INFILL IMPACT FUND

The Innovative Solution to California’s Housing Crisis

Legal Disclaimer

This information is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as investment, tax, or financial advice, any recommendation, or an offer to sell, or a solicitation of any offer to buy, an interest in any security, including an interest in this company or in any other investment or project managed or advised by Sundae, Inc., SDRE Homebuyers LLC or Reditus Fund I, LLC. Any offer or solicitation of an investment may be made only by delivery of the Sundae, Inc., SDRE Homebuyers LLC or Reditus Fund I, LLC and its affiliates confidential offering documents (collectively, the "Offering Documents") to accredited and/or sophisticated investors. Prospective investors should review carefully and rely solely on the Offering Documents in making any investment decision. Targeted returns discussed in this presentation are used for measurement orcomparison purposes and only as a guideline for prospective investors, shareholders or other to evaluate this opportunity. Targeted returns should be evaluated over the time period indicated and not over shorter periods. No representation is made that Sundae, Inc., SDRE Homebuyers LLC or Reditus Fund I, LLC will or is likely to achieve its objectives, that Sundae, Inc., SDRE Homebuyers LLC or Reditus Fund I, LLC business plan will be successful, or that an investor in Sundae, Inc., SDRE Homebuyers LLC or Reditus Fund I, LLC, and its affiliates will or islikely to achieve results comparable to those shown or will make any profit or will not suffer losses or loss of principal. An investment in Sundae, Inc., SDRE Homebuyers LLC or Reditus FundI, LLC involves risks, as disclosed in any final offering docs.

THIS PRESENTATION INCLUDES OR MAY INCLUDE CERTAIN STATEMENTS, ESTIMATES, AND FORWARD-LOOKING PROJECTIONS WITH RESPECT TO THE ANTICIPATED FUTURE PERFORMANCE OF THE COMPANY. SUCH STATEMENTS, ESTIMATES, AND FORWARD-LOOKING PROJECTIONS REFLECT VARIOUS ASSUMPTIONS OF THE MANAGER THAT MAY OR MAY NOT PROVE TO BE CORRECT OR THAT MAY INVOLVE VARIOUS UNCERTAINTIES. NO REPRESENTATION IS MADE, AND NO ASSURANCE CAN BE GIVEN, THAT THE COMPANY CAN OR WILL ATTAIN THE MANAGER'S PROJECTED RESULTS. ACTUAL RESULTS MAY VARY, PERHAPS MATERIALLY, FROM SUCH PROJECTIONS.

Any statements made in this presentation are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

All investments, including real estate, is speculative in nature and involves a risk of loss. We encourage any investors to invest carefully. We also encourage investors to get personal advice from your professional investment advisor, CPA or other trusted financial advisor and to make independent investigations before acting.

IT IS IMPORTANT YOU UNDERSTAND THAT WHILE WE ARE PROVIDING PROJECTIONS BASED ON THE FACTS AND FIGURES AVAILABLE, NO ONE CAN TRULY PREDICT THE FUTURE.

01 San Diego Has a Problem: Housing Availability & Affordability

Housing affordability is an issue for at least half of San Diegans

50% of San Diegans cannot find market-rate rental housing they can afford

60% of San Diegans cannot afford home ownership

Housing affordability impacts 100% of low-income residents and a large portion of moderate-income households

~70% of moderate-income households cannot afford home ownership, and >30% cannot afford rent

San Diego Rents and Home Prices have exploded in the last 4 years

Source: Redfin

Source: Redfin

Not only are housing costs up, but inventory is <⅔ of 2019 levels

Source: Redfin

San Diego

rental

vacancy is one of the lowest in the nation

Source: US Census Bureau (CA & US), Marcus & Millichap 2024

National Investment Forecast

San Diego needs 15,000 new units per year to keep up with growth. Only 3,200 will be delivered in 2024.

Source: San Diego Association of Governments

“San Diego is only going to produce approximately 3,200 housing units this year (the goal to keep up with demand is 15,000 units). This number is approximately 1% of the total housing stock and ADUs are included in this figure. Very few units will be produced for the next few years as the city of San Diego only approved 5,300 housing units in 2022. I doubt all of these will be built.”

Austin Ray Huffman First Vice President Investments 2024

These trends will be pressured even further as job growth accelerates

5,000 New Apple jobs with a new 45 acre campus

3,000 New jobs at Horton Plaza, a mall-to-office development in Downtown San Diego

3,500 New biotech jobs from IQHQ, a 200,000 sq. ft. Class A office development

700 New high paying jobs at Amazon in a 123,000 sq. ft. space in UTC

02 Changes to Residential Development Laws are Addressing San Diego’s Affordability Problem

New California laws provide ample incentive for development

AB 68 & AB 881

1/1/2020

Streamlines and improves the ADU development processes (limits requirements for off-street parking, owner-occupancy, setbacks and requires action on ADU applications within 60 days)

SB 13

1/1/2020

Prohibits the enforcement of parking standards for ADUs within ½ mile of public transit

AB 670 & AB 671

1/1/2020

Prevents HOAs from banning or unreasonably restricting the construction of ADUs on single-family residential lots

SB 9

1/1/2022

Allows for the addition of up to 4 homes on an existing parcel

AB 2221

1/1/2023

Removes limits on front setbacks and makes it easier to install ADUs in community associations

SB 6

7/1/2023

Allows housing development on commercial property

AB 1033

1/1/2024

Allows owners to sell ADUs separately from their primary residence

SB 10

1/1/2022

Provides cities with an easier path for "up-zoning" residential neighborhoods close to job centers, public transit, and existing urban areas

AB 2011

7/1/2023

Creates approval for affordable housing on commercially-zoned land

With even more favorable laws on the horizon in

California

California State Wide - PENDING

AB 1332 - Already passed, takes effect Jan 2025; allows for a master plan approved in one jurisdiction to be approved in other jurisdictions with a 30 day required approval timeline

SB 1123 - In 2nd committee review; allows for subdivision in lots under 5 acres with less oversight

SB 1211 - In 2nd committee review; allows for 8 ADUs per multifamily lot instead of 2

SB 1164 - In 1st chamber review; would exempt ADUs constructed between 1/1/2025 and 1/1/2030 from property tax assessments for a period of 10 years

San Diego is leading the way to accommodate growth

“San Diego is the only city in the region that updates its zoning code annually with a large batch of policy changes.”

-San Diego Union Tribune

Specific to San Diego

City of San Diego Executive Order 2023-1

Expedites the City approval process of affordable housing projects to 30 days

New Zoning Laws:

Sustainable Development Areas (SDAs) & Transportation Priority Areas (TPAs)

Affordable home density bonus program

The race is on, but little more than a dent has been made

Since 2021, less than 60% of permit applications have been issued

Source: SANDAG Open Data

Source: sandiego.gov

“I can say the state of our city is rising[...] Rising to build more housing. Rising up against the urge to say ‘no’ because change is scary. Rising to meet the expectations of all our neighborhoods.”

Todd Gloria, Mayor of San Diego

Our

partnership is leading the charge, and

we have a sizeable head start

SDRE has submitted the majority of permits for projects over 5 units

● So far 49 projects permitted for a total of 641 units

● Upcoming 28 projects for a total 535 units.

Only 76 projects have been approved by the city for 5+ units

SDRE’s projects represent ~65% of the total activity in this segment

Our Fully Integrated Team is Leading the Charge

Integrated real estate partnership

Integrated real estate partnership

Josh Stech

Co-Founder and CEO, Sundae

Founding Partner, LendingHome(Kiavi)

Cofounder, Purpose Built Investments

$1B+ in Debt & Equity Capital Raised

Stanford BA Economics

Stanford BA Spanish

Founder and CEO, SDRE

Co-Founder PRO-CAL

Co-Founder, Vertical MVMT

X ADU units developed

Started in Property Mgmt at 18

15 years in SD Real Estate

Partner & Director, Fletcher Cove Capital

CEO, Investors 1031 Exchange

President Capital Markets, IMH Companies

$500M of successfully executed real estate investments

28 years of experience with Fiduciary Services

Supported 1,000+equity placements

Integrated real estate partnership

Co-Founder, Vertical MVMT

Brian Doyle President, SDRE

Founder, KL Drafting & Design

Processed over 1,500 permits through the county of San Diego

30+ years of construction experience

Petco Park, Indian Wells Tennis Garden, Hotel Del Coronado

CA State License Board A and B for 18 years

35 years in multifamily development

Led IMH Companies’ Multifamily Development Operations

COO of William Lyon Homes

Western Area President, Taylor Morrison Homes

Together we create a fully integrated value chain

Underwriting: Proven track record for precise forecasting using the best tools available in the industry

Sourcing: Targeted, multi-channel outreach towards lots with optimal development potential

Permitting: Intimate familiarity after processing over 1,500 permits through the county of San Diego

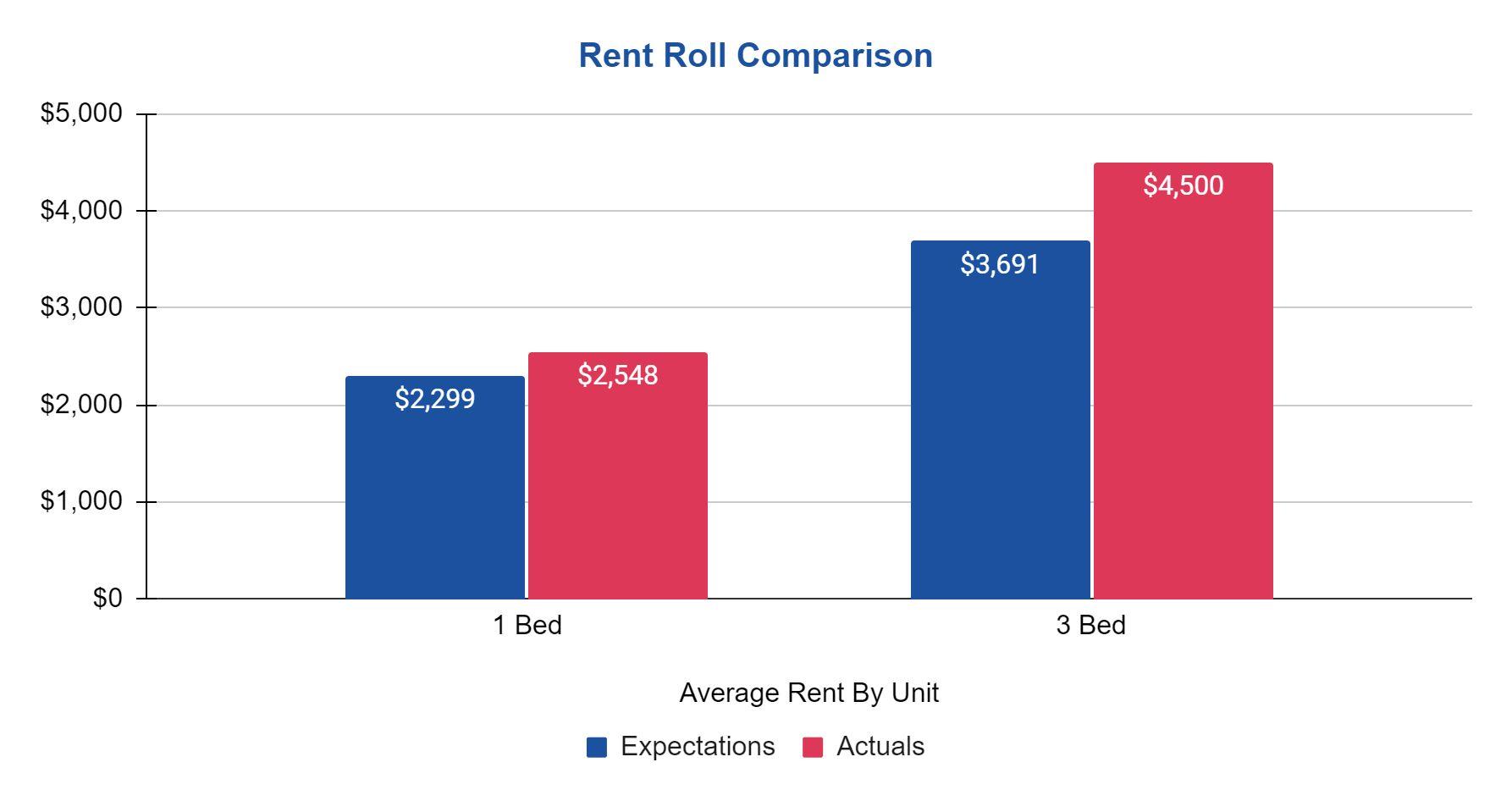

Leasing: 100% occupancy on first 2 large projects with rents exceeding expectations on all unit types

Design & Engineering: Over 50 years experience in a team with a sector-diverse background

Building: Precision execution with attention to detail and strict adherence to costs and timelines

Sales: Best in class team with millions in transactions closed

Examples of completed projects by our team

Total Cash Invested

Total Project Return

Project IRR Equity Multiple

36th Preece Iroquois N Elman

These projects have created housing solutions for highly qualified tenants in need of a better option

Savannah

DOB: 1995

Employer: Rady Children’s Hospital

Income: $107,000

Credit Score: 737

Delinquency

History: 0

DOB: 1963

Employer: Rescue Rooter

Income: $160,000

Credit Score: 687

Delinquency

History: 0

Ashwin

DOB: 1971

Employer: Enable Technologies, Inc.

Income: $260,000

Credit Score: 819

Delinquency

History: 0

DOB: 1964

Employer: US Naval Research Laboratory

Income: $153,000

Credit Score: 775

Delinquency

History: 0

04 Investment Opportunity: Infill Impact Fund

Staggered Project Status → Quick, Consistent Returns

Balancing Demand with Returns →1/1 Unit Focus

Single family home purchased for $1,100,000 on May 15th, 2022

Beds

Full Baths 1,385 Sq. Ft. Home

Sq. Ft. Lot

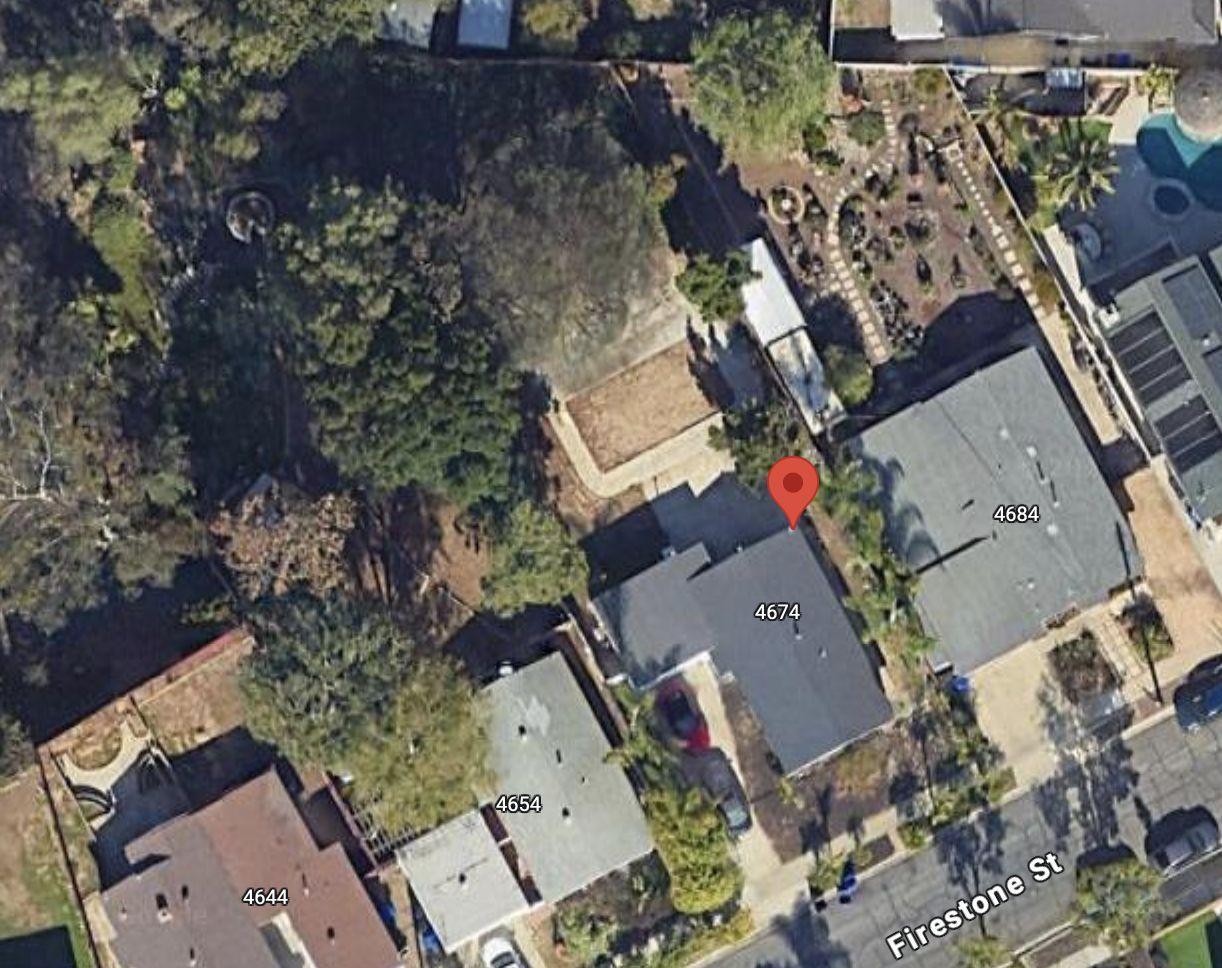

Project Example: 4674 Firestone Street, San Diego

Click here to watch video

Project Example: 4674 Firestone Street, San Diego

● 23 months from acquisition to CofO; currently for sale, Marcus & Millichap’s most active San Diego commercial listing

● 12 Units: 11 one bed/one bath, and 1 three bed/two bath

○ Converted house from a 4 bed/3 bath into 2 units (3/2 and 1/1)

○ Added 10 ADUs in backyard: all 1 bed, 1 baths

● Upscale finishes allowed for easy leasing and 100% occupancy

○ 3 months to lease entire complex; waited to set comps!

12 Units

Project Example: 4674 Firestone Street, San Diego

Equity $30,778,462 Total Profit $45,662,137 Total Resale Value $125,850,904 -Total Project Costs $80,188,767

Investment Opportunity

0% Management Fee

No fund-level management fee, pure expense pass through

Investor Protections

1st 20% IRR to LPs; next 20% IRR to GPs; 50/50 split between 40-60% IRR; GP receives upside above 60% IRR

2 Year Investment Horizon

Q1 2025 to Q4 2026, plus 1 year optional extension at GPs discretion

5-10% GP Commitment

Putting our money where our mouth is

25-30% Investor IRR

Exceptional returns; distributions along the way

$30M Total Equity Raise

Equity will be levered up through construction debt

$250K Minimum Investment

Prioritizing fewer, bigger investors

50% Subscribed

Existing investors + GP commitments;Target close 30-60 days

INFILL IMPACT FUND