Paycom Quick Fire Analysis

Introduction

In this analysis, I will cover the offerings of Paycom Software Inc (PAYC), a leading provider of cloudbased payroll and HR solutions. This will examine the company's competitive landscape, highlighting its strengths and weaknesses, and discuss the key risk factors that could impact its future performance. Finally, I will present my valuation of Paycom.

Company Description

Paycom describes itself as ‘a leading provider of a comprehensive, cloud-based human capital management (“HCM”) solution delivered as Software-as-a-Service (“SaaS”)’1. Paycom provides ‘functionality and data analytics that businesses need to manage the complete employment lifecycle, from recruitment to retirement’2. This includes talent acquisition, time and labour management, Payroll and human resource (HR) management.

Competitive Advantage

With the company rising during the era of the dotcom bubble it has stood the test of time and turned into a major competitor amongst the Payroll and HR industry. Since 1998 the company has been able to establish itself amongst companies and built a go to reputation for HR solutions. This software is easy to use which has driven adoption with a focus on providing an all-in-one solution. The most obvious competitive advantage here is the switching costs associated with changing provider. This is tedious and inconvenient for companies to do creating resistance to switching. Currently, retention of customers stands at 90% which is extremely high. Although it must be said, this figure has dropped from 94% as seen in 2022. A trend to pay attention to going forwards.

The main issue here surrounds the industry itself: no secret or real toll bridge exists creating a competitive advantage that would be hard for competition to replicate. Additionally, the rise of AI and the ever-accelerating trend of technological development has made the industry even more competitive. The need to innovate and prove ever more convenient products has accelerated in recent years. Since main stream adoption of AI in late 2022 we now have the added threat of AI that has unknown ramification for such a service-based company going forwards. How quick can solutions be brought to market? How compelling will they be and is there any scope to clearly stand out within the industry? The answers here are somewhat unknown. What is known is that the speed of development brought to market by AI is only going to increase going forwards. This increased capacity for solutions to be brought to market will drive down costs and could lead to a decrease in revenue potential from Paycom’s products as they try to remain competitive. A storm could be coming for the entire industry.

Industry

Paycom operates within the Human Capital Management Market which is crowded to say the least. Data shows that the industry is expected to grow from $29 billion to $44.7 billion from 2023 to 2032 when viewing data from GM insights3. I found this to be the most conservative measure and it only

1 Paycom 2023 Annual Report, https://investors.paycom.com/financials/annual-reports/default.aspx, Page 3, Access Date 10/09/2024

2 ibid

3 Human Capital Management [HCM] Market Size, Trends, 2032, https://www.gminsights.com/industryanalysis/human-capital-management-market, Access date: 11/09/2024

considers the North American market (which is Paycom’s main region of business). This means the market will compound at around 4% per annum. Other sources measure the market expanding at a much higher rate of between 7-8%+4. Overall, I find the 4% on the lower end of the spectrum with some statistics being unrealistically high. I personally anticipate the growth rate will trend towards 7% for the remainder of this decade in line with broad consensus.

Industry Trend visualised:

Competitive Landscape visualised:

4 Examples of this ranger are given in the following: https://www.marketsandmarkets.com/Market-Reports/human-capital-management-market-193746782.html & Human Capital Management Market, By Offering (Software, Services), By Deployment (On-premises, Cloud), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs)), By End-use, and By Region Forecast to 2028, https://www.emergenresearch.com/industry-report/human-capital-management-market, Both Accessed on the 11/09/2024

5 Human Capital Management Market, By Offering (Software, Services), By Deployment (On-premises, Cloud), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs)), By End-use, and By Region Forecast to 2028, https://www.emergenresearch.com/industry-report/human-capital-management-market, Both Accessed on the 11/09/2024

Management

The most promising factor I found when reviewing the company’s management is that the CEO and founder of Paycom Chad Richardson. Usually, founders bring a level of drive and experience to a business which is hard to replace with none founder CEO’s. The company is their pride and joy, so when difficulty occurs as has happened with Paycom, they usually put maximum effort in steadying the ship and pushing it forwards. With almost 27 years of experience Chad is likely more than capable of driving the company on to future success.

Unfortunately, management after considering the long-standing CFO dramatically trends below average tenure with the vast majority of the leadership team being at Paycom for less than one year.

6 Great video on risk facts for Paycom on Youtube. This image was taken from the video as I was unable to locate the original source. Highly recommend checking it out: The Top 5 Risks to Paycom Stock!, René Sellmann, https://www.youtube.com/watch?v=i1nCW5_igaQ, Access Date: 11/09/2024

7 Paycom Software, https://simplywall.st/stocks/us/commercial-services/nyse-payc/paycom-software Access Date, 11/09/2024

This shows that the troubles facing Paycom have translated into a major reshuffling of management as the company tries to overcome its current troubles.

As to insiders owning the company itself, the picture does not improve. Whilst 12.7% ownership by insiders would typically be quite attractive, the CEO owns 11.6% of this. 1.1% ownership amongst all other insiders does not stow a great amount of attractiveness within the company itself to justify buying the stock.

Additionally, the CEO has been selling his stake despite the company’s share price dropping significantly. If confidence in the company was high internally, and shares were now trading at a significant discount to real value, surely Chad would be buying as much as possible?

This is also reflected in the sell side pressure from insiders across the board with a dramatic miss match of selling vs buying of this dramatically cheaper company.

Below is a list of the most apparent risks that Paycom faces going forward over the next few years and highlights many of the company headwinds. This in part reflects the share price falling over 70% since its all-time high towards the end of 2021:

Recession risk and a high-interest rate environment is a clear headwind to attracting new customers. A slowing of the economy entails less demand and less free cash for companies to invest in Paycom’s HR and payroll solutions. Companies are also feeling the pinch as cash flows are constrained as debt has become expensive since central banks raised interest rates at the fastest pace in recorded history to combat inflation. Whist I see this as a very clear headwind, I do think this will ease going forwards in the short to medium term. At the time of writing12, the Federal Reserve is expected to start dropping interest rates this month as inflation is heading towards their 2% target. Less restrictive conditions will increase the free cash companies have to invest in services like Paycom. Additionally, many macro indicators like the ISM and liquidity indicators show conditions have likely already bottomed since 2022-2023 meaning a recession will not occur for the next few years. All positive tail winds going forwards.

Transition To Beti business can be viewed as a tailwind with much of the company’s high margin legacy revenue stream such as payroll corrections are being made redundant. The software is building and using AI to enhance its service and providing a highly efficient service. The product allows users to check and make corrections to their pay check before it is finalised. This puts employees in control and helps reduce errors. Afterall, employees can easily highlight any issues reducing strain on HR which is often time consuming and costly. The product appears to have been so successful it has cannibalised the company to some extent. Going forward, the amount of customer retention and new users needs to be monitored as this will be a good indicator of Beti’s success.

New users have slowed dramatically over the last few years. This will clearly have a knock-on effect with increasing overall revenue and is a significant factor as to why revenue growth has been reduced to around 9%. This is far below the company’s historic growth which has been consistently above 20% excluding the dip caused by Covid.

12 12th September 2024

13 Beti®, https://www.paycom.com/software/beti/, Access date: 13/09/2024

The US market is limited in scope and will create headwinds for Paycom going forwards as the market becomes more saturated. Revenue growth will have to come from price increases if new users stall or fall. This is why Paycom has started to offer its products in Canada and Mexico. The risk here is that these markets are further from their region of success in North America and their dynamics are less understood. Additionally, the company is now trying to offer its products to enterprise customers with employees of 10,000+. Here it will go up against large players like ADP 16 who have a better grasp on the market. This will be challenging despite the need for Paycom to cross this chasm. Future growth will be a lot more difficult vs what was possible when the company first went public in 2014. Paycom is trying to expand into large companies away from its small to mid-sized company focus which has been very successful over the past decade.

The final point highlighted earlier is the rise of AI, innovation happens faster, cheaper and allows for more competition. This is unfortunately the case in the HR and payroll industries operating within the Human Capital Management sector. My biggest worry here is that each company offers a

14 Paycom 2023 Annual Report, https://investors.paycom.com/financials/annual-reports/default.aspx, Page 50, Access Date 10/09/2024

15 Paycom Software Revenue (Quarterly YoY Growth): 9.07% for June 30, 2024, https://ycharts.com/companies/PAYC/revenues_growth, Access date: 12/09/2024

16 Automatic Data Processing, Inc.

commodity like product and that the competitive advantage is easy to bypass. This is definitely going to get easier as technology improves. Just look at what Beti has done, whilst great for the customer it has not yet shown any benefit to Paycom and its investors. Beti will either go down as a great longterm play or a move that causes Paycom to shoot itself in the foot. What also needs to be considered is that all companies here are trying to improve convenience. If Paycom did not create Beti then a competitor would make a similar product sooner or later stealing market share. It is clearly a challenge of the sector and not Paycom specifically.

Valuation

My Valuation on Paycom using a standard discounted cashflow that adjusts future growth from 10% down to the industry growth rate of 7% midway through my valuation. This therefore assumes future growth will remain around its current benchmark and makes no assumptions that this will improve. This has been done as the risks surrounding Paycom are great and unknown going forwards.

Additionally, this has been discounted with my desire to generate a 15% return which is my personal benchmark of outperformance. Anything less and I would rather reduce my risk and just own a US major index like the S&P 500.

Available cash has also been added into my valuation with this being available. This should clearly be considered in conjunction with the company’s future cashflow generation ability.

I have assumed I will be able to sell the company at around a price to earnings ratio of 15. This is conservative in my opinion and is far below the average amongst peers in the Human Capital Management space. That being said, there may be PE compression across the sector with the rise of AI as technology is deflationary squeezing margins. Many of the highly profitable products will likely become redundant through products similar to Beti.

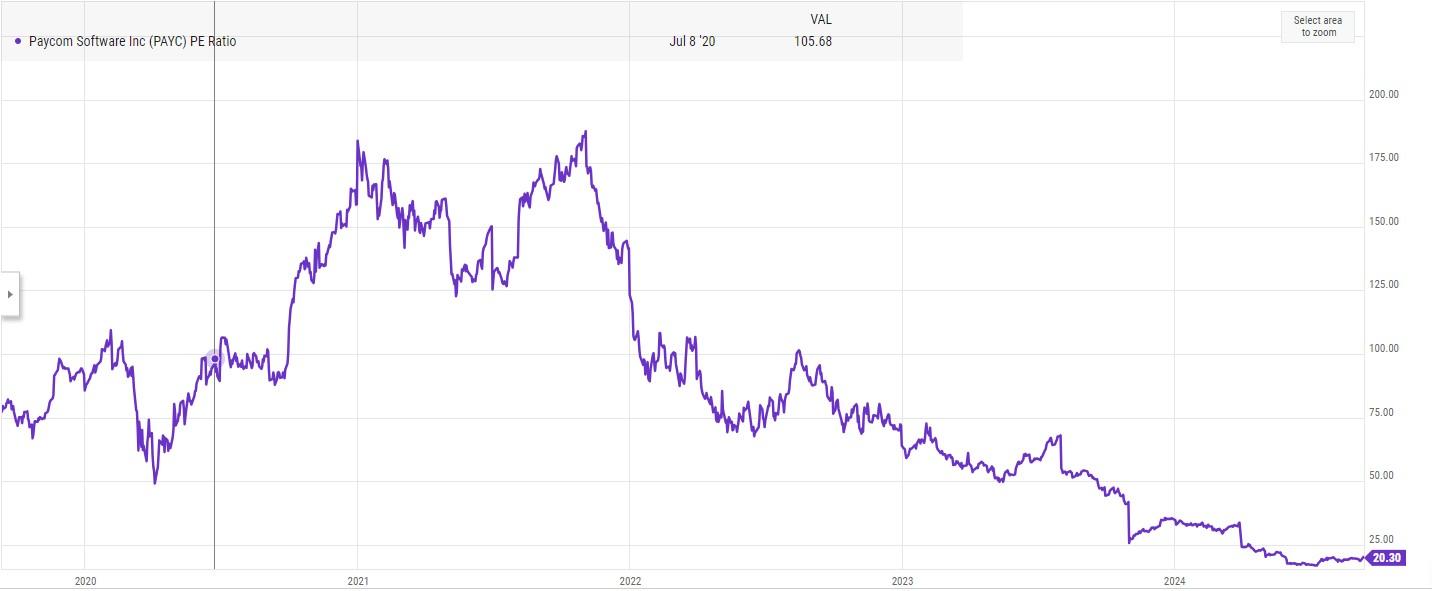

As you can see my assumed PE is below the current low of 20 for Paycom. Historically the PE for Paycom has been very hight reflecting its incredible growth.

17 Paycom Software Inc (PAYC) PE Ratio, https://ycharts.com/companies/PAYC/chart/#/? calcs=id:pe_ratio,include:true,,&chartId=&chartType=interactive&correlations=&customGrowthAmount=&data InLegend=value&dateSelection=range&displayDateRange=false&endDate=&format=real&legendOnChart=false &lineAnnotations=&nameInLegend=name_and_ticker¬e=&partner=basic_2000"eLegend=false&reces sions=false&scaleType=linear&securities=id:PAYC,include:true,,&securityGroup=&securitylistName=&securityli stSecurityId=&source=false&splitType=single&startDate=&title=&units=false&useCustomColors=false&useEsti

Even the large $100 billion plus company ADP trades at a PE of 30+. Bare in mind the ability to grow here is very limited.

Across the board my PE assumes the bottom bound of industry averages.

mates=false&zoom=10&hideValueFlags=false&redesign=true&chartAnnotations=&axisExtremes=, Access date: 12/09/2024

18 Automatic Data Processing, Inc. (ADP), https://finance.yahoo.com/quote/ADP/, Access date: 12/09/2024

19 Price to Earnings Ratio vs Peers, https://simplywall.st/stocks/us/commercial-services/nyse-payc/paycomsoftware/valuation, Access date: 12/09/2024

With that said I still want to take additional steps to mitigate the fact I may be wrong. I put present value of the stock assuming the above at around $343 dollars. I then want to put a discount rate of 50% on this which puts the present value at around $172 dollars.

As of the time of writing , Paycom trades at $168.50. Whilst I do not consider this investment advice, and you should conduct your own research – I consider this company a strong buy.

Conclusion

Overall, Paycom operates in a highly competitive yet profitable industry. Despite the recent decline in stock price, I consider the company's valuation attractive, even when taking into account potential future risks to the sector. However, a red flag is the behaviour of senior management, including the CEO. The lack of insider buying, particularly when the shares are undervalued, is a concerning sign. Sell-side pressure should be viewed as a warning. With revenue growth slowing and the threat of AIpowered products like Beti potentially reducing profitability within the industry, one would expect the CEO to be aggressively buying stock.

Furthermore, the product itself appears to be commoditized, and this trend is likely to continue as technology erodes the advantages held by large, well-established companies.

Despite these concerns, I believe the company is trading significantly below its intrinsic value. Even with a substantial margin of safety, the company's stock price falls below my acceptable purchase price, making it a strong buy opportunity

Please note, I own no shares in Paycom.

20 Paycom Software, Inc. (PAYC), https://finance.yahoo.com/quote/PAYC/, 12/09/2024

Paycom 2023 Annual Report, https://investors.paycom.com/financials/annual-reports/default.aspx, Access Date 10/09/2024

Paycom 2014 Annual Report, https://investors.paycom.com/financials/annual-reports/default.aspx, Access Date 10/09/2024

Paycom Software, https://simplywall.st/stocks/us/commercial-services/nyse-payc/paycom-software Access Date, 11/09/2024

This Company Can’t be Ignored | PAYCOM Stock Analysis, https://www.youtube.com/watch? v=Ty9kc_Ck5QI, Access date: 11/09/2024

Secretly recorded staff meeting reveals big problems at Paycom…, https://www.youtube.com/watch? v=11YRTZIr--k&t=201s, Access date: 11/09/2024

The Top 5 Risks to Paycom Stock!, https://www.youtube.com/watch?v=i1nCW5_igaQ&t=13s, Access date: 11/09/2024

Paycom Stock: The BIGGEST Opportunity in 2024?, https://www.youtube.com/watch? v=90YXSGy2vEI&t=470s, Access Date: 11/09/2024

GRAB STOCK: DOWN 70%! HIDDEN GEM OR RISKY BET?, https://www.youtube.com/watch? v=Q9ySs7ZqCek, Access date: 11/09/2024

Human Capital Management [HCM] Market Size, Trends, 2032, https://www.gminsights.com/industry-analysis/human-capital-management-market, Access date: 11/09/2024

Human Capital Management Market Size, Share, Industry ..., https://www.marketsandmarkets.com/Market-Reports/human-capital-management-market193746782.html, Access date: 11/09/2024

Human Capital Management Market, By Offering (Software, Services), By Deployment (On-premises, Cloud), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs)), By Enduse, and By Region Forecast to 2028, https://www.emergenresearch.com/industry-report/humancapital-management-market, Access date: 11/09/2024

Paycom PLUMMETS Because Of...a Great New Product? | $PAYC Q3 2023 Earnings Analysis, https://www.youtube.com/watch?v=94qdnIIwRoc, Access date: 12/09/2024

Paycom Software, Inc. (PAYC), https://finance.yahoo.com/quote/PAYC/, 12/09/2024

Price to Earnings Ratio vs Peers, https://simplywall.st/stocks/us/commercial-services/nyse-payc/paycom-software/valuation, Access date: 12/09/2024

Automatic Data Processing, Inc. (ADP), https://finance.yahoo.com/quote/ADP/, Access date: 12/09/2024

Paycom Software Inc (PAYC) PE Ratio, https://ycharts.com/companies/PAYC/chart/#/? calcs=id:pe_ratio,include:true,,&chartId=&chartType=interactive&correlations=&customGrowthAmo

unt=&dataInLegend=value&dateSelection=range&displayDateRange=false&endDate=&format=real& legendOnChart=false&lineAnnotations=&nameInLegend=name_and_ticker¬e=&partner=basic_2 000"eLegend=false&recessions=false&scaleType=linear&securities=id:PAYC,include:true,,&secu rityGroup=&securitylistName=&securitylistSecurityId=&source=false&splitType=single&startDate=& title=&units=false&useCustomColors=false&useEstimates=false&zoom=10&hideValueFlags=false&re design=true&chartAnnotations=&axisExtremes=, Access date: 12/09/2024

Paycom Software Revenue (Quarterly YoY Growth):

9.07% for June 30, 2024, https://ycharts.com/companies/PAYC/revenues_growth, Access date: 12/09/2024

Beti®, https://www.paycom.com/software/beti/, Access date: 13/09/2024