What is Fletcher Cove Capital?

Fletcher Cove Capital helps place capital for some of the largest multifamily and single-family homebuilders in some of the strongest real estate markets in the country.

Who is Fletcher Cove Capital?

Tommy Hinson CEO

Mr. Hinson is a partner and director at multiple national multifamily and single-family development firms. Fletcher Cove Capital is the central company through which he places capital at SDRE, IMH Companies, NextLevel Homes, and the Reditus Fund.

He previously served as the Chairman of a debt fund used for land development and construction. He has been responsible for real estate underwriting and analysis, as well as capital structuring for several companies.

Mr. Hinson also is the Chief Executive Officer at Investors 1031 Exchange. He has been in the fiduciary services industry since 1996 and has executed over $500M of various real estate investments, as both an employee and a Principal.

Marc is a community-focused real estate developer, father, surfer, and musician. With over 10 years’ experience in development, he brings hands-on experience and provides valuable insights in all facets of land development—from acquisition to construction. A strategic thinker, he implements a comprehensive approach to the evaluation and execution of viable development opportunities and brings this knowledge with him to capital markets at FCC.

Mike is based in San Diego and focuses on all aspects of business growth and development throughout Southern California. His role at FCC is to work with investors and their advisors to find the most tax efficient manner to structure their real estate holdings and transactions. For the last 5 years, Mr. Riis led a team of ten individuals at the largest global insurance company, where he focused on insuring single family & multifamily portfolios. He has been involved in the real estate industry for eight years through insurance and capital markets.

Zak runs operations for FCC and multiple related companies. With a background in architecture, he received the Alpha Rho Chi medal at MIT, from which he received a Master of Architecture degree. He also holds a BSE magna cum laude in Civil Engineering from Princeton University, received a Fulbright fellowship, and has worked at top architecture firms around the world.

Marc Gould Mike Riis Zachariah DeGiulio

Where is Fletcher Cove Capital?

3,000+ units under development

3 of the hottest metropolitan areas in the country (San Diego, Salt Lake City, and Boise)

Multiple investment offerings, from immediate cash-flow to buy-and-hold

1031 Exchange options available

Current Project:

2596 Chalcedony Street, San Diego, CA 92109

126 Units | Pacific Beach Returns $13,665,943

2596 Chalcedony Street, San Diego, is located west of Interstate 5 in popular Pacific Beach, and offers excellent access to downtown and North County. With San Diego’s thriving economy, Chalcedony Street presents high-value rental opportunities, making it a prime choice for those looking to invest in the city’s growth.

The lots can accommodate 126 additional units that are fully entitled. Investors receive a 15% preferred return and an anticipated 28.22% IRR.

months Total Cash Needed $10,944,836 Equity Multiple 2.25x

& Stabilization

Pre-Development Review from the City of San Diego

2596

Chalcedony St

Ocean Beach Pacific Beach

Downtown San Diego

The Stacked Plan

High Efficiency, High Volume-Based Building

By recycling the same model, we can expedite the drafting/ engineering permit process by nearly half the time. We have multiple sets of plans that stack; one example is below

This floor plan consists of four units. Stackable up to 3 stories, it can have a total of 12 units. It uses the same design, while still providing a quality standard of living for the tenants and neighborhood.

Site Plan

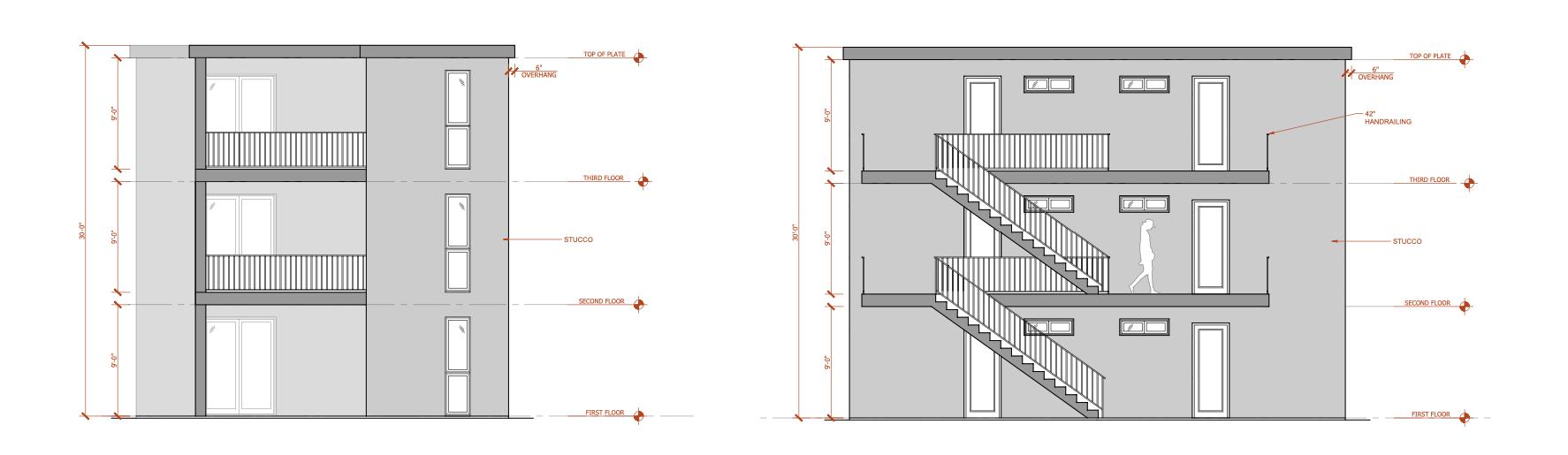

Elevations

Track Record

Nearby Completed Project

Purchase:

$889,000 (July ‘21)

Existing Units

2 Units Added

2 Sale

$3.2M (July ‘23) Hold Time 24 months

Project Summary

Acquisition $6,108,000 Soft Costs $8,288,871 Hard Costs $19,799,500 Total $34,196,371

Project Phases and Equity Needs

Phase 1

Phase 2

Project Phases and Equity Needs

Phase 3

Phase 4

Project Returns

IRR and Cash Flow

10 Year Trended Income/Expense after

$49,211,134

$71,144,361

Legal Disclaimer

This information is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as investment, tax, or financial advice, any recommendation, or an offer to sell, or a solicitation of any offer to buy, an interest in any security, including an interest in this company. Any offer or solicitation of an investment may be made only by confidential offering documents (collectively, the "Offering Documents") to accredited and/or sophisticated investors. Prospective investors should review carefully and rely solely on the Offering Documents in making any investment decision. Targeted returns discussed in this presentation are used for measurement or comparison purposes and only as a guideline for prospective investors, shareholders or other to evaluate this opportunity. Targeted returns should be evaluated over the time period indicated and not over shorter periods. No representation is made that the project will or is likely to achieve its objectives, that the business plan will be successful, or that an investor in the project, and its affiliates will or is likely to achieve results comparable to those shown or will make any profit or will not suffer losses or loss of principal. An investment in this project involves risks, as disclosed in any final offering docs.

THIS PRESENTATION INCLUDES OR MAY INCLUDE CERTAIN STATEMENTS, ESTIMATES, AND FORWARD-LOOKING PROJECTIONS WITH RESPECT TO THE ANTICIPATED FUTURE PERFORMANCE OF THE COMPANY. SUCH STATEMENTS, ESTIMATES, AND FORWARD-LOOKING PROJECTIONS REFLECT VARIOUS ASSUMPTIONS OF THE MANAGER THAT MAY OR MAY NOT PROVE TO BE CORRECT OR THAT MAY INVOLVE VARIOUS UNCERTAINTIES. NO REPRESENTATION IS MADE, AND NO ASSURANCE CAN BE GIVEN, THAT THE COMPANY CAN OR WILL ATTAIN THE MANAGER'S PROJECTED RESULTS. ACTUAL RESULTS MAY VARY, PERHAPS MATERIALLY, FROM SUCH PROJECTIONS.

Any statements made in this presentation are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

All investments, including real estate, is speculative in nature and involves a risk of loss. We encourage any investors to invest carefully. We also encourage investors to get personal advice from your professional investment advisor, CPA or other trusted financial advisor and to make independent investigations before acting.

IT IS IMPORTANT YOU UNDERSTAND THAT WHILE WE ARE PROVIDING PROJECTIONS BASED ON THE FACTS AND FIGURES AVAILABLE, NO ONE CAN TRULY PREDICT THE FUTURE.