In this issue: – Michael W. Dunagan: Does the State Stand Behind Texas Title Certificates? – Why Your Automotive Dealership Needs to Focus on Delivering Exceptional Customer Experiences – Data Breach and Information Security Incident Response for Auto Dealers – On the Road with TIADA

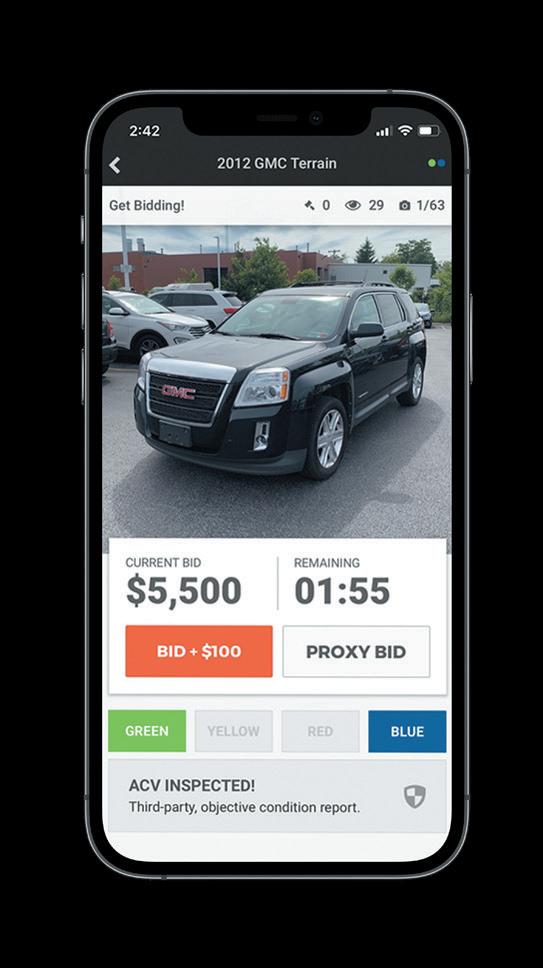

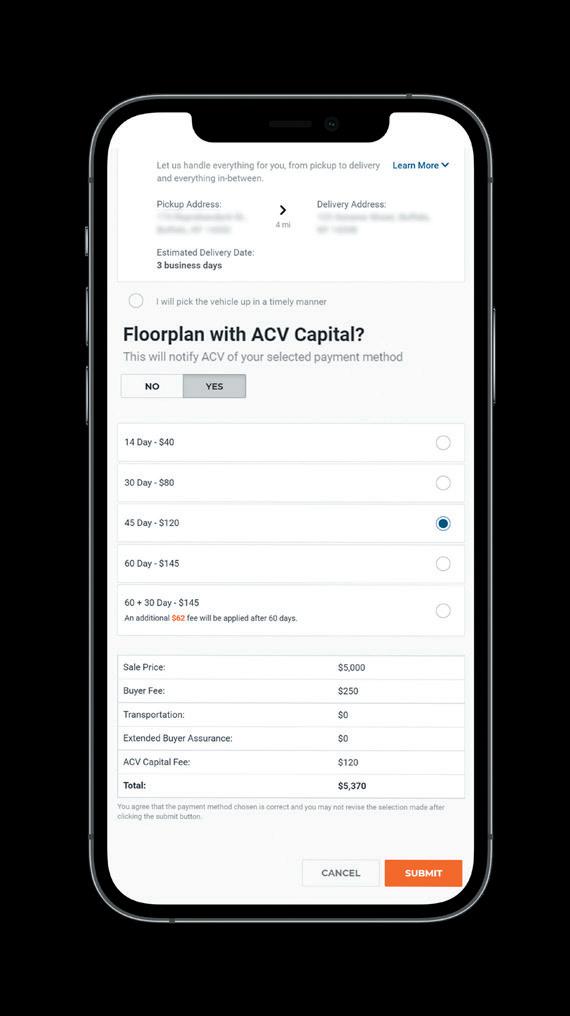

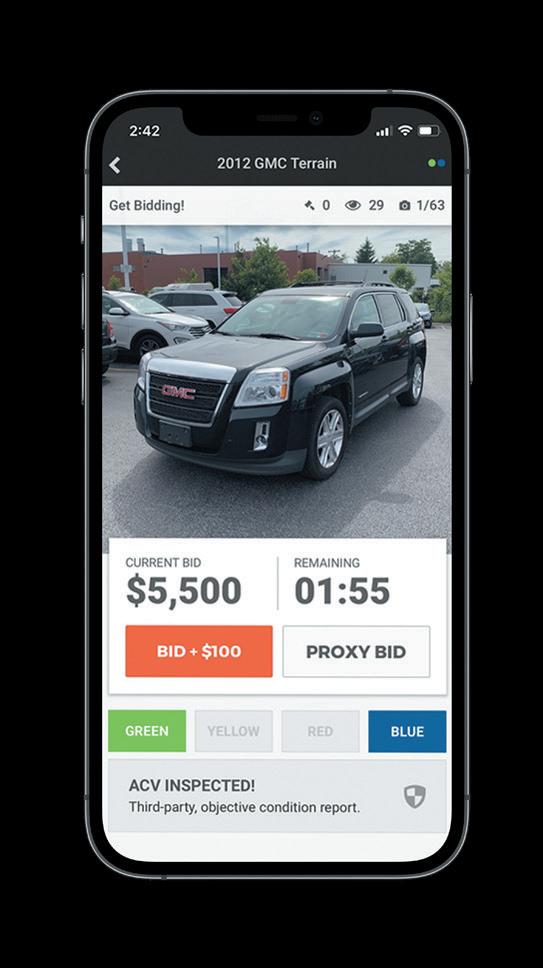

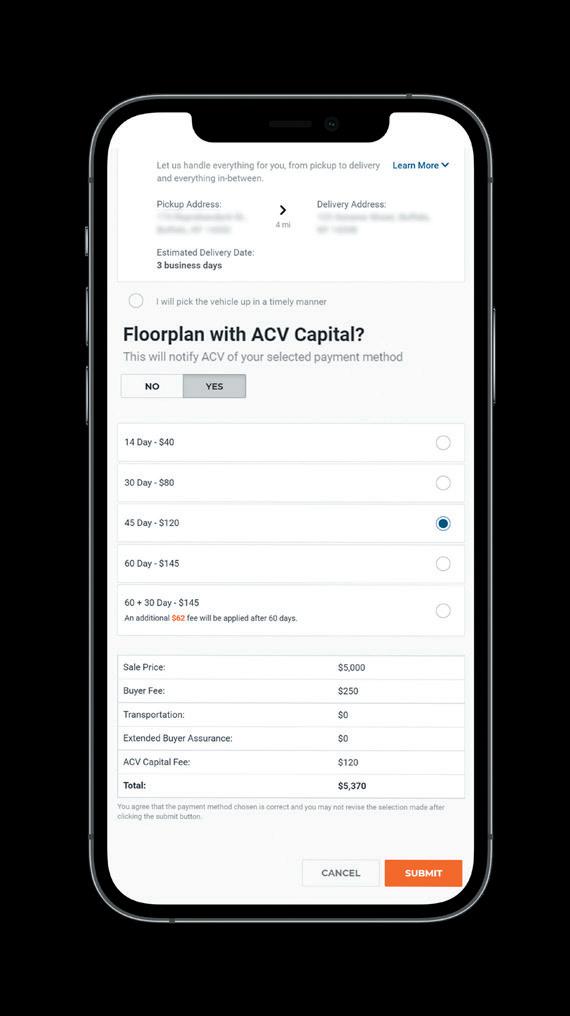

• Know your fees upfront; no hidden title, audit, curtailment or Fed-Ex fees • Fee is determined by the amount financed and the term selected • Up to 90-day terms available • Include financing for transportation costs Financing Made Simple. ACV Capital offers short-term inventory financing for buyers to purchase vehicles on our digital marketplace. Our financing product includes straightforward pricing, allowing our customers to know their inventory costs upfront. SCAN HERE TO LEARN MORE

TIADA Board of Directors

PRESIDENT Ryan Winkelmann/BJ’s Autohaus 5005 Telephone Road Houston, TX 77087

PRESIDENT ELECT

Eddie Hale/Neighborhood Autos PO Box 1719 Decatur TX 76234

CHAIRMAN OF THE BOARD

Mark Jones/MCMC Corporate 264 Exchange Burleson, TX 76028

SECRETARY

Vicki Davis/A-OK Auto Sales 23980 FM 1314 Porter, TX 77365

TREASURER

Greg Phea/Austin Rising Fast 8024 IH 35 North Austin TX 78753

VICE PRESIDENT, WEST TEXAS (REGION 1)

Brad Kalivoda/Fiesta Motors 2599 74th Street Lubbock, TX 79423

VICE PRESIDENT, FORT WORTH (REGION 2)

Greg Reine/Auto Liquidators 39670 LBJ Freeway Dallas TX 75237

VICE PRESIDENT, DALLAS (REGION 3)

Chad Lancaster/Chacon Autos 11800 E. Northwest Hwy Dallas TX 75218

VICE PRESIDENT, HOUSTON (REGION 4)

Russell Moore/Top Notch Used Cars 900 East Davis Conroe, TX 77301

VICE PRESIDENT, CENTRAL TEXAS (REGION 5)

Robert Blankenship/Texas Auto Center 6809 Suite B S IH35 Austin, TX 78744

VICE PRESIDENT, SOUTH TEXAS (REGION 6)

Armando Villarreal/McAllen Auto Sales, LLC 4215 S. 23rd St McAllen, TX 78503

VICE PRESIDENT AT LARGE Lowell Rogers/11th Street Motors 1355 N 11th St, Beaumont, TX 77702

VICE PRESIDENT AT LARGE Cesar Stark/S&S Motors 7699 Alameda Ave. El Paso, TX 77915

EXECUTIVE

TexasDealer contents

Volume XXII / Issue 11 / November 2022 Notice to all members concerning services and products: TIADA was established in 1944 to develop professional standards of service and conduct for the independent auto industry. Opinions expressed herein are not necessarily those of the TIADA management, the Board of Directors or the member ship. Likewise, the appearance of advertisers or their indemnifications of TIADA does not constitute endorsement of the products or services featured. Editor: Stephen Pallas Magazine Ad Sales: Patty Huber, 512-310-9795 Did You Know? The deadline for meeting the FTC Safeguards Rule requirements is coming up on December 9, 2022. See page 25 for more information about TIADA’s Safeguards Rule Course.

TIADA

DIRECTOR Jeff Martin 9951 Anderson Mill Rd., Suite 101 Austin, TX 78750 Office Hours M-F 8:30am – 4:30pm 512.244.6060 • Fax 512.244.6218 jeff.martin@txiada.org 4 Officers’ Message by Vicki Davis, TIADA Secretary 10 On The Cover: Interest Hikes Could Bring Early Pain, Eventual Gain, to Dealer Ecosystem by Daryl Lubinsky 15 Data Breach and Information Security Incident Response for Auto Dealers by Anne Marie Lee-Edwards 17 TIADA Membership Application 19 Legal Corner: Does the State Stand Behind Texas Title Certificates? by Michael W. Dunagan 20 Upcoming Events 27 Regulation Matters: FTC, CFPB and DOJ Enforcement Actions by Earl Cooke 33 Board of Directors Meeting Minutes 35 Why Your Automotive Dealership Needs to Focus on Delivering Exceptional Customer Experiences by Larisa Bedgood 37 On the Road with TIADA by Stephen Pallas 40 TIADA Auction Directory 45 Local Chapters 45 New Members 46 Behind the Wheel by Jeff Martin

officers’ message

by Vicki Davis

Keys to Successful Delegation

Delegation: this is a word I think most business owners and managers struggle with. We often do not want to give up a job or duty to someone else because we can just do it ourselves and we know it will be done correctly and we will not have to check it. But, at the end of the day, we cannot do everything, and we must rely on our employees to do their jobs and rely on the training they have been given to get the job done. We must, however, inspect what we expect. By that I mean, we must teach our staff on how to do a job, set specific and clear expectations, and then periodically check them. When employees are doing something in correctly, it is our responsibility to show them what they are doing wrong.

When you have successfully implemented these steps, you will achieve the kinds of delegation you want for your business. Sometimes this can be frustrating. If, for example, an employee does not catch on as fast as you think they should to complete a project, you may feel compelled to take over the task. Just remember you have been doing this a long time and they have often just started doing it. Remain patient, have empathy for your staff, and trust in the process.

Delegation is something I struggle with all the time. I believe you must prioritize your time, regardless of your job title. You must do the most important jobs and delegate the rest to others. A friend of mine once told me he lived by the 80% rule. He said no one is going to do the job exactly as you would, and he felt if they do it 80% of the way he wanted, then he could live with that. I

A-OK Auto Sales (Porter)

TIADA SECRETARY

adopted his rule and feel it has taken a lot of pressure off myself as a business owner and my staff.

Sometimes you will be (and I sometimes do get) ag gravated if it is not done exactly the way you would like. When I remind myself about the 80% rule, I find it much easier to move on. When you have a job that you are going to delegate out, look to the strengths of your team and delegate accordingly. Some will be good at certain things, and other employees will show strength elsewhere. I have one employee that is great with any thing to do with Microsoft Excel, and she is tasked with anything that has or needs an Excel spreadsheet.

I also believe delegating work out promotes teamwork and makes your employees feel important. If we do not delegate work out to our team, we do not need them… and believe me, we need them.

Another reason to learn to delegate is you do not want any one person to have too many responsibilities. If you lean too heavily on any individual, anything that happens to them can cause massive disruption in your business. I once had a management-level employee suffer a very bad case of COVID. Although I had encouraged her to delegate some of her work to others, she would not. She had a very difficult time catching up when she came back to work, but if she had delegated some of her work, things would have been much more efficient for her and for the business.

We hire good people to help us, and we must all learn to work as a team. This does require delegation, but just remember to inspect what you expect, and your delegation will get much easier to digest.

If we do not delegate work out to our team, we do not need them…and believe me, we need them.

4 Texas Dealer November 2022

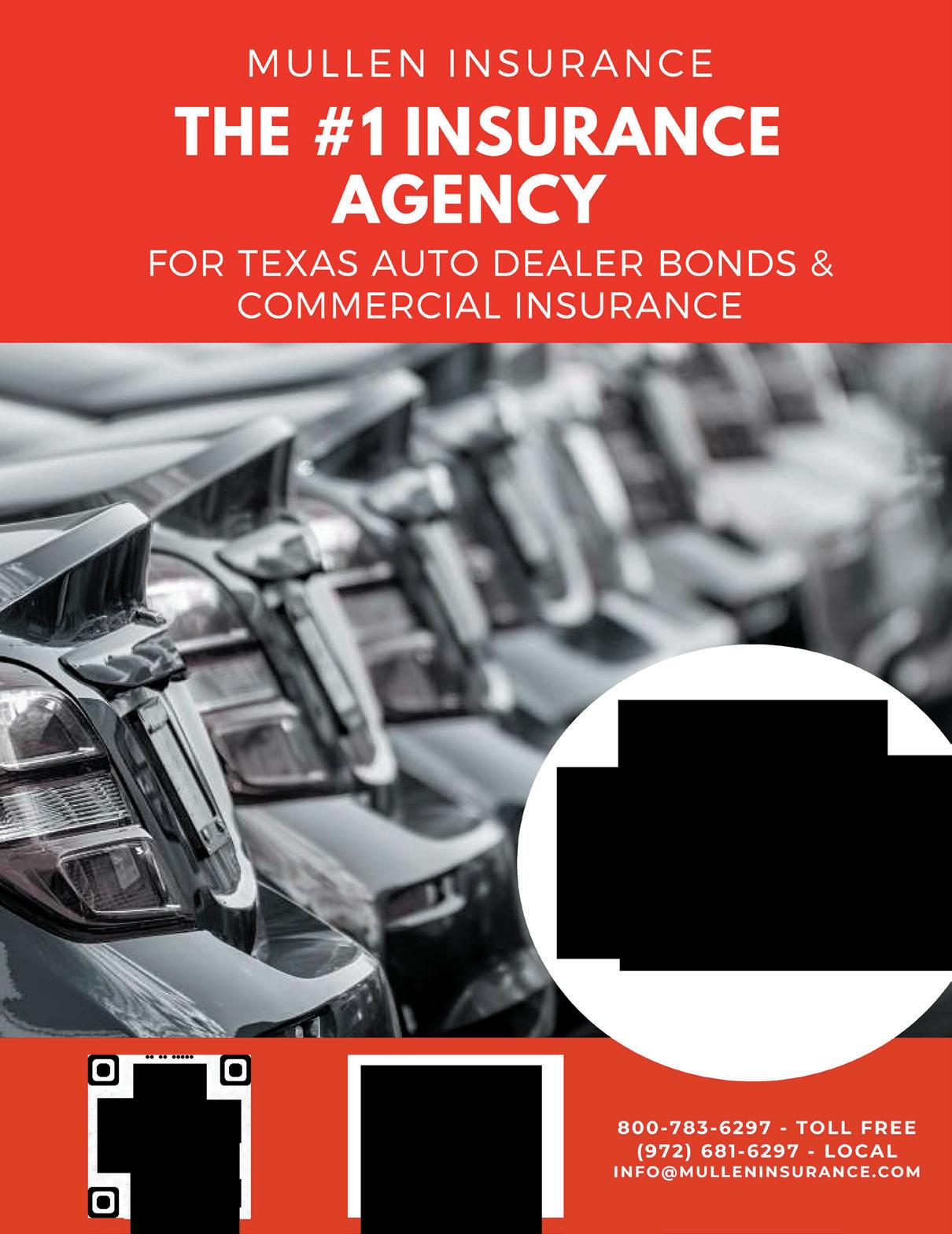

■ ■ ■ ■ ■ ■ Discover the flexibility, convenience and security of our user friendly no cost dealer management system. Our OMS platform includes access to credit reports, vehicle valuations for a simplified sales process as ·well as cost-saving benefits, and business reports that give management an advantage over your ,11t' competitors. LOBEL FINANCIAL ■ ■-,. www.lobelfinancial.com Q 800-871-8051 II marketing@lobelfinancial.com Copyright© 2022 Lobel Financial. All rights reserved. Member NIADA. ■ ■ ■ ■ ■ ■ ■ ■ ■ ■

One of the quickest ways to ruin a dealership’s profit margin is to be hit with a fine from a regulatory agency, or to lose a lawsuit filed by a customer. This seminar will focus on the practical side of compliance that understands you have a business to run — and you want to run it right.

This seminar from TIADA attorney Michael W. Dunagan is the final answer in BHPH compliance. Mike speaks dealer, and with 45 years of experience representing hundreds of BHPH dealers, he knows your business inside and out.

Attend this workshop and learn all about:

• How to prepare for (and survive)

OCCC exam

• What to do when the

• Repossessions:

arrives

• TxDMV Enforcement –

•

•

•

• Properly handling financing

• Real-life DTPA court cases

• Body shops, mechanics,

issues

• Specific lien-protection steps

• Federal regulations affecting

• Alternatives

•

•

an

Bankruptcy Notice

from A to Z

Title Management Issues

Most common advertising violations

Your right to insurance proceeds

Using the courts to get your car back • Procedures to stay off the CFPB’s radar • Techniques to avoid consumer lawsuits

on repairs

towing and storage

BHPH dealers

to traditional insurance

Most common OCCC customer complaints

How to respond to an attorney demand letter • Dealer issues in Comptroller audits To register visit Txiada.org or by phone at 512.244.6060 . Keeping Your BHPH Dealership Legal & Compliant in partnership with Dealer Academy Presenter Michael W. Dunagan, TIADA General Counsel, author of Dealer Financing of Used Car Sales and Texas Automobile Repossession: A Lien Holder’s Legal Guide. Time 9:00am - 4:00pm Cost $249 Members, Each Additional $199 (must be from same dealership) $498 Non-members Monday, December 12, 2022 Houston, Texas Sheraton Houston Brookhollow Hotel 3000 North Loop | West Houston, TX 77092 713.688.0100 Sponsored by: Texas Dealer November 20226

20 23 JULY 23-25, 2023 SAN ANTONIO, TX SAVE THE DATE

the cover

by Daryl Lubinsky

CrossPointe Auto in Amarillo, Texas, recently sold a 2020 F-150. The customer’s monthly payment on the vehicle is $552.

Six or seven months ago, that cus tomer’s payment would have been $477, said Cross Pointe Auto Owner and General Manager, Dean Sather.

“So, their payment on this vehicle just went up 75 bucks, purely interest,” Sather said.

Sather was referring to the Federal Reserve’s recent interest rate hikes: The late-September increase was the fourth this year.

David Lobel of Lobel Financial provided a simple summary of the situation, noting that higher interest rates mean purchasing or expand ing through credit is more expen sive for consumers and businesses.

That should eventually slow de mand, he stated.

The hikes, combined with other factors, like supply chain issues, have affected the entire indepen dent dealer ecosystem, including dealers, customers, and lenders. Those groups will feel various nearterm and long-term effects from the higher interest rates.

Effects On The Independent Dealer Ecosystem

Jonathan Smoke, Chief Economist for Cox Automotive, said that for the near term, the feeling that the in dustry will see pain early on to bring stable prices and control inflation is a reality.

“We’re likely to see an environ ment that’s tougher to sell vehicles

and tougher to manage a business, because costs are still going up, and in the near term, it means the demand side gets hurt as well,” said Smoke.

Longer term, Smoke believes that for the end of this year and likely much of next year, the environ ment should return to being strong and much more stable for dealers. Unemployment could increase in percentage from the low threes to around the low sixes percent. “Although an increase of any type is never a good thing, an approximate 3% increase for a recession is rela tively mild,” Smoke said.

“That means most people are go ing to hold on to their jobs, we’re going to return very quickly to a very strong U.S. economy that has a strong labor market, and with that

on

Texas Dealer November 202210

always comes the demand for ve hicles,” Smoke said, adding that the inventory shortages should eventu ally ease.

“If interest hikes reduce inflation, that’s good for consumers, whose wage increases will boost their bot tom line and help them buy bigticket items like cars,” Smoke said. “And that will help dealers.”

Smoke brought up the 2022 Cox Automotive Dealer Sentiment Index, and one survey question asked in dependent dealers which aspects of the industry were holding back their business. The economy was the top answer. Interest rates came in at No. 4.

“And the Fed communicated they’ve got at least another point and a half to go, so that means floor planning is also likely to get more expensive,” he said.

Smoke was speaking in late September as the East Coast was preparing for Hurricane Ian, and he could see an analogy with the inter est rate situation.

“A key takeaway from my reading of the Fed meeting last week was we need to be packing an umbrella for the vehicle market,” Smoke said. “It’s likely to get tougher before it gets better. But dealers are natu ral entrepreneurs and have gone through cycles before. This is not going to be remotely close to the worst cycle that they’ve likely ever experienced, and I think the one challenge with this environment is we’re going to be seeing interest rates that, by the end of this year or early next year, are going to be at levels we haven’t seen in 20 years.”

Millennials and others who have not owned multiple cars have never seen interest rates quite like that. An adjustment period will be neces sary for dealers to manage expecta tions and help customers navigate an environment in which financing purchases cost more money. But Smoke is confident dealers will han dle that situation and be successful. He said that many dealers were

selling cars just fine in the late ’90s and early 2000s at the time rates were previously this high.

“I have no doubt that the audi ence will take it in stride and know that means they need to be con servative with their inventory, they need to be prepared to know that there are going to be challenges with their customer base being as strong as it has been, but … you know there will be a positive at the end of this, hopefully, stronger and better for the bottom-line economic situation,” he said.

More on the Dealer Portion of the Ecosystem

Maria Pericaz of Express Auto Financial in Grand Prairie, Texas, and Sather at Cross Pointe Auto ad dressed the interest rate situation by noting that fewer people are buying cars for the “experience” of buying. They’re buying cars because they have to.

Pericaz said interest rate increases have played a significant role in her company’s recent slowdown in sales.

“It used to be an exciting experi ence and used to be something like, ‘I know I have a good car, but I want something better.’ Now, they’re say ing, ‘I know my car is falling apart; I prefer to keep fixing it instead of buying.’ I feel like they are seeing not only interest going up but all their expenses going up because of it, so they’re making choices to save money versus expense it,” Pericaz said.

Sather expressed the situation similarly, describing the higher-end vehicle market as “more of a need buy versus a want buy.”

“They had their car totaled by hail; someone ran a stop sign and hit him and totaled their car; that’s a need buy versus a want,” Sather said. “‘My wife wants to get a new car, so we’re going to go look at Escalades.’ There’s a lot less of that. The way I see it, at least in our mar ket, is it’s going to adjust the people

that are out buying as the economy is constricting. The stock market is definitely hurting. Interest rates are going up. There’s a whole lot more need buying versus want buying be cause the cost for that same vehicle today versus what it would have cost them five or six months ago, as I showed you, there’s a $75 a month difference.”

More on the Customers

Ken Shilson, an automotive con sultant specializing in the buy-here, pay-here business, addressed how interest rates affect buy-here, payhere customers, describing those customers as “unbankable” consum ers with very limited liquidity and financial capacity who could not qualify for a traditional loan and are entering into loans with very high interest rates.

“An increase in interest rates doesn’t necessarily affect their bor rowing cost, because it’s already maxed out,” Shilson said. “But during times like now, when those customers possess limited liquid ity, they must find ways to pay their bills. So they start taking out credit card debt,” Shilson added.

“And they max out their credit card debt, which is at a higher inter est rate, which makes their liquidity situation even worse,” Shilson said.

“Those customers often go on to obtain payday loans or cash ad vances, which are also at very high interest rates. Any increase in their cost of credit further limits their liquidity,” Shilson said.

“So it does have an adverse effect on the customer because he has less capital to work with, he’s living off credit cards and other means, and so that just increases the cost of that situation,” he said. “It reduces his liquidity.”

More on the Lenders

Sather at Cross Pointe Auto said his company does business with a local credit union that raised its rates effective Sept. 21. This is after

November 2022 Texas Dealer 11

15% OFF DEALERS GET ENROLLMENT Use code: TEXAS TAX SEASON IS BACK! Let Tax Max file your customers’ tax returns and have all the tax refund money sent to your dealership (Retail, BHPH, Franchise). Don’t chase tax refunds all around your city. Let Tax Max put all the tax refund money in YOUR HANDS! www.TaxMax.com 866-642-4107 BHPH Taxes by Text FREE TAX PREPARATION for your customers and employees Additional BHPH Programs Send your customers a text link in 30 seconds and they will work directly with Tax Max to file their tax returns. The dealership no longer does any of the work, AND THE MONEY IS STILL SENT TO THE DEALERSHIP! Irregular Payment Program - Use Tax Max all 365 days of the year to reduce terms up to 21%. Collections Program - Use Tax Max to collect on your past due accounts. Repairs Program - Use Tax Max to collect on your repair notes. All repair notes should have a Tax Max balloon payment due on March 15. With our NEW Elite Tax Max option, Tax Max will prepare and file the federal and state tax returns for FREE! (Call Tax Max for details)$ More benefits! Increase down payments by an average of $1,711 Increase lot traffic FREE Marketing Materials Customers can “Drive Now - Pay Later” Ask about our Tax Refund Advance $6,000Up to Same Day Money

having already raised the interest rate three times prior to that, on August 1, July 18 and April 1.

He said many lending insti tutions are raising rates more frequently.

“For a while there, you might get a rate increase every seven or eight months, nine months, now we’re seeing some of them every month bumping their rates up,” Sather said. “Of course, as the rates keep going up, they’re bumping their ABC credit rates higher.”

Shilson said banks are see ing the opportunity to increase the yield on their loans, but the concern for them is whether buyhere, pay-here customers will be able to pay in the future.

“There’s no more government stimulus, there are no more ad ditional unemployment benefits, so their concern is, without those supplements, will these customers be able to pay for the auto loan?

The answer is we just don’t know,” Shilson said. “We just have to hope that they prioritize the car payment as they have in the past and will continue to make the car payments because they need the transportation.”

Lobel summed up the increased interest rates’ effects on the auto dealer ecosystem, noting that auto finance companies have seen their cost of funds increase dramatically. He stated that those higher interest rates will eventu ally be passed through to dealers’ customers, adding that monthly payments will increase and pur chasing a vehicle will become less affordable.

“In addition, as the likelihood of a recession increases, lend ers will tighten underwriting guidelines to minimize the in crease in credit losses typical in an economic downturn,” Lobel stated. “Both of these factors will contribute to reduced sales at dealerships.”

Finance more customers and sell more cars. Be your own captive finance company. 877. 592 .4672 | agoradata.com © 2022, Agora Data, Inc All rights reserved November 2022 Texas Dealer 13

Data Breach and Information Security Incident Response for Auto Dealers

by Anne Marie Lee-Edwards Compliance Specialist at AutoSavvy

by Anne Marie Lee-Edwards Compliance Specialist at AutoSavvy

Risk/Issue

Whether an auto dealer conducts third-party or in-house financing, they retain a signifi cant amount of personal information. The security of this information is increasingly important as data breaches and other cybersecurity issues become more frequent. In addition to any potential or exist ing regulations governing the storage and handling of this information, the responsibility a dealer has to its customers to protect that information is paramount to fostering a relationship built on trust.

Rule/Affirmative Duty

TEXAS RULE

The Texas-specific rule governing data breaches was modified as of September 1, 2021, and the complete rule can be found in Section 521.053 of the Texas Business & Commerce Code. The Texas rule allows 60 days for the notice of the breach to be given to the Texas Attorney General and only requires such notice if the breach af fects at least 250 Texas residents. However, the rule also

requires that the company experiencing the breach pro vide direct notification to all persons, not just Texas resi dents, whose sensitive personal information was acquired or reasonably believed to be acquired as the result of the breach, regardless of the number of affected persons. Accurately assessing the breach and providing the correct notice to affected persons is discussed further below.

FEDERAL RULE

In addition to the requirements at a Texas state level, there are various Federal laws governing information security and data breach notifications and responses. The most relevant rule for auto dealers is the Gramm-LeachBliley Act (GLBA). Under this Act, an organization’s duty to notify the appropriate regulator, law enforcement, and potentially affected consumer begins when it becomes aware of the potential information security incident. The dealer must coordinate the notification letter to its consumers as soon as possible. The Federal Trade Commission (FTC) offers a wealth of information and advice regarding data breach responses on its website at

feature

15November 2022 Texas Dealer

www.ftc.gov. Seeking the advice of your legal counsel is always the best way to determine what the dealer’s notifi cation duties are to both its consumers and its regulators.

Response and Compliance with the Rule

The key to a successful data breach response is to engage the right key people as soon as a breach is discovered. By implementing the continuous monitoring requirements under the FTC Safeguards rule, any dealer should be alert ed immediately to a suspected data breach. The first sign of a potential breach is the most critical time to take steps to decrease the damage done. The information technology (IT) department or outsourced IT professional(s) for the dealership should take point on any remediation measures to assess the problem and stop data loss. Key questions you should ask an external IT professional include:

What experience does the firm have with responding to data breaches?

What is the timeframe to determine what data was compromised and for remediation?

In conjunction with the IT department, it is equally cru cial to engage with legal counsel. Whether this is internal legal counsel or someone outside of the dealership, finding an attorney who can coordinate the response within the al lotted timeframe is essential. When seeking outside coun sel, key questions you should ask legal counsel include:

What experience the firm/attorney has with handling data breach responses?

Does the firm/attorney have a contracted document review team or an internal document review team?

Does the firm/attorney have the current capacity to meet the response deadlines and other requirements?

In cases where a formal response or notification is required to be sent to each affected individual, your le gal counsel may use their own document review team or suggest retaining an outside document review firm, depending on the size of the breach and the required response deadlines. These firms specialize in the timely and accurate response and reporting procedures for data breaches and can provide various solutions for dealers experiencing a data breach.

Prevention

Prevention and information security policies are always the most effective forms of data protection. Strict compliance with the requirements under FTC Safeguards rule is key to preventing information se curity and data breach incidents. The guidance of the FTC on these matters is a valuable tool that is already at the disposal of every auto dealer and should be used as each dealer implements both security measures and responses to a suspected incident.

6/22 16 Texas Dealer November 2022

Mailing Address (if different from above): City: State: Zip: ___________ PLEASE INDICATE PAYMENT METHOD: Check or Money Order payable to TIADA Check # __________ CreditCard Card Number: Sec.Code: Expiration Date: ____________ Monthly Payments - $41.58 per month Via Credit Card (Please enter card information above) Via Bank Draft (Authorization Agreement required - contact state office) Mail or Fax Application To: TIADA Membership Services, 9951 Anderson Mill Rd., Suite 101, Austin, TX 78750 FAX 512.244.6218 www.txiada.org 512.244.6060 Dues are not deductible as charitable contributions for income tax purposes but may be deductible as miscellaneous itemized deductions, subject to IRS restrictions. It is estimated that 20 percent of your dues dollars is used for lobbying activities and is therefore not deductible. Business Name: ____________________________________________ Select one: Dealer MemberAssociate Member Contact Person: Address: City: State: Zip: County: E-mail address: Business Phone: Fax: Dealer P Number: Cell Phone: Become a TIADA Member MembershipDues: texas independent automobile dealers association TIADA texas independent automobile dealers association TIADA TIADA Who referred you to TIADA? Dues include NIADA and local chapter membership where applicable. New Member Good through 12/31/2023. Pay full amount today and receive the rest of 2022 for free. Renewing Member good through 12/31/2022. $499 November 2022 Texas Dealer 17

C M Y CM MY CY CMY K EPI-TIADAhalf NOV2022.pdf 1 10/2/22 11:25 AM

Does the State Stand Behind Texas Title Certificates?

Dealer’s Question: If the state issues a title certificate to a motor vehicle, does the state stand behind the title to the vehicle? Can I rely on the fact that the state is sued the title certificate to a vehicle that I buy to ensure that I receive a good title?

Answer: Unfortunately, the an swer to both questions is no.

The Certificate of Title Act was passed to prevent fraud in the purchase and sale of motor vehicles by making the cer tificate of title to a motor vehicle the primary and controlling evi dence of ownership. The possession of a certificate of title, however, is not a guarantee by the state that the holder is the true owner of a vehicle. Ownership of a motor ve hicle is governed by the common law rules of property ownership. Thus, there is a difference between “title,” meaning true ownership rec ognized by the law, and “certificate of title,” meaning a piece of paper issued by the state that creates a presumption of ownership.

While the certificate provides evidence of ownership, and a pre sumption that the holder is the true owner, there are many situations where the holder of a title certifi cate is not the true owner. For in stance, a forged assignment usually does not transfer title, and someone taking possession of a vehicle from the forger may have the original title certificate which, on its face, appears to vest title in the holder. But, under the laws governing

personal property, anyone taking from the forger gets no title and the true owner of the vehicle is the per son from whom the forger attempt ed to steal the vehicle. By proving true ownership under the law of property, the owner may overcome the presumption of ownership that the certificate of title carries.

Another area where the certifi cate of title may not indicate true ownership involves the use of a cer tified copy original title (CCO). The Certificate of Title Act authorizes the Texas Department of Motor

by Michael W. Dunagan TIADA COUNSEL

Vehicles to issue a certified copy (or duplicate title) when an application is submitted by the registered own er (if there is no lien) or lien holder reflecting that the original has been lost or destroyed.

Since there is little if any effort to verify the validity of the applica tion, it is easy to see how a thief can obtain what appears to be a valid, official, original, negotiable title certificate. Over the years, we’ve received a large number of calls from vehicle lien holders who have found that their collateral has been

legal corner

November 2022 Texas Dealer 19

[One] area where the certificate of title may not indicate true ownership involves the use of a certified copy original title (CCO). The Certificate of Title Act authorizes the Texas Department of Motor Vehicles to issue a certified copy (or duplicate title) when an application is submitted by the registered owner (if there is no lien) or lien holder reflecting that the original has been lost or destroyed.

Upcoming Events

assigned to a new “owner” on a CCO that the true lien holder never authorized. In many cases involving fraudulently obtained CCOs, a sub sequent review of the title history documents reveals that an applica tion was made in the lien holder’s name. Proof of identity and autho rization to make the application that was presented to the DMV is often a fake business card showing that the applicant is an employee of the lien holder.

CCOs continue to be a major tool used by thieves and fraudsters to attempt to remove valid liens from title records and “sell” the vehicles to unsuspecting buyers, or to obtain loans from cash-for-title lenders.

The Title Act states that any sub sequent purchasers on a CCO take only the title the applicant actually possessed. This means that if the CCO is issued to a thief or forger, who is not the true owner or lien holder of the vehicle, all assignees on the CCO chain take title that is inferior to the true owner.

Unfortunately, once the vehicle is transferred on the fraudulently obtained CCO, the true owner or lien holder must bear the expense of suing the state and the other par ties to have the lien validated by a court, and to have the other title certificate invalidated. Even though the forgery on a title application form is probably a felony criminal offense, law enforcement agencies will usually not get involved. Law enforcement will usually also not get involved in disputes over own ership between innocent parties (the lien holder on one side and a “buyer” or lender on the other), claiming that the situation is a “civil matter.”

There is a common belief that issuance of a CCO automatically “nullifies” the original title certifi cate. The Texas Title Code does have a provision that states that the issu ance of a “valid” CCO does in fact nullify the prior original (the key word here being “valid”). The State’s title system makes the assumption that the original title certificate is

TIADA DEALER ACADEMY Online registration available. www.txiada.org December 2022 12 Keeping Your BHPH Dealership Legal & Compliant Sheraton Houston Brookhollow Hotel 3000 North Loop West Houston, TX 77092 OTHER TIADA EVENTS February 2023 6 Board of Directors Meeting Austin, TX 7 TIADA Day at the Capitol Austin, TX April 2023 24 Board of Directors Meeting Austin, TX July 2023 23 Board of Directors Meeting JW Marriott Hill Country Resort, San Antonio, TX 23-25 TIADA Conference and Expo JW Marriott Hill Country Resort San Antonio, TX

Texas Dealer November 202220

A Houston dealer recently found out the hard way that a stateissued title certificate can’t always be relied upon ... the vehicle seller, who had a freeand-clear original title, applied for and obtained a CCO. With two title certificates in hand, he first obtained a loan at a cashfor-title business, giving the original title as collateral. He then went to the dealer’s lot, making the sale on the CCO.

fact lost or destroyed, and that,

the CCO is used to make the first transfer after its issuance, it

the title of record that the

recognizes. This

affect true

cases of conflict

determined

is a

registration does not mean the state compels buyers and sellers to rely exclusively on title certificates as proof of ownership (emphasis added).

law concepts of ownership. If fact, in almost all court cases that have addressed this situation, the holder of an original certificate has been found to hold ti tle superior to the holder of a CCO that was subsequently improperly issued. The ultimate determination in case of a conflict between two or more certificates to the same vehicle will be made by a court of law, not the administrative policy of the title system.

The motor vehicle title system in Texas is known as a recording system. That is, DMV records on its computer system information that comes from other parties, such as county tax assessors and individu als. The information, unless obvi ously invalid on its face, is accepted as presented without verification. The issuance of a title certificate based on information submitted is not a statement of guarantee from the state that the certificate reflects true title to the vehicle.

The San Antonio Court of Appeals, in a case involving a title dispute, summed up the position of the state with regard to the issuance of titles:

The Texas Department of Motor Vehicles is not and never claimed to be an insur er of the genuineness of the legal title of a vehicle...The state does not guarantee or warrant that the one named on the title certificate is the true owner...A prudent buyer must look to the whole context of a sale, not merely to the certificate...Simply because the state mandates

The Court also pointed out that the state enjoys protection from liability under the doctrine of sov ereign immunity. This means that the state can’t be sued for damages it causes unless it agrees (through an act of the legislature).

We’ve also seen cases where a

true owner of a vehicle can use a CCO to commit fraud. A Houston dealer recently found out the hard way that a state-issued title certifi cate can’t always be relied upon. He purchased a vehicle from an individual who showed up at the dealer’s lot with a CCO title to the vehicle. The dealer purchased the vehicle and put it into his inven tory. After the vehicle was sold to a retail customer, the dealer submitted title transfer papers to the county. The title application

CASH. COMMITMENT. CERTAINTY. SpartanDealerPartners.com 855.233.3605 Bulk Purchase and Line of Credit Programs For over 10 years, Spartan Financial Partners has been the partner clients turn to when it comes to accessing cash for their business. Now, more than ever, we remain dedicated to providing the cash you need for both your short and long-term needs Client Testimonial “ ” Spartan Financial is a great company to do business with. They are very competitive when acquiring vehicle bulk paper portfolios. Their team is very professional and the whole process from pricing to post sales is quick and smooth. They have improved our business model to perform at a higher level. Spartan’s expertise gave us a clearer understanding of the auto finance industry and we have established a long-term business relationship with the Spartan team. - L.J.G., Spartan Client in

if

becomes

system

policy

DMV record-keeping procedure and does not

ownership of a vehicle. In

between two certificates, actual ownership will be

by a court under common

November 2022 Texas Dealer 21

was rejected by the county on the grounds that the original title cer tificate had been submitted two days earlier by a cash-for-title busi ness to record its lien.

It appears that the vehicle seller, who had a free-and-clear original title, applied for and obtained a CCO. With two title certificates in hand, he first obtained a loan at a cash-for-title business, giving the original title as collateral. He then went to the dealer’s lot, making the sale on the CCO.

While it would be impossible to discuss in this limited space all the various types of title conflicts, there are several general rules that may help avoid title problems:

Everyone who sells a vehicle and transfers title in Texas guaran

The certificate of title is only a presumption of title. The best guarantee of good title is buy ing from someone who has the integrity and financial ability to stand behind the vehicles sold. Wholesale auto auctions add their guaranty of good title to the ones given by sellers to auc tions buyers.

Beware buying from individuals who appear on your lot with a vehicle they must sell in a hurry. Even though the title certificate may appear to be genuine, the vehicle could be stolen or may have been purchased with a hot check, or it may be just one of multiple title certificates.

If the price of a vehicle makes it

you are required by law to make it good to your buyer. The de fenses of “I didn’t do anything wrong” or “I relied on the docu mentation issued by the state” do not apply here.

Do not take a CCO unless you know the seller will stand behind the vehicle. The seller may be a victim, too, and feel he or she has no obligation to take the loss. For every CCO, there is generally at least one other title certificate out there somewhere. It may actually be lost or destroyed, or it may be in the hands of a seller, floorplanner or lien holder (such as a cash-for-title business).

Be wary of the seller who wants cash or a check on the spot, es pecially on Friday afternoon or Saturday. There may be a reason he or she wants money so fast.

Use extreme caution when buy ing from non-dealers. A licensed independent dealer is bonded and has at least $50,000 back ing up the titles the dealer as signs. A non-dealer, on the other hand, is not bonded and is not likely to have non-exempt assets from which a judgment can be collected.

It is important that someone whose business depends upon ob taining true title and ownership of motor vehicles understands the na ture of title certificates. By applying that knowledge with some common sense and caution, major losses can hopefully be avoided.

Michael W. Dunagan is an attorney in Dallas, Texas who has represented the Texas Independent Automobile Dealers Association for over 45 years. He has written a number of books and hundreds of articles for trade journals and law reviews. His clientele includes dealers, banks, finance companies, auto auctions and credit unions.

700+ Consignment Sale 9am Every Thursday 1028 S Portland okc All Sales Available Online every week DAAOKC.COM 405/947/2886 al y Auto SmartLane, Santander Chrysler Capital,Avis Budget Group Hertz Corp,Exeter,Holm,Auto Finance,Credit Unions,Banks New & Used Car Dealerships Thrifty Car Rental Uhau of OKC Mercedes Benz of OKC Joe Cooper Auto Group Location Servies FW Remarketing, Flexco,Express Cars &Trucks, Many more! FullServiceAuction WEDRIVE WEDRIVE WEDRIVEOKLAHOMA OKLAHOMA OKLAHOMA Texas Dealer November 202222

. .. . . .. .. . .. . . .... . ...... .. .. . .. ... . . .. .. . . . ... ... . ..... . . . . . . . . . . . . .. .. . . ...... .. ... .. .. . ... . . . . ... . . . ... . . . .. ... .. .. .. ... .. . ... . . ... .. .. .... .. . .. ....... ... .. . .. .. . . ... . . .... ... ... .... ... .. . ... . ... . .. . ... . . . . . .. ... ... . ....... . .. . .. .. .... . ..... ... .. . .. . . . ... . . . . . . ... . . . .... . .. . . .. . .. . .. .. .. . .... . . . . ... . .. ... ....... . . . . . .. . .. .. . . . .. . .. .. .... ... . . .. . . . . .. .. . ... .. . ..... . . . .. . .... . .. .. .. ... . . ... .. ... . . .. ... ... . . . ..... .. . .. . .... . .. .. . . . .. .. ... .. . . . ... ...... .. . .. .. . .. . .. ... .... .... . . . .. . ... .. ... . . .. . .. .. .. . .... ... ...... . . ... ... ... . . . .. . . . .. . .. .... . . .. ..... .... .. . . ..... . .. .. . . •40 Years Serving Texas Dealers • 4.9 Star Avg. Customer Rating • Independently Owned W h y C h o o s e U s ? M U L L E N I N S U R A N C E . C O M V i s i t U s O n li n e f o r C u s t o m i z e d S o lu t i o n s & H e lp f u l I n s i g h t s W h y C h o o s e U s ? M U L L E N I N S U R A N C E . C O M V i s i t U s O n li n e f o r C u s t o m i z e d S o lu t i o n s & H e lp f u l I n s i g h t s

Ensure your staff knows how to protect consumer information Eto nsure your staff knows how to protect consumer information to comply with the FTC requirements, avoid inadvertent exposure cof omply with the FTC requirements, avoid inadvertent exposure of your customer's information, government enforcement yactions, our customer's information, government enforcement actions, lawsuits, and bad lpress. awsuits, and bad press. Brought to you by TIADA. Powered by the Dealer BEducation rought to you by TIADA. Powered by the Dealer Education Portal. Portal. Visit Visit dealereducationportal.com dealereducationportal.com Or scan the QR Code for info and Oregistration r scan the QR Code for info and registration S a f e g u a r d Ss a f e g u a r d s C o m p l i a n c e C o u r s Ce o m p l i a n c e C o u r s e Volume purchase discounts available for purchase of 10+ courses The course is flexible and on-demand to fit your busy schedule All users earn a certificate upon completion Sample policies and agreements are included at no additional charge Keep Your Dealership Compliant with Kthe eep Your Dealership Compliant with the FTC's Safeguards FRequirements TC's Safeguards Requirements O n l y $ 7 5 f o r t h e Q u a l i f i e d I n d i v i d u a l O n l y $ 4 9 E a c h f o r A l l O t h e r E m p l o y e e s V o l u m e D i s c o u n t s a t $ 4 0 f o r A n y C o u r s e 25November 2022 Texas Dealer

A u t o De a l e r S o l u t i o n s

regulation matters

FTC, CFPB and DOJ Enforcement Actions

In this edition of Regulation Matters we will look at a few recent enforcement actions taken by the Federal Trade Commission, Consumer Financial Protection Bureau, and Department of Justice. These enforcement actions are a great way to know what the focus of the agencies will be going forward. Please let these companies’ misfortunes help you prevent a simi lar fate by reviewing your own internal policies at this time to make sure you comply with the law.

Right to Repair

The Federal Trade Commission took action against motorcycle manufacturer Harley-Davidson Motor Company Group, LLC. According to the FTC’s com plaints, Harley was imposing illegal warranty terms that voided customers’ warranties if they used anyone other than the company and their authorized dealers to get parts or repairs for their products. The FTC also alleges that Harley-Davidson failed to fully disclose all of the terms of its warranty in a single document, requiring consumers to contact an authorized dealer ship for full details. The FTC alleges that these terms harm consumers and competition in multiple ways, including:

Restricting consumers’ choices: Consumers who buy a product covered by a warranty do so to protect their own interests, not the manufacturer’s. Harley’s warranty improperly implied that as a condi tion of maintaining warranty coverage, consumers had to use the company’s part or services for any repairs.

Costing consumers more money: By tell ing consumers their warranties will be voided if they choose third-party parts or repair services, Harley forces consumers to use potentially more expensive options provided by the manufacturer. This violates the Warranty Act, which prohibits these clauses unless a manufacturer provides the required parts or services for free under the warranty or is granted an exception from the FTC.

Undercutting independent dealers: The Warranty Act’s tying prohibition protects not just con sumers, but also independent repairers and the manu facturers of aftermarket parts. By conditioning their warranties on the use of authorized service providers

by Earl Cooke TIADA DIRECTOR OF COMPLIANCE AND BUSINESS DEVELOPMENT

and branded parts, Harley infringed the right of inde pendent repairers and manufacturers to compete on a level playing field.

Fair Credit Reporting Act and Hyundai Capital America

On July 26, 2022, the CFPB issued a consent order against Hyundai Capital America (Hyundai). Hyundai furnishes credit information on the auto loans it services by sending monthly data files to consumer reporting

These enforcement actions are a great way to know what the focus of the agencies will be going forward. Please let these companies’ misfortunes help you prevent a similar fate by reviewing your own internal policies at this time to make sure your polices comply with the law.

27November 2022 Texas Dealer

companies. The CFPB alleges that over several years Hyundai repeatedly furnished information containing numerous systemic errors to consumer reporting com panies and that it knew of many of these inaccuracies for years before attempting to fix them. When Hyundai furnished inaccurate negative consumer information, it may have negatively affected consumers’ access to credit. The CFPB alleges that Hyundai violated the Fair Credit Reporting Act (FCRA) and Regulation V by failing to promptly update and correct information it furnished to consumer reporting companies that it determined was not complete or accurate, and continuing to furnish this inaccurate and incomplete information; failing to pro vide the FCRA-required date of first delinquency on cer tain delinquent or charged-off accounts; failing to mod ify or delete information disputed by consumers that it found to be inaccurate; failing to establish reasonable identity theft and related blocking procedures to respond to identity theft notifications from consumer reporting companies such that Hyundai continued to report such information that should have been blocked on a con sumer’s report; and failing to establish and implement reasonable written policies and procedures regarding the accuracy and integrity of information provided to consumer reporting companies. According to the CFPB, these FCRA violations also constituted violations of the

Consumer Financial Protection Act of 2010 (CFPA).

The CFPB also concluded that Hyundai’s use of ineffec tive manual processes and systems to furnish consumer information was unfair in violation of the CFPA. The consent order requires Hyundai to take steps to prevent future violations and to pay $13,200,000 in redress to af fected consumers and a $6,000,000 civil money penalty.

DOJ and Servicemembers Civil Relief Act

The Department of Justice recently made settlements with two financial institutions for alleged violations of the Servicemembers Civil Relief Act. One was related to repossessions and lease terminations and the other was related to the interest rate charged to servicemembers who qualify for a reduced rate under the SCRA.

Lease Termination and Repossession

The SCRA provides certain legal and financial pro tections for servicemembers and their families. The law prevents an auto finance or leasing company from repossessing a servicemember’s vehicle without first obtaining a court order, as long as the servicemember made at least one payment on the vehicle before entering military service. The SCRA also allows servicemembers to terminate a vehicle lease early after entering military service or receiving certain qualifying military orders.

(cont’d on pg. 30)

28 Texas Dealer November 2022

Visit with the approved providers below to learn about the value of offering a CPO. KIRK LAURITSEN klauritsen@avp.com ROB FOX rfox@BuckeyeReinsurance.com KEVIN STOLL kevin@preferreddealersolutions.com For more info, visit Txiada.org /TiadaCPOprogram or call 512.244.6060 Maximize Your Sales Potential with the TIADA CPO Program.

If a servicemember terminates a vehicle lease under the SCRA, the leasing company may not impose any early termination charges and must refund, within 30 days, any rent or lease amounts paid in advance. In a complaint filed in the U.S. District Court for the Northern District of Texas, the DOJ alleged that, since 2015, GM Financial has improperly denied servicemembers’ lease termination requests, charged servicemembers improper early termi nation fees or lease amounts after the date of termination, and failed to provide servicemembers timely refunds of lease amounts they paid in advance. The department al leged that GM Financial’s failure to properly handle ser vicemembers’ lease termination requests resulted in over 1,000 SCRA violations. The complaint also alleges that, since 2015, GM Financial has unlawfully repossessed 71 vehicles owned by SCRA-protected servicemembers.

GM Financial agreed to pay $3,534,171 to the af fected servicemembers and a $65,480 civil penalty to the United States. GM Financial will pay at least $10,000 to each of the 71 servicemembers who had their vehicles repossessed. For the servicemembers who were charged an improper fee when they terminated their vehicle leases, GM Financial will refund the fee and will pay ad ditional damages of three times the fee or $500, which ever is greater. Servicemembers whose requests to ter minate their vehicle leases were improperly denied will

receive a refund of certain payments plus up to $5,000 in additional damages. The order also requires GM Financial to repair the servicemembers’ credit, provide SCRA training to its employees, and implement policies and procedures that comply with the SCRA.

Interest Rate Reduction

The SCRA provides that interest on any debt incurred by a servicemember before entering military service is limited to 6 percent per year. To take advantage of the interest rate cap, a servicemember must provide the creditor with written notice and a copy of their military orders or other documentation of their military service no later than 180 days after leaving service. After receiv ing notice, a creditor must forgive any interest in excess of 6 percent retroactively back to the date orders are is sued calling the servicemember to active duty.

The DOJ alleges problems with a bank’s handling of in terest rate benefit requests. The DOJ alleges that the bank was failing to apply interest rate benefits back to the date orders were issued calling the servicemember to active duty. The department also determined that the bank had improperly delayed the approval of interest rate benefits to some servicemembers. To resolve those allegations, the bank entered into a settlement requiring the company to pay over $700,000 to servicemembers and a $60,788 civil penalty and to be subject to monitoring by the DOJ.

6/22 30 Texas Dealer November 2022

Courses

They

These

flexibility, so you

courses are designed for any

that affect their businesses.

On-Demand Offerings Texas Independent Automobile Dealers Association TIADA designed and implemented some important on-demand courses to give dealers quality educational programs they can access throughout the year.

programs are essential for dealers to stay compliant.

offer

can complete them according to your schedule. These

dealers with questions related to various regulations

Want to avoid having your title transfer paperwork rejected at the tax office? This online course is designed to walk you through the title transfer process and is best suited for people new to transferring titles or those who want to brush up on the basics. This course has been reviewed for accuracy by the Tax Assessor-Collectors Association of Texas. $ 48 for the course * Also available in Spanish The Basics of Transferring Titles * In this two-part video course TIADA counsel Michael Dunagan answers repossession related questions for both the dealer starting out and those dealers who want a refresher. Dunagan goes through the basics of self-help repossession, repossession when a client has filed bankruptcy, and using the courts to regain collateral through sequestration. The course also covers all the repossession letters and includes a downloadable deck of slides to follow along with the course. $ 98 for two 1-hour videos Repossession 101: What You Need to Know To register visit Txiada.org/on-demand Call us at 512.244.6060 or email us if you need assistance. Featured

board of directors meeting minutes

October

Hilton Austin Airport

compiled by Texas Dealer staff

Board Members in Attendance: Lowell Rogers, Russell Moore, Greg Reine, Vicki Davis, Eddie Hale, Ryan Winkelmann, Mark Jones, Brad Kalivoda, Chad Lancaster, Bob Blankenship

TIADA Staff in Attendance:

Jeff Martin, Earl Cooke, Teresa Orkun, Patty Huber, Stephen Pallas

At its meeting on Monday, October 27, 2022, TIADA took the following actions:

President Ryan Winkelmann called the meeting to order at 12:50 p.m.

Minutes of Last Meeting

Secretary Vicki Davis presented the minutes from the last meeting.

A motion was made to accept the minutes.

Moved by Eddie Hale, seconded by Bob Blankenship — PASSED

Treasurer’s Report

Mark Jones presented the Treasurer’s Report on behalf of Treasurer Greg Phea who was absent.

Discussion took place regarding diversification of reserve account.

A motion was made to accept the Treasurer’s report.

Moved by Vicki Davis, seconded by Russell Moore — PASSED

President’s Report

Ryan Winkelmann discussed TIADA’s attendance at the El Paso IADA golf event, the Weslaco and Abilene dealer meetings, and the NIADA Leadership Conference. He also shared the

committee appointments with the board. Board members reported on their member outreach calls.

Executive Director’s Report

Executive Director Jeff Martin reported on various meetings and conferences staff attended, provided a report on the 2022 Conference & Expo, and talked about the upcoming TIADA Day at the Capitol. He also updated the board on recent staff changes and discussed pursuing market research and reports as a member benefit.

Associate Executive Director Teresa Orkun presented a report on dealer professional development and membership.

Director of Business Development and Compliance Earl Cooke presented a report on governmental relations and INDEPAC.

Director of Associate Member Relations Patty Huber presented an associate member update. Mark Jones presented FY’22 and FY’23 budget.

New Business

A motion was made to purchase $10,000 in I bonds. Moved by Eddie Hale, seconded by Brad Kalivoda — PASSED

A motion was made to adjourn the meeting. Moved by Vicki Davis, seconded by Mark Jones — PASSED

Ryan Winkelmann adjourned the meeting at 4:50 p.m.

Respectfully submitted, Vicki Davis, Secretary

A complete copy of any reports referenced in this document and more detailed notes from the meeting are on file at the TIADA office and available upon request.

27, 2022

| Austin, TX

33November 2022 Texas Dealer

Yes, I would like to he lp with TIADA’s grassroots effort! ______________________________________________________________________________________ Please list me as a sustaining donor. I would like to support my industry by making a monthly credit card donation of $____ Add me to the KEY-PERSON list! I know (Name of Legislator) _______________________________________________ as a Acquaintance Personal Friend Professional Contact I would like to attend political fundraisers in my area I would like to support my industry by pledging a one-time donation of ___$1,000 ___$500 ___$250 ___$100 Other $________ ______________________________________________________________________________________ Personal Check Payable to INDEPAC Personal Credit Card Name__ Company ___ Home Address_ Email ** Personal Check or Personal Credit Card only Corporate contributions are prohibited by state law Contributions are not tax deductible as charitable contributions for federal income tax pu rposes. ** Charge my Credit Card V MC D AM Exp: / CVV: Name on Card: Card Billing Address (if different): Or donate online at www.txiada.org >> Resources >> Advocacy >> Political Action Committee c/o TIADA 9951 Anderson Mill Rd Suite 101, Austin Texas 78750 PHONE 512.244.6060 FAX 512 244 6218 EMAIL accounting@txiada.org Referred by: Texas Dealer November 202234

Why Your Automotive Dealership

to

on Delivering Exceptional Customer Experiences

by Larisa Bedgood VP of Marketing at V12, a Porch Company

when having the best billboard, the largest inflatable gorilla, or the best selection of

was enough to get consumers heading into your dealership? This is no longer the case, as new digital channels and changing consumer expectations have transformed the marketplace. Consumers have more options, do more research, and expect a seamless experience across channels before they will even consider stepping onto your dealer lot.

the industry, dealerships included, companies need to know their current and prospective customers and deliver a highly personalized experience. This requires data, lots of it, and the technology and analytic capabili ties to analyze these insights to deliver targeted messaging

the proper channels and at the right time.

in

do expect are

of the

to find information and in

across multiple channels, and

and consistent experience.

is happy with their experience, the

acquisition, retention of

enhanced brand loyalty, and posi tive

feedback. According to the automotive

feature

Remember

inventory

No matter

across

What Do Consumers See as the Ideal Customer Experience? Research by Economist Intelligence Unit revealed that the top five areas consumers identified as leading to a positive experience included: 1 47% – Fast response to inquiries or complaints 2 46% – Simple purchasing process 3 34% – Ability to track orders in real-time 4 25% – Clarity and simplicity of product information across channels 5 22% – Ability to interact with the company over mul tiple channels For dealerships, while having the ability to track orders in real-time doesn’t necessarily apply, some

key elements that consumers

quick responses to their inquiries, the ability

teract with your dealership

receiving a personalized

When a consumer

results pay off

new customer

existing customers,

reviews and

Needs

Focus

35November 2022 Texas Dealer

research site Cars.com, the breakdown, by type of car, for reviews and customer feedback is as follows: used-car sales at 38%, new-car sales at 37%, and service at 24%.

According to the 2016 J.D. Power Report, customers, on average, will positively recommend the dealership from whom they purchased their vehicle six times, with young er buyers slightly more likely to recommend (6.2 times) than those older than 55 (5.2 times). These numbers can be improved when dealers offer an outstanding customer experience: getting 10 points on a 10-point scale in terms of experience can lead to a rise in the average of recom mendations to eight positive comments.

Dealerships Must Improve the Buying Process

Autotrader’s Car Buyer of the Future study shows that only 17 out of 4002 people prefer the current car buy ing process. The survey, released last year, revealed four main areas in which consumers want improvements to the buying customer experience.

Test Drives: While 88 percent of consumers say they will not buy a car without test driving it first, the ma jority report that they do not prefer the way test drives are currently conducted (an accompanied test drive with a salesperson). Instead, they want more conve nience and less pressure while test driving, such as having the ability to test drive multiple vehicles across brands in a single place and taking a test drive with a product specialist instead of a salesperson.

Deal Structuring: Negotiating will be a part of the car buying process for the foreseeable future, and consumers indicate that they would like to see a big change in the way they go about negotiating the deal structure. Of those who liked the idea of online deal building, over half, 56 percent, want the ability to start the negotiation on their own terms—preferably on line—and 45 percent would like to remain anonymous until they lock in the deal structure.

Financing Paperwork: Nearly three-fourths of consumers, 72 percent, want to complete the credit ap plication and financing paperwork online. The key fac tors driving this desire are to save time at the dealer ship (reported by 72 percent of those who favor online paperwork) and to have less pressure while filling out paperwork (reported by 71 percent of those who favor online paperwork). A separate study conducted by Cox Automotive in 2014 showed that buyers spend an av erage of 61 minues in the F&I offices, more than twothirds the total amount of time they want to spend at the dealership (90 minutes). Moving paperwork online and enabling consumers to complete it on their own time would greatly enhance the in-dealership experi ence and cut down on the time they spend in the deal ership on the day of purchase.

Service: When it comes to servicing their vehicles, 83 percent of consumers indicate that they would like to have the ability to access a network of local service centers that honor service agreements. The key factor driving this desire is convenience. Of those who prefer local service networks, 76 percent want to go to a service center close by, and 63 percent want to be able to service the vehicle anywhere.

If the buying process was improved, 72% of consum ers stated they would visit dealerships more often, 66% said that they would be much more likely to buy from a dealership that offers their preferred experience, and 53% stated they would buy a vehicle more often.

Data-Driven Customer Experiences

Optimizing each engagement with your dealership plays an important role in the overall experience, wheth er it is revamping the test drive process, streamlining paperwork, or offering popcorn and snacks while your customers are waiting for service. However, each of your competitors can offer the same amenities, so once again, you are challenged to set yourself apart from the compe tition. At the heart of a truly excellent and differentiated customer experience is data. Using data-driven insights to deliver highly personalized messaging and interactions greatly impacts the brands and companies a consumer chooses to do business with.

You already have a wealth of data available sitting in your CRM, website inquiries, customer service records, browsing history, and more. By integrating each of these sources and adding additional third-party insights, you have the opportunity to deliver highly relevant commu nications to increase acquisition and boost retention.

For example, data such as age, income, and gender helps you decide what medium of outreach may be best. Information on lifestyle, interests, and hobbies can tell you if you should market a minivan to parents with young children or an SUV for lovers of the outdoors. Specialty data sourced from a VIN marketing database provider can provide insights into the type of vehicle your prospect is currently driving, such as make, model, and year and if they are in positive equity.

Consumers constantly leave clues about who they are, what they like, and what they’ll buy next. When these insights are gathered and analyzed, you have the op portunity to personalize your outreach and target new customers before the competition may even be aware that they are in the market or what may influence them to purchase. And with 86% of consumers stating that personalization plays a role in their purchasing decisions (Infosys), taking the time to develop a personalized cus tomer experience will pay off every time.

A version of this article first appeared on the V12 website. For more insights on dealership marketing solutions, please visit v12data.com .

36 Texas Dealer November 2022

On the Road with TIADA

by Stephen Pallas TIADA Director of Marketing and Communications

The Texas House Transportation Committee met in Brownsville in early September 2022. TIADA Executive Director Jeff Martin attended the meeting and took the opportunity to make stops as he traveled to visit with independent dealers along the

the association is there to help. With the inventory issues we are facing, it’s great to know TIADA has resources like the auction app to help dealers save time and money.”

Xavier also mentioned that, as a relatively new dealer, knowing he has the association’s full support makes him feel more secure in his business, especially when it comes to compliance. “Between the resources, educa tion, and conference, I’m not left alone and know I have somebody to reach out to. I also feel much more con nected to other dealers because of my membership.”

Jeff’s next stop was Superior Auto Sales in Beeville. This family-owned and operated dealership has been a fixture in Beeville for years. Larry Dziuk (who has been a TIADA member since 1994) and his son-in-law Shawn Ramon showed Jeff around the dealership and discussed their business and the industry. Their biggest concern at the time was how long it was taking TxDMV to renew their license, how difficult it is finding vehicles these days, and some of the complexities that come with out-of-state titles.

“If you are ever in the area, make it a point to stop by and see these guys,” Jeff said. “They have a fantastic operation.”

300-mile journey between Austin and Brownsville. The normal sixhour trip turned into a 15-hour adventure, and, as Jeff says, “it was worth every minute.”

His first stop was Fuentes Autos, in Edna, where he spent some time talking to owner Xavier Fuentes. He has been in business for less than a year and, like most deal ers, his biggest struggle is finding affordable inventory. Xavier grew up in the mechanic and auto body repair business with his dad, so he is doing what he does best: finding vehicles that need a little TLC and working hard to get them back on the street.

“It means a lot that he stopped by,” said Xavier. “It gives me an up lifting feeling to know that if I need anything related to the business,

feature

Jeff and Xavier Fuentes of Fuentes Autos, Edna.

Jeff with Larry Dziuk and Shawn Ramon of Superior Auto Sales, Beeville.

37November 2022 Texas Dealer

For Jeff’s last stop, he invited Texas State Representative Abel Herrero to meet with Ana and Faustino Garcia, who own and operate A & F Auto Sales in Kingsville. Representative Herrero serves district 34, which encompasses Brownsville, Alice, Beeville, Harlingen, Kingsville, and San Benito.

They spent a lot of time talking about how they got in the business and, now that they have two sons help ing, how things have changed. They recently attended the TIADA Conference and have already started imple menting many of the new ideas. Ana and Faustino are passionate about helping the underserved in their community and have even started a non-profit to assist

the people who live in Colonias. During the meeting, Rep. Herrera, who was already familiar with their work, pledged to continue helping the non-profit.

TIADA also hosted a dealer luncheon in Weslaco. “It was a great turnout,” said Jeff. “We had dealers from Pharr, Brownsville, McAllen, Donna, and in-between.” The luncheon was part of a series of events around the state the association is coordinating to bring together dealers with legislators and experts on policies related to the independent automobile industry.

Special guests in Weslaco included Representative Armando “Mando” Martinez and State Senate candidate Morgan LaMantia. Both discussed issues facing inde pendent automobile dealers and took questions from the crowd.

Armando Villarreal, from McAllen Auto Sales, LLC, serves as the TIADA Region 6 Vice-President. He was instrumental in helping organize the luncheon. “This is a unique opportunity to visit with our local legislator in a relaxed atmosphere and discuss issues that specifically affect our industry,” Armando said. Martin wrapped up the luncheon by reviewing TIADA’s legislative priorities for the 2023 legislative session and answering several compliance questions from the dealers.

“I want to give a special thanks to all the dealers who allowed me to stop by and visit with them last week,” said Jeff. “Spending time at these dealerships helps us better represent your voice in Austin.”

Attendees of the Dealer Luncheon in Weslaco.

Jeff and Rep. Abel Herrero visited with Ana and Faustino Garcia of A & F Auto Sales in Kingsville.

38 Texas Dealer November 2022

*Coupons range from $75 to $500 each on buy sell fees. L e t Y o u r M e m b e r s h i p P a y f o r I t s e l Lf e t Y o u r M e m b e r s h i p P a y f o r I t s e l f Save SOver ave Over $10,000!* $10,000!* Download the TIADA DApp ownload the TIADA App Over O45 ver 45 Participating Participating Auctions in ATexas! uctions in Texas! Step 1) Search for "TXIADA" Step 2) Download the App Step 3) Create Your Account Step 4) Save Big! Discounts on auctions and much more

TIADA Auction Directory

Abilene

ALLIANCE AUTO AUCTION ABILENE

www.allianceautoauction.com

6657 US Highway 80 West, Abilene, TX 79605 325.698.4391, Fax 325.691.0263

GM: Brandon Denison Friday, 10:00 a.m.

$AVE : $200

C.M. COMPANY AUCTIONS, INC.

www.cmauctions.com

2258 S. Treadaway, Abilene, TX 79602 325.677.3555, Fax 325.677.2209

GM: Gregory Chittum Thursday, 10:00 a.m.

$AVE : $200

IAA ABILENE*

www.iaai.com

7700 US 277, Hawley, TX 79601 325.675.0699, Fax 325.675.5073

GM: Shawn Lemke Thursday, 9:30 a.m.

$AVE : up to $200 Sell Fee

Amarillo

IAA AMARILLO*

www.iaai.com

11150 S. FM 1541, Amarillo, TX 79118 806.622.1322, Fax 806.622.2678

GM: Shawn Norris Monday, 9:30 a.m.

$AVE : up to $200 Sell Fee

Austin

ADESA AUSTIN www.adesa.com

2108 Ferguson Ln., Austin, TX 78754

512.873.4000, Fax 512.873.4022

GM: Michele Arguijo Tuesday, 9:00 a.m.

$AVE : $200

ALLIANCE AUTO AUCTION AUSTIN

www.allianceautoauction.com

1550 CR 107, Hutto, TX 78634

737.300.6300

GM: Brad Wilson Wednesday, 9:45 a.m.

$AVE : $200

AMERICA’S AA AUSTIN / SAN ANTONIO

www.americasautoauction.com

16611 S. IH-35, Buda, TX 78610

512.268.6600, Fax 512.295.6666

GM: Jamie McCollum Tuesday, 1:30 p.m. / Thursday, 2:00 p.m.

$AVE : $200

IAA AUSTIN* www.iaai.com

2191 Highway 21 West, Dale, TX 78616 512.385.3126, Fax 512.385.1141

GM: Geoffrey Rabb Tuesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

METRO AUTO AUCTION AUSTIN www.metroautoauction.com 8605 Cullen Ln., Austin, TX 78748 512.282.7900, Fax 512.282.8165

GM: Brent Rhodes 3rd Saturday, monthly $AVE : $200

Corpus Christi

CORPUS CHRISTI AUTO AUCTION www.corpuschristiautoauction.com 2149 IH-69 Access Road, Corpus Christi, TX 78380 361.767.4100, Fax 361.767.9840

GM: Hunter Dunn Friday, 10:00 a.m. $AVE : $200

IAA CORPUS CHRISTI* www.iaai.com

4701 Agnes Street, Corpus Christi, TX 78405 361.881.9555, Fax 361.887.8880

GM: Patricia Kohlstrand Wednesday, 9:00 a.m. $AVE : up to $200 Sell Fee

Dallas-Ft. Worth Metroplex

ADESA DALLAS www.adesa.com 3501 Lancaster-Hutchins Rd., Hutchins, TX 75141 972.225.6000, Fax 972.284.4799

GM: Allan Wilwayco Thursday, 9:30 a.m. $AVE : $200

ALLIANCE AUTO AUCTION DALLAS

www.allianceautoauction.com 9426 Lakefield Blvd., Dallas, TX 75220 214.646.3136, Fax 469.828.8225

GM: Robert Kersh Wednesday, 1:30 p.m.

$AVE : $200

AMERICA’S AA DALLAS www.americasautoauction.com 219 N. Loop 12, Irving, TX 75061 972.445.1044, Fax 972.591.2742

GM: Ruben Figueroa Tuesday, 1:00 p.m. / Thursday, 1:00 p.m.

$AVE : $200

IAA DALLAS*

www.iaai.com 204 Mars Rd., Wilmer, TX 75172 972.525.6401, Fax 972.525.6403

GM: Bob Bannister Wednesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

IAA DFW* www.iaai.com 4226 East Main St., Grand Prairie, TX 75050 972.522.5000, Fax 972.522.5090

GM: Julissa Reyes Tuesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

IAA FORT WORTH NORTH* www.iaai.com 3748 McPherson Dr., Justin, TX 76247 940.648.5541, Fax 940.648.5543

GM: Jack Panczyk Tuesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

MANHEIM DALLAS** www.manheim.com 5333 W. Kiest Blvd., Dallas, TX 75236 214.330.1800, Fax 214.339.6347

GM: Rich Curtis Wednesday, 9:00 a.m.

$AVE : $100

MANHEIM DALLAS FORT WORTH** www.manheim.com 12101 Trinity Blvd., Fort Worth, TX 76040 817.399.4000, Fax 817.399.4251

GM: Nicole Graham-Ponce Thursday, 9:30 a.m.

$AVE : $100

METRO AUTO AUCTION DALLAS** www.metroaa.com 1836 Midway Road, Lewisville, TX 75056 972.492.0900, Fax 972.492.0944

GM: Scott Stalder Tuesday, 9:00 a.m.

$AVE : $200

El Paso

AMERICA’S AUTO AUCTION EL PASO www.epiaa.com 7930 Artcraft Rd., El Paso, TX 79932 915.587.6700, Fax 915.587.6700

GM: Luke Pidgeon Wednesday, 10:00 a.m.

$AVE : $200

IAA EL PASO* www.iaai.com 14651 Gateway Blvd. W, El Paso, TX 79927 915.852.2489, Fax 915.852.2235

GM: Jorge Resendez Friday, 10:30 a.m.

$AVE : up to $200 Sell Fee

Save thousands on buy or sell fees at these participating auctions! * VALID FOR SELL FEE ONLY AT INSURANCE AA LOCATIONS ** ONLINE AUCTION AVAILABLE

Texas Dealer November 202240

MANHEIM EL PASO www.manheim.com

485 Coates Drive, El Paso, TX 79932 915.833.9333, Fax 915.581.9645

GM: JD Guerrero Thursday, 10:00 a.m.

$AVE : $100

Harlingen/McAllen

IAA MCALLEN* www.iaai.com

900 N. Hutto Road, Donna, TX 78537 956.464.8393, Fax 956.464.8510

GM: Ydalia Sandoval Tuesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

BIG VALLEY AUTO AUCTION** www.bigvalleyaa.com

4315 N. Hutto Road, Donna, TX 78537 956.461.9000, Fax 956.461.9005

GM: Lisa Franz Thursday, 9:30 a.m.

$AVE : $200

Houston

ADESA HOUSTON www.adesa.com 4526 N. Sam Houston, Houston, TX 77086 281.580.1800, Fax 281.580.8030

GM: Brian Wetzel Wednesday, 9:00 a.m.

$AVE : $200

AMERICA’S AA HOUSTON www.americasautoauction.com 1826 Almeda Genoa Rd., Houston, TX 77047 281.819.3600, Fax 281.819.3601

GM: Ben Nash Thursday, 2:00 p.m.

$AVE : $200

AMERICA’S AA NORTH HOUSTON www.americasautoauction.com 1440 FM 3083, Conroe, TX 77301 936.441.2882, Fax 936.788.2842

GM: Buddy Cheney Tuesday, 1:00 p.m.

$AVE : $200

AUTONATION AUTO AUCTION - HOUSTON www.autonationautoauction.com

608 W. Mitchell Road, Houston, TX 77037 822.905.2622, Fax 281.506.3866

GM: Juan Gallo Friday, 9:30 a.m.

$AVE : $200

HOUSTON AUTO AUCTION www.houstonautoauction.com 2000 Cavalcade, Houston, TX 77009 713.644.5566, Fax 713.644.0889

President/GM: Tim Bowers Wednesday, 11:00 a.m.

$AVE : $200

IAA HOUSTON* www.iaai.com 2535 West. Mt. Houston, Houston, TX 77038 281.847.4700, Fax 281.847.4799

GM: Alvin Banks Wednesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

IAA HOUSTON NORTH* www.iaai.com

16602 East Hardy Rd., Houston-North, TX 77032 281.443.1300, Fax 281.443.4433

GM: Aracelia Palacios Thursday, 9:00 a.m.

$AVE : up to $200 Sell Fee

IAA HOUSTON SOUTH* www.iaai.com 2839 E. FM 1462, Rosharon, TX 77583 281.369.1010, Fax 833.595.8398

GM: Adriana Serrano Friday, 9:30 a.m.

$AVE : up to $200 Sell Fee

MANHEIM HOUSTON www.manheim.com 14450 West Road, Houston, TX 77041 281.924.5833, Fax 281.890.7953

GM: Brian Walker Tuesday, 9:00 a.m. / Thursday 6:30 p.m. $AVE : $100

MANHEIM TEXAS HOBBY www.manheim.com 8215 Kopman Road, Houston, TX 77061 713.649.8233, Fax 713.640.6330

GM: Darren Slack Thursday, 9:00 a.m. $AVE : $100

Longview

ALLIANCE AUTO AUCTION LONGVIEW www.allianceautoauction.com 6000 East Loop 281, Longview, TX 75602 903.212.2955, Fax 903.212.2556

GM: Chris Barille Friday, 10:00 a.m. $AVE : $200

IAA LONGVIEW* www.iaai.com 5577 Highway 80 East, Longview, TX 75605 903.553.9248, Fax 903.553.0210

GM: Edgar Chavez Thursday, 9:00 a.m. $AVE : up to $200 Sell Fee

Lubbock

IAA LUBBOCK* www.iaai.com 5311 N. CR 2000, Lubbock, TX 79415 806.747.5458, Fax 806.747.5472

GM: Chris Foster Tuesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

TEXAS LONE STAR AUTO AUCTION** www.lsaalubbock.com 2706 E. Slaton Road., Lubbock, TX 79404 806.745.6606

GM: Dale Martin Wednesday, 9:30 a.m $AVE : $75/Quarterly

Lufkin

LUFKIN DEALERS AUTO AUCTION www.lufkindealers.com 2109 N. John Reddit Dr., Lufkin, TX 75904 936.632.4299, Fax 936.632.4218

GM: Wayne Cook Thursday, 6:00 p.m.

$AVE : $200

Midland Odessa

IAA PERMIAN BASIN* www.iaai.com 701 W. 81st Street, Odessa, TX 79764 432.550.7277, Fax 432.366.8725 Thursday, 11:00 a.m.

$AVE : up to $200 Sell Fee

ONLINE ACV AUCTIONS** www.acvauctions.com 800.553.4070

$AVE : $250

E-DEALERDIRECT** www.e-dealerdirect.com chris@edealerdirect.com

$AVE : Up to $500/month

San Antonio

ADESA SAN ANTONIO www.adesa.com 200 S. Callaghan Rd., San Antonio, TX 78227 210.434.4999, Fax 210.431.0645

GM: Clifton Sprenger Thursday, 10:00 a.m. $AVE : $200

IAA SAN ANTONIO* www.iaai.com 11275 S. Zarzamora, San Antonio, TX 78224 210.628.6770, Fax 210.628.6778

GM: Paula Booker Monday, 9:00 a.m. $AVE : up to $200 Sell Fee

MANHEIM SAN ANTONIO** www.manheim.com 2042 Ackerman Road San Antonio, TX 78219 210.661.4200, Fax 210.662.3113

GM: Mike Browning Wednesday, 9:00 a.m. $AVE : $100