INVESTMENT OPPORTUNITY

▪ IMH Companies (“IMH”), a vertically-integrated housing developer across the multifamily rental and for-sale segments, is seeking approximately $40M of equity to capitalize its co-investment requirements for 18 development projects in Salt Lake City and Boise.

▪ IMH has relationships with institutional LP’s which enables it to minimize its investment to 5-10% of the equity on each transaction and generate outsized returns through highly attractive promote waterfalls (which investors will participate in).

▪ IMH is a vertically integrated organization with in-house construction teams on-the-ground in Salt Lake City and Boise (where it owns development projects), as well as acquisition and asset management capabilities in the Southeast and Texas (where it owns multifamily valueadd assets), we are led by an executive team with over 200 years of combined experience in large private and public builders.

▪ IMH utilizes a disciplined acquisition strategy, targeting high growth markets with strong fundamentals (where public builders/investors have yet to establish a major presence) and utilizing a formal investment committee process with representation from each of its shareholders.

▪ The firm has grown to-date through organic acquisitions and strategic M&A (including the merger with Next Level Homes), which accelerated its presence in Salt Lake City, and now has an established in-market presence. IMH remains positioned to capitalize on opportunistic acquisitions at both the asset and corporate level.

By capitalizing IMH’s $40M IMH Communities I equity raise, investors have the unique opportunity to:

▪ Generate Meaningful Returns: As IMH forms joint ventures with institutional equity partners, the firm is typically required to co-invest 10% of the equity on a transaction and is entitled to promote structures where it receives a disproportionate share of profits based on performance.

▪ Reduced Risk: IMH and its guarantors will be providing any and all guarantees under the required financing documents with no personal recourse to investors. As such, investors have the opportunity to participate in attractive upside returns with downside risk limited to invested capital.

▪ Participate in Follow On Investments: Due to its growth trajectory – and its in-market presence in Salt Lake City and Boise – IMH has access to additional (and frequently off-market) investment opportunities which will need follow-on capital.

▪ Monthly Cash Flow - IMH Communities I investors have the opportunity to earn: ▪ A 12% annualized return with distributions paid monthly. (Based on unreturned capital.) ▪ A pro-rata profit share of 10% of IMH’s total profit.

Our established network of domestic and international relationships, including the access created through our developer advisory services, allows for the sourcing of transactions, often before they are brought to market. ▪

We proactively respond to opportunities; seizing off-market transactions with our partners’ proven track records, local market knowledge, and ability to conceive and execute an effective operating and management plan.

Our management team evaluates each asset not as it is today, but rather where it should be competitively positioned for the future. Comprehensive value-creation techniques are deployed to enhance each asset’s cash-flow, profit generation and exit value.

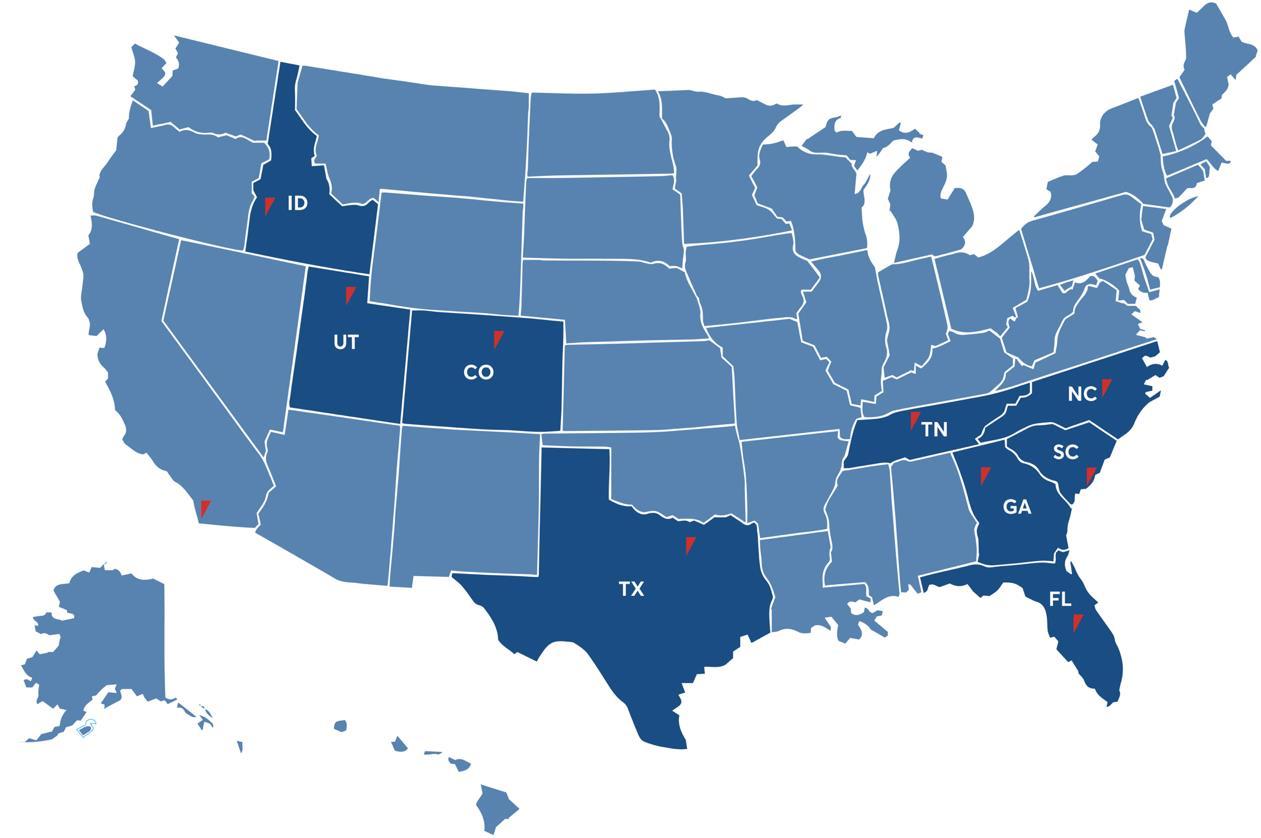

IMH has a clear geographic strategy for its development and multifamily value-add verticals:

▪ DEVELOPMENT (Salt Lake City, Boise & Denver): IMH concentrates on these Mountain West markets, which are driven by an imbalance of Supply and Demand but still are not dominated by large Public Homebuilders and REITs. In these markets IMH has on-the-ground development teams, which result in optimal execution and off-market deal sourcing.

▪

(Southeast & Texas): IMH targets highgrowth markets where the firm can make accretive ‘ROI’ investments (e.g. interior and exterior improvements) supported by strong market rent growth and macroeconomic trends.

Mr. Monce is the founder of IMH and is responsible for the vision and execution of the firm’s business plan. He is a member of the Investment and Executive Committees.

Throughout his 38-year career, Mr. Monce was a co-founder and owner of the Ryness Company, one the nation’s largest development consulting firms. He directed the company’s growth and led development and acquisition teams to close over $6B in real estate transactions annually. In less than five years, the firm was transformed into a nation-wide industry leader and recognized authority in development projects throughout the US. Mr. Monce’s companies have been involved in real estate transactions totaling more than $30 billion across multiple asset classes.

Mr. Doyle is responsible for the firm’s operational capabilities and is a member of the Investment and Executive Committees. In 35 years in real estate development and homebuilding, Mr. Doyle was the Chief Operating Officer in charge of Operations for William Lyon Homes (NYSE: WLH), a publicly traded and top 20 homebuilder, and most recently a Western Area President for Taylor Morrison Homes (NYSE: TMHC), a publicly traded and top 5 homebuilder. In those 35 years, he has been responsible for overseeing the development and building of over 30,000 homes and over $25 Billion in home closing revenue. Mr. Doyle earned a Bachelor of Arts degree in Economics from California State University Long Beach.

Mr. Rosen is responsible for the acquisitions and dispositions of all multifamily investments. He is also a member of the Executive Committee. Mr. Rosen’s 40+ year real estate career has encompassed all phases of real estate development, investment and strategic consulting on projects throughout North America and Asia, primarily as a principal. Property types have included multifamily, single-family, destination retail & entertainment, and office buildings. Mr. Rosen earned a Masters in Business Administration from Dartmouth College’s Tuck School of Business and a Bachelor of Arts in Economics from the University of California, Los Angeles. He has been a frequent speaker at industry conferences and was a visiting speaker in International Property Development at the University of Southern California’s Master of Real Estate Program.

Mrs. Ahrens is responsible for the firm’s financial planning, coordinating, and auditing of all accounting operational functions. She plays an integral role in formulating company budgets to ensure that expenses are in line with projected revenue. Mrs. Ahrens started her career in accounting 20 years ago and has concentrated on real estate and construction accounting for the last 8 years. With strong business acumen, she is focused on driving growth with sound fundamentals, business metrics, and performance management for effective decision making and stage-appropriate operations. Mrs. Ahrens earned a Bachelor of Science in Business Administration – Finance and a Master of Business Administration with an emphasis in Accounting from California State University San Marcos.

Mr. Wojewodzki is responsible for operations, acquisitions and dispositions of all multifamily (value-add) investments. He is also a member of the Executive and Investment Committees.

Highly experienced in the acquisition, finance, development, and management of major institutional-grade assets, Mr. Wojewodzki has held senior executive positions with four of the nation’s largest financial institutions. In those firms, his responsibilities included investment origination, asset management, investor relationship management and investment committee assignments. As a Principal, Mr. Wojewodzki has also acquired and developed residential, retail, and office properties Mr Wojewodzki earned a Bachelor of Arts in Finance and Business Administration from Monmouth University He has held memberships in the Urban Land Institute, International Council of Shopping Center, American Land Development Association, and the Appraisal Institute.

Mr. Thomas is responsible for all home building and multifamily operations within Utah. He is also a member of both the Executive Committee and the Investment Committee.

As a seasoned corporate and securities attorney with an excess of 20 years of business experience, Mr Thomas has served as chief executive and corporate counsel of a regional land development and residential building company. Within his securities practice, he has orchestrated many corporate mergers and acquisitions and facilitated the formation and initial public offerings of numerous companies, working with regulators of such public exchanges as the London Stock Exchange, German Exchange, New York Stock Exchange, and the Over-The-Counter markets. Mr. Thomas holds a Juris Doctorate degree from Texas Tech University School of Law and is licensed to practice in Texas and Utah.

Mr. Pehrson is responsible for land acquisition, construction, sales and service for all home building and multifamily operations within Utah. He is also a member of the Executive Committee.

Throughout his 25+ year career, as a Principal, he has acted as developer and general contractor for new mixed-use developments, residential communities, and commercial projects. Mr. Pehrson has successfully overseen all phases of the property development process and is particularly accomplished in managing the complex challenges of the entitlement process.

Mr. Mann is responsible for all land acquisition, construction, sales and service for all home building operations within Colorado and Idaho. He is also a member of the Executive Committee.

A 40+ year construction industry veteran, he has managed all aspects of construction, from the earliest stage of design through product delivery. During his career, Mr. Mann has successfully managed firms ranked within “Engineering News Review – Top 100 Contractors Within the United States” and several billion dollars in construction projects. Mr. Mann earned his Bachelor of Science degree in Economics from Stanford University and Masters in Business Administration from UCLA.

Mr. Hinson is responsible for all capital formation, inclusive of both private investors and large-scale institutional investors. He is also a member of both the Executive Committee and Investment Committee.

Mr. Hinson has been in the fiduciary services industry since 1996, maintaining an established clientele inclusive of both taxable and tax-deferred investment objectives, with a focus on tax-free exchanges. He has raised over $500 million in investment equity, including those syndications in which he was a sponsor. Mr. Hinson earned a Bachelor of Arts in Business Administration from Tarleton State University. He also carried the Series 82 and Series 63 FINRA security licenses that focus on private placement and alternate investments.

Mr Scolari acts as Senior Vice President of Capital Markets for IMH and is a Member of the Executive Committee

Mr. Scolari was a co-founder of DAS Alliance Group, a real estate investment and development company. His 20+ year career has focused on commercial real estate finance, investment banking, venture capital, and advisory services during which time he has managed and arranged in excess of $2 Billion of transactions. He has served as a top tier Portfolio Manager in private banking for one of the nation’s largest banking firms and was a Top 10% loan producer He was also responsible for an operations unit and was responsible for managing its 1,700 employees. Mr. Scolari earned a Bachelor of Arts degree in Business and Finance from UABC.

Mr. Riis is a Manager in Capital Markets and works closely with Thomas Hinson on capital formation.

For the last 5 years, Mr. Riis lead a team of ten individuals at the largest global insurance company where he focused on insuring single family & multifamily portfolios. He has been involved in the real estate industry for five years through insurance and capital markets. Mr. Riis graduated from University of Denver where he won a Division 1 Lacrosse National Championship. Originally from Encinitas, he spends most of his spare time coaching both club and high school lacrosse in North County, San Diego.

Ms. Day is directly responsible for investor relationship management, reporting, and client communications. She is also a member of the Executive Committee. During her 25 years actively involved in the real estate industry, Ms. Day has owned and operated a successful real estate consulting and investment firm. As a consultant to developers and investors, she provided residential sales and marketing expertise, assisted in fundraising, and managed investor relationships. Ms. Day earned a Bachelor of Science degree from the University of Southern California’s Marshall School of Business, with an emphasis in real estate and marketing. She has been a guest speaker throughout Southern California, educating aspiring real estate investors about various real estate investing strategies.

IMH follows a disciplined and systematic investment process and is subject to the overall policy direction of the Investment Committee. The stages of the investment process are highly integrated, with formal Investment Committee review as the final point of the process.

Identify potential market opportunities through deep industry contacts

Research & tour the local market

Prepare stress-tested financial analysis

Negotiate pricing and deal structure

Review and evaluate risks, strengths, and weaknesses

Deep analysis of investment brief

Business plan creation

Investment Committee Approval

Comprehensive review and due diligence (environmental, geological surveys, & property condition reports)

Sourcing lenders and debt terms

Legal review and risk mitigation

Business plan execution

Implementation of operating efficiencies

Budget to actual operating performance reviews

Repositioning of assets for value creation

Exit and liquidation planning

IMH utilizes targeted acquisition criteria for its Development and Multifamily Value-Add verticals. DEVELOPMENT

▪ Market driven by an imbalance of Supply and Demand

▪ Markets not dominated by large Public Homebuilders and REITs

▪ Dynamics strong for all housing types: For Sale SFD, For Sale SFA and Multifamily Development

▪ Opportunities for Finished Lots, Mapped Lots and Entitlement Projects

▪

Geographically positioned to leverage our Operational Excellence

▪

For Sale Projects: 40% “Yield Score” (Margin + IRR) ▪ Typically 20%+ Profit Margins ▪ Typically 20%+ IRR

▪

Core Markets (Southeast, Texas & Mountain West)

▪ Markets that have the following conditions: high barriers to entry, strong and sustainable employment / population growth, positive supply / demand dynamics, diversified economic base and decreasing vacancy rates

▪

Assets located in strong economic markets near major employment centers with excellent access to major transportation nodes, as well as close proximity to retail shopping, entertainment venues and good schools

▪

Opportunity to implement a value-add program, including interior unit upgrades (ideally first generation), exterior improvements, enhancing amenity facilities, and employing a professional community-oriented management company

Target Size: 200-500 units; $50-$100M acquisition price ▪

▪

3-5 Year Hold Periods ▪

15-20% Leveraged IRR

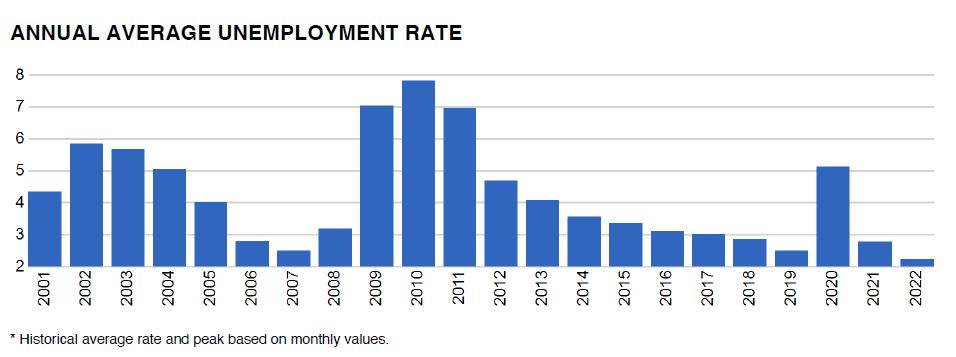

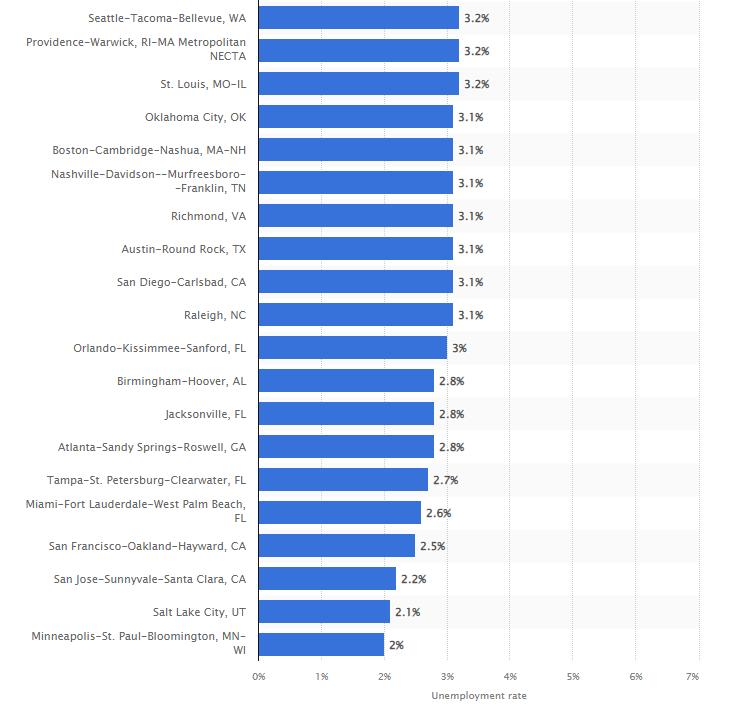

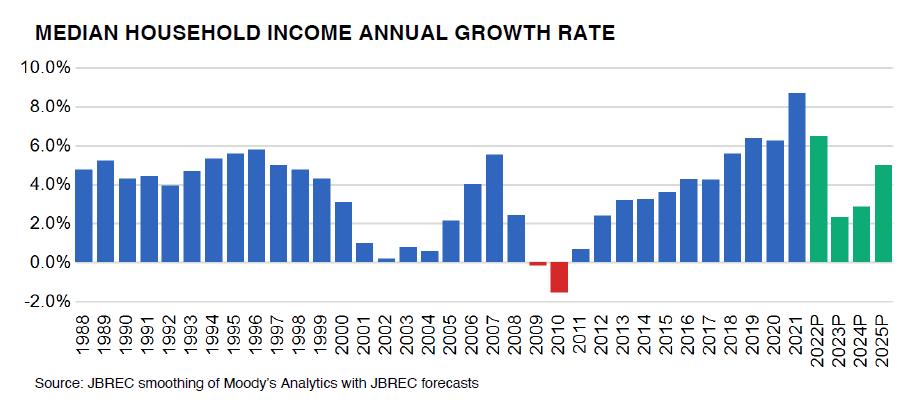

SLC has the 2nd lowest unemployment rate in the US (at 2.1%) and has experienced consistently positive wage growth over the past 30+ years (excluding the 2009-2010 GFC).

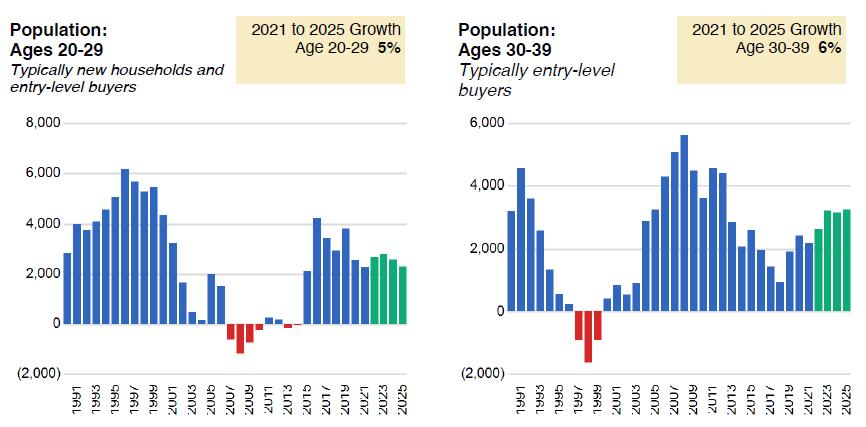

Salt Lake City has the 2nd highest Millennial population in the US (39%), with the Millennial population forecasted to increase at 56% per annum through 2025.

Rank

1 Madison,WI 40.4% 86% 1.40% $64,280 23% 97 1,569

2 SaltLake City,UT 38.8% 85% 1.40% $58,008 24% 97.7 2,563

3 Minneapolis,MN 38.6% 84% 2.20% $67,214 22% 103.2 3,275

4 Seattle,WA 38.6% 83% 3.20% $80,420 28% 112 7,091

5 Fargo,ND 37.6% 87% 1.80% $58,158 17% 94 497

6 Columbus,OH 36.6% 81% 3.00% $56,252 22% 94.2 3,052

7 Austin,TX 36.2% 81% 3.20% $64,913 27% 101.8 3,537

8 Cincinnati,OH 34.7% 77% 3.00% $59,607 17% 93.5 2,119

9 Nashville,TN 34.4% 83% 2.60% $62,076 23% 97 2,719

10 St.Paul,MN 33.1% 82% 2.20% $67,214 21% 103.2 1,289

11 St.Louis,MO 32.9% 80% 2.90% $60,844 17% 95.7 2,337

12 Lincoln,NE 32.8% 84% 1.10% $53,057 21% 93.8 777

13 SanFrancisco,CA 32.5% 84% 3.80% $111,050 23% 117.4 4,550

14 Raleigh,NC 31.8% 79% 2.80% $60,884 24% 95.7 2,719

15 Reno,NV 31.6% 85% 2.90% $66,075 22% 98.9 1,240

16 Kansas City,MO 31.3% 83% 2.70% $58,057 21% 94.7 1,668

17 Indianapolis,IN 30.7% 77% 2.00% $60,431 18% 94.7 2,285

18 Des Moines,IA 30.6% 82% 2.60% $58,076 20% 94.9 1,214

19 Chattanooga,TN 30.3% 84% 2.70% $49,865 21% 92 957

20 OklahomaCity,OK 29.6% 76% 1.70% $52,688 21% 93.8 2,104

21 Omaha,NE 29.3% 80% 1.50% $61,040 21% 95.3 1,574

22 SiouxFalls,SD 28.6% 89% 1.80% $67,117 17% 94.1 603

23 Tulsa,OK 28.5% 78% 2.00% $58,071 18% 92.9 1,765

24 SanJose,CA 27.7% 80% 3.20% $121,619 23% 112.1 4,965

25 Louisville,KY 26.6% 77% 3.00% $55,676 20% 91.9 1,924

(1) Source: PolicyGenius - January 24, 2022

(2) "Fun Businsess" include including bars, restaurants, and other entertainment venues

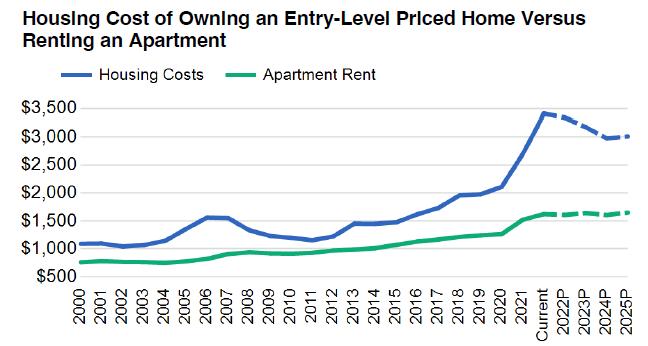

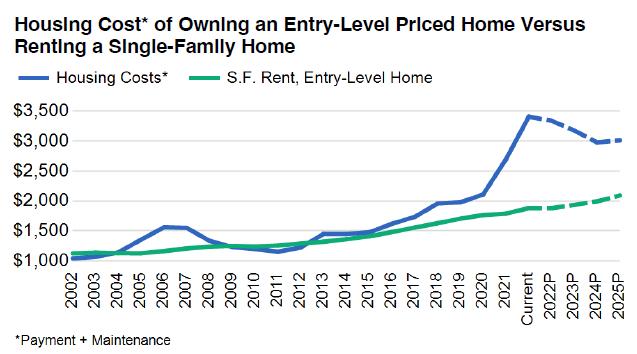

Renting is ~2x less expensive than buying in Salt Lake City, which has created significant tailwinds for both SFR/BFR and traditional multifamily apartments in the market.

Renting is the easy and economic choice for renters, particularly Millennials, in SLC.

1.8x 2.3x

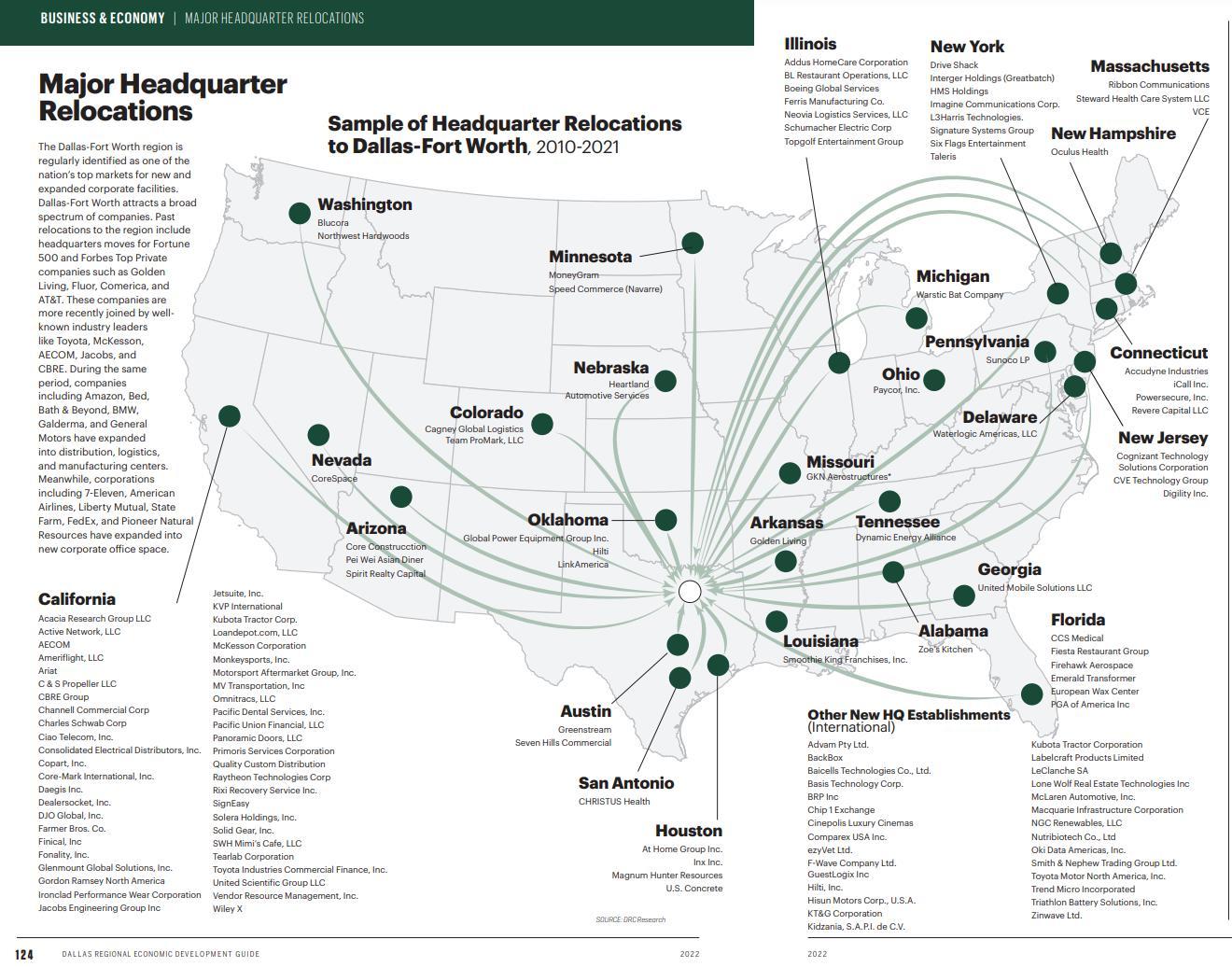

DFW is benefitting from corporate relocations, largely from California, but also Illinois and New York.

DFW is also seeing growth from international companies establishing HQ’s in the US.

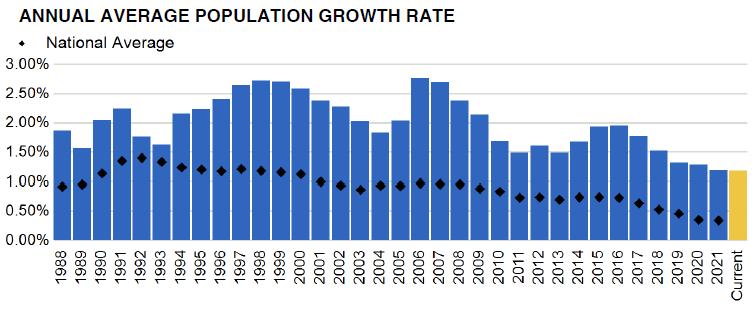

DFW’s pro-business approach is working as population growth remains well in excess of the national average.

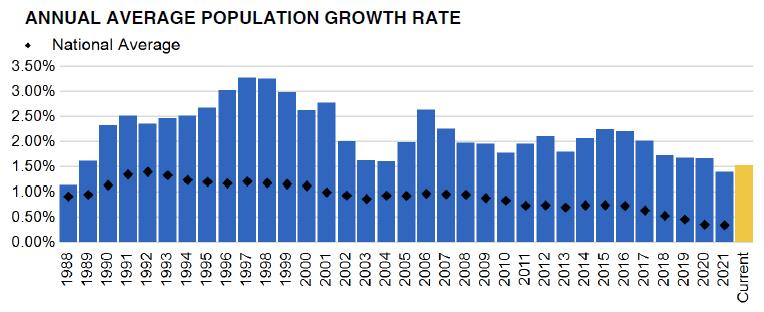

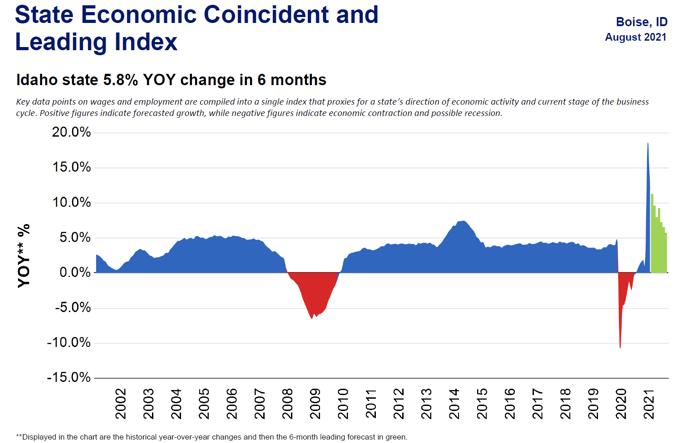

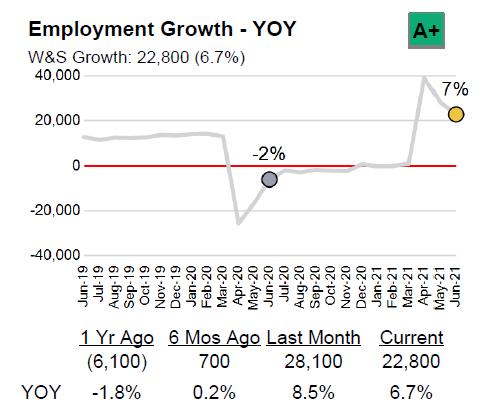

Boise has 7% employment growth, and the state of Idaho has positive overall economic health and trajectory.

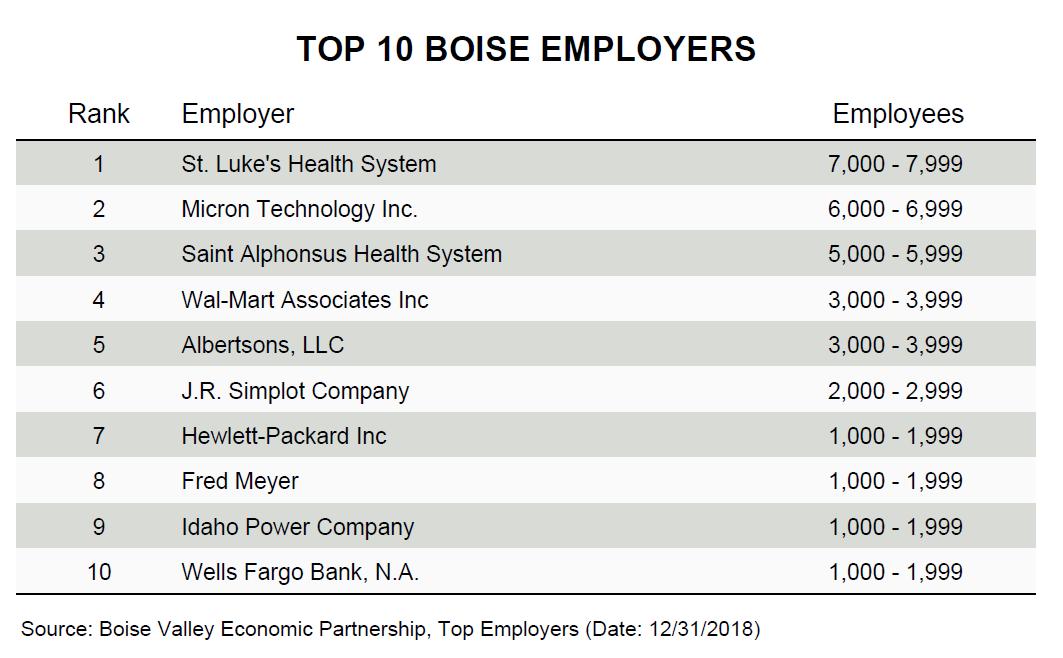

The largest employers in the market are in healthcare (St Luke’s and Saint Alphonsus) and technology (Micron).

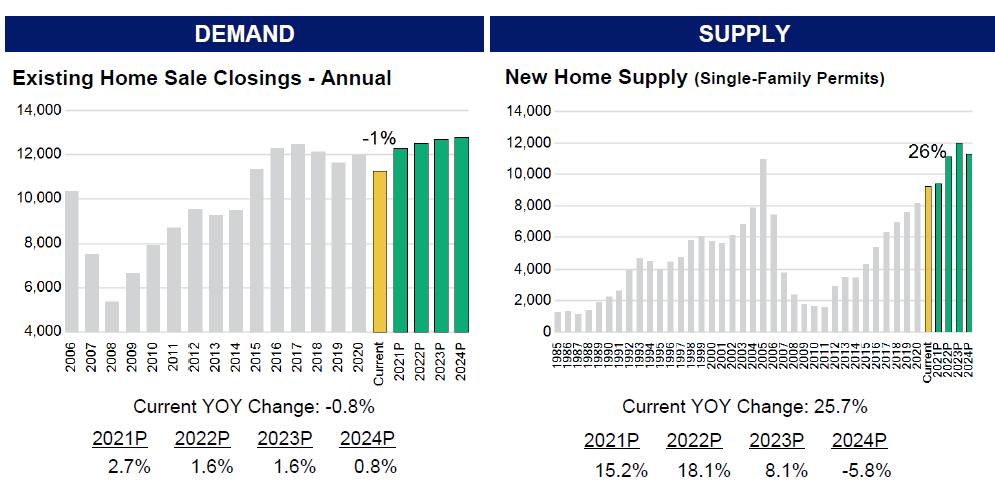

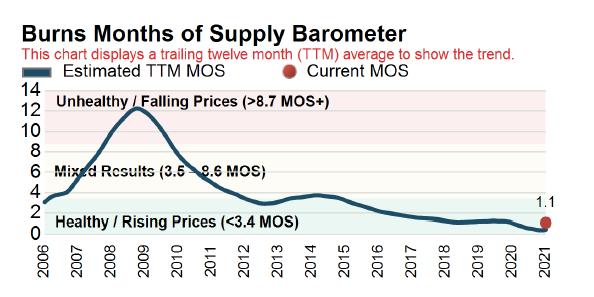

Boise is ranked as a ‘Very Strong’ housing market per John Burns Consulting. This is a result of:

▪ During the GFC, new housing starts dipped below 2,000/year and hovered around 4,000/year.

▪ Meanwhile, Boise has experienced positive employment and population growth resulting in demand of > 10,000 units/year and a housing shortage.

▪ The result is approximately 1 month of inventory with supply expected to return to +/- 10,000 units/year.

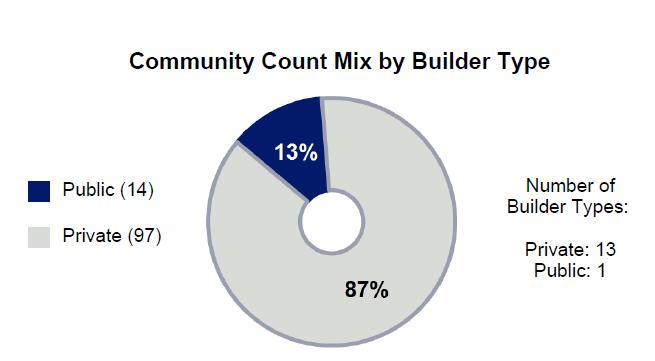

The Boise market is still largely comprised of private builders, which creates significant opportunity for IMH.

The largest market player (CBH) is an Idaho focused private builder. The only public builder in market is Toll Brothers, which owns 14 communities.

This confidential investment memorandum (“memorandum”), including the attached exhibits contains confidential, non-public and proprietary information. The company provides the memorandum solely for confidential use by prospective investors. Without prior written permission from the company, prospective investors shall not release, copy, discuss or use the memorandum for any purpose other than evaluating whether to invest in the company. Each recipient agrees to return the memorandum and any other documents or information furnished by the company if the recipient declines to invest. The memorandum was prepared from information provided by the company. The company’s professional advisors did not independently verify any information contained in the memorandum or otherwise made available by the company, and therefore they do not represent or warrant the accuracy or completeness of such information

The company has not authorized any offering literature or advertising other than the memorandum. No one is authorized to provide any other information or to make any representation except those contained in the memorandum. Do not rely on any information or representation that does not appear in the memorandum. Prospective investors must rely on their own examination of the company, its proposed business and this offering, including the merits and risks involved Prospective investors should carefully evaluate the “risk factors” described in this memorandum or in the subscription agreement. The memorandum does not offer investment, tax or legal advice to prospective investors. Prospective investors should consult their own counsel, accountant or investment advisor about the legal, tax and related implications of investing in the company. Prospective investors may ask questions and receive answers about the offering, the company or any other relevant matters. The company will provide other information requested by prospective investors if the company possesses such information or can acquire it without unreasonable effort or expense.

The company offers interests only to accredited investors (as defined in rule 501(a) under the securities act of 1933, as amended, including the rules and regulations promulgated thereunder) and without registration under federal and state securities laws. This memorandum does not offer to sell or solicit an offer to buy securities in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation. The company may withdraw this offering at any time and reserves the right to reject any subscription, in whole or in part, for any reason. The company will hold a subscriber’s subscription funds until the company accepts or rejects that subscription; rejected subscription funds will be promptly returned to the subscriber without interest. Investments in the company will be illiquid The transferability and resale of the interests are severely limited by the limited liability company agreement, the federal securities act and applicable state securities laws. There will be no public market for the interests and none is expected to develop. Prospective investors should be aware that they must bear the financial risk of this investment indefinitely and may risk loss of their entire investment.

In making an investment decision, investors must rely on their own examination of the person or entity creating the securities and the terms of the offering, including the merits and risks involved. These securities have not been recommended by any federal or state securities commission or regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. Any representation to the contrary is a criminal offense. No person has been authorized to give any information or make any representations other than those contained in this memorandum, and, if given or made, such information or representations must not be relied upon as having been given by the offerors. Statements contained herein as to the content of any agreement or other document are summaries and, therefore, are necessarily selective and incomplete and are qualified in their entirety by the actual agreements or other documents. The company will make available to any prospective investor prior to the consummation of the sale the opportunity to ask questions of and receive answers from the company or persons acting on behalf of the company concerning the terms and conditions of this offering, the company or any other relevant matters and any additional reasonable information to the extent the company possesses such information or can acquire it without unreasonable effort or expense. The company does not expect to update or otherwise revise this memorandum or other materials supplied herewith unless there is a material change in the information set forth herein prior to the closing or termination of the offering hereunder. The delivery of this memorandum at any time does not imply that the information contained herein is correct as of any time subsequent to the date of this summary This summary is submitted in connection with the offering described herein and may not be reproduced or used for any other purpose. We reserve the right to reject the subscription of any prospective investor even if such investor satisfies all suitability standards discussed in this memorandum. If the prospective investor receiving this memorandum does not submit an offer to purchase, or if such offer is submitted but not accepted by us, the prospective investor agrees to promptly return this memorandum and all attached documents.

This memorandum does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized, or in which the person making such an offer is not qualified to do so, or to any person to whom it is unlawful to make an offer or solicitation. Neither the information contained herein, nor any prior, contemporaneous or subsequent communication should be construed by the prospective investor as legal or tax advice. Each prospective investor should consult his own legal and tax advisors to ascertain the merits and risks of the transactions described herein prior to subscribing to securities.

In making an investment decision investors must rely on their own examination of the company and the terms of the offering, including the merits and risks involved. These securities have not been recommended by any federal or state securities commission or regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. Any representation to the contrary is a criminal offense. These securities are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the securities act of 1933, as amended, and the applicable state securities laws, pursuant to registration or exemption therefrom Investors should be aware that they will be required to bear the financial risks of this investment for an indefinite period of time.

This memorandum is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities in the company or any related or associated company. Any such offer or solicitation will be made only by means of the company’s confidential memorandum and/or subscription agreement and in accordance with the terms of all applicable securities and other laws None of the information or analyses presented are intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this memorandum does not constitute investment advice or counsel or solicitation for investment in any security. This memorandum does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever The company expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the memorandum, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.

This memorandum contains forward looking statements and forecasts concerning the plans, intentions, strategies, expectations, predictions and financial forecasts concerning the future activities and results of operations for the company, as well as other future events or conditions. For this purpose, any statements contained herein that are not statements of historical fact are deemed forward looking statements. Without limiting the generality of the foregoing sentence, words such as “believe,” “may,” “will,” “could,” “intends,” “estimate,” “might,” “continue”, their negatives or comparable terminology indicate forward looking statements. Please understand that the company’s actual results or activities or actual events or conditions could differ materially from those estimated or forecasted in such forward-looking statements due to a variety of factors, some of which may be beyond the control of the company. The potential opportunities (pipeline) shown in this memorandum may not be available at the time the fund is deploying capital The pipeline represents a sample of specific opportunities that were available at the time the memorandum was published.

Although the company believes that the underlying assumptions and the expectations reflected in such forward-looking statements are reasonable, no assurances can be given that such assumptions and expectations are correct because actual results are uncertain and unpredictable All assumptions, projections and expectations merely represent the company’s considered opinion. To the extent that actual events differ materially from the company’s assumptions and estimates, actual results will vary from the forward-looking statements. Additional factors could cause actual results to differ materially from the expectations disclosed in this memorandum. See “risk factors” for a discussion of some factors that could cause the company’s actual results, actual activities, actual events or actual conditions to differ from those anticipated. This memorandum reflects the company’s knowledge and information on the date of this memorandum. The delivery of this memorandum or the sale of LLC interests shall not imply that the company’s affairs or prospects have not subsequently changed. All written and oral forward-looking statements attributable to the company or its agents are expressly qualified in their entirety by this discussion.