our tenants are paramount in everythingwedo

our tenants are paramount in everythingwedo

This Business Plan covers the period 1st April 2024 to 31st March 2027 and was given its final approval by the Committee of Management at their meeting on 17th April 2024

This Business Plan will be:

Comprehensively reviewed every 3 years

This plan will be updated annually and presented to the Committee of Management for final approval each year. Revisions will include changes as a result of outcomes from the Committee of Management’s Annual Strategy Day.

For this plan to be of productive use, in addition to the above, it will also be reviewed periodically by the CEO and presented to the Governing Body (Committee of Management) for consideration and approval to ensure they are alerted to any changes (either internal or external) which could affect this plan’s efficacy.

Information concerning activities and projects aligning with and achieving strategic objectives will be routinely presented to the governing body at their monthly meetings.

As part of our strategic plan to implement our core values and better serve our tenants, WGHC implemented a new, fully integrated housing and asset management software system in April 2024

OurMissionStatement:

Our tenants are paramount in everything we do

OurVision:

To become the leading housing cooperative in Scotland, recognised as a Centre of Excellence

After: WGHC’scurrentstock Page6

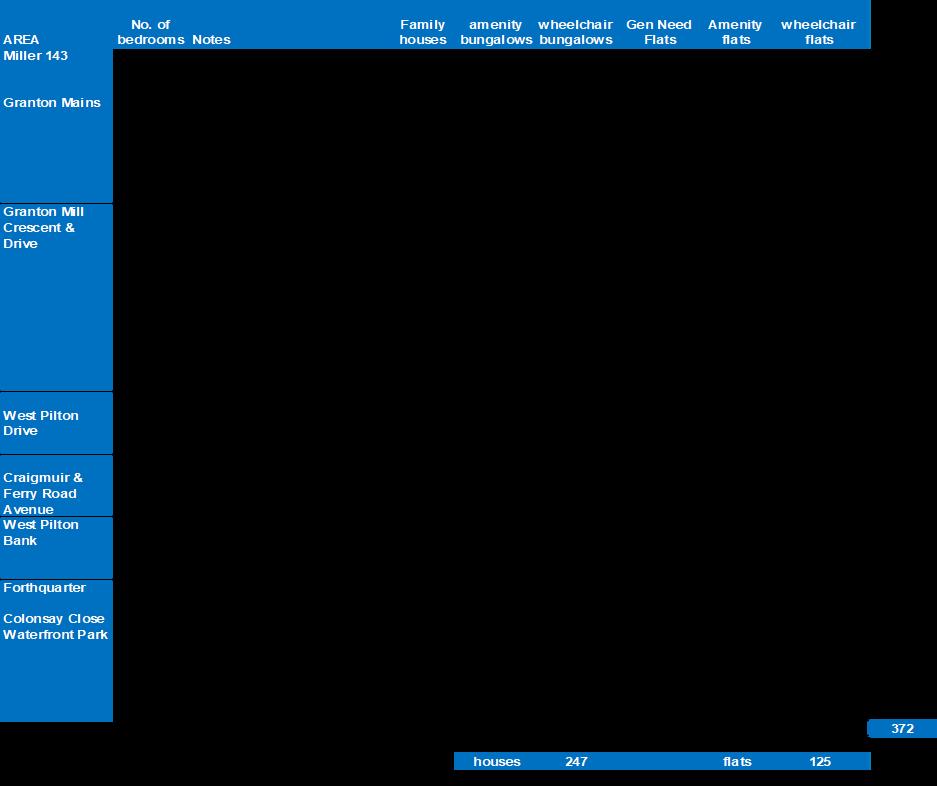

West Granton Housing Co-operative Limited (WGHC) was formed in 1990 by residents of the West Granton area of north Edinburgh in order to provide new rented housing in an area dominated by low demand council housing Initially deck access blocks in West Granton itself were demolished and a phased redevelopment of the area took place We now own 372 properties and two play park areas. We are community based with all our stock based in North Edinburgh between the Forthquarter development at the Waterfront, Granton and Ferry Road Avenue

www.westgrantonhousing.coop

West Granton Housing Co-operative Limited is a fully mutual co-operative housing association and a Registered Social Landlord (RSL) registered with The Scottish Housing Regulator. The registration number is HAC225

West Granton Housing Co-op (WGHC) is registered as a Society under the Co-operative and Community Benefit Societies Act 2014. As such we must make an annual return to the Financial Conduct Authority Our registration number is 2357 RS

The registered office is 26 Granton Mill Crescent, Edinburgh EH4 4UT.

West Granton Housing Co-op has been designated as a Scottish Public Authority by an order made under section 5 of the Act, known as the Freedom of Information (Scotland) Act 2002 (Designation of Persons as Scottish Public Authorities) Order 2013.

WGHC is a not-for-profit organisation Any surpluses are used for the objectives of the co-operative. No surpluses are distributed to members. Members cannot buy their homes.

WGHC is an independent RSL We are not a member of a group nor a subsidiary of another company. WGHC itself has no subsidiaries.

www.westgrantonhousing.coop

WGHC’s Financial Services Agent

· Prospect Housing Association

6 Westburn Avenue, Edinburgh EH14 2TH

WGHC’s Auditors

· Financial Auditor: CT, 61 Dublin Street, Edinburgh EH3 6NL

· Internal Auditor:

Wylie and Bisset, 168 Bath Street, Glasgow G2 4TP

WGHC’s Solicitors:

· TC Young

69a George Street

Edinburgh EH2 2JG

WGHC’s Chartered Surveyors

· F3

99 Giles Street

Edinburgh EH6 6BZ

WGHC’s IT and Website Hosting Support

· WELGO

www welgo co uk

www.westgrantonhousing.coop

WGHC also has a list of approved contractors it uses to assist with the delivery of its operational services such as reactive maintenance Our list of approved contractors is published on our website

ARCHIE

(Allianceofregisteredco-operativesand housingassociationsinEdinburgh

Co-opsUK

InvestorsinExcellence

EmployersinVoluntaryHousing

ScottishFederationofHousingAssociations

Scotland’sHousingNetwork

ScottishProcurementAlliance

We use this income to achieve our objectives; fulfil our statutory and legislative requirements and be both efficient and cost effective in our business processes.

However, our rents still have to remain affordable whilst representing value for money.

The cost of living crisis increases and rent affordability is a real concern and will continue to test the financial resilience of registered social landlords across Scotland for some time to come

Prior to the cost of living crisis, the WGHC Committee of Management had decided that the level by which our rents increase should generally be no higher than the Consumer Price Index (CPI)

However, the steep rise in inflation in to double figures commencing in 2022, coupled with the rise in bank interest rates, has meant that Committee have had to review and update its financial assumptions and projections to ensure that we remain financially viable whilst continuing to offer value for money to tenants through affordable rents.

Whilst inflation or CPI (the consumer price index) has recently fallen to 3 4% (February 2024), CPI only measures the average change in price of a basket of consumer goods and services like food, clothing, restaurants and cafes, furniture, jewellery, hairdressing, etc

CPI does not take into account many of the costs that WGHC has to pay for such as contractor labour costs or the cost of large-scale improvement projects such as updating boilers, kitchens or bathrooms.

In the 12 months up to April 2023, CPI reached a high of 11.1% (in October 2022). In that same period, costs for WGHC increased, on average, by 18%.

Since January 2023, CPI has averaged 8.6%, peaking at 10.4% in February 2023 before falling to 3.9% in November and more recently to 3.4% in February 2024. However, the goods and services which WGHC has to buy in to provide its services, have not fallen in the same way.

Although we are not building any new houses at the moment, we, like every other social landlord are still having to budget for increasing costs. This has meant we have had to spread our larger kitchen, bathroom and boiler replacement programmes over 2 or 3 years, instead of completing them in the usual 1 year period. The changes to these programmes are publicised to our tenants in Newsletters.

One of the things we look at when assessing how affordable our rents are each year, is to look at the rents charged by other social landlords in Edinburgh To do this we use the SFHA Affordability Rent Tool This shows we continue to have, on average, the 3rd lowest rents in Edinburgh

Over the past 15 years we have tried to keep annual rent increases to a minimum These figures are shown in the table opposite We do recognise the effect inflation and higher rent increases have on our tenants and WGHC has jointly funded the recruitment of an Energy Advisor to help tenants with their fuel bills and we have also applied for various sources of funding to help tenants with their fuel and food costs as well as making available items of winter clothing and various small electrical cooking appliances.

The decision to increase rents by 7% for 2024-25 was not taken lightly. As both a Co-operative and as a social landlord we are a not-for-profit organisation, but we have to ensure WGHC remains financially viable and that we continue to operate successfully and provide ongoing services to tenants.

West Granton Housing Co-operative’s business model means their membership is made up of tenant members Significant effort to engage tenants and promote high levels of participation is therefore essential to protect the viability of our organisation.

Using professionally made videos, social media, emails, letters, texts and face-to-face engagement, WGHC communicates the importance of engagement with our tenants. This comprehensive approach proved successful with record levels of attendance at our most recent AGM.

When consulting with tenants, WGHC are open about our costs and financial situation and clearly explain the rationale behind our decisions. For 2024-25 we consulted on two rent increase options –6 5% and 7% Some simple affordability analysis showed tenants what impact these increases would have on their weekly and monthly rents; this helped tenants understand the affordability impacts of any such increase. Our tenants were invited to share their views and any comments with the management committee and co-op staff.

The 2024/25 consultation received a 30% return rate from tenants – our highest ever for a rent increase consultation. The results showed higher levels of support for the 7% rent increase. Tenants felt that this level of increase was ‘fair and affordable’ and added that even with the proposed increases, their rents still felt like very good value Tenants backed this up with reference to a good repairs and maintenance service, ongoing cost of living and financial support initiatives and transparency over how their rent was being used

Tenants were involved throughout the consultation process and felt that their feedback was listened to. This experience was supported by WGHC’s continuous engagement efforts, which we recognise as being important for our business model and overall tenant satisfaction

Moving forward, one of the key challenges over the next 3 years is keeping rents affordable as tenants face both a steep rise in energy and living costs. In addition, we need to continue to ensure that our properties remain in good condition and are compliant with all regulatory and statutory requirements.

Through a cost effective planned maintenance programme, we need to manage the investment made in to our assets to ensure they remain in high demand with the overall objective of protecting our cash flow

Finally, we also need to ensure that we continue to meet our loan covenants with our lender, Nationwide Building Society, who require us to operate with a minimum interest ratio cover of 110%. As at 31st December 2023 our interest ratio cover was 467%.

Scenario Financial Planning for our budgetary requirements for the next 12 months to five years years show that we will be looking to secure private finance to help fulfil our planned maintenance programmes for the replacement of kitchens and bathrooms We have already commenced initial talks with our existing lender, Nationwide Building Society, to discuss future lending requirements and also the possibility of restructuring some of our existing borrowing

Change is a constant.

It is always happening.

Some changes may present us with more risks than others

Some changes may happen externally (inflation, interest rates, laws, etc)

Some changes may happen internally (changes in staffing, changes in our procedures, changes to our assets, changes in our loans, etc)

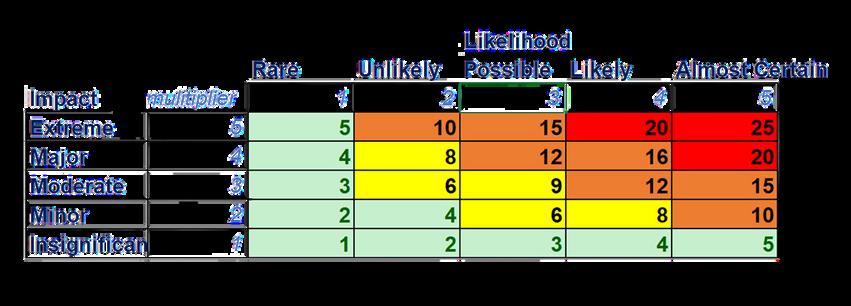

It is therefore a necessary part of governance and business planning that we regularly scan and the environments in which we operate to identify and anaylse any new and all existing risks to determine the likelihood of them happening /affecting WGHC and the impact these might have on our organisation We then need to look at what actions we need to take to either mitigate, tolerate or control these. This is called Risk Management.

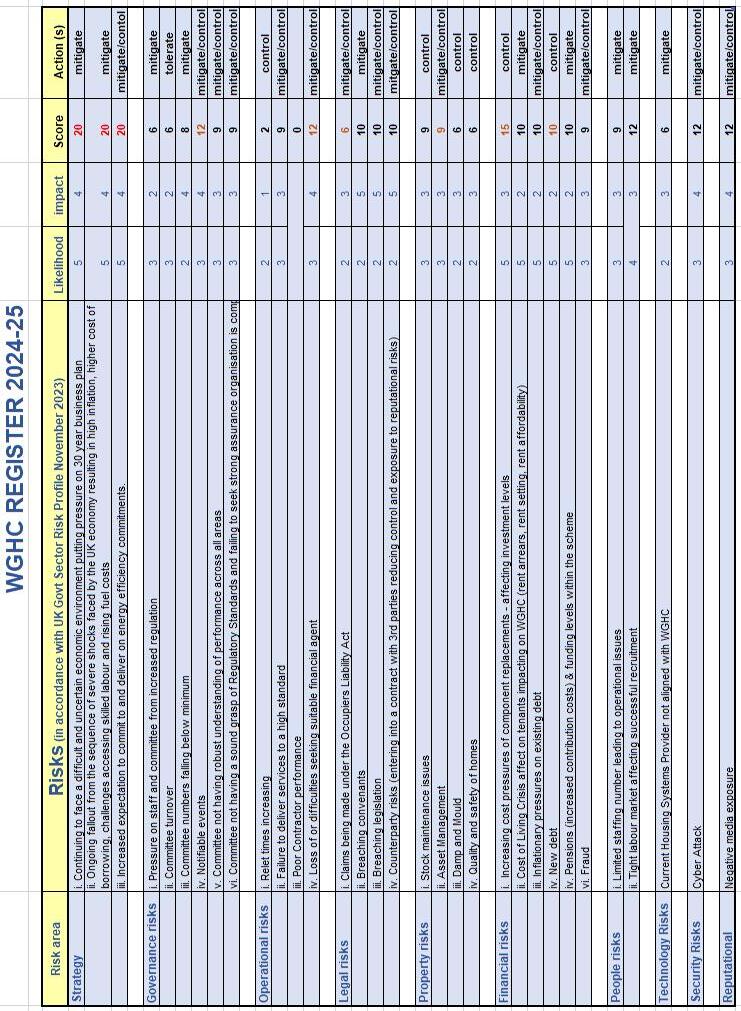

The UK Government Housing Sector risk profile has been used to form the basis for drafting this year’s WGHC Risk Register In addition to this basis, the specific risks facing WGHC, have also been identified and added in as a result for this year’s risk analysis

The risks were placed into the Risk Register and scored using the following scoring table:

A copy of WGHC’s Risk Register for 2024-25 can be found on the following page (page 13)

As a registered social landlord, we are an organisation that owns properties to rent within the social housing sector These properties are our assets and provide us with our only source of income.

We therefore need to ensure that these assets (our properties) are fit for purpose and should be at all times:

Managed efficiently and generating demand

· In good condition with a costed, affordable maintenance programme

· Making a positive contribution to our business plan

Delivering value and amenity

Planning investment in our housing stock is key.

As is adopting a more strategic approach to asset management and recognising the importance of integrating this across our business One of our new strategic objectives within this plan is to re-structure our existing Maintenance Team with a shift towards increased focus on Asset Compliance and Maintenance. We have also introduced bi-annual (once, every 2 years) asset management visits to each of our properties to undertake both an internal and external condition survey

Scottish Housing Quality Standard (SHQS)

Currently, 91% of our stock meets the SQHS standard

With exception of the agreed exemptions and abeyances, the main reason for us not meeting the SQHS standard in all our properties relates to storage space in some kitchens. When some properties were built the Scottish Housing Quality Standard had not been introduced and kitchen

For exa at the c into kitc include within th mission striking f our tena

wwwwestgrantonhousingcoop

Currently, 100% of WGHC properties meet the EESSH standard.

Scottish Social Housing Net Zero Standard (SHNZS)

This new standard will replace EESSH2

This new standard will be introduced by the Heat in Buildings Act (once passed by Parliament).

It will prohibit the use of fossil fuel heating as the primary heating system in all buildings by 1st January 2046.

It is expected that the new SHNZ will come into effect in 2025.

Two of the biggest challenges to the delivery of the SHNZS are the financial costs for landlords the associated financial impact on tenants through increases to both their heating costs and rents

The Scottish Government recently carried out a public consultation on some of the proposals within the Bill. At the publication date of this Business Plan, the results of the consultation are yet to be made known

In line with the need to achieve both climate change and fuel poverty aims, it is proposed that a fabric efficiency rating for social housing is introduced. Two options on how this should be measured were included in the consultation.

WGHC met with a Scottish Government representative to discuss how this might affect WGHC’s stock It was confirmed that WGHC’s stock would meet the 2033 target where all properties would meet the equivalent of the current EPC rating C. However, the future challenge for WGHC would be how it could achieve the current equivalent of an EPC Rating B by 2044 At present 61 out of our 372 properties already meet the B rating

Given technologies in this area are rapidly developing it was agreed that WGHC could afford to put on hold any significant plans in respect of achieving the 2044 target. In addition, any future government funding that might be available is still very much undetermined but it is however, highly likely, that WGHC (like all other social landlords) will have to self-finance any investment required. Our 30 year financial plans show this investment being delayed until 2033 when most of WGHC’s current loans will have been repaid in full

WGHC are currently trialling solar panels which have been fitted on one of its 4 bedroom townhouses. This trial will run for a 12 month period to establish what savings the tenants have benefited from with the electricity costs.

An electric vehicle charging point has also been installed

In addition, WGHC are also currently exploring the costs of rolling out a programme of solar panel installations over a 10 year period on each of its 247 houses

There are no plans over the next 3 years for WGHC to build more properties.

WGHC owns 372 properties in North Edinburgh Our stock type is varied

The table below shows our stock profile:

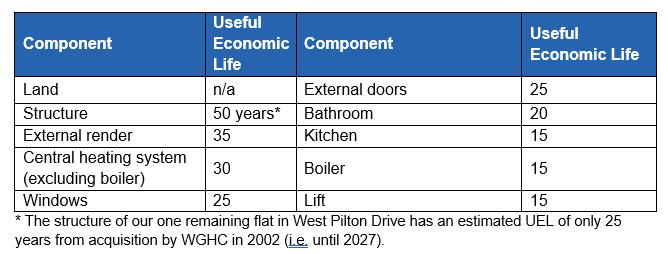

Some works to houses are treated as capital expenditure. For accounting purposes, the cost is added to the value of the housing stock and spread over the useful economic life of the component through depreciation

The “useful economic life” or “UEL” is the time it is expected to last before needing replaced again Cost divided by UEL is the annual depreciation charged to operating costs It is up to each social landlord to identify components and assess UELs based on analysis of its own housing stock.

Estimates of UEL are also important in planning ahead We use them to estimate when components will be replaced and to try to ensure resources (mainly cash and staff time) are in place to carry them out

Land is not depreciated.

The components we use and their estimated economic lives are shown in the table below:

In compliance with the Chartered Institute of Public Finance and Accountancy (CIPFA) Code of Practice, WGHC defines its treasury management activities as: “The management of WGHC’s cash in bank and cash flows and its banking transactions; the effective control of the risks associated with those activities; and the pursuit of optimum performance consistent with those risks”

WGHC regards the successful identification, monitoring and control of risk to be the prime criteria by which the effectiveness of its treasury management activities will be measured.

WGHC acknowledges that effective treasury management will provide support towards the achievement of its business objectives.

In addition to 3 day to day operational accounts with the Royal Bank of Scotland and a 32 day Notice Account with Santander, WGHC has an Instant Access Business Savings Account with Nationwide Building Society.

The purpose of this “holding account” is to retain a minimum cash balance of £600k to ensure the organisation maintains this minimum level at all times to comfortably meets its ongoing operational costs, liabilities, cash liquidity and interest loan cover ratio (loan covenants) of 110%

WGHC has 5 mortgages with its lender, Nationwide Building Society

Nationwide is a mutual co-operative financial institution and its ethos is therefore very much align with West Granton Housing Co-operative which is fully mutual.

2 of the mortgages are on a variable rate (SONIA COMPOUND) and expire 2031 and 2033 3 are on a fixed rate of 1.21% (including margin) and expire 2036,2038 and 2039 respectively.

The existing loan agreements carry with them covenants and we monitor these closely to ensure ongoing compliance

Interest cover remains strong at 476% compared to the 110% interest cover covenant required by Nationwide Building Society All figures are correct as at 31st December 2023

In addition to the above 5 loans with Nationwide Building Society, WGHC secured a loan from the Scottish Government for £148k, interest free over a 5 year period, for the purpose of upgrading all its smoke alarm systems to ensure they were compliant with the new regulations following Grenfell.

This loan expires in February 2025

The maintenance of our assets (our stock) and the replacement of housing components (bathrooms, kitchens, windows, boilers, etc) is expensive

This expenditure can result in considerable and uneven spend in peak years, especially now given the volatility of the current economic environment WGHC looks to even out any such peaks by practising zero year budgeting and where required, run replacement programmes over a 2 to 3 year period to ensure its cash flow is protected.

It is important that WGHC is able to afford its investment programmes through its financial planning. We do this by using the economic life of components and plan forward to determine when they are next to be replaced. This is worked out on a larger scale by stock type, streets and areas Using historic, detailed, costed works programmes and building in financial assumptions (such as inflation, interest rates and cash flow projections) we are then able to determine when and what capital expenditure is needed to ensure that WGHC will have sufficient cash to fund it

The key financial objectives underpinning our financial projections are to:

Secure the long term financial viability of WGHC

Sustain our strong financial reputation

Ensure compliance with loan covenant requirements

Meet the costs of our corporate objectives

Note regarding Pensions:

As participants in the Scottish Housing Association Pension Scheme (defined contributions scheme) we have once again have been assessed as “low risk”

The financial assumptions used in our scenario planning are as follows:

For our planned maintenance and component replacement costings VAT is included but not inflation. We use Brixx modelling software which applies the inflation and rolls this forward over the span of the financial plan.

All assumptions are reviewed annually in line with Zero Year Budgeting

A loan of £1.5 million is applied to the cash flow plan in February 2025; the terms of the loan is 20 years with an assumed rate of interest of 3%

Financial Reporting Standard (FRS) 102 is assumed

The financial projections can be found in the Appendices - Section 16 of this report.

In the event when WGHC considers any strategic changes, including the development of new housing stock or the departure of the CEO, WGHC will use an Options Appraisal tool to evaluate each option with the goal of ensuring that we maximise the chances of securing our organisational objectives by identifying the most appropriate set of actions

The value of the option appraisal too is that it takes the appraiser through the process stage by stage, helping to ensure that everything relevant is taken into account

The basic stages of an Options Appraisal process are set out below:

The financial scenario of not developing/acquiring any new units for the foreseeable future shows that the Co-operative is in a much stronger financial position when no development is undertaken

WGHC begins paying off the first of its current 5 loans from 2031 onwards. Looking at possible development opportunities and costs from 2031 onwards is an option However, the feasibility of any house building development plans (along with the chances of any land being available on which to build) will be at the expense of any investment in WGHC moving towards and achieving the Scottish Housing Net Zero Standards Given the current and predicted future legislative requirements of moving towards all WGHC’s stock required to achieve an EPC ‘B’ rating (or fabric efficiency future equivalent) and the cessation of using fossil fuels as a heat energy source the likelihood of WGHC building any more properties within the foreseeable future is not a viable option

Any options appraisal should always evaluate the viability of the proposed option by assessing the value of net cash flow that results from its implementation

As with any process, WGHC options appraisal need to be resourced properly to ensure that its works well and ensure that the process is proportionate to the significance of the decision being made

Some possible outcomes of an options appraisal could include:

• Retain status quo.

• Transfer of services or stock to an external organisation (i.e. another RSL).

• Form a partnership and work in collaboration with other external agencies/other RSL

• Cessation: stop delivering the service

WGHC continues to be a service led, consistent, accountable, learning and excellence aspiring social landlord with ‘community’ and ‘co-operative’ at its very core. Serving its tenant members, the local and wider community, making the homes it owns safe and warm places to live whilst aiming to enhance the lives of its tenant members

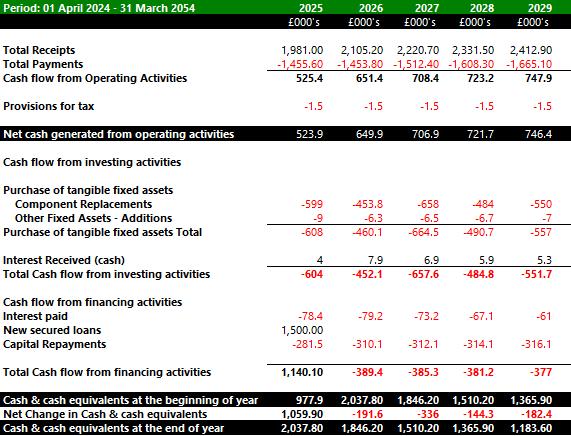

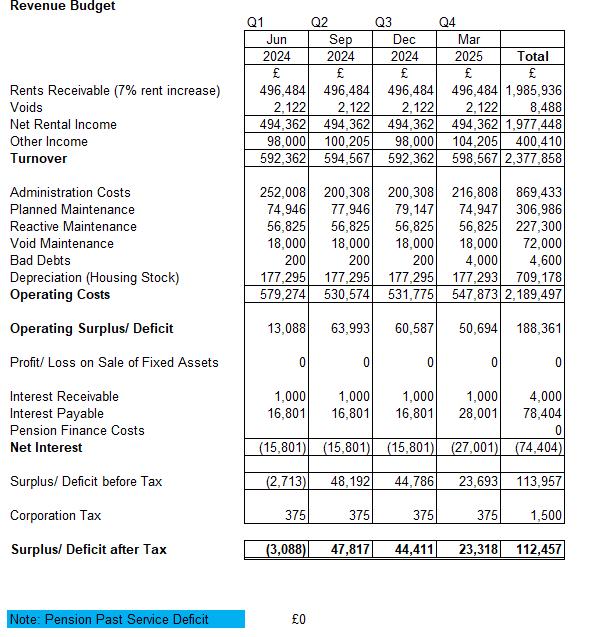

The following financial information can be found in the appendices:

Appendix 1

5 year planned maintenance and component replacement budget

Appendix 2

Year 1 Revenue Budget Summary

Appendix 3

12 month statement of cash flow for 2024-25

Appendix 4

5 year statement of cash flow for 2025 to 2029

12monthstatementofcashflow2024-25