We specialize in private market investments that reflect our investment philosophy: investing where there is a strong demand for our capital, deploying capital to solve problems we understand, and being well compensated for taking risk.

As a leading investment manager since the early days of the space, Kingsbridge brings a wealth of experience and insight to this innovative asset class.

Kingsbridge has been at the forefront of investing in innovative technologies, we believe in helping accelerate these advancements to shape a better future.

https://kingsbridgealts.com/

efoo@kwm.us.com

BY IAN LYNCH alchelyst

Private capital firms have long been lauded for their ability to create value within portfolio companies. By implementing operational improvements, streamlining inefficiencies, and unlocking growth potential, these firms have transformed underperforming businesses into highly profitable enterprises. However, an important question arises: are these firms applying the same principles to their own operations? In other words, are private capital managers looking in the mirror and utilizing the lessons they’ve learned from operational improvements at the portfolio company level to enhance their own asset management companies (AMCs)?

The private capital industry has experienced dramatic growth over the last decade, with many managers doing whatever was required to keep up with the pace of expansion. As the industry matures, now is the time to take stock and ensure that their asset management companies are operationally ready for the challenges and opportunities of the next decade.

This article explores how general partners (GPs) in private capital are leveraging operational insights to optimize their internal operations. We will examine the potential for applying portfolio company strategies to

asset management, the unique revenue and cost challenges facing AMCs, and the opportunities to learn from hedge funds and other more mature players in operational outsourcing.

Private equity and private capital managers have established a robust playbook for driving value creation in portfolio companies. This playbook often includes:

z Streamlining Operations: Identifying inefficiencies in supply chains, processes, or organizational structures and implementing lean methodologies.

z Enhancing Revenue Growth: Developing new products, entering new markets, or optimizing pricing strategies to boost top-line growth.

z Investing in Technology: Modernizing legacy systems, automating processes, and leveraging data analytics to drive better decision-making.

z Strengthening Talent: Building stronger leadership teams and implementing performance-based cultures.

These strategies have yielded significant returns,

creating alpha beyond traditional financial engineering. The question now is whether private capital firms can internalize these approaches to improve their own AMCs.

The revenue potential of a private capital firm varies significantly depending on the asset class it manages:

z Leveraged Buyouts (LBOs): Offer significant upside through performance fees, driven by high returns on equity investments.

z Private Debt: While offering steady cash flows, these strategies lack the same performance fee potential as LBOs.

z Real Estate and Infrastructure: Provide stable, long-term cash flows but come with operational and regulatory complexities.

z Venture Capital: Features high-risk, high-reward dynamics but relies heavily on a few large winners to drive performance. The variability in revenue generation creates a complex financial landscape for GPs, requiring them to manage expectations while diversifying their product offerings.

Private capital firms incur significant costs, particularly as their strategies grow more complex:

z Regulatory Compliance: Navigating global regulatory frameworks requires significant investment in legal, risk, and compliance teams.

z Data and Technology: Implementing advanced analytics and maintaining secure IT infrastructure is expensive but essential.

z Talent: Attracting and retaining top investment professionals and operating partners comes at a premium.

z Fundraising and Investor Relations: Building relationships with limited partners (LPs) and maintaining transparency involves ongoing expenditures. With these challenges, GPs must identify areas where operational improvements can drive cost efficiency and improve margins.

Private capital firms have a wealth of experience improving the operations of their portfolio companies. Translating these lessons to their own businesses requires introspection and a willingness to adopt best practices internally. Key areas where GPs can drive operational improvements include:

Just as portfolio companies are encouraged to embrace data analytics, AMCs can benefit from improved data utilization:

z Investor Analytics: Using data to better understand LP preferences, predict fundraising trends, and tailor investment products.

z Performance Monitoring: Implementing dashboards that provide real-time insights into fund performance and operational metrics.

z Operational Efficiency: Using analytics to identify bottlenecks in internal processes and streamline workflows.

Private equity firms often restructure portfolio companies to align incentives and improve accountability. Applying similar principles internally can yield benefits:

z Performance-Based Incentives: Aligning compensation structures with firm-wide objectives to drive results.

z Upskilling and Reskilling: Investing in training programs to enhance the capabilities of existing teams.

z Organizational Clarity: Redesigning roles and responsibilities to eliminate redundancies and improve collaboration.

Portfolio companies frequently modernize their technology stacks to gain a competitive edge. GPs can do the same by:

z Automating Manual Processes: Reducing administrative burdens through workflow automation.

z Enhancing Cybersecurity: Protecting sensitive investor data with robust IT security measures.

z Leveraging AI and Machine Learning: For tasks such as investment screening, risk analysis, and LP reporting.

4. Cost Management and Outsourcing

Just as portfolio companies optimize cost structures, AMCs can explore cost-saving measures, including:

z Shared Services Models: Centralizing functions like HR, IT, and compliance across funds to achieve economies of scale.

z Outsourcing Non-Core Activities: Delegating functions like fund administration, tax, and accounting to third-party providers.

z Vendor Management: Renegotiating contracts with service providers to secure better terms.

5. Cultural Transformation

Cultural alignment is often a focus during portfolio company turnarounds. Private capital firms can benefit from fostering a culture of innovation and continuous improvement within their AMCs:

z Empowering Teams: Encouraging bottom-up feedback and innovation.

z Promoting Diversity: Building diverse teams that bring varied perspectives to problem-solving.

z Fostering Agility: Creating a mindset that embraces change and experimentation.

Hedge funds, which have operationally matured earlier in many respects, offer valuable lessons for private capital managers seeking to improve their operations. Hedge funds have embraced outsourcing for decades, allowing them to focus on their core competency—generating alpha. Key takeaways include:

1. Focus on Core Competencies

Hedge funds often outsource non-core activities like fund administration, IT, and compliance. This enables them to:

z Reduce overhead costs.

z Access specialized expertise.

z Scale operations efficiently as assets under management (AUM) grow.

Private capital firms can adopt similar practices to streamline their operations while maintaining focus on investment activities.

2. Technology-First Approach

Hedge funds have been early adopters of technology, leveraging advanced trading systems, data analytics, and risk management tools. Private capital firms can emulate this approach by investing in technologies that:

z Enhance deal sourcing and due diligence.

z Improve portfolio monitoring.

z Facilitate LP communication and reporting.

3. Operational Resilience

Hedge funds have built resilient operational models that can withstand market volatility. Private capital

firms can achieve similar resilience by:

z Diversifying revenue streams across asset classes.

z Building scalable processes that adapt to changes in fund size and structure.

z Maintaining strong liquidity management practices.

Private capital firms are uniquely positioned to apply the lessons learned from portfolio company turnarounds to their own operations. By focusing on data-driven decision-making, technology adoption, cost management, and cultural transformation, GPs can build best-in-class AMCs that deliver superior returns for investors while maintaining operational excellence.

z Benchmark Performance: Regularly assess internal operations against industry best practices to identify improvement opportunities.

z Invest in Technology: Prioritize investments in automation, analytics, and cybersecurity to drive efficiency and innovation.

z Adopt Outsourcing Strategically: Leverage third-party providers for non-core functions to reduce costs and improve scalability.

z Align Incentives: Ensure that compensation structures and organizational goals are aligned to foster a performance-driven culture.

z Learn from Others: Study the operational strategies of hedge funds and other asset managers to adopt proven practices.

By looking in the mirror and embracing continuous improvement, private capital managers can unlock new levels of profitability and operational excellence. Just as they have transformed their portfolio companies, they can transform their own businesses—creating value not only for investors but also for their organizations.

alchelyst is a growing fund administration business catering to Alternatives established in Ireland in 2023. The business is led by Joan Kehoe, Ian Lynch and Brian Fitzgerald.

Ian Lynch Founder and CCO alchelyst

Private market alternatives have evolved from niche investment vehicles used by institutions into a core component of diversified, resilient portfolios. High-net-worth individuals (HNWIs), family offices, and Registered Investment Advisors (RIAs) increasingly integrate these assets to align with and satisfy financial goals.

The size and depth of the private market are driving the high interest and rapid adoption of alternative investments. As the number of publicly listed companies has declined almost consistently for three decades, the value of the private markets has grown. Moreover, those companies that go public tend to do so later and at higher valuations.

The takeaway is this: high-growth innovation businesses have historically built significant value within the private market. Investors who limit their portfolios to publicly traded assets likely miss out on interesting

opportunities for value creation and growth potential.

The number of companies growing value in the private market is currently over six times more than in the public sector. Using a general metric of company maturity as a framework, the number of public companies with annual revenues exceeding $100M in the U.S. is 2,800. Comparatively, the number of private companies of that size is 19,000. Many of those private businesses are in disruptive sectors (e.g., healthcare technology, cybersecurity, etc.), making them valuable to longevity-minded investors seeking involvement in the innovation economy.

As a whole, the private market can deliver stronger risk-adjusted returns and lower volatility than traditional stocks and bonds. Within the asset class, there is an

impressive 20,000+ types of investment vehicles. Each provides a specific potential for access, diversification, risk, liquidity, return potential, and flexibility. That scale, scope, and variety give investors and their advisors almost unlimited potential to build a diversified portfolio that meets their goals.

The argument for integrating alternatives is simple, and most advisors are increasing private market allocations within their client portfolios (or plan to soon). Moreover, the client base exists – thanks to innovative vehicles like Evergreen funds, which are open to unlimited numbers of accredited investors, the private market is open to approximately 4.3M Americans. Alternatives offer advisors ways to capture this large pool of potential clients and build their business and competitive advantage through bespoke strategies and care.

While it’s simple to explain why integrating alternatives is valuable, many investors and advisors have questions about how. How do private alternatives perform? How do they reward illiquidity? And how should investors integrate the assets into an existing portfolio – particularly one that still employs a traditional 60/40 stock/bond mix?

Answering these questions is key to unlocking the strategic value of the private market.

Historically, the private markets have helped to deliver strong, stable performance relative to risk. Many public market asset classes are impacted by value swings due to factors like algorithmic trading practices, shortsighted shareholder behavior, and macroeconomic

factors. Because private market portfolio managers typically take a longer-term, active approach to monitoring their companies, the integration of private market assets can elevate their resilience and long-term value creation.

Because private market alternatives reduce portfolio correlation to public markets, they can help diversify portfolios while seeking to reduce risk. Private assets often maintain stability during public market downturns as company valuations aren’t moving on a minute-by-minute basis, providing a hedge against broader economic uncertainty. Diversification that includes a mix of private equity and private credit can be a reliable way to drive capital appreciation through value creation in portfolio companies (equity) while generating reliable cash flow through interest income (credit).

Besides being more stable, private equity, private credit, and real estate investments typically generate better risk-adjusted returns than public stocks and bonds over time because of their (estimated) rates of return. For example, private equity funds had a median annualized return of 15.2% over the past decade, outperforming global public equity portfolios, which returned about 7.0% annually. In large part, this benefit can be attributed to the active value creation and board representation of private equity managers in their portfolio companies, the ability to execute their strategy without the wild fluctuations in the share price, and the illiquidity premium.

The long-term nature of private market investments reiterates the value of capable, involved fund managers. Alternatives require rigorous underwriting processes to ensure high-quality deal flow and lower downside risks. Ongoing monitoring is equally critical.

Fund managers actively oversee portfolio companies, adjusting strategies to preserve capital and maximize returns over a decade or more.

Liquidity is a primary concern because alternatives typically require investors to lock up capital for an extended period. Innovative structures like Evergreen funds are solving these challenges with a perpetual capital structure that gives high-potential companies sufficient time to build value and allows investors to balance long-term growth with scheduled liquidity windows. These features allow investors to benefit from compounding returns while managing liquidity needs (e.g., 40 Act Funds, Interval Funds, and BDCs).

In some cases, investors can request redemptions, helping to align with specific goals instead of the fund manager dictating liquidity. The allowance benefits the fund manager, as they can execute their strategy and provide liquidity without disrupting underlying investments. And it empowers RIAs to partner with their clients over many years, helping them to generate income and grow the value of their portfolio in ways that meet their evolving goals.

Across the broader private market, the value of alternatives has gained momentum over the past decade. The rate of growth for Evergreen funds has outpaced this impressive progress. Assets under management (AUM) for this asset class more than quadrupled to $430B in the past 10 years (representing a CAGR of approximately 15.6%). The adoption of the Evergreen class has been driven by assets like 40 Act Funds, Interval Funds, and BDCs, all of which improve ease of access for private market investors and reduce frictions common to more traditional private market investment vehicles. These funds are distinctly able to deliver on the best features of alternatives – greater potential to capture the benefits of a diversified portfolio, structured liquidity options, capital preservation.

Evergreen funds are some of the most widely used private market investment vehicles. Regulated under the Investment Company Act of 1940, they provide a high level of transparency, including regular reporting, governance oversight, and detailed disclosures. These protections make these funds an accessible and trusted choice for investors entering private markets.

Evergreen funds offer several distinct advantages, depending on whether they are equity or credit strategies. Building both types into a portfolio mix enables investors and their advisors to capture the benefits of both structures.

z Evergreen Equity funds generate long-term growth and opportunities to capture the benefits of compounding by focusing on building and improving high-impact innovation companies in promising sectors.

z Evergreen Credit funds seek to provide private senior-secured loans to middle-market companies and above, generating public equity-like returns at the top of the capital stack.

Because Evergreen funds have a perpetual capital structure and tend to be long-term, they tend to add new portfolio companies while exiting other positions. Rather than capital calls, they often offer monthly or quarterly admittance with full funding at close and liquidity features (e.g., quarterly, semi-annual, or annual opportunities to redeem capital). The structure balances growth, capital generation, and access to a diversified portfolio. For the fund managers, the necessary oversight supports lasting relationships and business growth.

One of the most notable benefits of Evergreen funds is how they are designed to widen access for individuals and households that qualify as accredited and

above. Traditional private funds typically have prohibitively high barriers to entry ($250k minimum and often exceed $10M). Evergreen funds change this dynamic by providing accredited investors with structured access to the private market at substantially lower minimums (typically $25k-$250k).

Accredited investors are those who meet specific financial criteria, such as earning an annual income of $200,000 (or $300,000 jointly with a spouse) in the last two years with the expectation of maintaining it, or having a net worth exceeding $1 million, excluding the primary residence.

For accredited investors, family offices, and other HNWIs, Evergreen funds offer a strategic pathway to capture historical outperformance and consistent yield generation. SEC oversight ensures robust reporting, governance, and investor protections, helping to mitigate risk. The perpetual nature of the funds tends to appeal to more mature businesses, which helps to reduce the J-curve for investors because many of the companies have already gained traction and scale. Rather than allocating a large amount of capital to one manager, many Evergreen fund investors gain access to multiple managers (e.g., direct, fund-of-fund, multi-strategy funds), which adds another level of diversification to dampen volatility and reduce risk.

Integrating Evergreen funds requires a disciplined approach that considers how the alternatives complement a client’s broader portfolio strategy and support their goals, growth and allocation needs, and risk tolerance.

z Assess Client Objectives: Begin with a clear prioritization of growth, income generation, and capital preservation, then identify the vehicles that align with those goals.

z Determine Allocation Size: As advisors evolve the asset allocation of their investment portfolios from

traditional 60/40 mixes to 50/30/20 (public stocks, public fixed assets, and alternatives), the actual percentage breakout should reflect the client’s specific goals.

z Emphasize Liquidity Planning: Evergreen funds have varying liquidity characteristics that allow managers to meet their clients’ needs. Those redemption features can help determine the types of Evergreen fund(s) to integrate and the exact portfolio construction of fund managers to ladder their private market liquidity.

z Leverage Tax Efficiency: Evergreen fund distributions can be tax-advantaged, which allows RIAs to determine which custodians and account type (qualified or non-qualified) to use to help their clients maximize after-tax returns.

z Support Portfolio Reporting and Client Engagement: SEC regulations have injected high levels of transparency into Evergreen fund monitoring and reporting. This consistency and clarity support client trust and alignment over a long-term partnership.

With the benefits that the private market, alternatives, and assets like Evergreen funds offer over what is available to investors through the public market, it’s no surprise that 90% of RIAs say they will increase the allocation of alternatives within their clients’ portfolios by 10-15% over the next five to ten years. For advisors, this asset class offers critical levers to pull to grow their businesses and compete in a rapidly consolidating marketplace. For investors, they are essential to resilient, bespoke, growth-focused portfolios that can support their long-term goals.

For more information about BIP Ventures Evergreen BDC,including features and associated risks,visit BIP EvergreenFunds.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.Investors should consult their advisors and review all relevant ma-

1Private Market Investing: Staying Private Longer Leads to Opportunity, Hamilton Lane, April 2022. Performance of private markets varies, and past performance does not guarantee future results.

2How to Invest in Alternative Assets, JP Morgan, April 2024

3Podcast Episode 10: Democratizing Alternative Investments with Guest Matt Brown of CAIS, Alternatives by Franklin Templeton, May 7, 2024

4Special Study: 2023 Report on the Review of the Definition of “Accredited Investor,” Securities and Exchange Commission, 2023

5Special Study: 2023 Report on the Review of the Definition of “Accredited Investor,” Securities and Exchange Commission, 2023

6Historical Performance of Private Equity, Private Equity List, November 2024. These figures are estimates and subject to market fluctuations and individual fund performance.

7Regulated under the Investment Company Act of 1940, Evergreen funds offer transparency, governance, and regular reporting. These features make them accessible and trusted options for entering private markets. Evergreen funds’ structures can involve limited liquidity and require disciplined planning to align with investor goals.

8The Future is Evergreen: The Next Generation of Private Market Funds, iCapital, January 2024 Integration strategies must account for market-specific risks and align with regulatory compliance. 9Integration strategies must account for market-specific risks and align with regulatory compliance.

10CAIS - Mercer Survey Finds Advisor Demand Accelerating for Alternative Investments, CAIS, 2023

11The Case for Integrating Private Market Alternatives, BIP Capital, 2024

12Podcast Episode 10: Democratizing Alternative Investments with Guest Matt Brown of CAIS, Alternatives by Franklin Templeton, May 7, 2024

Phil Davidson Managing Director BIP

For investors seeking to capture this tremendous value potential, alternatives are essential. These assets provide varying levels of diversification, resilience, and risk-adjusted returns that often far outpace what is possible via public market vehicles

Within alternatives, evergreen funds offer an advantageous combination of compounding growth, structured liquidity, and reduced volatility. These funds provide long-term exposure to high-impact companies while maintaining flexibility for investors.

The BIP Ventures Evergreen BDC brings these advantages together, offering a streamlined way for investors and advisors to capture private market opportunities. Learn more: www.bipevergreenfunds.com

BY MICHAEL BRICE

BW Cyber

CrowdStrike’s recent outage sure got the tech world talking about the risks associated with a global supply chain cyberattack. Their stock certainly took quite a hit, and the long-term financial ramifications won’t be fully understood for years. And to be clear, the CrowdStrike outage was not a cyberattack, so if you had hoped your cybersecurity insurance “Contingent Business Interruption” coverage was going to cover

your losses – you’re out of luck (we will talk about cyber insurance coverage in the future, but be aware: if you’re an asset manager your policy is probably NOT covering you like you think it is). No, this was a ‘software release’ mistake of epic proportions affecting 8.5 million Microsoft Windows devices worldwide and causing billions of dollars in losses.

That’s a pretty big oopsy!

But why am I, a cybersecurity consultant, mentioning this when this was not a cybersecurity incident? It wasn’t phishing, it wasn’t malware – just a genuine human error in an update file that caused Windows machines to go offline.

Well, the cynic in me is concerned that this event could lead to greater oversight (more like overreach) of the tech sector by the U.S. government – a general regulatory overreach culminating in more cybersecurity regulations due to concerns about a potential “Cyber 9/11”.

While a Cyber 9/11 is a valid concern, so are additional federal regulations. We already have the Federal Risk and Authorization Management Program (FedRAMP) as well as the Cybersecurity Maturity Model Certification (CMMC) program. If you are not familiar with FedRamp, it is a United States federal government-wide compliance program that provides a standardized approach to security assessment, authorization, and continuous monitoring for cloud products and services. CMMC extends cyber requirements to commercial vendors supporting the government. Could this type of regulation be extended to commercial tech industry at large?

I hope not, because I don’t believe that the government is going to be able to make IT any less risky. After all, we continue to hear and see day after day that the US government has been hacked and our personal records are compromised by criminals – taken from the very people who may want to put additional reg-

ulations on private industry. And we already have the SEC with their cybersecurity regulations as well (yes, the SEC has also been hacked). And candidly, from a purely capitalistic perspective, the threat of billions of dollars of market capital loss due to an outage of the magnitude that CrowdStrike suffered is much more of a deterrent than a government fine. I think I’ve made my position clear: I am concerned and clearly against any type of governmental regulatory knee-jerk reaction to the CrowdStrike outage.

So why then am I writing about CrowdStrike?

It’s because most people are aware of the CrowdStrike outage even if they have never heard of MDR (Managed Detection and Response) or were not affected. It became the ‘shiny object’ news event that everyone heard about. But what about the billions of dollars lost every year in the US to oversees cyber wire fraud? Why aren’t we talking about that?

Well, I am, I have been, and I will continue to do so. It’s a national threat and it needs attention. Moreover, while CrowdStrike may have resulted in billions of commercial losses, at least those funds didn’t go to support organized crime and possibly global terrorism. I can not say the same for overseas wire fraud. According to the FBI’s IC3.gov reporting, cyber wire fraud financial losses incurred each year are much greater than the CrowdStrike event. Moreover, there is the very likely possibility this stolen money is ultimately funding global terrorism directed at the U.S.

I’m concerned. And to make matters worse, there is no U.S. government organization who has had Congress put their ‘finger’ in that organization’s proverbial belly button with the mandate: “You are responsible to address Cyber Wire Fraud and help the American people when they are attacked”.

If you read my blogs, you know I’ve written about cyber wire fraud quite extensively. I also speak about cyber wire fraud at conferences across the U.S. most months to help educate hedge fund managers, and private equity fund managers about the financial risks posed by this extremely impactful crime. My summary is always the same: You most likely cannot procure enough Cybersecurity Insurance and/or a Financial Institution Bond (e.g., a Crime Policy) coverage to protect you against the potential for yber wire fraud. Why? Because the crime is so prevalent that the insurance industry has sub-limited this coverage due to the high likelihood of a successful attack. So, if or when you are attacked and suffer a cyber wire fraud loss – you will struggle mightily to get assistance to recuperate the funds. Why? Because there is no single commercial or governmental organization responsible to help you get your funds back. Good luck. Perhaps you can get help from the Secret Service, the FBI or even your local sheriff. I’m not being sarcastic. Getting cyber wire fraud assistance to recover funds in the tens of thousands, hundreds of thousands or even in the millions of dollars is potluck at best. I know this first hand, having led scores of wire fraud forensic investigations. The recovery rate is about 10% and it always involves government individuals who get involved because they care – not because they have a legal mandate. If you’ve ever been the victim of a cyber wire fraud you know very well what I am saying.

So, if the government is spurred by the media and politics to do “something cyber related” as a result of the CrowdStrike non-cyber event, I want to use this event as a platform for Congress to address cyber wire fraud. With that goal in mind, I am currently engaged in preliminary discussions with the staff of Congressman Andrew Garbarino of New York’s 2 nd district. He is a Member of the House Homeland Security Committee and Chairman of the Subcommittee on Cybersecurity and Infrastructure Protection. I’m quite impressed that he seems to understand the magnitude and threat posed by cyber wire fraud and the lack of organizational responsibility mandated by Congress to help support the American public, and American commercial industry to respond to these attacks and prevent these funds from making their way to global terrorists.

In summary, I believe the squeaky wheel gets the oil in politics. Cyber wire fraud is a multi-billion-dollar issue which may well be funding global terrorism. And yet there is not a single government agency that is federally funded or mandated to report to Congress with the primary goal to defend and protect Americans against wire fraud. Generally, unless you identify the fraud within approximately 3 business days, the odds are not in your favor of getting your money back – odds that diminish every day that goes by after day 3. I’m not trying to dismiss the impact of the CrowdStrike ‘oopsy’. Instead, I truly hope that the U.S. government doesn’t use this issue as an excuse to justify more regulation and rules on tech providers. Our government’s focus should be on helping businesses to combat cyber wire fraud and stop the loss of billions of dollars going overseas to criminals.

Michael Brice Founder and President BW Cyber

BW Cyber is a full service cybersecurity vendor providing comprehensive technology security solutions and related cybersecurity regulatory compliance packages for the Asset and Wealth Management Industry.

BY BRIAN TAYLOR & ERRYN BARKETT

In the dynamic and ever-evolving world of finance, access to timely and flexible funding can mean the difference between success and failure. Private funds specializing in short-term bridge lending offer a commonsense approach, velocity, and execution to borrowers in need of capital. This article delves into the operational mechanics of such private funds, the scenarios where short-term bridge lending becomes indispensable, and the broader significance of private credit in today’s economy.

Bridge lending, often referred to as interim or gap financing, is designed to provide quick, short-term loans to bridge the gap between more permanent financial solutions. These loans are typically secured by collateral, such as real estate or other hard assets, and are intended to be repaid within a short timeframe, usually ranging from a few months to a year.

Private funds that specialize in this type of lending operate outside of the traditional banking system. They are not subject to the same regulatory constraints as banks/credit unions, allowing them to offer more flexible terms and faster approval processes. This agility is crucial for borrowers who need immediate access to funding to capitalize on opportunities.

A private bridge lending fund pools capital from investors to finance short-term loans. These funds are managed by professionals who assess the creditworthiness of borrowers, the value of the collateral, and the viability of the exit strategy for each loan. Here’s a deeper look at the mechanics:

z Capital Pooling: Investors commit capital and subscribe to the fund, which is then used to finance loans. This capital can come from various sources, including high-net-worth individuals, family offices, institutional investors, and individual investors.

z Loan Origination: The fund managers identify potential borrowers who need short-term financing. These borrowers could be real estate developers, investors growing a real estate portfolio, borrowers that specialize in flipping houses, and businesses in need of purchasing hard assets.

z Risk Assessment/Underwriting: A thorough evaluation of the borrower’s credit worthiness, the collateral’s value, and the exit strategy is conducted. The goal is to ensure that the loan can be repaid within the agreed timeframe.

z Disbursement and Monitoring: Once approved,

funds are disbursed to a closing agent: Title Company or Attorney. In some instances, funds may be disbursed directly to the borrower. The fund managers closely monitor the loan to ensure compliance with the terms and to mitigate risks.

z Repayment and Distribution: Exit strategies will differ depending on the project. Upon repayment, the capital is returned to the fund, along with interest and fees. These returns are then reinvested or distributed to the investors, minus the management and performance fees (if applicable).

Bridge lending is particularly valuable in scenarios where time is of the essence, and traditional financing options are either unavailable or too slow. Some common use cases include:

z Real Estate Transactions: Developers and investors often use bridge loans to quickly acquire properties or refinance existing debts while waiting for long-term financing. This is especially common in competitive real estate markets where delays can result in lost opportunities.

z Business Expansion: Companies needing immediate capital for expansion, acquisition, and to fuel growth might turn to bridge loans. These loans provide the necessary funds to seize growth opportuni-

ties without waiting for lengthy approval processes.

z Auction Purchases: Buyers looking to purchase assets at auctions often require quick access to funds. Bridge loans can be arranged swiftly, enabling buyers to meet the payment deadlines and secure their desired assets.

Private credit, including bridge lending, has gained significant traction in recent years. Its importance stems from several key factors:

z Flexibility: Private lenders are not bound by the same regulatory constraints as banks and credit unions. This allows the fund to offer more flexible terms, customize loans to meet specific borrower needs, and provide rapid approvals.

z Access to Capital: For borrowers who do not meet the stringent criteria of traditional banking guidelines, private credit provides an alternative source of funding. It is also worth noting that the banking climate changes for each individual bank and credit union. Traditional financial institutions are bound to certain concentration limits that may disallow future lending in certain areas of their portfolio i.e. 1-4 family, multi-family, real estate development, and C&I. This is particularly important for small

and medium-sized enterprises (SMEs) and entrepreneurs who may lack the credit history, collateral required by banks, or the strategy implemented does not fit into traditional lending requirements.

z Market Efficiency: By providing quick access to capital, private credit enhances market efficiency. It enables businesses to act on time-sensitive opportunities, which can drive economic growth and innovation.

z Risk Diversification: For investors, private credit offers a way to diversify their portfolios. The returns provided by private funds are uncorrelated with traditional asset classes, providing a hedge against market volatility.

While private bridge lending funds offer significant advantages, they are not without challenges and risks:

z Credit Risk: The primary risk is that borrowers may default on their loans. To mitigate this, funds must conduct thorough due diligence and maintain a diversified portfolio of loans.

z Liquidity Risk: Bridge loans are typically illiquid, meaning that investors may not be able to access their capital until the loan is repaid. This requires careful liquidity management.

z Regulatory Risk: Although private lenders are less regulated than banks, they must still comply with certain legal and regulatory requirements. Changes in regulations could potentially impact the operations of these funds.

z Economic Cycles: The performance of bridge lending funds can be affected by economic cycles. During downturns, the risk of borrower defaults may increase, and the value of collateral may decrease.

Examining real-world examples can provide a better understanding of how bridge lending functions in practice. Below are a few illustrative case studies:

z Real Estate Acquisition – Investment Property: Real estate investors will utilize quick capital access to purchase deals with “cash”. The borrowers will then add value to the properties through renovation, and then will seek permanent financing.

z Real Estate Acquisition – Fix & Flip: Real estate investors have utilized quick capital access to purchase deals with “cash”. This typically means that they have purchased the property well below market value. The borrowers will then take the distressed properties and add value through renovation. The properties will then be listed for sale on the MLS

for a variety of different buyers including: first-time home buyers, buyers downsizing or in some cases move into a larger home, or a different location.

z Real Estate Development – New Construction: A real estate developer went to a local bank to obtain a new construction loan for a spec build. The bank was at its concentration limit even though the borrower was well-qualified. A private bridge lending fund stepped in, providing a short-term loan that enabled the developer to start construction. The project proceeded without interruption.

z Real Estate Development – Historical Redevelopment: A real estate developer specializing in historical redevelopment was in the process of converting an old manufacturing plant to an apartment complex with a craft brewery on site. An integral part of this process is state and federal tax credits along with project grants. A private lending fund provided a short-term loan that enabled the devel-

oper to continue project and proceed without interruption. The fund was ultimately repaid with the syndication and sale of the Historical Tax Credits.

z Business Capital: Private lending funds have provided capital for companies to expand operations including purchase/refinance of vehicles, equipment, and other hard assets. Private funds provide expedited timing and the necessary funds to allow companies to grow.

z Auction Acquisition: An entrepreneur identified a lucrative opportunity to purchase a fix and flip house at an auction. However, the borrower needed immediate funds to close on the property (30 days). A private bridge lending fund quickly approved the loan, enabling the borrower to acquire the asset well below market value.

The regulatory environment for private credit and bridge lending varies by jurisdiction. While these lenders are not subject to the same stringent regulations as banks, they must still comply with certain legal requirements designed to protect investors and ensure fair lending practices. Understanding the regulatory landscape is crucial for both lenders and borrowers.

z United States: In the U.S., private lenders must adhere to federal and state regulations, including the Securities Act, which governs the offer and sale of securities, and the Dodd-Frank Wall Street Reform and Consumer Protection Act, which introduced new financial regulations following the 2008 financial crisis.

The future of private credit and bridge lending is shaped by several emerging trends:

z Technology and Innovation: Advances in technology are transforming the private lending landscape. Fintech platforms are streamlining the loan origination and approval processes, making it easier for borrowers to access funds quickly. Blockchain technology is also being explored for its potential to enhance transparency and reduce fraud in lending transactions.

z Regulatory Changes: The regulatory landscape for private credit is continually evolving. Policymakers are seeking to balance the need for investor protection with the desire to promote innovation and market growth. Staying ahead of regulatory changes is crucial for private credit funds to remain compliant and competitive.

Private funds specializing in short-term bridge lending play an essential role in the financial ecosystem. They provide a vital source of capital for borrowers in need of immediate financing solutions, enabling them to seize opportunities. The flexibility and accessibility of private credit make it an indispensable tool for many businesses and individuals.

However, like any financial product, bridge lending carries inherent risks that must be carefully managed. Investors in these funds should be aware of the potential challenges and work with experienced fund managers who can navigate the complexities of this specialized lending niche.

In summary, the rise of private credit and bridge lending underscores the evolving nature of the financial landscape. As traditional banking institutions tighten their lending criteria, private lenders step in to fill the gap, providing crucial support to those in need. This symbiotic relationship between borrowers and private lenders not only drives economic growth but also fosters innovation and resilience in an ever-changing world.

Written by Brian Taylor and Erryn Barkett of C4T, LLC, a Private Fund Manager, focused on income generating strategies like short-term bridge lending.

Cybernetix Ventures is focused on advancing robotics and industrial AI by addressing critical gaps in early-stage funding. The firm’s approach combines deep industry expertise with a clear focus on supporting founders, delivering strong returns, and fostering growth across construction, logistics, manufacturing, healthcare, agriculture and climate. By investing in hardware-software solutions and prioritizing a use case-focused approach to robotics, Cybernetix Ventures helps startups build scalable businesses with lasting impact. With its growing portfolio and commitment to the robotics community, Cybernetix Ventures is well-positioned to drive meaningful progress in industrial innovation.

Fady Saad is the Founder & GP of Cybernetix Ventures and Co-founder of MassRobotics, the first and largest robotics & AI startup escalator in the world. This Q&A discusses Cybernetix Ventures and strategies for driving the next wave of industrial innovation.

Q: How did Cybernetix Ventures start, and what challenges did you see in the venture capital space for robotics companies?

Fady Saad: Cybernetix was launched in 2021 as a response to a noticeable gap in venture capital funding for early-stage robotics companies. What we realized is that VC investments were either heavily skewed toward consumer or enterprise SaaS or tough tech like biotech—robotics didn’t fit neatly into either category. Robotics combines elements of both software and hardware, and many VCs were either unprepared or unwilling to take on this hybrid challenge. This is why we have been advocating for robotics as its own investment class, one that requires a unique set of financial models, milestones, and support structures.

Our focus was to address this gap by investing in early-stage companies, specifically at the pre-seed, seed, and Series A stages. Evaluating early-stage robotics companies can be particularly tricky, especially without revenue to assess. But we believed that by starting from

the ground up, in very specific verticals of manufacturing, logistics, construction, and healthcare, and later expanding into agriculture and climate tech, we could build a portfolio of companies ready to scale in sectors that would be the first to embrace robotics solutions.

Q: What are some misconceptions about robotics investments that VCs should understand?

FS: One of the biggest misconceptions is the idea that investing in robotics will play out like investing in software, particularly SaaS. That’s simply not the case. While robotics is no longer as capital intensive as it used to be, the timing of funding rounds is different—it’s not uncommon to see multiple Series A rounds. The sales cycle for robotics, especially in B2B markets like manufacturing or logistics, can take anywhere from three to twelve months. This is a far cry from the quick SaaS subscription models that investors are used to.

However, once a robotics solution is in place, it’s very sticky. The churn rate is far lower compared to software, and companies have additional revenue streams from things like services, spare parts, and consumables. So, while robotics requires a shift in mindset for investors, those who understand the long-term value stand to benefit greatly. Intuitive Surgical is a great example of these dynamics and the multiple revenue streams that

can be built on top of a robotics platform.

Q: What advice do you give to startups about balancing robust hardware with scalable software?

FS: One of the key pieces of advice we give startups is to stay laser-focused. The most successful companies are those that have identified a specific problem to solve and are clear about who their target customers are. The danger is in trying to create a generic platform that can do everything. It’s much better to focus on solving one problem exceptionally well. Once you’ve achieved product-market fit and are generating revenue, only then should you consider expanding to adjacent product lines. In the early stages, with limited resources, spreading yourself too thin can lead to failure.

Cybernetix Ventures is an early-stage venture capital firm leading the way for investments into robotics, automation, and industrial AI startups. Headquartered in Boston, Cybernetix connects its portfolio to national and global robotics ecosystems, bringing unparalleled expertise to companies poised to make major impacts in large, essential sectors – manufacturing, logistics, construction, healthcare, climate and agriculture. The firm’s portfolio encompasses 20 investments across North America and Europe.

Cybernetix is committed to delivering on three pillars of value: exceptional support for founders, phenomenal returns to LPs, and impactful ecosystem leadership for robotics communities. Cybernetix is led by Fady Saad and Mark Martin, who have 50 years of combined robotics technologies, operations and investing experience, and supported by executives from iRobot, Kiva/Amazon Robotics, Flagship Ventures, Locus Robotics, Tufts University, and Cummings Foundation. The firm pioneered Robotics Invest, an annual summit where top founders, investors, and business leaders in robotics come together to build the next wave of robotics unicorns. Robotics Invest includes two days of insightful knowledge sharing, featuring keynote speeches, dynamic panels, interactive roundtables, and unparalleled networking opportunities.

Fady Saad Founder & GP of Cybernetix Ventures and Co-founder of MassRobotics

BY HANK BOUGHNER

Historically, investors navigating private markets and the alternatives ecosystem have had to rely on relationships, intuition and broad segment strategies to make critical decisions, gleaning what they could from limited specific company and fund information. By necessity, the art and science of dealmaking was tilted more heavily toward the art: being in the know, timing, vision and sensing opportunity. Only those with significant deal volumes could piece together enough relevant information for data-backed dealmaking.

However, the landscape for dealmaking “science” has been changing recently, moving the universe of data availability and transparency in private markets somewhat closer to its public counterpart. Though significant gaps still, and likely will always, remain, investors are reevaluating how to best approach this asset class amid new streams of data that are leveling the playing field and driving new opportunities.

Trends Accelerating Private Investment Data Transparency

The private investment landscape is undergoing a significant shift as data transparency becomes a crucial factor in decision-making. Despite a history that’s been characterized by limited visibility, the private markets information landscape is changing at a rapid pace. As such, investors seek—and are coming to expect—more granular, reliable data as they navi-

gate increasingly complex markets.

Here are four key areas driving this evolution:

1. Institutional Investors Amassing Proprietary Data: Institutional investors now have decades of exposure to private markets, enabling them to build vast repositories of proprietary data from their investments. Consider how Yale University analyzed its alternatives investing history to create the Yale Endowment Model, now a benchmark that informs the investment strategies and capital deployment models of institutional investors. As more institutional investors adopt similar strategies, the effect ripples through the industry; they also come to expect greater transparency from private investment firms.

2. Specialized Global Data Providers: As financial markets have become increasingly complex and globalized, a specialized industry for alternatives data has emerged. Data firms, such as Preqin and others, have been able to leverage advancing technology to collect, aggregate and analyze global data across asset classes. This data offers deeper insights into private markets and helps investors better understand more complicated investment landscapes.

3. Data Aggregators For Private Companies: The trend toward increasingly specialized data is becoming even more granular as data firms become more adept at mining and processing data from various sources. It has created the ability for data providers to develop new products and services that include the ability to obtain more detailed data on individual pri-

vate companies. Investors are using it to conduct more rigorous due diligence and risk assessments.

4. The “Retail-ization” Of Private Markets: Private investments have been largely out of reach for everyday investors due to high investment minimums and the complexity of accessing these opportunities. But, global investments firms like Blackstone are at the forefront of making previously exclusive investments available to a broader range of investors. The retail-ization of private markets has yielded new platforms and investment products that allow individual investors easier access to private equity and real estate funds without minimum investment requirements or lock-up periods. Marketing these products to retail investors requires greater disclosure so they can make informed decisions.

Much of the data conversation tends to reflect its ever-growing volume, but the velocity of data is a particularly exciting area of growth in private markets. Even if it’s not always “real-time,” the visibility and data refresh rates are making information more actionable. The faster accumulation and processing of data from diverse sources is giving investors a quicker and deeper understanding of sector performance and individual companies. Deal cycles are speeding up as these insights are applied to uncover and decide on opportunities more rapidly. The ability to react swiftly to changing conditions offers a critical competitive edge in the increasingly dynamic investment landscape.

What’s more, this data begets more data. As firms continually feed new data into their analytics models, they generate more robust insights. Accumulating data points from past deals, sector performance and market conditions enable investors to identify trends and patterns more adeptly. The ability to track and compare variables such as deal sizes, valuations or sector-specific benchmarks allows firms to fine-tune their strategies and make data-backed adjustments.

Data transparency in private markets is increasing,

but it will likely never resemble the level of disclosure seen in public markets. This shouldn’t be the goal, as both serve distinct purposes in the financial ecosystem. Together, they achieve a balance that supports diverse capital needs, and gives private companies greater flexibility to innovate, grow and build value for investors.

However, as investors and regulators push for more transparency in private markets, visibility is increasing in ways that allow investors to navigate private markets with greater precision. This can encourage more capital to flow into private investments and fuel the exploration of innovative ideas. As transparency grows, investors will benefit from better insights while businesses maintain the advantages of remaining private for as long as it suits them.

Despite the abundance of private market data, identifying actionable signals amid the noise comes with its own challenges. Data in private markets is fragmented across diverse sources. It’s also largely unstandardized, making it difficult to compare and analyze in an “apples-to-apples” fashion. Even as the data science progresses, analyzing private market data is complex, and a great degree of trust will need to be built around the quality and accuracy of data-driven predictions or advice.

Data alone can’t drive every investment decision, but it is ascending into its place as a central driver of strategic processes. As such, the future of private markets looks increasingly dynamic and data-driven, and it’s reshaping how investors approach opportunities in this space.

NOTE: This article was originally published on Forbes.

Hank Boughner CEO Dynamo Software

Hank Boughner is the CEO of Dynamo Software, an end-to-end cloud platform for the alternatives investing ecosystem.

Uncorrelated recently spoke with Kevin Shea at Disciplined Alpha about the Harbor Long Short Equity ETF. The discussion is summarized below.

Uncorrelated: Can you provide a Summary of the ETF and the compelling features it offers?

Kevin Shea: The ETF invests in Large Cap and Mid Cap U.S. stocks. It has four unique features that include a Regime Model that determines gross and net exposure and Growth versus Value style tilts, distinct Industry Group based stock selection models, a separate Short Model, and an Alpha Opportunity Model that determines which parts of the market have the most op-

portunity to generate alpha.

Uncorrelated: Can you describe how you developed these four features? Perhaps connect them to your broader career and the roles you had over time. For structure, please organize them chronologically. Which feature did you develop first?

KS: While we are probably best known for our Regime Model, the first feature I developed was the distinct Industry Group based stock selection models. My first career was in Biotech. In the early 1990s, I worked at a biotech company in Boston doing HIV research. It was intense work, as there were no drugs on the market for

HIV. If somebody got infected, their life expectancy was only 24 months. I worked with a team to develop an antibody. This research turned into a Master’s Thesis, an article, a patent, and ultimately a drug in clinical trials.

Due to the progress on the scientific front, we needed a business development person. I started working in this role part time while pursuing and earning an MBA, with a concentration in Finance and a minor in International Studies.

After graduating in 1995, I entered the Management Development Program at John Hancock that involved rotations in several parts of the firm. The first rotation was in the Health Insurance division. This made me reflect on the fact that Biotech and Health Insurance are both Industry Groups within the same Health Care Sector, but they are fundamentally different from each other. Biotech companies make significant investments in research and development (R&D), to develop distinct products protected by patents, over a decade plus product development cycle, and with heavy national regulatory hurdles to overcome prior to marketing. Health Insurance companies typically make relatively little investments in R&D, over a much shorter product development time, are more focused on operational product efficiency, and also look for the general account to seek to increase in value over time in order to pay out future claims.

Due to the inherent fundamental differences in the business models of the companies in these Industry Groups, it seemed natural from a stock selection perspective to build Industry Group dependent models.

I subsequently rotated to three different groups in the mutual fund division of John Hancock. I attended meetings with company managements and sellside fundamental analysts across all Industry Groups. The insights gained from these and subsequent meetings, which now number over 1,000, has allowed me to gain insight into the drivers of stock performance within a given Industry Group. I have taken these insights and rigorously backtested them to build Industry Group dependent stock selection models.

This is a very differentiated feature of the strategy . The investment management industry has evolved over the years, but we believe it is still tilted toward fundamental analysis for stock selection. While fun-

damental managers and analysts know a lot about the companies they cover, they generally have not backtested their conclusions about the specific drivers of performance. Quantitative managers and analysts, on the other hand, frequently run backtests, yet in our experience very few ever talk to company managements to understand the business models of the companies they are trying to model. Very few managers and analysts try to both understand the compelling fundamental drivers of performance within a given Industry Group, as well as backtest those ideas before incorporating them into an investment strategy. We think it is important to do both.

Uncorrelated: Interesting. Which were the next of the four features that you developed?

KS: I developed the separate Short Model followed by the Alpha Opportunity Model. I joined Invesco to build a Mid Cap product in 1999. Shortly after I arrived, the market started to decline significantly. While the overall U.S. equity and the Nasdaq declined, I noticed that the stocks that declined the most were not necessarily the worst ranked stocks in our existing Long Model. This led us to explore the idea of building a separate Short Model. We weren’t directly shorting stocks at the time, so we called this a Bomb Avoidance model. It was exciting to find predictors of underperformance, which we combined into an overall Model. It was somewhat frustrating, however, to not just avoid the stocks likely to underperform, but to potentially be able to actively take advantage of this insight by selling them short.

A couple of years later I had the opportunity to build a Market Neutral product at a predecessor firm to Disciplined Alpha, D.A. Capital Management. As there are fewer tools to work with in Market Neutral than a variable exposure product, it is important to focus on those parts of the market where you are rewarded for being correct. This work led to our Alpha Opportunity Model.

Uncorrelated: So that leaves the Regime Model. Can you expand on that? This sounds particularly interesting.

KS: I agree. In business school, it is common for finance professors to review the Fama French model in which the expected “total” return of a stock is driven by the exposure to the market, size, and value. The market “relative” return of a stock is thus driven by a stock’s exposure to size and value. Finance professors tend to then typically review a lot of data and conclude that over the long run, if one buys small cap value stocks, they may potentially outperform the market. While this is conceptually correct, the long run for an academic might be ten years.

After surveying numerous allocators, I found that historically the most popular time-period that they use to evaluate performance is the most recent three years, followed by the most recent five years.

In the late 1990s, Growth stocks significantly outperformed Value stocks. The internet Bubble finally blew up from 2000 to 2002, during which period, Value stocks significantly outperformed Growth stocks. This was followed by a significant “Junk Rally” in the second and third quarter of 2003, when low-priced, low-quality stocks outperformed.

At a high level, there was a shift from Risk On in

the late 1990s, to Risk Off from 2000 to 2002, to an extreme level of Risk On in two quarters in 2003. Put another way, first Growth stocks outperformed, then Value stocks outperformed, then Growth stocks outperformed again.

In my experience, many Growth and Value managers tend to be very passionate about their investing styles. Growth managers look for the latest new technology. Lately this has often had to do with AI. Growth managers also likely then pay a high multiple of future earnings or cashflow to buy these stocks. Value managers, on the other hand, historically admit that they are not likely to invest in companies that may cure cancer or reinvent the internet. They will state that they invest in “boring” companies, but these companies have real earnings, and they buy these companies at attractive valuations. They often point out that Value strategies have the potential to hold up in times of market turmoil.

A Regime approach to investing historically does not categorically embrace Growth or Value as an inherently better method of investing. Instead, it relies on a model that indicates one of these styles is likely to outperform over the medium term. In our case we use

a combination of Macro data and Relative Valuation to determine which of these styles is likely to outperform.

Very few managers take a Regime approach to investing. Based on manager databases and conversations with sellside strategists that publish on Regime models, we believe there might be about 20 managers in the industry that have a formal Regime approach to investing.

Uncorrelated: This does indeed seem like a very differentiated feature. Can you discuss why a Regime approach to investing may be particularly important at this point in time?

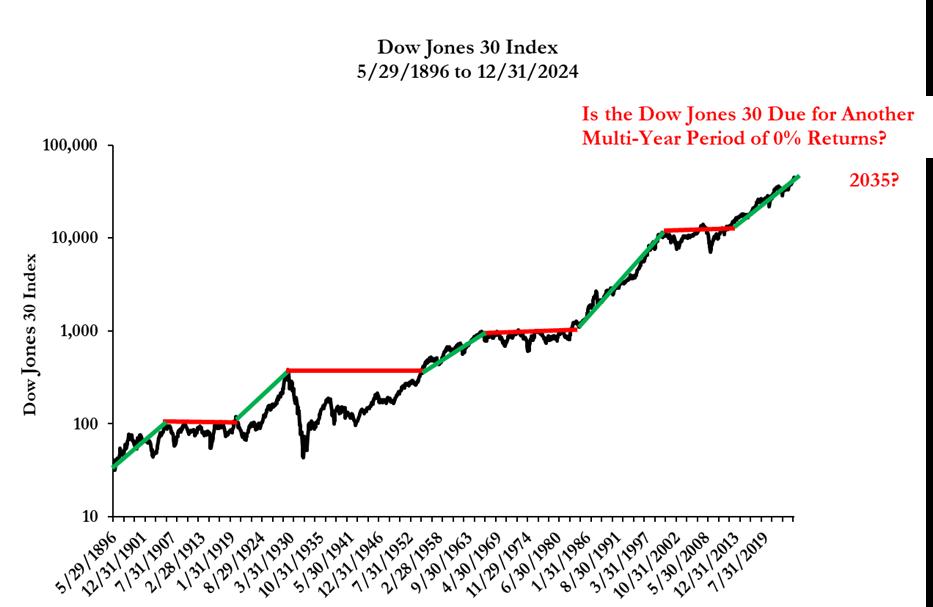

KS: It is the very same reason why your Uncorrelated Conference is timely. I have brought with me a chart of the very long-term cumulative return of the Dow Jones 30 Index from May 29th, 1896, to December 31st, 2024. As can be seen, there are multi-year periods when the stock market generated approximately 0% annualized returns. These periods are highlighted in red. There are other multi-year periods when the stock market generated above average returns. These periods are highlighted in green.

The third red line from the left, represents an almost fourteen-year time period from November 29th, 1968, to September 30th, 1982. This was also a period of historically above average inflation. Adjusting for inflation, the Dow Jones 30 Index actually “declined” by approximately -65%.

In the past, these multi-year periods have not all been precisely the same length of time. The recent green line, which started September 30th, 2010, has persisted for 171 months, and is slightly longer than the average of the other periods of above average returns at 157 months. Put another way, I believe the Dow Jones 30 Index may be due for a multi-year period during which it generates 0% annualized returns. While it is unclear if this multi-year period may begin this month, this quarter, or this year, it could be prudent to not bet against the past 128 years of data.

Many products that are marketed as solutions to diversify a Long portfolio, have correlations with the Dow Jones 30 Index of approximately .85 to .90, and, in my experience, are unlikely to deliver returns that keep up with inflation during a multi-year period when the

Dow Jones 30 Index may generate 0% annualized returns. Some Long Short equity strategies have much lower correlations with the Dow Jones 30 Index, and I feel may be better positioned for such a time period. In our case, this is due to the Regime Model. While the Dow Jones 30 Index generated 0% annualized returns from January 31st, 2000, to September 30th, 2010 (-0.13% to be precise), there were several year time periods when Growth stocks outperformed, then Value stocks outperformed, etc. Having the ability to shift between tilting to Growth stocks and Value stocks has the potential ability to generate absolute returns during such a time period.

The left axis reflects the Dow Jones 30 Index, and the information is from the first month end of the inception of the Dow Jones 30 Index May 29th, 1896, to December 31st, 2024.

Uncorrelated: I understand you have partnered with Harbor Capital, in the launch of an ETF version of your strategy. Can you tell us more about this?

KS: We are very excited about this partnership. Harbor Capital has $63.1 billion in assets under management as of September 30, 2024. In the last few years, the mutual fund industry has shown signs of maturing while the ETF industry has expanded dramatically. According to available information on the ETF market, in 2024, the overall ETF market grew 28%, while Active ETF market grew approximately 43%. The overall ETF market now exceeds $10 trillion in assets. In the last three years, Harbor Capital has focused on bringing compelling ETF products to the marketplace. They now offer about 20 ETF products across a variety of asset classes. They also have a salesforce with coverage throughout the country.

The Disciplined Alpha Onshore Fund LP, which launched almost ten years ago, was reorganized into the Harbor Long Short Equity ETF in December 2023. We agreed and after a lot of work by both parties, this was the first hedge fund to ETF conversion in the industry that we are aware of.

Uncorrelated: Sounds like an exciting partnership. Thank you for your time.

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800- 422-1050.

ETF performance prior to 12/4/23 is attributable Disciplined Alpha Onshore Fund LP (the “Predecessor Fund”). The historical NAV of the predecessor are used for both NAV and Market Offer Price performance from inception to ETF listing date. Performance periods since LSEQ listing date may contain NAV and MOP data of both the newly formed ETF and the predecessor fund performance. Please refer to the Fund prospectus for further details.

Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

For Institutional Use Only. Not for Distribution to the Public.

The HFRX Equity Hedge Index measures the performance of the hedge fund market. Equity hedge strategies maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both

quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios.

All investments involve risk including the possible loss of principal.

Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge.

The views expressed herein are those of Kevin Shea, Disciplined Alpha at the time the comments were made. These views are subject to change at any time based upon market or other conditions, and the author/s disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent. The discussion herein

is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Short selling securities could potentially have unlimited loss due to the price of securities sold short increasing beyond the cost of replacement and the limitless increase on the value of a security. The Fund utilizes a quantitative model and there are limitations in every quantitative model. There can be no assurances that the strategies pursued or the techniques implemented in the quantitative model will be profitable, and various market conditions may be materially less favorable to certain strategies than others. The Harbor Long-Short Equity ETF (the “Fund”) acquired the assets and assumed the then existing known liabilities of the Disciplined Alpha Onshore Fund LP (the “Predecessor Fund”), a Delaware limited partnership, on 12/4/23, and the Fund is the performance successor of the reorganization. This means that the Predecessor Fund’s performance and financial history will be used by the Fund going forward from the date of reorganization. Performance information prior to 12/4/23 reflects all fees and expenses, including a performance fee, incurred by the Predecessor Fund. Disciplined Alpha LLC (“Disciplined Alpha”) served as the general partner and investment manager to the Predecessor Fund, which commenced operations on 1/1/15 and, since that time, implemented its investment strategy indirectly through its investment in a master fund, which had the same general partner, investment manager, investment policies, objectives, guidelines and restrictions as the Predecessor Fund. Regardless of whether the predecessor fund operate as a stand-alone fund or invested indirectly through a master fund, Disciplined Alpha managed the Predecessor Fund assets using investment policies, objectives, guidelines and restrictions that were in all material respects equivalent to those of the Fund. However, the Predecessor Fund was not a registered fund and so it was not subject to the same investment and tax restrictions as the Fund. If it had been, the Predecessor Fund’s performance may have been lower.

Diversification does not assure a profit or protect against loss in a declining market.

ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold. Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

The Dow Jones 30 Index is an unmanaged index generally representative of the U.S stock market.

The Russell 1000 Growth Index is an unmanaged index generally representative of the U.S. market for larger capitalization growth stocks.

The Russell 1000 Value Index is an unmanaged index generally representative of the U.S. market for larger capitalization value stocks.

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

Foreside Fund Services, LLC is the Distributor of the Harbor Long-Short Equity ETF.

Mr. Shea is CEO of Disciplined Alpha LLC. and has 25 years of investment experience. Previously he was the Director of Quantitative Research at Cadence Capital, responsible for implementing a regime-based approach across multiple products representing $5 bb. Mr. Shea has also held the positions of Portfolio Manager at Batterymarch where he managed $600 mm, and CIO and Founder of DA Capital where he grew the firm from $10 mm to $450 mm over four years. He has also been a Portfolio Manager at Invesco, responsible for $100 mm, and a Quantitative Analyst at John Hancock Funds. Mr. Shea holds a B.A. in Liberal Studies from the University of Notre Dame, an A.L.M. in Biology from Harvard University, and an M.B.A. in Finance and International Studies from Boston College. Mr. Shea co-teaches a Proseminar in Finance at MIT’s Sloan School of Management. He is a member of the CFA Institute, and the Institute for Quantitative Finance, also known as the Q Group. He is also a member of the Financial Accounting Standard Board’s (FASB’s) Investor Advisor Committee (IAC). Mr. Shea has been quoted in numerous publications including aiCIO, Emerging Manager Monthly, Hedge Fund Alert, HFM Week, Institutional Investor, and WatersTechnology. He has spoken at numerous conferences in the U.S. and internationally sponsored by Allianz, Argyle Executive Forum, Battle of the Quants, Capital IQ, FactSet, HFM Week, International Quality & Productivity Center, Northfield and Sentiment Analysis Symposium.

Kevin W. Shea, CFA Chief Executive Officer Portfolio Manager Disciplined

BY FRANK CACCIO OpsCheck

In the financial industry, where precision, accountability, and adaptability are non- negotiable, operational excellence isn’t merely a target—it’s a foundation. Financial firms operate in a world of complex regulations, intricate transactions, and high client expectations. At the same time, they face mounting pressure to streamline workflows, cut operational costs, and leverage technology. Balancing these demands requires a refined approach to operations management, one that prioritizes transparency, risk mitigation, and proactive oversight.

Operational transparency is vital in the financial sector. Leaders need real-time insights into every layer of operations, from trade execution and compliance

checks to client reporting and performance metrics. Having a clear, consolidated view into these activities enables timely decision-making and helps firms manage client expectations and regulatory demands effectively.

z Best Practice Insight: Financial institutions should implement integrated dashboards and real-time reporting systems that provide an end-to-end view of critical functions. This enables operational leaders to detect inefficiencies, optimize resource allocation, and ensure that all processes remain aligned with organizational goals.

In finance, accountability isn’t just about tracking tasks—it’s about safeguarding reputational integrity

and trust. With stringent compliance requirements and heightened scrutiny, firms must ensure that each role is clearly defined and responsibilities are thoroughly documented. This level of detail helps mitigate the risk of errors and enables quick, accurate audits if needed.

z Best Practice Insight: Establishing precise role definitions, combined with comprehensive task tracking and audit trails, is essential. This structure ensures accountability at every level and creates a reliable system for identifying responsibility in the event of discrepancies or compliance inquiries.