THURSDAY, JULY 24, 2025

Explain April’s $137m

deficit swing, PM told

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Opposition last night demanded the Prime Minister explain “the glaring discrepancy” between the $135.4m Budget surplus he projected for April 2025 and the actual $2.1m deficit outcome.

Kwasi Thompson, the Opposition’s finance spokesman, told Tribune Business that the $137.6m negative swing that was revealed yesterday - less than two months after the Prime Minister detailed a rosy April outlook in his 2025-2026 Budget communication at end-May - was “not a minor clerical oversight” but “a major gap”.

Speaking after this newspaper noticed the gulf between the Prime Minister’s April forecast and the subsequent outcome, as detailed in the Ministry of Finance’s report

on the month’s fiscal performance, he argued that the sudden, unexplained swing and its extent “casts serious doubt on the reliability” of the Government’s projected $75.5m surplus for the current 2025-2026 fiscal year. Simon Wilson, the Ministry of Finance’s financial secretary, could not be reached for comment and did not respond to Tribune Business messaged questions seeking an explanation for the changes. However, Mr Thompson told

this newspaper that the swing is “a big difference. Over a $100m difference”.

The Prime Minister, in unveiling the 2025-2026 Budget, hailed April 2025’s revenue performance as being at “a high level”. He told the House of Assembly: “Typically, the month of April contributes approximately 12 percent to the total revenue intake over a ten-month period.

Auto H & L agrees to $200k interest overcharge penalty

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ONE of this nation’s largest used car dealers has agreed to pay a $200,000 penalty to settle claims that it overcharged interest on vehicle loans it made to almost 2,000 Bahamians.

The Securities Commission last night published the settlement deal, signed-off on Tuesday this week by its chairman, retired Supreme Court judge K Neville Adderley, and Auto H & L’s president, Hal Shears, which was struck over allegations that the dealership violated

the Rate of Interest Act that protects Bahamians from becoming victims of predatory or usury lending.

Setting out the “facts agreed” between the two

Further BPL bill increases ‘a never-ending nightmare’

By NEIL HARTNELL Tribune Business Editor

nhartnell@tribunemedia.net

AN Opposition senator last night branded escalating Bahamas Power & Light (BPL) costs “a never-ending nightmare” as homeowners began to receive August bills showing 25-30 percent increases. Michela Barnett-Ellis, who is understood to be seeking the Free National Movement’s (FNM) Killarney nomination, said in a voice note she had been “shocked” by her latest BPL bill and challenged the state-owned energy monopoly’s previous assertion that energy costs would “level off” by early 2024.

Pointing out that it is now mid-2025, and Bahamian households and businesses are still enduring rising electricity prices “with no explanation and no relief”, she added that

parties, the settlement recorded that the regulator “conducted routine examinations” of Auto H & L, one of its financial and corporate services provider licensees, in March 2022 and 2023. The Securities Commission “observed a number of breaches” of the relevant Act and associated legislation, including the Rate of Interest Act.

“Further, Auto H & L had reported to the Commission that, some time in 2019, a dump truck crashed into Auto H & L’s offices destroying a number of client records in the process,” the settlement added. “Consequently, Auto

H & L was unable to properly account for the number of clients impacted by their error involving the Rate of Interest Act, further aggravating this particular issue.

“Auto H & L, when responding to those findings, agreed that there was a breach of the Rate of Interest Act and indicated to the Commission that this had been done inadvertently.” The Securities Commission, in a May 23, 2023, meeting with the auto dealer directed that the Baker Tilly Gomez accounting firm would conduct an “independent exam”

Insurers: ‘No material increase’ over health costs via NHI reform

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN insurers yesterday said that while they “don’t expect any material increase” in medical coverage costs due to National Health Insurance (NHI) reforms this cannot presently be guaranteed.

Marcus Bosland, the Bahamas Insurance Association’s (BIA) deputy chair for life and health insurance, told Tribune Business the industry is still awaiting the accompanying regulations and any “devil in the detail” before it can determine the precise impact on the pricing and benefits structure of existing private medical policies following the NHI Bill’s tabling in Parliament.

The Bill’s main purpose is to introduce the Standard Health Benefit (SHB), which will act as the “minimum” primary care benefits package available to NHI beneficiaries who currently total some 161,000. Private health insurers, such as Colina, Family Guardian and CG Atlantic, will agree with NHI to become “approved insurers” to provide the SHB to beneficiaries enrolled with the Government’s scheme.

Mr Bosland told this newspaper that the Government has agreed to give health insurers and their existing private clients a one-year transition period, which starts immediately upon the Bill’s passage into law, to adjust premium pricing and benefits accordingly. He added that the industry believes this will provide sufficient time for what are likely to be “a lot” of changes to the illnesses, treatments and procedures covered by benefits packages in existing private medical insurance policies.

BY ANNELIA NIXON Tribune Business

Reporter anixon@tribunemedia.net

THE Bahamas Taxi Cab Union has officially joined the Trade Union Congress (TUC) in hopes that progress will be made to resolve the long-time rivalry between taxi and livery drivers.

Tyrone Butler, who has been vocal about his objection of livery drivers being allowed the right to operate within spaces that “is

usually reserved for taxi drivers”, noted that conversations with transport minister JoBeth ColebyDavis has gone nowhere. Mr Butler, who as The Bahamas Taxi Cab Union president represents in excess of 1,500 active taxi drivers with the union’s membership just under 400 persons, believes they are “going to be able to make some headway in that regard” through their addition to Obie’s Ferguson

Imagine if your hotel’s air conditioning unit gave you a warning that it was about to fail just before it actually did. Or if a water pump in Andros signalled that it needed attention before breaking down and causing an

BAHAMAS CAN’T IGNORE AI PREDICTIVE MAINTENANCE ROYE II KEITH

island-wide disruption. That is the power of artificial intelligence (AI) powered predictive maintenance, and it is quietly becoming one of the most cost-saving tools for businesses around the world. Predictive maintenance uses artificial intelligence

to monitor equipment in real-time, learning how it operates under normal conditions and recognising the subtle signs of wear or failure. Unlike traditional maintenance, which either waits for something to break or relies on a fixed schedule

regardless of whether servicing is needed or not, AI takes a more intelligent approach. It steps in only when necessary, but always just in time. For businesses, this means fewer unexpected breakdowns, lower repair bills and less time lost to

equipment failures. In fact, global studies have shown that predictive maintenance can reduce breakdowns by as much as 70 percent, lower maintenance costs by up to 25 percent, and improve overall productivity by a significant margin.

For companies managing expensive infrastructure or equipment - think airlines, shipping operators, hotels or utility providers - these numbers translate into millions saved annually.

The Bahamas, though often thought of in terms of its sun, sea and sand, is a country that runs on complex systems. Tourism, logistics, aviation and utilities all depend on equipment that simply cannot afford to break down unexpectedly. A hotel in Nassau cannot have its cooling system fail in the middle of summer. A water treatment facility in Eleuthera cannot afford an unplanned outage during a drought. And shipping operations between New Providence and the Family Islands cannot be delayed by a faulty motor or crane.

This is why AI-powered predictive maintenance is especially relevant to the Bahamian economy. It offers a way to protect critical systems, maintain business continuity and improve the guest and customer experience. In tourism, where reputation and reliability are everything, preventing avoidable equipment failures ensures visitor expectations are met and reviews remain positive. In the utilities sector, predictive tools can safeguard water and power systems from failure, helping maintain public trust and minimising emergency repair costs.

Moreover, in a country where replacement parts often take weeks to arrive and specialised technicians are sometimes flown in, preventing breakdowns before they happen can save both time and foreign exchange.

The fewer emergency imports and rushed jobs required, the more stable and cost effective our operations become.

There is also potential for local job creation. As the technology becomes more accessible, Bahamian IT firms and engineering consultants could offer AI-based maintenance services, creating opportunities for young professionals in the digital space. With the right training programmes and incentives, we could develop homegrown expertise in smart infrastructure management. Looking ahead, there is a real opportunity for publicprivate partnerships (PPPs) to pilot AI-driven maintenance in key sectors. From Bahamas Power & Light’s (BPL) grid to major resorts, predictive analytics could become a national strategy for economic resilience. It would mean fewer disruptions, smarter spending and more efficient use of limited resources.

In a country where every hour of downtime costs money, and where service reliability can make or break an industry, embracing AI for maintenance is not just a high-tech novelty. It is a practical, forward-thinking move that could redefine how we manage the systems that keep The Bahamas running.

And in a place where tourism is our business and efficiency is everything, that is a future we cannot afford to ignore.

‘More opportunities’ from segregated accounts bill

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE segregated accounts companies bill will open more opportunities for local account representatives, corporate administrators, attorneys, accountants and insurance professionals, according to Prime Minister Philip Davis.

Speaking in Parliament yesterday, Mr Davis said the bill is a step towards strengthening the country’s reputation as a “world class” financial services centre as the government continues to push the second largest industry.

“You see, for many local professionals, the financial services industry represents a powerful avenue for career advancement, which grants opportunities to Bahamians at the highest levels. It may be the most significant contributor to the middle class of The Bahamas over the last few generations,” said Mr Davis.

“Throughout the 2025/2026 fiscal year, as we

roll out our plan to expand opportunities by promoting economic growth, stimulating job creation, and investing in training and education, the financial services industry, as the second pillar of our economy, must be an integral part of our plans.”

He said the bill will offer investors and family offices “unparalleled structural flexibility” through offering Incorporated Segregated Accounts Company (ISAC) which allows each segregated account to hold a separate legal identity.

“Unlike traditional SACs, ISACs grant each cell a separate incorporated status. This enhancement strengthens asset protection, simplifies lending arrangements, and aligns our offerings with the most innovative international structures. For sophisticated investors and family offices, this provides unparalleled structural flexibility,” said Mr Davis.

The bill will also allow foreign companies incorporated in The Bahamas to redomicile as either SACs or ISACs through a single

GB businesses frustrated by ongoing power woes

BY ANNELIA NIXON Tribune Business Reporter

anixon@tribunemedia.net

COMPANIES must become “self-reliant” and “resilient”, according to one businessman following Grand Bahama Power Company’s power woes.

Chappies Pharmacy and Drug Store’s proprietor, Robert Nabb, said he lost confidence in GB Power years ago as it constantly struggles to produce reliable power around the summer time. To ensure he can maintain medicines in the right temperatures and have constant access to patient records, he invested in a generator years ago.

“They’ve been having problems for several years, and especially in and around this time,” Mr Nabb said.

“Sometimes it’s been a little earlier, sometimes a little later. So years ago, Chappies Pharmacy and Drugs made it a policy that we were going to not depend upon Grand Bahama Power. We have our own generator, a diesel generator, which kicks in.

Obviously as a pharmacy we can’t afford to lose power. We need power in order to keep our medicines cool, in order to provide computer services, which keeps track of patients’ records. So we couldn’t depend on Grand Bahama Power and we came to that decision several years ago. Even before Dorian, we came to the decision we’d have to invest in our own ability to have a backup power system. So that’s the company side. Do I have confidence in their ability? Probably not.”

While he admits the initial expense of investing in a generator was steep, he considers the inability to provide service to his customers a bigger cost. He stressed the importance that Bahamians, especially those in business, reconsider being heavily reliant on unreliable sources.

“Even things as simple as the fact that the internet depends on the power,” Mr Nabb added, “we then had to go to remote services through Aliv. So we’ve had to become very creative in what we’ve done with regards to becoming

process facilitating a “a smooth transition”.

“Many Latin American structures currently domiciled in other regional financial services centres face pressure to relocate due to changing tax treaties and regulatory scrutiny. Our continuation framework provides a convenient bridge and avoids disruptions, making it easy for new clients to migrate to The Bahamas,” said Mr Davis.

He said the bill also enables non-regulated companies governed by the Companies Act or International Business Companies Act to convert into SACs or ISACs and included “comprehensive” demerger capabilities.

“Previously, segregated account structures primarily served regulated entities, such as investment funds and captive insurance companies. This expansion democratises access to this sophisticated risk management structure,” said Mr Davis.

“There are also now comprehensive demerger capabilities for segregated

resilient. And I think that’s something that if there’s one message... I’m a former geography teacher, so one thing I’ve always tried to preach to my students, and to people, we have to become more resilient as a nation, and we can’t depend on what we depended upon 10, 15, 20 years ago, because the landscape is changing drastically. And so as much as companies can’t, we were luckily in the position where we could. And that was an investment we had to make. We had to pay it off. And yes, it was costly.

“We’ve even transferred that to my home situation, where we are solar. We invested in solar. It was expensive. We had to take out a loan for it, but it is going to pay off, and it has already paid off in that I don’t have power losses at home. And so the message that I’m trying to get out is Bahamians have to start becoming more self-reliant and resilient. [You] can’t be worrying about the powers that be.

“And yes, we all complain about GB Power and the price hikes. Prices aren’t going down. The price of oil is the price of oil, whether we like it or not, GB Power doesn’t control that. BPL doesn’t control that. And so they’re going to charge you. So if you’re in a position where you can invest, even small investments in

accounts. This bill’s demerger provisions represent a huge leap in structural flexibility. In fact, through this bill, segregated accounts now have unprecedented mobility. ISACs can merge with other incorporated accounts, transfer between different ISACs, or continue as independent companies. ISACs themselves can merge or effectively demerge as their incorporated accounts spin off.”

Mr Davis said the bill introduces “enhanced governance standards” and addresses regulatory overlap by clearly defining which regulator supervises regulated companies seeking SAC or ISAC status.

“We are establishing clear rules to identify the regulator, prevent gaps in supervision, and enable comprehensive oversight without bureaucratic redundancy,” said Mr Davis.

“Every SAC and ISAC must appoint a licenced segregated accounts representative: a qualified professional who will ensure proper administration and regulatory compliance.

becoming more self-reliant and more self-sufficient, that’s the direction Bahamians have to go. And that’s the direction Chappies pharmacy has gone, because we want to be able to provide service for our customers, and we want to be reliable.

“The thing is, I can’t blame BPL or Grand Bahama Power because they’re the only producers on the island. If you look at America, if Florida Power and Light in South Florida has a problem, they can import power from Georgia or other states because the grid is connected. We’re an isolated grid. So, they’re in

This requirement serves multiple purposes. It guarantees local presence and accountability. It creates professional opportunities for Bahamian service providers. It gives regulators a clear point of contact for supervisory matters. And, most importantly, it maintains standards that protect our international reputation.” He said the bill enhances creditor protection through new notification requirements and solvency certifications.

“This bill strengthens creditor protection through comprehensive notification

a difficult situation. I’m not putting the blame on them. Don’t get me wrong. I want to make that clear. I’m not putting the blame on them. They have circumstances that they can’t control. It happens. But as a company, we’ve learned that we can’t depend on them 12 months of the year.”

Adina Knowles, owner of Onyx Salon said she now realizes she will have to invest in a generator after the power outages made it difficult for her to complete a client’s makeup. Ms Knowles, who continued her client’s makeup outside after the power outage said the lack of air conditioning

requirements and solvency certifications. Directors must formally attest to solvency before major transactions, and creditors receive advance notice of structural changes that might affect their interests,” said Mr Davis.

“For new registrations, demergers, and continuations where liabilities exceed $1,000, the Bill mandates written creditor consent and notice published in the Gazette. This approach protects legitimate creditor interests without imposing prohibitive transaction costs on routine operations.”

added to the challenges, as her client began to sweat. Fortunately, due to majority of the outages being island-wide, Ms Knowles said she doesn’t risk losing future business.

“Thank God I have good setting make-up because I had already set her face,” Ms Knowles added. “I was able to complete it, but it definitely was challenging that the AC is connected to the power, so she was getting hot and, it was very difficult to complete that service. So I realised that I would need to get a generator for things like this

RELIABLE - See Page B5

FINANCIAL PROVIDER MARKS NEW $40M HQ’S OPENING

A BAHAMIAN financial services provider has celebrated both the opening of its $40m Collins Avenue headquarters and its 15th anniversary.

Leno Corporate Services marked the two major milestones on Friday, July 18, with an event that brought together government leaders, business executives, clients, staff and wellwishers. Guests, including Prime Minister Philip Davis KC and Governor General Dame Cynthia Pratt, were led on a tour of the building - located at the top of Collins Avenue’s hill - prior to the official opening.

“This is our national headquarters going forward,” said Leno founder, president and chief executive, Sean K. Longley.

“Fifteen years ago, Leno began as a humble but powerful vision, one rooted in determination, integrity, ambition and the belief that a wholly Bahamian-owned firm could deliver first-class service in this country - and I could say wholeheartedly we’ve achieved that.”

The new seven-storey, 50,000-square-foot office complex was designed, engineered and constructed by Bahamian professionals.

“We’ve gone from being zero dollars under management back 15 years ago to over $1bn under management and administration. And that’s not just local; that’s international and Bahamian,” Mr Longley said.

“That, for me, is a testament of what we can

achieve as Bahamians. One of the things that I’m so proud of is that, back in 2018, we were able to donate to the University of The Bahamas an endowment of $250,000. You make money, but the thing is you have to be able to give back. I value my staff. They’ve done a wonderful job. Without them we could not have achieved what we’ve achieved.” The Prime Minister praised Leno’s impact on the Bahamian economy, adding: “Look at what you have done. You have changed the skyline of our capital but, more importantly, you have changed the expectations of a generation.

“You didn’t wait on luck. You didn’t wait on praise. You got to work and, over 15 years you built something strong. You started out with little but hope and aspiration - no short-cuts,

no special treatment — just a belief, as you indicated, that if you stay the course, work with discipline and keep your head high, you can build something that lasts.

“We celebrate your business, we celebrate doors. But we must also change the culture. We must celebrate people who build with integrity, who employ others, who take the long road when the easy one is tempting.”

Montgomery Braithwaite, Leno’s chairman, added: “As chairman of Leno Corporate Services and Leno Trust, I believe that I have provided some guidance along the way — but make no mistake — what you see here today is the product of Sean’s vision, his determination and the incredible team that surrounds him.

“This centre is a tangible symbol of what happens

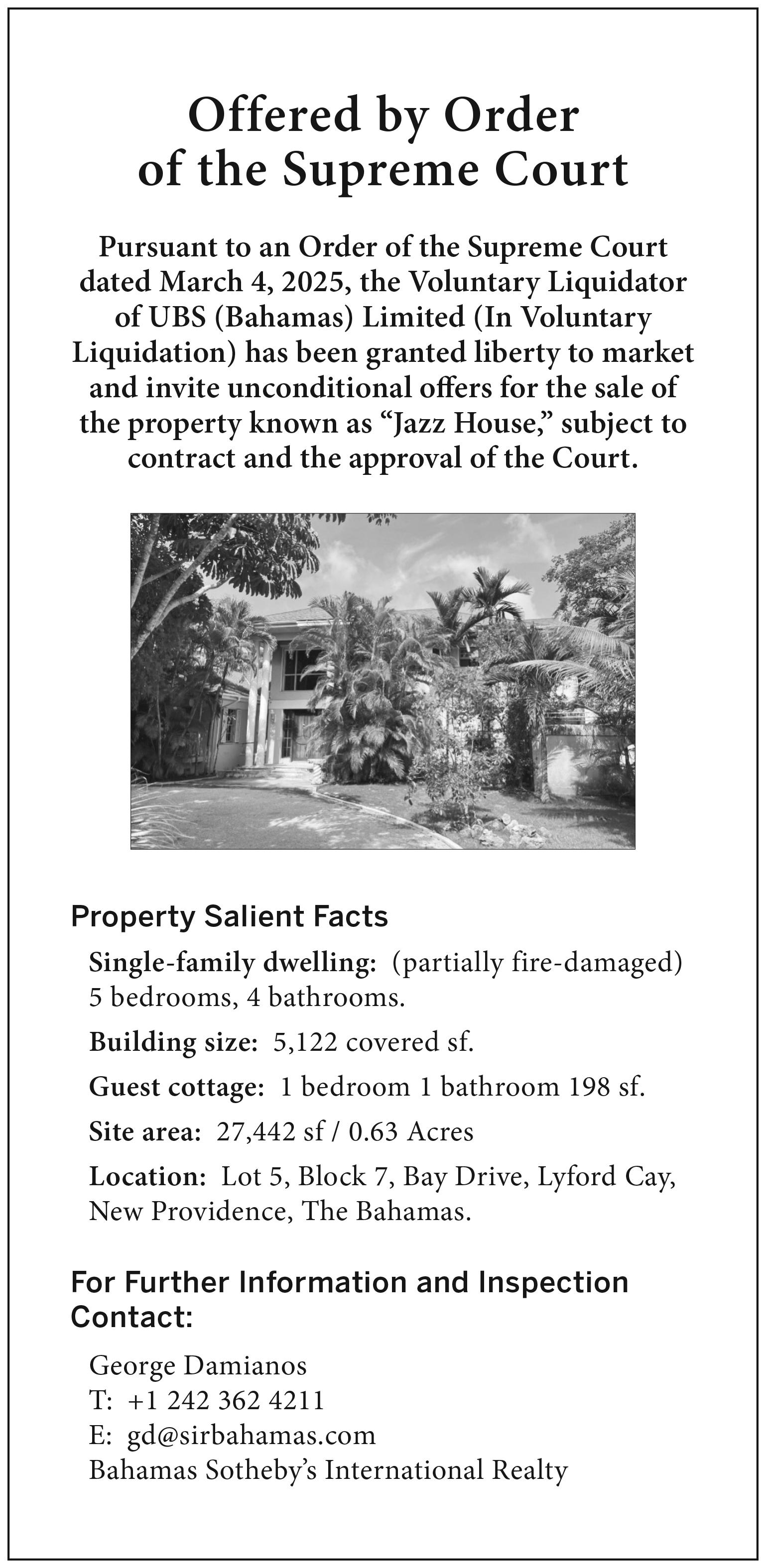

Realtor reconstructing its Governor’s Harbour office

A Bahamian realtor says it has begun reconstruction of its Governor’s Harbour office after completing demolition of the existing structure.

HG Christie Ltd, in a statement, said there is now a cleared lot where construction will begin imminently. The previous structure, though beloved for its history, was small and outdated. The firm said that as Eleuthera’s real estate market continues to expand, the need for a more spacious, modern office to better support HG Christie’s agents and offer a welcoming environment for clients has grown.

“We’re excited to begin a new chapter in Governor’s Harbour by rebuilding our

office from the ground up,” said John Christie, president and managing broker of HG Christie. “This project is not just about a new building; it’s about reinvesting in Eleuthera and reaffirming our long-standing commitment to the island and its community.

“We look forward to welcoming clients into a modern space that reflects both the beauty of Eleuthera and the legacy of HG Christie.” The real estate firm is currently operating from temporary premises behind the Buccaneer Club off Haynes Avenue, ensuring continuity of service during the construction period. It is aiming to complete

construction in time for a 2026 re-opening.

“The Eleuthera real estate market in 2025 continues to show strong momentum, with growing interest from both Bahamian and international buyers seeking the island’s natural beauty, sense of community and lifestyle,” said Anne Bethel, HG Christie’s top-producing agent in Eleuthera.

“We’re seeing demand across the board - from beachfront estates to charming cottages and investment properties. It’s an exciting time to be part of Eleuthera’s evolution, and I’m proud to help clients find their special spot in this unique part of The Bahamas.”

when passion meets persistence, and when a small, nimble company rises to meet the needs of its clients with excellence.”

Mr Braithwaite thanked the company’s partners, employees and clients. “In a business like ours, where trust must be earned and credibility built over time, your support — your confidence — has made all the difference,” he said.

“Yes, there have been bumps along the road, but in the 15 years there’s a sense of satisfaction.. that the people who have invested with us, the people who have shown their trust in us, we’ve grown with them.

“And, today, there’s a sense of satisfaction that we have not disappointed. We have made some mistakes along the way, but generally the investment, the confidence that was placed in Leno has been manifested

in our success and their success.”

Cleora Farquharson, Leno’s vice-president of business development and client relations, added: “It’s a testament to young Bahamian entrepreneurship and what we could do, not just on the domestic level but on an international level.

“This 15 years is a culmination of all that dedication and hard work that was a distant dream 15 years previously — and now it’s a reality. This edifice is a testament to vision, to those hard years of working. It’s a beautiful building. It’s stateof-the-art and I’m very, very proud to be a part of this.”

Khrystle RutherfordFerguson, a Leno director, added: “Leno has come a long way. I’m just so happy to be a part of this venture and to lend my expertise in any way possible, because I really believe in the vision that Sean has set for Leno.

“I think customer service separates Leno from its competitors. Not only customer service but vision. Vision is very big. The good book says that without vision, the people perish. And it is very much true, because we see it all around. We see it on every level of this building. Not only is there the vision but the customer service and the staff. They’re friendly and they’re knowledgeable.

“I really believe in the product that Leno has here and that it delivers on a daily basis. In fact, I have investments here and my husband has investments here, too. I am not just on the Board to say that I’m a part of this, but we also put our funds here because we believe in this vision. And we know that it will continue to succeed and grow leaps and bounds. I’m very much looking forward to the next 15 years and beyond.”

Andre White, Leno’s chief operating officer, said: “From the time that we started 15 years ago, we’ve had a very hands-on approach to dealing with our customers. From the smallest customer in their college savings plan or individual retirement accounts to our private wealth clients , every single one of them is important to us. We’ve grown from being an aspiring company to one that’s now at the pinnacle of its success, and we just see the growth continuing from this point on.”

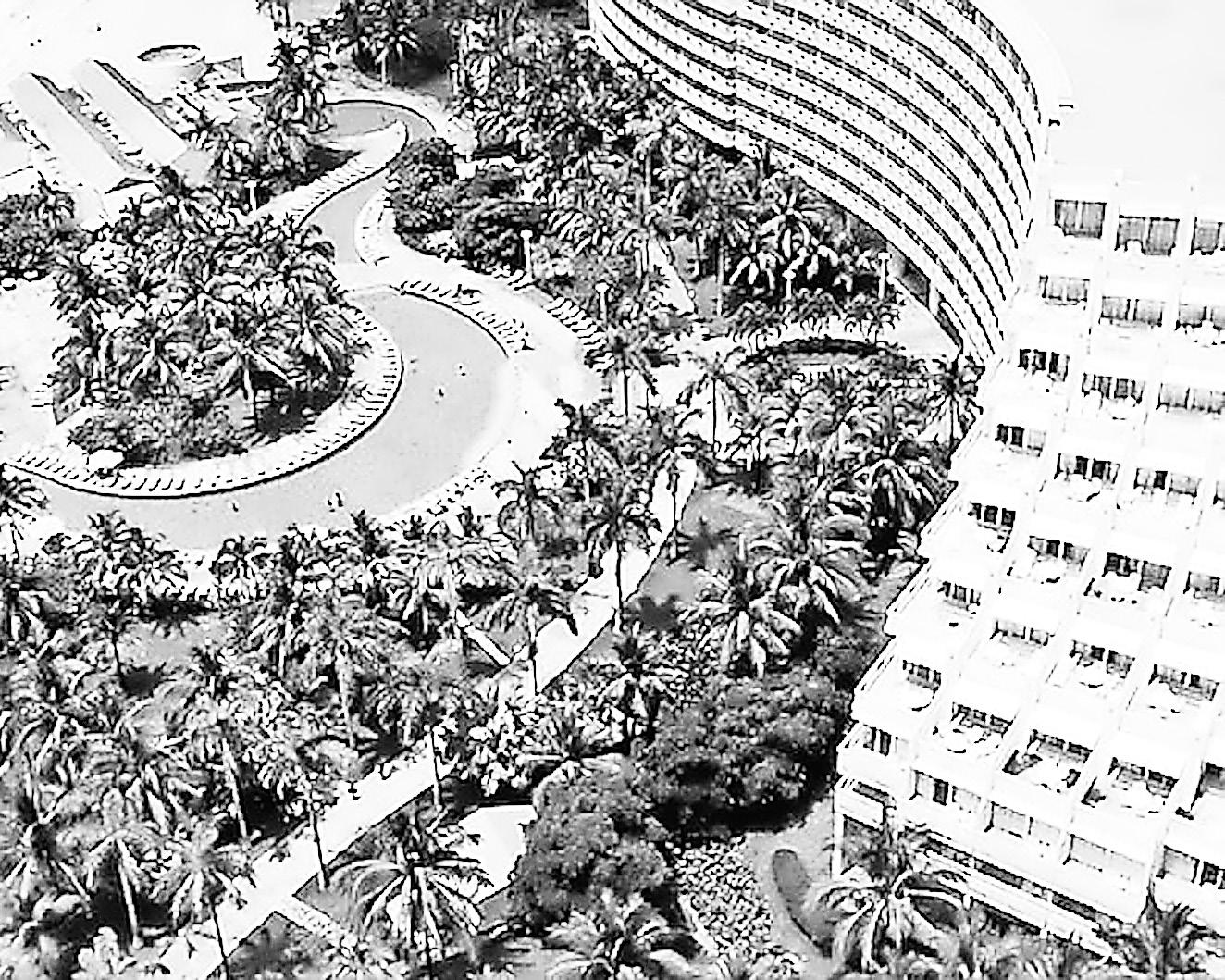

Thompson: Have we been given the $120m for Grand Lucayan?

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE government has been accused of not being “forthcoming” with information about the status or the $120m Grand Lucayan sale by the Opposition’s financial spokesman, Kwasi Thompson.

Speaking in Parliament yesterday, Mr Thompson asked for an update on the sale of the Grand Lucayan resort and its surrounding property to Ancient Waters Bahamas Limited, a Bahamian subsidiary of US-based Concord Wilshire Capital (CWC).

Mr Thompson said the resort is no longer taking reservations - indicating a closure is eminent - but the government still has not disclosed whether the funds for the sale have been secured.

GB

“The Grand Lucayan, as we have been informed, is no longer taking reservations. They are, in essence, proceeding to close. They are no longer taking reservations to when it comes to their ballroom and how they do business. So we need to understand what is the plan with respect to the Grand Lucayan,” said Mr Thompson.

“An announcement was made about $120m. We on the side the Leader of the Opposition, raised questions as to was an agreement for sale signed, was a conveyance signed, was the $120m in the bank? Was that transferred over to the government? We do not see any information, and the government has not been forthcoming with the information as to what is happening.”

He said employees have still not been notified whether their employment

businesses urge more clarity by utility

RELIABLE - from page B3

that is unexpected. But it definitely was an inconvenience. And then, of course I had appliances that just stopped working like the fan because of the surge, where they cut back on and things that I had plugged in.

“Most of the power outages was island-wide so it wasn’t just in this area, it was like all over. Luckily in that instance, the clients were pretty understanding, so it didn’t affect whether they were coming back or not. But I did think it was important for me to get a generator, which puts me in expense.”

Ms Knowles is currently using a borrowed generator until she is able to purchase one of her own.

However, she is concerned that the extra expense may trickle down to her customers. Noting that the cost of living is high, she said she will strive to keep her prices as is, despite the added expense of purchasing and maintaining a generator. While Mr Nabb believes that GB Power will resolve the generation issues, he said they can benefit from more transparency.

“Let’s just be honest with the people,” Mr Nabb added. “I mean, fine, you might have had a lightning strike, but I don’t think that accounted for everything. And like I said, when you talk to people in Grand Bahama who are in the know, they know it’s more than just that- so just transparency. Be real.

GRAND LUCAYAN

will be transferred or dismissed and noted that there is currently no demolition work being done at the site.

“The government also had spoken about demolition. One can look at the site now and there is no indication whatsoever of

“People want to know, honestly, what’s going on. And I would also say that I don’t have their bottom line or their books. I don’t know what profits they are making, but I would hope the Grand Bahama Power would start doing some reinvestment so they don’t have this problem in the future. Some of the money is some of the money you’re earning from this community plow back into your infrastructure so that you’re able to provide better services. Because should the day come when Grand Bahama starts to expand again and starts to do well again and we start to see the population start to increase again Grand Bahama Power is going to be dependent upon to provide power for a growing community. You can’t do that if you having problems generating power for the community you have now.”

Ms Knowles agreed adding if GB Power were to ever be in competition with another power company, transparency and integrity would likely help them retain customers. She

demolition being planned to occur,” said Mr Thompson.

“The employees have not been informed as to what is the status of their employment when they are going to be transferred over, or if they are going to be transferred over, when they’re

also noted that she is concerned about a potential hike in power bills due to the repairs GB Power must tackle.

“I know that with those power surges and being so unexpected, a lot of appliances and stuff went down,”

going to be severed, what is the severance pay going to be? All of that speaks to the government, lack of providing transparent information in their dealings.”

Long Island MP Adrian Gibson also questioned the government about how infrastructural work in his constituency announced by the Davis administration will be funded.

Mr Gibson said the 2025/2026 budget did not allocate funds for the $20m roadworks in Long Island or the Deadman’s Cay airport runway expansion and questioned how funding would be sourced.

“We are waiting for the roadways to start in Long Island, we heard about all this $20m worth of road works. We’re going to see asphalt being put down on the road. We’re going to see the old roads being ripped up. And frankly, I’m still wondering where the

Ms Knowles said. “That’s a lot of money out. And on the end of the day, even though they pay it out, I think ultimately the community is charged in the end. So my concern is how it’s going to affect the prices of our power in the future.

funding is coming from for these roads. I didn’t see it in the budget. There was no funds allocated for these roadways in the budget,” said Mr Gibson.

“How is this airport being funded? Again, this is not in the budget. There’s no allocation whatsoever in the budget for the runway or any other aspect of the airport. We continue to await word as to how the proposed airport works in Long Island is going to be funded, because I don’t see anywhere in the national budget.”

Last month, the government signed a $20m contract with Rowdy Boys for the reconstruction of 18 miles of roads and the modernization of the island’s water system. The first official site meeting for the Deadman’s Cay airport $19.8m project runway expansion project was held last week.

So they may be able to get it fixed, but my concern is, how is that going to affect us futuristically, and their additional costs? I wouldn’t want after they fix it, and then they charge me a $500 or $800 bill, and my bill, normally $300.”

Opposition: ‘Serious doubt’ over $75m Budget surplus

ADJUSTMENT - from page B1

“According to the latest preliminary financial data, April 2025 is consistent with this trend, accounting for approximately 13 percent of total revenue over the ten-month period. The preliminary financial data shows revenue specifically for the month of April 2025 at $352.7m. The strong revenue performance in April suggests that fourth quarter revenue performance will be very strong.”

The revenue numbers were close to those detailed in the Ministry of Finance’s April 2025 report. However, Mr Davis was some way off the mark with his surplus/ deficit projection, which measures by how much the Government’s revenue income either exceeds or is less than its total spending for a particular period.

“Earlier in this communication I mentioned the fiscal performance for April 2025. With the strong revenue performance, preliminary data shows April 2025 at a surplus position of $135.4m. So again, Madam Speaker, it is due to this second half performance that we feel confident in reaching a deficit within our target range of 0.3 to 0.7 percent of GDP.”

That, based on the Ministry of Finance’s release, was

rather optimistic as - rather than a surplus - total spending for April exceeded revenue income by a modest $2.1m to produce a deficit. While it has to be recognised that one month does not make a fiscal year, and that deficits have been brought down from their $1bn-plus peak during the COVID-19 pandemic, the April 2025 outcome raises several issues. This year’s performance, in contrasting sharply with April 2024’s $36.2m Budget surplus, leaves the Government’s fiscal deficit for the first ten months of the 20242025 fiscal year at $168.8m - a sum almost $100m more, or equal to 141.8 percent, of the full-year target set at $69.8m.

And the two remaining months in the fiscal year - May and June - are traditionally when the Government has run high deficits due to the fact that the Ministry of Finance is presented with bills and IOUs which it often knows nothing about by ministries, departments and agencies eager to clear liabilities before the fiscal year-end.

Given this history, the Davis administration is unlikely to make up significant ground and get closer to the full-year target. It did, though, manage to contain the combined May and June 2024 deficit to just $9.8m, although many

observers suspect this was achieved by kicking multimillion dollar payables owed to vendors into the new fiscal year - something it can do under its cashbased accounting system.

Still, a repeat of this in 2025 would place the full-year deficit at around $178.6m and represent a small improvement on 20232024’s $194m. However, such an outcome trigger a number of consequences, including the possibility that this current fiscal year’s forecast Budget surplus could be endangered if significant receivables have been pushed into it.

One source, speaking on condition of anonymity, asserted that if the $168.8m ten-month deficit persists for a full year it will trigger fiscal responsibility clauses within the Public Financial Management Act that require the Government to come to Parliament with a corrective plan if they miss the deficit target by a sum greater than 0.5 percent of gross domestic product (GDP).

Based on the Government’s own 20252-296 Budget numbers, 0.5 percent of GDP is equivalent to $87.25m. So a full-year deficit higher than $157.05m would, in theory, trigger that corrective action plan clause. “They are way off from where they projected

Regulator must approve auto dealer’s liquidation

of the company’s books between 2019 and 2023.

The review took place from August 2023 through October 2023 and “confirmed that Auto H & L had charged interest in contravention of the Rate of Interest Act”. Further meetings between the Securities Commission, headed by Christina Rolle, and the dealer took place on January 17, 2024, and May 6, 2024, to discuss the “breaches” and issue a public notice to inform Auto H & L clients of what happened. This was deemed necessary because of the client files lost in the purported dump truck accident. The financial services regulator, in a May 7, 2024, letter “imposed penalties” for the violations and “directed Auto H & L to repay its clients the interest charged in excess of the lawful rate. The process, which commenced in or around October 2024 under the

to be,” the source said of the Government.

“If they are off by more than 0.5 percent it’s supposed to trigger the fiscal readjustment plan. The projected surplus number is already looking shaky ad if they kick more of the payables into this year that will make it almost impossible. Their Budget targets are almost completely out of the window. If the Prime Minister said consistently they are going to meet that target, what is the Ministry of Finance saying now?

“How could the Prime Minister have been so off? It’s one thing to be projecting a $100m surplus and only achieve $80m... That’s a massive, massive deviation and one they should have really explained. You just don’t put that out there with no explanation. The creditors and credit rating agencies will be looking at that and being off by such an amount for a given month.”

Mr Thompson, meanwhile, added: “The Prime Minister must provide a satisfactory explanation for the glaring $137m discrepancy in the Government’s April fiscal reporting. The Prime Minister’s annual Budget communication is the Government’s most important financial statement to the Bahamian people. As such, its figures must be accurate, consistent and credible.

“In his Budget communication, the Prime Minister said the following: ‘With the strong revenue performance, preliminary data shows April 2025 at a surplus position

supervision of Baker Tilly Gomez, remains ongoing”.

The settlement agreement reveals that the Securities Commission and Auto H & L reached a February 21, 2025, agreement that the vehicle dealer would make “a payment of $200,000 in full and final settlement of the penalties imposed” for breaching the Rate of Interest Act and related laws. For the purposes of the settlement only, the Securities Commission has agreed to Auto H & L “neither admitting nor denying breaches, allegations and/ or liability”. However, the regulator will be free to start administrative or

of $135.4m’. It is deeply concerning that the Prime Minister announced a projected $135m surplus for April 2025, only for official fiscal data to later reflect a $2m deficit for that same month.

“This is not a small difference. It is a major gap that demands a clear and transparent explanation. This is not a minor clerical oversight. It raises serious questions on the integrity of the projections presented to the public by the Prime Minister,” Mr Thompson added.

“Bahamians are right to be concerned. If a $135m surplus can vanish in just one month, it casts serious doubt on the reliability of the Government’s claim of a $75m surplus going forward. What this situation highlights is the urgent need for stronger financial governance and greater accountability. The Bahamian people deserve better - better math, better accounting and better management of public finances.”

The Ministry of Finance, in its statement, made no mention of the difference between the Prime Minister’s Budget projection and the April outcome as shown by its own data. It merely referred to a “moderate overall deficit” for the month, and said: “During the review month, revenue receipts totaled $347.4m, a 3.9 percent decrease from the prior year, with the tax component declining by $15.2m to $325.8m.

“This outcome was primarily driven by timing

court proceedings should the vehicle dealer breach any aspect of the settlement agreement. And Auto H & L “shall restore to its clients, both current and former, sums due and owing to them arising from excess interest charged for the periods 2019 to 2023”. It also has to seek the Securities Commission’s “prior approval” should it choose to wind-up or liquidate its business.

The Rate of Interest Act regulates the interest that can be charged on loans, stipulating that this must not exceed 20 percent per annum on credit of more than $100 or 30 percent on sums below $100. While

differences in the receipt of Business Licence fees compared to the prior year. Key gains were registered for VAT collections ($8.6m) and gaming tax receipts ($6.5m). Non-tax revenue edged higher by $0.9m to $21.5m, almost entirely derived from the sale of goods and services ($21m).” April 2025, though, should have enjoyed a significant advantage on the revenue front given that Easter fell during the month whereas it arrived in March the year before. Thus peak tourism activity from the Easter weekend should have been captured in April this year, helping to boost tax and other revenue collections, but instead the Government’s income was down by almost 4 percent.

“Aggregate expenditure settled at $349.5m, with the recurrent and capital components at $330m and $19.6m, respectively,” the Ministry of Finance added of April spending. “The year-over-year $25.4m gain was largely associated with higher outlays for the use of goods and services ($20m), transfers ($7.5m) and subsidies ($7.3m).

“Capital expenditure declined by $3.1m due to lower spending on transfers and acquisition of nonfinancial assets. As a result of the above movements, the Government’s overall fiscal position for April 2025 recorded an estimated deficit of $2.1m. Financing activities for the month featured an estimated increase in the outstanding debt stock by $6.7m.”

the Securities Commission’s release then did not specifically say so, the fact Auto H&L was “in breach” seems to imply it was charging interest in excess of those percentages.

The auto dealer, which was based on Tonique Williams Highway, had “asserted that these miscalculations were inadvertent” and has pledged to “fully reimburse” all impacted Bahamians for the period between 2019 and 2023.

“It’s just under 2,000 people and close to $1m in interest adjustments. Not $1m, but close to $1m,” one well-placed source said previously of the sums and clients involved.

Tribune Business understands that Baker Tilly Gomez had to reconstruct some of Auto H&L’s via electronic means after the truck accident. The loan amounts were relatively small, representing credit issued for the purchase of autos and other consumer items to lower and middle income Bahamians.

Borrowers were given until August 30, 2024, to supply proof of their identity, their loan and its terms/ rate, and payments made on it to Mr Gomez and Baker Tilly Gomez. In return for being compensated, impacted borrowers have to sign a ‘Deed of Release’ whereby they surrender the right to take future legal action over this matter against Auto H&L.

Bill’s ‘not perfect but we support it’

AMEND - from page B1

Some of these will now be incorporated into the SHB, which is set to include primary care; early detection and preventative care; diagnostic imaging; and paediatric care.

Other SHB benefits involve “maternity care by a general practitioner, or by an obstetrician and/ or gynaecologist” and “screening programmes for cancer and other specified conditions”. Mr Bosland yesterday explained that NHI’s pricing structure is markedly different from how private health insurers determine their fees and benefits packages.

While private insurers seek to share the risk with clients through the likes of co-payments and deductibles, NHI mandates that no costs are incurred by patients at “the point of service” when they see a doctor. As a result, underwriters who agree to become “approved insurers” will have to cover 100 percent of the SHB costs

rather than the insured part-pay these. But, while this would normally increase health insurance costs and premiums paid by clients, Mr Bosland told Tribune Business the private sector is optimistic any major hikes will be avoided thanks to the use of NHI’s provider network and the “fairly decent costs” agreed by the Government-funded scheme and the doctors who care for its patients.

Revealing that insurers would “have liked a little more time” to provide feedback on the NHI Bill, he added that consultation was nevertheless adequate because the industry had seen - and commented on - a 2022 version of the legislation that is not dissimilar to the current model.

“It’s been kicked around for a bit and now it’s back,” Mr Bosland acknowledged, noting that the SHB is chiefly focused on primary care and laboratory services. “In broad strokes we largely support the initiative,” he added of the

insurance industry’s position. “It does, though, mean a fair degree of change for insurance companies and our health insurance clients.

“It will mean that the products themselves have to amended to comply with the law. The Government has indicated to us there will be a gap of one-year between the Bill being passed into law and when the requirements and underlying package will be enacted. It gives the insurance companies time to adjust their products, their systems and continued education of the public.

“Plus it gives enough time for the Government to do the remainder of the work.... There’s some additional legislative work that has to happen to give effect to the requirements of the Bill. It’s not going to affect anybody immediately.” Mr Bosland said this additional work involved drafting the regulations that typically give laws enforcement teeth.

Revealing that the BIA and its members are largely in favour of the NHI reforms, he added: “I do think the changes make sense for The Bahamas and the one-year gap gives sufficient time to adjust. In broad strokes, the

Order paves the way for new fuel hedging

BPL’s fuel charge had risen by at least 70 percent from the fuel-hedged 10 cents per kilowatt hour (KWh) that the Davis administration inherited when it took office in September 2021.

“When they took office, the fuel charge was around 10 cents,” Ms Barnett-Ellis blasted. “Today, it’s over 17 cents. That means it’s 70 percent more before your usage and VAT. BPL said prices would level-off by early 2024 but it’s now mid2025 and the bills are still rising with no explanation and no relief, so where’s the cheaper electricity we were promised because from where I stand this is not a new day; it’s a never-ending nightmare.”

Tribune Business received its BPL bill, for the JuneJuly period and payable in early August, at 1am yesterday morning based on the e-mail. Following the neardoubling of its previous bill, which was paid earlier this month, the August bill has increased by a further 38.4 percent month-on-month or several hundred dollars.

This is close to the alltime high of August 2023, after BPL increased its fuel charge by 163 percent over an eight-month period to recoup under-recovered fuel costs caused by the failure to continue supporting

the utility’s existing fuel hedge. The bill is also akin to a second mortgage.

Other contacts spoken to by this newspaper reported similar increases, with one source revealing their latest bill was even higher than August 2023. “Somebody told me people are already complaining about their bills on social media,” they said, speaking on condition of anonymity. “My bill is the highest it’s been since 2019.

“This bill is ridiculous. It’s a high, high bill. Unbelievable. This bill is even worse. It’s 30 percent higher this month than it was last month, and last month was ridiculous. It’s crazy. It’s really unbelievable.”

Another source added:

“We just got our bill and it’s 25 percent higher come to think about it. The fuel charge seems to be pretty elevated. There’s something really fishy going on there.”

BPL has previously blamed the sudden summer 2025 bill hikes on increased energy consumption and the hot weather. It added that increased load demand has forced it to rely more

insurance industry and the BIA itself support the legislation. It’s not perfect but we support it. Everything will likely change a lot.”

With the SHB providing the “minimum” care and benefits package for NHI enrollees, private Bahamian health insurers will now restructure their own policies and premium pricing accordingly in reaction to its introduction.

“Most insurance companies, their products are fairly comprehensive,” Mr Bosland explained. “For most providers, it’s not things that will be added but the structure of benefits will change quite a bit. NHI requires no fee at the point of service. The way private insurance companies largely operate is through co-payments and deductibles, where they and the insureds share the cost.

“Effectively, under NHI, insurance companies will pay 100 percent of the underlying costs. The Government will effectively be mandating us to offer NHI-style pricing as part of our private health insurance products that we sell to our clients. Normally, that would increase costs and require premium costs to go up.

“But because we will be using the NHI network, and they’ve agreed fairly decent costs with the medical providers, we don’t expect there to be any material increase in costs at this point in time. That’s not a guarantee because the devil is in the detail.” That “devil” could potentially be contained in the regulations accompanying the Bill but these have yet to be released.

Asked whether there had been sufficient consultation with the Government, Mr Bosland replied: “It seems like a good initiative. We think it’s a step forward. You can always complain, but we did have sight of this Bill a few months ago. We were able to provide them with very detailed feedback.

“Because this affects insurance companies we wanted time to review it.

We did not get as much time as we would have liked, but did have the benefit of seeing the previous iteration of this Bill, which was substantially similar to the current one. The review was fairly easy and, all things being equal, we are comfortable the insurance industry was able to do an adequate review.

“The Government took our comments into consideration, looked at every single one, gave feedback on and responded to everyone, and they did adjust the Bill in respect of some comments made; not all. The process was not ideal; we’d have liked more time, but because we had reviewed and commented on the previous iteration we think the consultation process was adequate.”

Under the new NHI Bill, beneficiaries will be able to “select a standard health benefit provider” from those approved by the NHI Authority. An “approved insurer”, who will offer the SHB package, must demonstrate “financial stability”; its compliance with the Insurance Act; and “ability” to provide the required benefits.

Such an insurer will be charged with providing “the standard health benefits to every insured person enrolled in [NHI] and covered by an agreement with the Authority”. They will also be mandated to inform the NHI regulator if a plan beneficiary’s “private sickness and health insurance is lapsed [and/or] cancelled and encourage them to enroll in the Governmentrun scheme.

on rental generation units that operate on automotive diesel oil (ADO) - the most expensive of the fuels that BPL uses.

And, while Ms BarnettEllis is correct that BPL’s current fuel charge is 17.4 cents per kilowatt hour for consumption that is less than 800 KWh, it is actually 21.4 cents per KWH for the bill portion above 800 KWh. The latter rate would thus represent a doubling, or around 100 percent increase, from the hedged fuel charge of September 2021.

Following last month’s BPL bill outcry, the Government introduced a taxpayer-funded Summer Energy Rebate to lower BPL’s fuel charge by 1.1 cents per KWh for both portions of the bill - under and over 800 KWh.

The fuel charge below 800 KWh was to be lowered from the 18.5 cents

that appeared in Bahamians’ July bills to 17.4 cents, representing a 6 percent discount, while for over 800 KWh it was to be lowered from 22.5 cents to 21.4 cents. While that has been done, it appears to have made little difference for many customers given their increased energy consumption.

The move came after social media lit up in outrage as consumers received their bills due for payment in July. Almost all questioned the sharp month-over-month increases, with posts seen by Tribune Business showing all-in cost increases ranging from 38.6 percent to almost tripling via a 199 percent jump.

Higher BP bills represent a drain on the economy by inflicting higher expenses on Bahamian businesses and households, reducing investment and hiring dollars while also impacting families’ disposable incomes and consumer demand.

The latest bills emerged just as the Government yesterday tabled in the House of Assembly an Order

that appears to both give legal effect to BPL’s new base tariff rates that were unveiled in summer 2024 and pave the way to reinstate the fuel hedging that was previously abandoned.

The Electricity (Tariff Rate for Electricity Services) Order 2025 implements the base tariffs set out in BPL’s Equity Rate Adjustment, including the 14.9 percent increase for the first 900,000 KWh consumed by the utility’s largest customers - the likes of hotels and food stores.

This tariff is being increased from 8.7 cents per KWh to 10 cents, while the rate for “all remaining units” is to jump by 45.2 percent - from 6.2 cents per KWh to 9 cents. All other BPL customer classes, including households and commercial, as well as temporary supply, will see their base rates either decrease or remain constant.

The Order also specifies how BPL’s fuel charge is to be calculated, and the items to be included in these sums, such as “upper cylinder lube oil”; fuel additives required by generation engine manufacturers;

foreign exchange and bank fees incurred with fuel purchases; and “relevant and reasonably incurred” expenses associated with purchasing power from renewable and other independent power producers. Also eligible to be included in the BPL fuel charge are “costs and fees” associated with fuel hedging. The Order also paves the way to segment BPL’s customer base and levy different fuel charges linked to what is termed “equitable distribution”, as well as hold the fuel charge “constant for a period of 12 months in order to provide price stability to the consumer”.

The latter can only be done as part of a fuel hedging strategy, and the Order also provided for the creation of an “over and under recovery account” to monitor any fuel hedging, compare this to global spot market prices and what is charged to BPL customers, and make any adjustments as necessary.

Union moving to new umbrella body

SWITCH - from page B1

KC’s umbrella union, the TUC.

“Because of our business, we’re in the ground transportation, on any given day, on any given site where taxi drivers congregate, be it at the port, especially at the airport and at the different hotel properties, we are finding that a lot of our members are being harassed,” Mr Butler said. “They’re being denied their rightful space on these properties and the biggest challenge that we have right now is that the government has allowed a franchise called livery franchise to operate in a space that is usually reserved for taxi drivers.

“The law does not provide for a livery franchise to be operating in the same space as a taxi driver. And so the government has been enabling these livery franchise to go out there and operate and basically become a competitor to the taxi industry, and that itself, we’ve been struggling with the government long before I became the president.

This union has been grappling with the government to try and eliminate that, but it seems as if what this government has done is they upped the ante, so to speak, because they’ve now issued more livery plates.”

Mr Butler at a press conference at Mr Ferguson’s office yesterday added: “And so I would invite any of you on any given day, come with me at the Nassau International Airport and see for yourself the number of livery drivers that are standing in the taxi space, competing with taxi drivers when, clearly, the law does not allow for that to happen. It can only happen because the government, the Nassau Airport Authority, NAD, they are encouraging this solicitation by livery drivers. And you go to bigger properties like Atlantis, it’s the same thing. Livery drivers are congregating on the property, soliciting, engaging in any number of things with the employees of these properties. So it’s been a challenge for us. We’ve been in conversations with the minister about trying to

fix these issues, and we’ve been making very little progress.”

Mr Butler said the competition between taxi and livery drivers has “substantially” cut into the profits of taxi drives as more taxi franchises have been issued resulting in “a system of about 900 to 1,000 plates, to now 1,700 plus”.

“And then on top of that, the government has introduced an additional three to 400 livery plates,” he added. “So you’re talking a bigger number, but the market and the space that the taxi operate in hasn’t expanded, with the exception of Baha Mar, but that in itself is not enough. And so what we have is this erosion of revenue coming from the taxi drivers going elsewhere.”

While Mr Butler called for the government to have livery franchises “follow the law”, he claimed that livery drivers participate in solicitation and selling a vehicle vs a service.

“It is insulting to a customer for a customer to walk out of the hotel or the airport, and somebody

ask them if they would like a particular type of vehicle. They’re not selling a service. They’re selling a vehicle. They’re asking guests if they would like an SUV or a town car. Those are types of vehicles. Those types of vehicles are offered by the major tour operators, Bahamas Experience, Leisure Tours, Majestic Tours, they are the approved tour operators who offer limousine service. To have an individual with one SUV or one town car soliciting a customer for his vehicle. It is wrong. It is insulting. And any government that encourages that really has no vision for what is good customer service.

“Not only is the government doing it, but it is also encouraged by large properties like Atlantis and Nassau Airport Development company. I can’t in this day and time imagine having spent more than 30 years in hospitality industry, we’ve come to this place where we are allowing people to sell a particular type of vehicle. Customers don’t travel to select vehicles. Customers travel to select service. If you expect car service, you can book through one of the major car companies. That is just the way it is and this government has been reckless, to say the least, in the last couple of years, in the way

Krispy Kreme, GoPro and Beyond Meat surge as the latest meme stock revival rolls on

By DAMIAN J. TROISE AP Business Writer

AS THE stock market pushes into record territory and some companies trade at lofty levels, investors are once again looking for bargains among some of Wall Street's beaten down companies.

The latest so-called meme stocks include doughnut maker Krispy Kreme, camera maker GoPro and plant-based meat maker Beyond Meat. Each company initially surged Wednesday before mostly leveling off, even though overall they have been struggling to notch profits.

The trio stepped in for department store Kohl's and the online-based real estate company Opendoor Technologies, which fell sharply Wednesday after surging over a number of days. It's a sign of how quickly the hot meme stocks can fall out of favor.

"While this activity reflects rising risk appetite, it remains isolated and has

yet to challenge the broader market's calm and steady tone," said Mark Hackett, chief market strategist at Nationwide. Wall Street defines a meme stock as a stock that gains significant popularity

and trading volume, primarily driven by social media hype and online communities, rather than the company's fundamental financial performance. Think GameStop and

they’ve allowed the indus-

try to run. And we believe that now, with the Congress here, Mr Ferguson, we believe we’re going to be able to make some headway in that regard.”

While The Bahamas Taxi Cab Union once shared a “relationship” with the TUC, Mr Butler added that eventually both his union and the Livery Drivers Association came to be represented by The Bahamas National Alliance Trade Union Congress. Noting that it wasn’t a comfortable position for his his members, his belief is that their “interest is best served by becoming aligned with the Trade Union Congress”.

“To have two organisations competing against each other in the workspace, but represented by the same president in one Congress, that that just wasn’t something that we felt was in our best interest,” Mr Butler said. “So it was a conflict of interest. We are fighting livery drivers every day, and then we have to sit with them in a Congress meeting headed by Miss Belinda Wilson. That was something that we expressed our disappointment, and we thought that, that could not work. She made an attempt to try to get us to work together, but I don’t see how that would have benefit the Bahamas

price, that could prompt the people betting against the stock to buy more shares to cushion their own losses.

While this activity reflects rising risk appetite, it remains isolated and has yet to challenge the broader market's calm and steady tone.

Sugar rush Krispy Kreme initially surged early Wednesday but finished just 4.6% higher, adding to its 26.7% gain a day earlier. The company has seen several years of falling profits and revenue. Wall Street expects it to post a loss for 2025. During its last earnings update, the company pulled its financial forecast for the year as it reassesses its partnership with McDonald's.

Blackberry in 2021, and a few subsequent instances. Often, meme stocks are initially the target of "short sellers," or investors betting against the stock. If other investors start buying the shares and boost the

Shaky frame GoPro jumped 12.4% on Wednesday to follow its 41% gain on Tuesday. The company last posted an annual profit in 2022 and revenue has been sliding for several years as it faces more competition in a market for smartphone cameras that it once dominated. Wall Street is forecasting that the company will eke out a slight profit in 2025.

Taxi Cab Union, because how do you represent one person on this hand, it just made no sense to me.”

Mr Ferguson added that taxi drivers “ain’t getting the deal” and they will play a significant role. Addressing Mr Butler, Mr Ferguson added: “We will sit down, put a plan together, and we will carry out the plan, not against the political party.

“Mr president, you in charge with your officers,” Mr Ferguson added. “You just let us agree on when you want us to do what you want us to do. We will sit down, put a plan together, and we will carry out the plan, not against the political party. That ain’t what we’re doing. We are interested in the workers. If you treat the workers good, we have no problem with you.

“I’m so glad you’re here, because I know we can do something. I can assure you of that. We’re going to do something that is going to be dramatic, and it’s going to be effective. We ain’t got to fight nobody. We know who we are. We know the law too. So we’re going to stand with you. This is a very important day for you and your body, and when you’re ready, you just call me and you and me meet with your officers, with my offices, and we’ll sit down and we work the deal out.”

"Beefy" gains

Beyond Meat initially jumped Wednesday, but closed just 1.4% higher and is now up more than 20% for the week. The company has been struggling for years and has yet to notch an annual profit since going public in in 2019. The company warned in its latest earnings update that it is "experiencing an elevated level of uncertainty" and it pulled its financial forecasts for 2025.

Losing momentum Investors who buy now are betting that the momentum will continue, but it can shift suddenly.

Kohl's, which operates 1,600 stores across the country, reversed course Wednesday and slipped about 14.2% following gains a day earlier. It is still up 28.4% this week. It is wrestling with a number of challenges including a revolving door of CEOs and weak sales.

Opendoor Technologies shares also faded, falling 20.5% to give back nearly all of this week's gains. The stock nearly tripled last week. The stock's recent gains came as hedge fund manager Eric Jackson touted the stock on X.

US AUTOMAKERS SAY TRUMP’S 15% TARIFF DEAL WITH JAPAN PUTS THEM AT A DISADVANTAGE

By JOSH BOAK and ALEXA ST. JOHN Associated Press

U.S. automakers worry that President Donald Trump's agreement to tariff Japanese vehicles at 15% would put them at a competitive disadvantage, saying they will face steeper import taxes on steel, aluminum and parts than their competitors.

"We need to review all the details of the agreement, but this is a deal that will charge lower tariffs on Japanese autos with no U.S. content," said Matt Blunt, president of the American Automotive Policy Council, which represents the Big 3 American automakers, General Motors, Ford and Jeep-maker Stellantis.

Blunt said in an interview the U.S. companies and workers "definitely are at a disadvantage" because they face a 50% tariff on steel and aluminum and a 25% tariff on parts and finished vehicles, with some exceptions for products covered under the United StatesMexico-Canada Agreement that went into effect in 2020.

The domestic automaker reaction reveals the challenge of enforcing policies across the world economy,

showing that for all of Trump's promises there can be genuine tradeoffs from policy choices that risk serious blowback in politically important states such as Michigan and Wisconsin, where automaking is both a source of income and of identity.

Trump portrayed the trade framework as a major win after announcing it on Tuesday, saying it would add hundreds of thousands of jobs to the U.S. economy and open the Japanese economy in ways that could close a persistent trade imbalance. The agreement includes a 15% tariff that replaces the 25% import tax the Republican president had threatened to charge starting on Aug. 1. Japan would also put together $550 billion to invest in U.S. projects at the "direction" of the president, the White House said.

The framework with Japan will remove regulations that prevent American vehicles from being sold in that country, the White House has said, adding that it would be possible for vehicles built in Detroit to be shipped directly to Japan and ready to be sold.

But Blunt said that foreign auto producers, including the U.S., Europe

and South Korea, have just a 6% share in Japan, raising skepticism that simply having the open market that the Trump administration says will exist in that country will be sufficient.

"Tough nut to crack, and I'd be very surprised if we see any meaningful market penetration in Japan," Blunt said.

Asked at Wednesday's briefing about whether Trump's sectoral tariffs such as those on autos were now subject to possible change, White House press secretary Karoline Leavitt said that the issue had been going through the Commerce Department.

The framework with Japan was also an indication that some nations simply saw it as preferential to have a set tariff rate rather than be whipsawed by Trump's changes on import taxes since April.

But for the moment, both Japan and the United Kingdom with its quotas on auto exports might enjoy a competitive edge in the U.S.

"With this agreement in place it provides Japan with a near-term operating cost advantage compared to other foreign automakers, and even some domestic U.S. product that uses a high degree of both

Meta launches new teen safety features, removes 635,000 accounts that sexualize children

By BARBARA ORTUTAY AP Technology Writer

INSTAGRAM parent

company Meta has introduced new safety features aimed at protecting teens who use its platforms, including information about accounts that message them and an option to block and report accounts with one tap.

The company also announced Wednesday that it has removed thousands of accounts that were leaving sexualized comments or requesting sexual images from adult-run accounts of kids under 13. Of these, 135,000 were commenting and another 500,000 were linked to accounts that "interacted inappropriately," Meta said in a blog post.

The heightened measures arrive as social media companies face increased scrutiny over how their platform affects the mental

health and well-being of younger users. This includes protecting children from predatory adults and scammers who ask — then extort— them for nude images.

Meta said teen users blocked more than a million accounts and reported another million after seeing a "safety notice" that reminds people to "be cautious in private messages and to block and report anything that makes them uncomfortable."

Earlier this year, Meta began to test the use of artificial intelligence to determine if kids are lying about their ages on Instagram, which is technically only allowed for those over 13. If it is determined that a user is misrepresenting their age, the account will automatically become a teen account, which has more restrictions than an adult account. Teen accounts are private by default. Private

foreign production and parts content," said Karl Brauer, executive analyst at iSeeCars. "It will be interesting to see if this is the first domino to fall in a series of foreign countries that decide long-term stability is more important that short term disputes over specific tariff rates."

Autos Drive America, an organization that represents major Japanese companies Toyota, Honda and Nissan and other international automakers, said in a statement that it is "encouraged" by the announced trade framework and noted its members have exceeded domestic automaker production for the past two years.

The statement urged "the Trump administration

to swiftly reach similar agreements with other allies and partners, especially the European Union, South Korea, Canada and Mexico."

The Japanese framework could give automakers and other countries grounds for pushing for changes in the Trump administration's tariffs regime. The president has previously said that he values flexibility in negotiating import taxes. The USMCA is up for review next year.

Ford, GM and Stellantis do "have every right to be upset," said Sam Fiorani, vice president at consultancy AutoForecast Solutions. But "Honda, Toyota, and Nissan still import vehicles from Mexico and Canada, where

the current levels of tariffs can be higher than those applied to Japanese imports. Most of the high-volume models from Japanese brands are already produced in North America."

Fiorani noted that among the few exceptions are the Toyota 4Runner, the Mazda CX-5 and the Subaru Forester, but most of the other imports fill niches that are too small to warrant production in the U.S.

"There will be negotiations between the U.S. and Canada and Mexico, and it will probably result in tariffs no higher than 15%," Fiorani added, "but nobody seems to be in a hurry to negotiate around the last Trump administration's free trade agreement."

messages are restricted so teens can only receive them from people they follow or are already connected to. In 2024, the company made teen accounts private by default.

Meta faces lawsuits from dozens of U.S. states that accuse it of harming young people and contributing to the youth mental health crisis by knowingly and deliberately designing features on Instagram and Facebook that addict children to its platforms.

Trump administration canceled a $4.9B loan guarantee for a line to deliver green power

By JOHN HANNA Associated Press

THE Trump administration on Wednesday canceled a $4.9 billion federal loan guarantee for a new high-voltage transmission line for delivering solar and wind-generated electricity from the Midwest to the eastern U.S.

The U.S. Department of Energy declared that it is "not critical for the federal government to have a role" in the first phase of Chicago-based Invenergy's planned Grain Belt Express. The department also questioned whether the $11 billion project could meet the financial conditions required for a loan guarantee.

President Donald Trump has repeatedly derided wind and solar energy as "unreliable" and opposed efforts to combat climate change by moving away from fossil

fuels. The Department of Energy also said Wednesday that the conditional commitment to Invenergy in November was among billions of dollars' worth of commitments "rushed out the doors" by former President Joe Biden's

administration after Biden lost the election.

"To ensure more responsible stewardship of taxpayer resources, DOE has terminated its conditional commitment," the agency said in a statement. It wasn't immediately clear how much the

department's action would delay or stop the start of construction, which was set to begin next year. The company's representatives didn't immediately respond to emails Wednesday seeking comment

The company has said its project would create 4,000

jobs and new efficiencies in delivering power, and that it would save consumers $52 billion over 15 years. The line would deliver electricity from Kansas across Missouri and Illinois and into Indiana, connecting there to the power grid for the eastern U.S. It could deliver up to 5,000 megawatts of electricity.

"When electricity demand and consumer power bills are soaring, it's hard to imagine a more backward move," said Bob Keefe, executive director of E2, a nonpartisan, Washington-based group supporting renewable energy.

Keefe called the Grain Belt Express "one of the country's most important energy projects" and suggested Trump canceled the loan guarantee "just because it will bring cleaner energy to more people."

But two prominent Missouri Republicans, U.S. Sen. Josh Hawley and state Attorney General Andrew Bailey, are vocal critics of the project, describing it as a threat to farmland and land owners' property rights. Bailey called the project a "scam" and a "boondoggle."

Hawley said on July 10 that he had secured a pledge from U.S. Energy

Secretary Chris Wright to cancel the loan guarantee in a conversation with him and Trump.

Critics like Hawley object to the company's ability to use lawsuits against individual land owners along the line's route to compel them to sell their property, which Hawley called "an elitist land grab." Online court records show that the company filed dozens of such lawsuits in Missouri circuit courts in recent years, and the Missouri Farm Bureau's president posted on the social platform X Wednesday that the project threatened to "sacrifice rural America in the name of progress."

Democrats on the U.S. Senate's energy committee suggested on X that Trump, Wright and Hawley "just killed" the project, but Invenergy announced in May that it had awarded $1.7 billion in contracts for work on the project. And Bailey suggested in a statement that the project could still go forward with private funding without the loan guarantee, saying, "If Invenergy still intends to force this project on unwilling landowners, we will continue to fight every step of the way."

FOR HOPE ON CLIMATE CHANGE, FOLLOW THE MONEY, UN CHIEF TELLS AP

By SETH BORENSTEIN AP Science Writer

FOR nearly a decade, United Nations SecretaryGeneral Antonio Guterres has been using science to warn about evermore dangerous climate change in increasingly urgent tones. Now he's enlisting something seemingly more important to the world's powerful: Money. In an exclusive interview with The Associated Press, Guterres hailed the power of market forces in what he repeatedly called "a