2022 Fall Update

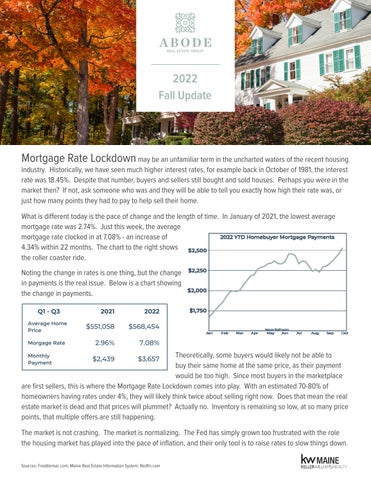

Mortgage Rate Lockdown may be an unfamiliar term in the uncharted waters of the recent housing industry. Historically, we have seen much higher interest rates, for example back in October of 1981, the interest rate was 18.45%. Despite that number, buyers and sellers still bought and sold houses. Perhaps you were in the market then? If not, ask someone who was and they will be able to tell you exactly how high their rate was, or just how many points they had to pay to help sell their home. What is different today is the pace of change and the length of time. In January of 2021, the lowest average mortgage rate was 2.74%. Just this week, the average mortgage rate clocked in at 7.08% - an increase of 4.34% within 22 months. The chart to the right shows the roller coaster ride. Noting the change in rates is one thing, but the change in payments is the real issue. Below is a chart showing the change in payments.

Theoretically, some buyers would likely not be able to buy their same home at the same price, as their payment would be too high. Since most buyers in the marketplace are first sellers, this is where the Mortgage Rate Lockdown comes into play. With an estimated 70-80% of homeowners having rates under 4%, they will likely think twice about selling right now. Does that mean the real estate market is dead and that prices will plummet? Actually no. Inventory is remaining so low, at so many price points, that multiple offers are still happening. The market is not crashing. The market is normalizing. The Fed has simply grown too frustrated with the role the housing market has played into the pace of inflation, and their only tool is to raise rates to slow things down. Sources: Freddiemac.com, Maine Real Estate Information System, Redfin.com