1951 Camp Greene St

Current Owner of Record:

Bou Ghanem

Project Type: PUD Condominium Cooperative Other (describe)

applicable):

Market Area Name: Map Reference: Census Tract:

The purpose of this appraisal is to develop an opinion of: Market Value (as defined), or other type of

This report reflects the following value (if not Current, see comments): Current (the Inspection Date is the Effective Date)

Approaches developed for this appraisal: Sales

To assist the client(s) in determining market value.

Alaa Bou Ghanem

Alaa Bou Ghanem

Location: Urban Suburban Rural

Built up: Over 75% 25-75% Under 25%

Growth rate: Rapid Stable Slow Property values: Increasing Stable Declining Demand/supply: Shortage In

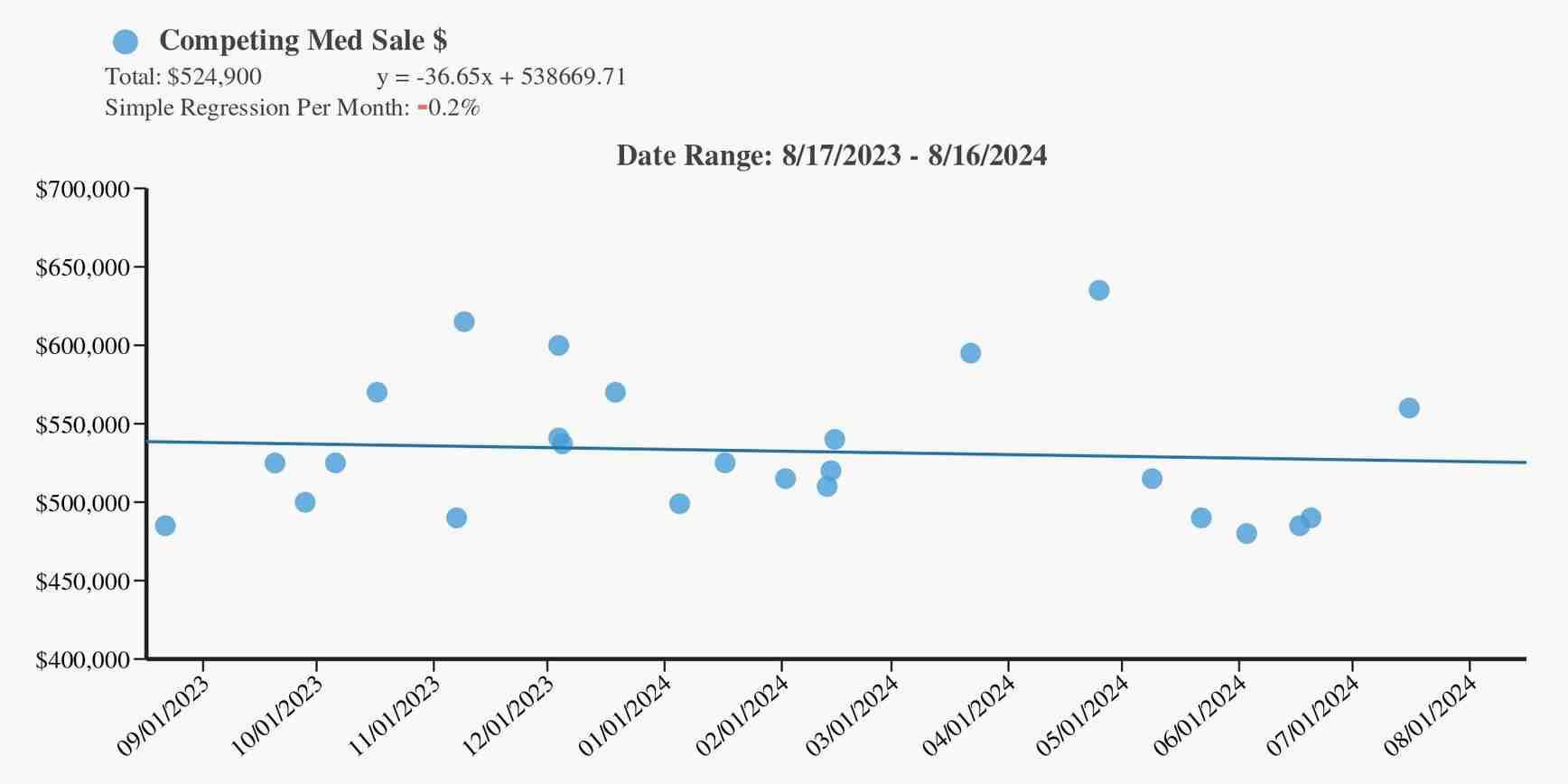

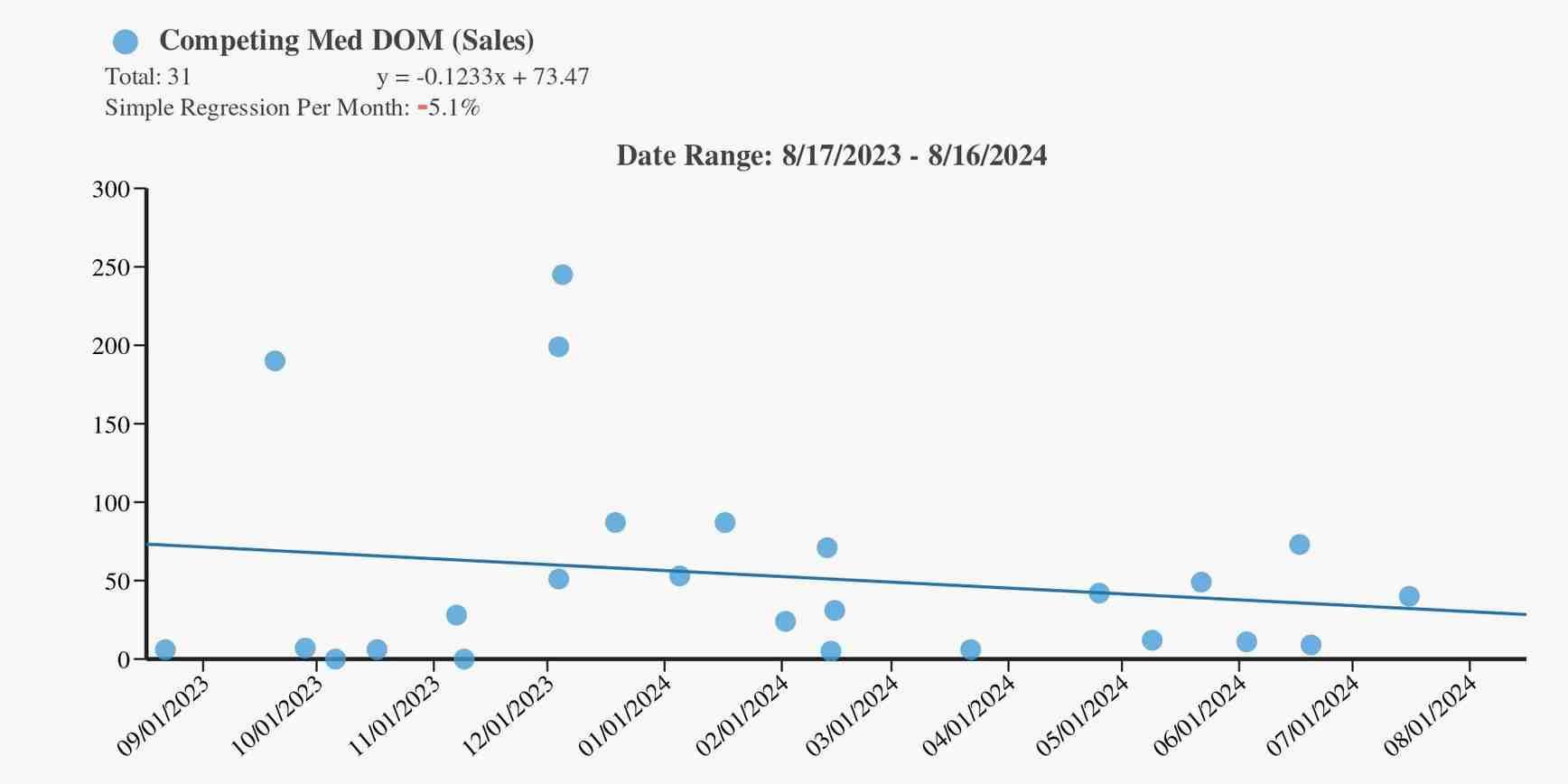

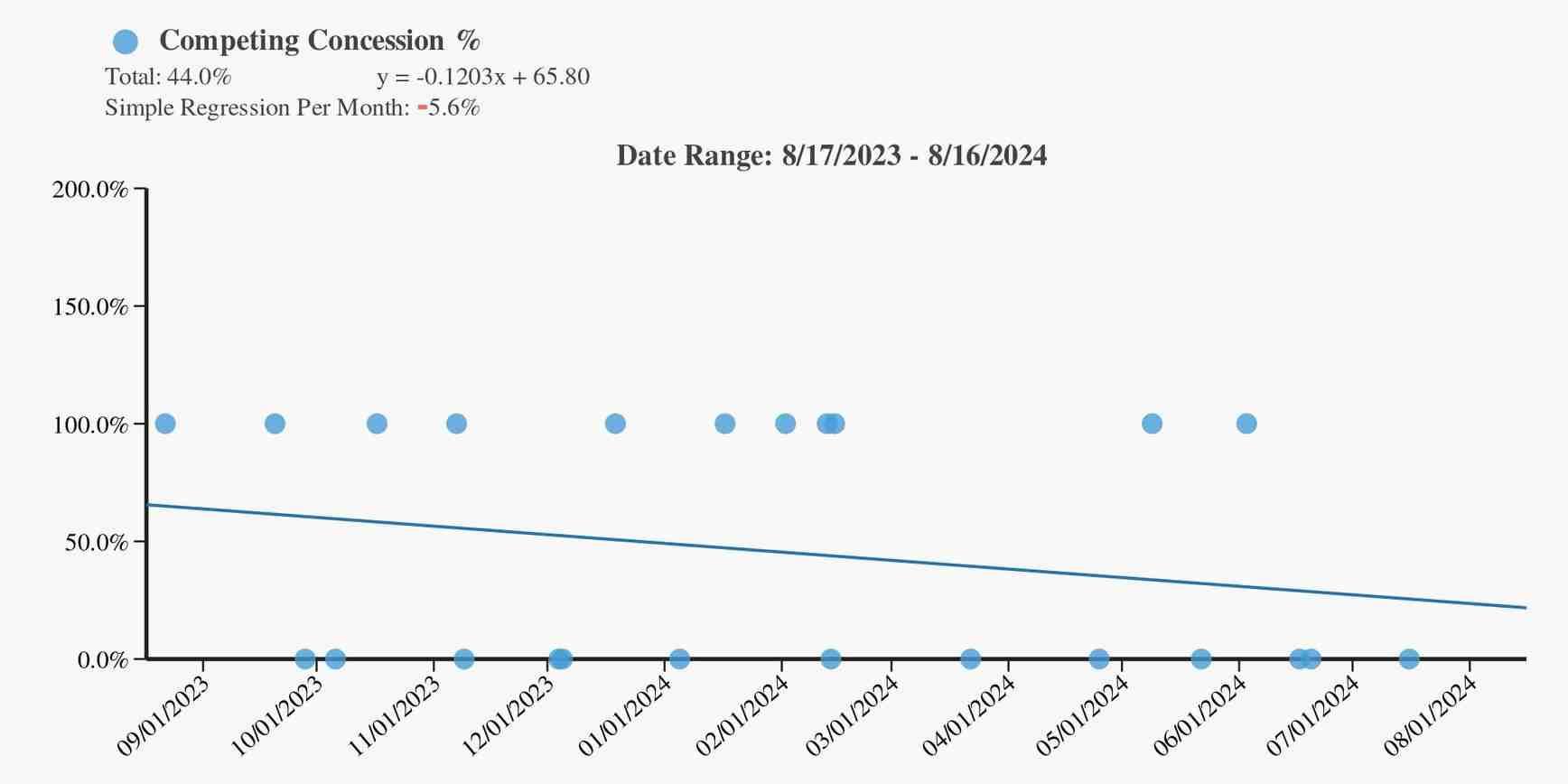

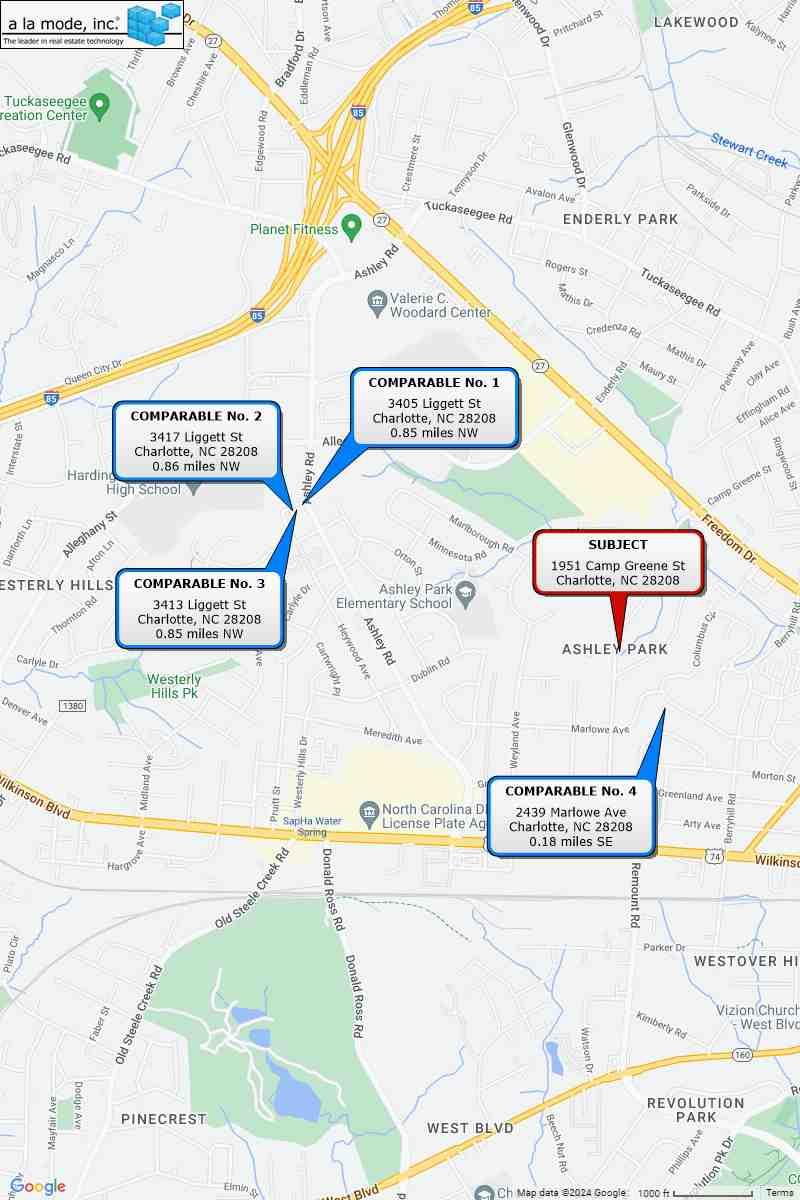

I-85 to the north, West Blvd. to the south, W. Brookshire Fwy./I-77 to the east, and Charlotte Rte 4 to the west. An analysis was performed on 25 competing sales over the past 12 months. For those sales, a total of 44.0% were reported to have seller concessions. This analysis shows a change of -5.6% per month. The sales within this group had a median sale price of $524,900 with a low of $480,000 and a high of $635,000. This analysis shows a change of -0.2% per month. Based on all sales in this same group, there is a 3.4 month supply. This analysis shows a change of -5.6% per month. These sales had a median DOM of 31. This analysis shows a change of -5.1% per month. For those sales, a total of 0.0% were reported to be REO. Information reported in the CanopyMLS system (using an effective date of 08/16/2024) was utilized to arrive at the results noted on this addendum. Any percent change results noted in these comments are based on simple regression.

Zoning District See attached addendum.

See attached addendum.

No apparent adverse easements or encroachments noted or observed. Appraiser assumes typical utility easements. There are no non-residential land usage or potential external influences near the subject property that impact the marketability or value.

County Records, Realist

05/12/2023

$235,000

County Records, Realist

The subject had a prior arms length, market oriented transfer on 05/12/2023 for $235,000 prior to the parcel split (Warranty Deed - Doc #38116-478). There are no further transfers to note.

Proximity

CNPYMLS #3938630/DOM 190 CountyRec/ApprFiles/Realist

ArmLth

CNPYMLS #4059516/DOM 1 CountyRec/ApprFiles/Realist

ArmLth

Conv/0 10/06/2023

Simple

CNPYMLS #4124974/DOM 12 CountyRec/ApprFiles/Realist

ArmLth

Quality

Most adjustments were based upon a paired sales analysis with consideration to local building costs, appraiser's knowledge and experience of the market area, current trends, and research of marketability differences in property characteristics. Some line items may not warrant an adjustment if the variance is not perceived by the market, or if there is insufficient data to derive an adjustment. Adjustments for GLA were made at $110 per square foot and were rounded to the nearest $100. Adjustments were not made for differences of less than 100 square feet.

Generally, land valuations were based on recent vacant lot sales, or overall market data extracted from county records, MLS sales data, and where appropriate. Land valuations may also be based on the allocation method, which establishes a ratio for land value to total property value for a given market area, or extraction method.

Comments on Cost Approach (gross living area calculations, depreciation, etc.):

Physical depreciation, attributable to normal wear and tear, is estimated to be 0%. No functional or external obsolescence observed. DwellingCost cost figures generally used, except when local figures are available. If the subject is over 5 years old, the cost approach is risky at best and should not be relied upon. Eff. Age 0/Econ. Life 60 Years = 0% Phy. Depr.

Estimated Remaining Economic Life (if required):

INCOME APPROACH TO VALUE (if developed) The Income Approach was not developed for this appraisal.

Estimated Monthly Market Rent $ X Gross Rent Multiplier = $

Summary of Income Approach (including support for market rent and GRM):

Indicated Value by Income Approach

PROJECT INFORMATION FOR PUDs (if applicable) The Subject is part of a Planned Unit Development.

Legal Name of Project:

Describe common elements and recreational facilities:

See attached addendum.

This appraisal is made ''as is'', subject to completion per plans and specifications on the basis of a Hypothetical Condition that the improvements have been completed, subject to the following repairs or alterations on the basis of a Hypothetical Condition that the repairs or alterations have been completed, subject to the following required inspection based on the Extraordinary Assumption that the condition or deficiency does not require alteration or repair:

to completion of builder's plans and specs.

This report is also subject to other Hypothetical Conditions and/or Extraordinary Assumptions as specified in the attached addenda. Based on the degree of inspection of the subject property, as indicated below, defined Scope of Work, Statement of Assumptions and Limiting Conditions, and Appraiser’s Certifications, my (our) Opinion of the Market Value (or other specified value type), as defined herein, of the real property that is the subject of this report is: $ , as of: , which is the effective date of this appraisal. If indicated above, this Opinion of Value is subject to Hypothetical Conditions and/or Extraordinary Assumptions included in this report. See attached addenda.

true and complete copy of this report contains pages, including exhibits which are considered an integral part of the report. This appraisal report may not be properly understood without reference to the information contained in the complete report. Attached Exhibits:

Date of Report (Signature):

Expiration Date of License or Certification: Inspection of Subject:

SUPERVISORY APPRAISER (if required) or CO-APPRAISER (if applicable)

Supervisory or Co-Appraiser Name: Company: Phone: Fax: E-Mail:

Date of Report (Signature):

License or Certification #: State: Designation: Expiration Date of License or Certification:

Inspection of Subject: Interior & Exterior Exterior Only None Date of Inspection:

Borrower/Client

Property Address

N/A

City County State Zip Code

Lender

1951 Camp Greene St Charlotte Mecklenburg NC 28208

Alaa Bou Ghanem

-ThisrealpropertyappraisalreporthasbeenpreparedundertheUniformStandardsofProfessionalAppraisalPracticeoption entitled“AppraisalReport.”

-Althoughtheappraisalcommunicatedinthisreportwasnotpreparedforafinancialinstitution,thedefinitionofmarketvalue specifiedinregulationspublishedpursuanttoTitleXIoftheFinancialInstitutionsReform,Recovery,andEnforcementActof 1989(FIRREA)hasbeenusedinthisassignment.

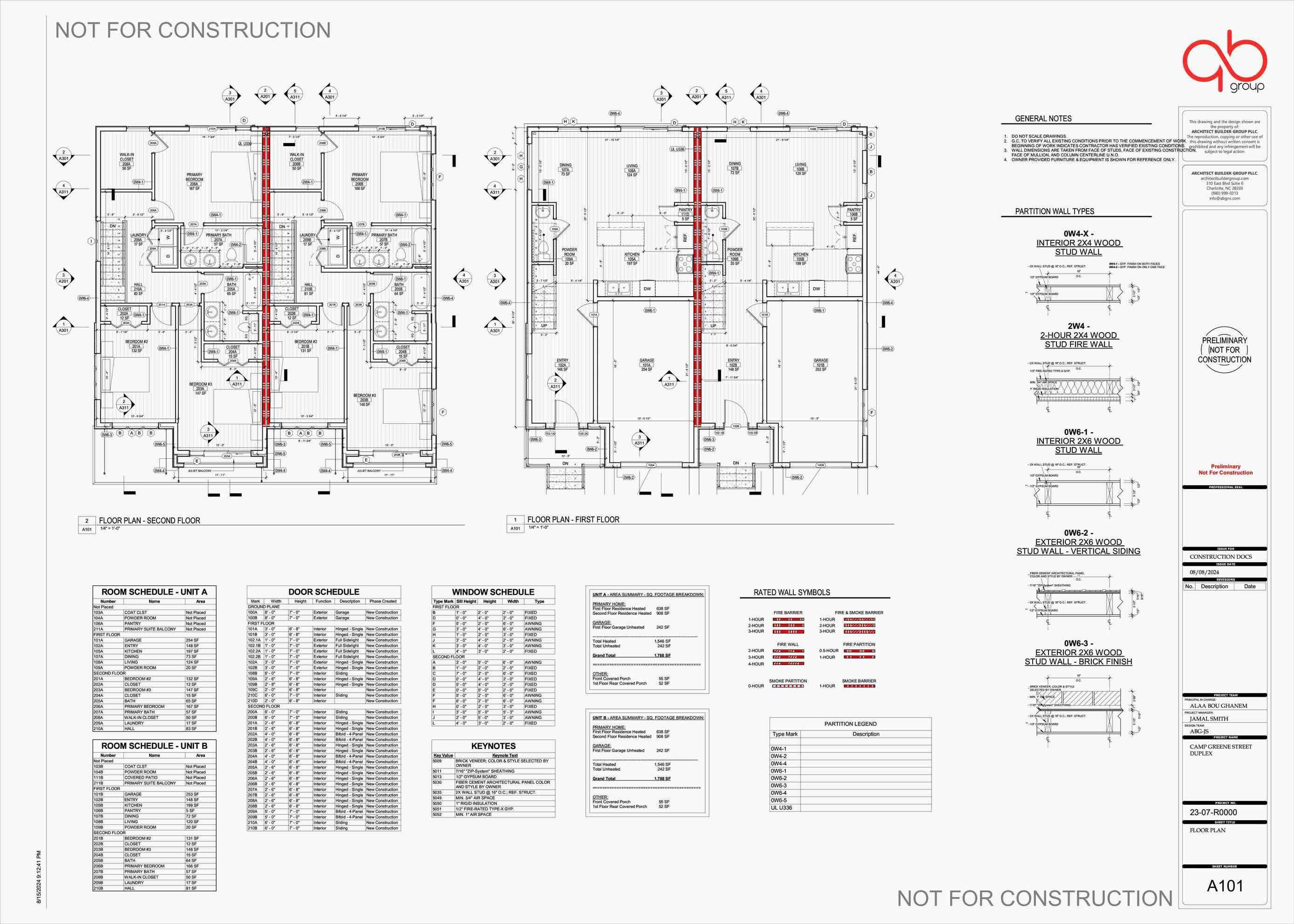

-TheappraiserwasunabletoabidetoANSIZ765-2021standards,asplandimensionswereusedinsteadofactual measurementsincalculatingsquarefootage.Thesubject'sfinishedsquarefootagemayvaryfromthefinishedsquarefootage ofthehouseasbuilt.

-Theappraiserhasviewedthepropertysolelyforvaluationpurposesandtoobservepropertycharacteristicsthatatypical purchaserwouldconsiderintheirdecisionmakingprocess,aswellasthoseitemsoutlinedintheassumptionsandlimited conditionsandcertificationtothisappraisal.Personalpropertywasnotincludedintheappraisedvalue

-Theappraiserhasdeterminedthatthesalescomparisonandcostapproachestovaluearebothrelevantanalysesinthis assignment.Bothhavebeencompletedandwereconsideredwhendeterminingthesubject’sfinalestimateofvalue.

Developmentoftheincomeapproachwasnotnecessarytodevelopacredibleopinionofvalue.Therewasnotsufficientrental datawithinthismarketareatodeveloptheincomeapproach.

-ComparablesalesdatawastakenfromlocalMLS(CanopyMLS)andconfirmedviapublicrecordsand/ordiscussionswith listingagents.

-Thiscompletevisualinspectionisnotintendedtobethesamedepthorforthesamepurposeasahomeinspection.Personal propertywasnotincludedintheappraisedvalue.Theappraiser'sinspectiondidnotincludeidentificationortestingformold, radon,lead-basedpaint,UFFI,asbestos,orotherenvironmentalhazards,asidentificationofthesesubstancesisbeyondthe scopeoftheappraiser'sexpertise.

-Thisappraisalwasperformedwithnohypotheticalconditions.

-Thisappraisalwasmadesubjecttocompletionofbuilder'splansandspecs.Thisconstitutesanextraordinaryassumption.Use ofthisextraordinaryassumptionmayaffectassignmentresults.

-Theappraiserhasconcludedthehighestandbestuseoftheproperty,asimproved,tobeit'scurrentuse.Thisopinionis supportedbythefactthattheimprovedpropertyisphysicallypossible(seeimprovementsdescriptionandpictures),isa legaluse(seesitesection/zoning),isfinanciallyfeasible(seesalescomparisonapproachforsalesofsimilarproperties),and isconsideredtobethemaximallyproductiveuse(improvementscontributepositivelytothesiteanditwouldnotbefeasible tochangethemtoamoreproductiveusewithoutsubstantialcapitalimprovement).

-Theappraiserwillnotberesponsibleformattersofalegalnaturethataffecteitherthepropertybeingappraisedorthetitletoit, exceptforinformationthatheorshebecameawareofduringtheresearchinvolvedinperformingthisappraisal.Theappraiser assumesthatthetitleisgoodandmarketableandwillnotrenderanyopinionsaboutthetitle.

-Theappraiserwillnotgivetestimonyorappearincourtbecausehemadeanappraisalofthepropertyinquestion,unless specificarrangementstodosohavebeenmadebeforehand,orasotherwiserequiredbylaw.

-Unlessotherwisestatedinthisappraisalreport,theappraiserhasnoknowledgeofanyhiddenorunapparentphysical deficienciesoradverseconditionsoftheproperty(suchas,butnotlimitedto,neededrepairs,deterioration,thepresenceof hazardouswastes,toxicsubstances,adverseenvironmentalconditions,etc.)thatwouldmakethepropertylessvaluable,and hasassumedthattherearenosuchconditionsandmakesnoguaranteesorwarranties,expressorimplied.Theappraiserwill notberesponsibleforanysuchconditionsthatdoexistorforanyengineeringortestingthatmightberequiredtodiscover whethersuchconditionsexist.Becausetheappraiserisnotanexpertinthefieldofenvironmentalhazards,thisappraisalreport mustnotbeconsideredasanenvironmentalassessmentoftheproperty.

-Icertifythat,tothebestofmyknowledgeandbelief:

-Thestatementsoffactcontainedinthisreportaretrueandcorrect.

-Thereportedanalyses,opinions,andconclusionsarelimitedonlybythereportedassumptionsandlimiting conditionsandaremypersonal,impartial,andunbiasedprofessionalanalyses,opinions,andconclusions.

-Ihavenopresentorprospectiveinterestinthepropertythatisthesubjectofthisreportandnopersonalinterest withrespecttothepartiesinvolved.

-Ihavenobiaswithrespecttothepropertythatisthesubjectofthisreportortothepartiesinvolvedinthis assignment.

-Myengagementinthisassignmentwasnotcontingentupondevelopingorreportingpredeterminedresults.

-Mycompensationforcompletingthisassignmentisnotcontingentuponthedevelopmentorreportingofa predeterminedvalueordirectioninvaluethatfavorsthecauseoftheclient,theamountofthevalueopinion,the attainmentofastipulatedresult,ortheoccurrenceofasubsequenteventdirectlyrelatedtotheintendeduseof

N/A

Property Address

City County State Zip Code

Borrower/Client Lender

1951 Camp Greene St Charlotte Mecklenburg NC 28208

Alaa Bou Ghanem

thisappraisal.

-Myanalyses,opinions,andconclusionsweredeveloped,andthisreporthasbeenprepared,inconformitywith theUniformStandardsofProfessionalAppraisalPractice.

-Ihavemadeapersonalinspectionofthepropertythatisthesubjectofthisreport.

-Nooneprovidedsignificantrealpropertyappraisalassistancetothepersonsigningthiscertification.

-Iselectedandusedcomparablesalesthatarelocationally,physically,andfunctionallythemostsimilartothe subjectproperty.

-Ihavemadeadjustmentstothecomparablesalesthatreflectthemarket'sreactiontothedifferencesbetween thesubjectpropertyandthecomparablesales.

ComparableSummary

ComparablesSummary&EstimatedIndicatedValue

ESTIMATEDINDICATEDVALUEOFTHESUBJECT:$533,000

IndicatedWeightValue

-Theestimatedindicatedvalueisdeterminedbyusingthegrossadjustmentofsalepriceforeachcomparableasameasureof therelativequalityofthecomparable.Theindicatedvalueisderivedbymultiplyingtheweightofeachcomparablebythe adjustedsalepriceofthatcomparable,repeatingforeachproperty,thenaddingthemalltogether.Thisweightedaverageis usedastheindicatedvalueofthesubject.

-Aswithanymethod,thistechniqueisnotperfect.However,itdoesdoaverygoodjobofgivingmoreweighttothemostsimilar comparableswhileatthesametimeminimizingvaluesneartheextremesoftheindicatedvaluerange.

Comparable1

Comparable2

Comparable3

This report was prepared under the following USPAP reporting option:

Appraisal Report

This report was prepared in accordance with USPAP Standards Rule 2-2(a).

Restricted Appraisal Report This report was prepared in accordance with USPAP Standards Rule 2-2(b).

Reasonable Exposure Time

My opinion of a reasonable exposure time for the subject property at the market value stated in this report is:

7-30 days.

This opinion is estimated to be aligned with the marketing time reported in the neighborhood section on page one of this report, which is less than 90 days.

Additional Certifications

I certify that, to the best of my knowledge and belief:

I have NOT performed services, as an appraiser or in any other capacity, regarding the property that is the subject of this report within the three-year period immediately preceding acceptance of this assignment.

I HAVE performed services, as an appraiser or in another capacity, regarding the property that is the subject of this report within the three-year period immediately preceding acceptance of this assignment. Those services are described in the comments below.

- The statements of fact contained in this report are true and correct.

- The reported analyses, opinions, and conclusions are limited only by the reported assumptions and limiting conditions and are my personal, impartial, and unbiased professional analyses, opinions, and conclusions.

- Unless otherwise indicated, I have no present or prospective interest in the property that is the subject of this report and no personal interest with respect to the parties involved.

- I have no bias with respect to the property that is the subject of this report or the parties involved with this assignment.

- My engagement in this assignment was not contingent upon developing or reporting predetermined results.

- My compensation for completing this assignment is not contingent upon the development or reporting of a predetermined value or direction in value that favors the cause of the client, the amount of the value opinion, the attainment of a stipulated result, or the occurrence of a subsequent event directly related to the intended use of this appraisal.

- My analyses, opinions, and conclusions were developed, and this report has been prepared, in conformity with the Uniform Standards of Professional Appraisal Practice that were in effect at the time this report was prepared.

- Unless otherwise indicated, I have made a personal inspection of the property that is the subject of this report.

- Unless otherwise indicated, no one provided significant real property appraisal assistance to the person(s) signing this certification (if there are exceptions, the name of each individual providing significant real property appraisal assistance is stated elsewhere in this report).

Additional Comments

None.

APPRAISER:

Signature:

Name:

Date Signed:

Matthew McNinch 08/20/2024 A8627

State Certification #: or State License #: State: Expiration Date of Certification or License: Effective Date of Appraisal:

06/30/2025

08/16/2024

SUPERVISORY APPRAISER: (only if required)

Signature: