airline to sell more and different content through new and richer channels.

08

Think finance

Getting the finance team involved early in the process could be the key to unlocking the highperformance retailing potential of ONE Order.

Advancement through collaboration

Enhance the aviation services industry and build a network of like-minded professionals passionate about advancing the sector.

Kiu System Solutions

A company that provides a robust and innovative PSS and suite of airline solutions.

@AfricanAirlines @AFRAA.AfricanAirlinesAssociation

https://www.linkedin.com/company/african-airlines-association/ www.afraa.org

2 | African-skies | MAY – July 2023

07

10

23

Contents

28

FEATURES 26

33

A sustainable future

Embraer aim to bring best-in-class aircraft to market at an accelerated pace to help customers and partners meet their climate goals.

37

Airlines taxes and charges in Africa

The objective of this paper is to benchmark the level of air ticket taxes and charges across the continent in comparison with other regions, and identify areas of improvement.

44

Flying Clear of Turbulence

African-skies

PUBLISHERS

Camerapix Magazines Limited

EDITORIAL DIRECTOR

Rukhsana Haq

MANAGING EDITOR

Maureen Kahonge

SENIOR DESIGNER

Sam Kimani

REGULARS

PRODUCTION MANAGER

Rachel Musyoni

ADMINISTRATION | ADVERTISING

Azra Chaudhry (UK)

Rose Judha (Kenya)

African-skies is published quarterly for AFRAA by Camerapix Magazines Limited

Correspondence on editorial and advertising matters may be sent to either of these addresses

Editorial and Advertising Offices:

Camerapix Magazines Limited

PO Box 45048, 00100, GPO Nairobi, Kenya

Tel: +254 (20) 4448923/4/5

Mobile: 0739 265511

Email: creative@camerapix.co.ke

Camerapix Magazines (UK) Limited

32 Friars Walk, Southgate, London, N14 5LP

Tel: +44 (20) 8361 2942

Mobile: +447756340730

Email: camerapixuk@btinternet.com

afraa@afraa.org

Printed in Nairobi, Kenya

All rights reserved. No part of this magazine may be reproduced by any means without permission in writing from AFRAA. While every care is taken to ensure accuracy in preparing African-skies, the publishers and AFRAA take no responsibility for any errors or omissions contained in this publication.

©

Message from AFRAA’s Secretary General 01 AFRAA diary 48

2023 CAMERAPIX MAGAZINES LTD

AFRAA data 59

A rationalised and better integrated network, increased traffic, and better aircraft utilisation, will drive costs down. 3

A bright future for the African commercial aviation industry

It’s an exciting time for commercial aviation in Africa. Across the entire continent, there are new trends and developments to respond to. Airlines on the continent are looking for smaller aircraft to implement into their operations, particularly narrowbody types and regional turboprops and jets. In East Africa, we’ve witnessed an increase in activity and change in key players, with Addis Ababa in Ethiopia recently becoming the biggest connecting hub in Africa. There has also been a notable increase in activity in Central Africa, alongside the usual high levels across Southern Africa, which continues to be a dynamic aviation market. Seizing the opportunities that exist in the African commercial aviation industry means being fully aware of – and being prepared to respond to – the developing trends and the challenges that exist across the regions.

4 | African-skies | MAY – July 2023 FEATURE

Recession prompts growth in regional aircraft

It’s perhaps surprising to talk about opportunities given the International Air Transport Association (IATA) predicted that the continent’s airlines will post a loss of around $213 million in 2023, as the industry continues to recover from COVID-19. Despite this, disruption leading to recession doesn’t necessarily lead to inactivity. Instead, a downturn shapes the prospects that exist. For commercial aviation, a recession creates a spike in demand for smaller aircraft offering the lowest risk, typically regional turboprops and jets as well as narrowbody aircraft. Across the continent, we are seeing a particularly strong interest in some of the turboprop models – with more fuelefficient aircraft offering better solutions for domestic operations. This is especially the case for customers who plan to fly to remote destinations.

Challenges faced by Africa

Alongside the many developments across Africa, there are also challenges that hold back the potential of aviation across the continent. Africa’s airlines face significant costs imposed on them by governments, fuel is up to 40% more expensive than elsewhere in the world, accessing financing can be difficult, and with no open-skies agreement regionally or across the continent, growth via route connectivity is stifled. Additionally, even before the pandemic, the airline analytics consultancy OAG noted that the sheer number of airlines operating in Africa posed a challenge, preventing each airline from building a solid base and financial and structural core to survive in the face of competition and new entrants.

5 FEATURE

Planning for the future

Despite the headwinds airlines face, we see a bright future for the African commercial aviation industry, with growing demand across the continent. While the short-term future of aviation is unpredictable, the sector has always been resilient, and we can expect good things from the African market over the coming years. One development we are watching closely is the potential for the Single Market for Air Transport in Africa (SAATM)’s Focus Africa Initiative, announced in April 2023. Focus Africa involves six areas of concentration, namely safety, infrastructure, connectivity, finance and distribution, sustainability, and future skills. Airlines and governments need to address all areas before they can realise the goal of creating a single transport market. We believe this is the first big

step in the right direction to advance the liberalisation of civil aviation in Africa and give impetus to the continent's economic integration agenda.

For these, and all African airlines moving forward, it will be important to collaborate with expert partners, with the right combination of heritage, local knowledge and access to data to provide genuinely trusted advice. It’s this expert insight that we pride ourselves on at Jetcraft. Our commercial aviation team has been operating in Africa, particularly trading regional and narrowbody aircraft, since 2015. Our diverse offering includes jets from Airbus, Boeing, Bombardier, De Havilland, Embraer and other manufacturers. To find out more about how Jetcraft Commercial can help you seize opportunities in the African aviation sector, visit: www.jetcraftcommercial.com

6 | African-skies | MAY – July 2023 FEATURE

NDC adoption: Tools for a successful partnership commercial toolkit

A successful NDC partnership is one where travel partners engage positively with an airline to sell more and different content through new and richer channels. During the more than 10-year journey, pioneer airlines have pursued various strategies to encourage travel partners to move from consuming content through the Global Distribution Systems to NDC. The big question for every airline is what adoption strategy will work best for them. Well, it depends. Each strategy employs ‘levers’ of content differentiation or commercial terms to achieve the desired results.

Are you considering implementing IATA NDC? Do you want to grow the success of your strategy?

Do you need help encouraging your airline’s travel partners to migrate to NDC platforms? If you’ve answered yes to any of these questions, download the ‘NDC adoption: Tools for a successful partnership’ commercial toolkit, where Accelya’s Bill Cavendish looks at some of the most common and potent adoption strategies, such as:

• Dangling the carrot: Create a winwin-win situation for the airline-agentcustomer by offering a reward. With this approach, airlines attract sellers

by offering exclusive content and packages (often fare brands) through NDC channels.

• Wielding the stick: Remove incentives for travel sellers to use non-NDC channels by adding surcharges and/or excluding content from the GDS.

• The wholesale model: Place the power firmly in the hands of the travel agent, who then decides from whom and under what terms to source NDC content. The airline provides the agent with its content – and perhaps an incentive – and it’s up to the agent to select an aggregator (GDS or third party).

If you’re still deciding what the best strategy for your airline is, Accelya’s commercial toolkit can guide you. It also includes Tye Radcliffe’s exclusive comparison of the various NDC adoption strategies. Tye is Accelya’s SVP of Product Strategy for the Order group, so he knows the results strategies like carrot, stick, or the wholesale model can give your airline.

Get your copy of the NDC adoption commercial toolkit here or visit www.accelya.com for more information

7 FEATURE

AUTHOR: Bill Cavendish Global Business Development Accelya

Making the most of ONE Order: think finance!

Getting the finance team involved early in the process could be the key to unlocking the high-performance retailing potential of ONE Order.

Technological changes typically bring opportunities for airlines. That covers both expanded commercial potential and the simplicity of systems and processes. Maximising those opportunities though requires that every team that will be impacted by the change is involved from the start. Bringing the finance team out from ‘behind the scenes’ in the planning and integration phase could be critical in a transformational change such as the implementation of ONE Order.

As the latest step in a journey from paper tickets to a single order, ONE Order will bring a customer-focused digital record that strips out inefficiencies and improves communication between order management, revenue accounting, and delivery providers. For finance, the rewards can be lower costs and a reduction in reconciliation activity.

has a 360-view of what’s going on in the organisation so that surprises can be avoided. Ensuring this is delivered in a change as fundamental as new messaging and standards for Order transformation, and subsequent settlement and accounting is therefore essential.

AUTHOR: Muffi Lokhandwala Business Development for

Solutions

Solutions

Early input from all key teams is critical Although often regarded as ‘back office’, finance has a critical role to play in compliance, risk, and reporting. Best practice demands that finance

Financial

at Accelya

“Marketing or commercial has these big ideas, and finance gets forgotten. This is not something that they can wait till the last minute to involve us.”

8 | African-skies | MAY – July 2023 FEATURE

Jenny Benjamin, Revenue Accounting Director, Alaska Airlines

Too often, however, the input of teams that will implement and integrate new standards is introduced too late. Early cooperation can help to avoid bottlenecks and difficulties further down the line. There’s a lot to think about as airlines consider the implementation of ONE Order to drive transformation. And in the journey to high-performance retailing, it’s critical to think as carefully about what happens on the back end in accounting and control systems as the front end. This is particularly urgent if airlines are to achieve IATA’s goal of being in control of 100% of Offers & Orders by 2030.

Where finance can make it count

Some of the key steps finance teams could consider are as follows:

• Sharing their insights into developing the ONE Order vision.

• Ensuring their inputs are considered by commercial teams in the ONE Order build/buy process.

• Getting involved in technology planning, rollout, and roadmap development.

• Input in planning the transition approach as we move from the legacy of RBDs, Fares & Rules, PNRs, eTickets & EMDs to Dynamic Offers and customer-centric Orders.

• Designing an optimised accounting process.

• Meeting auditing and legal compliance. With ONE Order, the airline’s finance team still exists in a complex environment. Their world is characterised by issues such as the integration of financial and sales data, operating with multiple payment providers, and working in markets with very different regulatory regimes.

It also has the same responsibilities, including fast, accurate reporting and seamless settlement; to prepare accounting systems capable of delivering new and innovative products, and it should be ready to accept new services, such as those offered by third-party vendors, in the future.

Simplification is hard work but comes with rewards

The truth is that simplification requires a lot of hard work! Accelya has worked with the industry’s early adopters in both NDC and ONE Order and has helped to develop roll-out strategies. And while every airline has its unique journey, one universal learning is that there are huge benefits for those that take account of the need of all internal stakeholders right from the get-go.

“It’s about tying up everything to get one end-to-end collaborative process so that what was the intention in the frontend is being delivered at the back-end.”

9 FEATURE

Philip Fernandes, SVP Product Strategy, Accelya

African aviation – another set of crossroads

Time for a right turn

AUTHOR: John Grant Chief Analyst, OAG

AUTHOR: John Grant Chief Analyst, OAG

The World Cup is now a distant memory, and the success of Morocco was a great result for African soccer showcasing both the skill and resilience of a well-drilled team where everyone accepted their roles and responsibilities. Increasingly, COVID-19 and the global pandemic is also a distant memory and now something we have all learned to live with and adapt our ways of life. As a learning experience then the pandemic was certainly a shared learning and for all of us picking up the pieces after lockdowns, restrictions on travel and our social networking then times have never been harder. The parallels with Africa’s aviation industry run deep but rather like the resilience of us all there are reasons for optimism from the learnings and recovery.

10 | African-skies | MAY – July 2023 FEATURE

A devastating event

For many airlines, the pandemic was a moment of survival of the fittest and even they struggled! Those carriers lucky enough to have deep cash reserves managed to survive, scarred but not materially damaged; Ryanair entered 2020 with enough cash reserves for a few years and some African carriers had enough cash reserves for a few weeks!

In 2020, Africa’s airlines lost some US$7.7 billion, millions of employees within the wider travel eco-system lost their jobs and some eight airlines went into bankruptcy – although some of those were teetering on the edge beforehand.

In 2022, African airlines are expected to have lost some US$638 million,

with those losses hopefully reducing to US$213 million in 2023. Even allowing for those 2023 estimates to be upgraded as the recovery gathers pace, Chinese travel restrictions to ease faster than expected and with a stronger demand profile, Africa’s aviation industry will continue to be marginal. It is a tough existence but there are signs of hope in all regional markets and a sense that maybe 2023 could be a turning point for the industry, or is that just sheer optimism? Let’s examine the facts.

More airlines than ever – but not the right type and size?

There have never been more scheduled airlines in Africa than there are now,

some 264 airlines from around the world operated to the continent at some stage last year; that is the highest number for many years. Equally positively, 120 of those airlines (45%) are African domiciled airlines, again the highest number over the last twelve years although that is the lowest proportional share since 2010. Alarmingly there were only eight low-cost domiciled African airlines operating and that number has never reached double digits in the history of scheduled aviation in Africa as the chart below highlights. Indeed, only two airlines, Air Arabia Maroc and Egypt have been consistently operating through that time, many others have been and gone.

African Scheduled airline operators by segment 2010 vs 2022

11 FEATURE

OAG

Source: OAG Schedules Analyser

130 120 110 100 90 80 70 60 50 40 30 20 10 0 AfricanDomiciledLegacyAirlines NonAfricanDomiciledLegacyAirlines AfricanDomiciledLowCostAirlines NonAfricanDomiciledLowCostAirlines Number of Airlines 2010 2022

By means of contrast, there were twenty-five non-domiciled low-cost carriers operating flights to Africa with those airlines ranging from Ryanair with over 2.4 million seats to the new Wizz Air Abu Dhabi entry with some 33,000 seats and plans to grow further.

Low-cost carriers struggle to survive

Analysed by market segment it is very clear that both penetration and growth in share of the low-cost airline segment is

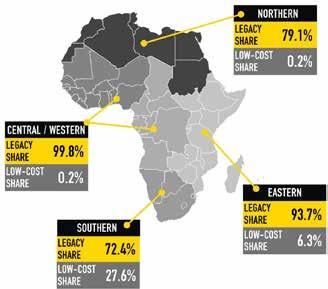

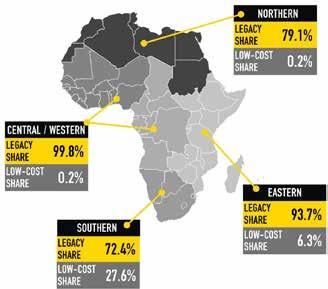

very low, particularly in West, Central, and Eastern Africa where more than nine out of ten seats are operated by legacy airlines. The global average for January 2023 is for 35% of all capacity offered to be operated by low-cost airlines highlighting just how far behind the rest of the world African aviation is in embracing what is now a proven industry segment that stimulates new market demand, enhances connectivity, and ultimately drives economic growth.

Any discussion around the low-cost market quickly gravitates towards the difficulties of operating in very regulated markets, stimulating demand with very high levels of taxation, shortages of skilled

resources, and the need to challenge established distribution channels and build direct booking activity. All of these are valid points and are proving very difficult to change but is there a

12 | African-skies | MAY – July 2023 FEATURE

Departing region Legacy capacity Low-cost airlines capacity Legacy share % Low-cost share % Africa: Central/Western Africa 34,735,644 85,380 99.8% 0.2% Africa: Eastern Africa 31,925,315 2,163,087 93.7% 6.3% Africa: North Africa 41,390,785 10,909,399 79.1% 20.9% Africa: Southern Africa 19,690,078 7,513,410 72.4% 27.6% Total 127,741,822 20,671,276 86.1% 13.9%

Legacy / low-cost airline share by Africa regional market 2022

OAG

Source: OAG Schedules Analyser

more fundamental issue that needs to be addressed, the thorny area of consolidation and scale.

Operational challenges

For any airline to be successful it needs to operate a diverse network that allows it to weather the inevitable changes in markets as they react to external factors. For some carriers it’s a wide geographic network which provides that resilience, for some it’s a balance between clear business and leisure markets, and for others it’s the creation of bases across a

country or continent that allow resources to be reallocated at short notice.

For most airlines in Africa applying any of those principals is challenging as the capacity hockey stick below shows. In total, African domiciled airlines scheduled nearly 40% of capacity and this is supplied by the five largest airlines, with Africa’s single largest airline – Ethiopian Airways – operating 14% of all capacity alone. For comparative purposes the top five airlines in 2022 had a 38% share of capacity and the largest carrier, Ryanair had a 15% share of capacity. So, whilst

13 FEATURE

Source: OAG Schedules Analyser OAG 16 14 12 10 8 6 4 2 0 E T AH QI WB MK HC NP 3T AZM 8U J7 C2 RRV TWC NUA NE EXZ D3 YI VM MD 6N 3Q MNO NYS S cheduled capaci t y ( m illions)

2022 Scheduled airline capacity African domiciled airlines

at a macro level African airlines have a very similar profile to their counterparts in Europe, it is at a more granular levels that the challenges of operating become clear. The average capacity operated per day by an African domiciled airline in 2022 was 2,284 seats whilst the average

number of daily flights operated was 24, again for comparative purposes in Europe the average was 51 suggesting that each carrier has at least twice as much operational scale as those in Africa, and with scale comes efficiency. Another part of efficiency is reflected in the type of

aircraft operated – looking at last year’s data it highlights one of the greatest challenges facing aviation in Africa: the need for small aircraft types. Over two fifths of scheduled flights were operated with Turboprop aircraft while another 20% were operated by regional jets resulting in more than 61% of all flights being operated by aircraft that typically have fewer than 50 seats per flight. For any airline creating a longterm sustainable turbo-prop/regional jet network is challenging, typically requiring high selling fares and high aircraft utilisation and whilst the fares are high the continual punitive taxes applied effectively discourage demand stimulation

in all but the most wealthy or tourist markets.

Productivity at the other end of the spectrum across the wide-bodied fleets of African airlines highlights another series of challenges and inefficiencies. Looking at the current planned first quarter 2023 schedules reveals several carriers operating with a low number of daily wide-bodied services. While airlines such as Ethiopian (114), Air Mauritius (137) and South African (131) are striving for a high degree of operational use, carriers such as RwandaAir, Air Peace and Uganda Airlines appear to be using their aircraft for less than two flights a day, hardly efficient operations by any measurement criteria.

14 | African-skies | MAY – July 2023 FEATURE

Airline domicile region Narrow-bodied Jet Wide-bodied Jet Regional Jet Turboprop Africa: Central/Western Africa 103,016 9,844 72,500 42,522 Africa: Eastern Africa 38,137 23,868 26,103 360,511 Africa: North Africa 156,547 13,335 4,865 28,998 Africa: Southern Africa 69,333 5,036 97,674 37,503 Total 367,033 52,083 201,142 469,534

Scheduled flights by aircraft type, African domiciled airlines 2022

OAG

Source: OAG Schedules Analyser

Q1 2023 Scheduled wide-bodied services and active fleet sizes, African domiciled airlines

At another set of crossroads?

Post-pandemic with the recovery now in full swing, African aviation appears to be at another set of crossroads, and it would be fair to say it has plenty of experience of such moments but frequently failed to take the right direction. The key question is what the right direction should be and is it possible to make progress that is both sustainable, grows access to travel and importantly creates a profitable industry for all. There is no ‘golden bullet’ to establish that position but perhaps there are some ideas or thoughts to consider. Industry consolidation has often been discussed as a way forward, but it has yet to deliver results for either majority or minority partners in Africa. Disputes over ownership and control, allocation of resources, scheduling, management teams and even pricing have frustrated attempts at any form of consolidation.

The loss of strategic control, protection of national interest and frequent changes of government control have proved difficult barriers to overcome, and many attempts have floundered on ‘majority investment, minority influence’ type arguments. Given the history, politics, and failure of previous attempts then it would be a brave airline CEO to suggest a consolidation play in the near future. But are their other alternatives?

An African airline alliance? Is a partnership approach a more realistic and less emotive means of creating the necessary critical mass and network that a pan-African airline could operate and provide the necessary supporting foundations for the wider airline community to build around? Is it possible to make something happen? Well, there are four very distinct geographic regions

within Africa and in each of those there is a dominant airline operator that has successfully secured enough scale and mass to survive and move forward, could some form of partnership between those carriers be a catalyst for change?

Each of these airlines enjoy strong market positions in their respective regions, in most cases offering at least twice as much capacity as the second largest airline in that region and all having a range of existing partnerships in place with smaller carriers. Post-pandemic many airlines have realised that they were lucky to survive the event, in many cases, without Government support, sympathetic lessors and some savage cuts in resources they would have collapsed. No airline CEO wants to be in that situation again so developing new strategies that de-risk such exposure will be vital in the next few years and

15 FEATURE

Airline Q1 2023 Scheduled Wide-bodies services Number of active Wide-bodied aircraft Planned wide-bodied Flights per day Planned flights per aircraft Ethiopian Airlines 7,763 68 86.3 114 EgyptAir 1,581 18 17.6 88 Kenya Airways 895 9 9.9 99 Royal Air Maroc 846 10 9.4 85 Air Mauritius 824 6 9.2 137 Air Algerie 725 6 8.1 121 Air Austral 432 5 4.8 86 South African Airways 262 2 2.9 131 Compagnie Africaine d’Aviation 252 2 2.8 126 TAAG Angola Airlines 226 6 2.5 38 Air Tanzania 196 2 2.2 98 RwandAir 187 2 2.1 94 Tunisair 183 2 2.0 92 Air Peace 126 3 1.4 42 Air Senegal 123 1 1.4 123 Uganda Airlines 79 2 0.9 40 Source: OAG Schedules Analyser & CAPA OAG

AFRICA’S PARTNERSHIP ALLIANCE

creating strategic but non-equity-based partnerships represent a way forward. Previous partnerships in Africa have always been built around investment rather than recognising the commercial benefits that could be created by working together. But most of those have failed, were those attempts to run before walking realistic? Could softer options have been considered and was too much effort wasted at the negotiating table with too many ‘interested parties’?

Absolutely YES!

Africa’s new opportunity

In the early stages of the pandemic many people uttered the phrase ‘in adversity is opportunity’. However, there is some truth in the sentiment and African aviation now has that opportunity to make a quantum

leap forward in terms of its development, value to economic growth and most importantly connecting a continent that is frequently best connected via Paris or Rome at the moment. To make that happen requires trust but no cash. It requires partnerships rather than ownership. And most importantly it requires inspirational leadership to step forward. But nothing is impossible with the right mindset.

African aviation is once again at a crossroads, the journey to date has been long, impacted by too many detours and stumbled across too many roadblocks as it has attempted to make progress. The latest crossroad is probably the last opportunity in a reset world, can the continent make the right turn?

16 | African-skies | MAY – July 2023 FEATURE

sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat.

WORK STEP 4

Figure 1: Potential partnership structure for African aviation

Quo vadis, airline customer experience?

The revival of the digital passenger journey post-pandemic

AUTHOR: Mirko Kopf Associate Consultant Customer Experience at Lufthansa Consulting

New technologies enter the airline industry at fast pace. Airlines need to adapt and upgrade their product to stay relevant. Passengers prefer to fly with an airline that finds the right balance between digital and human touchpoints. In a fast-moving environment, making the right investment decisions becomes increasingly challenging. With digitalisation gaining momentum, airlines need to follow the call for a more digital customer journey. Africa’s airlines have entered the path of recovery and embarked on the journey of digitalisation with many good examples leading the way. Systematic assessments help to adapt to ever evolving customer needs by identifying and prioritising investment areas.

17 FEATURE

Airlines are forced to enhance their product experience with new innovations entering the industry

Rising up from the severe impact caused by the COVID-19 pandemic, the airline industry is sure to find its way back to pre-pandemic standards. According to AFRAA’s Annual Report 2022, the year 2021 heralded a period of recovery with traffic continuously increasing. OAG data confirms that as of March 2023, overall seat capacity (in terms of available seat kilometres) in 2023 are projected to reach almost pre-pandemic levels.

This, and former crises (e.g. 1973 oil crisis, 9/11 and the 2007-2008 financial crisis), show that the industry always manages to find its way back to recovery and growth. Still, in the phase of recovery, many airlines, especially European carriers, had to face chaotic ramp-up and challenging operational environments during last-year’s summer operations. So, what is there to take away at this stage? The industry seems resilient and with a lot of energy, it will get back on track. However, trends that were urgent pre-pandemic are still valid or have even gained importance. One of these trends is the call for a more seamless and hassle-free travel experience. Airlines around the world have recognised this trend and are upgrading their product experience by driving digital development. Hawaiian Airlines and airBaltic are entering the latest stage in highspeed inflight connectivity by teaming up with Elon Musk’s Starlink. Star Alliance encourages its members in the usage of biometrics and many airlines follow the call for digitalisation by introducing self-service digital touchpoints. African carriers are also embarking on the journey of innovation. Ethiopian Airlines partnered with Immfly, a Spain-based provider for digital on board software and solutions, to bolster up the inflight e-commerce and connectivity experience. Together with Clickatell, a frontrunner in chat commerce and mobile messaging, FlySafair offers a convenient payment solution via WhatsApp through a pay-bylink capability. Customers can checkout their purchase by receiving a secure link directing them to a payment page. In times of high popularity of mobile messaging and mobile payment this solution provides an enhancement to the digital travel experience.

18 | African-skies | MAY – July 2023 FEATURE

The industry is not standing still. Extended reality (including virtual and augmented reality) and robotic assistants are just two of many fascinating innovations which will impact the future passenger journey – all with the mission to smoothen operations and improve customer satisfaction.

The aviation industry experienced a paradigm shift within the last 12 months. Disrupted processes and slow ramp-up around the world impacted passengers’ satisfaction and trust. With recovery underway starting last year, the strategic focus shifted from financial survival and rigid cash management to stable operations and improved customer experience. And, it is now time for airlines to revamp their product, in order to not fall behind the competition.

Africa’s digital ecosystem embarks on a journey of growth

Whilst traffic projections give reasons to be optimistic, other factors also indicate a promising future. The Agenda 2063 by the African Union provides a clear way forward – also in terms of digitalisation and connectivity. Aiming to have a worldclass infrastructure across the continent, the agenda targets ambitious growth in internet connectivity, broadband access and mobile penetration. Paired with a young demographic structure (median age of <25 years) and growing digital affinity, the information and communication technology sector will play an increasingly important role.

Africa’s tech startup scene pictures this development well. With more and more Africans gaining access to the internet and mobile phones, a wave of startups has emerged across the continent.

19 FEATURE

According to a recent article on disruptafrica.com, in 2022, a total of 633 African tech startups emerged, which is already double compared to 2019, as reported by the German Institute for Global and Area Studies in 2022. Last year, techcabal.com posted that the continent is now home to seven unicorns. Whilst the tech scene is still nascent and small compared to worldwide heavyweight ecosystems like the US, the dynamic in Africa is evident and the ecosystem is amongst the fastest-growing in the world, Financial Times published in its ‘Africa’s fastest growing companies 2022’ ranking.

This evolution also taps into the airline industry. With an increasingly digitally savvy population and new technologies emerging, African airlines need to recognise the change in customer behaviour and adapt their product experience accordingly to meet expectations. Airlines that do not

acknowledge the importance of an increasingly digital customer journey and challenge their current digital maturity may risk falling behind in mid-and long-term.

Africa’s airlines catching up in digital product experience

Africa’s main carriers understand the importance of digitalisation and have already taken the first steps. The number of African social media users has risen continuously amounting to 384m users as of 2022, Statista released in its ‘Social media in Africa – statistics & facts’. Facebook is still predominant with a market share of >80% as of 2022. Social media is a crucial channel along the customer journey as it provides content for marketing purposes but can also be used as an effective platform for interaction and social selling. A well-managed social media platform

provides a focal entry point into the customer journey. Africa’s top airlines are present on Facebook and other channels with considerable follower bases (e.g. Ethiopian Airlines: 3.1m, Egyptair: 1.7m as of March 2023).

A smooth and seamless booking flow improves conversion and retention rates. An efficient online booking process can be, for example, assessed through the number of clicks required to book a flight. This metric goes into the core of digital experience. Simplistic and intuitive booking flows are the essence of a successful user experience. The Spanish airline Vueling has mastered the process, offering the most convenient and seamless online booking experience with only 16 clicks required to book a flight (see figure). Compared to this benchmark, Kenya Airways performs extremely well (19 clicks), outpacing industry leaders such as LOT or KLM.

20 | African-skies | MAY – July 2023 FEATURE

Ease of online booking by number of ‘clicks’ required to book a flight Vueling British Airways Kenya Airways LOT FlySafair Royal Air Maroc KLM Ethiopian Airlines Egyptair 17 18 19 21 25 26 26 27 29

Assessing digital maturity requires a comprehensive view

Contrary to common perception, achieving digital maturity is more than introducing digital features. Whilst these certainly are visible from the customer perspective and impact customer satisfaction, the topic is much broader since non-visible factors are equally important. Internal enablers are crucial to drive digital maturity. Digitalisation and innovation require an environment in which each and everyone involved is eager to challenge and push the boundaries. In a fast-paced environment, flexibility, the willingness to acquire new digital skills and a culture of innovation are key. In a cross-industrial survey amongst UK companies, the Learning & Work Institute in 2021 stated that 76% of employers acknowledge that a lack of digital skillsets will affect their future profitability. Visionary leadership with a clear goal and roadmap is a first step in the right direction, but only worth a fraction if not put into practice. Empowerment and forward-thinking need to be promoted to encourage employees to carry out the vision in their work routine.

To drive digital maturity along the customer journey, airline managers need to critically reflect and examine three core areas:

1. Does the digital experience already reflect current industry standards and opportunities to address today’s and future passenger expectations? What areas along the customer journey require product investments?

2. How deep is digitalisation anchored into the organisation and strategic agenda? Do we have a vision and clear targets defined for the future?

3. Are our employees equipped with the right skills and tools? Do we have an innovative culture and work environment?

A step-by-step status quo assessment along the customer journey is the first phase in the process. It helps to identify gaps to industry best-practice as well as competitors and supports the definition of a desired target picture and concrete actions. And whilst the digital experience is significant and shapes the overall customer journey, the target picture for each airline may look different.

21 FEATURE

Considering elements such as business model, operational environment, or even macro- and socio-economic factors is essential in painting the future picture.

Choosing where to invest becomes increasingly challenging

In this highly dynamic environment, airlines need to continuously re-assess their digital strategy. New technological innovations force airlines to adapt their product experience to stay relevant, since passengers prefer to fly with an airline that combines best digital and human service elements. Strategic decisionmaking becomes increasingly challenging. Knowing which investments to prioritise helps to make smart and efficient decisions to position the airline ahead of the competition. Time is a valuable asset in this context, as changes and turnarounds will not materialise overnight. Undergoing digital transformation unlocks a rewarding return. According to an MIT Sloan study, companies undergoing digital transformation achieve net margins of 14.0 percentage points above industry average. Methodologies and tools exist to understand where to start and which steps to take first.

Digital maturity assessments help to identify improvement potentials and defining next steps

Systematic approaches exist to identify improvement potentials in consideration of industry best-practice. Digital maturity assessments are no new invention but have already proven themselves in various sectors and provide a framework to determine the individual maturity and improvement areas. By applying scoring and clustering methodologies, these assessments provide an effective and transparent diagnostic. Given the dynamic industrial pace, regular status-quo analyses help to determine next steps, prioritise investments and make timely strategic decisions in order to stay ahead of the competition.

Finding the right balance

Passengers call for a smooth and hassle-free experience. A digital customer journey helps airlines to meet the expectations and positively impact customer satisfaction. However, the individual digital maturity level also depends on several external factors. Despite the accelerating trend of digitalisation, passengers do seek human interaction in the form of individual attention, courtesy and helpfulness in certain moments. Nonetheless, digitalisation is on top of the strategic agenda and a crucial differentiating factor. The developments prove that Africa’s carriers have embarked on a promising journey of digitalisation with many good examples leading the way and it will be pivotal to persevere along this journey. Reviving digital customer experience therefore remains key to overcome the challenges of the modern airline world and pave the way towards a successful and sustainable future.

22 | African-skies | MAY – July 2023 FEATURE

A digital customer journey helps airlines to meet the expectations and positively impact customer satisfaction.

Female wings in African airspace

Women are still the distinct minority in aviation professions on the African continent. Maseka Kithinji explored the reasons in her master’s thesis written at Austria’s Danube University Krems.

AUTHOR: Ms. Maseka Kithinji

AUTHOR: Ms. Maseka Kithinji

In December 1903, powered aviation was launched by the Wright brothers. While aviation pioneers took the world by storm, the reservations that flying women faced grew just as quickly. Despite this, a few female pilots managed to break into the domain claimed by men. Harriet Quimby, the first woman to cross the English Channel in 1911, and the famous Amelia Earhart a decade later, are examples of those female aviation pioneers.

Women’s interest in the aviation industry was not unique to the Western world, but was soon sparked in Africa as well. Two decades after the first woman took to the skies in Europe, the first female pilot conquered African airspace. Lotfia Elnadi was not only the first African, but also the first Arab female pilot. She acquired her pilot’s license on 27 September 1933, after enrolling in an Egyptian flight school. After these initial milestones, the path into the cockpit for African women was led primarily through the military. In 1963, for example, Melody Danquah of Ghana was among the first three women to be trained as pilots in Ghana’s national air force. Years later Asli Hassan Abade in 1976 from Somalia followed suit and became

23 FEATURE

an Air force pilot in Somalia, to date there has not been another female aviator that has been able to join the Somali air force due to the political atmosphere in Somalia. One of the most important factors in the development of African women aviators was the independence and social progress of African nations. In East Africa, Kenya’s Irene Koki Mutungi became the first female pilot to fly with the national carrier, Kenya Airways, beginning in 1995, and remained the only one in her field for the next six years. In 2004, she became the first African woman to captain a commercial airliner – first a Boeing 737, and later a 787.

Today, in the 21st century, women are still a minority in highly skilled positions in the aviation sector. IATA’s 2022 statistics provide data on the number of women in aviation worldwide. For example, women make up six (6) percent of CEO’s, five point eight (5.8) percent of pilots, less than nine (9) percent of aeronautical engineers, and eighteen (18) percent in the flight dispatcher category. The master’s thesis prepared by the author of this paper is the first academic study to specifically address the issues of women in African aviation, specifically in Kenya and South Africa. It shows that wide economic disparities, cultural history and social upbringing are just some of the unique challenges facing young African girls. For example, when they want to enter the aviation industry, many lack male or female role models who could point them toward or guide them in a career in aviation.

Women interviewed in the study who had made an entry into aviation careers said they had struggled with overt or subtle biases during training. Among them were comments from instructors such as,

24 | African-skies | MAY – July 2023 FEATURE

Harriet Quimby

Amelia Earhart

Irene Koki Mutungi

Harriet Quimby Melody Danquah

Asli Hassan Abade

Harriet Quimby Lotfia Elnadi

‘Women are difficult or slow to train,’ or, ‘Girls hurt themselves easily.’ In South Africa, racist remarks were also often made. Among them: ‘These black girls are troublesome...’

However, the biggest challenge in finding a job for African women is not gender, but the few jobs available. This is compounded by gender bias in corporate hiring processes.

In addition to the nature of corporate culture, another important factor is the importance and influence that family and faith have on women aviators and their career advancement. Numerous respondents expressed the difficulty of being a wife and mother while pursuing a career in aviation. One of the Kenyan participants specifically stated that it was impossible to balance both without God’s intervention. The majority of participants from Kenya and South Africa strongly believe that faith in God has shaped their aviation careers to date, and provided them with employment.

A participant from South Africa pointed out an interesting perspective on the topic of family and aviation. She expressed that the difficulty of finding a spouse and starting a family as an African female aviator is a decision influenced by male and African culture. The idea that ‘women don’t want to have children’ or the unspoken ‘African rule’ in households that ‘women should take care of the homestead’ influence the decision for, or against, a career in aviation. Thus, starting a family can simultaneously mean the end of a career in aviation.

The biggest challenge for women in African aviation is accessing the opportunities available to them. This begins with the application process, continues with training, and extends

to everyday work and opportunities for advancement. The existence of educational institutions, the quality and type of training offered, and the suitability and availability of jobs are all important. From the data presented globally on this topic – and the African perspective – it is clear that the challenges faced by women in aviation are not limited to continents. A negative work culture prevails in many companies, work-life balance is problematic, and the negative impact of the pandemic on the labour market is still a dominant issue, especially in Africa. While the corporate culture is inherently competitive, the implicit bias and discrimination against women in many places leads them to leave employment early.

This article is based on a master’s thesis by Maseka Semo-Olesi Kithinji titled, The Aviation Industry in Africa: An Analysis of the Challenges Women in Aviation Face in Kenya, South Africa and Other African Countries in the Department of Business Administration, Professional MBA in Aviation Management at Danube University Krems, Austria.

The Aviation Industry in Africa: An Analysis of the Challenges Women in Aviation Face.

25 FEATURE

MixJet Flight Support Leaders Drive Aviation Industry Advancement Through IASO Collaboration

MixJet Flight Support is a distinguished aviation services company that has made its mark in the industry under the astute guidance of its CEO, Mr. Munir Khalifa, and EVP, Mr. Shukri Khalifa. Both are regarded as stalwarts in the aviation sector, with a wealth of knowledge and expertise in aviation services.

Mr. Munir Khalifa commented on the significance of flight support in the aviation industry: “Flight support is a critical component of the aviation sector, encompassing several disciplines that require a high level of expertise and knowledge to provide comprehensive support to the aviation industry. MixJet Flight Support takes pride in being a premier provider of aviation support services globally.”

Mr. Shukri Khalifa, the EVP of MixJet Flight Support, added, “We believe in innovation and keeping pace with the latest technologies and trends in the aviation industry. Our focus is on providing high-quality services to our customers and ensuring they enjoy a seamless experience. Our team works relentlessly to provide end-to-end support to our customers, from flight planning to on-ground assistance.”

In addition to serving as CEO of MixJet Flight Support, Mr. Munir Khalifa is also the founder of the International Aviation Services Organization (IASO). This non-profit organisation aims to organise, educate, and enhance the aviation services industry by fostering collaboration among aviation services companies worldwide. Through IASO, Mr. Khalifa has played a pivotal role in promoting best practices and providing a forum for consultation on industry issues, leading to substantial improvements in the aviation services industry.

MixJet Flight Support, as a founding member company, is delighted to support IASO’s mission to enhance the aviation services industry. Later this year, IASO is organising an event to introduce the organisation to a broad audience in the region and the world, creating a tremendous opportunity for members and non-members alike to network, share knowledge, and discuss improvements within the industry to make a more sustainable and business-friendly environment.

This upcoming event will provide a platform for industry professionals to share insights and explore opportunities

26 | African-skies | MAY – July 2023 FEATURE

for collaboration while keeping abreast of the latest developments in the aviation services industry. It promises to be a spectacular affair, with MixJet Flight Support leading the way in promoting best practices in aviation services and ensuring the highest level of credibility and representation for IASO members. The dynamic leadership of Mr. Munir Khalifa and Mr. Shukri Khalifa has propelled MixJet Flight Support to the

forefront of the aviation services industry. Their commitment to IASO is instrumental in promoting best practices in the aviation services industry and ensuring credible representation for all members. The forthcoming event provides a unique opportunity to learn more about IASO's work to enhance the aviation services industry and build a network of likeminded professionals passionate about advancing the sector.

27 FEATURE

We believe in innovation and keeping pace with the latest technologies and trends in the aviation industry.

20th anniversary

Kiu System Solutions

This year, 2023, marks the 20th anniversary of Kiu System Solutions, a company that provides a robust and innovative PSS and suite of airline solutions. Our structure combines the best practices of both Legacy and Low-cost systems, therefore, we offer the only new generation hybrid and multi-hosting system that exists in the market today. Today, Kiu System Solutions sits amongst the top 10 PSS providers worldwide.

Kiu, or Knowledge in Use, was born from a lifetime of experience within the travel and tourism industry, with very specific experience gained from airline operations. Alberto Desimone, the CEO and joint Founder of Kiu, has spent a lifetime in travel and tourism which started in 1983, where he founded a wholesale and retail tour operator which rose to become amongst the top five tour operators in Argentina. This fascination with the industry extended and, in 1987, one of the largest tourist attractions in Argentina, ‘Train to the Clouds’ was acquired and operated. 1990 saw a further expansion with the formation of Dinar Airlines, a scheduled and charter air operator which established a wide route network to 40 destinations, both

28 | African-skies | MAY – July 2023 FEATURE

domestic and international from its base in Buenos Aires. The airline operated a fleet of MD83 and Boeing 767 equipment and quickly commanded 25% of the scheduled air service market and 70% of the charter market operating over a hundred charter flights a week. At the time of its sale in 2002, Dinar Airlines had risen to rank as number 109 in the top rated companies of Argentina with an annual turnover of USD $250 million and a staff complement of over 1,000 employees.

During the years of Dinar Airlines, Alberto Desimone, along with Walter Procofio ‘who later went on to become the co Founder and COO of Kiu System Solutions’ identified a gap in the market for an innovative PSS and additional suite of solutions for airlines. Its objective was to support the distribution and selling process of airline inventory while providing friendly tools to improve the passenger experience at all stages and touch points while at the same time cutting distribution costs for the operator. In 2003, Kiu was born and the journey of the business as we know it today commenced.

As of March 2023, Kiu hosts 7.13% of the world’s airlines directly in the Kiu PSS across 33 countries on four continents. We operate our own GDS (code C1) which currently is used by 34,000 travel agencies in our key markets. Our reach across the globe is further enhanced with relationships with indirect distribution and ticketing solutions which enables us, through Kiu GDS, to maximise the presence of our customers globally and increase their sales without the use of legacy GDS systems which comes with all associated costs. Today, Kiu has a vision

to be ‘a world leader in new generation systems’ and to ‘process five percent of the world passenger market’.

Kiu GDS is somewhat unique to our business essentially since we operate our own fully-fledged GDS system (C1). The GDS features the same system functionality as a traditional GDS with no compromise on system functionality. Currently Kiu GDS holds the inventory of 152 airlines in 80 countries. Our airline customers distributing through Kiu GDS have budget certainty that costs are understood and known in regards to GDS activity in that no costs are involved for the airline or the travel agency until a passenger boards a flight at which point a boarded passenger fee is applied – this makes our GDS a very low-cost distribution channel. Within our PSS and GDS we operate our own e-ticket server and EMD-S/EMD-A server and operate in full conformity with the IATA standard. In our low cost model of business, fares are held directly within the PSS or where a customer wishes to have wider distribution through other channels, the operator may fare files through ATPCO. Kiu PSS and Kiu GDS operate in two different interfaces. Firstly we offer the graphic user interface called Kiu-Click which is very simple to use and easy for non-experienced airline or travel agency staff and is very similar to the customer experience when booking online through an internet booking engine. The second interface is the cryptic interface where traditional GDS entries are used to book and issue tickets. The cryptic interface accepts both Amadeus and Sabre commands so individuals with experience on such systems can very quickly work in the Kiu environment with minimal training.

29 FEATURE

We offer the graphic user interface called Kiu-Click which is very simple to use and easy for non-experienced airline.

Both interfaces are available to our customers but also to all travel agencies using Kiu GDS.

Over the years, Kiu has primarily been built on the extensive experience of its employees, ninety percent of which originate from the airline industry coupled with out-of-the-box thinking technical development staff managed by Walter Procofio, COO and joint Founder, who manages the development of functionality and maintains our leading edge hybrid system to ensure we are always current, stay a step ahead and bring innovation to the market while ensuring that we are always responsive to the needs of our customers and the industry. Kiu operates fourteen offices worldwide with a team of approximately 160 employees.

The head office is situated in Buenos Aires, Argentina with a secondary office in Montevideo, Uruguay and customer support and representation offices in Venezuela, France, Spain, the UAE, Bangladesh, South Africa, Portugal, the United Kingdom, Burkina Faso, Peru and Bolivia.

While we offer a comprehensive PSS with over 3,000 functionalities, we complement this with a full suite of integrated solutions:

• Kiu E-Commerce

• Kiu DCS

• Kiu GDS

• Kiu Admin (Revenue Accounting)

• Kiu Cargo

• Kiu Loyalty

• Kiu BI (Business Intelligence)

• Kiu Maintenance

• Kiu Operations

• Kiu Mobile App

• Kiu Web3 (a new distribution platform based on blockchain infrastructure and crypto currency).

In selecting Kiu as a PSS provider, our customer can custom build the system that they need to meet the requirements of their business. As the business develops, additional functionality can be added or specific solutions can be added to suit their changing needs. Our PSS is able to support legacy, low cost, charter and startup operations – and we always believe that no company is ever too small for our suite of solutions. We fully support unilateral or bilateral codeshare and interline operations as well as distribution through the legacy GDS systems.

Our client base and footprint in the market was launched in South America and grew exponentially. There was a

30 | African-skies | MAY – July 2023 FEATURE

natural connection with Spain and thus our footprint organically reached Europe. This was followed by entry into Middle Eastern and Asian markets and an uptake of our PSS on the African continent. With increasing competition and rising costs, our multi-hosting hybrid system provides the necessary tools to airlines for commercial success. In the last three years, we have attracted 39 new clients which represents a 90% growth over 2019. It seems that the industry is tiring of the high cost associated with traditional distribution channels and seeks alternative solutions which offer excellent value and functionality propositions supported by excellence in customer service and support.

When COVID-19 arrived on our shores not only was the airline industry hit with catastrophic conditions, but this extended to its support partners. Our primary income is derived from the volume of flown passengers in our network in that the majority of our income is derived from boarded passenger fees and so needless to say with few passengers in the air, our revenue stream was significantly reduced. As we realised that COVID was not going to be a short-term hit, we made a decision that there was an opportunity during this period to further develop our products and thus deployed our teams on projects for the future. We continued with integrations for airlines however we could no longer travel and be on site for training and migrations as was always the norm in this industry. This forced us to explore online tools that would allow us to provide training and support in an effective way for our customers with the reassurance that there was no reduction

in overall quality of the product. Today, our customers tell us that they prefer this solution as it is flexible, allows larger numbers of people to attend training from multiple locations simultaneously and reduces the typical costs and logistics associated with training, those being staff travel, hotel and per diems and managing staff workloads for longer periods of time. We took this a step further and made significant investment in our online help platform. Today our help and support platform is extensive allowing not only operators using our PSS but also travel agents using our GDS to download manuals, chat in community groups, create tickets to report system issues and further track progress, but more importantly we developed a tool and increased staffing levels so that we now offer 24/7/365 human support. At any point while on the help platform, the travel agent or airline agent can request an immediate call back and in seconds, one of our customer service representatives will call in live time allowing a full discussion and in most instances an instant resolution of a problem is achieved. Customer support is multilingual. Today we believe more than ever that excellence in customer support and service is a differentiator for Kiu in our sector.

Another differentiator within our suite of solutions is Kiu BI or our Kiu Business Intelligence module. This is an information platform that allows the airline to see in real terms the performance of flights as far out as 330 days from departure in terms of sales, reservations and flown data. The system is updated every fifteen minutes. All sales channels are captured

31 FEATURE

and updated at this frequency so the airline has the real picture of performance and can make operational decisions based on robust data. Its robust and flexible database has the capacity to generate statistics according to individual operator needs.

Our revenue accounting solution, Kiu Admin, is very comprehensive and can work as a stand alone solution. We have clients hosted in legacy systems who have chosen Kiu Admin because of its comprehensive functionality and ability to integrate into other systems. Some additional facts:

• Kiu PSS features over 3,000 different functionalities.

• Kiu is cloud based using Amazon Web Services with redundancy.

• There is minimal latency due to servers located in both North America and Europe.

• Customers receive updates of the system at no cost.

• The system requires minimum bandwidth requirements.

• We support a catalogue of over 400 different ancillary services all supported by ATPCO for the sale of ancillaries allowing an operator to

maximise revenues in creative and different ways. Ancillary services can be sold at all points in the travel experience both pre and post ticketing and and during checkpin and is achieved with the issuance of an EMD-A or EMD-S as may be applicable to the specific service or product.

• Our DCS is approved in common airport platforms (CUTE) SITA, ARINC, Ultra, Resa.

• We offer Interline Through Check-in (IATCI).

• We manage APIS or PNRGOV as required.

• Our PSS fully supports interline agreements, unilateral and bilateral codeshare, Interline Through Check-in (IATCI) and connectivity with other GDSs.

• We have developed a tool unique to Kiu to specifically manage hard and soft block sales in seamless fashion. This tool is called Kiu Allotment Manager (KAM).

• The operator manages the system back end so the operator is not dependent on Kiu when changes are required although we are always there to help – 24/7/365.

Going forward, there are a number of projects in development. Firstly, through our relationship with TravelX, Kiu will launch a new product, Web3, a product that works with crypto currency and blockchain technology allowing us to be the first PSS to offer distribution through this channel. Another project will be the release of Kiu GDS Direct to the market as a standalone product which will allow airlines using any PSS in the market to distribute their own product through our platform with immediate access to our network of travel agencies already using our system.

For a more comprehensive understanding of our system visit our website at www.kiusys.com where you are also able to make contact with us. You are also welcome to contact our Commercial Director for Africa, Rodger Whittle, by e-mail at rwhittle@kiusys.com

32 | African-skies | MAY – July 2023 FEATURE

Passion to create a sustainable future

As the world’s priorities change to focus on environmental impact, Embraer is doing everything possible to make sure E-jets are some of the most sustainable aircraft in the sky –and have been doing so for some time.

It is not just the aircraft – the commitment to sustainability is at the core of Embraer’s entire production chain, from processes,

facilities, to the supply network. It was the first company in the aviation industry to achieve the ISO 14001 in Dow Jones Sustainability Index standard certification for its Environmental Management System in principal facilities and continues to lead with some of the industry's most robust ESG goals to date

33 FEATURE

Innovation is in our DNA Embraer believes that the transition to a low-carbon economy and the need to adapt air transportation to this new model represents a great opportunity. The aircraft manufacturer is stepping up the efforts to minimise the carbon footprint by remaining dedicated to innovative

solutions that have a broader impact on customers, local communities, and on the aircraft. Embraer aims to decarbonise its direct and indirect operations by focusing mainly on carbon reduction and efficiency. Excluding product use, the Scope 1 and 2 emissions are estimated to account for close to 75% of the company's footprint

which is why it is the priority in this space. On top of that, considering product use, since the aircraft that we design and build account for meaningful carbon emissions, it's imperative to innovate designs and technologies with sustainability in mind. Toward this goal, we aim to bring best-inclass aircraft to market at an accelerated pace to help customers and partners meet their climate goals. This is a team effort, and we must work across industries and borders to address the climate crisis. –said Daniel Galhardo Gomes, Product Strategy Director at Embraer Commercial Aviation.

SUSTAINABILITY IN ACTION.

Net zero carbon emissions by 2050. Making regional aviation cleaner and quieter. Our sustainability roadmap and product development plan have been constructed to help us achieve these goals. Our new generation E2 is the most fuel efficient single-aisle aircraft in the market today with a potential reduction of CO2 emissions up to 30%. In 2025 we are planning the first flight of our hydrogen-powered electric demonstrator.

Between 2027 and 2030 expect to see our next generation turboprop and E2 flying 100% SAF compatible. By the

mid-2030s we are planning to introduce the sustainable Energia family of aircraft, powered by revolutionary propulsion architectures. 2045 will likely see the flight of our first hydrogen-powered turboprop and finally, in 2050, a hydrogen-powered E2 or similar sized aircraft will take to the skies.

Undoubtedly these are bold and ambitious steps, but with over 50 years of market knowledge and expertise behind us, we are confident that we will deliver what we set out to do, transforming the way we all fly.

Design for Environment is an important driver of innovation at Embraer. It prioritises resources and processes with low environmental impact, minimises energy consumption and materials used, optimises product and materials lifecycle, and facilitates disassembly for reuse and recycling as part of a circular economy. Multidisciplinary Design Optimization is Embraer’s key performance indicator approach to aircraft design which has an eye towards efficiency and reducing carbon footprint. This process ensures optimal performance and is built into every design from the start with aerodynamics, aero-propulsion optimum integration, and light-weighting of airframes as part of Embraer’s core multidiscipline design optimisation process that drives down aircraft energy usage and improves CO2 emissions savings. The company also cuts emissions by eliminating the autoclave process for its thermoplastic composite materials, which can save up to 40% of energy consumption during the manufacturing process.

34 | African-skies | MAY – July 2023 FEATURE

2045 2050 NG Turboprop H2 Energia Hybrid Energia Electric Energia H2 Fuel Cell NG Turboprop 100% SAF Energia H2 Gas Turbine 2030 2035 2040 E2 100% SAF 2045 2050 NG Turboprop H2 Energia Hybrid Energia Electric Energia H2 Fuel Cell NG Turboprop 100% SAF Energia H2 Gas Turbine 2030 2035 2040 TODAY 2025 E2 – Most efficient single-aisle aircraft E2 100% SAF

Disruptive technology, radical new aircraft, and electric propulsion

While there has been a 2% per year fuel burn reduction since 1970, combustion engines are reaching their fuel efficiency limit. To design for the lowest carbon propulsion, we cannot rely on just swapping equipment or fuels in current aircraft designs. Rather, Embraer is taking a system-thinking approach to go beyond ‘tubes and wings’ to a whole redesign of what the future of aircraft can be. Right size, right weight, right propulsion –Embraer is engineering a full revision of what aircraft of the future can and should be to truly advance a climate-neutral pathway for flight.

Embraer joined the Target True Zero initiative launched by the World Economic Forum (WEF) as part of the commitment to achieve zero-emissions aviation goals through new propulsion and fuel technologies. The initiative will identify ways to accelerate the deployment of zero-emissions aviation by leveraging electric and hydrogen technologies. Small aircraft, meaningful impact It will take an all-in approach when considering efficiency technology, so it’s important to align the best energy alternative with the appropriate design. This alignment will maximise carbon savings, dependent on aircraft size and type, to drive peak performance and optimal footprints. Embraer believes it can make the most significant impact in small and regional aircraft with that in mind.

• Regulations have changed, allowing small airplanes to move to electric, so Embraer is working to bring this technology to market.

• The new era of electric aviation should start with small and regional aircraft rather than larger jets.

• Embraer has a strong record of safety, proven technological capability, and know-how to get equipment certified for use faster.

• Embraer believes that electrification is another way to facilitate the opening of new markets with intercity mobility and open more doors to underserved economies.

Prioritising the energy transition of regional aircraft can offer gains in efficiency while reducing emissions and costs that make it possible to provide additional routes while creating access to underserved communities and rural areas. In the U.S., over 5,000 regional airports are not in active use as current fleets in the marketplace are not costeffective with the business-as-usual model. Using existing infrastructure to reinstate more regional service, Embraer aims to revolutionise the market with new technology and fleet options that can enable more efficient routes – reducing total overflown miles and associated fuel usage – all while allowing airlines to stay cost-competitive and profitable.

Research collaborations on SAF

Until future technologies are available on the market, SAF will play a key role in reducing aviation emissions in the short and medium term. Embraer has a history of alternative fuel innovation, with our first ethanol-powered aircraft certified back in 2004. The manufacturer promotes the development and adoption of biofuels, mainly SAF, by sponsoring research and development through multipartner engagements. We partner with BioValue and BECOOL multi-stakeholder conveners of academia, the private sector, and research laboratories to help make our aspirations into realities. Together, we have advanced biofuels, SAF, and the

35 FEATURE

technical, economic, environmental, and social assessment of various biomass production systems and biorefinery configurations. Embraer had begun the use of SAF in its U.S. operations starting in 2021.

Embraer’s goals to shape the green future of aviation

Carbon Neutral operations by 2040 –Scope 1+2:

• Aligned with Paris Agreement goal to limit global warming to 1.5 degrees Celsius.

• 50% reduction in net carbon emissions by 2040 from a 2018 Baseline.

• 100% energy from renewable sources by 2030 and intermediate goal of at least 50% renewable by 2025.

• Begin using Sustainable Aviation Fuel (SAF) in 2021 and aim for at least 25% by 2040.

• Offsetting any residual emissions that will not be reduced through efficiency

projects, available alternative energy or advancing technology.

Carbon-Neutral Growth from 2022 (2021 baseline) – Scope 1+2:

• Commit to capping carbon emissions to 2021 levels while growing operations.

Net Zero Aviation by 2050 (Scope 3) will be achieved by:

• Developing products, services, and disruptive sustainable technologies including electrification, hybrid, biofuels including SAF and other innovative energy alternatives.

• Working together with suppliers to make our current aircraft compatible with the use of 100% SAF.

• Actively working with the supply chain to expand the global SAF production scale.

• Continuously improving the efficiency of our current aircraft until the certification of new technologies.

Launch zero-emission eVTOL aircraft by 2026.

36 | African-skies | MAY – July 2023 FEATURE

Embraer aims to revolutionise the market with new technology and fleet options that can enable more efficient routes.

Airlines taxes and charges in Africa article on study done by the African Airlines Association

Introduction

The COVID-19 pandemic unprecedently marked the year 2020. The global economy almost stopped, resulting in a 3.5% contraction, the worst performance since the 1930s. Since early 2021, the global economy is gradually recovering with the ease of many restriction measures. The GDP rebounded by 5.7% last year, and the growth is expected to continue, despite an anticipated slowdown due to the Russia-Ukraine war and its economic repercussions.

The travel and tourism industry was particularly impacted: with the borders closures, travel bans, and lockdowns taken in almost all countries worldwide, the number if international tourist arrivals dropped by 72.8% in 2020. Unfortunately, 2021 was another challenging year for the industry, as the number of international tourists rebounded by only 9%. In Africa particularly, the rebound compared to 2020 was insignificant: 0.8% only.