The Crossroads - Fiat vs Bitcoin

Introduction

The following writing will cover the current state of money and how fiat currency has resulted in a fragile economic system. From there, the properties of sound money will be covered and why Bitcoin offers the solution to the current regime. Thereafter, a brief overview of how Bitcoin will be used as a defence infrastructure in the digital age before concluding on such findings.

A brief History

To begin with, I consider it essential to know what has caused Bitcoin to prosper. If the current monetary system was operating efficiently, I doubt Bitcoin would have gained the traction it has. Whilst many have spoken about how Fiat currency came to be, a brief reflection on history is still required for context.

On August 15th 1971 president Nixon suspended the convertibility of dollars into gold. Up until this point, many currencies were backed by the dollar due to the absence of their own gold standard. The reason for this being that dollars are backed by gold, so countries tying their own currency to gold would be on a de facto gold standard. With the last bastion of the gold standard falling with the dollar, the world was faced with a paradigm shift. All currency is backed by faith in government and the system. From this date forwards, the fiat currency standard was ushered in. Fractional reserve banking took full force and debasement took place on a large scale. With no restrictive measure on currency production preventing exploitation, debasement and rehypothecation, fractional reserve banking was/is able to take place on a scale beyond all possibilities seen on a gold standard. Whilst the gold standard was removed and its application was disobeyed multiple times by countries prior to 1971 – it did provide some form of restraint on currency production. As with anything that can be exploited, humans will take full advantage of a system that they can benefit from. The exploitation that occurred from 1971 onwards came to a tipping point in 2008 when the global financial crisis occurred. At this point two paths stood before world leaders: let the crisis run its course or step in to contain the issues by papering over the cracks. The latter was done via bail outs and quantitative easing. Whilst this prevented the 2008 crisis from getting any worse, it simply kicked the issue further down the road. As a result, the underlying problem continued to get worse and the point of no return was passed.

The national debt of the US doubled as a result of the 2008 financial crisis 1 which is in line with the excessive amount of debt creation all developed western countries took on to prevent the 2008 financial crisis from getting any worse.

The clue to the 2008 financial crisis is in the name, financial by nature and stems from the banking system’s reckless behaviour caused by mortgage-backed securities. Those closest to the money printer exploited it to the maximum degree. With banking causing great financial losses, politics got drawn into the equation with many investigations to find such criminal activity. Instead of criminals being found liable for their actions, the full power of the banking cartel could be seen by those who looked. The very fragility of the banking system prevented those who caused the issue in the first place from failing. For if they failed the whole system would fail. The issue with extreme leverage is

1 Inside Job (2010 Full Documentary Movie), https://www.youtube.com/watch?v=T2IaJwkqgPk; Time 11.20; Access Date: 14/08/2023

that extreme fragility occurs. In response to the 2008 financial crisis, justice was attempted but shut down for the reasons listed above. The banking practices of HSBC provides a good example of the power and immunity banks wield in the current fiat system:

HSBC

From the evidence provided by the corruption case brought against HSBC in late 2012 the US Justice Department (DOJ) with all the evidence against the bank decided to only pursue a fine. 2 The reason further action was not pursued was revealed by head of the DOJ: ‘Lanny Breuer’ later that day when he stated “we don’t want to make a decision that is going to have all kinds of horrible collateral consequences”3. In other words, to pursue HSBC would cause significant stress on the financial system – fractional reserve banking means debts are not backed by sufficient assets and the removal of so much capital would result in a daisy chain of further collapse: just imagine the removal of HSBC as the first domino to fall. This was confirmed when, one week later, Attorney General Eric Holder revealed that the DOJ had been assessing collateral consequences all along. 4 Once again, the position that when insufficient collateral exists due to the nature of the current banking system: pursuit is not feasible. The perverse incentives require you to cover your eyes or at least cherry pick issues. By doing so you appear to be on the side of justice whilst propping up the criminal activities of those who control money itself.

To some extent, this was caused by the immunities granted to HSBC via the Bank of International Settlement (BIS) – discussed below. However, if contagion needs to be avoided despite the influence of the BIS and its disguised cartel criminal activities, the fiat system is simply fragile. Its fragility requires the need for such criminal actions to keep it disguised and afloat. Cabinet members including the Attorney General enforce foreign legal immunities for Banks instead of US law. These immunities come from the Bank of International Settlement in Switzerland 5 . What is in it for the BIS? The transfer of wealth to those in control of the money supply is the simplest explanation. Corruption within the banking system can be covered up with bailouts and debasement to paper over such activities. For the most part the banking cartel has been successful in its activities because the burn is slow. When the burn is slow, no one is aggravated enough to act on such criminal activities. Like a frog slowly brought to the boil in a pot of water, or as Jordan Peterson famously states ‘things get to terrible places one tiny step at a time’ and ‘before you know it you are going to be back three miles from where you started’.6

Regarding the above, some insight must be given to the Bank of International Settlement (BIS). This is commonly referred to as the Bank of Central Banks and dictates monetary policy on an international level. Much of what the Bank does behind closed doors is shrouded in secrecy, but the power it wields cannot be disputed. For instance, the BIS acts almost like its own sovereign state: for example,

2 All the Plenary's Men, https://www.youtube.com/watch?v=2gK3s5j7PgA; Time 1.40; Access Date: 05/08/2023

3 All the Plenary's Men, https://www.youtube.com/watch?v=2gK3s5j7PgA; Time 2.35; Access Date: 05/08/2023

4 All the Plenary's Men, https://www.youtube.com/watch?v=2gK3s5j7PgA; Time 2.55; Access Date: 05/08/2023

5 All the Plenary's Men, https://www.youtube.com/watch?v=2gK3s5j7PgA; Time 6.50; Access Date: 05/08/2023

6 Tyranny, One Tiny Step at a Time | Jordan Peterson on JRE, https://www.youtube.com/watch?v=16uBwZxtzi0; Access Date 08/08/2023

the building and surrounding land cannot be entered into by Swiss Public Authorities unless given express consent7, and no property or assets can be seized8 .

The incentives

Despite the criminality present in the current banking system, it is important to zoom out even further. If Bitcoin had identical properties as fiat currencies, then the banking system would exploit and adopt it the same as any other currency. One can deduct from such a thought experiment that the incentives have to be realigned to prevent such actions from taking place. Afterall, human greed is the overarching reason the financial system has failed the common person since the fiat standard was introduced. For this reason, a look at the characteristics of sound money is required. This is a topic covered by many experienced Bitcoin educators in great detail – my favourite being Vijay Boyapati and Saifedean Ammous who I will now reference in great detail.

Sound Money

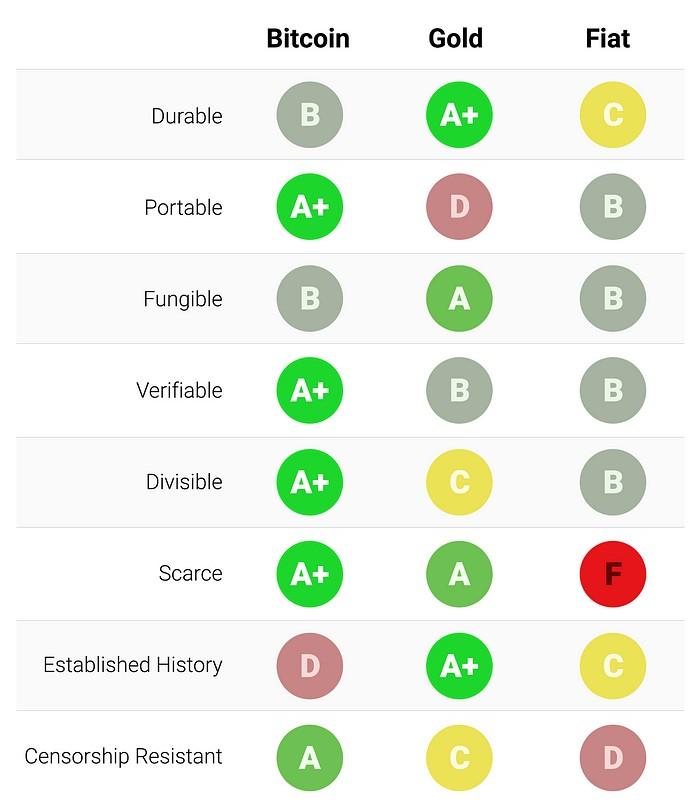

The below breaks the qualities money must have and is the best I have seen: 9

Durable: the good must not be perishable or easily destroyed. Thus, wheat is not an ideal store of value.

Portable: the good must be easy to transport and store, making it possible to secure it against loss or theft and allowing it to facilitate long-distance trade. A cow is thus less ideal than a gold bracelet.

Fungible: one specimen of the good should be interchangeable with another of equal quantity. Without fungibility, the coincidence of wants problem remains unsolved. Thus, gold is better than diamonds, which are irregular in shape and quality.

Verifiable: the good must be easy to quickly identify and verify as authentic. Easy verification increases the confidence of its recipient in trade and increases the likelihood a trade will be consummated.

Divisible: the good must be easy to subdivide. While this attribute was less important in early societies where trade was infrequent, it became more important as trade flourished and the quantities exchanged became smaller and more precise.

Scarce: As Nick Szabo termed it, a monetary good must have “unforgeable costliness”. In other words, the good must not be abundant or easy to either obtain or produce in quantity.

Scarcity is perhaps the most important attribute of a store of value as it taps into the innate human desire to collect that which is rare.

It is the source of the original value of the store of value.

Established history: the longer the good is perceived to have been valuable by society, the greater its appeal as a store of value. A long-established store of value will be hard to displace by a new upstart

7 Article 3 of the Agreement between the Swiss Federal Council and the Bank for International Settlements to determine the Bank’s legal status in Switzerland, https://www.bis.org/about/headquart-en.pdf; Access Date: 05/08/2023

8 Article 4 (2) of the Agreement between the Swiss Federal Council and the Bank for International Settlements to determine the Bank’s legal status in Switzerland, https://www.bis.org/about/headquart-en.pdf; Access Date: 27/08/2023

9 Vijay Boyapati, The Bullish Case for Bitcoin, https://vijayboyapati.medium.com/the-bullish-case-for-bitcoin6ecc8bdecc1; Access Date: 19/08/2023

except by force of conquest or if the arriviste is endowed with a significant advantage among the other attributes listed above.

Censorship-resistant: a new attribute, which has become increasingly important in our modern, digital society with pervasive surveillance, is censorship-resistance. That is, how difficult is it for an external party such as a corporation or state to prevent the owner of the good from keeping and using it. Goods that are censorship-resistant are ideal to those living under regimes that are trying to enforce capital controls or to outlaw various forms of peaceful trade.

The table below grades Bitcoin, gold and fiat money (such as dollars) against the attributes listed above and is followed by an explanation of each grade:

Failings of Fiat

Whilst all of the above properties are relevant to having a sound currency, it is clear current fiat money fails on the grounds of scarcity and censorship resistance. Referring to the 2008 financial crisis and the subsequent 2012 case in HSBC one can see that such activities were perpetrated on the grounds of scarcity. If fiat could not be produced with zero cost, then large banks would not been able to fund the ever-expanding bubbles up until 2008. Since then, we have seen ever expanding money creation with the 2020 Corona Virus pandemic and lockdowns making the 2008 stimulus look small. With stimulus entering the real economy inflation started to show up in March of 2021 and was not contained to financial assets like 2008.

As the proverbial can was kicked further down the road like in 2008, many economies have taken on larger amounts of debt. With interest rates trending on a 40-year decline as yields were compressed ever lower, such debts did not matter because they could be refinanced at lower and lower rates. Debts could not only be maintained but further increased. However, as mentioned earlier, high debt makes economies fragile. In this case, the large amounts of debt and high inflation now means many western economies are having to refinance large amounts of debt at much higher interest rates. This is due to central banks hiking interest rates at record speeds to combat inflation. Interest on debt is fast becoming the largest cost to every highly indebted economy. Servicing these interest payments has resulted in larger deficits meaning countries are having to go out and borrow even more just to stay afloat. From the outside it looks like many countries may be entering into a debt spiral where high debts require more borrowing, more borrowing leads to more debt which then leads to more borrowing – and so on and so forth11. With money being so easy to produce in the current system, it is not feasible for one to assume that we will just default: that would cause too much pain. As we saw in 2008: the issue will get kicked down the road until it can be kicked no more. With debt and inflation at record highs - that time seem to be getting closer...

The likely conclusion to this story is that money creation will accelerate. As debt becomes too expensive, the currency used to denominate that debt will be debased until the debt becomes cheap and the small guys like you and me will see their wealth evaporate if we leave most of our wealth in fiat currency12. There is no free lunch, those who hold the currency or have obligations to be repaid in that currency will finance such reckless spending and debt creation. It is up to individuals to look for hard assets to preserve wealth in the current inflationary cycle.

Subconsciously many individuals are aware of the debasement that happens to currency and choose to go further out on the risk curve. Examples include storing wealth in real estate and investing in the stock market. The real issue here lies in the fluctuating real estate prices as interest rates increase and decrease with the whims of central bank interest rate decisions. Regarding stocks, it is getting ever more difficult to value assets correctly when a currency is being devalued at breakneck speed. It is like aiming at a target moving ever faster and expecting to hit a bulls-eye. As this increases a fixed point of reference becomes harder to find. A stock that looks expensive may well be cheap because the value of the underlying currency is being reduced at such a rapid pace. This leads to more speculation as more assumptions are made by individuals – less and less certainly exists. Eventually, as it always does, the game of musical chairs will stop and may risk takers trying to safeguard their wealth will find no chair to sit on. The assets their wealth was stored in gave the illusion of wealth and their net worth will perish.

11 A good explanation of a debt spiral can be found by James Lavish: https://twitter.com/jameslavish/status/1562078782453792768?s=20; Access Date: 03/09/2023

12 This is known as the ‘monetization’ of debt.

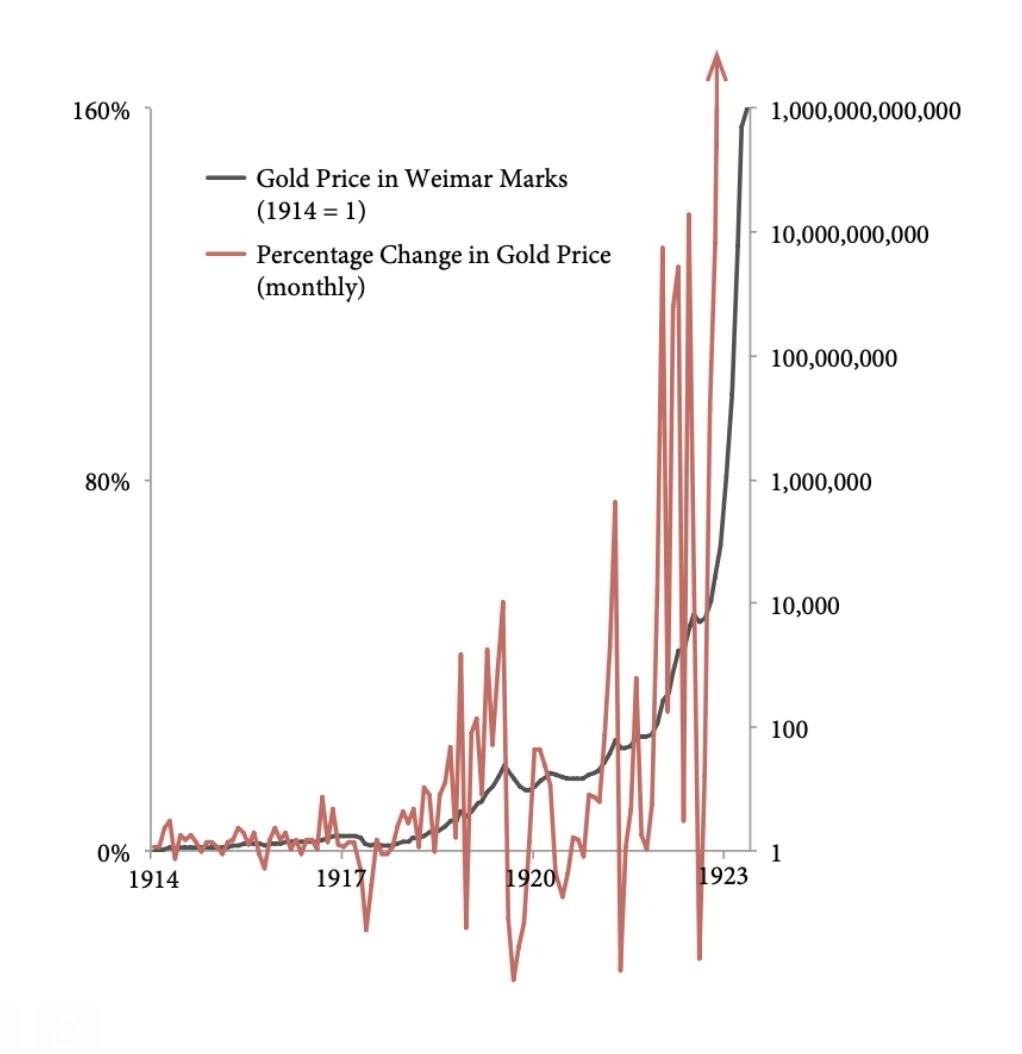

A good example I like to refer to in this situation is the price of gold during the demise of the Weimar republic after World War 1. As the country started to hyperinflate with no way of paying its war debts imposed after the treaty of Versailles, price action got more and more volatile. The ability for the average person to withstand the see-saw motion of an asset as robust and stable as gold lead to great amounts of wealth destruction. The emotional toll this would have had on participants must have been very damaging back then. Speculation was rampant and many assets would act like the below. Many people would have made and lost fortunes multiple times trying to conserve and grow their wealth during this time period:

I for one see similarities starting to form between modern western societies with many storing wealth in alternative assets. Many know the currency loses value over time, this is normal – isn’t it? Many speculate on stocks in order to outperform the inflation seen instead of committing solely to productive work. Why would they? Wages are low and purchasing power is eaten up with higher

prices occurring on a monthly basis at the time of this writing14. Frustration is rampant even if subconsciously with many people – all most people want is a currency that maintains its value knowing it is worth the same next year as it is today. Better planning for the future can take place and a lower burden is placed on the average working citizen. The quality of living standards on this point alone have decreased substantial with the constant need to try and keep pace with currency debasement. If you accept it, you just get poorer, and most people see this as normal. Most have grown up in society where this is all they have ever known. A silent hopelessness fills the hearts of many millennial and Gen Z individuals who have only ever seen the price of assets to live a good life get ever more expensive and unaffordable. Housing is more unaffordable now than it has ever been for most people under 40, and in the UK, housing is more unaffordable now than it has been since the Victorian times15 .

The solution

In light of the 2008 financial crisis, Satoshi Nakamoto created Bitcoin in an attempt to combat the corruption present in the financial system. The intent here was to make a money that was immune to the inflationary pressures all other moneys undercome when something becomes valuable or if they have the ability to easily produce more of it. The following passage gives a brief summary on the mechanics as to how Bitcoin functions:

Bitcoin was built as the first peer to peer form of electronic cash by Satoshi Nakamoto. The intention behind it being the removal of trust through the imposition of a fixed supply and a ledger documenting every transaction by every user so all participants share a common ledger 16. A new block containing transaction is added to the existing ledger every 10 minutes. Members of the network expend electricity to solve complex mathematical equations. Whilst these transactions are hard to calculate they are easy to verify. Once a node calculates the equation correctly and announces it to the network, all other nodes are able to verify the transaction. The first miner to do this receives a block subsidy consisting of Bitcoin as a reward: otherwise known as a block reward. Those who compete to produce the next block are referred to as miners with the process itself referred to as mining.

As Bitcoin’s price increases more and more miners enter the network and are attracted to producing the next block in order to receive the next subsidy reward. As expected, price increases attract more competition for the block rewards which would normally result in the blocks being mined much faster. To combat this, difficulty adjustments take place. This means the difficulty of solving the mathematical equations increases as more competition enters the network. Instead of blocks being solved much faster, the resources (electricity and therefore capital) used to mine the next block increase. This also ensure new blocks are added around every 10 minutes 17

Overall, the difficulty adjustment for Bitcoin prevents resources from being committed to mining Bitcoin faster as it becomes more valuable; it instead increases the cost of committing valid transactions to the network18

14 At least here in the UK.

15 Jameson Lopp, UK housing most unaffordable since Victorian times, https://twitter.com/lopp/status/1603017614095441920?s=20; Access Date: 02/09/2023

16 Saifedean Ammous, The Bitcoin Standard (Wiley & Son Inc 2018); Page 171; Access Date: 13/08/2023

17 Saifedean Ammous, The Bitcoin Standard (Wiley & Son Inc 2018); Page 172 -173; Access Date: 13/08/2023

18 Saifedean Ammous, The Bitcoin Standard (Wiley & Son Inc 2018); Page 173; Access Date: 13/08/2023

‘Bitcoin can best be understood as a distributed software that allows for transfer of value using a currency from unexpected inflation’.19 For a detailed overview on what Bitcoin is I advise any reader who has not done so to read the Bitcoin Standard by Saifedean Ammous.

Maturation of Bitcoin

Many have proclaimed that Bitcoin can never function like a currency because it is too volatile, but are missing the life cycle of a currency coming into existence. As with a human, many stages of development must occur before someone matures into an adult. This is best described by Vijay Boyapati:

The evolution of a money first starts as a collectable based on its ‘peculiar properties’ before transition into a store of value as more people demand it. As more people demand it, its price will increase. As more people acquire it, the value increase will start to dwindle. This will result in the stabilisation of price resulting in a transition of use-function to a medium of exchange. People will start exchanging it because the price is likely to remain the same and the opportunity cost 20 will likely fall dramatically. As more and more people accept the money there will be less need to compare it against other currencies to initiate a transaction. Instead, people will openly accept it in and of itself resulting in the last phase being achieved: unit of account21 .

Whilst we have now surpassed the collectable époque (I consider this all Bitcoin held before it gained monetary value in 2010), we are still firmly within the store of value era. Bitcoin is still appreciating at rapid speed on a year over year basis. For this reason, not many people are willing to part with it because the opportunity cost of spending it is far too high. Whilst the eye watering accretion in price seen from later 2017 and before has now gone, we are still seeing gains that outperform all other asset. For this reason alone, many see no better alternative and continue to hold for the long term.

As for the latter two époques, only time will tell how and when this will play out.

Degradation and Social Unrest

Until recently the use case of Bitcoin has focused on the creation of sound money. More recently, the use cases have been expanded beyond money to include defence has credible merit and for good reason (which is covered below).

In the current system, those in power are able to keep most of the rewards for themselves through the various mechanisms of modern society. The prime example of this is societies trust in fiat money itself. There is nothing tying money to value now that it is backed by nothing in light of its delinking with gold in 1971. The whole value proposition is built on the foundation of trust that the currency is valuable. This very proposition has allowed those with power to exploit their currency by maintaining the illusion of value. As with the fragility of the banking system referred to at the beginning of this writing, it has expanded to include money itself. In the fiat ecosystem, neither can be weak whilst the other exists – both have to work in conjunction to survive.

The common person has therefore seen a steady, and more recently rapid, decline in their standard of living as the supposed value of fiat currency is devalued. The delinking of actual scarcity via a gold standard and what we have today (fiat currency). On mass, those who are subject to fiat currency are realising that it is actually worthless. Trust in the system is starting to break down and the illusion

19 Saifedean Ammous, The Bitcoin Standard (Wiley & Son Inc 2018); Prologue XVI; Access Date: 05/08/2023

20 Opportunity cost is the chance of missing out on the upside value increase.

21 Vijay Boyapati, The Bullish Case for Bitcoin, https://vijayboyapati.medium.com/the-bullish-case-for-bitcoin6ecc8bdecc1; Access Date: 19/08/2023

that is fiat wealth is starting to reveal itself. When nothing backs an asset that has real-world energy intensive properties like gold (due to scarcity and the energy intensive nature of mining it) things start to deteriorate fast. In the last few years since the 2020 pandemic society has become more infuriated with the cost of living and standard of living decrease. A recent example of this being the Rich Men North of Richmond song released by Oliver Anthony22. A further example of the implication’s inflation has on society was given by Charlie Munger back in February of 2022 23 who stated: ‘inflation is a very important subject, you can argue it’s the way democracies die’; furthermore, ‘if you overdo it too much you ruin your civilization’24 – ‘it’s the biggest long-range danger we have apart from nuclear war’, and his working hypothesis ‘is that over the next 100 years the currency’s going to zero’25 .

Proof of Power vs Arbitrary Power (Proof of Work)

Historically, natural selection first established property rights through ‘proof of power’: those who had the most power (physically) would have first choice of all resources26. The problem with proof of power stems from the energy intensity and risk of injury exerted when projecting such power to assert dominance. Relating to Bitcoin proof of power replicates energy expenditure to assert property rights.

However, as risk of injury became a major downside, the neolithic age humans established a new way to determine property rights through imaginary power: we call this arbitrary power 27. This is where society structures itself into agreed positions where power is delegated to those with titles, and responsibilities which are only enforced by trust and agreement to obey the system they exist within. Anyone who disagrees with the regime will be overpowered through enforcement. Arbitrary power still leans on physical power to maintain its existence. Without it, physical power would destroy it at the first possible instance someone realises it can be exploited.

Proof of power without injury

As mention prior, Bitcoin replicates the energy expenditure required of proof of power, but exerting not physical risk to itself by doing so. Furthermore, proof of work mimics the decentralised nature of proof of power: in proof of power, you can only exert as much energy as your own body can produce. This is a revolutionary innovation and compares to the move from proof of power to arbitrary power when first initiated back in neolithic times. Physical power is inclusive28, meaning Proof of power is far more meritocratic than abstract power. Those in control of an arbitrary system tend to centralise control and take most of the rewards for themselves. Within crypto currency proof of work reflects proof of power whilst proof of stake goes back to abstract power29 wherein those with the most assets have most of the power. Real world arbitrary financial/economic tyranny include the recent

22 Oliver Anthony - Rich Men North Of Richmond, https://www.youtube.com/watch?v=sqSA-SY5Hro; Access Date: 02/09/2023

23 Charlie Munger talks Activision, investing, Russia and why he's not a fan of bitcoin and more, https://www.youtube.com/watch?v=GNTczyGLdhc; Time 03.00; Access Date: 02/09/2023

24 Referring to money printing.

25 Referring to the dollar.

26 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 02:20; Access Date: 16/08/2023

27 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 06:00; Access Date: 16/08/2023

28 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 25:30; Access Date: 17/08/2023

banning of Russian foreign currency reserves by western societies. A further example being The Truckers Rebellion in Canada where contributors to the non-violent movement saw their bank accounts frozen by the Canadian government. As referred to by Preston Pysh: anyone should have the right to transact some type of value to another regardless of what anyone else in the world thinks’30. Bitcoin with its proof of power inclusiveness gives society on a global scale the ability to take back control of their own money and do with it what they please.

The most important take away is that Abstract power only exists in the imagination 31. The issue with abstract power hierarchies is that people must be trusted not to exploit them, not to be unsympathetic to them and not to invade them32. Therefore, abstract power is a trust-based system and tends to breakdown over a long enough period of time. As Preston Pysh stated: “parasites are not allowed into an abstract power situation, or it will eventually collapse” 33. This mirrors the fragility present in the current fiat system because fiat money is arbitrary by nature – trust based. Bitcoin is tied to the physical reality of energy expenditure vs virtual reality, ones and zeros which can be exploited34

Put differently, abstract power can only be sustained for as long as people believe in it. For me this is the reason currencies always fail. When a government has the ability to de-peg a currency to increase its supply. Arbitrary power is able to take advantage of money itself with those in power closest to money and its creation exploiting it at the expense of its population. This only exists because we allow it and trust in the arbitrary system itself. But as mentioned arbitrary power fails as soon as trust is lost. As Charlie Munger stated, inflation is a good way of destroying society which is based on the devaluation of currency itself. Therefore, trust is usually lost when high inflation exists for an extended period of time.

Beyond Money

Outside of the tangible world around us it is also important to consider the implication of Bitcoin on Cyberspace. Until Adam Back and the invention of the hash cost function, there was no way of imposing a physically restrictive cost to the abstract power conveyed through cyberspace 35

We now live in a world consumed for the most part by the internet. It is therefore important that Bitcoin imposes proof of work within the digital domain and not just on money itself. Without some linkage to real world cost arbitrary power will run rampant within the digital domain which is just another breeding group for arbitrary power to flourish. Whilst Bitcoin has been first used for monetary purposes it is far more than that. The idea of tying energy and therefore physical power to

29 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 1.17.35; Access Date: 18/08/2023

30 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 1.29.00; Access Date: 18/08/2023

31 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 30:10; Access Date: 17/08/2023

32 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 31:55; Access Date: 17/08/2023

33 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 32:52; Access Date: 17/08/2023

34 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 50:30; Access Date: 17/08/2023

35 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 1.01.50; Access Date: 18/08/2023. ‘The hash cost function created by Adam back had the sole purpose of imposing real world prohibitive cost on people and programs on other computers’.

cyberspace is a brand-new way of securing cyberspace outside of the traditional arbitrary rule base that has governed it. Bitcoin can therefore be seen a ‘giant global scale physical defence infrastructure’.

Overall, Bitcoin can be seen as a power-based control structure to control the legitimate state of custody of property and to physically defend ourselves in a non-lethal way. This makes Bitcoin far bigger than just money36. However, this domain is new, whilst I am excited of the prospect Bitcoin brings to defence, I am unsure how this will play out. I am also unsure how much of Bitcoin’s value proposition lies outside of money itself. For the time being I am convinced that Bitcoin’s main value proposition exits with the creation of sound money. This may change going forwards and as Bitcoin infiltrates society.

Conclusion

Bitcoin’s creation came at a time of great economic devastation in the throes of the 2008 Great Financial Crisis. The very crisis alone saw wealth get destroyed as it was not real to begin with. The whole banking crisis was unwounded through high leverage, fractional reserve banking and rehypothecation. The daisy chain impact on the world as a whole saw tax payers front the bail out with the perpetrators getting away scot-free based on the collateral consequences of not doing so. In other words, the bailout had to come to prevent the crisis from turning into a full-scale depression. Since then, financial repression has only increased as the arbitrary rules are fixed against the working person to transfer power to the ruling class. The common person is starting to wake up to this reality and breaking point gets ever closer.

Bitcoin functions via incentives that counter the current fiat arbitrary system. Linking energy to the network the same way the gold standard was intended for traditional currencies. There is a fixed supply that cannot be manipulated by those with arbitrary power allowing individuals to protect their wealth over the long term. This allows for individuals to counter the current debasement, fraud and inflation perpetrated by the ruling class in a peacefully manner. No violence is committed only the prevention of those in power from taking monetary energy from those who have worked hard to generate it in the first place. It is a bandage that aims to foster stability by protecting every persons’ property rights in a decentralised manner – in so doing, protects civilization itself.

Whilst Bitcoin is not brand-new it is in its infancy. Extreme volatility lies ahead, but as adoption continues and governments are forced to print ever more money it should perform as intended – a debasement hedge. As it matures it should start to act more like a currency and volatility should decrease.

Going forwards the power Bitcoin has outside of money will extend protection of purchasing power to cyberspace. This will help remove arbitrary power away from a current zero costs environment. Overall society will benefit in multiple domains as energy is able to reconnect to both economic reality and cyberspace.

Thankyou for reading.

36 Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Time 02.02.45; Access Date: 18/08/2023

Bibliography

All the Plenary's Men, https://www.youtube.com/watch?v=2gK3s5j7PgA; Access Date: 05/08/2023

Saifedean Ammous, The Bitcoin Standard (Wiley & Son Inc 2018); Page 171; Access Date: 05/08/2023 & 13/08/2023

Swiss Federal Council and the Bank for International Settlements to determine the Bank’s legal status in Switzerland, https://www.bis.org/about/headquart-en.pdf; Access Date: 05/08/2023 & 27/08/2023

Tyranny, One Tiny Step at a Time | Jordan Peterson on JRE, https://www.youtube.com/watch?v=16uBwZxtzi0; Access Date 08/08/2023

Inside Job (2010 Full Documentary Movie), https://www.youtube.com/watch?

v=T2IaJwkqgPk; Access Date: 14/08/2023

Proof of Stake (PoS) Versus Proof of Work (PoW) w/ Jason Lowery (BTC098), https://www.youtube.com/watch?v=ikPnr23h7qg; Access Date: 16/08/2023, 17/08/2023 & 18/08/2023

Vijay Boyapati, The Bullish Case for Bitcoin, https://vijayboyapati.medium.com/the-bullishcase-for-bitcoin-6ecc8bdecc1; Access Date: 19/08/2023

Dylan LeClair, https://twitter.com/DylanLeClair_/status/1396518689177063429?s=20; Access Date: 29/08/2023

Jameson Lopp, UK housing most unaffordable since Victorian times, https://twitter.com/lopp/status/1603017614095441920?s=20; Access Date: 02/09/2023

Oliver Anthony - Rich Men North Of Richmond, https://www.youtube.com/watch?v=sqSASY5Hro; Access Date: 02/09/2023

Charlie Munger talks Activision, investing, Russia and why he's not a fan of bitcoin and more, https://www.youtube.com/watch?v=GNTczyGLdhc; Access Date: 02/09/2023

James Lavish, https://twitter.com/jameslavish/status/1562078782453792768?s=20; Access Date: 03/09/2023