TThe global music industry is transforming rapidly, fueled by innovation, cultural shifts, and an explosion in new revenue opportunities. With streaming, blockchain, education, and real estate converging to create new pathways, music is no longer just an art form—it’s a powerful investment category. From startups to superstar-led ventures, the music economy is drawing attention from angel investors, institutional funds, and impact-driven players alike. This month’s special issue explores the strategies, platforms, legal frameworks, and bold ideas that are reshaping the future of music investing. Here's a look at key developments and themes shaping the landscape and presenting compelling opportunities for entry, expansion, and purpose-driven impact.

The Sound of Opportunity:

Why Now Is the Time to Invest in Music

The music industry is experiencing a renaissance, presenting a symphony of opportunities for investors. With the evolution of digital platforms, the resurgence of live events, and the increasing value of music catalogs, the sector offers diverse avenues for investment. Understanding the current landscape and emerging trends is essential for those looking to harmonize their portfolios with the rhythm of this dynamic industry.

Catalog Gold:

How Music Royalties Became Wall Street’s New Obsession

The music industry has long been a source of cultural enrichment, but in recent years, it has struck a chord with investors seeking alternative assets. Music catalogs—comprehensive collections of an artist's or songwriter's works—have emerged as valuable commodities, attracting significant attention from financial markets. This article delves into the dynamics of catalog acquisitions, the motivations driving both artists and investors, and the inherent risks and rewards of investing in music royalty income streams.

From Garage to Global:

Investing in Independent Artists

In an era where technology has leveled the playing field, independent music artists have emerged as some of the most influential and innovative voices in the industry. From modest home studios to international stages, today's DIY musicians are building sustainable careers without the backing of major record labels. This shift has not only empowered artists but has also opened the door for new types of investors to enter the space.

Beatcoin:

Music Meets Blockchain and NFTs

The digital age has continuously reshaped the music industry, but the emergence of blockchain technology and Web3 applications may be its most transformative chapter yet. From altering the nature of ownership to redefining fan engagement, the intersection of music and blockchain has introduced a new era of decentralization, direct monetization, and investment potential. At the center of this revolution are NFTs and tokenized royalties— concepts that are rapidly gaining traction among artists, fans, and forward-thinking investors alike.

Studio Startups and Sonic Tech: Where Music Meets Innovation

The music industry is no longer confined to instruments, microphones, and record labels. At the intersection of creativity and code lies a growing frontier of innovation: studio startups and sonic technology. These companies are transforming how music is created, produced, distributed, and monetized. For investors, this rapidly expanding space offers fresh opportunities to support disruptive technologies with broad commercial potential.

Labels, Licenses & Legal Gameplans:

Smart Contracts and Music IP

As music continues to evolve in a digital-first world, so too must the legal structures that govern it. The surge in independent music distribution, streaming, NFTs, and blockchain-based platforms has transformed how music is made, monetized, and protected. Amid these shifts, one constant remains: clear legal frameworks are essential, especially for investors entering the space.

Music Real Estate:

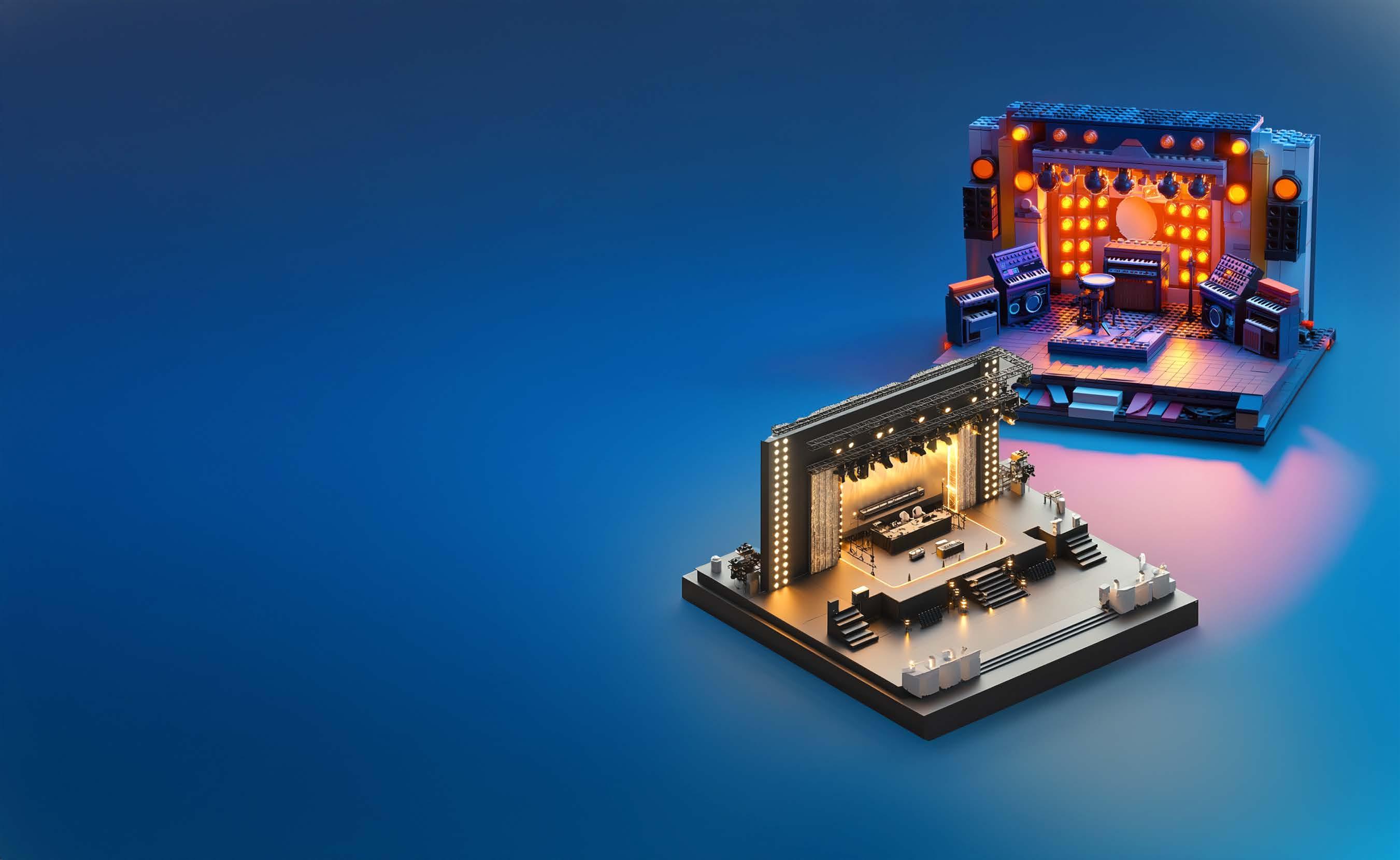

The Business of Owning Studios, Venues & Festivals

In the music industry, conversations about investment often center around streaming platforms, publishing rights, and digital innovation. Yet, one of the most underappreciated and potentially lucrative avenues lies in music real estate. From legendary recording studios and intimate performance venues to sprawling festival grounds, physical infrastructure plays a critical role in shaping the culture and commerce of music.

The New Moguls: Artists as CEOs and Label Owners

In today’s music industry, artists are no longer content with simply creating and performing. Increasingly, they are seizing control of their business empires by owning their masters, launching record labels and imprints, building brands, and investing across industries. This evolution marks the rise of the artist as a CEO—a powerful shift that challenges the traditional gatekeeping of record labels and entertainment conglomerates.

The Heart of the Deal:

Philanthropy, Equity, and Investing with Purpose

As the music industry continues to evolve, a new kind of investor is emerging—one that is as focused on impact as on income. With increasing awareness around social equity, mental health, and community development, many investors are asking a critical question: how can we put our money into music in a way that supports people, not just profits? The answer lies in a growing movement that blends financial return with social responsibility: impact investing in music.

The music industry has evolved from a traditionally insular world of labels and radio to a diverse, tech-driven marketplace where anyone can participate as a creator, consumer, or investor. For those interested in investing, music offers unique advantages— royalty income, cultural relevance, and access to a rapidly

“Influential Magazines, driven by its unwavering aim and mission, strives to be a catalyst for global business transformation. Our commitment extends beyond the conventional, as we envision Unlocking vast business potential in emerging economies. This endeavor creates an unparalleled opportunity for worldwide expansion and knowledge exchange. The emerging nations, marked by dynamic markets and untapped resources, beckon entrepreneurs, investors, and enterprises globally to partake in mutually beneficial ventures. Influential Magazines serves as the conduit for this transformative journey, shedding light on the visionary growth strategies, infrastructure development, and burgeoning consumer bases within the emerging nations. As these economies evolve and innovate, our mission is to foster international collaboration, creating a vibrant space where industries thrive, and insights are shared. Embracing the business potential in these emerging economies not only unlocks doors for unprecedented growth but also nurtures a global dialogue, enriching our collective understanding of diverse business landscapes and strategies. The emerging nations, through Influential Magazines, transcend being mere destinations for business, they also become dynamic hubs for cross-cultural learning and collaboration."

The music industry is experiencing a renaissance, presenting a symphony of opportunities for investors. With the evolution of digital platforms, the resurgence of live events, and the increasing value of music catalogs, the sector offers diverse avenues for investment. Understanding the current landscape and emerging trends is essential for those looking to harmonize their portfolios with the rhythm of this dynamic industry.

The digital revolution has transformed the music industry, opening new revenue streams and expanding its global reach. Streaming services have become the heartbeat of music consumption, leading to a significant increase in industry revenues. In 2023, the International Federation of the Phonographic Industry (IFPI) reported an 11.2% growth in global music revenue compared to the previous year, with streaming accounting for a substantial portion of this increase.

This surge has attracted a diverse group of investors, from private equity firms to individual stakeholders, all eager to capitalize on the industry's upward

trajectory. The predictable and diverse revenue streams from music catalogs— encompassing streaming, physical sales, synchronization in media, and public performances—make them particularly appealing assets.

Several key trends are currently influencing the music investment landscape:

Streaming has become the primary mode of music consumption, with services like Spotify and Apple Music leading the charge. This shift has resulted in a steady flow of royalties, making investments in music rights increasingly lucrative. The number of paid streaming subscribers continues to rise, reflecting a growing global appetite for accessible music.

The acquisition of music catalogs has emerged as a prominent investment strategy. Companies like Hipgnosis Songs Fund have been at the forefront, acquiring rights to extensive song libraries. Founder Merck Mercuriadis

emphasizes that proven songs have predictable and reliable earnings patterns, making them investable assets comparable to gold or oil.

The placement of music in films, television shows, commercials, and video games—known as synchronization or sync licensing—has become a significant revenue source. This avenue offers substantial, though sometimes unpredictable, income boosts for rights holders.

Live music events are witnessing a resurgence, contributing to the industry's growth. Investments in venues, festivals, and related infrastructure are becoming increasingly attractive. For instance, the Queensland government's Live Music Venue Business Grants aim to support venues in upgrading facilities and hiring bands, thereby enhancing the live music scene and making it more accessible to the public.

The financial indicators underscore the music industry's robust health and investment potential:

• Global Revenue Growth: The global recorded music market is projected to grow revenues by 51% to $42.4 billion by 2030, reflecting the industry's strong upward trajectory.

• Streaming Revenue: In 2021, streaming services accounted for $12.3 billion in revenue, marking a $2.2 billion yearover-year increase. This trend highlights the growing dominance of streaming in the music consumption landscape.

• Catalog Sales: In 2021, more than $5 billion was spent on music rights acquisitions, indicating a strong market for catalog investments.

For those considering investing in the music sector, several strategies can be pursued:

• Direct Investment in Music Rights: Purchasing rights to songs or catalogs can provide a steady income stream through royalties. Platforms now facilitate connections between investors and music creators, democratizing access to these opportunities.

• Equity Investment in Music Companies: Investing in publicly traded music companies, such as streaming platforms or record labels, allows investors to benefit from the overall growth of the industry. Companies like Spotify have shown rising profits and subscriber growth, appealing to investors.

• Funding Live Events and Venues: With the revival of live music, investing in venues or festivals can be profitable. Government grants and initiatives supporting live music scenes can further enhance the viability of such investments.

While the music industry offers compelling investment opportunities, it's essential to approach with due diligence:

• Market Analysis: Understand the current trends and demand within the music sector to make informed decisions.

• Legal Frameworks: Ensure clarity in contracts and rights ownership to protect investments.

• Diversification: Spread investments across different areas within the music industry to mitigate risks.

• Stay Informed: Keep abreast of technological advancements and shifts in consumer behavior that may impact the industry.

The music industry's evolution presents a harmonious blend of cultural significance and financial opportunity. As streaming continues to dominate, catalog acquisitions rise, and live experiences regain momentum, the sector stands as a compelling arena for investment. By tuning into the current trends and conducting thorough due diligence, investors can position themselves to reap the rewards of this dynamic and ever-evolving industry.

he music industry has long been a source of cultural enrichment, but in recent years, it has struck a chord with investors seeking alternative assets. Music catalogs— comprehensive collections of an artist's or songwriter's works—have emerged as valuable commodities, attracting significant attention from financial markets. This article delves into the dynamics of catalog acquisitions, the motivations driving both artists and investors, and the inherent risks and rewards of investing in music royalty income streams.

Music catalogs encompass the rights to a collection of songs, including the associated royalties generated from various revenue streams such as streaming, radio airplay, licensing, and live performances. The acquisition of these catalogs has become a strategic move for investment firms aiming to diversify their portfolios with assets that offer predictable and potentially lucrative returns.

Several prominent entities have positioned themselves at the forefront of music catalog acquisitions:

• Hipgnosis Songs Fund: Founded by industry veteran Merck Mercuriadis in 2018, Hipgnosis has been instrumental in elevating music rights as a mainstream asset class. The company has acquired catalogs from renowned artists, including Justin Bieber, whose

extensive collection was purchased for a reported $200 million in January 2023.

• Primary Wave: This firm specializes in acquiring and managing music rights, focusing on iconic artists and their legacies. Primary Wave has secured deals involving the works of legends such as Whitney Houston and Bob Marley, aiming to revitalize and monetize these timeless catalogs.

• Round Hill Music: With a diverse portfolio, Round Hill has invested over $200 million across 40 acquisitions in 2022 alone. Their strategy involves purchasing rights from both emerging and established artists, reflecting a commitment to a broad and balanced investment approach.

Artists Cashing Out: Motivations and Benefits

For artists, selling their music catalogs represents a significant decision influenced by various factors:

• Financial Security: The lump sum received from selling a catalog can provide immediate financial stability, allowing artists to manage their wealth effectively and invest in new ventures.

• Estate Planning: Monetizing a catalog simplifies estate management, ensuring that the artist's legacy is preserved and that their heirs are not burdened

with complex rights management issues.

• Market Timing: With the current high valuations in the market, artists may choose to capitalize on favorable conditions, securing a premium for their life's work.

Investor Interest: Understanding the Appeal

Investors are drawn to music catalogs for several compelling reasons:

• Steady Revenue Streams: Music royalties offer consistent income through various channels, including streaming platforms, radio airplay, and licensing agreements. This predictability is particularly attractive in volatile economic climates.

• Low Correlation with Traditional Markets: The performance of music royalties often exhibits low correlation with traditional financial markets, providing a hedge against market fluctuations and enhancing portfolio diversification.

• Cultural Significance: Iconic songs possess enduring popularity, ensuring a lasting revenue stream. The cultural impact of certain catalogs can translate into sustained financial returns, as timeless music continues to resonate across generations.

The acquisition of these catalogs has become a strategic move for investment firms aiming to diversify their portfolios with assets that offer predictable and potentially lucrative returns.

Music catalogs encompass the rights to a collection of songs, including the associated royalties generated from various revenue streams such as streaming, radio airplay, licensing, and live performances. The acquisition of these catalogs has become a strategic move for investment firms aiming to diversify their portfolios with assets that offer predictable and potentially lucrative returns.

Risks and Rewards of Royalty Income Streams

While the prospect of investing in music royalties is enticing, it is essential to consider both the potential rewards and inherent risks.

Potential Rewards

• Attractive Returns: Music royalties can yield competitive returns, with some investments averaging over 12%. This performance is bolstered by the global proliferation of streaming services and digital platforms.

• Inflation Hedge: Royalties often serve as an effective hedge against inflation, as payments can rise in line with price increases, protecting the real value of the investment.

• Portfolio Diversification: Incorporating music royalties into an investment portfolio can enhance diversification, reducing overall risk exposure due to their low correlation with traditional asset classes.

Associated Risks

• Market Dynamics: Shifts in

consumer behavior, technological advancements, and changes in music consumption can impact royalty revenues. The rise of new platforms or changes in streaming algorithms may affect the profitability of certain catalogs.

• Legal Complexities: The music industry is fraught with legal intricacies, including copyright disputes and ownership challenges. Investors must conduct thorough due diligence to ensure clear and uncontested rights to the catalogs they acquire.

• Valuation Challenges: Accurately assessing the value of a music catalog is complex, influenced by factors such as historical earnings, future potential, and the cultural relevance of the works. Overestimating a catalog's value can lead to disappointing returns.

For those contemplating investment in music royalties, several strategies and considerations are paramount:

• Diversified Portfolio: Investing in a range of catalogs across different genres and eras can

mitigate risks associated with changing musical trends and audience preferences.

• Active Management: Engaging with experienced management teams who can effectively monetize and promote the catalog through licensing deals, sync placements, and other revenuegenerating activities is crucial.

• Due Diligence: Comprehensive analysis of the catalog's performance history, legal standing, and market potential is essential to make informed investment decisions.

• Long-Term Perspective: Music royalty investments often require a long-term commitment to realize substantial returns, necessitating patience and a strategic outlook.

The burgeoning interest in music catalogs as investment vehicles underscores a broader recognition of their financial and cultural value. While the market presents promising opportunities, it also demands careful navigation of its complexities. Investors equipped with a thorough understanding of the industry's nuances, coupled with strategic planning and diligent management, can potentially reap harmonious rewards from this unique asset class.

In an era where technology has leveled the playing field, independent music artists have emerged as some of the most influential and innovative voices in the industry. From modest home studios to international stages, today's DIY musicians are building sustainable careers without the backing of major record labels. This shift has not only empowered artists but has also opened the door for new types of investors to enter the space. Independent artists represent a fast-growing, high-potential market —and those who recognize the trends early stand to benefit from both financial returns and cultural impact.

The Rise of the DIY Music Career

The democratization of music production and distribution has fundamentally changed how artists create, release, and promote their work. Affordable digital audio workstations, easy-to-access plug-ins, home recording equipment, and online platforms like SoundCloud, Bandcamp, and DistroKid have enabled artists to manage nearly every aspect of their music careers independently.

Social media platforms such as TikTok, YouTube, and Instagram have replaced traditional marketing departments, allowing artists to go viral overnight or steadily build loyal fanbases. With streaming platforms providing global distribution and data analytics tools offering direct feedback on performance, independent artists today can reach international audiences while retaining control over their creative direction and ownership rights.

This technological shift has redefined what it means to be a successful artist. While the major label system still plays a role in breaking top-tier acts, the DIY route is now a proven model. Independent artists can monetize their music through a variety of channels, including streaming royalties, merchandise, touring,

licensing, crowdfunding, sync deals, and direct-to-fan platforms.

As the independent music sector grows, it's attracting attention from a wide range of investors. Angel investors, venture capitalists, micro-labels, and even fans are now engaging with independent artists as viable investment opportunities. Unlike traditional record label deals that often heavily favor the label, many modern investment structures are more equitable and transparent, allowing artists to maintain control of their masters and creative vision while accessing resources for growth.

Angel investors, in particular, have started backing early-stage music careers much like they would a startup. These investors provide capital for studio time, marketing, tour support, or video production in exchange for a revenue share or equity stake in future earnings. Because of the low initial costs and high potential return on investment, backing independent artists has become an attractive alternative asset class.

Music-focused venture funds and artist development platforms have also emerged, providing structured financing to independent acts while leveraging data analytics and audience insights. Companies like UnitedMasters and Stem offer tools for artists to distribute music, track income, and access funding without giving up ownership. These platforms are transforming artist development into a scalable, tech-enabled process.

Moreover, platforms such as Indify, BeatBread, and Amuse are changing the funding landscape by using algorithms to identify rising talent and provide advances based on streaming performance and fan engagement. These models reduce the risks traditionally associated with discovering and supporting new artists, while

offering backers an efficient way to connect with high-potential acts.

The rise of independent artists is not just theoretical—it’s visible in the careers of major stars who have gone from unknowns to global forces without major label backing.

Chance the Rapper is one of the most prominent examples. He gained national attention with his mixtape “Acid Rap” and went on to win multiple Grammy Awards without ever signing to a major label. He relied on free distribution, social media promotion, and strategic partnerships, proving that independent artists can compete at the highest levels of the music industry.

Russ, a rapper and producer from Atlanta, built his career by releasing a song every week for over a year on SoundCloud. His relentless work ethic and connection to fans helped him amass millions of streams before signing a distribution deal on his own terms. He has remained an outspoken advocate for artist ownership and independence.

Billie Eilish, although later signed to a major label, began her journey with home-produced tracks that she and her brother uploaded to SoundCloud. Her early success and viral growth caught the attention of the industry, but her foundation as an independent creator was key to her rise.

Closer to grassroots movements, artists like Tobe Nwigwe and LaRussell have built thriving music ecosystems with strong branding, authentic storytelling, and ownership-first mindsets. Their success is rooted in community support, direct-to-fan strategies, and

a refusal to compromise their artistic integrity.

These success stories demonstrate that independent artists are not just an alternative—they are shaping the future of music.

Investing in an independent artist requires more than liking their sound. Just like evaluating a startup, backers need to assess the artist’s brand, work ethic, scalability, and potential for long-term growth.

One of the first indicators of investability is consistency. An artist who regularly releases quality content, engages with fans, and actively builds their presence shows a level of discipline and intent that can translate into long-term viability. Viral moments can create hype, but consistency creates sustainable value.

Engagement is another key metric. A high number of followers doesn’t necessarily equal success—what matters is how invested the audience is. Are fans streaming music regularly, showing up to live shows, buying merch, and sharing content? An engaged community can power an artist’s career through thick and thin.

Ownership and business acumen also signal readiness for investment. Artists who understand their rights, manage their finances, and treat their music career like a business are more likely to use investment capital effectively. Those who have already built independent revenue streams—even on a small scale—have demonstrated proof of concept.

Data analytics now play a major role in evaluating talent. Streaming numbers, playlist placements, geographic growth, social media

insights, and YouTube views provide quantifiable indicators of market traction. While numbers aren’t everything, they can support a broader story of growth and momentum.

It’s also important to evaluate the artist’s team. Do they have a manager, producer, or creative partner who brings structure and accountability? The presence of a strong support system increases the likelihood that an artist can navigate challenges and scale sustainably.

Lastly, vision matters. Artists with a clear message, a distinct aesthetic, and an understanding of their audience are more likely to break through the noise. Investors should look for originality, purpose, and storytelling that resonates beyond trends.

Those interested in backing independent artists should approach the process strategically and with a long-term mindset. Building relationships is key—connect with artists early, learn about their journey, and explore ways to offer support beyond money. Capital is important, but mentorship, connections, and marketing support can also add value.

Use platforms that facilitate investment and track performance. Tools like BeatBread and Royalty Exchange allow investors to engage with music assets in a secure and structured environment, while giving artists autonomy. These platforms often provide insights into catalog performance, income projections, and ownership rights, which help reduce risk.

Consider investing in artists whose values align with your own. Music is more than a business—it's culture. Supporting artists who

reflect your beliefs, represent underserved communities, or champion meaningful causes can bring both financial and social returns.

Remember that music investment is not a guaranteed quick win. The industry is dynamic, tastes change, and even talented artists may face obstacles. Diversifying your artist portfolio and focusing on long-term partnerships rather than short-term trends can increase your chances of success.

Due diligence is essential. Review contracts, royalty splits, publishing arrangements, and distribution terms. Understand how the artist plans to use the funding and how you will receive your return—whether through a revenue share, royalties, or equity in future projects.

Transparency and trust are vital. Clear communication, fair expectations, and mutual respect lay the foundation for strong investor-artist relationships.

Investing in independent artists represents one of the most exciting opportunities in the modern music industry. As technology continues to disrupt traditional gatekeeping structures, indie artists are proving that talent, vision, and hustle can take them from the garage to global stages.

For investors, this moment presents a chance to support rising voices while participating in a movement that blends creativity, community, and commerce. By identifying high-potential talent, building authentic relationships, and leveraging the tools available in today’s music ecosystem, anyone can become part of the next great success story—one song, one stream, and one smart investment at a time.

The digital age has continuously reshaped the music industry, but the emergence of blockchain technology and Web3 applications may be its most transformative chapter yet. From altering the nature of ownership to redefining fan engagement, the intersection of music and blockchain has introduced a new era of decentralization, direct monetization, and investment potential. At the center of this revolution are NFTs and tokenized royalties— concepts that are rapidly gaining traction among artists, fans, and forward-thinking investors alike.

Blockchain, the decentralized ledger technology behind cryptocurrencies like Bitcoin and Ethereum, has extended its influence well beyond financial services. In the music world, it offers a way to register and verify ownership of content, track usage, and ensure fair distribution of royalties. For years, artists have struggled with complex licensing arrangements, delayed royalty payments, and opaque reporting systems. Blockchain promises to streamline these processes with real-time, transparent data and immutable smart contracts.

A smart contract is a self-executing contract with the terms of the agreement directly written into code. In the context of music, this means royalties can be automatically distributed to all contributors—such as songwriters, producers, and featured artists— immediately when a song is streamed or sold. This level of automation and accuracy minimizes human error and reduces the need for intermediaries like traditional publishers or royalty collection agencies.

This model not only improves fairness for artists but also changes how ownership is perceived. Instead of a single entity owning the master rights to a song, multiple parties can now hold fractional ownership via blockchain tokens. This opens the door for fans and investors to participate directly in an artist’s success by purchasing a stake in their work.

NFTs as a New Music Asset Class

NFTs, or non-fungible tokens, have emerged as a powerful tool in this new musical landscape. Unlike cryptocurrencies that are interchangeable, NFTs are unique digital assets that represent ownership of a specific item—such as a song, album, visual art, or

exclusive experience. When artists mint music NFTs, they essentially create a verifiable digital certificate of authenticity tied to a piece of content.

Early adopters have used NFTs to sell limitededition tracks, concert tickets, backstage access, and even virtual meet-and-greets. These tokens are often sold on marketplaces like OpenSea, Zora, or Sound.xyz, and they can appreciate in value depending on the artist’s popularity and the uniqueness of the asset.

Artists such as 3LAU, RAC, and Kings of Leon have already launched successful NFT projects. 3LAU, a DJ and electronic music producer, famously sold over $11 million worth of music NFTs in a single auction. These included digital versions of his music, unreleased tracks, and custom songs for toptier buyers. The success of such projects has signaled to artists and investors alike that NFTs offer more than novelty—they represent a sustainable and scalable business model.

For artists, NFTs allow a direct-to-fan revenue model. Rather than relying on a label to distribute and promote music, artists can drop NFT-based releases directly to their supporters, setting their own prices and receiving immediate payment in cryptocurrency. This disintermediation empowers creators and fosters deeper artistfan connections by rewarding loyalty and participation.

One of the most intriguing developments within the music blockchain space is the concept of tokenized royalties. This model enables artists to convert a portion of their future royalty income into blockchain-based tokens that can be bought, sold, or traded. Each token represents a fractional share of royalty rights, allowing holders to earn passive income as the song generates revenue over time.

This approach effectively transforms music royalties into investable assets, much like stocks or real estate. Platforms such as Royal, Opulous, and SongVest are pioneering this space by facilitating the issuance, sale, and management of royalty tokens. These platforms allow artists to raise capital without giving up creative control or traditional equity. At the same time, they provide investors with a new asset class that combines the cultural

appeal of music with the financial benefits of recurring income.

Royal, founded by DJ and entrepreneur Justin Blau (3LAU), enables fans and investors to own streaming royalty rights for songs by purchasing tokens directly from artists. When the song earns money on platforms like Spotify or Apple Music, token holders receive a proportional share. The platform also adds a layer of exclusivity by offering holders perks such as unreleased music, exclusive merchandise, and event access.

Investors are drawn to tokenized royalties for their potential to deliver stable, long-term cash flows while diversifying away from traditional markets. Since music consumption tends to be recession-resistant and globally distributed, royalty streams can serve as a hedge against volatility in equities or real estate. Moreover, the cultural relevance of owning a piece of a hit song adds emotional value that is rare in other asset classes.

However, like all investment opportunities, tokenized royalties require careful evaluation. Not all songs have the same earning potential, and revenue can fluctuate based on factors such as virality, playlist placement, or artist activity. Evaluating a token's value involves analyzing historical royalty performance, projected earnings, market sentiment, and the contractual terms attached to the asset.

Despite its promise, the music NFT and blockchain space is still young and evolving. As such, investors and artists must be cautious and well-informed to navigate the landscape effectively.

One of the most critical areas to monitor is intellectual property rights. The success of an NFT or royalty token depends on the legal clarity of ownership and usage rights. Investors should confirm that artists fully control the work being tokenized and that all contributors are accounted for in the smart contract. Disputes over copyright or improper representation of rights can lead to legal action and loss of value.

Another area of concern is the volatility of the crypto market. Since most NFTs and music tokens are bought and sold using cryptocurrencies like Ethereum, their value can be significantly affected by broader market swings. This makes short-term price predictions difficult and may impact liquidity

One of the most critical areas to monitor is intellectual property rights. The success of an NFT or royalty token depends on the legal clarity of ownership and usage rights. Investors should confirm that artists fully control the work being tokenized and that all contributors are accounted for in the smart contract. Disputes over copyright or improper representation of rights can lead to legal action and loss of value.

for investors looking to exit positions.

Scams and fraudulent offerings are also prevalent. With the low barrier to entry in NFT marketplaces, not all projects are created with integrity. It’s essential to verify the reputation of the artist, the platform, and the terms of the smart contract before making any purchase or investment.

Technology infrastructure remains a challenge as well. Scalability issues, high gas fees (transaction costs on the Ethereum network), and security vulnerabilities can complicate the user experience and limit adoption. However, ongoing innovations in Layer 2 solutions and alternative blockchains such as Solana and Polygon are helping to address these concerns.

Regulation is another wildcard. As governments and financial institutions begin to take a closer look at NFTs and tokenized assets, new rules may emerge that impact how these products are created, sold, or taxed. While regulation may ultimately bring stability and legitimacy, early-stage investors should stay informed and flexible as the legal framework develops.

For artists, maintaining authenticity and community trust is vital. A rushed or poorly planned NFT launch can alienate fans or damage a brand. It’s important to focus on genuine value—offering music, experiences, or utilities that truly reward fans and create lasting engagement.

Investors looking to enter the space should prioritize projects that have clear utility, active artist involvement, and a

roadmap for long-term value creation. Whether it’s access to live events, exclusive content, or real-world merchandise, tangible benefits help support token value and build a loyal ecosystem.

Understanding the underlying smart contract is equally important. Investors should review how royalties are tracked, how payments are distributed, and whether there are restrictions on transferability. A transparent and wellcoded contract reduces risk and enhances confidence in the investment.

In addition, considering diversification within the space is wise. Rather than putting capital into a single artist or project, spreading investments across multiple tokens and platforms can reduce exposure to individual performance and increase the chances of participating in a breakout success.

As blockchain technology continues to evolve, the tools for evaluating music NFT investments will become more sophisticated. Emerging platforms are already integrating data analytics, AIpowered predictions, and user-friendly dashboards to help investors make better decisions.

For artists, the blockchain revolution represents more than just a financial opportunity—it’s a chance to reshape the relationship between creator and consumer. For investors, it offers a frontrow seat to the future of media ownership, revenue sharing, and decentralized innovation. In this new world, the beat doesn’t just go on—it becomes an asset.

QThe music industry is no longer confined to instruments, microphones, and record labels. At the intersection of creativity and code lies a growing frontier of innovation: studio startups and sonic technology. These companies are transforming how music is created, produced, distributed, and monetized. For investors, this rapidly expanding space offers fresh opportunities to support disruptive technologies with broad commercial potential.

With the help of artificial intelligence, machine learning, cloud computing, and digital signal processing, today’s music tools are becoming smarter, faster, and more accessible. As the digital landscape evolves, investing in the companies that fuel this transformation has become one of the most promising avenues within the creative economy.

Audio technology has evolved far beyond the simple recording devices of the past. Today’s tools allow artists and producers to manipulate sound in real time, collaborate remotely, and generate high-quality music with minimal equipment. Digital Audio Workstations (DAWs) have become the heart of modern music production, and as their capabilities expand, so too do the possibilities for creators and investors.

Traditional DAWs like Ableton Live, Logic Pro, FL Studio, and Pro Tools remain central to professional workflows.

However, newer platforms are emerging that incorporate AI to simplify the creative process. These AI-powered tools can generate melodies, suggest chord progressions, isolate stems from finished songs, and even master tracks automatically. Such features enable musicians to work faster and lower the barriers to entry for beginners.

Artificial intelligence is also being used to generate entirely new compositions. Companies like Amper Music and AIVA offer AI-generated music tailored for commercial use, such as advertising, film scores, and video games. These tools use machine learning algorithms trained on massive libraries of songs, enabling them to replicate the emotional tone or genre of a given input with surprising accuracy.

For investors, the appeal lies in the scalability and broad application of these technologies. Music AI tools can serve a global creator community that ranges from independent bedroom producers to film studios and content marketers. Subscriptions, licensing fees, and usagebased models provide diverse and recurring revenue streams.

As music creation becomes increasingly digital and decentralized, startups have emerged to address specific needs within the creative pipeline. These companies are building platforms that help creators collaborate in real time, integrate audio tools with social media, and monetize their work without relying on traditional

industry gatekeepers.

One example is LANDR, a cloud-based audio mastering and distribution platform that uses AI to analyze and optimize tracks. It offers instant mastering services and music distribution capabilities, enabling artists to release polished songs quickly. LANDR has attracted attention from major investors and now serves millions of users worldwide.

Another standout is Splice, a subscriptionbased service offering royalty-free samples, loops, and plug-ins. Splice has become a staple in many producers' toolkits by allowing easy access to high-quality sounds and encouraging collaboration through cloud-based project sharing. The platform also features rent-to-own plugin models, lowering the cost of professional production tools.

Endlesss, a real-time collaborative music creation app, allows multiple users to jam together live from anywhere in the world. With a mobile-friendly interface and loopbased design, it caters to spontaneous creation and makes music production more social and interactive.

Audius, a decentralized music streaming platform built on blockchain, empowers artists to publish their music without intermediaries. By eliminating traditional streaming fees and giving artists greater control, Audius offers a compelling alternative for both creators and listeners.

Boomy, another innovative platform, allows users to create songs with AI in seconds. Users with little to no musical

training can select a style, tweak the elements, and export a finished song, which can then be monetized on streaming platforms. This type of democratization opens new markets and revenue possibilities, especially in the era of usergenerated content.

These startups are not only revolutionizing how music is made but also reshaping how it is shared and monetized. For investors, the most promising ventures combine cutting-edge technology with user-friendly design and scalable business models.

Venture capital has played a critical role in accelerating innovation in the music tech space. Investors are recognizing the massive growth potential within the creator economy and are actively seeking opportunities to fund platforms that empower artists, simplify production, and enhance audience engagement.

Early-stage funding rounds for music startups often come from angel investors, music professionals, and media-focused venture funds. As these startups demonstrate traction, larger VC firms step in to fuel their next stage of growth. In recent years, platforms like Splice, LANDR, and Audius have all secured significant funding, indicating that institutional interest in music tech is growing.

Accelerators and incubators are also contributing to the rise of studio startups. Programs like Techstars Music, Abbey Road Red (the innovation branch of the iconic Abbey Road Studios), and The Music Fund provide mentorship, funding, and networking opportunities to early-stage companies in music and audio tech. These accelerators not only offer capital but also connect founders with industry professionals, helping them test their products in real-world environments.

Techstars Music, for example, has backed over 40 startups since its inception, including Endel, which creates

personalized soundscapes for focus and relaxation using AI. By supporting founders with music-specific expertise and connections, these programs increase the odds of successful product-market fit.

Major music companies are also establishing corporate venture arms to invest directly in promising technologies. Sony Music and Warner Music have both launched funds to support music tech startups, often with the goal of integrating these tools into their existing ecosystems. Such investments provide startups with immediate credibility and access to distribution channels, while offering investors a clearer exit path through acquisition.

For individual investors or syndicates, entering the music tech space can also be facilitated through crowdfunding platforms. Sites like SeedInvest, Wefunder, and Republic occasionally feature music startups seeking community investment. While these opportunities carry risk, they also offer early access to potentially high-

growth ventures.

When evaluating investment opportunities in music and audio technology, it's important to assess both the technology and the market fit. Investors should look for companies solving real pain points in the music creation or distribution process, especially those offering efficiency, scalability, and a clear path to monetization.

Understanding the target user base is crucial. Platforms that cater to emerging creators, podcasters, and content marketers may offer broader appeal than those aimed solely at elite producers. The rise of shortform video and social media content has increased demand for easy-to-use music tools, making this a prime area for innovation.

User experience and design matter just as much as functionality. Creators often choose tools that are intuitive, affordable,

and seamlessly integrated into their workflows. Companies that prioritize onboarding, community support, and crossplatform compatibility are more likely to achieve sustained adoption.

Revenue models should be analyzed carefully. Subscription-based platforms can offer recurring income, but their success depends on user retention and churn rate. Marketplaces or token-based platforms may benefit from volume but are more sensitive to shifts in user behavior.

Investors should also consider the technical infrastructure and intellectual property behind the product. Strong engineering teams, proprietary algorithms, and scalable architecture can provide a competitive edge. Patents or trade secrets related to audio processing or AI functions may further strengthen a company’s long-term prospects.

Monitoring broader industry trends is equally important. As spatial audio, immersive media, and virtual reality become more prevalent, audio tech

companies that support these formats could see increased demand. Similarly, tools that align with wellness, education, or productivity—such as generative soundscapes—can appeal to non-traditional users and open new markets.

Finally, due diligence should include an evaluation of leadership and team experience. Founders with backgrounds in music, tech, and entrepreneurship are better positioned to navigate the unique challenges of the industry. Advisors and board members with ties to major platforms or labels can also accelerate growth.

Studio startups and sonic tech are more than just buzzwords—they represent the infrastructure of the next generation of music. As creators become more empowered, and listeners seek deeper, more interactive experiences, the tools behind the scenes are becoming central to the industry’s evolution. For those ready to invest, this is a space where innovation meets rhythm—and opportunity echoes with every beat.

s music continues to evolve in a digital-first world, so too must the legal structures that govern it. The surge in independent music distribution, streaming, NFTs, and blockchain-based platforms has transformed how music is made, monetized, and protected. Amid these shifts, one constant remains: clear legal frameworks are essential, especially for investors entering the space.

From intellectual property (IP) to smart contracts, understanding the foundation of music law and how to structure fair, futureproof agreements is vital for those putting capital into music. Whether backing artists, tech platforms, catalogs, or publishing rights, strong legal protections safeguard both creative integrity and investment potential.

Investing in music is not like buying into a traditional business. Music is a form of intellectual property, and with it comes a maze of rights, responsibilities, and regulations. For investors, a misstep in this space could lead to disputes, lost revenue, or entanglement in lawsuits. This is where legal frameworks play a critical role.

A music IP asset—such as a song, album, or catalog—is only valuable if the ownership and revenue streams tied to it are clearly defined and enforceable. Contracts must outline who owns what, how income is split, and what usage rights are permitted or restricted. Investors need this transparency to evaluate the strength and scalability of their investments.

Legal frameworks also provide a roadmap for resolving disputes, clarifying royalty payments, and ensuring fair treatment of all stakeholders. As the music ecosystem becomes increasingly global and digital, the

need for consistent and reliable legal protection is only growing.

In the age of data-driven deals, IP clarity makes it easier to track income, plan growth, and attract partners. It also enhances the resale value of an asset, whether it’s a catalog being sold or a company being acquired. The absence of a solid legal foundation can severely diminish an asset’s value or derail an otherwise promising investment.

Protecting music rights begins with understanding the different forms of ownership and how they’re typically divided. In music, the two primary types of rights are composition rights (related to the underlying music and lyrics) and master rights (the actual sound recording). Each can be split among multiple parties— songwriters, producers, artists, and publishers—so getting clarity on who owns what is essential.

Fair and enforceable contracts should specify:

• Ownership shares for each party involved

• Royalty splits for various income streams (streaming, licensing, sync, performance)

• Terms for licensing and usage, including any geographic or platform-specific limitations

• Duration of the agreement, including renewal or exit clauses

• Dispute resolution methods and jurisdiction

When entering into agreements with artists or startups, investors should ensure that these provisions are clearly documented, negotiated with transparency, and reviewed by legal experts. Contracts should not only protect the investor's interests but also provide fair terms to the creators and other rights holders involved. Exploitative or onesided agreements may lead to public backlash or long-term legal complications.

Technology is also changing how these contracts are created and executed. Increasingly, artists and companies are using smart contracts—self-executing agreements written in code—to automate payment flows and enforce rights. This adds efficiency and reduces dependency on intermediaries, but it also raises the stakes for clarity and accuracy at the outset.

Smart contracts are digital agreements deployed on a blockchain that automatically execute actions—like paying royalties or transferring rights—once certain conditions are met. They can streamline operations, reduce administrative costs, and increase transparency in a traditionally opaque industry.

For example, a smart contract tied to a song’s streaming revenue can be programmed to instantly split royalties between an artist, producer, and investor. No waiting for quarterly payouts, no manual accounting, no third-party collection agency fees.

Smart contracts also open the door to fractional ownership models. Fans and investors can now purchase small shares of a song’s future royalties, turning music into a community-supported asset. This model not only provides funding for artists but also creates new financial products for investors.

However, there are challenges. The immutable nature of blockchain means that once a smart contract is live, it’s difficult to change. If a contract is written with unclear or incorrect terms, it could lead to unintended or unfair outcomes. Moreover, while blockchain may enforce the agreement, it doesn’t replace the need for a legal contract that is recognized in court.

Investors need to approach smart contracts with the same diligence they would apply to any legal agreement. That means working with experienced entertainment lawyers and technologists who understand both the legal and technical implications.

Legal Insights: An Interview with an IP Strategist

To explore how investors can navigate this

landscape with confidence, we spoke with Natalie Ruiz, an intellectual property strategist and entertainment law advisor with extensive experience in music rights and technology.

Q: Why is legal structure so crucial when investing in music IP?

Natalie Ruiz: “When you invest in music, you’re investing in an invisible asset. Unlike physical goods, music lives in contracts and metadata. If that structure isn’t clean, enforceable, and transparent, the value can be lost overnight. Investors often underestimate how complex these rights can be, especially when songs have multiple collaborators or unclear ownership history.”

Q: What are the most common mistakes you see in music contracts today?

Natalie Ruiz: “A major one is the lack of

clarity around future uses—like NFTs, AIgenerated remixes, or Web3 platforms.

Contracts drafted even five years ago didn’t account for these developments. I also see artists signing deals without understanding reversion rights or royalties from sync licensing. From an investor standpoint, failing to verify ownership or neglecting to register copyrights can lead to serious setbacks.”

Q: How can smart contracts be used responsibly in the music industry?

Natalie Ruiz: “Smart contracts have real potential, especially for automating royalties and enabling micro-investment. But they should never replace a strong legal agreement. The smart contract is a tool—it’s not the full picture. Work with legal and tech teams who can build the contract together, and always plan for versioning and

adaptability as laws evolve.”

If you’re looking to invest in music IP, tech platforms, or artist partnerships, your strategy should start with due diligence. Don’t rely solely on a pitch deck or past performance data. Ask for documentation of rights ownership, copyright registration, prior contracts, and revenue splits. Understand whether the IP is exclusive, how it’s being monetized, and who controls the licensing process.

Be proactive in hiring or consulting with entertainment lawyers, especially those who are keeping up with emerging tech and digital licensing models. The intersection of Web3 and music is still developing, and having counsel who understands these

changes can help you avoid pitfalls.

When evaluating smart contracts, confirm they align with traditional legal agreements and include fallback clauses. Assess how revenue is tracked and distributed, and whether the infrastructure is secure, scalable, and compliant with data and tax regulations.

Focus on fair deals, not just profitable ones. The music community is increasingly aware of ethical investment, and artists are favoring partners who support ownership, transparency, and growth. Building a positive reputation in the industry can open more doors than a single short-term win.

If you’re backing a music platform or tech company, pay attention to their IP strategy. Are they acquiring rights, licensing properly, and offering creators fair terms? Are their

smart contracts vetted by legal experts? Do they have policies in place for content moderation, dispute resolution, and international compliance? These factors will influence not only their longevity but also your return on investment.

The music industry may be powered by creativity, but behind the scenes, it runs on contracts. From streaming to sampling to smart contracts, every beat and byte must be protected, accounted for, and fairly managed. For investors, legal fluency isn't just a protective measure—it’s a competitive advantage.

n the music industry, conversations about investment often center around streaming platforms, publishing rights, and digital innovation. Yet, one of the most underappreciated and potentially lucrative avenues lies in music real estate. From legendary recording studios and intimate performance venues to sprawling festival grounds, physical infrastructure plays a critical role in shaping the culture and commerce of music.

As live events bounce back from the pandemic-era shutdowns and content creation continues to thrive, the demand for high-quality, accessible, and brandable music spaces has surged. This demand presents a compelling case for investors interested in tangible assets with long-term value and diverse revenue streams.

The music industry may be driven by creativity, but it relies on space—space to record, perform, collaborate, and engage with audiences. Owning that space is not only a cultural play but also a strategic business move.

Recording studios remain essential, even in an age where home production is popular. Professional studios offer top-tier acoustics, isolation booths, and industry-standard equipment that many artists and producers can’t replicate at home. For high-end recording needs—

such as orchestral scores, commercial projects, or album sessions—worldclass studios continue to attract a premium clientele. Owning a welllocated, fully equipped studio can generate income through hourly bookings, long-term rentals, residencies, and production partnerships.

Boutique studios are gaining popularity, especially in cities with emerging music scenes. These smaller spaces cater to independent artists, podcasters, voice actors, and content creators seeking affordable yet professional environments. With modular designs and customizable packages, boutique studios can offer flexible services such as engineering, mixing, and mastering, alongside rehearsal and writing rooms. For investors, this model allows lower entry points and the ability to scale across multiple locations or markets.

Music venues, ranging from small clubs to midsize theaters, form the heartbeat of local entertainment ecosystems. As demand for live experiences increases, venue ownership offers reliable foot traffic and opportunities for ticketed events, food and beverage sales, private rentals, and sponsorships. Strategic real estate acquisitions in music-friendly districts —especially in revitalized urban neighborhoods—can yield strong appreciation in both cultural and monetary value.

For those with larger budgets, owning or developing spaces tailored for music education, collaboration hubs, or hybrid event-production spaces can combine rental income with community impact. Institutions, universities, and private creative academies are increasingly seeking professional environments to support artist development, making educational partnerships a valuable angle for music property owners.

The Economics of Owning and Operating Venues

Music venues are more than just performance spaces—they’re revenue engines. A well-run venue generates income from multiple streams: ticket sales, concessions, alcohol, VIP packages, merchandise, brand activations, and private bookings. Additionally, many venues offer rehearsal space or collaborate with promoters to share risk and reward on events.

Ownership also creates the opportunity for real estate development. Music venues often serve as anchors for mixed-use developments, driving foot traffic to nearby restaurants, retail spaces, and nightlife. This synergy can increase the property’s value and open doors for public-private partnerships or incentive programs from local governments seeking to promote arts and culture.

To maximize profits, many venues partner with established promoters or

booking agencies to secure consistent programming. Some venues also enter into exclusive beverage distribution deals, product placement agreements, or licensing partnerships that bring in additional revenue while reducing operational costs.

Owning a venue does come with challenges —such as maintenance, regulatory compliance, soundproofing, and unpredictable ticket sales—but those risks can be mitigated by strong management, diverse programming, and effective marketing. Investors should evaluate location, acoustics, and accessibility when selecting a venue to acquire or develop.

In major cities, venue ownership is often tied to cultural heritage. Owning an iconic space can enhance brand value and attract high-profile artists, corporate events, or media productions. Even smaller venues with loyal followings can become community staples that deliver consistent cash flow and influence.

Festival Grounds and Brand Collaborations

Music festivals are among the most dynamic and commercially potent experiences in the industry. From Coachella to Afro Nation, festivals generate significant revenue through ticketing, sponsorship, concessions, and media rights. While organizing a festival requires intensive logistics and upfront capital, owning or partnering in the property and infrastructure provides longterm leverage.

Festival organizers often lease land or partner with cities and municipalities. However, owning the grounds where festivals take place gives organizers complete control over programming, design, and profit distribution. Investors who own or develop festival-ready land can also lease it seasonally to multiple events, expanding its annual utility.

Festival spaces that include camping, hospitality, or recreational components can

create year-round value. Developing ecoconscious and flexible infrastructure—such as modular staging, green energy systems, and multipurpose layout designs—can attract a variety of music, art, wellness, and tech events.

Brand partnerships are key to enhancing both revenue and credibility in the festival world. Corporate sponsors across beverage, fashion, tech, and lifestyle sectors actively seek exposure to live audiences. Owning a festival site or producing a festival brand allows investors to tap into these highvalue marketing deals. Strategic cobranding with artists, influencers, or companies can multiply visibility and create unique, monetizable experiences.

Some festivals also integrate digital extensions such as livestreams, exclusive content platforms, and NFT-based ticketing. These innovations expand reach beyond the physical event and generate additional monetization opportunities for property and production owners.

The revenue potential of music real estate lies in its layered income streams. Studios can charge by the hour, day, or project. Venues can monetize through event nights, corporate rentals, and long-term leases. Festival grounds can be utilized for concerts, cultural fairs, seasonal events, and off-season programming like retreats or brand summits.

Lease agreements, licensing deals, and equity partnerships add further complexity and opportunity. For example, a venue owner might lease out operations to an experienced hospitality group in exchange for a percentage of gross sales. Similarly, a studio owner could license the space to a label or collective under a usage agreement that preserves long-term ownership.

For investors looking to enter the space, it’s essential to assess property values in emerging creative districts. Gentrification

patterns often follow artistic activity, making early investment in arts-centered neighborhoods a potentially lucrative real estate play. Identifying areas with a growing music scene, supportive zoning laws, and cultural incentives can position investors ahead of market shifts.

Some investors opt to develop multi-use music spaces that blend performance, recording, retail, and hospitality. These hybrid models can attract diverse clientele and maximize property utility. Rooftop concert spaces, in-house cafes, or branded merchandise boutiques are examples of how music real estate can be integrated with broader lifestyle experiences.

Tax incentives and public grants can further support music-focused real estate ventures. Local governments frequently provide funding or tax abatements to property owners who develop arts and culture infrastructure, especially in underserved areas or redevelopment zones.

Long-term, real estate assets tied to music often outperform other entertainment investments due to their tangible nature and embedded cultural value. While artist brands can rise and fall, a well-located, well-run venue or studio continues to generate income and appreciates over time.

For private investors, real estate funds focused on entertainment or creative properties offer diversified exposure with professional oversight. For institutional investors, backing development firms or hospitality groups that integrate music into their portfolio offers access to high-growth assets.

As music continues to evolve across digital and physical frontiers, the places where it is made, shared, and celebrated remain critical. Whether through iconic studios, transformative venues, or festival landscapes, music real estate offers a powerful blend of creative impact, cultural capital, and financial return.

n today’s music industry, artists are no longer content with simply creating and performing. Increasingly, they are seizing control of their business empires by owning their masters, launching record labels and imprints, building brands, and investing across industries. This evolution marks the rise of the artist as a CEO—a powerful shift that challenges the traditional gatekeeping of record labels and entertainment conglomerates.

With the ability to distribute music directly to fans, build global platforms via social media, and partner with investors or brands on their own terms, artists are redefining success. For investors, this transformation opens new doors to align with vision-driven creatives who not only generate hits but also own the infrastructure around their art.

For decades, artists operated under contracts that traded ownership for exposure. Record labels would fund the production, distribution, and marketing of an album in exchange for ownership of the masters and a large share of revenue. While this model helped many careers take off, it also left artists with limited control over their intellectual property and financial destiny.

In today’s digital-first, creator-driven economy, that model is being rewritten. Artists are learning the value of their catalogs and the importance of owning their masters—the original sound recordings of their music. When artists own their masters, they control how their music is licensed, sold, sampled, or used in film, television, or commercials. That ownership translates into direct royalty payments and long-term wealth.

The rise of streaming platforms has further empowered artists to operate independently. With lower distribution costs and access to global audiences, artists can retain control over their music while reaching millions of listeners. This shift has encouraged many artists to launch their own labels and imprints, giving them full creative and business control over their music and that of others they sign.

Through strategic ownership and diversification, today’s top artists are building cross-industry empires. They are investing in fashion, tech, cosmetics, alcohol, real estate, and wellness. By leveraging their influence and fan base, they’re able to create brand ecosystems that multiply income streams and deepen cultural relevance.

Rihanna exemplifies the modern music mogul. While she began her career under a traditional record label, her transition to entrepreneur has redefined what success looks like for artists. She owns the masters to her music catalog through her label Westbury Road Entertainment and has turned her focus toward business ventures like Fenty Beauty and Savage X Fenty. These ventures have not only eclipsed her music earnings but have positioned her as one of the wealthiest entertainers in the world. Rihanna’s empire demonstrates how artists can leverage fame into global ownership and control, expanding beyond the stage while staying rooted in authenticity.

Jay-Z is often cited as the blueprint for artist entrepreneurship. From launching Roc-AFella Records to co-founding Roc Nation, he has built a vertically integrated empire

that spans music, sports, tech, and spirits. He acquired his masters from Def Jam and later signed a landmark deal with Live Nation to expand Roc Nation into a fullservice entertainment company. Jay-Z also invested in Tidal, a music streaming platform that offered artists higher royalty rates and equity opportunities. His approach combines cultural leadership with business savvy, proving that artists can be both creative forces and boardroom power players.

Taylor Swift’s battle for her masters highlighted the stakes of ownership. After her original catalog was sold without her consent, she made the unprecedented decision to re-record her earlier albums and release them under her own label, Republic Records in partnership with Universal Music Group. Her “Taylor’s Version” releases have been both critically and commercially successful, demonstrating her unique ability to shift industry dynamics through narrative, fan engagement, and business strategy. Swift’s story has also educated a generation of young artists about contractual rights and artistic independence.

Burna Boy has become a global icon while maintaining strong ties to his African roots and artistic vision. Through his label Spaceship Entertainment, he has cultivated a platform that promotes Afro-fusion and elevates African talent on the world stage. Burna Boy’s Grammy-winning success has been built on authenticity, strategic partnerships, and a firm grasp of his brand’s global potential. His work highlights the importance of culturally anchored entrepreneurship in building sustainable music businesses.

These artists are not outliers—they represent a broader movement of musicians

taking ownership of their careers and assets. From J. Cole’s Dreamville to Bad Bunny’s Rimas Entertainment, artist-led labels are reshaping industry dynamics and giving creators the tools to monetize their work on their own terms.

The mogul mindset is about vision, ownership, and leverage. It requires artists to see themselves not just as performers but as brands, strategists, and executives. This shift begins with education—understanding how contracts work, how royalties are earned, and how intellectual property can be managed and monetized.

Artists with a mogul mindset take control of their narrative. They build personal brands that extend beyond music, often creating product lines, media platforms, and digital experiences that reflect their values. These initiatives deepen fan loyalty and offer monetization opportunities that aren’t dependent on traditional music sales or streaming payouts.

They also focus on scalability. Whether by signing new talent, launching content studios, or creating lifestyle brands, mogul-minded artists think in terms of ecosystems. Their

ventures are often connected, with music driving traffic to products, performances leading to brand deals, and fan engagement fueling multiple verticals.

From an investment standpoint, aligning with artist-led ventures offers access to cultural capital that is difficult to replicate elsewhere. Creators bring built-in audiences, storytelling skills, and the ability to tap into trends long before they reach mainstream awareness.

Investors who support artists as entrepreneurs gain not only equity in potential breakout businesses but also alignment with movements that shape culture.

The mogul mindset also values equity over short-term cash. Instead of taking advances or large payouts upfront, many artists are now negotiating for ownership stakes, backend deals, or licensing terms that preserve long-term control. This approach encourages sustainable wealth creation and opens the door for future exits, catalog sales, or brand acquisitions.

For emerging artists and investors alike, these case studies provide a roadmap. Building wealth in music today is about owning your masters, structuring smart partnerships, and thinking beyond the music itself. It’s about developing IP that travels,

products that connect, and platforms that scale.

Success in this model doesn’t require superstardom. With the right foundation, artists at every level can build businesses that grow with them, tapping into fan support, content monetization, and cultural influence. The tools are more accessible than ever— digital distribution, direct-to-consumer platforms, data analytics, and crowdfunding all lower the barrier to entry for music entrepreneurs.

Investors can support this shift by funding artist-owned labels, backing content studios,

developing tech tools for independent creators, or providing capital for catalog acquisitions and brand expansion. Partnering with artists who have both talent and a clear business vision can result in returns that are financial, cultural, and lasting.

The rise of the artist-CEO reflects a larger trend across industries: creators want more control, and audiences want deeper connections. The music mogul of the future isn’t just in the studio—they’re in the boardroom, the pitch meeting, and the founder’s seat. As artists continue to build their own lanes, the opportunity to invest in that journey has never been more promising.

s the music industry continues to evolve, a new kind of investor is emerging—one that is as focused on impact as on income. With increasing awareness around social equity, mental health, and community development, many investors are asking a critical question: how can we put our money into music in a way that supports people, not just profits? The answer lies in a growing movement that blends financial return with social responsibility: impact investing in music.

This approach challenges the traditional mindset that investing and philanthropy must exist in separate realms. Instead, it reframes music as both a creative industry and a powerful vehicle for change. From empowering underserved artists to funding music therapy and education, purpose-driven investments are reshaping the landscape and inviting capital to flow toward initiatives that uplift, heal, and inspire.

Investing in music with a purpose involves more than writing checks. It’s about ensuring that the structures supporting creative talent are fair, accessible, and designed for longterm empowerment. Socially responsible music investments aim to create economic opportunities while addressing systemic challenges in the industry.

This could mean funding platforms that offer equitable revenue splits, supporting record labels that prioritize artist ownership, or investing in technologies that help creators retain control of their intellectual property. It may also involve financing music ventures that emphasize environmental sustainability, mental health support, or community building.

In this space, due diligence goes beyond financial models to assess mission alignment. Investors are increasingly examining whether a project fosters inclusion, supports emerging or marginalized voices, and contributes positively to the broader ecosystem. The return on investment isn’t just measured in revenue but in the positive social and cultural impact created.

Some investment firms are developing funds specifically focused on ethical entertainment, targeting companies and creators that commit to diversity, transparency, and community reinvestment. These funds consider not just how money is made, but whom it benefits— and what legacy it builds.

Philanthropic-minded investors are also leveraging alternative models such as revenue-sharing agreements that prioritize fair compensation, or grants with built-in support services like mentorship and mental

health resources. These structures allow artists to thrive creatively and financially without the long-term obligations often tied to traditional deals.

One of the most powerful applications of impact investing in music lies in supporting artists and communities that have historically been excluded from mainstream industry pathways. Whether due to geographic, racial, economic, or systemic barriers, many talented creators lack the resources and networks needed to break through.

Investing in these artists is not charity—it’s smart business with a broader purpose. Untapped talent exists in every corner of the world, and supporting it creates opportunities for both cultural exchange and commercial success. From independent rappers in underserved U.S. cities to indigenous musicians in Latin America or youth collectives in Africa, diverse voices bring unique perspectives and rich storytelling that resonate globally.

Investors can play a key role by funding artist development programs, seed-stage record labels, or cultural incubators based in

underserved regions. These ventures provide access to recording equipment, business education, legal support, and performance platforms—tools that level the playing field and unlock creative potential.

Some organizations are creating music residencies and grant programs specifically for Black, brown, and indigenous artists, LGBTQ+ musicians, and creators living in rural or economically disadvantaged areas. These initiatives are designed to build infrastructure, not just offer one-time support.