Predicting ETH's Next Move: How will the Price React?

In a surprising turn of events, the current U.S. administration has approved the Ethereum (ETH) ETF, driven by political pressures from the impending election. This approval comes after former President Donald Trump unexpectedly voiced support for cryptocurrencies, compelling the Biden administration to respond. Ethereum has now been officially classified as a commodity, a significant milestone following Bitcoin’s notable out performance since the Ethereum merge in September 2022. The pressing question now is: how will Ethereum’s price respond to this regulatory shift?

The surprise

On May 20th, just over a month ago, negative sentiment was dramatically reversed by a tweet from Eric Balchunas, a senior ETF analyst at Bloomberg.

The next step was for the 19b-4s to be approved:

Which it was on 23rd of May 2024:

In Eric’s own words the sudden change of sentiment came as a complete surprise. Both himself, Nate and others highly focused on ETF developments did not see this coming.

From this, the price of Ethereum skyrocketed: Both in USD

And against BTC

Price Action once ETFs Start Trading

After listening to a recent interview with Raoul Pal and Ran Neuner discussing the impact on price the ETF will have on ETHs price a comment was made about the significantly reduced amount of capital required to move ETHs price.

After looking at what dictates price movement, David Lawant’s tweet perfectly surmised the metrics that would be necessary:

Breaking down the tweet mentioned above helps clarify several factors influencing Ethereum's price action once ETFs go live. Although I lack access to various subscription-based on-chain data services to verify data over a 30-day moving average, comparing daily data can still offer valuable insights. At the time of the tweet, Ethereum's market capitalization was reported to be around 30%. Crossreferencing this with CoinGecko data as of June 13, 2024, confirms that Ethereum's market cap aligns closely with this figure, standing at 31.6%.

Simultaneously, when comparing the overall 24-hour trading volumes of Ethereum and Bitcoin, we find data that aligns with the earlier observations. Specifically, Ethereum's trading volume is 47.26% of Bitcoin's, consistent with the trends highlighted in the tweet.

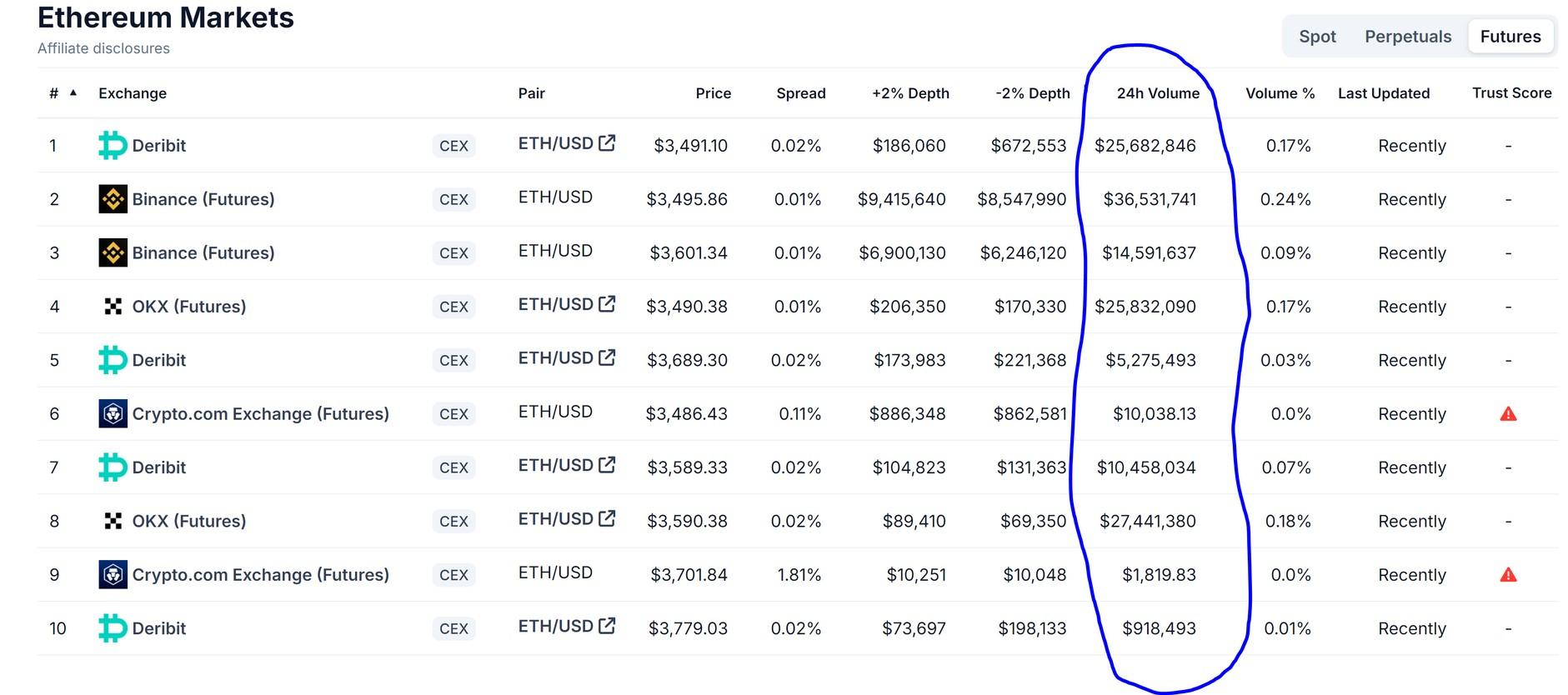

Shifting focus to the futures market, an analysis of the top ten futures markets for Bitcoin (BTC) and Ethereum (ETH) reveals that the data from June 13, 2024, diverges from the 30-day moving average mentioned in the tweet.

Volume for ETH vs BTC came in at just over 31% and not the 50-60% highlighted in the original tweet.

Finally book depth also deviated from the moving average as presented in the above post:

To assess the depth of the order book for both Bitcoin (BTC) and Ethereum (ETH), I examined their current spot prices—£66,320 for BTC and £3,530 for ETH—as of June 15, 2024. For BTC, I focused on total demand 1% above and below the spot price, specifically around £65,656.80 and £66,983.20. Similarly, for ETH, I assessed total demand 1% above and below the prevailing spot price resulting in £3,494.70 and £3,565.30 respectively. This data was sourced from Coinglass.com, providing a snapshot of market demand and liquidity at different price levels for these cryptocurrencies on the 15th June 2024.

liquid. Buying volume is 99% of BTC and sell volume is 90.1%. This is far higher than the 70 -80% mentioned by David Lawant.

Overall, after cross-referencing the data, David Lawant’s analysis appears more optimistic for the potential price of Ethereum (ETH) once the upcoming ETFs are launched compared to my own assessment. As we anticipate the significance of this data in the coming weeks, we may be hopeful for a substantial price increase. However, what we desire and what actually unfolds can often differ. I will explore these dynamics in the following discussion.

First, let’s consider major factors that will cause the price to rise:

1) Market Capitalization of ETH is around one third of Bitcoin (BTC). Every $ of Inflow into ETH will provide more upside pressure on the price for this reason.

2) Ethereum (ETH) has become deflationary as on-chain activity has risen, following the implementation of the London Upgrade (EIP-1559). With a growing focus on ETH and the crypto bull market beginning to gain momentum, the burn mechanism will likely intensify as on-chain activity accelerates.

It can be argued that activity on the Ethereum network has been relatively low since The Merge in September 2022. Despite this, the total ETH supply has decreased by 352,000 as of the 23rd of June 2024. Just imagine the impact going forwards as this bull market accelerates!

3) The supply of Ethereum (ETH) is further reduced due to the absence of selling pressure from staked ETH.

4) As of June 23, 2024, 26.79% of ETH is staked. This significant portion of staked ETH means that ETF inflows will be targeting a smaller pool of available coins, potentially driving up prices as demand meets a constrained supply.

What will limit a dramatic price rise?

1) As mentioned earlier, ETH's market capitalization is approximately one third that of BTC, which could be bullish for its price if significant inflows occur once ETFs begin trading. However, this situation presents a double-edged sword. While a smaller market capitalisation requires less capital to drive up prices, it also means that liquidity can have a stronger impact in suppressing positive price movements when new capital enters the market.

ETH demonstrates higher liquidity compared to BTC when adjusted for its size. If ETH possesses 50-60% of BTC's liquidity while representing only 33% of its market size, ETH is better positioned to absorb inflows.

A greater ability to absorb inflows means less upside potential.

This is further evidenced by ETH showing even higher liquidity in terms of the ability to buy and sell within 1% of the current price. If this metric stands at 70% or higher, it highlights ETH's capacity to absorb demand once ETFs are launched.

However, if the assessment reveals ETH's liquidity to be between 90.1% and 99% compared to BTC within this range, it suggests even greater liquidity. While this is advantageous for market stability, it could potentially limit price increases.

2) Selling pressure from the ETH Grayscale Trust is expected due to their comparatively higher fees, which are likely to outweigh those of their competitors. As of June 23rd, there is $10.25 billion locked up in the trust that will become liquid upon launch, potentially exerting a significant impact on the price of ETH.

However, this could change depending on how the ETH Grayscale Trust plays this launch. After witnessing massive outflows in the BTC Trust, Grayscale may want to be more competitive and retain more ETH:

3) The delta between spot & ETF BTC will be narrower than that of ETH. As BTC cannot be staked there is less incentive to hold the real asset. ETH can be staked outside of the ETF unlike BTC.

This makes the ETH ETF less attractive which will likely reduce inflows.

4) BTC was the first ETF of its kind. A great deal of interest was sparked from this that ETH will not have. The wind has been taken out of ETH's sails so to speak. Less excitement means less demand.

Both points 3 & 4 are credited to the Galaxy Brains podcast episodes: 'Markets are Shifting w/ Beimnet Abebe' & 'SEC Unexpectedly Expedites ETH TF w/ Eric Balchunas' without which I probably would not have considered.

My Conclusion on ETH’s Price Post ETF Launch

Overall, I anticipate that the ETH ETF will drive significant price increases as we approach 2025. However, discussions on X (formerly Twitter) highlighting ETH's advantages over BTC post-ETF launch often overlook certain limitations. Many people have exceedingly high expectations that may lead to disappointment in the weeks ahead.

Now what?

S-1 statements stand as the final road block between ETH and its spot ETF

All S-1 amendments are now in and being processed by the SEC:

ETF is expected to go live around the 2nd of July:

Until then, all we can do is wait. Expect significant volatility over the next month, so buckle up and enjoy the ride.

Bibliography:

Post by Eric Balchunas, https://twitter.com/EricBalchunas/status/1792636523050906102, Access date: 20/05/2024

Post by Nate Geraci, https://twitter.com/NateGeraci/status/1792330334169903568, Access date: 20/05/2024

Post by Eric Balchunas, https://twitter.com/EricBalchunas/status/1801725292404261308 , Access date: 23/06/2024 SEC Unexpectedly Expedites ETH ETF w/ Eric Balchunas, https://www.youtube.com/watch?v=_kg3R5BMYFw, Access date: 24/05/2024

Newly-Approved Spot Ether ETFs Could Start Trading by Mid-June: Analyst, https://cryptonews.com/news/newly-approved-spot-ether-etfs-could-start-trading-by-mid-june.htm, Access date: 25/05/2024

Markets Are Shifting with Beimnet Abebe, https://www.youtube.com/watch?v=6PxpgsV-sEk, Access date: 31/05/2024

Crypto is About to GO BANANAS! w/ @CryptoBanterGroup, https://www.youtube.com/watch? v=0KuC70kpSus, 05/06/2024

Tradingview ETH/BTC, https://www.tradingview.com/chart/Vh5FtxMk/?symbol=COINBASE %3AETHUSD, Access date: 13/06/2024

David Lawan, https://twitter.com/dlawant/status/1799119957977903336, Access date 13/06/2024

CoinGeko Bitcoin Price, https://www.coingecko.com/en/coins/bitcoin, Access date 13/06/2024

CoinGeko Ethereum Price, https://www.coingecko.com/en/coins/ethereum, Access date 13/06/2024

BTC/USDT OrderBook (Spot), https://www.coinglass.com/merge/BTC-USDT-SPOT, Access date: 15/06/2024

ETH/USD OrderBook (Spot), https://www.coinglass.com/merge/ETH-USD-SPOT, Access date: 15/06/2024

Post by

Post by Nate Geraci, https://twitter.com/NateGeraci/status/1804264951315403233, Access date: 23/06/2024

Post by James Seyffart, https://twitter.com/JSeyff/status/1793750784624214517 , Access date: 23/06/2024

Post by Nate Geraci, https://x.com/NateGeraci/status/1805063215992201384, Access date: 24/06/2024