2022 MID-YEAR REPORT

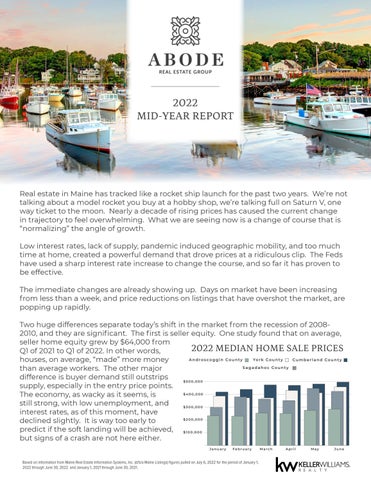

Real estate in Maine has tracked like a rocket ship launch for the past two years. We’re not talking about a model rocket you buy at a hobby shop, we’re talking full on Saturn V, one way ticket to the moon. Nearly a decade of rising prices has caused the current change in trajectory to feel overwhelming. What we are seeing now is a change of course that is “normalizing” the angle of growth. Low interest rates, lack of supply, pandemic induced geographic mobility, and too much time at home, created a powerful demand that drove prices at a ridiculous clip. The Feds have used a sharp interest rate increase to change the course, and so far it has proven to be effective. The immediate changes are already showing up. Days on market have been increasing from less than a week, and price reductions on listings that have overshot the market, are popping up rapidly. Two huge differences separate today’s shift in the market from the recession of 20082010, and they are significant. The first is seller equity. One study found that on average, seller home equity grew by $64,000 from Q1 of 2021 to Q1 of 2022. In other words, houses, on average, “made” more money than average workers. The other major difference is buyer demand still outstrips supply, especially in the entry price points. The economy, as wacky as it seems, is still strong, with low unemployment, and interest rates, as of this moment, have declined slightly. It is way too early to predict if the soft landing will be achieved, but signs of a crash are not here either. Based on information from Maine Real Estate Information Systems, Inc. (d/b/a Maine Listings) figures pulled on July 6, 2022 for the period of January 1, 2022 through June 30, 2022 and January 1, 2021 through June 30, 2021.