RediShred Capital Corp ($KUT.v)

Business

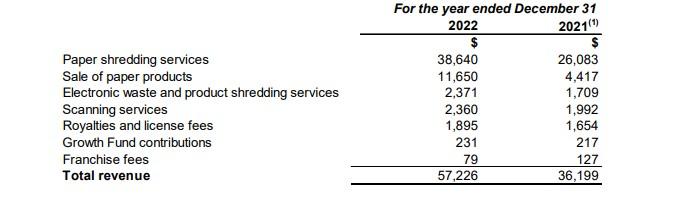

RediShred Capital Corp is a Canadian based recycling, scanning and data destruction company. Their services are provided through three key brands (detailed below) which drive the majority of company revenue. Over the last decade RediShred has been able to grow business operations substantially turning the business profitable for the first time in 2014 and more than doubling revenue since 2020. It is clear that RediShred is in the middle of its growth stage as a company and is largely unknown internationally. With the company going unnoticed by most investors due to its microcap size1, it may well be a hidden gem in plain sight. Below I carry out a deep dive into the strengths and weaknesses of the company and conclude whether it is a company worth buying.

Brands

Proshread security:

The strongest and well known brand of RediShred which provides documentation shredding and hard drive destruction services. This is what most will associate RediShred with as a company and constitutes 56.52% of revenue2

Proscan Solutions:

Provides scanning services for documentation which many office based businesses need as we move into a digitized society. This constitutes a much smaller 9.39% of revenue3

Secure E-Cycle:

Primarily focused on end-of-life office equipment: either restoring old equipment for sale into the secondary office equipment market (such as developing countries), or recycling computers the company cannot sell. However, there is no clear breakdown of revenue for this business segment. Part of this business falls under ‘Electronic waste and product shredding services’ which constitutes 6.15% of total revenue4:

1 Around $70 million at the time of writing.

2 As of Q4 2022 data: Consolidated Financial Statements December 31, 2022 and 2021; https://www.proshred.com/RediShred/wp-content/uploads/sites/4/2023/04/RediShred-Capital-Corp-FS-Q42022-Final.pdf ; page 25; access date: 15/06/2023.

3 Ibid.

4 Ibid.

5 Ibid.

Business Overview and Industry

Overall, the business generates most of its revenue from the shredding of paper 6. This, in part, comes from the total addressable market and the ability to generate recurring revenue. Since the company has diversified away from shredding to incorporate two other segments: RediShred purchased the EWaste business from their pro-shred Kansas business in early 20197 and Proscan from their Springfield Massachusetts franchisee8 .

The shredding industry itself is in contraction due to the decline in storage of paper documentation with the advancement of digitization9. However, there is still decades of paper on the shelves according to CEO Jeffrey Hasham, and digitization has created an environment of ‘paper on demand’. This latter point refers to the printing of documentation for work related matters, but the need to have it destroyed once it has served its purpose.

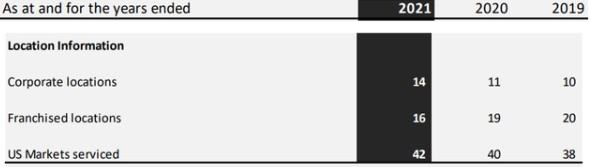

When considering the shredding market and its total addressable size it is, at best, in slow decline. If the rate of change increases as digitization continues to interweave with almost everything this could even increase. With this in mind the main drivers of growth cannot be pinpointed to broad industry growth but primarily three factors: Acquiring franchisees and small local competitors (known as independents), price increase driven by the current inflationary environment, and increasing recurring revenue by attracting a sticky customer base10

Regarding acquisition, Jeffrey Hasham has been on a tare. Purchases from 2018 to March 2023 have totalled roughly $70 million. This constitutes a significant portion of RediShred’s rapid expansion which has been done exclusively within the US market.

It is worth noting, there is no intention to expand RediShred organically in the country of RediShred’s origin: Canada. This limits RediShreds total growth as it hamstrings its ability to expand internationally with its closest neighbour. However, Mr Hasham has not ruled out RediShred’s ability to enter the Canadian market via acquisition (which, from the above, he is quite fond of doing). So far, the acquisition strategy has proven successful and is the main driver of growth within the company. Additionally, RediShred has been able to add some of its subsidiaries all of which have operated efficient and profitably11. This demonstrates the ability of management to make strategic acquisitions all of which benefit the strength of RediShred.

Furthermore, price increases have been passed onto the customers RediShred serves which has allowed the company to navigate this current inflationary environment. This has enabled RediShred

6 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; (Shredding is their cash cow’; time 3.10); access date: 22/06/2023.

7 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 8.00; access date: 22/06/2023.

8 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 10.45; access date: 22/06/2023.

9 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 5.50; access date: 22/06/2023.

10 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; (‘Small to medium sized customers are sticky with an attrition rate of 5% or less’; time 22.00); access date: 22/06/2023.

11 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 13.00; access date: 22/06/2023.

to tackle the rise in costs associated with running their business12. However, it must be noted, I have been unable to find an accurate source regarding these price increases.

Where the moat lies (Competitive Advantage):

The financial strength of RediShred has allowed the business to position itself for attractive deals within the current difficult financial environment. Many independents are available at discounted prices as owners seek to leave the market, particularly as the age demographic is over sixty – many are willing to sell at lower multiples and retire.13. This Plays into RediShred’s growth plan. As these independent shredding companies are acquired, they can benefit from the efficiencies of the RediShred network driving down costs and increasing their profitability. This results in the price paid being much lower in reality14. For instance, the current purchase range of independents is 3-5 times EBITDA but after factoring in cost savings the reality is much lower. The problem is, I have found no evidence that quantifies this specifically. In essence the current difficult financial environment opens new potential acquisitions for RediShred. The total addressable market of independents equates to around 750 million dollars: meaning if RediShred acquires just five percent of this market it would add around 40 million in revenue15. Based on the financial data from the 2022 annual report this statistic alone would increase revenue by 69.90%16 which does not account for the additional cost savings that would be passed on by strengthening the RediShred network and increasing efficiency.

In addition to this, cost of entry provides another competitive advantage pricing out new competitors with the average start-up cost running into the hundreds of thousands17. This is reflected in RediShred’s requirement for franchisees to have a net worth of at least £1.5 million back in their 2015 annual report. I have not seen this figure discussed since but the figure is likely to be much higher as a result of inflation and monetary debasement:

12 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; (‘For instance Fuel has contributed to the largest part of increased costs over the 2 nd and 3rd quarter of 2022’; time 12.20); access date: 22/06/2023

13 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 19.00; access date: 22/06/2023

14 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 16.45; access date: 22/06/2023

15 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 6.50; access date: 22/06/2023

16RediShred Capital Copr 2022 Annual Report, https://www.proshred.com/RediShred/wp-content/uploads/sites/4/2023/05/Annual-Report-2022print.pdf ;page 18; access date: 25/06/2023

17 Credit has to be given to Tristan De Blick for this as I would have likely missed the high entry price as a price. I read this from his review of RediShred: RediShred: 3 Reasons Why This Paper Shredding Business Is A Surprisingly Good Investment; https://seekingalpha.com/article/4567318-RediShred-3-reasons-why-this-papershredding-business-is-a-surprisingly-good-investment;access; access date: 15/07/2023

18RediShred Capital Copr 2015 Annual Report; https://www.proshred.com/RediShred/wp-content/uploads/sites/4/2019/08/ANNUAL-REPORT-2015.pdf; page 6; access date: 15/07/2023

It is clear that costs and competition are high, and the low revenue generation per shredding stop requires high route density for revenue generation. This results in the need of the above-mentioned network effects to take place for success within this industry. From this, the competitive advantage of RediShred comes from its network and the inability for new competition to easily enter the market.

RediShred’s revenue generation strategy

There is a focus on acquiring recurring revenue: with the typical customer using RediShred’s service every four weeks at $100 per service19. This has enabled RediShred to build consistency with its revenue stream which allows RediShred to reduce what Jeffery (CEO) refers to as ‘chunkiness’ (inconsistent or infrequent revenue). As with most people consistency is sort after. With the small to medium sized business being underserved by shredding companies and larger competitors such as Iron Mountain who are disinterested with these small recurring revenue streams, RediShred is able to capitalize on these low hanging revenue opportunities20. Personally, I consider this a brilliant move by management in their attempt to seize untapped portions of the market.

In conjunction with management’s intelligent decision to serve untapped revenue, they are clearly aware of the challenges posed by the declining paper market which will eventually impact the business. In part, this has been done via their acquisition of Proscan which is touted as ‘new age storage’ and builds on the attractive reality that scanning documents is cheaper than storing them physically21. This can be rolled out into their existing RediShred infrastructure to provide this service with minimal scaling costs with the service being hosted in existing real estate. Additionally, this provides less chunky revenue (which the CEO as previously mentioned is a fan of) 22, and counters the chunky revenue reality of services such as Secure e-Cycle. For instance, it is not a common occurrence for customers to dispose of old computers as their useful life spans several years.

It is also worth noting that RediShred it trying to capture more of the value chain by acquiring paper recycling facilities and retaining more profit. This is because RediShred only gets a fraction of the revenue generated from the recycled paper they sell. To combat this, RediShred purchased two new baling and plant-based facilities enhancing their recycling capabilities and value capture 23 .

19 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 6.45; Access Date: 22/06/2023.

20 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 21.00; access date: 22/06/2023.

21 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 9.38; access date: 22/06/2023.

22 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 11.35; access date: 22/06/2023.

23 RediShred: RediShred: 3 Reasons Why This Paper Shredding Business Is A Surprisingly Good Investment; https://seekingalpha.com/article/4567318-RediShred-3-reasons-why-this-paper-shredding-business-is-asurprisingly-good-investment;access; access date: 15/07/2023.

Financial Metrics

Overall, the business strategy deployed from 2018 onwards focusing on acquisitions rather than the expansion of franchisees has produced some outstanding growth for the company. Since 2020 the compound annual growth rate for revenue is 50% with net cash from operations and shareholder equity up 30% and 25% respectively. Net income is up a whopping 361% with EPS up 794%. This has all been achieved whilst total liabilities have increased slightly faster than cash flow generation but far below the revenue increase24. This is visualised below:

Compound Annual Growth Rate since 2020

With the sheer increase in EPS and net income the other metrics can be view a little clearer below:

Compound Annual Growth Rate since 2020

I also found the chart below in Tristan De Blick’s Seeking Alpha article to illustrate RediShred’s strategy transition to acquisitions over attracting new franchisees:

24 With the current rate of debt expansion landing in-between net cash provided by operating activities and revenue I hold a neutral position on this financial metric. I am not concerned currently but if this metric starts to edge towards revenue, I would see this as a red flag. Excessive debt creation to fund growth is usually bad in my opinion.

Management

From assessing the 10-Ks going back to 2012 it appears that the management team at RediShred have done a very good job scaling the business, turning it from a money losing company to a stable corporation.

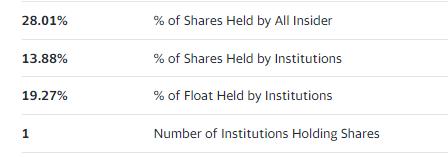

Inside ownership

I tend not to focus on management in great detail with my purchase strategy focusing on the competitive advantage driving most of revenue. Nonetheless some important metrics help ensure management are competent and are on shareholders’ side.

Personally, I see RediShred’s moat as unformed but developing with its brand awareness expanding as its network is built out. Therefore, management plays a key role in its success. Below, a few of the most important points not discussed elsewhere are mentioned.

From the get go, management seems to have a pretty solid interest in the company with most of the largest shareholders constituting inside senior management. This is nice to see as it shows that their interests align with seeing the company prosper:

Overall management holds more than a quarter of the outstanding shares:

Furthermore, many of the top executives have a long history with RediShred which is a good indication of alignment of interest with shareholders. Here is a list of tenure when looking into time served by top executives listed on their website:

CEO Jeffrey Hasham: 15 years 3 months28

Kasia Pawluk, Senior Vice President of Finance & Acquisitions: 12 years 10 months 29

Ron Gable, Executive. Sr Advisor Strategy 8 years 1 month30

Francesco Marascia, VP Strategic Initiatives & PROSCAN® Solutions 7 years 1 month31

CEO

Jeffrey Hasham has a history of company turnarounds32 which is backed up by the performance of RediShred since he assumed the top position turning the company profitable from 2014 onwards. Furthermore, it seems that his experience as a trained accountant has transitioned into a good ability to efficiently deploy capital. For instance, he often references that he will not purchase a well-run franchisee for more than 6.5x EBITDA or an independent for more than 5x EBITDA 33 which demonstrates his intention to deploy capital prudently34. This is nice to see as many CEO tend to avoid this one small point and expand for the sake of claiming success for growing their company even if it destroys shareholder value in the process.

Equity raises and shareholder destruction

27 https://finance.yahoo.com/quote/RDCPF/holders?p=RDCPF; access date: 29/06/2023.

28 https://www.proshred.com/RediShred/management-team/; access date: 29/06/2023; and https://www.linkedin.com/in/jeffrey-hasham-mba-cpa-ca-2972a3b/; access date: 29/06/2023.

29 https://www.proshred.com/RediShred/management-team/; access date: 29/06/2023; and https://www.linkedin.com/in/kasia-pawluk-cpa-ca-65140750/; access date 29/06/2023.

30 https://www.proshred.com/RediShred/management-team/; access date: 29/06/2023; and https://www.linkedin.com/in/rgableapcstrategy/; access date: 29/06/2023.

31 https://www.proshred.com/RediShred/management-team/; access date: 29/06/2023; and https://www.linkedin.com/in/francescomarascia/ ; access date: 29/06/2023.

32 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 1.23; access date: 22/06/2023.

33 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 16.45; access date: 22/06/2023.

34 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 10.00; access date: 22/06/2023.

The CEO points out that there is a focus on the dilutionary impacts of issuing new equity to raise money for their expansionary efforts35. Although this has occurred in the past – it may become more frequent with the cost of borrowing increasing. Therefore, equity raises may well be there only viable option for the cash needed to continue at their current rate of expansion. Knowing this, a close eye must be maintained on this detail.

Competition

RediShred has attacked the shredding and recycling market by going after small and medium sized businesses which its competitors are not focused on acquiring. It has also focused on ease of use to attract more customers and build out its brand. For instance, it does not charge delivery or retrieval fees like its competitor Iron Mountain 36. Even though RediShred has been able to thrive amongst much larger competitors by manoeuvring around them, they are destined to eventually butt heads. As their size increases, they will have no choice but to compete for the same market. Bearing this in mind, a look into two of RediShred’s main competitors is justified:

Iron Mountain

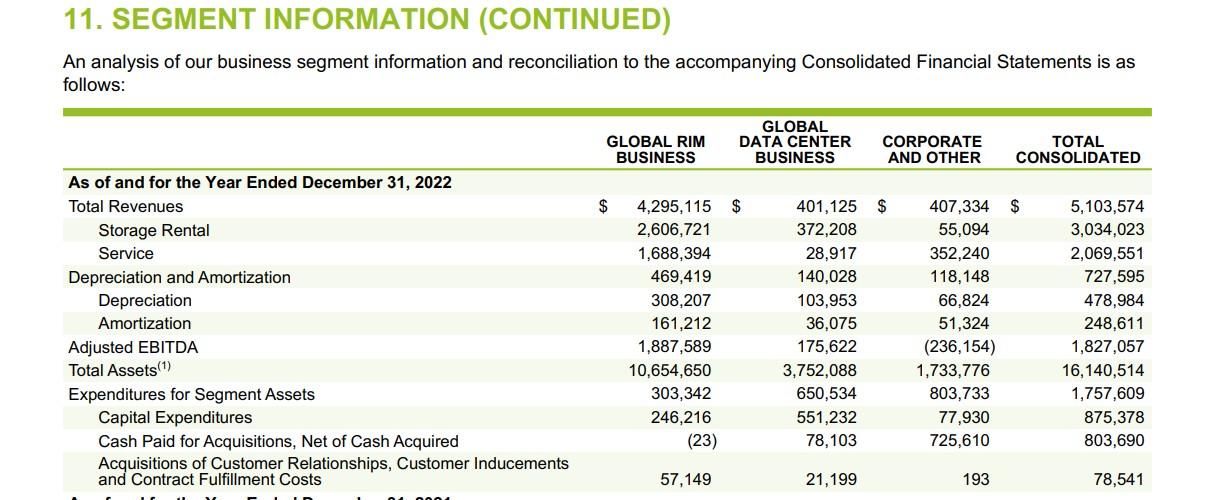

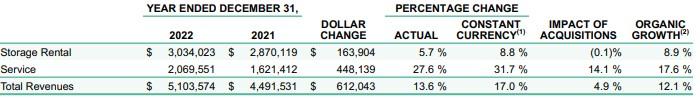

With Iron Mountain boasting revenue at year end 2022 of over $5 billion 37, it significantly dwarfs that of RediShred and clearly reveals its size as a Microcap company. Earnings are currently 89 times the size of RediShred when simply comparing the top line38. Currently Iron Mountain has more than 225,000 customers in 60 countries, and serves 95% of Fortune 1000 companies. Additionally, they are the market leader in the physical ecosystem supporting information storage and retrieval. Furthermore, they operate a new information storage ecosystem which acts as a bridge between physical and digital media. This directly competes with the Proshred and Proscan brands at RediShred.

Iron Mountain has pointed out a few factors that will drive growth which are well worth paying attention to. For instance, their continued growth in faster growth emerging economies, and leveraging their brand of 70 years of customer trust. In comparison RediShred is unable to compete in emerging markets as they have no presence there; furthermore, their history is dwarfed by Iron Mountain’s 70-year existence which suggests their brand is far less recognisable.

35 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 18:05; access date: 22/06/2023.

36 Q&A with Jeff Hasham, CEO of RediShred (KUT-TSXV); https://www.youtube.com/watch?v=Fp2k4_Ns9Yc; time 10.00; access date: 22/06/2023.

37 $5103.57 vs RediShred’s Revenue of $57.23 million; Iron Mountain Incorporated Annual Report; https://s23.q4cdn.com/202968100/files/doc_financials/2022/q4/IRM-2022-10K-as-filed.pdf; page 71; access date: 05/07/2023; and RediShred Capital Corp, Consolidated Financial Statements, Q4 2022; https://www.proshred.com/RediShred/wp-content/uploads/sites/4/2023/04/RediShred-Capital-Corp-FS-Q42022-Final.pdf; page 10; access date: 05/07/2023.

38 When comparing Q4 2022 data.

From the segment data it is hard to distinguish what revenue directly competes with RediShred’s as their segments are only broken down into two categories. However, it is clear, that the Data Centre business will directly compete with Proscan.

Important to note is that their Global Data Centre business appears to have well entrenched network effects from their business operations in this segment for the last 15+ years. Evidence is provided here as they provide data services for the most heavily regulated services and 5 of the top 10 cloud service providers use Iron Mountain39. First mover advantages thus exist by acquiring a large part of the top potential clients.

Industry Insights

‘We believe that competition for records and information customers is based on price, reputation and reliability, quality and security of storage, quality of service and scope and scale of technology. While the majority of our competitors operate in only one market or region, we believe we provide a differentiated global offering that competes effectively in these areas’40

The above is a direct quotation from the 2022 business overview of Iron Mountain, but helps deliver insights into the business structure of the shredding industry. It always comes down to price and quality of service. This also highlights that, for the most part, everyone in the shredding industry is dealing with a commodity where the company with the most attractive (lowest) prices wins. This is not like Coca Cola or Apple who have a secret recipe or a switching cost that allows them to charge prices well in excess of competition but retain all of their user base.

The decline in physical documentation is highlighted in their company risk factors:

39 Iron Mountain Incorporated Annual Report; https://s23.q4cdn.com/202968100/files/doc_financials/2022/q4/IRM-2022-10K-as-filed.pdf; page 10; access date: 05/07/2023.

40 Iron Mountain Incorporated Annual Report; https://s23.q4cdn.com/202968100/files/doc_financials/2022/ar/final-2022-annual-report.pdf; page 5; access date: 05/07/2023.

‘Our Records Management and Data Management service revenue growth is being negatively impacted by declining activity rates as stored records and tapes are becoming less active and more archival. The amount of information available to customers digitally or in their own information systems has been steadily increasing in recent years, and we believe this trend will continue’. 41

This highlights the declining industry which will result in RediShred having to fight for a shrinking portion of the economic pie. How long their ability to manoeuvre around competition will last is going to get increasingly difficult as they scale operations. There is also no guarantee that scanning and digital services will be required to the same degree by these companies. The risk here is that digitisation does not create the same demand as physical legacy services.

Digitization results in more unsustainable revenue streams:

In addition, ‘the digitization of records may shift our revenue mix from the more predictable storage revenue to service revenue, which is inherently more volatile’42

This highlights that there is less friction with digital revenue mixes which can be linked to Proscan for RediShred. Physical documentation is much stickier as there is much more friction with having it dealt with. Digital has no physical footprint and can be dealt with much faster or put off much easier to be dealt with another day or in great amounts of bulk. This will result in revenue becoming chunky which no company actually wants because consistency allows for predictability and better planning.

As with RediShred, most of the revenue growth will be driven through acquisitions:

‘Strategic acquisitions are an important element of our growth strategy and the success of any acquisition we make depends in part on our ability to integrate the acquired business and realize anticipated synergies.’43 This is reflected in their 2022 annual report as a large part of their revenue growth44 came from the acquisition of ITRenew which added $213.1 million to the top line.

However, unlike RediShred the financial strength and room for growth is clearly reflected in the below metrics:

41 Iron Mountain Incorporated Annual Report;

https://s23.q4cdn.com/202968100/files/doc_financials/2022/ar/final-2022-annual-report.pdf; page 9; access date: 05/07/2023.

42 Iron Mountain Incorporated Annual Report;

https://s23.q4cdn.com/202968100/files/doc_financials/2022/ar/final-2022-annual-report.pdf ;page 10; access date: 05/07/2023.

43 Ibid.

44 In2022

45 Iron Mountain Incorporated Annual Report;

https://s23.q4cdn.com/202968100/files/doc_financials/2022/ar/final-2022-annual-report.pdf ;page 45; access date: 05/07/2023.