‘Every 100 migrants cost taxpayers $500k’

By NEIL HARTNELL Tribune Business Editor

THE MINISTRY of Finance’s top official has voiced fears that the migration crisis could “throw our Budget off completely” with taxpayers incurring an additional $500,000 in costs for every 100 new arrivals reaching Bahamian shores.

Simon Wilson, the financial secretary, told Tribune Business that costs incurred in dealing with the exodus from Haiti and Cuba were chief among the unplanned “extra expenses” that the Government and Bahamian taxpayers had to absorb during the six months to end-December 2023.

Speaking as the Government unveiled data on its 2022-2023 firsthalf fiscal performance, he explained that the soaring number of illegal migrants was imposing a variety of direct and indirect costs that the Public Treasury must cover. Besides the cost of more frequent repatriation flights, the Government also has to fund increased overtime payments to Immigration, police and Defence

Force officers plus meet expenses associated with feeding and detaining those apprehended.

Asserting that the Davis administration will be “close to or will beat” its full-year $564m fiscal deficit target, Mr Wilson told this newspaper of the unplanned first-half expenditure:

“Immigration is probably the biggest one. With the repatriation exercises, it’s probably the biggest one. When we repatriate them we have to feed them, detain them and accommodate them. That can be pretty expensive.

“If those numbers continue to be at the numbers they are, it will throw our Budget off completely. It could

‘Egregious conduct’: Ex-PLP MP faces law profession axe

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A FORMER PLP MP and Senator faces being disbarred from the Bahamian legal profession over “the most serious and egregious” conduct related to client monies that were to pay $116,300 in due taxes.

really run up a bill. It has a knock-on effect on everything.” Subsequently providing further insight, Mr Wilson said: “I can tell you this. For every 100 migrants we will probably have to pay an extra $500,000 in direct or indirect costs.

“When we see a loaded Haitian vessel, or the US coast guard says we’ve apprehended 300 migrants, that’s directly or indirectly close to $1.5m.” Keith Bell, minister of labour and Immigration, last month said The Bahamas caught and repatriated some 3,349 migrants to Haiti in 2022. Based on Mr Wilson’s

‘Scary’ food hikes starting to stabilise

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIANS “finally have some hope” that food price inflation is easing, Super Value’s president says, while admitting that the past two years have been “scary” for both retailers and consumers.

Debra Symonette told Tribune Business the 13-store supermarket chain is hopeful that food costs are “stabilising” and may even decrease over the rest of 2023 although she warned that any decline will not be sudden or dramatic.

Confirming that she had never before experienced such rapid, broad-based

price increases of the kind seen in COVID-19’s immediate aftermath, which were worsened by subsequent supply chain bottlenecks and Russia’s invasion of Ukraine, she added that

Decades-old systems hit fiscal reporting deadlines

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE GOVERNMENT’S fiscal transparency drive has burdened decades-old accounting and payroll systems with legally-mandated reporting deadlines they are not equipped to meet, a top official is asserting.

Simon Wilson, the Ministry of Finance’s financial secretary, told Tribune Business that The Bahamas had gone about imposing increased accountability and governance in reverse fashion by setting reporting deadlines prior to getting the necessary systems in place rather than the other way around.

Emphasising that he “fully supports” enhanced fiscal transparency, he said the Government’s accounting and payroll systems - 32 years-old and 22 years-old, respectively - have never been “integrated” and struggle to produce accurate numbers in accordance with the deadlines set by the Public Finance Management Act. The Davis administration has constantly come under fire from the Opposition for failing to meet the reporting timeline set out by the Act, but Mr Wilson told this newspaper: “Let’s put it this way. Our accounting system is 32 years-old. It has never

A four-person Bahamas Bar Association disciplinary tribunal, in a February 15 ruling, ordered that Pleasant Bridgewater “be struck from the roll” of practicing attorneys after she was unable to account for funds advanced to her by a client to cover closing costs for a real estate transaction.

The tribunal, headed by Supreme Court justice, Renae McKay, noted that the complaint against the one-time Marco City MP by Gary and Janis Belcher had remained unresolved for now close to 15 years and there was “no evidence” that Ms Bridgewater “has or can otherwise account for the funds”.

The Belchers, expatriate real estate investors, had

agreed in 2008 to acquire Lot 44 in ‘The Isles of Old Bahama Bay’ for some $1.163m. Ms Bridgewater acted as attorney for both the Belchers, as buyers, and the vendor, Dale Johanneson, and the transaction closed with the latter receiving the required sales proceeds.

However, the Belchers subsequently accused Ms Bridgewater of failing to pay the 10 percent Stamp Duty (now VAT) to the Public Treasury despite the necessary funds being advanced to her. They alleged that she has “failed

business@tribunemedia.net MONDAY, FEBRUARY 20, 2023

SEE PAGE B6

nhartnell@tribunemedia.net SEE PAGE B8 SEE PAGE B7

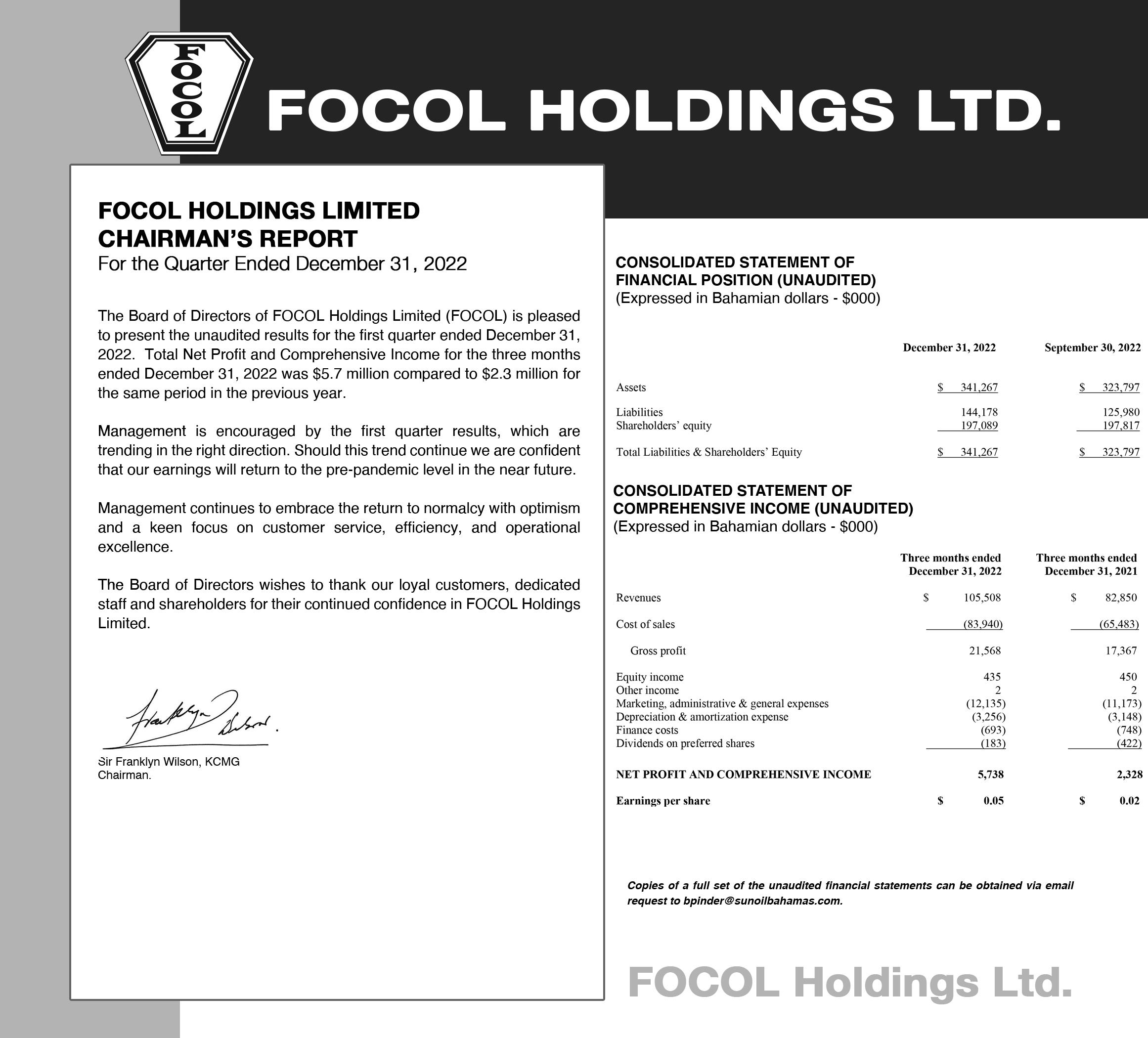

PAGE B11 DEBRA SYMONETTE • Crisis could ‘throw our Budget off completely’ • Top official confident ‘close to or beat’ deficit • Opposition: Gov’t ‘squandering’ revenue rise SIMON WILSON KWASI THOMPSON PLEASANT BRIDGEWATER

SEE

$5.76 $5.76 $5.46 $5.92

Make best strategic use of your Board’s directors

By Derek Smith Jr

CORPORATE governance has been transformed over the past century from an ‘old boys clubhouse’ to a strategic asset focused on preparing a company to withstand future volatility in markets, human capital, competition, money laundering, cyber crimes and other factors. According to Forbes contributor Betsy Atkins: “When we look back five years from now, governance 4.0, the era of future-proofing, will seem the obvious thing we should have embraced sooner.”

A critical component of corporate governance is the Board of Directors. Principle VI of the Organisation for Economic Co-Operation and Development (OECD) provides a list of Board of Directors responsibilities that include, but are not limited to, acting on behalf of shareholders and establishing various committees led by qualified individuals. The Insurance Commission of The Bahamas’ guidance note for corporate governance and oversight assessment criteria, most recently amended in August 2018, explains: “In general, corporate governance and oversight involves relationships between an organisation’s Board, management, shareholders, customers and employees.”

And, while accepting that corporate governance processes will vary from company to company, the Central Bank of The Bahamas’ corporate governance guidelines, revised in May 2013, further explain that “the Board of a licensee should comprise (except where specific exemption has

been granted) both executive and non-executive members, as appropriate to the organisation’s needs, who can act independent of undue influence from internal and external sources”. The strategic usage of directors is the focus of today’s article.

Strategic director composition

Taking an honest assessment of your Board’s composition is the first step. Your current Board members should be profiled regarding their experience, background, demographics and skills. Once gaps have been identified, fill them.

It is possible, for instance, that your Board has only one female member and no members with expertise in ESG (environmental and social factors). These are the gaps that should be filled when recruiting new Board members.

In The Bahamas, various regulators have established minimum standards, including fit and proper criteria and composition requirements for Boards.

Take a strategic approach to leadership in committees

There is a tendency for Board leadership roles to be awarded to the loudest voices in the room. It would be more effective to rotate committee chairs regularly to give everyone a chance and provide fresh perspectives.

The rotation of your nominating and governance chair is particularly critical. Additionally, it is essential to set committee objectives and use executive sessions to ensure alignment between the board and chief executive.

Moreover, the committee chair should be

process-oriented, willing to challenge ideas to promote understanding among committee members, a good listener and a proponent of committee evaluations.

Embrace hybrid Board meetings for maximum participation

Some strategists contend that, post-pandemic, the best approach is to host either entirely digital or entirely in-person meetings so that everyone is on an equal footing. This writer disagrees. Adopting a hybrid system with a set rules of engagement for all participants increases participation, real-time transfer of crucial analysis, and the ability to have a wide range of Board members’ expertise available for decision-making.

Conclusion Today, more than ever, Boards must place a high priority on diversity. It is often easier to say than to do. Despite this, achieving your company’s goals and increasing your Board’s effectiveness is feasible with the proper framework.

• NB: About Derek Smith Jr Derek Smith Jr. has been a governance, risk and compliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfsburg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certified anti-money laundering specialist (CAMS), and the compliance officer and money laundering reporting officer (MLRO) for CG Atlantic’s family of companies (member of Coralisle Group) for The Bahamas and Turks & Caicos.

PAGE 2, Monday, February 20, 2023 THE TRIBUNE

Atlantis concern over cruise line’s PI environment impact

By YOURI KEMP Tribune Business

AN ATLANTIS executive says the Paradise Island mega resort has concerns over how Royal Caribbean Cruise Lines (RCCL) plans to mitigate any environmental risks resulting from its proposed Beach Club project.

Vaughn Roberts, Atlantis’ senior vice-president of government affairs and special projects, confirmed to Tribune Business that the resort has reservations about the cruise line’s plan to develop the western portion of Paradise Island in the Colonial Beach area.

He added, though, that it has no position on the dispute playing out between Bahamian entrepreneur, Toby Smith, and the Government and Royal Caribbean over the former’s leasing of Crown Land to facilitate renovation of the Paradise Island lighthouse and his own ‘beach break’ destination.

Mr Roberts said: “I think we’re obviously closely watching how it all plays out, and certainly we were very supportive of the lighthouse being restored. We would like to also see anything that’s done there be done in a very environmentally responsible way.

“So we know that there are coral reefs there, we know that there has to be other environmental habitats there. So we just want to make sure it’s all done in a responsible way. Cruise lines have reports of dumping in the ocean and stuff.

We’re not saying Royal Caribbean is guilty, but there have obviously been incidents in the past. We just haven’t seen enough of Royal Caribbean’s plans to know how they’re going to mitigate any risks.”

Mr Roberts’ comments came after the chief justice, Sir Ian Winder, last week ruled that Mr Smith did not have a valid, legally binding lease from the Government for the two Crown Land parcels he was seeking for his project. This was because the minister then-responsible for Crown Lands, ex-prime minister, Dr Hubert Minnis, did not execute the necessary paperwork by applying his signature.

Mr Smith had based much of his three-year legal fight on a January 7, 2020, letter from Richard Hardy, acting director of the Department of Lands and Surveys, which was headlined “approval for Crown Land lease” over the two tracts he wanted. These covered a two and threeacre parcel, respectively, and included the lighthouse at Paradise Island’s western end and a ‘beach break’ destination in the Colonial Beach area.

The Bahamian entrepreneur signed the lease forwarded by Mr Hardy,

and returned it to the Government for execution by the minister responsible for Crown Lands, who was then Dr Minnis. The latter, though, did not sign the lease on the Government’s behalf as it emerged that Royal Caribbean Cruise Lines had rival designs on two of the Crown Land acres also sought by Mr Smith for its own $110m Royal Beach Club project.

Mr Smith has always maintained that, as a Bahamian entrepreneur, he was shoved aside to make way for a major foreign investor even though he had received his approvals and allegedly-binding Crown Land leases first. The chief justice’s decision now potentially paves the way for Royal Caribbean to move ahead with its Royal Beach Club project on Paradise Island’s western end if it - and the Government - so choose.

Campbell Cleare, the McKinney, Bancroft & Hughes attorney and partner, who is representing Royal Caribbean on its

Paradise Island ambitions, told Tribune Business he was unable to confirm if the Supreme Court judgment has cleared the way for his client to proceed. “I don’t know the answer to that question. There may be something in the judgment that prohibits that,” he responded. “I haven’t had a chance to read the judgment. I really couldn’t answer that right

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

now. Once I read it and take instructions from my client I will be in a position to answer that.” One option for Mr Smith is to appeal the verdict to the Court of Appeal, which would at least keep the disputed Crown Land in litigation for a little while yet.

Another Paradise Island business owner, speaking under condition of anonymity, said of Royal Caribbean’s project: “If they’re going to do this it’s going to take away a lot of business from people who are in this industry. For the taxi drivers and people who have a chance to come to Paradise Island, they will not come any more because the cruise ship is going to sell their packages directly.

“Royal Caribbean is going to suck business out of Paradise Island. The thing is nobody is going to want to stay on Paradise Island or even downtown, and Royal Caribbean is just going to take all of their guests to their side of the island. Lots of people are going to lose their jobs, too.

“Sure, Royal Caribbean is going to create jobs on the other side, but if somebody has been in the business for

the past 15 years and that is their bread and butter, then they will come on and take this over and affect our bread and butter.”

However, Wesley Ferguson, president of the Bahamas Taxi Cab Union, backed Royal Caribbean’s plans. “This is a win-win for the people because, like I said previously, Royal Caribbean will put in programmes and plans for that property and it will definitely benefit the poor Bahamian people that are in the tourism industry,” he argued. “It will also inadvertently create new opportunities for those who wish to go into the service industry.”

Rebutting the environmental concerns, and fears of job losses elsewhere if Royal Caribbean moves forward with their plans, Mr Ferguson added that “not everybody is going to agree” but argued that the majority of smaller tourism operators will benefit more from the cruise line’s project than Mr Smith’s.

• Also see pg A13

We are seeking to employ the position of Landscape Manager here at February Point Resort Estates in beautiful Great Exuma. We are hoping to find candidates with a minimum of 2-3 years’ experience. We offer a competitive salary and excellent benefits; housing will also be considered. Interested persons should send their resume to:

teneeshia@februarypoint.

THE TRIBUNE Monday, February 20, 2023, PAGE 3

Reporter ykemp@tribunemedia.net

LIGHTHOUSE POINT, PARADISE ISLAND

NEW YACHT SHOW AIMS TO OUTSHINE CARIBBEAN RIVALS

THE Bahamas is aiming to establish itself as the Caribbean’s yachting focal point with a trade show that organisers say has already attracted more vessels than rivals elsewhere in the region.

The first-ever Bahamas Charter Yacht Show, in a statement, said it is already outshining rival Caribbean events by attracting some 41 vessels to its launch. This, it added, compared favourably with the Caribbean Charter Yacht Show and the Antigua Charter Yacht Show, the region’s two main industry events, which last year attracted 13 and 33 vessels, respectively.

“It just goes to show how many yachts and brokers want to spend their money here,” said Peter Maury, of the Association of Bahamas Marinas (ABM), said of the inaugural event’s line-up. “Yacht charter customers

are among the wealthiest visitors to our country, and the industry knows that cruising The Bahamas is top of their bucket list.” The Bahamas Charter Yacht Show will be held in Nassau from February 23-26, with events starting this Wednesday at four

major New Providence marinas. It is being presented by the ABM, in partnership with the International Yacht Brokers Association (IYBA) and the Ministry of Tourism & Aviation.

Organisers said the US yacht market was estimated

to be worth US$18.9bn in 2020, the year that COVID19 struck. They added that this figure is projected to quadruple by 2027. By comparison, China, the world’s second largest economy, is forecast to reach a projected market size of $15.1bn by 2027. This data was highlighted to showcase the industry’s potential impact on job creation and economic activity in The Bahamas.

“The chartering of privately-owned yachts by high-net-worth individuals is exploding right now, and The Bahamas - both in terms of its geographical location and its stunning natural beauty - is uniquely placed to take advantage,” Mr Maury said. “This show is the launching pad for potential growth in the lucrative luxury tourism industry, establishing the islands of The Bahamas as

the premier boating destination in this hemisphere.”

The Bahamas Charter Yacht Show’s organisers say yachting already employs thousands of Bahamians as crew members; in vessel upkeep and repair; cleaning and detailing services; and food and beverage provision. Christopher Edwards of Blessed Detailers Cleaning Company, said he got involved in the yacht business three years ago, and now his company services ten international yachts that are frequent repeat customers.

“The yachting industry has been very kind to us,” Mr Edwards said. “And it isn’t just cleaning and detailing services that are benefiting. One of my friends is an upholsterer and he repairs furniture on many vessels that call into Nassau. I also refer a friend who is an electrician to

work on any problems that may arise on the yachts, and another friend purchases groceries for several vessels. My uncle, who owns a limousine company, does well taking the clients between the airport and the ship. It’s a whole network of us. “Of course, the knockon effects benefit the economy generally. We get paid for servicing these yachts, meaning we can employ more Bahamians and make our purchasing power felt in local shops, in the grocery stores, circulating more funds in the wider community. The money brought into this country by foreign yachts is a lot more than just dockage fees –that is what I thought, too, before I got involved.”

Cotton Bay revival targeting $12m yearly wage, tax boost

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

REPRESENTATIVES of the developer behind the Cotton Bay Club’s $200m revival have forecast that the project will generate an annual $12m economic impact in wages and taxes alone when fully operational.

Executives from Cotton Bay Holdings, the RitzCarlton Reserve developer headed by Colombian billionaire, Dr Luis Carlos Sarmiento, gave the projection to government and community stakeholders at a recent south Eleuthera meeting where they confirmed they hope to start construction this year

subject to obtaining all the necessary permits and approvals.

Daniel Zuleta, Cotton Bay Holdings’ company manager, said: “The project’s second phase, the construction stage, is scheduled to begin later this year and is anticipated to stimulate 300 direct jobs and is expected to last at least 24 months, providing in excess of $8m annually in wages.

“During this phase, two new public roads will be developed, Cotton Bay Road and Cocoplum Drive, which will provide public beach access. These roads are being designed by CCG (Caribbean Civil Group).” Eleuthera-based companies, Nu View Construction and Quick Fix Construction,

have already completed preliminary work on site.

Outlining the projected future economic impact, the developer added: “Once completed and operational, the resort will employ 200 Bahamians resulting in wages in excess of $10m per annum. Additionally, through taxes and fees, the development estimates a further economic contribution of over $2m annually.”

Attendees at the meeting included Clay Sweeting, MP for south and central Eleuthera, as well as island administrators and representatives from the Ministry of Public Works and the Department of Environmental Planning and Protection (DEPP).

‘‘Cotton Bay Ritz-Carlton Reserve is planned as an open-air luxury resort to feature 90 guest rooms and 60 Ritz-Carlton Reserve branded residences, designed to include a mixture of two to five-bedroom villas,” Mr Zuleta added. “In addition to first-class luxury amenities and services, a signature 18-hole championship golf course, a luxurious spa, swimming pools and signature restaurants are planned for the island retreat.”

The Cotton Bay RitzCarlton Reserve will be one of only five such resorts globally, and Mr Zuleta added: “The Cotton Bay Ritz-Carlton Reserve will span approximately 220 acres of the 400-acre property currently owned by the

developer. The remainder of the property is reserved for a future developmental phase, yet to be planned.”

Given the scope and complexity of the project, he said it required a phased approach beginning with the current design and pre-construction activities.

“We remain committed to assembling a team of bestin-class professionals to collaborate and bring this project to full fruition,” said Mr Zuleta, as he announced that a number of Bahamian service providers and consultants have been contracted already.

The developers are also in the process of selecting the project’s architects of record, who will be announced in the coming weeks. Cotton Bay Holdings said: “We are committed to preserving the natural beauty of our island paradise as a key component of our CSR (corporate social responsibility) strategy,

protecting the environment and preserving the unique ecosystem and natural resources for future generations to enjoy.

“Waypoint Consulting Ltd have been retained as our environmental consultant to develop our Environmental Impact Assessment (EIA) and Environmental Management Plan (EMP), and are working alongside our design teams and the Ministry of Environment and Housing’s Department of Environmental Planning & Protection (DEPP).”

Melissa Alexiou, spokesperson for Waypoint Consulting, said: “We provide professional environmental consulting services throughout The Bahamas and are excited to be working with Cotton Bay on this transformative development for our country.

Head of Facilities and Maintenance

This is a rare and exciting opportunity to join an outstanding and ambitious team at Inspired who recently opened premium school on the island of New Providence in The Bahamas. The school has already proven to be incredibly successful and is now moving into its second year.

We are looking for an exceptional Head of Facilities and Maintenance, who brings outstanding experience, high standards and a solution focused approach. You will be able to demonstrate the ability to assist in the key decision making related to systems, their commissioning and critical infrastructure required for our new, state of the art school campus in Western New Providence. Working with the site delivery team, consultants and others, as Head of FM you will be central to ensuring a smooth transition of the project from live construction to practical completion and handover. Amongst other responsibilities you will: deliver monthly and annual strategic reporting and planning; produce a multi-year campus maintenance plan; coordinate all maintenance related works to the campus and its facilities; support the site team throughout the current construction process, whilst always ensuring regulatory compliance and adherence to global best practice.

King’s College School offers the highest quality modern facilities in a purpose-built state-of-the-art facility on an expansive 10-acre campus, ensuring that students benefit from a learning environment that has been designed for how students learn in the modern day.

Facilities include football pitches, tennis and padel courts, as well as dance, drama, and art studios. There will also be state-of-the-art science labs, a multi-purpose hall, a 25m swimming pool, an adventure park playground, and plenty of green spaces and shaded areas for students to enjoy.

When joining King’s College School, The Bahamas, you will join the family of the award-winning Inspired Education Group, the leading global group of premium schools, with over 80 schools operating in 23 countries. We offer a competitive salary and benefits and access to best practice and career pathways with some of the very best schools worldwide.

To apply please send a CV and letter of motivation to admin@kingscollegeschool.bs

PAGE 4, Monday, February 20, 2023 THE TRIBUNE

TODAY! CALL THE TRIBUNE TODAY @ 502-2394

THE 164-foot mega yacht, ‘Highlander’, will be among the stars of the Bahamas Charter Yacht Show from February 23-26.

ADVERTISE

Rumour has it

The ups and downs in the international markets continued last week. Robust economic data fuelled concerns about interest rates but, at the same time, consumer activity remained strong. This created a dilemma for many investors.

The recent zigzag course taken by stock exchanges continued during the middle of last week.

Despite a plethora of new economic data, the major share indices worldwide failed to chart a clear line. Yet, over the course of the year, they have increasingly freed themselves from their lows.

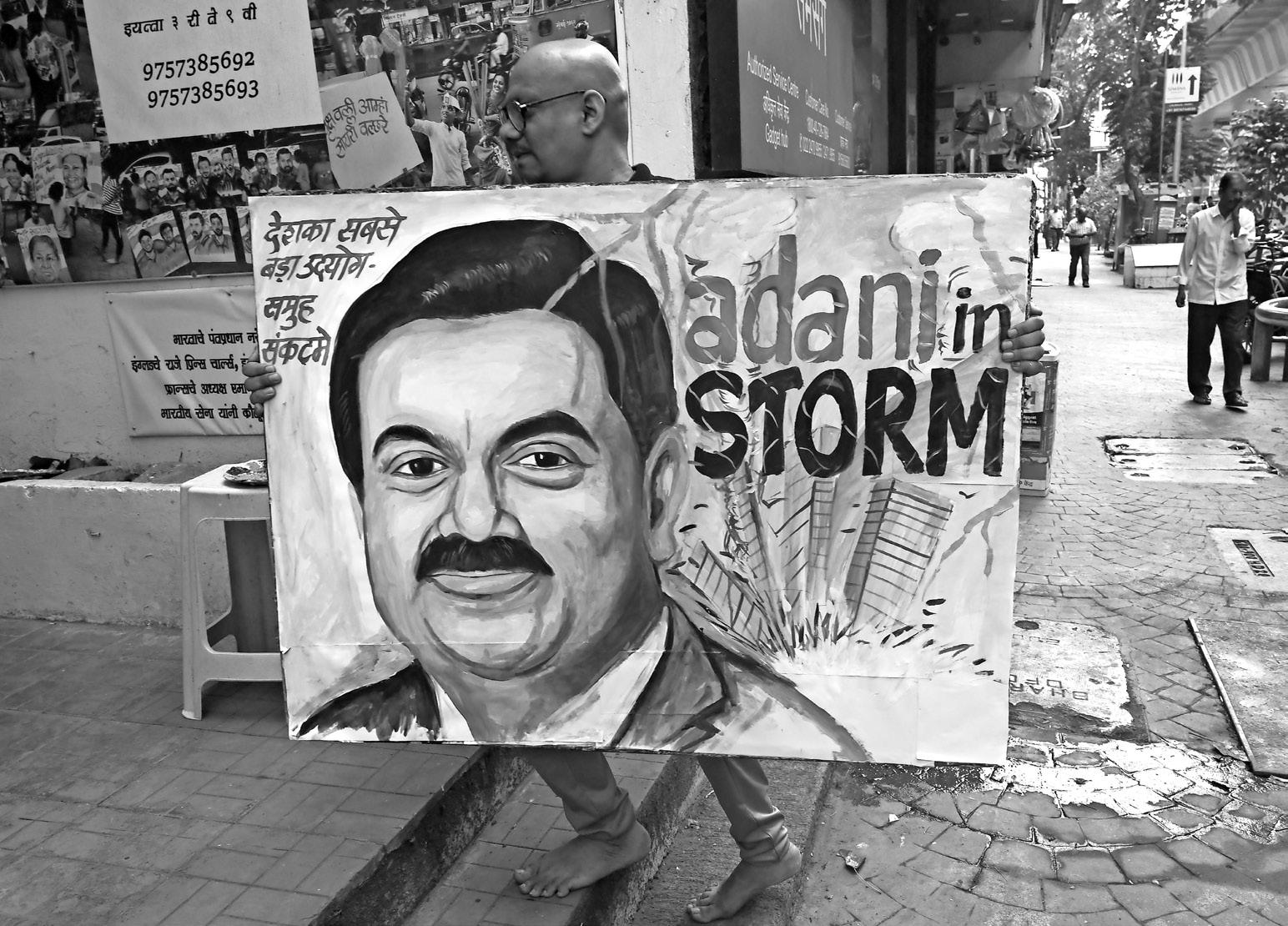

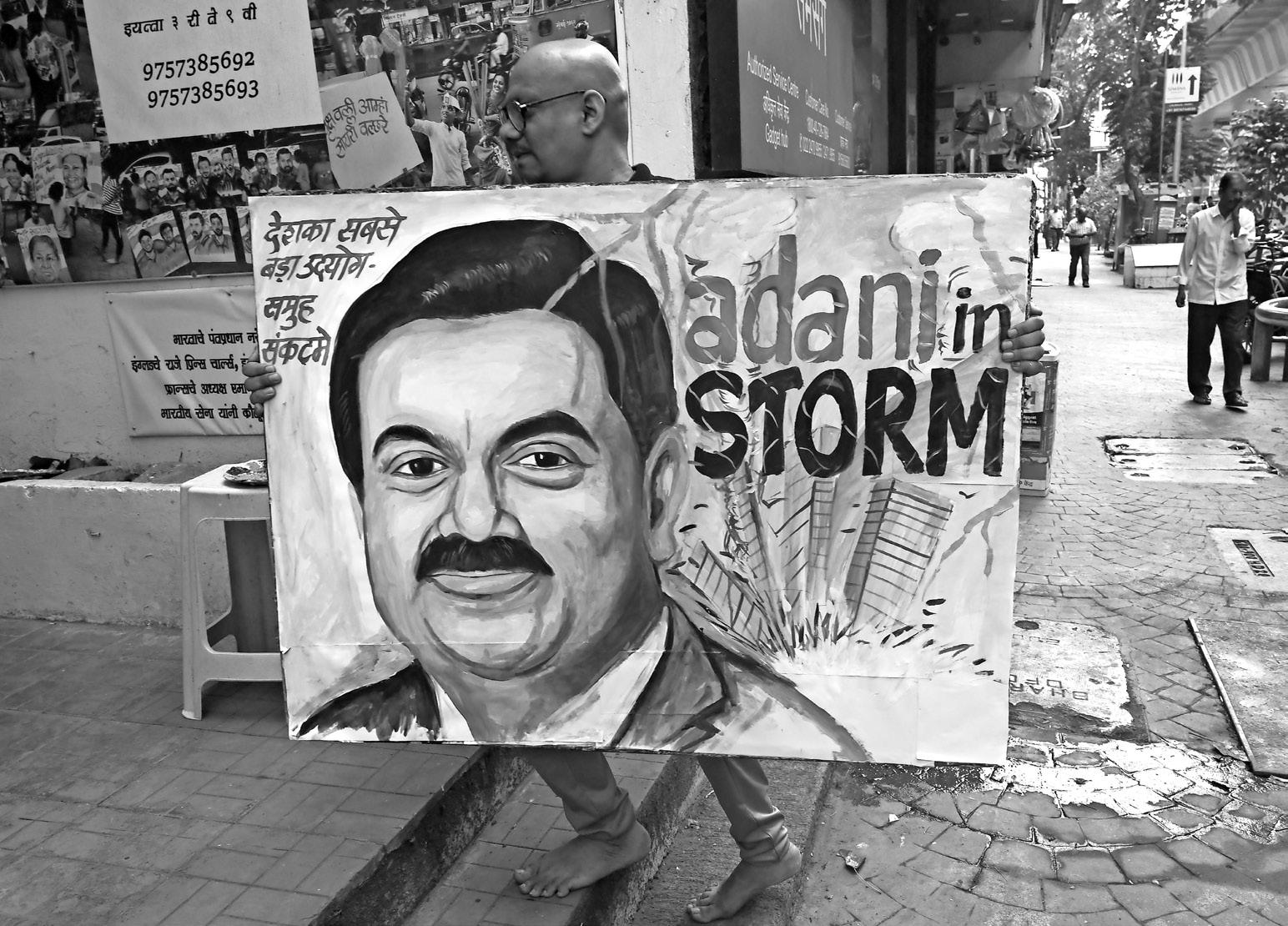

However, the once-second wealthiest man in the world has likely experiences two of his worst-ever weeks. It is a financial affair that is second to none. Hindenburg Research and its founder Nathan Anderson, a small financial house from New York that specialises in short selling, accusef the Indian industrial mogul, Gautam Adani, of nothing

less than the “biggest fraud in economic history”. For decades, Adani is alleged to have committed “brazen stock manipulation” and financial fraud via his company, the Adani Group, a commodity and industrial conglomerate. Shell companies in The Bahamas, family members in top positions in the group of companies, and falsified balance sheets are said to have obscured reality, covered up debt and thus inflated Adani’s share price up by up to 85 percent.

Since the release of the 100-page report two weeks ago, the Adani Group has lost more than $100bn in market value despite vehemently denying these claims. Mr Adani’s personal net worth has also come under severe pressure. In just seven days, his wealth has shrunk by $50bn. The man who last year was considered the second-richest person on earth has now slipped to 15th place on the well-known Forbes list. But what is a short seller? These are investors who sell shares without owning them first. To do this, they borrow the stock beforehand for a

fee and sell them on. The speculators hope that, if the share price falls, they can buy back the shares at a lower price. The difference between the ‘buy’ and ‘sell’ price minus the borrowing fee is their profit. Short sellers are often small teams that put together devastating reports after months of research. Hindenburg Research states that their team spent around two years researching the Adani Group’s corporate network. Anderson has repeatedly proven that he can be successful with his reports. Probably his biggest coup so far was the hydrogen truck start-up, Nikola. Using a video, Hindenburg proved that the thenNikola boss, Trevor Milton, simply rolled a hydrogen truck downhill, although he claimed that the drive would work long ago. The start-up’s stock lost twothirds of its value and Milton lost his job. It is far from clear whether Gautam Adani will recover from the attack. What is clear, however, is that Anderson may already have solid gains on his short positions. Last year

alone, short sellers made $300bn in profit betting on falling prices. For its part, Adani Enterprise cancelled a planned $2.5bn share offering in the wake of the attack. It remains an up and down on the markets.

THE TRIBUNE Monday, February 20, 2023, PAGE 5

CCO @

By CHRIS ILLING

ActivTrades Corp

to account for the funds”, and also failed to lodge the conveyance documenting their purchase for recording in the registry of records.

Realtors spoken to by Tribune Business yesterday said Ms Bridgewater’s actions, or inactions, had left her former clients exposed on two counts. Besides facing the prospect of having to pay a penalty, usually equivalent to 20 percent of the taxes due, the Belchers may also have to now pay a higher principal amount if the Government determines the property has increased in value.

And, without the conveyance being recorded, the couple’s title to their Old Bahama Bay property is not perfected or secured. Ms Bridgewater, who has the right to appeal, could not be located for comment

prior to press time last night. However, the disciplinary tribunal ruling noted that Ms Bridgewater did not deny receiving all the necessary funds from the Belchersincluding those to pay Stamp Duty - while also admitting five years later that taxes have not been paid.

“The complainant (Gary Belcher) advised that the deposit of $116,300, and the balance of the purchase price and closing costs in the amount of US$1.125m, respectively, were paid by wire transfer to [Ms Bridgewater’s] firm to allow the completion of the transaction to take place,” the ruling noted.

These costs were included, and broken out, in the completion document issued by Ms Bridgewater on March 20, 2008. These costs included $58,150 for the Belchers’ share of the Stamp Duty, equivalent to 5 percent

THE AUDLEY C. KEMP SR. ESTATE BENEFICIARIES

In the Estate of AUDLEY C. KEMP SENIOR late of Waterloo Road in the Eastern District of the Island of New Providence one of the Islands of The Commonwealth of the Bahamas, deceased.

NOTICE is hereby given that the Judicial Trustee Report as of December 2022 is available for review. All Beneficiaries are asked to contact Ms. Sydnease Rolle for arrangements to be made to obtain a copy of the report. Identification must be provided.

Legal Administrator

Email: srolle.ake@gmail.com

Telephone: 603-1022/805-3976

of the purchase price, as the 10 percent is typically split 50/50 between buyer and seller. None of the costs was disputed, and the tribunal’s ruling said: “The attorney does not deny that all of the requisite funds were received by the firm. Payment of the Stamp Duty and subsequent recording of the conveyance documents are part of the scope of works contemplated by the attorney and the complainant as evidenced by the completion statement. The attorney failed to pay the government Stamp Duty and record the conveyance.”

Ms Bridgewater “confirmed” she had acted for the Belchers in the transaction and received the funds, and admitted “that she failed to pay the Stamp Duty and record the conveyance. The admission most germane to this matter is made in the attorney’s e-mail to the complainant of May 29, 2013”.

The former PLP and Senator wrote: “Please see attached a copy of your conveyance. I have the original and [am] preparing it for stamping and recording. There is a penalty (20

percent of the Stamp Duty amount) due to the delay in stamping, which is not your fault at all and therefore not your expense. It has to be borne by me. Unfortunately, your matter is one of the several that I must resolve.”

During the hearings, Ms Bridgewater did not dispute the non-payment of taxes and admitted there “was an issue with the Stamp Duty”. The only thing she disagreed with was the $116,300 sum, but the Tribunal noted it was normal practice to withhold the seller’s Stamp Duty (now VAT) portion from the purchase price and apply it to paying the tax. And, as Ms Bridgewater was representing both sides in the deal, “she was at all material times seized of the full amount” of tax due.

Branding her arguments to the contrary as “disingenuous”, the Tribunal found of Ms Bridgewater: “The attorney offered no explanation as to where the funds were or why they were not immediately available on her firm’s account at the time Stamp Duty was to have been paid. The attorney did, however, acknowledge, as referred to

NOTICE

NOTICE is hereby given that JACINTH KARLENE BARNETT of #42 Queens Street, P. O. Box N-3940, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of February 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

above, that it was and is her responsibility and indicated that she was trying to make arrangements to settle the matter.....

“The expectation within the practice of conveyancing is that the Stamp Duty would have been paid forthwith upon the closing, or at least at as reasonably practicable a time after closing as possible after closing. It should be a matter of days, weeks at a stretch, but certainly not as in the present case, years later still being unaccounted for.

“The attorney has alluded to having experienced personal issues and difficulties which, while regrettable, are no excuse or explanation for the attorney’s failure in this regard.” The Tribunal reiterated that attorneys hold client funds on escrow or in trust, and monies designated for a specific purpose can only be used for that objective, with every cent accounted for.

“This matter has been outstanding from 2008. The Tribunal has seen no evidence of any actual attempt by the attorney to make good the loss beyond her mention of her desire or intent to do so. There is also no evidence that the attorney has or can otherwise account for the funds,” the Tribunal noted.

“The complainant has suffered extreme prejudice as a result of the failure of the attorney to act in accordance with her duties. This Tribunal finds.... that the funds were not applied to their purpose and have not been accounted for in any way, compounded by the length of time that has elapsed with the complete failure to mitigate by the attorney.”

As a result, the Bar’s code of professional conduct was breached.

Ms Bridgewater is no stranger to controversy. She had to resign from the Senate after being charged alongside her client, ambulance driver Tarino Lightbourne, with attempting to extort money from Hollywood actor, John Travolta, by threatening to expose information surrounding the death of his teenage son, Jett, while the family were on holiday in The Bahamas.

Then-justice Dame Anita Allen was forced, though, to declare a mistrial amid jury deliberations for fear the outcome may have been prejudiced by statements made at a PLP conclave by now-Broadcasting Corporation of The Bahamas (BCB) chairman, Picewell Forbes, suggesting she had been acquitted. The charges against Ms Bridgewater and her client were ultimately dismissed after Mr Travolta decided to spare his family the emotional toll of a second trial.

Ms Bridgewater had also previously acted as attorney for Jasper Knabb, the Pegasus Wireless chief, whose promises to establish an operation in Freeport just prior to the 2007 general election ultimately proved empty after he pled guilty to US securities fraud and accounting violations. There is no suggestion that Ms Bridgewater did anything wrong in relation to Pegasus or Mr Knabb.

Besides Justice McKay, the other disciplinary tribunal members were Stephanie Unwala, Alexander Maillis and James Bain. The Bar’s marshalls were Sean Moree, of McKinney, Bancroft & Hughes, and Peteche Bethell.

NOTICE

IN THE ESTATE OF PEGGY JOYCE PINDER, late of Russell Island near the Settlement of Spanish Wells, St. George’s Cay in the Commonwealth of The Bahamas, Deceased

IT IS HEREBY NOTIFIED, for the information of those it may concern, that all persons having any claim or demand against the said Estate are required to send the same to the undersigned on or before the 20th day of March, A.D. 2023 and if so required by notice in writing from the undersigned to come in and prove such demand or claim or in default thereof be excluded from the bene t of any distribution made before such debts are proved;

AND NOTICE is hereby given that all persons indebted to the said Estate are requested to settle their respective debts at the Chambers of the undersigned on or before the date hereinbefore mentioned.

Dated the 20th day of February, A.D. 2023

CALLENDERS & CO. Chambers, One Millars Court, P.O. Box N-7117, Nassau, The Bahamas

Attorneys for the Personal Representatives

PAGE 6, Monday, February 20, 2023 THE TRIBUNE

‘EGREGIOUS CONDUCT’: EX-PLP MP FACES LAW

AXE FROM PAGE B1

PROFESSION

Decades-old systems hit fiscal reporting deadlines

been upgraded. Our payroll system is 22 years-old, has never been upgraded, and they are not integrated.

“So when you see those numbers, those reports, in the timeframe required, it requires persons and hours from a team of people in the Treasury and Ministry of Finance to produce them. When we have this reporting schedule, which I fully support, the challenge is you have a reporting schedule that we have committed to but the information infrastructure is not available. That’s difficult.”

Asked whether the Act should be amended to revise the fiscal reporting deadlines, and make them more realistic and aligned with the Ministry of Finance/Treasury capabilities, Mr Wilson replied: “I’d prefer more than that.

I’d prefer more modern information systems. The information system we have now is not designed for this reporting schedule.

“Typically, you have a reporting system before you have a reporting schedule. We’ve done it the other way.

We’ve imposed a reporting burden on a system where, the kind of information you need in the time you need it, you can’t produce it. It requires a lot of interaction. If we could upgrade the system, then the reporting schedule would not be a problem. It’s very, very critical. The information system,

these reporting deadlines, are very, very difficult.” The Act requires the monthly fiscal reports to be submitted to the Cabinet “no later than four weeks” after the relevant period ends, with the document released publicly one week after that. Thus the November 2022 report should have been released in early January 2023, rather than on Friday, February 17, making it over one month late. The December 2022 report was also late, albeit by a week to ten days, as it should have been unveiled by the first week in February.

The Government is also late with the so-called “fiscal snapshot” for the 2022-2023 second quarter, which covers the period October-December 2022. This, too, should have been published at end-January/ early February but has yet to emerge. These missed deadlines come ahead of the Davis administration’s unveiling of the mid-year Budget, which is likely to be released in the House of Assembly this week.

However, Kwasi Thompson, the Opposition’s finance spokesman, yesterday again berated the Davis administration for missing its statutory fiscal reporting deadlines. “We are grateful that the Government has finally gotten around to releasing its tardy monthly fiscal summary reports for November 2022 and December 2022,” he blasted.

“It still has not released the required second quarter fiscal report covering the period of July to December 2002, which is also late. The minister of finance seems to continuously be in violation of the statutory deadlines mandated in sections 69 and 70 of the Public Finance Management Act.”

Mr Thompson also picked up on another Opposition theme - this time the discrepancies in the Government’s explanation of how it is accessing the $232.3m in International Monetary Fund (IMF) special drawing rights (SDRs) that were held by the Central Bank as part of the external reserves.

The Government and Ministry of Finance had previously denied that this transaction involved borrowing the SDRs or “printing money”, as the Opposition had alleged.

However, the December fiscal report confirmed the full $232.3m had been drawn down by the Davis administration while classifying this as “bank loans” or part of some $250m in “foreign currency loans”.

Arguing that the Government was admitting to borrowing, and the obligation to repay, in its report, Mr Thompson said: “The Central Bank detailed in its December report the Government’s ‘drawdown’ of the $232.3m IMF SDRs. Why didn’t the Ministry of Finance’s report note this as an advance specifically from

the Central Bank, which it patently is?

“Why try to obscure its origin by labelling it simply a foreign currency loan? How is it now a loan when, in January, the press statement from the Ministry of Finance claimed it was not “borrowing money” from the Central Bank? What are the loan terms - the interest rate, the duration? Was money sourced from the IMF itself to monetise these drawing rights?

“Where is the MOU (memorandum of understanding) that was signed between the Ministry of Finance and the Central Bank? Why is an MOU between two public entities a secret?” Mr Thompson continued.

“Now that the Ministry in its own report has acknowledged the obvious truth - that it is taking the unprecedented step and borrowing money from the Central Bank external reverses - the minister of finance must now explain why he pursued what is clearly an illegal advance of funds from the

Central Bank contrary to Section 21 of the Central Bank Act. “This is breaking the law, plain and simple. Claiming that you are going to bring legislation to fix the breaking of the law after the fact is not an acceptable position.” Mr Wilson confirmed to Tribune Business that the $232.3m was the IMF SDRs, and that this was used to repay $180m in

foreign currency borrowings, leaving $52.3m unused. He also indicated that the SDRs were encashed and monetised. One source, speaking on condition of anonymity, argued that the SDR transaction was akin to “printing money” because of the $52.3m balance as yet unused.

THE TRIBUNE Monday, February 20, 2023, PAGE 7

FROM PAGE B1

HIKES STARTING TO STABILISE

there had been a time when Super Value and others in the sector “didn’t know where it was going to end”.

With many Bahamians still “crying” about the cost of living crisis, and squeeze imposed on household budgets by higher food prices and other necessities, Ms Symonette told this newspaper: “We are seeing some relief, and getting some relief, from the prices.

“Eggs have decreased. We advertise the specials every week, and eggs have come down greatly. We’ve specialled them for $4.99. They were shooting way up, mainly because of the bird flu, but farmers have recovered from that,” she said. “We’ve been able to sell them for $4.99 right now, and next week we hope to sell them even lower. We’re hoping they come down to what we want them to be.

“We’ve also seen a decrease in corn beef prices. We have corn beef for $2.69; that’s a certain brand. There are some brands even cheaper than that. Even the meat, we’re seeing the prices.... poultry is stabilising, and pork and beef are actually going down a little as well as produce.

“The only thing that we are seeing an increase in rice. That is probably because of the ongoing war [in Ukraine] and issues with the export of the wheat.” But, while there is every indication that food inflation is starting to ease, and the persistent rise in many prices taper-off, it is highly unlikely costs will suddenly plunge to where they were in early 2020 pre-COVID.

“We’re very hopeful that everything is going to stabilise or even decrease,” Ms Symonette said. “It’s going to be gradual, month by month. You’ll see it drop, or won’t see any increase. It’s going to be very beneficial to consumers. When we do get a good price we will be able to pass them on to the customer. We know they

need some relief, so we are anxious to pass that on.

“It’s not as bad as it was. We don’t have the supply issues. They have eased a lot. We’ve gotten a lot of relief from that. We’re basically getting what we want on time. We source from as many vendors as possible to ensure we get the best possible price and can also offer variety. If one price does not suit your pocket, we have other brands. If prices are too high on one, get another that is more affordable.”

Ms Symonette admitted that the Bahamian food distribution industry, both retailers and wholesalers, has been in uncharted territory since COVID-19 struck and unable to do much to influence food price inflation given that this nation imports most of what it consumes and is therefore largely a price taker exposed to external shocks.

“In my time I’ve never seen it this bad,” she told Tribune Business of food costs. “We were always having increases; increases from this supplier, the other supplier. It was scary because we didn’t know where it was going to end. We’re finally hearing something positive. It’s been a while, but there’s some hope finally.

“We’re hoping that food prices remain stable, and some the products actually have decreases in prices. We’re seeing a stabilisation. We’re going to have to see what the suppliers are saying. We haven’t got any notice to expect any increase, so that’s a good sign, apart from rice. We’ve been told that’s going up, but they haven’t said exactly by how much. We’re waiting for them to give us a price.”

Super Value, and its rivals, sought to counter food inflation by stocking up in advance at lower prices where they could, as well as sourcing from new suppliers able to offer the most competitive terms and rates.

“We’re very confident, very confident,” Ms Symonette said. “We really fell good

about the future, and prices coming down and being able to offer our customers some relief.

“We have a lot of people who are just crying every time you listen. They’re saying the prices are so high. I’m sure they’re going to welcome this with open arms. Now they are able to buy a little more. Bahamian food security, and being able to produce more of what the country eats locally, have assumed increasing importance post-COVID, and Ms Symonette said Super Value will buy more from local farmers if they can produce the consistent quality and quantity required.

“The supply chain issues created by COVID showed us it’s very important we don’t have to depend on all these imports,” she added. “If we can start producing locally, and in the quantity required, that would be a good thing. Right now we support as many local farmers as we can but the quantity is just lacking. They can’t supply all our needs. We still have to go outside The Bahamas, but if they are able to do it, we will definitely support them.”

However, Philip Beneby, the Retail Grocers Association’s (RGA) president, warned that food price volatility has not gone away. “There are still items that are on the rise, and it fluctuates,” he explained. “Sometimes it moves from item to item. The other week it was lettuce and eggs. Eggs are still high, and lettuce is down a bit. It fluctuates.

“We haven’t seen any decrease in anything; not yet. The inflation around the world is still the same. My daughter has just come out of Panama, and the prices are a bit lower than here. Those prices which we were used to seeing are not there any more.” Mr Beneby forecast that, while food prices will likely stabilise, they will hold and remain constant at their current levels.

PAGE 8, Monday, February 20, 2023 THE TRIBUNE

‘SCARY’

PAGE B1

FOOD

FROM

Harbourside Marine is seeking: Facility Engineer

• Must have strong knowledge in electrical and Plumbing • Able to work unsupervised

Please email resume to: ian@hbsmarine.com

NOTICE

NOTICE is hereby given that

EDRICK PATT DOYEN of Wilmar Road off Soldier Road New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that

DENNIS ANTHONY BARNETT of #42 Queens Street, P. O. Box N-3940, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 20th day of February 2023 to the Minister responsible for nationality and Citizenship, P. O. Box N-7147, Nassau, New Providence, The Bahamas.

JOB OPPORTUNITY

Grocery Store Managers needed

Only persons with experience in the grocery business should apply must be energetic, organized and detail oriented.

Email resume to charles@acgbahamas.com

ANALYTICAL RESEARCH ADVISORS, LLC.

LIQUIDATOR’S NOTICE

Pursuant to Section 138(6) of the International Business Companies Act NOTICE is hereby given that ANALYTICAL RESEARCH ADVISORS, LLC., a company registered under the International Business Companies Act, has been dissolved and struck off the Register as of the 11th day of March 2022.

Sterling (Bahamas) Limited Liquidator

NOTICE

SPV 1 KINGSWAY LTD. (Voluntary Liquidation)

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act 2000, the above-named Company is in dissolution, which commenced on the 30th day of January, A.D., 2023. The Liquidator is Galnom Ltd., CUB Financial Center, Western Road, Nassau, Bahamas.

Galnom Ltd. Liquidator

ISLAND BAY PHASE III CONDOMINIUM ASSOCIATION

P.O. BOX F-42040, FREEPORT, GRAND BAHAMA CONTACT PHONE 242-646-7888 maureen.hamill01@gmail.com

Island Bay Phase III Condominium Association, the body corporate for and on behalf of Island Bay Phase III Condominiums, does hereby offer for sale by virtue of its charge held over the hereinafter described Apartment Unit, made between the said body corporate of the one part and the owner of the other part, and now lodged for record in the Registry of Records in the Commonwealth of the Bahamas:

ALL THAT ONE BEDROOM CONDO BEING APARTMENT UNIT 113A ISLAND BAY PHASE III CONDOMINIUM SITUATED IN THE CITY OF FREEPORT IN THE ISLAND OF GRAND BAHAMA.

Such condo is sold “AS IS” and may be viewed by appointment made with the manager of the said Island Bay Phase III Association, contact details listed above.

All offers should be sealed bids in writing and should be tendered on or before March 15, 2023 to Cafferata & Co., at P.O. Box F-42614, or drop off at Cafferata & Co. offices Poinciana and West Mall Drive, Freeport, Grand Bahama, Bahamas.

THE TRIBUNE Monday, February 20, 2023, PAGE 9

JOB OPPORTUNITY

FRIDAY, 17 FEBRUARY 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2669.750.080.0024.690.93 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/EYIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0040.06 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.762.04Benchmark BBL 2.76 2.760.00 5,0000.0000.020N/M0.72% 2.652.31Bahamas First Holdings Limited BFH 2.65 2.650.00 0.1400.08018.93.02% 3.102.25Bank of Bahamas BOB 3.02 3.020.00 0.0700.000N/M0.00% 6.306.00Bahamas Property Fund BPF 6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas Waste BWL 9.65 9.650.00 0.3690.26026.22.69% 4.503.25Cable Bahamas CAB 4.09 4.090.00 -0.4380.000-9.3 0.00% 10.657.50Commonwealth Brewery CBB 10.23 10.230.00 0.1400.00073.10.00% 3.652.54Commonwealth Bank CBL 3.58 3.580.0061,3500.1840.12019.53.35% 9.307.01Colina Holdings CHL 8.50 8.500.00 0.4490.22018.92.59% 17.5012.00CIBC FirstCaribbean Bank CIB 15.99 15.990.00 0.7220.72022.14.50% 3.252.05Consolidated Water BDRs CWCB 3.05 3.04 (0.01) 0.1020.43429.814.28% 11.2810.05Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.83 9.940.11 0.6460.32815.43.30% 11.5010.75Famguard FAM 11.20 11.200.00 0.7280.24015.42.14% 18.3014.50Fidelity Bank (Bahamas) LimitedFBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.55Focol FCL 3.98 3.980.00 0.2030.12019.63.02% 12.1010.00Finco FIN 12.10 12.100.00 0.9390.20012.91.65% 16.2515.50J. S. Johnson JSJ 15.76 15.760.00 0.6310.61025.03.87% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.001.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.001.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.001.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.4599.95BGRS FL BGRS91032 BSBGRS910324 99.9599.950.00 100.12100.12BGRS FL BGRS88037 BSBGRS880378100.03100.030.00 94.1594.09BGRS FX BGR132139 BSBGR1321391 93.3693.360.00 101.55101.42BGRS FX BGR124228 BSBGR1242282 101.45101.450.00 103.49103.38BGRS FX BGR118027 BSBGR1180276 102.70102.700.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.592.11 2.593.87%3.87% 4.903.30 4.904.87%4.87% 2.271.68 2.273.03%3.03% 203.47164.74 195.65-3.84%-3.84% 212.41116.70 180.14-15.19%-15.19% 1.771.71 1.773.07%3.07% 1.981.81 1.988.44%8.44% 1.881.80 1.884.42%4.42% 1.030.93 0.95-7.23%-7.23% 9.376.41 10.188.63%8.63% 11.837.62 13.6115.01%15.01% 7.545.66 7.732.87%2.87% 16.648.65 13.13-20.87%-20.87% 12.8410.54 12.06-4.33%-4.33% 10.779.57 10.62-0.31%-0.31% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75%

31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Dec-2022 31-Dec-2022 6.95% 4.50% 31-Dec-2022 31-Dec-2022 4.50% 6.25% 31-Dec-2021 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 31-Dec-2022 22-Sep-2033 15-Aug-2032 26-Jul-2037 26-Jul-2035 15-Oct-2039 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 30-Sep-2025 31-Dec-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 4.37% 4.81% 5.29% 5.14% 5.60% 26-Jul-2037 4.42% 15-Jul-2039 15-Jun-2040 4.66% 4.82% 13-Jul-2028 13-Oct-2027 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 5.35% 5.00% (242)323-2330 (242) 323-2320 www.bisxbahamas.com

MARKET REPORT

‘Every 100 migrants cost taxpayers $500k’

figures, that would have resulted in Bahamian taxpayers incurring some $16.5m in extra costs related to these repatriations. If the total number of repatriated migrants, some 4,748, is used - including 1,001 Cubans - then the extra costs jump to over $23.5m.

By contrast, the Immigration Department’s full-year 20222023 repatriation budget for illegal immigrants stands at $1.827m. Of the $1.204m it received for such purposes in the prior 2021-2022 fiscal year, this sum had been virtually exhausted during the first nine months to end-March 2022 with some $1.189m spent.

Mr Wilson’s comments give an insight into the growing financial burden being imposed on The Bahamas as increasing numbers of Haitians, as well as Cubans, seek to flea a combination of violence, poverty, repression and social instability in their respective home nations.

The Prime Minister last night said some 1,023 migrants have already been repatriated to their home countries during the first six to seven weeks of 2023.

The governance and law and order crisis in Haiti was among the most prominent topics discussed by Caribbean leaders at last week’s CARICOM Heads of Government meeting in Nassau.

Meanwhile, Ministry of Finance data revealed that the 2022-2023 half-year fiscal deficit, measuring by how much the Government’s spending exceeds its revenue income, came in at $275.6m or 48.9 percent of the fullyear’s projected $564m in ‘red ink’.

The deficit was incurred despite a $121.5m, or 10.7 percent, year-over-year increase in revenue to $1.259bn for the six months to end-December 2022. Total government spending rose by a slightly higher $128.1m to $1.534bn, albeit the rate of growth was slightly less than for revenue at 9.1 percent. Recurrent spending, which features the Government’s fixed costs such as salaries and rents, was up by 8.5 percent or $110.6m year-on-year at $1.417bn.

Kwasi Thompson, the Opposition’s finance spokesman, yesterday seized on the Government’s spending growth exceeding that of its income to argue that the Davis administration was “squandering the benefits of increasing revenues” through extra expenditure while “Bahamians continue to suffer”.

He added: “By their reports, through the midpoint of the fiscal year, while total revenue has increased some $121m when compared to the previous year, total spending has gone up by $128m. So even while things are improving the

Government through the mid-year has made the deficit position worse when compared to the same point last year, tacking on some $275.6m to the national debt.

“The deficit has also increased year-over-year from $269m in 2021 to $275.6m in 2022. Given that the deficit has gotten worse even in an improving economy, with no pandemic-related spending, the Opposition is concerned that the Government will not meet its planned budget deficit target.

“By fiscal year end we are concerned that we will end up with a larger-than-projected debt [sic; deficit] and a deteriorating fiscal situation that will require even more borrowing and more taxes on the Bahamian people.” Mr Wilson, though, voiced optimism that the Davis administration will achieve its year-end $564m deficit forecast.

“We’re going to be very close,” he told Tribune Business. “We incurred some extra expenses, but we’re going to be close. The revenue is going to pick up, and typically in the second half of the fiscal year the deficit is a lot lower, so barring anything unforeseen we will be close to target or beat target.

“What we expect is that the second half deficit will be lower than the first-half. The bulk of revenues come in during the first half of the calendar year. When we see

that number, all things being equal, the deficit target is not unreasonable. It puts us in a very advantageous position in the second half of the year.”

The second half of the fiscal year is when the Government typically generates the bulk of its tax revenues as the period coincides with the peak winter tourism season and heightened economic activity, as well as Business Licence fee payments, the bulk of real property tax payments and commercial vehicle licensing month.

While the year-over-year increase in the first-half fiscal deficit is relatively modest, and the $275.6m in ‘red ink’ is still below 50 percent of the full-year projection, one source said the figures should nevertheless be of concern to the Davis administration when it comes to meeting its fiscal projections.

Speaking on condition of anonymity, they explained this was because of the traditional spike in government spending towards the fiscal year-end in June as ministries, departments and agencies raced to have bills paid - some of which the Ministry of Finance is unaware of. This occurred in the prior 2021-2022 fiscal year, when June’s $318.7m deficit alone was 46.2 percent of the full-year total as the Davis administration sought to pay unplanned arrears purportedly left by its predecessor.

“Expenditure bumps up in the second half of the year as folks try to catch up on arrears. May and June are when a lot of invoices come in to meet year-end,” the source said. “If I was them I would be a little bit concerned about the pace of expenditure. It’s those last couple of months when expenditure spikes. You don’t want to be at half your deficit target at the midpoint. You want to be there in February.

Mr Wilson, though, described the first-half revenue performance as “encouraging” and “very strong”. He added: “We were tracking about 5 percent ahead of Budget at the halfyear on the revenue side. We did very well in January, although we think we could do better. We were running about 6 percent above projections for total revenue at the end of January. February is also turning out to be an encouraging month.”

January contains the VAT tax filings from December’s Christmas period, and Mr Wilson added: “We are 10 percent over prior year but think we have more room to grow. I don’t want to give you a projection, but we think we have more room. We’re doing a VAT gap study or tax gap study soon, and that will provide us with scientific information as to what our true potential is.”

Mr Wilson said the Government was hoping to hire a firm to conduct the necessary studies by the end of the 2022-2023 fiscal year’s third quarter, which closes

THE WEATHER REPORT

at end-March. However, Mr Thompson pointed to what he argued was the worsening of the Government’s fiscal position based on the monthly deficits for November 2022 and December 2022 compared to their prior year comparisons.

While the Government incurred a collective $89.5m in ‘red ink’ during those two months in 2021, that number surged to $178.8m - an $89.3m or almost 100 percent increase - in 2022. “While we are pleased to see the rise in revenue year-over-year in both November and December, it is most concerning that we also saw a rise in deficits totaling over $90m over the same period last year,” Mr Thompson said.

“Clearly, the Government has taken more from the people but we are in a worse fiscal position..... We again call on the Government to curtail its lavish and extravagant spending and instead put priority on the programmes which provide benefits directly to Bahamian families and communities.”

Another source, meanwhile, pointed to the slowdown in VAT collections when measured against the full-year Budget total at the half-way mark. “Last year they had collected 68 percent of Budget VAT,” they said. “This year, at the mid-point, they’d only collected 43.4 percent. There’s an underperformance of VAT relative to last year and Budget. VAT is the biggest revenue component, and if they don’t meet that target it puts the deficit target in jeopardy.”

Shown is today’s weather. Temperatures are today’s highs and tonight’s lows.

THE TRIBUNE Monday, February 20, 2023, PAGE 11

FROM PAGE B1 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 60° F/16° C High: 85° F/29° C TAMPA Low: 65° F/18° C High: 77° F/25° C WEST PALM BEACH Low: 65° F/18° C High: 86° F/30° C FT. LAUDERDALE Low: 68° F/20° C High: 84° F/29° C KEY WEST Low: 74° F/23° C High: 83° F/28° C Low: 69° F/20° C High: 82° F/28° C ABACO Low: 73° F/23° C High: 78° F/26° C ELEUTHERA Low: 71° F/22° C High: 79° F/26° C RAGGED ISLAND Low: 75° F/24° C High: 79° F/26° C GREAT EXUMA Low: 74° F/23° C High: 79° F/26° C CAT ISLAND Low: 71° F/22° C High: 82° F/28° C SAN SALVADOR Low: 71° F/22° C High: 81° F/27° C CROOKED ISLAND / ACKLINS Low: 75° F/24° C High: 79° F/26° C LONG ISLAND Low: 74° F/23° C High: 80° F/27° C MAYAGUANA Low: 74° F/23° C High: 80° F/27° C GREAT INAGUA Low: 74° F/23° C High: 82° F/28° C ANDROS Low: 69° F/21° C High: 81° F/27° C Low: 70° F/21° C High: 82° F/28° C FREEPORT NASSAU Low: 69° F/21° C High: 85° F/29° C MIAMI

5-Day Forecast Brilliant sunshine and nice High: 82° AccuWeather RealFeel 87° F The exclusive AccuWeather RealFeel Temperature® is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Mainly clear Low: 69° AccuWeather RealFeel 68° F Mostly sunny High: 84° AccuWeather RealFeel Low: 69° 88°-70° F Breezy in the morning; sunshine High: 85° AccuWeather RealFeel Low: 71° 89°-71° F Partial sunshine High: 85° AccuWeather RealFeel Low: 72° 89°-72° F Partly sunny with a passing shower High: 85° AccuWeather RealFeel 89°-69° F Low: 71° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY almanac High 82° F/28° C Low 70° F/21° C Normal high 77° F/25° C Normal low 64° F/18° C Last year’s high 84° F/29° C Last year’s low 63° F/17° C As of 1 p.m. yesterday 0.00” Year to date 1.22” Normal year to date 2.41” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau New Feb. 20 First Feb. 27 Full Mar. 7 Last Mar. 14 Sunrise 6:41 a.m. Sunset 6:07 p.m. Moonrise 7:10 a.m. Moonset 6:47 p.m. Today Tuesday Wednesday Thursday High Ht.(ft.) Low Ht.(ft.) 7:37 a.m. 3.4 1:18 a.m. -0.9 8:00 p.m. 2.9 2:01 p.m. -0.8 8:26 a.m. 3.3 2:12 a.m. -0.9 8:51 p.m. 3.0 2:48 p.m. -0.9 9:14 a.m. 3.2 3:05 a.m. -0.8 9:42 p.m. 3.1 3:33 p.m. -0.8 10:01 a.m. 2.9 3:58 a.m. -0.6 10:32 p.m. 3.0 4:19 p.m. -0.7 Friday Saturday Sunday 10:49 a.m. 2.7 4:51 a.m. -0.4 11:23 p.m. 2.8 5:05 p.m. -0.5 11:39 a.m. 2.3 5:45 a.m. -0.1 5:53 p.m. -0.3 12:17 a.m. 2.7 6:43 a.m. 0.2 12:32 p.m. 2.1 6:44 p.m. 0.0 marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: SW at 7-14 Knots 3-5 Feet 10 Miles 77° F Tuesday: SW at 8-16 Knots 2-4 Feet 10 Miles 77° F ANDROS Today: SE at 4-8 Knots 0-1 Feet 10 Miles 81° F Tuesday: SE at 4-8 Knots 0-1 Feet 10 Miles 81° F CAT ISLAND Today: E at 6-12 Knots 3-6 Feet 10 Miles 77° F Tuesday: SE at 6-12 Knots 2-4 Feet 10 Miles 77° F CROOKED ISLAND Today: E at 10-20 Knots 3-5 Feet 10 Miles 79° F Tuesday: ESE at 8-16 Knots 2-4 Feet 10 Miles 79° F ELEUTHERA Today: SE at 6-12 Knots 3-6 Feet 10 Miles 77° F Tuesday: SSE at 4-8 Knots 2-4 Feet 10 Miles 78° F FREEPORT Today: SW at 7-14 Knots 1-3 Feet 10 Miles 79° F Tuesday: WSW at 6-12 Knots 1-3 Feet 10 Miles 79° F GREAT EXUMA Today: E at 7-14 Knots 0-1 Feet 10 Miles 77° F Tuesday: SE at 4-8 Knots 0-1 Feet 10 Miles 77° F GREAT INAGUA Today: E at 10-20 Knots 2-4 Feet 10 Miles 79° F Tuesday: E at 8-16 Knots 2-4 Feet 10 Miles 79° F LONG ISLAND Today: E at 8-16 Knots 2-4 Feet 10 Miles 79° F Tuesday: ESE at 7-14 Knots 1-3 Feet 10 Miles 79° F MAYAGUANA Today: E at 8-16 Knots 4-8 Feet 10 Miles 78° F Tuesday: ESE at 7-14 Knots 3-6 Feet 10 Miles 78° F NASSAU Today: SE at 6-12 Knots 1-2 Feet 10 Miles 77° F Tuesday: SSE at 4-8 Knots 0-1 Feet 10 Miles 78° F RAGGED ISLAND Today: E at 10-20 Knots 3-5 Feet 10 Miles 78° F Tuesday: ESE at 8-16 Knots 1-3 Feet 10 Miles 78° F SAN SALVADOR Today: SE at 6-12 Knots 1-2 Feet 10 Miles 77° F Tuesday: SE at 6-12 Knots 1-2 Feet 10 Miles 78° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2023 H tracking map

N S E W 3-6 knots N S E W 7-14 knots N S E W 7-14 knots N S E W 6-12 knots N S W E 7-14 knots N S W E 10-20 knots N S W E 10-20 knots N S E W 4-8 knots

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net