Best Cities for Real Estate Investment in 2025

Real estate investors are always searching for the next profitable market, where high returns on investment (ROI) and strong economic fundamentals drive long-term gains. In 2025, shifting demographics, evolving workplace trends, and economic policies are shaping new hotspots in both the U.S. and global markets. Identifying emerging cities with strong growth potential is crucial for investors looking to maximize returns.

House hacking has emerged as one of the most effective strategies for new real estate investors to build wealth while reducing or even eliminating their housing costs. By renting out portions of a primary residence, investors generate rental income that offsets their mortgage payments and living expenses. This approach has gained traction as housing affordability continues to be a major challenge, especially for first-time buyers. In 2025, shifting economic conditions and evolving market trends have made house hacking more relevant than ever.

Investors in the real estate market often face a crucial decision: should they rent their properties on a short-term basis through platforms like Airbnb or opt for traditional long-term leases? Both strategies offer distinct benefits and challenges, making the right choice dependent on market conditions, investor goals, and property location. Understanding the pros and cons of each approach helps real estate investors maximize profitability and optimize their rental strategies.

The agricultural landscape of the Caribbean is undergoing a transformation, driven by a new wave of agro-entrepreneurs who are embracing innovation, sustainability, and modern business strategies. With increasing global demand for organic produce, specialty crops, and sustainable farming practices, small-scale farmers and agribusinesses in the Caribbean are playing a pivotal role in enhancing food security and boosting exports. As governments, investors, and entrepreneurs recognize the potential of agribusiness, the region is poised for a resurgence in agriculture that could redefine economic opportunities for island nations.

AgriTech in Latin America

Agriculture has long been a cornerstone of Latin America’s economy, with countries like Brazil, Argentina, and Mexico ranking among the world’s largest food producers. However,

traditional farming methods are facing new challenges, including climate change, soil degradation, and an increasing global demand for sustainable food production. To address these challenges, the region is experiencing a rapid shift toward agricultural technology (AgriTech), integrating artificial intelligence (AI), drones, and precision farming to enhance efficiency and yield.

Agro-Resorts

The Caribbean has long been known for its pristine beaches, luxury resorts, and vibrant cultures. However, a new trend is emerging in the region that blends tourism with sustainability—agro-resorts. These eco-conscious destinations combine farming with hospitality, offering travelers an immersive experience that connects them with nature, local agriculture, and sustainable living practices.

Timberland Investments in Latin America

Latin America, known for its vast natural resources and biodiversity, is becoming a prime destination for investors seeking opportunities in sustainable forestry. With rising global demand for timber, increasing interest in reforestation projects, and supportive government policies, timberland investments are gaining traction across the region. As sustainability becomes a key driver in global markets, Latin America presents a unique opportunity for investors to capitalize on both environmental conservation and financial returns.

The Rise of 3D-Printed Homes

The real estate industry is undergoing a revolution, with 3Dprinted homes emerging as a game-changer in affordability, scalability, and sustainability. This cutting-edge technology is redefining how homes are built, significantly reducing construction time and labor costs while offering innovative design possibilities. As investors seek new opportunities in the real estate market, 3D-printed homes present a compelling case for the future of housing development.

Regenerative Agriculture in Latin America

Latin America has long been a powerhouse in global agriculture, producing a significant portion of the world's food, including soybeans, coffee, and beef. However, decades of industrial farming have left vast tracts of land degraded due to soil erosion, deforestation, and excessive chemical use. In response, regenerative agriculture is emerging as a game-changer, offering solutions that not only restore soil health but also enhance farm productivity and land value.

“Influential Magazines, driven by its unwavering aim and mission, strives to be a catalyst for global business transformation. Our commitment extends beyond the conventional, as we envision Unlocking vast business potential in emerging economies. This endeavor creates an unparalleled opportunity for worldwide expansion and knowledge exchange. The emerging nations, marked by dynamic markets and untapped resources, beckon entrepreneurs, investors, and enterprises globally to partake in mutually beneficial ventures. Influential Magazines serves as the conduit for this transformative journey, shedding light on the visionary growth strategies, infrastructure development, and burgeoning consumer bases within the emerging nations. As these economies evolve and innovate, our mission is to foster international collaboration, creating a vibrant space where industries thrive, and insights are shared. Embracing the business potential in these emerging economies not only unlocks doors for unprecedented growth but also nurtures a global dialogue, enriching our collective understanding of diverse business landscapes and strategies. The emerging nations, through Influential Magazines, transcend being mere destinations for business, they also become dynamic hubs for cross-cultural learning and collaboration."

eal estate investors are always searching for the next profitable market, where high returns on investment (ROI) and strong economic fundamentals drive long-term gains. In 2025, shifting demographics, evolving workplace trends, and economic policies are shaping new hotspots in both the U.S. and global markets. Identifying emerging cities with strong growth potential is crucial for investors looking to maximize returns.

The U.S. real estate market continues to see shifts in demand, largely influenced by population migration, affordability, and job market expansion. Certain cities stand out as prime locations for investment due to their economic resilience and development prospects.

Austin, Texas remains one of the most promising real estate markets in the U.S. The city has consistently ranked among the fastest-growing metropolitan areas, thanks to a thriving tech sector, a business-friendly environment, and a steady influx of new residents. As remote work continues to shape housing trends, Austin’s suburban and exurban areas present strong investment opportunities, especially in singlefamily rentals and multifamily

properties. Nashville, Tennessee has emerged as a top choice for real estate investors, with a booming economy driven by healthcare, technology, and a strong entertainment industry. With no state income tax and a relatively low cost of living, Nashville is attracting professionals and businesses alike. The demand for rental properties is surging, making it a strong market for long-term buy-and-hold investments.

Raleigh-Durham, North Carolina is experiencing sustained population growth, fueled by the presence of major universities, a skilled workforce, and a rapidly expanding tech sector. The Research Triangle continues to draw companies and workers, creating a strong rental market and increasing property appreciation rates. Investors focusing on both single-family and multifamily properties will find substantial opportunities in this area.

Tampa, Florida is another market seeing significant investment potential. The city's combination of warm weather, no state income tax, and a growing job market is attracting new residents and businesses. The demand for rental properties, especially in suburban neighborhoods, continues to rise, making Tampa a prime location for real estate investments.

Phoenix, Arizona remains an attractive destination for real estate investors, thanks to its affordability, population growth, and business-friendly climate. The city’s expanding economy, fueled by tech and manufacturing, has led to a steady increase in home prices and rental demand. Investors can benefit from both short-term rental opportunities and long-term property appreciation.

Outside the U.S., several global cities are gaining attention for their real estate investment potential. Economic growth, political stability, and infrastructure development are key factors making these locations attractive for investors.

Lisbon, Portugal continues to be a top European market for real estate investors, offering relatively affordable property prices compared to other major Western European cities. Portugal’s Golden Visa program and strong tourism industry have fueled real estate demand, making short-term rentals and luxury apartments particularly lucrative investments.

Dubai, UAE remains a prime market due to its tax-free incentives, strong economic growth, and increasing foreign investment. The city’s real

Best Cities for Real Estate Investment in 2025

Diversification remains crucial for real estate investors. Instead of focusing solely on one city or property type, spreading investments across different markets and asset classes can help reduce risk. Combining residential, commercial, and short-term rental properties can create a balanced portfolio that withstands economic fluctuations.

estate sector is rebounding, with high rental yields and long-term appreciation potential. Investors looking for highend residential properties or short-term rental opportunities in tourist-heavy districts will find Dubai to be a profitable choice.

Mexico City, Mexico is attracting attention as an affordable and highgrowth investment destination. The city's real estate market has been expanding due to a rising middle class, a growing expat community, and an increasing demand for rental properties. The affordability of real estate, compared to major U.S. and European cities, makes Mexico City an appealing option for investors looking for longterm appreciation and rental income.

Bangalore, India is one of Asia’s fastest-growing real estate markets, thanks to its position as the country’s leading tech hub. With major multinational companies setting up operations in the city, there is increasing demand for high-quality residential and commercial properties. Bangalore’s relatively affordable real estate prices, combined with strong economic growth, create excellent investment opportunities.

Istanbul, Turkey offers a unique mix of cultural heritage and modern development, attracting both local and foreign investors. The city’s affordable real estate prices and the Turkish Citizenship by Investment program make it an attractive option for

international investors. Rental demand is strong, particularly in central districts and areas with high tourism footfall.

Choosing the right city is only part of the equation. Successful real estate investment in 2025 will require smart strategies tailored to market conditions. Investors should consider multiple approaches to maximize returns and mitigate risks.

Diversification remains crucial for real estate investors. Instead of focusing solely on one city or property type, spreading investments across different markets and asset classes can help reduce risk. Combining residential, commercial, and short-term rental properties can create a balanced portfolio that withstands economic fluctuations.

Short-term rentals continue to be an attractive investment option, particularly in cities with strong tourism and business travel. Locations such as Lisbon, Dubai, and Nashville are prime markets for Airbnb and other vacation rental platforms. However, investors should stay informed about local regulations governing short-term rentals to avoid legal issues.

Long-term rental properties offer stability and consistent cash flow. Cities like Raleigh-Durham, Phoenix, and Mexico City have growing populations and strong rental demand,

making them ideal for long-term investment. Single-family homes, multifamily properties, and build-torent developments are all viable strategies in these markets.

Commercial real estate in emerging markets presents strong growth potential. With the rise of remote work, co-working spaces and mixeduse developments are seeing increased demand. Investing in office spaces in tech hubs like Bangalore and Istanbul or logistics properties in high-growth areas can yield high returns.

Leverage local incentives and government programs when investing in foreign markets. Some countries offer residency or tax incentives for real estate investors, such as Portugal’s Golden Visa program or Turkey’s Citizenship by Investment initiative. Understanding these benefits can significantly enhance investment potential.

The best cities for real estate investment in 2025 will be those with strong economic fundamentals, population growth, and favorable investment climates. Whether in the U.S. or global markets, identifying high-growth areas and implementing smart investment strategies can lead to significant returns. Investors should conduct thorough market research, diversify their portfolios, and take advantage of emerging trends to capitalize on the opportunities ahead.

House hacking has emerged as one of the most effective strategies for new real estate investors to build wealth while reducing or even eliminating their housing costs. By renting out portions of a primary residence, investors generate rental income that offsets their mortgage payments and living expenses. This approach has gained traction as housing affordability continues to be a major challenge, especially for first-time buyers. In 2025, shifting economic conditions and evolving market trends have made house hacking more relevant than ever.

The concept of house hacking is not new, but it has evolved significantly over the years. Traditionally, investors purchased duplexes, triplexes, or fourplexes, lived in one unit, and rented out the others. However, house hacking has expanded beyond multi-unit properties. Investors now use singlefamily homes with accessory dwelling units (ADUs), basements, garage conversions, or even spare bedrooms to generate income. Platforms like Airbnb and Vrbo have further expanded house hacking opportunities by enabling shortterm rentals.

As more people embrace remote work and flexible living arrangements, coliving spaces and rent-by-the-room strategies have also become increasingly popular. Young professionals, digital nomads, and students seeking affordable housing options drive demand for these setups. With the right property and management strategy, investors can achieve positive cash flow while

maintaining a comfortable living arrangement.

Several economic and market factors have contributed to the continued popularity of house hacking. Rising home prices and interest rates have made it more difficult for many to afford traditional homeownership. House hacking offers an alternative by reducing financial burdens and increasing access to real estate investment.

The growing demand for affordable rentals plays a crucial role in the success of house hacking. Many cities across the U.S. and globally are experiencing housing shortages, making rental units highly sought after. House hackers can leverage this demand to ensure steady rental income, whether through longterm leases or short-term vacation rentals.

Government incentives and loan programs designed to encourage homeownership also make house hacking more accessible. FHA loans, VA loans, and other low-down-payment mortgage options allow buyers to acquire multi-unit properties with minimal upfront capital. In some cases, local governments provide tax incentives or grants for homeowners who add ADUs or convert existing spaces into rental units.

Choosing the right property is the foundation of a successful house hack. Investors should look for homes with

separate entrances, multiple bedrooms, or the potential to add additional living spaces. Multi-family properties, homes with finished basements, or those with detached units offer built-in rental income opportunities.

Understanding local rental regulations is critical, especially in cities with strict short-term rental laws or zoning restrictions. Investors should research whether their target market allows ADUs, shared housing arrangements, or short-term leasing before purchasing a property. Compliance with local laws ensures smooth operations and avoids potential legal issues.

Financing options can make or break a house hacking strategy. Leveraging government-backed loans allows investors to secure properties with as little as 3.5% down in the case of FHA loans. VA loans offer even better terms for eligible veterans, allowing zerodown purchases. Conventional loans with house hacking-friendly terms are also available, and creative financing strategies such as seller financing or lease options can help investors secure deals with minimal capital.

Property management plays a crucial role in maximizing house hacking success. Screening tenants thoroughly, setting clear lease terms, and maintaining the property efficiently contribute to long-term profitability. For those who prefer a hands-off approach, hiring a property management company can help handle tenant interactions and maintenance responsibilities.

Leveraging technology enhances efficiency and profitability. Smart home

features such as keyless entry, automated lighting, and security cameras provide convenience and security for both landlords and tenants. Property management software and online rental platforms streamline rent collection, lease management, and maintenance requests, making house hacking more manageable.

Some cities offer more favorable conditions for house hacking than others. Markets with strong rental demand, affordable home prices, and landlord-friendly regulations tend to provide the best opportunities. Emerging secondary cities and suburban areas often yield better returns than expensive metropolitan centers. Mid-sized cities with growing job markets, such as Nashville, Raleigh, and Austin, continue to attract new residents, increasing rental demand. These cities offer relatively affordable properties with high appreciation potential. Investors in these areas can benefit from long-term rental stability and property value appreciation.

University towns remain excellent house hacking locations, as students consistently need affordable housing. Cities with major universities, such as Ann Arbor, Boulder, and Gainesville, provide reliable rental demand. Properties near campuses or public transportation hubs are particularly attractive to student renters. Touristheavy locations present lucrative shortterm rental opportunities. Investors in cities such as Orlando, Las Vegas, and New Orleans can generate significant income by renting out properties on vacation rental platforms. However, it is essential to research local short-term rental regulations to ensure compliance and avoid unexpected restrictions.

One of the biggest advantages of house hacking is the ability to build equity

while reducing or eliminating housing costs. Instead of paying rent or a full mortgage out-of-pocket, rental income covers a significant portion of the housing expenses, allowing investors to save and reinvest profits.

House hacking provides a low-risk entry point into real estate investing. Unlike traditional rental properties, where investors must cover mortgage payments without occupying the home, house hackers benefit from direct oversight of their investment. Living on-site allows for better property management, quicker responses to maintenance issues, and improved tenant relationships.

This strategy accelerates portfolio growth. With reduced housing costs and extra rental income, investors can save for future property acquisitions. Many house hackers use the “live-in, rent-out, move-on” approach, where they live in a property for a few years, rent it out entirely after moving to a new house hack, and repeat the process. Over time, this method builds a robust real estate portfolio with multiple income-generating properties.

Tax benefits further enhance the profitability of house hacking. Mortgage interest deductions, depreciation, and expenses related to rental property management can offset taxable income, reducing the investor’s overall tax burden. Proper tax planning can optimize deductions and maximize long-term wealth accumulation.

While house hacking offers numerous benefits, it also comes with challenges. Sharing a living space with tenants requires adaptability and strong interpersonal skills. Setting clear boundaries and expectations from the beginning helps maintain a positive landlord-tenant relationship.

Market conditions can impact rental income potential. If rental demand

declines or local economic conditions shift, investors may face difficulties securing tenants or maintaining consistent cash flow. Conducting thorough market research and choosing properties in high-demand areas can mitigate these risks.

Maintenance and property management responsibilities require time and effort. Managing multiple tenants or shortterm rental guests can be demanding, especially for first-time landlords. Investors should be prepared to handle repairs, tenant disputes, and administrative tasks or consider outsourcing these responsibilities.

Financing restrictions may limit some investors’ ability to house hack. Certain loan programs require owneroccupancy for a specific period, restricting investors from quickly transitioning properties into full-time rentals. Understanding mortgage terms and planning for future investment moves ensures long-term flexibility.

Final Thoughts on House Hacking in 2025

House hacking continues to be an attractive strategy for real estate investors in 2025, offering a practical way to reduce housing expenses while building long-term wealth. The evolving housing market, affordability challenges, and changing rental demand create ideal conditions for house hacking to thrive.

Investors who strategically select properties, leverage financing options, and implement smart management practices can achieve financial independence and create sustainable income streams. Whether using multiunit properties, ADUs, or co-living arrangements, house hacking remains a powerful entry point into real estate investment, helping investors secure their financial future while living for free.

nvestors in the real estate market often face a crucial decision: should they rent their properties on a short-term basis through platforms like Airbnb, or opt for traditional long-term leases? Both strategies offer distinct benefits and challenges, making the right choice dependent on market conditions, investor goals, and property location. Understanding the pros and cons of each approach helps real estate investors maximize profitability and optimize their rental strategies.

Short-term rentals, commonly listed on platforms such as Airbnb and Vrbo, cater to travelers seeking temporary accommodations. These rentals range from single rooms to entire homes and are typically rented for a few nights to a few weeks. The flexibility and high earning potential of short-term rentals make them an attractive option for many property owners.

One of the biggest advantages of short-term rentals is their ability to generate higher rental income compared to longterm leases. Because guests pay a premium for nightly stays, landlords can often earn more in a month than they would from a single long-term tenant. Additionally, short-term rentals allow property owners to adjust pricing based on demand, maximizing revenue during peak travel seasons and events.

Property owners have more control over their units with short-term rentals. They can schedule maintenance, updates, and personal use of the property between bookings. This

flexibility is especially beneficial for investors who want to use the property themselves occasionally or adjust their rental strategy based on market trends.

Short-term rentals also provide diversification in revenue streams. Unlike long-term leases, where landlords depend on a single tenant for extended periods, short-term rentals attract a variety of guests. This reduces the risk of prolonged vacancies if a tenant moves out unexpectedly.

Despite the income potential, short-term rentals come with challenges. Higher operational costs, including cleaning fees, utility expenses, and furnishing requirements, can cut into profits. Property owners must also actively manage bookings, guest communications, and maintenance, which can become time-consuming. Hiring a property management company can help, but it adds to the overall cost.

Regulatory restrictions are another major concern for shortterm rental investors. Many cities have implemented strict laws governing Airbnb-style rentals, including zoning restrictions, permit requirements, and occupancy limits. Failing to comply with local regulations can result in fines and legal complications, making it essential for investors to research short-term rental policies before entering the market.

Long-term leases involve renting properties to tenants for extended periods, typically six months to a year or more. This traditional rental model offers stability and predictable

income, making it a favored choice for investors seeking lower-risk opportunities.

One of the main advantages of long-term leases is consistent cash flow. With a signed lease agreement, landlords receive a fixed rental payment each month, reducing income fluctuations. This stability is particularly valuable in uncertain economic conditions when short-term travel demand may decline.

Long-term rentals require significantly less management compared to short-term options. Landlords are not responsible for constant guest turnover, daily maintenance, or frequent cleaning costs. Tenants generally take on responsibilities such as utilities and minor upkeep, reducing the landlord's expenses.

Tenant screening and lease agreements provide security for landlords. A signed lease ensures the tenant commits to a specified rental period, minimizing the risk of frequent vacancies. Additionally, security deposits and rental application processes help landlords select responsible tenants who are more likely to care for the property.

Long-term rentals often come with lower operational costs. Unlike short-term rentals that require frequent cleaning, new furnishings, and ongoing hospitality services, long-term tenants furnish their own spaces and handle day-to-day living expenses. This reduces maintenance costs and

improves overall profitability.

While long-term leases provide stability, they also limit the landlord’s ability to adjust rental rates. Unlike short-term rentals, where prices can be updated regularly, long-term leases lock in a fixed rate for months or years. This can be a disadvantage in rapidly appreciating markets where rental prices rise faster than lease renewals allow.

Tenant-related challenges can also arise in long-term rentals. Eviction processes can be time-consuming and costly if a tenant fails to pay rent or violates lease terms. Property damage caused by long-term occupants may also require significant repairs once they move out, potentially leading to unexpected costs.

Choosing between short-term rentals and long-term leases depends largely on the real estate market. In tourist-heavy destinations, short-term rentals can outperform long-term leases due to high occupancy rates and premium nightly pricing. Locations near major attractions, business hubs, or event centers often see strong demand for vacation rentals.

For investors in suburban or residential areas, long-term leases may provide more reliable income. These markets generally attract families, professionals, and students who prefer stability over short-term stays. Strong job markets, reputable schools, and community amenities contribute to

sustained long-term rental demand.

Economic conditions also impact rental profitability. During economic downturns, travel demand may decrease, reducing short-term rental bookings. In contrast, long-term rentals typically remain stable as people continue to need housing regardless of economic cycles. Investors should assess the resilience of their target market before committing to a specific rental strategy.

Hybrid rental strategies offer a balanced approach to maximizing profits. Some investors use a seasonal rental model, renting properties short-term during peak seasons and transitioning to long-term leases in off-peak months. This approach allows investors to capitalize on high-demand periods while maintaining steady income throughout the year.

Diversification within a portfolio can also enhance profitability. Owning a mix of short-term and long-term rentals across different markets reduces risk and ensures stable cash flow. Investors can allocate properties based on market conditions, adjusting their strategy as demand shifts.

Leveraging tax advantages can further boost returns. Shortterm rental hosts may qualify for tax deductions on expenses such as furnishing, utilities, and marketing. Long-term rental owners benefit from depreciation, mortgage interest

deductions, and property tax write-offs. Consulting with a tax professional helps investors optimize their tax strategies for maximum profitability.

Effective property management plays a crucial role in both short-term and long-term rental success. Short-term rental hosts should invest in high-quality furnishings, professional photography, and guest experience enhancements to attract premium bookings. Long-term rental landlords should prioritize tenant retention by maintaining properties well and responding promptly to maintenance requests.

Ultimately, the decision between short-term rentals and longterm leases depends on an investor’s financial goals, risk tolerance, and market conditions. Short-term rentals offer high-income potential and flexibility but require active management and may face regulatory hurdles. Long-term leases provide stability, lower maintenance costs, and predictable cash flow but limit rental rate adjustments and require a longer commitment.

Investors who prioritize high cash flow and have the time or resources for property management may find short-term rentals more lucrative. Those who prefer a hands-off, steady investment approach may benefit more from long-term leases. Evaluating local demand, legal considerations, and personal investment strategies ensures informed decisionmaking and long-term success in real estate investing.

The agricultural landscape of the Caribbean is undergoing a transformation, driven by a new wave of agro-entrepreneurs who are embracing innovation, sustainability, and modern business strategies. With increasing global demand for organic produce, specialty crops, and sustainable farming practices, small-scale farmers and agribusinesses in the Caribbean are playing a pivotal role in enhancing food security and boosting exports. As governments, investors, and entrepreneurs recognize the potential of agribusiness, the region is poised for a resurgence in agriculture that could redefine economic opportunities for island nations.

The Role of Agro-Entrepreneurship in the Caribbean

Agriculture has long been a staple of Caribbean economies, historically centered around sugar, bananas, and other commodity crops. However, the decline of traditional export markets, climate change challenges, and a growing reliance on food imports have highlighted the need for diversification. Agro-entrepreneurship is emerging as a solution, blending traditional farming with innovative business models that emphasize sustainability, efficiency, and value-added products.

Small-scale farmers and agribusiness owners are leveraging modern techniques to increase productivity and resilience. Hydroponics, vertical farming, and organic cultivation are becoming more prevalent, allowing farmers to produce high-value crops in limited spaces while minimizing environmental impact. Agro-

entrepreneurs are also exploring processing and packaging solutions that extend the shelf life of local produce, creating new opportunities for export and retail markets.

One of the driving forces behind the rise of agro-entrepreneurship in the Caribbean is the need for enhanced food security. Many island nations rely heavily on food imports, which makes them vulnerable to supply chain disruptions, currency fluctuations, and global price volatility. By investing in local farming initiatives, Caribbean nations can reduce their dependence on imports and create a more stable food supply.

Local food production is not only a matter of economic stability but also public health. Fresh, locally grown produce offers better nutritional value compared to imported goods that may spend weeks in transit. Governments and non-profit organizations are actively supporting community farming initiatives, school gardens, and urban agriculture programs that encourage citizens to grow their own food and reduce reliance on imports.

Agro-entrepreneurs in the Caribbean are embracing cutting-edge technologies to enhance productivity and sustainability. Precision agriculture, which uses data analytics, drones, and automated irrigation systems, is helping farmers maximize yields while minimizing resource usage. Smart greenhouses equipped with climate control technology

allow year-round production of crops that were once limited by seasonal weather patterns.

Blockchain and digital supply chain solutions are also transforming agribusiness. By implementing transparent tracking systems, farmers and exporters can improve efficiency, reduce waste, and ensure quality standards are met for global markets. These innovations provide a competitive edge and make Caribbean agricultural products more attractive to international buyers.

The Caribbean is uniquely positioned to capitalize on growing consumer demand for organic, sustainable, and ethically sourced food products. Niche markets such as organic coffee, tropical superfoods, and artisanal food products present lucrative export opportunities for small-scale farmers and agroentrepreneurs.

Many Caribbean nations are gaining recognition for their premium agricultural products, including Jamaican Blue Mountain coffee, Trinidadian cocoa, and St. Lucian sea moss. With the right branding, certification, and market access, these products can command premium prices in international markets. Agroentrepreneurs who invest in certification programs, such as organic and fair trade labels, can enhance their competitiveness and tap into global demand.

Tourism also provides a valuable avenue for agricultural exports. Farm-to-table dining experiences, agritourism ventures,

and partnerships with local hotels and resorts allow farmers to showcase their products to international visitors. By integrating agriculture with tourism, Caribbean nations can create a sustainable revenue stream that benefits both industries.

Investors seeking opportunities in emerging markets should look to Caribbean agribusiness as a sector with strong growth potential. With the right infrastructure and financial backing, small-scale farms can scale operations, adopt advanced technologies, and expand into export markets.

Public-private partnerships are

playing a crucial role in developing the sector. Governments are offering incentives such as tax breaks, grants, and low-interest loans to support agribusiness innovation. International organizations and development banks are also funding agricultural projects that promote sustainability and climate resilience.

Agri-tech startups focusing on smart irrigation, soil enhancement, and biobased fertilizers are gaining traction in the region. These innovations not only improve efficiency but also align with global sustainability goals, making them attractive for impact investors. By investing in agribusiness, stakeholders can contribute to economic development, job creation, and environmental sustainability.

Despite the potential for growth, agroentrepreneurs in the Caribbean face several challenges. Climate change poses a significant threat, with rising temperatures, extreme weather events, and soil degradation affecting agricultural productivity. Farmers must adopt climate-smart practices such as drought-resistant crops, permaculture techniques, and waterefficient irrigation systems to mitigate these risks.

Access to financing is another hurdle. Traditional banks often view agriculture as a high-risk sector, making it difficult for small farmers to secure loans. Alternative financing options, such as microloans, crowdfunding, and impact investing,

are emerging to bridge this gap and provide much-needed capital to agroentrepreneurs.

Infrastructure limitations, including inadequate transportation networks and outdated processing facilities, can hinder market access. Governments and private sector players must invest in modernizing supply chains, improving logistics, and enhancing distribution channels to ensure agricultural products reach consumers efficiently.

Future of Caribbean AgroEntrepreneurship

The future of farming in Caribbean island nations lies in the hands of innovative agro-entrepreneurs who are blending tradition with modern

business strategies. By embracing sustainable practices, leveraging technology, and exploring niche markets, the region’s agricultural sector can thrive in an increasingly competitive global economy.

Education and training will play a crucial role in shaping the next generation of farmers. Universities, vocational schools, and agricultural extension programs must equip young entrepreneurs with the skills needed to succeed in a rapidly evolving industry. Encouraging youth involvement in agriculture will ensure long-term sustainability and the continued growth of the sector.

Collaboration among governments, private investors, and farmers is essential for unlocking the full

potential of Caribbean agribusiness. By fostering an ecosystem that supports innovation, financial access, and infrastructure development, island nations can create a resilient agricultural industry that contributes to economic prosperity and food security.

Caribbean agro-entrepreneurship represents more than just farming—it is a movement toward selfsufficiency, economic empowerment, and environmental stewardship. With the right investments, policies, and strategic partnerships, the region can position itself as a global leader in sustainable agriculture, ensuring a prosperous future for generations to come.

Agriculture has long been a cornerstone of Latin America’s economy, with countries like Brazil, Argentina, and Mexico ranking among the world’s largest food producers. However, traditional farming methods are facing new challenges, including climate change, soil degradation, and an increasing global demand for sustainable food production. To address these challenges, the region is experiencing a rapid shift toward agricultural technology (AgriTech), integrating artificial intelligence (AI), drones, and precision farming to enhance efficiency and yield.

As AgriTech gains traction, farmers and investors alike are recognizing its potential to revolutionize the industry. From AI-driven analytics to droneassisted monitoring, smart farming is not only boosting productivity but also positioning Latin America as a global leader in agricultural innovation.

Artificial intelligence is at the forefront of the AgriTech revolution in Latin America. Farmers are leveraging AIpowered analytics to predict weather patterns, monitor soil health, and optimize crop yields. Advanced algorithms analyze vast amounts of data collected from sensors and satellite imagery, providing real-time insights that help farmers make informed decisions.

Brazil, the largest agricultural exporter in Latin America, has seen a surge in AI adoption. Companies like Solinftec are developing AI-driven platforms that automate decision-making, allowing farmers to detect diseases, track irrigation needs, and reduce pesticide use. These technologies not only enhance productivity but also contribute to sustainability by minimizing resource wastage.

Argentina, known for its vast soybean and wheat production, is also embracing AI. Startups such as DeepAgro are utilizing AI to develop smart weed detection systems that reduce reliance on chemical herbicides. By incorporating machine learning, farmers can identify problem areas in their fields with pinpoint accuracy, improving efficiency while maintaining environmental integrity.

Drones have become an essential tool in modern agriculture, providing farmers with a bird’s-eye view of their crops. These unmanned aerial vehicles (UAVs) are equipped with multispectral cameras and sensors that capture detailed images, helping farmers monitor plant health, detect irrigation issues, and assess soil conditions.

Mexico, a major exporter of avocados, tomatoes, and maize, has embraced drone technology to improve farming efficiency. AgriTech firms are utilizing drones to map fields, identify pest infestations, and optimize fertilizer application. By detecting problems early, farmers can take targeted action, reducing costs and increasing yields.

In Argentina, drone technology is revolutionizing livestock farming as well. Cattle ranchers are using UAVs to monitor herd movements, identify sick animals, and even assess pasture conditions. This aerial intelligence allows farmers to improve livestock management while minimizing labor costs and resource use.

Brazil is also leading the way in droneassisted farming, with large-scale soybean and sugarcane plantations integrating UAVs into their operations. These drones provide real-time data that helps farmers adjust their planting strategies, optimize irrigation, and

detect potential crop diseases before they spread.

Precision Farming: Enhancing Efficiency and Sustainability

Precision farming is transforming agriculture in Latin America by enabling farmers to apply inputs such as water, fertilizer, and pesticides with pinpoint accuracy. This approach maximizes efficiency while reducing environmental impact, making farming more sustainable.

Argentina is at the forefront of precision agriculture, with its vast Pampas region serving as a testing ground for cutting-edge techniques. Farmers are using GPS-guided tractors, automated irrigation systems, and real-time soil analysis to optimize every aspect of crop production. By applying fertilizers and water only where needed, precision farming minimizes waste and improves profitability.

In Mexico, precision agriculture is helping smallholder farmers compete with larger agribusinesses. Startups are developing mobile apps that provide real-time recommendations based on satellite data, empowering farmers to make smarter decisions. These digital tools help optimize planting schedules, reduce water usage, and enhance soil fertility, ultimately boosting crop yields.

Brazil is integrating precision farming on a massive scale, particularly in its soybean and sugarcane industries. Farmers are deploying variable-rate technology (VRT) to apply fertilizers and pesticides more efficiently, reducing costs while ensuring crops receive the right nutrients. By leveraging data analytics and IoTconnected devices, Brazilian agribusinesses are achieving recordhigh productivity while maintaining environmental responsibility.

With

continued investment, collaboration, and technological advancements,

AgriTech will play a crucial role in shaping the future of agriculture in Brazil, Argentina, and Mexico. By embracing digital solutions, farmers can navigate challenges, improve efficiency, and ensure food security for a growing global population.

The rapid adoption of AgriTech in Latin America presents a wealth of investment opportunities. Governments, venture capital firms, and international agribusinesses are increasingly funding startups that specialize in AI, drones, and precision farming. Investors looking to enter the region’s agricultural sector should consider emerging companies that are driving innovation.

Brazil has become a hub for AgriTech investment, attracting funding from global firms eager to capitalize on its vast agricultural potential. Companies developing AI-driven solutions, smart irrigation systems, and automated farm machinery are seeing strong growth. With government incentives supporting digital agriculture, Brazil remains an attractive destination for investors looking to fund nextgeneration farming technologies.

Argentina’s AgriTech scene is also drawing attention, particularly in the realm of precision farming and AI applications. Startups focusing on soil health monitoring, crop analytics, and farm automation are gaining momentum. The country’s strong agricultural tradition and skilled workforce make it a promising location for investment in smart farming solutions.

Mexico offers unique investment prospects, especially in drone technology and digital farming platforms. The country’s diverse agricultural landscape provides ample opportunities for startups developing AI-powered tools for smallholder farmers. With increased government support for agricultural innovation, Mexico is becoming a key player in Latin America’s AgriTech sector.

Despite the promising advancements in AgriTech, several challenges remain. Infrastructure limitations, including poor internet connectivity in rural areas, can hinder the adoption of digital farming tools. Many small-scale farmers lack access to financing, making it difficult to invest in advanced technologies. Governments and private sector players must work together to provide financial support and improve technological accessibility.

Climate change also poses a significant risk, with unpredictable weather patterns affecting crop yields. While AgriTech can mitigate some of these challenges through predictive analytics and adaptive farming techniques, longterm solutions require investment in climate-resilient agriculture.

Additionally, regulatory barriers and data privacy concerns must be

addressed to ensure that AgriTech solutions are implemented effectively. Clear policies on data ownership, drone usage, and AI-driven decisionmaking will be essential for the continued growth of the industry.

Future of Smart Farming in Latin America

AgriTech is revolutionizing Latin American agriculture, providing farmers with innovative tools to enhance productivity, reduce costs, and promote sustainability. As AI, drones, and precision farming continue to evolve, the region is poised to become a global leader in smart farming.

With continued investment, collaboration, and technological advancements, AgriTech will play a crucial role in shaping the future of agriculture in Brazil, Argentina, and Mexico. By embracing digital solutions, farmers can navigate challenges, improve efficiency, and ensure food security for a growing global population.

The rise of AgriTech in Latin America is not just a technological shift—it is a movement toward a smarter, more resilient agricultural industry. As investors, farmers, and governments align their efforts, the region’s farming sector will continue to thrive in the face of evolving global demands.

he Caribbean has long been known for its pristine beaches, luxury resorts, and vibrant cultures. However, a new trend is emerging in the region that blends tourism with sustainability— agro-resorts. These eco-conscious destinations combine farming with hospitality, offering travelers an immersive experience that connects them with nature, local agriculture, and sustainable living practices.

As the demand for responsible travel increases, agro-resorts are gaining popularity among eco-conscious tourists who seek more than just a beachside vacation. These resorts provide farm-to-table dining, hands-on agricultural experiences, and a deeper understanding of the region’s food production and environmental conservation. This trend is not only redefining Caribbean tourism but also creating lucrative opportunities for investors interested in sustainable hospitality and agribusiness.

Agro-resorts integrate traditional resort amenities with working farms, allowing guests to participate in agricultural activities such as organic farming, beekeeping, coffee production, and aquaponics. Unlike conventional resorts that rely heavily on imported food and resources, agro-resorts prioritize sustainability by growing their own produce and sourcing ingredients locally. This model not only reduces the carbon footprint but also promotes food

security and economic benefits for local communities.

These resorts attract a diverse group of travelers, including eco-tourists, wellness enthusiasts, and culinary adventurers. By combining relaxation with education, agro-resorts offer unique experiences that foster appreciation for the natural environment and local farming traditions. Guests can take part in farm tours, cooking classes, and eco-friendly workshops while enjoying luxurious accommodations and scenic landscapes.

Several Caribbean islands are at the forefront of the agro-resort trend, blending agriculture with tourism to create sustainable experiences. Countries like Jamaica, the Dominican Republic, St. Lucia, and Puerto Rico are home to resorts that prioritize environmental stewardship and sustainable farming practices.

Jamaica, known for its lush landscapes and vibrant agricultural sector, has embraced agro-tourism with resorts that offer farm-to-table dining and organic gardens. Properties such as Zimbali Retreats and Stush in the Bush provide guests with immersive farm experiences, where they can harvest fresh produce and learn about traditional Jamaican farming techniques.

The Dominican Republic, one of the

region’s largest agricultural producers, has seen a rise in eco-resorts that incorporate coffee and cacao farming into their guest experiences. Visitors can tour plantations, participate in harvesting activities, and gain insights into sustainable farming methods. These resorts highlight the country’s rich agricultural heritage while promoting responsible tourism.

St. Lucia, with its volcanic soil and thriving agriculture, is home to resorts that integrate organic farming and permaculture into their hospitality offerings. Many of these eco-lodges emphasize biodiversity conservation and agroforestry, allowing guests to explore the island’s unique ecosystems while enjoying farm-fresh meals.

Puerto Rico has also joined the movement with farm resorts that combine agritourism with luxury accommodations. These properties focus on regenerative farming, sustainable seafood production, and agroforestry, making them attractive destinations for travelers who value environmental responsibility.

The growth of agro-resorts in the Caribbean presents significant investment opportunities for entrepreneurs, real estate developers, and agribusiness investors. As ecotourism gains momentum, properties that incorporate sustainable farming into their operations are becoming

increasingly profitable. Investors can capitalize on this trend by developing new agro-resorts, partnering with existing farms to create agritourism experiences, or funding technological innovations that enhance sustainable agriculture within the hospitality industry. One of the key advantages of investing in agro-resorts is the dual revenue streams they offer. In addition to traditional hospitality income from accommodations, dining, and wellness experiences, these resorts generate revenue through agricultural production. Fresh produce, artisanal food products, and eco-friendly farm goods can be sold on-site or exported, creating an additional financial incentive for investors.

Another promising investment avenue is the development of farm-based eco-

villages and retreats. These properties cater to digital nomads, wellness travelers, and long-term visitors seeking sustainable living experiences. By incorporating renewable energy, organic farming, and self-sufficient food production, agro-resorts can attract a growing market of travelers looking for holistic and environmentally friendly lifestyles.

Governments in the Caribbean are increasingly supporting sustainable tourism initiatives, offering incentives such as tax breaks and grants for projects that align with eco-tourism and agrotourism goals. Investors who prioritize sustainability can take advantage of these policies to develop profitable and environmentally responsible hospitality ventures.

While the agro-resort model presents exciting opportunities, it also comes with challenges that investors and resort operators must navigate. One of the primary obstacles is the initial investment required to develop infrastructure that supports both hospitality and agriculture. Establishing an integrated farm-resort system demands significant capital for land acquisition, sustainable building materials, irrigation systems, and ecofriendly accommodations. Climate change poses another challenge, as unpredictable weather patterns can impact crop yields and water availability. Agro-resorts must implement climate-resilient farming techniques, such as permaculture, rainwater harvesting, and soil

regeneration, to ensure long-term sustainability. Labor shortages in the agricultural sector can also affect operations. Many Caribbean nations face challenges in attracting and retaining skilled farm workers, which can hinder the efficiency of agro-resorts. Training programs, fair wages, and partnerships with local farming communities can help mitigate this issue by creating sustainable employment opportunities.Another concern is the balance between tourism and conservation. While agro-resorts aim to promote sustainable travel, the influx of visitors can put pressure on local ecosystems if not managed properly. Implementing strict environmental guidelines, waste management strategies, and responsible visitor education can help mitigate negative impacts on the surrounding environment.

Agro-resorts represent the future of sustainable tourism in the Caribbean, offering a unique blend of hospitality and agriculture that appeals to conscious travelers. As demand for eco-friendly travel experiences continues to rise, the sector is expected to expand, attracting more investors and entrepreneurs who recognize the value of combining tourism with sustainability.

Advancements in agricultural technology, such as hydroponics, aquaponics, and smart irrigation, will further enhance the efficiency and productivity of agro-resorts. By leveraging these innovations, resorts can increase food production while reducing environmental impact, making the model

even more attractive to both travelers and investors.

Community engagement and local partnerships will play a crucial role in the success of agro-resorts. By collaborating with small-scale farmers, artisans, and environmental organizations, resorts can strengthen their connection to the local economy while promoting sustainable development.

The Caribbean’s agro-resort movement is not just a passing trend—it is a transformative approach to tourism that aligns with global efforts to promote responsible travel and environmental stewardship. As more travelers seek meaningful and sustainable experiences, agro-resorts will continue to thrive, setting a new standard for eco-conscious hospitality in the region.

atin America, known for its vast natural resources and biodiversity, is becoming a prime destination for investors seeking opportunities in sustainable forestry. With rising global demand for timber, increasing interest in reforestation projects, and supportive government policies, timberland investments are gaining traction across the region. As sustainability becomes a key driver in global markets, Latin America presents a unique opportunity for investors to capitalize on both environmental conservation and financial returns.

Timberland investments provide a hedge against inflation, portfolio diversification, and long-term asset appreciation. Unlike other commodities, timber grows in value over time, offering investors a tangible and renewable resource that can generate steady revenue streams. As global demand for wood products rises, driven by urbanization, construction, and the need for sustainable materials, Latin American forestry investments offer an attractive alternative to traditional asset classes.

One of the main advantages of timberland investments is their resilience to economic downturns. Timber prices tend to remain stable, as trees continue to

grow regardless of market fluctuations. This makes forestry an appealing option for investors looking for long-term security and steady returns.

Several countries in Latin America are emerging as major players in the timber industry. Nations with strong forestry sectors include Brazil, Chile, Colombia, and Uruguay, each offering unique investment potential.

Brazil, home to the world’s largest rainforest, is a key player in the global timber industry. The country has a wellestablished forestry sector, with vast eucalyptus and pine plantations that serve domestic and international markets. Sustainable forestry initiatives, backed by government incentives, are helping to curb deforestation while promoting responsible timber production.

Chile has a long history of timber production, with strong infrastructure and regulatory frameworks that support sustainable forestry. The country’s forestry sector is primarily based on fastgrowing species such as radiata pine and eucalyptus, which are used for construction, paper production, and bioenergy. With favorable land costs and a stable investment climate, Chile

remains a top choice for timberland investors.

Colombia is emerging as an attractive destination for forestry investments, thanks to its favorable climate and vast areas of underutilized land. The country’s government is actively promoting reforestation projects, offering incentives to investors who engage in sustainable land management. With a growing economy and improving security conditions, Colombia presents a promising opportunity for those looking to invest in timberland.

Uruguay has developed a reputation for sustainable forestry practices, with a highly regulated industry that prioritizes environmental protection. The country’s timber sector is centered on eucalyptus plantations, which are widely used for pulp and paper production. Uruguay’s stable political environment, transparent legal framework, and strong export markets make it a desirable location for forestry investments.

As concerns about deforestation and climate change grow, sustainable forestry and reforestation projects have gained significant momentum in Latin America. Governments and private organizations

are increasingly recognizing the importance of responsible land management and are implementing policies that promote reforestation efforts.

Many countries in the region have established forest certification programs, such as the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certification (PEFC), to ensure that timber products meet sustainability standards. Investors who engage in certified forestry projects can benefit from premium pricing and access to international markets that prioritize sustainable sourcing.

Carbon offset programs are another incentive for investing in reforestation projects. Companies looking to reduce their carbon footprint are willing to purchase carbon credits from forestry projects that absorb and store CO2. This additional revenue stream enhances the financial viability of timberland investments while contributing to global climate mitigation efforts.

Investment Strategies for Timberland in Latin America

Investing in timberland requires careful planning and strategy. Investors can choose from several approaches, depending on their financial goals, risk tolerance, and investment horizon.

Direct land acquisition is a common strategy, allowing investors to purchase and manage their own timber plantations. This approach provides full control over operations, but it also requires expertise in forestry management and regulatory compliance. Many investors choose to partner with local forestry companies to handle day-to-day operations and ensure sustainable practices.

Timberland investment funds offer a more passive approach, allowing investors to pool their capital with others to acquire and manage large-scale forestry projects. These funds are managed by professionals with expertise

in forestry economics, providing investors with diversification and reduced operational risks.

Publicly traded timber companies present another investment avenue, offering exposure to the forestry sector without the need for direct land ownership. Companies that specialize in sustainable timber production, paper manufacturing, and biomass energy provide investors with opportunities to benefit from the growing demand for wood products.

Real estate investment trusts (REITs) focused on forestry allow investors to gain exposure to timberland assets through publicly traded securities. These REITs generate income through timber sales, land leases, and carbon credit programs, making them an attractive option for those seeking liquidity and steady dividends.

While timberland investments in Latin America offer significant opportunities, they also come with inherent risks that investors must consider.

Regulatory uncertainty is a key concern, as forestry policies and land ownership laws vary across countries. Changes in government regulations or shifts in environmental policies can impact the profitability of timber investments. Conducting thorough due diligence and working with local legal experts can help mitigate regulatory risks.

Climate change and natural disasters pose challenges to forestry investments, as droughts, wildfires, and pests can affect timber yields. Implementing resilient forestry practices, such as species diversification and sustainable water management, can help reduce the impact of climate-related risks.

Market volatility in timber prices can influence investment returns. While timber is generally considered a stable asset, fluctuations in global demand and

supply chain disruptions can affect pricing. Diversifying timber markets and securing long-term contracts with buyers can help investors navigate market fluctuations.

Investments in Latin America

As the global demand for sustainable wood products continues to grow, Latin America is poised to become a leading destination for timberland investments. Advances in forestry technology, such as precision agriculture, drone monitoring, and genetic tree improvement, are enhancing productivity and sustainability in the sector.

Governments across the region are increasingly supporting sustainable forestry initiatives through incentives, tax breaks, and land restoration programs. Investors who align their strategies with these policies can benefit from long-term financial gains while contributing to environmental conservation.

The rise of green finance and impact investing is also driving capital into timberland projects. Institutional investors, private equity firms, and ESG-focused funds are showing increased interest in forestry as a sustainable and profitable asset class. By integrating sustainability principles into their investment strategies, investors can tap into a growing market that prioritizes responsible land management and environmental stewardship.

Timberland investments in Latin America offer a compelling blend of financial returns, sustainability, and long-term value appreciation. With careful planning, strategic partnerships, and a commitment to responsible forestry, investors can capitalize on the region’s vast natural resources while contributing to global efforts in climate resilience and biodiversity conservation.

The real estate industry is undergoing a revolution, with 3Dprinted homes emerging as a game-changer in affordability, scalability, and sustainability. This cutting-edge technology is redefining how homes are built, significantly reducing construction time and labor costs while offering innovative design possibilities. As investors seek new opportunities in the real estate market, 3D-printed homes present a compelling case for the future of housing development.

3D printing, or additive manufacturing, involves using automated machines to layer materials and construct structures with precision. Unlike traditional construction, which relies heavily on manual labor and extensive supply chains, 3D printing reduces reliance on multiple contractors and materials, cutting costs and speeding up the building process. Concrete-based 3D printing is the most common method for home construction, providing durable and weather-resistant structures that meet housing standards.

Developers and companies specializing in 3D-printed homes are leveraging this technology to address housing shortages, create disaster-resistant dwellings, and make sustainable homeownership more accessible. The

speed of construction, coupled with reduced material waste, makes 3Dprinted homes an attractive option for those seeking cost-effective and ecofriendly housing solutions.

One of the most compelling advantages of 3D-printed homes is affordability. Traditional home construction involves multiple phases, including labor, materials, transportation, and permits, all of which contribute to high costs. By contrast, 3D printing minimizes labor expenses and material waste, significantly lowering the overall cost of home construction.

The reduction in construction costs makes homeownership more accessible to low-income families and first-time buyers. In regions struggling with housing affordability, 3D-printed homes offer an alternative solution that can bridge the gap between supply and demand. Additionally, for investors, lower production costs translate to higher margins and increased scalability in the housing market.

Scalability and Mass Production Potential

3D printing technology is highly scalable, enabling developers to construct multiple homes in a fraction of the time required by traditional methods. Companies specializing in

this technology have demonstrated the ability to print homes in as little as 24 hours, making large-scale projects feasible and efficient.

The ability to rapidly produce homes is particularly valuable in disaster relief and low-income housing initiatives. Governments and private investors are exploring 3D-printed housing projects as a way to quickly provide shelter in areas affected by natural disasters or economic hardship. This scalability offers a new pathway for addressing global housing shortages while generating investment opportunities in high-demand markets.

Sustainability and Environmental Benefits

Sustainability is a major driving force behind the adoption of 3D-printed homes. Traditional construction generates significant material waste, with excess wood, metal, and concrete often discarded during the building process. 3D printing, on the other hand, uses only the necessary amount of material, reducing waste and promoting eco-friendly practices.

Many 3D-printed homes utilize sustainable materials such as recycled concrete, biodegradable plastics, and even locally sourced raw materials. These innovations lower the environmental impact of construction

while maintaining structural integrity and longevity. Some projects have even experimented with renewable energy integration, such as solar panel installations and energy-efficient designs, making 3D-printed homes an attractive option for eco-conscious investors.

Investment Opportunities in 3D-Printed Real Estate

Investors are taking notice of the potential for 3D-printed real estate, with opportunities emerging in both residential and commercial sectors.

Early adopters are benefiting from lower upfront costs and the ability to scale projects quickly. Several investment avenues exist for those looking to enter the market, including direct development, partnerships with 3Dprinting companies, and real estate funds specializing in innovative housing solutions.

The rental market presents a lucrative

opportunity for 3D-printed homes. With housing shortages driving demand in major metropolitan areas, investors can leverage the affordability of 3D-printed properties to offer competitive rental rates while maintaining strong profit margins. Additionally, short-term rental platforms, such as Airbnb, present another avenue for generating returns, as unique and sustainable housing options attract a growing number of travelers.

Land acquisition strategies also play a key role in 3D-printed home investments. Investors can purchase land in developing regions, where housing demand is high, and deploy 3D-printing technology to quickly establish residential communities. By positioning themselves in high-growth areas, investors can capitalize on appreciation and long-term returns.

Despite its potential, 3D-printed home construction faces challenges that

investors must consider. One of the primary hurdles is regulatory approval. Many regions lack established building codes for 3D-printed structures, creating uncertainties in permitting and zoning regulations. As the technology becomes more widely accepted, regulatory frameworks will need to adapt to accommodate this innovative construction method.

Material limitations also pose a challenge. While concrete-based printing is widely used, there is ongoing research into alternative materials that offer greater flexibility and sustainability. As the industry evolves, improvements in materials and printing techniques will enhance the feasibility and efficiency of 3D-printed home projects.

Public perception and market acceptance are additional factors to consider. Although 3D-printed homes are gaining popularity, some consumers remain skeptical about their durability, aesthetics, and long-term value.

Education and marketing efforts will be essential in overcoming these concerns and establishing 3D-printed homes as a mainstream housing option.

Future Applications and Growth Potential

The future of 3D-printed homes extends beyond single-family residences. The technology is being explored for multiunit developments, commercial buildings, and mixed-use communities. Cities facing rapid urbanization and housing shortages can benefit from large-scale 3D-printed housing initiatives that reduce costs and accelerate construction timelines.

Luxury real estate is another potential application, with architects and designers experimenting with customized, high-end 3D-printed homes that incorporate unique shapes and modern aesthetics. These developments cater to a growing market of buyers

interested in cutting-edge, sustainable housing solutions.

The integration of artificial intelligence and automation is also expected to enhance 3D-printing capabilities, further reducing labor costs and increasing efficiency. Smart home technology can be seamlessly incorporated into 3Dprinted structures, creating residences that are not only affordable but also equipped with advanced energy management and security systems.

Governments and international organizations are beginning to recognize the potential of 3D-printed homes in addressing global housing challenges. Partnerships between private investors, technology firms, and public institutions are likely to accelerate the adoption of this innovative construction method, creating new opportunities for growth and investment.

The rise of 3D-printed homes represents a significant shift in the real estate landscape. With affordability, scalability, and sustainability at its core, this technology has the potential to reshape housing markets worldwide. For investors, early adoption presents an opportunity to capitalize on a transformative industry that aligns with the future of construction and urban development.

While challenges remain, continued advancements in technology, regulatory adaptation, and market acceptance will likely drive widespread adoption in the coming years. As real estate markets evolve, 3D-printed homes are poised to become a key component of the housing sector, offering new possibilities for investors, developers, and homeowners alike.

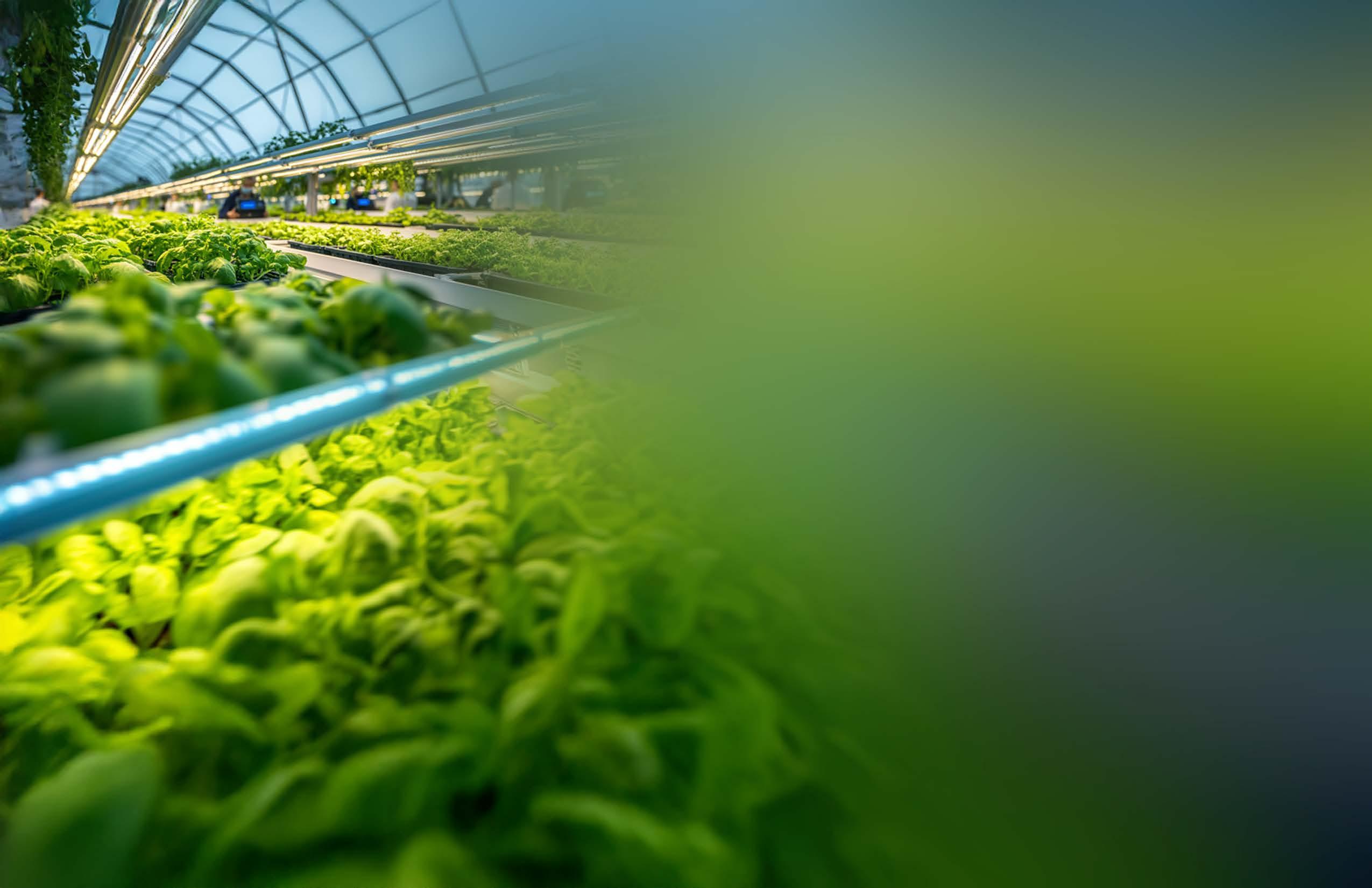

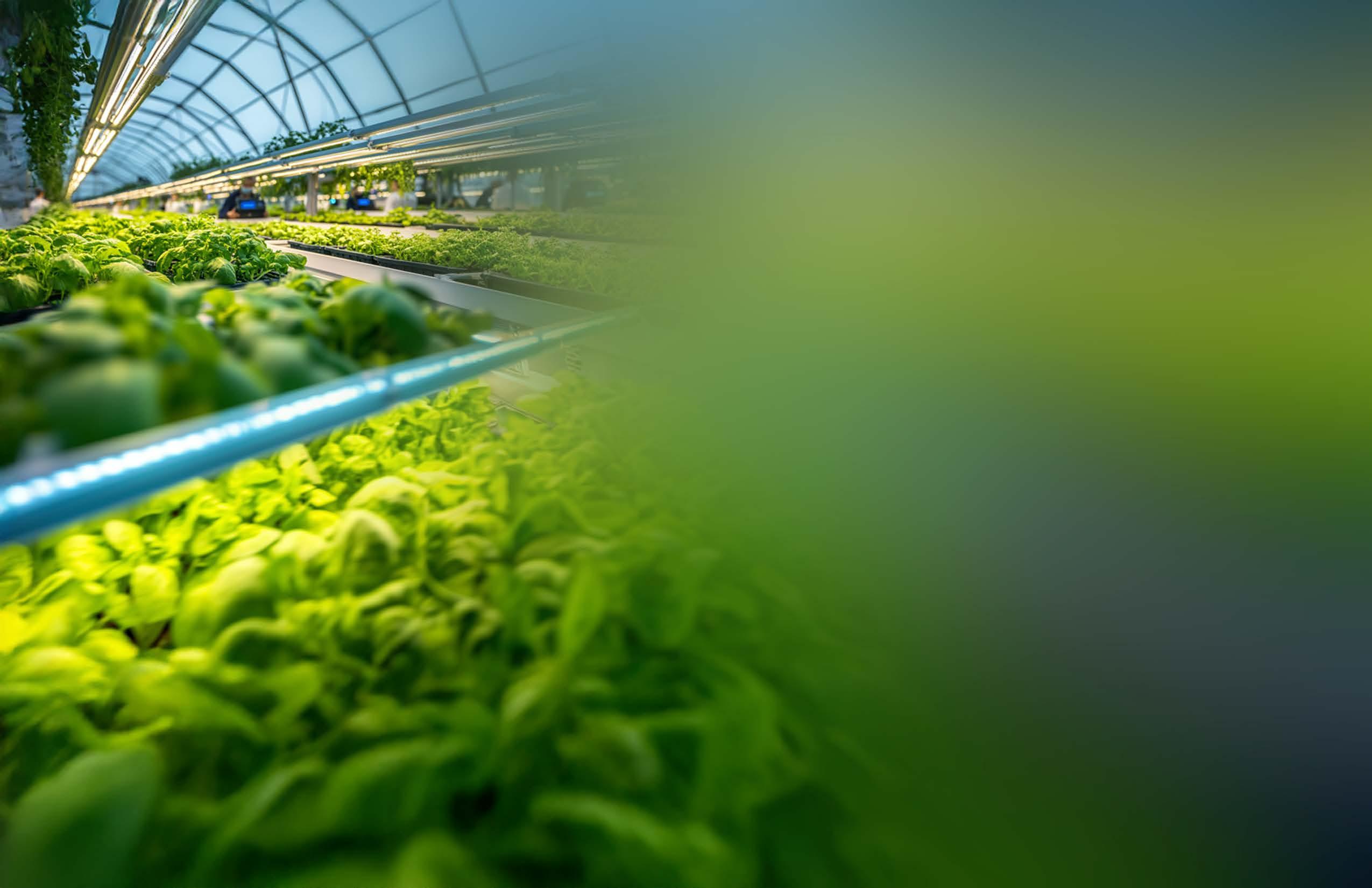

The global agricultural sector is undergoing a major transformation, driven by the need for sustainable food production, technological advancements, and shifting consumer preferences. With climate change posing challenges to traditional farming, indoor farming has emerged as an alternative that promises year-round production, resource efficiency, and localized food supply chains. Investors, farmers, and policymakers are closely examining the potential of both models to determine which will shape the future of food production over the next decade.

Efficiency

One of the most significant factors in the debate between indoor farming and traditional farmland is productivity. Indoor farms, such as vertical farms and hydroponic systems, can produce higher yields per square foot compared to traditional farmland. This is largely due

to controlled environments that optimize light, water, and nutrients, allowing for multiple harvests per year without the constraints of seasons.

Traditional farmland, on the other hand, benefits from natural ecosystems and large-scale production capacity. While crop yields are subject to weather conditions, soil quality, and water availability, technological advancements in precision agriculture are helping to mitigate these challenges. Drones, AIdriven soil analysis, and improved irrigation systems are enabling traditional farmers to maximize efficiency and reduce resource wastage.

As the global population continues to rise, scaling food production is essential to meet increasing demand. Traditional farmland remains the dominant model for large-scale food production, with extensive fields capable of feeding millions. However, scalability is increasingly being challenged by urbanization, land degradation, and

unpredictable climate patterns.

Indoor farming, particularly vertical farms, presents a solution by utilizing urban spaces such as warehouses and repurposed buildings. By growing food closer to consumers, these farms reduce transportation costs and carbon footprints. However, scalability remains a challenge due to high energy costs associated with artificial lighting and climate control systems. While technological advancements in renewable energy and automation are helping reduce expenses, widespread adoption of indoor farming at a global scale is still in progress.

Investment Potential: Opportunities and Challenges

Both indoor farming and traditional farmland offer distinct investment opportunities, each with its own risks and rewards. Traditional farmland has long been a stable investment, with land value appreciation and steady returns from crop sales. Investors looking for long-term security often favor farmland due to its proven track record and the

crops.

Indoor farming, while still in its early stages, has attracted significant investment from venture capitalists and agritech companies. The promise of high-yield production in limited spaces, reduced water usage, and the ability to grow pesticide-free crops appeals to investors focused on sustainability and innovation. However, the high initial costs of setting up indoor farms, along with operational expenses such as energy consumption, pose financial risks. Those investing in indoor farming must carefully evaluate advancements in automation, LED lighting efficiency, and alternative energy sources to determine profitability.

Environmental Sustainability: Which Model is Greener?

Sustainability is a key consideration in the future of agriculture, as both models strive to minimize environmental impact. Traditional farmland, particularly large-scale industrial farms, has been criticized for soil depletion, excessive water use, and greenhouse gas emissions. However, regenerative agriculture practices such as crop rotation, notill farming, and carbon sequestration are helping to restore soil health and promote sustainability in traditional farming.

Indoor farming, by contrast, significantly reduces water usage— using up to 90% less water than conventional farms. By eliminating the need for pesticides and reducing transportation emissions, it presents a more eco-friendly option in urban settings. The primary environmental drawback of indoor farming is its reliance on artificial energy sources for lighting and climate control. Sustainable solutions such as solar panels and energy-efficient LED

lighting are being developed to address this issue.

Consumer preferences are also shaping the future of farming. The demand for locally grown, organic, and pesticide-free produce is driving interest in indoor farming.

Supermarkets, restaurants, and food retailers are increasingly partnering with urban farms to supply fresh produce with minimal transportation time. This trend supports the growth of indoor farms, particularly in cities where access to traditional farmland is limited.

Despite this, traditional farmland remains essential for staple crops such as wheat, corn, and rice, which are not yet feasible for indoor production at scale. The global food supply still relies heavily on traditional farms to meet caloric needs, and consumer demand for staple grains ensures their continued importance in agriculture.

For investors looking to enter the agricultural sector, diversifying across both models may offer the best strategy. Traditional farmland investments provide long-term stability and steady income from crop production, while indoor farming investments offer potential for high returns in emerging markets driven by innovation.