$5.25 $5.29 $5.46 $5.16

$5.25 $5.29 $5.46 $5.16

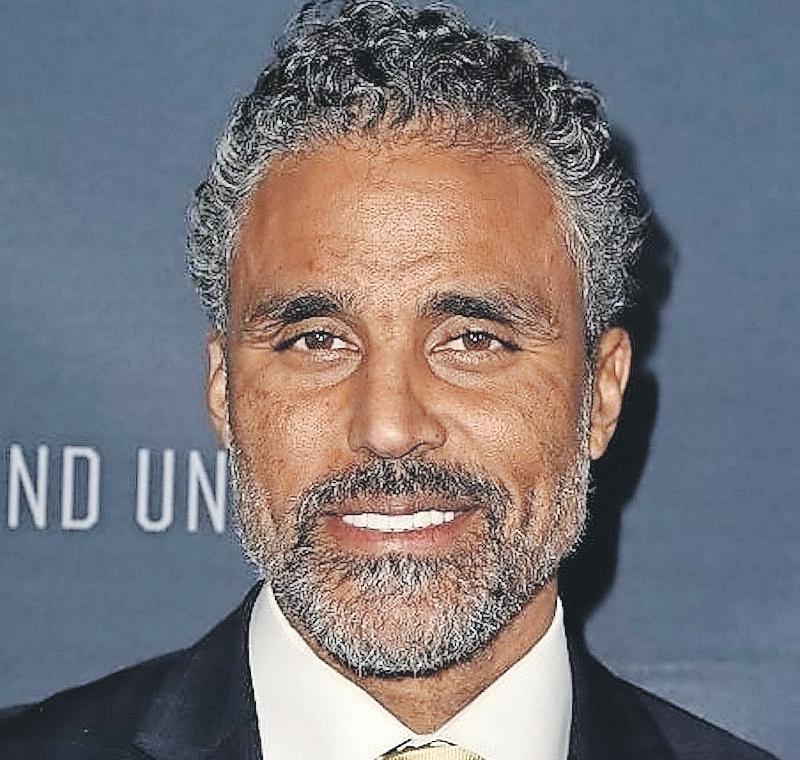

A BAHAMIAN former professional basketball player is investing $50m in an Arawak Cay manufacturing facility he hopes will enable this nation to become “a leader in the field” of climate-resilient construction.

Rick Fox, the ex-Los Angeles Laker, told Tribune Business that Partanna Bahamas, his carbon-negative concrete innovator, has already outgrown its initial facility at the former Bacardi factory and hopes to start construction this year on a new plant that will provide the foundation for up to to 300 jobs at full operation.

Speaking as Partanna signed a Memorandum of Understanding (MoU) with the Caribbean ClimateSmart Accelerator (CCSA), which will help to promote the impact of its work to a global market, he added that the company will “move as fast as the Ministry of Housing can move” on a product he believes can have a disruptive effect on the construction industry similar to the

• Ex-NBA star: Bahamas can be ‘leader in the field’

• Set to ramp up carbon-negative concrete supply

• Targets cut to Bahamas yearly 3,000 home deficit

impact that Tesla has had on the auto market.

Suggesting that The Bahamas faces a 3,000-strong annual home deficit, with the supply of quality affordable housing outstripped by demand, Mr Fox told this newspaper that his company aimed to help the Government narrow this gap with home construction and materials that are both resilient to, and help to counter, climate change’s growing impact from ever more frequent and powerful storms.

“Our first laboratory, and development of our first prototype, sit out at Bacardi. We’ve outgrown it. We’re moving to our second facility. We have equipment on the ground and are setting up to go commercial. It will be right there on the port at Arawak Cay. It will allow us to move around the islands. It’s really a supporting anchor to build, not just those 30 homes, but an industry around sustainable housing in The Bahamas.”

Partanna, in its Memorandum of Understanding (MoU) signed with

SEE PAGE B4

NASSAU Cruise Port yesterday disclosed it is aiming to slash annual debt servicing costs by several million dollars through refinancing the $138m bond debt that kickstarted its transformation at COVID’s peak.

Michael Maura, its chief executive, told Tribune Business that the Prince George Wharf operator is seeking “realign the cost of capital with the level of risk” now that the $300m redevelopment of its facilities is nearing construction completion.

Voicing optimism that most, if not all, investors will elect to rollover their bonds and exchange them for new securities, he added that the reduced risk associated with the project was

SEE PAGE B6

A 50-year Freeport licensee today calls on the Grand Bahama Port Authority’s (GBPA) owners and Hutchison Whampoa to either finally live up to their development obligations or “get out of the way”.

Stephen Crane, the luxury goods and jewellery retail entrepreneur long associated with Freeport’s Colombian Emeralds operation, is joining the call for the St George and Hayward families to “either sell” the city’s quasi-governmental authority or partner with an entity able to fulfill the

THE Government and insurance industry last night traded blows over fears that Bahamian healthcare costs will further increase due to a new VAT treatment set to take effect from April 1, 2023.

The row erupted after the Bahamas Insurance Association (BIA) issued a late Friday statement warning that medical bills and treatment costs for thousands of Bahamians will increase due to the Ministry of Finance’s decision to stop insurers recovering the 10 percent VAT paid on health insurance claims payments from the Government.

Such a move, the industry’s trade body warned, will likely make private healthcare less accessible - and increasingly unaffordable - for more Bahamians

as they will now be responsible for paying VAT on top of their actual medical bill. However, this was disputed by the Ministry of Finance, which argued that the change’s impact on individual and group (employer) health insurance policies will be “insignificant”.

The ministry, in last night’s response to the BIA, said it was “clearly against the VAT Act” for insurers to claim back the 10 percent

GBPA’s responsibilities and attract fresh investment.

Echoing the thoughts of many observers, he argues in a letter sent to Tribune Business (see Page 2B) that both the GBPA and Hutchison Whampoa “abdicated their obligations” by effectively “dumping” Grand Bahama International Airport and its multimillion dollar repair costs on the Government postHurricane Dorian rather than tackling the task themselves.

“Grand Bahama enjoys unparalleled tax, stability and locational advantages, giving it extraordinary potential for sustainable

SEE PAGE B12

MY 2023 New Year’s wish for Freeport, Grand Bahama, is that the island is given a new start, and one that brings back full employment island-wide.

Grand Bahama enjoys unparalleled tax, stability and geographical advantages, giving it extraordinary potential for sustainable economic growth, but the Port Authority (GBPA) is no longer fulfilling its obligations to residents and licensees. The Hawksbill Creek Agreement came with many privileges, but it also obligated the Port Authority to sustainably develop Grand Bahama.

In recent years, the Port Authority has both failed to invest itself and also to attract other significant investment to generate sufficient quality employment. When Grand Bahama was ravaged by Hurricane Dorian, instead of stepping up to re-open Grand Bahama International Airport, the Port Authority and Hutchison abdicated their responsibilities by dumping the burden on the Government and, in so doing, abandoned their own obligations to Grand Bahama’s residents.

Admittedly the Port Authority goes through the motions of encouraging local entrepreneurs, and has been fortunate enough to attract a few new businesses. However, these initiatives do not begin to scratch the surface

of the challenge of creating full employment or revitalising sustainable economic development for Grand Bahama.

Re-establishing full employment will be achieved by attracting qualified investors who bring new resources to the island, both financial and intellectual, and who will commit to helping the island address pressing social issues such as improving education and income opportunities for all. They will be attracted to invest on Grand Bahama by a new Port Authority that leads by investing itself, works with partners to redevelop important infrastructure, and works with the Government to modernise the Hawksbill Creek Agreement.

BAHAMAS Bureau of Standards and Quality (BBSQ) executives last week met with European Union (EU) officials in a bid to build a stronger

exporting culture in this nation.

The hour-long meeting and site visit focused on a project to enhance The Bahamas’ quality certification infrastructure through the creation of a Metrology Laboratory that can affirm

the accuracy of weights and measurement.

BBSQ staff discussed the current status of the 24-month initiative, which is financed by the EU under the CARIFORUMEU Economic Partnership Agreement (EPA) and CARICOM Single Market

Despite other investments, Hutchison Whampoa has demonstrated its only interest is the container port. Hutchison has proven that it is not the development partner that the Government of The Bahamas or the Port Authority hoped it would be. As such, Hutchison should divest itself of the important real estate holdings it is not developing.

The Port Authority does not have the required financial and intellectual resources, or a productive enough working relationship with government, to uphold its development obligations so it should either sell to, or partner with, an entity that does. Currently, the Port Authority and Hutchison occupy the joint positions and the responsibilities of the island’s developers, but

and Economy (CSME) standby facility for capacity building, managed by the Caribbean Development Bank (CDB).

Pauline Curry, the BBSQ’s chairwoman, said: “We are grateful for the EU’s commitment to prioritising the value of accurate and reliable quality infrastructure for The Bahamas and, indeed, the region.”

The project aims to strengthen the services provided by BBSQ so that businesses can improve the quality of their products to meet local and international market requirements.

The project is expected to stimulate private sector development and facilitate trade by supporting export competitiveness.

Dr Renae Ferguson-Bufford, the BBSQ’s director, said: “The people and businesses of The Bahamas stand to benefit greatly from this initiative. As the project progresses, we look forward to an even stronger co-operation with the EU.”

they are unable or unwilling to fulfill their development obligations. Both entities should do so now or, get out of the way.

Grand Bahama not only needs new investment; it also needs to update its commercial practices to attract modern, dynamic industries. Red tape and unnecessary delays in approving new licenses, companies and business processes should be replaced by easy, transparent and efficient processes. Government should partner with a new Port Authority to streamline processes on Grand Bahama; processes that, if proven to be successful on Grand Bahama, could be introduced country-wide.

Reversing Grand Bahama’s decline is critical to the island and its people, but also to the country, because

Grand Bahama should be the engine that drives prosperity for all The Bahamas.

A change in Grand Bahama’s developers is overdue. As a longtime licensee I believe it is time for the Grand Bahama business community to band together, work with government and a new GBPA to implement the changes that will create full employment and help bring the island into the 21st century. As the nation celebrates its 50th anniversary of independence, there could not be a better time for Grand Bahama to get the new developers it deserves. If you share this wish, please reach out.

The visit showcased a metrology container laboratory that was mobilised at the BBSQ in January 2022. The laboratory will establish a sustainable industrial metrology service that includes an ISO/IEC17025 compliant quality management system, which allows calibration and testing in mass and volume.

The project is also providing BBSQ laboratory staff with technical training in the quality management system, which will enable the Bureau to produce accurate results that help Bahamian businesses build confidence in their products among local consumers and global export markets.

levy on medical claims payouts - a practice allegedly costing the Public Treasury millions of dollars. It added that one audit of an unnamed health insurance provider in 2021 showed it had “received over $20m illegally” through this mechanism.

The Ministry of Finance and BIA also disputed the latter’s assertion that the Government has been less than transparent with both the Bahamian public and medical profession, both of which will be directly impacted by the changed VAT treatment, and failed to properly consult with them.

“In our most recent meeting with the Ministry of Finance and the Department of Inland Revenue, we asked whether the Government intended to make a public statement regarding its decision. We received a one-word response: ‘No’,” the BIA alleged.

The Ministry of Finance, in its riposte, attacked the insurance industry for releasing a statement it asserted “relies so little on the facts”, while accusing the sector of “misconstruing” the two sides’ negotiations and seeking to “politicise a technical issue”.

It alleged that the BIA and its health insurance members had admitted they were applying the incorrect VAT treatment to medical claims payments, and the Government had agreed to their request for a transition period lasting months to adjust to the correct method. The Ministry of Finance, adding that it thought an “amicable solution” had been reached, also accused insurers of seeking to “unnecessarily alarm consumers” about the resulting cost impact.

Nevertheless, the battle between industry and government has ignited at a time when, according to the Prime Minister himself on Saturday, the Princess Margaret Hospital (PMH) is in “truly crisis” along with the rest of the public healthcare system.

Any increase in private medical costs thus threatens to drive more persons, unable to afford healthcare coverage, into an already overburdened and strained public system. Such a move would also represent a further cost hike just when hundreds of Bahamian households and companies are grappling with the inflation-driven cost of living crisis.

Tribune Business revealed in May 2022 that the Government and health insurance industry were negotiating to resolve their differences over the VAT treatment of medical claims payouts. At present,

insurers can deduct, or offset, the VAT portion of patient care bills submitted to them by doctors, hospitals and other medical facilities against what it pays to the Government from the 10 percent levy imposed on client premiums.

This practice, though, will end in two months’ time after the industry said it was told by the Department of Inland Revenue that it plans “to increase the VAT burden on medical, dental and vision” insurance from April 1, 2023. “Health insurance policies are taxable, and clients currently pay VAT on their premiums,” the BIA said.

“Like all other companies selling taxable products, insurance companies are currently able to recover VAT paid on health insurance claims and other inputs so that our clients’ VAT burden is only the VAT on their premiums. The Department of Inland Revenue intends to stop insurance companies from being able to recover the VAT paid on health insurance claims.

“This would mean that, in addition to continuing to pay VAT on their premiums, clients will now also be responsible for the VAT on the underlying medical service...... As an example, if the portion of a health insurance claim paid by the insurer is $5,000, the insurer currently pays VAT of $500 on that claim to the medical provider and recovers it from the Government. However, effective April 2023, the insured receiving the service would be responsible for paying the $500 to the medical provider.”

The Government’s position is that health insurance claims are being paid on behalf of the end-user, or consumer, and thus should be VAT-able with the 10 percent levy not recoverable by insurers such as Colina, Family Guardian and CG Atlantic. However, the industry is arguing that the Ministry of Finance is wrong to treat the payment of clients’ medical expenses and the treatment received as two separate services.

“The BIA has argued that health insurance is a means of financing medical care, and it is unreasonable and illogical to ignore the linkage between the two. As both health insurance and medical services are taxable, health insurance claims should continue to be tax-deductible for health insurers, otherwise the Government would be knowingly applying two layers of VAT to health insurance. The Government has rejected our position,” the BIA added.

“The Department of Inland Revenue’s new VAT rules will harm local healthcare providers. The rule

change increases the cost of using health insurance to access services from Bahamian providers. Insureds can escape this additional tax burden by receiving treatment overseas. This will reduce the clientele of Bahamian healthcare providers and increase the drain on our foreign exchange reserves.”

The Ministry of Finance, in its reply, argued that Bahamian health insurers have been applying an incorrect VAT treatment to claims payouts for the past eight years ever since the tax was introduced on New Year’s Day 2015. “For transparency purposes, the Department of Inland Revenue (DIR) in 2021, while conducting an audit of a health insurance company discovered the incorrect treatment of VAT paid to health providers,” the ministry said.

“Audit results revealed that the company claimed back the VAT as input VAT, although it was not a beneficiary of the service provided. This is clearly against the VAT Act. This company subsequently benefited by receiving over $20m illegally, that should have been paid to the Government.”

After finding similar issues during a VAT audit at another health insurer, the Ministry of Finance said it realised this might be an industry-wide issue. Talks were initiated between the BIA and its members on one side, and the Government - including the Prime Minister and Michael Halkitis, minister of economic affairs - to find a solution.

“In these discussions, the BIA acknowledged that health insurers were applying the incorrect VAT treatment and petitioned the Government for a transition period to apply the correct treatment. This offer was formally made to the Government by the BIA, and was formally accepted by the Government,” the Ministry of Finance said. “The attempt by the BIA to imply that this was a unilateral decision by the Government is again not factual.”

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

Simon Wilson, the Ministry of Finance’s financial secretary, last night told Tribune Business that the VAT Act simply does not allow health insurers to treat VAT payable on claims payments as an ‘input’ and recover this from the Government. “The issue is the ability of insurance companies to charge or recover ‘input’ VAT from health insurance claims. The issue is the law doesn’t allow that,” he said.

“The choice we have as a Ministry of Finance, as a government, was to allow this to continue or move the practice to be consistent with the law. That’s the choice we had. We looked around, did some comparisons and our advice - and advice from external persons - was he practice should be consistent with the law.

“The issue the industry identified was that they needed a transition. We gave them a transition. That goes up until April. The transition went almost 12 months since we identified the issue, and we thought we’d come to an agreement.” Mr Wilson said the VAT Act is aligned with “international best practice” on the issue, and disputed fears that

the changed treatment will increase medical bills, reduce private healthcare’s affordability and hurt the medical profession.

“I don’t know if that’s true,” he argued. “The reality is health insurance costs have bee rising by double digits prior to this change. I don’t think this is going to accelerate the rate of health insurance costs. Health insurance is a very competitive market. We don’t have a monopoly. We have several providers looking for market share. Certainly, on group insurance it’s very competitive, so I don’t imagine that dynamic changing, but we have to monitor it.”

Mr Wilson also voiced scepticism that increasing the VAT burden will drive Bahamians to seek medical care overseas as this will be offset by increased travel costs. “The rate of VAT on health services is not changing; there would be no double layering of taxes,” the Ministry of Finance said.

“What is changing is the treatment of this VAT paid by the health insurance company. This would be no different from treatment of VAT paid on insurance claims by general insurers as of April 1, 2023. Different companies will deal with

these adjustments in different ways. However, the health insurance market in The Bahamas is very competitive. The BIA is seeking to unnecessarily alarm consumers about this adjustment, and this is unfortunate.”

The Ministry of Finance also rejected the BIA’s assertion that it had adopted an “unorthodox consultation process”, and that the changed VAT treatment was “presented as a ‘fait accompli’ and our concerns and recommendations have largely been ignored”. The industry also accused the Government of failing to consult with, and notify, the public and healthcare providers of the change.

Mr Wilson, in response, said the issue did not rise to the level of a policy change or alteration to the VAT Act itself - events that would require advance consultation. He presented it as a “technical matter in terms of interpretation of the law” confined to one group of VAT taxpayers, which was typical of issues that the Ministry of Finance deals with regularly and does not require “any fanfare”.

SEEKING:

• Perform preventative maintenance on buildings including but not limited to: semi-skilled carpentry, painting, plastering, plumbing, cleaning, limited air conditioning and mechanical repair work.

• Replace light bulbs and related tasks.

• General cleaning tasks.

• Assist in the demolition and refit of vacant units.

• Perform beginner level plumbing work; clear obstructions from water and sewer lines.

• Inspect building facilities to identify building maintenance needs; complete inspection and preventive maintenance reports.

• Remove and or repair a variety of floor coverings such as carpeting, tile, wood.

• Operate a variety of mechanical tools and equipment such as drills, pressure washers, landscape equipment, and various hand tools required for carpentry, plumbing, and maintenance skills.

• HVAC – Inspect, clean, and maintain air handler units – including but not limited to: changing filters, wiping down units, ‘blowing out’ drains & adding bleach, minor insulation repairs, completing general services, etc.

• Monitor supply inventory.

• Be on call for emergencies.

For clarity, all tools and materials will be provided by the owner and must be used exclusively at the above owners properties. An inventory & check-in/check-out system is in place.

Salary: $325-$405 per week depending on skill and experience

Email resume to:

the Davis administration at last year’s COP27 climate conference, pledged to build 30 affordable homes using its carbon-negative concrete in Hurricane Dorian-ravaged Abaco this year.

“Our commitment is to move as fast as the Ministry of Housing can move,” Mr Fox said. “Currently, right now we’re in the starting blocks looking to have the first 30 homes done by the end of the year. Our facility at Arawak cay will be able to produce and meet the needs in our MoU

with the Government. The Government has a 3,000 home deficit on a a yearly basis structured on top of a 15,000 home deficit” to start with.

Describing Partanna’s tie-up with the Government as a true public-private partnership (PPP) that aimed to create a comprehensive climate smart, resilient solution while also meeting The Bahamas’ growing housing needs, the ex-NBA player added that the company will ultimately have the capacity to construct “anywhere from a minimum of 100 homes

a year up to 1,000 homes a year”.

“We’re building the facility at Arawak Cay to meet the demand,” he added, confirming that Partanna was proceeding through the required environmental and town planning approval processes, as well as securing the necessary utility connections for power and water supply.

Mr Fox said he hoped to have the Arawak Cay facility “set up by September”, and aiming to ramp up production through 2024 and 2025 to meet demand.

“We’re building a facility to meet the needs of the

1,000 in coming years,” he added, estimating that Patrtanna’s venture will ultimately create 300 jobs between its own factory, wider industry and homebuilding commitments with the Government.

“There will be tons of jobs created. Our building materials will be able to be passed on to others wanting to use them,” Mr Fox told Tribune Business. “Just here in the Bahamas over the next three years, as we develop our manufacturing capacity we will put $30m in the ground at Arawak Cay and develop further beyond that.

“We’re looking at making The Bahamas and region at large a carbon negative building materials industry.... We want to develop from here a hub for materials flowing through the Caribbean and into the US. We’re building an industry.

“That’s exciting because, as a country, the more industries you create, the more jobs you create, the more exports you create in

carbon-negative materials and building, that means as a country and community you become the leaders in that field. That’s what I’m most excited about. We’re a country that has taken the initiative and steps to not only save ourselves but, quite frankly, save others.”

Partanna’s concrete employs recycled steel slag and brine. Its binding components are designed to absorb carbon dioxide as they cure in production, and continue to do so throughout their lifecycle. The company says a 1,250 square foot home constructed by itself, and employing its concrete product, removes 22.5 tons of carbon dioxide from the Earth’s atmosphere while a standard home of the same size actually emits 70.2 tons.

Mr Fox formed Partanna in partnership with architect Sam Marshall. Both have witnessed the devastating impacts of climate change, the former with the aftermath of Hurricane Dorian in Abaco, and the

latter via the wildfires that have frequently ravaged the US state of California. The two thus developed a shared interest in climate resilient, sustainable building materials, with Mr Marshall having worked on the concrete solution for seven years, and Mr Fox some three-and-a-half.

While acknowledging that concrete’s central role in construction and development is “not leaving us any time soon”, Mr Fox said the product was responsible for 8 percent of pollution, with the building industry at large generating some 38 percent. This led to their focus on creating a sustainable, climate-resilient solution to the traditional products presently employed worldwide.

“Partanna cannot build enough to be a threat to the construction industry at large,” he conceded. However, his ambitions are for it to provide a growing sustainable alternative to traditional concrete and cement products for developers and contractors increasingly seeking out climate and environmentally-friendly materials.

“I believe we can incentivise choice in the way we build. I believe we can have the impact that Tesla has had for the vehicle industry. We can be that for construction,” Mr Fox told Tribune Business. He added that the costs of Partanna’s concrete was “on par, right in line” with rival traditional cement and concrete when it came to the finished product.

Agreeing that Partanna is “going to disrupt, and is disruptive for the construction industry” with its concept of carbon-negative building materials, the former LA Lakers player added: “It’s the most impactful way to provide solution-based action. We’re talking about action. It’s all in the execution as we move to ramp up. We’re just executing; more action, less talk.”

Artificial intelligence (AI) was an often-used word on Wall Street last week. A few days after Microsoft announced the lay-off of 10,000 employees, a billion dollar deal was unveiled. The company revealed last Monday that it had made a “multi-year, billion dollar investment” in OpenAI, a company which develops products such as ChatGPT.

The software from OpenAI has been available free of charge since November 2022. Within a week, over one million users tried to get the ChatBot to chat. GPT stands for Generative Pre-trained Transformer, and is the prototype of a chatbot, which is a text-based dialogue system as a user interface based on machine learning. The AI is being trained with an enormous amount of data. The system can respond to human text input. Simple knowledge

questions can be answered on command, but computer code can also be written, or a business plan drawn up. The investment amounts to $10bn according to insiders. Microsoft had already invested $1bn during the start-up phase. In the meantime, founder Sam Altman has changed the company structure so that part of the OpenAI team is allowed to generate profits. The company describes itself as a “limited profit” firm. This structure will remain after the investment by Microsoft. Analysts, however, see the partnership for Microsoft as an opportunity to earn a lot of money. Because ChatGPT is one of the most innovative AI technologies in the industry, Microsoft is acting aggressively on this front and does not want to be left behind on this

potentially game-changing AI investment. Microsoft announced earlier this month that it intends to integrate ChatGPT into its Azure cloud service. In addition, Microsoft wants to make the service available to all its business customers after the OpenAI applications were initially only available to selected users.

The text generator, ChatGPT, and the image generator, DALL-E 2, are among the best-known AI models from the research organisation founded by Elon Musk, Peter Thiel and other investors. The partnership is now entering its third phase, as Microsoft announced. It will expand the development and use of specialised supercomputer systems to accelerate OpenAI’s groundbreaking independent research. There is speculation about

Will Hold a Secret Ballot Poll

On Tuesday 28 February 2023 from 9:00 a.m. until 5:00 p.m.

At the Cafeteria BPL Head Office (Peter I. Bethel Building) on Blue Hill Road, New Providence and at The Labour Department Offices in Abaco, Eleuthera and Exuma

All Officers and Financial Members are asked to attend and cast their vote.

an integration of the technology in Microsoft’s search engine, Bing, as well as in the Office products. But this amazing technology also carries a lot of risks. Job loss, for example. And also the creation of nonsense and ideological colouring. So far, little is known about how ChatGPT chooses the texts that

go into its responses. The AI is based on the number of texts and opinions that are available on the Internet on a topic. In extreme cases, this means that if more people claimed that the earth is flat than round, ChatGPT could adopt this misinformation.

The savvy investor will keep an eye on AI.

FROM

now “materially less” than when the initial offering was placed in May 2022 at the pandemic’s height.

Now, with the cruise industry returning at volumes higher than 2019’s pre-COVID record, Mr Maura told this newspaper that Nassau Cruise Port is justified in seeking to refinance at lower - albeit “competitive” - interest rates for investors. Declining to give specifics, he indicated that the cruise port operator is seeking to slash its bond interest coupon by a few percentage points to cut annual debt servicing costs. The Nassau Cruise Port chief justified the move by pointing to multiple indicators of the project’s improved risk profile, including projections that total cruise passenger arrivals for 2023 will exceed four million and beat 2019’s preCOVID record of 3.85m. This, in turn, will produce

increased income for the port operator, whose revenues are driven by the volume-based passenger and port facility charges that, combined, are increasing due to inflation.

“The quick answer is that we’re looking to refinance just in order to get the benefit of the fact that our project is nearing completion,” Mr Maura disclosed. “Generally, the risk level of the project, and of the port, is much less today given that we’re on the backside of the pandemic.

“At the time we went into that debt raise in May 2020, the industry had shut down and money cost us 8 percent [interest]. We did over 3.3m passengers in 2022, a portion of which was in and during the pandemic. Our 2022 fourth quarter exceeded the 2019 fourth quarter, so clearly the industry is on the rebound.

“The six berth we’ve constructed has already yielded us great results in the form

of over 26,000 passengers on a given day. We’ve had several days with over 25,000 passengers. That indicates that pier is paying for itself, and in four months we will begin the process of opening the upland areas and generating landlord income and ancillary fees incidental to the port and passenger facility charges,” he continued. “We just felt the timing was right. There’s a lot of good news out there about our project. The risk levels today are far less than they were in May 2020. We’re just looking to realign the cost of capital with the risk level.” Mr Maura spoke after Nassau Cruise Port confirmed it will redeem the bond debt, split into a $102.16m Bahamian dollar tranche and $32.24m of US dollar financing, on April 30, 2023.

Asked how optimistic he is on the likelihood existing investors will seek to rollover, he added: “I think

we’re confident. The fact we’re doing the refinance tells you we’re confident. If we felt there was a material risk we would not be able to rollover the debt at a lower rate we would not be doing it.

“Our expectation is that we would be able to roll this over. We hope and expect they will have confidence in this project to reinvest their money at a lower but competitive rate. The risk today is materially less than the risk in May 2020. This project has already demonstrated the strong demand the cruise industry has for The Bahamas, for Nassau. Our confirmed bookings for 2023 are over four million passengers, and confirmed bookings for 2024 are over 4.4m passengers.

“The future is very bright, and considering that 2019 at 3.85m passengers was a record for Nassau, we will beat that this year. That underlines the value proposition of Nassau Cruise

Port, the wider Bahamas, and the confidence the industry has in our government and the operation of Nassau Cruise Port and the future that New Providence offers to the tourism sector.”

Mr Maura said CFAL, which led the original 2020 bond offering, is again leading the refinancing this time around. An offering memorandum, detailing Nassau Cruise Port’s progress and revised financial projections, is now being finalised for presentation to existing bond holders and the wider capital markets.

Meanwhile, the Nassau Cruise Port chief confirmed that the port’s main revenue earners are increasing in line with inflation. The port and passenger facility charge, which were a combined $8.50 in midNovember 2019, have been adjusted upwards to just over $9 for 2023.

“Those are our principal charges, and charges

that are going to drive 90 percent of our revenues at Nassau Cruise Port,” Mr Maura said. “Those charges go up by the US Consumer Price Index each year, and in 2023 those charges went up by 6.8 percent. The 6.8 percent was a figure provided to Nassau Cruise Port by the Ministry of Finance.

“Not only did they authorise us to increase the passenger and port facility charge by 6.8 percent, but Nassau Cruise Port will pay the Government 6.8 percent more on 2023 on the lease. We also received notice from the Ministry of Finance in December 2022 that the US consumer price index increase for January 2024 will be 7.1 percent.

“The Ministry of Finance gives one year’s notice. In effect, there’s a one-year lag that’s intended to allow us to give the cruise industry a year’s notice of the increase so they can adjust their pricing to their consumers in sufficient time.”

Jarol Investments Limited is seeking to fill the following position:

• Maintains accounting records by making copies; filing documents.

• Counting cash and verifying amount received with Z reports.

• Maintains accounting database by entering data into the computer; processing backups.

• Preparing bank deposits.

• Protects organization’s value by keeping information confidential.

• Updates job knowledge by participating in education opportunities.

• Accomplishes accounting and organization mission by completing related results as needed.

• Compiling daily cash collection report.

Interested persons should email their resume to careers@ chancesgames.com. or visit our Head Office on Prince Charles Drive (across from Restview Funeral Home) between the hours of 9 a.m. to 5 p.m.

of the United States

Vacancy Announcement

The American Embassy in Nassau is accepting applications for the following position: Supply Clerk (Expendables)

Open to:

All Interested Applicants/ All Sources

Duties:

Manages the delivery, issuance, storage, disposal, and inventory control of expendable supplies. The position is in the General Services Section and under the supervision of the GSO Property Supervisor or Designee

Interested candidates are required to possess the following skills and qua lifications:

• Education: Completion of high school education is required.

• Experience: A minimum of two (2) years of experience in supply/warehousi nwexpendable s or property/supply management is required.

• Language: English level Ill (good working knowledge) Written/Speaking/Reading. This may be tested.

• Skills & Abilities: Computer competencies including basic skills in Microsoft Office applications. This may be tested. Must have had a valid, current driver's license for a minimum of five (5) years. Must be able to lift a maximum of 51 lbs. (23kg) under OSHA standards.

The complete Vacancy Announcement and Application forms are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs

Applications will not be accepted at the Security Gate o f the Embassy, by Mail, E-mail or other means of delivery.

Opening Period: Mondav Januan 23 - Fridav February 3, 2023.

Due to the high volume of applications, unsuccessful candidates will not be contacted.

CLUB Med is making “money flow through the island” as regular direct flights bringing guests to the San Salvador-based resort resumed last week after a near three-year absence.

Alison Mortimer, owner of Tiny’s Beauty and Drug Supply, told Tribune Business that “everybody is happy” on San Salvador since direct service from Europe resumed. “Let’s pray to God that the hotel stays open, and pray that there is no pandemic and no virus coming around. So let’s just hope that it stays open,” she said.

“Every week they have a full flight from Paris just about, and it’s always over 150 guests on the plane.

They also have Air Canada and Bahamasair coming to bring guests into the resort. So we’re doing good; the resort is full of people.”

The “money is flowing through the island now, and you can feel it” was the general sense among San Salvador residents spoken

to by this newspaper. Club Med was shuttered for two years due to the health and travel-related fears sparked by the COVID-19 pandemic, with the resort’s operators concerned about the ability of the island’s healthcare facilities to handle any emergencies.

Ms Mortimer, meanwhile, warned employees at the resort to “take the job seriously. Don’t do anything that would cause the owners to have a negative view of San Salvador to have to close down the resort any time soon”.

Vanessa Rolle, D&W Car Rental’s general manager, said a flight carrying 275 passengers arrived in San Salvador last Thursday which was “really good for business”. She also manages a small convenience store, and has seen a significant uptick in business at both operations due to island residents whose incomes and spending power have been boosted by employment at Club Med and spin-off opportunities.

Tourists venturing offproperty from Club Med have also impacted business, and Ms Rolle said: “They’re coming around and

FROM PAGE B2

The metrology container has been furnished with cabinetry, balance tables, laboratory supplies, air conditioning and a humidifier to meet International Standards Organisation (ISO) criteria, and the procurement of laboratory equipment will soon begin.

The BBSQ has also engaged with industry stakeholders from pharmaceuticals and healthcare, plus manufacturing and energy, to highlight the benefits of the metrology container laboratory and to better understand private sector needs.

Aniceto Rodriguez Ruiz, head of co-operation for the

EU’s mission to Jamaica, Belize and The Bahamas, said: “We are pleased to support this project as it promotes trade as a vehicle for development. By helping national authorities certify quality standards, we are helping small and mediumsized enterprises to attract and access the biggest export markets in the European Union.

“We are also protecting 460m consumers from problems that could arise without standards of quality.” The EU team’s visit is part of a wider mission to The Bahamas to meet with institutions who have benefited recently from the 27-nation bloc’s cooperation projects.

INTENT TO CHANGE NAME BY

DEED POLLThe Public is hereby advised that I, KERLENE ESTHER JOHNSON of Township, Marsh Harbour, Abaco, Bahamas, intend to change my name to KERLENE

ESTHER JOHNSON BURKE LUNDY If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

INTENT TO CHANGE NAME BY

DEED POLLThe Public is hereby advised that I, ANISHKA SHENIQUA LATOYA ROLLE of Turtle Drive, Bel Air, Estates, New Providence, Bahamas, intend to change my child’s name from DAVAUGHN KIPLIN LEROY FAWKES to DAVAUGHN CORDELL TREVOR ROLLE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O. Box N-742, Nassau, New Providence, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE is hereby given that TURISSA NELLIE PRUDENT of Village Road, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 23rd day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

sightseeing, and they want to stop in and get a water. They have a lot of things at Club Med, but if they want to buy other little toiletries and other little things then they come by.

“I’m excited because it’s bringing more business for me, but the only draw back is that the resort took all of my workers from me. They all left to go to work for Club Med, and now I have to

find new employees, but this is a good thing.”

Besides worker shortages, accommodation on San Salvador is another challenge. Ms Mortimer said Club Med has been

feverishly looking for additional housing for staff, but the island is now near capacity. “They may have to build their own living quarters,” Ms Mortimer added.

NOTICE is hereby given that SHAMIKA LAUREN RUSSELL, of P.O. Box EE-15052 #23 Corolita Lane, Culmer’s Vill, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 30th day of January 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

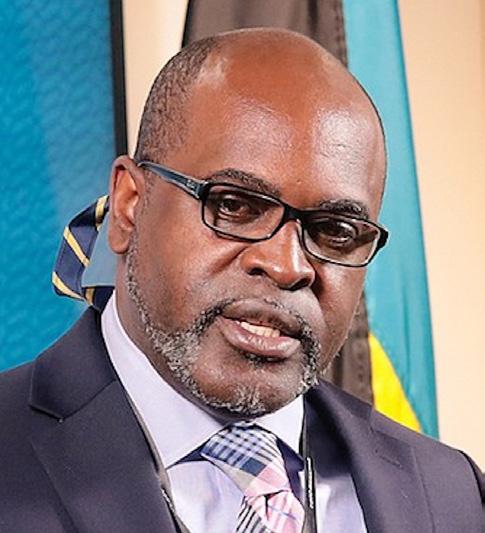

THE Attorney General has blasted what he described as “special interest groups” for their “sordid hit jobs” on the reputation and competitiveness of The Bahamas and other international finance centres (IFCs).

Ryan Pinder KC, addressing the Central Bank’s fourth anti-money laundering (AML) research conference, said the two days of discussion that it fostered should “confirm or dispel” the “conjecture of the various international supranational and special interest groups”.

“These groups have gone to great lengths over the years to paint international financial centres in the

poorest of lights regarding taxation and money laundering without much solid evidence to support their sordid ‘hit’ jobs,” he argued.

“In fact, international financial centres like The Bahamas clearly demonstrate that despite our small sizes and a diversity of external threats, we still punch above our weight, have better regulation, and rate higher than the large

economically powerful countries who actually make the international rules and regulations.”

Mr Pinder did not name these “special interest groups”, but it is highly likely he was referring to the likes of the Organisation for Economic Co-Operation and Development (OECD), European Union (EU) and even the Financial Action Task Force (FATF). All

three, at multiple points over the past two decades, have blacklisted or listed The Bahamas for being noncompliant or uncooperative on some aspect of its taxation and/or anti-financial crime regulatory regimes.

Hailing the conference’s track record for providing credible data on anti-money laundering and counterterror financing efforts, Mr Pinder said The Bahamas has implemented critical legislation that includes the Proceeds of Crime Act 2018 and the Financial Transactions Reporting Act 2018.

He added: “As FTX Digital [Markets] Limited is a hot button current issue, The Bahamas would like to advise that the Digital Assets and Registered Exchanges Act (DARE) was passed into law in December 2020. The provisions of this legislation allowed for the country to take swift action to place the company into provisional liquidation as warranted in November 2022.

“The operations are being dealt with within the

confines of the insolvency laws of The Bahamas, with the assets under the control of court-appointed liquidators and the regulator, the Securities Commission of The Bahamas. The DARE Act, and the guidance and rules of the Securities Commission of The Bahamas, allowed The Bahamas to become compliant with recommendation 15 of the FATF as it pertains to virtual asset service providers (VASPs).

“Recommendation 15 requires that VASPs be regulated for anti-money laundering and countering the financing of terrorism purposes; that they be licensed or registered; and subject to effective systems for monitoring or supervision. I think it appropriate to mention that The Bahamas is one of the few, if not one of the first countries in the world, to be fully compliant with Recommendation 15 as it pertains to virtual asset service providers.”

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

Embassy

is accepting applic ations for the following position:

Trades Helper

Open to:

All Interested Applicants / All Sources

Duties:

Assists skilled technicians i n the perfom1ance of maintenance and repair work. The incumbent will also be assigned tasks to include material handling, painting, custodial type work, common laborer work, and grounds maintenance and gardening work.

Interested candidates are required to possess the following skills and qualifications:

• Education: Completion of Seconda ry school is required.

• Experience: A minimum of two (2) years of maintenance or construction semi-skilled work experience in skilled trades such as mechanical (HVAC and Plumbing), electrical, carpentry, with significant focus on building systems.

• Language: English (Limited knowledge) Written/Speaking/Reading. This may be tested.

Skills & Abilities: Must have had a valid, current driver's license for a minimum of five (5) years.

The complete Vacancy Announcement and Application forms are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs

Applications will not be accepted at the Security Gate of the Embassy, by Mail, E-mail or othe1· means of delivery.

Jarol Investments Limited is seeking to fill the following position: Surveillance

• Monitor operations to ensure compliance with safety or security policies or regulations. Observe individuals’ activities to gather information or compile evidence.

• Operate surveillance equipment to detect suspicious or illegal activities.

• Discuss performance, complaints, or violations with supervisors.

• Monitor establishment activities to ensure adherence to all gaming regulations and company policies and procedures.

• Observe gaming operations for irregular activities such as cheating or theft by employees or patrons, using audio and video equipment.

• Report all violations and suspicious behaviors to supervisors, verbally or in writing.

• Act as oversight or security agents for management or customers. .

• Be prepared to work within a shift system

• Retain and file audio and video records of gaming activities in the event that the records need to be used for investigations.

• Perform other related duties as assigned by Management.

Interested persons must require surveillance experience, certification, training, communication skills, attention to detail, ability to work independently and should apply at Jarol Investments Limited Head Office, Prince Charles Drive (Across from Restview) between the hours of 9am to 5pm. Or send your CV to careers@ chancesgames.com Subject: Surveillance Officer – Your Name

economic growth, but the Port Authority is no longer fulfilling its obligations to residents and licensees. The Hawksbill Creek Agreement came with many privileges, but it also obligated the Port Authority to

sustainably develop Grand Bahama,” Mr Crane wrote. “In recent years, the Port Authority has both failed to invest itself and has also failed to attract other significant investment to generate sufficient quality employment. When Grand Bahama was ravaged by

Dorian, instead of stepping up to re-open Grand Bahama airport... the Port Authority and Hutchison abdicated their responsibilities, dumping the burden on the Government and, in doing so, abandoning their own obligations to Grand Bahama’s residents.”

Mr Crane said Hutchison Whampoa, the Hong Kong-based conglomerate, had shown it was “only interested” in Freeport Container Port and the harbour. While it holds a 50 percent equity stake and management control in Grand Bahama Development Company (DevCO), it has long been viewed as ‘land banking’ rather than developing the thousands of acres under its control.

“Hutchison has proven that it is not the development partner that the Government of The Bahamas or the Port Authority hoped it would be. As such, Hutchison should divest itself of the important real estate holdings it is not developing,” Mr Crane argued.

“The Port Authority does not have the required financial and intellectual resources, or a productive enough working relationship with government, to uphold its development obligations so it should either sell to, or partner with, an entity that does. Currently, the Port Authority and Hutchison occupy the joint positions and responsibilities of the island’s developers, but they are unable or unwilling to fulfill their development obligations. Both entities should do so now or, get out of the way.”

Arguing that change is long “overdue”, he added that “reversing Grand Bahama’s decline” is critical not just to Freeport and the wider island but because it “should be the engine that drives prosperity for all The Bahamas”. Mr Crane’s comments likely reflect the views of many other GBPA licensees, and also

align with Friday’s call by the late Sir Jack Hayward’s grandson “to reimagine and revolutionise” the Port Authority.

Mr Crane, speaking to Tribune Business yesterday, said he first came to Freeport in 1968 and has been a witness to much of its development, growth and struggles. “I’ve seen it stall, I’ve seen it decline and it’s time for change,” he said. “Grand Bahama has a lot of problems that are immensely solvable, but they are not solvable by the people occupying the top positions at the developers.

“I found it an incredibly wonderful place to do business and development, and it breaks my heart to see it the way it is. I really care about Grand Bahama. It’s been my home for 50 years. My perspective is that the community has been hollowed out because so many people have left. People that can get up and go have gotten up and gone.”

Mr Crane’s comments come as Rupert Hayward on Friday pledged “an ambitious masterplan for change” to create “thousand of jobs” in Freeport, while backing Prime Minister Philip Davis KC’s stance that Grand Bahama is “in desperate need of progressive and transformational change”.

Speaking after this newspaper revealed the Government is exploring its options over how to bring about Freeport’s revival through what some believe could be the greatest transformation in the city’s management since its founding treaty, the Hawksbill Creek Agreement, was signed in 1955, Mr Hayward indicated his family

intend to play a central role in this by acting as a Bahamian partner for “blue chip” foreign investors.

While providing no specifics, Mr Hayward told this newspaper he has already submitted “a new partnership” proposal that “can attract billions of dollars in investment [and] create thousands of jobs” for Freeport and the wider Grand Bahama to the Davis administration.

The Government is presently examining whether change at the GBPA is best achieved through either a private buyer acquiring the Hayward and St George families’ ownership interests, the Government doing itself or the regulatory and quasi-governmental powers being devolved back to Nassau.

Mr Hayward’s statement indicated he is seeking to restructure the GBPA and its relationship with the Government such that the latter has more say over Freeport’s running and future through “a true Public-Private Partnership” that represents the interests of all parties including city residents and GBPA licensees.

The GBPA, while described by some as a ‘regulatory shell’, still possesses considerable powers that include business licensing, building code and environmental enforcement, city management, and the power to levy fees and service charges together with the operation of a free trade zone that offers multiple forms of tax relief to investors.

However, its incomeearning assets have been transferred to Port Group Ltd. These include the 50 percent equity stakes in DevCO and the Freeport Harbour Company, likely to be the two families’ most valuable assets, together with interests in multiple other companies such as Freeport Commercial & Industrial, another major landowner.