Bahamas on track, but ‘slow spending faster’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

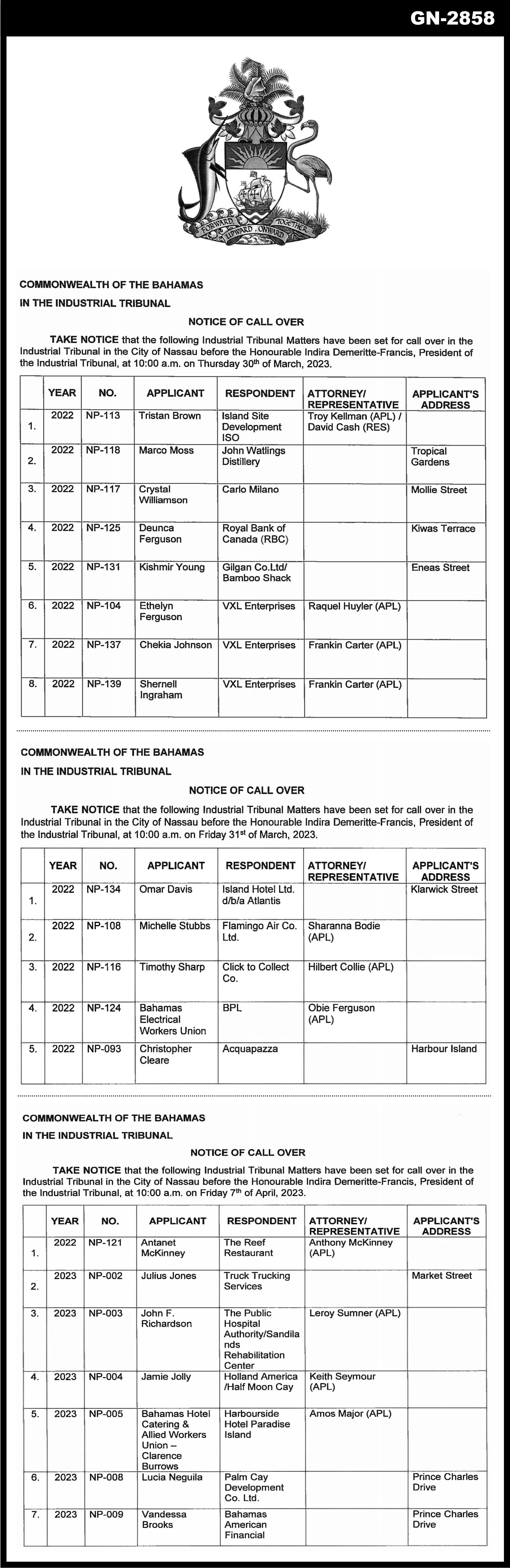

THE BAHAMAS must produce “a faster slowdown on spending” to ensure it hits the revised $575.4m full-year deficit target and other key fiscal goals, a major international financial services group is urging.

Santander’s US capital markets unit, in a March 10 research note on The Bahamas to its institutional investor clients, warned that “spending needs to slow” in what was otherwise a relatively upbeat assessment on the country’s “remarkable recovery” in tourism and year-overyear improvement in government

• Santander: ‘Decelerate’ to hit $575m deficit

• But hails ‘remarkable recovery’ for tourism

• ‘Huge credibility boost’, warns of ‘slow fix’

revenues as the economy emerged from COVID’s ravages. However, it said the $124.7m revenue increase for the 2022-2023 fiscal

Petroleum retailer: Gov’t says ‘they want us to fail’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A GAS station operator yesterday suggested a six-month job swap with a Cabinet minister so the latter can gain a full understanding of the industry’s plight, adding: “He’s telling us he wants us to fail.”

Vasco Bastian, the Bahamas Petroleum Retailers Association’s (BPRA) vice-president, told Tribune Business he was willing to exchange roles with Michael Halkitis, minister of economic affairs, so he can see exactly why the sector is pushing so hard for an increase in its price-controlled fixed margins.

Responding after Mr Halkitis, speaking during the Senate’s mid-year Budget debate, reiterated the Government’s continued opposition to any increase in gasoline or diesel margins, he urged the minister “for the love of

Jesus” to reconsider his and the Davis administration’s position.

With gas station operators unable to remain profitable, and absorb ever-increasing costs and inflationary pressures via fixed margins that have not increased for more than 11 years, Mr Bastian said he and other dealers noticed that the Government has granted concessions to multiple foreign investors and the trade unions but is unwilling to do the same for Bahamian investors who “fuel the economy every day”.

Emphasising that he has “the utmost respect” for Mr Halkitis, and that his comments were not to be taken personally, he nevertheless argued that the minister’s Senate statement “tells Bahamian gas station operators throughout the Commonwealth of The Bahamas they they don’t care about us”.

SEE PAGE B8

Hotels strike ‘glass ceiling’ on 15-20% room shortage

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS may be unable to fully meet tourism demand for 12-18 months due to a room shortage caused by up to 15-20 percent of available inventory being taken offline, a senior hotelier has revealed.

Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) president, told Tribune Business he is optimistic the industry will soon “shatter the glass ceiling” caused by an imbalance between supply of available rooms and the surge in post-COVID

‘Absolutely not worried’ by Royal Caribbean’s PI plan

year’s first half “has not been sufficient to compensate” for a 26 percent year-over-year increase in total government spending during the three months to end-December 2022. During this period, Santander said the total deficit had increased by 75.2 percent year-over-year - from $145m in the 2021 calendar year’s fourth quarter to $254m in 2022.

“There is no immediate threat to the full year 2022-2023 fiscal targets on still six months remaining, and the July to December 2022 deficit of $281m at 49 percent of the full-year budgeted deficit of $564m,” Santander said in its Bahamas investor

SEE PAGE B7

• Cruise port chief ‘very confident’ enough visitors for all

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

NASSAU Cruise Port’s top executive says he is “absolutely not worried” about Royal Caribbean’s $100m Paradise Island project sucking away passengers to the detriment of his facility and other Bahamian-owned businesses.

Michael Maura told Tribune Business he is “very confident” there will be sufficient visitor volumes to support his $300m project, Bay Street and downtown Nassau merchants, restaurants and straw vendors, and all cruise-reliant industries once the cruise giant’s Royal Beach Club opens in 2025.

Noting that there will be days when Nassau Cruise Port receives as many as 30,000-plus passengers, he argued that not all will want “to go and sit on a beach”

but, instead, seek out authentic Bahamian experiences involving this nation’s culture, heritage, cuisine and other unique aspects. For that reason, Mr Maura renewed his call for Bahamian investors and entrepreneurs to invest in tours, excursions and attractions that will deliver such experiences ahead of Royal Caribbean’s beach club project becoming operational,

visitor demand for the destination.

Speaking after Dr Kenneth Romer, the Ministry of Tourism’s deputy directorgeneral and acting head

SEE PAGE B10

business@tribunemedia.net MONDAY, MARCH 13, 2023

SEE PAGE B9

ROBERT SANDS

MICHAEL MAURA

BAHAMAS Petroleum Retailers Association (BPRA) members.

$5.70 $5.76 $5.72 $5.92

SILICON VALLEY BANK’S FAILURE SHOWS RISK MANAGEMENT KEY

As a governance, risk and compliance professional, I must emphasise the importance of establishing a solid risk management framework to protect against possible catastrophic corporate failures. The current business environment is constantly evolving, and new risks are emerging. Therefore, adopting a robust risk management strategy is essential to protecting businesses from future uncertainties.

The primary objective of a risk management framework is to identify, assess and mitigate risks. By identifying the potential risks, a company can create a proactive strategy to address them. This helps minimise risks and their possible impact on the company’s

operations and financial stability.

One of the significant risks that businesses face is financial collapse. This can occur due to various reasons, such as economic downturns, natural disasters or plain mismanagement.

A robust risk management framework can help companies mitigate these risks and prevent financial collapse. This article will highlight three crucial points to keep in mind, and provide one recent example of where risk management was unsuccessful.

Identify, assess and mitigate risks

The primary objective of a risk management framework is to identify, assess and mitigate risks. By conducting a comprehensive risk assessment, a company

can identify potential risks and evaluate their likelihood and impact on the business. This is crucial in creating a proactive strategy to address the risks, minimising their impact on the company’s operations and financial stability. The risk assessment process should involve all stakeholders in the company and be updated regularly to reflect any changes in the business environment.

Develop a risk mitigation strategy

Once risks are identified and assessed, developing a risk mitigation strategy is next. The risk mitigation strategy should include plans and processes to manage the identified risks, assign individual responsibilities and develop contingency plans

to manage the risks effectively. Monitoring and reporting should also be conducted to ensure the mitigation strategies are working effectively.

Financial collapse

Financial collapse is a significant risk that businesses face due to various factors, such as economic downturns, natural disasters or mismanagement. A robust risk management framework can help companies mitigate these risks and prevent financial collapse. However, companies face other risks, such as operational, legal and reputational risks. Therefore, a comprehensive risk management framework should address all these risks. For example, operational risks can include system failures or employee errors. Legal risks can consist of lawsuits or regulatory fines. Finally, reputational risks can occur due to negative publicity or customer complaints.

News of Silicon Valley Bank’s (SVB) failure on March 10, 2023, is a clear example of how poor governance and risk management can lead to

Derek Smith By

disastrous consequences. According to Fortune, SVB functioned without a chief risk officer for more than eight months. Despite being a well-known and established player in the banking industry, SVB failed to adequately address internal governance and risk issues, which may have contributed to its eventual collapse. This failure highlights the importance of effective risk management and regulatory compliance in the banking industry, and raises questions about

SVB’s leadership and oversight practices.

In conclusion, a robust risk management framework is essential for businesses to mitigate possible collapse. Companies can protect their operations and financial stability by identifying, assessing and managing risks. With a robust risk management strategy in place, companies can not only survive but also thrive in the face of uncertainty.

• NB: About Derek Smith Jr Derek Smith Jr. has been a governance, risk and compliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfsburg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certified anti-money laundering specialist (CAMS), and the assistant vice-president, compliance and money laundering reporting officer (MLRO) for CG Atlantic’s family of companies (member of Coralisle Group) for The Bahamas and Turks & Caicos.

Disney’s Lighthouse Point project to open summer ‘24

DISNEY Cruise Line has confirmed Lighthouse Point on Eleuthera’s southern tip is set to open in summer 2024 after local artists and advisors worked with it to infuse Bahamian culture into the destination.

Sharon Siskie, Disney Cruise Line’s senior vicepresident and general manager, said in a statement: “At Disney Cruise Line we have a deep appreciation for the Bahamian community. We are connected in many ways, including our shared values of storytelling and hospitality. With the opening of Lighthouse Point, visitors from around the world will experience the magic of The Bahamas in a new way - one that truly celebrates its natural and cultural beauty.”

When cruise passengers arrive at Lighthouse Point, Disney said they will be greeted by buildings designed to appear as shells, which upon further inspection, will reveal native flora and fauna and the history of Junkanoo parades. References to folklore characters will be seen throughout.

Several Bahamian artists were involved in the design of Lighthouse Point. Imogene Walkine, a ceramic artist from Eleuthera, said: “The unique opportunity of working with Disney with my ceramic work has been the blessing of sharing my version of the Bahamian story to the world, and being a part of the positive vibes that Disney brings to its visitors.

“It’s very special to be able to work in your given gift. It’s very important to have the opportunity not just to share it with my local

and native Bahamians, but for the world to be able to recognise that we have a story to tell in our own unique way and we take a lot of pride in our culture.”

Andret John, a Bahamian wood carving artist from New Providence, added: “I grew up with Disney and these ideas of magic and bringing fantasy to life. So, to have this opportunity is beyond my wildest dreams. To have a platform where you can express yourself so freely, and to work with a partner like Disney who allows you that freedom, is even more resounding in what I do as an artist.

“Understanding that [you’re working for Disney and they] completely trust you to freely produce what you enjoy doing - that in itself is magnificent and phenomenal.” Some 90 percent of the project’s electricity needs will be generated via solar energy, while the pier where cruise ships dock will be designed to avoid the need for dredging while providing elevated walkways.

Kevin Thomas, Walt Disney Imagineering’s creative director, said:

“Lighthouse Point is a place of extraordinary natural beauty, so our goal has always been to create designs that accentuate its qualities in an organic way. We’re focused on low-density, sustainable development that protects and preserves the environment, allowing the site’s biodiversity to shine.”

Similar to Disney’s cruise ships and Castaway Cay, its existing destination in The Bahamas, Lighthouse Point will offer Bahamian

storytelling alongside favorite Disney characters. A Bahamian art and cultural pavilion featuring special programmes and local artists will also provide visitors to Lighthouse Point with the opportunity to learn about the traditions and natural beauty of The Bahamas.

Joey Gaskins, Disney Cruise Line’s public affairs director, said: “As a Bahamian, I’m excited that guests will have a chance to learn more about our unique culture, history and natural environment. We are using sustainable designs that reflect elements of nature and are incorporating the work of Bahamian artists that, together, will create an experience unlike anywhere in The Bahamas.”

Disney Cruise Line’s plans call for developing only 16 percent of Lighthouse Point. More than 190 acres will be donated by Disney to the Government and people of The Bahamas. Full access to the property for non-commercial purposes will be provided to citizens and residents of The Bahamas.

The company added that a collection of new port adventures, developed in partnership with local tour operators, will take guests beyond Lighthouse Point to explore the culture and beauty of Eleuthera.

Lighthouse Point will open for select sailings in summer 2024. Details on inaugural itineraries and additional information about entertainment, dining, retail and excursions will be released at a later date.

PAGE 2, Monday, March 13, 2023 THE TRIBUNE

LIGHTHOUSE POINT PROJECT RENDERING

DISNEY’S

BAHAMAS ‘ON TRACK’ FOR OCTOBER EU DELISTING

being non-cooperative in its fight against tax avoidance and evasion.

ownership reporting portal, will result in us being compliant.”

THE ATTORNEY General says The Bahamas is “on track” to address the deficiencies that led to its renewed blacklisting by the European Union (EU) with the 27-country bloc set to “review” this nation’s progress in August.

Ryan Pinder KC, speaking on the sidelines of the Society of Trust and Estate Practitioners (STEP) Bahamas conference last week, indicated the Government is hoping The Bahamas will satisfy the EU’s concerns such that it is delisted in October 2023. That is the next scheduled date for the EU to assess the countries it has cited for allegedly

“The next round of review is later this year,” Mr Pinder said. “I think they come in in August and make a determination in October. We are well on track to putting in a new portal and new implementation of the economic substance reporting.

“Unfortunately, the prior attempt was not adequate and, coupled with COVID and other challenges the countries had, we just were not able to comply with the requirements of implementation. It’s not a legal issue. It’s an implementation issue, and we believe that the new portal we’re getting that’s provided by BDO, which is the same company that does our beneficial

The EU blacklisted The Bahamas in October because it was unable to correct deficiencies in its economic substance reporting regime prior to the April 2022 deadline. This relates to the Commercial Entities (Substance Requirements) Act 2018, which requires companies conducting “relevant activities” to confirm they are carrying out real business in The Bahamas via annual electronic filings.

These companies must show they are doing real, legitimate business in a jurisdiction and are not merely brass plate, letterbox fronting entities acting to shield taxable assets and wealth from their home

country authorities. The EU, which reviews its tax non-cooperation initiative twice yearly, kept The Bahamas on its blacklist when the bloc met last month to assess it and other cited nations.

“The Bahamas facilitates offshore structures and arrangements aimed at attracting profits without real economic substance by failing to take all necessary actions to ensure the effective implementation of substance requirements,” the EU’s February 14, 2023, summary concluded.

Given that escaping the EU’s listing involves a process to remedy identified deficiencies, it was always unrealistic to expect that The Bahamas would be delisted in February, thus making October the likely

first opportunity for this nation to escape.

Mr Pinder told the STEP Bahamas conference: “The European Union, through its Code of Conduct Group, performs annual monitoring of the effective implementation of substance requirements under EU list criterion 2.2.

“Shortly after the general election [in September 2021], the Government received notice of certain deficiencies related to the implementation of the Commercial Entities Substance Requirements Act 2018 and the economic substance reporting that were found in the annual monitoring for 2019 and 2020.

“Our administration has worked diligently to satisfy the concerns of the European Union. However, not

all deficiencies could be addressed before the determination of our review. As we know, the European Union added The Bahamas to its list of non-cooperative jurisdictions.”

Tribune Business previously reported that deficiencies with the economic substance reporting portal, and an inability to test, analyse and inspect the data, was the critical factor behind the EU blacklisting.

Mr Pinder told the STEP conference: “To give some context, the deficiencies primarily lie in the reporting portal and methodology that was put in place.

“As you might know, the former administration looked to put the substance reporting through the

SEE PAGE B6

Online civil registry disabled to help ‘protect data integrity’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE ATTORNEY General has revealed online access to the civil registry at the Registrar General’s Department was shut down “to preserve the integrity of the data” that it holds.

Ryan Pinder KC, addressing the Society of Trust and Estate Practitioners (STEP) Bahamas conference, said full restoration of the online portal was anticipated “within weeks” as a “complete maintenance overhaul and security upgrade” is in process for the civil registry.

“Currently, remote access to the Registrar General’s Department’s Civil Registry Integrated System (CRIS) has been temporarily disabled in order to preserve the integrity of the data in the Registrar General’s Department’s custody. In that regard, a complete maintenance overhaul and

security upgrade to CRIS is underway. We are working assiduously to restore access for all users and expect full restoration within weeks,” he said.

This update came less than two weeks after Mr Pinder told Tribune Business that long-standing problems with the Registrar General’s Department’s online portal for the civil registry “are beyond our control” as lawyers and realtors branded the situation “a horror”.

The attorney general said then that he “understands the frustration” over woes that private sector executives say have persisted for up to “six months” and increased both the time and cost associated with real estate transactions.

He pledged that the Government is “doing whatever we can to rectify” the issues caused by the Registrar General’s portal going offline since last summer, which has left attorneys, in

particular, unable to conduct rapid and relatively inexpensive searches for title deeds and particular conveyancing documents.

“The issues related to the civil registry are being addressed and should be online in a matter of weeks,” Mr Pinder told this newspaper. “We are looking at a new civil registry platform much as in the same framework as we are going to launch on the commercial side.

“The issues with the current system are beyond our control and we are doing whatever we can to rectify in the short-term pending a new solution. I understand the frustration and delays, but the issues are out of our control on why it has had to be down.” He did not go into specifics on what had caused the online portal to shutdown, but there were suggestions - still unconfirmed - of possible hacking attempts and security breaches.

Besides deeds and documents related to real estate conveyances, the civil registry is also responsible for births, deaths and marriages. These functions make the Registrar General’s Department a hub around which not just the private sector and economy, but the whole of society, functions given that it touches all citizens and residents at some point in their lives.

“In addition, we have received a proposal to put in place a new civil registry online portal developed by the same developers as the new company platform to ensure that we do not have similar frustrations over antiquated technology,” Mr Pinder added.

“This will provide comprehensive search capabilities for civil documents and also allow an integrated online user

experience. This will be a significant improvement to what we experience today and the customer service experience will be greatly improved.”

The attorney general said the Registrar General’s Department was aiming to move into its new location on the ground floor of the Bahamas Financial Centre, located at the corner of Shirley and Charlotte Streets in downtown Nassau, by the end of April. And the new companies registry platform - separate and distinct from the civil registry - has now been released to the agency for internal testing and adjustments.

“We have been constructing a new state-of-the-art location that will allow for proper customer service to clients of the registrar general. This will be at the ground floor

of the Financial Centre, with specialty services on other floors in the Financial Centre The Registrar General looks to move into their new location soon, forecasted to be the end of April. We believe this will allow a professional atmosphere in a modern customer service setting,” Mr Pinder said.

“As many of you would know we have been developing a new, stateof-the-art online company registry platform. This platform is designed to be similar to the platform used in the Cayman Islands. I am pleased to advise that this week I was able to be given a demonstration of the new corporate registry platform.

“The registry platform has also been released to the Registrar General for internal testing and

SEE PAGE B4

THE TRIBUNE Monday, March 13, 2023, PAGE 3

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

CAPACITY CONCERNS DRIVING 14 OUT ISLAND AIRPORT BIDS

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

MANY Family Island airports “no longer meet” growing tourist and airline demands, the Government’s top aviation official said yesterday, as he justified the rationale for putting 14 locations out to bid.

Dr Kenneth Romer, the Ministry of Tourism’s deputy director-general and acting director of aviation, told the Office of The Prime Minister’s weekly press briefing that airport operations and development was critical to the “national strategy” for further developing this industry.

He added that seeking private sector capital, development and operations/ management expertise for the 14 airports, which were put out to tender on March 1, will “really unlock infrastructural growth” through an anticipated collective $263m investment in their upgrade.

The airports, which will still be owned by the Government, will be leased to the respective winning bidders for 30 years via public-private partnership (PPP) arrangements in a bid to improve airlift connectivity and increase their capacity to handle ever-growing volumes of tourist arrivals to the Family Islands.

“The reality is… the airports must be developed to ensure they comply with ICAO (International Civil Aviation Organisation) standards and to ensure that they are lending themselves to good experiences for both international and domestic travellers,” Dr Romer said.

“The facilities no longer meet the current and growing demands of airlift and, of course, traffic growth is constrained by capacity. We’re [the Ministry of Tourism] going out there speaking about attracting additional airlift, but the airlines are constantly speaking about the ability

DR KENNETH ROMER

of these airports to handle capacity.”

“Beyond the next five years, it [the PPPs] will be a part of our national strategy for the development of aviation again throughout archipelago. I believe that the concurrent and timely capital investments are going to seek to optimise our levels of service, and this is critical for us as a tourism-dependent nation.”

Dr Romer said the bidding process launched on March 1, 2023, with the request for bidders to

pre-qualify before the process moves into the Request for Proposal (RFP) phase and, ultimately, the selection of the most-qualified and suitable candidates to upgrade the airports.

He added that the prequalification phase is “simply to seek relevant industry qualifications, invite qualified and experienced concessionaires to be a part of the design the building, financing, operating and maintaining a portfolio of Family Island airports”.

The Ministry of Tourism, Aviation and Investments is estimating that a collective $263m investment will be required to turn the 14 selected airports into hubs of a size and standard appropriate for their location. Exuma and North Eleuthera are projected to require the greatest capital spend, at around $65m each, with Governor’s Harbour, Rock Sound, New Bight and Deadman’s Cay (Long Island) all pegged at around $18m apiece.

San Salvador was projected to carry a $15m price tag, with the quartet of Marsh Harbour, Sandy Point, Treasure Cay and Congo Town in Andros all projected to need a $10m investment. The smaller aviation gateways in the Exuma cays - Staniel Cay, Fowl Cay and Black Point, were each pegged at $2m.

Dr Romer said yesterday that the Government’s goal is to turn the 14 airports into “profit centres” where feasible. “We believe it can be done throughout the 14 targeted airports, exclusive of Grand Bahama and Great Harbour Cay, which was launched in 2022,” he added.

“Grand Bahama, of course, an announcement is imminent with Grand Bahama, and when we have these airports operating profitably there’s going to be some responsibility for maximising revenue and managing costs to generate an optimised profitability.”

Dr Romer then confirmed: “We’re going

to go in an order of airports: Abaco, the Leonard Thompson International Airport, at [then at] tier three, Sandy Point and Treasure Cay airports. Andros, Congo Town airport, Cat Island, New Bight International Airport as a part of this particular portfolio.

“Eleuthera is going to get triplets when it speaks to Governors Harbour, North Eleuthera and also Rock Sound. The main Exuma airport is going to be targeted for development. As a matter of fact, we are pleased that development has continued and construction is in earnest in Georgetown, Exuma, with three in the Exuma cays, specifically Black Point, Farmer’s and Staniel Cay. “Long Island again is targeted for development through Deadman’s Cay International Airport, and San Salvador has also been targeted, very important again for Club Med, and so we have targeted 14 in this particular portfolio.”

Online civil registry disabled to help ‘protect data integrity’

FROM PAGE B1

adjustments.... We have engaged a consultant who is working to assist with the migration of data. The Registrar General will shortly invite private sector representatives to participate in an internal pilot programme of the new company registry. In this exercise, the private sector will test the system and provide meaningful input on the operations and user experience,” Mr Pinder added.

“We will have an opportunity to make adjustments to reflect the comments received from industry. The next phase should be to open the portal up generally

to the private sector for new incorporations while we continue to migrate and cleanse the quality of the historical data. Once the migration and scanning is complete the company registry will have all the data and all the services will be widely available.

“There will be options for subscriptions to the service to receive more personalised service and delivery options for larger entities that frequently use the Registrar services.” Mr Pinder reiterated that the Government will assess whether splitting the Registrar General’s Department into separate corporate and civil registries will generate

operational efficiencies, and a “preliminary review” has been conducted to determine if legal reforms are needed to facilitate this.

Elsewhere, Mr Pinder said the Government will soon release a public consultation paper on introducing corporate income tax in The Bahamas and its potential impacts. This comes as the G-7/OECDled initiative on a minimum 15 percent corporate tax rate for multinationals earning 750m euros per annum and above forges ahead.

Under the former Minnis administration, The Bahamas has already agreed to comply with this initiative,

which would impose a 15 percent minimum tax on Bahamas-based entities that are part of such groups.

“A corporate income tax is clearly a novel approach in The Bahamas and will have significant regulatory reform for the country in tax administration, affecting almost every area of the cross-border economy,” Mr Pinder said.

“We as the Government of The Bahamas have been working internally to prepare for the implementation. We have received a final report on the impact to our economy of a corporate income tax, evaluating at what levels it can be implemented, and we look to release shortly a Green Paper for public consultation on a corporate income tax.”

Mr Pinder added that the Financial Action Task Force (FATF), the global standard-setter for combating money laundering and other financial crimes, is examining revisions to its recommendations on the transparency and beneficial ownership of legal arrangements such as trusts. Given that much of The Bahamas’ private wealth management business is based on trusts and estate planning, he said this has potentially “material implications” for financial services.

“Recommendation 25 currently requires trustees to obtain and hold information on beneficiaries or classes of beneficiaries. FATF is considering setting the nexus of such obligations to countries where the trustees reside or where the

trusts are administered,” the attorney general said, noting that some wanted disclosure obligations to go as far as establishing central registries/databases of their identities.

“Clearly the recent EU ruling on public registers would have an effect on this advocacy,” Mr Pinder said of the Tax Justice Network. “They take it even further, advocating that the FATF should prohibit discretionary trusts or at least consider them to be high risk for secrecy, sanction avoidance and prevention of asset recovery. These positions are rather extreme, but they are the comments being submitted to the FATF.”

PAGE 4, Monday, March 13, 2023 THE TRIBUNE

MANAGING OUR PERSONAL FINANCES

Financial literacy and emotional control matter at least as much as income in determining how wealthy someone is likely to become. Managing money can be a challenge for many people, regardless of their income level. The reasons for this are complex, but one key factor is the role of emotions in financial decision-making.

Fear, anxiety and impulsiveness can all affect how we manage money. For example, fear of missing out (FOMO) can cause individuals to overspend and make impulsive purchases, while anxiety can lead to oversaving and hoarding money.

Furthermore, managing money can be challenging even for those who have a lot of it. Some may have a high income, but still struggle with their finances due to poor financial planning or overspending. On the other hand, some people

who have a lower income manage their money well and become wealthy through smart investments and careful spending. One example of a person who managed their money well despite starting-off with a low income is Chris Gardner, on whom the film The Pursuit of Happiness is based. Gardner was homeless and struggling to make ends meet while raising his young son. He took a chance on an unpaid internship at a stock brokerage firm and eventually worked his way up to becoming a successful investor and entrepreneur. Gardner’s story is a testament to the power of determination and hard work in overcoming financial obstacles.

On the other hand, there are many examples of wealthy individuals who

Air arrivals 100,000 off pre-COVID in ‘22

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

AIR arrivals to The Bahamas in 2022 fell just 100,000 short of the 1.6m received in 2019 prior to the COVID-19 pandemic that shut tourism down for much of 2020 and 2021, it was revealed yesterday.

Dr Kenneth Romer, the Ministry of Tourism’s deputy director-general, told the Office of The Prime Minister’s weekly press briefing that air arrivals

for 2022 totalled 1.5m as opposed to the last full-year pre-COVID performance. Asserting that January’s numbers have reinforced the Ministry of Tourism’s belief that The Bahamas can hit 2023’s forecast for a 20 percent increase in visitor arrivals, he added: “We saw that in January of this year that overall tourism arrivals month-over-month, we had 636,000 in 2019 and we were almost to one million, almost 900,000, which represents an increase of some

end up destitute due to their inability to manage personal finances. One such case is former NBA player Antoine Walker. Despite earning more than $100m during his career, Walker filed for bankruptcy in 2010 due to overspending and poor investments.

One reason why those with money struggle to save or invest is due to lifestyle inflation. Lifestyle inflation occurs when individuals raise their spending as their income increases. As a result, they may find it challenging to save or invest money.

Another reason why many battle to save or invest is due to a lack of financial literacy. Many adults have never been taught how to manage their money in school or at home, and they may not

33 percent when we compare with 2019.

“This is significant for us as a destination. When we speak about air arrivals, for the first time air arrivals actually exceeded pre-pandemic numbers in January 2019. We saw some 129,000 in 2019, and we have now soared to about 132,000 year-over-year for January 2023 compared to 2019. So we believe that we are on the right track when it comes to the significant roads we’re making in overall tourism, and also air arrivals.”

Dr Romer’s comments came as Nassau/Paradise Island resorts revealed that 2022’s room revenue more than doubled

SEE PAGE B12

know where to start when it comes to financial planning. Without proper guidance, they may struggle to make informed financial decisions – even those with high-flying careers.

Overspending can have a significant impact on our financial health. When we spend more than we earn, we accumulate debt and may struggle to save money for emergencies or investments. On the other hand, over-saving can also be detrimental to our financial health. When we hoard money, failing to invest at least part of it, we miss potential investment returns, become more exposed to inflation and may not have enough to retire comfortably.

In conclusion, managing money can be a difficult task, even for high earners. The role of emotions in financial decision-making, lifestyle inflation and a lack of financial literacy are just a few of the reasons why people struggle to manage their finances. However, it

is possible to become financially stable and wealthy through careful planning, smart investments and sensible spending.

THE TRIBUNE Monday, March 13, 2023, PAGE 5

By RICARDO EVANGELISTA Activ Trades

KING MIDAS

CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

DPM LEADS DELEGATION TO MAJOR CRUISE SUMMIT

THE DEPUTY Prime Minister will lead a Ministry of Tourism delegation to a major cruise industry event set to take place in Florida from March 27-30.

Chester Cooper, also minister of tourism, investments and aviation, will lead a team to Seatrade Cruise Global Conference, which is scheduled for Broward County Convention Centre in Fort Lauderdale, Florida, in a bid to drive

increased passenger numbers and vessel calls to The Bahamas.

Now in its 38th year, under the theme ‘Forward Momentum’ the conference will bring together government officials, tourism stakeholders, industry suppliers and cruise executives from more than 100 countries to analyse trends and discuss current issues facing the industry.

“Without a doubt, cruising is one of the exciting

ways to see the beautiful islands of The Bahamas,” said Mr Cooper in a statement. “Having had to pivot our tourism plans during the height of the COVID-19 pandemic, we are now capitalising on all our efforts for a continued robust tourism rebound in all sectors of our economy including cruising.

“And even as The Bahamas prepares to celebrate its Golden Jubilee of Independence, our attendance at Seatrade Conference

this year is much more consequential. We have heightened our focus on the future of cruising and implementing plans that will position The Bahamas to exponentially increase its share of the cruise market over the long term.”

On Monday evening, March 27, the Ministry of Tourism, Investments and Aviation will co-sponsor the Cruise Line International Association (CLIA)

BAHAMAS ‘ON TRACK’ FOR OCTOBER EU DELISTING

Department of Inland

Revenue framework. This method was ineffective and presented many problems with the actual administration of the reporting and implementation was challenged given the shut downs related to the pandemic and

the lack of human capital working at the time.

“To remedy this situation we thought it more appropriate to start from scratch and have an entirely new reporting portal and framework put in place. We have solicited a number of proposals for a separate substance reporting portal

and platform that has been designed for the specific purpose, much like what you experience with the BOSS system and beneficial ownership reporting,” he continued.

“We have decided on BDO to develop a new portal for economic

substance reporting. This is the same company who implemented and manages the BOSS system, which has been a reliable and compliant system for beneficial ownership registry. We believe this is the proper way to do it and be in compliance with what is

NOTICE

NOTICE is hereby given that ANDREA STEWART of P. O. Box AP-59223, Eastbrook Road, Highland Park, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Business on the Beach reception for 700 cruise executives at the Marriott Harbour Beach Resort in Fort Lauderdale. Guests can expect live Bahamian music by the Lassie Doh Boys, a Junkanoo rush-out and sampling of Bahamian cuisine and signature drinks.

In 2022, The Bahamas received 5.39m cruise visitors. The Bahamas is home to nine ports of call: Nassau, Freeport, Bimini,

expected of us for the effective implementation of the substance reporting regime.

“We also look to put in place a framework to allow us to verify, whether through inspection or audit or some other acceptable method, the accuracy of the data being used in the substance reporting. This is also an important remediation element. We look to be in a position to be re-rated by the EU as compliant later this year.”

Ministers in the Minnis administration have previously refuted assertions that nothing was done to correct these deficiencies. They have argued that the company which originally developed the portal was contracted to fix the weaknesses, and a plan was left in place prior to the September 2021 general

Princess Cays, Half Moon Cay, Coco Cay, Great Stirrup Cay, Castaway Cay and Ocean Cay. Seatrade Cruise Global draws more than 500 exhibitors, and is organised by the Florida-Caribbean Cruise Association (FCCA) to facilitate discussion by cruise and maritime experts and decision-makers on tourism development, including ports of call, safety and security.

election to remedy the EU’s concerns.

Kwasi Thompson, former minister of state for finance and others, have instead argued that the Government’s failure to follow through on this and act more rapidly led to the EU blacklisting. They have also asserted that the departure of Stephen Coakley-Wells, who headed the Ministry of Finance’s international tax unit, and the disbanding of the unit itself may have meant no one in government was focused on the EU issue.

Prime Minister Philip Davis KC also signed three letters that were sent to the EU over a six-week period between December 2021 and January 2022 promising that The Bahamas would comply with its demands by the April deadline.

JOB OPPORTUNITY

AccuRad Imaging Consultants is a diagnostic imaging reporting/teleradiology company operating in the Bahamas. AccuRad provides diagnostic imaging reporting services to facilities and doctor’s offices throughout the Bahamas. The imaging modalities reported include, but are not limited to, x-ray, mammography, CT, ultrasound and MRI. AccuRad is seeking a fellowship trained radiologist to join the practice. Fellowship training in oncology imaging and neuroradiology is preferred. On-site work is not required. The candidate is expected to be able to provide coverage on weekends and/or stat holidays. Occasionally, there may be overnight coverage requirements. Competency in reporting all above mentioned modalities is a must. Only candidates who have completed a full radiology residency program and attained board certification by examination will be considered. Fellowship/subspecialty training must have been acquired at an accredited institution in the US, Canada or UK. All applicants must be eligible for specialist licensure in the Bahamas.

Interested applicants can submit their CV and statement of interest via email to admin@accurad.live

PAGE 6, Monday, March 13, 2023 THE TRIBUNE

FROM PAGE B3

ACCURAD IMAGING CONSULTANTS SEEKING RADIOLOGIST

Bahamas on track, but ‘slow spending faster’

FROM PAGE B1

note, headlined ‘The revenues are robust but spending needs to slow’.

“However, the current pace of spending is not sustainable and there isn’t much flexibility against any shocks or budget seasonality. The next few months of data needs to reaffirm a faster slowdown on spending to reassure full-year Budget compliance. The medium-term fiscal projections rely upon higher trend revenues. However, the fiscal year 2022-2023 adjustment depends on lower spending.” The halfyear revenue increase has largely been consumed by higher spending.

Simon Wilson, the Ministry of Finance’s financial secretary, told Tribune Business that the Davis administration has no worries over its level of recurrent spending or ability to hit the year-end deficit target and other vital fiscal indicators.

“There’s no concern over recurrent expenditure,” he emphasised. “Recurrent expenditure as a percentage of GDP has gone down by 1 percentage point.”

Recurrent spending, which largely covers the Government’s fixed costs such as salaries, rents and personal emoluments, has reduced from 12.6 percent of gross domestic product (GDP) to 11.6 percent during the 2022-2023 fiscal year’s first half, Mr Wilson added.

The reduction, though, has largely been driven by the increase in economic output or GDP as the economy reflates post-COVID.

Total spending during the 2022-2023 fiscal year’s first half rose by $119.3m year-over-year, including a $105.3m increase in recurrent expenditure, even though the Government has been able to sharply reduce social assistance and business/unemployment support related to COVID19 as the pandemic and associated restrictions ease.

Michael Halkitis, minister of economic affairs, during his mid-year Budget debate contribution in the Senate last Thursday, argued that there was often a tendency to view government spending - and any increases in it - solely as an extra cost despite the fact these monies were often spent with Bahamian businesses and thereby increased economic activity.

Dissecting the recurrent spending increase to $1.417bn for the six months to end-December 2022, he said $42.4m of the $105.3m jump came from a “higher public service wage bill” sparked by staff increases, salary adjustments, industrial agreements with the likes of the nurses and teachers, the minimum wage rise and increments and promotions.

This $42.4m “went directly into the pockets of workers”, the minister added. There was also a $24.1m increase in government spending on goods and services, and a $41.1m jump in the Government’s interest payments on its debt to $280m. “In an environment of rising interest rates, we see interest payments rising and still the necessity for the Government to borrow money,” Mr Halkitis said. “Unfortunately the debt remains at

elevated levels, so we have to spend more money.”

He added, though, that reducing or cutting public spending too drastically - especially the civil service wage bill, and expenditure on goods and services - could have negative consequences for a small economy such as The Bahamas where the Government accounts for a significant percentage of economic activity.

“The majority of that is being spent with Bahamian businesses, putting money into the economy,” Mr Halkitis said. “We shouldn’t always look at spending as how much something costs, as a negative, because you’re spending within the economy.”

Asserting that the Government was “on course” to achieve its moderatelyincreased deficit target of $575.4m for the full year, the minister added that the $4.9m primary budget surplus achieved during the 2022-2023 first half meant The Bahamas was no longer “on the slippery slope” of having to borrow money to pay interest on its existing debt.

The primary surplus measures by how much the Government’s revenues exceed recurrent spending when interest or debt servicing costs are stripped out from the latter. “For the first half of this fiscal year, the primary balance reflected a surplus of $4.9m,” Mr Halkitis said. “If you’re running a primary deficit, you’re borrowing money to pay interest.

“It’s a slippery slope and bad situation to be in. When you reverse that, and run a primary surplus, you no longer need to borrow to pay interest. You run a primary surplus for several years, and you start to see your debt go down. That is a very, very positive sign.”

The pace of government spending was the major, but largely only, concern in Santander’s analysis of The Bahamas’ fiscal position and wider economy. It added that the early 2023 tourism performance, with arrivals up 33 percent for January compared to the same month in 2019 preCOVID, made forecasts of a 20 percent increase in tourism numbers for the full year “seem conservative”.

“The strong recovery in tourism remains the backbone for economic growth and fiscal consolidation,” Santander said. “The latest data for January 2023 shows an almost three times’ increase from January 2022 with 12-month rolling tourist arrivals of 7.5m. The departure tax through the first half of fiscal year 2022-2023 is running at 74 percent of the Budget. This provides some budget flexibility on a mature phase of economic recovery elsewhere in the region.”

The 7.5m figure exceeds the record 7.2m for total visitor arrivals received by The Bahamas during a calendar year, which was 2019 and pre-COVID. “The tourism data starts the year strong with almost one million visitors in January,” Santander added. “The builds upon the remarkable recovery from 2.1m tourists in 2021 to seven million in 2022.... This jumpstart to the year makes the official 20 percent target seem conservative for 2023.

NOTICE

DUCAL INVESTMENTS LTD.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas registered in the Register of Companies under the Registration Number 201049 B.

(In Voluntary Liquidation)

Notice is hereby given that the liquidation and the winding up of the Company is complete and the Company has been struck off the Register of Companies maintained by the Registrar General on the 20th day of February, 2023.

Dated this 9th day of March, A.D. 2023

Guilherme Pacheco de Britto

“The visitor arrivals now far exceed 2019 levels with growth trajectory dependent on an easing of prior bottlenecks including more frequent flights from the US and further foreign direct investment (FDI) in the tourism sector. There is still spare capacity with the hotel occupancy rates increasing from 47.9 percent in January 2022 to 55.7 percent in January 2023.

“The release of the first half fiscal data reaffirms the importance of the strong economic momentum, especially on the frequent criticism that revenue collection and growth projections are optimistic.” Santander said “revenue collection remains quite robust” following a total 12 percent year-over-year increase in the 2022 calendar year’s fourth quarter, which was achieved by a “7 percent year-overyear deceleration” in VAT revenues.

This, though, was offset by a 40 percent rise in international trade taxes and revenue rises elsewhere. However, spending concerns were never far away. “This has not been sufficient to compensate against the 26 percent year-over-year increase in overall spending in the 2022 fourth quarter, with the overall deficit increasing from $145m in the 2021 fourth quarter to $254m in the 2022 fourth quarter,” Santander added.

“The Government continues to unwind the COVID-related spending on subsidies and social assistance. However, all the other categories are higher, including wages and

debt service.... The resurgence of higher spending needs to decelerate in the second half of fiscal 20222023 to comply with the annual Budget deficit and to remain on the trajectory to reach fiscal surplus in 2024-2025.”

The Davis administration will likely take encouragement from Santander’s assessment that it is on the right course, albeit a fiscal

turnaround will take some time to complete given the scale of the task and an $11.036bn central government debt.

“The Bahamas is still heading in the right direction but it’s a slow fix on reverting the fiscal deficit to surplus (fiscal year 20242025) and slowly working down the debt ratios (fiscal year 2030-2031),” Santander said, the latter year

referring to when the debtto-GDP ratio is forecast to hit 50 percent in line with the Fiscal Responsibility Act’s goals.

“There has been a huge credibility boost on policy management..... The Bahamas is not likely to relapse into crisis, and should be more resilient to a US economic slowdown,” it concluded.

THE TRIBUNE Monday, March 13, 2023, PAGE 7

LIQUIDATOR

Petroleum retailer: Gov’t says ‘they want us to fail’

And, while Mr Halkitis had urged the petroleum dealers to keep negotiating with the Government in a bid to reach an “amicable solution”, Mr Bastian said they should keep talking “for what” given that the administration’s position that it will not deal with the core or root problemthe price controlled fixed margins. Asked about the petroleum dealers’ next move, given the position as outlined by the minister, Mr Bastian said: “I know where we’re going. We’re going to the church and will ask the church to pray for Michael Halkitis. Because obviously the minister of economic affairs, and I want you to quote me on the record, the minister of economic affairs does not love the gas station operators.

“I have to go to church and ask them to pray for Mr Halkitis. I have the utmost respect for Mr Halkitis, but he doesn’t understand the plight we face. We’re asking,

and we want you to ask, Mr Halkitis to reconsider his stance and position on the petroleum retailers.”

Mr Bastian then suggested that he and the minister of economic affairs swap jobs for six months, after which the dealers and the Government could meet and agree a lasting solution once the latter gained a better insight into their difficulties. “Ask the Prime Minister to appoint me minister of economic affairs for six months, and I will sign over all my documents to him [Mr Halkitis] and he can run my business for six months,” the Association vice-president said.

“I give my station to Mr Halkitis for six months, and I take his job for six months and go into the minster of economic affairs position. Let’s swap.” Mr Bastian’s comments come after the Association and its members met last week in an “emergency meeting” to discuss what action they will take given that the industry’s fixed margins - at their current levels - mean

they can no longer operate profitably. “I tell Mr Halkitis: For the love of Jesus, reconsider his position. We are investors in this economy and we are hurting,” Mr Bastian told Tribune Business. “The Government has done stuff for the unions, the Government has done stuff for Royal Caribbean for its beach club on Paradise Island. They have done stuff for major resorts lie Albany, for Disney Cruise Line. How have they done things for everybody except for us Bahamians who fuel the economy every day?

“I go to work every day at 4.30am to 5am to make sure we provide an essential commodity for the Bahamian people. I’ve just now come home at 2pm. Tell Mr Halkitis: Have a heart. I tell Mr Halkitis: It’s not personal. He has his job to do, but please reconsider his position. That’s all we’re asking and saying.

“He’s telling me, and other dealers.. he’s telling us he wants us to fail and he doesn’t care about us.

VACANCY FOR SALES AGENT

Applications are invited from suitably qualified and experienced individuals for the position of Sales Agent in a travel agency.

The core duties include:

• Assist individuals and groups make travel arrangements, which will include cruises, booking flights, hotels and sightseeing tours

• Assist customers in choosing their destinations, transportation, and inform the travelers of passport and visa requirements, rate of currency exchange and import duties

• Maximize sales and customer holiday experience by suggesting upgrades

• Have the ability to assess each customer’s unique needs, preferences, and budget to ensure their trip goes as smoothly as possible; and

• Should have a book of clients to enhance income generation

Skills, Knowledge, and Competencies:

• Passionate interest in geography, with strong domestic and international travel knowledge

• Excellent command of both written and spoken English

• Ability to build strong relationships with clients, both over the phone and face to face.

• Proficient in the Amadeus system, Quickbooks, Microsoft office, internet research skills for customer information.

• Ability to work in a target-based environment and achieve sales goals and objectives

Qualifications and Experience

• A minimum of three (3) BGCSEs (A college degree would be a plus but not essential).

• 3-5 years’ experience with established clientele

Interested persons should submit their resumes with a cover letter to: rdmsf72@yahoo.com

Deadline to apply is March 22nd. Compensation will be commensurate with relevant qualifications and experience.

Mr Halkitis’ statements tell Bahamian gas station operators throughout the Commonwealth of The Bahamas that he doesn’t care about us and wants us to fail. How can he do that?” Mr Bastian asked.

“Please ask Mr Halkitis to reconsider his position, and then let’s meet and finalise a solution once and for all to allow us to keep feeding our families, keep people employed and help us to make our mark as business owners in the country. Please, Mr Halkitis, reconsider. I ask him the question: Does he love Bahamian business owners or not? He has my job for six months, I have his job for six months, and then he can let me know if his position’s the same.”

Mr Halkitis, in closing the Senate’s mid-year Budget debate was resolute in asserting that the Government will not approve any measures that “immediately increase” the price of gasoline such as the margin increase that retailers have been screaming for over the past year.

He argued that the Government was not “unsympathetic” to their situation, and urged the retailers to keep talking and negotiating with it. However, given that a margin increase is at the centre of the industry’s demands, it would appear that the sector and Davis administration are at an impasse or stalemate as gas station operators mull measuressuch as operating hour and staff hour cuts, possibly even lay-offs - in a bid to slash costs and stay afloat.

Asked whether the Association and its members were willing to keep talking to the Government, Mr Bastian repeated “for what” three times given that it has taken the core issue - the industry’s margin structure and dealers’ need for an increase - seemingly off the table. He added

that the sector is adamant that it wants the fixed margin structure changed to a percentage similar to “breadbasket items”, which would ensure its earnings rise in line with oil and gas price hikes. “Why should we work every day and not be in business,” Mr Bastian asked. While Mr Halkitis last week said the Government has already taken “certain actions” to give the retailers some relief, Mr Bastian yesterday said: “I can’t explain that. He needs to explain that. Ask him to explain that to you. I can’t explain that.”

The last margin increase enjoyed by gas station operators occurred in 2011, some 12 years ago, under the last Ingraham administration, and operating costs and inflationary pressures will have increased substantially then.

That took gasoline margins from 44 cents per gallon to 54 cents, where it has remained ever since. Retailers had pushed for a 50 percent or 27 cents per gallon increase that would have taken this to 81 cents per gallon, but the Government has refused to budge despite the argument this is essential to keeping dealers in business.

The sector is arguing its main problem is that a fixed 54 cent margin is no longer sufficient to absorb ever-increasing costs, which include higher overdraft and card fees, plus rising utility and labour costs.

The minimum wage rise has hit gas stations hard, given that many persons were employed at this salary level. The resulting $50 per week, or 24 percent, increase has also required them to pay increased National Insurance Board (NIB) costs. And last year’s spike in gas and oil prices, while increasing dealer’s top-line sales, means higher turnover-based Business

Licence fees even though profits have not changed due to the fixed margins.

NIB contribution rate increases and the up to 163 percent increase in Bahamas Power & Light’s (BPL) fuel charge also await, with many already struggling to cover the elevated Business Licence fees due by March 31. While Business Licence concessions may give gas station operators temporary relief, Mr Bastian said the industry is “tired of band aids; band aids fall off all the time.

“It’s all tied together,” he added. “If you go from a minimum wage of $210 a week to $260 per week, that’s a 24 percent increase, and National Insurance contributions also rise. Then BPL said they are going to increase. It’s all inter-related.

“Michael Halkitis is a trained economist. He should understand this. I have the utmost respect for Michael Halkitis. I’ve known him for 40 years, and know him to be a good, decent human being. He’s a friend, and I love him, but how could he do this to business owners?”

Mr Halkitis and the Government, though, have repeatedly stated that their priority is to further shield Bahamians from price hikes and inflationary pressures on essential commodities such as gasoline given the cost of living crisis impacting hundreds of Bahamian families.

However, it is the Government that earns the greatest economic benefits from the petroleum industry via the Public Treasury. Besides 10 percent VAT levied on every gallon of gasoline and diesel sold, it also receives a $1.15 ad valorem charge without incurring any of the costs faced by retailers and wholesalers.

PAGE 8, Monday, March 13, 2023 THE TRIBUNE

FROM PAGE B1

Applications must be submitted to yachts.recruitment@thlmarine.com

advocating that “there’s a lot to go around” in terms of sheer visitor numbers.

“I’m very confident,” the Nassau Cruise Port chief replied, when asked whether there are sufficient visitor volumes to support the Royal Beach Club as well as Bay Street, downtown Nassau and other cruise-reliant industries. “Not everybody wants to go and sit on a beach when they’ve sat on a beach several times during their cruise as well as likely gone to Coco Cay as well.”

The latter is Royal Caribbean’s private island destination in the Berry Islands, and Mr Maura added: “There’s a lot to go around. The challenge we continue to have, as of today, is we need more for people to do. We as Bahamians, as The Bahamas, need to invest in experiences, invest in the polishing of our heritage sites, invest in our downtown.

“Obviously we’ve [at the cruise port] made a significant investment in entertainment, food and beverage, and Bahamian authenticity at the port. But people want to see more than that. People take cruises to foreign destinations to experience foreign cultures, different people, to go back with stories about The Bahamas.

“While that includes having a lovely time on a beach, it’s hard to distinguish one beach experience from another when getting into the cuisine, heritage and culture of a people, of an island, is what they come from. Am I worried about the Royal Beach Club? Absolutely not,” the cruise port chief continued.

“Royal Caribbean will need to bring more people to Nassau, and the bookings we have for Royal Caribbean show they will be increasing their calls, they will be increasing the number of people and there will never be a ship that comes to Nassau and all the passengers go to the Royal Beach Club. It just never happens. We have a great opportunity in front of us.”

Bay Street merchants, restaurants and others who rely on the cruise industry have previously voiced fears that if Royal Caribbean’s Paradise Island project received the go-ahead it will have negative impact on their businesses, downtown Nassau and the wider economy by reducing the customer pool available to them.

This concern was echoed by Audrey Oswell, Atlantis president and managing director, who in voicing the mega resort’s opposition to the cruise giant’s plans wrote: “The proposed

beach club project would ensure that thousands of Royal Caribbean visitors to Paradise Island will bypass our downtown, negatively impacting merchants, restaurants and other venues that rely on tourism...

“The increased volume of activity in Nassau harbour to support the beach club operations will potentially restrict further expansion of marinas, the re-establishment of seaplane service for Paradise Island, development opportunities on Paradise Island and in the blighted waterfront areas of downtown Nassau, as well as other commercial vessel activity.”

Mr Maura, though, said Nassau Cruise Port’s transformation into six berths, with the ability to accommodate two of the largest Oasis class cruise ships at any given time, meant there will be days when more than 30,000 passengers will in Nassau with most exiting the ship seeking activities to do. The cruise port has set a present daily record of 28,554 passengers, who were received on February 27, 2023, despite the ongoing construction work.

“We will definitely have spikes of 30,000-plus in a day,” Mr Maura said.

“If you had to average it out, we probably average between 12,000 and 13,000 passengers per day over the year but, again, we’re going to have these spikes of 30,000 visitors per day.

“We have some days where we don’t have any ships; very few of those, and if we have one ship a day that’s 5,000. The bottom line on this is 12,000-13,000 visitors on a given day on average is a lot of people to invite to experience our Bahamas.

“They would have had several opportunities to visit a beach some place else. We will find, as we do when we vacation, they want to experience more than a beach. I’m absolutely confident we will do well by the Royal Beach Club, and do well by other investments in and around New Providence, and provide more things for visitors and Bahamians to do. When a destination has a lot to do, a lot of stories to tell, a destination has a lot of people.”

Mr Maura said the concerns raised in relation to the Royal Beach Club project had not surfaced when the likes of Atlantis or Baha Mar added new amenities, such as the latter’s Baha Bay water park. “The fact is we’re improving the

destination,” he added. “These [projects] make our destination more attractive to families in search of a vacation.”

Royal Caribbean has yet to respond to the environmental and economic issues raised by Atlantis and Ms Oswell last week. She had argued that approval of the the cruise line’s $110m Paradise Island project is “premature” and urged Bahamians to call on the Government to “put the brakes on”.

She also argued that there are “too many red flags” and unanswered questions related to the development, adding that Atlantis had raised some 50 queries relating to environmental issues when the project was first unveiled for public consultation by the Department of Environmental Planning and Protection (DEPP) but had not received a single answer. Tribune Business understands that Royal Caribbean was blindsided by Atlantis and Ms Oswell going public with their concerns and criticisms. It is understood that the cruise line had previously reached out to the mega resort over its plans, due to the fact the two will become western Paradise Island neighbours, and was seeking to respond to its queries, but in some instances is unable to do so because designs are still being completed for wastewater and other systems.

Referring to the Government’s announcement that Royal Caribbean’s project has been approved, subject to obtaining all necessary environmental approvals, the Atlantis chief said: “I believe the green light is premature, with so many unanswered questions regarding the project’s environmental and economic impact still to be addressed.......

“What is needed now, before it’s too late, is a heightened level of scrutiny and discourse. Too much is at stake to stay silent.

It has not been confirmed that the Royal Caribbean project does not pose serious threats to our beautiful beaches, marine life and their habitats. If this residential land is overdeveloped or the beaches and coastline altered in anyway, the Paradise Island coastline, Cable Beach, Saunders Beach and our economic livelihood stand to suffer.”

THE TRIBUNE Monday, March 13, 2023, PAGE 9

‘ABSOLUTELY

FROM PAGE B1 CALL 502-2394 TO ADVERTISE TODAY!

NOT WORRIED’ BY ROYAL CARIBBEAN’S PI PLAN

HOTELS STRIKE ‘GLASS CEILING’ ON 15-20% ROOM SHORTAGE

FROM PAGE B1

of aviation, last week said The Bahamas has a “capacity” challenge in terms of sufficient hotel room inventory to accommodate all visitors, he added that the Government was encouraging owners and operators of shuttered resorts to “accelerate” plans for their renovation or sale.

“The fact of the matter is that the co-operative effort between the Ministry of Tourism and private sector hotels has generated a significant demand for vacationing in The Bahamas,” Mr Sands told this newspaper. “The reality is that pent-up demand is right now surpassing the available supply of rooms, principally caused be a number of hotels being out of operation, in renovation or in transition in terms of sales agreements.

“We have a component of that in New Providence, a large component of that in Grand Bahama, and some hotels in the Family Islands that may not have reopened since COVID. While the amount of rooms involved there may be less, it is just as significant. The reality is that the efforts by partners in the sector have created this demand, and once we get this inventory back it will shatter the glass ceiling we have have somewhat imposed on ourselves in terms of available rooms.

“The demand for the destination is outpacing our ability to provide supply at the moment. It’s testament to the fact that The Bahamas as a destination is very much in demand, and that’s a major incentive for further investors to invest in hospitality in the islands of The Bahamas.”

On New Providence, both downtown Nassau’s British Colonial resort and the former Melia Nassau Beach Resort have been closed for months in the former’s case, and several year’s in the latter’s, for renovation and rebranding by their respective owners. Atlantis’ 400-room Beach Towers is also awaiting redevelopment into Somewhere Else by Grammy Award-winning musician and producer, Pharrell Williams, and his business partner David Grutman.

“It will last until we can add additional inventory,” Mr Sands said of the visitor demand-room supply imbalance. “It’s hard to say, but would think this is at least 12-18 months period-wise.

In fairness to the Government, they’re working very hard to encourage operators that have the capacity that is still not on line to accelerate their plans to advance their work, so we do not find ourselves in this position for a long time period.”

Asked if this was a good problem for the industry to have, the BHTA president replied: “Yes and no. Certainly, if we can increase the occupancy without reducing the demand that’s a good thing but, at the same time, if that demand does not find accommodation here it will go elsewhere.

“I think the first thing we want is to get the available inventory back online. That may represent anywhere

from 15-20 percent of potential capacity. The quicker we get that back online we will be in a much better position, and any other new projects that are in train to cause them to come online as soon as possible.”

Mr Sands said visitor lengths of stay continue to be longer than pre-COVID, with many hotel guests remaining in The Bahamas for a day or two more, which also impacts hotel room availability. “For the first time in a long period of time, we’re getting visitors from virtually every US state,” he added, “which tells us The Bahamas’ brand is reaching further and deeper. That creates further demand for the destination, and demonstrates that collective digital marketing is working very well.”

Dr Romer, speaking to the capacity challenges last week, said: “We had a situation the other day where an airline couldn’t find seven rooms for stranded passengers. Just Saturday past we had an air transit that made a diversion from Cuba into Nassau, 210 passengers, and we had hoped to overnight them in Nassau but we couldn’t find rooms at any of our properties to overnight passengers coming in. Our challenge right now is capacity.”

He said The Bahamas had “soared back” to 7.1m total visitors for the 2022 fullyear, a figure just 100,000 shy of the record-breaking 7.2m arrivals welcomed in 2019 prior to the COVID19 pandemic. He added that this nation had recovered to about 97 percent of 2019 visitor levels last year.

“Air arrivals are very important because they contribute to heads in beds,” the Ministry of Tourism official said, adding that such stopover visitors typically generate a per capita spending impact that is 28 times’ greater than their cruise counterparts.

Disclosing that 2022’s stopover visitors were around 100,000 below 2019 levels, standing at 1.5m compared to 1.6m, Dr Romer said: “We are about 90 percent recovered at the end of 2022.” This, combined with January’s performance, had given The Bahamas confidence that it can meet the 20 percent year-over-year growth in visitor arrivals for 2023 that is being targeted by Chester Cooper, deputy prime minister and minister of tourism, investments and aviation.

While total visitor numbers for January 2023 were up by 33 percent compared to the same month in 2019, Dr Romer said that month saw air arrivals exceed preCOVID figures for the first time at around 132,000. This compared to 129,000 for January 2019.

“It gives you an idea of what February and March look like,” he disclosed of January’s performance.

“Those numbers are holding for February and March.....”

He added that the latter two months appear to be on the same growth trajectory as January 2023, providing further confidence that The Bahamas will hit its 20 percent arrivals growth target for the year.

PAGE 10, Monday, March 13, 2023 THE TRIBUNE

year-over-year as the industry benefited from the post-COVID travel rebound.

The Nassau Paradise Island Promotion Board (NPIPB), during a New York event designed to promote the destination to travellers, disclosed that occupancies at member properties rose by 23 percentage points compared to 2021 while room revenue was up year-over-year by 112 percent.

The gains were aided by the fact that 2021 provided relatively weak comparatives given that it was still plagued by COVID-related lockdowns and other restrictions. Still, the figures

unveiled by the Nassau Paradise Island Promotion Board provided further evidence of the ongoing recovery, with foreign air arrivals to the destination rising 71 percent to endDecember 2022.

Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, said on Monday that January 2023’s tourism arrivals were some 210,000 ahead of comparatives from 2019’s “banner year” as The Bahamas bids to “meet or exceed” 20 percent growth targets.

He told the House of Assembly during the midyear Budget debate that visitor numbers for the first month of the year were some 33 percent

NOTICE

as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 6th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that ALEXANDRIA ARTHURNIQUA CAREY of Jack Fish Drive, Carmichael Road, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 6th day of March, 2023 to the Minister responsible for nationality and

Box

ahead of that pre-COVID performance.

“In terms of arrivals, we see that in 2022, the numbers were up 233 percent over 2021 and we achieved the seven million visitor mark but fell just shy of 2019,” Mr Cooper said. “To understand the gravity of the seven million mark, note that it has only happened once before in the history of The Bahamas. We are targeting 20 percent growth in tourism for 2023, and we have every reason to believe we are going to meet and or exceed that target.”

Describing 2019 as a “banner year for tourism” with over 7.2m visitors, Mr Cooper added: “January 2023 is a 33 percent increase over 2019 and this trend is holding throughout the islands.” The deputy prime minister yesterday said there had been a 400 percent rise in sea arrivals for Grand Bahama, with “momentum growing” ahead of the Carnival cruise port being completed next year.

Departure tax collections have increased with the growth in visitor arrivals following their

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

NOTICE is hereby given that WILLIAM DORSAINT of Marsh Harbour, Abaco The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that CHRISTOPHER STEWART of P. O. Box AP-59223, Eastbrook Road, Highland Park, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

www.bisxbahamas.com

COVID-induced interruption, with Mr Cooper saying:

“For the first six months of this fiscal year, departure tax collections totaled $71.5m, an improvement of $45m or 85 percent over the prior year.

“In the first half of the year, we collected 73.7 percent of the Budget target for departure tax. Beyond arrivals in 2022, room revenues, average daily rates, overall occupancies and spending by cruise visitors are all up.”