252 UNITS 2012 YEAR BUILT AUSTIN-SAN ANTONIO METROPLEX L U X U R Y A P A R T M E N T H O M E S

Ravi Gupta

Vikram Raya COO / Founder CEO / Founder

Ravi Gupta

Vikram Raya COO / Founder CEO / Founder

TABLE CONTENTS

Executive Summary

Financial Analysis

Property Description

Location Overview

Portfolio & Performance

SUMMARYexecutive V I L L A S | 2 0 1 2 A U S T I N - S A N A N T O N I O M E T R O P L E X

INVESTMENTsu

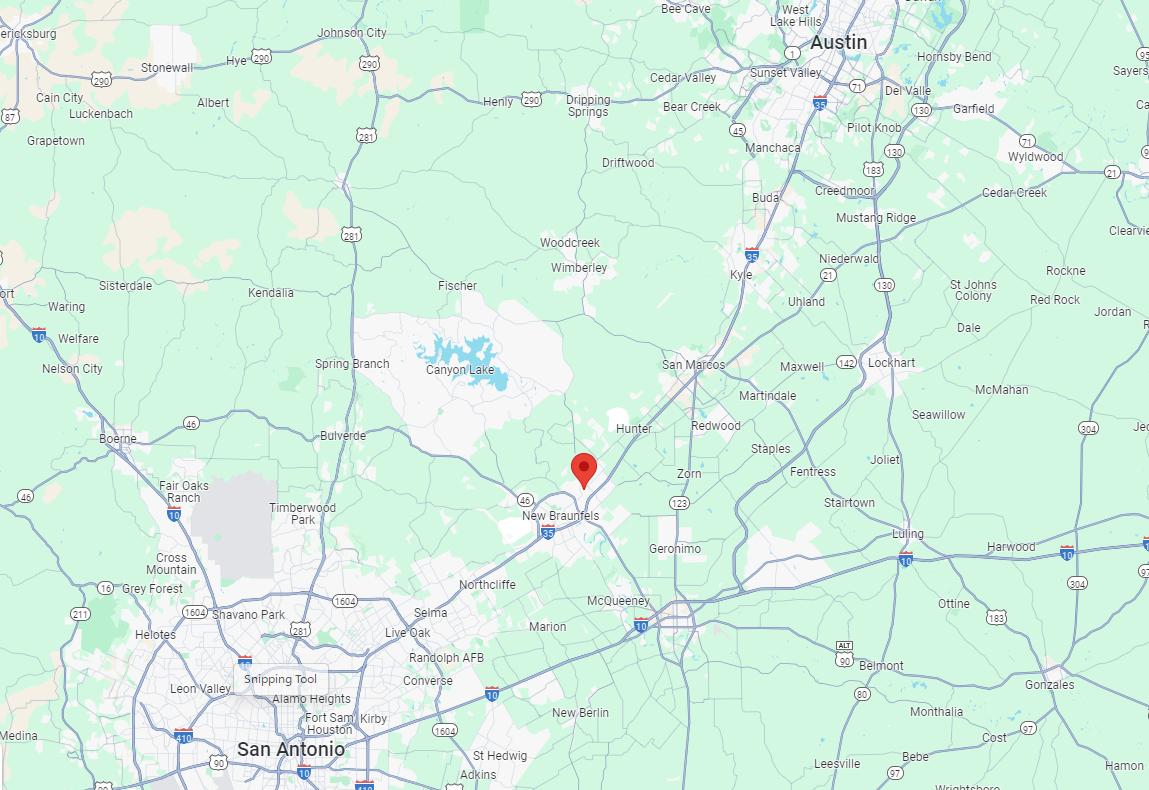

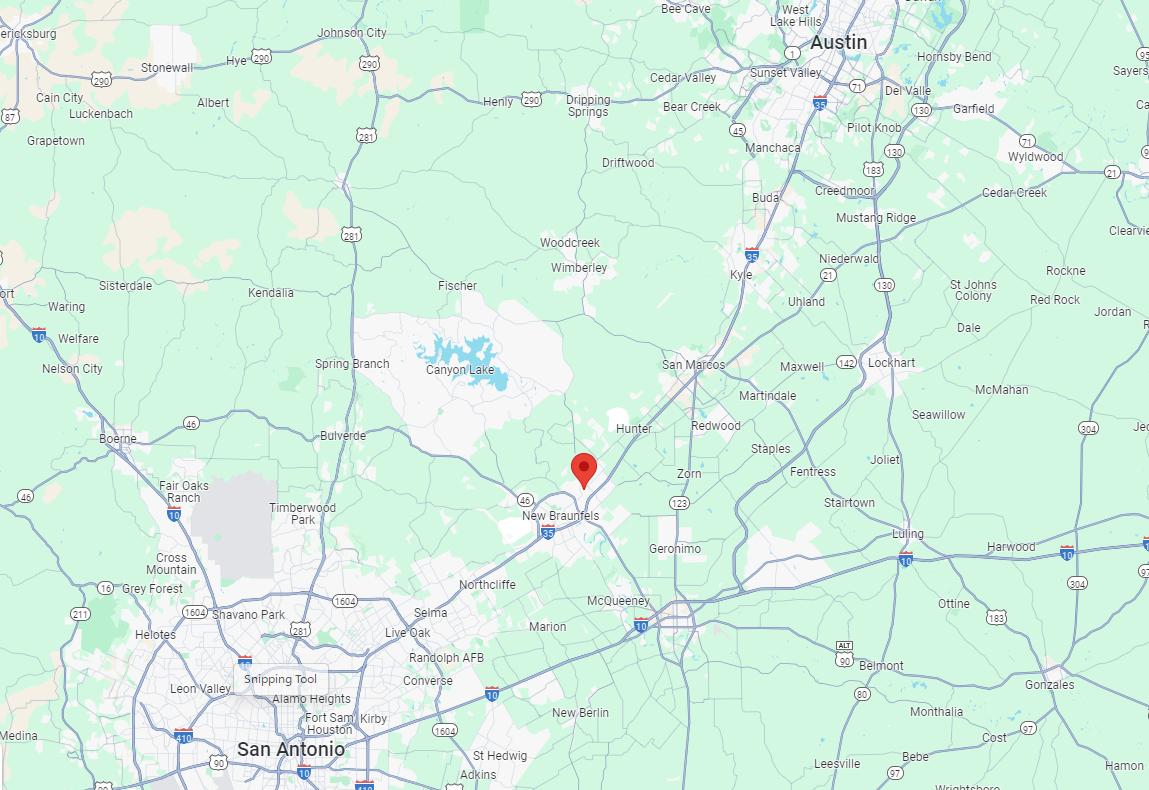

Viking Capital presents Villas at Sundanc generation multifamily asset built in 2012. Th New Braunfels, Texas, in the Texas Innova Interstate 35 between Austin and San Anton the "Third Fastest Growing City in the population growth of nearly 40% in five yea is driven by new major employers, enterta tourism. The New Braunfels submarket occupancy in the Austin-San Antonio MSA. This deal benefits from robust tenant deman growth and a low-cost basis. With minimal n

Viking Capital secured this asset at a s positioning this property as an exce opportunity.

CAP RATE(T-12) EXPENSE RATIO (T12) PHYSICAL OCCUPANCY DSCR YR 1 DSCR AVG. PURCHASE PRICE HOLD PERIOD EQUITY LP CLASS A LP CLASS B RESERVE CLASS 5.0% 55% 93% 1.63 1.75 $37,350,000 5 YEARS $19,995,774 $2,000,000 $13,000,000 $5,000,000

OFFERING summary

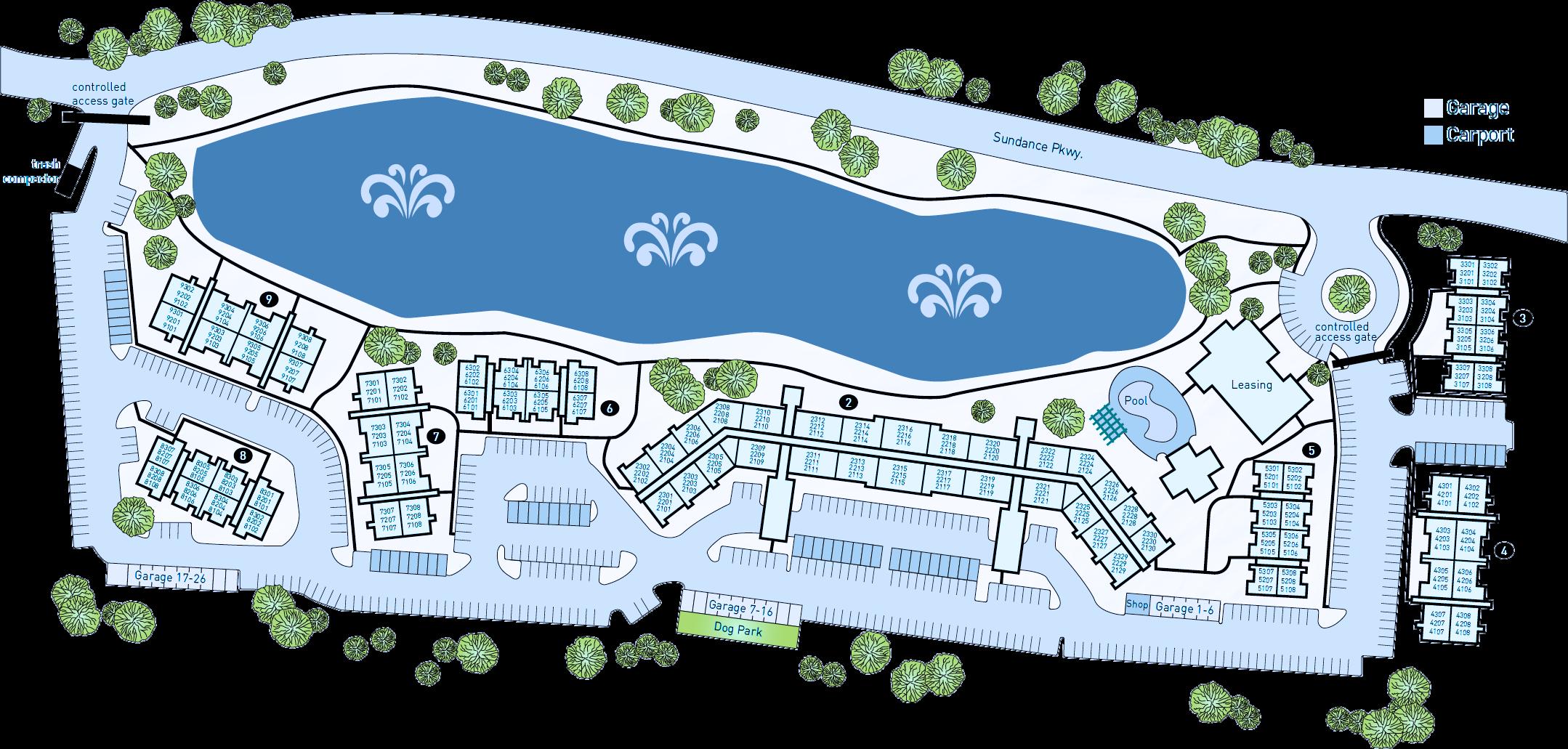

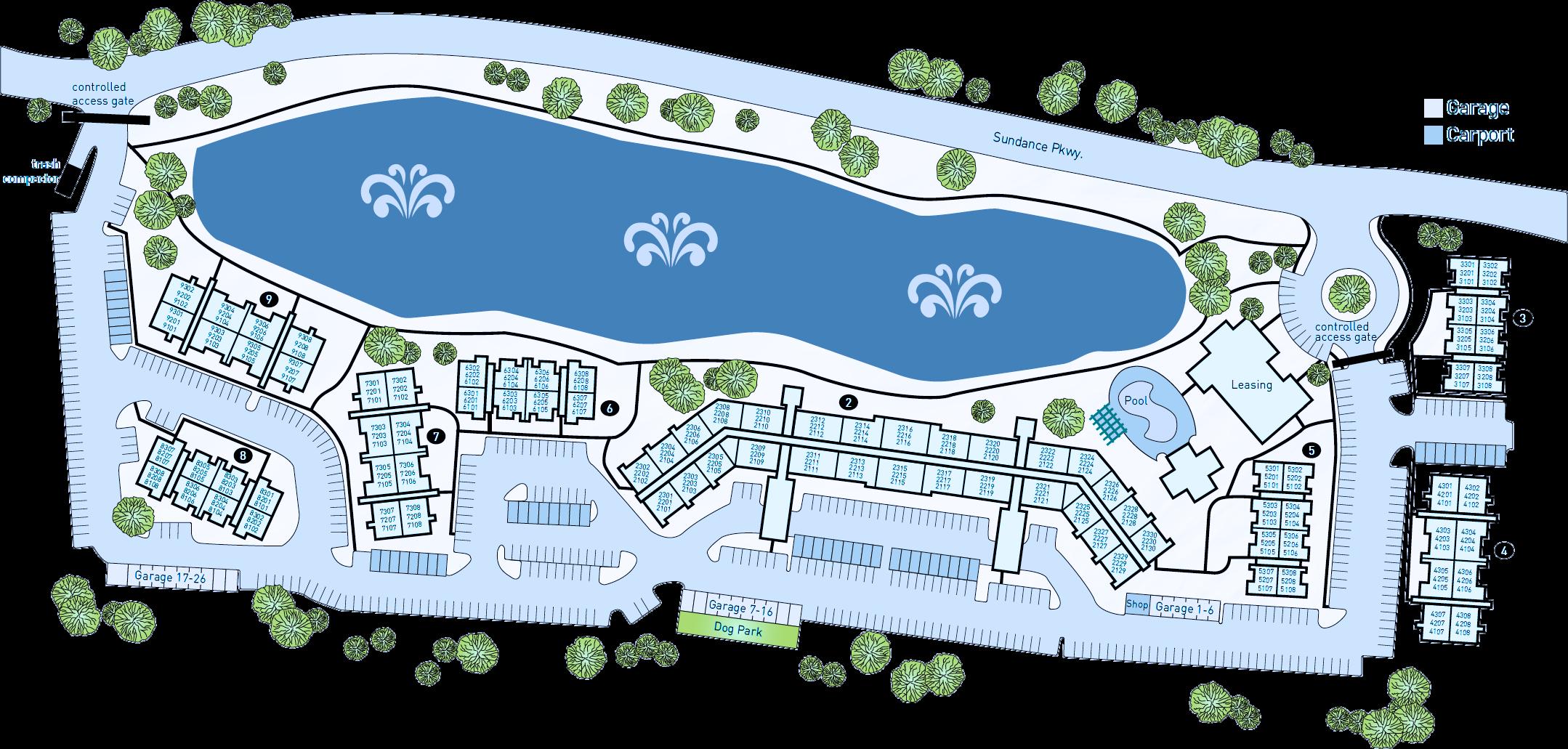

Austin,Tx 252 UNITS 2012 YEAR BUILT 931 AVG UNIT SF 234,666 RENTABLE SF 21.8 UNITS PER ACRE 11.5 ACRES 9 8 RESIDENTIAL 1 CLUBHOUSE BUILDINGS: 26 ON SITE & PARKING: DETACHED GARAGES 50 CARPORTS PROPERTYsummary

A S S E T

Resort-style pool

Expansive clubhouse

Common area

Wi-Fi Business center

Lounge

Storage space

Pet play area

Fitness center

Bike storage

Gated community

Grills Pond

9' Ceilings

11.6 Acres

Concrete foundation with stucco siding

FINANCIAL

5.70% Interest Rate

Clear core-plus strategy mitigating risk through strong submarket rental growth of nearly 40%.

VALUE-ADD

Exterior Renovation Budget of $2,298,840 includes:

Exterior private yards

Concrete/sidewalk repairs

Landscaping refresh

Parking lot seal & stripe

Pedestrian gate repairs

HVAC repair

L O C A T I O N

At the heart of the Texas Innovation Corridor, between Austin and San Antonio, the city’s population has increased by nearly 40 percent in the past five years. The addition of new major employers, entertainment centers, and exceptional demographics has driven continued growth.

Description # Units % Mix Avg SF Avg Rent Rent/SF 1 BR / 1 BA 138 55% 784 $1,248 $1.59 2 BR / 2 BA 114 45% 1,110 $1,531 $1.38 Total / Avg. 252 100% 931 $1,382 $1.46 Year Completed Total Units Average Unit Size (SF) Physical Occupancy Avg. In Place Rents Avg. Market Rents Units Primed for Light Upgrade 2012 252 931 SF 93% $1,382 $1,448 252 CONSIDERABLEORGANICRENTGROWTHPOTENTIAL PROPERTY SUMMARY = $66 PER UNIT IMMEDIATELY UNIT MIX

P O T E N T I A L R E T U R N S 25% 20% 15% 10% 5% 0% RISK / VOLATILITY 20% 30% 40% 50% 60% 70% 80% 90% 100% CORE CORE PLUS VALUE ADD NEW

DEVELOPMENT VILLAS AT SUNDANCE

THREE-TIERED RETURN OPTIONS

THREE-TIERED RETURN OPTIONS

THREE-TIERED RETURN OPTIONS

A three-tiered return structure gives investors options when placing their equity. Investors have the ability to invest in either tier of equity Class A, Class B, Reserve Class, or a combination of Class A and Class B. Diversifying in both A and B classes allows for a risk-adjusted, blended return.

THREE-TIERED EQUITY

Allows Investors to Match Investment Goals

8

Minimum Investment Minimum Investment Minimum Investment $50,000 $50,000 $500,000 Prioritized Cash Flow 10% Preferred Return No Profit Share 7% Preferred Return 70/30 Profit Share 8% Preferred Return 80/20 Profit Share

structure

LP Equity Pref. Hold Period Equity Multiple Avg. CoC AAR offering CAPITAL STRUCTURE Purchase Debt Total Equity DEBT LP: CLASS A LP: CLASS B LP: RESERVE $2,000,000 10% 5 Years 1.5x 10% 10% $13,000,000 7% 5 Years 1.8x-2.0x 5.6% 16%-20% $5,000,000 8% 5 Years 1.9x-2.1x 5.6% 18%-22% $5M $37,350,000 $24,178,000 $19,995,774 $13M $2M $24M

Annual Percent Return Annual Distribution Equity Split Total Expected Return Including Return of Principal ($100k) Year 1 Year 2 Year 3 Year 4 Year 5 Annual Percent Return Annual Distribution Equity Split (70/30) Total Expected Return Including Return of Principal ($100k) Annual Percent Return Annual Distribution Equity Split (80/20) Total Expected Return Including Return of Principal ($500k) 10% 10% 10% 10% 10% $10,000 $10,000 $10,000 $10,000 $10,000 $150,000 4% 5% 6% 6% 7% $4,000 $5,000 $6,000 $6,000 $7,000 $190,000 4% 5% 6% 6% 7% $20,000 $25,000 $30,000 $30,000 $35,000 $1,000,000 $0 $62,000 $360,000

$100,000 INVESTMENT returns

INVESTOR

40 2027 2027 60% 60% 40% 40% 20% 20% 2024 2024 2025 2025 2026 2026 0% 0% bonus TAX BENEFITS DEPRECIATION

SENSITIVITY analysis

Cap Rates Exit Price IRR Equity Multiple AAR 4.60% $70,163,761 16.16% 2.00x 19.98% 4.70% $68,670,915 15.67% 1.96x 19.17% 4.80% $67,240,271 15.20% 1.92x 18.40% 4.90% $65,868,020 14.73% 1.88x 17.67% 5.00% $64,550,660 14.27% 1.85x 16.96% 5.10% $63,284,961 13.83% 1.81x 16.28% 5.20% $62,067,942 13.39% 1.78x 15.62% 5.30% $60,896,849 12.96% 1.75x 14.98% 5.40% $59,769,130 12.38% 1.71x 14.13%

CLASSB

Cap Rates Exit Price IRR Equity Multiple AAR 4.60% $70,163,761 17.26% 2.09x 21.82% 4.70% $68,670,915 16.79% 2.05x 21.01% 4.80% $67,240,271 16.33% 2.01x 20.24% 4.90% $65,868,020 15.88% 1.98x 19.51% 5.00% $64,550,660 15.44% 1.94x 18.80% 5.10% $63,284,961 15.02% 1.91x 18.12% 5.20% $62,067,942 14.60% 1.87x 17.46% 5.30% $60,896,849 14.19% 1.84x 16.83% 5.40% $59,769,130 13.80% 1.81x 16.23% RESERVECLASS analysis

SENSITIVITY

ANALYSISfinancial V I L L A S | 2 0 1 2 A U S T I N - S A N A N T O N I O M E T R O P L E X

LOAN PRINCIPAL $24,178,000 LOAN TO VALUE 66% LTV INTEREST RATE 5.70% FIXED OR ADJUSTABLE Fixed AMORTIZING PERIOD 30 INTEREST ONLY 24 Months *Subjecttochangebeforeclosing

DEBT

$19.5 M increase in value

INCOME 1 2 3 4 5 Gross Potential Income 4,449,026 4,594,909 4,822,036 5,071,156 5,317,292 - Loss to Lease -109,156 -2.50% -22,975 -0.50% -24,110 -0.50% -25,356 -0.50% -26,586 -0.50% - Vacancy -348,094 -7.80% -321,644 -7.00% -337,543 -7.00% -299,625 -5.90% -265,865 -5.00% - Concessions -74,280 -1.70% -37,611 -0.80% -18,846 -0.40% -15,213 -0.30% -15,952 -0.30% - Models, Office, Employee Units -31,361 -0.70% -32,774 -0.70% -34,394 -0.70% -36,171 -0.70% -37,927 -0.70% - Bad Debt -7,537 -0.20% -22,975 -0.50% -24,110 -0.50% -25,356 -0.50% -26,586 -0.50% Effective Gross Rental Income 3,878,598 4,156,931 4,383,033 4,669,435 4,944,376 Other Income 422,799 435,659 448,910 462,564 476,634 Private yards 18,333 48,221 50,021 51,542 53,110 Total Net Income 4,319,731 4,640,811 4,881,964 5,183,542 5,474,119 Renovations Units renovated 0 42 84 84 42 Renovation Premiums earned 0 4,200 8,400 8,400 4,200 EXPENSES /unit /unit /unit /unit /unit Real Estate Taxes 633,418 2,514 647,701 2,570 654,208 2,596 660,780 2,622 667,418 2,648 Insurance 222,398 883 226,887 900 231,466 919 236,138 937 240,905 956 Contract Services 60,589 240 61,812 245 63,060 250 64,333 255 65,631 260 Electric 50,023 199 51,032 203 52,063 207 53,113 211 54,185 215 Gas 764 3 779 3 795 3 811 3 827 3 Water and Sewer 220,291 874 224,737 892 229,273 910 233,901 928 238,622 947 Trash Removal 77,465 307 79,029 314 80,624 320 82,251 326 83,912 333 Other Utilities 12,374 49 12,624 50 12,879 51 13,139 52 13,404 53 Management Fee 129,592 514 139,224 552 146,459 581 155,506 617 164,224 652 Repairs and Maintenance 152,848 607 155,933 619 159,081 631 162,292 644 165,567 657 General/Admin 76,424 303 77,967 309 79,540 316 81,146 322 82,784 329 Advertising and Leasing 50,949 202 51,978 206 53,027 210 54,097 215 55,189 219 Payroll 382,120 1,516 389,833 1,547 397,702 1,578 405,729 1,610 413,918 1,643 Total Expenses 2,069,256 8,211 2,119,537 8,411 2,160,176 8,572 2,203,236 8,743 2,246,586 8,915 %EGI 47.90% 45.70% 44.20% 42.50% 41.00% Net Operating Income (NOI) $2,250,475 $2,521,274 $2,721,789 $2,980,305 $3,227,533

closing $19.5M INCREASE IN VALUE P R O F O R M A

*Subject to change before

upside

LIGHT UPGRADES

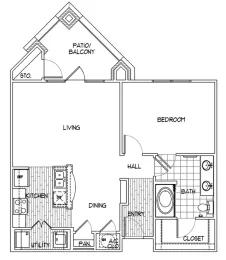

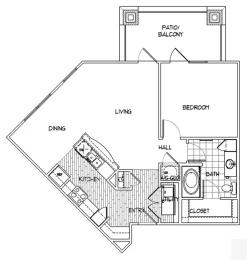

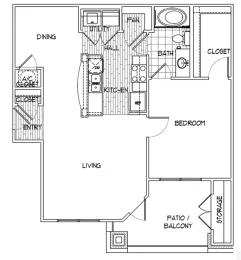

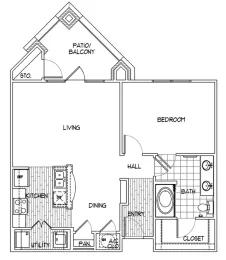

252 VALUE-ADD 1 Bedroom / 1 Bathroom 138 Units 675-844 SF 2 Bedroom / 2 Bathroom 114 Units 1,025 - 1,162 SF

UNITS AVAILABLE FOR

=

100%

C L A S S I C U N I T S1 0 0 %

$5,000

UPGRADE PER UNIT

Units Available for Upgrades 100%

Full-Sized Washer & Dryer

Stainless Steel

Ceiling

Ceramic

Built-In

Kitchen

Granite

Kitchen

Wood-Style Flooring

Appliances

Fans

Tile

Shelves

Island

Countertops

Pantry European-Style Cabinetry

DESCRIPTION property V I L L A S | 2 0 1 2 A U S T I N - S A N A N T O N I O M E T R O P L E X

Water/Sewer Hot Water Gas Electric Trash Cable & Internet City of New Braunfels Individual Water Heaters City of New Braunfels City of New Braunfels New Braunfels & Valet Living Spectrum Application Fee Administration Fee Security Deposit Pet Fee Pet Rent Month-to-Month e Story Garden Style Elevators in Building #2 crete Slab ted Concrete and Stucco hed & Composite Asphalt gle per et information

Address Year Built Number of Units Total Square Feet Average Unit Size Site Size Density 2056 Sundance Parkway 2012 252 234,666 Square Feet 931 Square Feet 11.57 Acres 21.8 Units Per Acre Overview Carports Detached Garages Open Spaces Total Spaces Parking Ratio 50 26 379 455 1.81 Spaces per Unit Laundry Washer /Dryer All Units - Full Sized Utilities Leasing Fees $60 / Applicant $200 $250 $300 Non-Refundable $20 $300 Upcharge Overview Resident Property Resident Resident Resident

Parking/Garage

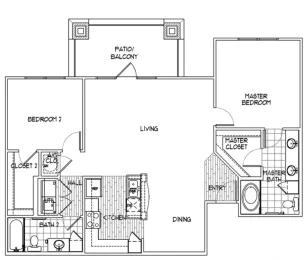

SITE plan VILLAS AT SUNDANCE

COMMUNITY amenities

Resort-style pool

Expansive clubhouse

Common area Wi-Fi

Business center

Lounge

Storage space

Planned social activities

Pet play area

Fitness center

Bike storage

Gated community

Grills Pond

RESORT-STYLEPOOL OUTDOORKITCHEN

MODERNFITNESSCENTER

RESIDENTCLUBHOUSE

E L I T E F I T N E S S C E N T E R

R E S I D E N T C L U B H O U S E

L O U N G E A R E A

B U S I N E S S C E N T E R

P O O L S I D E O U T D O O R K I T C H E N

R E S O R TS T Y L E P O O L

Units - 55%

mix

UNIT 138

1Bedroom 2Bedroom 114 Units - 45%

UNITamenities

Open floor plans

European-style cabinetry

Stainless-steel appliances

Granite countertops

Kitchen pantry

Full-size washer and dryer

Generous closet space

Wood & ceramic tile flooring

Ceiling fans

Kitchen island*

Built-in shelves*

Outside storage*

Incredible waterfront views*

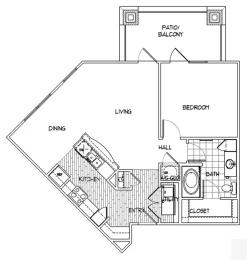

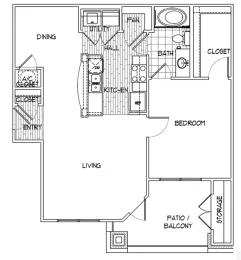

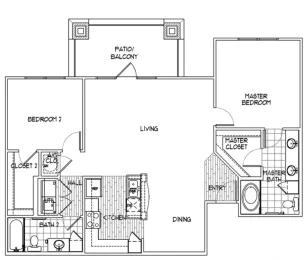

Plans Floor 1 BEDROOM, 1 BATH | 675 SF A1 1 BEDROOM, 1 BATH | 839 SF A2 1 BEDROOM, 1 BATH | 841 SF A3 1 BEDROOM, 1 BATH | 844 SF A4 2 BEDROOM, 2 BATH | 1,025 SF B1 2 BEDROOM, 2 BATH | 1,135 SF B2 2 BEDROOM, 2 BATH | 1,157 SF B3 2 BEDROOM, 2 BATH | 1,162 SF B4 O N E B E D R O O M T W O B E D R O O M

36 COMPARISON rent V I L L A S | 2 0 1 2 A U S T I N - S A N A N T O N I O M E T R O P L E X

Rent COMPARABLES

32 Property Year Built Units Avg Size Market Rent Market Rent/SF Effective Rent Effective Rent /SF Avg Occupancy* Moderno 2023 280 904 $1,558 $1.72 $1,537 $1.70 90% Berkshire Creekside 2017 416 880 $1,461 $1.66 $1,461 $1.66 93% Canyon House 2017 288 837 $1,419 $1.70 $1,358 $1.62 90% Alexan Gruene Crossing 2024 297 934 $1,705 $1.82 $1,508 $1.61 1% Tacara at Gruene 2023 300 870 $1,518 $1.75 $1,401 $1.61 57% Lodge At Guadalupe 2013/2018 308 811 $1,305 $1.61 $1,305 $1.61 95% Bainbridge Creekside 2024 291 971 $1,672 $1.72 $1,543 $1.59 3% Creekside Vue 2015 150 940 $1,475 $1.57 $1,475 $1.57 93% Lakeview Villas 2018 313 898 $1,390 $1.55 $1,390 $1.55 93% La Sierra 2008 152 889 $1,440 $1.62 $1,357 $1.53 90% Landings At Creekside 2015 268 986 $1,489 $1.51 $1,489 $1.51 93% Villas At Sundance 2012 252 931 $1,356 $1.46 $1,382 $1.48 90% WTD. AVERAGES 904 $1,486 $1.64 $1,437 $1.59 92%

1 2 3 4 5 6 7 8 9 10 11 12

*Average occupancy excludes assets in lease-up

Moderno

Moderno

R E N T C O M P A R A B L E S 1 9 10 4 5 8 7 11 2 3 6 12

Berkshire Creekside

Canyon House

Alexan Gruene Crossing

Tacara at Gruene

Lodge At Guadaloupe

Bainbridge Creekside

Bainbridge Creekside

Lakeview Villas

La Sierra

Landings At Creekside

Villas At Sundance

36 OVERVIEWsubmarket V I L L A S | 2 0 1 2 A U S T I N - S A N A N T O N I O M E T R O P L E X

% OF POPULATION WITH COLLEGE EDUCATION

EMPLOYMENT

AGE AVERAGE HOUSEHOLD INCOME JOB GROWTH BY 2027 FIVE-MILERADIUS

location New Braunfels, TX $83,825 FIVE-MILERADIUS 78% FIVE-MILERADIUS FIVE-MILERADIUS 46.5% 35 32% FIVE-MILERADIUS

WHITE COLLAR

MEDIAN

OVERVIEW

NEW BRAUNFELS stats

New Braunfels experienced record-breaking growth of 32.25% in 2023 without an increase in unemployment.

Located on the Comal and Guadalupe Rivers, tourism in New Braunfels boasts an economic impact of $700 million and employs over 7,700 direct workers.

Money Magazine names New Braunfels one of the “Best Places to Live” which isn’t surprising given the strong job market increasing 1.7% year-over-year, 1.5% over the national average.

Texas

37% RENTER OCCUPIED HOUSING

$85,825 AVG. HOUSEHOLD INCOME

78% WHITE COLLAR JOBS

5-MILE RADIUS

S T R O N G S U B M A R K E T demographics

FAVORABLE APARTMENT

market

TOURISM BENEFITS EMPLOYMENT

Located on the Comal and Guadalupe Rivers, tourism in New Braunfels boasts an economic impact of $700 million in economic impact year-over-year.

STRONG OCCUPANCY

The New Braunfels submarket also boasts the highest occupancy rate in the entire Austin - San Antonio MSA.

POSITIVE MIGRATION

Over the past five years, the city's population has surged by almost 40 percent, fueled by new major employers, entertainment centers, and favorable demographics. With an average of 15 new residents arriving daily, New Braunfels has been the nation's third fastest-growing city since 2000. The total population has surged by 58 percent.

Schlitterbahn Waterpark 3.1Miles Landa Park 4.2Miles Comal Park 3.1Miles San Marcos Premium Outlets 12.5Miles JCPenney TJ Maxx Ross Dress for Less Famous Footwear Best Buy T-Mobile N E A R B Y A T T R A C T I O N S Town Center at Creekside 2.2Miles BEAUTY Bath and Body Works Sally Beauty Supply Ulta HOME Dollar Tree Five Below Hobby Lobby HomeGoods Mattress Firm Target

MIXED-USE DEVELOPMENT

Total Area

Total Completed Space

Additional Planned Space

Total Businesses Annual Visitors Total Job Creation

Acre

Phases)

L O C A T I O N O V E R V I E W

Expected Delivery (All

>400

>1

>750,000 SF >75 >10 Million >3,000 2025

Million SF

THE WORLD’S LARGEST WATERPARK

L O C A T I O N O V E R V I E W 2.5Miles

VILLAS AT SUNDANCE

CLOSE PROXIM

45 Miles to Downtown Austin

30 Miles to Downtown San Antonio

Austin

San Antonio

170 Miles to Houston

OVERVIEWgreater area V I L L A S | 2 0 1 2 A U S T I N - S A N A N T O N I O M E T R O P L E X

#1 Best place to start a business Growth in the working age population Tech Town since 2020 City for college graduates AUSTIN f a s t e s t g r o w i n g t e c h h u B #1 #2 #1

AUSTIN

2020 (2.29 Million) 85+ 50k 40K 30k 20k 10k 0 0-4 5-9 10-14 15-19 20-2425-2930-3435-3940-4445-4950-5455-5960-6465-6970-7475-7980-84 Male Population Female Population 0 95M 0.9M 0 85M 0.8M 0.75M 0.7M 2000 2005 2010 2015 2020

VILLAS AT SUNDANCE IS LOCATED RIGHT IN THE MIDDLE OF SAN ANTONIO AND AUSTIN, TEXAS PROVIDING A LARGER JOB POOL

APPLE SA UNIVERSITY OF TEXAS HEALTH SCIENCE CENTER TEXAS SCHOOL DISTRICT M OR TEXAS GOVERNMENT AMAZON DELL ORACLE JOINT BASE SAN ANTONIO

USAA GOOGLE META IBM EMPLOYS 10,100 EMPLOYS 7,000 EMPLOYS 32,277 EMPLOYS 13,000 EMPLOYS 130,000 EMPLOYS 1,500 EMPLOYS 2,000 EMPLOYS 8,738 EMPLOYS 75,000 EMPLOYS 18,300 EMPLOYS 39,500 EMPLOYS 19,000 EMPLOYS 16,837 EMPLOYS 5,600

HUBS

AUSTIN A WORKER & BUSINESS FRIENDLY CITY

4 MILLION SF FACILITY

A U S T I N S N A P S H O T 52MILES

PRE-PRODUCTION JULY 2023 SERIAL PRODUCTION NOVEMBER 2023

A U S T I N S N A P S H O T &

A U S T I N S N A P S H O T

NUE A U S T I N S N A P S H O T

CONTRIBUTES A MINIMUM OF

IN GSP

N D U S T R Y

CYBERSECURITY INDUSTRY EMPLOYS 130,000 TEXANS AND

$35.5 BILLION

I

A U S T I N S N A P S H O T

1.6M STUDENTS

THE UNIVERSITY OF TEXAS BAYLOR UNIVERSITY

TEXAS TECH UNIVERSITY

TEXAS A&M

UNIVERSITY OF HOUSTON RICE UNIVERSITY

TEXAS CHRISTIAN UNIVERSITY

TEXAS FOOTBALL

A U S T I N

#1 #7 Top 5 Theme Park Location #1 Best Vacation Spot in the US - Travel and Lesiure 2023 Seventh Largest City in the US

S A N A N T O N I O W O R K F O R C E SAN ANTONIO

10% GROWTH YOY

A T T R A C T I O N S T O U R I S M

ATTRACTIONS & TOUR

S A N A N T O N I O

2.3M GUESTS IN 2023

S A N A N T O N I O

CONTACT US invest@vikingcapllc.com vikingcapitalinvestments.com text ‘SUNDANCE‘ 826-205-0259 P R E M I E R A P A R T M E N T H O M E S

PORTFOLIO PERFORMANCEand

OUR TRACK RECORD

In Assets Acquired Units under Management Average LP AAR million 26 Properties Acquired

5,406 24%

$830

ABOUT VIKING CAPITAL

Viking Capital was founded in 2015 and has become a premier multifamily investment firm with agile investment sourcing, structuring, execution, and asset management capabilities and the flexibility to scale and cater to investor preferences.

Through its team of acquisitions, asset management, and disposition experts, Viking Capital invests in tier 1, secondary and tertiary markets across the United States.

EXECUTIVE TEAM

VikramRaya CEO,Co-Founder

ChrisParrinello Directorof InvestorRelations

RaviGupta COO,Co-Founder

NathanLoy Directorof Acquisitions

JudahFuld VPofAcquisitions

AmirNassar InvestorRelations Manager

EdMonarchik Directorof AssetManagement

AmberButler Investor Concierge

AshleyPenrod DirectorofMarketing

ChariteeBoyd AssetManagement Analyst

Sold/Current Market Units Purchase Price C U R R E NT & P R E VI O U S P R O J E C T S Sold 2018 Sold 2018 Sold 2018 Sold 2019 Sold 2019 Sold 2021 Sold 2021 Sold 2022 Sold 2022 Sold 2022 Current Current Current Current Current Current Current Current Current Current Current Current Current Current Current Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Tyler, TX Austin Dallas Dallas Dallas Atlanta Atlanta Washington DC Atlanta Atlanta Indiana Atlanta San Antonio Houston Atlanta Atlanta Atlanta South Bend Atlanta Atlanta 242 188 152 118 62 266 90 284 304 415 350 16 192 49 368 222 400 181 210 192 120 167 252 188 188 188 $22350,000 $17,782494 $15317506 $7,600,000 $5900,000 $35,000,000 $7000000 $36,300000 $41,000,000 $61,750000 $31,350,000 $6,700,000 $25,800,000 $19300,000 $55,000,000 $41,000,000 $76,000,000 $37,000,000 $26,000,000 $34 ,000,000 $19,600,000 $39,250,000 $57250,000 $33250,000 $28200,000 $52,000,000 TOTAL 5,406 $837,460,000 Dawson Forest Pending 26

Elevate at Huebner Grove 210 $26,000,000 Fund Asset Mar-22 Elevate at the Pointe 181 $37,000,000 $11,500,000 Dec-21 Elevate on Main 400 $76,000,000 $20,700,000 Sept-21 Elevate Twenty-Three 222 $41,000,000 $11,000,000 Jun-21 Marbella Place 368 $52,700,000 $19,110,000 Jan-21 The Griffin 49 $19,300,000 $7,716,000 Jul-20 Veritas at East Cobb 192 $25,800,000 $11,250,000 Dec-19

CURRENTASSETSUNDERMANAGEMENT

The Hills at East Cobb 3 Years 268 10%* Reserve at Walnut Creek 3 Years 284 35% Estates at Las Colina's 3 Years 415 24% The Avery 4.5 Years 304 20% Total 2,033 Avg. 24%

EXITS & PERFORMANCE

STEWART’S MILL 1988 188 $28.2M AssetClass YearConstructed No ofUnits PurchasePric B AtlantaMSA, AssetCass YearConstructed No ofUnts PurchasePrce SouthBend,IN 2018 $33.25M B+ 188 PARK 33 AssetCass YearConstructed No ofUnts PurchasePrce Atlanta,GA 2006 $39.25M B+ 176 ELEVATEEAGLESLANDING AssetClass YearConstructed No ofUnits PurchasePrice Atlanta, 2005 $57.25M B 252 ELEVATE GREENE AssetCass YearConstructed No ofUnits PurchasePrce Smyrna,GA 1986 $41.1M B 222 ELEVATE TWENTY-THREE AssetCass YearConstructed No ofUnits PurchasePrce Marietta,GA 1980 $25.8M B 192 VERITAS AS EAST COBB AssetCass YearConstructed No o Units PurchasePrice Stockbridge,GA 1999 $52.7M B+ 368 MARBELLA PLACE

1986 120 $19.6M AssetClass YearConstructed No ofUnits PurchasePrice B Atlanta,GA ELEVATE WOODSTOCK AssetCass YearConstructed No ofUnts PurchasePrce Houston,TX 2007 $34M A 192 KINGS COVE AssetClass YearConstructed No o Units PurchasePrice SanAntonioTX 1981 $26M B 210 ELEVATE HUEBNER GROVE AssetCass YearConstructed No ofUnts PurchasePrce Atlanta,GA 1969 $37M B 181 ELEVATE AT THE POINTE AssetCass YearConstructed No ofUnts PurchasePrce SouthbendIN 2000 $76M B+ 400 ELEVATE ON MAIN AssetCass YearConstructed No ofUnts PurchasePrce Washington,DC 2010 $19.3M A 49 THE GRIFFIN

Ravi Gupta

Vikram Raya COO / Founder CEO / Founder

Ravi Gupta

Vikram Raya COO / Founder CEO / Founder

Ravi Gupta

Vikram Raya COO / Founder CEO / Founder

Ravi Gupta

Vikram Raya COO / Founder CEO / Founder

Moderno

Moderno