Digital payments ‘not as robust’ despite 30% rise

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMIAN use of digital payments is “not as robust as we’d like to see” yet, one provider asserted yesterday, even though the volume of transactions it processed increased by 30 percent in 2022.

Jeffrey Beckles, Island Pay’s managing director, told Tribune Business that an estimated 26 percent of consumers and merchants are regularly using the technology for financial transactions compared to industry expectations that 40 percent would have fully “embraced” it by now.

Although adoption rates are “getting better”, he argued that both the Government and industry need to close the public education “gap” on digital payments, and Bahamians bring the ease with which they conduct electronic transactions while travelling abroad back home.

Describing digital payments as “a revolution that is here to stay”, and “something to be embraced and not feared”, Mr Beckles told this newspaper that adoption would receive a significant boost if the Government

starts to pay for good and services using the Sand Dollar.

This, he argued, would foster business and consumer confidence in the Central Bank-backed digital currency, with the Island Pay chief also voicing optimism that increased use of electronic transactions will position Bahamians and the country’s economy to “thrive” in an increasingly globalised environment.

“It’s evolving at a steady pace, albeit not at the rate we would want, but it’s steady. It’s getting better,” Mr Beckles replied, when asked about the pace of digital payments adoption in The Bahamas. “It’s doing better than it was, but is not as robust as we’d like to see it. But we’re making steady progress.....

“Given how sophisticated the Bahamian consumer is, and how savvy merchants are, we would have thought that by now from a national perspective we would have seen at least 40 percent of consumers and merchants embracing it.”

The Island Pay chief said the provider currently has 30,000 clients with electronic wallets, and 58,000 total

SEE

• Bahamas below industry’s 40% adoption expectation

•

•

Bahamas ‘big part of the FTX puzzle’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

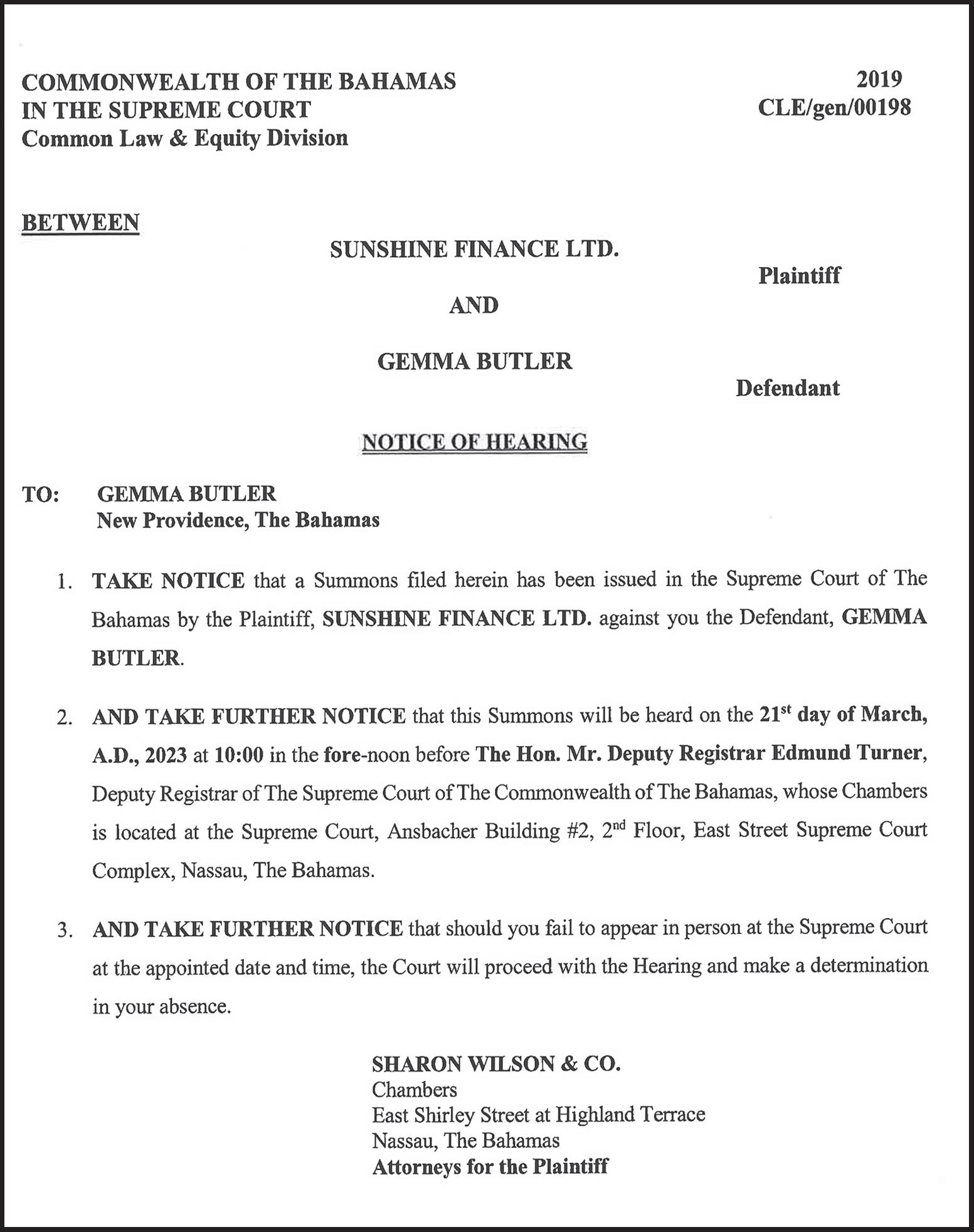

FTX’s Bahamian operation was yesterday branded “a big piece of the puzzle that needs to get resolved” as its provisional liquidators successfully obtained US legal recognition for their ongoing investigations.

Attorneys representing Brian Simms KC, the Lennox Paton senior partner, and PricewaterhouseCoopers (PwC) accounting duo, Kevin Cambridge and Peter Greaves, sought to dispel previous suggestions that FTX Digital Markets was a relatively insignificant and “under sized” part of the collapsed crypto exchange’s empire when they appeared before the Delaware Bankruptcy Court.

Construction work permits ‘shifting in wrong direction’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE “balance” between Bahamian and foreign labour in the construction industry has “started to shift in the wrong direction”, a prominent contractor is arguing, while calling for a halt to all general labour work permits.

Leonard Sands, the Bahamian Contractors Association’s (BCA) president, told Tribune Business in a recent interview it had become too easy for the sector to obtain work permits even for low-level, unskilled jobs and this was placing Bahamian workers at a disadvantage.

In particular, he argued that it was “unfair” for Bahamians to compete against expatriate workers for “general labour” positions on construction sites that require no specialist

SEE PAGE B7

Hotel union eyes industrial agreement ‘red letter day’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE HOTEL union’s president yesterday said it will be a “red letter day” for its several thousand members when their now ten-year wait for a new industrial agreement with the main employer body is ended.

Darrin Woods, the Bahamas Hotel, Catering and Allied Workers Union’s (BHCAWU) chief, told Tribune Business that he hopes to close a deal with the Bahamas Hotel and Restaurant Employers Association, which represents Atlantis in particular,

by mid-second quarter this year. The union and its members have been without an industrial agreement since the last one expired in January 2013, and Mr Woods said that apart from increased

Bankruptcy judge, John Dorsey, signed the order granting the Bahamian trio Chapter 15 status, which will enable them to conduct investigations and pursue assets belonging to the local subsidiary with the full backing of the US legal system. He did so after their US legal representative, Chris Shore of

the White & Case law firm, provided an update on the Bahamian provisional liquidators’ work to-date.

In doing so, Mr Shore also revealed that the Bahamian Supreme Court has ratified the co-operation agreement thrashed out between the provisional liquidators and John Ray, the Chapter 11-appointed head of 134 FTX-related entities that are currently under the Delaware court’s supervision.

Besides giving the Bahamian trio the go-ahead to consummate the co-operation deal, it also emerged that the Supreme Court on Tuesday recognised one of Mr Ray’s team as the representative of those Chapter

business@tribunemedia.net

FEBRUARY 16, 2023

THURSDAY,

SEE PAGE B4

SEE PAGE B7

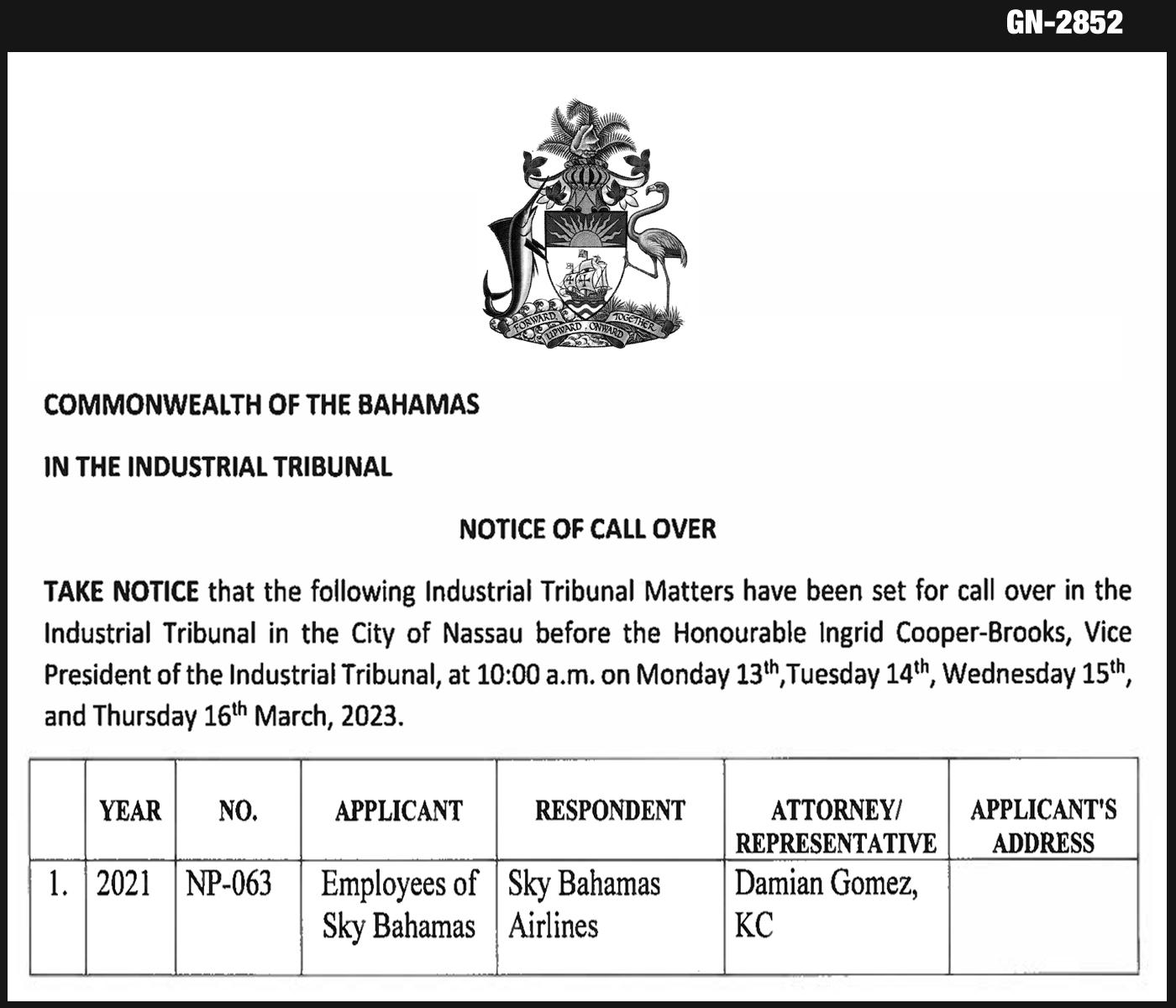

SANDS

PAGE B5 LEONARD

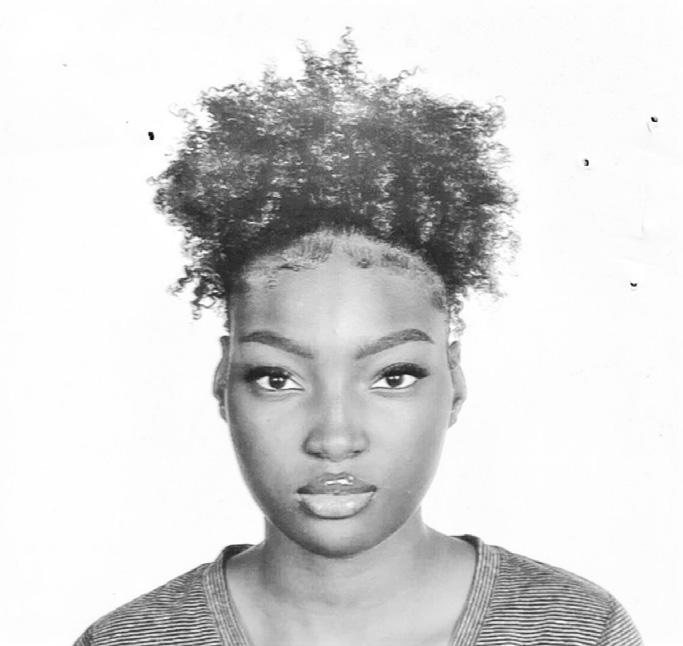

JEFFREY BECKLES

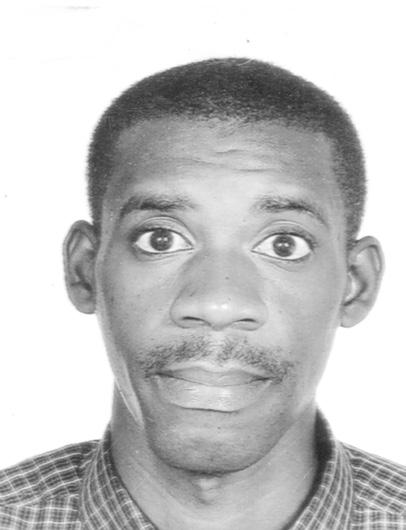

DARRIN WOODS

BRIAN SIMMS KC

Provider: ‘Why not do at home what you do travelling’

$5.76

Govt’s frequent Sand Dollar use to be ‘game changer’

$5.76 $5.46 $5.92

BUSINESSES REPORT STRONG SALES FOR VALENTINE’S DAY

By Fay Simmons jsimmons@tribunemedia.net

BUSINESSES that specialise in Valentine’s Day sales yesterday said demand for flowers and gift arrangements appeared strong despite continued concern over inflation pressures and the high cost of living.

M Ferguson, floral department manager, Lily of the Valley Florists, said lastminute sales had picked up. She said: “It’s going well. It has been slow during the year, but you know this

time of year, people wait for the last minute to come in and place orders.”

Proprietor of The Flirty Flower, Jeffarah Gibson, said there was high demand for roses and non-traditional gifts while pre-order sales had been strong. She said: “People really wanted red roses. We were actually sold out from the last week in January. It seems as though people wanted something that was non-traditional, but still very edgy, very unique, and that was what we offered.

“I would say for small business, a solo venture, it was really good. I still have people even up to right now asking me if I’m able to create arrangements for them or do something for them. That clearly showed me there is a real demand for that particular style of floral gifting.”

The popularity of nontraditional gifts was also noted by Riel Major, owner of Berry Sweet, who said edible arrangements are popular because people enjoy a sweet treat. She

said: “I think people just like to have something nice to eat. It’s a really nice and delicious treat, and I use good quality ingredients.”

Ms Major said Valentine’ Day and Mother’s Day are consistently her strongest sales days of the year, and this year repeated that trend. She said: “Valentine’s Day and Mother’s Day bring in the most business. Valentine’s Day sales were good, pretty average for what I usually bring in every year.”

BAHAMAS

SPONSORS

TOP CAPTIVE INSURANCE FORUM

THE BAHAMAS Financial Services Board (BFSB) was again among the main sponsors of a major global captive insurance conference.

The industry body, in a statement, said it took ‘gold’ sponsor status at the 32nd annual World Captive Forum, which was held at Trump National Doral in Miami, Florida, from February 1-3. The three-day event, hosted by Business Insurance, offers educational sessions, roundtable discussions, an exhibit hall and networking opportunities for the captive insurance industry.

The BFSB described captive insurance as a costeffective alternative for business owners when it comes to managing their own risks and providing insurance coverage.

As the captive industry continues to evolve, events such as the World Captive Forum provide a platform where emerging topics can be discussed by chief

executives, managers and regulators in the captive insurance industry. These topics included hybrid captives; asset management outlook; protected cell captives; cyber captives; reinsurance and fronting; strategic and innovative captive uses; using captives to support environmental, social and governance (ESG) improvements; and medical stop loss captives. The Bahamas was represented at World Captive Forum by Michele Fields, the Insurance Commission’s superintendent; Carl Culmer, the Insurance Commission’s manager of policies and practices; Gerard Lightfoot, of the Insurance Commission’s supervision unit; Dr Tanya McCartney, BFSB chief executive and executive director; Rianna Sobiech, BFSB’s marketing and special projects associate; and Guilden Gilbert, chief executibe of Chandler Gilbert Captive Managers.

CIBC IN FIRST FOR CARIBBEAN BANK

CIBC FirstCaribbean says it is the first regional bank to be named to the Financial and International Business Association’s (FIBA) Board of Directors in the group’s four-decade history.

The bank, in a statement, added that its chief compliance officer, Candice Huggins, will represent the bank on the Board for a period of one year. Ms Huggins said: “The fact that CIBC FirstCaribbean was asked to serve on the Board of Directors of FIBA is testament to the recognition of the strength of our anti-money laundering and counter terror financing.... programmes, and our commitment to ensuring regulatory compliance regionally and internationally”.

FIBA represents international banking in the US,

Latin America and the Caribbean. Its goal is to provide high-level educational and advocacy support to its membership, which includes community banks and the largest financial institutions active in international banking. Membership includes the largest financial institutions from the US, Europe, Latin America and the Caribbean.

PAGE 2, Thursday, February 16, 2023 THE TRIBUNE

CANDICE HUGGINS

Govt told: ‘Reverse course’ on Business Licence move

By NEIL HARTNELL Tribune Business Editor

THE Opposition’s finance spokesman yesterday renewed demands for the Government “to reverse course” and improve the ease of doing business surrounding the Business Licence renewal process.

Kwasi Thompson, the east Grand Bahama MP, in a statement called on the Davis administration to “reduce the bureaucracy and roadblocks that stop Bahamians from conducting lawful commerce” and ease the compliance checks it is conducting to verify the accuracy of turnover figures reported by companies for Business Licence renewals.

He urged: “Grant all Business Licenses without delay unless the Department of Inland Revenue has firm evidence of non-compliance. Flag those businesses that the Department of Inland Revenue thinks may be

under-reporting their business revenue or evading taxes. And use the tax audit team and revenue collection teams to go after those specific businesses.

“The Government must stop punishing the innocent for the guilty. End the practice of requiring business tenants to get real property tax information from landlords. That is not the responsibility of tenants, and this requirement is wholly unreasonable.

“Give the businesses until the next licensing period to become compliant with the new financial information requested by the Department of Inland Revenue. The Government should not push this on small businesses with no notice and time to prepare, and to find the monies to prepare the required financial information.”

However, Michael Halkitis, minister of economic affairs, last week said approving Business Licences and then seeking to enforce compliance

afterwards had resulted in the build-up of significant fee arrears due to the Government. And, if landlords will not provide business tenants with their real property tax numbers, a name and location will suffice for the Department of Inland Revenue’s purposes.

Mr Halkitis said the Department of Inland Revenue was not requiring small businesses with an annual turnover of less than $100,000 - and which have to pay zero Business Licence fees - to provide income statements as proof of turnover. This newspaper had been informed that the agency is asking, post-submission, for figures such as revenue and gross profit in its checking.

However, he added that the tax authorities simply “cannot look the other way” when 47 percent of Business Licence applicants are submitting no turnover or “exactly the same amount for the last three years”. The Department of Inland Revenue,

the minister said, must not ignore discrepancies and inconsistencies, or take turnover figure supplied by companies “at face value” if they “do not make sense”, given the need to collect all monies due to the Public Treasury.

While conceding that turnover verification checks do cause delay in Business Licence renewals, he added that the revenue agencies believe they “can strike the balance” between regulation, ease of doing business and collecting the proper amount of fees.

Mr Thompson, though, yesterday asserted that the 2020 report produced by the Prime Minister’s Delivery Unit under the Minnis administration showed Business Licence renewal times had been cut from 61 days to six days. “We demand that the Government reverses its course and adopt the policies put in place by the FNM that improved the ease of doing business, and that put funds in the hands of

entrepreneurs and small businesses,” he added.

“The Davis administration is now frustrating Bahamian businesses that cannot get their licenses timely. There is a better way for the Government to get to its goal of better tax compliance for Bahamian businesses. We call on the Government to do the following. Develop and publish a plan that specifically advances ease of doing business for Bahamian small businesses. The Government must reduce the bureaucracy and roadblocks that stop Bahamians from conducting lawful commerce instead of increasing the impediments that they are doing now.”

“They’re being required to provide some additional information so the Department of Inland Revenue is in a position to verify turnover,” Mr Halkitis said of businesses. “What we are undertaking is that all Business Licence renewals that apply will be dealt with by March 31 so that

Poultry farmer’s eight year land wait persists

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

AN ABACO poultry farmer was yesterday still waiting for the Government to give him ownership of his property despite the transaction being verbally approved by the Prime Minister.

Lance Pinder, Abaco Big Bird Poultry’s operations manager, told Tribune Business that the eight-year wait for his leased property to be conveyed to him continues. “We had first applied two years before the Perry Christie administration ended, so that has

been well over seven years now. We are on our second 21-year lease right now,” he disclosed.

“The Prime Minister (Philip Davis KC) had given me approval for it last March. That’s what he had told me..... that he had given approval for it to go ahead but, to be honest, I have been so busy that I haven’t been able to push it and follow up with it as I probably should. You have to pull so many teeth.”

Obtaining title ownership to the 100 Crown Land acres that Abaco Big Bird currently leases assumed additional importance after Hurricane Dorian devastated its operations in

We are seeking to employ the position of Landscape Manager here at February Point Resort Estates in beautiful Great Exuma. We are hoping to find candidates with a minimum of 2-3 years’ experience. We offer a competitive salary and excellent benefits; housing will also be considered. Interested persons should send their resume to: teneeshia@februarypoint.

TEMPLE CHRISTIAN SCHOOL STAFF VACANCIES 2023 – 2024

Temple Christian School invites applications from qualified Christian persons for the following positions for the 2023-2024 school year:

Positions for immediate filling:

• Maintenance Supervisor

• Elementary Librarian

• Teacher’s Aide

• Janitress

Faculty/staff positions for 2023-2024:

• Elementary Teacher

• Mathematics Teacher

• Biology Teacher

• Business Studies Teacher

• Language Arts Teacher

• Religious Studies Teacher

• Pre-school Vice-Principal

Applicants must:

Be a practicing born-again Christian who is willing to subscribe to the statement of faith of Temple Christian School.

Applications are available on the school’s website www.templechristianbahamas.com and at the Administrator’s Office, 4th Terrace East Collins Avenue (directly behind the New Evangelistic Temple). A detailed job description is also available at the Office of the Administrator.

Applications are to be submitted to: Dr. Samuel L. Rutherford Administrator

Temple Christian School

4th Terrace East, Collins Avenue P.O. Box N-1566 Nassau, Bahamas Ph: 325-1095 / 322-5157

The deadline for receipt of applications is Tuesday, February 28, 2023 at 3:00 p.m.

early September 2019. The farm was unable to use the land as collateral for repair financing since it was only a tenant, which severely hampered its reconstruction efforts.

Abaco Big Bird is still not operating at 100 percent capacity and is “stagnated”. This situation is being worsened by “supply chain issues” and a shortage of baby chicks. “We’re getting our inventory back to a healthy level now, and hopefully the chick

shortage will sort itself out. It seemed to have settled down for a bit, and if that continues then maybe we can get back to expanding the business again,” Mr Pinder added.

“When you own the property it opens up more way more opportunities for you for financing, and to feel better about investing serious money in it yourself. If you’re growing tomatoes, which is a threemonth crop, you don’t feel so bad about it. But when

no one will be in danger of not having their application completed...

“What Inland Revenue has to do is verify that what businesses are reporting, as best as they can, is accurate. The law empowers Inland Revenue to request additional information. So, for example, if they see a return that just does not make sense, it’s too low, but you might have a business who, you know that they did not make $20,000 last year, all right, and you have ways to check this by Customs imports etc, utility bills and all sorts of things.”

“In this particular case, that is under-reporting, and so it is incumbent upon them to do some checks because if we look at the big picture all of us are taxpayers, and all of us are required to pay our share, and so the Department of Inland Revenue cannot just look the other way when someone is providing the number and just take the number at face value.”

you build $100,000 chicken coops, or avocados that take five and six years just to mature to start getting a lot of revenue out, you feel a little a little more hurt when you don’t own it.”

Abaco Big Bird began operations in 1995 when Mr Pinder was in his late 20s. Now aged 47, he does not want to make it to his sixties without owning the property. “I’ve been at this since I was in my 20s and I’m 47 now, but what am I going to

do when I’m 67 years-old? I would have worked for my whole life up here and don’t even own the land? That’s not a good feeling,” he said.

“The Government started putting a lot of money into agriculture, so hopefully some of it will take. But the Government can’t do it all either, and people from the private sector have to step up and participate, buy the stuff and support the farmers.

THE TRIBUNE Thursday, February 16, 2023, PAGE 3

nhartnell@tribunemedia.net

BAHAMAS ‘BIG PART OF THE FTX PUZZLE’

11 entities so that he can act on their behalf in any legal proceedings in this nation. And Tribune Business understands that the Supreme Court has also agreed to extend FTX Digital Markets’ provisional liquidation for a further six months as requested.

Rounding off what was a good outcome for the Bahamian provisional liquidators, Judge Dorsey also backed their arguments and those of Mr Ray in rejecting the US Justice Department’s bid to appoint an independent examiner to probe FTX’s collapse. He agreed that it would result in a duplication of effort and unnecessary costs to the liquidation estates, which were likely to reduce investor/creditor recoveries by more than $100m.

Mr Shore, signalling to the Delaware court that the Bahamian provisional liquidators have been far from idle since their November 10, 2022, appointment, described FTX Digital Markets as “a subsidiary of the international platform, the international silo” for the crypto currency exchange.

Seeking to rebut earlier assertions by Mr Ray and his team that the Bahamian operation was “under-sized”

in terms of the role it played within the overall FTX group, he said: “From our perspective, it’s a big piece of the puzzle that needs to get resolved.” Mr Shore justified his description by pointing to the funds that flowed out of FTX Digital Markets’ custody accounts to FTX Trading and Alameda Research, worth $5.6bn and $2.1bn, respectively.

“To get a proper sense of the size here, you’re talking about $7.7bn of cash outflows from The Bahamas estate to US creditors,” he added. And, while he did not refer specifically to the $100m said to have been paid out to 1,500 “Bahamian” clients in breach of asset freezes imposed on FTX in the immediate aftermath of its collapse, Mr Shore said such transactions - potentially representing fraudulent preferences that should be repaid - were receiving significant attention.

“There’s a ton of work being done on the antecedent transactions; not to related parties, but third parties, to determine if persons associated with those transactions need to bring money back into the estate,” Mr Shore continued.

Essentially going over the Bahamian provisional liquidators’ first report to the Supreme Court, he added

that FTX Digital Markets’ 83-strong workforce included some 38 expatriates who had relocated to this nation from the crypto exchange’s other operations in Hong Kong and the US.

Pointing to the significance of $255m in Bahamian real estate purchases, which potentially represents one of the best investor/creditor recovery sources, Mr Shore said the 52 properties identified to-date included office suites, residential accommodation for staff and the six-acre site identified for FTX’s headquarters at Bayside Executive Park just off West Bay Street.

“All those properties, we think, are valued north of $250m. They were all financed by FTX Digital Markets and are on FTX Digital Markets’ balance sheet as an inter-company receivable,” he continued.

“It was agreed that the joint provisional liquidators will take the lead in liquidating the real estate in The Bahamas. We’re going to sell and market the assets, and have discussions about where those assets go at a later date.”

That means deciding whether the proceeds from liquidating FTX’s Bahamian property portfolio should go to FTX Digital Markets’ estate, and be used to

compensate its investors/ creditors, or to Mr Ray, the Chapter 11 companies and their separate set of investors/creditors. This is potentially one of many battles that could yet be fought between the Bahamian provisional liquidators and Mr Ray’s team despite their cooperation agreement.

FTX had moved to transfer customers of its international platform to FTX Digital Markets prior to its November 2022 implosion. “One of the questions that is going to come up in this case is what was the status of that movement between the time FTX Digital Markets was constituted, and FTX Digital Markets and FTX Trading filed these proceedings,” Mr Shore said. He added that the “customer migration issue” was one of several that would have to be resolved “over the next six months”. Other matters include determining whether, and which, assets were being held in trust for clients or belong to FTX itself.

“There are unresolved legal and factual issues over whether customer assets are held in trust or as deposits,” Mr Shore said, identifying the potential restructuring of FTX’s international exchange platform and closing of open trade

contracts as further outstanding problems.

Encouraging the Delaware Bankruptcy Court to view the Bahamian provisional liquidation proceedings as similar to a Chapter 11 case, he added that “beginning right from their appointment” the trio had sought to identify and gain control of almost $220m in cash identified as belonging to FTX Digital Markets and its clients. The majority of this sum, some $143m or close to two-thirds, was held at two US-based institutions, Silvergate and Moonstone.

Although the Bahamian provisional liquidators sought to secure that $143m, they did not yet have the full legal weight of Chapter 15 recognition and those assets were instead seized by the US Justice Department. “The joint provisional liquidators are in active discussions with the Department of Justice for the release of those funds, and we hope to have a consensual resolution on that,” Mr Shore said.

He added that the trio had performed “about all the things you’d expect a Chapter 11 trustee to do”, including establishing proper cash controls and management systems, as well as contacting FTX Digital Markets’ potential 2.4m clients and creditors encouraging them to submit contact details.

“The main goal, which was reached very early on in the

OFFICE CLOSURE

Dear Valued Customer,

Please be advised that all NUA Insurance Agents & Brokers branches will be closed on Thursday 16 February 2023 to facilitate a company event.

We resume regular business operations on Friday 17 February.

We regret any inconvenience this may cause

case, was the co-operation agreement [between the provisional liquidators and Mr Ray] which this court has approved and the Bahamian court has approved. It gives us a framework to figure out how the two proceedings will be done,” Mr Shore added.

John Bromley, the attorney representing Mr Ray and the FTX entities in Chapter 11 protection, confirmed that the Bahamian and Delaware proceedings have both been mutually recognised in each other’s jurisdictions. “We did have a hearing yesterday [Tuesday] in The Bahamas,” Mr Bromley told Judge Dorsey.

“The Supreme Court of The Bahamas agreed to enter an order consistent with the order your honour is entering. They allow the two proceedings to be recognised; the US proceedings in The Bahamas, and the Bahamian proceedings recognised here.... The co-operation agreement required both orders be entered. They are mutually dependent on each other.”

Mr Bromley described this as “coincident” recognition, but this newspaper understands his suggestion that the Supreme Court “recognised the Chapter 11 proceedings” in The Bahamas is inaccurate. Rather than recognise the proceedings, one of Mr Ray’s representatives was recognised by the Supreme Court.

Acknowledging that there are numerous “open issues” to resolve, Mr Bromley added: “The co-operation agreement is a starting point. The issue of whether assets belong in The Bahamas estate or US estate are open issues. The US debtors reserve their rights on that.”

Judge Dorsey also ruled against the bid by the Justice Department’s trustee for an independent examiner to be appointed to probe FTX’s collapse. He found this would be overkill, given the multiple other investigations already underway, and would add an extra cost “in the tens of millions of dollars and likely to exceed $100m”. This would ultimately have to be paid by the crypto exchange’s creditors and investors, thus reducing the amount they will recover.

Mr Simms and Mr Greaves were physically present in the Delaware court for the hearing. The liquidators’ attorney, Sophia Rolle of Lennox Paton, attended via Zoom, as did Dr Peter Maynard, Jason Maynard and Colin Jupp of Peter Maynard & Co, the Bahamian attorneys acting for Mr Ray and FTX Trading.

PAGE 4, Thursday, February 16, 2023 THE TRIBUNE

FROM PAGE B1

NUA INSURANCE AGENTS & BROKERS LTD Third Terrace & Collins Avenue, Nassau, NP, Bahamas www.nuainsurance.com | Tel: 242-302-9100

NOTICE

DIGITAL PAYMENTS ‘NOT AS ROBUST’ DESPITE 30% RISE

users “on the domestic side” in The Bahamas. “On the foreign visitor side, the Sand Dollar tourist wallet is picking up again since we launched it in November last year,” Mr Beckles said of an initiative designed to encourage visitors to pay local tourism and services providers via the digital currency.

“We’ve now seen 2,600 downloads of the tourist wallet. It means they’re getting access to Sand Dollars and spending it right here.

That’s a game changer. If we can grow that to where we can see millions of tourists using Sand Dollars in The Bahamas and Sand Dollar wallets, imagine the effect that will have on the Family Islands.”

Asked how current digital payment adoption rates measure up against the industry’s 40 percent expectation, Mr Beckles said: “In a country where it is 97 percent cash-centric, I would say about 30 percent....

Remember we have a small economy here in terms of people. That number should be well above 40 percent. And thirty percent is stretching it. Twenty-six percent would be accurate. We are going to keep pressing against that target.”

Mr Beckles said the digital payments embrace would be aided if Bahamians bring the behaviour they learn on foreign trips home with them.

“When you consider we have a working population of 220,000-230,000, it would be reasonable that most consumers begin to use digital tools in The Bahamas,” he added.

“Many of those same 220,000 who are working use digital payment mechanisms in the jurisdictions where they travel. We are more savvy and sophisticated than we behave. We’d like to see Bahamians do exactly the same thing as they practice abroad. If they use Google Pay or Apple Pay when they travel, they should the same transactions at home.

“The environments they are travelling in are predominantly cashless with

increasing digital payments. Why not do it at home? You do it when you travel.”

Mr Beckles added that the effort will benefit from plans to accelerate the Sand Dollar’s roll-out in the coming months, coupled with greater Central Bank and private sector focus on educating consumers and businesses about the merits of using the Bahamian digital dollar to settle payment transactions. While usage has been below provider expectations, it continues to grow. “We saw a 30 percent increase in digital transactions processing in 2022,” Mr Beckles said of Island Pay. “Numerically I can’t say what that number is, but there was a 30 percent increase in transactions year-over-year.

“We see that as a good gateway into a very strong 2023 keeping in mind that we’re under a commitment in 2025 with regard to the amount of cash in circulation.” Asked whether he was referring to the Central

Bank’s plans to eliminate the use of physical cheques by end-2024, he replied: “Most entities by the mid to end of this year will be done with it.

“Based on what we’re seeing, the message is: ‘Don’t wait until the last minute. Do what you have to now’. What we’re seeing is that more payment options are becoming available, so merchants believe they can get it done. Not only do we believe that the Sand Dollar is a good solution for the unbanked, under-banked and financial inclusion, digital payments allow everyone.....

“It doesn’t matter your income level. It allows everyone access to these tools. It means that the more people with digital tools in their hands, the greater the adoption. It’s just the fact that, at the end of the day, consumers and merchants reals the process of digital payments is cheaper than traditional means. It’s a revolution that is here to stay. It’s not

WE ARE CLOSED ON Thursday 17 February 2023

Dear Valued Customer,

Please note that all Bahamas First offices will be closed on Thursday 16 February 2023 to facilitate a company event

We resume regular business operations on Friday 17 February. We regret any inconvenience this may cause

BAHAMAS FIRST GENERAL INSURANCE COMPANY 32 Collins Avenue, Nassau, NP, Bahamas www.bahamasfirst.com | Tel: 242-302-3900

something to fear; it’s something to be embraced.”

Mr Beckles said digital payment adoption rates will enjoy a major boost “when more and more mainstream merchants begin to adopt the Sand Dollar, and when the Government starts to consistently use its own digital currency for payments”.

High consumer traffic areas, such as malls and the airport, as well as fast food restaurants and hardware store, were all identified as having a role to play.

“I think the other thing that has to drive that is the Government,” the Island Pay chief added. “They’ve

created a digital version of the fiat, and a tremendous expression of confidence in the Sand Dollar is when the Government starts to use it. Nothing beats confidence if you own it and use it, and tell the Bahamian community that you are paying your contractors and contracts for services in Sand Dollars.

“I can tell you that people will be running to get the Sand Dollar. Imagine if employers paid people in Sand Dollars. It’s cheaper and more efficient in so many ways. We can do it. That’s what we call a real game changer.”

Mr Beckles said Island Pay will “continue to drive” its merchant services and tourist Sand Dollar wallet in 2023, adding: “We’re going to put a lot of energy into that.” As for digital payments overall, he told this newspaper: “It is the way of the future for The Bahamas. There is no doubt about that. We have every confidence that it will be.

“We’re excited about it. There are real opportunities to advance The Bahamas. Keep in mind the reason we’re doing this is because The Bahamas will be better positioned, Bahamians will be better positioned, to thrive in a global economy. That’s what we’re aiming for.”

THE TRIBUNE Thursday, February 16, 2023, PAGE 5

PAGE B1

FROM

By YURI KAGEYAMA AP Business Writer

ASIAN shares edged higher Thursday, cheered by a stronger than expected reading on U.S. retail sales that set off a rally on Wall Street.

In the latest data on the regional economy, Japan's trade deficit reached a record 3.497 trillion yen ($26.2 billion) in January. Imports for the world's third largest economy jumped amid higher raw

material and energy costs, and a weak yen. Exports rose 3.5%.

Japan's benchmark Nikkei 225 gained 0.7% in morning trading to 27,705.72. Australia's S&P/ ASX 200 rose 0.7% to 7,406.70. South Korea's Kospi jumped 1.7% to 2,469.63. Hong Kong's Hang Seng surged 2.1% to 21,241.94, while the Shanghai Composite added 0.7% to 3,304.77.

"Asian equities were higher on Thursday after a

ASIAN SHARES JUMP BOOSTED BY A STRONG READING ON US RETAIL JOB OPPORTUNITY

Grocery Store Managers needed

positive day on Wall Street, where price action was driven by strong retail sales in the US, which signaled a hot economy at the start of the year," Anderson Alves at ActivTrades said in a report.

Japanese machinery orders for December returned to growth after contracting in the previous month.

The total value of machinery orders received by 280 manufacturers in Japan, a key indicator for private sector investment, rose a seasonally adjusted 6.5% in December from the month before.

On Wall Street, the S&P 500 rose 0.3% to 4,417.60 after swinging from early losses to gains through the day. The Dow Jones Industrial Average added 0.1% to 34,128.05, while the Nasdaq composite rose a more forceful 0.9% to 12,070.59. Sales at U.S. retailers jumped by more last month than expected, even as shoppers contended with higher interest rates on credit cards and other loans. The surprising strength offers hope that the most important part of the U.S. economy, consumer spending, will remain resilient despite worries about a possible recession. It's the latest piece of data to show the economy remains stronger than feared.

PAGE 6, Thursday, February 16, 2023 THE TRIBUNE

Email resume to charles@acgbahamas.com

Only persons with experience in the grocery business should apply must be energetic, organized and detail oriented.

Construction work permits ‘shifting in wrong direction’

skills. Instead, Mr Sands said the industry needed to hire locals for such posts and train them, adding: “The work is there for us to do.”

Speaking after Keith Bell, minister of labour and Immigration, halted the processing and acceptance of all new Haitian work permit applications due to the governance collapse in The Bahamas’ southern neighbour, the BCA chief told this newspaper the move was unlikely to negatively impact the construction industry’s workforce.

“In terms of that decision, I don’t think it’s going to have any real impact at all because I think there are sufficient numbers of persons already on work permits,” Mr Sands said.

“From our position, we have more than we need already. Our position is that we do not need to increase that number at all.

“If you look at the number of work permits we have across the board in the area of construction, I think you would find we are quite saturated with work permits. Not to tell the minister how to do his job, but we are very encouraged by his position to hold off on new Haitian work permit applications at this time.

“I think the industry is quite saturated with work permits and expatriates at this time. I think that,

right now, those on permits are enough. I can say that the more we grant these applications, the more we continue to put the Bahamians that can work in this area at a disadvantage,” the BCA chief continued.

“While we recognise there needs to be a mix of people from the local community and persons with skills from outside the country in The Bahamas, I think the balance has started to shift in the wrong direction. I think it’s become too easy to make applications for work permits in the sector and get them, so I think we need to look at pulling that back.

“We’re glad the minister has started to look at doing that. If you make it too easy, you will do it that way. If you make it harder, you make it more likely that the contractor will look around the community for workers. If you make it harder to get a work permit, people will look to local labour to fill the void. We welcome that.”

Mr Sands said contractors were “sensitive” to Haiti’s present plight. However, he added that it was dangerous for The Bahamas to rely on a construction workforce that was overweight with expatriates given that they were “transient” employees who can simply pack up and leave.

“There has to be a balance because the industry will fall into a precarious situation where it relies on

a workforce that is transient and leaves you,” he told Tribune Business. “You can see the void that creates. You never want to be in the position of relying too heavily on a workforce that is transient. We always have to rely on the strength of the Bahamian workforce, which is the backbone of the economy.”

Mr Sands said construction industry work permits should only be granted for key positions and specialist skills, or in cases where no qualified Bahamians were available and willing to do the work. “I make the argument that there should never an application, or a permit granted, for someone coming for general labour,” he added.

“We have enough people in this country who, if granted the opportunity, can do general labour work. We should not be granting no permits for general labour. They have no skills to bring to the table. They’re in the same position as a 19 year-old without skills leaving high school. Why grant a work permit for general labour? That should be discontinued. It impacts our industry more than anything else.

“If a person from outside the country is getting a work permit with no skills, and someone inside the country is looking for a job but has no skills, they’re competing directly. It’s not fair to the local worker. They should not be

Hotel union eyes industrial agreement ‘red letter day’

FROM PAGE B1

financial compensation to at least partially offset the increased cost of living a new deal will also provide better job security.

Atlantis and other resorts have operated as if the previous agreement’s terms and conditions are still in effect because a former union leadership failed to begin negotiations on a new deal within the stipulated timeframe of at least 90 days before the January 2013 expiry. As a result, BHCAWU union members have not enjoyed any wage or benefit improvements for the past ten years other than those provided by their employers.

“We’re still proceeding along with those,” Mr Woods said of the union’s various industrial agreement negotiations. “We’re almost there. There are one or two small things we are trying to get over. We envision bringing that to a close in short order.”

Besides the Association, the union is also locked in industrial agreement talks with other entities including Restaurants Bahamas (KFC), Best Western, Graycliff and Harbourside. Mr Woods yesterday voiced optimism that once one deal was concluded, especially the one with the Atlantis group, other properties will follow suit by agreeing theirs.

“All of them are pretty much in the same light,” he said of the talks’ status. “We believe that once we conclude one the rest will follow suit. They’re all at the same stage; the financial side of things. When one drops the rest will follow. We’re anywhere in the first to mid-second quarter to have those completed.”

Referring specifically to the negotiations with the Association, the union president added: “That one will be a red letter day for us to bring to a conclusion for various reasons. That one is the most important for us. That one sets the tone for the industry as a whole. Even though we have separate agreements with other entities, they look to the master agreement as the example. The agreement with the Association sets the tone for whatever is going to happen.”

As to the impact on union members from finally obtaining a new industrial deal, Mr Woods said: “What

it will do is give them a little bit more leeway at the belt, give them room to breathe and give them a sense of security. In the absence of an industrial agreement, anything tends to happen, but once these agreements are in place they dictate exactly how things should be.

“In addition to increases in wages, benefits and the like, it gives them increased security and something to protect them. It goes a long way and is the number one priority. To be without an industrial agreement it’s almost like living in a Wild Wild West; you operate with no rules at all.

“Everything we’ve done has been focused on trying to bring all negotiations to a closure, and not only a closure. One thing that we’ve committed to the members is that we will get an industrial agreement that can be registered and become binding on the parties, forming part of their employment contract. That is paramount. Once we have done that it will surpass anything done on their behalf going back as far as I can remember.”

Mr Woods previously said many hotel staff worked “unprecedented” five-day weeks during the 2022

tourism season’s slowest months. The post-COVID tourism recovery’s momentum meant many employees worked double the twothree day weeks typically endured during September and October to meet the demand.

“We have pretty much come through the slower period with higher occupancies and expanded work levels. August, September and October, you’d usually be working two to three days. With the exception I told you about, those other areas were working five days minimum, which is unprecedented for that time of the year. If we’re able to ride the proverbial wave through 2023 we believe that should take us all the way to Easter,” he said at the time.

“We understand there’s an expected uptick in tourist arrivals next year, and we hope that translates into heads in bed in the hospitality industry, not Airbnb, so our people can benefit.” Mr Woods said higher occupancies, and greater guest numbers, translated into higher tipped or gratuity income for housekeepers, room attendants and persons working in service areas such as the restaurants.

competing with someone with no skills from outside the country. That makes no sense. That practice should be discontinued,” Mr Sands said.

“It should not be the policy of any government. The BCA’s position is we believe we can train anyone. If someone comes with no skills we can train them. We prefer to train

locals rather than someone with a language barrier. The work is there for us to do. We have a huge responsibility but have to do the work.”

The Government has adopted the position that no new work permits will be processed for Haitians until revised protocols are introduced to ensure the authenticity of documents

produced by that country’s government. Existing work permit applications and renewals will face vigorous review and scrutiny, while existing and new permits to reside applications for Haitian citizens will only be considered on a case-by-case basis. Approvals will be granted in “exceptional cases” only.

THE TRIBUNE Thursday, February 16, 2023, PAGE 7

PAGE B1

FROM

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

Small/ Medium Resort is searching for a candidate to fill a position of a Night Auditor. The ideal candidate must be able to handle both the duties of the front desk agent and accounting duties. The auditor accounts for the day’s business and remains available to serve the overnight needs of customers.

Responsibilities:

• Posts room charges and taxes to guest accounts.

• Posts guest charge purchase transactions not posted by the front office cashier.

• Checks figures posting and documents for accuracy.

• Verifies all account postings and balances.

• Tracks room revenues, occupancy percentages, and other front office statistics.

• Run end of day process in property management software (PMS).

• Understand principles of auditing, balancing, and closing out accounts.

• Knows how to operate PMS and other front office equipment.

• Understand and knows how to perform check-in and check-out procedures.

Core Competencies:

• Excellent oral and written communication skills

• Ability to execute duties with accuracy and proficiency

• Demonstrate a keen eye for details

• Ability to work under pressure and follow company guidelines

• Strong interpersonal skills and ability to maintain a harmonious relationship with co-workers

• Ability to maintain confidentiality

• Reliable, dependable and flexible team-player

Required Qualifications:

• Bachelor’s Degree in Accounts

• 2 + years’ experience in field or similar position

• Excellent computer skills and proficiency

Submit Resume to info@sandyport.com

P.O. Box SP-63162, Nassau, Bahamas, fax (242) 327-6512

CBO projects higher unemployment, slow exit from inflation

By FATIMA HUSSEIN, JOSH BOAK AND KEVIN FREKING Associated Press

THE Congressional Budget Office said Wednesday that it expects the U.S. economy to stagnate this year with the unemployment rate jumping to 5.1% — a bleak outlook that was paired with a 10-year projection that publicly held U.S. debt would nearly double to $46.4 trillion in 2033.

The office’s updated 10-year Budget and Economic Outlook outlined stark expectations for the decade ahead, where Social Security would be unable to pay full benefits to recipients in 2032 — with a roughly 20 percent reduction in benefits across the board — and the net interest costs on U.S. debt would eclipse what the nation spends on defense.

“The debt trajectory is unsustainable,” CBO director Phillip Swagel told journalists at a press conference after the report’s afternoon release. The CBO can’t tell Congress what to do, he said, “but at some point, something has to give — whether it’s on spending or revenue.”

The latest figures seemed to affirm the worst fears of many U.S. consumers and businesses. But in a reminder that the U.S. economy has seldom behaved as anticipated through the pandemic and its aftermath, the employment forecast looks very different from the pace of hiring so far this year.

The CBO estimated that just 108,000 jobs will be added in 2023, but

employers added 517,000 jobs in January alone. It also assumes that inflation will ease from 6.4% to 4.8% this year, far more pessimistic than Federal Reserve officials who in December said inflation would fall to 3.5%.

The CBO separately pointed to the risks of not increasing the government’s legal borrowing authority, noting that the Treasury Department could exhaust its current “extraordinary measures” to keep the government running while President Joe Biden and House Speaker Kevin McCarthy jostle over a deal.

Treasury Secretary Janet Yellen wrote to congressional leadership last month, stating that her agency will use creative accounting measures to buy time until Congress can pass legislation that will either raise the nation’s $31.4 trillion borrowing authority or suspend it again for a period of time.

If tax receipts from this year’s filing season fall short of estimated amounts, the U.S. could hit its statutory debt ceiling earlier than July, according to the nonpartisan organization, which provides independent analyses of budget and economic issues to Congress.

Following the CBO issuing its report, Senate Democrats reiterated their calls for Republicans to help pass legislation to increase the nation’s borrowing authority. Then, they said, lawmakers could turn their attention to funding the government and addressing the solvency of Medicare and Social Security.

“We don’t want to cut benefits. We don’t want to privatize. We don’t want to do the kinds of things that Republicans have talked about in that area,” Senate Majority Leader Chuck Schumer, D-N.Y., said of Social Security. “And we have some plans to make it solvent, which you’ll hear from down the road.”

Sen. Chuck Grassley, R-Iowa, ranking member of the Senate Budget Committee, said the report “paints a dire picture.”

“If we don’t get serious about reining in spending, reducing annual budget deficits and bringing down the debt, the country will end up spending more on interest payments than the programs that actually benefit Americans,” Grassley said.

The outlook warns about rising yearly budget deficits. In 2033, the CBO anticipates that the yearly shortfall in tax revenues relative to spending would exceed $2.85 trillion, more than double the deficit in 2022. Publicly held debt was roughly equal to U.S. gross domestic product in 2022, but it would climb to 118% of GDP by 2033.

The office says the biggest drivers of rising debt in relation to GDP are increasing interest costs and spending for Medicare and Social Security.

The two parties also engaged in blaming the other side for the rising deficit projections. Republicans blamed Democrats for spending too much during the Biden presidency and Democrats blamed Republican for the tax cuts undertaken during the Trump presidency.

The Winterbotham Trust Company Limited is looking to fill the position of Corporate Services Administrator

Main Function: Provides for the efficient ongoing administration of corporate clients and support to management and will report to the Corporate Services Supervisor.

In this challenging position you will be responsible for but not limited to the following tasks:

• Assist with the ongoing administration of foreign and domestic companies

• Primary liaison with third party providers for corporate client matters

• Preparation and filing of Annual Returns, Statements and declarations

• Legalization of documents with various foreign consulates

• Preparation of minutes/resolutions

• Assisting with company dissolutions and Good standings

• Preparation of Share Certificates

• Processing license applications for entities registered with Winterbotham

• Ensuring accurate client billing and statements of accounts

• Ensuring ongoing and accurate update of Company database.

• Ensuring compliance with company and regulatory requirements

• Be alert to current ad new operating procedures and legislation relevant laws, rules and guidelines

• Responding to client inquiries

• Other duties as assigned.

The successful applicant must have the following qualifications:

• Associates’ Degree in Business Administration, Economics, Banking & Finance or Accounting or equivalent

• Minimum of three (3) years’ experience in financial services or similar position

• Knowledge of various relevant industry Acts eg. The IBC and Companies Acts, FCSP and External Insurers Acts

• Above average fluency with spoken and written English at a professional level

• Basic knowledge of math and some accounting principles

• Fluency in Spanish and Portuguese (optional)

• Computer literate (MS Office products and Microsoft Windows operating system)

• Strong organization and communication skills

• Team Player

• Capability to work under pressure

Applications/resume should be sent by e-mail to: jobs@winterbotham.com

Under reference “Corporate Services Administrator”

ABSOLUTELY NO TELEPHONE INQUIRIES WILL BE ACCEPTED

Persons not meeting the above requirements need not apply Please note that only individuals short-listed for an interview will be contacted Deadline for applications Wednesday, February 22nd, 2023

PAGE 10, Thursday, February 16, 2023 THE TRIBUNE

POSITION AVAILABLE NIGHT

AUDITOR

BISX EXECUTIVE GIVES STOCK EXCHANGE INSIGHT

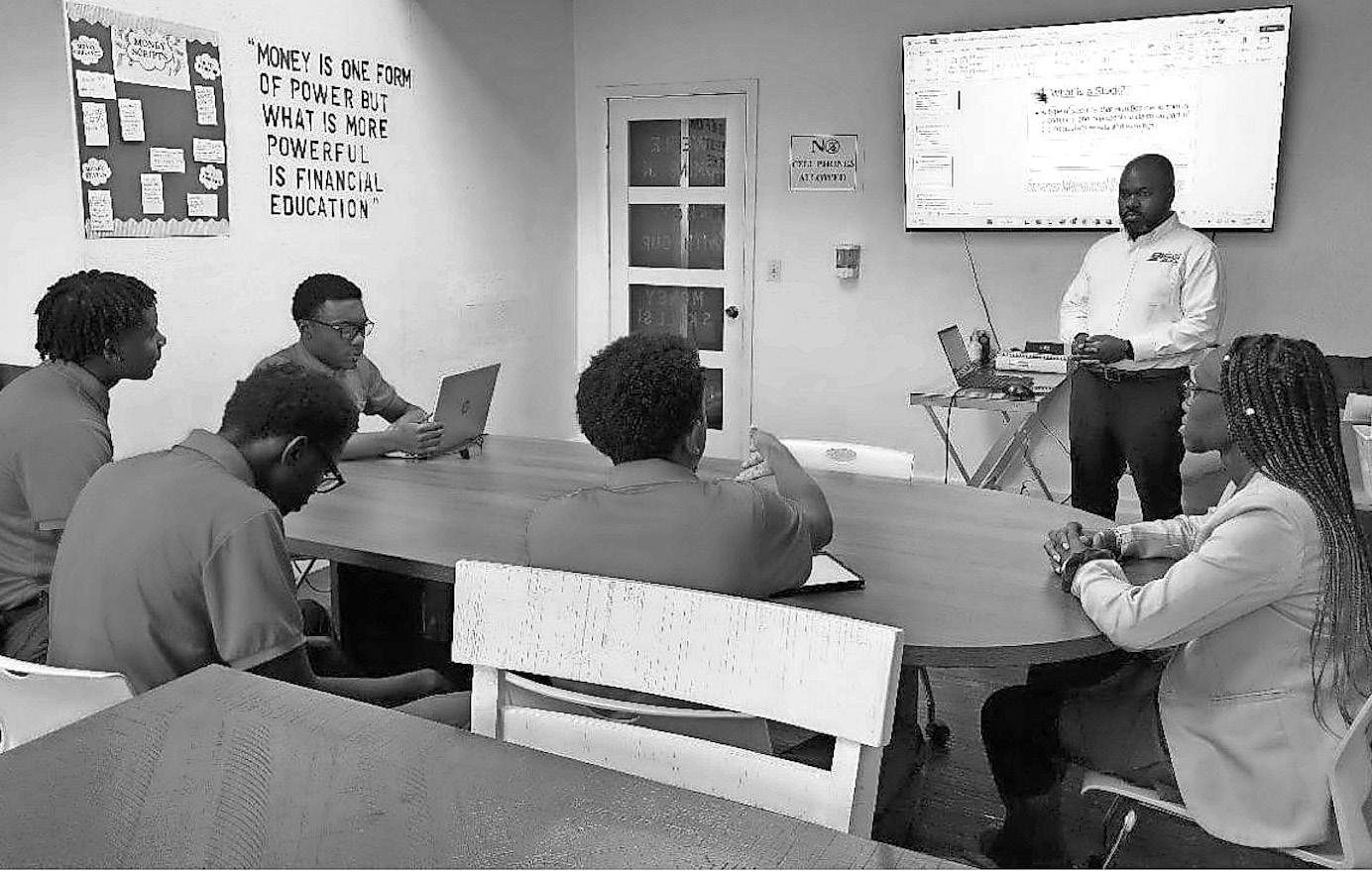

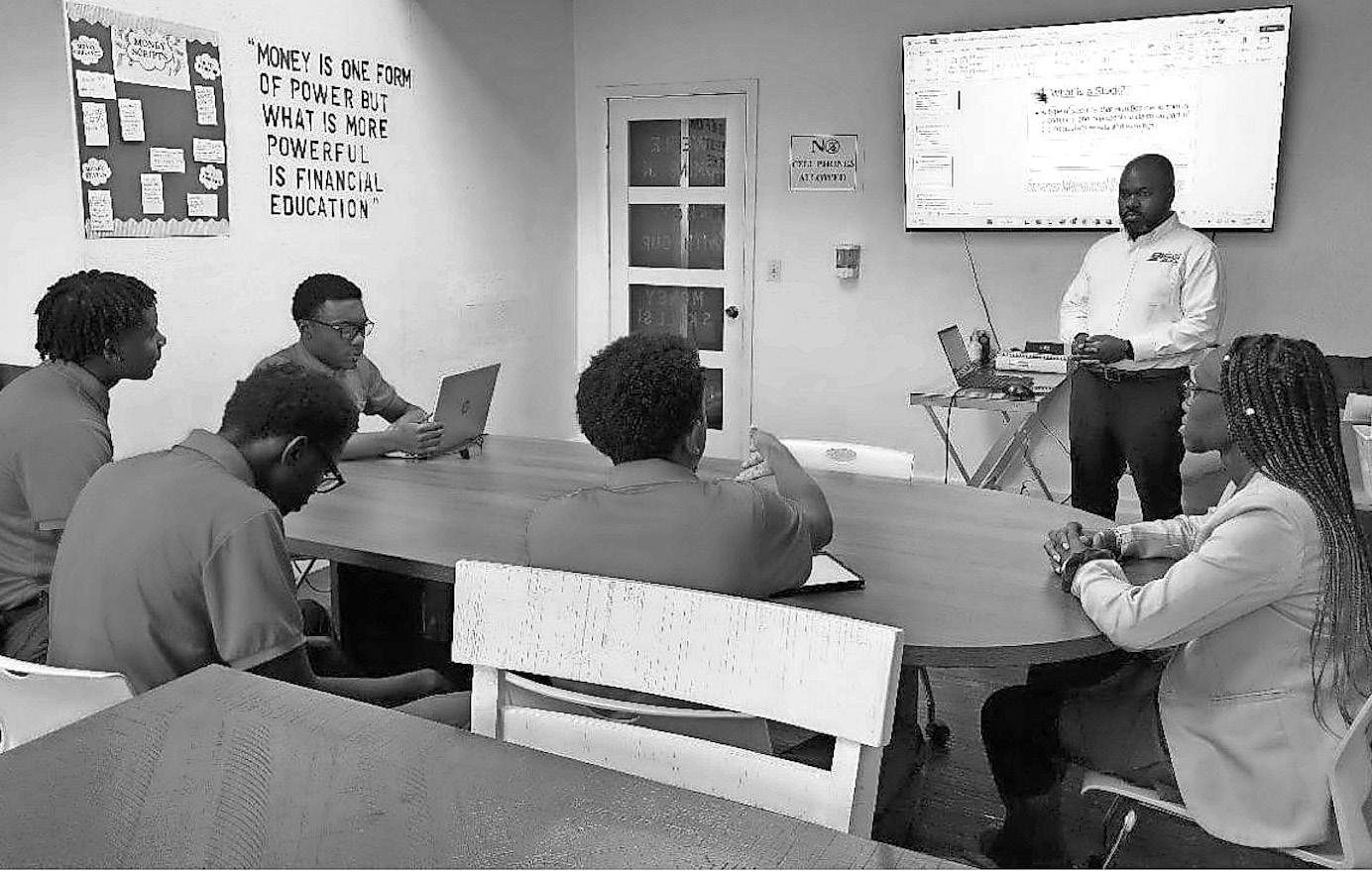

A SENIOR Bahamas International Securities Exchange (BISX) has given students an insight into how the trading platform operates.

Holland Grant, BISX’s chief operating officer, spent January 30, 2023, with the 12th grade personal finance class at the International School of Business Entrepreneurship and Technology (ISBET). He also focused on items from the students’ personal finance curriculum, and linked stock exchange principles to this.

Besides speaking about stocks, bonds, mutual funds and capital market principles, Mr Grant also explained about how stock exchanges work and benefit an economy. He said: “I’d like to thank Miss Rolle, their teacher at ISBET, who reached out to me about speaking to her class.

“Teachers play such a crucial role in our society and don’t get enough recognition for their commitment to students. I’d also like to commend the students of Miss Rolle’s class. Interacting with them was enjoyable. I was especially impressed with

BISX chief operating officer, Holland Grant, with the ISBET Bahamas 12 Personal Finance Class. HOLLAND Grant interacting with students during his presentation. the quality of the questions that they asked as it showed the depth of their knowledge.” The students said Mr Grant’s presentation “was very informative and gave us more insight about what persons can invest in locally”. Miss Rolle, their teacher, added: “Teaching our students about the local investment market is so important. Many of them aren’t aware of local investment options, along with the fact that The Bahamas has its own securities exchange.

“It was a great session with the students as we continued our conversation about types of investments and securities exchanges as a part of our school’s curriculum at the International School of Business, Entrepreneurship and Technology.”

Mr Grant added: “Investor education and connecting with students is and must be an essential part of BISX efforts to building the Bahamian capital markets. The students of today become the investors of tomorrow, and so

BISX always accepts every opportunity to speak to a school as this is a critical way of us supporting the invaluable contributions of Bahamian teachers.

“We are also proud of our social media outreach and the work that we do with our brokers to foster an investor culture in The Bahamas. We encourage readers to connect with us on Instagram @bisxbahamas to see more of our investor education output.”

THE TRIBUNE Thursday, February 16, 2023, PAGE 11

HOLLAND Grant during his presentation.

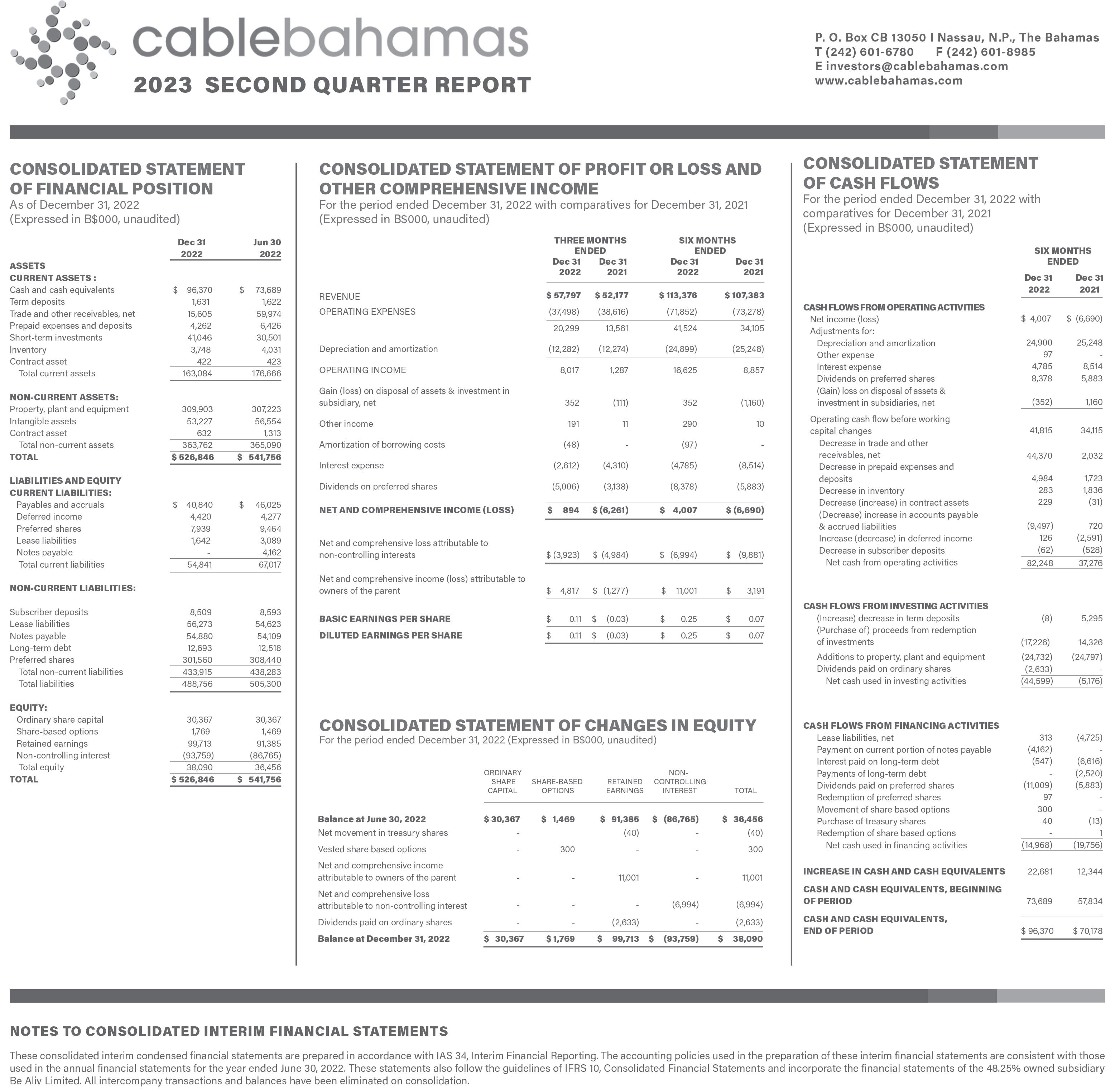

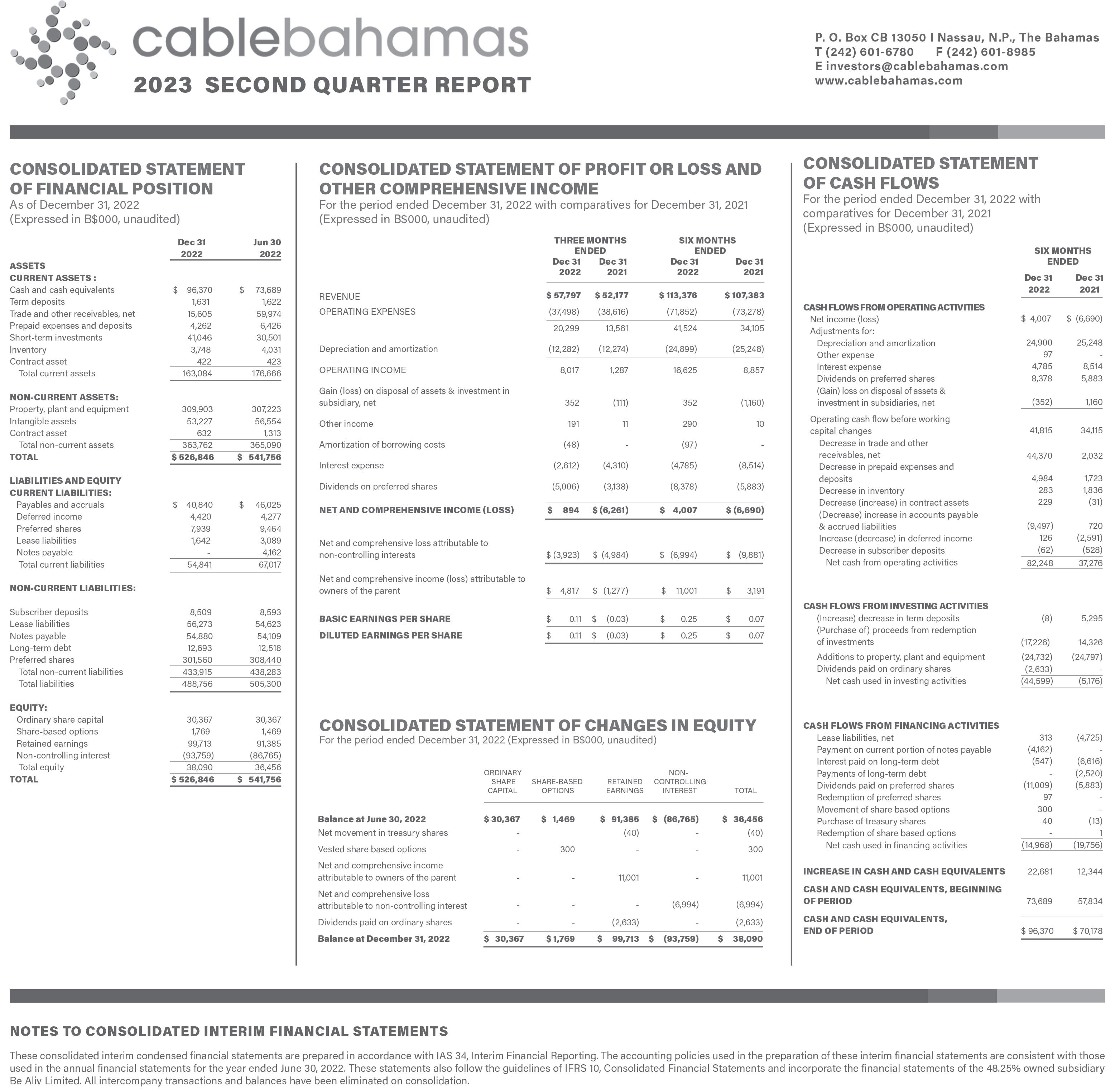

Fidelity Bank (Bahamas) Limited (Incorporated under the laws of the Commonwealth of The Bahamas) Consolidated Statement of Financial Position (Unaudited) As of 31 December 2022 (Expressed in Bahamian dollars) 2022 2021 $ $ ASSETS Cash on hand and at banks 275,816,907 378,754,192 Investment securities 109,031,419 105,409,865 Loans and advances to customers 372,034,039 401,585,362 Other assets 2,156,416 1,937,147 Investments in joint ventures 170,750 195,695 Property, plant and equipment 10,622,023 11,219,518 Total assets 769,831,554 899,101,779 LIABILITIES Deposits from customers 656,879,927 769,754,950 Accrued expenses and other liabilities 4,393,681 4,851,294 Debt securities - 20,068,330 Total liabilities 661,273,608 794,674,574 EQUITY Capital – ordinary shares 20,449,512 20,449,512 Capital – preference shares 15,000,000 15,000,000 Revaluation reserve 1,131,765 1,176,670 Retained earnings 71,976,669 67,801,023 Total equity 108,557,946 104,427,205 Total liabilities and equity 769,831,554 899,101,779 Consolidated Statement of Comprehensive Income (Unaudited) For the Twelve (12) Months Ended 31 December 2022 (Expressed in Bahamian dollars) 3 Months Ended 12 Months Ended 31 December 31 December 31 December 2022 2022 2021 $ $ $ INCOME Interest income Bank deposits, loans and advances 14,855,216 59,894,117 61,364,667 Investment securities 1,028,145 3,965,156 3,982,687 15,883,361 63,859,273 65,347,354 Interest expense (2,413,604) (10,918,702 ) (12,078,349 ) Net interest income 13,469,757 52,940,571 53,269,005 Fees and commissions 1,681,457 6,144,978 3,719,527 Other income (91,273) 183,707 349,834 Total income 15,059,941 59,269,256 57,338,366 EXPENSES General and administrative 4,571,002 16,891,161 13,599,790 Salaries and employee benefits 3,544,382 13,809,185 13,098,308 Provision for loan losses 2,006,764 6,843,589 6,000,529 Depreciation and amortisation 390,218 1,583,967 1,475,720 Allowances for impairment - - 1,000,000 Total expenses 10,512,366 39,127,902 35,174,347 Operating profit 4,547,575 20,141,354 22,164,019 Share of profits of joint ventures (2,308) (24,945 ) 5,713 Net income 4,545,267 20,116,409 22,169,732 OTHER COMPREHENSIVE INCOME Items not reclassified to net income Property, plant and equipment revaluation - -Total comprehensive income 4,545,267 20,116,409 22,169,732 Weighted average number of ordinary shares outstanding 28,830,129 28,830,129 28,822,954 Earnings per share 0.15 0.66 0.74 Consolidated Statement of Changes in Equity (Unaudited) For the Twelve (12) Months Ended 31 December 2022 (Expressed in Bahamian dollars) Capital – Capital –Ordinary Preference Revaluation Retained Shares Shares Reserve Earnings Total $ $ $ $ $ As of 1 January 2022 20,449,512 15,000,000 1,176,670 67,801,023 104,427,205 Comprehensive income Net income - - 20,116,409 20,116,409 Other comprehensive income Property, plant and equipment revaluation -Total comprehensive income - - - 20,116,409 20,116,409 Transfers Depreciation transfer - - (44,905 ) 44,905Total transfers - (44,905 ) 44,905 Transactions with owners Issuance of ordinary shares - - - -Dividends – preference shares - - (975,000) (975,000 ) Dividends – ordinary shares - - (15,010,668) (15,010,668 ) Total transactions with owners - - (15,985,668) (15,985,668 ) As of 31 December 2022 20,449,512 15,000,000 1,131,765 71,976,669 108,557,946 Dividends per share 0.52 0.65 Consolidated Statement of Changes in Equity (Unaudited) For the Twelve (12) Months Ended 31 December 2021 (Expressed in Bahamian dollars) Capital – Capital –Ordinary Preference Revaluation Retained Shares Shares Reserve Earnings Total $ $ $ $ $ As of 1 January 2021 20,410,050 15,000,000 971,225 61,429,700 97,810,975 Comprehensive income Net income - 22,169,732 22,169,732 Other comprehensive income Property, plant and equipment revaluation -Total comprehensive income - 22,169,732 22,169,732 Transfers Depreciation transfer - - 205,445 (205,445)Total transfers - 205,445 (205,445)Transactions with owners Issuance of ordinary shares 39,462 - 104,038 143,500 Dividends – preference shares - - (975,000) (975,000 ) Dividends – ordinary shares - - (14,722,002) (14,722,002 ) Total transactions with owners 39,642 - (15,592,964) (15,553,502 ) As of 31 December 2021 20,449,512 15,000,000 1,176,670 67,801,023 104,427,205 Dividends per share 0.51 0.65 Notes to the Consolidated Financial Statements (Unaudited) For the Twelve (12) Months Ended 31 December 2022 (Expressed in Bahamian dollars) Corresponding Figures Where necessary, corresponding figures are adjusted to conform with changes in presentation in the current year. Capital Management The objectives of Fidelity Bank (Bahamas) Limited (the Bank) when managing capital, which comprises total equity on the face of the consolidated statement of financial position, are: To comply with the capital requirements set by the Central Bank of The Bahamas (the Central Bank). To safeguard the Bank’s ability to continue as a going concern so that it can continue to provide returns for its shareholders and benefits for other stakeholders; and To maintain a strong capital base to support the development of its business. Capital adequacy and the use of regulatory capital are monitored by the Bank’s management, employing techniques designed to ensure compliance with guidelines established by the Central Bank, including quantitative and qualitative measures. The required information is filed with the Central Bank on a quarterly basis. The Central Bank, the Bank’s principal regulator, requires that the Bank maintains a ratio of total regulatory capital to risk-weighted assets at or above a minimum of 14.00%. For the twelve (12) months ended 31 December 2022 and the year ended 31 December 2021, the Bank complied with all of the externally imposed capital requirements to which it is subject.

NOTICE is hereby given that VERRILUS SYLVERRAIN of Betsy Village, Governor’s Harbour, Eleuthera, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that DARVILLE LEONARD of Pinedale Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that DANIELLA BEAUCHAMP of Ruby Drive Winton Heights, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that BIANCA M. LIBERUS of Pinewood Garden, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that CHANTIL ISMA of Murphy Town Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that JULIEN PETIT-DOS of Ruby #35 Union Village, New Providence, The Bahamas is applying to the Minister responsible for

(a) INTUIZIONE INTERNATIONAL LIMITED is in dissolution under the provisions of the International Business Companies Act 2000.

(b) The Dissolution of said Company commenced on February 16, 2023 when its Articles of Dissolution were submitted and registered by the Registrar General.

(c) The Liquidator of the said company is Zakrit Services Ltd. of 2nd Terrace West, Centreville, Nassau, Bahamas.

(d) All persons having Claims against the abovenamed Company are required on or before March 16, 2023 to send their names and addresses and particulars of their debts or claims to the Liquidator of the company or, in default thereof, they may be excluded from the benefit of any distribution made before such debts are proved.

February 16, 2023

ZAKRIT SERVICES LTD.

LIQUIDATOR OF THE ABOVE-NAMED COMPANY

THE TRIBUNE Thursday, February 16, 2023, PAGE 13

NOTICE

WEDNESDAY, 15 FEBRUARY 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2672.960.350.0127.901.05 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/EYIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0040.06 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.652.31Bahamas First Holdings Limited BFH 2.65 2.650.00 0.1400.08018.93.02% 3.102.25Bank of Bahamas BOB 2.98 3.020.0415,5000.0700.000N/M0.00% 6.306.00Bahamas Property Fund BPF 6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas Waste BWL 9.65 9.650.00 0.3690.26026.22.69% 4.502.90Cable Bahamas CAB 4.26 4.260.00 -0.4380.000-9.7 0.00% 10.657.50Commonwealth Brewery CBB 10.23 10.230.00 0.1400.00073.10.00% 3.652.54Commonwealth Bank CBL 3.58 3.580.00 0.1840.12019.53.35% 9.307.01Colina Holdings CHL 8.50 8.500.00 0.4490.22018.92.59% 17.5012.00CIBC FirstCaribbean Bank CIB 15.99 15.990.00 0.7220.72022.14.50% 3.252.05Consolidated Water BDRs CWCB 3.00 3.070.07 0.1020.43430.114.14% 11.2810.05Doctor's Hospital DHS 10.50 10.500.00 5000.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.93 9.930.00 0.6460.32815.43.30% 11.5010.75Famguard FAM 11.20 11.200.00 0.7280.24015.42.14% 18.3014.50Fidelity Bank (Bahamas) LimitedFBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.55Focol FCL 3.98 3.980.00 0.2030.12019.63.02% 12.1010.00Finco FIN 12.10 12.100.00 0.9390.20012.91.65% 16.2515.50J. S. Johnson JSJ 15.76 15.760.00 0.6310.61025.03.87% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.001.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.001.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.001.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.4599.95BGRS FL BGRS91032 BSBGRS910324 99.9599.950.00 100.12100.12BGRS FL BGRS88037 BSBGRS880378100.03100.030.00 94.1594.09BGRS FX BGR132139 BSBGR1321391 93.3693.360.00 101.55101.42BGRS FX BGR124228 BSBGR1242282 101.45101.450.00 103.49103.38BGRS FX BGR118027 BSBGR1180276 102.70102.700.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.592.11 2.593.87%3.87% 4.903.30 4.904.87%4.87% 2.271.68 2.273.03%3.03% 203.47164.74 195.65-3.84%-3.84% 212.41116.70 180.14-15.19%-15.19% 1.771.71 1.773.07%3.07% 1.981.81 1.988.44%8.44% 1.881.80 1.884.42%4.42% 1.030.93 0.95-7.23%-7.23% 9.376.41 10.188.63%8.63% 11.837.62 13.6115.01%15.01% 7.545.66 7.732.87%2.87% 16.648.65 13.13-20.87%-20.87% 12.8410.54 12.06-4.33%-4.33% 10.779.57 10.62-0.31%-0.31% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75% MARKET REPORT 31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Dec-2022 31-Dec-2022 6.95% 4.50% 31-Dec-2022 31-Dec-2022 4.50% 6.25% 31-Dec-2021 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 31-Dec-2022 22-Sep-2033 15-Aug-2032 26-Jul-2037 26-Jul-2035 15-Oct-2039 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 30-Sep-2025 31-Dec-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 4.37% 4.81% 5.29% 5.14% 5.60% 26-Jul-2037 4.42% 15-Jul-2039 15-Jun-2040 4.66% 4.82% 13-Jul-2028 13-Oct-2027 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 5.35% 5.00% (242)323-2330 (242) 323-2320 www.bisxbahamas.com

NOTICE

Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas. NOTICE

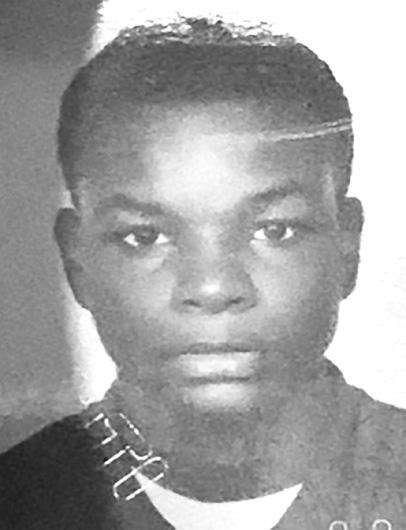

N O T I C E IS HEREBY GIVEN as follows:

CARE We listen to your needs COMMITMENT- We are committed to helping your business grow CONSISTENCY- We offer consistent service to all clients

Call our Advertising Department on 502-2350, and speak to a Sales Executive today. Get started on the road to success!

Stocks tick higher as hopes on economy joust rate fears

By STAN CHOE AP Business Writer

STOCKS ticked higher on Wall Street Wednesday as hopes for a resilient economy jousted with worries about inflation following a much stronger reading than expected on U.S. retail sales. The S&P 500 rose 0.3% after swinging from early losses to gains through the day. The Dow Jones Industrial Averaged edged up by 38 points, or 0.1%, while the Nasdaq composite rose a more forceful 0.9%.

Sales at U.S. retailers jumped by more last month than expected, even as shoppers contended with higher interest rates on credit cards and other loans.

The surprising strength offers hope that the most important part of the U.S. economy, consumer spending, can stay afloat despite worries about a possible recession looming. It’s the latest piece of data to show the economy remains more resilient than feared.

At the same time, though, the strong buying potentially adds more fuel to inflation, which a report earlier this week showed is cooling by less than expected. Upward pressure on inflation could force the Federal Reserve to stay more aggressive in keeping interest rates high.

High rates can drive down inflation, but they also drag on investment prices and raise the risk of a painful recession.

“Will it lead to that traditional recession or a shallow recession, or will we power through it and have more strong growth with still-high rates?” asked Tom Hainlin, national investment strategist at U.S. Bank Wealth Management. “That’s still the unknown, which is how

resilient can the consumer be in this higher for longer” rate environment.

“It seems like both consumers and corporate America came into this in pretty good shape and so far are holding out OK,” he said.

The worries about higher rates and a firmer Fed have been most evident in the bond market, where yields on Treasurys have jumped since a report two Fridays ago showed the U.S. job market remains stronger than expected.

The yield on the two-year Treasury, which tends to track expectations for the Fed, briefly jumped toward 4.70% and its highest level since November after the retail sales report, up from less than 4.60% overnight and from 4.62% late Tuesday. It then eased back to 4.60%.

The 10-year yield, which helps set rates for mortgages and other important loans, rose to 3.79% from 3.75% late Tuesday.

Following Tuesday’s data on inflation that was slightly hotter than expected, economists at Deutsche Bank raised their forecast for how high the Fed will take its key overnight interest rate. They now see it ultimately rising to 5.6%, up from their prior forecast of 5.1%.

The Fed has already pulled its overnight rate all the way to a range of 4.50% to 4.75%, up from virtually zero a year ago.

The Deutsche Bank economists said they still expect a recession, but that the near-term strength in the economy could push its timing into the last three months of the year, later than they earlier thought.

Many other traders have also been raising their forecasts for how high the Fed will ultimately take interest

rates. They’ve also sharply reduced bets for the Fed to cut rates late this year. Even still, stocks are hanging onto healthy gains for the year despite recent rockiness. The S&P 500 is up 8% as strong data build hope that the economy may be able to avoid a recession. Or, if one hits, perhaps it may be only a short and shallow one.

The next big milestone for the market will likely be the Fed’s meeting in late March, when policy makers will give their latest forecasts for where interest rates will be at the end of the year, Hainlin said. That could lead to choppy trading in markets until then, as investors try to guess which way it will go.

On Wall Street, shares of Airbnb jumped 13.4% Wednesday after reporting stronger profit and revenue for its latest quarter than analysts expected. It also said trends remain encouraging into the new year, and it gave a forecast for revenue that topped Wall Street’s.

On the losing end were stocks of energy producers, which fell 1.8% for the worst performance by far of the 11 sectors that make up the S&P 500.

One of the sharpest drops came from Devon Energy, which fell 10.5% after reporting weaker profit for the latest quarter than expected.

This earnings reporting season has been muted, with many companies reporting pressure on their profits from higher costs and interest rates.

All told, the S&P 500 gained 11.47 points to 4,417.60. The Dow rose 38.78 to 34,128.05, and the Nasdaq climbed 110.45 to 12,070.59.

THE TRIBUNE Thursday, February 16, 2023, PAGE 15