JOSH STONE Guardrail Technologies Inc.

The promise of artificial intelligence (AI) in business is to increase efficiency and reduce costs. In contract drafting and negotiation, large language models (LLMs) can produce initial drafts and analyze agreements in seconds— something that might take lawyers hours. Yet despite these advantages, AI often has the opposite effect if not used thoughtfully.

This article explores how misuse of AI in contract negotiations, can result in wasted time, increased legal bills, and even damaged professional relationships. Here’s how:

AI lacks human intuition. While seasoned negotiators can adapt based on expectations or interpersonal cues, AI cannot distinguish between a straightforward relationship and a more complicated negotiation. As a result, LLM-generated documents can misfire—providing content that is overly complex or too simplistic for the situation at hand.

Bottom line: When AI is used without human calibration and close review, it may produce output that is tone-deaf or mismatched to the context, sending the wrong signals to counterparties.

Contracts and their negotiations are not just about legal terms—they are about relationships. Trust develops through forthright interactions, and parties form impressions based on communication style, fairness, and responsiveness.

Sending an AI-generated draft or commentary that’s not aligned with the stage, scope, tone, or substance of the negotiation can make the sender appear careless—or worse, disrespectful. AI that generates excessive or irrelevant comments may erode trust and derail negotiations.

Tip: Contract tone, balance, and complexity should be carefully managed by humans—not delegated to AI.

AI can generate content quickly—but that doesn’t

mean it’s valuable. Long, verbose emails or sprawling document redlines can result from unedited AI output. Language generated by LLMs often bury key points in unnecessary fluff, creating confusion, wasted time, and frustration.

Real-world problem: I’ve frequently received AI-written emails that tried to sound impressive but buried the point in flowery language. Instead of helping, it made me think less of the sender.

In contracts, this effect is amplified. AI may flag issues as unfair just because they aren’t symmetrical— without recognizing differences in party roles or deal dynamics.

Bad AI output costs real money. Submitting a poor-quality draft to your own lawyer means they’ll spend more time fixing it—possibly at $500 to $3,000 per hour. The same goes for a counterparty’s counsel. When one party sends a document that isn’t fit for purpose, it can needlessly drive up everyone’s legal bills and sour the working relationship.

Advice: Don’t let AI create more work for people who charge by the hour.

Despite the risks, AI can be helpful—if used wisely. Here’s how to integrate it productively:

• Choose the right lawyer: Before asking your attorney to review AI-generated documents, ask whether they already have a solid starting form for the contract type. Using a forum they are comfortable with typically reduces drafting costs.

• Use AI to assist, not micromanage: Don’t use AI to “second-guess” your lawyer or micromanage their process (e.g., asking a LLM to pick apart their work). Instead, collaborate with them on whether AI can streamline drafting and let them do their job.

• Avoid unfair requests of professionals: Don’t ask an attorney to “bless” a document you generated with AI unless they’ve had meaningful input and

are fairly compensated for risk and effort. As noted above, letting them run the process may actually reduce costs.

Never copy-paste AI-generated contract comments into an email without review. Sending a note like “please consider the points below” can lead your lawyer to overanalyze irrelevant comments, driving up costs.

Best practice: Vet every AI-generated suggestion:

• Is it relevant?

• Is it material?

• Is it necessary in the context of the deal?

Only send the ones that truly merit discussion.

Some employees misuse AI to challenge attorneys and impress management by using a LLM to spot a laundry list of potentially irrelevant issues. But playing “stump the lawyer” with obscure issues spotted by a LLM does more harm than good. Managers should ensure:

• Employees understand how to use AI responsibly and not for ego or similar purposes

• The company’s firms deliver real human expertise—not just AI drafting

• Legal advice isn’t sourced blindly from machine-generated suggestions

Remember: You shouldn’t pay expert rates for AI-generated work product.

If you receive a draft or set of comments that’s clearly low quality, it’s okay to pick up the phone. A short conversation between humans can save days of

unnecessary legal back-and-forth and the related costs. Depending upon the context, it may be reasonable to say something like:

“We looked at your draft, and it’s not really appropriate for this deal. Let’s recalibrate and save everyone some time and legal expense.”

AI can reduce legal costs—but only when paired with human oversight, strategy, and judgment. If you want efficiency, not frustration, take the time to manage AI properly.

Josh Stone General Counsel Guardrail Technologies

At Guardrail Technologies, we empower organizations to use AI with confidence. Our fully customizable Trust Layer wraps around your AI workflows so that your data remains secure, your AI use compliant, and your business in control. Businesses use Guardrail Technologies to get real time oversight, end to end protection, and a robust Guardrail that allows them confidently and securely grow with AI.

Our proprietary technology solves a dilemma for businesses: To stay competitive, you need AI. But without the right controls, it could put everything at risk. Protect what matters most with Guardrail Technologies.

BY ETHAN PENNER

Chairman, Hill Street Realty — Real Estate

Visionary | Author | Educator | Thought Leader | 2025 California Governor Candidate

It was sometime in the 1990s when the term “Alternative Investments” became fashionable. The phrase was intended to imply all things not named publicly traded stocks, investment-grade bonds, or cash. I’m fairly certain it was coined by the marketers of stocks and bonds—likely with the help of a few academic allies—whose goal was to cast everything outside the mainstream as inherently riskier, and therefore only worthy of a token portfolio allocation. Back then, 3–5% was the standard recommendation for alternatives,

and even that seemed generous. But then came David Swensen at Yale, whose endowment model pushed that figure toward 10%, 15%, and eventually 30% or more among the bolder institutions.

As allocations to alternatives grew over the past three decades, the definition of “alternative investments” never matured. Today, the label covers everything from crypto to timberland, CCCrated debt to stabilized apartments—assets with vastly different risk, liquidity,

and income characteristics. Grouping them together is lazy portfolio construction. Consider the facts:

• In 1996, there were over 8,000 publicly traded companies in the U.S.; today, there are around 4,000 (World Bank, Wilshire).

• Meanwhile, the number of private equity-backed U.S. companies exceeds 100,000, encompassing venture-backed startups and middle-market operating businesses.

• This means the majority of the investable opportunity set now exists outside public markets—yet traditional portfolio frameworks still treat these assets as peripheral.

It’s time to rethink how we classify and allocate to real assets. Multifamily real estate, in particular, offers a track record, income profile, and structural risk characteristics that set it apart from speculative or illiquid investments. It doesn’t belong in the same bucket as memecoins or moonshots. It deserves its own category—and, in many portfolios, a larger role.

Over the past three decades, U.S. multifamily real estate has delivered an average annual return of 8.8%, according to NCREIF—outperforming bonds and approaching equity-level returns, but with far less volatility. Its strong Sharpe ratio reflects stable, cash-flow-driven performance, not speculative appreciation. During the Global Financial Crisis, multifamily declined modestly (~10–12%) and recovered quickly, unlike office or retail. In the COVID-19 downturn, occupancy remained above 93% nationally, and rents rebounded within a year. Few asset classes can match this consistency across market cycles.

A key reason for multifamily’s resilience is its lease structure. Unlike commercial leases, which may not reset for 5–10 years, apartment leases typically reset every 12 months—sometimes even sooner. That gives land-

lords the ability to adjust pricing in near real time as inflation rises.

You can see this in the data. In 2021, when U.S. CPI inflation hit 7%, the highest level in 40 years, multifamily rents increased by 13.5% nationally, according to Zillow. In top markets like Phoenix, Tampa, and Austin, annual rent growth exceeded 20%. This dynamic may provide a more immediate inflation response than other asset types, though outcomes will vary by market and cycle. Try getting that kind of inflation correlation out of long-dated bonds or private equity funds locked up for 10 years.

Another differentiator is multifamily’s ability to absorb leverage. Stabilized apartments generate consistent income, allowing for modest, responsible leverage—typically around 60–65% loan-tovalue. That’s enough to enhance returns without exposing investors to margin calls or interest rate shocks.

Unlike other asset classes that rely on aggressive debt structures—think private equity buyouts at 8–10x EBITDA—multifamily’s leverage is supported by real cash flow. That’s why the delinquency rate on multifamily CMBS loans has historically remained under 1.5%, even during downturns, compared to 7–8% for hotel or office loans during COVID-19. With fixed-rate, amortizing debt and interest rate caps, these portfolios are built to weather storms. And unlike bonds, whose values plummet when rates rise, multifamily often sees improved net operating income due to rising rents, partially offsetting rate pressure.

Let’s zoom out even further. Multifamily benefits from powerful, long-term demographic trends. Millennials and Gen Z are driving demand: Combined, these cohorts represent over 170 million Americans, and they’re renting longer than previous generations.

Home affordability is at a 40-year low: According to Redfin, less than 15% of homes on the market in 2023 were considered affordable for the typical U.S. household. The U.S. housing shortage is severe: Fred-

die Mac estimates a structural shortfall of 3.8 million homes, with new construction failing to close the gap. All of this drives sustained, inelastic demand for rental housing. The capital markets may ebb and flow, but people will always need a place to live.

To illustrate how multifamily fits into a modern asset allocation framework, consider two investors:

• Investor A allocates 15% of their $10 million portfolio to venture capital and crypto. They experience illiquidity, high volatility, and unclear valuation paths.

• Investor B allocates the same 15% to a diversified pool of low-leveraged, cash-flowing multifamily assets. They receive consistent distributions, NAV stability, and inflation-linked growth.

• Investor A is exposed to risk narratives. Investor B owns real assets with real income.

• One’s hoping for alpha. The other’s already collecting it.

This isn’t about dismissing innovation. It’s about clarity. If your goal is income, capital preservation, and resilience, multifamily real estate stands out as one of the few “alternatives” that arguably belongs at the center of your portfolio.

It’s time to stop lumping everything outside of stocks and bonds into one “alternative” bucket. That label might have served a purpose 30 years ago, but today it’s an anachronism—a lazy construct that muddies portfolio thinking.

Multifamily isn’t an alternative. It’s a proven, essential, resilient asset class that merits real consideration as a core holding. It throws off cash. It protects against inflation. It’s backed by structural demographic forces and behaves well under modest leverage. In a world addicted to volatility and chasing the next shiny thing, multifamily offers something refresh-

ingly rare: clarity, consistency, and common sense. Let the others chase unicorns. I’ll take 300 units in Houston.

Disclaimer: This article is for informational and educational purposes only and should not be construed as investment advice or solicitation to buy or sell any securities.All investments carry risk,including the potential loss of principal. Past performance is not indicative of future results. Investors should consult their own financial and legal advisors before making any investment decisions.The views expressed herein are those of the author and do not necessarily reflect the views of any firm or affiliate.

Ethan Penner, Chairman Hill Street Realty

Ethan Penner, Chairman, Hill Street Realty — Real Estate Visionary | Author | Educator | Thought Leader | 2025 California Governor Candidate

Hill Street Realty is a vertically integrated real estate investment firm with a 24-year exclusive focus on value-add multifamily assets in high-growth U.S. markets. Our principals bring over 40 years of direct leadership experience, supported by a team with a combined 90 years in real estate investment, operations, and asset management. By managing the entire investment lifecycle in-house, we enhance execution precision, reduce operational friction, and create durable value for our investors.

The futures industry is a specialized segment of the broader financial markets, characterized by a wide range of participants, including both hedgers and speculators. This diversity creates a variety of business opportunities, drawing the interest of emerging finance professionals. Choosing an FCM as a service provider is an important decision especially for emerging managers seeking to grow their fund and leverage investments accordingly.

An FCM, which operates as an Independent Software Vendor (ISV) of the exchange is a significant benefit to the emerging manager. When a trading platform and API are developed and maintained in-house as op-

posed to relying on third-party data or routing vendors such as CQG or Rithmic, users benefit from a platform with no routing or connection fees and may have access to a free or significantly discounted API, which may be appealing from a cost-management perspective.

Real-time access to account information is important for managing trading strategies, hedging positions, or overseeing managed accounts. Choose a platform designed to provide direct access to middle and back-office data, including profit and loss reports, account details, and trade fills. Seek out an FCM that facilitates internal communication across its client services, trade

desk, compliance, accounting, and risk departments to support a consistent flow of information to clients.

An FCM that is eager to grow is always best for an emerging manager in the growth phase. Find a firm that positions itself as a boutique service provider, assigning each account a dedicated account manager who is a registered Associated Person (AP) of the firm, specializing in futures clearing and execution.

An FCM with a trade desk staffed with professionals with experience is vital. Trade desks should be available 23 hours a day, six days a week, offering support for order execution and account operation. This can be especially valuable for new introducing brokers or traders who require consistent operational assistance.

For introducing brokers, managing trading activity and risk across multiple accounts can be challenging. Find an FCM, which offers back-office risk management tools with features such as auto-liquidation and customizable limits for individual accounts. These tools are designed to address the differing risk profiles of larger hedgers compared to smaller self-directed accounts.

Ultimately, always seek service providers who emphasize a collaborative and solution-oriented culture aimed at flexibility and client support.

Raymond Grigon

Ironbeam is registered Futures Commission Merchant (“FCM”) providing brokerage, clearing, execution and technology services for Exchange Traded Futures and Option Contacts. We have a robust operational and technological infrastructure to leverage for market connectivity and futures trading. We offer multiple trading platforms and products and have exclusive access to the Firetip trading platform.

FUTURES

Ironbeam provides direct market connectivity, allowing traders to execute futures trades accurately and quickly. Their platform supports advanced order types, real-time SPAN margining, and smooth integration across desktop, web, and mobile devices, ensuring efficient trade execution from any location.

Ironbeam takes pride in providing 24hour professional support whenever the futures markets are open. Their skilled trade desk and customer service representatives are dedicated to assisting clients with platform navigation, trade-related questions, and technical issues.

Ironbeam platform is designed for the modern futures trader, offering over 300 built-in indicators, custom server-side order types, and advanced charting tools. Compatible with desktop, web, and mobile apps, traders can access a robust and adaptable trading environment aligned with institutional standards.

As a CME Group clearing member and Futures Commission Merchant, we offer a comprehensive end-to-end experience for selfdirected traders. This includes comprehensive trading tools, professional support, and the opportunity to learn about investing in Managed Futures. We facilitate this through hosting regional gatherings where investors and futures-based fund managers can have open dialogue and transparency, which is vital for both the investor and the fund manager.

Ironbeam's chart trading feature is robust and empowering, allowing traders to execute and manage trades directly from interactive charts. This functionality, available across all devices, includes placing trades, adjusting stop orders, and setting limits, providing a streamlined and intuitive trading experience.

Ironbeam's API is now equipped with WebSocket streaming capabilities, delivering real-time market data with reduced latency. This advancement ensures that developers and algorithmic traders are always up-to-date with immediate updates on price quotes and market depth, enhancing the speed and efficiency of their futures trading strategies.

FRED RUFFY Regiment Securities

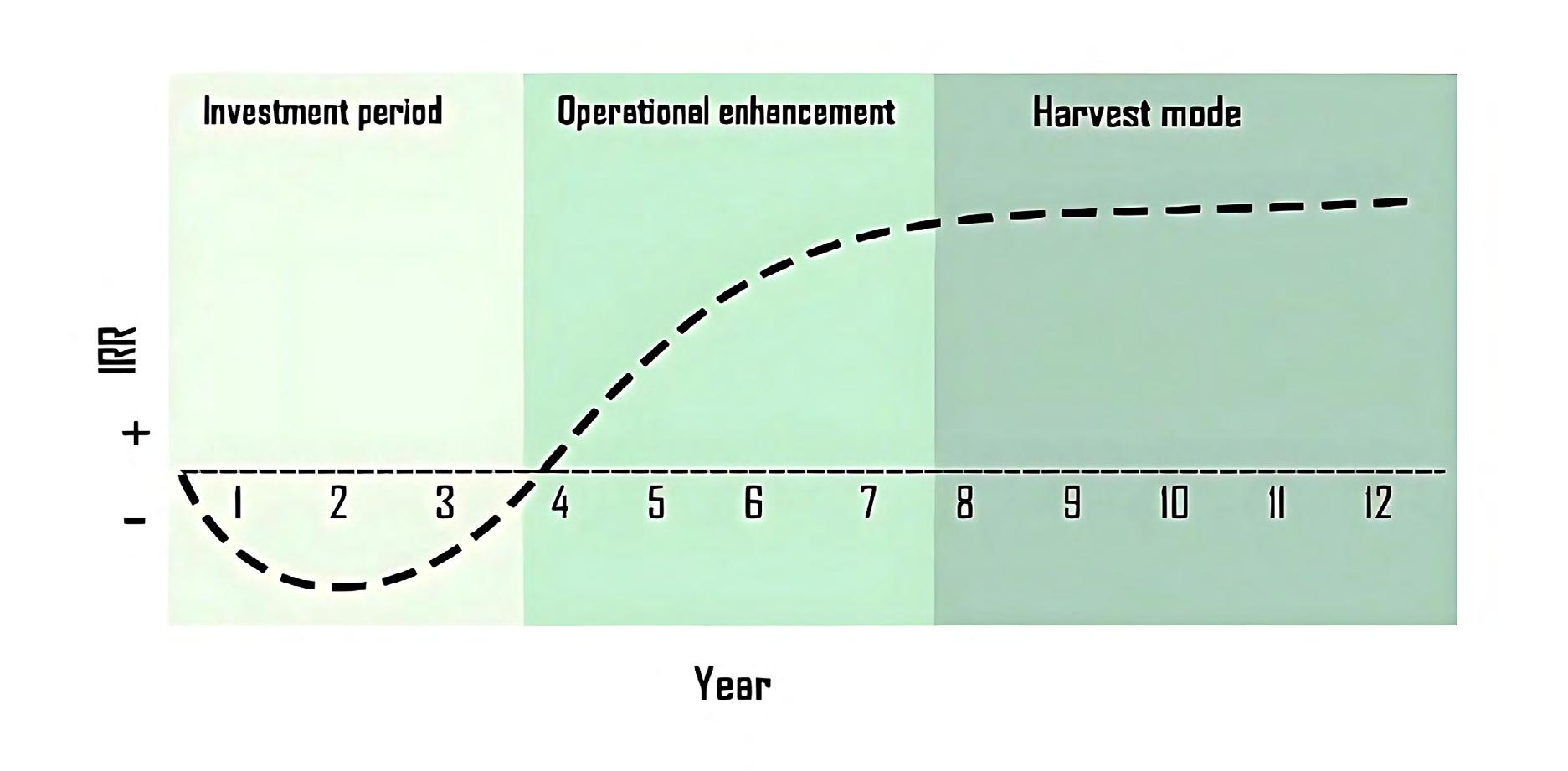

The J-curve is based on the observation that private equity investments typically have negative cash flows in the early years before seeing gains in later years as investments mature and exits generate returns. Here’s why it matters.

In private equity, the J-curve describes the tendency for investments to show negative returns in initial years and then show increasingly positive returns as the investments grow and mature. This means that early investors must often experience unfavorable returns until a gradual recovery, a return to the starting point, and (ideally) growth beyond the initial investment.

The J-curve underscores the need for patience, as private equity investments often come with long lock-up periods and limited liquidity, preventing investors from accessing their capital in the early years. The upshot is the potential for added diversification and above-market returns in later years as successful private investments can potentially experience exponential growth.

For illustrative purposes only.

Private equity investments generally involve pooling capital into funds that acquire, manage, and eventually exit private companies with the goal of generating significant returns. Often structured as funds (venture capital, buyout funds, or fund of funds), investments can span a wide range of industries, including technology, retail, real estate, energy, infrastructure, healthcare and biotech.

Unlike publicly traded securities, which can be bought and sold freely, private equity investments typically require a long-term commitment, sometimes a decade or more. During this time, fees, underperforming early investments, and the slow deployment of capital can contribute to negative returns before portfolio companies mature and generate meaningful gains.

Private equity funds typically follow a J-curve return pattern, often starting with negative returns due to early costs and premiums paid for acquisitions. Over time, as portfolio companies grow, net asset value (NAV) increases, with returns materializing during exit events, typically after three to eight years. The J-curve concept in private equity originated from economists and investment analysts studying the cash flow patterns of private equity funds, and it gained prominence in

the 1980s and 1990s as the industry matured. It gets its name from the shape of line for the typical internal rate of return (IRR) over time.

While no two investments are exactly alike, it can help to break the J-curve down into three distinct phases. During the investment period, typically the first few years, the fund deploys capital into portfolio companies, incurring fees and expenses that often result in negative early returns.

The operational enhancement phase follows and represents the time when fund managers work to improve the financial and operational performance of the investments, aiming to increase their value. Finally, in harvest mode, the fund exits investments through sales, IPOs, or other liquidity events, realizing gains and generating returns for investors.

Companies that receive capital from private equity funds are often privately held for several years, meaning they lack an observable market price. Unlike publicly traded stocks, with values that fluctuate and are published throughout the trading day, private equity investments generally require a long-time horizon to determine their fair market value. This also means that private equity investments are less susceptible to the whims of market sentiment, high-frequency traders, and the hot money flows that cause volatility in the

secondary markets.

Also, during the early stages, private equity firms actively work to enhance the companies they invest in— whether through operational enhancements, strategic restructuring, or expanding market reach. Because these transformations take time to materialize, funds may initially report holdings at cost before any measurable value appreciation occurs.

As a result, early-stage performance data can be misleading, especially for younger funds still in the steepest part of the J-curve. The initial losses—driven by management fees, uninvested capital, and early underperformance—may give an overly negative impression of a fund’s long-term potential.

For investors with long-term perspectives and time horizons, private equity offers the potential for significant value creation as portfolio companies mature and exit strategies, such as IPOs or acquisitions, generate returns. However, the J-curve is a reminder that private equity investors should be prepared for an initial dip in investment returns in the early years, understanding that private equity requires patience, a longer-term time horizon, and (in some cases) a tolerance for illiquidity. Unlike publicly traded stocks, these investments aren’t easily bought and sold through mainstream brokers, and their value may take years to materialize.

Meanwhile, the benefits to private equity investments are added diversification and the potential for enhanced returns. At Regiment Securities, we’re vetting new opportunities that strike the best balance between risk and reward in today’s vast private equity market. New offerings are in the pipeline that are being structured to offer access to private markets and liquidity. Contact us to discuss the types of investments that can potentially play a role in your portfolio.

Past performance may not be indicative of future results. Diversification and asset allocation do not ensure a profit or protect against a loss.Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio.

This document has been prepared to provide background information only.This document does not constitute an offer or invitation to subscribe or purchase any securities.An invitation to invest will only be made on the distribution of a final private placement memorandum and subscription agreement to duly qualified recipients, following applicable registrations and other securities law requirements.A full description of the investment terms and strategies (and related risk factors) of the offering will be outlined in the above-referenced documents. In the case of any inconsistency between the descriptions or terms in this marketing document and the above referenced final offering documents, the offering documents shall control. Due to, among other things, the volatile nature of the markets and the investment strategies discussed herein, the investment strategies of this offering may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager,and should consult with qualified investment, legal and tax professionals before making any investment.

Independent Representative Regiment Securities

Fred Ruffy is an independent rep with Regiment Securities, LLC, a Chicago-based investment bank focused on alternative and uncorrelated investments. He’s a veteran content strategist specializing in trading, capital markets, and alternative investments. Fred has worked with leading broker-dealers and investment firms to craft high-impact communications for retail and institutional audiences.

CYNTHIA KELLY STP Investment Services

On August 28, 2024, the Financial Crimes Enforcement Network (FinCEN), part of the U.S. Department of the Treasury, issued its final rule titled Anti-Money Laundering/Countering the Financing of Terrorism Program and Suspicious Activity Report Filing Requirements for Registered Investment Advisers and Exempt Reporting Advisers (Final Rule). This rule significantly expands the scope of anti-money laundering (AML) requirements by including most SEC-registered investment advisers (RIAs) and all Exempt Reporting Advisers (ERAs) (jointly referred to as “advisers”) in the broader regulatory framework that was previously limited to more traditional financial institutions like banks, mutual funds, and broker-dealers.

The Final Rule will come into effect on January 1, 2026, and mandates that advisers subject to the rule

(“covered advisers”) establish a risk-based comprehensive AML compliance program, conduct customer due diligence, and adhere to independent testing and reporting requirements, such as filing Suspicious Activity Reports (SARs) with FinCEN. These are just some of the adopted changes that are part of an ongoing effort to strengthen the financial system against money laundering, terrorist financing, and other illicit financial activities.

The core legislation guiding these regulations is the Bank Secrecy Act (BSA), which, as amended by the USA PATRIOT Act, requires “financial institutions” to establish AML programs that meet certain standards. Historically, investment advisers were excluded from

the BSA’s definition of “financial institutions,” meaning that RIAs and ERAs were not subject to the same AML rules as other financial entities.

However, the Final Rule modifies this exclusion, bringing investment advisers under the BSA’s regulatory umbrella. This expansion is meant to close a gap in the AML framework and ensure that the U.S. financial system is protected from abuse by bad actors, including money launderers and those attempting to finance terrorism. As a result, covered advisers will now be subject to the same AML obligations as banks and other financial institutions, with certain modifications.

While the Final Rule largely mirrors the proposed rule issued in December 2020, a few important

clarifications have been made in response to public comments and feedback:

Definition of “Investment Adviser”/Certain Excluded Advisers. The Final Rule specifically excludes certain RIAs from AML obligations. These include: Firms that qualify for SEC registration because they are a mid-sized advisory firm, a multi-state adviser, or a pension consultant; Those with $0 reportable assets under management; State-registered investment advisers; Foreign private advisers; and Family offices.

Certain Excluded Clients. Investment advisers that are subject to the Final Rule may exclude from the rule’s requirements the following types of clients: Mutual funds; Bank- and trust company-sponsored collective investment funds; Any other investment adviser subject to the rule.

Application to Foreign-Located Advisers. For-

eign-located RIAs and ERAs will only be required to apply the requirements of the rule to their U.S.-based advisory activities, advisory activities provided to U.S.based persons, and advisory activities provided to a foreign-located private fund that has U.S.-based investors.

FinCEN explained that these changes and the exclusions detailed above are designed to tailor the application of the Final Rule to the diverse range of activities and structures within the investment adviser community.

While the January 1, 2026, deadline may imply that time is on your side, firms should take a pragmatic approach and be realistic about the timeframe that will be necessary to design, adopt, implement, and test a fully compliant AML/Countering the Financing of Terrorism (CFT) program based on their own risks and business model. RIAs and ERAs must ensure they understand and can implement key elements of the Final Rule, particularly in the following areas:

The cornerstone of the Final Rule is the requirement that covered advisers develop and adopt a written AML compliance program that is risk-based and reasonably designed. Advisers are cautioned not to take a one-size-fits-all approach to adopting an AML program. Advisers should focus on identifying where the risk of money laundering is highest based on their own operations and business model. This can only be determined through a thorough risk assessment, which helps identify potential weaknesses in customer due diligence, transaction monitoring, and other aspects of the firm’s operations that could be exploited for money laundering activities. Factors that should be considered could include: customer base; the types of services provided; and geography, such as reviewing for non-Financial Action Task Force (FATF) countries. By understanding their specific risks, advisers can design an AML program that is tailored to their unique business practices and customer base.

Specifically, the program must include:

Designated AML Compliance Officer(s): An adviser subject to the Final Rule must designate one or more persons or a committee to be responsible for implementing and monitoring its AML/CFT program. The person(s) designated with this responsibility must be an employee or officer of the covered adviser or its affiliate; an outsourced AML/CFT officer is not permitted. Advisers should consider whether the individual designated by the firm to serve in this role will need additional training and/or resources. An RIA is permitted, but not required, to designate its AML/CFT officer as the same individual who it has designated as its chief compliance officer.

Written Internal Policies and Controls: These policies must be reasonably designed to prevent the investment adviser from being used for money laundering and financial crimes. Internal controls should also outline the procedures for monitoring and reporting suspicious activities in compliance with the applicable provisions of the BSA.

Customer Due Diligence (CDD): The program must include risk-based procedures for assessing customers, understanding their risk profiles, and monitoring their activity. CDD will be an ongoing process designed to detect suspicious activity at an early stage. It should be noted that the Final Rule does not impose specific Customer Identification Program (CIP) requirements. The SEC and FinCEN have jointly proposed a CIP rule § 1032.220(a)(6), which has yet to be adopted. The Final Rule also does not require beneficial ownership verification for legal entity clients, but this requirement is expected to be integrated into a forthcoming revision to the CDD Rule.

Ongoing Training: The scope, frequency, and content of the adviser’s AML/CFT training program should align with employees’ responsibilities and their exposure to AML/CFT requirements or risks. The program should provide general awareness of AML/CFT risks and requirements, along with specific guidance tailored to employees’ roles. Taking into consideration specific job functions when developing the firm’s training program will empower employees to identify potential signs of money laundering, terrorist financing, or

other illicit activities. Training can be delivered through in-house or external seminars, as well as virtual or computer-based methods. Employees involved with AML/ CFT matters must be trained upon assuming their duties and should receive periodic updates and refreshers to stay informed about the program and evolving risks.

Independent Testing: To ensure that the AML program is effective, the firm must arrange for independent testing. This testing can either be done internally by personnel not directly involved in the day-to-day operations of the AML program or through external vendors. The Final Rule outlines the importance of testing to identify vulnerabilities in the program and implement corrective actions.

Many advisers likely already have certain protocols in place that they can build upon while conducting a gap analysis. These may exist in the adviser’s current onboarding processes, existing customer identification practices, and Reg S-ID red flags program. Reviewing existing processes against the new AML requirements will help identify areas where processes need to be enhanced, or new ones implemented. Advisers can then formalize and refine these processes to comply with the specific requirements outlined in the Final Rule.

One of the major compliance responsibilities introduced by the Final Rule is the requirement for covered advisers to file Suspicious Activity Reports (SARs) with FinCEN. SARs must be filed when a transaction meets the following criteria: Involves or aggregates assets of $5,000 or more; Indicates that the transaction: Involves illegal funds or is structured to conceal such funds; Evades BSA reporting requirements; Has no legitimate purpose or deviates from the typical behavior of a client, without a reasonable explanation; or facilitates criminal activity.

This new requirement for covered advisers mandates that they establish SAR programs as part of their AML/CFT compliance. Advisers must file SARs for transactions conducted “by, at, or through” them when they know, suspect, or have reason to suspect a possible violation of law. FinCEN clarified that advisers are

not required to retroactively review pre-compliance date transactions but must include pre-compliance date information if relevant to SAR filings. Examples of reportable suspicious activities include unusual fund transfers, fraudulent transactions, and potential violations of sanctions or export controls.

The rule specifies that SAR obligations align with existing requirements for financial institutions like broker-dealers and mutual funds and are tailored to investment advisers’ advisory roles. It also permits joint SAR filings when multiple institutions are involved in the same transaction. Confidentiality requirements prevent disclosure of SARs except as authorized, and SAR-related information can only be shared within an adviser’s organization or with relevant authorities under specific conditions. The rule emphasizes that SAR filing responsibilities do not extend to non-advisory activities or portfolio companies but apply to transactions within the adviser’s scope of AML/CFT programs. Additionally, advisers are protected from liability for good-faith SAR filings under the safe harbor provisions. For example, if an adviser submits a SAR report and it is determined nothing nefarious was going on, the adviser would not be retaliated against under the safe harbor provisions.

The Final Rule mandates that advisers ensure independent testing of their AML program’s effectiveness. Testing should be performed by personnel or qualified external parties who are not involved in the day-to-day operations of the AML program. While FinCEN acknowledges the potential burden for small advisers, it rejected a request to allow personnel involved in the AML/CFT program to conduct the testing, as this would compromise its purpose. Advisers with simpler operations and lower risk profiles may collaborate with similar firms to share resources for independent testing, provided independence is maintained.

Covered advisers are allowed to delegate the implementation and operation of certain AML/CFT

program responsibilities to third-party service providers, including foreign-located fund administrators. However, advisers remain fully responsible and legally liable for compliance with AML/CFT requirements. Any delegation of AML/CFT responsibilities must be governed by contractual agreement. Fleshing out the third-party’s obligations will take time, and it is unclear whether third parties, such as custodians, brokers, and administrators, will be willing to sign a reliance agreement.

Advisers that elect to delegate certain AML/CFT program responsibilities must conduct due diligence and periodic oversight of service providers to ensure effective implementation. FinCEN clarified that foreign-located service providers are permissible as long as oversight follows a risk-based approach and ensures access to program-related records for FinCEN and the SEC. Delegation does not absolve advisers of responsibility for overall compliance, and conditions governing delegation permissions can pose significant challenges, including reluctance from third parties to contractually agree to assume responsibility.

To support effective AML compliance, advisers may consider investing in technology that can streamline and automate key compliance functions. Some tools that may be beneficial include:

AML Software: Automated systems can help with client onboarding, background checks, and ongoing transaction monitoring. These systems can also identify suspicious transactions in real time and alert compliance officers, making the SAR filing process more efficient and accurate.

Transaction Monitoring Tools: These tools are critical for tracking large or irregular transactions that could indicate money laundering or other illicit activities.

While technology can make AML compliance processes more efficient, they aren’t necessary. As noted earlier, advisers can leverage existing processes like customer onboarding procedures, client risk assessments, identity verification processes, customer due diligence, risk profiling, transaction screening, and any AML

training provided to employees to identify red flags such as reluctance to provide information and frequent transactions in and out of accounts.

The Final Rule marks a significant shift in the regulatory landscape for RIAs and ERAs. These firms must take proactive measures to design and implement comprehensive AML compliance programs before the January 1, 2026, deadline. By establishing robust internal controls, enhancing due diligence processes, training staff, and leveraging advanced technology to monitor and report suspicious activities, advisers can meet these new regulatory demands effectively.

1https://www.govinfo.gov/content/pkg/FR-2024-09-04/pdf/202419260.pdf

Cynthia Kelly Senior Compliance Consultant STP Investment Services

STP helps financial firms navigate complex investment and regulatory landscapes with integrated services in operations, fund administration, and compliance. Powered by expert professionals, contextual service, and the BluePrint platform, STP combines strategic, middle-to-back office services with compliance consulting, enabling firms to focus on growth and client service through innovative technology and skilled experts.

GREG POAPST Fundviews Capital

Independent registered investment advisors (RIAs) and small family offices in the U.S. face growing challenges in today’s wealth management landscape. Commoditization of services – driven by fee compression, standardized model portfolios, and the rise of lowcost digital platforms – has made it harder than ever to stand out. At the same time, market volatility and uncertainty in recent years have exposed the limits of traditional portfolios. In this context, alternative investments (“alts”) are emerging as a crucial tool for advisors. By integrating alternative asset classes into client portfolios, RIAs can differentiate their offerings, deliver improved risk-adjusted returns, and enhance their firm’s enterprise value. This whitepaper examines the case for alternatives in wealth management, including their role in expanding the efficient frontier, capturing liquidity/ complexity premiums, and ultimately helping advisors thrive in a competitive industry.

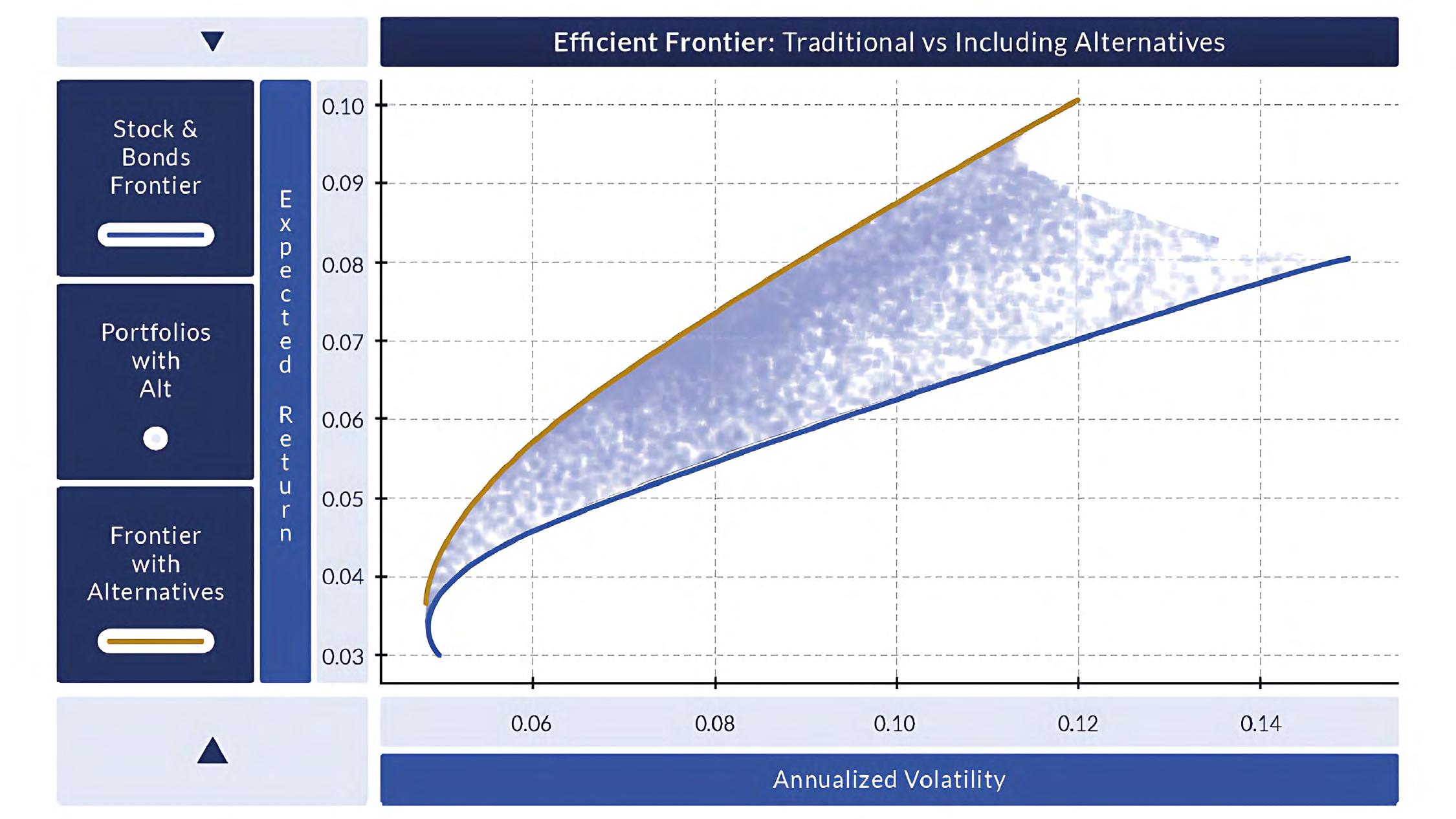

Modern portfolio theory teaches that adding assets with differing returns and risk profiles can improve a portfolio’s overall risk-return tradeoff. Historically, the efficient frontier – the set of optimal portfolios maximizing return for each level of risk – was constructed from traditional stocks, bonds, and cash. Over time, however, the investable universe has broadened dramatically. New asset classes such as private equity, venture capital, real estate, infrastructure, hedge funds, private credit, and others have expanded the efficient frontier, enabling investors to potentially earn higher returns for a given level of volatility (or reduce volatility for a target return) by including these alternatives.

In practical terms, introducing alternatives can improve portfolio diversification because many alts

Figure: Efficient Frontier for a traditional stock/bond portfolio (blue curve) versus a portfolio that includes an allocation to alternatives (gold curve). The inclusion of alternative assets pushes the frontier outward – at each level of volatility (risk), the portfolio with alternatives can achieve a higher expected return. In this illustrative example, adding alternatives raises the potential return from ~7% to ~9% at ~10% volatility, demonstrating how new asset classes expand the investment opportunity set.

have low or modest correlation with public markets. For instance, real estate or infrastructure may respond to different economic drivers than equities, and private credit or hedge fund strategies can perform well in environments when publicly traded assets falter. By combining such assets with stocks and bonds, advisors can construct portfolios that lie above the traditional 60/40 frontier, achieving superior Sharpe ratios. Numerous studies have shown that portfolios including alternatives have delivered enhanced risk-adjusted returns over long periods. Institutions like endowments and pensions embraced this approach decades ago – the famous “endowment model” (pioneered by Yale) allocated heavily to alternatives and significantly outperformed a 60/40 mix over the long run. Today, independent advisors can follow suit on behalf of individual clients, moving portfolios beyond the constraints of traditional asset classes. The efficient frontier in 2025 is far higher and broader than it was in Markowitz’s 1950s framework, thanks to the addition of these alternative investments.

Why do alternatives have the potential to boost

risk-adjusted returns? A core reason is that private and complex assets often carry a liquidity premium (or complexity premium) – investors demand higher returns for investments that are illiquid, opaque, or operationally complex. In other words, because an investor’s capital may be locked up for years in a private fund (illiquidity) or because specialized expertise is required to underwrite a deal (complexity), the asset must offer extra compensation in the form of higher expected returns. Over time, this has translated into outperformance of many alternative asset classes relative to public markets on a risk-adjusted basis.

Empirical data bear this out. For example, private equity funds have historically generated higher long-term returns than public equity indices. One analysis notes that private equity has achieved risk-adjusted returns exceeding those possible in the public equity markets (Private equity - Wikipedia). Indeed, across multiple decades, broad private equity indices have outperformed the S&P 500 by several percentage points annually (even after fees), while exhibiting lower measured volatility (partly due to smoother valuations). This is evidence of an illiquidity premium accruing to long-term investors.

Empirical data bear this out. For example, private equity funds have historically generated higher longterm returns than public equity indices. One analysis notes that private equity has achieved risk-adjusted returns exceeding those possible in the public equity markets (Private equity - Wikipedia). Indeed, across multiple decades, broad private equity indices have outperformed the S&P 500 by several percentage points annually (even after fees), while exhibiting lower measured volatility (partly due to smoother valuations). This is evidence of an illiquidity premium accruing to longterm investors.

www.fundviewscapital.com

Similarly, private credit (direct lending) typically yields more than comparable public corporate

bonds – middle-market private loans might yield, say, 8-10% where liquid high-grade bonds yield much less – compensating investors for liquidity constraints and bespoke underwriting. Real estate and infrastructure investments often provide steady income and total returns competitive with equities but with lower correlation and volatility, thus improving portfolio Sharpe ratios. Even hedge funds, which often involve complex trading strategies, have delivered diversifying return streams; certain strategies (e.g. global macro or market-neutral funds) have shown higher risk-adjusted returns than long-only equity, albeit with wide dispersion among managers.

It is important to note that not all alternatives automatically outperform, and there is considerable variance. However, the opportunity for superior riskadjusted performance is a defining characteristic of alternatives. Investors with long-term horizons and less need for immediate liquidity – which describes many RIA clients like high-net-worth families and foundations – are well positioned to capture these premiums. By allocating a portion of portfolios to illiquid and complex assets, advisors aim to harvest these additional returns, enhancing overall portfolio outcomes. In essence, alternatives allow access to unique return drivers (private market growth, skill-based alpha, real asset cash flows) that can richly reward patience and expertise.

It is important to note that not all alternatives automatically outperform, and there is considerable variance. However, the opportunity for superior risk adjusted performance is a defining characteristic of alternatives. Investors with long-term horizons and less need for immediate liquidity – which describes many RIA clients like high-net-worth families and foundations – are well positioned to capture these premiums. By allocating a portion of portfolios to illiquid and complex assets, advisors aim to harvest these additional returns, enhancing overall portfolio outcomes. In essence, alternatives allow ccess to unique return drivers (private market growth, skill-based alpha, real asset cash flows) that can richly reward patience and expertise.

Wealth management has increasingly become

commoditized. Fee compression is squeezing margins – for example, a 2018 industry study found the average advisory fee charged by RIAs was about 0.95% of assets reflecting pressure on the traditional ~1% AUM fee. Basic portfolio management using the classic 60/40 stock-bond allocation is now widely available at low cost, and many firms offer similar financial planning services. This standardization makes it difficult for independent RIAs to articulate a unique value proposition. When every advisor is delivering similar asset allocations and planning advice, clients may gravitate towards the lowest-cost provider or larger brands, further eroding loyalty and pricing power.

To counteract these trends, RIAs must find ways to differentiate beyond the basics. Alternatives provide a compelling avenue to do so. Unlike generic stock and bond portfolios, alternative investments (such as private equity, private credit, hedge funds, real estate, etc.) are not commoditized – access often requires specialized expertise, networks, and due diligence that an advisor can uniquely provide. By curating quality alternative opportunities for clients, an RIA can offer a value-added service that is not easily replicated by robo-advisors or cookie-cutter models. This not only justifies advisory fees, but also strengthens client relationships. Highnet-worth clients, inparticular, increasingly expect access to institutional-grade investments; an advisor who can deliver on that expectation will stand out. Moreover, clients committing to illiquid alternative funds (often with multi-year lockups) are inherently more “locked

in” with their advisor, improving client retention and lifetime value. In short, alternatives give independent advisors a powerful tool to combat commoditization –creating distinctive offerings, delivering enhanced value, and cementing loyalty.

In addition to improving client portfolios, offering alternative investments can directly increase the enterprise value of an RIA firm. Buyers and investors tend to place higher valuations on wealth management businesses that demonstrate unique capabilities and diversified revenue streams. RIAs that incorporate illiquid/ alternative products – especially through proprietary access or in-house funds – are often seen as more differentiated, growth oriented enterprises, and can command higher EBITDA multiples in M&A transactions.

There are several reasons for this valuation premium. First, proprietary alternative offerings (such as an RIA’s own private fund or a bespoke alternatives platform) can generate additional fee revenue beyond the standard AUM fee. For example, an advisor who launches a private real estate fund for clients might earn asset management fees or performance fees from that vehicle. These revenue streams are typically uncorrelated with market levels (they may be based on committed capital or realized gains) and thus add stability and upside to the firm’s financials. Second, clients invested in illiquid funds are stickier – they are less likely to leave

the firm, given the long-term nature of the investments and the logistical complexity of moving those assets. This increases the duration of the RIA’s client relationships and AUM, which is attractive to acquirers. Third, an RIA with established alternative investment infrastructure (due diligence team, legal/compliance framework for private offerings, etc.) has effectively built a higher barrier to entry against competitors. All these factors contribute to buyers willing to pay a premium for such firms.

Industry observers indeed note that alternative-focused RIAs trade at elevated multiples. While a typical independent RIA might sell for, hypothetically, ~6-8× EBITDA, firms with robust alternative investment platforms and proprietary products can see significantly higher multiples in practice. This reflects the market’s view that these firms have stronger growth prospects and more resilient client bases. Offering alternatives can even transform an RIA’s identity from a pure advisory practice to a hybrid “wealth manager/asset manager” model, which often warrants a higher valuation akin to boutique asset management firms. In summary, embracing alternatives is not just good for clients – it can directly boost the equity value of the advisory business itself, an important consideration for owners planning for future succession or sale.

Industry observers indeed note that alternative-focused RIAs trade at elevated multiples. While a typical independent RIA might sell for, hypothetically, ~6-8× EBITDA, firms with robust alternative investment platforms and proprietary products can see significantly higher multiples in practice. This reflects the market’s view that these firms have stronger growth prospects and more resilient client bases. Offering alternatives can even transform an RIA’s identity from a pure advisory practice to a hybrid “wealth manager/asset manager” model, which often warrants a higher valuation akin to boutique asset management firms. In summary, embracing alternatives is not just good for clients – it can directly boost the equity value of the advisory business itself, an important consideration for owners planning for future succession or sale.

Recent volatility and uncertainty in public markets

have further underscored the case for alternatives. The last few years provided a stress test for the traditional portfolio paradigm. In 2022, for example, both equities and bonds suffered steep losses simultaneously – the S&P 500 index dropped about 19% for the year (its worst annual decline since 2008) and the Bloomberg U.S. Aggregate Bond index also fell by double digits (its worst year on record). A classic 60/40 portfolio delivered one of its poorest performances in decades. Many investors were caught off-guard as the usual negative correlation between stocks and bonds broke down due to surging inflation and rising interest rates. This “everything down” scenario has prompted investors and advisors to seek diversification beyond the traditional asset classes.

Alternatives can act as a shock absorber and return enhancer in such turbulent periods. Some alternative strategies are designed to thrive in volatility – for instance, certain hedge funds (like global macro or managed futures funds) generated positive returns in 2022’s chaos even as both stocks and bonds fell. Private markets, while not immune to economic cycles, do not experience the day-to-day volatility of public markets; valuations are smoothed and based on fundamentals, which can help investors stay the course without the whiplash of market prices. Real assets like infrastructure or commodities-tied assets can hedge against inflation, which was a major concern in 2022. Private credit became especially attractive in the rising rate environment, as yields on private loans reset higher and banks pulled back lending (creating more opportunities for private lenders). In essence, the case for diversifying with alts becomes strongest when traditional assets are under strain.

Even in 2023-2025, uncertainty remains elevated – whether due to inflation’s trajectory, geopolitical risks, or the tail end of the pandemic’s economic impacts. Forward-looking return expectations for stocks and bonds (given high valuations and low starting yields, respectively) are modest in many forecasts. Investors and advisors are therefore looking to broaden their toolkits. This has been evidenced by rising allocations to alternatives among wealth management clients. For example, many advisory firms reported increasing client interest in private investments after the volatility of 2020 and 2022, and industry surveys indicate that a majority of fi-

nancial advisors plan to boost alt allocations in the next few years to improve portfolio robustness. In short, the challenges of the current market environment are accelerating a trend that was already underway – the embrace of alternative investments as a core component of asset allocation. Rather than being a luxury or an afterthought, alts are becoming a necessity for those seeking true diversification and enhanced returns in the face of public market instability.

Integrating alternative investments into a wealth management practice is more feasible today than ever before. RIAs have multiple channels to access alts, ranging from off-the-shelf products to bespoke fund launches. Advisors should choose the approach (or combination of approaches) that best fits their firm’s size, expertise, and client needs.

The primary channels include:

• Public/Semi-Public Vehicles (BDCs, Interval Funds, Non-Traded REITs): A variety of registered alternative products exist that provide retail or semiliquid access to alternative strategies. Business Development Companies (BDCs), for instance, are closed-end investment companies that invest in private companies or loans and often trade on public exchanges. They offer high income (from lending to middle-market businesses) and are accessible to retail investors. Interval funds are another vehicle – structured as continuously offered closed-end funds, they hold illiquid assets (private credit, real estate, etc.) but allow periodic redemptions (e.g. quarterly). Interval funds provide a way for clients to invest in alternatives with some liquidity and regulatory oversight. It is important to be wary that in times of crisis; you may not be able to get your capital back in a timely manner. Nontraded REITs (real estate investment trusts that are not exchange-listed) are yet another example: these funds invest in portfolios of properties or real estate loans, offering diversification into real assets and typically a steady yield. They do not trade daily like publicly listed REITs, but investors can often redeem on a limited basis (subject to caps or black-

out periods). These public/semi-public vehicles are distributed through custodians and broker-dealer networks, making them relatively easy for RIAs to implement. They come with built-in management teams and custodial arrangements, so the advisor’s role is to perform due diligence on the product and allocate appropriately in client portfolios. Such vehicles have exploded in popularity (for example, Blackstone’s non-traded REIT raised tens of billions in recent years), bridging the gap between retail capital and institutional-caliber alternative investments.

• Alternative Investment Platforms (iCapital, CAIS, Fundrise / Fundviews, PPB, Glasfunds, etc.): In the past, access to private funds (e.g. a top-tier private equity or hedge fund) was limited to large institutions or ultrawealthy investors with multimillion-dollar minimums. Today, fintech platforms have democratized access, allowing independent advisors to tap into institutional funds at lower minimums and with streamlined administration. Platforms like iCapital Network and CAIS partner with leading fund managers across private equity, venture capital, private credit, real estate, and hedge funds, creating feeder funds or share classes that smaller investors can enter (often with minimums in the tens or hundreds of thousands, rather than millions). These platforms handle the operational heavy lifting – they aggregate RIA client subscriptions, conduct due diligence on fund managers, facilitate paperwork and compliance (accreditation checks, subscription documents), and often integrate with custodians for reporting. Other players such as PPB Capital Partners, Glide Capital (portfolios), Glasfunds, and Opto Investments, similarly provide curated menus of alternative funds to the RIA community. Other platforms such as Fundviews Capital, Glide Capital (hosting), and Outsourced COO / CFO firms provide the structure and operations, while letting the wealth manager focus on due diligence and sourcing of alts. By using a platform, an advisor can plug-and-play into a wide selection of vetted alternative funds, or operational capabilities – essentially outsourcing the product sourcing and admin. This drastically lowers the barrier to entry

for offering alts. An RIA can allocate client assets to, say, a private equity fund or an interval fund on these platforms almost as easily as buying a mutual fund, while the platform ensures all regulatory and operational details are handled. The trade-off is an additional platform fee or slightly higher expense ratios, but in exchange the advisor gains scale and access that would be hard to achieve alone. These platforms have become increasingly popular, and even large asset managers and banks have launched their own (for example, Goldman Sachs’ “GS Select” platform for alternatives). The platform route allows independent advisors to deliver institutionalquality alts to clients efficiently.

• Launching Proprietary Funds and Vehicles: A more advanced route is for an RIA to create its own alternative investment vehicles for clients. This could range from setting up a simple special purpose vehicle (SPV) for a single private deal, to launching a commingled private fund (e.g. a private real estate fund or fund-of-funds) that the RIA manages. By doing so, the advisor can offer truly exclusive opportunities – deals or funds only available to their clients – and potentially capture additional economics (management fees, carried interest). However, this approach requires significant commitment to build the necessary legal, compliance, and operational infrastructure. The RIA must engage legal counsel to draft offering documents (PPMs, LLC agreements), ensure compliance with securities exemptions (Reg D filings for accredited investor offerings, etc.), set up fund administration and custody for the vehicle, and have the expertise to source and manage the underlying investments. In essence, the firm takes on the role of a GP/asset manager in addition to advisor. Many larger family offices and RIAs have successfully done this – for example, launching proprietary private equity co-investment funds or real estate partnerships for their clients. The benefits are compelling: the firm can tailor the strategy to client needs, potentially offer lower fees than thirdparty funds, and strengthen the firm’s brand as an investment originator rather than just allocator. It also deepens client engagement (investors feel they are part of something unique run by their

Public / Semi-public products (“Liquid Alts”)

Interval Funds

Non-Traded REITs

Proprietary Vehicles Alternative Investment Platforms (Ops only) Alternative Investment Platforms (With DD)

Outsourced COOs / CFOs

advisor). Still, it’s not a step to be taken lightly; firms that go this route often start by hiring or partnering with experienced alternatives professionals or outsourcing portions of the process (e.g. using third-party fund administrators or turnkey fund setup services). For RIAs that reach sufficient scale and expertise, proprietary products can be the capstone of an alternatives strategy – offering maximum differentiation and economic benefit.

In practice, many advisory firms will use a combination of these channels. For example, an RIA might utilize an alternative platform for core private fund allocations, supplement with some interval funds or BDCs for semi-liquid exposure, and eventually develop a niche proprietary fund for a strategy where they have unique insight. The key point is that accessing alternatives is no longer reserved for the largest institutions – even modest-sized RIAs have many tools at their disposal to integrate alts into client portfolios in a controlled, compliant way.

The wealth management industry is at an inflection point. As traditional offerings become commoditized and market dynamics call into question long-held portfolio assumptions, independent RIAs and family offices must innovate to thrive. Embracing alternative investments provides a powerful answer to these challenges. Alternatives enable advisors to differentiate their services, offering clients opportunities and outcomes beyond what a simple stock/bond mix can achieve. They allow portfolios to access a wider efficient frontier, capture illiquidity premiums for long-term benefit, and mitigate the risks of public market volatility. Furthermore, by integrating alternatives – whether through third-party platforms, specialized funds, or proprietary products – advisors can elevate the value of their own enterprises, positioning their firms as forward-thinking and resilient in the marketplace.

It’s important to recognize that incorporating alternatives is no longer an overwhelming hurdle. There are multiple accessible paths: from userfriendly feeder platforms to interval funds to creating an in-house fund with the help of outsourced experts. Advisors can start incrementally, building knowledge and comfort

over time. The most critical step is to get started – to begin educating clients (and staff) on the role of alternatives, to perform due diligence on available offerings, and to make thoughtful initial allocations. Those advisors who develop competency in alternatives will be able to offer a more compelling value proposition – one that addresses clients’ evolving needs for higher returns, lower correlation, and bespoke opportunities. In contrast, advisors who ignore this movement risk falling behind competitively and delivering subpar outcomes in a world beyond the 60/40 paradigm.

In conclusion, the message is clear: alternative investments are no longer “alternative” – they are essential. For independent RIAs and small family offices, integrating alts is not just an investment decision but a strategic business decision. By embracing alternatives, advisors can better serve their clients and secure their own future in an increasingly challenging wealth management landscape. The case for alternative investments in wealth management rests on a simple idea – to truly excel and endure, advisors must expand their horizons, and there is a rich world of opportunities waiting beyond the traditional asset classes.

Greg Poapst Managing Partner

Fundviews Capital

Fundviews Capital works with asset managers and business operators with in-depth knowledge and expertise in specific asset classes and want to take their business to the next level. Fundviews provides institutional fund structuring and back-office solutions for our partners, allowing them to focus on doing what they do best; asset management. This cohesive relationship creates the perfect environment to scale business to a whole new level.

DAVID KAISER

Methodical Investments LLC

When institutional investors consider the approaches of growth stock portfolio managers they have long recognized two main established schools of thought — those following subjective, fundamentals-based stock selection and those who are numbers analysis-based followers. The latter group contains what might be described as the old school quant based technical analytics approaches — think candlestick and Elliot Wave — and the new school — think high frequency trading and AI / LLM (large language model) modeling.

But what about when it comes to institutional investors considering the approaches of value stock money managers? What likely comes to mind is the subjective-based, bottom-up fundamental stock picking approach, which value managers have long been known to typically follow; and sometimes there can be a top down asset allocation slant added in.

Due diligence vetting of qualitative, subjective-based value investing strategies can prove to be challenging. For institutional investors evaluating value equity managers, portfolio manager decision making as to what constitutes a stock being undervalued versus priced low for good reason, and portfolio construction, can be perceived to be an issue. Investors are too often betting on a specific person (the portfolio manager) or people (investment team), rather than a clearly defined investment methodology. If the team changes, so does the expertise, and ultimately the investment process.

Among the sensible investment process due diligence vetting questions investors may ask themselves are whether the portfolio managers under consideration seem to be simply making a mean reversion case for each holding without having ample detail to support their case on a stock by stock

basis. Also of concern in evaluating fundamental-based portfolio managers can be the siren call of subjective, behavioral biases — anchoring bias, confirmation bias and recency bias, to name a few. These can steer portfolio managers away from making thoughtful, prudent allocation decisions for their portfolios. Many an institutional investor wants portfolio managers to steer clear of allowing emotional bias to creep into their decision making. Also, are the portfolio managers under consideration seeing and explaining themselves as being stock pickers or portfolio managers? (Allocators often prefer those managers whose focus is on the complexion of their basket of holdings, not stocks as ‘onsies’.)

Could there be a different, non-qualitative way of going about value equity investing that might have the potential to lessen such concerns? We believe there is.

We believe there is a different approach value investors can take; one that offers the potential to remove behavioral biases from portfolio management and spot and take advantage of windows of investment opportu-

nity guided by company-specific data.

We believe that a portfolio of value stocks can be selected systematically, based on quantitative rather than qualitative criteria. Further, we believe such an approach has the potential to deliver higher risk-adjusted returns than an appropriate benchmark as well as the potential to outperform it over time.

For this, a proprietary, data-based fundamental analysis approach to value investing is needed. But run how?

In this day and age, when one hears the phrase data-driven investing LLM AI may be what first comes to mind. Feed a large amount of data into a model and see what it might reveal to act on. As investors have found, many investment firms using such technology do not know what factors, weighted how, are driving their AI models to generate trading signals, or identify securities in which to invest. It is a black box even to many of its users. For allocators who desire to understand and buy into an investment strategy’s methodology, and to have consistency in its application, they may question how such an investment process is able to be repeatable.

It is our view that AI modeling is not required. Instead, for a data-based fundamental analysis approach to value investing to be successful an investor should

filter, screen, rank and re-rank companies within the appropriate value universe to identify those possessing what one believes to be the strongest combinations of data-based operating and valuation metrics.

From this, one has the potential to build a long-only equity portfolio of undervalued companies whose stocks may have the greatest price appreciation potential, whether resulting from mean reversion or converting from a value stock to a growth stock.

To achieve this, we believe an investor will need to run a series of muti-factor metrics in order to screen, score, rank and re-rank all of the companies multiple times from multiple perspectives. We understand that even within value investing, different metrics drive price appreciation at different times. That is why a muti-factor metrics analytics approach is required.

By aiming to create a basket of holdings that is attractive by the numbers, we believe this has the potential to keep an investor on target to achieve a satisfactory long-term return objective. For this reason, the aggregate characteristics of the portfolio should be viewed as if they were from those of a one-company portfolio.

Also, while the companies that make up the portfolio are relevant and important, as this style of value investing is more systematic, and subjective-based research and bias are less prevalent, the portfolio should be diversified with enough securities so that a few bad apples do not spoil the bunch. Think about planting an apple orchard. What matters is the health of the orchard and how it relates to the fruit yield. A farmer would not waste time, energy, and other resources to address one dying tree at the expense of keeping the entire orchard healthy.

While due diligence vetting of qualitative, subjective-based value investing strategies can prove to be challenging, vetting of data-based value investing strategies may prove to be easier for sophisticated investors to evaluate. Look for clarity and detail in strategy implementation explanations, both for understanding how

the manager thinks and finding enough methodology structure to decide whether the process is, indeed, a repeatable one (and thereby have a lesser risk of strategy drift). For that, look for those where the characteristics that drive that strategy are readily available and easily shared with investors. Lastly, while valuation is relative, not absolute, the data metrics of a value equity portfolio as a whole should be clear to see and identify the differentiation between a portfolio, its benchmark and competitors.

David Kaiser Managing Partner &CIO Methodical Investments LLC

David Kaiser is the Managing Partner and CIO of Methodical Investments LLC, which he founded in 2022. He has spent over 20 years at an investment management boutique, where he held roles including research analyst, portfolio manager, and senior investment associate.

Methodical Investment, LLC’s intended role within an investor’s total portfolio is to provide capital appreciation potential from exposure to potentially undervalued companies that have, in our opinion, strong operating characteristics.

Our goal in our flagship fund, Method Investments, LP, is to outperform the Russell 2500 Value Index benchmark over a 5-year rolling period, in an attempt to add alpha without adding commensurate risk.

SID GHATAK

Increase Alpha, LLC

In today’s era of accessible computing power and open-source machine learning, many focus on finding the perfect algorithm. But anyone who’s implemented a live equity prediction system knows the real differentiator is feature engineering. This practice—transforming raw, messy data into the optimal inputs for a predictive model—is what separates backtested illusions from real, durable alpha.

There’s a misconception that deep learning will automatically “discover” alpha with enough data. In practice, even the most sophisticated neural networks succeed only with high-quality, context-rich features. Traditional quant models have relied on hand-crafted features—ratios, spreads, indicators, and classifications—built on economic logic and human intuition.

These models offer transparency, but are usually limited in the complexity of relationships they capture.

Deep learning promises to reveal more nuanced, nonlinear dynamics. However, greater flexibility is a double-edged sword: neural nets are prone to overfitting and can be misled by irrelevant patterns if inputs aren’t carefully curated. When it comes to equity prediction, the quality and construction of your features matter even more than the complexity of your model architecture.

Feature engineering is both an art and a science. It means converting vast stores of financial data—prices, volumes, company filings, and alternative sources—into signals a model can effectively use. Well-constructed features capture key financial patterns, like momentum

“Inquantfinance,thesecret isn’tthealgorithm—it’s whatyoufeedit.”

or mean reversion, in a way that’s accessible to a machine learning model. Poorly engineered features introduce noise or lead to overfitting.

Technical features such as moving averages, RSI, and momentum scores create signals from price history. Fundamental features like valuation multiples, profit margins, and leverage ratios ground the model in company realities. Alternative data features draw on news sentiment, web analytics, or satellite counts, offering new sources of edge. Composite features such as principal components or regime indicators combine multiple signals into a more powerful summary. In deep learning, features aren’t just inputs—they’re the scaffolding that allows the model to “understand” the market.

It’s tempting to believe that deep learning models

can uncover every meaningful signal in data on their own, just as neural networks in vision find edges and shapes. In real-world finance, it’s more complicated. Market data is noisy, ever-changing, and typically less abundant than in other fields. The most effective approaches combine engineered features with model-driven insights. The highest-performing strategies blend classic, thoughtfully engineered signals with model-driven transformations, letting deep learning amplify—rather than replace—human expertise.

Signal-to-noise and data-snooping are major pitfalls. Financial markets generate many possible predictors, but only a small fraction have true predictive power. It’s easy to mistake random patterns for real signals— especially without rigorous out-of-sample testing. Many

“winning” factors fail in live trading.

Non-stationarity and regime change are constant threats. A feature that once offered predictive value can lose its edge—or even invert—as market conditions change. The challenge is not just to find the right signals, but to maintain and adapt them as markets evolve.

Complexity and dimensionality can overwhelm a model. More features do not always mean better performance. Too many can lead to overfitting, too few can mean missing critical information. Balancing feature quantity and quality requires systematic reduction techniques and deep experience.

Domain knowledge matters.

Understanding which features make economic sense helps prevent models from chasing irrelevant relationships.

Start with economic logic. Domain knowledge should inform which features to try—such as earnings surprises, momentum, or liquidity.

Reduce redundancy. Use feature selection techniques or dimensionality reduction to avoid overfitting and keep models manageable.

Blend manual and automated engineering. Allow the model to learn from a strong foundation of curated features.