2025 Spring Update

Inventory has been the biggest challenge in housing for the past five years, and it is very much a story of regional differences. This recent statistic from Newsweek illustrates the stark contrast, noting that “the state of Florida has 177,000 homes for sale, the most on record, while the entire Northeast has 77,000 homes for sale.” So if you want a deal—and especially if you can tolerate the risky condo market in the Sun Belt—head south!

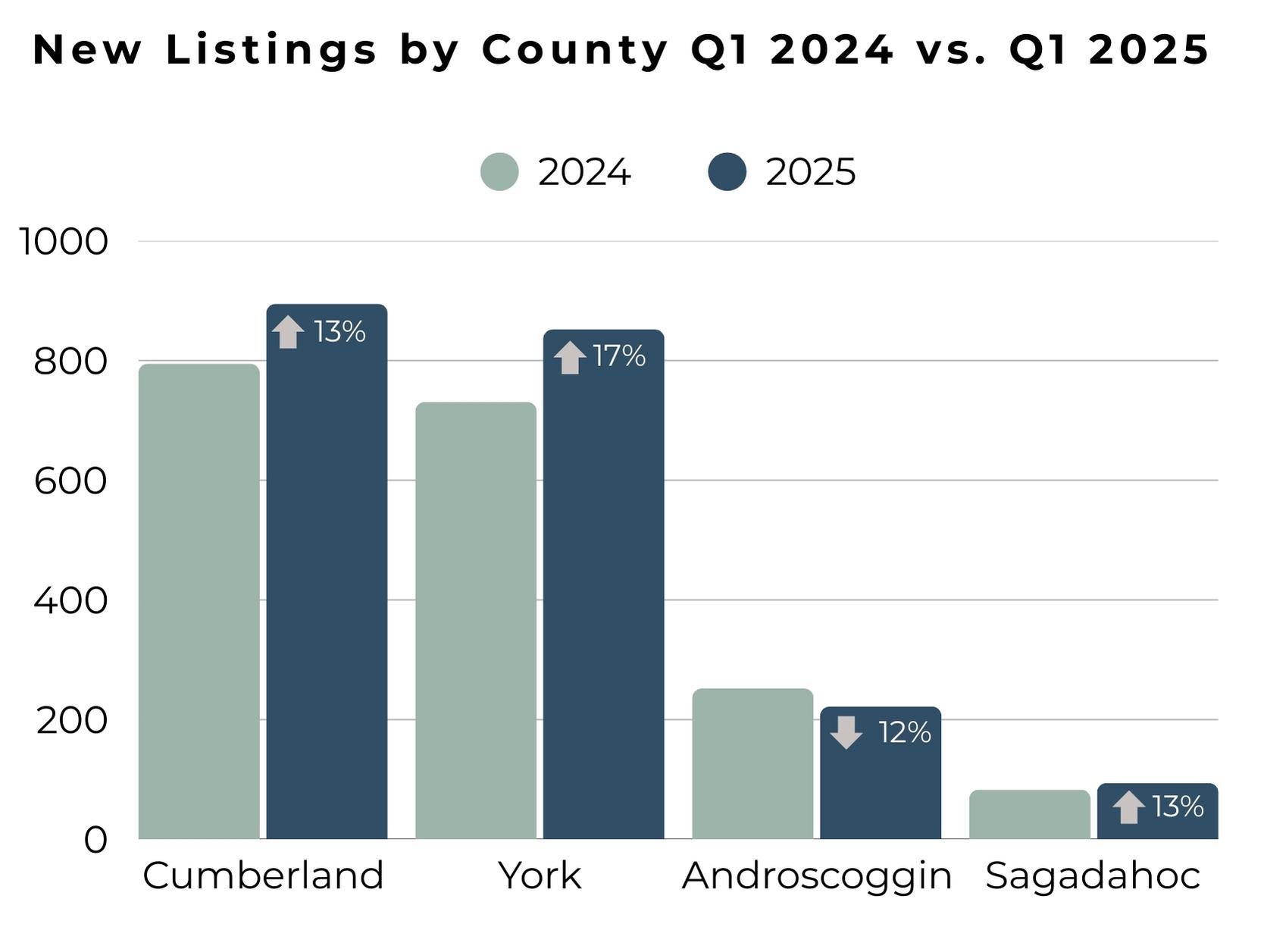

However, if you’ve been waiting for the tide to turn here in Maine, the market is shifting, at least in terms of choices. In Cumberland County, the number of condominiums for sale increased 30% during Q1 (January–March) of 2025; however, the average sale price changed less than 1% and held steady at around $560K. The number of single-family homes for sale went up 9%, and the average price there also changed less than 1%.

For buyers, this shows up as having more time to see homes and consider an offer, more opportunities to compete against cash offers, the return of home inspections as a reasonable expectation, and even the chance to negotiate on price—subtle but very welcome changes for those who have struggled in the market over the past few years.

Pricing Smarter in Today’s Market

When you start to look at sold prices by town, the numbers can look extreme. For example, in the chart on the right, the median price in Gray went up 56% in the first quarter of 2025! In Gray, the number of sales increased from 12 to 20 as a slew of new construction homes priced in the $700s sold, driving up the price point for the whole town.

It’s important to drill down by price range within each town, whether you’re a buyer or a seller. For instance, the entry-level price point in Portland is in the $400s, and sales this spring have been brisk. As of today, there are only four homes for sale in that range, while there are eight for sale in the $800s.

An article in the Portland Press Herald noted that Maine home sale prices in March decreased after “72 straight months of year-over-year rises.” The dip in median sales price was just shy of 1%; however, the reporter noted that the last year-over-year decrease before that was in March of 2019, when prices fell almost 1% to $200,000.

As the market normalizes—and perhaps even drops a bit—sellers are often the last to adjust to the present market. They remember how their neighbor’s house sold far over list price for cash and with no inspection. Buyers, on the other hand, live in the present—looking at what’s for sale right now and how those homes compare in condition and turnkey features.

If you’re thinking of selling in the next year or two, or considering a major renovation, it’s wise to have a consultation on what improvements will give you the best return on investment. And it’s always easier to start sooner rather than later when planning a move!

Median Home Prices Q1 2024 vs 2025

1st Quarter 2024 vs 1st Quarter 2025

Greater Portland Southern Maine

Midcoast Central Maine

Lakes Region and Lewiston-Auburn

$325,000 5%