TRENDING COMPILED BY SONIA BELL

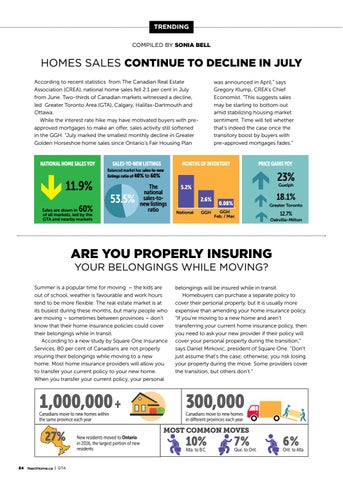

HOMES SALES CONTINUE TO DECLINE IN JULY According to recent statistics from The Canadian Real Estate Association (CREA), national home sales fell 2.1 per cent in July from June. Two-thirds of Canadian markets witnessed a decline, led Greater Toronto Area (GTA), Calgary, Halifax-Dartmouth and Ottawa. While the interest rate hike may have motivated buyers with preapproved mortgages to make an offer, sales activity still softened in the GGH. “July marked the smallest monthly decline in Greater Golden Horseshoe home sales since Ontario’s Fair Housing Plan

NATIONAL HOME SALES YOY

11.9%

SALES-TO-NEW LISTINGS

was announced in April,” says Gregory Klump, CREA’s Chief Economist. “This suggests sales may be starting to bottom out amid stabilizing housing market sentiment. Time will tell whether that’s indeed the case once the transitory boost by buyers with pre-approved mortgages fades.”

MONTHS OF INVENTORY

PRICE GAINS YOY

Balanced market has sales-to-new listings ratio of 40% to 60%

60%

53.5%

Sales are down in of all markets, led by the GTA and nearby markets

The national sales-tonew listings ratio

23% Guelph

5.2% 2.6% National

GGH

18.1%

0.08%

Greater Toronto

GGH Feb. / Mar.

12.7% Oakville-Milton

ARE YOU PROPERLY INSURING YOUR BELONGINGS WHILE MOVING? Summer is a popular time for moving – the kids are out of school, weather is favourable and work hours tend to be more flexible. The real estate market is at its busiest during these months, but many people who are moving – sometimes between provinces – don’t know that their home insurance policies could cover their belongings while in transit. According to a new study by Square One Insurance Services, 80 per cent of Canadians are not properly insuring their belongings while moving to a new home. Most home insurance providers will allow you to transfer your current policy to your new home. When you transfer your current policy, your personal

1,000,000 + Canadians move to new homes within the same province each year

27% 84 NextHome.ca NextHome.ca | GTA

belongings will be insured while in transit. Homebuyers can purchase a separate policy to cover their personal property, but it is usually more expensive than amending your home insurance policy. “If you’re moving to a new home and aren’t transferring your current home insurance policy, then you need to ask your new provider if their policy will cover your personal property during the transition,” says Daniel Mirkovic, president of Square One. “Don’t just assume that’s the case; otherwise, you risk losing your property during the move. Some providers cover the transition, but others don’t.”

300,000 Canadians move to new homes in different provinces each year

MOST COMMON MOVES New residents moved to Ontario in 2016, the largest portion of new residents

10% Alta. to B.C.

7%

Que. to Ont.

6%

Ont. to Alta.