PI resort, development escape tax debt sell-off

A PARADISE Island resort and Long Island investment project are among those that have escaped being sold-off by the Government through settling their alleged real property tax delinquency.

Details provided by the Department of Inland Revenue (DIR) reveal that Club Land’ Or, located at the heart of Paradise Island with its entrance immediately facing the Sir Sidney Poitier bridge exit, is among 14 New Providence commercial properties that have avoided being among the first auctioned off as the Government seeks to collect on up to $900m in tax arrears. This was also confirmed by this paper’s sources.

Described as a hotel on “Paradise Island opposite the Sir Sidney Poitier bridge”, the DIR’s website state its outstanding real property tax debt has been “resolved” ahead of the April 2, 2024, auctions of the first batch of delinquent commercial properties and vacant land. Club Land’ Or, which has been closed since the COVID pandemic as its owners continue to seek a buyer, was said to be valued at $11.436m. Similarly, the near-15,000 acre site for a proposed Long Island development was also said to have “resolved” its real property tax status before going under the auctioneer’s hammer. That location was touted as recently as the Long Island Business

Outlook conference on November 16, 2023. The acreage matches exactly the number given by Geoff Fulton, chairman of Maritek Bahamas, for his Chrysalis project. Dexter Fernander, the Department of Inland Revenue’s (DIR) operations manager, told Tribune Business that the first set of of delinquent properties have been auctioned as scheduled and the tax authorities are now assessing the value and quality of bids received.

He voiced optimism that the Department of Inland Revenue’s move “will change the culture” among Bahamian taxpayers from one where paying real property tax was treated as an optional extra to an attitude and practice of being fully compliant.

“We are patiently waiting to see the results of it and to quantify it,” Mr Fernander said of the Department of Inland Revenue exercising its ‘power of sale’ over long-standing delinquent real estate and its owners. “Many have played the blame game,

Adapt to tourist profile so we ‘blow past’ 2019

Editor

led by the so-called

Bank’s Out Island sites ‘a philanthropic service’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

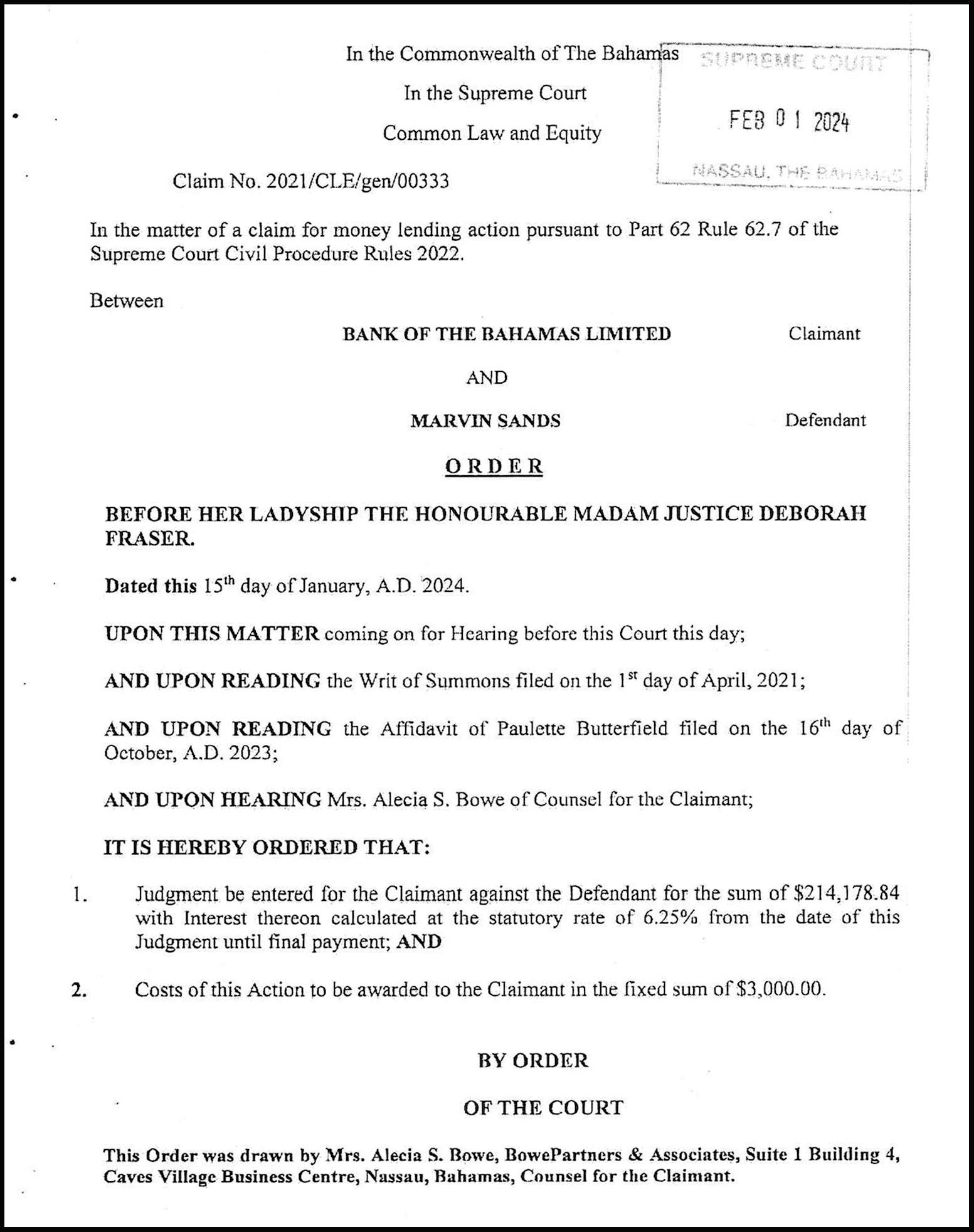

BANK of The Bahamas’

top executive yesterday described its Family Island presence as an act of “philanthropy” amid complaints that woes at its branch have left south Eleuthera in “a dire situation”. Neil Strachan, the BISX-listed institution’s managing director, confirmed to Tribune Business that the automated teller machine (ATM) at its south Eleuthera branch was “up and down” due to frequent breakdowns that have forced businesses and individuals to “queue from morning to night” in a bid to access their money.

Revealing that Bank of Bahamas is exploring “agency banking” as an alternative means to provide more efficient financial services, he added

that “zero” Family Island branches are profitable and its continued presence in these locations is only maintained at the behest of its majority shareholderthe Government.

Mr Strachan also argued that Family Island communities are failing to uphold their side of the relationship, saying many persons were “quick to complain” when things go wrong yet fail to provide sufficient support. As an example, he cited a recent business symposium held in Eleuthera that was attended by a six-strong Bank of The Bahamas team, yet only five persons from the business community attended.

The Bank of The Bahamas chief spoke out after multiple south Eleuthera businesses argued that the loss of the ATM, the “only facility for 60 miles” before reaching Governor’s

business@tribunemedia.net THURSDAY, APRIL 11, 2024

PI hotel project’s 100 ‘permanent’ job pledge A DEVELOPMENT that aims to be Paradise Island’s “first new hotel for many years” yesterday said its project will create 100 permanent jobs and a similar number of construction posts. HotelConsult Bahamas, developer of the proposed Paradise Yacht Club, which will occupy the site of the former Paradise Harbour Club and Columbus Tavern if approved by the regulatory authorities, pledged that it will generate up to 30 percent of its energy needs from renewable sources. Speaking after this week’s Town Planning Committee public hearing on the project, which saw various Paradise Island residents and neighbours voice concerns over the resort’s scale, rezoning of a residential lot for a 74-space parking facility, traffic congestion and overall impact on quality of life, the developer promised to “breathe new life” into the tourism product. Brent Creary, managing architect of Archventure Ltd, the project’s architects, said: “The project will revitalise a derelict site, create By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B6 FAMILY Island hotels must adapt to a visitor demographic profile that has been flipped upside down over the past decade if they want to “blow past” pre-COVID numbers, a top tourism official is warning. Kerry Fountain,

Out Island

motion

Tribune Business it was critical

ment as he pointed to “discrepancies” between record-setting early 2024 air arrivals and the sector’s financial performance. He

stopover visitor profiles have

demographic

decade

was

By NEIL HARTNELL

the Bahamas

Pro-

Board’s (BOIPB) executive director, told

that resorts understand how visitor profiles have changed and target their desired market seg-

added that

switched from a

that, one

ago,

Tribune Business

nhartnell@tribunemedia.net

Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B4 SEE PAGE B4 SEE PAGE B5 KERRY FOUNTAIN

$5.61 $5.75 $5.96

By NEIL HARTNELL

$5.75

THE BENEFITS AND PITFALLS OF BECOMING AN ENTREPRENEUR

Some people identify from an early age that they were meant to become an entrepreneur, while others find themselves starting a business due to life changes such as parenthood, retirement or losing a job. Others may be employed, but are wondering whether the role of a business owner/entrepreneur is right for them. Owning a business has both its advantages and disadvantages. Each entrepreneur must weigh the pros and the cons carefully to decide whether or not the risk is worth the reward.

Nonetheless, there are a number of benefits to starting a business: Advantages of small business ownership Independence: Entrepreneurs are their own bosses. They make the decisions. They choose the hours and

to whom to do business with. Financial gain: Owning your business removes the income restraint that exists in being someone else’s

employee. Many entrepreneurs are inspired by the mega-millionaire entrepreneurs we see today, such as Steve Jobs, Elon Musk, Jeff Bezos and Mark Zuckerberg.

Control: It enables one to be involved in the total operation of the business - from concept to design to creation, and from sales to business operations to customer service. This ability to be totally immersed in the business is very satisfying, and this level of involvement allows the business owner to truly create a dream of their own.

Prestige: It offers the status and prestige of ownership. When someone asks: “Who did this?”, the entrepreneur can answer: “I did.”

Opportunity: Entrepreneurship creates an opportunity to help the

local economy by contributing to society as a whole.

Disadvantages of small business ownership

Much like the little boy said when he got off his first roller-coaster ride: “I like the ups but not the downs.” Well, there are certainly a few downs to owning a small business.

Time commitment: At the beginning, it is likely there may be few employees, which may result in the owner handling most of the duties - everything from purchasing to banking and advertising.

Uncertainty: Even though the business may be successful at the start, external factors such as downturns in the economy, new competitors entering the marketplace, or shifts in consumer demand may affect growth for a while. And sometimes even

NO CONSUMER RESPITE DESPITE INFLATION EASE

In January, monthly inflation saw its most significant three-year dip, a 0.6 percent decrease compared to December, continuing the trend from November and December’s 0.5 percent

drops. But while statistics paint a picture of decreasing inflation, the reality at the supermarket checkout counter still presents a different story for consumers.

Many have longed for prices to return to preCOVID levels, but the hard truth is they might not. Let’s look deeper.

entrepreneurs who follow a comprehensive planning process may never be able to anticipate all the potential changes in the business environment.

However, from an overall perspective, determine start-up costs. Can you commit on your own, or will you need to secure other financing? Research the marketplace. Evaluate the competition using the SWOT (strengths, weaknesses, opportunities and threats) analysis and evaluate if this specific business will weather. Be sure to outline your business goals, including what you wish to accomplish and what will you consider a success?

Ultimately, there will be many questions and uncertainties, especially when starting a business. All of the answers will not automatically be available.

Despite the decline from the high of 122.51 in October 2023 to 120.98 in January 2024, according to the most recent data from the Bahamas National Statistical Institute (BNSI), the Consumer Price Index (CPI) All Items Index remains stubbornly higher compared to the same periods over the past three years – 109.71 in January 2021, 113.93 in January 2022, and 119.39 in January 2023.

This means that the typical basket of goods consumed by Bahamians remains more expensive than they were at the same point in the past three years. Therefore, while tourism-led growth and increasing job numbers indicate recovery, the economic recalibration following the COVID pandemic has not yet run its course in The Bahamas.

In fact, despite the easing inflation, headwinds persist as US consumer prices begin an upward trajectory once more. In the US, whose economy is closely intertwined with The Bahamas’ own, inflation –though subdued - remains above target.

However, despite potential challenges, most small business owners I am sure will be pleased with their decision to become an entrepreneur. Nothing of value comes easy, and when businessmen are able to manage the challenges, the rewards can be worth it both professionally and personally. Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

welcomes feedback at deedee21bastian@gmail.com a professionally-trained graphic designer/brand marketing analyst, international award-winning author and certified life coach.

While the Davis administration has outlined various policy measures promising to alleviate the cost of living for Bahamians, including increased funding for farmers and energy reform, these medium-to-long-term strategies offer little respite for Bahamians facing high prices today.

The economic interconnection between the US, and tourism and importdependent nations such as The Bahamas, underscores the vulnerability of the latter to external economic forces. As the US battles with inflation, the effects are felt far beyond its borders, influencing The Bahamas’ economic dynamics.

The implications are significant. In navigating the complexities of inflation, a balanced approach is paramount. Bahamians must adopt a realistic perspective regarding the Government’s control over rising prices. On the other hand, there remains the pressing need for more immediate government attention to alleviate the burden of soaring prices on Bahamian households.

So, where does this leave us? Navigating uncertain waters requires a collaborative effort between governments, businesses and communities. By remaining agile and responsive to evolving economic conditions, The Bahamas can weather the storm of fluctuating inflation.

The US Labour Department’s consumer price index (CPI) for March, released yesterday, showed prices climbed 0.4 percent, surpassing expectations of 0.3 percent. Over the 12 months through March 2024, the US CPI increased by 3.5 percent, the highest rise since last September, with projections suggesting the economy could miss its 2 percent target this year. This could imply less price stability than expected for the country over the near-term, given that trends in the US typically trickle down to The Bahamas in subsequent months.

PAGE 2, Thursday, April 11, 2024 THE TRIBUNE

AS the tide of inflation in The Bahamas seems to be ebbing, it prompts reflection on what this means for the average Bahamian’s wallet.

DEIDRE BASTIAN By

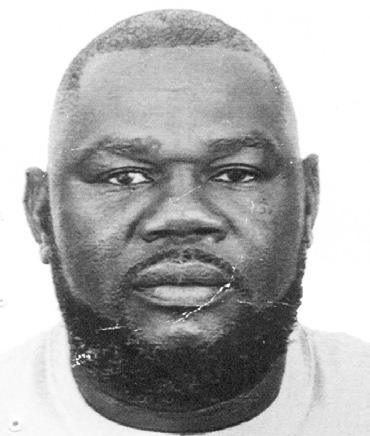

PM says ‘black hole’ east of East Street

THE Prime Minister yesterday branded the section of downtown Nassau east of East Street as “a black hole” for The Bahamas even though it contains some of New Providence’s most valuable real estate.

Philip Davis KC, speaking during a walking tour of Bay Street and the wider downtown area, said its eastern side - featuring empty, derelict and decaying buildings, some of which have already been demolished by the Government - must be revived by providing activities for tourists. He added that resolving its flooding issues will make the location more accessible to pedestrians.

Investments and Aviation’s global relations consultant, who is spearheading the Government’s downtown revitalisation efforts, yesterday revealed that the site of one demolished building has been identified as a potential location for the Tin Ferl pop-up food vendor community.

going to see a lot of progress as it relates to those properties where the buildings have been demolished.”

guests something to look at, once they would have walked east of East Street.”

Part of the problem has been the flooding.. they’ve seen much progress in that area, and so the work continues. “We’ve been demolishing the dilapidated buildings going east of East Street. We are thinking of perhaps considering some kind of attraction that will include some cultural and other activities so that we can attract more of those persons off the ship to come and enjoy what we have.”

Senator Randy Rolle, the Ministry of Tourism,

“East of East street has been almost a black hole for the country. Lack of activity, both economic and otherwise, and yet it is perhaps our most valuable pieces of real estate in the country,” the Prime Minister said. “So we have had a concerted effort to see how we can revitalise East Bay Street. There is a need to increase the attractions and other initiatives for tourists who are coming here in droves to be able to enjoy.

Asserting that the initiative is making “great progress”, Mr Rolle said the Government has sent letters to the owners of demolished buildings informing them of its future plans for downtown Nassau. “Most” were said to be in agreement.

“It’s going very well,” Mr Rolle added. “Certainly, we have much great progress. We have been through some negotiation processes as it relates to speaking with some of our partners, who were the property owners of demolished buildings. [That] has now been completed. “We’ve sent letters to all of the owners and stakeholders as to what the Government plans to do with the property. They, most of them, are in agreement. And so, in the next couple of weeks, you’re

Mr Rolle said the Government has sent out requests for proposals (RFPs) for its downtown mural project, seeking offers from Bahamian artists to paint murals, which will make the area more visually-pleasing for tourists as they move east of East street. It has also identified the site of one of the demolished buildings as a potential location for the Tin Ferl community.

“One of the properties, we have identified the group Tin Ferl, who back during the pandemic, they were the ones who were on Mackey Street, and so they had a large following there,” Mr Rolle added. “We’re looking to put them east of Elizabeth Avenue.

“They have a huge following. Certainly, with all the cruise ship passengers and most of the cruise ship passengers now starting to head east of East Street, we think that’s going to be a great benefit. Certainly, we’re looking to have more Bahamian and cultural things. And so, giving the

PM DISMISSES FEARS GBPA BATTLE WILL RUIN INVESTMENT

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Prime Minister yesterday dismissed concerns that the escalating battle with the Grand Bahama Port Authority (GBPA) over the Government’s $357m payment demand will ruin investor confidence.

Philip Davis KC argued that the “astronomical” number of projects seeking government approval,

and the “billions of dollars in the pipeline”, countered assertions by the GBPA, his political opponents and members of the private sector that the very public row will undermine investor confidence in Freeport and the wider Bahamas.

Questioning why investors are still choosing to do business in The Bahamas if their confidence has been shaken, Mr Davis argued: “What I say to them [is] look at what is happening in the country. We have billions of dollars in the

pipeline already agreed to and more about to come. If it’s going to destroy investor confidence, why are they still coming?”

Mr Davis said capital is being “attracted” to many Family Islands, including Exuma, Cat Island, Abaco and Bimini, and questioned why developers are investing in The Bahamas “as a whole” but not Grand Bahama. “The number of projects I still have on my desk to talk about and to deal with is astronomical,” he added.

Mr Rolle disclosed that the Government plans to demolish three more rundown Bay Street buildings and, over the coming weeks, many of these sites will be converted to green spaces that corporate partners have agreed to develop. He said: “What we’ve done is we’ve taken the approach of a partnership. It is important for persons to know that of all the buildings that were demolished, the Government only, I think, paid for one of them. The rest were done by the stakeholders. And so that is something that we’re proud of, because it speaks to the partnership that we have built over the last couple of weeks.

“Within the coming weeks, you’re going to see a lot of the spaces now available filled with green space. We have identified corporate partners, and the corporate partners have agreed to assist us in the development of these green spaces.”

Many visitors, including up to 30,000 passengers that disembark at Nassau Cruise Port daily, walk down Bay Street but many complain about the area’s poor condition, lack of cleanliness and the absence of activities.

The downtown revitalisation project is aiming to give Bay Street a facelift through the installation of pedestrian zones, a business incubation centre, green spaces, a cultural village and other initiatives.

“The challenge is why is this capital not being attracted to Freeport? It’s being attracted in Exuma, being attracted to Cat Island. It’s being attracted to Abaco, to Bimini, to the cays in the Exumas. Why not Grand Bahama?

THE TRIBUNE Thursday, April 11, 2024, PAGE 3

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

SEE PAGE B15

PHILIP DAVIS KC

PI HOTEL PROJECT’S 100 ‘PERMANENT’ JOB PLEDGE

around 100 permanent jobs and focus sustainability through the use of renewable energy and modern building materials and techniques.”

Paradise Yacht Club will feature 101 units overlooking Nassau Harbour, with HotelConsult Bahamas saying it will create some 100 permanent jobs and the same number during construction. “The Paradise Yacht Club project represents more than just a development; it is part of a vision for a sustainable future,” said Joshua Brooks a representative of HotelConsult Bahamas.

“We’re proud to breathe new life into this site, transforming it into a vibrant destination that not only provides opportunities for employment but also respects the environment.”

He added that the project will aim to generate more

than 30 percent of its power through renewable energy.

“Our sustainability efforts include the use of low U-value insulation and glazing; a passive design to minimise solar gain; using the direct power of the sun for water heating; a waste recycling programme with on-island partners; rainwater harvesting from the roof; a compost programme; recycling of grey water for landscaping; and a commitment to support local farming partners,” Mr Brooks said.

The project will feature a seven-storey main building with a footprint of around 19,000 square feet. The 101 units, ranging from approximately 370 to more than 1,000 square feet, will each have a balcony with harbour views. The ground floor will host amenities such as a restaurant and retail areas, along with an outdoor gym and swimming pool.

“Our goal is to create a boutique hotel with a charming restaurant that captures the essence of Bahamian hospitality,” Mr Brooks said. “Paradise Yacht Club will provide a memorable experience for the local community and tourists and also serve as a source of pride for the community.”

The project’s neighbours, though, on Monday night voiced concerns over the extra traffic it will generate in a residential area of Paradise Island. They also expressed opposition to the proposed rezoning of one of HotelConsult’s land parcels, lot 13, from residential to commercial to facilitate a 74-space parking facility.

A resident of the Shangri-La Condominiums said the planned resort should not be given permission to convert the lot as its commercial use will devalue neighbouring properties.

He also argued that the project is not financially beneficial to the residents of Cloister Drive, who are mostly Bahamians, adding that one property owner should not make the entire community “suffer”. If the resort proceeds, he warned the developers will “leave us no choice but to take legal action”.

“It will not financially benefit the residents of Paradise Island Colony Subdivision; it will benefit someone [else],” he asserted. “I’m sure at some point someone’s going to ask, if you don’t already know, who are the ultimate beneficial owners of that property. And does a portion of one lot within a community dictate that everybody else should suffer? “For example, if you have a home and there’s a lot built on it next door to you. And they tear it down and they decide, well, we’re

going to build a parking garage. We’re going to build a mechanic shop and then everyone and their mother is going to bring cars to it, and they’re going to be on cement blocks. Your value of your home is not what it was the day before. This is why we are here. “We bought this, we are no different to you as individual residents. Most of us, like you, are Bahamian and we spent hard-earned money to make a difference for our families. I do not believe, and I could be corrected, that the developer is Bahamian, and I do not believe that that development is for the benefit of Cloister Drive nor for the benefit of Paradise Island Colony subdivision. And you will leave us no choice but to take legal action…” It is understood that the project’s principal is a Bahamas resident. Another Paradise Island resident, meanwhile, argued that

Adapt to tourist profile so we ‘blow past’ 2019

FROM PAGE B1

‘Baby Boomers’, referring to those born between 1946 and 1964, to one which is now headed by ‘Generation X’, who were born between the mid-1960s and late 1970s.

Millennials, or ‘Generation Y’, who were born between 1981 and 1996, have moved from third to second most-prevalent demographic among Family Island stopovers during those ten years, Mr Fountain added, while the youngest segment,

‘Generation Z’, has moved from fourth to third. ‘Baby Boomers’, the former leaders, are now in fourth and make-up the smallest visitor segment. Asserting that all tourism operators, and not just resorts, need to be aware of their ever-shifting customer base, Mr Fountain said room nights sold and room revenue indicators for Promotion Board member properties during the first two months of 2024 had been skewed by five hotels - including two major ones who he did not identify

Notice is hereby given that in accordance with Section 138 (8) of the International Business Companies Act, No.45 of 2000, the dissolution of Luce Fund Ltd. has been completed, a Certifcate of Dissolution has been issued and the Company has therefore been struck off the Register. The date of completion of the Dissolution was October 19th, 2023.

Crowe Bahamas Liquidator

- have yet to report their figures.

Using hotels that were also open in 2019 and 2023, thus ensuring a likefor-like comparison, he told this newspaper: “Our room nights sold for same member hotels for the January-February period were down 14 percent when compared to the same January-February period in 2023, and 33 percent down when compared to 2019.

“However, there are some key island performers like Abaco, Andros, Eleuthera and Long Island which all performed or out-performed the JanuaryFebruary 2023 period. This year, when we look at room revenue from the same member hotels for JanuaryFebruary when compared to the same period in 2023 and 2019, room revenues are down 9 percent against last year and 26 percent compared to 2019.”

Mr Fountain said he has “no doubt” those numbers will look much better when the performance of the five missing hotels is factored in, and added: “What we’re also seeing is positive hotel performance being driven by increased average daily room rates (ADRs) and room revenue.

“I can tell you how it looks now. We forecast that we will continue to see hotels perform above and beyond in terms of ADRs and room revenues through the end of June.” Mr

Fountain said Family Island resorts, including the Promotion Board’s members, had experienced minimal impact from the fall-out created by saturation global media coverage of the US and Canadian crime advisories on The Bahamas.

“I don’t think so,” he replied, when asked about the impact. “We didn’t see a lot of cancellations when that advisory was first issued. What we don’t know is how many people didn’t book. That may have been a factor but we can’t say that with 100 percent certainty.”

Mr Fountain, though, told Tribune Business that “there’s some discrepancies” between the room nights sold performance of same Promotion Board member properties and the stopover air arrivals figures unveiled by the Ministry of Tourism, Investments and Aviation for the first two months of 2024.

“The air stopover numbers are now starting to match 2019 numbers, but we are not seeing it at our hotels in terms of room nights sold and room revenue,” he added. “I have to ask myself: Why are we as a Board relevant?”

Questioning if Family Island resorts have adapted to the changing profile, and tastes and demands, of their visitors, Mr Fountain said: “One of the things I have noticed is the demographic profile of the stopover visitor to the Out Islands has

changed in the last ten years. “Less than ten years ago Baby Boomers used to make up the majority. It’s very interesting that they have now dropped to number four after those other three groups. They all have different vacation expectations and needs for each generation type. Our Family Island hotels must adapt their product offering to the type they most want to appeal to.”

As an example, Mr Fountain said ‘Generation X’ was typically seeking family activities, and a mix of relaxation and adventure. Therefore. hotels need to offer a family-friendly package featuring outdoor activities and activities for children. ‘Generation Y’, though, want “unique experiences and social interaction”, so it was important technology is integrated into the vacation so they can share pictures with family and friends. Technology amenities, local experiences and a social space is what this group is demanding, he added, noting that this explained why Family Island hotels have identified reliable Internet service as a key priority. Meanwhile, “digital savvy and eco-conscious” ‘Generation Z’ are seeking sustainable and authentic experiences, so social media spaces and Bahamian culture must

parking garage

extra traffic volumes that will negatively affect the quality of life of neighbours. He said: “Cloister Drive east and west is a residential area. Children ride their bicycles; we walk unhindered on Cloister Drive. I’m very concerned about lot 13 and the new entrances being proposed for the parking garage at the top of lot 13. That is of concern to me. And the quality of life of those of us who live on Cloister Drive can be very affected by that particular concern.” Plans submitted to the Department of Physical Planning revealed that the project is being expanded to a seven-storey hotel featuring a 46 percent increase in units compared to earlier plans. The number of hotel rooms and apartments, which will be spread across the upper six floors, is being increased by 32 units - from the 69 cited last year to 101 in the latest version submitted to the planning authorities.

be included in the product offering.

As for ‘Baby Boomers’, with a focus on comfort, service and relaxation, Mr Fountain said resorts must provide amenities such as spas as well as “attentive staff”. He added: “The business has changed. It’s not that people are not going to the Family Islands. They are, but they are looking for different types of accommodation and product offerings.

“Hotels need to adapt to blow past 2019 numbers. And it’s not just hotels that need to adapt their product offering to these changing customer profiles. We desperately need help with the Government and private sector working together to address the shortcomings that are negatively impacting the experience with Family Island vacations.”

Pointing to affordable, reliable and sustainable energy as another Family Island hotel priority, Mr Fountain added: “These things tie together. This is what the customer wants and we’re not delivering that. It doesn’t matter what the country does, what the Ministry of Tourism does, what the Bahama Out Island Promotion Board does to promote the country, what makes it possible is to have a good product.

“We have to start there. It’s why it’s so important hotels understand what the customer is looking for and make sure that is what we offer.”

PAGE 4, Thursday, April 11, 2024 THE TRIBUNE

the

will attract

FROM PAGE B1 LEGAL NOTICE Luce Fund Ltd. Registration No. 203191 B INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000) In Voluntary Liquidation

PI resort, development escape tax debt sell-off

blaming their legal representative for not making the adjustment. Maybe there was a transfer or sale and it’s showing the old name.

“We’re doing continuous updates to some of the information coming in.

Unfortunately, it has been a position where a foreigner has sold to another foreigner and there’s a lag with the lawyer on the clearance. We’re trying to change our message to tax registrants to make sure they are aware they have tax obligations, and that their legal representatives are declaring it in a timely manner.”

The Department of Inland Revenue is still determining how much real property tax arrears it has collected from advertising properties for sale - both from those owners whose assets who were in immediate danger of being auctioned to satisfy the debt, and others who - though not on the listwere sufficiently alarmed to begin reducing and paying off their arrears.

“We are starting to see individuals coming in or making their first attempt to come into the Department before it goes to sale,” Mr Fernander added. “Unfortunately, some did not come back, so we have concluded the first set of transactions. They have been put up for auction and the bid phase has closed.”

While providing no details on how many properties have been auctioned off, or the expected sales proceeds that will help the Government recoup some of its real property tax arrears, he said all offers

are being reviewed by an “independent” group featuring professionals such as appraisers and surveyors, as well as public officials. “The group is reviewing the bids and going through their due diligence and the process,” Mr Fernander added. “They will give us a better understanding of what is the current market value, looking at the interests of both the Government and the transaction.” The Government has previously asserted it is aiming to reclaim between $35m to $50m in unpaid real property tax annually through the auction process. “We hope this will change the culture,” the Department of Inland Revenue’s operations chief told Tribune Business. “Individuals previously only moved to pay their tax bills if they were refinancing or selling their properties. You know you have tax obligations every year. We’re hoping this changes the culture of individuals with tax obligations.

“We had to reach this point. We’ve sent out third

party collectors, tried for four to seven years to collect the revenue and have reached this point of power of sale. We cannot go for another ‘x’ years facing this astronomical debt amount.”

Mr Fernander said the delinquent property selloff had also sent a message that Bahamians are not immune, as only owneroccupied property owned by this country’s citizens is exempt under the Real Property Tax Act from being auctioned over unpaid tax arrears. He also called on executors to make sure property taxes were fully paid-up before estates are probated, while urging second homeowners with properties in the Family Islands to make sure their assets are properly registered. In Club Land’ Or’s case, the threat of auction would have put paid to any hopes of selling the resort. Obie Ferguson QC, the Trades Union Congress (TUC) president, who is representing the hotel’s former middle managers who were members of the Bahamas Hotel Managerial

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

Association (BHMA), yesterday said he had been informed its owners are “looking very aggressively” to find a buyer. The property closed without staff being paid their due severance and other entitlements as required by the Employment Act, and Mr Ferguson said it was his understanding that these liabilities will have to be settled from any purchase price paid for the property. Club Land’ Or was being advertised for sale by one Bahamian realtor with a $25m asking price, a significant drop from the $40m originally sought.

“I was made to believe they are looking very aggressively in trying to find a buyer,” said Mr Ferguson, who estimated that - with interest - the collective $821,292 allegedly owed to his clients as well as the sums owed to former line staff will likely be approaching $1.5m-$2m.

“I’m made to believe they are seriously looking for a buyer,” he added. “I’ve been checking on the progress for the last couple of weeks but I have not gotten

anything of substance. We are very interested because it affects a lot of people as a result of the monies due to them.

“I am of the view that on the sale of the property the workers will get what they are entitled to, the union

dues they collected and never paid. They will not be able to sell the property unless and until payment is made as they will not be able to give the purchaser a valid receipt. Payment will be made out of the purchase price for the hotel.”

THE TRIBUNE Thursday, April 11, 2024, PAGE 5

FROM PAGE B1

Bank’s Out Island sites ‘a philanthropic service’

Harbour, had exacerbated problems caused by the bank’s failure to “keep pace” with the area’s rapid economic growth driven by investments such as Disney Cruise Line’s Lighthouse Point project.

Chris Cates, a Rock Sound resident who operates a gas station and lumber/hardware store with his family, told Tribune Business that as many as 40 persons can be found queuing outside Bank of The Bahamas’ branch at any one time as they can only gain access to their accounts manually.

Asserting that the branch’s ATM has been offline for about a week, he said: “We are really challenged here. I want to sensitise the powers that be to our plight. We are really struggling. South Eleuthera has a seen a resurgence in our economy thanks to Disney and Lighthouse Point. Unfortunately, Bank of The Bahamas has not been able to keep pace. “We’re in a position where it’s near-impossible to do business banking and individual banking. I think of the elderly and working class folks. There is literally a line, and it can be as many as 40 persons outside, and

that lasts from morning to night. “We have a huge expatriate workforce here because of Disney. It’s crazy the manpower hours being lost because of the inability to serve the public. As a business, you cannot get your deposits into the bank. It’s just getting them in, because you cannot get into the bank. I think the staff at Bank of The Bahamas are doing the best they can with what they have, but they are seriously under-staffed.”

Mr Strachan yesterday agreed that it was “accurate” to say the south Eleuthera branch’s ATM is presently off-line, and that there have been frequent problems with it. He explained that IBM, the machine’s manufacturer, does not keep the necessary spare parts in The Bahamas and these have to be sourced from Florida, which delays repairs and lengthens the time taken to restore its services.

“The ATM has been up and down,” the Bank of The Bahamas managing director confirmed. “We’ve had several issues, primarily with the machine breaking down. The challenge for us is the parts, IBM, they don’t keep the parts in inventory locally. We have to go and get the parts, and there are technical issues. They have

legitimate complaints. We have to wait a little.”

Mr Cates, meanwhile, said the situation is impacting “dozens of people”. He added that some persons “sit out from 7am in the morning hoping to be first in line”, with his elderly motherwho handles banking for the family’s businesses - sometimes making up to four attempts per day to deposit money, and even returning home unable to accomplish this.

“The big challenge is if the ATM never works, if someone wants $50 out of their account, they have to queue up to enter the bank like someone opening a new account,” he added. “We have people lining up because the ATM is never operational. It’s very unsafe for businesses to do cash banking.

“They now have a policy where they close Wednesday. That’s the wildest decision to make, to close in the week, and open every other Saturday to compensate.” Mr Strachan confirmed that Bank of The Bahamas’ South Eleuthera branch is now opening on the second and fourth Saturday of every month “so we have tried to accommodate the community as best we can”.

Mr Cates said persons receiving their pay on Friday are unable to access it until Monday, after the weekend, because they are unable to enter the bank before it closes. “South Eleuthera is grateful for the economic boom, but we need help with our banking,” he told Tribune Business. “It’s a dire situation with our banking. It’s no reflection on the team in the bank; I feel they’re handicapped by lack of resources.

“I feel like we’ve gone backwards with our banking. We had Scotiabank for years, and before that Barclays, and they served us well. We’re in a real quandary. If you generate significant turnover and can’t get it in the bank, it’s a real problem.”

Mr Strachan, though, argued that the relationship with Family Island communities is, in effect, a two-way street and Bank of The Bahamas is not receiving sufficient support for maintaining unprofitable branches to serve them.

“The bank just participated in a business symposium down there put on by the Eleuthera Chamber of Commerce,” he said. “How many persons do you think attended? Five. The organisers included a session about banking, and I sent a team down there of six employees to participate. They had five people that showed up.

“It was organised by [Chamber president] Thomas Sands. He called me, and I said we’d participate to see what we could do to improve banking in that area. The bank is performing a philanthropic service in areas of the Family Islands. “It’s not profitable. None of the Family Islands are profitable. Zero. That’s why all the other banks pulled out. We’re there. The shareholders [the Government, through NIB and the Public Treasury] want us to be there to service the island.”

Mr Strachan said Bank of The Bahamas is exploring “agency banking”, which will involve appointing existing businesses as its agents to provide financial services on its behalf, as a means to operate in the Family Islands. He added that it is the process of negotiating and agreeing contracts now.

“It’s an alternative means to provide the same level of service more efficiently,” he added. “We don’t get the support from the community. They complain, but don’t support. They’re quick to complain, but when we have a business symposium and only five people show up, they’re not serious. “We’re trying to find alternative means. I’m hoping agency banking works. I think it will. Fidelity has done a bit in Exuma. We’ll see what happens. We’ll make some public announcements shortly.”

Mr Sands, echoing Mr Cates’ concerns, told Tribune Business that the ATM’s loss has been a serious blow the ease of doing business in a community and private sector that still rely heavily on cash-based transactions.

“There are challenges,” the Eleuthera Chamber of Commerce president affirmed. “Their ATM is down. They are the only bank in this area. The line is around the door when they open and the ATM being down for a significant period of time.

“A lot of people rely on it. It’s the only ATM between here and Governor’s Harbour. It’s the only ATM for 60 miles. It’s the lifeblood for 60 miles for the community. It’s an important part of the community and economy. It means people don’t have cash to go and purchase from some businesses, and a lot of businesses are still mainly cash transactions.

“Let me say that it has been indicated to me they [Bank of The Bahamas] intend to make some improvements. I don’t think they have announced them yet, but the community is growing rapidly. It’s kind of a different day than it was two to three years ago. The rate of growth is significant, and we all have to prepare for a growing economy.”

PAGE 6, Thursday, April 11, 2024 THE TRIBUNE

FROM PAGE B1

DETROIT Associated Press

FORD is recalling nearly 43,000 small SUVs because gasoline can leak from the fuel injectors onto hot engine surfaces, increasing the risk of fires. But the recall remedy does not include repairing the fuel leaks. The recall covers certain Bronco Sport SUVs from the 2022 and 2023 model years, as well as Escape SUVs from 2022. All have 1.5-liter engines.

Ford recalls nearly 43,000 SUVs due to gas leaks that can cause fires, but remedy won’t fix leaks NOTICE

Ford says in documents filed with U.S. safety regulators that fuel injectors can crack, and gasoline or vapor can accumulate near ignition sources, possibly touching off fires. Dealers will install a tube to let gasoline flow away from hot surfaces to the ground below the vehicle. They'll also update engine control software to detect a pressure drop in the fuel injection system. If that happens, the software will disable the high pressure fuel pump, reduce engine

NOTICE

NOTICE is hereby given that BIENFAITE LOUIS of Exuma, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 11th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

power and cut temperatures in the engine compartment, according to documents posted Wednesday on the National Highway Traffic Safety Administration website. Owners were to be notified by letter starting April 1. The company says in documents it has reports of five under-hood fires and 14 warranty replacements of fuel injectors, but no reports of crashes or injuries.

In an email, Ford said it is not replacing fuel injectors because it is confident the recall repairs "will prevent the failure from occurring and protect the customer." The new software also will trigger a dashboard warning light and allow customers to drive to a safe location, stop the vehicle and arrange for service, the company said. NHTSA documents filed by Ford say the problem happens only in about 1% of the SUVs. The company also said it will extend warranty coverage for cracked fuel injectors, so owners who experience the problem will get replacements. Ford said repairs are already available, and details of the

any

company also said it isn't recommending that the SUVs be parked only outdoors because there's no evidence that fires happen when vehicles are parked and the engines are off.

hereby given that FREDDY TAPIA GUILLEN of Apartment #52 Unit #4, Sapphire Ridge, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE NOTICE

IN THE ESTATE of KANDY KAY PINDER late of the Settlement of Cherokee Sound on the Island of Abaco, one of the Islands of The Common wealth of The Bahamas, deceased.

Notice is hereby given that all persons having any claim or demands against the above named Estate are required to send their names, addresses and particulars of the same duly certifed in writing to the undersigned on or before the 2nd day of May A.D., 2024, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Executors shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

MICHAEL A. DEAN & CO.,

THE TRIBUNE Thursday, April 11, 2024, PAGE 7

extended warranty will be available in June. Ford said the recall is an extension of a 2022 recall

the same problem. The repair has already been tested on vehicles involved in the previous recall,

Ford

for

and

said it's not aware of

problems. The

is

Attorneys for the Executors Alvernia Court, 49A Dowdeswell Street P.O. Box N-3114 Nassau, The Bahamas

2024. The venue and time to be announced.

are

vacancies);

No

foor

NOTICE The Public Workers’ Co-operative Credit Union Limited announces that its 44th Annual General Meeting will be held on Friday, May 31st,

Applications

invited from members in good standing who may wish to run for the following vacant positions: Board of Directors (3

Supervisory Committee (2 vacancies) and Credit Committee (2 vacancies). Nominations forms are available at our Nassau and Freeport offces or by emailing sthompson@pwccu.org. Completed Nomination forms, along with a cover letter and resume must be submitted by 4 pm on Monday, May 6th, 2024, either by delivering to any of our offces or via the email listed.

nominations will be allowed from the

PM dismisses fears GBPA battle will ruin investment

FROM PAGE B3

“And that’s just a question they [the GBPA] have to answer. If investor confidence has been shaken, why do we still have all the interest to invest in the Bahamas as a whole and not in Grand Bahama in particular?”

The GBPA at the weekend warned that a very public dispute between Nassau and Freeport will “prove hugely damaging” to the latter’s economy and investor confidence, just as Grand Bahama is poised to enjoy a $2bn investment pipeline.

“The sad prospect of investors being potentially discouraged from investing if they feel that their money and property may no longer be safe harms no one more than the thousands of regular hard-working Bahamians whose livelihoods and families depend on the city of Freeport,” it argued.

GRAND

“Foreign Direct investment will likewise suffer, if investors fear a stable jurisdiction within which property rights and freedom from government coercion is not guaranteed. This claim has sadly created uncertainty for the investment climate of Grand Bahama, which has the potential to undermine the economy as it is just beginning its resurrection from a series of devastating hurricanes, most recently, the hugely destructive Dorian, as well as the COVID-19 pandemic.

“Central government’s co-operation is required. Continued hostility towards the shareholders of the Port Authority is counter-productive and unnecessary. Again, we urge central government to withdraw its unjustified claim and let us jointly resolve the issues in good faith. This is what the residents, licensees and investors in the Port Area deserve.”

THE TRIBUNE Thursday, April 11, 2024, PAGE 15

BAHAMA PORT AUTHORITY (GBPA) HEADQUARTERS