At a Glance April 2023 Confidential Information REGION 1

Company History Introduction to UHM’s Senior Management

Testimonials

Production Summary Industry-Leading Tech Stack Marketing Sponsorships & Brand Ambassadors

Partners Coaching Partners (PCP)

Since our inception in 1970, Union Home Mortgage has guided hundreds of thousands of aspiring homebuyers through the process of achieving homeownership. Driven by the belief that homeownership should be accessible for everyone, we go the extra mile for every customer, while providing a personalized experience unmatched in the industry.

.

Code

Our commitment to delivering personal, world-class service has helped us expand our reach into over 48 states + D.C. and grow our annual lending volume over $5 billion in responsible lending per year and over $15.7 billion in 2021.

Our Story Table of Contents Union Home Mortgage At a Glance 2 3 Promises Kept

16 19 20 21 22 24 25 26 3 4 9 10 11 13 14 15

Borrower

State

Branch

Mutual

Union Home Mortgage Foundation Awards Union

of Conduct

Licenses

Network

Title

Home Insurance Services Third Party Originations (TPO)

Table of Contents

Guided by the vision and dedication of our President and CEO, Bill Cosgrove, we’ve built a world-class company where people come first. With a culture that stands out in the mortgage industry, you won’t find employees here – only Partners - who live by the shared values of our Code of Conduct. We respect one another, communicate openly and hold each other accountable.

Our Story

Bill Cosgrove

President & CEO MBA Chairman 2015

Bill Cosgrove is the President and CEO of Union Home Mortgage Corp. Bill has enjoyed a storied and illustrious career as an industry leader and advocate for the mortgage banking industry. He began his mortgage banking career in 1986 as a residential loan officer. He continually outperformed his peers and developed a reputation as one of the “go to” loan officers in Northeast Ohio.

In 1994, Bill joined Union Home Mortgage Corp. He continued to excel and in 1998 was named President of the firm and purchased the organization the following year becoming 100% owner. Since then, he developed a culture and operating philosophy that grew the company from its humble roots in Cleveland to a nationally acclaimed Mortgage Bank. Under his ownership, loan production at UHM has grown over 5,000%, reaching $3.2 billion in 2018. In 2021, the company’s loan production exceeded $15.7 billion. Bill has earned the Certified Mortgage Banker (CMB) designation as a testament to his dedication and commitment to the mortgage industry.

Bill continues to be an industry leader, and his advocacy is well illustrated as evidenced by:

• Mortgage Bankers Association (MBA) National Chairman in 2015

• Ohio Mortgage Bankers Association (OMBA) President 2007-2008

• MBA MORPAC National Chairman 2008-2010 raising $1.1 Million for industry advocacy

• MBA Board of Directors 2012-2019 Chairman of MBA’s GSE Repurchase Request Task Force

Co-Chairman of the Loan Originator Qualification Task Force

• MBA’s Legislative Steering Committee Member

• MBA Residential Board of Governors (RESBOG) Advisory Committee

Senior Management

Bill has testified before the Ohio House of Representatives as President of OMBA. In addition, he has testified on behalf of the industry in Washington, D.C., before the House Financial Services Sub Committee and Senate Banking Committee. He has been interviewed by The Wall Street Journal, USA Today, New York Times, numerous trade publications and local and national news networks. Bill is the first professional in Ohio history to serve both as President of the Ohio MBA and Chairman of the National Mortgage Bankers Association.

Bill’s success in the Mortgage Industry has not gone unnoticed. He has been the proud recipient of many awards and commendations over the years including:

• Awarded the MBA’s Andy Woodard Distinguished Service Award, the highest honor bestowed on an individual member of the association in 2016

• Awarded the coveted William Hodupp Award for his many contributions to the Ohio MBA in both 2008 and 2013

• Awarded the National Mortgage Bankers Associations Burton C. Wood National Legislative Service Award for his superior legislative efforts representing the mortgage banking industry in 2011

• Induction into the Bedford, Ohio High School Distinguished Hall Of Fame for his accomplishments in Mortgage Banking in 2003

• Crain’s Cleveland Business “40 under 40” as one of the top 40 young executives in Northeast Ohio in 2000

• In 2020, Bill was recognized as a regional EY Entrepreneur of the Year. The annual award seeks to recognize entrepreneurs that deliver transformative innovation, growth and prosperity through their entrepreneurial pursuits.

Bill is a proud father of three children and a loving husband. He enjoys spending quality family time when away from his active business schedule.

Senior Management

Union Home Mortgage At a Glance 4 5 Promises Kept

Al Blank

Senior Vice President, Business Development

Jim Ferriter

Senior Vice President, Retail Sales

Al joined Union Home Mortgage in January 2013. With more than 35 years of experience in the financial sector both in banking and nonbank financial institutions, he brings extensive knowledge in capital markets, growth and development, as well as operational fulfillment. Al graduated from the University of Mount Union in 1984 and later received his Master of Business Administration from Kent State University’s Executive MBA Program. Al’s served on the board of numerous non-profit and community organizations, including Vice Chairman of MBA Residential Board of Governors for 2020 and Chairman-Elect for 2021, Co-Chairing the Mortgage Servicing Rights Liquidity Committee and participating as a member of the MBA GSE task force.

As SVP of Retail Sales, Jim recruits and develops Partners by using leadership skills and expansive knowledge of the industry. He implements infrastructure and systems to support the success of the retail division and deliver profitable growth for the company. Jim says,

“UHM is known for its outstanding leadership in the mortgage banking community, and I am extremely fortunate to be a Partner working to grow this great organization.”

Senior Vice President, Mortgage Operations

Jill has been with Union Home Mortgage since August 2012. Jill’s career started in January 1994, and she has since worked her way through all facets of mortgage lending. At Union Home Mortgage as the SVP of Mortgage Operations, Jill has assumed responsibility and accountability for all mortgage operations functions in all three channels of business. This includes the overall leadership, growth, development and fulfillment infrastructure to best achieve the goals set for long term growth of the organization. Jill carries all underwriting designations and is also a Certified Mortgage Underwriter (CRU) through the MBA.

Vice President, National Retail Sales

Being a partner with UHM since 2012, I have witnessed firsthand the growth, the execution, the fulfillment, and most importantly the commitment to truly be the world of “Promises Kept” to those we work with and those who we are honored to service.

As a regional manager with UHM, my primary goal is to grow the region by increasing the production of our current Partners and bringing on new mortgage professionals who want to take their business to the next level. UHM is an easy sale to serious Mortgage Loan Officers…incredible execution, fulfillment, and pricing, combines with strong compensation equates to an opportunity for Partners to increase their production and income year over year. As a side note…if you are a Mortgage Professional and would like to learn more about who we really are, do not hesitate to reach out. I am certain you will not regret the connection.

Senior Management

Senior Management

Jill Ross Bryan Wright

Union Home Mortgage At a Glance 6 7 Promises Kept

Josh Brader Brian Snyder

Regional Manager

Region 1

Josh is a Regional Manager at Union Home Mortgage and is passionate about serving his team and making a positive impact in their lives.

He has been a partner with Union Home Mortgage since 2017 and has been in the mortgage industry since 2001. His primary focus is to help his team grow their production and to bring in new partners who want to take their business to the next level. With an outstanding company culture, an innovative technology platform and a highly efficient loan manufacturing process we offer a great platform for our Loan Officers to build a sustainable, long-term business.

Regional Manager Region 1

Borrower Testimonials

What do our customers think of our partners?

92.63%

Had an excellent experience

As a Regional Sales Manager, Brian is passionate about serving his team and making a positive impact in their lives. He has been a partner with Union Home Mortgage since 2017 and has been in the mortgage industry since 1999. His primary focus is to help his team grow their production and to bring in new partners who want to take their business to the next level. With an outstanding company culture, an innovative technology platform and a highly efficient loan manufacturing process we offer a great platform for our Loan Officers to build a sustainable, long-term business.

Brian is actively involved in the Columbus Mortgage Bankers Association, serving in several leadership positions including President of the association in 2016. He graduated from Ohio University and lives in Dublin, Ohio with his wife and four kids.

“I had a really great experience with UHM. They were constantly reaching out to make sure that I understood the process and each step. They gave me an abundance of information and made sure I was well educated to make this process easier on me.”

Adriana T.

“My experience with Union Home Mortgage was very positive. My loan officer was highly recommended. There was frequent communication and clear expectations as to what I needed to provide which made the experience very smooth. I would definitely recommend Union Home Mortgage.”

Jennifer B.

Senior Management Borrower Testimonials

Union Home Mortgage At a Glance 8 9 Promises Kept

Union Home Mortgage serves borrowers in over 48 states within the United States + D.C.

Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware D.C. Florida Georgia Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Dakota South Carolina Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming

State Licenses UHM Branch Network

branches across the United States. Region 1 Ohio - 33 Region 2 Michigan - 15 Region 4 Delaware - 1 Maryland - 3 New Jersey - 5 Pennsylvania - 9 Virginia - 6 West VirginiaRegion 5 Louisiana - 4 Oklahoma - 5 Arkansas - 1 Kansas - 2 Missouri - 3 New Mexico - 2 Texas - 16 Region 6 Alaska - 1 Arizona - 2 ColoradoNevada - 1 New Mexico - 1 Oregon - 1 Utah - 2 WashingtonRegion 7 Florida - 9 Alabama - 9 Georgia - 4 South Carolina - 9 Region 8 North Carolina - 18 Kentucky - 3 Tennessee - 8 Mississippi - 1 Florida - 1 South Carolina - 2 Region 12 Illinois - 2 Indiana - 4 Iowa - 1 Kentucky - 1 Minnesota - 1 Wisconsin - 2 Region 15 Arizona - 1 California - 5 Florida -11 Indiana - 4 Michigan - 11 North Carolina - 3 Ohio - 4 Tennessee - 1 Corporate + (2) Strongsville Branches + Strongsville Servicing Branch Union Home Mortgage At a Glance 10 11 Promises Kept

UHM Retail Branch Network 200+

Mutual Title

Union Home Mortgage’s mission is to deliver world-class mortgage experiences from pre-qualification to closing and beyond. Partnering with sister company, Mutual Title Agency, this mission is delivered.

Mutual Title was founded in 2004 to deliver title and escrow closing experiences that are fast, thorough and well-informed with a proactive approach to issue resolution. Above all, Mutual Title puts people –homebuyers, sellers, real estate agents and loan officers – first.

Mutual Title is licensed in D.C., Florida, Maryland, Michigan, Ohio, Pennsylvania, Tennessee and Virginia. Coming soon in September 2022, Mutual Title will also be licensed in the state of New Jersey.

THE MUTUAL TITLE DIFFERENCE TITLE SERVICES YOU CAN COUNT ON.

1:1 Attention to Each Order

13 Average Days to Close

96% Customer Satisfaction

Branch Network Mutual Title

Union Home Mortgage At a Glance 12 13 Promises Kept

Union Home Insurance Services

Union Home Insurance Services (UHIS) offers world-class home and auto insurance services that are personalized to each customer’s needs. As a necessary step in the homebuying process, UHIS is integrated into the UHM experience to help answer questions, provide quotes and help customers save on their insurance.

UHIS is licensed in Georgia, Illinois, Indiana, Iowa, Kentucky, Maryland, Michigan, Minnesota, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Virginia and Wisconsin

Our Partners:

CUSTOMER REVIEWS

Working with Patti and the UHIS team could not have been easier. In just a few short minutes, they were able to save me over $1,400* a year on my insurance premiums and even provided me with additional coverage above and beyond what my previous carrier offered. I can’t recommend working with the UHIS team highly enough.

Cody N.

Third Party Originations

As a successful business channel of the UHM family, Union Home Mortgage Third Party Originations (TPO) allows the company to support businesses in the industry across the country. UHM TPO is strategically focused on providing world-class resources, technology, servicing and processing to help brokers, credit unions and others grow their business.

Change where and how you do business. Spend less time clicking and more time growing your business.

Contacting Patti at UHIS was a great decision. She answered all questions and provided quotes quickly. We switched all of our policies with significant savings. The customer service alone was amazing, and the process to switch everything was very easy. Thank you, Patti, for being such an amazing Partner.

Shelly W.

We were able to save more than $600* a year switching from Allstate Insurance over to Union Home Insurance Services. Aside from the amazing savings, the customer service provided by Patti Marshall and her team is unparalleled! They really do provide everything you’re looking for and do it all with a smile! We have and will continue to refer all of our family and friends to Union Home Insurance Services!

Emily G.

Third Party Originations

Pipeline Management Overlays Rate Sheets Marketing Materials Pricing Calculators UHMGO!

Union Home Insurance Services

Union Home Mortgage At a Glance 14 15 Promises Kept

2023 (As of 3/31/23)

UHM 2020 – 2023 Q1 YTD

Production Summary

2020

Production Summary Production Summary

Retail Units Volume Conventional 21,484 4,885,679,223 Government 8,055 1,686,216,785 Total 29,539 6,571,896,008 Wholesale Units Volume Conventional 5,579 1,567,031,967 Government 1,834 501,117,210 Total 7,413 2,068,149,177 Consumer Direct Units Volume Conventional 3,373 694,689,471 Government 772 162,144,913 Total 4,145 856,834,384 Correspondent Purchase Units Volume Conventional 11,513 3,614,630,471 Government -Total 11,513 3,614,630,471 Conventional 41,949 10,762,031,132 Government 10,661 2,349,478,908 Total 52,610 13,111,510,040 Average Loan Size $249,211

Retail Units Volume Conventional 11,096 2,760,203,758 Government 4,627 1,092,416,160 Total 15,723 3,852,619,918 Wholesale Units Volume Conventional 4,011 1,257,370,565 Government 824 220,847,004 Total 4,835 1,478,217,569 Consumer Direct Units Volume Conventional 1,401 308,223,276 Government 316 67,305,958 Total 1,717 375,529,234 Correspondent Purchase Units Volume Conventional 106 31,003,747 Government -Total 106 31,003,747 Conventional 16,614 4,356,801,346 Government 5,767 1,380,569,122 Total 22,381 5,737,370,468 Average Loan Size $256,350

2021

2022

Retail Units Volume Conventional 20,115 4,327,743,273 Government 7,623 1,522,443,879 Total 27,738 5,850,187,152 Wholesale Units Volume Conventional 4,794 1,181,762,674 Government 1,647 366,021,682 Total 6,441 1,547,784,356 Consumer Direct Units Volume Conventional 2,391 558,464,008 Government 664 170,535,922 Total 3,055 728,999,930 Correspondent Purchase Units Volume Conventional 6,989 2,253,324,733 Government -Total 6,989 2,253,324,733 Conventional 34,289 8,321,294,688 Government 9,934 2,059,001,483 Total 44,223 10,380,296,171 Average Loan Size $234,726

Retail Units Volume Conventional 2,001 498,407,356 Government 1,031 250,900,228 Total 3,032 749,307,584 Wholesale Units Volume Conventional 556 173,321,668 Government 116 26,597,198 Total 672 199,918,866 Consumer Direct Units Volume Conventional 78 18,442,200 Government 42 9,624,172 Total 120 28,066,372 Correspondent Purchase Units Volume Conventional 198 39,550,925 Government 101 19,785,782 Total 299 59,336,707 Conventional 2,833 729,722,149 Government 1,290 306,907,380 Total 4,123 1,036,629,529 Average Loan Size $251,426 Union Home Mortgage At a Glance 16 17 Promises Kept

Union Home Mortgage Historical Production

UHM Historical Production 2021 2022 2023* 51,000 7,060,000,000 6,060,000,000 8,060,000,000 5,060,000,000 4,060,000,000 3,060,000,000 12,060,000,000 11,060,000,000 13,060,000,000 14,060,000,000 15,060,000,000 10,060,000,000 9,060,000,000 2,060,000,000 1,060,000,000 60,000,000 46,000 56,000 61,000 66,000 71,000 76,000 41,000 36,000 31,000 26,000 21,000 16,000 11,000 6,000 1,000 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2009 2007 2006 2005 2004 2003 2001 2000 1999 1998

Volume Units Year Volume Units 1998 156,808,771 1,421 1999 161,260,698 1,398 2000 158,261,565 1,315 2001 264,531,411 2,061 2003 458,576,796 3,413 2004 247,840,005 1,989 2005 264,130,332 2,000 2006 260,451,975 1,987 2007 254,367,033 1,856 2009 479,379,134 3,421 2011 590,701,490 3,745 2012 1,151,693,485 7,067 2013 1,079,058,337 7,132 2014 937,233,115 6,417 2015 1,428,442,166 9,487 2016 2,401,954,175 14,737 2017 2,467,702,755 14,889 2018 3,023,743,060 17,347 2019 4,458,328,599 23,019 2020 10,380,296,171 44,223 2021 13,111,510,040 52,610 2022 5,737,370,468 22,381 2023* 1,036,629,529 4,123 *Through 3/31/23

Union Home Mortgage At a Glance 18 19 Promises Kept

Industry-Leading Tech Stack

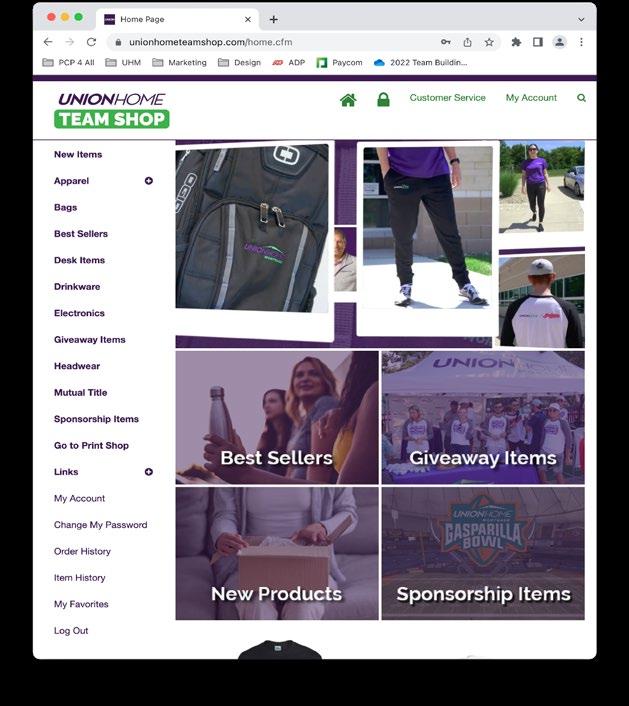

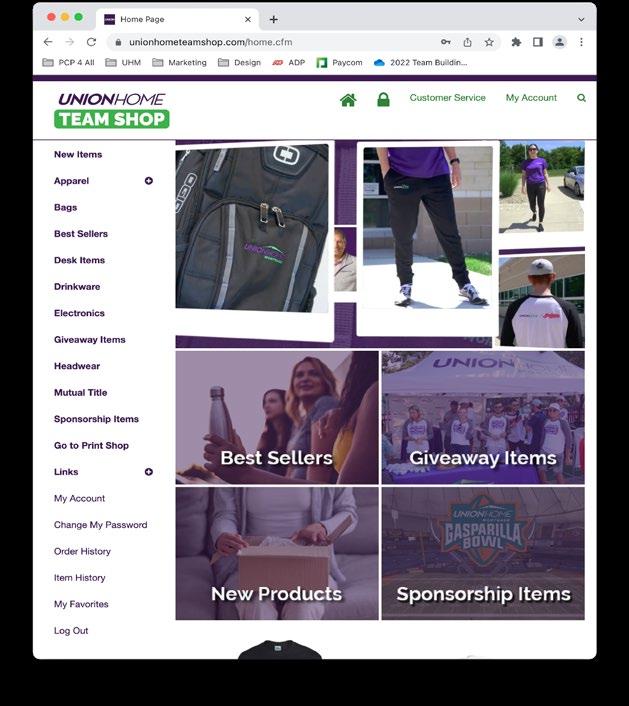

Marketing

The Union Home Mortgage Marketing Department brings all areas of marketing subject matter expertise under one roof so our Partners' marketing-related requests can be successfully managed with a holistic marketing solutions approach. Our Project, Creative and Social Media Teams collaborate together on corporate strategy and on a one-to-one level to support business growth for our Sales Partners across the organization. With a top priority of making Union Home Mortgage a household name in all markets, the UHM Marketing Department leverages all mediums to drive success for our Sales Partners in the unique communities they serve.

Branding

Team Logos

Union Home Team Shop

Loan Officer/Team Branding on

All Assets

Communications

Email Templates

Email Campaigns

Flyers

Social Media Graphics

Social Media Automated

Postings

Custom Ads

Sponsorships

Social Media Resources

Brand Ambassadors

Union Home Mortgage is the official and exclusive mortgage provider of several regional and national brands where we utilize the passion of fans to create strong brand association. UHM receives significant visibility, growing brand awareness through in-stadium signage, media and digital assets. Our sponsorships have also allowed us opportunities to support and engage our Partners and help them build strong relationships within their communities and engage prospective Partners. In all of our sponsorships, we look to align our goals and objectives with the assets of each brand.

From left to right:

Denzel Ward

• NFL Cornerback

• Former Ohio State University Cornerback

Tom Hamilton

Jason Dufner

• PGA Tour Winner

Bernie Kosar

• NFL Quarterback Legend

Social Media Tips and Tricks

Social Media Profile Set Up

Educational Webinars

Monthly Loan Officer Content Calendars

Content Libraries – Graphics, Gifs, Videos

One-on-One’s

Paid Advertising Support

Stock Photos

Youtube Videos

Marketing

Union Home Mortgage At a Glance 20 21 Promises Kept

241 PARTNERS

What is PCP?

Partners Coaching Partners is our internal coaching program designed for every loan originator at Union Home Mortgage. With voluntary enrollment, Partners are grouped with fellow Partners at their production level and matched with a coach who has been where their fellow Partner wants to go! We coach our fellow Partners through personal accountability systems driving measurable increases in leads, closings and personal savings, while focusing on work and life harmony. We have 5 Levels of Coaching to meet our Partners where they are.

Why PCP?

PCP (Partners Coaching Partners)

PCP Partner Growth

PCP IS A COMMITMENT TO YOURSELF

Partners, Coaches and Union Home Mortgage demonstrate measurable growth in 5 key areas:

Tori McKimm

Tori experienced 158% growth in unit volume and 181% growth in production volume from 2019 to 2021.

Q1 TOTAL PRODUCTION:

1,404 Units | $361,573,711

48.2% of UHM Retail Volume

Accountability is the shortest distance between where you are and where you want to be. Six of our top Seven producers at UHM are Coaches in Partners Coaching Partners. Our Coaches have a pay-itforward, givers- gain mentality reflecting the values of senior management. Within the program we multiply our time to compound our results and maximize the value we add to our partners, clients and customers. We manage our money as a reflection of our life values, as we continue to build a world-class, award-winning workplace. We do our part to grow the company to a top 25 national lender, with 500 Partners in PCP. Every day we honor our Code of Conduct, our culture and our corporate slogan of “Promises Kept” in everything we say and do.

Stephen Micham

Stephen experienced 317% growth in unit volume and 342% growth in production volume from 2019 to 2021

Kat Miller

Kat experienced 284% growth in unit volume and 336% growth in production volume from 2019 to 2021

PCP (Partners Coaching Partners)

People

Process

Productivity Prospecting

Profit

Union Home Mortgage At a Glance 22 23 Promises Kept

Union Home Mortgage Foundation

At UHM, we believe in empowering responsible homeownership – one of the quickest pathways to homeownership is ensuring that individuals and families are in a position to not only afford a home, but maintain one as well. The UHM Foundation was launched in 2015 to equip families with the tools and resources to achieve economic self-sufficiency. We do so by providing funding and offering programs around two main pillars: Financial Literacy, and Housing.

We also support our partners passions and provide a few extra ways to give back to organizations our partners are engaged with. We offer volunteer paid time off hours, host donation drives, provide a matching gift program, grant annual partner impact awards, and much more.

Union Home Mortgage Foundation

M O R T G AGE F O U N DA T ION Awards Union Home Mortgage At a Glance 24 25 Promises Kept

Code of Conduct

Everyday, be engaged and passionate. Your fellow Partners are counting on you. Have fun, but get it done on time!

As a Partner, you are responsible for creating and maintaining a positive work environment with all other Partners. Your fellow Partners are counting on you.

Promises Kept.

PROMISES KEPT.

Each Partner must be committed to GROWTH, PRODUCTIVITY and EXECUTION. The foundation of all future success!

Over-communicate with everyone: Customers, Realtors, Brokers and fellow Partners.

EVERY STEP OF THE WAY HOME.

COMPETITIVE EDGE: Sales Training, Coaching and Accountability for all Loan Officers and Account Executives!

Every day, create “Raving Fans” of Customers and fellow Partners by exceeding expectations.

Be professional: respect fellow Partners. Never have a verbal conflict with anyone over anything. If you do, all Partners lose.

Research before you react.

Every day, live by our slogan of “Promises Kept.”

At Union Home Mortgage, our Partners live by the shared values of our Code of Conduct: respect, open communication and accountability. This commitment to inclusivity, as well as delivering personalized service unmatched in the industry, is why we’re honored to be recognized across the country as a top mortgage lender and great place to work year after year.

Code of Conduct

1 2 3 4 5 6 7

8 9 10

Union Home Mortgage At a Glance 26