Growing a business from idea to longterm success is no walk in the park. All entrepreneurs want to know their enterprise is doing well, but some may feel that, if you grow too quickly, you risk depleting your resources or not being able to keep up with customer demand.

Yet expand too slowly, and a business could stagnate and lose out on lucrative opportunities.

There is no universal formula for determining optimal growth, which always creates uncertainty. Running a business is

move will make trading more difficult.

ANDROS Chamber of Commerce president

Darin Bethel said Bank of The Bahamas’ decision to slash operating hours at its Kemp’s Bay branch to just one day per week while leaving its Mangrove Cay location open four days per week gave “little to no consideration to the economic make up and commerce” on the island.

Speaking to Tribune Business, Mr Bethel said while South Andros business owners understand financial institutions are increasingly transitioning to digital platforms the decision to amend such a critical service should have been discussed with residents beforehand.

He said the area is still heavily dependent on inperson banking services to facilitate trade with suppliers in New Providence and internationally and the

“While BOB is making sharp business decisions to make their company operate more efficiently, I would hope they give more consideration to the business owners in the entire south Andros community and how their decisions effect commerce,” said Mr Bethel. “We are still dependent on weekly trade between the capital to keep our businesses growing and provide essential services to the community. This move will make trading that much more difficult.”

Mr Bethel said financial institutions should discuss important decisions with the customers they serve prior to making them so the business community has adequate time to make informed continuity plans and ensure minimal disruption.

“The main concern of the business community is that, while they understand that there’s a move to digitalization and a cashless society, these things should be done

with consultation with the community. Financial institutions should make the community they serve a partner in their planning, and so that they can help them understand what the way forward would look like for them,” said Mr Bethel.

“Considering the many years they’ve been operating here and using those businesses funds to operate their affairs and now, they just pull out without even a notice, without even a community meeting or anything announcing their plans so businesses could start to plan and make adjustments in their affairs to adapt to the new environment.”

He noted that while digital platforms may be sufficient for residents, businesses often find it less convenient, especially in the area where the ATM is often out of service and there is a limit on deposit amounts.

Me Bethel called for the government to collaborate with Family Island communities and help them to establish “substitutes”

so they are not impacted as severely when financial institutions reduce hours or close locations.

“I plead to the Government to start looking at alternatives for business to continue functioning North and Central Andros have experience a very noticeable decrease to their economies since RBC and ScotiaBank left these communities and we are still searching for solutions and petitioning banks to return if only minimal service,” said Mr Bethel.

“What’s happening in Kemp’s Bay is the first step to leave the community without a brick-and-mortar banking and force people to digital banking without serious consideration or consultation with their most reliable and valuable customers the business community on how these changes would affect their daily operations.”

He added that the decision to reduce days in Kemp’s Bay, which has about 3,000 residents and increase the service in

By ANNELIA NIXON

Business

THE Water and Sewerage Corporation (WSC) is putting “some measures

in place where they could get sorted out” following a number of complaints regarding water woes in Barracks Hill, Eleuthera. Given Eleuthera’s longstanding water issues, WSC assured residents that

they’re working to resolve them, especially in Barracks Hill. Assistant supervisor for the island Damon Bethel said the water woes in that area in particular remain a problem due to it being a high rise, the nightly

Mangrove Cay, which has about 1,500 residents has left business owners in South Andros feeling as though they were “taken for granted” after years being loyal customers.

“These communities heart and centre is by way of the resilience of small business operators. To operate practically without banking is where this move to reduce services is headed. Open for just four hours offering limited services to a community that has three times more small business and double population, compared to four days in the smaller community it just leaves business owners feeling like their service to the Bank of the Bahamas has been taken for granted and they are being left to fend for themselves,” said Mr Bethel. He said that while the move from traditional banking to digital banking is “inevitable” it has to be done strategically and with consultation to ensure business owners are informed and prepared for the changes.

“The reverse osmosis plant is a privately-owned company,” Mr Bethel said.

cutbacks and the island’s great demand. However, he also noted that infrastructural problems at the privately-owned Reverse Osmosis Plant, contributes to many of the interruptions residents experience.

“The substitute for tradition banking is very much available but commercial banks must consider that these Family Islands are very rural in their business practices and new advancement should be accompanied by training and planning. Not just pulling the rug from under their feet’s taking away the practices they have become accustomed to and not pointing them in the new direction with instructions on how to remain relevant and successful,” said Mr Bethel.

“Our community needs support to transition to what’s next and if you’re a company that benefited for years from these businesses and the use of their revenue to support your business its small investment to educate folks on the way forward and should not be an oversight. Business owners in these communities are very disappointed in the lack of consideration to consult with them before making such bold moves.”

“Water and Sewerage, we don’t have no jurisdiction over them at all. They produce the water for us, basically. If our normal production level is 600,000 gallons per minute, if that drops to 300 and remember now, you’ve got the mainland plant that’s servicing Harbour Island, Spanish Wells and the mainland, and you dropping that from six to three then obviously that’s going to cause an issue. So that’s one of the problems that we face from time to time with the reverse osmosis plant not being stabilised. You have instances, like

By FAY SIMMONS Tribune Business

AMENDMENTS to the Executive Entities bill and the Banks and Trust Companies bills “reinforce” the country’s commitment to having a strong regulatory regime, Prime Minister Philip Davis said yesterday. Speaking in Parliament yesterday, Mr Davis said the changes will give the Central Bank direct oversight of executive entities that function as trustees and fill an “important gap” in our regulatory structure,

bringing us in line with international standards. The changes to the Executive Entities bill ensure all

executive entities fall under the regulator’s remit while the banks and trust companies’ regulation amendment defines a “qualified executive entity”.

“Under this legislation, QEEs will be exempt from full licensing requirements but must appoint a Registered Representative and adhere to the same AML/ CFT standards as other financial institutions,” said Mr Davis.

“This includes important Know Your Customer requirements to ensure complete transparency when it comes to all activities and individuals involved, keeping us

compliant with the Financial Action Task Force’s recommendations.”

He said the bill also introduces fees and brings executive entities under the same overisight used for private trust companies.

“The bill also establishes appropriate fees, which include $5,250 for registration and $3,750 annually. And it applies the same oversight, sanctions, and compliance mechanisms as we currently use for Private Trust Companies,” said Mr Davis.

“Together, these amendments ensure that the Central Bank of The Bahamas will have direct

FROM PAGE B1

Gateway District plan it remains a longer-term project especially given current global economic turmoil.

Speaking after NAD unveiled a two-stage bidding process, with the deadline for initial expressions of interest set at June 25, 2025, Ms Walkine told Tribune Business: “The primary reason we are prepared to do this now is because we recognise the kind of demand we’ve been seeing in Nassau/Paradise Island can only be sustained by adding more inventory...

“The timing is goo. It will be a couple of years before it’s all done. During that time whatever conditions are going on now will settle, and it will add some inventory to the rooms in Nassau/ Paradise Island. It just made sense to get it done now.

“We continue to be asked all the time: ‘Why don’t you have a hotel at the airport?’ It’s amazing the amount of comments and feedback we get from passengers, airline crews. Everyone seems to think we should have, as an international airport, some type of hotel accommodation. The timing is as good a time as any to put it out there now.”

Ms Walkine said NAD hired consultants to conduct studies to determine whether an airport hotel is economically feasible, while also consulting realtors and other persons to “determine exactly what we need” and if western New Providence “can accommodate that”.

She added: “It had to make business sense... It was determined that it could certainly translate into more rooms, and the destination needs more rooms. We’re not talking about a five-star hotel. We’re talking a three t four-star hotel with conference facilities, restaurants, maybe a pool, maybe a spa; just enough comfort so people not even travelling might find a reason to stay there.” NAD, in a statement, argued that reviving the airport hotel project “is well-timed” given tourism’s continued strength following the COVID pandemic and suggested there is sufficient travel demand to sustain up to a 240-room property. The proposed five-acre hotel site is currently being used as a cell phone call-up parking lot, lying immediately southwest of the intersection between Windsor Field Road and airport exit. While the level of construction investment, and number of building and fulltime jobs, will ultimately be determined by the developer and its third-party developers, Ms Walkine said the airport hotel “can be scaled” according to demand. She suggested it could be developed, via two buildings each featuring 120 rooms, one building at a time.

Asked whether the Government’s energy reforms factored into NAD’s plans, Ms Walkine replied: “Yes, big time. That is absolutely

correct. Yes, it did, and that was part of our consideration. We think there’s a good argument to be made for this hotel, or hotels, to be developed and succeed. We really think so.”

Besides the potential 240 rooms, NAD added that the identified five-acre site also has the ability to accommodate around 280 parking spaces with much of the necessary infrastructure already in place. It added that the hotel could cater to a variety of guests, including travellers and visitors to the Family Islands who either want to - or are forced toovernight in Nassau.

Most international airports have multiple hotels either within their properties or in close proximity.

NAD said other guest markets for such a hotel at LPIA could include flights crews, persons visiting for one-day conferences and meetings, and clients coming in to visit western New Providence financial institutions, law firms and other businesses. The convention and conference market would be another major target.

The hotel is part of what NAD described as a wider Landside Development Master Plan and Strategy (LDMS) that it is developing in collaboration with its management partner, Vantage Group. This would create a ‘Gateway District’ to further stimulate economic development in western New Providence, while diversifying LPIA’s

revenue streams beyond the existing aeronautical and non-aeronautical income.

Ms Walkine, though, described this as NAD’s “big picture” vision for the airport and surrounding area that remains some way off from being executed.

“The hotel is first, and that will give us some time to consider the rest,” he told Tribune Business

“In the environment we’re in today, with some uncertainty about what’s happening with the US economy and the impact on our business, we need to be a bit more cautious in terms of determining when and how to roll-out other elements of that gateway project. It’s something we’re very determined to do.”

Some 3.71m passengers passed through LPIA during NAD’s 2023 financial year, just shy of the 3.99m processed in its 2019. Its facilities are designed to span 20-40 years and accommodate up to five million passengers, and Ms Walkine said the annual passenger record had been broken in 2024.

“With our record-breaking passenger traffic in financial year 2024 and a strong post-pandemic tourism rebound, we believe that this is the right time to revisit the hotel development as a key component of our broader landside development vision for LPIA,” she added in a statement.

“Nassau’s western district is booming and LPIA sits at the centre of this

regulatory oversight of Executive Entities that function as trustees, while filling an important gap in our regulatory architecture. This change reinforces The Bahamas’ commitment to preventing money laundering, combating terrorism financing, and upholding the highest standards of financial integrity.”

Mr Davis, who has been outspoken about the unfair standards that developing counties face when dealing with global tax organisations, took the opportunity to note that the country has met and “surpassed” international standards and will continue to push

surge in growth. A welldesigned airport hotel not only addresses a critical accommodation gap but also strengthens our role as a driver of economic development.

“This opportunity is about more than a hotel - it’s part of a larger vision to create a dynamic Gateway District that meets the needs of travellers and the wider community, both now and into the future.”

The revived hotel project comes as room availability lags behind tourism growth.

In 2023, average occupancy rates reached 72.1 percent, with some properties reporting rates as high as 95 percent during peak periods in 2024.

Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, said: “Our thriving tourism sector, coupled with a reduction in available hotel rooms post-pandemic, highlights the urgent need for new accommodations. As we plan for the future, we must ensure that the necessary infrastructure is in place to support and sustain our growth.”

The hotel project bidding process is separated into two phases. In the first ‘expression of interest’ phase, potential developers must show their qualifications, financial capacity, development experience and project approach. Short-listed candidates will then be invited to participate in a second phase Request for Proposal (RFP) to determine the winning bidder.

NAD added that “Bahamian participation is strongly encouraged, and

for standards to be applied

“fairly and consistently.

“We have met and, at times, even surpassed the highest global standards. But while we are committed to meeting international standards, we also recognise that these standards must be developed and applied fairly and consistently across all jurisdictions,” said Mr Davis.

“So, today, as we continue to demonstrate our willingness and ability to meet compliance standards, we are simultaneously working to ensure that these standards evolve in a fair and balanced way.”

proponents will be required to outline how they intend to incorporate local partnerships and community investment into their plans”.

Tribune Business revealed plans for an LPIA airport hotel as far back as October 2011. The original developers were said to be the owners of the Atlantic Resort & Spa in Fort Lauderdale, and the project was anticipated to create between 100-150 full-time jobs via a resort of ‘fourstar’ standard, rather than the typical ‘two-star’ airport hotel.

George Allen, one of the principals in the original developer group, told Tribune Business at the time they had elected not to pursue the LPIA airport hotel because feasibility studies showed it could sustain only 50 rooms.

This was 50 per cent of the inventory eyed by NAD, and Mr Allen said the group had instead looked at developing a mixed-use proposal for the site involving a smaller hotel, offices, retail and restaurant. This, though, failed to match NAD’s demands.

By FAY SIMMONS Tribune Business

OPPOSITION leader

Michael Pintard accused the Davis administration of taking an “ad hoc” approach to financial sector legislation yesterday.

While giving his support to the amendments to the Executive Entities bill and the Banks and Trust Companies bills in Parliament yesterday, Mr Pintard questioned why the government has not presented a strategic plan for the financial sector to open new opportunities and help the country to rebuild its lost market share.

“We must again make the point here regarding the Davis administration’s ad hoc approach to financial services industry, and in this instance, the international financial sector.

Where is the documented strategic plan for the international financial sector that incorporates the view and perspectives of all key stakeholders in the industry?”, he asked.

“Why are we only seeing a piecemeal legislative adjustment when a substantial refocus is required to ensure that The Bahamas both builds back its market share that we have lost over time and successfully exploit new opportunities.”

He said the government has only delivered “rhetoric” and has not taken the time to expand the banking sector and it is having a negative impact on residents of Family Islands. “We have seen little to no evidence of a strategic plan by this administration for the financial services sector. We see no vision for how to expand this sector, no significant investment in the Bahamas workforce to equip them for future

opportunities and for all their talk of developing new products and shouting from their seat, entering new markets, they have failed to lead in this regard or becoming global leaders,” said Mr Pintard.

“Precious little has actually been delivered, rhetoric, plenty. What we have is governance by near autopilot. This administration continues to chase headlines and deliver half measures. It reacts but seldom leads, and the Bahamian people, especially those outside of New Providence are paying the price.”

Speaking on the Bank of The Bahamas’ decision to slash operating hours at its Kemp’s Bay branch, Mr Pintard said the banking “crisis” has been building over successive administrations and Family Island residents have gotten frustrated.

“This crisis has been building. Yes, we fully

accept for years, but as a representative on a Family Island, our second major island, Bahamians have been complaining, and we have stood with them challenging the commercial banks when they have reduced hours, introduced fees, when we felt they have not acted in the best interest of persons who’ve been losing their largest single investment, their homes, we have stood with them,” said Mr Pintard.

Mr Pintard also responded to criticism from MP for South Andros and Mangrove Cay Leon Lundy and indicated that the wider Cabinet does not share their concern about the state of banking on Family Islands.

“For years, commercial banks have pulled out of one island after another for years, leaving entire communities without access to basic financial services, and under the PLP, this

trend has accelerated. The member for South Andros and Mangrove Cay now joins the member for Fox Hill [Fred Mitchell] who periodically talks about the challenges we have in the banking sector. The irony is both of them sit in the Cabinet,” said Mr Pintard.

“So, the interesting thing, is they seek to function as activists, which suggests to us that their colleagues are not listening to them that their colleagues don’t share the concern about the challenges that face Bahamians as it relates to the banking system in the country. So it’s almost it’s most unfortunate that in their own Cabinet they are voices crying in the wilderness.” He said the challenges in the financial sector is a “reflection of the wider challenges under the PLP administration”.

“Bahamians are left unbanked, many unemployed and many

underwater. And make no mistake, the challenges in the financial services sector is a reflection of the wider challenges under the PLP administration.”

Last week, Mr Lundy spoke out about the Bank of The Bahamas’ decision to slash operating hours at its Kemp’s Bay branch to just one day per week while leaving its Mangrove Cay location open four days per week. He said the move was a “disservice” to Bahamians still reliant on branch banking and another example of how Family Islands and their communities are “treated as an afterthought” by the commercial banking sector and others. Mr Pintard then renewed calls for the Davis administration to “take banking reforms off the backburner” and demonstrate that they willing to correct the failures in the banking sector.

FROM PAGE B1

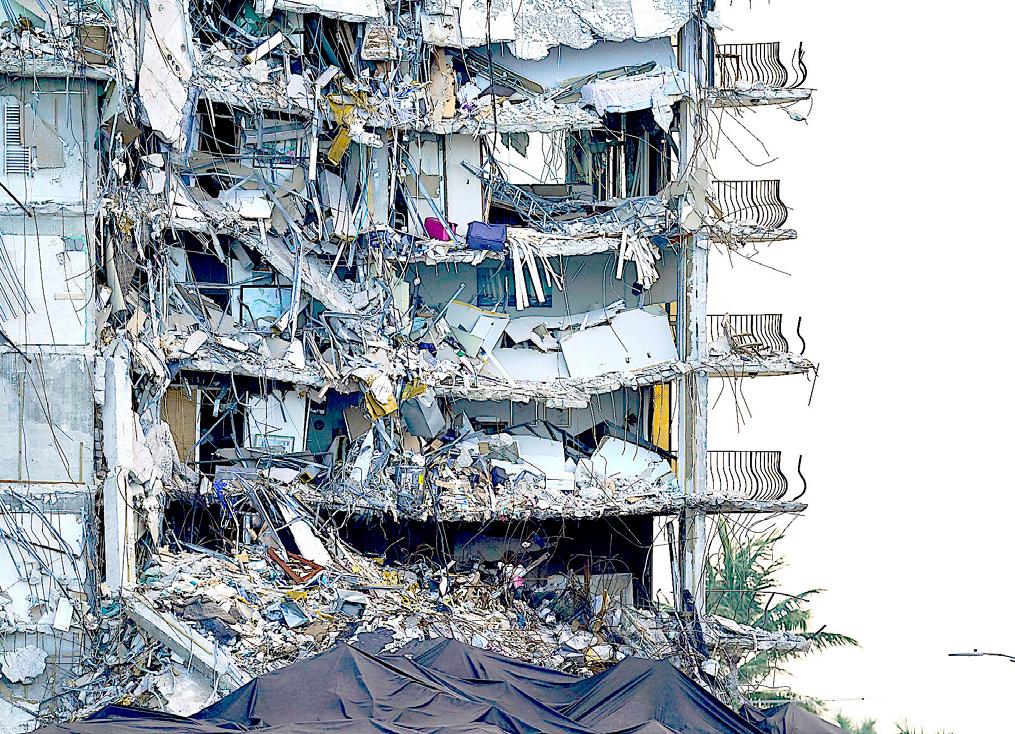

expecting heads to roll at the highest level in The Bahamas. I’m expecting nothing but heads to roll at that level.”

NCL did not respond to Tribune Business requests seeking comment before press time last night. However, this newspaper was yesterday informed by sources at the Berry Islands destination that its island director, operations manager, food and beverage director and at least one other person in a managerial position were yesterday summarily “terminated without cause” after NCL executives arrived on the island.

One source, speaking on condition of anonymity, suggested that the firings were “retaliation” against those thought to have spoken out to the Department of Labour and had

been expected. They said those terminated were escorted by security to pack up their belongings and taken off Great Stirrup Cay before being flown to Nassau. They are due to depart The Bahamas today. Another contact, accusing the Department of Labour of “foot dragging” in visiting and launching an investigation into employee complaints, voiced fears that key witnesses and evidence will no longer be present or accessible with remaining staff keeping silent because they did not want to suffer the same fate.

“Our suspicions came true. They came this morning,” one source said of the NCL executives, who were said to have arrived on Great Stirrup Cay accompanied by the cruise line’s Bahamian agent and representative. “When they

called we put one and one together.”

They added that the terminated employees were “escorted by security to pack-up and moved out ASAP”, although the island director was given several days to wind-up his affairs.

“This is all because we were crying for the Department of Labour to come and investigate this matter. We knew they would pull this stunt and retaliate, and cutoff anyone who spoke out,” they added.

“We knew this was coming. The Department of Labour was dragging their feet. We expected them to pull this stunt. They had to jump the gun and cut-off whoever spoke out before the Department of Labour reached. If those people are gone, and the Department of Labour comes, there will be nobody to speak up.”

Previous correspondence sent to Tribune Business by

Great Stirrup Cay employees alleged that they have been working 70-hour work weeks, in excess of the Employment Act’s 40-hour work week, without being paid overtime or receiving holiday or vacation pay in breach of Bahamian law and regulations.

These claims were corroborated by Mr Thompson, who said the Department of Labour had received similar complaints that it is now probing. Subsequent letters from the same sources claimed the problems date back to mid2023 when NCL and Great Stirrup Cay’s management company purportedly became “aware” that some expatriate employees were working beyond the scope of their work permits and performing excessive hours.

“Following internal awareness of the situation, it was advised that retroactive compensation and

legal reconciliation should be pursued before public exposure or governmental enforcement took place,” the letter said. “Despite awareness, no formal resolution - (including payment of retroactive wages or full legal compliance with Bahamian regulations - has yet occurred.

“Expat employees were found to be working beyond the validity of their work permits, with most staying up to 10 months while only three months were covered. There are currently approximately 50 employees working without valid employment contracts.”

The letter alleged that Bahamians have been equally impacted. “A group of Bahamian nationals employed on Great Stirrup Cay have also come forward reporting that they, too, are owed retroactive payments,” it added.

“These individuals have raised concerns that they were not paid in full accordance with their contracts, nor were they compensated appropriately for overtime and extended working hours. The lack of action in resolving these outstanding payments suggests the issue is systemic, impacting both foreign and local workers alike....

“There is an urgent need for immediate government engagement by the Department of Labour and Department of Immigration [and] a clear timeline for retroactive payments, contract regularisation, permit compliance for both expatriate and Bahamian staff. Employees fear unjust termination, repatriation and a lack of protection despite having raised concerns through formal disputes.”

FROM PAGE B1

responsible for overseeing that particular Act. However, she disclosed that many quarry owners and operators have rejected requests to apply for - and obtain - a certificate of environmental clearance (CEC) from her agency. And Bahamas Wildlife Enforcement Network (BahWEN) officers are now conducting checks to determine if these operations are complying with existing environmental laws and regulations.

“To my knowledge, the Bahamas Wildlife Enforcement Network (BahWEN) officers have been out conducting visits of known quarry sites to confirm that the owners and operators are in compliance with environmental laws,” Dr Neely-Murphy said. “Most of them have been requested to apply for a certificate of environmental clearance from the DEPP so that the environmental conditions under which they may safely operate may be outlined. Many of them have decided not to

director, did not respond to Tribune Business inquiries and phone calls before press time last night. Carbon Management is structured as a public-private partnership (PPP) where the Government holds 49 percent equity ownership and receives 85 percent of all “upstream revenues” generated.

However, Laconic pledged: “This programme will finance independently-verified blue carbon removals generated by Carbon Management Ltd’s scientific management of The Bahamas’ expansive seagrass ecosystems via the issuance of Laconic’s pioneering sovereign carbon security product.

“The agreement marks the first-ever blue carbon sovereign carbon securities transaction and is set to position The Bahamas at the forefront of global climate leadership.” The announcement marks the first signs of tangible progress being made in realising the Davis administration’s long-touted carbon credit ambitions for some time.

Relatively little has been heard about the initiative

for the past year, but the Government is seeking to convert The Bahamas’s seagrass meadows and mangrove forests - which act as ‘sinks’ to remove and extract carbon dioxide from the world’s atmosphereinto assets that generate multi-billion dollar income and new revenue streams for the country by monetising this benefit they offer.

Laconic, adding that its ‘carbon security’ will not require The Bahamas to provide a sovereign guarantee, said: “The programme will see verified, additional and real carbon removals generated by Carbon Management Ltd’s scientific management of up to 150,000 square kilometres of the nation’s seagrass ecosystems monetised over the next five years in full compliance with” the Paris climate commitments and accords.

“This transaction establishes a new standard for environmental finance, and sets a critical precedent for countries seeking innovative national-level solutions to meet their climate targets while sustainably growing their economies via the national level financing of approved

apply and now BahWEN is conducting their checks.

“Many of the sites have been mined to expose the freshwater lens and are very near to critical infrastructure. Owners and operators should apply to the DEPP for a CEC at the earliest opportunity.” Mr Sands, though, seemingly confirmed that the result has been that “limestone quarry pits are all closed in Nassau since Thursday last week, which is significantly impacting construction”.

Noting that there are around three to four

sustainable development Goals (SDGs),” it added.

Mr Ferguson was quoted as saying: “The Commonwealth of the Bahamas is committed to becoming a full economy net-remover of atmospheric carbon by 2035.

“By working with Laconic, we will be able, for the first time, to generate sufficient development financing, technology transfer and capacity building to enable our country to make this commitment a reality – enhancing our sectoral conditional ambition under the Paris agreement to the benefit of not only our own people, but the entire global community.”

The strategy appears to be for Laconic to issue its ‘sovereign carbon securities’, whose value will be based on The Bahamas’ seagrass meadows and the amount of carbon dioxide they extract from the Earth’s atmosphere. These would then be traded by investors and companies, and potentially listed on regulated stock exchanges both in The Bahamas and around the world.

“The Bahamian commitment to blue carbon solutions is a shining example of how governments can use global capital markets to finance national level conservation and sustainable development initiatives that drive meaningful longterm economic growth whilst contributing to global

limestone-producing quarries in Nassau, located on Tonique Williams Highway and in southern New Providence, he added: “They’ve all been closed based on the actions of the Ministry of the Environment until they receive a permit, which the minister and director of planning have to give them.

“It impacts anyone doing any roadworks where you need physical limestone material, anyone doing a building who needs to do a floor and foundation. You need quarry aggregate from limestone. Just imagine

decarbonisation efforts,” said Andrew Gilmour, Laconic’s chief executive.

“This partnership is proof that the capital markets are now awakening to the immense opportunities in carbon finance, and we are excited to work with The Bahamas to unlock a new source of permanent foreign direct investment (FDI) for the country’s economy.”

Besides the Government, some 2 percent of Carbon Management Ltd is held by unspecified nongovernmental organisations (NGOs), with the remaining 49 percent held by the firm’s operating/management partner, Beneath The Waves.

The Prime Minister, in summer 2022, said that with a Heads of Agreement with Beneath The Waves already concluded, the Government will receive 85 percent of Carbon Management’s “upstream” revenues with Beneath The Waves gaining the remaining 15 percent.

He added that the Government would, via its equity stake, receive 49 percent of Carbon Management’s “downstream” revenues associated with the trading of Bahamian blue carbon credits on the secondary market. And Beneath The Waves’ 15 percent management fee was “the most attractive of all offers received”.

Beneath The Waves was founded in 2013 as a non-profit focused on

all the jobs on this island that need limestone fill and they’re backed up. It’s significant.”

Suggesting that the Government is moving to take enforcement “to another step”, the BCA president added of the consequences: “You’re holding up business activity in construction with the closing of the quarry sales.

“Persons in the heavy equipment industry have been calling, making complaints. They cannot make money because they cannot operate their trucks if there

Marine Protected Areas, threatened species, deep sea conservation and blue carbon. However, to convert this nation’s seagrass and mangrove assets into income streams, Vera, the environmental verification group, has to certify their potential blue carbon credit value.

Besides Mr Ferguson and Antoine Bastian, the Genesis Fund Services’ chief, the directors/advisers to Carbon Management Ltd also include Michael Paton, the Lennox Paton attorney and partner; Jeffrey Kerr, president and chief executive of Green Leaf Financial Services; and Dr Livingstone Marshall, senior vice-president of environmental and community affairs at Abaco’s Baker’s Bay development.

Dr Carlton Watson, from the University of The Bahamas, and Dr Alyson Myers, vice-president of development and research at Sandy Cay Development, are other members of the Bahamian scientific and environmental

is no aggregate to move. If they’re not moving their trucks they are not making money.

“The equipment operators who work on the roads, moving aggregate with back hoes, they cannot make money because there is no aggregate to push around.

I don’t think people understand the snowball effect. When you do something in construction it affects several people every time. The screams are going to get louder and louder.”

community named as directors/advisers to Carbon Management. The final three members - Dr Austin Gallagher, Dr Carlos Duarte and Cristina Mittermeier - are all affiliated with Beneath the Waves.

Mr Ferguson previously suggested The Bahamas could build a fund worth up to $60bn by 2050 to finance environmental and climate change protection if it maximises its blue carbon credits.

“What we are trying to do is be responsible, while at the same time maximising the value that we can get so that we could be in a position by 2050 to have an endowment fund that’s probably $40, $50 or $60bn that could then be reinvested to protect ourselves,” he added.

The CFAL chief said the revenue generated from selling these blue carbon credits will be used to further the country’s sustainable development goals (SDGs) and reduce the “tax burden” facing Bahamians.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

I said, if they have to do a mechanical repair or do a little shutdown, or if they have a problem with power, because power is an issue as well... However, we do have the backup generator for our systems and the reverse osmosis plant, and that’s been very reliable over the last few months.”

Asked about contracts and whether the Bahamas government will continue to do business with the plant’s owner, Aqua design, Mr Bethel responded executives stationed in New Providence would better be able to flush out the details. However, as a solution to provide some relief to Eleutherans, he suggested revising the shutdown time.

“When we do cutbacks at night, instead of us normally running our four pumps, we would cut back to say, one or two pumps to preserve water just in case we have a situation with the reverse osmosis [plant] on the mainland,” Mr Bethel said. “So we would like to have storage for in cases of an emergency. The problem is that when we do come back online fully, because of the demand that is on Harbour Island… Harbour Island is full with a lot of people, a lot of tourists, you have a lot of construction going on, so that particular area, Barracks Hill, it’s always the last area to become pressurised on the island.

“So what we’ve been doing, we recently installed another pump so that water can get to them faster. And then also, we’ve installed some air valves around the island because sometimes you’ll have little pockets of air, and that will cause water to take long to get to some areas as well. But like I said, it’s just because of the demand that’s on the island. That’s why it’s taking them so long. And then what happens is, by times as the water gets to them, it’s almost time for our shutdown again.

“So what I suggested to management was that we changed the time for the shutdown so we can still accommodate them somehow, as in, you know, they can fill up some water

during the evening or what have you. So they can probably fill their bottles or whatever to last them throughout the day, until the lines become fully pressurised. Because when we do the shutdowns, it’s done for at least two to three days. But once we do that, once it’s finished, then we don’t do that anymore. They may be fully pressurised within a day or two, and then they wouldn’t have any problems there on out. So we’re trying to get it solved for them… but it’s just that one particular part which is on a rise, that is the last to get water. It’s really unfortunate, but we’re really trying to put some measures in place where they could get sorted out.”

One Harbour Island resident expressed disappointment in the state of Eleuthera’s water situation. She told Chelsea Cleare, owner of the Hotdog Lady, said she keeps 30-50 water bottles filled up in order to effectively and safely run her mobile business. She said given how much Harbour Island contributes to the economy, they deserve better water conditions, adding that The Bahamas must find an alternate source of water.

“Getting in bed with somebody who can’t help you make the bed, that don’t make sense,” Ms Cleare said. “From what I understand, the water problem here in Harbour Island, the island has outgrown.

The island has really tripled in terms of what is needed here. The infrastructure here is very outdated. So they gave us a new water tank, which we are grateful for with the water tank, because the old one had a massive hole in it. But what I’m saying is why is it still not able to do the job? Harbour Island contributes a great number of money to funding, whether it be Water and Sewerage, whether it be BPL, whether it be Cable Bahamas, and it’s still that we are still treated as third world citizens in our country. We have to argue for water. And whenever we make enough noise, that’s when they give you a little bit of relief, and then it just goes back to normal.”

Recalling a protest held by residents last year, Ms Cleare warned many residents have threatened to stop paying their water bill adding: “Frankly, it really doesn’t matter if they don’t get water from you because they don’t get water now.”

She said: “I heard a few residents talking about not paying water bills... so I think people are going to start to go back to the old ways and probably find a way to dig a well and hook up their house themselves, because it’s more reliable. And once one person gets one working, that’s all you need. You only need to light one match for it to start a fire.”

Opinion

We

In

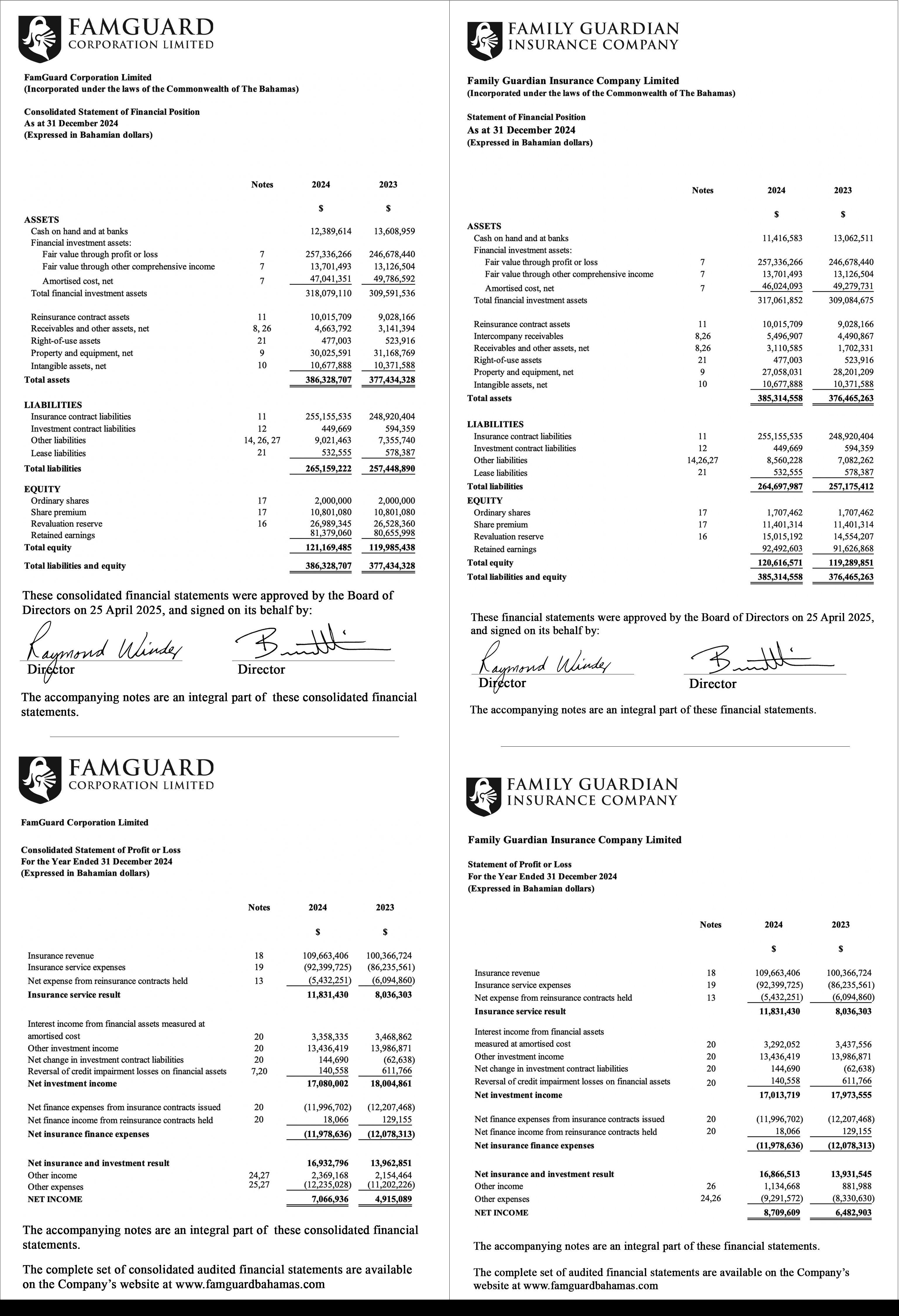

Accounting Standards. Basis for Opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of our report. We are independent of the Company in accordance with the International Ethics Standards Board for Accountants’ International Code of Ethics for Professional Accountants (including International Independence Standards) (IESBA Code), and we have fulfilled our other ethical responsibilities in accordance with the IESBA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Other Matters

The financial statements of the Company for the year ended December 31, 2023, were audited by another auditor who expressed an unmodified opinion on those statements on April 24, 2024.

Responsibilities of Management and the Board of Directors for the Financial Statement

Management is responsible for the preparation and fair presentation of the financial statements in accordance with IFRS Accounting Standards, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

The Board of Directors are responsible for overseeing the Company’s financial reporting process. Auditor’s Responsibilities for the Audit of the Financial Statement

This report is made solely to the Board of Directors, as a body. Our audit work has been undertaken so that we might state to the Board of Directors those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Bank and the Board of Directors as a body, for our audit work, for this report, or for the opinion we have formed.

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control.

Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

• Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company to cease to continue as a going concern.

Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with the Board of Directors regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

April 30, 2025

FROM PAGE B2

like an adventure. It can be scary sometimes. Furthermore, the biggest source of uncertainty lies in whether or not your business will be successful, causing many questions that may cloud your judgment. Such questions may include: Am I on the right path? Which area of my business should I adjust

to improve performance?

What is working and what is not? Was this a mistake? Am I on the right path?

Managing a business is certainly not a walk in the park, and it is unlikely you will see massive profits early in your start-up, but you should see signs that point to profitability in the future.

If there is a strong growth showing from the start, that

FROM PAGE B1

by retorting, ‘but you’re still on the French blacklist’. Remember he said that?” asked Mr Davis.

“Now that’s a contradiction in terms because France is a member of the EU. And usually what the EU says goes through to all the jurisdictions. He was correct, but you know, my Attorney General don’t sit down and take these things lightly, and I suspect within the next few days, you’ll be hearing from him on that subject matter as to whether or not we are still blacklisted. I ga leave that to him.”

Both France and the Netherlands kept The Bahamas on their own tax blacklists for the whole of 2024 despite the EU’s late February decision to remove this nation from its own.

Both states are members of the 27-nation EU, but the bloc’s determination that The Bahamas had remedied alleged deficiencies in its ‘economic substance’ reporting regime and was worthy of removal made no impact on France or the Netherlands’ national policies.

Indeed, according to a note from Deloitte & Touche’s French affiliate, France decided on February 17, 2024, to maintain The Bahamas as one of five jurisdictions subject to full defensive measures - including punitive withholding taxes on payments such as interest, dividends and royalties - for the whole of last year with that decision to only be reviewed come 2025.

The French move was decided just three days before the EU resolved to delist The Bahamas

on February 20, 2024. As for the Netherlands, the decision to maintain The Bahamas’ blacklisting was taken on December 29, 2023, and remained in effect without change for a whole year.

“Inclusion of a jurisdiction on the Dutch blacklist applies for the entire calendar year 2024 with an annual revisit of the list effective the following calendar year,” one Dutch accounting firm said. Those jurisdictions targeted are ones with no or a low rate corporate income tax of 9 percent or less, which means The Bahamas’ plan to implement the 15 percent minimum global corporate tax rate may be of some help.

However, in the meantime, The Netherlands will impose similar measures to France via withholding taxes at a 25.8 percent rate, controlled foreign company rules and other strictures designed to discourage

is a trend which will help your business a great deal. The following points can help validate those assumptions, and achieve business objectives and revenue projections, which are crucial to a successful business model.

* Does It Solve a Problem?: It is encouraging if your small business solves a problem for someone. It should be easier or cheaper

business with The Bahamas and other low-tax states.

While national blacklistings are less comprehensive and impactful than those imposed by multinationals, such as the EU and Organisation for Economic Co-Operation and Development (OECD), they nevertheless pose a reputational risk and undermine the ‘ease of doing business’ with entities and individuals from those nations by adding to the cost and time associated with financial transactions.

Mr Pinder last March blasted the French decision as “complete and utter foolishness”. He told the Society of Trust and Estate Practitioners (Bahamas) conference that he had conveyed such sentiments to the French ambassador when they and a delegation were visiting The Bahamas the previous week.

He questioned the logic in France’s decision to keep The Bahamas on its list of non-cooperative jurisdictions for tax purposes when it was a member of the same EU that, just three days later, delisted this nation from the 27-country

for the customer to seek your solution rather than attempting to solve it on their own.

* Will enough people want it?: It is great if your business can solve someone’s problem, but are there enough people with the same problem? You need to have a large enough market or audience so that your small business can sustain itself.

* Will customers pay what you are asking?: The value of your solution must be far greater than the cost someone incurs to purchase it from you. The sooner you have strong marketing in place, the better, since marketing effectively is a way

bloc’s separate blacklist after determining it had remedied deficiencies in its economic substance reporting regime.

Mr Pinder said France’s decision to keep The Bahamas on its blacklist was a “policy decision” that a minister could reverse if they saw fit. “The French were at the meeting. They are members of the OECD.

The FHTP (OECD Forum

to sustain your business beyond doubts.

Great product

Most importantly, ensure you have a great product in place - one which customers are going to respond well to. It will serve as an indication that your business will have much better sales and reputation, both of which are great attributes for a successful operation.

Knowing if your small business will be successful is a big deal. It s like putting together a puzzle, needing all the pieces to make the picture come together. You will find your successful formula only if you are attentive, diligent and give

on Harmful Tax Practices) unanimously agreed to the process,” he added. “They are members of the European Union. The European Union agreed to the process. They were very much aware on January 1 that we had completed our obligations of exchanging [economic substance] information. Yet they say because they decided at

your business the time and attention it merits. Knowing when to check, to analyse and adjust can propel your small venture forward and improve its chances of turning into a successful business. Until we meet again, live life for memories as opposed to regrets. Enjoy life and stay on top of your game.

• NB: Columnist welcomes feedback at deedee21bastian@gmail.com ABOUT COLUMNIST: Deidre M. Bastian is a trained graphic designer/ brand marketing analyst, international award-winning author and certified life coach.

their meeting, which was two weeks prior to the EU’s, they won’t follow the EU’s directive.

“I told them this is complete and utter foolishness. This is a policy decision by their government. They can go right back right now and have a minister change that policy decision and remove us from their list. Otherwise, I have no more time to speak about this.”

By SARAH PARVINI AP Technology Writer

CONSERVATIVE activ-

ist Robby Starbuck has filed a defamation lawsuit against Meta alleging that the social media giant's artificial intelligence chatbot spread false statements about him, including that he participated in the riot at the U.S. Capitol on Jan. 6, 2021.

Starbuck, known for targeting corporate DEI programs, said he discovered the claims made by Meta's AI in August 2024, when he was going after "woke DEI" policies at motorcycle maker Harley-Davidson.

"One dealership was unhappy with me and they posted a screenshot from Meta's AI in an effort to attack me," he said in a post on X. "This screenshot was filled with lies. I couldn't believe it was real so I checked myself. It was even worse when I checked."

Since then, he said he has "faced a steady stream of false accusations that are deeply damaging to my character and the safety of my family."

The political commentator said he was in Tennessee during the Jan. 6 riot. The suit, filed in Delaware Superior Court on

Tuesday, seeks more than $5 million in damages. In an emailed statement, a spokesperson for Meta said that "as part of our continuous effort to improve our models, we have already released updates and will continue to do so."

Starbuck's lawsuit joins the ranks of similar cases in which people have sued AI platforms over information provided by chatbots. In 2023, a conservative radio host in Georgia filed a defamation suit against OpenAI alleging ChatGPT provided false information by saying he defrauded and

NOTICE is hereby given that MANIES ALLISAR ALVENA of Kemp Road, Apache Alley, Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 01th day of May 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

embezzled funds from the Second Amendment Foundation, a gun-rights group.

James Grimmelmann, professor of digital and information law at Cornell Tech and Cornell Law School, said there is "no fundamental reason why" AI companies couldn't be held liable in such cases. Tech companies, he said, can't get around defamation "just by slapping a disclaimer on."

"You can't say, 'Everything I say might be unreliable, so you shouldn't believe it. And by the way, this guy's a murderer.' It

can help reduce the degree to which you're perceived as making an assertion, but a blanket disclaimer doesn't fix everything," he said. "There's nothing that would hold the outputs of an AI system like this categorically off limits."

Grimmelmann said there are some similarities between the arguments tech companies make in AI-related defamation and copyright infringement cases, like those brought forward by newspapers, authors and artists. The companies often say that they are not in a position to

NOTICE is hereby given that KHLOE KAYLA NELSON of Key West Street, New Providence, Bahamas, applying to the Minister responsible for Nationality and Citizenship, for Registration/Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of April, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

supervise everything an AI does, he said, and they claim they would have to compromise the tech's usefulness or shut it down entirely "if you held us liable for every harmful, infringing output, it's produced."

"I think it is an honestly difficult problem, how to prevent AI from hallucinating in the ways that produce unhelpful information, including false statements," Grimmelmann said. "Meta is confronting that in this case. They attempted to make some fixes to their models of the system, and Starbuck complained that the fixes didn't work."

When Starbuck discovered the claims made by Meta's AI, he tried to alert the company about the error and enlist its help to address the problem. The complaint said Starbuck contacted Meta's managing executives and legal counsel, and even asked its AI about what should be done to address the allegedly false outputs.

According to the lawsuit, he then asked Meta to "retract the false information, investigate the cause of the error, implement safeguards and quality control processes to prevent similar harm in the future, and communicate transparently with all Meta AI users about what would be done."

The filing alleges that Meta was unwilling to make those changes or "take meaningful responsibility for its conduct."

"Instead, it allowed its AI to spread false information about Mr. Starbuck for months after being put on notice of the falsity, at which time it 'fixed' the problem by wiping Mr. Starbuck's name from its written responses altogether," the suit said. Joel Kaplan, Meta's chief global affairs officer, responded to a video Starbuck posted to X outlining the lawsuit and called the situation "unacceptable."

"This is clearly not how our AI should operate," Kaplan said on X. "We're sorry for the results it shared about you and that the fix we put in place didn't address the underlying problem."

Kaplan said he is working with Meta's product team to "understand how this happened and explore potential solutions."

Starbuck said that in addition to falsely saying he participated in the the riot at the U.S. Capitol, Meta AI also falsely claimed he engaged in Holocaust denial, and said he pleaded guilty to a crime despite never having been "arrested or charged with a single crime in his life."

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, KENNY ALMADO WILSON, of Lucaya, Grand Bahama. intend to change my name to MICHAEL ANTHONY BROOME If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, The Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE is hereby given that GARY LEE ORELIEN CLARIDGE of Claridge Road, New Providence, Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 01th day of May 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that HEROLD PIERRE of Kemp Road, Nassau, The Bahamas, applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of April, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

By STAN CHOE AP Business Writer

MUCH like its wild month of April, a scary Wednesday for Wall Street found a gentler ending as U.S. stocks stormed back from steep early losses to continue their manic swings amid uncertainty about what President Donald Trump's trade war will do to the economy.

The S&P 500 rose 0.1% to extend its winning streak to a seventh day. The Dow Jones Industrial Average added 141 points, or 0.3%, while the Nasdaq composite edged down by 0.1%.

It was a stunning reversal after the S&P 500 dropped as much as 2.3% and the Dow fell 780 points in early trading. Stocks initially tumbled after a report suggested the U.S. economy may have shrunk at the start of the year, falling well short of economists' expectations, in a sharp turnaround from the economy's solid growth at the end of last year.

Importers rushed to bring products into the country before tariffs could raise their prices, which helped drag on the country's overall gross domestic product. Such data raised the threat of a worstcase scenario called "stagflation," one where the economy stagnates yet inflation remains high. Economists fear it because the Federal Reserve has no good tools to fix both problems at the same time. If the Fed were to try to help one problem by

adjusting interest rates, it would likely make the other worse.

"Even if today's weak GDP may have partially reflected companies trying to get ahead of tariffs, it was still a stagflation warning shot over the bow of the economy," according to Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management. But some better news came later in the day when a report said the measure of inflation that the Fed likes to use slowed in March. Inflation decelerated to 2.3%, closer to the Fed's goal of 2%, from February's reading of 2.7%.

Stocks began paring their losses almost immediately after the report.

If inflation keeps trending lower, it would give the Fed more leeway to cut interest rates in order to juice the economy. Expectations are building for the Fed to cut its main interest rate at least four times by the end of this year, according to data from CME Group, though it likely won't begin at its next meeting next week.

Much of Wednesday's economic data raised concerns about a weakening economy. A report on the job market from ADP suggested employers outside the government may have hired far fewer workers in April than economists expected, less than half.

It's discouraging because a relatively solid job market has been one of the linchpins keeping the U.S. economy stable. A more comprehensive report on

the job market from the U.S. government will arrive on Friday.

Wednesday's reports add to worries that Trump's trade war may drag the U.S. economy into a recession. The president's on-againoff-again rollout of tariffs has created deep uncertainty about what's to come, which could cause damage by itself.

"I'm not taking a credit or discredit for the stock market," Trump said Wednesday. "I'm just saying we inherited a mess."

Uncertainty around Trump's tariffs has already triggered historic swings for financial markets, from stocks to bonds to the value of the U.S. dollar, that battered investors through April. The S&P 500 briefly dropped nearly 20% below its all-time high set earlier this year, with scary headlines at one point warning of the potential for the worst April since the Great Depression.

But the uncertainty has been two-sided, and hopes that Trump may relent on some of his tariffs helped the S&P 500 claw back a chunk of its losses. It ended April with a decline of just 0.8%, much milder than March's, and it's only 9.4% below its record.

Stronger-than-expected profit reports from big U.S. companies have helped support the market, and Seagate Technology jumped 11.6% for one of Wednesday's biggest gains after the maker of data storage joined the parade. Gains for other storage makers also helped to offset

drops for stocks within the artificial-intelligence industry, which have been pulling back on worries their prices shot too high in prior years.

Super Micro Computer warned that some customers delayed purchases in the latest quarter, which caused the maker of servers used in AI and other computing to slash its forecast for sales and profit. Its stock tumbled 11.5% for the largest loss in the S&P 500.

Starbucks sank 5.7% after the coffee chain fell short of analysts' forecasts for revenue and profit in the latest quarter. Starbucks did log its first quarterly sales increase in more than a year, but acknowledged that its turnaround effort is far from complete.

All told, the S&P 500 rose 8.23 points to 5,569.06. The Dow Jones Industrial Average rose 141.74 to 40,669.36, and the Nasdaq composite fell 14.98 to 17,446.34. It still marked the close of a third straight losing month for the S&P 500. Stocks in the energy industry took some of the hardest hits, dropping over three times more than any of the other 11 sectors that make up the index.

Halliburton, an oil services company, lost nearly 22% in April as the price of crude slid on worries that tariffs will weaken the global economy. In the bond market, Treasury yields fell as investors ratcheted up their expectations for cuts to

interest rates by the Fed. The yield on the 10-year Treasury eased to 4.17% from 4.19% late Tuesday. Lower interest rates in general give boosts to prices for stocks and other investments.

Yields have largely been sinking since an unsettling, unusual spurt higher earlier this month rattled both Wall Street and the U.S. government. That rise had suggested investors worldwide may have been losing faith in the U.S. bond market's reputation as a safe place to park cash. In stock markets abroad, indexes rose across much of Europe after finishing mixed in Asia.

By SAMYA KULLAB and HANNA ARHIROVA Associated Press

UKRAINE is ready to sign an agreement that would give the U.S. access to its valuable rare minerals in the hopes of ensuring continued American support for Kyiv in its grinding war with Russia, senior Ukrainian officials said Wednesday.

Ukraine's economy minister and deputy prime minister, Yulia Svyrydenko, flew to Washington on Wednesday to help finalize the deal, Prime Minister Denys Shmyhal said during an appearance on Ukrainian television. Although the main part of the agreement had been settled, there were still hurdles to overcome, said a senior Ukrainian official who spoke on condition of anonymity because the official wasn't authorized to discuss the matter publicly.

For Ukraine, the agreement is seen as key to ensuring its access to future U.S. military aid.

"Truly, this is a strategic deal for the creation of an investment partner fund," Shmyhal said. "This is truly an equal and good international deal on joint investment in the development and restoration of Ukraine between the governments of the United States and Ukraine."

U.S. President Donald Trump indicated in February that he wanted access to Ukraine's rare earth materials as a condition for continued U.S. support in the war, describing it as

reimbursement for the billions of dollars in aid the U.S. has given to Kyiv. But talks stalled after a tense Oval Office meeting of U.S. and Ukrainian leaders, and reaching an agreement since then has proven difficult and strained relations between Washington and Kyiv.

Treasury Secretary Scott Bessent said Wednesday during a Cabinet meeting at the White House that the Trump administration was ready to sign off on a deal, but that there was still work to do.

"The Ukrainians decided last night to make some last-minute changes," Bessent said when asked about reports that Ukraine was ready to agree to the pact. "We're sure that they will reconsider that. And we are ready to sign this afternoon if they are." He didn't elaborate as to the late changes he said Ukraine made.

The U.S. is seeking access to more than 20 raw materials deemed strategically critical to its interests, including some non-minerals such as oil and natural gas. Among them are Ukraine's deposits of titanium, which is used for making aircraft wings and other aerospace manufacturing, and uranium, which is used for nuclear power, medical equipment and weapons. Ukraine also has lithium, graphite and manganese, which are used in electric vehicle batteries.

After Kyiv felt the initial U.S. draft of the deal disproportionately favored

American interests, it introduced new provisions aimed at addressing those concerns.

According to Shmyhal, the latest version would establish an equal partnership between the two countries and last for 10 years. Financial contributions to a joint fund would be made in cash, and only new U.S. military aid would count toward the American share. Assistance provided before the agreement was signed would not be counted. Unlike an earlier draft, the deal would not conflict with Ukraine's path toward European Union membership — a key provision for Kyiv.

The Ukrainian Cabinet approved the agreement Wednesday, empowering Svyrydenko to sign it in Washington. Once signed by both sides, the deal would need to be ratified by the Ukrainian Parliament before it could take effect. Putin wants answers before committing to a ceasefire

The negotiations come amid rocky progress in Washington's push to stop the war.

Russian President Vladimir Putin backs calls for a ceasefire before peace negotiations, "but before it's done, it's necessary to answer a few questions and sort out a few nuances," Kremlin spokesman Dmitry Peskov said. Putin is also ready for direct talks with Ukraine without preconditions to seek a peace deal, he added.

"We realize that Washington wants to achieve quick progress, but we hope for understanding that the Ukrainian crisis settlement is far too complex to be done quickly," Peskov said during his daily conference call with reporters.

Trump has expressed frustration over the slow pace of progress in negotiations aimed at stopping the war. Western European leaders have accused Putin of stalling while his forces seek to grab more Ukrainian land. Russia has captured nearly a fifth of Ukraine's territory since Moscow's forces launched a full-scale invasion on Feb. 24, 2022.

The American president has chided his Ukrainian counterpart, Volodymyr Zelenskyy, for steps that he said were prolonging the killing, and he has rebuked Putin for complicating negotiations with "very bad timing" in launching deadly strikes on Kyiv.

Trump has long dismissed the war as a waste of lives and American taxpayer money — a complaint he repeated Wednesday during his Cabinet meeting. That could spell an end to crucial military help for Ukraine and heavier economic sanctions on Russia.

US wants both sides to speed things up

The U.S. State Department on Tuesday tried again to push both sides to move more quickly and warned that the U.S. could pull out of the negotiations if there's no progress.

By MARY CLARE JALONICK Associated Press

SENATE Democrats are forcing a vote Wednesday evening on whether to block global tariffs announced by Donald Trump earlier this month, a potentially tough vote for some Republicans who have expressed concerns about the policy but are wary of crossing the president. Trump announced the farreaching tariffs on nearly all U.S. trading partners April 2 and then reversed himself a few days later after a market meltdown, suspending the import taxes for 90 days. Amid the uncertainty for both U.S. consumers and businesses, the Commerce Department said

Wednesday that the U.S. economy shrank 0.3% from January through March, the first drop in three years. It is unclear whether the resolution will pass the Senate, and House passage is even less likely. But Democrats say they want to put Republicans on the record either way and try to reassert congressional powers.

"The Senate cannot be an idle spectator in the tariff madness," said Oregon Sen. Ron Wyden, the lead sponsor of the resolution.

All 47 Senate Democrats are expected to support the resolution, which means they would need four Republican votes for passage. A similar resolution that would have thwarted Trump's ability to impose tariffs on Canada passed

the Senate earlier this month with the support of Sens. Susan Collins of Maine, Lisa Murkowski of Alaska and Rand Paul and Mitch McConnell of Kentucky. All but McConnell have indicated that they will vote for the broader resolution Wednesday.

Wary of a rebuke to Trump, Republican leaders have encouraged their conference not to vote for the resolution, even as many of them remain wary of the tariffs. Vice President JD Vance attended a Senate GOP luncheon Tuesday with U.S. Trade Representative Jamieson Greer, who assured senators that the administration is working on trade deals with individual countries.

Republicans who have been skeptical of the tariffs said they won't vote with Democrats, arguing it is a political stunt. North Carolina Sen. Thom Tillis said he backs separate legislation by Iowa Sen. Chuck Grassley that would give Congress increased power over determining tariffs but would vote no on the resolution, which he said is only about "making a point."

Democrats say the Republicans' failure to stand up to Trump could have dire consequences.

"The only thing Donald Trump's tariffs have succeeded in is raising the odds of recession and sending markets into a tailspin," said Democratic Leader Chuck Schumer, D-N.Y. "Today, they have to choose

"We are now at a time where concrete proposals need to be delivered by the two parties on how to end this conflict," department spokeswoman Tammy Bruce quoted U.S. Secretary of State Marco Rubio as telling her.

Russia has effectively rejected a U.S. proposal for an immediate and full 30-day ceasefire, making it conditional on a halt to Ukraine's mobilization effort and Western arms supplies to Kyiv.

Russian Foreign Minister Sergey Lavrov claimed Wednesday that Ukraine had accepted an unconditional truce only because it was being pushed back on the battlefield, where the bigger Russian forces have the upper hand.

UN says Ukrainian civilian casualties are on the rise

Meanwhile, Ukrainian civilians have been killed or wounded in attacks every day this year, according to a U.N. report presented Tuesday in New York.

– stick with Trump or stand with your states."

The Democratic resolution forces a vote under a statute that allows them to try to terminate the emergency that Trump declared in order to put the tariffs in place.

Massachusetts Sen. Elizabeth Warren called it a "fake" emergency that Trump is using to impose his "on again, off again, red light, green light tariffs."

The tariffs "are pushing our economy off a cliff," Warren said.

The Republican president has tried to reassure

The U.N. Human Rights Office said in the report that in the first three months of this year, it had verified 2,641 civilian casualties in Ukraine. That was almost 900 more than during the same period last year.

Also, between April 1-24, civilian casualties in Ukraine were up 46% from the same weeks in 2024, it said.

The daily grind of the war shows no sign of letting up. A nighttime Russian drone attack on Ukraine's second-largest city, Kharkiv, wounded at least 45 civilians, Ukrainian officials said.

Also Wednesday, the Ukrainian Security Service claimed its drones struck the Murom Instrument Engineering Plant in Russia's Vladimir region overnight, causing five explosions and a fire at the military facility. The claim could not be independently verified.

a nervous country that his tariffs will not provoke a recession as his administration has focused on China. He told his Cabinet Wednesday morning that his tariffs meant China was "having tremendous difficulty because their factories are not doing business." Trump said the U.S. does not really need imports from the world's dominant manufacturer. "Maybe the children will have two dolls instead of 30 dolls," he said. "So maybe the two dolls will cost a couple bucks more than they would normally."

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act 2000, the above-named Company is in dissolution, which commenced on the 29th day of April, A.D., 2025. The Liquidator is Galnom Ltd., CUB Financial Center, Western Road, Nassau, Bahamas.

Business Companies Act (No. 45 of 2000) In Voluntary Liquidation

Notice is hereby given in accordance with Section 138 (8) of the International Business Companies Act, No. 45 of 2000, the Dissolution of RERITIBA, S.A. has been completed, a Certificate of Dissolution has been issued, and the Company has therefore been struck off the Register. The date of completion of the dissolution was the 22nd day of April, 2025.

Trump says US kids may get '2 dolls instead of 30,' but China will suffer more in a trade war

By JOSH BOAK Associated Press

PRESIDENT Donald Trump on Wednesday acknowledged that his tariffs could result in fewer and costlier products in the United States, saying American kids might "have two dolls instead of 30 dolls," but he insisted China will suffer more from his trade war.

The Republican president has tried to reassure a nervous country that his tariffs will not provoke a recession, after a new government report showed the U.S. economy shrank during the first three months of the year.

"You know, somebody said, 'Oh, the shelves are going to be open,'" Trump continued, offering a hypothetical. "Well, maybe the children will have two dolls instead of 30 dolls. So maybe the two dolls will cost a couple bucks more than they would normally." His remarks followed a defensive morning after the Commerce Department reported that the U.S. economy shrank at an annual rate of 0.3% during the first quarter. Behind the decline was a surge in imports as companies tried to front-run the sweeping tariffs on autos, steel, aluminum and almost every country. And even positive signs of increased domestic consumption indicated that purchases might be occurring before the import taxes lead to price increases.

Trump pointed his finger at Biden as the stock market fell Wednesday morning in response to the

Trump was quick to blame his Democratic predecessor, Joe Biden, for any setbacks while telling his Cabinet that his tariffs meant China was "having tremendous difficulty because their factories are not doing business," adding that the U.S. did not really need imports from the world's dominant manufacturer.

gross domestic product report. "This is Biden's Stock Market, not Trump's," the Republican president, who took office in January, posted on his social media site. "Tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers. Our Country will boom, but we have to get rid of the Biden 'Overhang.' This will take a while, has NOTHING TO DO WITH TARIFFS."