FRIDAY,

KC’s alarm over ‘death knell’ for development

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government’s

$137.5m April reversal to a modest deficit “certainly shakes confidence” in the fiscal data it releases, a banker asserted yesterday, but “doesn’t impact The Bahamas’ financial situation”. Gowon Bowe, Fidelity Bank (Bahamas) chief executive, told Tribune Business he would “expect heads to roll” at the Ministry of Finance if the Prime Minister’s initial announcement of a $135.4m April Budget surplus had been caused by “a significant error in calculation” or faulty data that was used to derive that figure.

The Ministry of Finance’s monthly fiscal performance report for April 2025, released on Wednesday, revealed that the rosy surplus figure unveiled by Philip Davis KC was somewhat off the mark as the actual outcome was a modest $2.1m deficit. The

Government yesterday struggled to explain the slide from projected surplus to actual deficit, which occurred in less than two months since the Budget’s unveiling.

The Davis administration yesterday sought to take cover behind the word “preliminary”, which the Prime Minister had used in referring to the forecast $135.4m April surplus when he disclosed it during the 2025-2026 Budget communication. It also blamed the significant difference between that figure and the $2.1m deficit

outcome on “late postings by the Treasury, particularly related to interest expenses on Treasury Bills”, and suggested that it was “normal” for reconciliations between preliminary and final monthly fiscal data to occur.

Latrae Rahming, the Prime Minister’s communications director, said in a statement: “In the 2025-2026 Budget communication, it was made clear that the fiscal data presented for April 2025 was

Ex-Bahamas broker chief hits ‘flawed’ $15.5m fine proposal

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE principal of a former Bahamian broker/dealer has slammed recommendations that he be ordered to pay $15.537m in fines and disgorged profits as “flawed” and “punitive and political”.

Guy Gentile, head of Mintbroker International, which was placed into full liquidation by the Bahamian Supreme Court in December 2021, hit out after Judge Edwin Torres on Monday recommended that he “disgorge” $13.13m in profits/revenues

earned by his former Nassaubased business. The judge found Mr Gentile, a one-time FBI informant whose Elizabeth on Bay plaza-based business was used

Atlantis agrees to 70 voluntary separations

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

ATLANTIS has accepted just one-third, or 70, applications for voluntary redundancy by its middle management staff, the Government’s labour chief has confirmed.

Howard Thompson, the director of labour also voiced no concerns over the Paradise Island’s planned temporary closure of its Coral Towers complex from August 17 - a move that could last for up to eight weeks. He added that no staff redundancies or terminations are planned.

Describing the closure as a “yearly routine exercise”, Mr Thompson said: “My understanding is that this is a yearly routine exercise approaching the slow season. I understand that there will be no termination or downsizing, but that employees will be taking their usual vacation leave during the time.

“My understanding is that both the union and executives at Atlantis have been in constant communication with the company regarding this matter.” Mr Thompson also revealed that 70 managerial employees took voluntary separation

Opposition urges disclosure over $61m ‘short-term loans’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government was yesterday urged to provide full disclosure over almost $61m of “shortterm advances” provided to five unnamed “government business enterprises” during the 2024-2025 third quarter.

Kwasi Thompson, the Opposition’s finance spokesman, argued that the failure to name the entities who received the financing, the nature and terms

of the funding, and what it was used for represented “a startling lack of transparency” after the transactions were unveiled in the Ministry of Finance’s fiscal report for the 2024-2025 third quarter and nine months to end-March 2025. “The Government provided short-term advances totaling $60.8m to five government business enterprises (GBEs),” was as much as the report disclosed. “In financing activities, the balance

by US law enforcement to ensnare securities fraudsters, “jointly and severally liable” to pay the $13.13m because he was in charge of Mintbroker when it was found to have violated US securities laws.

He also recommended that the ex-Mintbroker chief “disgorge” a further $520,000 personally, plus pay a “firsttier” civil penalty worth $1.887m. However, the combined penalties and disgorgment recommended are almost 23 percent, or some $4.6m, less than the $20.151m punishment that had been sought by the US Securities & Exchange Commission (SEC)

over Mr Gentile’s Bahamas activities.

A south Florida jury last year found Mr Gentile and Mintbroker International liable for violating US securities laws by actively soliciting American clients despite not being registered with the SEC. And, Mr Gentile, in an e-mail reply to Tribune Business inquiries, confirmed he will be challenging the penalties and disgorgement recommendations.

Asserting that the “entire case” against him “won’t survive the light of day on appeal”, the Mintbroker

By NEIL HARTNELL and FAY SIMMONS Tribune Business Reporters

AN attorney yesterday warned that permitting the “ad hoc” removal of restrictive covenants will be “the death knell for orderly development in The Bahamas”.

Gail Lockhart Charles KC, who is representing New Providence Development Company and Old Fort Bay Company, told Tribune Business a “complete breakdown of the planning process in The Bahamas” will occur if the Town Planning Committee approves the joint request from five property owners to extinguish the “restrictive covenants” governing the development of their Western Road land parcels.

Speaking after Wednesday night’s public consultation on the application, she argued that the Committee is only empowered by law to extinguish such covenants via the Zoning By-Law process where changes have to be approved by the minister responsible for planning. As a result, it has no powers or authority to grant such requests from individual applicants such as these.

But, should the committee approve the application by Llan-Y-Rafon Investments, Lorishill Ltd, BRAM, New Hope Investments and Michael Symonette, all of whom own parcels of between five to 5.053 acres, Mrs Lockhart-Charles told this newspaper it will set “an exceptionally dangerous precedent for the entire Bahamas”.

She explained that it would pave the way for land and property owners, wherever they are located, to simply apply to the Town Planning Committee to extinguish covenants restricting different forms of development for their real estate regardless of the impact on neighbours or the public interest.

As an example, Mrs Lockhart-Charles said a decision in favour of the five would effectively open the door for residents in all New Providence gated communities to follow suit and seek land use changes that allow them to open a restaurant or commercial venture

Conserving energy amid brutal summer

Bahamian small businesses have, for many years, complained about the high and rising cost of energy. The harsh reality is that the failure of countless numbers of micro, small and medium-sized enterprises (MSMEs) can be directly linked to high energy costs.

This week’s column focuses on practical ways companies can conserve energy during the hot and brutal summer months. Here are a few suggestions for energy conservation and savings:

1. Maximise natural light

* Rearrange workspaces to take advantage of natural light.

* Use light-coloured walls and surfaces to reflect sunlight.

2. Optimise Lighting

* Switch to energy-efficient LED lighting, which uses significantly less energy and emits less heat than traditional bulbs.

* Install motion sensor lights in infrequently used areas.

* Use dimmer switches or task lighting to adjust light levels as needed.

* Turn off lights when leaving a room or at the end of the workday.

* Open blinds and curtains during the day to let in natural light, reducing the need for artificial lighting.

Albany advances Bahamian chefs

THREE chefs from the high-end Albany development recently returned from international training where they achieved new personal milestones and prepared to assume more senior roles.

Albany said chefs Ashtin Pinder, Jeffery Arthur and Ynise Cargill are among a growing number of Bahamian being empowered to lead not only in the kitchen but to eventually assume executive and management roles. Their recent training trips to restaurants in Boston and Lake Nona, Florida, mark a shift in Albany’s culinary culture from imported talent to homegrown leadership.

“I feel happy with it. What they said they were going to do, they’re doing,” said Chef Pinder, who now serves as lead sushi chef at Vespa. “They’re trying, and it’s getting there.”

Chef Pinder began his culinary journey in the back of the house, bussing tables at a local sushi bar. Without formal training, he observed, asked questions and worked his way up, eventually joining Albany five years ago. His recent training at Nami Lake Nona, a Japanese restaurant in Orlando, Florida helped refine not just culinary techniques but his mindset.

“It changed how I view my goals,” he said. “Seeing their inventory systems, the way they manage tools, ingredients and even simple plating, it made me want to bring more of that discipline home.”

Chef Arthur, junior sous chef at Wave, began his culinary training at the College of The Bahamas (now University of The Bahamas), inspired by a chocolate pudding he made in ninth grade.

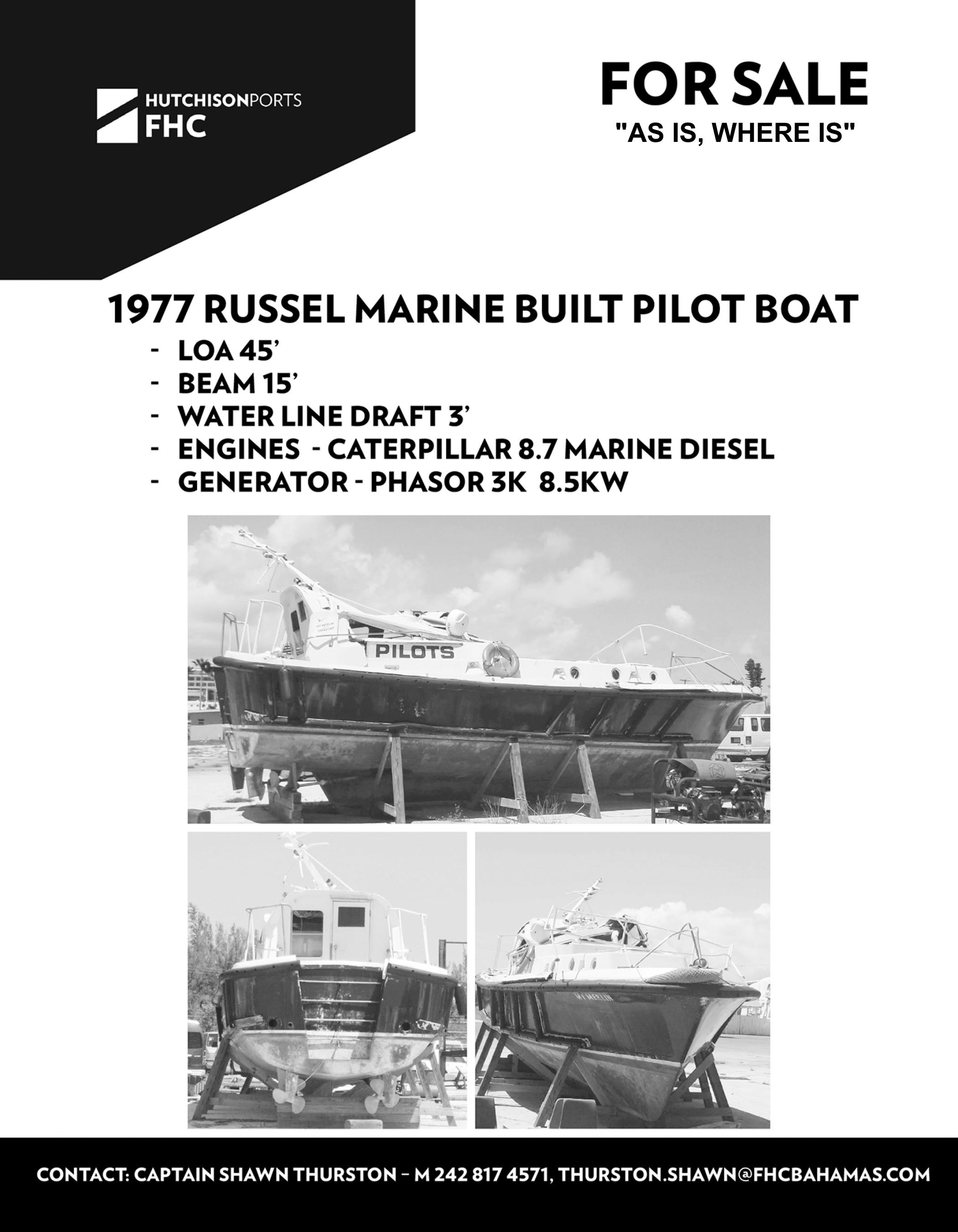

Carnival hails $600m GB ‘game changer’

CARNIVAL Cruise Line

welcomed the first 5,000 guests to its $600m Celebration Key private port on Saturday with twice daily calls set to be made on the destination

The cruise line, in a statement, said it has employed 1,200 Bahamians including those who had left Grand Bahama to seek employment elsewhere in the aftermath of Hurricane Dorian. Dozens more Grand Bahamians are expected to benefit from entrepreneurial opportunities on-site and in the wider Grand Bahama community.

Christine Duffy, Carnival’s president, said Celebration Key’s development “has been an incredible journey”.

“Obviously we started working on this many years

ago, and then when the pandemic happened everything stopped, and so the restart, coming back stronger, better than ever, and I think people really appreciate the value and fun you have on a cruise, and a Carnival cruise, to be able to bring people here,” she said.

“All of us at Carnival are very proud that we have hired more than 1,200 Bahamians to help build, and now operate, Celebration Key. And remember, many of these people are coming back home after Hurricane Dorian in 2019 that really ravaged this island.

“So the fact that they are able to come back home means so much to them, and to all of us, because supporting the local community, creating jobs, giving

3. Efficient cooling and HVAC

* Ensure proper insulation and ventilation to keep cool air in and hot air out.

* Use programmable thermostats to set different temperatures for different times of the day and when the building is unoccupied.

* Consider using fans to circulate air and reduce the reliance on air conditioning.

* Ensure your HVAC system is well-maintained and filters are clean.

* Maintain a comfortable but slightly higher temperature setting for your cooling system.

4. Equipment and appliances

He continued to refine his skills at local resorts and eventually joined Albany through a network of industry mentors. After being selected for training at the Atlantic Seafood Company in Boston, a fast-paced, seafood-centric kitchen, Chef Arthur experienced first-hand how global kitchens run at scale. “It reignited something in me,” he said. “The executive chef was open, showed me operations from the ground up - inventory; scheduling; line execution;

people opportunities to build their businesses here in Grand Bahama was an important objective to us in this development project,” Ms Duffy added. “I have had the chance to meet many of them who have said this has given them the opportunity to come back home. We are very proud of that. We are very proud of the partnership and collaboration that we have had with the Government and the community, and this is only phase one, so this will continue to grow.”

The Carnival president said Saturday’s opening was “truly just the beginning”. Executives are estimating that Celebration Key will welcome “two million guests this year alone”. Almost 25 years in the making, the destination will be supported by access to a fleet of 20 Carnival ships from 10 different US home ports.

* Turn off computers, monitors and other equipment when not in use.

* Unplug chargers and other devices that consume energy even when not actively in use.

* Consider replacing older, energy-inefficient equipment with newer, energy-efficient models.

* Use power strips to easily turn off multiple devices at once.

* For manufacturing facilities, consider using energy-draining equipment during off-peak hours.

5. Operational Practices

* Conduct an energy audit to identify areas of high energy consumption.

even kitchen tech and lab testing for ingredients.”

More than the recipes or modern kitchen gadgets, it was the culture of structure and excellence that stuck with him. “It reminded me this isn’t just about food. It’s management. It’s legacy. It’s training the next group coming up,” Chef Arthur said.

Ynise Cargill, a junior sous chef who works at Albany’s casual dining venue, Footprints, has a background in baking and pastry that started in childhood and was shaped

* Encourage staff to adopt energy-saving habits.

* Consider flexible or hybrid working arrangements to reduce the number of employees in the office at any given time.

* Consider investing in renewable energy sources.

* Review your energy tariff to ensure you are getting the best possible rate

a talent management and organisational development consultant, having completed graduate studies with regional and international universities. He has served organisations, both locally and globally, providing relevant solutions to their business growth and development issues. He may be contacted at tcconsultants@ coralwave.com.

at Bahamian resorts. But it was her time at Chroma Modern Bar + Kitchen in Lake Nona, Orlando, that added another layer of expertise.

Chef Cargill admitted she did not expect to be selected. “You hear employers say they believe in their local staff, but Albany really showed it. They didn’t just talk; they chose us,” she said. “It made me feel seen.”

The programme not only validated her skills, but deepened her interest in the management side of hospitality. Chef Cargill is now leaning into leadership, focusing on operations, relationships and mentorship, especially for those just entering the field.

“There’s a lot to learn. But you have to want to be taught,” she said. “People come in thinking it’s just about cooking, but there’s pressure, inventory, conflict resolution, creativity - it’s a whole business.”

Albany said that under the direction of Ivan Haller, its vice-president of food and beverage, it continues to reinforce its long-standing commitment to the

professional growth of its Bahamian team. The resort has recently elevated two team members to senior leadership roles - D’Angelo Charlton was promoted to executive chef, and Maneiko Marshall has assumed the role of director of service and personnel development.

“Our goal isn’t just to train; it’s to transform,” said Mr Haller. “We’re investing in people, empowering future leaders, and building a culture where Bahamian talent can thrive and rise. Seeing D’Angelo and Maneiko step into these well-earned leadership positions is a proud moment for all of us at Albany.”

Chef Charlton’s appointment, in particular, resonated with the returning chefs. “It felt like the ceiling lifted,” said Chef Arthur. “Now we have someone in the top kitchen role who understands our experience.” Chef Cargill added. “It makes a difference to be led by someone who gets where you’re coming from. We know he’s rooting for us.”

“We believe this is really a game changer for our brand,” Ms Duffy said. “The fact that we are able to bring 20 ships here from 10 different home ports will expose and provide the opportunity that we have already seen with the $600m investment in Grand Bahama. You can imagine the resources and support it took to bring this property to life.”

Ms Duffy said further investments in Celebration Key, along with additional upgrades at Half Moon Cay, will diversify the company’s Bahamian product even more.

“In phase one, we’ve got two berths that can accommodate our largest vessels today, and also the largest vessel we will have in the future, coming in 2029,” she added. “In phase two of this project we will add an additional two berths (June 2026) which are already under construction, and more things for our guests to enjoy.

“We are also investing in our island, Half Moon Cay, so I think that as I say game changer, an itinerary that enables us to have people call at Celebration Key as well as relax away at Half Moon, and remember because we are here at Grand Bahama island, guests also have the ability to leave here if they want to go do a shore excursion, or if they want to go rent a boat, or go shopping in Freeport. So it really opens up a lot of new opportunities for innovation and we think it is really a fantastic collaboration.”

Key opening day fanfare!

Nuvolari Chotoosingh, the Ministry of Tourism’s general manager for Grand Bahama, described the opening of Celebration Key as a “huge opportunity for Grand Bahamians and Grand Bahamian entrepreneurs in general”. He applauded the Government for “doing all it could to ensure a smooth development of this project”.

“This is a fantastic product. I have walked around, I have seen the visitors enjoying themselves taking in the Bahamian product, but what I found most exciting was some of those visitors actually getting on the tour buses and going out to explore the rest of the island and what we have to offer in terms of our product,” Mr Chotoosingh said.

“We want them to engage with our local people and experience the Bahamian spirit, the Bahamian camaraderie and enjoy some of the other products that we have, and hopefully come back again and again either as cruise or hotel guests. That is something that is very important to us.

“That represents a huge economic impact, and because of what Carnival’s investment means to Grand Bahama it’s certainly going to have a major impact on the economy - not just for Grand Bahama, but the entire country, and so we look forward to continuing to work closely with Carnival. The Bahamas government has done all it can to ensure a smooth development of this project. Hats off to the government and hats off to Carnival.”

SBDC grants $100,000 to aid disabled entrepreneurs

By ANNELIA NIXON

THE Small Business Development Centre (SBDC) yesterday provided grant funding worth a collective $100,000 to ten entrepreneurs with disabilities.

The SBDC, in partnership with the Ministry of Social Services, the National Commission for persons with disabilities and the Ministry of Youth Sports and Culture, executed on its Persons with Disabilities initiative that its executive director, Samantha Rolle, described as “the first of its kind locally”.

“At the SBDC, we have dedicated a great deal of time and resources to develop this programme that deeply impacts all entrepreneurs,” Ms Rolle said. “As we prepared for this programme, the SBDC team completed sensitivity training to ensure we serve entrepreneurs with disabilities with greater empathy and understanding.

“Through this initiative, we were also able to offer training and mentorship that specifically benefited entrepreneurs, while also encouraging our community to support businesses owned by persons with disabilities.

“Today, we are proud to announce that ten entrepreneurs throughout the Bahamas will receive $100,000 in grant funding through our inaugural entrepreneurs with disabilities initiative. These recipients represent a wide range of industries - from landscaping to food and beverage, consulting and more, highlighting the diverse abilities of these entrepreneurs.”

Rashard Ritchie, assistant director of youth at the Ministry of Youth Sports

and Culture, which provided funding support to recipients between the ages of 18 and 35, added: “Sustainable development has become a bit of a buzz word over the last several years. In just about every news story or speech at a conference, or in places like these, we hear the words ‘sustainable development’.

“For some, these words represent skyscrapers, large manufacturing plants or solar power stations. And while these may be great for society, it is not all that is required for sustainable development. True sustainable development requires equity, inclusion and forward thinking minds that challenge stigmas preventing development.

“Stigmas are major challenges for achieving development goals. There are many stigmas in our society today that stifle our development as a country. One of the major stigmas that is a barrier to inclusive and sustainable development are stigmas regarding persons with disabilities,”

Mr Ritchie added.

“Some think they are unable to do anything because of their ability, or that their disability hinders their ability. If we are to progress towards sustainable development as a country, then there must be no place for stigmas like these. When we stigmatise disabled persons, rather than be inclusively innovative, we limit the greatness we can achieve when we break barriers.

“This Entrepreneurs with Disabilities grant initiative is an example of how the Ministry of Youth, Sports and Culture and the Small Business Development Centre are breaking barriers hand-in-hand with partners like the National Commission for persons with disabilities and the

FUNDING - See Page B5

Tourism’s future bookings ‘are looking quite strong’

By ANNELIA NIXON Tribune Business Reporter anixon@tribunemedia.net

TOURISM executives yesterday shrugged off Atlantis’ decision to temporarily close the Coral Towers and said “forward bookings look as if they’re going to be quite strong”.

Latia Duncombe, the Ministry of Tourism’s director-general, reiterated that resorts undergo maintenance and improvements during the slower part of the tourism season. She added that she is looking forward to “rooms coming back on stream, renovated, improved and even better than before”.

“From time to time, properties choose slower seasons to make the necessary repairs to make sure that the standard and the visitor experience is surely what it should be in the islands of The Bahamas,” Mrs Duncombe said.

“And this happens throughout the entire destination and throughout the entire region. You have to select the time to make sure that the property’s

maintenance continues to happen. And so no, not a concern.”

She added: “I would say that properties make decisions internally in terms of the best time to choose to provide maintenance upgrades. At the end of the day, it’s all about the visitor experience, making sure that the property itself is delivering on the experience that we’ve told our visitors that they’re going to have at the properties at the destination.

“Maintenance is always required. And so these companies make a decision on timing; when is the best time. And so they’ve made the decision; this is the time. They’re also facilitating all of the guests into other towers. And so certainly we are excited, or we look forward, I would say, to the rooms coming back on stream, renovated, improved and even better than before.”

Joy Jibrilu, chief executive of the Nassau/Paradise Island Promotion Board, said: “We all know that in the summer months, numbers dwindle. And, of course, to some degree, you never want to see any of your rooms shut down. But if that means greater occupancy for

the Royal Towers and for the Cove and the Reef, well that would be great.

“So rather than spreading it, we’re concentrating it. And what it also means is that we just hope for a much stronger end of third quarter, fourth quarter, and, in fact, the forward bookings are looking as if they’re going to be quite strong. So that’s very, very positive.

Mrs Duncombe predicted a strong finish to 2025, adding: “We’ve seen our global sales missions in Florida. We were in Canada earlier this year for the director’s spring visit. It. I was there again for our global sales missions. We’re going to have 26 non-stop flights starting in the fall from Toronto into Nassau.

Another mission is being planned. So we do expect a strong finish to the year.

“From time to time, we do look at the numbers, we do look at the visitor experiences, but we continue to promote the destination.

We’ve launched our new campaign. It’s not just one island, it’s a lifetime of them, reminding our visitors there’s so much to see and to do in the islands of The Bahamas.

If you’ve only seen one or

PM ASSERTS ENERGY ‘BILLS HAVE NOT RISEN’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Prime Minister yesterday defended his administration’s energy reform initiatives while maintaining that Bahamas Power & Light (BPL) “bills have not gone up”.

Responding to reports that electricity bills payable in August have risen by 25 percent to 30 percent monthover-month, Philip Davis KC asserted that consumption - rather than BPL’s tariff or fuel charge - has risen due

to the summer heat and is responsible for the increases. He explained that residents and businesses are consuming more energy, which caused bills to increase against those issued earlier in 2025. But, compared to last year, Mr Davis said electricity bills have been reduced.

“I think we have to appreciate when they say their bills would have increased by 25 percent what they are comparing it to. Because if they’re comparing it to what happened in the earlier part of this year, then that would not be a fair comparison,” said Mr Davis.

“Usually, in the summer, electricity bills go up because of the heat and because of consumption. So if they compare their bill this summer with their bill from last summer, they will see that they’re paying less this summer than they’re paying last summer, and that is where the comparison ought to be.

“Consumption rises with the heat and that is what the actual facts are. Bills have not gone up. Consumption has gone up, and I invite persons to compare their bill this summer for last summer.”

Mr Davis said his administration is “delivering” on its

two or three islands, you’ve not seen it all - 16 islands for our visitors to come enjoy, and also to explore.”

Despite entering the slow season, Mrs Duncombe said The Bahamas is currently at its peak due to the upcoming Goombay Summer Festival which will showcase Bahamian culture. “So some seasons, I would say, are softer than others,” she added. “I would never say that it’s slow; just a little bit softer than others.

“And, right now, we’re in the peak of our cultural season, Goombay Summer Festival, that will be held on the streets of Nassau tomorrow [today], and we’re going to be having an amazing time. Goombay is a time where we have festivals throughout all of the islands of The Bahamas.

“So that energy, that excitement, our artisans, our Bahamian artists, our foods; there’s nothing like Bahamian foods, it’s all going to be on display. So for our visitors that are here, they can come and enjoy and, globally, we continue to market and promote the destination.”

energy reforms and, once the improvements are completed, there will be further reductions in electricity bills.

“I think we are delivering on what we have. Of course, work is still continuing. The grid that requires replacement, restoration and remediation, that work is continuing. Once that is complete, you’ll see more decreases we are bringing online,” said Mr Davis.

“We are moving from heavy oil to LNG, that’s still going on. Once that is in place, we will see further decreases and each of those initiatives should be completed by the end of this year or early next year.”

‘Complete breakdown of planning process’ threat

on their properties, thereby undermining the quality of life for other residents.

“It would be the death knell of orderly development with respect to covenants contractually entered into between parties as part of their bargain,” she told Tribune Business. “It would just mean that all somebody has to do is sign an agreement, sit back and when they want to do something with their land that they agreed not to do, all they have to do is go to Town Planning and ask them to extinguish the covenants.

The five, who own separate parcels of about five acres each on the southern side of Western Road between the Old Fort Bay roundabout and Lyford Cay, are urging the Town Planning Committee to “extinguish restrictive covenants” previously imposed by New Providence Development Company that prevent their properties from being used for commercial purposes.

“They bought the property with restrictive covenants, signed the agreement that they were not allowed to do this, not allowed to do that with the property. That was part of the bargain, and now they want the Town Planning Committee to do this for them,” Mrs Lockhart-Charles added. “It is a complete breakdown of the planning process in The Bahamas. It’s the death knell for orderly development.” She added that her clients’ orderly masterplanning of western New Providence, clearly setting

out where residential and commercial development is to take place and governing this by the use of restrictive covenants, would be “disrupted” if the Committee approved the application.

“How is it in the public interest for the Town Planning Committee to insert itself in that and change the covenants?” Mrs LockhartCharles asked. “What kind of precedent is it going to set? Why shouldn’t someone in a gated community wake up one day, decide they will have a restaurant or commercial activity on their lot that increases the value never mind the restrictive covenants?

“There is no provision under the Act for someone to make an application for the restrictive covenants to be removed. That’s not provided for in the Act. The Act provides for development applications. You cannot develop it without getting approval. You own the land, you make an application for development...

“This just erodes confidence in the enforceability of contractual rights that have existed and enabled property development for years.” Mrs LockhartCharles, in a subsequent e-mail to Tribune Business, further explained: “Restrictive covenants are not mere formalities; they are fundamental tools in real estate development.....

“Enforceability of these covenants provides certainty that the land will be developed in a regulated and planned manner, which in turn adds value. The Planning and Subdivision Act makes it clear that the Town Planning Committee’s authority to impose or extinguish restrictions on

land use is exercisable only within the framework of the Zoning By-Law process.

“Under the Planning and Subdivision Act, Zoning By-Laws are prepared by the Department of Physical Planning under the director’s direction and subsequently approved by the minister. There is no provision in the Act for these powers to be invoked in an ad hoc manner through individual planning applications.”

She added: “For the Town Planning Committee to entertain a private landowner’s application for the extinguishment of restrictive covenants sets an exceptionally dangerous precedent for the entire Bahamas.

“There are numerous developments in the east and west of New Providence, as well as elsewhere in The Bahamas, where properties have been sold by developers as part of carefully structured, master-planned communities.

“Restrictive covenants are a critical component of this framework, providing assurance to hundreds of purchasers that their investments will be safeguarded by the consistent and compliant development of neighbouring parcels. These covenants are designed not only to preserve the distinctive character of these areas but also to afford purchasers the security that the agreed-upon standards will be upheld.

“For the Town Planning Committee to now insert itself in this process to interfere with, indeed to totally destroy, a bargain made between two parties which regulates the future use of land sold from party A to party B is an extremely dangerous thing. Such interference destabilises the settled expectations of

property owners and erodes

confidence in the integrity of planned developments.”

Owen Wells, the McKinney, Turner and Company attorney representing the five property owners, confirmed at Wednesday night’s public consultation that while his clients have no commercial developments planned at this point they would like restrictive covenants lifted to “consider the future”.

He argued that his clients are burdened by the “draconian” covenants placed on their properties decades ago that restrict them to just single-family residential development, and would like them lifted to increase their land values and have the ability to consider future commercial ventures.

“There is no consideration for any commercial development at this time. Each party simply just wants the covenant lifted so they can consider the future and, to be frank, it also increases the land value. So that’s where they are right now. There’s no consideration for anything at this time,” said Mr Wells.

He said the restrictions are “outdated” as the area has developed significantly since the covenants were placed on the properties, while New Providence’s population is also “shifting” into the western district, making multi-family ventures such as condominiums and complexes “vital”.

“Anyone who’s been in that area has drove past that area or is familiar with that area, will know that the land has evolved tremendously from five years ago, 10 years ago, 20 years ago. What we have now is an area that we would say is considered commercial,” said Mr Wells.

“Right now, as it stands, it would not help create jobs, which we all know is vital to the economy, and it doesn’t generate taxes for the Government, as the land is idle and vacant. A viable production of the land for our clients would be something

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

commercial in nature, where the value of their land, their investment that they would have made in the 1980s and 1990s, significantly increases.”

Mr Wells added that the five parcels are located near Old Fort Bay and Albany, and the property owners would like to participate in the area’s continued development. “Although each parcel of the land may be considered small, approximately five acres, where they’re located is a corridor this makes a redevelopment potentially significant. That corridor would consist of Albany, Lyford Cay, Old Fort Bay,” he said.

“That whole corridor is developing. As such, the owners of the land would like to be a part of this development, and have made an application. Unfortunately, the properties are burdened by what we call draconian restrictive covenants, which were included in their conveyances from the late 80s or early 90s.”

Mr Wells added that the covenants were imposed to prevent the emergence of competition, and rival developments, while New Providence Development Company was constructing the Old Fort Bay community and, later, the Old Fort Bay Town Centre. As both projects have been completed, Mr Wells asserted it is time for others to “move on and achieve some goals” in the area.

“We go further to saying that the enforcing land owners, who would be Old Fort Bay, have already achieved the objectives of the covenants, which we say is for the fully developed residential community,” said Mr Wells

“Their community is fully developed, whether it be the residential area behind the gates or whether it be the commercial complexes that will consist of Pineapple House and any other endeavour that they may be connected with.

“So we say that the covenants that they had in place, which would have restricted any other commercial enterprise at that time, are already extinguished. They’ve already achieved their goals, and now it’s time for others in that area to move on and achieve some goals of their own in a commercial nature.”

Mrs Lockhart-Charles, though, questioned whether the Town Planning

Committee has the authority to remove restrictive covenants from a parcel of land without an application for development being submitted. She argued that the Town Planning Act does not include an application for the extinguishment of covenants, and the Committee should not be used to remove a “private bargain that you entered into freely and voluntarily”.

“The Act provides for applicants to make applications, typically for development. It doesn’t provide for entities to make applications for the Town Planning Committee to intervene in their private arguments and extinguish their covenants,” said Mrs Lockhart-Charles

“The Committee has to determine applications, and they can only determine applications that are provided for by the Act. The committee is a creature of statute.

“The Committee has many powers. You come before the Committee on an application for development. You don’t come before the Committee with a request to extinguish your private bargain that you entered into freely, and voluntarily and ask the Committee to extinguish covenants because you no longer want to comply with that.”

Mrs Lockhart-Charles, in her statement to Tribune Business, added: “It was also troubling to observe that, during the hearing, a member of the Town Planning Committee openly and unequivocally endorsed the applications in question.

“It is a principle recognised both domestically and internationally that members of decision-making bodies must maintain strict impartiality, avoiding even the appearance of bias or pre-determination. These standards are essential to preserving public trust and ensuring that all parties, including applicants, objectors and the general public, are afforded a fair and transparent process.

“The actions and statements in question raise serious questions regarding procedural fairness and the proper exercise of the Committee’s statutory functions, and erode confidence in the planning process.”

Controversy ‘doesn’t alter Bahamas’ fiscal situation’

preliminary and subject to revision.

“The variance between the initial surplus estimate and the finalised figures is primarily the result of late postings by the Treasury, particularly related to interest expenses on Treasury Bills. This is a normal part of the reconciliation process between preliminary and final monthly fiscal data.

“What remains most important is that all indicators continue to point toward the overall fiscal deficit for the full fiscal year, which ended on June 30, 2025, falling within the projected range of 0.3 to 0.7 percent of GDP, as communicated by the Prime Minister. The Government remains committed to sound fiscal management, accurate reporting and full transparency throughout the budgetary process.”

However, as reported by Tribune Business, the April outcome leaves the Government’s deficit for the first ten months of the 2024-2025 Budget year at $168.8m - a sum almost $100m more, or equal to 141.8 percent, of the full-year target set at $69.8m. This raises significant doubt that the full-year deficit will fall within the $52.35m to $122.15m range set by the Government.

And the two remaining months in the fiscal year - May and June - are traditionally when the Government has run high deficits due to the fact that the Ministry of Finance is

presented with bills and IOUs which it often knows nothing about by ministries, departments and agencies eager to clear liabilities before the fiscal year-end. Given this history, the Davis administration is unlikely to make up significant ground and get closer to the full-year target. It did, though, manage to contain the combined May and June 2024 deficit to just $9.8m, although many observers suspect this was achieved by kicking multi-million dollar payables owed to vendors into the new fiscal yearsomething it can do under its cash-based accounting system.

A repeat of this in 2025 would place the full-year deficit at around $178.6m and represent a small improvement on 20232024’s $194m. However, such a move could trigger a number of consequences, including the possibility that this current fiscal year’s forecast Budget surplus could be endangered if significant receivables have been pushed into it.

Fiscal observers, meanwhile, also questioned the Government’s explanation that “late postings” of interest payments to investors holding its Treasury Bills was responsible for the $137.5m divergence. They pointed out that the Government’s interest, or debt servicing, costs - particularly the timing of such payments, how much and on which instruments - are known far in advance.

Thus, even if the interest payments had not been

posted for April by the Public Treasury, they argued that officials would have known they were due and should have factored them into the monthly numbers and deficit calculations. The Government spent $86.2m on interest or debt servicing costs in April 2025, which is similar to the $85.4m outlay for the same month in 2024.

Michael Pintard, the Opposition leader, also challenged the Government’s explanation last night in arguing that it had “only made the situation worse”.

“Simply put, given that the Ministry of Finance and the Public Treasury know the timing of all interest payments during the year, there is no way the debt servicing on Treasury Bills would not have been fully factored into any calculation of the deficit or surplus for any month,” he blasted.

One source familiar with the Government’s fiscal operations, speaking on condition of anonymity, said of the Public Treasury “late postings” explanation: “That is a real weak excuse. It is laughably absurd. There is no way that, if the finance team was calculating the projected surplus or deficit for that month, would they leave out those interest payments.

“Interest is set. There are no fluctuations. Even if they are not yet posted they are one thing that you can mark your calendar by. It’s an absurd, sad, sad excuse. I can say without contradiction that the Public Treasury does cash flow projections every year

Broker chief says case Will

not survive appeal

REPORT - from page B1

chief said Judge Torres had blasted his disdain for a trading regulation that is likely to soon be relaxed because the US Financial Industry Regulatory Authority (FINRA) views it as too restrictive.

“To be clear, this was not a final ruling, just a recommendation from a magistrate judge. We are formally objecting, and Judge Bloom [the judge overseeing the court battle with the SEC] is required to conduct a de novo review of the issues,” Mr Gentile blasted.

“The magistrate’s report is deeply flawed. It recommends I be held jointly liable for over $13m in revenue that I never received, plus speculative penalties with no legal basis. The recommendation violates binding Supreme Court precedent....., which limits disgorgement to net profits personally obtained, not gross company revenue.

“The penalty figure is even more bizarre, based on a fictional SEC ‘registration fee’ that doesn’t actually exist. We’ll be filing objections.If Judge Bloom adopts the recommendation without correction, we’ll be appealing immediately. There’s simply no lawful basis for the financial figures the SEC is pushing,” he argued.

“And yes, I do believe the report is punitive and political, not equitable. What’s ironic is that this

entire case centred on the now-discredited Pattern Day Trading rule - a rule FINRA is actively working to repeal as outdated and harmful. Punishing someone for calling it ‘stupid’ while regulators now agree with that view shows how disconnected this process has become from common sense.”

The existing ‘pattern day trading’ rule limits investors with less than $25,000 in their margin account from borrowing to trade four or more times in a fiveday period. FINRA is now mulling whether to reduce this sum to $2,000.

“This entire case won’t survive the light of day on appeal,” Mr Gentile subsequently asserted to Tribune Business. “The magistrate is recommending I pay $13m I never received, plus a fake $1.8m ‘registration fee’ that doesn’t exist - all because I criticised a rule even FINRA is now repealing.

“Judge Bloom flipped her own definition of ‘solicitation’ after trial just to manufacture liability, contradicting what she said at summary judgment. The jury charge was rigged, the law was rewritten mid-case, and now they want to bury me with penalties that have no legal foundation. Everything about this case is wrong and, frankly, something is rotten in Denmark. We’re going to expose it.” Judge Torres recommended that Mr Gentile be “permanently enjoined”, or barred via an injunction,

from committing similar US securities law violations to those asserted by the SEC. He ruled that Mr Gentile created Sure Trader, his Bahamas-based brokerage, to get around the Pattern Day Trader rule and FINRA.

“Here, the record is replete with testimony and references to Gentile’s years’ long opposition to the Pattern Day Trader Rule,” Judge Torres wrote, recalling how in his own testimony he admitted that he “decided to set up a firm internationally so that foreign people would not have to deal with getting restricted. . . . No one likes the rule. It’s a stupid rule”.

“By his own admission, Gentile created Sure Trader to circumvent what the business he founded later termed ‘the nasty PDT rule’ and ‘FINRA, the killjoy Financial Industry Regulatory Authority’,” Judge Torres added. “Gentile’s behaviour indicates a disdain for some elements of the securities laws and a clear willingness to flout them.”

He also remarked on the “brazenness” of some of Mr Gentile’s evidence and the “lawyerly bravado” that accompanied some of his attorney’s findings. “Accordingly, there is nothing in the record before us to suggest that Gentile has either recognised the wrongful nature of his conduct or issued any assurances that he will not continue to violate

on a month-by-month basis with specific peculiarity, and factored into that are all the known interest payments.

“You know the timing in advance. They know when they come due; whether it’s 180 days or 360 days. Even if they were not posted they would have known of them.”

Mr Bowe, meanwhile, told Tribune Business that future fiscal data presented by the Government will have its credibility called into question unless the Ministry of Finance can clearly explain the variation between the Prime Minister’s forecast and April’s actual deficit outcome and the reasons for why this has occurred.

Suggesting that the cause could have been faulty data and/or miscalculation by Ministry of Finance officials; an error by the Prime Minister’s speechwriters and those who put together the Budget communication; or a combination of both, the Fidelity Bank (Bahamas) chief nevertheless said the fall-out is unlikely to damage The Bahamas’ fiscal position or reputation with the credit rating agencies.

He explained that the likes of Moody’s and Standard & Poor’s (S&P), as well as multilateral agencies such as the International Monetary Fund (IMF), have already predicted that the $69.8m deficit target for 2024-2025 was unlikely to be met. As a result, the $168.8m deficit for the ten months to end-April 2025 was largely in line with their forecasts so they are unlikely to be disturbed by the April controversy.

However, Mr Bowe warned against the politicians exploiting the situation to the extent it becomes a “game of chicken little”

the securities laws,” Judge Torres added. “These factors, then, also counsel in favour of imposing an injunction.” The $1.887m penalty was based on the registration fee that Sure Trader would have paid to be licensed by the SEC, while the $520,000 personal disgorgement was based on a consulting fee Mr Gentile and his family allegedly received from the Bahamian broker/dealer.

Mr Gentile enjoyed a somewhat colourful stay in the Bahamas, with Tribune Business reporting in 2016 how he and his broker/ dealer, then-based in the Elizabeth on Bay Plaza on Bay Street, were allegedly used as “bait” by the Federal Bureau of Investigations (FBI) to help snare numerous international securities fraudsters.

where the Government’s opponents constantly cry “the sky is falling, the sky is falling”. Arguing that this would be an “exaggeration”, he instead urged Bahamians to demand “accountability” and the reasons for the $137.5m “variance”, with consequences for those who made mistakes.

“I would say the concern comes from whether or not the Government clearly explains the error in the communication by the Prime Minister,” Mr Bowe told this newspaper. “I would be most concerned if the Ministry of Finance remains silent in refusing to clarify whether there has been misrepresentation on the part of the Ministry of Finance.

“I’m not by any stretch of the imagination saying there has not been a significant variance. But I would doubt the level of variance is purely a miscalculation versus what was in the political exuberance that took place in the House of Assembly” during the Budget communication. Mr Bowe said the difference could have occurred if those writing the communication included the wrong figures.

“The concern only arises if the Ministry of Finance fails to appropriately analyse and articulate the reasons for such a significant variation,” he added.

“I don’t put that on the Minister of Finance and the legislators. I put that on the Ministry of Finance,” he added.

“They are relying on the technical people to provide the information. They are not going to be performing audits on the information. I would expect heads to roll if there was such a significant error in calculation.”

Mr Gentile claimed that he and his Bahamian businesses were “forced” to play key roles in undercover ‘sting’ operations targeting criminals earning millions of dollars from market manipulation scams. Their participation even extended to the ‘bugging’, both by video and sound, of MintBroker’s Bahamian head office in a successful bid to gain evidence against a Canadian fraudster who subsequently pleaded guilty to the charges against him. He also attracted international media coverage after his Russian-born, model girlfriend, Kristina Kuchma, 24, in a fit of rage drove his Mercedes S400 hybrid into the pool at his Ocean Club home after he ended their 18-month relationship by text and

‘First of its kind’ Initiative is

FUNDING - from page B3

Ministry for Social Services. This initiative has cancelled the stigmas of society and brought us closer to realising our goal for a better Bahamas.”

However, Mr Bowe argued that given existing “scepticism” about the Government’s fiscal targets and projections it was unlikely that what he described as “an egg in the face moment” for the Government will have any impact on The Bahamas’ financial standing and reputation.

Given that the fiscal year’s fourth quarter is a “break even” period for the Government at best, he explained that creditors, credit rating agencies and multilateral agencies had already factored in that The Bahamas was unlikely to “make up the stagger” between the end-March 2025 deficit of $166.7m and the full-year’s $69.8m goal. “As it relates to the fiscal circumstances of the country, this doesn’t have a significant impact because people had not factored in such a level of decline,” Mr Bowe told Tribune Business. “It certainly does shake the level of confidence in the quality of [the Government’s] communications, and that needs to be resolved by deliberate analysis and articulation of whether this was an error in calculation, an error in communication or a combination of both.

“It’s of the magnitude that it should result in significant consequences for the party responsible; a fall on the sword-type moment.” He added that the fall-out may result in external investors relying on their own fiscal projections, due to a loss of trust in the accuracy of the Government’s, reiterating: “It doesn’t shake confidence in the country but it does shake reliance on the Government’s information.... It doesn’t change the fiscal circumstances of the country.”

allegedly reneged on a promise to provide $50,000 for one of her business ventures.

Mr Gentile and his company exited the Bahamas at end-2019 when faced with regulatory actions and investigations by the Securities Commission of The Bahamas. However, in so doing, he bought sufficient time to voluntarily wind-up the broker/dealer himself and remove all its assets from The Bahamas.

That came after Philip Davis KC, then the Opposition’s leader, acting on Mr Gentile’s behalf filed a successful Judicial Review challenge that thwarted the Securities Commission’s efforts to take regulatory action against MintBroker for several months.

hailed

David Seymour, a young entrepreneur who owns and runs a music studio aimed at providing support for mostly disabled singers, said the grant funding will help “secure” his business and allow him to help others.

“I try to make sure they have more understanding with music because certain studios, when you go to studios, they don’t really help you along the way,” Mr Seymour said. “They just there to really make money. So for singers, I try to give them as much help as I can.”

Another recipient, Kirkland Culmer, owner of Culmer’s Mechanical & General Construction, added: “I must thank God for the Small Business Development [Centre]. This grant will allow me to purchase some more tools which is needed for the business, and help me finish fixing my shop, and give me a chance, an opportunity to train others.

“My disability don’t define me. In fact, a lot of times I thank God for it. Like I tell anyone with disability, if you believe it, you could achieve it. You could do anything.”

DPM: Forward bookings recovering following Q1

TEMPORARY - from page B1

packages after the resort offered them in response to employee demand.

“I am aware that top executives from Atlantis have been in communication with senior government officials weeks ago concerning this matter. I’ve been made to understand that a written communication was sent to the supervisory and management employees at Atlantis, inviting persons interested in accepting

early retirement and or separation packages to communicate their interest,” the labour chief said. “That communication was sent to both foreign and Bahamian supervisors at the resort. I am advised that over 200 employees expressed an interest in accepting the separation package. However, the resort only accepted 70 of those management employees. This number includes both

Bahamian and foreign management workers.”

Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, said Atlantis is “recalibrating” and conducting renovations. He voiced confidence that any issue will “correct itself”, and added that the temporary closure of the Coral Towers is similar to previous years.

“What we have seen is Atlantis recalibrating and using an opportunity to

Water Corp and PHA drive subsidy increase

ADVANCES - from page B1

under the net acquisition of financial assets advanced to $83.2m as the Government made sinking fund contributions to assist with financing future debt obligations and additional loans were made to government business enterprises.”

Asserting that taxpayers deserved more detail on how their dollars are being spent, Mr Thompson asserted: “Every day Bahamians are faced with more troubling revelations about this government’s approach to public finance - an approach marked by secrecy, evasion, and a startling lack of transparency.

“The recent release of the Government’s third

quarter fiscal report for the 2024-2025 fiscal year only reinforces this alarming trend. Buried within that report is a revelation that the Government advanced some $60.8m in short-term loans to unnamed government business enterprises.

“No explanation has been offered. No public disclosure has been made as to which entities received this money or what these loans were for. And, once again, the people of The Bahamas are left in the dark about how their money is being spent,” he added.

“There can be no legitimate reason for keeping these transactions secret. This government is obligated, constitutionally and morally, to report and

California utility creates compensation program for victims of January's deadly Eaton Fire near LA

By CHRISTOPHER WEBER Associated Press

SOUTHERN California Edison announced this week that it will create a program to compensate victims of January's devastating Eaton Fire near Los Angeles, even as the cause of the blaze that killed 19 people remains under investigation.

The creation of the Wildfire Recovery Compensation Program seems to suggest that the utility is prepared to acknowledge what several lawsuits claim: that its equipmentsparked the conflagration in Altadena.

"Even though the details of how the Eaton Fire started are still being evaluated, SCE will offer an

expedited process to pay and resolve claims fairly and promptly," Pedro Pizarro, chief executive of Edison International, the utility's parent company, said in a statement Wednesday. "This allows the community to focus more on recovery instead of lengthy, expensive litigation."

Officials haven't said what caused the fire that destroyed more than 9,400 homes and other structures. It is not clear how much money the utility will contribute to the program. A lawsuit filed by Los Angeles County in March claims that costs and damage estimates were expected to total hundreds of millions of dollars, with assessments ongoing.

explain how every dollar of taxpayer money is used. Any disbursement from the consolidated fund, whether a loan or direct expenditure, must be drawn from budget allocations approved by Parliament. That is not a suggestion; it is the law, enshrined in our Constitution and reinforced in the Public Finance Management Act.”

Mr Thompson also questioned why the five entities would require additional loans or advances if they had already received the taxpayer subsidies allocated to them in the 2024-2025 Budget. “The people have a right to know. The Government has a duty to tell,” he argued.

SCE said the compensation program, which will go into effect this fall, would be open to those who lost homes, rental properties or businesses. It would also cover those who suffered injuries, were harmed by smoke or had family members who were killed.

Among those suing SCE is EJ Soto, whose rental home in Altadena where she grew up was destroyed by flames. She first heard about the program on the news.

She said she considers the program's creation as a "form of admission" from the utility that its equipment caused the inferno. Soto worries that her family will receive "pennies on the dollar" and said the utility is trying to get out ahead of future lawsuits.

"All our memories are there, places we raised our children. Money won't bring that back. They need to know that our pain is greater than that," Soto said Thursday.

The SCE payment plan is being created by

do some renovations. This is not unlike many years before, and we anticipate that, at the end of the day, we’ll have an even better product,” Mr Cooper said.

“We know that Atlantis has been a world’s favourite for quite some time, but we also know that it started to show its age. So I’m personally happy to see that this is happening and, over the course of time, I think it will correct itself.”

Mr Cooper said forward bookings are “recovering”, and both the 2025 second and third quarters are expected to be strong while the fourth quarter is expected to meet or exceed last year’s numbers. “The numbers ahead continue to look strong.

The Ministry of Finance report, meanwhile, noted that taxpayer subsidies had increased by more than $25m year-over-year to hit over 82 percent of the 20242025 Budget’s full-year allocation with three-quarters of that period or nine months gone.

“Subsidies, which include transfers to governmentowned and/or controlled enterprises that provide commercial goods and services to the public, rose by $25.1m (8 percent) to $338m, and accounted for 82.1 percent of the Budget,” the report said.

“Subsidies to public non-financial corporations increased by $24.3m (8.2 percent) to $320.4m, reflecting higher assistance to Water and Sewerage ($10.2m) and the Public Hospital Authority ($22m). Transfers to private enterprises and other sectors rose by $0.9m (5.2 percent) to $17.6m.”

Future bookings are recovering versus what we saw in the first quarter. We expect the second and the third quarter to be strong, and the fourth quarter to be as strong as last year or better. So the future continues to look cautiously optimistic,” said Mr Cooper.

“As I laid out in our Budget presentation, tourism is not without its challenges. We know that geopolitical issues continue to confront us, and we must continue to preserve all of the guest experience that we can to ensure that they continue to come back and continue to allow our future bookings to continue to be preserved.”

Vaughn Roberts, the Atlantis executive

The Ministry of Finance report also disclosed that “other payments” rose by more than $41m, or almost 21 percent year-over-year, to hit almost $240m for the nine months to end-March 2025. “Other payments were boosted by $41.2m (20.8 percent) to $239.5m (66.3 percent of the Budget),” it added.

“Current transfers not elsewhere classified broadened by $35.6m (22.4 percent) to $194.1m, largely owing to disbursements of planned allocations for scholarships and grants to the Beaches and Parks Authority, the Court Services Council, and the School of Agriculture and Marine Science.”

Breaking down the Government’s recurrent or fixed-cost spending, the Ministry of Finance added:

“Compensation of employees grew by $20m (3.2 percent) to $649m (73 percent of the Budget), and was primarily explained by

vice-president of administration and strategic initiatives, in an e-mail response to Tribune Business inquiries confirmed the temporary closure although he provided few other details while suggesting it was consistent with actions taken in prior years during the slower part of the tourism calendar.

“Yes, the Coral Towers will temporarily close after August 17,” Mr Roberts said. “This is not unusual at all. For the past 20 years Atlantis has used this shoulder season to reduce some operations. This year, we will also finish some plumbing repairs which were suspended earlier due to high occupancies.”

higher outlays for National Insurance contributions, salaries and allowances.

“Spending on the use of goods and services was boosted by $82.4m (19.1 percent) to $514.2m. Rental costs, comprising payments for office lease and rent, vehicle leases and living accommodation, increased by $5.4m (6.3 percent) to $92.2m. Utilities and telecommunications outlays advanced by $25.5m to $58m.

“Spending on services, including security services, consultancy services, operation of facilities and healthcare services, grew by $38.8m (19.4 percent) to $238.6m. Outlays for special financial transactions rose by $26.4m to $39.9m on account of payments made to NIB related to the administration of the prescription drug plan, as well as budgeted contingent liability pension payments to BTC.”

administrators who helped form similar programs, including the September 11th Victim Compensation Fund of 2001. LA County previously won more than $64 million in a settlement with Southern California Edison over the 2018 Woolsey Fire. Investigators determined SCE's equipment sparked that blaze, and the utility also paid more than $2 billion to settle related insurance claims. Utility equipment has sparked some of the deadliest and most destructive fires in state history in recent years. LA Fire Justice, which advocates for wildfire victims, said in a statement Thursday that the SCE program's creation shows that the utility is prepared to accept responsibility. But the nonprofit said a fund by Pacific Gas & Electric following wildfires in Northern California was slow to roll out and inefficient.

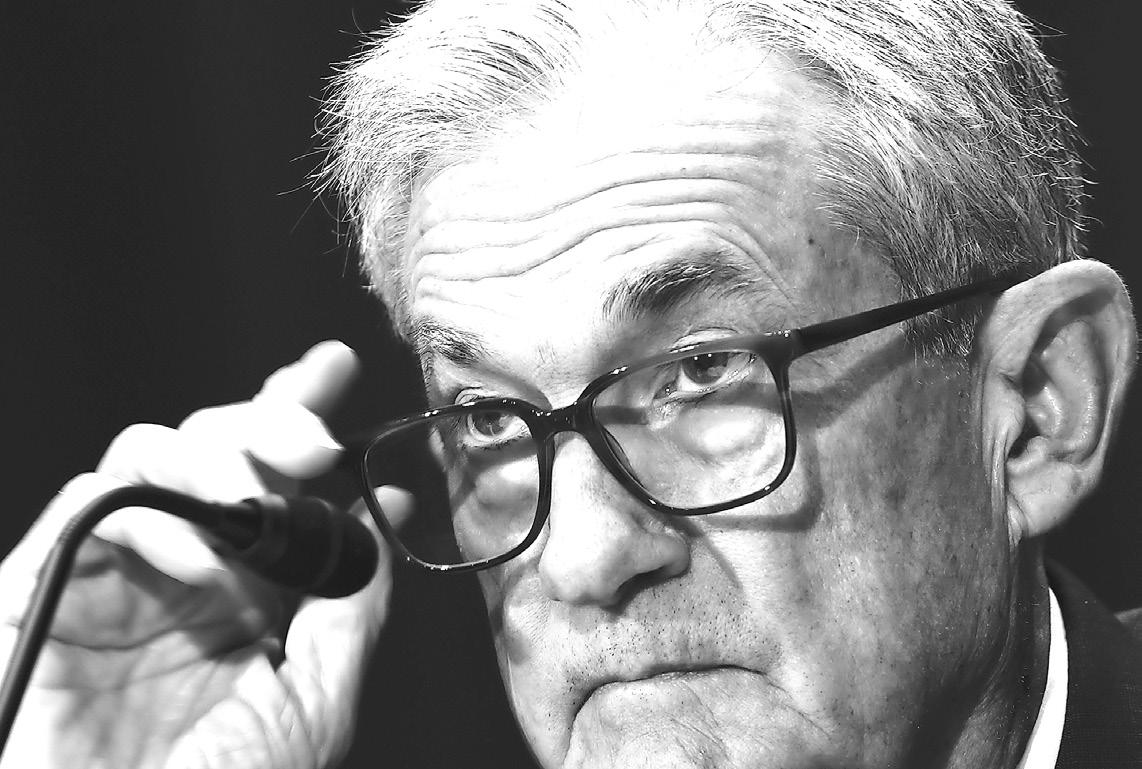

How Trump could use a building renovation to oust Fed Chair Powell

By CHRISTOPHER RUGABER and JOSH BOAK Associated Press

PRESIDENT Donald Trump may have found a way to achieve his goal of removing Federal Reserve Chair Jerome Powell: by accusing him of mismanaging the U.S. central bank's $2.5 billion building renovation project.

The push comes after a monthslong campaign by Trump to try to rid himself of the politically independent central banker, who has resisted the Republican president's calls to slash interest rates out of concerns about the administration's tariffs sparking higher levels of inflation.

The Supreme Court recently signaled that Trump can't fire Powell simply because the president disagrees with him on interest rates. But legally he could do so "for cause," such as misconduct or dereliction of duty.

Trump has seized on that provision, indicating that Powell's handling of an extensive renovation project on two Fed buildings in Washington could be grounds to take the unprecedented and possibly legally dubious step of firing him.

The project has been underway for years, going back to Trump's first term. But it only recently caught the White House's attention.

Last week, when asked if he thought the building renovation was a "firing offense," Trump said, "I think it is." But he later added that it was "highly unlikely" that he would ultimately remove Powell before his term expires in May 2026.

The risk of the Fed losing its political independence could undermine America's

financial markets, possibly leading to a meltdown in stocks and investors charging a premium to lend to the U.S. economy. Here's what to know: Ousting Powell risks setting off market panic

The Fed chair has been an obstacle in Trump's efforts to gain total control over the executive branch.

Powell and his board have the dual mandate of maximizing employment and keeping prices stable, a task that can require them to make politically unpopular moves such as raising interest rates to hold inflation in check. The general theory is that keeping the Fed free from the influence of the White House — other than for nominations of Fed officials — allows it to fulfill its mission based on what the economy needs, instead of what a politician wants.

An attempt to remove Powell from his job before his term ends would undercut the Fed's long-standing independence from day-today politics and could lead to higher inflation, higher interest rates and a weaker economy.

The Fed's main headquarters is over 90 years old

The Fed says its main headquarters, known as the Marriner S. Eccles building, was in dire need of an upgrade because its electrical, plumbing and HVAC systems, among others, are nearly obsolete and some date back to the building's construction in the 1930s.

The renovation will also remove asbestos, lead and other hazardous elements and update the building with modern electrical and communications systems.

The H-shaped building, named after a former Fed chair in the 1930s and

'40s, is located near some of Washington's highestprofile monuments and has references to classical architecture and marble in the facades and stonework. The central bank is also renovating a building next door that it acquired in 2018.

The Fed says there has been periodic maintenance to the structures but adds this is the first "comprehensive renovation."

The renovation costs have ballooned over the years

Trump administration officials have criticized the Fed over the project's expense, which has reached $2.5 billion, about $600 million more than was originally budgeted.

Like a beleaguered homeowner facing spiraling costs for a remodeling project, the Fed cites many reasons for the greater expense. Construction costs, including for materials and labor, rose sharply during the inflation spike in 2021 and 2022. More asbestos needed to be removed than expected. Washington's local restrictions on building heights forced it to build underground, which is pricier.

In 2024, the Fed's board canceled its planned renovations of a third building because of rising costs.

The Fed says the renovations will reduce costs "over time" because it will be able to consolidate its roughly 3,000 Washington-based employees into fewer buildings and will no longer need to rent as much extra space as it does now.

White House budget director calls renovations 'ostentatious'

Russ Vought, the administration's top budget adviser, wrote Powell a letter that said Trump is "extremely troubled" about

the Fed's "ostentatious overhaul" of its facilities.

The Fed's renovation plans call for "rooftop terrace gardens, VIP private dining rooms and elevators, water features, premium marble, and much more," Vought said in last week's letter.

Powell has disputed the claims, which were given wide circulation in a paper issued by the Mercatus Center, a think tank at George Mason University, in March 2025. The paper was written by Andrew Levin, an economist at Dartmouth College and former Fed staffer.

"There's no VIP dining room," Powell said last month during a Senate Banking Committee hearing. "There's no new marble. ... There are no special elevators. There are no new water features. ... And there's no roof terrace gardens."

Some of those elements were removed from initial building plans submitted in 2021, the Fed says.

White House also takes issue with the Fed reducing its renovation costs

The Fed's changes to its building plans have opened it up to another line of attack: White House officials suggest the Fed violated the terms of the approval it received from a local planning commission by changing its plans.

In its September 2021 approval of the project, the National Capital Planning Commission said it "Commends" the Fed for "fully

engaging partner federal agencies." But because the Fed changed its plans, the administration is indicating it needed to go back to the commission for a separate approval. Essentially, White House officials are saying Powell is being reckless with taxpayer money because of the cost of the renovation, but they are also accusing him of acting unethically by scaling back the project to save money.

James Blair, the White House deputy chief of staff whom Trump named to the commission, said in a post on X that Powell's June congressional testimony "leads me to conclude the project is not in alignment with plans submitted to & approved by the National Capital Planning Commission in 2021."

Blair said he intends to review materials from the Fed on how the approved 2021 renovation plans have changed and circulate a letter among his colleagues on the commission that would go to Fed officials. The Fed has asked for an independent review of the project

The central bank says, in a series of frequently asked questions on its website, that it is "not subject to the direction" of the commission and has only complied with its directives voluntarily.

Instead, the Fed said it is accountable to the Senate and the House of Representatives and is overseen by an independent inspector general, not the White House.

TRUMP’S ORDER TO BLOCK ‘WOKE’ AI IN GOVERNMENT

ENCOURAGES TECH GIANTS TO CENSOR THEIR CHATBOTS

By MATT O'BRIEN AP Technology Writer

TECH companies look-

ing to sell their artificial intelligence technology to the federal government must now contend with a new regulatory hurdle: proving their chatbots aren't "woke."

President Donald Trump's sweeping new plan to counter China in achieving "global dominance" in AI promises to cut regulations and cement American values into the AI tools increasingly used at work and home.

But one of Trump's three AI executive orders signed Wednesday — the one "preventing woke AI in the federal government" — marks the first time the U.S. government has explicitly tried to shape the ideological behavior of AI.

Several leading providers of the AI language models targeted by the order — products like Google's Gemini and Microsoft's Copilot — have so far been silent on Trump's anti-woke directive, which still faces a study period before it gets into official procurement rules. While the tech industry has largely welcomed Trump's broader AI plans, the anti-woke order forces the industry to leap into a culture war battle — or try their best to quietly avoid it. "It will have massive influence in the industry right now," especially as tech companies are already capitulating to other Trump administration directives, said civil rights advocate Alejandra Montoya-Boyer,

senior director of The Leadership Conference's Center for Civil Rights and Technology.

The move also pushes the tech industry to abandon years of work to combat the pervasive forms of racial and gender bias that studies and real-world examples have shown to be baked into AI systems. "First off, there's no such thing as woke AI," Montoya-Boyer said. "There's AI technology that discriminates and then there's AI technology that actually works for all people."

Molding the behaviors of AI large language models is challenging because of the way they're built and the inherent randomness of what they produce. They've been trained on most of what's on the inter-

Biden's AI industry initiatives. "Large language models reflect the data they're trained on, including all the contradictions and biases in human language."

Tech workers also have a say in how they're designed, from the global workforce of annotators who check their responses to the Silicon Valley engineers who craft the instructions for how they interact with people.

“First off, there’s no such thing as woke AI. There’s AI technology that discriminates and then there’s AI technology that actually works for all people.”

Alejandra Montoya-Boyer

net, reflecting the biases of all the people who've posted commentary, edited a Wikipedia entry or shared images online.

"This will be extremely difficult for tech companies to comply with," said former Biden administration official Jim Secreto, who was deputy chief of staff to U.S. Secretary of Commerce Gina Raimondo, an architect of many of President Joe

Trump's order targets those "top-down" efforts at tech companies to incorporate what it calls the "destructive" ideology of diversity, equity and inclusion into AI models, including "concepts like critical race theory, transgenderism, unconscious bias, intersectionality, and systemic racism."

The directive has invited comparison to China's heavier-handed efforts to ensure that generative AI tools reflect the core values of the ruling Communist Party. Secreto said the order resembles China's playbook in "using the power of the state to stamp out what it sees as disfavored viewpoints."

The method is different, with China relying on direct

The Environmental Protection Agency wants to bring back the weed killer dicamba

By MELINA WALLING Associated Press

THE Environmental Protection Agency has proposed allowing the weed killer dicamba for genetically engineered soybeans and cotton, two crops that are grown extensively in the United States. This week's recommendation comes after the first Trump administration made the same move, only to have courts block it in 2020 and 2024. This is the first year since 2016 that dicamba has not been allowed to be used on crops, according to Nathan Donley, the environmental health science director at

the Center for Biological Diversity, a national conservation nonprofit.

Environmental groups say they will once again go to court to try to block it.

"This is an unfortunate roller coaster ride that the country has been in for about 10 years now, and it's just incredibly sad to see our Environmental Protection Agency being hijacked by this administration and facilitating decisions that are objectively going to make our environment less healthy," Donley said.

The EPA said via email that it "will ensure that farmers have the tools they need to protect crops and provide a healthy and

NOTICE

NOTICE is hereby given that RENOT BELLOT of Golden Gates #1, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of July, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

affordable food supply for our country" and the agency is "confident these products won't cause issues for human health or the environment."

The EPA added that the proposal will be open for public comment for 30 days and included a list of proposed guidelines on the use of the three dicambacontaining products in question.