FINANCIAL AID HANDBOOK

AN EASY-TO-NAVIGATE GUIDE FOR FIRST-YEARS

WHAT’S INSIDE: Welcome Message from the Office of Financial Aid � � � � � � � �3 Checklist Important dates and deadlines for First-Year Students � � � � � � � � � � � � � � � � � � � � � � � 4 Glossary Financial aid terms defined � � � � � � � � � � � � � � � 6 Financial Aid Portal Instructions for accessing the FA Portal on-line � � � � � � � � � � � � � � � � � � 8 Federal Verification Tips for those chosen for verification � � 12 College Cost Cost of Attendance; Direct and Indirect Costs � � � � � � � � � � � � � � � � � � � � � � 14 Credit Balance / Travel / Books/ Health Insurance 15 Types of Aid � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 16 A Guide to Work-Study � � � � � � � � � � � � � � � � � � � � � � � � � 17 A Guide to Student and Parent Loans 18 Billing and Payments � � � � � � � � � � � � � � � � � � � � � � � 20 Opportunities to use your Financial Aid � � � � � � � � � � 22 Study Abroad / Spring Term Abroad 22 Opportunity Grants/Resident Assistant/Greek Life � � � � � � � �23 Renewing your award Requirements for renewing financial aid � � � � � � � � � � � 24 Other Resources � � � � � � � � � � � � � � � � � � � � � � � � � � �26 Financial Aid Staff � � � � � � � � � � � � � � � � � � � � � � � � � � 27 2

Welcome and Congratulations!

Welcome, Class of 2028!

We in the Office of Financial Aid at Washington and Lee University understand that preparing for your first year at college can be overwhelming. With that in mind, we have compiled this booklet with information that should help clarify some of the important steps in the aid process and provide some additional details regarding using your grants, loans and/or work-study options. We look forward to assisting you throughout the 2024-25 academic year. Please carefully read all the following information included in this booklet and do not hesitate to contact us at 540-458-8717 or financialaid@wlu �edu if you have questions.

James Kaster, Director, Office of Financial Aid

The W&L Office of Financial Aid uses email for all essential correspondence. Please pay special attention to any email with the subject line “W&L Financial Aid”. Beginning June 15, we will use your W&L email address for any email correspondence.

3

FIRST-YEAR CHECKLIST

AND IMPORTANT

DATES

o May 15-31: Review your 2024-25 Financial Aid Notification on the Financial Aid Portal.

o June 10: Priority deadline to “Accept” Work-Study awards online.

o June 10: Work-Study application and hiring process opens for those who have accepted their Work-Study offer by the priority deadline.

o June 10: Priority deadline to “Accept” loan offers online and to complete any required federal loan documents (See “Guide to Student and Parent Loans”).

o June 30: Deadline for Virginia residents to submit the Virginia Tuition Assistance Grant (VTAG) application. Application should be submitted directly to W&L.

o June 30: Deadline for completing federal verification for those who were selected for verification.

o July 15: Deadline to submit the Signature Authorization form to the Office of Financial Aid. Enables continued access to online processes.

o July 15: Add Financial Aid access for parents or others in Friends and Family in Workday. See page 9 “Guest/Parent Access (FERPA)”.

o July 20: Review your billing account online to verify financial aid credits, pending/estimated aid, and to determine if you have a balance due

o July 26: Final deadline to Accept online any loan or WorkStudy offers. Pending loans or Work-Study at this point are marked “Decline” by the Office of Financial Aid.

Checklist 4

o August 1: Deadline to complete any required loan documents. All “Accepted” loans with incomplete documents at this point are “Decline” by the Office of Financial Aid.

o August 16: Summer deadline to apply for fall term Work-Study positions. If you have not obtained a Work-Study position by this date you will not have another opportunity until September 1.

o August 22: Mandatory on-campus Financial Aid information session for all athletes.

o August 23: Mandatory on-campus Financial Aid information session for international students.

o September 1: The last round of Work-Study hiring begins for those who are still seeking employment. Interested students must contact Student Employment by this date.

o September 2: Mandatory on-campus Financial Aid information session for all grant and scholarship recipients.

o September 4: Mandatory on-campus information session for all Work-Study participants.

o October 1: Deadline to submit the Sibling Enrollment Verification form for those families with more than one dependent in college. All benefits are removed after this date.

o October 15: Deadline to apply for a fall term Work-Study position.

5

Glossary

FINANCIAL AID TERMINOLOGY

Academic Term

Cost of Attendance

Credit Balance/ Refund

Federal Verification

FERPA

Financial Aid Notification

Grants/ Scholarships

At W&L there are two academic terms. The fall term and the winter/spring term.

The estimated total cost of attending W&L for one academic year. Includes: Tuition, fees, food, housing, books/supplies, personal and travel.

Aid funds or payments to your student account that exceed the charges. If your have a credit on your account you can request this credit from the Business Office in the fall at the start of the term.

A federally mandated process to confirm the accuracy of data provided by selected applicants on the Free Application for Federal Student Aid (FAFSA).

FERPA is a federal law that protects the privacy of student education records. This law restricts access to student records and allows access only to those individuals who are specifically assigned within W&L’s Friends and Family process.

A document that lists all specific aid options for which a student is eligible. This can include grants, scholarships, loans and/or work-study.

Sometimes called gift aid, this type of award provides funds that do not need to be repaid. Eligibility may be academic based or need based.

6

Loans

Need

Notification of Special Circumstances

Office of Financial Aid

Outside Scholarship

Pending or Estimated Aid

Priority Deadlines

Student Aid Index (SAI) vs Family Contribution

A form of financial aid that must be repaid. Terms and fees vary depending on the type of loan.

The student’s Cost of Attendance minus their Family Contribution. The Family Contribution for W&L is determined using an evaluation of the W&L need-based application.

The document families submit if they wish to appeal a W&L need-based award or if they wish to provide additional information on their need-based application. Also called the NSC.

The W&L office where students and families can meet with financial aid staff and review financial aid options.

Any award or benefit a student receives from a source outside of W&L.

Financial aid that has been awarded but has not yet disbursed to the student account.

Date in which documents and applications should be submitted to ensure that all aid will be credited to the students account in a timely matter.

Student Aid Index (SAI) is a federal value that represents a level of federal aid eligibility. It is generated by the FAFSA. The Family Contribution is the institutional value determined by evaluation of the W&L need-based application.

7

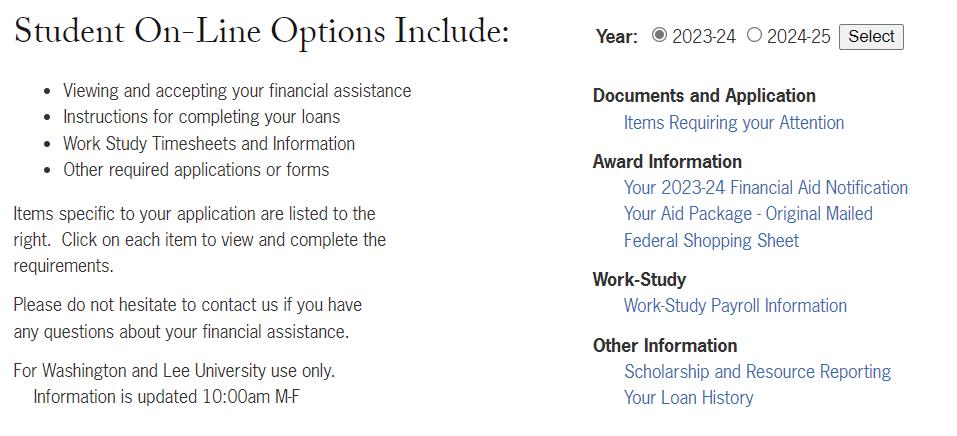

THE FINANCIAL AID PORTAL

Up until this point, you have been viewing financial aid information on the Applicant Portal. Your aid information has now been transferred to the Financial Aid Portal, and you can access this portal using the “Check Your Aid Status” link on the Financial Aid home page: my�wlu �edu/financial-aid. To make the most of your financial aid offers, we encourage you to familiarize yourself with the Financial Aid Portal.

Financial Aid Portal

8

ITEMS REQUIRING YOUR ATTENTION

A listing of documents and forms that may need to be completed to finalize your aid options. Periodic review of this page is recommended. Key areas of this page include:

Signature Authorization Form

The Signature Authorization form provides your consent to make on-line submissions and access on-line financial aid notifications. Please print the form, sign, and date. Submit the completed form to financialaid@wlu.edu as a pdf attachment.

Guest/Parent Access (FERPA)

This link will redirect you to the Friends and Family (F&F) instructions. Adding a parent or others to Friends and Family and giving them financial aid access will allow those individuals to view your Financial Aid Portal and allow the Office of Financial Aid to discuss Financial Aid issues with that individual.

Beginning the first day of the academic year, the Office of Financial Aid can share information only with individuals listed on your Friends and Family with the View Financial Aid Package option checked.

Verification of Sibling Enrollment

Signature Authorization Form

The Sibling Enrollment form is required for all students who are receiving the sibling in college benefit. You are required to verify your sibling’s full-time undergraduate enrollment at a 4- year college or university. The completed form is due October 1 and should not be completed until your sibling arrives on their campus in the fall.

Virginia Tuition Assistance Grant (VTAG)

Residents of Virginia will need to complete the VTAG application and submit to the Office of Financial Aid by June 30 to verify eligibility and residency. Please note the form requires handwritten signatures from both parent and student.

Federal Verification Documents

Various documents are required from students who have been chosen for federal verification. Please see pages 12-13 for details.

9

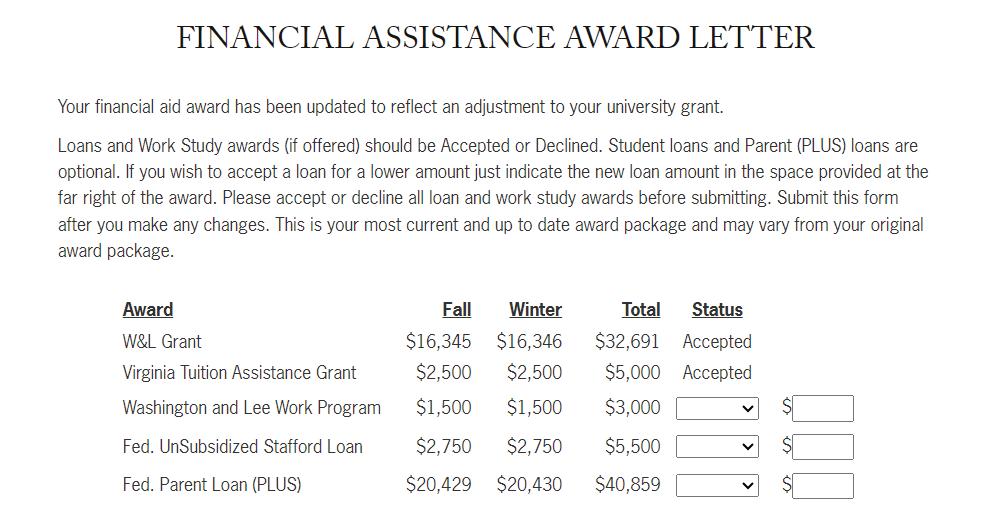

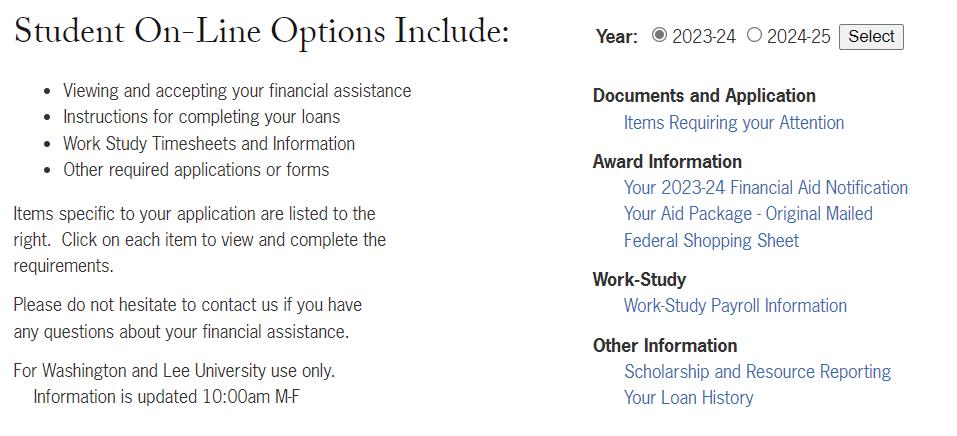

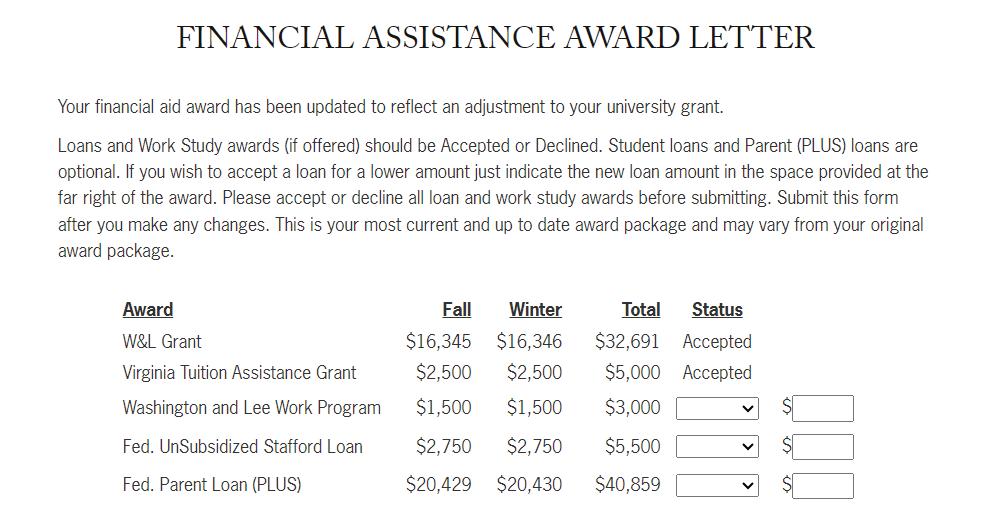

Your 2024-25 Financial Aid Notification

Access your 2024-25 Financial Aid Notification and mark all loans and/or Work-Study offers as Accept or Decline by the appropriate deadline listed in the Checklist. If you wish to accept a loan for a lesser amount, mark the loan as “Accept” and enter the updated amount in the box to the right of the loan offer. Do not forget to Submit the form. Grants/scholarships are accepted by the Financial Aid Office. Some aid may require the receipt of additional documentation before showing as being accepted. Any submission you make may take up to 48 business hours to update online. Below is an example of the aid notification.

Your Aid Package – Original Mailed

This is a static PDF copy of your original award notification and is not updated.

Federal Shopping Sheet

Clicking on the Federal Shopping Sheet takes you to the federal award template which can be used to compare awards from various schools. It is not the official W&L aid notification.

Portal

Financial Aid

10

Work-Study

This section of the Financial Aid Portal will list various links related to the WorkStudy program. Initially there may not be a WorkStudy section or any items listed under WorkStudy. Links to create an application and apply for open positions will appear in June for students who accepted their Work-Study award. See page 17 for further details on the WorkStudy program.

Scholarship and Resource Reporting

Allows you to enter details for any outside scholarship or benefit you receive. You are required to notify the Office of Financial Aid if you are receiving any scholarship or resource (tuition benefit, veteran benefit, etc.) from a source outside of the University. Outside scholarships and/or resources may affect your W&L award. Please see your original award notification for details.

Your Loan History

Provides a breakdown by academic year of any federal student loan, private loan, and/or W&L loan funds you have received while enrolled at W&L. A grand total and estimated monthly payment are calculated for each loan type. Your Loan History is available to you while enrolled and a short time after graduation.

11

Federal Verification

FEDERAL VERIFICATION

What is Federal Verification?

Verification is a federal process that requires the submission of additional materials to verify the information submitted on the FAFSA. Not everyone is selected for verification and W&L does not have any part in the decision of who is selected.

What Happens if I am Selected?

If your Free Application for Federal Student Aid (FAFSA) is selected for verification by the Department of Education, then the Office of Financial Aid must confirm the accuracy of the information reported on the FAFSA and/or the student’s identity. Those selected will be required to complete and submit the Verification Worksheet and/or Identity and Statement of Educational Purpose form. Students will be notified via e-mail which forms they are required to complete and submit. Students cannot, by federal regulation, receive any federal grants or loans until all verification is completed.

12

What Documents are Required?

Verification Worksheet

The Verification Worksheet is due to the Office of Financial Aid by June 30 and requires the student and parent (only when the student is a dependent) confirm the members of the household and tax filing status. Please note the form requires handwritten signatures.

Identity and Statement of Educational Purpose

The Identity and Statement of Educational Purpose must be completed in person at the Office of Financial Aid or in the presence of your local notary and submitted to the Office of Financial Aid before classes begin. The student must bring proof of identity, typically in the form of a state-issued ID or driver’s license. Our office must have the original form, mailed or hand-delivered to the Office of Financial Aid.

Please contact Shanice Hardy (shardy@wlu.edu), if you have any questions regarding the federal verification process.

13

College Costs COLLEGE COST

2024-2025 Cost of Attendance

Cost of Attendance is a list of the expected expenses you may incur during the academic year. These include tuition, fees, housing, food, books/supplies, miscellaneous and personal expenses and travel. Your financial aid offers are based on the full cost of attendance, i.e., if you applied for aid, then you have received aid offers that could include grant/scholarship, loans and Work-Study. The total of this aid will equal your cost of attendance.

Direct vs. Indirect Costs

The billed or “direct cost” for W&L includes tuition, fees, housing and food. Your Fall and Winter Term bills are posted in July and November. Firstyear students are billed for the full meal plan but can reduce the plan in subsequent years; your aid award will continue to be based on the full meal plan, meaning no reduction in aid if you choose a lesser plan in the future. There are other expenses you will incur during the year such as books, supplies, general personal needs and travel. These items are considered “indirect costs” and in most cases will not be part of your term bill. You will see book charges on your bill if you purchase your books or supplies from the University Store and choose to charge the purchase home.

Tuition $66,800 Activity Fee $675 Technology Fee $320 Health Services Fee $250 Housing $9,650 Food $9,035 Books and Supplies $2,370 Miscellaneous/Personal Expenses $2,600 Total Budget $91,700

14

Travel to Campus

Students are expected to make their own travel arrangements to and from W&L during the academic year. W&L does not pay for your travel, but you can use any credit generated by grants or loans to reimburse yourself for some or all of your travel expenses. An estimated amount for travel, based on the location of your home, is part of your overall student budget, and travel expenses are incorporated into your total aid package. These funds may be part of your grant or scholarship or may have been provided in the form of a loan offer. Any credit generated by a grant, scholarship or loan can be accessed at the start of your Fall and Winter Terms. The amount estimated for your travel may vary from your actual costs.

Buying your Books

You can purchase your textbooks and supplies from the W&L University Store when you arrive on campus, and they can be charged directly to your student account. If you have a credit on your account because of your grant/scholarship or loan, then this charge will reduce that credit. If you do not have a credit, you can still charge the supplies to your student account. This charge will show as an amount due on your next university bill.

Health Insurance

Health insurance is required for all students. A University health insurance plan can be purchased if you are unable to obtain coverage that meets W&L requirements. If you are required to purchase the W&L health insurance plan, you can receive funding to cover the additional cost. Some students with very high need are eligible for grant increases, and all other students can receive additional loan. Once you have purchased the W&L Insurance, the charge will appear on your student account. The additional funds from your grant or loan adjustment will disburse to your account in late August or early September. Please contact the Office of Financial Aid if you have questions regarding your eligibility to receive additional grant or loan funding to offset this cost.

15

TYPES OF AID

Need-Based Grant and/or Scholarship

Any grant or scholarship such as the W&L Grant, Johnson Scholarship, Pell Grant, VTAG, SEOG, etc., is considered gift aid and does not need to be repaid. There may be specific requirements for renewing the award, and each award may have restrictions or associated benefits. Please see “Renewing your Financial Aid” (pp. 24-25) and “Financial Aid that will Open Doors” (pp. 22-23) for more details.

Taxes Related to Grants/Scholarships

Scholarships and grants that exceed qualified tuition, mandatory fees, and course-related expenses such as books and supplies may be considered taxable income. Questions regarding the tax-ability of your scholarships and grants should be directed to the IRS or to a qualified tax consultant.

Federal and Institutional Work-Study

Work-Study is a financial aid option offered to many Washington and Lee students as a part of their overall financial aid package. Students who participate in the Work-Study program can contribute to the university and local community while earning the money they need to help offset some of their everyday expenses. Work-Study isn’t just about funding; it also provides employment experience and is an excellent way to boost your future resume.

Loans

Federal loans for students and parents may be offered as an option to cover the family’s contribution. For more information pertaining to loans and borrowing, please see “A Guide to Student and Parent Loans” on pages 18-19.

16

WORK-STUDY

W&L currently employs over 600 students through the WorkStudy program, offering employment in over 200 positions on and off campus. These positions include athletics, libraries, academic and administrative offices, the University Store and off-campus community based organizations. Many positions exist that support and enhance a student’s specific educational and career goals.

How do I Participate in the Work-Study Program?

If you have been offered Work-Study and wish to work during the 202425 academic year, you will need to accept the Work-Study offer listed on your on line Financial Aid Notification. Beginning June 10, students will be sent an email from Student Employment with additional details and a link to the Work-Study application. Here’s a summary checklist of important steps:

1. Accept your work-study award on-line by June 10.

2. Review the Work-Study instructions emailed to you in June.

3. Complete your Work-Study application on the FA Portal.

4. Review open positions on the FA Portal and Apply.

5. Monitor your applications and accept a position.

6. Complete your Student On-boarding and I-9 Verification.

What is it Like to be a Work-Study Student?

Work-Study awards are typically $3,000 for the academic year, which usually means a student may work seven to nine hours per week to earn the full award. The Work-Study amount must be earned to be received and is paid directly to the student based on the number of hours worked each pay period. The award amount listed is not guaranteed but is the maximum that can be earned in the program. Supervisors understand that education comes first and will work with students to arrange schedules that do not interfere with coursework demands. The hourly rate for a Work-Study student can range from $12.50 to $13.50, based on the complexity of the position. If you have additional questions about the W&L Work-Study program, please email Miranda Edwards, Student Employment Manager, at studentemployment@wlu.edu.

17

A GUIDE TO STUDENT AND PARENT LOANS

W&L meets financial need with a combination of grants and work-study. Loans are offered as an option, not a requirement, and can be used to replace the family contribution. If a Stafford (student) or PLUS (parent) Direct Loan is listed on your aid notification, then you will need to accept or decline the loan(s) and submit. Keep in mind that loans can be accepted at an amount less than the amount offered. To finalize the processing of a federal loan, you will need to complete the relevant documents specific to your loan (see below.) Forms are on-line at studentaid �gov�

A complete listing of required loan documents can be found on the FA Portal “Items Requiring Your Attention”. The priority deadline for completing all loan documents is June 10.

Federal Stafford Loans for Students

Federal Stafford loans are held in the student’s name and are paid to the Department of Education. Depending on eligibility, students may be offered one or both types of Stafford loan:

Subsidized Stafford loan: Interest is subsidized (does not accrue) while enrolled in college.

Unsubsidized Stafford Loan: Interest accrues from the time of disbursement.

Subsidized Stafford loans cost less to borrow due to the subsidized interest and should be chosen over the unsubsidized loan if given the option. Required documents for processing and disbursing to the student account include:

Master Promissory Note (MPN)

Entrance Counseling

Stafford loans apply to the student account balance as pending aid once the loan is accepted on the Financial Aid Portal. If the MPN and Entrance Counseling are not completed by August 10, it will be assumed you do not intend to process the loan and the loans will be canceled. The removal of the loans may create a balance due on your account.

Student borrowers are required to attend an in-person 1st Time Borrowers meeting during the fall term.

Loan

Guide

18

Federal Direct Loans for Parents (PLUS)

Parent PLUS loans are held in the name of a parent and require two online documents to be processed:

Master Promissory Note

PLUS Loan Application

Once processed, PLUS loans apply toward the accountbalance as pending aid prior to the July 15 bill and disburse shortly after classes begin. The priority deadline for receipt of electronic documents is June 10.

Please choose the credit balance option on the PLUS Loan Application carefully before submission. The W&L Business Office will request the same information and discrepancies will delay PLUS loan processing.

Private Loans

Students or parents who seek private loans from private non-federal lenders should contact Drake Breeden in the Office of Financial Aid to process the loan. Upon your completion of the private loan application, email ebreeden@wlu.edu for further details regarding the processing and timeline of disbursement for the loan. Loans that are applied for and certified prior to the July 15 bill apply toward the account balance. After August 10, private loans that are not fully processed and disbursed will be canceled. The priority deadline for having private loans ready for certification by W&L is June 10.

The federal student loan simulator will estimate your monthly loan payments and determine the actual cost to borrow: studentaid.gov/loan-simulator/

W&L provides an interactive budget worksheet to help you determine how much you may need to borrow. See page 24 for details.

More federal student loan information can be found here: studentaid.gov/understand-aid/types/loans/ subsidized-unsubsidized

19

BILLING AND PAYMENTS

In early July, you will be contacted by the Business Office with details on how to access the on-line payment system. All W&L billing is completed on-line. Within the payment system, you will be able to create accounts for other users such as your parents. Around July 15, registered users will receive a notice that the Fall Term bill is available for review. Payment is due on August 10. Subsequent bills from the Business Office will be posted around the 15th of each month and should be reviewed for any new charges/credits. Winter Term charges will show on the November bill. Please contact the Business Office at (540)458-8730 or businessoffice@wlu �edu for billing or payment questions. The Office of Financial Aid does not process any student billing or payments.

Estimated/Pending Aid

Estimated/Pending aid is an aid award that will reduce your bill, but has not yet actually disbursed, and will be applied to the account at a later date. Federal regulations prevent us from crediting federal grants and loans to your account in July when the fall bills are generated. However, these awards will display on your student account as estimate/pending aid once all requirements are met. Pending aid typically disburses the first week of classes or the following week..

Meal Plan Billing

W&L bills your meal plan based on the number of weeks in a term. However, financial aid grants, scholarships and/or loans are credited evenly between terms. The aid you receive for the fall term is half of your total aid for the entire year, and you can expect your winter term aid to be equal or similar. However, the winter term bill in November will reflect a larger meal charge, because the winter/spring term has more weeks. Since financial aid amounts do not vary between terms, but the meal plan charge does vary, you should be prepared for an amount due or credit on the winter term bill that will vary from what was reflected on your fall term bill.

Billing and Payments 20

Credit Balance

A credit balance on your student account is created if credits from financial aid or other sources are greater than the charges on your student account. A credit balance appears as a negative amount due. Students can schedule a refund of their credit balance by contacting the Business Office when they arrive on campus in fall. Winter credit balance refunds can be scheduled in January. A credit balance can be used to pay for indirect expenses such as books, supplies, personal expenses and travel.

Early Credit Balance Disbursement

In late July, some students with large credit balances will be contacted by the Business Office. These students will have the option to receive a portion of their credit as an early credit balance disbursement. Keep in mind, these funds are provided to assist in paying educational related expenses such as books and travel. It is wise to limit the use of this early disbursement to essential expenses necessary for your preparation to arrive on campus. In November, students who received the July disbursement will be contacted with information about the Winter Term early credit balance disbursement.

Holds and Late Fees

If you have an outstanding balance for an extended period, the Business Office may place a hold and/or assign a late fee to your account. Holds may prevent a student from registering for a class. A Business Office hold can only be removed by contacting the Business Office and paying the entire past-due balance. If you want to use a loan option to pay an outstanding balance you must accept the loan and complete all required documentation. An incomplete loan will not show as pending aid. You may wish to check your Items Requiring Your Attention to determine if any specific financial aid documents are incomplete. A student with an unpaid balance will continue to carry a hold and incur late fees until the balance is paid. It can take up to two weeks to process a loan, and during that period any Business Office hold will remain on the student account.

Please be aware the Office of Financial Aid does not place holds and cannot remove a hold that has been placed on a student account.

21

FINANCIAL AID THAT WILL OPEN DOORS

Study Abroad

If you receive grant, scholarship or loan(s) as part of your financial aid, then this aid can also be used to finance the cost of an approved Fall or Winter Term study abroad program. Grants and scholarships will be reduced in relation to the lesser cost of attendance of the study abroad program, but the overall family contribution should remain consistent with an on-campus term at W&L. You must attend the financial aid study abroad presentation in the academic term prior to your study abroad.

Spring Term Abroad

Spring Term Abroad (STA) is a unique part of the Washington and Lee experience. These courses allow students to get an up-close, intensive, and personal experience of the subject matter abroad with a W&L faculty member during the Spring Term. Unlike on-campus Spring Term courses that do not charge additional fees, there are additional fees associated with STA courses to cover travel, accommodation, facilities, and the other educational costs of the course. Any student who is receiving a university need-based grant will be eligible for funding to cover the additional expense related to an STA course. Students receiving merit scholarships are not automatically eligible for STA grants and must submit a complete need-based aid application to determine their eligibility. Students that are ineligible for need-based aid can request a loan to cover the cost instead.

Opportunities

22

Johnson Opportunity Grants

Grants are awarded on a competitive basis and are open to rising sophomores, rising juniors and rising seniors at W&L. The grants cover travel, living expenses, and other costs associated with the proposed project or summer activity. Grants are not limited to recipients of the Johnson Scholarship.

Resident Assistant

The W&L Residential Life program offers free housing and full meal plan for any student hired to the Residential Life Staff. First-year students may apply in the fall of 2024 for the academic year 2025-26. The value of the housing and meal plan will be reflected on the financial aid package as an award; however, it will not reduce any grant or scholarship you are receiving unless the total of all awards exceeds the cost of attendance.

Students should be aware that application for Residential Life Staff (2025-26), sign up for Spring-Term Abroad (Spring 2025) and application for many summer 2025 internships and research opportunities occur during the Fall Term of 2024.

Greek Life

Financial aid awards do not increase to cover any of the additional costs related to fraternities or sororities. However, your aid award does provide funding (in the form of grant and/or loans) that covers the standard costs for housing and food, and those funds can be used to help pay your housing and food expenses at the Greek organization.

23

RENEWING YOUR FINANCIAL AID

The deadline for submitting all required documents for need based awards and for scholarships is May 1, 2025 for the academic year 2025-26. Renewal requirements for each type of W&L institutional award, and select federal and state aid, are listed on the following page.

Please contact the Office of Financial Aid if you are unsure about the requirements for your grant or scholarship.

Change in Circumstances

The Notification of Special Circumstance form can be submitted with any on-time application, or can be submitted as an appeal for any award where the application was submitted on-time. The one-time deadline for returning student application is May 1. If financial circumstances for your family change significantly during the academic year, you should contact the Office of Financial Aid to determine if you are eligible to submit a mid-year Notification of Special Circumstance form. Mid-year appeals are considered in cases of involuntary job loss, illness/death, or other significant unplanned events leading to major financial disruptions.

Living Off-Campus

You are required to live in on-campus housing your first three years, but as a senior you may elect to live off campus. The level of financial aid you receive will not change when living offcampus. The Cost of Attendance that your financial aid is based on will continue to use the cost of the standard on-campus housing and the full meal plan, which may be more or less than you spend for living off campus. To make funds available for off campus expenses, credit balance checks and direct deposit to your personal account is available. Students should set up direct deposit via Workday if interested and checks can be requested from the Business Office.

Renewing Your Awards 24

Application Requirements

The Financial Aid portal opens for returning student documents in December 2024. You will be able to view your complete renewal requirements in the Items Requiring your Attention section.

W&L Grant

2025-26 CSS Profile

2025-26 FAFSA*

2023 Parent Tax Returns and W2s

Complete need-based applications submitted after May 1 will still be reviewed but will not be eligible for any type of appeal.

International Grant

International Grants are automatically renewed each year without a new application.

QuestBridge Scholarship

2025-26 FAFSA*

Johnson and W&L Scholars

2025-26 FAFSA*

Not all Johnson Scholars are required to complete the FAFSA. Please see your aid notification letter for additional clarification.

Federal Loans or Work-Study Only

2025-26 FAFSA

Virginia Tuition Assistance Grant (VTAG)

Re-application not required if enrolled each year

Permanent resisdence must remain in state of Virginia

*If the FAFSA is listed as a requirement for your grant or scholarship, and you are not eligible for federal aid due to your citizenship status, then you are not required to submit this form.

25

OTHER RESOURCES

FAQs for First-Year Students

Common first-year questions and answers on financial aid.

First-Year FAQs

my.wlu.edu/financial-aid/faqs-and-policies/first-year-faqs

Financial Aid Information and Resources

Detailed information on financial aid offered at W&L.

Aid Resources: my.wlu.edu/financial-aid/ faqs-and-policies/aid-resources

Budgeting and Managing Your Funds

Many students find it valuable to reconcile the grant funds, loans, workstudy earnings and other income with the various expenses they will incur while attending W&L. The College Budget Worksheet (linked below) is a tool that will help you in the financial planning of your education for the nine-month academic year.

College Budget Worksheet

my.wlu.edu/financial-aid/faqs-and-policies/aid-resources

Loan Simulator

A tool from studentaid.gov that helps you estimate monthly student loan payments and consider repayment plans.

Loan Simulator: studentaid.gov/loan-simulator Federal Aid Resources

Additional information about loans, grants and the FAFSA.

Federal Aid: finaid.org/loans/

Contacts and Resources

26

FINANCIAL AID STAFF

JAMES KASTER

Director of Financial Aid

W&L Need-Based Grants, International Grants

JENNIFER DAVIS

Associate Director of Financial Aid

Johnson Scholarships, National Merit

DRAKE BREEDEN

Senior Assistant Director of Financial Aid

Student and Parent Loans, Law School Student Aid

SHANICE HARDY

Assistant Director of Financial Aid

QuestBridge, Spring Term Abroad, Federal & State Grants

MIRANDA EDWARDS

Student Employment Manager Work-Study and Student Employment

MARTHA ROWSEY

Senior Financial Aid Coordinator

W&L Loans, Veteran Benefits, ACS Tuition Exchange

VICKI PICKLE

Financial Aid Coordinator

Student Employment, Application Processing

Office Hours: 8:30am – 4:30pm EST

EMAIL: financialaid@wlu.edu | studentemployment@wlu.edu

TELEPHONE: 540-458-8717

MAILING ADDRESS: Washington and Lee University

Office of Financial Aid 204 West Washington Street Lexington, VA 24450

CAMPUS MAP: go.wlu.edu/FA-location

27

Washington and Lee University is an equal opportunity institution. Complete statement at go.wlu.edu/eeo