2

*Analysis Start Date is 02/01/2026 and Takes Into Consideration a 1 Year Hold From This Date

NOI LEASE TYPES YEAR BUILT LOT SIZE

1988

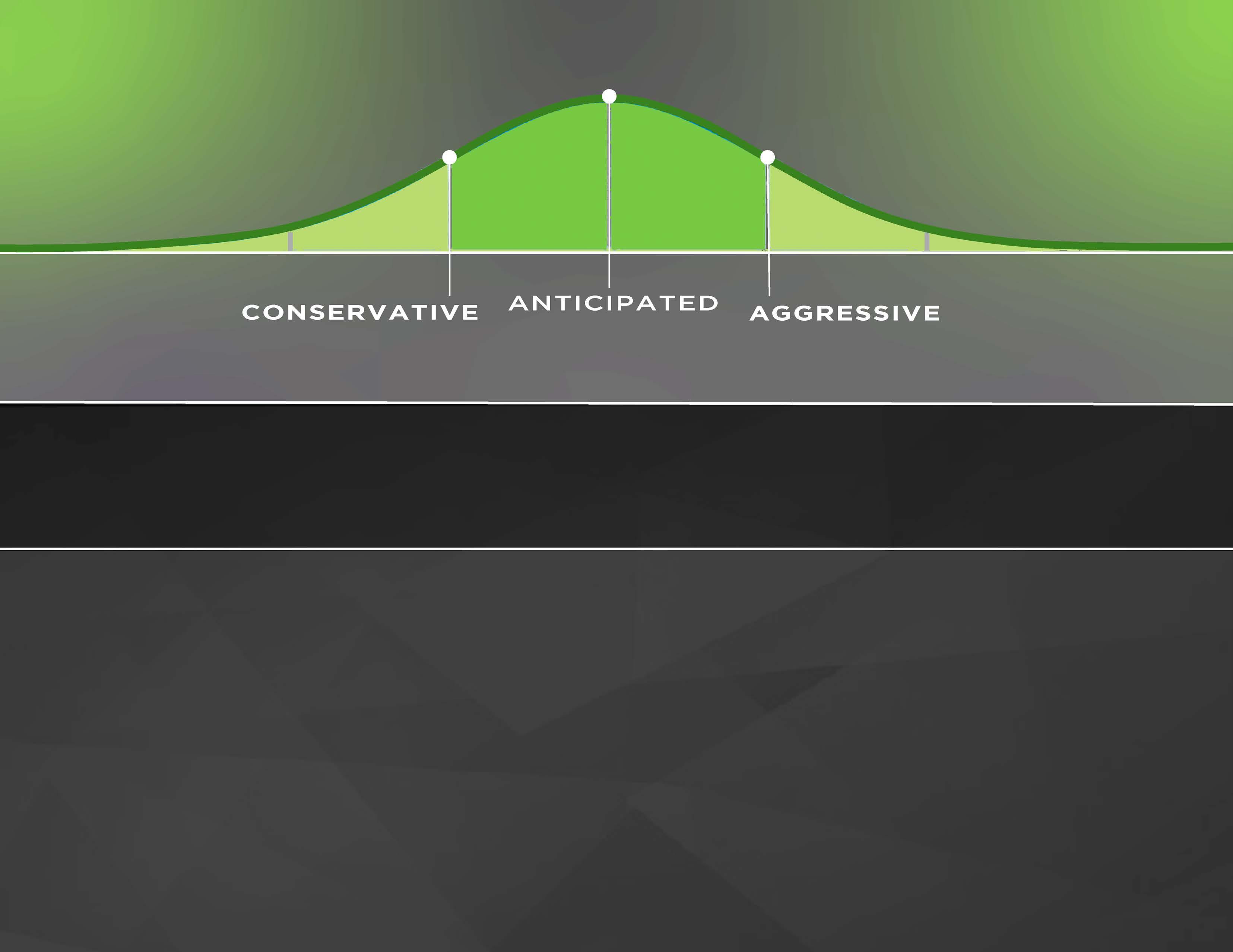

2.31 Acres $10,990,000 6.50% CAP $11,430,000 6.25% CAP $11,905,000 6.00% CAP

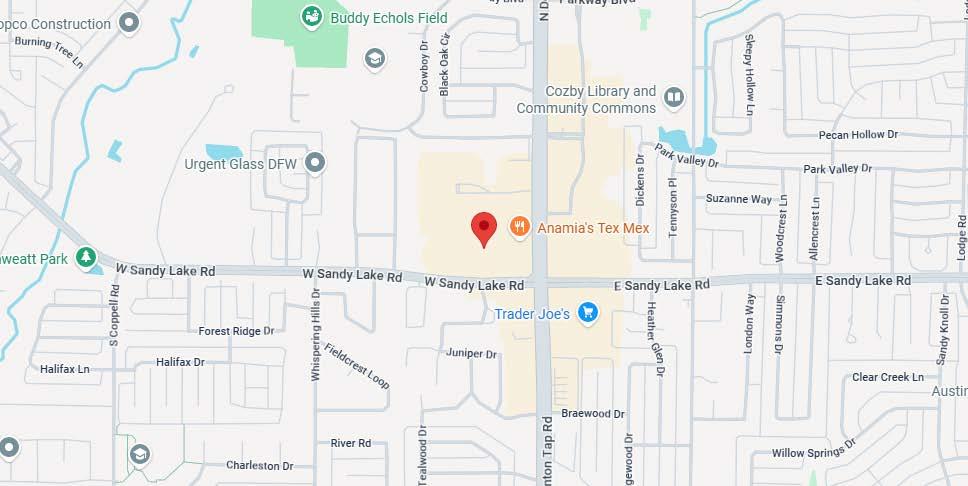

- High Barrier to Entry Market with Minimal Trades & Dense Dallas County RE - Sprouts Shadow Anchored

- AHHI Over $177,000 within a 1 Mile radius

- Replaceable Rents

- Dark Tenant (May Have to Offer Master Lease)

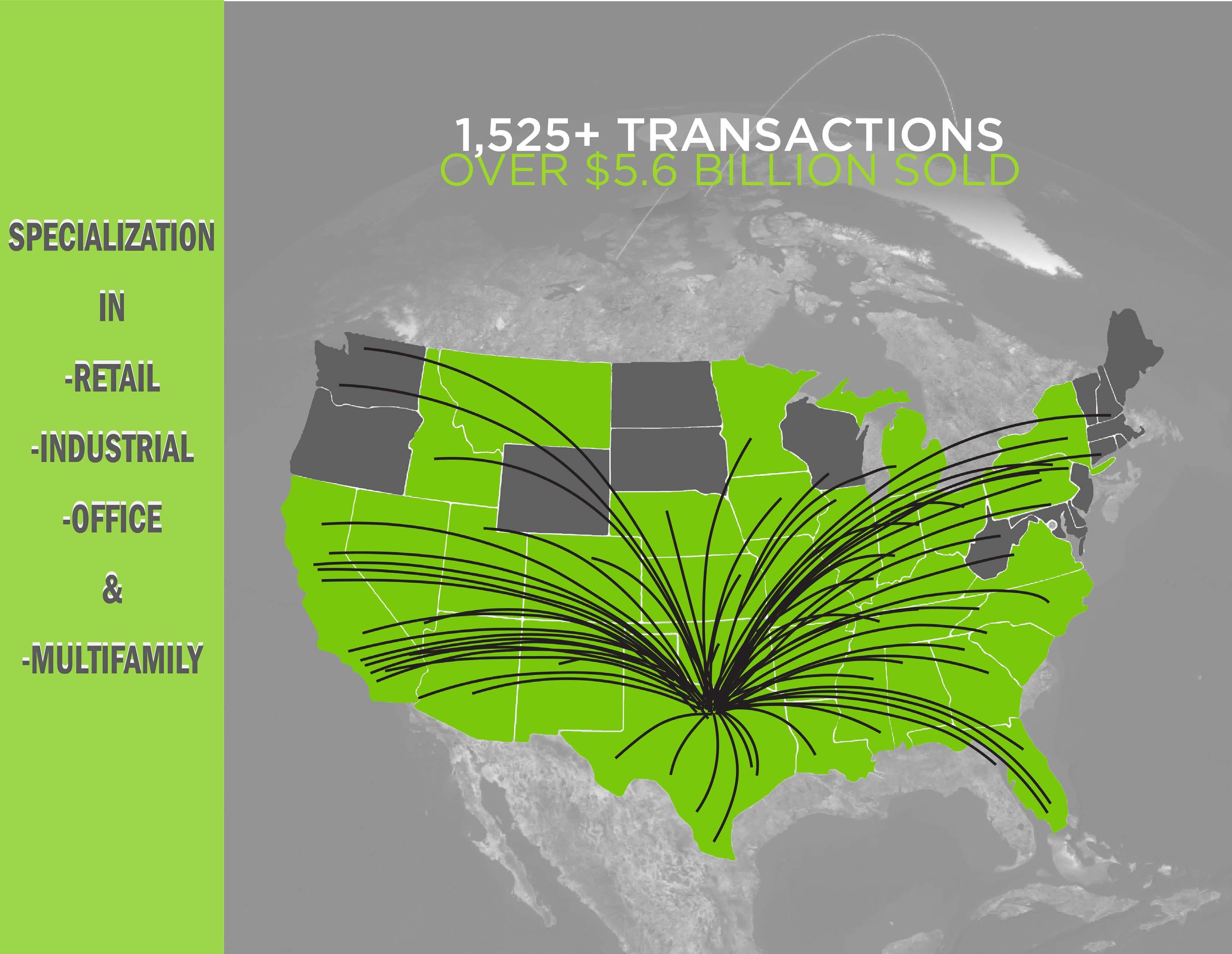

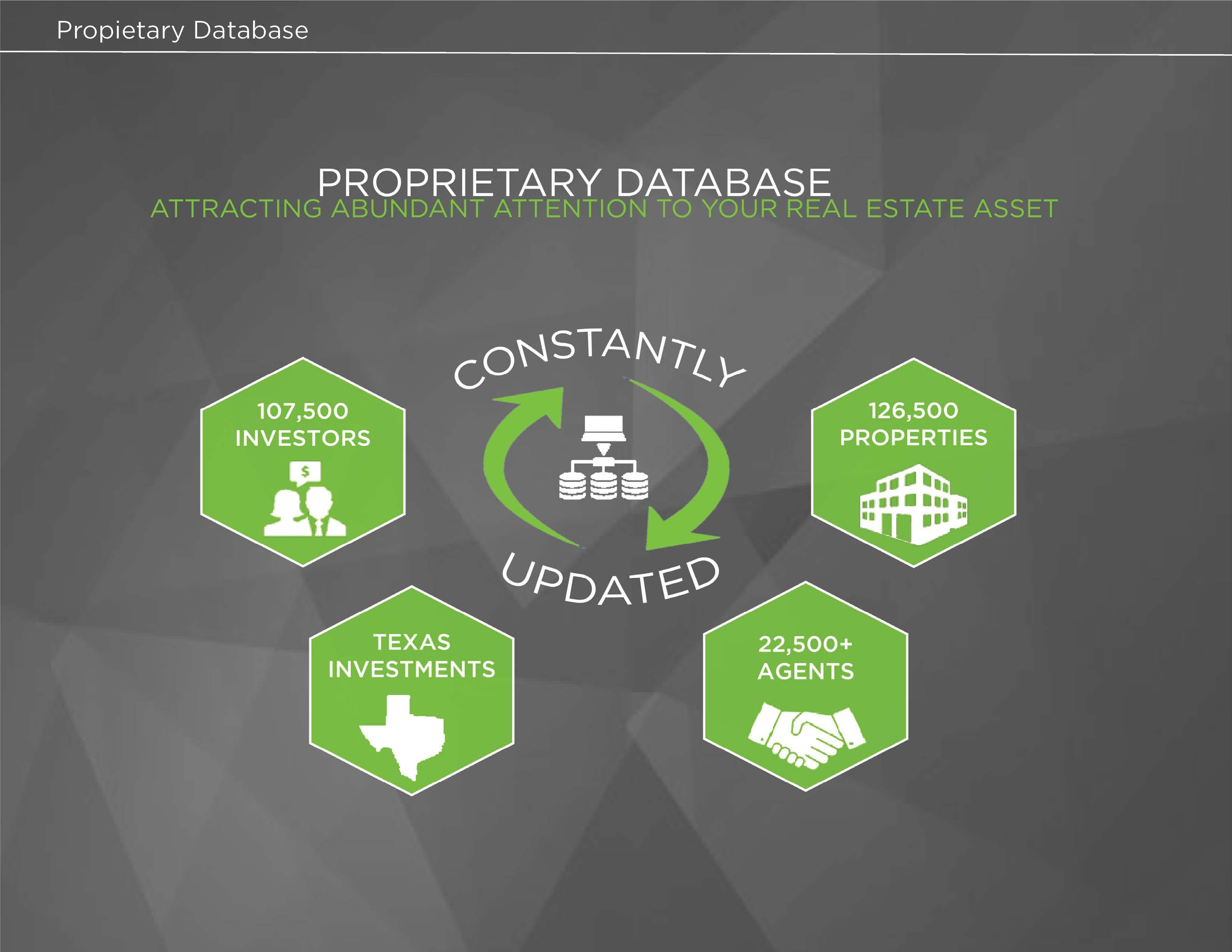

- STRIVE: Most Active Retail Team in Texas & Surrounding States

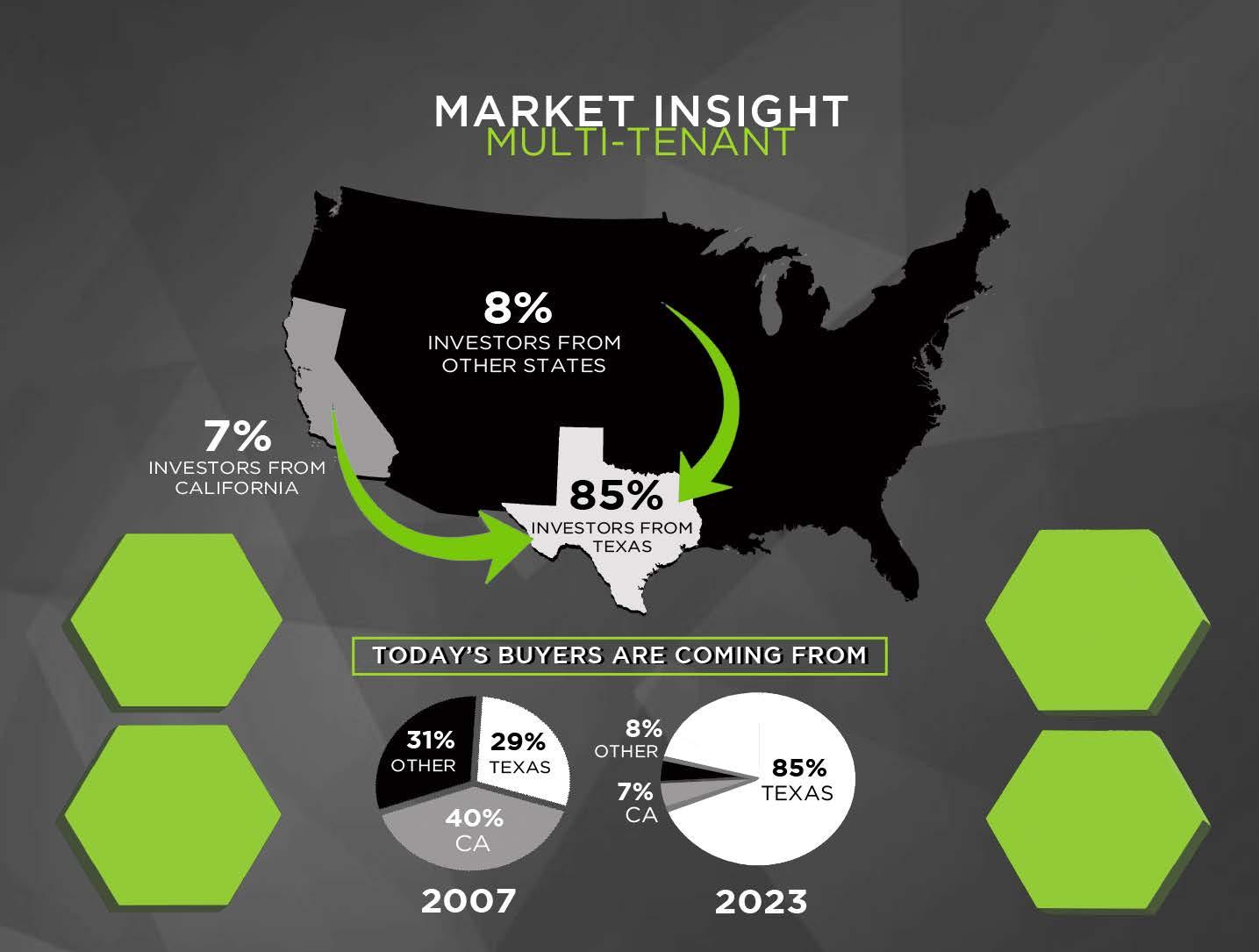

- Local, Regional, National, & International Private Capital Buyers, Many of Whom are in 1031 Exchanges

- Institutional Capital Targeting Quality, Stabilized Real Estate

- Track Record: We Close Transactions - Sold More Than 1,200 Retail Transactions

- STRIVE Team Controls the Entire Process - Underwriting & Financial Analysts, Full Marketing Dept, Transaction Coordinators, and Team of Agents to Ensure High Probability of Closing

- 100% Cooperation – More Buyers - More Offers = Higher Price

- Ability to Source Qualified Debt Thru High Street Capital

- If Awarded the Assignment, We Can Be on the Market Within One Week and Closed Within Our Average List-to-Close Time Frame of 5-6 Months STRENGTHS

- Sell Now to Take Advantage of the Current Market Before Interest Rates Increase Further and Capitalize on 1031 Buyers

PROPERTIES SOLD SINCE 2022

TOTAL VALUE SOLD SINCE 2022 SOLD & COUNTING

MULTI-TENANT PROPERTIES SOLD SINCE 2022 172 $5.6 BILLION 380 $1.5+ BILLION