The year 2025 sees the Arab British Chamber of Commerce reach its fiftieth year in business.

We will be marking this milestone anniversary with a gala dinner celebration on 23rd June coinciding with our flagship 4th Arab British Economic Summit (ABES2025).

The ABCC is pleased to extend an invitation to all our members, partners and friends to join us for this important celebration.

For the past half century, the ABCC has worked unflinchingly to serve the Arab and British business communities with its essential trade and commercial services.

Our 50th anniversary gala dinner will be a spectacular event to herald our half century. Join with us as we celebrate 50 years of building a stronger, closer Arab British partnership.

We hope that you can be with us as we reach this landmark in the pursuit of “friendship through trade.” The gala dinner will be an ideal opportunity for us all to look to the future with hope and confidence.

Wednesday, February 19, 2025

An ambassadorial roundtable on Investment Opportunities in Tunisia was hosted by the ABCC on 19 February in the Boardroom at the Chamber’s Mayfair premises.

The audience consisted of potential investors and business executives from various sectors of industry and members of the ABCC.

His Excellency Mr Yassine El Oued, Ambassador of The Republic of Tunisia in the UK, and his entourage were greeted and welcomed to the Chamber by Mr Bandar Reda, ABCC Secretary General & CEO and Mr Abdeslam El-Idrissi, ABCC Deputy CEO & Secretary General.

The roundtable was held in close cooperation with the Embassy of Tunisia and assisted by FIPA, the Tunisian foreign investment promotion agency, which had

prepared a detailed presentation. Mr Reda opened the discussion by introducing the Ambassador whom he warmly thanked for his participation in the event which would enable ABCC members to learn about Tunisia and gain valuable insights into the latest investment opportunities in the country.

In his keynote remarks, His Excellency paid tribute to the work of the Chamber and expressed his confidence that the meeting would not only strengthen collaboration between the UK and his country but would also help unlock new opportunities for growth, innovation and prosperity.

The Ambassador went on to stress the importance of British involvement in the Tunisian economy, in particular the energy sector where British Gas was one of the largest foreign investors with substantial investment in Tunisian energy infrastructure.

The energy sector was not the only area where UK companies were actively involved, His Excellency insisted, citing sectors such as automotives, engine components, textiles and information technology where UK firms were making positive contributions.

The Ambassador continued by elucidating the ambitious reform programme that Tunisia had been enacting in recent years, including incentives which were designed to attract more foreign investment and stimulate growth through partnerships between the public and private sectors.

Mention was made of the significant assets that Tunisia possessed, for example, its robust infrastructure and a skilled workforce that was one of the most well educated in the region.

In concluding, His Excellency Mr Yassine El Oued looked forward to the UK and Tunisia working closer together to build a brighter future based on innovation, collaboration and shared prosperity.

He invited British investors and entrepreneurs to visit the country

where they could meet with their Tunisian counterparts to explore the opportunities.

Following the Ambassador’s encouraging opening remarks, a more detailed presentation was delivered by Mr Zied Braham, Director of FIPA in London, who provided a detailed description of the country’s investment landscape.

The FIPA director began by outlining the flows of FDI over the past few years and explained that over 4,000 global companies were currently active in the local economy, contributing some 467 thousand jobs.

He said that almost 75% of these foreign companies were involved in wholly exporting.

In summary, Mr Braham highlighted

key attractions of Tunisia in sectors such as, aeronautics, digital, automotives, agribusiness, textiles and pharmaceuticals.

As well as boasting a dynamic businessfriendly environment, Tunisia offered exceptional living conditions conducive to successful personal and professional development.

Once Mr Braham had completed his wide ranging presentation, Mr Reda opened up the discussion by inviting contributions from those gathered around the table. Great interest was expressed in the various opportunities that had been outlined by the Ambassador and the FIPA Director, who expressed their readiness to assist any company seeking to further explore the potential that Tunisia was able to offer across the many sectors.

8-11 September 2025

Baghdad International Fairground, Baghdad, Iraq

This international trade exhibition to be held in the Iraqi capital, Baghdad, will feature latest details of oil, natural gas and petroleum projects in Iraq with a focus on the opportunities for foreign participation and investment. To attend this trade event or for more information, please contact the following

Contact details Azhar21hadi@yahoo.com Or UK19@iraqcomattache.com

1-4 June 2025

This edition of the Iraq Oil and Gas Technology Exhibition OIGATECH 2025 will be held 1–4 June 2025 at Baghdad International Fairground in Baghdad, Iraq, with the Iraqi Ministry of Oil serving as host.

For details of this event contact the following or see the website info@oigatech.iq https://oigatech.iq/contact/

Friday April 4th GMT+1 10:00 - 12:30

Course description:

This is an online course which covers the rules and procedures that were introduced after the UK left the EU on submitting customs declarations. A customs declaration is a form that must be submitted to UK customs that enables goods to be imported and exported. It is vital that importers and exporters understand the information required to be submitted to customs, as in most cases it is the importer and exporter who would be liable for this information, even if it is done by a third party.

The course will cover:

• The UK customs procedures

• Explanation of an EORI number

• What free circulation is

• Explanation of the SAD C88

• Key information for both import and export entries

• Procedures Codes

• Checking Entries

• UK Global Tariff - Tariff code/ Commodity codes

• Middle East Tariffs

• Key import and export documentation

• Content Requirements

• Commercial Invoices

• Proof of Export

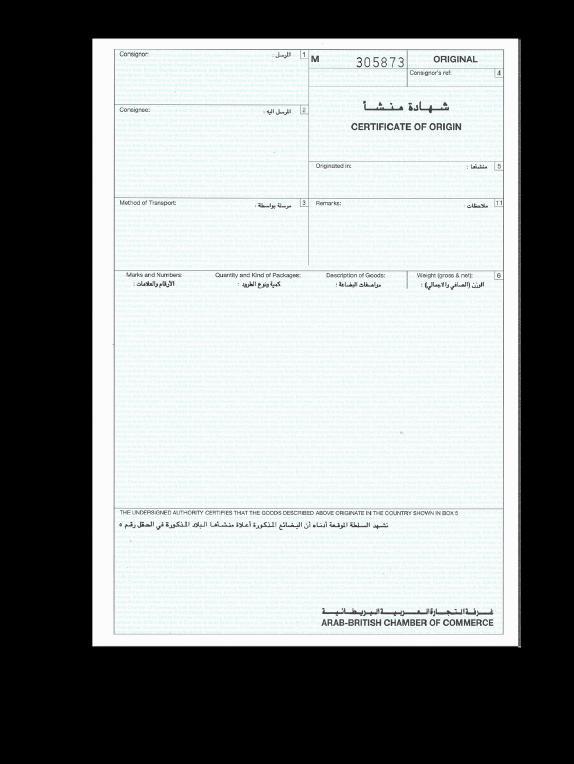

• Certificates of Origin

• Non-Preference

• Preference

• WTO Methods of Valuation for Import

• Customs Special Procedures

• Customs Warehousing

• Inward Processing

This course is suitable for people new to international business as well as experienced companies who need to refresh their knowledge post Brexit. It is especially beneficial for staff who work in export sales, purchasing, logistics, accountancy, import and export shipping departments, customer services, import and export administration.

A

‘I am delighted to invite you to participate in the Arab-British Chamber of Commerce’s flagship event of the year, the 4th Arab British Economic Summit – ‘Friendship Through Trade’.

This annual summit serves as a crucial platform for discussing emerging bilateral business opportunities including sustainable tourism, e-commerce, franchising, and innovations across all sectors among other topics. Now in its fourth year, ABES hosts a distinguished assembly of government ministers, officials, industry leaders, and visionaries from both the UK and the Arab world who convene to explore and debate the burgeoning opportunities that technological innovations and economic shifts are creating. Our past summits have set precedents for success and innovation and the 4th Arab British Economic Summit will not only continue this tradition but will elevate it to new heights.

With over 1,000 delegates registered and more than 35 speakers hosted during the 2023 summit across all sectors, I invite you to be at the forefront of this technological and economic transformation through joining us at this year’s summit. Your participation will offer your company several benefits, including increased brand exposure through numerous speaking opportunities, extensive media coverage and prominent exhibition booths.

Join us to pave the way for a future marked by enhanced collaboration and mutual prosperity. We are excited about the prospects that the forthcoming ABES2025 will open for enlightening discussions and invaluable networking opportunities.’

Mr Bandar Reda ABCC Secretary General & CEO

“The UK government has signalled that it wants to attract more investment into the economy, and its new drive for growth should certainly give momentum to the determination of UK negotiators to push forward the talks on the FTA toward a satisfactory conclusion,” said Bandar Reda, Secretary-General and CEO of the Arab British Chamber of Commerce.

The report carried by Arab News is as follows.

The UK’s economic fragility and global turmoil from President Donald Trump’s trade wars have given increased impetus for Britain to reach a free trade agreement with the Gulf Cooperation Council.

Talks for a deal between the six-nation bloc and Britain are continuing apace after restarting in September and are said to be at an advanced stage.

Yet the agreement could not come soon enough for the UK government, which is struggling to breathe life into a stagnant economy.

Prime Minister Keir Starmer has prioritized growth, and a GCC FTA would bring a significant boost to the UK’s finances and the governing Labour Party’s political fortunes.

The benefits would also be plentiful for Gulf countries, many of which have embarked on extensive reforms to diversify their economies away from hydrocarbons and toward modern sectors.

Arab News recently conducted an interview with our CEO & Secretary General, Mr Bandar Reda, on the prospects for the successful conclusion of the much discussed UK-GCC FTA.

Details of the negotiations are closely guarded, but economists and experts told Arab News they believe a final deal is close and that there is will from both sides to get the agreement in place.

“The UK government has signalled that it wants to attract more investment into the economy, and its new drive for growth should certainly give momentum to the determination of UK negotiators to push forward the talks on the FTA toward a satisfactory conclusion,” said Bandar Reda, secretary-general and CEO of the Arab-British Chamber of Commerce.

“With a fair degree of optimism then we can probably look forward to a positive outcome being achieved a little sooner than previously expected.”

The UK believes a GCC FTA would increase bilateral trade by 16 percent and could add an extra £8.6 billion ($10.7 billion) a year to the existing £57.4 billion worth of annual trade between the two sides.

Officials say it could also boost UK annual workers’ wages by around £600 million to £1.1 billion every year and increase UK GDP by between £1.6 and £3.1 billion by 2035.

The UK has been looking to forge fresh trade deals since leaving the EU, its biggest trading partner, in 2020.

With already strong trade links and historic ties to Gulf countries, establishing an agreement with the GCC as a whole became a priority.

Consisting of Saudi Arabia, the UAE, Qatar, Bahrain, Oman and Kuwait, the

GCC economic and political union is also seeking to make more trade agreements as a bloc.

A UK government report published in 2022 said an FTA with the GCC “is an opportunity to boost trade with an economically and strategically important group of countries, support jobs and advance our global interests.”

After the July election brought in his new UK government, Starmer prioritized relations with the Gulf, and a seventh round of trade negotiations got underway.

Jonathan Reynolds, the business and trade secretary, visited the region in September and delegations have travelled back and forth since.

The latest negotiation team from the GCC was in London last month, according to the Department for Business and Trade.

Starmer travelled to Saudi Arabia in December and met with Prime Minister and Crown Prince Mohammed bin Salman. He also visited the UAE and hosted the Qatari emir in London.

Several deals were announced during those meetings, as the new government made clear that attracting foreign investment from Gulf countries was key to its growth strategy.

At the same time, the economic pressures on Starmer’s administration have increased. Despite a relatively strong start to 2024, the UK economy failed to grow in the second half of the year.

Mr Bandar Reda CEO & Secretary General

Chancellor Rachel Reeves came under fire for her first budget, which dented business confidence with a series of tax hikes.

With UK borrowing costs hitting their highest level for several years last month, boosting trade with a bloc like the GCC through an FTA would be a significant boon for Starmer.

But it is not just the UK’s domestic economic woes that are looming over negotiators. With the US administration’s threats to impose tariffs on both allies and adversaries causing global financial uncertainty, Gulf countries will also be keen to ease trade restrictions with a major partner like the UK.

“One effect of the threat of tariffs might be to add urgency to the negotiations to conclude the UKGCC FTA,” Reda, of the Arab-British Chamber of Commerce, told Arab News.

Primarily, the agreement would remove or reduce tariff barriers to trade between GCC countries and the UK, easing the flow of goods and services.

The average tariff applied to UK exports by the GCC is around 5.5 percent, whereas imports from the Gulf face a 5.8 percent levy. However, the UK places no tariffs on oil and gas bought from GCC countries, and this accounts for most of the import value.

Still, removing the tariffs would help businesses on both sides by reducing costs but would particularly benefit the UK given that its exports account for 60 percent of total trade.

Perhaps more important, according to Freddie Neve, lead Middle East associate at the London-based Asia House think tank, would be removing red tape faced by importers and exporters.

“While reducing tariffs on these goods is an obvious target in the negotiations, arguably a larger opportunity relates to the reduction of non-tariff barriers,” Neve said. “These relate to regulations, standards, and procedures required of foreign firms to do business.

“A government analysis published before negotiations counted over 4,500 non-tariff measures applied by the GCC on the UK. Naturally, some of these will have been ameliorated by recent Gulf economic reforms, but an FTA that reduces these barriers would make it easier for UK companies to operate in and across the GCC.”

While the timing of the FTA would be good for the UK it also fits perfectly with the timetable of economic diversification underway in the GCC.

Saudi Arabia and the UAE in particular are moving away from reliance on oil revenues to modern, technologydriven economies.

Investing in the UK means they are able to tap into services and expertise in sectors where Britain has a competitive advantage, such as technology, life sciences, creative industries, education and financial services.

In particular, the UK’s 2022 assessment predicted an FTA would allow for cooperation in “industries of the future” such as artificial intelligence and renewable energy, in which Gulf countries are investing heavily.

“Over the past three years, innovations in AI and related sectors to do with the digital economy, e-commerce, advanced data and computing have developed enormously,” Reda said. “The Gulf states have all been seeking to position themselves at the forefront of these developments that are reshaping how we do business.

“These areas open up major new areas for UK-GCC cooperation as we all seek to maximize the potential offered by AI and cutting-edge tech. The FTA should give a tremendous boost to cooperation in these industries of the future.”

An FTA negotiation is a vast and complex process and there may well still be sticking points to be ironed out before a final deal is reached.

Douglas Alexander, the UK’s minister of state for trade policy and economic security, said in December that negotiators on the GCC agreement continued to have “constructive discussions on areas of sustainable trade,” such as environment and labour.

MPs have raised questions over whether the UK should be focusing on a GCC-wide agreement rather than individual deals with Gulf countries, citing variations in policies and regulations across the bloc.

But the GCC countries have been developing their concerted approach to trade and are pursuing similar agreements with the EU, China, and Turkiye.

“Negotiations with a bloc are always more challenging than bilateral deals,” Justin Alexander, a director at US consultancy Khalij Economics, told Arab News. “However, the GCC is functioning in the most joined-up way I have seen in my career, and all the GCC members are important partners for the UK, so it is highly motivated to make this work.”

He said he was not aware of any significant obstacles remaining in the talks and believed the deal is very near completion.

“The most significant element of the UK-GCC FTA for both sides will be the fact that it has been done, setting a precedent for further trade deals for both parties,” Alexander said. “Both sides are open, globally integrated economies and would benefit from modern trade deals.”

The Department for Business and Trade said trade deals played a “vital role” in the government’s mission for economic growth.

“We’re seeking a modern trade deal with the Gulf as a priority, and our focus is securing a deal that delivers real value to businesses on both sides, rather than getting it done by a specific date,” the department said.

Source: Arab News, 5 February 2025

The ABCC welcomes its new members and looks forward to working with them in the coming year.

Harley Street Practice Limited

Recovery Advisers

Riyad Bank

CaviarData NOVO Electric Technology

Value Retail Management (Bicester Village) Ltd

With over 40 years’ experience in technical translation, the Arab-British Chamber of Commerce specialises in Arabic/English and English/Arabic translation and has excellent facilities and top quality translators.

Our translators are officially qualified and trained to handle customer requirements accurately and professionally in both languages. Our experience lies in first class commercial, financial, legal and technical translation of the highest standard.

The Chamber’s translation service is officially recognised by all the Arab embassies in London and by the Foreign, Commonwealth & Development Office (FCDO).

However, we strongly advise clients that the FCDO should authenticate all official documentation translated from Arabic to English if it is to be used in the UK. Translation of official documents from English to Arabic, for use in the Arab world, must be authenticated by both the FCO and the Arab embassy of the country where the document is to be used.

The ABCC translation service covers all types of documents, including:

Birth/marriage/baptism/divorce/death certificates

Certificates of academic qualification

Certificates of Origin

Commercial invoices

Company/personal financial documents

Divorce documents from the Shar’i Mazun or from a court of law

Memorandum & Articles of Association

Passport details.

The Kingdom of Bahrain’s economy expanded by 2.1 percent year on year in the third quarter of 2024, driven by strong performance in its non-oil sectors, official data showed.

According to data from the Ministry of Finance and National Economy, non-oil sectors grew 3.9 percent during the period, accounting for 86.4 percent of real gross domestic product.

Key contributors included the information and communication sector, which surged 11.9 percent year on year, supported by increased mobile and broadband subscriptions.

Bahrain’s third-quarter growth mirrors positive trends across the Gulf Cooperation Council, with Saudi Arabia’s GDP rising 2.8 percent and Qatar’s advancing 2 percent, driven by ongoing economic diversification.

Despite these gains, Bahrain’s economy faced challenges in the oil sector, where activities contracted by 8.1 percent year on year, contributing to a 0.9 percent decline in nominal GDP.

However, non-oil sectors fared well, with the country’s financial and insurance activities performing strongly, growing by 5.8 percent, while electronic funds transfers increased by 13.7 percent year-on-year.

Manufacturing expanded by 4.2 percent, aided by higher production at the Bapco Refinery, while wholesale and retail trade grew by 2.1 percent, bolstered by a significant rise in e-commerce transactions.

In contrast, the oil sector faced headwinds due to maintenance activities at the Abu Sa’afa field and declining global oil prices. This resulted in a year-on-year contraction of oil

activities by 8.1 percent in real terms, while average daily oil production from the Abu Sa’afa field fell by 11.5 percent year on year.

Trade and investment activities also presented mixed results. The current account surplus narrowed by 54.5 percent year on year to 148.6 million Bahraini dinars ($394.2 million), largely due to a 19.2 percent decline in the value of oil exports.

Non-oil exports, however, saw modest growth of 1.1 percent, with base metals and mineral products leading the category. Foreign direct investment stock increased by 3.5 percent year on year, reaching 16.5 billion dinars. The financial and insurance sector remained the dominant contributor, accounting for 67.3 percent of the total foreign direct investments.

Development projects in various sectors continued to advance during the quarter. The Bapco Modernization Programme, completed in December 2024, increased refinery capacity by 42 percent, representing the largest capital investment in Bapco’s history.

In the tourism sector, four new fivestar hotels and the “Hawar Resort by Mantis” were inaugurated, enhancing Bahrain’s hospitality offerings.

The healthcare sector saw the construction of a new rehabilitation center in Al Jasra, while the Aluminum Downstream Industries Zone was launched as part of Bahrain’s Industrial Strategy.

Monetary and financial indicators reflected positive trends. The broad money supply expanded by 6.1 percent year on year, supported by a 15.6 percent increase in government deposits.

Total loans provided by retail banks grew by 4.9 percent year on year, with personal loans comprising nearly half of the total. The labour market recorded a 1.7 percent increase in the number of Bahrainis employed in the public and private sectors, reaching 153,842.

Recruitment under the Economic Recovery Plan met 98 percent of its annual target for 2024, while over 13,679 Bahrainis received training.

Bahrain’s capital markets also performed well, with the Bahrain All Share Index closing the third quarter at 2,012.77 points, a year-on-year increase of 3.8 percent. The Bahrain Islamic Index recorded even stronger growth, rising by 10.1 percent. Market capitalization increased by 2.4 percent, reaching 7.8 billion dinars.

In global competitiveness rankings, Bahrain retained its position as the freest economy in the Arab world, ranking 34th globally in the Economic Freedom of the World report.

Bahrain has also climbed eight places to rank 30th in the IMD World Digital Competitiveness Ranking, reflecting significant progress in adopting and leveraging digital technologies.

Source: Bahrain EDB

This transition toward a circular economy reflects the country’s commitment to sustainability, resource efficiency, and economic resilience

Jordan is taking decisive steps toward a structural transformation of its economic model, transitioning from a linear economy – characterised by resource extraction, production, and waste disposal -- toward a circular economy that prioritises resource efficiency, waste minimisation, and the regeneration of materials.

This strategic shift presents a compelling opportunity for the Kingdom to foster inclusive and sustainable economic growth, uphold its environmental commitments, enhance the added value of domestic production, and generate new employment opportunities.

According to the “Accelerating Circularity in the Arab Region” report issued by the United Nations Economic and Social Commission for Western Asia (ESCWA), a circular economy is defined as “an economic system in which materials and products remain in continuous use, alleviating pressure on natural ecosystems and facilitating their regeneration.”

The Jordanian Ministry of Environment underscores the circular economy’s pivotal role in mitigating environmental degradation, notably by reducing waste through recycling, reuse, and other sustainable practices. Furthermore, this model contributes to lowering greenhouse gas emissions, optimising resource utilisation, and promoting sustainable consumption and production patterns.

“The circular economy is an integral component of Jordan’s broader green economy agenda, pursued in collaboration with public and private sector stakeholders, as well as civil society institutions,” the Ministry stated to the Jordan News Agency (Petra), highlighting its incorporation into the nation’s education.

In line with this vision, the Ministry has developed the National Green Economy Action Plan (2021-2025), which prioritises six key sectors: energy, water, waste management, agriculture, tourism, and transportation.

Additionally, Jordan has aligned its climate action efforts with circular economy principles through strategic frameworks such as the Nationally Determined Contributions (NDCs) under the Paris Agreement.

The Ministry has licenced 183 waste management facilities, including privatesector enterprises engaged in recycling activities. These include eight battery recycling plants, 12 facilities for oil recycling, and an equivalent number for tire repurposing.

Furthermore, 34 electronic and electrical waste collection centres have been established across the Kingdom, complemented by the licencing of eight specialised e-waste recycling plants.

Jordan’s Economic Modernisation Vision (EMV)—a roadmap for long-term economic transformation—identifies the circular economy as a strategic priority within its Sustainable Environment pillar. The vision seeks to drive economic

expansion, generate employment, and ensure the preservation of natural and environmental resources.

A key focus of the EMV is the development of industrial eco-parks and the formulation of circular economy standards for industrial activities. Given that the per capita waste generation rate in Jordan ranges between 0.8 and 1 kilogram per day, the need for structured waste management and resource efficiency measures is pressing.

The Green Growth Executive Summary, which outlines the EMV’s strategic direction, identifies six critical sectors— energy, water, waste management, transportation, tourism, and agriculture—as drivers of the green economy. The report also emphasises the necessity of developing robust financing strategies to support these efforts.

At the global and national levels, responses to climate change present Jordan with a unique opportunity to accelerate its green transition through sustainable energy, green transportation, resource efficiency, cleaner production methods, and circular waste management solutions.

The Jordan Strategy Forum (JSF), a prominent private-sector think tank, asserts that Jordan can unlock significant economic, social, and environmental benefits by fully integrating circular economy principles beyond conventional waste management and resource efficiency strategies.

According to the JSF, the manufacturing sector, the largest contributor to Jordan’s economy, is poised for exponential growth. Forecasts indicate that by 2033, the sector will double in size, creating approximately 260,000 new jobs in chemicals, textiles, food production, pharmaceuticals, and engineering industries.

Given the sector’s substantial consumption of energy and raw materials, it is a prime candidate for circular economy adoption— offering opportunities to enhance efficiency, reduce waste, and reinforce sustainability.

In alignment with these objectives, Jordan launched an Integrated Resource Efficiency and Cleaner Production Initiative two years ago. The programme aims to provide technical and advisory

services to 15 industrial enterprises, supporting the implementation of cleaner production methodologies and resource-efficient practices across various sectors.

Waste Management

Official data from the Ministry of Environment indicates that Jordan produces an estimated 2.7 million tonnes of waste annually, with municipal solid waste accounting for 2.5 million tonnes, 50 percent of which is organic matter. Additionally, medical waste generation stands at 2,745 tonnes per year, while hazardous industrial waste reaches 45,000 tonnes annually. Plastic waste constitutes approximately 35 percent of total waste output.

Municipal waste collection services cover 90 percent of urban areas and 70 percent of rural regions, with certain categories—such as used mineral oils and lead-acid batteries—already being recycled. Approximately 2,000 tonnes of hazardous waste are processed annually at designated treatment centres.

Recycling

In a pioneering move, Jordan established its first Recycling Bank Centre in Amman, adhering to international best practices in commercial waste recycling. This facility enables the systematic collection of plastics, paper, metals, and cardboard from source-separated waste streams.

Fathi Jaghbir, President of the Jordan Chamber of Industry, emphasised the growing adoption of circular economy principles across Jordan’s industrial landscape. “Sectors such as construction, food production, chemicals, paper, and plastic manufacturing are increasingly integrating sustainable materials and recycled inputs into their production cycles,” he stated.

“The renewable energy sector is a cornerstone of the circular economy, providing clean and sustainable power solutions. Additionally, the agriculture sector is leveraging circular practices through organic farming, waste composting, and biomass energy production.”

Jaghbir highlighted that Jordanian industries are recognising the competitive advantages of circular economy integration, particularly in the context of global market dynamics that increasingly favour environmentally sustainable products. This transition is expected to reduce production costs,

improve product quality, and foster industrial innovation, positioning Jordanian businesses favorably in international markets.

Mohammad Walid Al-Jitan, a representative of the food and beverage manufacturing sector at the Jordan Chamber of Industry, echoed these sentiments. He underscored the sector’s commitment to enhancing efficiency, minimising waste, and utilising organic waste streams for compost or bioenergy production. The industry is also investing in biodegradable and recyclable packaging innovations.

Several Jordanian companies are at the forefront of circular economy innovation. Samer Al-Zumar, CEO of Smart Systems Company, noted that his firm is actively involved in recycling municipal waste, tires, plastics, and agricultural residues. These materials are converted into alternative fuels suitable for industrial applications, household heating, and poultry farming.

Al-Zumar stressed that Jordan faces dual challenges: high energy costs and mounting waste accumulation, both of which can be addressed through circular economy solutions. His company has established a primary waste sorting station in Amman, a recycling plant in Mafraq, and additional production lines in Al-Muwaqqar and Al-Dhabi’a.

Similarly, Alaa Abu Khazna, a representative of Jordan’s plastics and rubber industry, underscored the sector’s reliance on circular economy practices, particularly waste collection, sorting, and recycling into new plastic products.

Meanwhile, Mohammad Al-Samadi, Deputy General Manager of Al-Emlaq Industrial Group, emphasised that circular economy principles are the future of industrial sustainability. The group has implemented waste recycling, water reuse initiatives, and solar energy projects, including a 3-megawatt rooftop solar system covering 70 percent of its electricity needs.

Jordan’s transition toward a circular economy reflects its commitment to sustainability, resource efficiency, and economic resilience. With strong government policies, private sector engagement, and a growing recycling infrastructure, the Kingdom is positioning itself as a regional leader in sustainable economic transformation.

The Emirate of Sharjah’s free zones marked major achievements in 2024, reinforcing their pivotal role in establishing the emirate as one of the most attractive destinations for local, regional, and international companies.

During the last year, the Hamriyah Free Zone Authority (HFZA) and the Sharjah Airport International Free Zone Authority (SAIF Zone) combined attracted more than 1,600 companies from various countries around the world, including the UK, as well the US, various countries in Africa, India, Japan, Spain, Belgium and more.

In 2024, the Hamriyah Free Zone Authority attracted 900 companies and corporations across diverse sectors, specifically for the iron and steel manufacturing industry in the Middle East and Africa.

In a global acknowledgement of these achievements, the authority clinched prestigious international awards at the 2024 iteration of the Global Free Zones of the Year Award by fDi Intelligence, a publication by the Financial Times Group, for the second consecutive time.

The Sharjah Airport International Free Zone Authority experienced significant growth in the past year, attracting over 700 international and local companies from diverse sectors.

SAIF Zone has further strengthened its position as a regional investment destination for the gold, jewellery, and gemstone industries. Its Gold, Diamond, and Commodities Park is recognised as one of GCC’s largest gold refinery hubs,

accommodating over 55 gold refineries and hosting more than 250 regional and international companies specialising in gold, platinum, silver, and titanium manufacturing and trade.

Saud Salim Al Mazrouei, Director of HFZA and the SAIF Zone, emphasised that the significant accomplishments and milestones achieved by both zones in 2024 reflect the resilience and strength of Sharjah’s economy.

The achievements are guided by directives of His Highness Sheikh Dr. Sultan bin Mohammad Al Qasimi, Supreme Council Member and Ruler of Sharjah, who has prioritised efforts to diversify Sharjah’s economy and enhance the competitiveness of its free zones.

As a result, the emirate’s zones continue to attract foreign direct investment, fostering growth as hubs for advanced industries and commercial activities across various sectors.

Both HFZA and SAIF Zone have firmly established themselves as leading investment destinations in the Middle East and globally, hosting over 15,000 companies from 160 countries worldwide.

Al Mazrouei noted that these achievements create a strong impetus among Sharjah’s free zones to strengthen their developmental role and further their contributions to the emirate’s economy in 2025. This progress is underpinned by the steady growth of Sharjah’s economy, driven by the diversity and complementarity of its sectors and their alignment with

the emirate’s strategic ambitions and development plans.

This is reflected in Sharjah’s 2025 general budget, where the economic development sector accounts for 27 percent of the new budget, while the infrastructure sector ranks first, comprising 41 percent of the total general budget for 2025.

In line with their commitment to innovation and sustainability, both HFZA and SAIF Zone enhanced their operational frameworks in 2024 by leveraging cutting-edge digital technologies to create flexible and inclusive work environments.

Together, they now offer a comprehensive portfolio of 600 smart services, designed to optimise operational efficiency, streamline business activities, and deliver an investor experience centred on efficiency, speed, and excellence.

The two free zones also strengthened their focus on environmental sustainability by adopting innovative strategies to build an integrated system of eco-friendly services.

This included signing a strategic partnership agreement with “Bee’ah Group” and organising targeted initiatives, including events and workshops to encourage businesses and investors to embrace effective environmental solutions focused on energy efficiency, natural resource preservation, and emission minimisation.

Source: Emirates News Agency (edited)

A

new ‘global growth team’ of UK Trade Envoys has been appointed by the British Trade Secretary in a bid to drive forward UK exports and investment.

The appointment of new trade envoys comes ahead of a UK Trade Strategy set to be unveiled in the Spring, which will prioritise rebuilding relations with the EU and seizing opportunities to access new markets around the world, according to the Department for Business and Trade.

In an announcement from the DBT, the UK government stated that it was pulling “every lever available to drive economic growth under its Plan for Change”.

The new trade envoys are 32 parliamentarians drawn from across the political spectrum. They have been assigned target markets and tasked with identifying trade and investment opportunities for businesses and championing the UK as a destination of choice for investment in those markets.

Each market has been identified by the DBT as presenting significant potential for growing UK trade.

Business and Trade Secretary Rt Hon Jonathan Reynolds MP stated: “Trade and investment are key to delivering economic growth, the number one mission of this Government and a key part of our Plan for Change.”

As previously, the Trade Envoys work closely with the DBT and are appointed for their ability, relevant skills and experience based on their respective markets or sector knowledge, including government-to-government experience, as well as a commitment to the UK’s growth mission.

Alongside bolstering exports, attracting investments, and removing trade barriers, the government is also resuming trade talks with prospective

FTA partners, including – so far - the GCC, Switzerland and South Korea.

Among the new appointments are the following Trade Envoys designated for markets in the MENA region:

• Ben Coleman MP appointed to Morocco & Francophone West Africa

• Lord Iain McNicol of West Kilbride appointed to Jordan, Kuwait & the Occupied Palestinian Territories

• Sarah Olney MP appointed to North Africa

• Yasmin Qureshi MP appointment to Egypt.

Information derived from the Department for Business and Trade, 28 January 2025.

The latest official data on trade and investment between the UK and each of the Arab countries.

Total trade in goods and services (exports plus imports) between the UK and Algeria was £2.4 billion in the four quarters to the end of Q3 2024, a decrease of 5.0% or £125 million in current prices from the four quarters to the end of Q3 2023.

Of this £2.4 billion:

• Total UK exports to Algeria amounted to £673 million in the four quarters to the end of Q3 2024 (an increase of 3.9% or £25 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Algeria amounted to £1.7 billion in the four quar ters to the end of Q3 2024 (a decrease of 8.2% or £150 million in current prices, compared to the four quar ters to the end of Q3 2023).

Algeria was the UK’s 63rd largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.1% of total UK trade.

In 2023, the outward stock of foreign

direct investment (FDI) from the UK in Algeria was £146 million. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Algeria was £3 million, 48.6% or £3 million lower than in 2022. In 2023, Algeria accounted for less than 0.1% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and Bahrain was £916 million in the four quarters to the end of Q3 2024, a decrease of 12.2% or £127 million in current prices from the four quarters to the end of Q3 2023.

Of this £916 million:

• Total UK exports to Bahrain amounted to £676 million in the four quarters to the end of Q3 2024 (an increase of 5.3% or £34 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Bahrain amounted to £240 million in the four quar ters to the end of Q3 2024

(a decrease of 40.1% or £161 million in current prices, compared to the four quar ters to the end of Q3 2023).

Bahrain was the UK’s 91st largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Bahrain was £69 million, 16.1% or £10 million higher than in 2022.

In 2023, Bahrain accounted for less than 0.1% of the total UK outward FDI stock. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Bahrain was £54 million.

Total trade in goods and services (exports plus imports) between the UK and Comoros was less than £1 million in the four quarters to the end of Q3 2024, a change of less than £1 million in current prices from the four quarters to the end of Q3 2023. Of this less than £1 million:

• Total UK exports to Comoros amounted to less than £1 million in the four quarters to the end of Q3 2024 (a change of less than £1 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Comoros amounted to less than £1 million in the four quarters to the end of Q3 2024 (a change of less than £1 million in current prices, compared to the four quarters to the end of Q3 2023).

Comoros was the UK’s joint 229th largest trading partner in the four quarters to the end of Q3 2024 accounting for less than 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Comoros was less than £500 thousand. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Comoros was £4 million, 84.9% or £2 million higher than in 2022.

In 2023, Comoros accounted for less than 0.1% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and Djibouti was £35 million in the four quarters to the end of Q3 2024, a decrease of 31.4% or £16 million in current prices from the four quarters to the end of Q3 2023.

Of this £35 million:

• Total UK exports to Djibouti amounted to £25 million in the four quarters to the end of Q3 2024 (a decrease of 24.2% or £8 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Djibouti amounted to £10 million in the four quarters to the end of Q3 2024 (a decrease of 44.4% or £8 million in current prices, compared to the four quarters to the end of Q3 2023).

Djibouti was the UK’s 179th largest trading partner in the four quarters to the end of Q3 2024 accounting for less than 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Djibouti are not available due to data disclosure. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Djibouti was £929 million, 11.0% or £92 million higher than in 2022.

In 2023, Djibouti accounted for less than 0.1% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and Egypt was £4.7 billion in the four quarters to the end of Q3 2024, an increase of 2.6% or £118 million in current prices from the four quarters to the end of Q3 2023.

Of this £4.7 billion:

• Total UK exports to Egypt amounted to £2.7 billion in the four quarters to the end of Q3 2024 (an increase of 6.6% or £169 million in current prices, compared to the four quarters to the end of Q3 2023);

Continued from page 23...

• Total UK imports from Egypt amounted to £2.0 billion in the four quarters to the end of Q3 2024 (a decrease of 2.5% or £51 million in current prices, compared to the four quarters to the end of Q3 2023).

Egypt was the UK’s 48th largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.3% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Egypt are not available due to data disclosure. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Egypt was £621 million, 2055.6% or £593 million higher than in 2022.

In 2023, Egypt accounted for less than 0.1% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and Iraq was £1.3 billion in the four quarters to the end of Q3 2024, an increase of 17.5% or £189 million in current prices from the four quarters to the end of Q3 2023.

Of this £1.3 billion:

• Total UK exports to Iraq amounted to £1.0 billion in the four quarters to the end of Q3 2024 (an increase of 22.5% or £188 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Iraq amounted to £247 million in the four quarters to the end of Q3 2024 (an increase of 0.4% or £1 million in current prices, compared to the four quarters to the end of Q3 2023).

Iraq was the UK’s 85th largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Iraq are not available due to data disclosure. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Iraq are not available due to data disclosure.

Total trade in goods and services (exports plus imports) between the UK and Jordan was £1.3 billion in the four quarters to the end of Q3 2024, an increase of 17.1% or £194 million in current prices from the four quarters to the end of Q3 2023.

Of this £1.3 billion:

• Total UK exports to Jordan amounted to £1.0 billion in the four quarters to the end of Q3 2024 (an increase of 21.8% or £182 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Jordan amounted to £308 million in the four quarters

to the end of Q3 2024 (an increase of 4.1% or £12 million in current prices, compared to the four quarters to the end of Q3 2023).

Jordan was the UK’s 83rd largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Jordan was £6.4 billion accounting for 0.3% of the total UK outward FDI stock. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Jordan was £959 million, 12.6% or £108 million higher than in 2022.

In 2023, Jordan accounted for less than 0.1% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and Kuwait was £6.2 billion in the four quarters to the end of Q3 2024, an increase of 25.9% or £1.3 billion in current prices from the four quarters to the end of Q3 2023.

Of this £6.2 billion:

• Total UK exports to Kuwait amounted to £2.0 billion in the four quarters to the end of Q3 2024 (a decrease of 1.9% or £39 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Kuwait amounted to £4.2 billion in the four quarters to the end of Q3 2024 (an increase of 46.0% or £1.3 billion in current prices, compared to the four quarters to the end of Q3 2023).

Kuwait was the UK’s 40th largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.4% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Kuwait was £-34 million, £7 million lower than in 2022. In 2023, Kuwait accounted for less than 0.1% of the total UK outward FDI stock. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Kuwait was £262 million, 334.2% or £202 million higher than in 2022.

In 2023, Kuwait accounted for less than 0.1% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and Lebanon was £707 million in the four quarters to the end of Q3 2024, an increase of 2.8% or £19 million in current prices from the four quarters to the end of Q3 2023.

Of this £707 million:

• Total UK exports to Lebanon amounted to £535 million in the four quarters to the end of Q3 2024 (a decrease of

1.7% or £9 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Lebanon amounted to £172 million in the four quarters to the end of Q3 2024 (an increase of 19.4% or £28 million in current prices, compared to the four quarters to the end of Q3 2023).

Lebanon was the UK’s 96th largest trading partner in the four quarters to the end of Q3 2024 accounting for less than 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Lebanon was £75 million, 29.2% or £17 million higher than in 2022.

In 2023, Lebanon accounted for less than 0.1% of the total UK outward FDI stock. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Lebanon was £63 million, 12.6% or £9 million lower than in 2022.

In 2023, Lebanon accounted for less than 0.1% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and Libya was £2.5 billion in the four quarters to the end of Q3 2024, an increase of 61.7% or £941 million in current prices from the four quarters to the end of Q3 2023.

Of this £2.5 billion:

• Total UK exports to Libya amounted to £241 million in the four quarters to the end of Q3 2024 (a decrease of 14.5% or £41 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Libya amounted to £2.2 billion in the four quarters to the end of Q3 2024 (an increase of 79.0% or £982 million in current prices, compared to the four quarters to the end of Q3 2023).

Libya was the UK’s 62nd largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Libya are not available due to data disclosure. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Libya was £10 million, 28.3% or £4 million lower than in 2022.

In 2023, Libya accounted for less than 0.1% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and Mauritania was £127 million in the four quarters to the end of Q3 2024, an increase of 5.8% or £7 million in current prices from the four quarters to the end of Q3 2023.

Continued from page 25...

Of this £127 million:

Of this £3.8 billion:

• Total UK exports to Mauritania amounted to £92 million in the four quarters to the end of Q3 2024 (an increase of 5.7% or £5 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Mauritania amounted to £35 million in the four quarters to the end of Q3 2024 (an increase of 6.1% or £2 million in current prices, compared to the four quarters to the end of Q3 2023).

Mauritania was the UK’s 142nd largest trading partner in the four quarters to the end of Q3 2024 accounting for less than 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Mauritania are not available due to data disclosure. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Mauritania was £1 million, 67.6% or £2 million lower than in 2022.

In 2023, Mauritania accounted for less than 0.1% of the total UK inward FDI stock.

Morocco

Total trade in goods and services (exports plus imports) between the UK and Morocco was £3.8 billion in the four quarters to the end of Q3 2024, an increase of 7.7% or £274 million in current prices from the four quarters to the end of Q3 2023.

• Total UK exports to Morocco amounted to £1.4 billion in the four quarters to the end of Q3 2024 (a decrease of 4.1% or £59 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Morocco amounted to £2.4 billion in the four quarters to the end of Q3 2024 (an increase of 15.8% or £333 million in current prices, compared to the four quarters to the end of Q3 2023).

Morocco was the UK’s joint 51st largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.2% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Morocco are not available due to data disclosure. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Morocco was £17 million, 2.6% or £426.2 thousand higher than in 2022.

In 2023, Morocco accounted for less than 0.1% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and Oman was £1.5 billion in the four quarters to the end of Q3 2024, an increase of 1.4% or £20 million in current prices from the four quarters to the end of Q3 2023.

Of this £1.5 billion:

• Total UK exports to Oman amounted to £1.1 billion in the four quarters to the end of Q3 2024 (a decrease of 2.6% or £30 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Oman amounted to £383 million in the four quarters to the end of Q3 2024 (an increase of 15.0% or £50 million in current prices, compared to the four quarters to the end of Q3 2023).

Oman was the UK’s 78th largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Oman are not available due to data disclosure. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Oman was £142 million, 113.1% or £75 million higher than in 2022.

In 2023, Oman accounted for less than 0.1% of the total UK inward FDI stock.

Palestine (Occupied Palestinian Territories – UK Gov)

Total trade in goods and services (exports plus imports) between the UK and Occupied Palestinian Territories was £54 million in the four quarters to the end of Q3 2024, an increase of 38.5% or £15 million in current prices from the four quarters to the end of Q3 2023.

Of this:

• Total UK exports to Occupied Palestinian Territories amounted to £21 million in the four quarters to the end of Q3 2024 (a decrease of 4.5% or £1 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Occupied Palestinian Territories amounted to £33 million in the four quarters to the end of Q3 2024 (an increase of 94.1% or £16 million in current prices, compared to the four quarters to the end of Q3 2023).

Occupied Palestinian Territories was the UK’s joint 164th largest trading partner in the four quarters to the end of Q3 2024 accounting for less than 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Occupied Palestinian Territories are not available due to data disclosure. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Occupied Palestinian Territories was less than £500 thousand.

Total trade in goods and services (exports plus imports) between the UK and Qatar was £5.6 billion in the four quarters to the end of Q3 2024, a decrease of 39.6% or £3.7 billion in current prices from the four quarters to the end of Q3 2023.

Of this £5.6 billion:

• Total UK exports to Qatar amounted to £4.4 billion in the four quarters to the end of Q3 2024 (a decrease of 19.9% or £1.1 billion in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Qatar amounted to £1.2 billion in the four quarters to the end of Q3 2024 (a decrease of 68.3% or £2.6 billion in current prices, compared to the four quarters to the end of Q3 2023).

Qatar was the UK’s 45th largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.3% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Qatar was £83 million, 23.4% or £25 million lower than in 2022. In 2023, Qatar accounted for less than 0.1% of the total UK outward FDI stock.

In 2023, the inward stock of foreign direct investment (FDI) in the UK from Qatar are not available due to data disclosure.

Total trade in goods and services (exports plus imports) between the UK and Saudi Arabia was £15.8 billion in the four quarters to the end of Q3 2024, a decrease of 8.7% or £1.5 billion in current prices from the four quarters to the end of Q3 2023.

Of this £15.8 billion:

• Total UK exports to Saudi Arabia amounted to £12.4 billion in the four quarters to the end of Q3 2024 (a decrease of 0.8% or £103 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Saudi Arabia amounted to £3.4 billion in the four quarters to the end of Q3 2024 (a decrease of 29.2% or £1.4 billion in current prices, compared to the four quarters to the end of Q3 2023).

Saudi Arabia was the UK’s 24th largest trading partner in the four quarters to the end of Q3 2024 accounting for 0.9% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Saudi Arabia was £6.2 billion accounting for 0.3% of the total UK outward FDI stock. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Saudi Arabia was £685 million, 13.3% or £105 million lower than in 2022.

In 2023, Saudi Arabia accounted for less than 0.1% of the total UK inward FDI stock.

Somalia

Total trade in goods and services (exports plus imports) between the UK and Somalia was £34 million in the four quarters to the end of Q3 2024, a decrease of 56.4% or

Continued from page 27...

£44 million in current prices from the four quarters to the end of Q3 2023.

Of this £34 million:

• Total UK exports to Somalia amounted to £30 million in the four quarters to the end of Q3 2024 (a decrease of 41.2% or £21 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Somalia amounted to £4 million in the four quarters to the end of Q3 2024 (a decrease of 85.2% or £23 million in current prices, compared to the four quarters to the end of Q3 2023).

Somalia was the UK’s 180th largest trading partner in the four quarters to the end of Q3 2024 accounting for less than 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Somalia was £611 thousand. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Somalia was less than £500 thousand.

Total trade in goods and services (exports plus imports) between the UK and Sudan was £82 million in the four quarters to the end of Q3 2024, a decrease of 1.2% or £1 million in current prices from the four quarters to the end of Q3 2023.

Of this £82 million:

• Total UK exports to Sudan amounted

to £68 million in the four quarters to the end of Q3 2024 (an increase of 1.5% or £1 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Sudan amounted to £14 million in the four quarters to the end of Q3 2024 (a decrease of 12.5% or £2 million in current prices, compared to the four quarters to the end of Q3 2023).

Sudan was the UK’s 156th largest trading partner in the four quarters to the end of Q3 2024 accounting for less than 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Sudan was less than £500 thousand. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Sudan was less than £500 thousand.

Total trade in goods and services (exports plus imports) between the UK and Syria was £2 million in the four quarters to the end of Q3 2024, a decrease of 33.3% or £1 million in current prices from the four quarters to the end of Q3 2023.

Of this £2 million:

• Total UK exports to Syria amounted to £2 million in the four quarters to the end of Q3 2024 (a decrease of 33.3% or £1 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Syria amounted to less than £1 million in the four quarters to the end of Q3 2024 (a change of less than £1 million in current prices, compared to the four quarters to the end of Q3 2023).

Syria was the UK’s joint 214th largest trading partner in the four quarters to the end of Q3 2024 accounting for less than 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Syria was £292 million, 8.3% or £22 million higher than in 2022. In 2023, Syria accounted for less than 0.1% of the total UK outward FDI stock.

In 2023, the inward stock of foreign direct investment (FDI) in the UK from Syria was £13.0 billion accounting for 0.6% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and Tunisia was £746 million in the four quarters to the end of Q3 2024, an increase of 19.7% or £123 million in current prices from the four quarters to the end of Q3 2023.

Of this £746 million:

• Total UK exports to Tunisia amounted to £245 million in the four quarters to the end of Q3 2024 (an increase of 7.0% or £16 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Tunisia amounted to £501 million in the four quarters to the end of Q3 2024 (an increase of 27.2% or £107 million in current prices, compared to the four quarters to the end of Q3 2023).

Tunisia was the UK’s 95th largest trading partner in the four quarters to the end of Q3 2024 accounting for less than 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Tunisia was £62 million, 28.3% or £14 million higher than in 2022. In 2023, Tunisia accounted for less than 0.1% of the total UK outward FDI stock. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Tunisia was £5 million, 15.8% or £977 thousand lower than in 2022.

In 2023, Tunisia accounted for less than 0.1% of the total UK inward FDI stock.

Total trade in goods and services (exports plus imports) between the UK and United Arab Emirates was £23.4 billion in the four quarters to the end of Q3 2024, an increase of 2.0% or £454 million in current prices from the four quarters to the end of Q3 2023.

Of this £23.4 billion:

• Total UK exports to United Arab Emirates amounted to £14.9 billion

in the four quarters to the end of Q3 2024 (an increase of 5.1% or £719 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from United Arab Emirates amounted to £8.5 billion in the four quarters to the end of Q3 2024 (a decrease of 3.0% or £265 million in current prices, compared to the four quarters to the end of Q3 2023).

The United Arab Emirates was the UK’s 19th largest trading partner in the four quarters to the end of Q3 2024 accounting for 1.4% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in the United Arab Emirates was £4.3 billion accounting for 0.2% of the total UK outward FDI stock. In 2023, the inward stock of foreign direct investment (FDI) in the UK from the United Arab Emirates was £3.6 billion accounting for 0.2% of the total UK inward FDI stock.

Yemen

Total trade in goods and services (exports plus imports) between the UK and Yemen was £88 million in the four quarters to the end of Q3 2024, an increase of 69.2% or £36 million in current prices from the four quarters to the end of Q3 2023.

Of this £88 million:

• Total UK exports to Yemen amounted to £86 million in the four quarters to the end of Q3 2024 (an increase of 79.2% or £38 million in current prices, compared to the four quarters to the end of Q3 2023);

• Total UK imports from Yemen amounted to £2 million in the four quarters to the end of Q3 2024 (a decrease of 50.0% or £2 million in current prices, compared to the four quarters to the end of Q3 2023).

Yemen was the UK’s joint 151st largest trading partner in the four quarters to the end of Q3 2024 accounting for less than 0.1% of total UK trade.

In 2023, the outward stock of foreign direct investment (FDI) from the UK in Yemen are not available due to data disclosure. In 2023, the inward stock of foreign direct investment (FDI) in the UK from Yemen was £4 million, 49.7% or £1 million higher than in 2022.

In 2023, Yemen accounted for less than 0.1% of the total UK inward FDI stock.

Source: DBT country by country factsheets of the latest statistics on trade and investment between the UK and each stated country, 31 January 2025

The Kingdom of Saudi Arabia issued 14,321 investment licenses in 2024, reflecting a 67.7 percent year-on-year increase and underscoring the country’s growing appeal as a global business hub.

The kingdom is seeking to stimulate investment across its growing sectors including tourism, entertainment, healthcare, science, technology, and renewable energy.

A report from the KSA’s Ministry of Investment showed that 4,615 licenses were issued in the fourth quarter of 2024, marking a 59.9 percent increase compared to the same period the previous year.

According to the ministry, the surge highlights Saudi Arabia’s position as a leading investment destination, offering competitive advantages and a stable, supportive environment for businesses.

The report confirmed that this figure does not include licenses granted under the Kingdom’s Tasattur anticoncealment initiative.

Despite regional tensions, Saudi Arabia’s stable political environment and proactive economic reforms continue to attract investors.

The government’s commitment to economic diversification and reducing dependence on oil revenues has been a key factor in strengthening investor confidence.

The Ministry of Investment previously reported that Gross Fixed Capital Formation — a key indicator of investment activity — grew 7.4 percent

year on year in the third quarter of 2024.

This increase was primarily driven by an 8.3 percent rise in fixed capital formation within the non-government sector, along with a 2.3 percent uptick in government investment.

The consistent growth in private-sector investment reflects rising confidence among multinational corporations, reinforcing Saudi Arabia’s efforts to attract foreign direct investment and diversify its economy as part of Vision 2030.

According to a previous Invest Saudi report, the sectors with the highest number of licenses issued since the launch of Vision 2030 include manufacturing, construction, professional and scientific services, as well as wholesale and retail trade, and information and communication technology.

These industries have become key drivers of Saudi Arabia’s economic diversification strategy, highlighting the success of ongoing efforts to position the Kingdom as a regional hub for business and innovation.

Saudi Arabia has launched various initiatives to attract investment and solidify its status as a regional business hub. A key element of this strategy is

the Regional Headquarters Programme, which encourages multinational companies to establish operations in the Kingdom.

The initiative provides 30 years of tax relief, including zero percent corporate income and withholding tax on RHQ activities, along with a 10-year exemption from Saudization requirements.

Additionally, the top three RHQ executives receive premium residency at no cost, further enhancing Saudi Arabia’s appeal to global corporations.

In October last year, Saudi Investment Minister Khalid Al-Falih announced the Kingdom had already surpassed its Vision 2030 target of attracting 500 companies to Riyadh, with 540 making the city its regional base.

Beyond this programme, the Saudi government has taken steps to simplify investment processes. Initiatives include the Tourism Development Fund, launched with an initial capital of $4 billion, and the Kafalah programme, which provides loan guarantees of up to $400 million.

All these efforts aim to stimulate private investment in tourism, entertainment, healthcare, science, technology, and renewable energy.

For details of opportunities see the Invest Saudi website, https://investsaudi.sa/en/sectorsopportunities/

Highlighting some of the major developments in Arab airports over the past year along with future expansion plans.

‘Algiers airport can become an international hub’

Passenger traffic at Algiers International Airport is expected to exceed 10 million in 2025.

That was the prediction of the Chairman and CEO of Société de gestion des services et infrastructures aéroportuaires d’Alger (SGSIA), Mokhtar Saïd Mediouni, who announced that passenger traffic at Algiers International Airport will exceed 10 million at the start of the year.

The official also spoke about digitization and other new facilities for air travel in Algeria. Addressing the APN Transport and Telecommunications Committee, Mediouni hailed measures to facilitate air transport, particularly for Algerians abroad and international travellers. He also highlighted the widespread digitization of airport services in the

country and the integration of new applications to enhance the passenger experience.

Source: Algeria Invest

Bahrain International Airport kicks off runway maintenance plan

Bahrain Airport Company (BAC), the managing body of Bahrain International Airport (BIA), has commenced its 2025 runway maintenance plan aimed at ensuring safety, efficiency, and operational sustainability at the key regional airport.

The plan, which adheres to international aviation safety standards, is being executed in coordination with the Bahrain Civil Aviation Authority (BCAA).

Eyad Ismaeel, BAC’s acting VP of Facility Management, stated, “This

comprehensive runway maintenance plan shows BAC’s commitment to maintaining the highest levels of safety and efficiency at BIA throughout 2025. By adhering to international aviation safety and operational standards, we are not only enhancing BIA’s regional standing but also ensuring a seamless and secure travel experience for all passengers.”

The initial phase of the plan includes several crucial maintenance tasks, including rubber removal, friction testing, asphalt patching, runway remarking, shoulder repairs, strip grading, joint sealant and nitoseal applications, as well as airfield ground lighting repairs.

The lighting system will undergo LED upgrades, photometric testing, and manhole dewatering as part of the maintenance.

BAC emphasised that the 2025 maintenance plan is part of its broader strategy to invest in BIA’s infrastructure, enhancing the airport’s operational efficiency, and ensuring the provision of world-class service to both passengers and airlines.

Source: Gulf Business

Jordan

QAIA welcomes 8.8 million passengers in 2024

Airport International Group (AIG) celebrated an outstanding year in 2024, marked by achievements and initiatives for Queen Alia International Airport (QAIA) across operations, customer experience, environmental sustainability and community development.

This journey of progress culminated with “prestigious” recognitions that emphasised QAIA’s standing as Jordan’s

prime gateway to the world, most notably the Silver Jubilee Medal from His Majesty King Abdullah in recognition of its contributions to the service of Jordan, particularly in supporting local communities, according to a statement for The Jordan Times.

QAIA was acknowledged for its passenger satisfaction, earning the title of ‘Best Airport by Size and Region: Middle East’ for the second consecutive year and the eighth time overall in the ACI World 2023 ASQ Survey.

QAIA also attained a 4-Star Airport Rating by SKYTRAX World Airport Audit and renewed Level 3 of the ACI World Airport Customer Experience Accreditation.

Adding to its accolades, AIG received the Seal of Excellence under the King Abdullah II Award for Excellence for the Private Sector, lauding its achievement of organisational objectives.

Regarding airport infrastructure and operations, AIG signed an agreement with Joramco to build a new hangar, expanding aircraft maintenance capabilities and creating 400 jobs, where both sides renewed contracts for 30 years, reinforcing a long-term partnership to support QAIA’s strategic growth, the statement said.

Source: Jordan Times

Hamad Airport completes key terminal expansion

Qatar’s Hamad International Airport (DOH) has announced the opening of Concourse E as part of its latest terminal expansion programme.

Under this programme, two new concourses are being built, said the statement from DOH.

With the first of the two concourses, the Concourse E completion, it increases the number of overall contact gates by 20%.

Designed to further elevate the passenger journey, this development prioritises boarding efficiency, reduces reliance on remote gates and buses and incorporates accessibility and sustainability focused design, it stated.

The expansion adds 51,000 sq m of space to the airport, featuring eight new contact gates representing a 20% overall addition that enable faster boarding and improved operational efficiency.

The Concourse E boast several vital features including:

*Advanced Self-Boarding Technology: Enhancing passenger convenience with self-boarding gates that scan boarding passes automatically for a smoother travel experience.

Sustainable Infrastructure: Featuring cutting-edge energy-efficient systems, innovative water management solutions, and optimized thermal comfort, the concourse reinforces Hamad International Airport’s commitment to sustainability.

Hamad Ali Al Khater, the Chief Operating Officer at Hamad International Airport, said: “We are thrilled to see this modern concourse come to life, providing our passengers with a more seamless and comfortable travel experience. This expansion reflects our commitment to delivering world-class facilities that emphasize efficiency, accessibility and sustainability.”

“With the launch of Concourse E, travellers can experience the first phase of a transformative expansion aimed at elevating every aspect of their journey. This marks only the beginning, with further developments planned to enhance connectivity, capacity, and the overall experience at Hamad International Airport,” he added.

Sources: DOH/ Trade Arabia/Construction Week

Saudi Arabia Kingdom to open its domestic sector to international charter flights

The Saudi General Authority of Civil Aviation (GACA) is opening the domestic private aviation market to international operators, by announcing the removal of cabotage restrictions for foreign on-demand charter flights within the kingdom.

The new policy, effective May 1, 2025, will allow foreign charter operators to apply for permission to operate domestic flights, following specific requirements set by GACA.

The decision is part of GACA’s broader strategy to boost the private jet market, supported by the establishment of a sector development committee to engage international and domestic business jet operators. >>>

“GACA is unlocking new opportunities for the global aviation industry, by removing restrictions on charter flight businesses to operate domestically in the Kingdom,” remarked Imtiyaz Manzary, the General Manager for General Aviation at GACA.

“This regulatory decision supports GACA’s roadmap to establish Saudi Arabia as a general aviation hub, alongside an unprecedented infrastructure program to establish new private airports and terminals across the kingdom,” he stated.

Manzary said the removal of cabotage restrictions marks an important step in GACA’s strategy to enhance competition, attract foreign investment and provide greater flexibility for operators in the general aviation industry.

Alongside this decision, GACA has announced a national General Aviation Sector Development committee to enhance Saudi Arabia’s proposition as a general aviation hub, including international private aviation investors, operators, and service providers.

The committee will engage on infrastructure planning and regulatory processes, to enhance the Kingdom’s general aviation sector value proposition, he explained.

According to a company press release, the removal of cabotage restrictions marks an important step in GACA’s strategy to enhance competition, attract foreign investment, and provide greater flexibility for operators in the general aviation industry.

GACA’s General Aviation Roadmap was launched during the Future Aviation Forum in May 2024, including a comprehensive transformation programme to develop the general aviation sector into a $2 billion industry by 2030, supporting 35,000 jobs.

The roadmap aligns infrastructure planning and regulations

across the sector, delivering six dedicated business aviation airports and a further nine dedicated business aviation terminals.