The July Issue of Influential Magazine explores how influence, legacy, and culture are being redefined through custom coin artistry, community branding, and strategic leadership. As individuals and communities seek new ways to express wealth, values, and identity, personalized coin design has emerged as a powerful storytelling and investment medium. Paired with profiles of globally recognized women investors and thought-provoking essays on legacy, this issue is a visual and strategic celebration of what it means to build lasting impact in 2025 and beyond

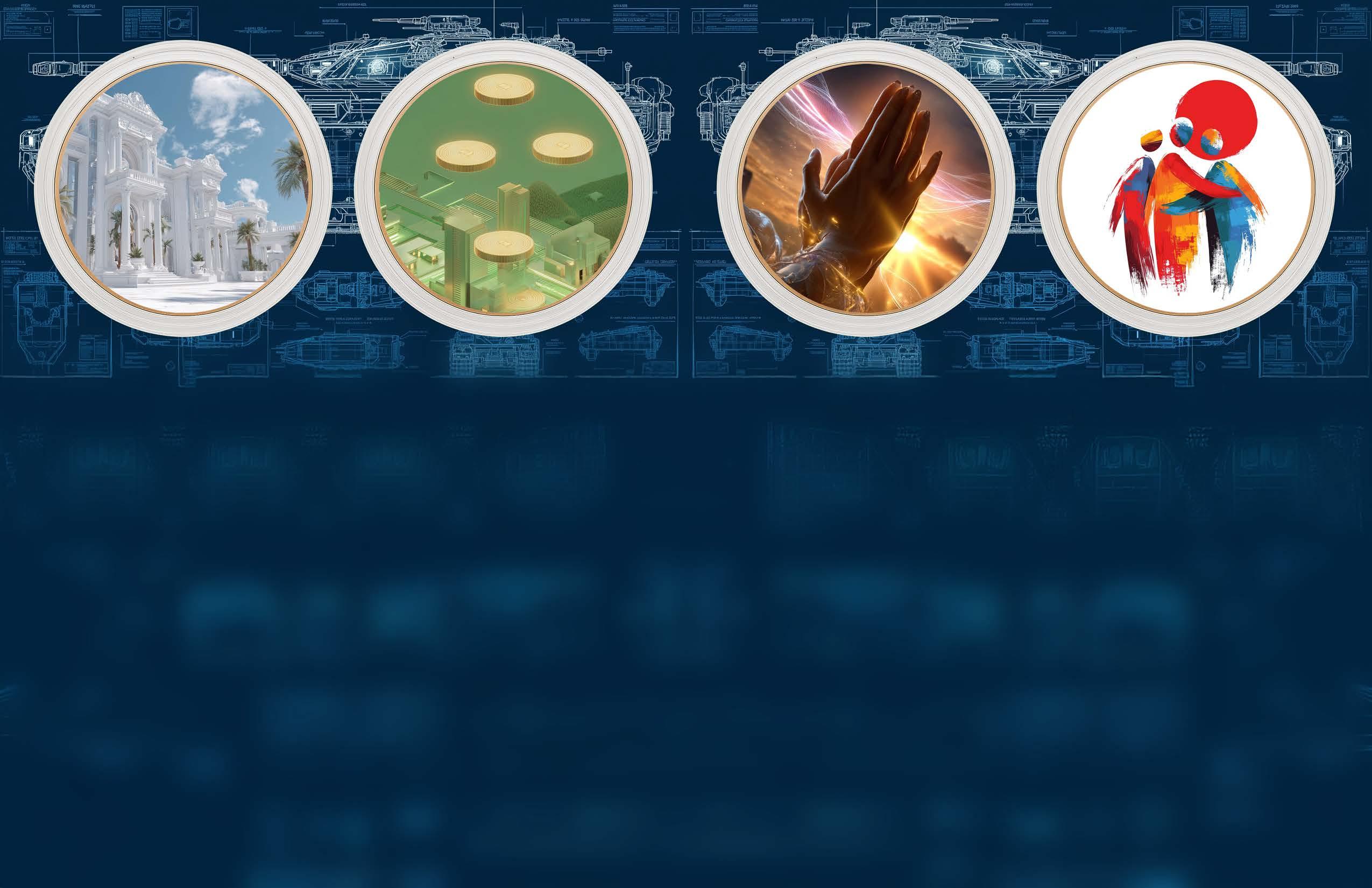

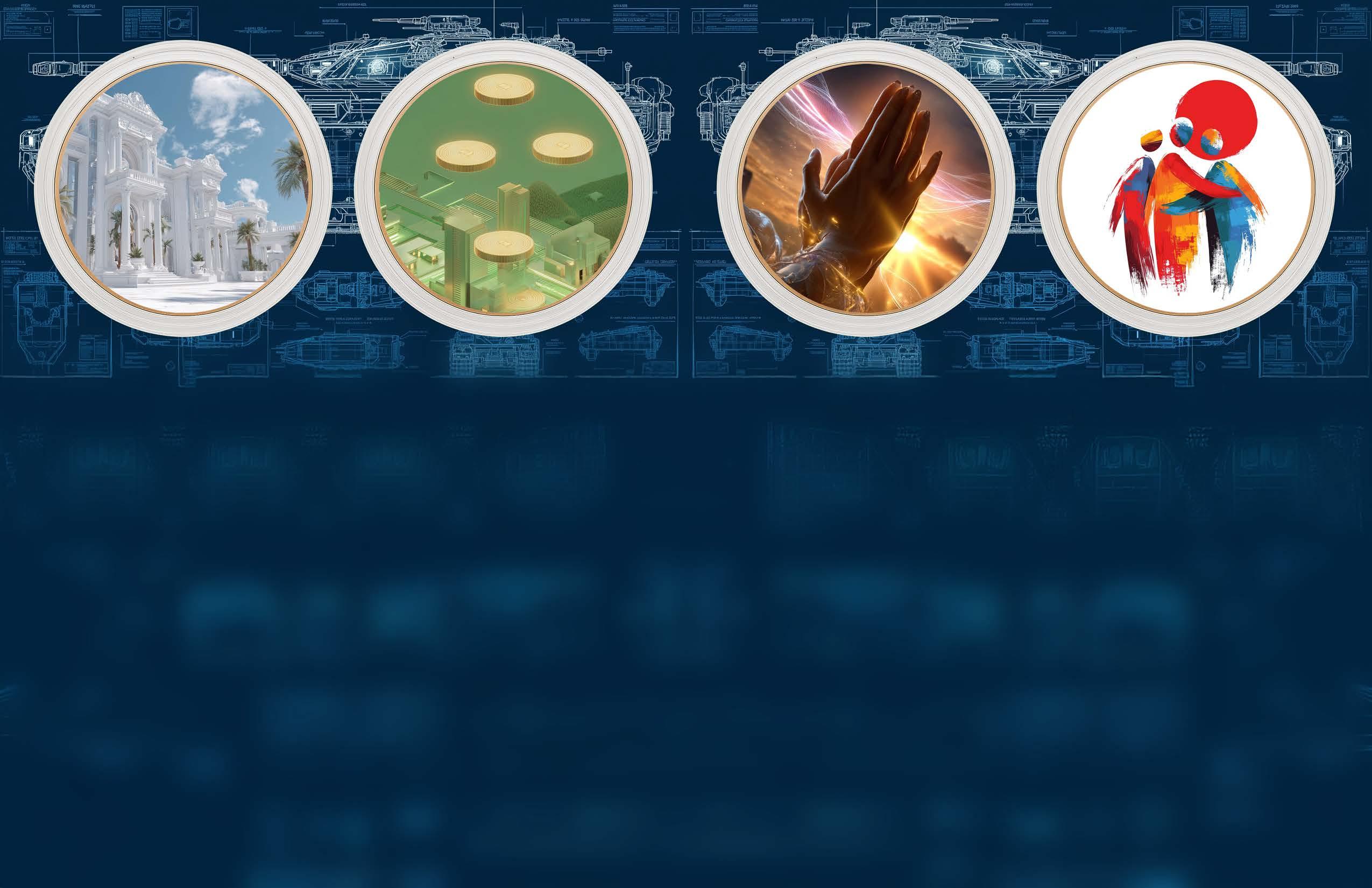

Legacy Minted: Introducing the Influential Coin Series

A bold editorial opening that frames custom coins as a new form of legacy storytelling. Each coin design reflects a mindset—faith, real estate, family, or entrepreneurship—and invites readers to visualize their values in metal. This series introduces pet-themed coins, Dubai tributes, and investment-inspired designs.

Pets with Purpose: The Rise of Pet-Themed Investment Coins

Explores the emotional and financial significance of custom pet coins. These designs are not only heart-centered keepsakes but are also rising in value as personalized, limited-edition collector items within the niche of sentimental investing.

Minted Mindsets: Visualizing Our Investment Philosophy in Coin Form

Custom coins as strategy icons—each design represents an investment pillar: gold, real estate, tech, faith, and family. These coins serve as visual anchors for investors seeking alignment between financial strategy and life values.

Dubai’s Treasure: A Visual Ode to the Emirates in Personalized Coin Art

Stunning personalized coin designs inspired by the elegance of Dubai’s skyline, cultural heritage, and architectural artistry. These coins are visual tributes to regional pride and are becoming collectors' favorites in the luxury design space.

Julie Stav: Latina Voice of Financial Empowerment

Spotlighting Cuban-American financial educator Julie Stav, who has empowered millions of Spanish-speaking families through education and media. Her work illustrates how financial literacy becomes a tool for legacy-building in underserved communities.

Raja Easa Al Gurg: Building the UAE’s Future Through Investment

A leading Emirati businesswoman transforming sectors from healthcare to education. Her investment philosophy prioritizes purpose and national development, showing how principled leadership can reshape the Gulf’s private sector.

Abigail Johnson: Leading Fidelity, Leading a Movement

As CEO of Fidelity Investments, Abigail Johnson leads with quiet force. Her integration of digital assets, low-cost platforms, and strategic longevity has redefined how one of the world’s most powerful asset managers adapts in the modern economy.

Dong Mingzhu: China’s Iron Lady of Industry and Innovation Chairwoman of Gree Electric, Mingzhu is a powerhouse of bold innovation. Her refusal to outsource and her focus on vertical integration make her one of the most influential industrial leaders in Asia—transforming Chinese manufacturing through techforward strategy.

The Power of a Community Brand: When We Build Together, We Grow Together

A sharp insight into how community identity and aligned values become a magnet for influence and scale. This piece explores how shared language, leadership, and rituals build lasting cultural and economic capital across groups and brands.

The Influence Equation: What Really Builds Legacy Today

A reflective essay unpacking how success is being redefined in 2025. Instead of wealth or visibility alone, true influence is being measured by faith, purpose, and long-term impact. The new equation for legacy is rooted in strategic alignment and generational stewardship.

“Influential Magazines, driven by its unwavering aim and mission, strives to be a catalyst for global business transformation. Our commitment extends beyond the conventional, as we envision Unlocking vast business potential in emerging economies. This endeavor creates an unparalleled opportunity for worldwide expansion and knowledge exchange. The emerging nations, marked by dynamic markets and untapped resources, beckon entrepreneurs, investors, and enterprises globally to partake in mutually beneficial ventures. Influential Magazines serves as the conduit for this transformative journey, shedding light on the visionary growth strategies, infrastructure development, and burgeoning consumer bases within the emerging nations. As these economies evolve and innovate, our mission is to foster international collaboration, creating a vibrant space where industries thrive, and insights are shared. Embracing the business potential in these emerging economies not only unlocks doors for unprecedented growth but also nurtures a global dialogue, enriching our collective understanding of diverse business landscapes and strategies. The emerging nations, through Influential Magazines, transcend being mere destinations for business, they also become dynamic hubs for cross-cultural learning and collaboration."

In a world where digital assets dominate conversations and virtual currencies are gaining ground, a quiet but powerful renaissance is taking place—one where physical form and personalized meaning converge. It’s happening in the shape of coins. Not just any coins, but customized, symbolic, and storydriven coinage that reflects identity, values, and legacy. With the launch of the Influential Coin Series, Influential Magazine introduces a bold new category: personalized coin artistry as a form of legacy investing

These aren’t traditional mintings from government treasuries. They are curated, conceptually designed, and minted with purpose—coins that carry stories, principles, and even the essence of personal and communal identity. This first-of-its-kind editorial and collectible series is both a creative expression and an investment exploration, kicking off with deeply symbolic editions like pet-themed coins, Dubai inspirations, and visual wealth philosophy designs.

Throughout history, coins have served as more than economic tools. In ancient Rome, coins bore the images of emperors and gods, meant to project power and continuity. In Africa, precolonial metal objects functioned both as currency and cultural markers. Across centuries and civilizations,

minted items have communicated identity, power, and memory.

Today, in the modern marketplace, coins are undergoing a transformation. High-net-worth individuals, influencers, family brands, and niche collectors are turning to bespoke coin designs as a way to commemorate their values, establish a generational mark, and enhance brand identity. Coins are no longer just about transactions. They are becoming part of a broader narrative economy—one where value is measured not only in ounces, but in meaning.

The Influential Vision: Coins as Legacy Storytelling

The Influential Coin Series launches with the idea that wealth is more than money—it’s story, culture, and influence, passed down across generations. Each coin in the series represents a theme central to modern investing life. For example, coins inspired by real estate depict keys, homes, and land—all anchoring the idea of stability and generational ownership. Others represent digital innovation, such as AI symbols and networked grids, nodding to the tech-driven wealth builders of the 21st century.

Future designs will include faith-based symbols, intergenerational family motifs, and iconic moments in business and entrepreneurship. Every detail— texture, edge, imagery, even inscriptions —has been developed to reflect an

ethos, not just an asset.

These coins serve not just as collectibles but as physical affirmations of one’s investment mindset. They act as visual reminders to stay disciplined, think long-term, and pursue legacy over short-term wins.

Pets with Purpose: A Touch of Heart in Every Mint

One of the first breakout sets in the Influential Coin Series is a tribute to pets and animal companions Designed to capture the loyalty, comfort, and companionship that animals offer, these coins blend emotional value with aesthetic elegance. Each design is customizable —whether honoring a family dog, a childhood cat, or even a beloved horse.

What makes these coins stand out is their blend of sentiment and symbolism. The designs can include paw prints, animals in motion, or stylized emblems that represent traits like loyalty, protection, or joy. Some families are even including pet coins in their heirloom packages, passing them down alongside photos and journals as part of their memory vaults.

This fusion of personal storytelling with tangible form makes the pet coin series not just a collectible—but a healing object, a legacy item, and an investment of emotional value

Personalized 1 Ounce Copper and Silver Coins

Dubai’s Design Language: Luxury Meets Cultural Elegance

Another exciting installment in the series draws direct inspiration from Dubai’s rich architectural and cultural visual language. Known for its global prestige, innovation, and luxury culture, Dubai has become a symbol of what forwardthinking investment looks like when fused with traditional heritage. The Dubai-inspired coins feature elements like the Burj Khalifa, sand dunes, calligraphy, and geometric architecture. These designs are not just a tribute to place—they are a celebration of vision. Dubai’s rise as a global financial and innovation hub makes it the perfect metaphor for coins that represent ambition, growth, and cultural pride Investors seeking to diversify their collectibles portfolio may find value in Dubai-themed mints not only for their visual elegance but also for the story they tell about emerging markets, global ambition, and cultural synthesis

The Influential Coin Series isn’t just about visuals—it’s also an invitation to think visually about your investment philosophy. Some coins in the series are based on abstract representations of financial values: compound interest, risk and reward, or diversified portfolios. Imagine a coin that reflects “faith and finance” through a braided design or one that illustrates “long-term vision” with an hourglass and tree roots. This form of visual investing reinforces mindset and strategy. Many investors are placing these coins on their desks or in personal vaults—not to trade or sell, but to anchor their thinking. These mints function like vision boards, but in metal form. They serve as inspiration pieces, aligning financial behaviors with symbolic, values-driven imagery.

When evaluating collectible coins like those in the Influential Series, it’s

essential to understand their value beyond material. While some coins may be made of precious metals, others are valuable due to limited edition status, design pedigree, or brand association.

Collectors and investors alike should consider:

• Rarity: Limited editions tend to retain or increase value over time due to scarcity.

• Story: Coins with strong backstories—such as family origin, geographic inspiration, or themed symbolism—tend to perform well in secondary markets and private trades.

• Audience Appeal: Personalized coins with specific audience targeting (like pet lovers or cultural groups) often build niche value rapidly.

• Condition and Packaging: Professional presentation, certificates of authenticity, and protective casings elevate longterm worth.

In other words, think like a hybrid: part collector, part investor, part brand strategist.

An unexpected but powerful development in the world of personalized coins is the rise of heirloom investing. Families are beginning to create personalized coin sets as part of generational wealth planning. These coins might represent a child’s birth year, a family motto, or milestones such as business launches, marriage, or spiritual commitments.

Unlike digital assets, these coins are tangible, beautiful, and symbolic. They can be passed from hand to hand, held during prayer, or displayed on a mantle —becoming part of the family's visual legacy. For investors who value multigenerational impact, this represents a meaningful category of long-term

investment that blends heritage with value.

For entrepreneurs, artists, and thought leaders, custom coin design offers an entirely new avenue for brand storytelling. Imagine a speaker who gifts a commemorative coin to event attendees, or a pastor who offers a symbolic coin during a baptism or dedication service. These tokens become part of a brand’s iconography —physical manifestations of their message and values. Organizations are also beginning to mint coins for team building, donor appreciation, and brand launches. In a crowded market, tactile branding is making a comeback. It cuts through the noise, offering something that feels substantial and personal.

As the Influential Coin Series expands, future collections will delve into more curated storytelling themes:

• Faith and Finance: coins rooted in scripture and spiritual values

• Motherhood and Legacy: designs that reflect generational impact through matriarchal lines

• Entrepreneurship & Vision: icons of courage, innovation, and grind

• Cultural Tributes: mints that represent different nations, traditions, and stories from around the world

Each new series will include original visuals, personalized design options, and editorial features that go deeper into the meaning and vision behind every mint.

GET COINS TODAY: https://www.7kmetals.com/ theinfluentialcoin

n a world where people are increasingly blending personal meaning with investment strategies, a new kind of collectible is gaining traction—pet-themed investment coins. These aren’t novelty trinkets or gimmicky gifts; they are meticulously designed, deeply symbolic, and in many cases, appreciating physical assets that tell a story. At the intersection of love and legacy, pet coins are creating a space where memories and wealth meet.

From regal golden retrievers to curious cats, parrots, rabbits, and even exotic reptiles, the custom minting of petthemed coins is becoming both a creative expression of affection and a strategic addition to collectible portfolios. Whether as heirlooms, keepsakes, or limited-edition collector’s items, these coins are transforming how pet lovers express devotion and build lasting legacies—one mint at a time.

The emotional bond between humans and their pets is one of the most enduring connections across cultures and generations. For many, pets are family—loyal companions who share life’s best and hardest moments. As such, memorializing pets in a tangible,

enduring form feels natural.

Personalized coins allow owners to capture the essence of their animals with incredible nuance. Some coins are engraved with a pet’s likeness, name, or paw print. Others incorporate stylized illustrations or breed-specific imagery that reflects the spirit of the animal. From joyful poses to calming symbols, these designs serve as both art and memory capsule.

In a time when emotional connection drives consumer decision-making, this form of investment becomes more than material—it becomes emotional currency, providing comfort, meaning, and pride. Collectors often display these coins in custom boxes, on shelves, or as part of family altars, treating them as personal totems.

While the emotional aspect is compelling, the financial potential of pet coins shouldn’t be underestimated. Custom, limited-edition coins— especially those made of precious metals—carry tangible investment value. As with other collectibles, the key to value lies in uniqueness, craftsmanship, and scarcity.

The growing niche market of pet-

themed coins appeals to a devoted demographic. The pet industry itself has ballooned into a multi-billion-dollar sector, encompassing food, healthcare, apparel, and now luxury collectibles. Investors who recognize the passion and spending power of this community are beginning to collect and trade pet coins not only for personal reasons, but for long-term growth.

Some designs are offered in serialized editions, with certificates of authenticity and tamper-proof packaging. Others are issued through private mints that specialize in high-relief engraving, using gold, silver, bronze, and hybrid metals. The combination of artistry, symbolism, and production quality makes these coins attractive to both first-time collectors and seasoned investors.

One of the most powerful uses of petthemed coins is in legacy planning and generational gifting. For families who have raised pets as part of their household identity, a custom coin can become a treasured heirloom. Some choose to mint a coin for each beloved pet across generations, creating a visual family history through animal symbolism. Others use the coins as heartfelt gifts—marking anniversaries,

For families who have raised pets as part of their household identity, a custom coin can become a treasured heirloom.

memorials, or celebrations like pet adoptions. They are frequently presented in velvet-lined display boxes or as part of a bundle that includes photographs, stories, or letters to the recipient. This form of gift-giving turns a coin into a living memory.

Instead of fading digital images or disposable merchandise, the coin becomes a permanent, weighty reminder of love and companionship. Over time, these items often become part of estate planning, passed down along with wills and photo albums, ensuring the pet’s legacy lives on.

The artistic development of pet-themed coins has progressed rapidly in recent years. What began as simple silhouettes and engraved names has evolved into a highly stylized form of animal representation. Some designs use abstract art to express personality—curved lines to show grace, etched eyes to reflect loyalty, or posture to suggest bravery.

Others incorporate visual metaphors, such as an eagle with wings spread to symbolize protection or a cat curled in rest to express peace and healing. These symbolic layers add a level of richness to the coin, allowing collectors to appreciate them as miniature sculptures and carriers of meaning

As minting technology has advanced, the ability to reproduce lifelike details—fur texture, eyes, muscle tone—has given rise to high-definition animal portraiture on coins. This opens up design possibilities that balance realism with reverence, ensuring the coin is not just a copy of a photo, but a tribute to a unique relationship.

Investment Tip: Know the Artist and the Mint

When investing in pet-themed coins, it's important to look beyond the subject matter and assess the reputation of the mint and artist involved. Coins created by

established mints with strong production histories tend to hold value more reliably, especially when paired with respected designers.

Artists who specialize in animal engravings or collectors' coins often bring with them a following, which can drive secondary market demand. Researching who created the artwork, what mint struck the coin, and whether the edition was limited or open can help determine long-term appreciation potential.

Additionally, materials matter. Coins produced in fine silver or gold are generally more valuable, but even nonprecious metal coins can gain collector interest if the design, story, and packaging elevate their perceived value.

While pet-themed coins have found strong footing in North America and Europe, they are beginning to resonate globally. In Asia, where symbolism and animal imagery carry significant cultural weight, pet coins are being used in festivals, spiritual rituals, and family events.

Some countries have long traditions of animal honorifics—like the Year of the Dog in Chinese culture—making these coins highly versatile in both gifting and investment contexts. In Latin America, family-centered traditions are embracing pet-themed mints as part of household celebrations and commemorative keepsakes. Even in the Middle East, where luxury gift culture is strong, highend pet coins are being positioned as exclusive, meaningful tokens of affection.

This international interest suggests that the category has the potential to move from niche to mainstream within the next few years, especially as mints partner with artists and storytellers who understand regional sentiment and symbolism.

For those looking to build a meaningful collection around pet-themed coins, intentionality matters. Collectors should consider aligning their acquisitions with specific memories, milestones, or relationships. Some start with a single custom coin and then expand into themed series—like all the pets they've had, or coins inspired by specific breeds.

Others focus on charity-aligned designs. Several mints now offer collaborations with animal shelters or wildlife conservation groups, where a portion of the proceeds supports rescue operations, veterinary care, or endangered species protection. Collecting these coins becomes both a personal and philanthropic endeavor.

Building a collection in this way doesn’t just satisfy emotional needs—it establishes a narrative asset, one that can be shared, displayed, and even inherited.

Design is not just about aesthetics; it plays a crucial role in a coin’s market value. Unique motifs, special finishes (like antique or proof), and design techniques such as high-relief or color fusion can significantly affect collector interest. Themes that resonate universally —like the bond between humans and animals—tend to perform well because they tap into emotions. When combined with craftsmanship and limited availability, these coins can rival other fine art collectibles in both desirability and value retention. Collectors and investors alike are drawn to items that blend emotion and artistry. Pet-themed coins, when executed with excellence, are achieving both.

GET COINS TODAY: https://www.7kmetals.com/ theinfluentialcoin

Philosophy

How Custom Coin Design Can Bring Strategy, Vision, and Values to Life

In a financial world driven by spreadsheets, stocks, and fast-moving markets, there is a growing hunger for investments that feel grounded, tangible, and deeply personal. While portfolios continue to expand across digital assets and high-tech opportunities, there’s a quiet return to symbols—visual cues that help investors stay anchored to their values. In this movement, a new medium is emerging: the investment mindset coin.

With the launch of Minted Mindsets, Influential Magazine is showcasing a collection of custom coin visuals that represent core investing principles: gold, real estate, technology, faith, and family. These coins don’t just reflect markets—they tell stories. They serve as reminders, motivators, and legacy tools for those who believe that strategy should be just as visible as success.

Each design is more than art. It is a meditation on belief systems that drive investing behavior. These coins don’t merely symbolize wealth; they embody the values behind why we build it, protect it, and pass it forward.

Symbols have always played a role in wealth creation. From the early days of minted currency, when coins bore images of kings, gods, and empires, to modern-day national mints that depict leaders, birds, or natural landmarks, the coin has always been about more than value—it’s about meaning.

In the case of Minted Mindsets, these coins take this historic connection and give it a modern twist. Each coin is designed not around a nation or a figurehead, but around a principle of investing. The result is a series of tangible tokens that reflect core philosophies investors live by.

When you hold one of these coins in your hand, you’re not just holding metal. You’re holding your vision. Whether you believe in slow wealth through real estate, generational stability through gold, the disruptive power of tech, or faith as your foundation, there is now a coin to represent that.

These coins act as psychological anchors. They keep investors focused during volatile times. They reinforce patience, discipline, and long-term vision. For many, they become tools not just for inspiration, but for education— especially when passed on to the next generation.

Few investments hold the same historical weight and universal trust as gold. Represented in the Minted Mindsetscollection by a coin etched with enduring symbols of protection and royalty, the gold coin serves as a visual reminder of one of the oldest and most respected wealth preservation strategies in the world.

Gold represents more than intrinsic value. It stands for safety in the storm. In times of economic uncertainty, inflation, or currency devaluation, gold has historically

served as a stabilizer. Many investors turn to gold not for fast returns, but for its role as a store of value, a hedge, and a physical asset unbound by digital volatility.

In coin form, gold becomes even more powerful. The act of holding, gifting, or storing a custom-minted gold coin elevates the psychological connection to security. Whether used to represent a family vault or a spiritual inheritance, the gold mindset coin captures the philosophy of wealth that outlasts trends.

The real estate mindset coin in the series embodies longterm stability, passive income, and land ownership—core pillars of financial independence. Real estate has long been one of the most accessible and dependable ways to grow wealth, build equity, and provide generational housing or rental income.

The coin’s design reflects structures, roots, and ownership— symbols of permanence and vision. It’s a reminder that while markets shift and currencies fluctuate, land remains. Ownership of real estate is about building a life, not just a line item.

Many investors are drawn to real estate for its compound value: appreciation over time, cash flow through rentals, and tax advantages. The coin brings these concepts to life visually. It invites conversations about stewardship, planning, and the long view of wealth.

Holding this coin reminds investors to build slow, invest

wisely, and structure their finances around real, touchable assets.

The tech-focused coin in the Minted Mindsets series is not about glamorizing trends—it’s about honoring innovation. Designed with circuitry, code patterns, and sleek digital elements, this coin represents the forward-thinking investor who understands that disruption creates opportunity.

Tech investing is often misunderstood as gambling on the next unicorn or crypto moonshot. In reality, it’s about strategic placement in industries and platforms that are reshaping how we live, work, and communicate. Whether it’s artificial intelligence, biotech, green energy, or digital infrastructure, technology investment is a mindset rooted in change and adaptability.

This coin is a token for the pioneers. It belongs on the desks of those building apps, investing in startups, or guiding companies through digital transformation. It doesn’t celebrate risk for risk’s sake—it celebrates intelligent positioning in sectors with exponential growth potential.

For investors with a strong tech strategy, this coin becomes a compass. It points to the future while reminding them to stay informed, agile, and discerning.

Perhaps the most unique coin in the Minted Mindsets collection is the faith-centered design. In an age of material

metrics, this coin stands as a reminder that not all value is measurable in dollars.

The faith coin is inscribed with symbols of hope, prayer, and eternal perspective. It is intended for those who see their financial journey as part of a larger calling—those who tithe, give, sow into missions, or build businesses that serve a higher purpose.

Faith is a mindset that transcends market timing. It encourages consistency in giving, integrity in business, and belief in unseen outcomes. This coin is for the kingdomminded investor who understands that stewardship is spiritual. Having this coin nearby—on your desk, in your journal, in a keepsake box—offers a moment of grounding. It challenges investors to remember that what they build here should reflect values that last far beyond a single generation.

The family mindset coin is perhaps the most intimate in the series. It reflects multi-generational planning, inheritance, education, and unity. Designed with intertwined figures, trees, and legacy motifs, it honors those who think not just about income—but impact.

For investors who prioritize building wealth to pass on—not just consume—this coin becomes a symbol of vision. It celebrates families who talk about money, share lessons, and build trust across generations. It honors the grandparent who opened a college fund, the parent who bought a home early, the child who now understands budgeting, and the siblings who plan together.

This coin belongs in homes, offices, trust planning meetings, and family financial summits. It is a piece of visual language that says: “We build together. We grow together. We protect each other.”

In financial culture today, where so much is individualistic and short-term, the family coin reclaims the communal aspect of investing. It reinforces the idea that financial decisions today shape freedom and opportunities for decades to come.

While the coins themselves are not always intended as tradeable commodities, they can serve as tools that enhance investment behavior. Visual cues have been shown in behavioral finance to reduce emotional trading, increase discipline, and support goal-setting.

By converting your core investment principles into a physical form, you’re creating reminders that move you from reaction to intention. For example, seeing the real estate coin daily can encourage saving for a down payment. Glancing at the tech coin might push you to research that emerging sector you've been curious about. Holding the faith coin during prayer or journaling could reset your priorities for giving and legacy.

Investors can use these coins as visual affirmations. Place them on a vision board, gift them to mentees, or even include them in family trust packages. Their purpose is not only to inspire—but to inform.

Dubai is a city of vision—where sand meets steel, tradition harmonizes with technology, and ambition is inscribed into the skyline. Its evolution from a modest fishing village into a global capital of luxury, innovation, and investment has inspired creatives, entrepreneurs, and investors around the world. Now, this legacy is being captured in an entirely new format: personalized coin art.

With the rise of storytelling through collectible design, Dubai’s most iconic elements—its architecture, desert landscapes, heritage patterns, and cultural motifs—are being translated into coins that go beyond currency. These are not government-issued dirhams or commemorative medals. They are privately minted, customized symbols of identity, crafted for those who want to hold Dubai’s energy in the palm of their hand.

From the towering Burj Khalifa to the poetic curves of Arabic calligraphy, each coin becomes a portable portrait of place, a fusion of art, emotion, and timeless value.

Dubai is unlike any other city on Earth. Its meteoric rise was not the result of mere resources, but of strategic imagination. Leaders in the UAE have long understood that wealth isn’t only material—it’s also cultural, architectural, and experiential. That philosophy is now echoing in the world of design-based investments.

Personalized coin art inspired by Dubai encapsulates the elements that make the city unforgettable. The skyline alone offers endless design potential, from the shimmering sail-like structure of the Burj

Al Arab to the architectural dominance of the Burj Khalifa. These landmarks are not just engineering feats; they are symbols of human aspiration and precision. The use of these elements in coin design allows collectors and investors to connect emotionally to the city’s story. Each coin becomes a mini-monument, a tribute to ambition realized. Whether given as a gift, displayed in an office, or passed down to future generations, these coins inspire the same bold thinking that built Dubai itself.

Beyond architecture, Dubai’s cultural identity is rich with visual storytelling. Arabic calligraphy, for instance, is one of the most celebrated artistic expressions in the region. Known for its flowing forms and rhythmic elegance, calligraphy is more than beautiful script—it’s a spiritual and cultural touchstone. Coins that incorporate traditional phrases or verses, often stylized in thuluth or kufic styles, create a powerful connection between faith, art, and heritage.

Other visual motifs found in personalized coins include geometric patterns, often seen in Islamic architecture, which represent infinity, unity, and balance. These designs don’t merely decorate; they communicate the spiritual and philosophical foundations of Emirati culture. When translated into coin form, these details offer collectors a deeply meaningful and richly textured object to treasure.

Even the desert, so often romanticized yet misunderstood, plays a role. Dune formations, camel silhouettes, palm trees, and falcons—all symbols rooted in tradition—can be woven into coin designs that reflect the city’s relationship to nature, survival, and transformation.

What makes Dubai-themed personalized

coins so compelling is their ability to represent not just a place, but a memory. Many visitors and residents alike associate the city with specific moments —an unforgettable family trip, a business milestone, a pilgrimage, or a season of transformation.

Custom coin commissions allow these moments to be preserved in physical form. A coin might feature a skyline from the exact angle seen from a hotel balcony. Another might include an engraved date marking a wedding anniversary at The Palm. These are not mass-produced souvenirs. They are heirlooms of individual narrative, made meaningful through personalized design. The growing popularity of such coins among global collectors speaks to the universal desire for symbols that fuse place with purpose. As the world becomes more digital, the desire for tactile, intentional objects increases. Coins created around Dubai’s imagery offer a rare fusion of beauty, story, and rootedness.

Investment Tip: Know the Market for Artistic and Regional Rarity

As with all forms of collectible assets, value depends not just on design quality but also on rarity and cultural relevance. Dubai-themed coin art occupies a unique position in the global collectible market: it’s highly specific, emotionally resonant, and increasingly sought-after by Middle Eastern collectors and international admirers of Gulf culture.

Those investing in this space should study the origin and uniqueness of each piece. Coins that feature original artwork, limited editions, or culturally significant inscriptions tend to perform well over time. In addition, pieces that include highrelief sculpting or hand-finishing tend to appreciate faster due to the labor and skill required to produce them.

Dubai’s association with luxury and exclusivity also gives these coins

additional cachet. While they may not function as traditional bullion-based assets, their design value, storytelling power, and aesthetic exclusivity can rival or exceed the returns of typical collectible coins when marketed properly and preserved professionally.

One of the underappreciated aspects of investing in personalized Dubai coins is their role in cultural diplomacy and bridge-building. When gifted or displayed, these coins communicate appreciation for the values of the region. They invite conversation, respect, and shared experience.

For international entrepreneurs and

investors who do business in the UAE, Dubai-themed coins can be used as brand extensions, partnership gifts, or ceremonial keepsakes. They express not only refinement but cultural awareness— qualities increasingly essential in global business.

Likewise, for Emirati citizens looking to celebrate national pride or preserve family legacy, these coins offer a way to ground identity in something both contemporary and timeless. Rather than relying solely on Western luxury symbols, the Dubai coin creates a regional language of excellence that is distinct, authentic, and visually powerful.

From Concept to Coin: The Creative Process

Designing a personalized coin

inspired by Dubai begins with a concept: a place, a phrase, a memory, or a motif. Artists and engravers then work with clients to transform that idea into a fully developed coin design. This includes layout, scaling, edge details, and finishes like matte, antique, or mirror-polished effects.

Advancements in minting technology now allow for incredible precision in small formats. Coins can include micro-details, dual textures, and layered reliefs that enhance realism and emotional impact. Some coins incorporate gemstone inlays, colored enamel, or laser etching for added depth.

Because these coins are often made to order or limited in quantity, the client plays a direct role in shaping the artistic direction. This level of personalization is rare in most

investment categories and gives the resulting product a high emotional and strategic value.

Legacy is not just about wealth—it’s about what’s remembered.

Personalized Dubai-themed coins are increasingly being used in legacy planning. Families are creating sets that commemorate their lineage, their travels, or their moments of transition.

In family offices or private vaults, coins are being included in memory boxes, next to letters and photos, forming part of a new kind of visual biography. Each coin becomes a page in a storybook of influence.

For business leaders, influencers, and

visionaries, these coins also represent personal branding. Some entrepreneurs have begun creating signature coins inspired by Dubai that are gifted to clients or included in high-tier packages—offering not just a token of thanks, but a physical expression of vision and values.

Dubai’s influence on the global imagination makes these coins particularly potent. They don’t just say “I invested in something beautiful.” They say, “I am part of something visionary.”

Investment Tip: Presentation and Preservation Matter

Beyond design, how you store, display, and present your personalized Dubai coins affects both emotional and financial value. Professional-

grade coin holders, archival packaging, and certificates of authenticity should accompany every piece.

For high-value coins, consider vault storage, insurance, and appraisal. If the coin was created with cultural or religious inscriptions, be sure to include translation or context materials for future generations or collectors. This not only enhances understanding but deepens appreciation and marketability.

Collectors should also document the story behind the coin—the “why” it was made. Provenance increases value, especially for custom-minted works. Whether that story is romantic, professional, spiritual, or familial, it gives the coin its place in history.

Julie Stav is more than a financial educator—she is a movement maker. For over two decades, she has been a trailblazer in demystifying money for millions of Spanish-speaking families, empowering communities who were often overlooked by mainstream financial systems. Her voice is recognized not just for its warmth and clarity, but for the practical, transformative knowledge it delivers.

Born in Cuba and raised in the United States, Julie Stav turned her personal story into a platform to uplift others. She understands from experience the anxiety, the cultural hesitation, and the misinformation that often keep families—especially Latino households—from building true, lasting wealth. Through television, radio, books, seminars, and media appearances, she has become one of the most trusted names in personal finance for the Latino community in the U.S. and Latin America.

Her success is rooted in education, but her influence comes from her authenticity. Julie doesn't speak down to her audience. She speaks with them —about real-life concerns, aspirations, and the pursuit of dignity through economic empowerment.

Julie Stav began her professional life as a teacher, and that educator’s mindset continues to shape her communication style. Instead of focusing on jargon or elite investing tactics, she emphasizes clarity, accessibility, and step-by-step progress. Her transition from the classroom to financial expert wasn’t a leap into another world; it was an extension of her mission to uplift and inform.

Recognizing the lack of culturally relevant financial education for Latinos, she created platforms that would speak directly to the realities of immigrant families, first-generation students, and working-class professionals trying to navigate credit, mortgages, and savings for the first time. Her book, Get Your Share, became a New York Times bestseller and is still widely used in financial literacy programs today.

Julie’s popularity surged when she brought her message to radio and television. As the host of the Spanishlanguage show Tu Dinero and appearances on networks like Univision, she reached audiences that traditional finance media often

ignored. Her approach combined storytelling with strategy—showing viewers how to see themselves as capable, worthy, and ready to take ownership of their financial future.

One of Julie Stav’s most powerful messages is about mindset. In communities where generational wealth has not been the norm, there can be a psychological barrier to wealth-building. Julie addresses this head-on, encouraging people to move beyond fear, secrecy, and scarcity thinking.

She teaches that investing isn't reserved for the elite. It's a practice, a skill set, and above all, a right. Her workshops often begin by encouraging participants to identify what wealth means to them—security, freedom, opportunity—and then guiding them toward financial tools that can support that vision.

Julie has been especially vocal about the importance of women taking charge of their finances. In many Latino households, women have traditionally managed household budgets, but they have not always been included in long-term planning, investing, or estate decisions. Julie

changes that narrative by positioning women as leaders and stewards of wealth—not just spenders, but planners and builders.

She emphasizes that money is not a taboo subject. Talking about it openly is the first step toward mastery. By creating a culture where financial conversations are encouraged and even celebrated, Julie has helped transform the way entire families approach money.

Julie’s most lasting contribution may be her insistence that education itself is a form of investment. She teaches that before buying a stock, opening a retirement account, or getting into real estate, families must invest in understanding. This philosophy turns financial literacy from an afterthought into a foundational strategy.

Through her seminars and courses, Julie explains the mechanics of banking, credit, interest, and compounding in ways that are culturally sensitive and easy to grasp.

Her materials are bilingual and often include analogies that resonate with immigrant and first-generation experiences—like comparing investment portfolios to family recipes, where each ingredient adds unique flavor and balance.

This accessible education leads to action. Julie’s audience has included single mothers who go on to open Roth IRAs, young professionals who begin automatic savings plans, and retirees who learn how to manage passive income. By grounding finance in real life, she removes the intimidation factor and opens the door to tangible growth.

She also encourages people to evaluate financial products through the lens of values. That means asking whether a particular account or investment aligns with one's goals, beliefs, and long-term vision. Julie believes wealth should be personal— not just profitable.

Where You Are, With What You Have

One of the most empowering messages Julie Stav offers is the idea that

investors don’t need to wait for the “right moment” or a large lump sum to begin. She urges people to start where they are. Whether someone can invest $25 a month or $2,500, the act of beginning—of stepping into the identity of an investor—is what creates momentum.

Julie emphasizes consistency over timing. Markets will rise and fall, but steady investment habits compound. She also encourages diversification, not just across asset classes but across life goals. This means allocating for retirement, yes—but also for education, homeownership, and entrepreneurship.

Her advice isn’t about chasing returns. It’s about creating a portfolio that reflects real-life goals and sustains them over time. She teaches that the greatest wealth isn’t always financial— it’s the peace of mind and freedom that come from making intentional financial decisions.

Bridging the Gap Between Wall Street and Main Street

Julie Stav has always seen her work as a bridge between high finance and real

Julie emphasizes consistency over timing. Markets will rise and fall, but steady investment habits compound. She also encourages diversification, not just across asset classes but across life goals. This means allocating for retirement, yes—but also for education, homeownership, and entrepreneurship.

families. While much of Wall Street speaks in complex formulas and speculation, Julie translates those conversations into practical insights that everyday people can use.

She demystifies stock investing by explaining how companies operate, how shareholders participate in profits, and how to use mutual funds as a riskreducing tool. She breaks down terms like capital gains, dividend yield, and risk tolerance with a teacher’s clarity and a friend’s encouragement.

Her commitment to inclusion is evident in her outreach efforts. Julie frequently partners with schools, churches, community organizations, and local governments to bring financial education to underserved neighborhoods. By doing so, she has helped thousands open their first investment accounts, buy their first homes, or repair their credit scores— each step a building block toward financial dignity.

Her message has also reached younger generations through digital platforms. As financial education evolves into mobile apps, short videos, and online

workshops, Julie has embraced technology to continue her mission in modern formats.

Julie Stav’s work is about more than finance—it’s about identity. In a media landscape that often underrepresents Latinas in positions of economic power, Julie’s visibility matters. She shows what is possible and reminds people that financial leadership is not limited by background, accent, or origin.

Her image on television, her name on bestselling books, and her voice in both English and Spanish serve as reminders that finance is not a gated community. It’s a space where all are welcome—if given the knowledge, confidence, and opportunity to enter.

Representation matters, especially in money conversations. Julie has often said that one of her greatest accomplishments is seeing women and families in her workshops begin to see themselves not just as survivors—but as investors, homeowners, and wealth creators.

Her influence has inspired a generation of bilingual financial educators, coaches, and authors who follow in her footsteps. She helped build the platform—and now she’s making space for others to rise.

For Julie, the final measure of financial success isn’t just in what you accumulate—it’s in what you share. She often teaches that the best investment is one that multiplies, and that includes the sharing of knowledge. She encourages families to pass along what they learn, involve children in budget conversations, and use family events to talk about goals.

This intergenerational approach ensures that wealth isn’t just created— it’s retained and expanded. Julie’s workshops often include multigenerational families sitting side by side, discussing real estate options, college savings, or the meaning of debt. This kind of environment fosters not just financial literacy, but cultural continuity and strength.

In the United Arab Emirates, a region known for its rapid economic growth, cutting-edge innovation, and strong cultural heritage, one name has emerged as a beacon of purposeful leadership: Dr. Raja Easa Al Gurg. As a pioneering businesswoman and investor, she has not only broken glass ceilings but also laid the foundation for other women to rise. Her influence reaches into sectors critical to the nation’s development— education, healthcare, finance, and philanthropy—making her one of the most respected and impactful figures in the Gulf.

For more than two decades, Al Gurg has been redefining what leadership looks like in the Middle East. She combines a keen business sense with a deep commitment to social impact, all while advocating for gender equity in the boardroom and beyond. Her role as the Managing Director of the Easa Saleh Al Gurg Group, a conglomerate founded by her father, has positioned her at the intersection of legacy, modernization, and inclusive growth.

Her story offers more than inspiration —it provides a practical blueprint for long-term investing, strategic leadership, and values-driven enterprise.

Dr. Raja Easa Al Gurg began her professional journey as an educator, serving as the headmistress of Zabeel Secondary School for Girls in Dubai. This early career choice laid the groundwork for her later commitment to educational reform and empowerment. It also revealed a core belief that still defines her leadership style: transformation begins with knowledge

Her shift from education to business came as she took a leadership role in the Easa Saleh Al Gurg Group, an organization involved in retail, construction, industrial, and real estate ventures. Under her stewardship, the company has expanded its portfolio and diversified its investments while maintaining a strong connection to UAE heritage and values.

This ability to move from one influential domain to another without compromising her purpose is what sets Al Gurg apart. She embodies the spirit of adaptive leadership, navigating both traditional structures and modern enterprise with equal grace.

Her dual expertise—education and

business—enables her to assess investment opportunities not only by profit margins but by their potential to educate, uplift, and sustain communities. Whether it's backing higher education initiatives or guiding investments in healthcare, her decisions are infused with long-term thinking and public benefit.

Championing Women in Finance and Leadership

In a region where female leadership has historically been limited by structural and cultural norms, Raja Easa Al Gurg has played a defining role in reshaping expectations. She has consistently used her platform to advocate for women in leadership, particularly in sectors like banking, commerce, and investment that have traditionally been male-dominated.

Her position as the first Emirati woman on the board of HSBC Bank Middle East, along with her leadership in the Dubai Business Women Council, has allowed her to drive forward policies and mentorship programs aimed at supporting female entrepreneurs and executives. Through these roles, she has encouraged women to see themselves not only as contributors to the workforce but as drivers of economic growth

In a region where female leadership has historically been limited by structural and cultural norms, Raja Easa Al Gurg has played a defining role in reshaping expectations. She has consistently used her platform to advocate for women in leadership, particularly in sectors like banking, commerce, and investment that have traditionally been male-dominated.

She understands that empowering women is not just a social imperative—it is a financial strategy. Economies that engage women more fully experience broader, more sustainable development. Al Gurg frequently highlights this in her talks and public statements, urging institutions to view diversity as a return on investment.

Her efforts have resulted in a growing number of Emirati women entering finance, managing businesses, and leading change across sectors. She is part of a powerful shift in the UAE’s identity—from a young nation defined by ambition to one defined by inclusive excellence

Investment Tip: Look Beyond Profit to Purpose

One of the standout qualities of Raja Easa Al Gurg’s investment philosophy is her commitment to purpose-driven investing. She is known for supporting projects that combine profitability with measurable social impact. For investors looking to adopt a similar approach, the takeaway is clear: consider how your money not only grows, but gives

In her business ventures, Al Gurg

encourages assessments of long-term viability and community impact. She advises that successful investments are not merely transactional—they are transformational. This means choosing sectors that align with personal values, support societal needs, and are positioned for sustainable growth.

Fields like healthcare, education, and green energy are examples of such opportunities in the current climate. These sectors offer not just financial returns, but measurable improvements in quality of life, especially in emerging markets like the Gulf.

By following her model, investors can adopt a mindset that fuses ethics with economics. Doing so helps build a portfolio that generates not only wealth, but significance.

Dr. Al Gurg’s commitment to healthcare investments reflects her broader vision for national progress. She serves as the Vice Chairperson of the board of trustees for the Mohammed Bin Rashid University of Medicine and Health Sciences and is a strong advocate for

better medical infrastructure across the entire UAE region.

Under her influence, her family’s foundation has supported numerous health-related initiatives, including cancer research, children’s hospitals, and funding for medical education. Her approach to healthcare investment is multi-layered: it’s about systems, training, and accessibility.

She recognizes that healthcare is not just a service sector—it’s a cornerstone of stability. Societies that invest in public health enjoy increased productivity, better educational outcomes, and stronger civic participation. As a business leader, she sees the healthcare sector as an essential component of longterm economic security, not merely a line item on a national budget.

This philosophy has translated into strategic investments in hospitals, wellness centers, and health-focused startups—many of which integrate technology and AI into diagnostics and patient care. For investors seeking future-proof sectors, her focus on health is both visionary and grounded.

Raja Easa Al Gurg’s enduring passion for education remains one of the most consistent themes in her investment and philanthropic work. As chairperson of the Al Gurg Education Foundation, she has overseen the distribution of scholarships and grants that support Emirati and Arab students at every level of learning—from primary education to postgraduate research.

She views education as both a moral obligation and a national strategy. In a country like the UAE, where innovation and diversification are key to economic sustainability, cultivating a highly skilled, educated population is critical.

Her foundation’s work includes partnerships with international universities, vocational programs, and investments in school infrastructure. These initiatives reflect her belief that investing in people is the most reliable path to lasting impact

For individuals seeking to align their investment strategies with community development, supporting education— whether through scholarships, edtech platforms, or institutional partnerships—

can offer both meaningful and measurable returns.

As the daughter of the late Easa Saleh Al Gurg, one of Dubai’s most respected businessmen and philanthropists, Raja inherited more than an empire—she inherited a mission. But she has never been content to simply maintain her father’s legacy. Instead, she has reshaped it for a new era.

Under her leadership, the Easa Saleh Al Gurg Group has become a symbol of modern Emirati enterprise—global in reach, diversified in structure, and grounded in values. She has championed innovation within the organization, encouraging investment in new technologies, expanding the group’s sustainability practices, and enhancing corporate governance.

At the same time, she has retained the essence of her father’s ethos: a belief in giving back, in building responsibly, and in valuing trust above all. This blend of heritage and innovation makes her one of the most balanced and forwardthinking business leaders in the Gulf. Her leadership style—measured,

principled, and vision-driven—offers lessons for any investor or entrepreneur navigating a fast-changing global economy. She proves that it is possible to honor the past while investing boldly in the future.

Investment Tip: Diversify Through Strategic Legacy

Raja Easa Al Gurg’s career demonstrates that diversification isn’t just a financial tactic—it’s a life strategy. By engaging in multiple sectors across business, healthcare, and education, she has created a portfolio that reflects resilience, vision, and social relevance.

For investors seeking to build a legacy, this means considering how diverse sectors contribute to a broader life narrative. Think beyond balance sheets to balance values. Diversify not only to spread risk, but to widen impact.

A strong investment legacy is one that survives disruption, aligns with personal values, and empowers others to do the same. Whether through family businesses, charitable foundations, or educational endowments, strategic diversification can build a lasting blueprint for influence.

bigail Johnson may not be a household name outside financial circles, but within the corridors of power in global finance, her influence is immense. As the Chairwoman and CEO of Fidelity Investments, one of the world’s largest asset management firms, Johnson stands as a rare force in an industry traditionally dominated by loud voices and larger-than-life personalities. Her leadership style is deliberate, datadriven, and quietly transformative. And yet, under her guidance, Fidelity has not only grown in size but has also redefined what it means to be a forward-thinking, customer-focused investment firm in the 21st century.

Fidelity manages trillions in assets across mutual funds, retirement accounts, and institutional services. But its reputation for innovation, user experience, and technology-forward investing is what truly sets it apart. That evolution has been largely driven by Johnson’s strategic vision—one that respects the legacy of her family business while pushing the company toward bold new frontiers in fintech, digital assets, and democratized wealth management.

Her journey offers both a case study in modern corporate leadership and a powerful model for investors who want

to adapt to changing times without compromising their long-term vision.

Abigail Johnson’s path to the top of Fidelity was not a result of entitlement, but of preparation and excellence. The granddaughter of Fidelity’s founder, Edward C. Johnson II, and the daughter of former CEO Edward “Ned” Johnson III, she joined the company in 1988 as an analyst after earning her MBA from Harvard Business School. Even then, she made clear her desire not just to participate in the family business, but to shape its future.

Her early years were marked by an emphasis on understanding the company’s vast infrastructure, including back-office operations, fund management, and client engagement. This comprehensive internal training provided her with insight into every layer of Fidelity’s complex engine. It also informed her people-centered approach to technology and customer service—a defining feature of her leadership style.

In 2014, Johnson became CEO, and by 2016, she was also named Chair of the Board. Under her direction, Fidelity has accelerated into the digital age without losing the institutional trust it has built

over decades. Her tenure is marked by both continuity and disruption, balancing the needs of long-term investors with the expectations of modern consumers.

When Johnson took over, Fidelity was already a major player in asset management and retirement planning. What she brought was a sharper focus on technology, accessibility, and innovation. She invested heavily in digital infrastructure, launching platforms and apps that allowed clients —especially younger generations—to engage with investing in new ways.

Fidelity’s online brokerage services became more intuitive and responsive under her leadership, while educational tools and financial literacy resources were expanded to serve both beginner and experienced investors. These moves reflected Johnson’s belief that financial services should be approachable, transparent, and empowering.

One of her most notable moves was Fidelity’s early exploration into digital assets and blockchain technology. While other traditional firms remained skeptical, Johnson began allocating

Her quiet demeanor should not be mistaken for passivity. Underneath her measured tone lies a fierce commitment to excellence, accountability, and client service. Fidelity has maintained its private ownership structure, which allows for long-term thinking free from the short-term pressures of quarterly earnings reports. Johnson has used this autonomy to make bold investments in tech, talent, and infrastructure that may not show immediate returns but are likely to shape the future of finance.

resources toward understanding and integrating crypto-related services. In 2018, Fidelity launched Fidelity Digital Assets, a subsidiary that provides custody and trade execution for cryptocurrencies to institutional investors. This placed Fidelity at the forefront of the crypto conversation in traditional finance circles.

For investors, this move signaled a willingness to embrace emerging trends with serious infrastructure and research— not just hype. It also revealed Johnson’s ability to anticipate shifts in consumer behavior and market structure before they become mainstream.

Abigail Johnson’s approach to innovation offers a valuable lesson for investors navigating volatile and evolving markets. She demonstrates that successful investing—whether on a corporate or individual level—requires both adaptability and discipline. Her decisions to enter new arenas like crypto were calculated, backed by research, and aligned with Fidelity’s broader mission to serve long-term investors.

This approach can be applied to personal investing. It’s important to remain open to new sectors, asset classes, and strategies, but those moves should be grounded in a clear understanding of risk, value, and

long-term objectives. Diversification and experimentation are key, but so is staying rooted in your financial philosophy.

Johnson’s leadership reminds investors that embracing change doesn’t mean abandoning principles. Instead, it means evolving strategically to ensure your financial portfolio reflects the realities of a fast-changing world.

Unlike many high-profile CEOs who seek the limelight, Johnson is known for her low-profile, high-impact style. She rarely gives interviews and maintains a tight focus on the internal mechanics of the business. This restraint has earned her respect in an industry where public personas often overshadow performance.

But her quiet demeanor should not be mistaken for passivity. Underneath her measured tone lies a fierce commitment to excellence, accountability, and client service. Fidelity has maintained its private ownership structure, which allows for long-term thinking free from the shortterm pressures of quarterly earnings reports. Johnson has used this autonomy to make bold investments in tech, talent, and infrastructure that may not show immediate returns but are likely to shape the future of finance.

Her influence extends beyond Fidelity. As

one of the few women to lead a top-tier financial firm globally, Johnson is often cited as a role model for aspiring female executives and fund managers. While she rarely speaks publicly about gender dynamics, her presence alone has shifted perceptions in a male-dominated industry.

Her rise is proof that leadership doesn’t have to fit one mold. In fact, Johnson’s career challenges the notion that success in finance must come with bravado. Her data-driven, results-oriented approach speaks for itself—and for the hundreds of thousands of employees and millions of clients who depend on Fidelity’s services.

One of the key strategies Johnson has emphasized is building digital trust. In an era where online platforms are vulnerable to data breaches, scams, and misinformation, maintaining consumer confidence is more critical than ever. Fidelity’s strong reputation for reliability, combined with its robust cybersecurity measures, has enabled it to scale its digital offerings without losing customer loyalty.

This trust-building is reflected in how the company handles transparency. Under Johnson’s direction, Fidelity has been a pioneer in reducing fees, providing clear disclosures, and expanding no-cost investment products. These customer-

One of the key strategies Johnson has emphasized is building digital trust. In an era where online platforms are vulnerable to data breaches, scams, and misinformation, maintaining consumer confidence is more critical than ever. Fidelity’s strong reputation for reliability, combined with its robust cybersecurity measures, has enabled it to scale its digital offerings without losing customer loyalty.

centric policies have attracted younger investors and increased the firm’s competitiveness in an industry racing to retain assets.

Fidelity’s strategy offers another investment takeaway. Trust and clarity are as valuable in financial markets as they are in business operations. Investors should seek out funds, companies, and platforms that not only perform well but also communicate honestly. Understanding how companies treat their clients and stakeholders can be a useful indicator of long-term sustainability.

Encouraging Financial Empowerment Across Generations

A consistent theme in Abigail Johnson’s leadership is financial education. Fidelity under her watch has doubled down on its mission to make investing more understandable and accessible for every generation. The firm’s resources for retirement planning, college savings, estate planning, and financial independence are continually updated to reflect life stages and economic realities.

Millennials and Gen Z investors have taken notice. Through mobile-first platforms and modern UX design, Fidelity has made it easier than ever for

first-time investors to enter the market. Johnson’s foresight in addressing this generational shift has positioned the company to stay relevant for decades to come.

This generational focus has also influenced product development. Fidelity was among the first major firms to offer zero-commission trades, fractional shares, and robust retirement tools tailored for different life goals. These innovations meet consumers where they are and empower them to grow regardless of income level or investing experience.

For individual investors, Johnson’s approach offers this insight: meet the moment, but plan for the future. Whether starting with small amounts or managing large portfolios, being proactive and informed is key. Resources are more available than ever, and taking the time to understand them can significantly impact your financial trajectory.

Abigail Johnson has not merely inherited a financial empire—she has re-engineered it for the next era. Her leadership balances tradition with transformation, and her willingness to

make long-view investments in technology, talent, and ethical leadership reflects a core belief: the best way to honor legacy is to grow it.

Under her guidance, Fidelity continues to expand its footprint globally while maintaining a stronghold in the U.S. retirement market. The company’s stability during economic upheavals, including the COVID-19 pandemic, has further solidified its position as a trusted partner for individuals, institutions, and advisors alike.

As the financial industry faces disruptions from artificial intelligence, blockchain, ESG regulation, and changing consumer behavior, Johnson’s calm but assertive style provides a compelling blueprint for leadership. She doesn’t chase headlines. She builds systems.

For those who view investing as more than numbers—who see it as a form of stewardship, strategy, and vision— Abigail Johnson’s story is more than a corporate biography. It’s a modern manifesto on how to lead with integrity, adapt with wisdom, and build with purpose.

Ithe high-stakes world of Chinese industry, where state-owned giants and private tech firms jostle for dominance, Dong Mingzhu stands alone. As Chairwoman and President of Gree Electric Appliances, she has transformed a modest air-conditioning manufacturer into one of the most respected and technologically advanced appliance brands in the world. Her leadership is marked by vision, tenacity, and a willingness to defy convention— even within China’s rigid corporate landscape.

Often dubbed the “Iron Lady” of Chinese business, Dong Mingzhu's ascent is not merely a tale of personal triumph. It is the story of how one woman has reshaped the narrative of what Chinese industry can be—efficient, innovative, and globally influential. Through her decisive leadership, Gree has not only become the largest residential air-conditioner manufacturer on Earth but also a symbol of national manufacturing pride and a case study in how to modernize legacy industries.

Her journey is a blend of tough management, forward-thinking investment, and unrelenting belief in innovation—a combination that offers

critical lessons for investors, entrepreneurs, and policymakers navigating global shifts in manufacturing and technology.

From Sales Clerk to CEO: A Path Forged Through Perseverance

Dong Mingzhu's story did not begin in a corporate boardroom or elite business school. Born in 1954 in Nanjing, she spent the early years of her career working in local government and raising a child as a widow. At age 36, she made a bold decision to leave her stable government post and move to Zhuhai, a coastal city in Guangdong province, to join a small home appliance firm—Gree Electric—as a salesperson.

It was a dramatic shift, especially for a woman with no formal business background and few industry connections. Yet, her resolve and natural leadership quickly became apparent. Within a few years, Dong rose through the ranks. She broke sales records, resolved chronic debt issues for the company, and ultimately became the face of Gree’s transformation.

Her steady rise culminated in her appointment as General Manager in

2001 and later Chairwoman in 2012. Throughout her leadership, she resisted pressure to cut corners or outsource key processes, insisting instead on vertical integration and product innovation. She believed that true growth had to be earned through quality and research, not simply aggressive expansion.

Building a Self-Reliant Manufacturing Powerhouse

At a time when many Chinese firms were eager to scale quickly through cheap labor and imported parts, Dong Mingzhu charted a different path. She invested heavily in Gree’s in-house R&D, pushing for self-sufficiency in core technologies, including compressors, circuit boards, and automation systems.

Under her leadership, Gree Electric transformed from an assembler into a vertically integrated giant. The company owns dozens of factories, thousands of patents, and one of the most advanced smart manufacturing systems in Asia. This commitment to in-house development was risky in the short term but paid off in long-term resilience and brand strength.

40 A company’s long-term value is often tied to the philosophy of its leadership. Dong Mingzhu’s career proves that ethical rigor, quality focus, and personal conviction can become organizational pillars.

For investors and business strategists, Dong’s approach offers a reminder that ownership of critical infrastructure—from technology to talent—can be more valuable than short-term margins. By avoiding dependence on external suppliers, Gree strengthened its position amid trade tensions, supply chain disruptions, and rising costs across global markets.

Dong also emphasized product quality as a non-negotiable. She famously said she would never allow a substandard product to leave the factory, even if it meant sacrificing short-term profits. This philosophy helped establish Gree as a premium brand not just in China, but in over 160 export markets.

Dong Mingzhu has never been content with maintaining the status quo. Her commitment to innovation extends far beyond air conditioners. Over the past decade, Gree has expanded into robotics, smartphones, new energy systems, and intelligent home appliances. Many of these moves were seen as unorthodox,

especially given the company’s stronghold in a single product category. But Dong viewed diversification as a form of technological insurance and brand evolution. One of her most forwardthinking decisions was launching Gree’s AI-driven appliances before the domestic smart home market had matured.

She directed substantial resources into software engineering, data analytics, and user interface design —an unusual move for a manufacturing firm, but one that positioned Gree to compete with tech-centric brands.

This emphasis on innovation extended to workplace structure. Dong introduced performance-based management, merit-driven promotion systems, and internal entrepreneurial incubators to support fresh ideas from younger employees. Her style is often described as strict but empowering. She demands results, but she also provides tools and autonomy. Investors looking to assess the health of a company’s future growth potential should take note. Dong’s example shows that internal innovation ecosystems

where experimentation is encouraged and cross-functional collaboration is the norm—can produce long-term value far beyond quarterly returns.

Dong Mingzhu’s long-term strategy provides a key lesson for investors in emerging markets and beyond. Companies that prioritize building their internal capabilities—from manufacturing to R&D to human capital—often have greater resilience and agility in uncertain markets. Her refusal to outsource vital components or dilute product quality in favor of speed positioned Gree as a durable, innovation-forward brand.

For retail and institutional investors alike, evaluating a company’s investment in its core competencies can serve as a proxy for sustainability. This means examining not only financial reports but also leadership philosophy, hiring trends, and R&D allocation. Companies led by decision-makers who invest in internal growth often weather economic downturns better and are more prepared to capitalize on new technologies and consumer trends.

Leading with National Pride and Global Perspective

Dong’s leadership has also reflected a deep commitment to China’s broader economic vision. She aligns closely with the national strategy of "Made in China 2025," a government initiative to upgrade Chinese manufacturing and reduce reliance on foreign technology. Her speeches often underscore the importance of domestic innovation and the responsibility of private firms to strengthen national competitiveness.

Yet, she balances this patriotism with a sharp understanding of global markets. Gree’s international expansion has been steady and calculated, targeting markets where the brand can offer premium value rather than merely competing on price. The company’s overseas factories and joint ventures reflect a nuanced strategy of glocalization adapting to local preferences while retaining brand integrity.

Dong’s global strategy provides insight into how businesses in traditionally domestic-focused sectors can grow responsibly. For investors tracking global

manufacturing or Asia-Pacific growth trends, companies that combine national policy alignment with global ambition are often better positioned to scale sustainably.

As one of the most prominent female CEOs in China, Dong Mingzhu’s influence extends beyond business. She is a vocal advocate for women in leadership, regularly encouraging young women to pursue careers in engineering, business, and innovation. In a corporate landscape still dominated by men, her success challenges stereotypes and expands possibilities. She has openly discussed the personal sacrifices she’s made for her career, including raising her son as a single mother and working long hours well into her sixties. Yet, she frames these experiences not as burdens but as part of a larger calling. For her, leadership is about service, vision, and responsibility—not comfort or convenience. Her leadership style blends assertiveness with mentorship. While known for her firm expectations, she has mentored countless young executives and engineers within Gree, many of

whom now lead key divisions. For investors and board members evaluating leadership teams, the presence of strong female leaders like Dong offers both stability and strategic clarity.

Investment Tip: Leadership Philosophy Shapes Company Culture—and Returns

A company’s long-term value is often tied to the philosophy of its leadership. Dong Mingzhu’s career proves that ethical rigor, quality focus, and personal conviction can become organizational pillars.

Investors should pay close attention to how leaders communicate, how they handle crisis, and how they treat product, people, and purpose.

Gree’s consistent profitability, reputation for quality, and resilience through multiple economic cycles reflect more than sound financials. They reflect a culture instilled from the top. For long-term investors, especially those looking for stable holdings in emerging markets, companies with founder-like leaders who emphasize product excellence and employee accountability often outperform.