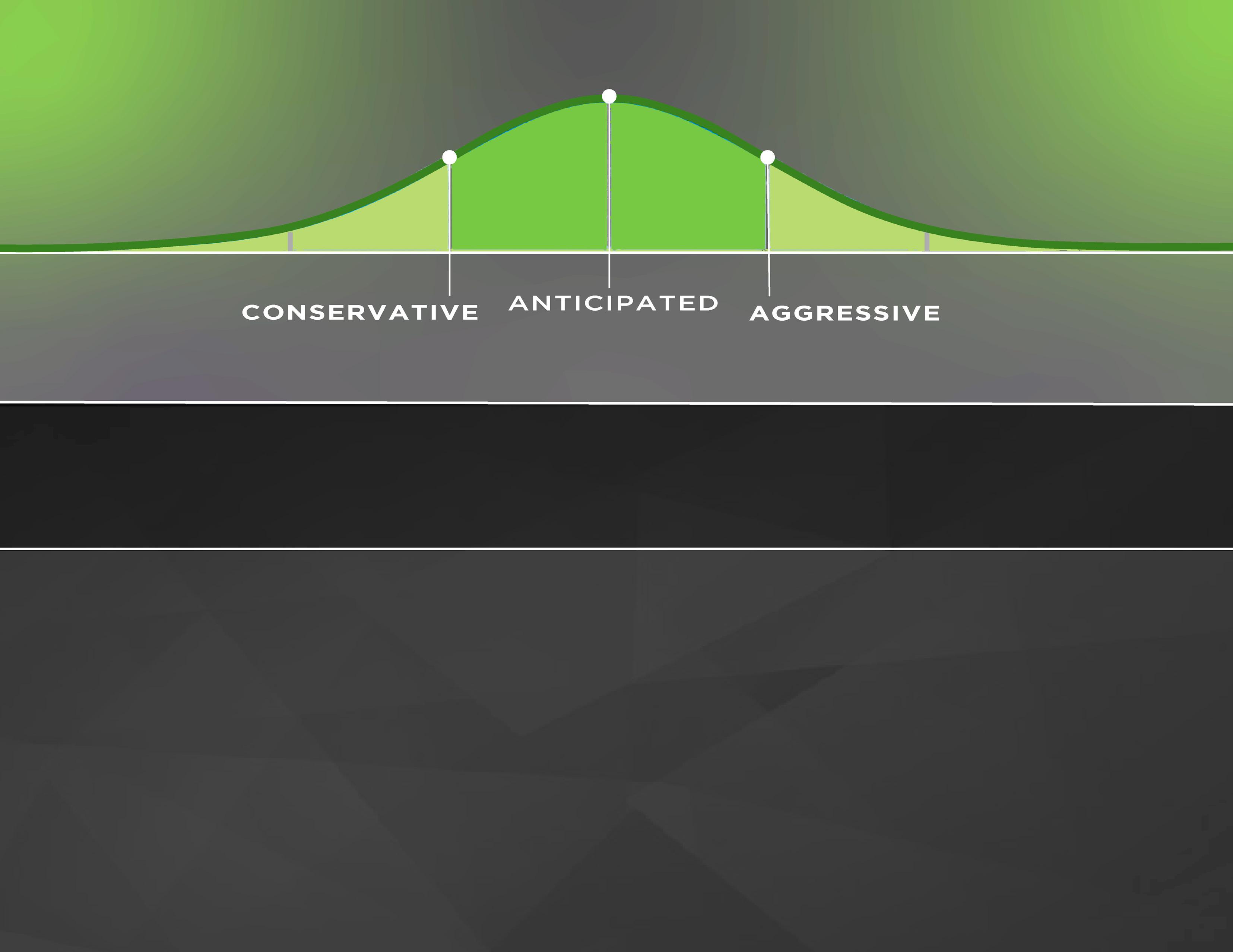

$10,140,000 8.50% CAP

$10,450,000 8.25% CAP $10,775,000 8.00% CAP

NOI LEASE TYPES YEAR BUILT LOT SIZE

2009

STRENGTHS

$861,877 Gross/NNN 3.70 Acres

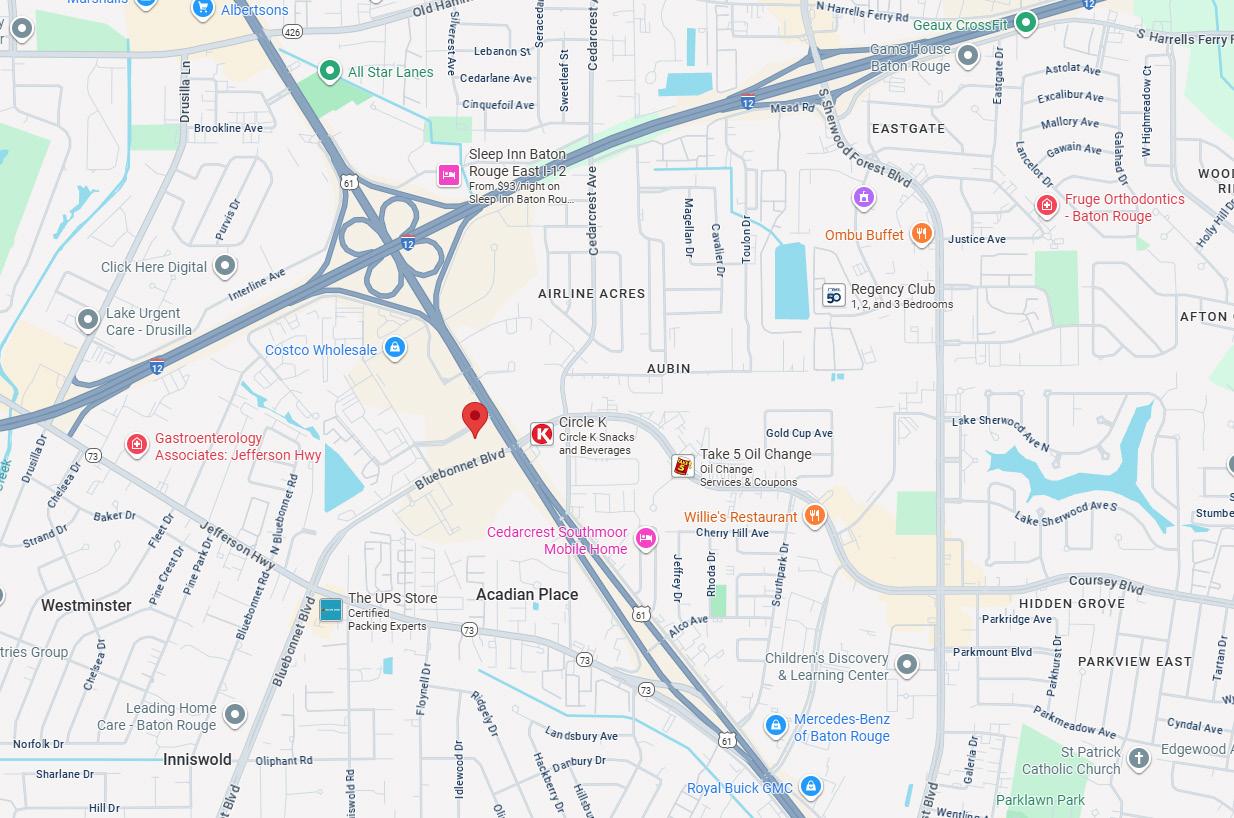

- On Hard Corner of Airline & Bluebonnet Offering High Traffic Counts

- Excellent Visibility & Frontage Along Airline Hwy

- Surrounded by Major Retailers Such as Costco & Home Depot

- Large Pylon Sign for Tenants

- 75% Occupied Creating Potential Upside

CHALLENGES

- Hard To Replace Government Rents

- Large Vacant Space – Smaller Tenant Pool Seeking that Size of Space

BUYER POOL

- Local, Regional, National, & International Private Capital Buyers, Many of Whom are in 1031 Exchanges

- Institutional Capital Targeting Quality, Stabilized Real Estate

QUALIFICATIONS

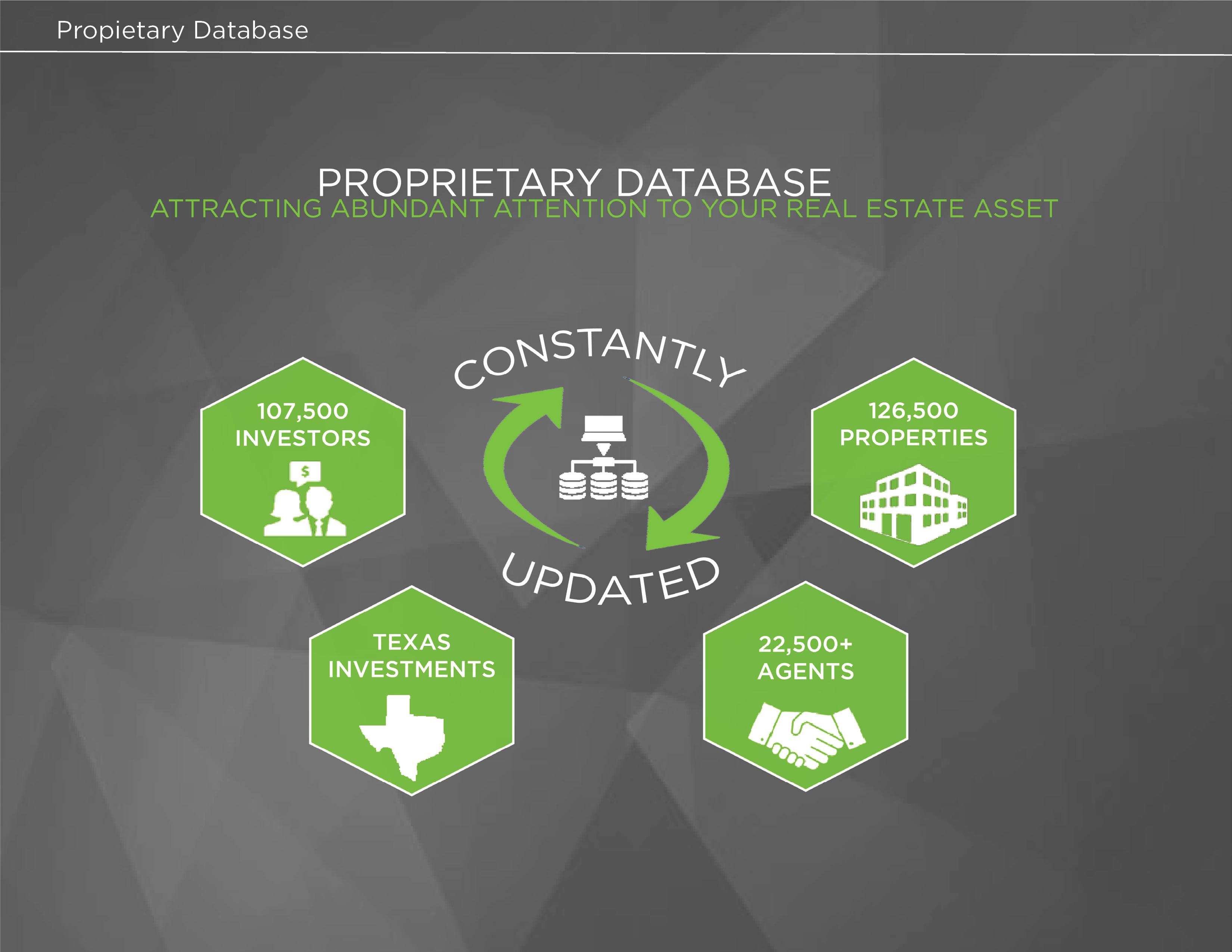

- STRIVE: Most Active Retail Team in Texas & Surrounding States

- Track Record: We Close Transactions - Sold More Than 1,200 Retail Transactions

- STRIVE Team Controls the Entire Process - Underwriting & Financial Analysts, Full Marketing Dept, Transaction Coordinators, and Team of Agents to Ensure High Probability of Closing

- 100% Cooperation – More Buyers - More Offers = Higher Price

- Ability to Source Qualified Debt Thru High Street Capital

RECOMMENDATIONS & TIMING

- Sell Now to Take Advantage of the Current Market Before Interest Rates Increase Further and Capitalize on 1031 Buyers

- If Awarded the Assignment, We Can Be on the Market Within One Week and Closed Within Our Average List-to-Close Time Frame of 5-6 Months