At Becker, your success is our number one priority. Our Community Association Practice offers a variety of benefits to help your community thrive. From educational classes, to video series, podcasts, and more, we’re here to help make your job as a board member or community manager as easy as possible. Make sure to take advantage of these resources and please reach out should you have any questions.

Becker’s video series, tackles some of the unique problems that homeowners and renters face today. We answer questions, no matter how far-fetched they may seem. From service animals to nudists in your community, we get to the bottom of it and let you know – “Can They Do That?”

BECKERLAWYERS.COM/CTDT

The Florida Condo & HOA Law Blog provides readers with up-todate analysis of issues affecting associations in Florida. With many years of cumulative experience, our blog authors are community association attorneys who help to keep you apprised of important issues affecting your community.

FLORIDACONDOHOALAWBLOG.COM

Did you know Becker provides over 200 educational classes per year throughout Florida on a variety of topics ranging from board member certification to compliance, and everything in between? Our most popular classes are available online!

BECKERLAWYERS.COM/CLASSES

Leading community association attorney Donna DiMaggio Berger acknowledges the balancing act without losing her sense of humor as she talks with a variety of association leaders, experts, and vendors about the challenges and benefits of the community association lifestyle.

TAKEITTOTHEBOARD.COM

The Community Association Leadership Lobby (“CALL”) provides an avenue for community leaders to become engaged in the legislative process. Stay informed on key issues and help influence new legislation in Florida’s Capitol.

CALlBP.COM

FLCAJ 2024–2025 Salary and Information Survey

HOA Strategic Planning: Building a Future for Your Community

Managers and Associations—Improving the Financial Picture

Cost-of-Living Increases and the Impact on Security Guard Pricing

Five Ways to Boost HOA Revenue Without Increasing Homeowner Fees

Managing Financial Challenges—Cost-ofLiving Increases

Balancing Act: The Essential Role of Reserve Studies, Lending, and Insurance in Florida Condominiums

Board Members Benefit from More Extensive

Certification Requirements

Facing the Challenge: How Florida Condominiums Can Tackle Escalating Fees and Reserve Requirements

Journal Notes

FCAP Community

CAM Matters—Betsy Barbieux

Readers' Choice Spotlight

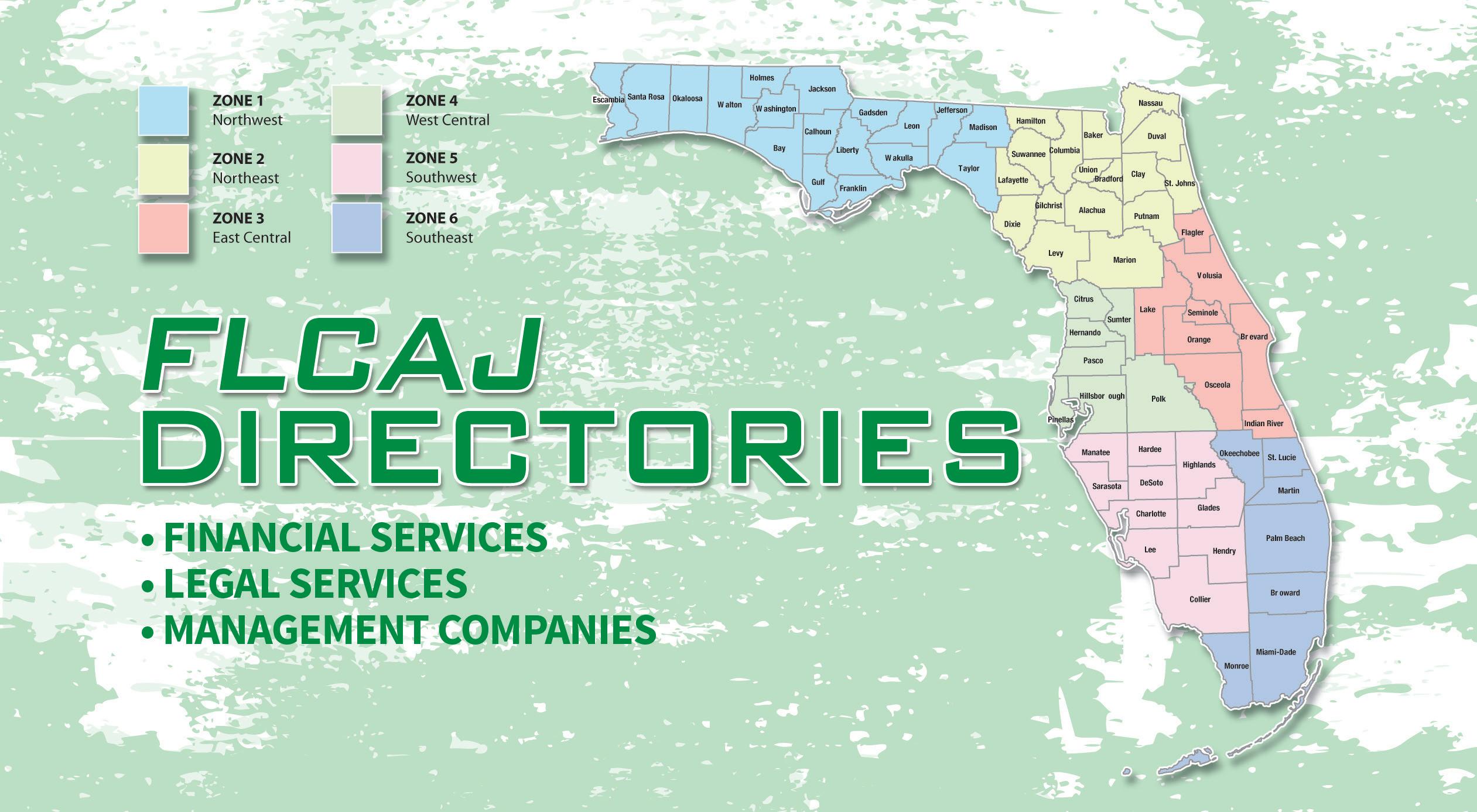

Financial, Legal, and Management Directory

Products and Services Directory

Display Advertisers’ Index

Rembaum's Association Roundup The Obligation to Maintain Official Records

Budgeting Challenges

The Florida Legislative Process Hot Off the Presses!

ELEVATOR COMMUNICATIONS MUST NOW INCLUDE:

Two-way messaging for hearing and/or speech imparied

Video capability

Display message to indicate help is onsite

*Enforced upon new construction or modernization

When it comes to elevator code, you’ve been through enough lately. We’re here to help navigate this next set of requirements, making it as seamless and hassle-free as possible.

Kings III works with elevator companies across the country in states that have already been enforcing this code since its inception. We have installers across the state of Florida, and our CabView monitoring solution works across multiple manufacturers of fixture hardware, so no matter the new panel installed, we can accommodate.

Welcome to 2025! January 20th is Inauguration Day for the 47th President of the United States. Besides praying for a peaceful transition of power, we wonder what domestic policies a new administration will pass that will have an impact on our community association living for better or worse. The next few years will provide us with these answers.

On page 8 the Salary & Information Survey provides information to review and analyze as reported by survey respondents in 2024. This is one tool that can be used to determine what salary and other benefits to provide for those who make your community a place you enjoy living in. Some good news for 2025 is that of those who completed the survey, manager salaries came in at a statewide average of $82,444 with an average salary bonus of $4,173. Many hourly employees, from front desk staff to head of maintenance and security personnel, also saw increases in their hourly wages.

The articles throughout this issue are primarily concerned with planning well for the future and responding well to financial challenges facing many community associations as we turn the page to 2025. As good as the news of rising wages is, as previously mentioned, it is also a reality that the cost of living has greatly increased. Planning for the future includes strategic planning, identifying ways to reduce security expenses without compromising safety, boosting community revenues, managing cost of living increases in laundry room facilities, implementing proactive risk management strategies with proper reserve funding, and facing the many challenges of escalating fees and reserve requirements.

On page 44 community association manager Oscar Borras helps board members face these challenges by encouraging them to pursue a sound educational foundation by pursuing with gusto the many changes now required by law to the board certification process.

Finally, on page 74 Ansbacher Law shares how the legislative process works. In 2025 the regular session convenes on March 4 and ends on May 2. There will be new legislation passed during this session that will add new laws and challenges in 2025 and beyond, but with good guidance like you can find in these pages, your community will be able to face the future with a solid financial plan and optimism.

FLCAJ wishes you a Happy New Year and a great 2025!

Editor

Publishers Richard Johns Dana Johns

Editor Michael Hamline

Art Director Nick Walker

Advertising Sales

Phone: (800) 425-1314

Email: info@fcapgroup.com

Circulation/Accounting Tammy Hanner Phone: (800) 443-3433 Fax: (501) 280-9233

Editorial Phone: (800) 443-3433 Fax: (501) 280-9233

FCAP Coordinator Dana Johns Phone: (800) 443-3433

Email: djohns@fcapgroup.com

Florida Community Association Journal is published monthly by True Source Publishing LLC 1000 Nix Road

Little Rock, AR 72211-3235

Email: info@fcapgroup.com

Website: FCAPgroup.com

Copyrighted by Florida Community Association Journal. Reproductions of any part of this publication without written permission of the publisher are prohibited.

Subscription Rates

$24 for one year, $48 for three years. Back issues are $5 each plus postage. Group rates for 3 or more people are available at $12 per person.

The publisher and editor(s) of this magazine do not accept responsibility for the content of any advertisement, including statements made by advertisers herein, or for the opinions expressed by authors of by-lined articles. The publisher and editor(s) also reserve the right to reject any ad or article for objectionable content in verbiage or images. The intent of this publication is to provide general information only and is not intended to provide specific advice or recommendations. Appropriate legal, financial, or engineering advice or other expert assistance should always be sought from professionals.

Postage paid at Little Rock, AR and additional offices (permit #1085).

Postmaster

Send address changes to: Florida Community Association Journal 1000 Nix Road Little Rock, AR 72211-3235

or email info@fcapgroup.com

Ansbacher Law, with board certified partners, 11 attorneys and over 30 professionals, is available to serve your community throughout Florida.

• Full service law firm for your Condominium or Homeowners Association.

• Florida’s leading construction defect team - Full contingency available, no fees or costs unless you win.

• Collections handled on deferred and contingency fee arrangement.

Florida Community Association Journal has been privileged for more than 35 years to present the annual Salary and Information Survey. The Survey is compiled using data from an online survey that is available year-round. As always, the Survey depends on participation from our readers, managers, and board members alike, and we want to thank all who responded by the web survey. We trust this information will be helpful in evaluating salary and benefits in your community in 2025.

The Survey is displayed in three pie charts, eight bar charts, a community profile, and a manager’s compensation profile that should make the information easier to see at a glance. The first pie chart breaks down responses by region; the second pie chart provides a general manager profile; and the third pie chart breaks down the type of association survey respondents live in and supplements the first bar chart

with typical manager profile information. The manager compensation bar chart contains the average manager’s salary and benefits. The five total income bar charts compare salary ranges with several key indicators: region, number of units, price of units, total annual budget, and length of employment. The final bar chart lists average hourly wages for other typical community association employees.

In 2024 the largest percentage of responses to the Salary Survey came from Southeast Florida at 40 percent with Central and Southwest Florida tying at 26 percent.

Survey participants who live in condominiums represent two-thirds of the responses at 67 percent, and HOA representation came in at 31 percent with the remaining 2 percent from cooperatives. Paid management is used by 90 percent while the other 10 percent of communities are self-managed by their volunteer board members.

The survey participants responded to several questions about their community association. The typical community surveyed in 2024 is an average of 35 years old and consists of 214 units. Of the communities that responded, 18 percent are located on the oceanfront. The average price for a unit came in at $630,795 with the average annual community budget at $2,715,590. On average each board of directors consists of five volunteers. Monthly assessments per community were found to be on average in the amount of $957. This year’s survey respondents with paid managers used on-site management 40 percent of the time and management

companies 50 percent of the time.

The manager profile shows the average age of a community association manager is 53. The ratio of managers by biological sex is 58 percent male to 42 percent. The average number of years of total management experience is 13, with the average manager having been at their current position for five years and devoting at least 45 hours per week to the job.

The most important statistic for managers deals with compensation. Manager salaries averaged $84,321 statewide for 2024, with bonuses averaging $4,173. Health insurance is being provided to 58 percent of respondents. This health insurance is provided for 22 percent of managers and their families versus 78 percent provided only for the individual. Life insurance policies are paid for at various levels for 23 percent of CAMs. The average number of vacation days provided is 15 days with six sick/personal days being made available.

The average number of employees per community association came in at 11. For the second year in a row, maintenance chiefs saw an increase in their hourly wages from $24.11 in 2023 to $29 in 2024. Maintenance staff, rental managers, front desk personnel, groundskeepers, housekeepers, administrative assistants, security chiefs, and security personnel also saw increases in their 2024 hourly wages as compared to 2023.

The average amount of time respondents have subscribed and read FLCAJ is seven years, with the longest having read the publication for 20 years. More than three-fourths of the readers say they read all or most of the monthly magazine, and 71 percent of respondets say they are likely or very likely to use the services of advertisers within the publication.

FLCAJ hopes that you find this information useful and helpful as we move into 2024. We encourage you to take part in the 2025–2026 Salary and Information Survey by taking some time to visit www.fcapgroup. com/survey and fill out the survey as completely as you are able. n

BY MAX GLASSBURG

trategic planning is an investment in the future of your homeowners’ association. The most successful HOAs have been using strategic plans for decades, and growing communities use them as guideposts to plan their future. So, what goes into a good plan? To find the best answer, we spoke to Jake Gold, director of education at the Community Associations Institute (CAI).

“The biggest challenge is often getting started,” he said, adding, “Many association managers don’t even know they should have a plan.”

Given the importance of strategic planning, this article is going to cover a lot of ground with the following main topics:

• Explanation of strategic planning for HOAs

• Three key benefits of a strategic plan

• Mission & vision statements

• The right time to plan

• Whether to hire a consultant

• Characteristics of a good strategic plan

• How to involve your homeowners

• The role of community management software

• Five simple steps to making an effective plan

Strategic plans help HOA boards move beyond reactive, day-to-day management to proactive, goal-oriented governance. A good plan typically includes a mission statement, a vision for the future, and specific action items to reach the outlined objectives.

According to Gold, “Many HOAs become absorbed in the details of running the community—maintenance, budgeting and enforcing rules—and fail to

Max Glassburg is a senior marketing writer at Yardi. He is usually found writing for Yardi Breeze and especially enjoys connecting with clients and sharing their successes with the real estate community. For more information, visit yardibreeze.com or call 800-866-1144.

think ahead. A strong strategic plan can transform a community from simply functioning to thriving.”

Strategic planning fosters a shared vision and sense of purpose among residents and leaders. In the best plans everyone understands the community’s long-term goals, such as improving amenities, building stronger social ties, or becoming more sustainable.

Without a strategic plan, a community may find itself veering off course due to shifting priorities and lack of cohesion. Ultimately, says Gold, this limits the association’s potential.

A well-crafted strategic plan brings numerous benefits to an HOA. It lets you showcase the HOA’s identity, align community goals, improve governance, and use the plan as a marketing tool for the community.

1. Market your HOA’s identity

Show potential homebuyers exactly what type of community they are stepping into. Whether you’re cultivating an active adult neighborhood with bustling social activities or a community focused on green spaces, a strategic plan will showcase what makes your HOA unique. When people can see the results of a plan, it’s easier for people to make home-buying decisions.

According to Gold, “By establishing the community’s strengths and long-term vision, the board can highlight aspects that appeal to prospective homebuyers.” Of course, this requires a strategic plan that visibly aligns with the community’s stated identity.

2. Align Community Goals

Beyond shaping identity, a strategic plan aligns all community decisions with overarching goals, ensuring consistency and focus. Without a plan, community board members often work against one another. A plan ensures board members, committees, and residents are all working toward shared goals and not pulling in different directions.

3. Improve governance

When goals and priorities are aligned, you can govern efficiently. Resources such as funds, time, and energy are allocated more effectively. This focus not only enhances the current living experience but also makes the community more attractive to future residents.

Many businesses have mission and vision statements. An HOA is no different. These terms are sometimes used interchangeably or mentioned together, but they play different roles in guiding a community’s development and focus.

Mission Statement

A mission statement defines your community’s purpose in the present. It addresses what the community stands for and outlines its core values and principles. It sets goals to ensure all stakeholders understand what’s driving the association’s decisions.

Vision Statement

A vision statement focuses on the future. It has a destination in mind and describes where the community aspires to be in the coming years. It sets the direction for long-term growth and development, serving as an aspirational guide. A well-crafted vision paints a picture of success, motivating residents and board members to work toward a shared dream. Together, the mission and vision statements provide direction and inspiration, ensuring that all decisions align with broader objectives.

Strategic planning is not a one-and-done thing. For an HOA to remain relevant and effective, its strategic plan needs to be looked at periodically to ensure it still aligns with the community’s evolving needs.

“A good rule of thumb is to reevaluate the plan every three to five years,” says Gold. During this time, demographic shifts or changes in the

community—such as an influx of young families or an aging population—can significantly affect priorities.

In some cases, annual reviews can be used to keep plans dynamic. These reviews serve as checkpoints to assess progress, adjust goals, and address emerging challenges.

Not everything is going to operate on schedule. For instance, if the board is constantly reacting to issues instead of proactively addressing community goals, the strategic plan may need to be revisited. Without a clear plan, board members’ individual priorities can drive decisions, leading to inconsistency. A strategic plan keeps everyone on the same page. Let’s say you don’t have a very engaged community to begin with. It’s not a hopeless situation. It’s just another sign that your plan needs to be looked at or you need a plan! Often when residents are disengaged, it means that the community’s direction is not clearly communicated or that decisions are not aligned with residents’ interests.

For many HOAs strategic planning can seem like a daunting task. Board members may not have experience in long-term planning. In such cases you may want to hire a consultant. Consultants bring expertise and an outsider’s perspective, helping boards focus discussions and avoid common pitfalls.

According to Gold, a thirdparty consultant can make a big

difference: “Consultants often guide boards through the entire process, from developing a vision to setting actionable goals.” By having an experienced professional facilitate the planning process, HOAs can develop a strategic plan that reflects the community’s unique needs and benefits from best practices in community management.

Local CAI chapters are an excellent resource. Many CAI instructors who teach strategic planning are also available for consulting. They offer practical knowledge and industry-specific insights while helping HOAs get core elements of the plan in place.

A focused session, often lasting just a day or an afternoon, can lay the foundation for a strategic plan.

A well-crafted strategic plan is a powerful tool for guiding decision-making and ensuring alignment. A poorly designed plan can create confusion, foster division, and wind up being ineffective.

According to Gold, one of the biggest differences between a good and bad plan comes down to community participation. He tells us, “A good plan is one that reflects the collective input of homeowners, not just the opinions of a few board members.” Involving residents, committees, and other stakeholders ensures the plan finds common ground among everyone.

“Measurable goals are crucial,” Gold emphasizes. Without clear benchmarks for success, it’s difficult to gauge progress or adjust strategies effectively. A vague or overly ambitious plan is challenging to implement and track.

There’s no faster way to turn a good plan into a bad one than by lack of follow-through. Ideas that are laid out but not acted upon are destined to fail. Inaction leads to frustration, which hurts participation and buy-in.

Homeowners buy in when they understand and believe in what you’re doing. It’s obvious when your strategic plan means something to the community because people will stay active in its implementation. So, share the plan, seek feedback, and be transparent about its progress.

According to Gold, HOA managers should be looking to include a diversity of opinions and perspectives. “The board of directors is ultimately responsible for steering the community, but engaging residents and committees in the planning process is crucial for a better outcome,” he says. When residents feel that their voices are heard, they feel a sense of ownership. This makes it more likely that they will rally behind the plan.

Committees play an essential role in strategic planning. Once a plan is established, committees can be tasked with specific activities that align with broader goals. For example, a landscape committee might focus on enhancing green spaces. No two communities are alike; therefore, no two committees are alike. Allow the unique passions, expertise, and creativity of your people to shine.

Surveys, meetings, and workshops help gather input about residents’ priorities and desired changes. The more input you have and the more transparent you are, the stronger the plan will be.

By centralizing information and operations, community management software helps align all members with the community’s vision and goals.

“Technology has a huge potential to make strategic planning easier for communities,” says Gold. The right software

can integrate the strategic plan into daily operations, ensuring that it doesn’t become just another document buried under paperwork.

Here’s an easy way to integrate your plan and your technology.

All-in-one association management software like Yardi Breeze Premier integrates community accounting, budgeting and reporting, homeowner services, and association management tools into one platform. Now you’re linking daily tasks with long-term goals, and HOA software can be used to streamline plan execution. The board can track goals in real time, and everyone wins.

This is the most cost-effective way to keep your strategic plan organized and on track.

Let’s recap. Developing a strategic plan for an HOA means transforming a community’s long-term vision into actionable goals. In most of the plans, you’ll complete the following five steps:

1. Create mission and vision statements

2. Engage stakeholders

3. Identify clear, specific goals for the community

4. Develop an action plan to achieve your goals

5. Share the plan with the entire community

Keep in mind that every plan is different and might not require all these steps in this order. Still, this is a good place to start if you’re new to strategic planning. n

BY RONALD E. PECK

Happy New Year, everyone! Now 2025 has arrived and is set to be an exciting adventure. With the election behind us and the new administration in place, we can now determine how to best work within your budget for the year.

Our Florida CAMs (community association managers) are the best of the best in the industry. As of November 8, 2024, the average annual salary for the CAM job category in Florida was $66,469 per year (per Zip Recruiter). While Zip Recruiter is seeing annual pay as high as $111,347 and as low as $18,682, the majority of CAM salaries range between

$46,700 (25th percentile) and $86,700 (75th percentile), with over $100,137 being the highest (90th percentile) in Florida.

However, the Bureau of Labor Statics in 2023 reported that the average annual salary of a licensed community association manager in Florida was approximately $71,257 per year. Variables including location and experience play a vital role in this calculation. The average hours that CAMs work per week was 45 (although some would argue this is an underestimation), and managers scored their career rating as 4.25 out of possible 5. These averages come from 1,482 CAM professionals in Florida who have taken the course with Prolicense Florida. As expected, there is a great divide between the CAM’s earning potential across the entire state of Florida. Salaries

Ronald E. Peck is the senior association banking relationship manager for Centennial Bank. He has 41 years of experience in relationship building, sales, and leadership. He is an active member and past board of director member for the Gold Coast chapter of the Community Associations Institute (CAI), past president and board of director member for the Central Florida CAI chapter, and a licensed community association manager (CAM). Ron resides in Williston, Florida, with his wife of 42 years, Nancy. He is a father of two and grandfather (Poppi) of five. For more information about Centennial Bank, call 866-227-0441 or visit my100bank.com

are higher in or near coastal regions and in larger-scale communities than in other situations. Entry level workers earn significantly less than highly skilled and experienced professionals.

The overall survey of licensed CAMs says they are optimistic, satisfied, and happy in their careers. With over 40,000 associations in Florida, management companies and community boards of directors are looking for qualified CAM professionals all the time. Presently there are 26,008 condominium associations, 14,587 homeowners’ associations (HOA), and 771 cooperative associations in the state of Florida.

CAMs complete the necessary courses and test for their CAM license. There is a requirement of 15 continuing education credits for a two-year renewal cycle.

One excellent organization where you can obtain these credits is CAI (Community Associations Institute). This national organization supports CAMs receiving educational requirements for their license renewal and provides a wealth of knowledge for the board of directors (BOD) to understand the roles, rules, and responsibilities of serving on a BOD. CAI is committed to keeping the industry at the top of its game. There are at least four other certifications designed to elevate the job title of CAMs.

1. Association Management Specialist (AMS)

2. Large-Scale Manager (LSM)

3. Accredited Association Management Company (AAMC)

4. Professional Community Association Manager (PCAM)

The PCAM certification requires extensive educational knowledge through courses and testing. One requirement is five years of direct community management experience, including relevant coursework and a large community association case study. In most cases this certification allows PCAMs to negotiate for higher salaries and professional advancement.

By now associations have already started the new budget year. The process and planning typically involve reviewing last year’s budget estimate to examine fluctuating line items like insurance, cost of living increases, adding to the reserve funds, and other association expenses. One simple key practice is

monitoring every month’s expenses and comparing those to the projections.

Minimizing and monitoring unit owner delinquencies is paramount to a healthy lifeline for the association. First, send the unit owner an “oops, you’re late’’ letter. If there is no response, follow up with a stern letter, and then send it off to the attorney for the last notification before placing a lien on the property. This must be uniform for all unit owners without exception.

Effective communication with the unit owners is key to understanding the mission of the board of directors’ (BOD) role. This is a voluntary position with little appreciation and applause. Unit owners may give lots of criticism—usually related to petty issues, but it happens.

The BOD’s main responsibility is to maintain and preserve property values, quality of life,

AND MONITORING UNIT

DELINQUENCIES IS PARAMOUNT TO A HEALTHY LIFELINE FOR THE ASSOCIATION.

FIRST, SEND THE UNIT OWNER AN “OOPS, YOU’RE LATE’’ LETTER. IF THERE IS NO RESPONSE, FOLLOW UP WITH A STERN LETTER, AND THEN SEND IT OFF TO THE ATTORNEY FOR THE LAST NOTIFICATION BEFORE PLACING A LIEN ON THE PROPERTY. THIS MUST BE UNIFORM FOR ALL UNIT OWNERS WITHOUT EXCEPTION.

and the safety of its unit owners. Please take the time to thank your BOD for volunteering their time and efforts. When unit owners, boards of directors, and/or management companies work together, it definitely benefits everyone involved. n

BY RON NEUMAN, ESQ.

As the cost of living continues to rise, many industries are feeling the financial pressure, including the security services industry. For condominiums and residential buildings, security guard pricing has become a growing concern for property managers and owners. With inflation, wage hikes, and rising insurance and operation costs, the price of hiring security personnel has increased significantly, prompting condominium boards and managers to look for effective ways to reduce security expenses without compromising safety.

The rising costs of security services are primarily driven by increased wages, which are necessary to attract and retain qualified security personnel. As housing prices, transportation, and everyday goods become more expensive, security agencies must offer competitive salaries to meet demand, contributing to higher prices for their services.

Other factors contributing to the price increases include the following:

• Increased Training Costs—As regulations evolve, security personnel must undergo specialized training in emergency response, customer service, and first aid (including CPR and AED), raising overall expenses.

Ron Neuman is a seasoned expert in the property management and security services industries and is currently working at Kent Security. With over 10 years of experience, Ron specializes in helping condominium boards and property managers develop cost-effective, secure solutions for residential buildings. A graduate of the University of Miami, Ron holds both a JD and an MBA, equipping him with a unique blend of legal and business expertise. In addition to his professional work, Ron serves as the president of his condominium board of directors at Brickell on the River North Tower, where he applies his knowledge of security and financial management to ensure the safety and efficiency of his community. He also serves on the board of the Brickell on the River Master Association. For more information, call 305-919-9400 ext. 268, email ronneuman@kentsecurity.com, or visit www.kentservices.com

• Operational Costs: The costs of maintaining a security fleet, including vehicles, fuel, and equipment like mobile patrol software, are also rising and are typically passed on to clients in the form of higher rates.

For condominiums, which often operate on tight budgets, these rising costs can strain finances. However, reducing security expenses while

maintaining safety is crucial. Fortunately, there are innovative solutions to help achieve this goal.

To counteract rising security costs, condominium managers and boards can adopt creative strategies that incorporate technology, optimize staffing, and streamline security operations. Below are some solutions that can help reduce overall security expenses while ensuring safety.

Leverage Technology for Enhanced Security

Incorporating technology into security operations can reduce the need for physical security guards, making it one of the most costeffective solutions for condominiums.

• Surveillance Systems— Modern cameras, particularly those with AI and facial-recognition capabilities, offer real-time monitoring, which can replace the need for additional security personnel. Cloudbased storage and remote access allow property managers to oversee the building from anywhere, ensuring effective surveillance at all times.

• Smart Access Controls— Keycards, biometric systems, and smartphone-based access controls can automate building entry, reducing the need for on-site doormen or guards. These systems not only improve security by restricting unauthorized access but also streamline daily operations.

• Virtual Guards—Some companies like Kent Security

offer remote security services where trained personnel monitor surveillance feeds from a central location. This solution is significantly more affordable than having physical guards on site 24/7 and can be particularly useful for large properties or condominiums with fewer security needs at certain times.

Integrate Concierge Services with Security Roles

Combining concierge services with security roles can reduce the number of full-time staff needed. By cross-training security personnel to handle additional tasks, condominiums can lower labor costs while maintaining a high level of service.

• Concierge Security—Concierge staff can be trained to handle routine

security duties like monitoring surveillance cameras, conducting patrols, and managing visitor logs. This reduces the number of guards required and adds value to the residents by providing extra services.

• Multi-Role Guards—Multirole guards who are trained to take on additional tasks beyond traditional security duties can help reduce staffing needs. For example, a guard might also be responsible for managing deliveries, assisting with light maintenance tasks, or even providing front desk support during off hours. This helps to ensure that security needs are met without the extra expense of hiring additional personnel.

Security Services to Specialized Agencies

Outsourcing security services to specialized agencies can provide significant cost savings compared to hiring full-time, in-house guards. Many security companies now offer flexible staffing models that allow property managers to adjust the level of service based on specific needs and budgets.

• On-Demand Staffing— Instead of paying for full-time guards, condominiums can opt for temporary or on-demand staffing. This allows for security coverage during peak hours or special events without the added cost of full-time salaries and benefits.

• Security Audits—Outsourced security companies can conduct regular security audits to identify areas for improvement and provide

cost-effective solutions that help optimize building security while lowering expenses.

In some communities a neighborhood watch or tenant watch program can be a valuable supplement to professional security services. Engaging residents in active surveillance can help deter crime and create a safer environment, often at little to no cost.

• Resident Involvement—Condominium communities can encourage residents to be vigilant and report any suspicious activity. While this approach doesn’t replace professional security, it can reduce the number of guards needed and foster a greater sense of community responsibility.

• Neighborhood Patrols—In some cases residents may even volunteer to conduct regular patrols of common areas. This can reduce the need for guards, especially during off-peak hours, without compromising security.

Efficiently scheduling security staff can reduce labor costs by ensuring that guards are only deployed when needed. Using scheduling software and analyzing past security trends can help property managers determine the optimal number of guards required at different times of the day.

• Peak Hours Coverage—Scheduling more guards during peak hours when security needs are higher (e.g., evenings or weekends) and fewer guards during off-hours can significantly cut costs without sacrificing safety.

• Overtime Reduction—By managing schedules effectively, property managers can reduce overtime and unnecessary shifts, lowering labor costs and improving overall efficiency.

The rising cost of living has put increased pressure on security budgets for many condominiums, but it doesn’t mean that property managers have to compromise on safety. By adopting innovative solutions such as leveraging technology, integrating concierge services with security roles, outsourcing staffing, and optimizing guard schedules, condominiums can reduce security expenses while ensuring the safety of residents.

The key is to find cost-effective, flexible strategies that balance security needs with the financial realities of operating a condominium. With careful planning by the involved stakeholders, as well as the use of modern solutions, it’s possible to maintain a secure environment without breaking the bank. n

BY CAMILLE MOORE

uccessfully running a community association comes with a unique set of challenges. One of the toughest challenges of all is boosting revenue without raising homeowner fees. After all, no one enjoys seeing their monthly fees increase; but the reality is, associations still need funds to maintain common areas, uphold community standards, and plan for the future. So, how can you increase revenue while keeping homeowners happy? It’s possible! Let’s dive into five creative ways your HOA can boost revenue without hiking up those fees.

Your association likely has valuable community amenities—think clubhouses, swimming pools, tennis courts, or event spaces. These facilities can be turned into revenuegenerating assets. By offering them for rent to residents for private events, parties, or meetings, your association can generate significant income.

Consider pricing for both peak and off-peak hours, offering discounted rates for residents, and allowing nonresidents to rent as well (with an added premium). Keep in mind that your association may need insurance riders for events held in community facilities, so it’s important to check with your insurance provider.

At RealManage we specialize in helping communities like yours achieve financial stability, streamline operations, and enhance resident satisfaction. Contact us today at www. realmanage.com/proposal-request or call 866-403-1588 to learn more!

Your community’s events and common areas are prime opportunities for financial sponsorship. Local businesses, especially those that benefit from the visibility, may be eager to support your community. From fully or partially sponsoring annual events, park benches, or even signage in common areas, these partnerships can provide a steady stream of income. In return, your sponsors gain access to the local market while supporting your HOA’s goals.

Many residents appreciate the convenience of extra services, and your association is in a unique position to provide them at a profit. Think about services like dog walking, lawn care, or home cleaning. You can even create a package for residents who want a full-service concierge experience. Not only does this create

a revenue stream, but it also strengthens the sense of community by offering services that make residents’ lives easier.

Tap into your community’s potential by hosting events and workshops. Fitness classes, gardening seminars, cooking workshops, or home improvement talks—these can all be ticketed events that add value to your residents while generating additional income. Partnering with local experts to run these sessions allows you to offer fresh, engaging content while keeping the profits flowing into the HOA coffers.

Remember to always be transparent about how the funds will be used. Homeowners are more likely to participate when they see the direct benefits of their contributions.

If your community has a well-trafficked newsletter, website, or social media channels, you can turn these platforms into revenue generators by offering advertising space. Local businesses would likely appreciate the opportunity to reach residents, and the exposure can be valuable. Whether it’s through digital ads on your website or a spot in the printed newsletter, this can create a recurring revenue stream without much effort.

To avoid overloading residents with ads, maintain a balance between useful content and advertisements. Think of it as turning your communications into revenue-generating tools without losing their primary value.

With the help of these innovative revenue-boosting ideas, your HOA can generate income without burdening homeowners with higher fees. Focus on enhancing the community experience and building partnerships that benefit both your association and your residents. In the end, a little creativity can go a long way to achieving your financial goals and keeping the community thriving! n

Go Green with Commercial Saline Systems! Save money, make your own Chlorine, enjoy a mineral pool!

Call us today for your FREE on-site evaluation!

• Water Management Programs for over 8,000 municipal & condo pools since 1983.

• Experts in chemistry controls, treatment, heating, heat retention, Ozone, UV & Saline.

• Master Distributor & Factory Service Center for over 10,000 parts & accessories.

• Leaders in Proven Green Technologies saving electricity, gas, water, and chemicals.

• Low cost monthly water quality programs starting at $69 a month. 800-940-1557 • www.CESWaterQuality.com

BY KENDAL KOPP

s the cost of living continues to rise, every penny counts for individuals and communities alike. For community boards managing shared amenities like laundry facilities, the inflation in the economy presents unique challenges for budgets and reserve funding. Owning laundry equipment, which was once a cost-effective solution, is becoming more expensive due to rising utility rates, maintenance costs, and inflation. But what can be done to keep these essential services affordable and efficient for everyone?

For a board member who is trying to look for the best solution to focus

on the budget, there are a few ways to tackle the issue of rising prices in shared laundry room spaces. One of the first places to start is comparing the cost of leasing versus owning. It might be time to consider the long-term leasing expenses being saved compared to the downsides of purchasing your machines. Building relationships with vendors that might secure favorable terms in your lease or have great plans on how to budget for future expenses with your leased machines can be cost effective in the long run compared to ownership of your laundry equipment and the fees that are continuing to rise to maintain the longevity of your equipment.

Leasing laundry equipment often provides community

Kendal Kopp is a dynamic professional specializing in editing, writing, media design, and public relations. With a talent for storytelling and an eye for detail, Kendal creates engaging content that connects with her audiences. Renowned for her editing expertise, she refines content to ensure clarity, precision, and impact. She combines her creativity and technical expertise in media design to deliver visually compelling projects like web design, video, and photography content. Her PR experience includes crafting strategic messaging and building meaningful brand relationships. For more information, email kendal@ciifl.com, call 786-620-7089, or visit commerciallaundries.com

boards with greater flexibility and lower upfront costs, making it an attractive option. This arrangement allows for predictable monthly expenses without the large capital investment required for ownership. Additionally, leasing agreements frequently include maintenance, warranties and sometimes even equipment upgrades, which can reduce the burden on boards and ensure the equipment remains in good working order without added costs. For communities with fluctuating laundry usage or those seeking to avoid the financial risk of a large initial investment, leasing can be especially advantageous.

Though long-term leasing expense may accumulate over time, the ability to upgrade or replace equipment as needed and avoid unexpected repair costs makes leasing an appealing choice. Boards should consider the total cost of leasing over time, including any potential rate increases or maintenance fees, and weigh it against the flexibility and lower financial risk leasing provides.

Another way to maintain your budget spending is to consider upgrading your machines to energy-efficient models. These machines are the best option to help save some money in the budgeting department. When you choose to upgrade your machines to energy-efficient technology, you are opting for one of the most effective strategies for offsetting rising utility costs. As electricity, water, and gas prices continue to rise, older and less efficient machines consume more energy and resources, increasing the expenses of the daily use of your laundry equipment. Energy-efficient washers and dryers, on the other hand, are designed to minimize energy consumption while maintaining high performance. Not only do these upgrades help lower monthly utility expenses, but also they extend the lifespan of the equipment by reducing wear and tear.

Maintaining a strong, long-term relationship with a trusted laundry equipment vendor is crucial for community boards looking to maximize both cost savings and service quality. A reliable vendor not only provides the best equipment options but can also offer ongoing support, maintenance services, and valuable insights into the latest industry trends and technologies. By working closely with a vendor who understands the

ANOTHER WAY TO MAINTAIN YOUR BUDGET SPENDING IS TO CONSIDER UPGRADING YOUR MACHINES TO ENERGY-EFFICIENT MODELS. THESE MACHINES ARE THE BEST OPTION TO HELP SAVE SOME MONEY IN THE BUDGETING DEPARTMENT.

unique needs of your community, boards can negotiate better terms, ensure timely repairs, and explore new equipment upgrades that deliver greater energy efficiency and cost-effectiveness. Whether you decide to buy your machines outright, lease your machines, or enhance your existing equipment, having a dedicated vendor partner like Commercial Laundries Inc. can help you make informed decisions that align with both your budget and long-term goals. The end result is reduced operational costs, fewer service interruptions, and greater satisfaction for your community members. Overall, navigating the rising costs of living doesn’t have to mean you have to compromise the quality and affordability of your laundry facilities. By carefully evaluating your options, whether through energy-efficient upgrades, renegotiation of leasing terms, or equipment ownership, you can better manage expenses and continue offering a vital service to your community. As a trusted laundry equipment vendor, we’re here to help you make informed decisions that align with your budget and long-term goals. Let us work with you to find the most cost-effective, sustainable solutions to keep your laundry operations running smoothly no matter what the future holds. With our support you can confidently navigate the changing economic landscape and ensure the continued success of your community’s amenities. n

COMMUNITY ASSOCIATION LAW SERVICES:

Covenant enforcement

Covenant amendments

Contract review/negotiation

Collection of assessments

Meeting package preparation

Attendance at meetings

Legal counsel on all day-to-day operational decisions

Review and negotiation of loan/line of credit documents

General litigation

And more!

Turnover meetings

Review of turnover documents

Assisting in the selection and hiring of turnover auditors, engineers and other consultants

7

*Information

Chapter 558 inspections and procedures

Negotiating repair protocols

All aspects of state/federal litigation for construction warranty claims, from settlement negotiations through trial

Give your residents the best experience possible, with fast, reliable internet and entertainment options. Xfinity’s future-ready technology delivers customized solutions designed for your unique community.

With the Xfinity network, residents can get a consistent, reliable connection, so everyone can work, stream, and game all at the same time.

The ultimate entertainment experience, with access to live TV, On Demand, sports, and their favorite streaming apps all in one place.

BY MATT KUISLE, P.E., RS, PRA

n the ever-evolving landscape of community associations, one trend has become clear: Lenders and insurers are focusing on reserves and reserve studies. Driven by a growing awareness of proactive risk management, this shift is important in keeping communities physically and financially sound. However, many associations have found this transition financially burdensome, especially older communities that have not historically prioritized adequate reserve funding.

Following the tragic collapse of Champlain Towers South Condominium, Florida legally mandated structural integrity reserve studies (SIRS) for qualifying

associations to be completed by the end of 2024. These studies require the inclusion of specific components in the report and mandate reserve funding for the repair and replacement of those components. Historically, reserve studies, which involve both a physical inspection of the association’s common property and a financial analysis of current reserve funds and creation of a long-term capital plan, were used as an internal capital planning tool. However, now that SIRS are required and because failure to budget for necessary repairs and maintenance can lead to costly surprises, lenders and insurers are now considering these studies when doing business with Florida condominium associations.

For community associations, securing affordable and

MATT KUISLE, P.E., RS, PRA, REGIONAL EXECUTIVE DIRECTOR, RESERVE ADVISORS

Matt Kuisle, P.E., RS, PRA, is the regional executive director for Reserve Advisors, leading the firm’s operations in Florida, Georgia, and the Carolinas. Matt has been conducting reserve studies for 24 years and is a frequent speaker and author. He is a licensed continuing education provider for Florida CAMs and serves on the Community Associations Institute National Board of Trustees and as a delegate with the Florida Legislative Alliance. Reserve Advisors is a leading provider of reserve study consulting services, having conducted reserve studies for more than 3,000 Florida communities.

comprehensive insurance coverage has become a growing struggle. A combination of factors such as natural disasters, inflation, supply chain challenges, escalating construction costs, and increasing costs of reinsurance (insurance for insurance companies) has contributed to this upward trend. At the same time, insurance companies have become increasingly cautious, often opting to cancel or refuse to renew policies, particularly for older buildings and those in coastal parts of the state. These factors have given Florida the highest home insurance premiums in the country, increasing an average of 42 percent from 2022 to 2023, according to the Insurance Information Institute.

These developments, along with the requirement to fully fund reserves, have led to dramatic increases in monthly dues for many

residents of community associations. Dues are rising faster than inflation nationwide, increasing an average of six percent in 2024, but according to Redfin, parts of Florida have seen dues increase by up to 15 percent, and that is before fully implementing the results of their SIRS, which may include structural repairs. Many associations are also issuing special assessments to complete overdue projects, and this combined increase in fees has become unaffordable for many homeowners, forcing them to sell.

However, with structural issues emerging as a major area of focus, lending standards are becoming increasingly strict as ensuring the structural soundness of an association’s buildings is essential in mitigating risk. Institutions are placing greater emphasis on conducting thorough inspections and structural assessments as communities with known structural issues, deferred maintenance to structural components, and inadequate reserves pose a financial risk to both lenders and potential buyers. This perfect storm of factors is making it difficult to sell condominiums and association units.

According to ISG World’s 2024 Quarterly Updates, 85 percent of all active condominium listings in South Florida are in buildings over 30 years old; and since 2023 those units have decreased in value by 21 percent. On the flip side (and reflecting the focus on structural integrity and upkeep), units less than 10 years old have risen in value by nine percent. If an association has historically failed to fund reserves and address maintenance needs, instead relying on assessments or loans to fix costly structural issues, it becomes much harder to sell units as it is

more likely that a buyer will become unable to afford their loan. Combined with higher mortgage rates, selling units, especially in older buildings, has become challenging; and buying them has become cost prohibitive for many.

Considering these developments, managers and boards alike should be increasingly recognizant of the value of proactive planning and budgeting. Conducting regular reserve studies and adhering to SIRS legislation helps associations spot potential maintenance issues early on and allocate funds accordingly. This can safeguard the long-term value of the property and ensure compliance with lending and insurance requirements.

A proactive budgeting approach allows for the timely

completion of capital replacement and maintenance projects, which can enhance an association’s overall attractiveness to prospective buyers. Communities with well-maintained infrastructure and documented, healthy reserve funds are perceived as more desirable investments, commanding higher market value through structural and financial reliability. Of course, because of the overall tumultuous atmosphere of Florida’s community association industry, it is inevitable that dues will continue to increase in many associations. To mitigate any potential issues, boards should be increasingly transparent and effective in their communications to unit owners. While most communities provide a 30-day notice for increases, giving as much advance notice as possible is

helpful for owners and reflects that the board takes seriously the financial burden on owners. These notices should be comprehensive, informing owners of the increase, the date it will go into effect, and the specific reasons for the increase. It is inevitable that some owners will have negative reactions to any increase in fees, so boards should make supporting records, information, and inspection documents available for review. Whether the funds will be used for insurance premium increases, necessary maintenance, or to achieve full reserve funding, owners deserve to know exactly how their money is being spent and what they will get out of it.

It is a turbulent time for associations in Florida, but two things are certain: Transparency with residents is key; and in the long run, proper reserve funding and community maintenance will pay off. By now most condominium buildings three stories or more should have their SIRS completed. This critical report will give insight into the physical and financial health of the association. While initially the news may not be great, making the difficult steps towards saving for and conducting needed repairs will give peace of mind to the owners and prospective buyers as well as lenders and insurers who are placing greater emphasis on structural integrity and financial preparedness. Boards and managers must prioritize regular reserve studies, adhere to SIRS legislation, and follow the maintenance and funding plans that will be crucial in weathering this storm. By prioritizing proactive maintenance and budgeting practices, not only can risks be mitigated but also the value of the property can be maintained for years to come. n

February 1, 2025 Embassy Suites Hotel

1601 Belvedere Rd, West Palm Beach

Registration: 8:00 AM - 11:30 AM

Complimentary Breakfast & Lunch

CASH & Raffle Prizes are for LICENSED CAMS and you must be present TO WIN!

60+ Booth Vendor Show and Free Education for LCAMS

Bring LOTS of business cards for the raffle prizes and the drawings !

1 CEU OPP/ELE By Erica Dalesandro @ Nouveau Elevators

10:30 - 11:30 am “Paint 101”

1 CEU OPP

By Jill Negron @ Sherwin Williams Paint Company

2:00 - 3:00 pm

Insurance Cost Savings & Preventative Maintenance” 1 CEU INS/OPP By Erin Nickerson Foster @ URI Now & Jordan Knowles-Bartley @ Brown & Brown Insurance

BY OSCAR BORRAS

ssociation board members’ lives significantly changed in 2024 with the implementation of new legislation. The State of Florida dramatically overhauled the certification process and requirements for community association board members. These recent changes are another example of the impact the Champlain Towers South collapse in Surfside has had on our communities and the scrutiny surrounding how associations are governed. The focus remains on helping board members build a sound educational foundation to make the many

pivotal decisions that go into overseeing a community.

Everyone involved stands to benefit from the revamped certification process, including board members, community managers, and individual owners.

What has changed for board members?

In the past, board members could either take a two-hour board certification course or sign an affidavit acknowledging they read the association’s governing documents and would do their best to uphold the policies and responsibilities defined in those documents. In practice, it was tantamount to an honor system.

Many board members are volunteers who may not have formal training or backgrounds in disciplines such as finance, engineering, or project

www.kwpmc.com

management—areas that are essential for effective community governance. Without access to specific educational training and resources, bridging the knowledge gap and helping newer board members gain the necessary expertise can be a significant challenge.

Today, all new board members are required to complete a more robust certification course within 90 days of being elected or appointed. Those who were board members prior to July 1, 2024, have until June 30, 2025, to complete the new certification course. Once secured, the certification is valid for seven years for condominium association board members and four years for HOA board members if the members serve continuously during these periods.

Florida’s Department of Business and Professional Regulation (DBPR) offers board member certification courses and approves additional proposed certification courses from third parties such as

association law firms. In addition to the certification, all board members will have to complete annual continuing education courses. For board members serving within homeowners’ associations (HOAs) the size of the community will determine the course length. If the community has fewer than 2,500 parcels, board members are required to have four hours of continuing education. If there are more than 2,500 parcels, that training increases to eight hours. Condominium association board members can satisfy the continuing education requirement with a one-hour course that focuses on state statute and administrative rule changes from the past year.

The new certification and continuing education courses are designed to support a wide range of needs, including language options in English and Spanish as well as the flexibility of in-person or virtual courses.

Board members can expect to learn about many important subjects, including the following:

• Structural integrity reserve studies (SIRS) and reserve requirements. Experts give in-depth presentations on reserves, the funding of reserves, and what goes into these studies.

• Milestone inspections implemented after the Champlain Towers tragedy, covering the scope of the inspections and key compliance deadlines.

• Board member election procedures, including a publication of election notices, election-day protocols, and how the state’s Division of Condominiums, Timeshares and Mobile Homes can support board elections.

• Financial literacy education, a critical topic given the fiduciary responsibilities board members have. Many associations manage multi-million-dollar budgets, so these teachings will help board members navigate highstakes budget decisions each year. The course focuses on annual financial reporting requirements, assessments for common expenses, fines, commingling of reserve and operating funds, annual operating budgets, allocation of reserve funds, maintaining financial records, and much more.

• Providing key information about the statutory rights and responsibilities of associations and individual owners. As community managers we proactively communicated the new certification requirements, and as course options became available, began to communicate them to our board members. Board members were generally very receptive to the enhancements and were excited about the opportunity to learn more about their responsibilities. Owners who do not currently serve on their boards even expressed interest in participating in courses. It is exciting to see everyone—from board members to community managers, non-boardmember owners, and vendors—understand the big-picture importance and benefits of enhanced education. n

BY SULY ENCALADA

Florida’s condominium associations face significant challenges adapting to new reserve requirements to enhance safety and ensure adequate funding for critical repairs. These legislative changes, introduced after the Surfside tragedy, are necessary to protect residents and property values. However, they have also brought escalating fees and financial pressure, leaving many associations searching for viable solutions.

With over 17 years of experience in property management and a focus on supporting condominium boards, I’ve seen how strategic planning and a proactive mindset can help associations navigate even the toughest challenges. This article outlines the new reserve requirements, their implications, and key

recommendations for effectively tackling these changes.

Florida’s updated laws require all condominium associations to maintain fully funded reserves for essential structural components like roofs, load-bearing walls, electrical systems, and waterproofing. These reserves must be based on a professional structural integrity reserve study (SIRS). While these requirements aim to prevent deferred maintenance and catastrophic failures, they come with the following notable challenges:

1. Increased Financial Burden—Associations are required to significantly increase reserve contributions, leading to higher monthly fees for owners.

2. Tightened Flexibility— Boards need more room to maneuver financially, with restrictions on using reserves for unspecified purposes.

3. Unfamiliar Territory—Many volunteer-led boards need to gain experience navigating the technical and financial complexities of these changes.

Suly Encalada has over 17 years of experience in property management and has been the director of business development for SOCOTEC, a leading engineering firm, for over two years. She specializes in helping condominium associations navigate complex challenges by providing strategic guidance and access to expert resources. Suly is passionate about empowering boards to make informed decisions that benefit their communities and ensure long-term success. For more information, visit www.socotec.us.

For many condominium boards, the transition to fully funded reserves feels overwhelming. Older buildings, which may already have deferred maintenance issues, are particularly hard hit. Associations must now balance increased costs with owners’ resistance to higher fees, all while ensuring compliance with the new regulations.

These changes also demand a shift in how boards operate, moving from reactive approaches to long-term planning. This can feel daunting, but with the proper guidance associations can turn these challenges into opportunities for greater financial stability and operational efficiency.

To help associations navigate this period, I recommend the following steps:

A professional reserve study is essential for understanding your building’s current and future needs. Partner with a qualified engineering firm to ensure the study is thorough and actionable. Use the findings to prioritize projects and set realistic funding goals.

When planning repairs or upgrades, look for ways to optimize costs without compromising quality. Value engineering—evaluating materials, methods, and designs—can lead to substantial savings. An experienced project advisor can help identify opportunities for efficiency.

Vendor and contractor negotiations are critical to managing costs. Secure competitive bids and ensure contracts are carefully reviewed to avoid unnecessary expenses. Consider involving an owner’s representative or project manager to oversee this process.

Transparent communication is key to gaining support for increased fees or special assessments. Regular updates, clear explanations of the benefits of fully funded reserves, and opportunities for owners to ask questions can build trust and cooperation.

Special assessments or loans may be necessary for associations facing immediate funding shortfalls. While these measures can be unpopular, presenting them as part of a well-thought-out financial plan can help owners see the bigger picture.

Proactive maintenance of your building’s systems and structures is one of the best ways to manage costs over time. Routine inspections and timely repairs can prevent minor issues from becoming major expenses.

Creating a multi-year financial strategy that aligns with the reserve study is essential. Working with financial experts can provide valuable insights and solutions.

While the new reserve requirements may feel like an immediate burden, they serve a critical purpose: ensuring the safety and longevity of Florida’s condominiums. Properly funded reserves reduce the risk of delayed repairs, protect property values, and provide peace of mind for residents.

This is an opportunity for boards to adopt a more strategic and professional approach to managing their communities. By investing in expert guidance and embracing long-term planning, associations can turn these challenges into a roadmap for sustainability and success.

Adapting to Florida’s new reserve requirements is challenging, but condominium associations can overcome the challenge with careful planning, open communication, and the right resources. While initially difficult, these changes are ultimately an investment in your community’s safety, financial health, and future. By taking proactive steps and leveraging their expertise, boards can navigate this transition successfully, ensuring a brighter and more secure future for all residents. n

We’ve Got You – And Your Car –COVERED.

Protect your vehicles from Florida’s harsh environment with Mullet’s Aluminum’s award-winning carports. Ideal for condominium, apartment and commercial properties, our structurally superior, site-specific systems are engineered for long-term performance, reducing vehicle heat and enhancing interior comfort.

With over 45 years of experience in manufacturing and installation, Mullet’s Aluminum is one of the largest architectural aluminum manufacturers in Florida - so don’t worry, we’ve got you covered. .

Call for a free quote or visit our website.

By Marcy Kravit, CMCA, AMS, PCAM, CFCAM, CSM Director of Community Association Relations Hotwire Communications FCAP Education Program Coordinator

Ah, the life of a community association manager—it’s a thrilling rollercoaster ride filled with board meetings, maintenance emergencies, and the occasional leak that seems to spring up just as you’re about to present your PowerPoint on your budget! If you’ve ever found yourself juggling these responsibilities—like a circus performer with a fondness for highrises in South Florida—read on for some humorous yet professional time management tips to keep you afloat, especially when tackling those pesky leaks.

When a leak bursts forth like an unexpected guest at a dinner party, it’s time to prioritize. The following actions are how you can tackle the chaos:

Assess the Leak—Is it a minor drip, or is it Niagara Falls in your lobby? Grab your trusty bucket and investigate. If it’s a major issue, it takes precedence over that “exciting” budget discussion. Make a quick determination of the leak’s source and severity. If it’s a small drip, you may be able to place it on a list for later repair. However, if it’s gushing, dive in and take immediate action.

In high-rise buildings, leaks can quickly escalate, so it’s essential to act swiftly. Check common areas first, then move to individual units if necessary. Once you’ve assessed the situation, determine the cause of the leak. Is it a plumbing issue, a malfunctioning AC unit, or something else? This diagnosis will guide your next steps.

Call the Experts—If you determine that the leak requires professional intervention, don’t hesitate to call in the experts. A remediation and restoration company can handle significant water damage and mitigate the risk of mold or further structural issues. If the leak’s source is plumbing related, contact a reliable plumber to address the issue. For leaks originating from air conditioning units, make sure to reach out to your HVAC technician. Having these specialists on speed dial can save you valuable time and stress.

Alert the Residents—Think of yourself as the town crier (minus the

funny hat). Inform residents about the leak and what you’re doing to fix it. Clear communication can turn potential panic into polite patience. Use emails, community boards, and even text alerts to keep residents in the loop. Just don’t send them a video of the flood—keep it professional! Providing updates as the situation evolves ensures everyone is on the same page and fosters a sense of community.

Document Everything—Snap some photos of the leak. These will be critical for your board meeting and any insurance claims. Good documentation can also help when discussing potential improvements to your building’s infrastructure. Plus, they make great conversation starters—“Remember that time we almost created an indoor swimming pool?”

Take notes on what actions you’ve taken, who you’ve contacted, and any conversations you’ve had with residents. This log will not only assist in your board meeting discussions but also serve as a reference for future incidents.

Determine When to Call the Insurance Company—If the leak is substantial and has caused significant damage, it’s time to call in the insurance experts. Review your policy to understand coverage details, then document the damage thoroughly before making the call. Be prepared with all necessary information—date of the leak, extent of damage, and any repairs already initiated. A proactive approach can save you time and headaches later.

When you contact the insurance company, be concise and clear about the situation. They may send an adjuster to assess the damage, so having all your documentation ready will help facilitate the process.

You’re not a one-person band, so don’t try to play all the instruments. Delegate! If you have a maintenance team, send them to tackle the leak while you prepare for the board meeting. Just make sure you don’t send them on a wild goose chase; clear instructions are your best friend.

Empower your team to take ownership of the situation. Assign someone to oversee the repair process and keep you updated. This allows you to focus on strategic planning and communication while knowing that the leak is in capable hands.

An agenda is your guiding star in the chaotic universe of community management. Prepare one that outlines specific meeting topics and allows for some lighthearted moments. Include an update on the leak situation, ensuring that your board is informed and engaged. Your agenda could look something like the following:

1. Call to Order

2. Approval of Previous Meeting Minutes

3. Financial Report & Budget Review

4. Maintenance Updates— Leak Situation: Current status and proposed solutions

5. Upcoming Community Events

6. Open Forum for Resident Concerns

7. Adjournment

By providing a clear structure, you keep the meeting focused and productive, allowing for a smooth transition between topics.

Consider time blocking your day like you’re a chef preparing a gourmet meal. Allocate specific times for urgent emails, board meeting prep, and—oh yes—addressing that pesky leak. This way you won’t end up mixing your “urgent” sauce with your “optional” side dish.

For instance, dedicate the first hour of your day to emergency issues, followed by time for email and communication, and then reserve a block for preparing for the board meeting. This structured approach helps you maintain focus and ensures that each task receives the attention it deserves.

Embrace the power of digital tools! Use property management software to keep track of everything, from maintenance requests to scheduled meetings. A shared calendar is your best friend. Just remember: if it’s not on the calendar, it’s like it never happened. Nobody enjoys the “Oops! I forgot!” moment.

A little sass can go a long way—try labeling your calendar tasks with fun names like “Water Woes” or “Meeting Madness.” This not only adds a touch of humor to your day but also makes your schedule more engaging.

After the board meeting, send out a summary with assigned tasks and schedule a quick staff meeting to discuss the leak and next steps. This ensures accountability and keeps your team aligned. A well-structured follow up can be the difference between a resolved issue and a lingering headache.

Make sure to check in with your maintenance team to see how the repairs are progressing and if any additional resources are needed. This ongoing communication is vital for maintaining a smooth operation.

Finally, take a moment to reflect on your day. What worked? What didn’t? Learning from each experience—while keeping a sense of humor— will make you a better manager in the long run. Consider keeping a “win jar” where you jot down successful moments or funny incidents related to leak management or board meetings. It can be a great morale booster!

Ask yourself questions. Did my team feel supported? Was communication clear with the residents? What can I do differently next time? This kind of reflection helps you grow and adapt in your role.

Being a community association manager is like walking a tightrope while juggling flaming torches—exciting, a bit scary, and definitely not for the faint of heart. But with a dash of humor, a sprinkle of organization, and a healthy dose of prioritization, you can turn chaos into harmony.

So, the next time a leak threatens your board meeting, just remember— you’ve got this! Embrace the challenges, laugh at the absurdities, and keep your community thriving. After all, in the circus of community management, you’re the ringmaster, and it’s your show!

By Betsy Barbieux, CAM, CFCAM, CMCA

Betsy, I attended your class recently in Lake Mary and have several questions.

1. I remember you saying HOAs can make money or “show a profit.” You explained the difference between not for profit and nonprofit. Did I understand that correctly?

2. Also, is it okay for the president to make motions if fewer than 12 members are present?

3. Lastly, if a homeowner gets obnoxious or disrespectful, is it acceptable to ask him or her to leave a board meeting?

- Denise

Denise,

Yes, you heard correctly. Certainly you may have surplus (money left in the checkbook) at the end of the year. Hopefully, you do, and you can start the next year with several months of expenses in the bank. The president is a full participating member; may make motions, seconds, and debate; and is required to vote. Votes of all board present in person or by Zoom/speaker telephone must be recorded in the minutes. Absolutely! It is a board meeting, and owners are there as guests, not participants. If you don’t want to ask him to leave, you may recess the meeting for a cooling off period of time or adjourn it.

- Betsy

Betsy,

I received a notice from the DBPR that my license was delinquent. I just got my license the first of this year, so I didn’t think I had to do anything. Help!

- Sherry

Sherry,

I’ve been getting several cries for help! Others are confused too. You DO have to renew your license, but you don’t have to take any CE hours in your first partial license period. Remember, all licenses expire on September 30 of an even-numbered year. Your next renewal and CE hours will be due no later than September 30, 2026. You’ll want to attend the YES/Yearly Educational Summit in August and get all your CE hours.

- Betsy

Betsy,

Do all the voting rules come from our own documents, or does Florida mandate some parts? I am planning on incorporating a voting change to our bylaws at our community dinner meeting because I think it is our only opportunity to get a quorum. My plan is to pass out ballots to verified lot owners at the door to vote. If we get a quorum, we vote. Notices to all lot owners will go out 15 days ahead of the meeting. Do you think I can do that? Our rules state

if we get a quorum, then the ballot must have 67 percent approval. If there is no quorum, there is no vote.

- Richard Rick,

If you are going to amend any of your documents, bylaws included, there is a statutory process to follow:

All voting is on a limited proxy/ written vote of owner form whether owners are present or are using mail, hand delivery, or email.