By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

VICTIMS of CLICO (Bahamas) implosion have made an impassioned call to the Government not to forget their continuing plight with an estimated $35m still required to make them whole.

Bishop Simeon Hall, who was among those impacted by the life and health insurer’s 2009 insolvency, told Tribune Business that the present focus on FTX contrasts sharply with the attention paid to the financial fall-out for hundreds of Bahamians who still have to fully recover their life savings and retirement income.

Agreeing that many CLICO (Bahamas) investors, especially those who

surrendered their policies, feel neglected and abandoned by society, he called for “a champion of the small man” given that the losses of expatriate millionaires and billionaires seem to take priority over those suffered by lower and middle income Bahamians.

“I think the people in authority have forgotten it. On the list of priorities CLICO might not be in the top 30. That’s how low

on the list it has become because they have their hands full,” Bishop Hall, now retired, told this newspaper of the Government.

“I just want to raise it again because every now and then I meet persons who say they have not got their monies; some got some of their monies, and some did not get anything at all.

“It’s been such a long time. A lady in the drug store the week before last,

she was literally in tears saying that she put all her money in CLICO, is now retired and can’t get what is owed to her. I lost thousands of dollars but I got a little something back. I’ve got about two-thirds of what was owed to me.

This thing with FTX has

PAGE B6

‘Don’t be led like sheep to the digital slaughter’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIANS were yesterday told “don’t be led like sheep to the digital slaughter” with a businessman arguing that the stance taken by some government agencies in not accepting cash was illegal.

Ethric Bowe, who helped lead the private sector’s push for relief over the New Providence Road Improvement project more than a decade ago, asserted that the public sector as well as businesses must continue to accept cash payments given

that the Bahamian dollar remains legal tender.

Pushing back against what he described as efforts to drive Bahamians into “a

AG: FTX US chief admits attacks ‘misguided’ by deal

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FTX’s US chief has admitted his attacks on The Bahamas’ integrity were “misguided” by agreeing to work with the failed crypto exchange’s local liquidators, the Attorney General argued last night.

Ryan Pinder KC, speaking after John Ray put his name to a statement vindicating the Securities Commission’s actions in protecting

FTX’s Bahamian liquidators to to control $46m Tether assets

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FTX’s Bahamian provisional liquidators have gained control of $46m in Tether stablecoins as part of their “co-operation” deal with the crypto exchange’s US chief that creates a “path forward” to resolve all remaining disputes.

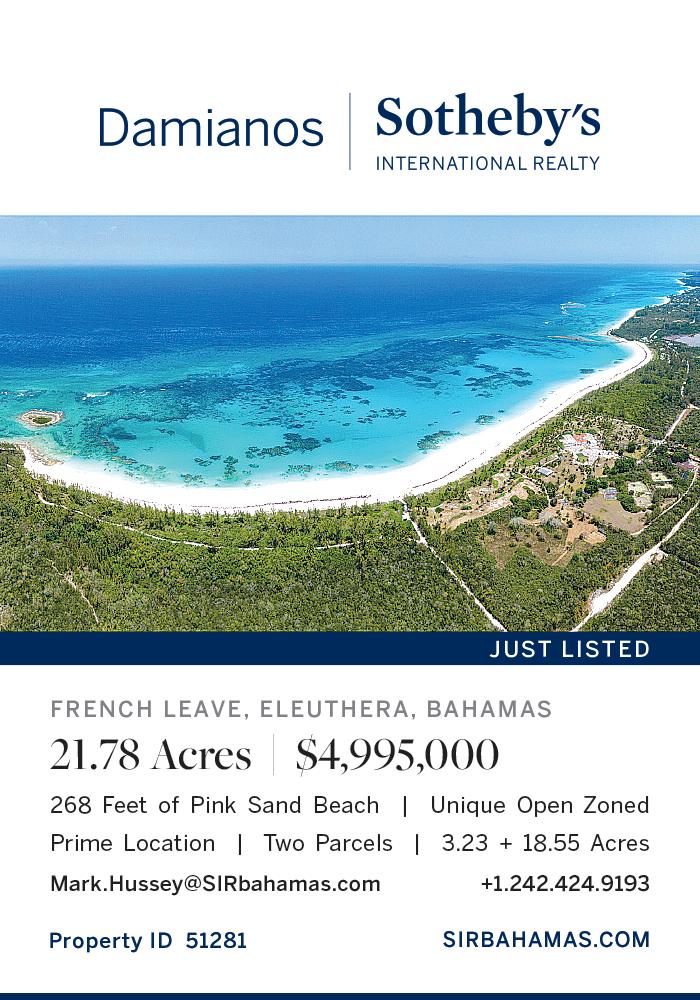

The agreement, which was filed in the Delaware federal bankruptcy court over the weekend, will also see the Bahamian trio “take the lead” in selling the $256.3m worth of high-end local real estate that FTX acquired prior to its spectacular implosion in early November 2022. They will be responsible for “arm’s length” marketing of these properties to

business@tribunemedia.net MONDAY, JANUARY 9, 2023

assets belonging to clients of FTX’s Bahamian subsidiary, told Tribune Business this was further evidence that the regulator

SEE

SEE

PAGE B12

PAGE B9

SEE

PAGE B7

CLICO victims: Don’t forget our $35m need

SEE

BISHOP SIMEON HALL

•

RYAN PINDER KC

• Cries: ‘We need champion of small man’ • And says: ‘Be more judicious on investors’

Former Bishop contrasts with FTX focus

$5.85 $5.86 $5.83 $5.21

ETHRIC BOWE

Volatility appears to be further increasing in an already-shaky environment. Risks and threats can be precursors to crisis situations for companies and non-profit organisations. The importance of understanding and preparing for these obstacles will intensify and cannot be overstated. From my conversations with senior executives, and risk and compliance professionals, the following is an overview of what business leaders and Boards can expect in 2023.

Conflicts of Interest management

Generally, in the context of Boards of Directors, a conflict of interest occurs when a member has multiple interests that can influence their actions or votes. Conflicts of interest must be managed carefully by directors. A mishandling of these personal conflicts can often cause

Derek Smith By

directors to breach their fiduciary duties to a company, its shareholders and employees. For example, it is common for directors to make the mistake of withholding material information from their fellow directors due to a misunderstanding that a duty of confidentiality to a third party excuses them from

disclosure responsibilities. When directors owe duties simultaneously to an investor or commercial partner of the company, as a result of their other relationships, navigating these ties can be particularly challenging (especially for sponsor designees serving on portfolio company boards). It is important to note that directors are not entitled to exculpation or indemnification for breaches of their duty of loyalty. During distress, personal liability for violations of the burden of loyalty is exceptionally high.

Risk oversight

Challenging environments may prompt specialised Board committees and minutes that reflect the nuances of the company. In critical operational areas, directors are expected to set up customised control systems that will allow them to detect and respond to red flags

as quickly as possible. It is essential that the Board creates specialised committees to monitor discrete risks, or ensures that the review of these risks falls within the purview of the existing committees. It is also essential to require managementlevel teams to report these risks to the Board periodically, and to engage outside experts to conduct risk audits to determine if mission-critical areas are being identified and appropriately addressed.

A Harvard Business Review article, entitled ‘2023 annual letter to Boards’, explained: “Cursory recording of the business transacted at Board meetings, or simply attaching decks to sparse minutes, will be given little weight in a Board’s defence of claims that it failed to fulfill its duty of oversight, particularly in connection with any motion to dismiss a complaint.” Meeting minutes should include the

circumstances and analysis considered in reaching a decision, and a list of follow-up requests by management. The minutes of subsequent meetings should reflect whether management has followed up with the Board, and whether the Board is satisfied with the response, or if additional follow-up is necessary.

Furthermore, director interactions between formal meetings, especially if they relate to significant Board issues, should be recorded in the minutes (through addenda and introductory paragraphs).

Pressures relating to privacy and regulation

According to Gartner Inc, by the end of 2023, “65 percent of the world’s population will have their data protected by modern privacy regulations”. Over 250 pieces of legislation dealing with cyber security were introduced or considered in 2022 in nearly 40 US states.

OPPOSITION: IS CUSTOMS BROKER ‘INTEGRATION’ LEGAL?

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Opposition’s finance spokesman last night queried whether the Customs laws and regulations must be changed before mandating that brokers acquire third-party software to “integrate” with its electronic import clearance system.

Kwasi Thompson, also east Grand Bahama’s MP, described the move as “unfair and possibly illegal” while also suggesting that it will undermine the ease and cost of doing business in The Bahamas. He spoke out after one Grand Bahama-based Customs broker spoke of his resentment at being forced to acquire software for integrating with the Electronic Single Window (ESW) known as Click2Clear.

Antoine Brooks, Island Traders Shop & Ship’s managing director, told Tribune Business: “The Customs Department offered to get us a free integrated system, but they never got back to us. I can’t do anything about the changes. I don’t agree with them. But if they are going to implement something new I thought they would give us something free to use, but it seems as if they have gone back on their words on that.

The cost is getting to me. We can’t pay that cost on a recurring basis, and they want us to have this in place for January 15. It is an alarming precedent that’s going on with the Government. They did it with the grocers and they did it with the pharmacies, and are doing it to us now. They

just constantly keep implementing these programmes with no type of dialogue and no type of communication with the stakeholders.”

Customs had previously mandated that brokers elsewhere in The Bahamas be fully “integrated” with its electronic goods clearance platform, Click2Clear, by January 2, 2023.

A flyer on the initiative, published last year, warned brokers, in-house brokers, retailers and wholesalers that all major importers “must submit Customs declarations via integration to Click2Clear. Bahamas Customs will not accept manual declarations nor documents. Only integration submissions will be accepted”.

The flyer named two suitable suppliers of the necessary software “integration”, Information Systems Ltd (ISL) and its SWIM product, and GAAC. However, rather than mandate that brokers and major importers use the services of either of these two entities, the Customs flyer said firms can “seek the services of an independent program developer”.

A subsequent January 3, 2023, notice warned that from Tuesday last week “integration is mandatory for the submission of declarations by all parties”. Previously, entries could be submitted directly to Click2Clear, but they now can only be processed through “integrated” third-party software - something that brokers have said adds to the cost of doing business.

Mr Brooks still feels pressured into purchasing one of the providers named by the

Government. “If we want to continue in business we have to pay one of those companies to be able to go on, and we have no choice because this is our livelihood,” he added. “We all are against it and we all hate it, but what are we going to do?

“Mr (Simon) Wilson, (the financial secretary), is always saying in the press that this is not a mandatory thing, but it is mandatory because if we don’t use the new integration we can’t get on to the system to satisfy our customers. Our business comes to a standstill. So don’t say it isn’t mandatory when it is mandatory.”

The Ministry of Finance has been pushing the “integration” because it is presently unable to obtain the data it requires under Click2Clear’s present system. It has also complained about misclassified tariff headings and other problems with entries.

Mr Thompson, in his statement, said: “We are reliably advised that the Ministry of Finance is now forcing all Customs brokers to implement a costly computer integration system in order to use Bahamas Customs Click2Clear system. They must also pay a monthly fee just to maintain the computer integration. This is an added cost and added burden on the backs of small businesses who already are struggling to survive.

“This unfair decision raises several questions. Is this legal? What legal statute gives the Ministry of Finance the authority to impose this charge? Why is Customs’ system itself not being changed to make the necessary integration? Wouldn’t

this be the more secure way of dealing with these issues? Why are brokers being asked to pay for this costly integration? Why is the Government refusing to listen to the business community and the broker community in implementation?”

Continuing with his questions, Mr Thompson added: “How can the Government prevent a duly-licensed Customs broker who has paid his fee from operating in The Bahamas if they have not implemented this new system? Wouldn’t the Customs Management Regulations need to be amended in order to make this mandate legal?

“Many Customs brokers have continued to complain that the integration is unnecessary, and the same conclusion could be accomplished in another way that does not involve the heavy expense to Customs brokers who have indicated that the cost will unfortunately be passed on to the public. The Government’s implementation of the new integration has lacked clarity, caused much confusion, and increased the costs of doing business in the Bahamas.

“This will ultimately increase the burden for all Bahamians and increase the costs for all imported goods including food, building supplies and all essential items. The Government should be finding ways to fight inflation. However, they are making import costs even more expensive. We call upon the Government to reverse its course and fulfill its promise to bring relief to the people of The Bahamas.”

Conclusion

In short, as a result of these market dynamics, successful companies will need to prepare carefully, take a focused approach and take decisive action while still being agile enough to meet the challenges that will come their way.

• NB: About Derek Smith Jr

Derek Smith Jr. has been a governance, risk and compliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfsburg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certified anti-money laundering specialist (CAMS), and the compliance officer and money laundering reporting officer (MLRO) for CG Atlantic’s family of companies (member of Coralisle Group) for The Bahamas and Turks & Caicos.

Bahamian crowdfunder targeting help for Haiti

A BAHAMIAN crowdfunding platform yesterday said it is exploring initiatives ranging from the listing of international foreign currency bonds to potential financial solutions for Haiti’s rebuilding.

ArawakX, in a statement issued yesterday, said it was eyeing multiple opportunities beyond The Bahamas’ borders in the wider Caribbean at a time when Prime Minister Philip Davis KC has assumed CARICOM’s chairmanship.

“We answered the call made back in May 2020 for a regional exchange, which was a key recommendation from Caribbean private sector representative, Dr Patrick Antoine, during a webinar organised by the Food and Agricultural Organisation (FAO),” said D’Arcy Rahming Snr, ArawakX’s chairman and chief executive.

“An exchange is a tool for economic expansion as it lowers the cost of capital and drives innovation. We are proud to say we are already accomplishing this across the region. In only 16 months, with our crowdfunding product we have been able to raise $2.4m for four issuers who have already expanded adding tens of new jobs. There are hundreds of companies in the pipeline, with the potential to hire thousands.

“One of our Bahamian clients has already expanded into another CARICOM country. We are in talks, through the IDB (Inter-American Development Bank), and with eastern Caribbean regulators, who have invited us to

PAGE 2, Monday, January 9, 2023 THE TRIBUNE

FIRMS WON’T BE ‘BOARD’ BY 2023 CORPORATE CHALLENGE

SEE PAGE B12

D’ARCY RAHMING SNR

‘TOO LATE’: FIRED GAMING BOARD EMPLOYEES CAN’T GET JOBS BACK

SEVENTEEN former Gaming Board employees, who were found to have been unfairly dismissed, have lost their bid for reinstatement some fourand-a-half years after they were terminated.

Senior justice Indra Charles, in a January 6, 2023, verdict found that the group had simply left it “too late” to seek to return

to their former jobs. She ruled that they should have moved far more rapidly to obtain a fresh reinstatement date from the Supreme Court as their rehiring prospects became “grimmer and grimmer as each day passes”.

Given that all 17 had been made redundant between October 2017 and February 2018, Justice Charles agreed with the Attorney General’s Office, which was representing the Gaming Board, that the

length of time which has elapsed made it impractical for the group to return to the casino and web shop regulator.

The ruling comes almost three years after Justice Charles first found, in February 2020, that 24 Gaming Board employees - split into eight managerial workers and 16 line staff - were “entitled to reinstatement, which should take place no later than June 30, 2020, and/or damages for wrongful and/or unfair dismissal”.

The 17-strong group, who were the subject of the judge’s early 2023 ruling, were among those 24. Justice Charles, in her initial verdict, slammed the Gaming Board’s failure to follow “clearly set out” employment law procedures when it dismissed the workers as “mind boggling”.

She suggested that the casino and web shop regulator had failed to adhere to modern industrial relations practices requiring

GYM OWNERS EYE NEW YEAR SPIKE IN BUSINESS

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

BAHAMIAN gym owners say business has increased by as much as 25 percent post-Christmas as persons move to work off the pounds gained during the holiday season.

Dr Kent Bazard, owner of Empire Fitness, told Tribune Business that such trends were a “regular thing” for the sector every time New Year hits as customers make good on their resolutions.

“Things taper off usually at around the end of

February, the beginning of March, but that’s when a lot of the marketing campaigns start to pick up around that time also,” he said, “media campaigns and other techniques for maintaining those new members that we got. So we know February and early March is when they start to drop off, so that is when we have to start targeting those people.”

COVID-19 is not yet behind gym owners, Dr Bazard emphasised, due to the close proximity between persons when they are working out in close quarters. “I do see a lot of people being eager to get back into fitness, and

get back into the gym, so we hope to see a continued increase, especially around the time where we are expected to have a drop off,” he added.

Jaime Thompson, Happy Hour Crossfit’s owner/ operator, said: “We’re definitely seeing a huge influx of people coming in for January. We have members coming back and new members joining in. We’re seeing about a 25 percent spike in new business now.”

While this spike is typical for Happy Hour Crossfit, he added that historically the business has retained its members all the way through October because

they are more “family oriented”. Mr Thompson added: “The members that join usually stick around, and then they head off for the summer to focus on things they didn’t have time to focus on while they were at work, and that typically lasts until October. Then, in October, it starts all over again and everything starts to pick back up.”

Describing it as a “pretty average” January season, Mr Thompson said the largest business increase experienced at this time was in 2021 when COVID19 restrictions were first lifted. This prompted many persons to return to the gym wanting to get fit.

employers to be candid and forthright with staff as it never showed how those workers were “chosen to be made redundant”.

And Justice Charles also ruled that the Gaming Board had failed to comply with both the Bahamas Public Services Union (BPSU) industrial agreement, which governed the impacted line staff, plus the 2017 reforms to the Employment Act that mandated “consultation must take place” with

He added: “There is no concern about COVID19 because we have a lot of things implemented to make sure we keep the place as clean as possible. So while members are certainly adhering to the social distancing, we just remind them to be courteous to one another and keep everything sanitary and watch out for everyone else.”

Will Saunders, general manager of Evolve Fitness, said customer traffic has not started to pick up yet, but he is expecting this week to have more people

the affected workers and their representatives when more than 20 are being terminated.

The Gaming Board had pressed ahead with the redundancies despite its chairman, Kenyatta Gibson, being told of the need to adhere to these procedures by BPSU and worker representatives. However, while the initial ruling required that the 24 impacted workers

signing up for new memberships. “They normally start around the end of January for us, so we are just patient. I think the lag has to do with the holiday being this Tuesday, so after that they will probably start coming into the gym,” he added.

Evolve normally sees a 30 percent increase in business in January, and Mr Saunders indicated he is expecting a repeat after tomorrow’s Majority Rule Day holiday.

PUBLIC NOTICE

Please be advised that MR. THEODORE JERMAINE TURNQUEST along with Turnquest and Co. located on Nassau Street are no longer authorized to conduct business on behalf of Opulent Heights No. 1 and 2.

THE TRIBUNE Monday, January 9, 2023, PAGE 3

NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By

SEE PAGE B10

RETAILER CREDITS ITS WINDOW DISPLAY FOR SALES DOUBLING

A CHILDREN’S store located in the Harbour Bay Shopping Plaza says sales of children’s clothing and products almost doubled last month compared to December 2021.

Sandbox attributed the growth to a nostalgic holiday campaign, Snowplace Like Sandbox, which was centred on a mechanical window display featuring life-size pandas, penguins and polar bears gliding through evergreens amid a flurry of snowflakes and dreamy northern lights.

The presentation took its inspiration from classic holiday campaigns of the past, when department store window displays would immerse shoppers in the Christmas season and capture the imagination of youngsters and adults alike. Each weekend in December, Sandbox invited

Employment Opportunity: President

The Organization: Templeton World Charity Foundation, Inc. (“TWCF”) is a global nonprofit foundation created by Sir John Templeton in 1996 in Nassau, The Bahamas. The Foundation supports a diverse group of researchers to discover new knowledge, develop new tools, and launch new innovations that make a lasting impact on human flourishing. The current grant portfolio of the Foundation comprises over 200 projects in more than 40 countries. TWCF is committed to a five-year strategy focused on innovations that enable human flourishing. Flourishing is a holistic concept that includes physical, mental, social, and spiritual well-being. Over the next five years, the Foundation will support a range of projects across three distinct stages: Discovery, Development & Launch. The Foundation facilitates partnerships with leading organizations across many sectors. Templeton World Charity Foundation has an annual grant payout of approximately 40M USD. The team consists of 12 employees today and 6 external advisors. In recent years, the foundation has established itself as a leading philanthropy that bridges the gap between fundamental scientific research, practical tools, and public action. For more information about Templeton World Charity Foundation and its active initiatives, visit our website at www.templetonworldcharity.org.

The Role

As President of the Templeton World Charity Foundation, the President is responsible for all aspects of the Foundation’s philanthropic activities as well as effective stewardship of its financial resources. The successful candidate will be required to reside in Nassau, The Bahamas, and will play a critical role in building and leading TWCF’s strategic philanthropy. This also includes an innovative perspective in maintaining and strengthening Sir John Templeton’s donor intent. This President will report to the Board of Trustees and will have responsibility, in accordance with its governing documents, for the day-to-day operations of the foundation.

Specific Responsibilities: As the leader of a dynamic and global organization, the President plays a crucial role in effective governance of the Foundation including across: (1) organizational leadership and development, (2) philanthropic grant-making, (3) financial stewardship, (4) engagement with the board and the family members as well as other stakeholders of the organization and (5) public communications and awareness of the foundation.

Organizational Leadership and Development:

• Lead a world-class interdisciplinary and distributed team of programmatic staff, business professionals, and technical experts.

• Continue to develop skills and capacities of team members.

• Work with service providers across various technical and business functions to ensure efficient delivery of services to the foundation.

• Serve as a mentor to business and programmatic staff to support the development of the next generation of foundation leaders in the Bahamas. Grantmaking:

• Continue to execute the foundation’s five-year strategy with a thoughtful approach to donor intent, while also applying innovative and creative approaches to respond to new opportunities. This includes supervision of the leadership of three main programmatic divisions of: (1) Discovery, (2) Development, and (3) Launch.

• Act as the Chief Grants Officer in maintaining a high standard of grants, including application of robust development, review, and approval processes. For most large grant proposals, this means working with the foundation’s Grants & Programs Committee for approval.

• Oversee administration and review of approved grants and programs.

• Enable organization-wide learning about the impact of foundation activity at an individual grant and portfolio level.

• Establishing productive connections among researchers, policy makers and practitioners in areas relevant to the foundation’s strategy.

Financial Stewardship:

• Although the President is not directly responsible for the investment decisions of foundation’s endowment, the candidate will be expected to have oversight of all aspects of including financial, tax and charter compliance and administrative functions.

• A number of these functions may be outsourced and for such functions the President will be responsible for managing the external services contracts and reporting on the same to the Board of Trustees and the TWCF Executive Committee. As such, the candidate will need a level of financial literacy to be expected of a senior executive. Oversight of the annual institutional planning process, ensuring that program plans for each TWCF purpose area are clear, accurate, of the highest quality, and in accordance with Sir John Templeton’s donor intent. Engagement with the board and the family members as well as other stakeholders of the organization:

• Through forward planning and clear communications, the President should ensure smooth alignment and coordination with the board on the strategy and operations of the Foundation. This means working with the Chair of the Board to facilitate meaningful dialogue and decisions for the Board of Trustees.

• Create an active engagement and open dialogue with the family members, the trustees, and other external stakeholders.

• Effective coordination with other foundations created by Sir John Templeton, including the Templeton Religion Trust and the John Templeton Foundation.

Working with the board and family members to continue to evolve a thoughtful understanding of donor intent.

Communications:

• Representation within multiple distinct communities including: philanthropy, non-profit, academy, policy - locally in the Bahamas and globally.

• Thought leadership in areas related to the foundation’s mission through written and video communications.

Required Qualifications and Skills

This job is open to a wide variety of backgrounds. The President should ideally embody the following professional qualifications and personal attributes:

Professional Qualifications

A Master’s Degree, or higher, in a discipline related to the work of The Foundation.

• A PhD and familiarity with research will be helpful but is not a prerequisite.

Competencies

Setting strategy

A demonstrated sympathy, understanding of and curiosity towards Sir John’s Donor Intent. This includes an understanding of the purposes and management of TWCF.

• The successful candidate will have concrete and specific experiences in as many topics relevant to TWCF as possible.

• Solid understanding of strategic planning, research and evaluation issues and methods, and an ability to apply this knowledge in a foundation.

An ability to think strategically about philanthropic investment across a range of fields and disciplines.

Ability to utilize data analytical tools for evaluation and knowledge dissemination.

• An ability to bring a global perspective and to place TWCF on the map across continents.

Leading teams

Demonstrated management experience, budgeting and planning skills, and internal team building skills.

Ability to inspire trust, to organize teams, and to sustain a positive, productive working environment.

Executing for results

• Demonstrated skills managing a charitable grant making entity; familiarity with the management of organizations with international compliance responsibilities will be helpful but not a prerequisite.

Ability to manage multiple lines of work simultaneously, and to be timely in meeting deadlines.

An attitude of active stewardship of the financial resources.

• Skills and experience in designing and adapting systems for management of resources, time, and other assets important in achieving foundation objectives.

Influencing and relationships building

Demonstrated ability to manage relationships with the Board, Board Committees, other charitable institutions, grantees and professional colleagues diplomatically and effectively.

• Ability to generate and deliver clear and persuasive verbal and written communications.

• Demonstrated success in collaborative work with both external and internal colleagues. An outstanding relationship builder, with a capacity to establish broad and diverse connections to a global community.

Personal Attributes

• Passionate commitment to the vision and mission of Sir John Templeton and strong interest in the topics that are funded by TWCF. This includes an interest and comfort in engaging in spiritual discussions across different religions and beliefs as well as an interest in the concept of free markets and entrepreneurialism.

Humility and willingness to work within defined operating and governance principles, established by the Foundation, that should not be changed.

• Curious mindset, willingness to keep learning, inquisitive, ability to ask the right questions with strong critical thinking skills.

• A humble spirit and a desire to benefit others through service, a real team player with an inclusive approach to the team. Qualified candidates only should submit CV and a cover letter to hr@templetonworldcharity.org. Applications will be accepted until January 20, 2023.

customers in for Saturdays with Santa and Frosty the Snowman, with branded giveaways and treats.

Nicky Saddleton, of Octopus Digital, developed the campaign. “We wanted to sweep kids into a winter wonderland, and help families restore important holiday traditions. Christmas is a special time that children haven’t been able to fully celebrate for over two years. When you’re a kid, that’s a long wait. Based on feedback from our customers and the business community, the windows had a tremendous impact this season, drawing customers in for an exciting, shopping experience.”

When store manager Cyrena Wallace polled staff about the consumer response, one associate estimated that half the customers she served mentioned the holiday windows. Gift wrappers stationed near the display reported that many passers-by peeked into the store for a look. Ms Wallace also fielded calls from other merchants inquiring about various display components, and noticed that children were especially fascinated by the “snow”.

She added: “The windows got so much attention, like the gentleman who drove by after church one Sunday. He saw the display and told his wife: ‘I’m coming back to get our grand baby that dress.’ When he and his wife came back, they bought four pieces, not just the piece they saw in the window.”

Monique Pratt, the display artist who helped design the store’s footprint, has directed visual merchandising at Sandbox since it opened in April 2019. “I came into this field from the world of Junkanoo. Being a Junkanoo artist is all about telling a story that merges costumes, music and dance, and brings it to Bay Street,” she said.

“I approach visual display the same way. Merchandising is the synopsis of a theme I bring to life. I aim to deliver the concept so clearly that you can ‘get it’ without words - you can see it from the door. As soon as marketing shared the snowplace theme, I began to imagine the elements connected with winter: Wild animals, snow and ice, starry skies.

“I knew that moving parts would bring the scene to life. Gentle mechanics could give the wild forest a more magical

feel. During the day, the display features revolving mannequins dressed in cosy winter layers. At night, the windows evoke mysterious Northern Lights, or starry Bahamian skies,” Ms Pratt added.

“Growing up in The Bahamas, Christmas meant lots of lights around the house and yard. Families took their children downtown or drove around town to take in the decorations. Because it gets dark here in winter, the holiday lights feel very dramatic. The trees in our window have that same feel.”

“My background as a Junkanoo artist also trained me to connect fantastic and familiar themes. One of the trees in our window has iced sweet treats. The ornaments with vibrant sprinkles inspired a confetti-like tree topper with a Junkanoo feel. When you look at the tree, you can’t really tell which world you’re in. It could be anywhere in the world. It tells a story that everyone can enjoy.”

Ms Pratt sourced winter display elements from outside The Bahamas. She visited colleagues at Neiman Marcus, a department store with wellknown window designs, and said: “Neiman Marcus allowed us to buy the props and mechanisms we needed. We agreed to share photos of the finished installation. They said: ‘We want to see what you do with these things in The Bahamas.’ I brought them back and customised them.

“It took about four weeks to complete the Sandbox window display. I’d say it’s my favourite design of all time. This window distills complex winter elements into the essence of Christmas. I think it was the kids’ favourite, too. While I was decorating, I noticed that children kept stopping to look. They were mesmerised by the lights and movement.”

Ms Pratt considers display merchandising a vintage art form with a bright future. “Dollar for dollar, visual merchandising is just as effective as television. Display windows target drive-by traffic strollers, and consumers who haven’t met your brand via TV follow social media,” she said. “We’ve set a standard in the plaza, and that seems to be attracting other creative Bahamian brands with an eye on the future.”

PAGE 4, Monday, January 9, 2023 THE TRIBUNE

DISPLAY artist, Monique Pratt, blends iced culinary ornaments with sugar sprinkle tones in a delicious display.

THE WINTER forest scene awakens wonder at Sandbox children’s store.

Photo:Rayette Nairn

MONIQUE Pratt wraps another visual merchandising season at Sandbox.

Photos:Joy Sweeting

Fresh start

By CHRIS ILLING CCO at ActivTrades Corp

By CHRIS ILLING CCO at ActivTrades Corp

The first trading week of 2023 is behind us after providing some hope on the global stock markets.

A robust labour market report from the US, and slightly weaker than expected inflation in the euro zone, gave the German Dax a boost on Friday. The leading German index was again very friendly in the late afternoon at 1.2 percent and, at times, climbed above the 14,600 point mark. It gained more than 4 percent last week.

In addition, inflation in the euro region

weakened more than expected in December. Consumer prices rose compared to December 2021, but less significantly than in November, and by less than expected among economists.

The US economy created more jobs than expected in December. Outside of agriculture, 223,000 jobs were added, the Department of Labor announced

on Friday. On average, analysts had only expected 203,000 new jobs. However, the increase in employment in the two previous months was revised downwards by a total of 28,000 jobs. The separate unemployment rate surprisingly fell to 3.5 percent from 3.6 percent in November. At the same time, wages rose less than expected, which brought relief when it came to the

possible further stoking of inflation.

Current US job data reassured investors on Friday. The New York indices, which had started the New Year relatively weak so far, are clearly in the black after initial fluctuations in the course of the publication. The Dow Jones Industrial Average rose by 2.1 percent to 33,640 points. Meanwhile, the tech-heavy Nasdaq 100 gained 2.7 percent to 10,585 points.

Asian stocks gained on Friday as the dollar lingered at a monthly high. The 225 Nikkei Index closed 0.6 percent higher at 25,975 points. The Shanghai

stock exchange was up 0.4 percent. The index of the most important companies in Shanghai and Shenzhen gained 0.6 percent.

The crypto currency, Bitcoin, continues to hover around the $17,000 mark. Bitcoin hit a record high of $69,000 in November 2021.

Oil prices rose on Friday. A barrel of North Sea Brent cost $79.83 in the late afternoon. That was $1.12 more than the day before. The price of a barrel for the American West Texas Intermediate (WTI) grade rose by $1.19 to $74.85. Oil prices have thus recovered somewhat from the significant losses of the

Commonwealth of The Bahamas In The Supreme Court

Common Law and Equity Side

In the Matter of the Quieting Titles Act 1959 AND

IN THE MATTER OF all piece parcel or lot of land being a portion of Lot No. 54, Malcolm Allotments situate in the Southern District of the Island of New Providence, Commonwealth of The Bahamas AND

IN THE MATIER OF the Petition of Loreen Leonora Russell

NOTICE

first trading days of the new year.

Oil prices were somewhat supported by the weaker dollar exchange rate. Crude oil is traded in dollars. A weaker dollar makes crude oil cheaper for investors from other currency areas.

Overall, however, oil prices have eased in the first week of the New Year. Weak economic data from China weighed on oil prices as it fuelled concerns about slowing demand in the world’s second largest economy. Market observers also pointed to price reductions for crude oil, which Saudi Arabia will deliver to Asia and Europe in February.

Businesses take midweek Majority Rule day in stride

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

BAHAMIAN businesses yesterday said they are taking the January 10 Majority Rule holiday in their stride despite losing another day of commercial activity so close to the Christmas festivities.

Lana Lee-Brogdon, president of New Oriental Cleaners, told Tribune Business that for “fluidity purposes” it would have been better if Majority Rule Day was celebrated on Monday, January 9, thus creating a long weekend

and avoiding any disruption caused by breaking the working week into two.

Confirming that the company has scheduled the Majority Rule holiday as a day off for staff, she added: “Either way it takes a day away from our business, so it really doesn’t matter now.

But, yeah, I would love to have it on the Monday.

“It’s just odd when you have these random holidays; like some change and some don’t. We’ve already scheduled with it on the Tuesday, so it’s neither here nor there for me really now.”

Dwayne Higgs, WHIM Automotive’s general manager, said: “It doesn’t really

matter what day it is in the week, it will still be a day off for my business. The placement of it really wouldn’t matter for us. It’s close to the end of year holidays, but you don’t have anything else until Easter, so we just take it in stride and just keep going.”

Peter Bridgewater, Open Systems Technologies’ president, said the holiday is due to the Bahamian people. “I don’t have a complaint about the day,” he added.

The Petition of Loreen Leonora Russell in respect of:ALL THAT piece Lot of land situate in the Southern District of the Island of New Providence and being a portion of Lot No. 54 Malcolm Allotments on the said plan of the said Subdivision LOREEN LEONARA RUSSELL claims to be the owner of the fee simple estate in possession of the said land and has applied to the Supreme Court of The Bahamas under S.3 of the Quieting Titles Act, 1959 in the above action to have its title to the said land investigated the nature and extent thereof determined and declared i n a Certificate of Title to be granted by the c ourt in accordance w i th provisions of th e said Ac t. C opies of the s aid P lan may be inspected during normal office ours at the Registry of the Supreme Court, Bridsh American Bank Building, Marlborough Street in the City of Nassau, and at the Chambers of E.D. M Law Group, Suite 2 upstairs Workers House, Harrold Road, Nassau Bahamas

NOTICE IS HEREBY GIVEN that any person having dower or a right to dower or any adverse claim not recognized in the Petition shall before the 23rd day of J anuary A.D. 2023 file in the said Registry of The Supreme Court and serve the Petitioner o r the above E D.M. Law Group a statement of such claim in the prescribed form verified by an Affidavit to be filed herewith. Failure of any such person to file and serve a statement of such claim by the above time will operate as a bar to such claim

E D.M. Law Group Suite 2 upstairs Workers House Harrold Road Nassau The Bahamas Attorneys for the Petitioner

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, SHERRY TERELL MADER of Freeport, Grand Bahama, Bahamas, intend to change my name to SHERRY TERELL MATHER If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

THE TRIBUNE Monday, January 9, 2023, PAGE 5

2022 CLE/qui/00821

• Eligible for HPC Physical Therapy Licensure • 3 years pelvic health experience • BLS + CPR certification current • Recognized pelvic health certification Send inquiries via the “Contact” tab on www.vivaptwellness.com website Minimal Requirement Viva Physio & Wellness is looking for A Pelvic Health Therapist JOB

OPPORTUNITY

PUBLIC NOTICE

CLICO victims: Don’t forget our $35m need

raised people’s consciousness in terms of how they give these institutions their money and then they go belly up.

“We need someone to champion the cause of the small man. I tried my best with some other pastors but we’re too passive in The Bahamas. That’s what I feel. Unlike the US, where you can sue for almost anything to get redress, it’s very difficult and expensive in The Bahamas.” Bishop Hall added that he had spoken to Michael Halkitis, minister of economic affairs, on the CLICO matter who had “said he’s working on it and would have something next [this] week”.

Neither Mr Halkitis nor Simon Wilson, the Ministry of Finance’s financial

secretary, returned Tribune Business calls seeking comment before press time last night. However, the Government has been consistent across several administrations in fulfilling its pledges and guarantees to make CLICO (Bahamas) clients whole via a phased series of payments.

This newspaper understands that $2m was paid out last September, with the 2022-2023 Budget allocating some $3.8m in total for “CLICO obligations” this fiscal year. The same $3.8m is also included in the “preliminary” spending estimates for the 2023-2024 and 2024-2025 fiscal years, and it is thought that a cumulative $75m may have been paid out by the Government todate since the first payments were made in 2016

However, while $6.629m was paid in 2020-2021, just $58,796 of the $7.4m allocated for 2021-2022 was shown as having been paid by March in the latter year. And this newspaper also understands that, while the balance of the $3.8m for this 2022-2023 fiscal year was supposed to have been paid out before Christmas, this did not happen and it is instead now scheduled to occur sometime before the June 2023 year-end.

“They’re looking to make a payment shortly,” one contact, speaking anonymously because their were not authorised to talk publicly, said of the Government and Ministry of Finance. “The country is challenged, but these people [former CLIC) Bahamas clients] are also challenged. It’s been almost 14 years. These people have

to be paid, and successive governments have indicated a willingness to do so.”

Well-placed sources, speaking on condition of anonymity, told Tribune Business that around $10 remains to be paid out collectively to CLICO (Bahamas) clients who have surrendered their life and other insurance/investment policies. And a further $25m, via a promissory note or some other debt security, is needed to underwrite the transfer of the insolvent insurer’s remaining in-force policies to another Insurance Commission licensee.

This $25m is necessary because CLICO (Bahamas) insolvency means it does not have sufficient assets to transfer and support the liabilities associated with these in-force policies. The last liquidator’s report for CLICO (Bahamas) showed it had a solvency deficiency, measuring by how much liabilities exceed assets, of some $55.817m.

Bishop Hall, revealing that FTX’s implosion had brought back memories of CLICO (Bahamas) collapse, told Tribune Business the crypto currency exchange’s failure again highlighted the need for greater scrutiny of incoming investors. “I pray that the FTX debacle will cause the Government to be more careful and judicious with how it analyses investors,” he added.

“We need the investors, and thank God for

them. They play a role in our development. It’s just that we want them so bad that we lower our guard. There must be some way companies coming into this country must leave money in some fund so if things go wrong people can be compensated. We need to be less passive and more aggressive.”

Suggesting that many CLICO victims have “given up taking on the fight”, with many suffering from “apathy” and a feeling of helplessness that there is little they can do but wait on the Government, Bishop Hall argued that he and the failed insurer’s other clients should be given the same priority as those investors in FTX.

“For every billionaire who put money in FTX there’s Mama Sou or Papa Lou who put $25,000 into CLICO,” Bishop Hall added. “It’s the same thing.

The amount of money is relative. It’s who owns the money. We’ve got to protect the small man. I think it’s because the expatriate is an expatriate. We need to stop this backward perspective that we show sometimes. We still have these latent social idiosyncracies that look after the big guy.”

Craig A. ‘Tony’ Gomez, the Baker Tilly Gomez accountant and principal, remains gagged in his role as CLICO (Bahamas) liquidator and unable to speak publicly. He was appointed after the insurer

was placed in Supreme Court-supervised liquidation in April 2009 following the financial difficulties that engulfed its Trinidad-based parent, CL Financial, which was chaired by Lawrence Duprey.

Despite findings that CLICO (Bahamas) broke Bahamian exchange control laws, plus other rules and regulations, with its investments in the Wellington Preserve real estate project in Florida, nobody has been held accountable or responsible for a corporate failure that impacted the domestic economy and hundreds of lower and middle income earners.

The Government has effectively stepped in to pay CLICO (Bahamas) policyholders, and make them whole, given the length of time it is taking Mr Gomez to realise the insurer’s remaining assets through a complex multi-jurisdictional process. Any assets he recovers will ultimately be used to reimburse the Government.

Under the terms of the guarantee, all surrendered policies, death benefits and CLICO (Bahamas) staff pensions are to be paid in full. Annuity holders and pension beneficiaries were to receive a maximum $10,000, with the balance supported by a seven, ten or 15-year promissory note and interest paid on these quarterly.

JOB OPPORTUNITY

Lead Math Teacher Needed.

A pre-eminent, well-established, independent, international school in Nassau is seeking a full-time qualified MATH TEACHER. Candidates should have sound classroom experience; a passion for innovative education; a professional attitude towards work; a friendly and cooperative disposition; a willingness to work in a team environment; a determination to grow professionally; and strong communication & organisational skills.

Successful candidates will be required to:

● To provide strategic leadership for the development and management of MATHS throughout the school.

● To identify areas for improvement linked to the School Improvement Plan and local and national initiatives.

● To develop and monitor schemes of work for MATHS across the whole school and ensure successful implementation which meets curriculum requirements

● To provide, monitor and evaluate the use of resources related to MATHS.

● To have an overview of and contribute to the planning and delivery of continu ous professional development and training related to MATHS.

● To monitor, assess and develop the roles of the class teachers in MATHS.

● To develop strategies for the use of MATHS to promote new teaching methods and improve learning throughout the school and monitor effectiveness in raising standards of teaching and learning.

● To monitor and evaluate pupil progress throughout the school in MATHS and set goals for MATHS across the school.

● To provide opportunities for working with parents and give specialist advice on MATHS.

● To arrange and promote MATHS curriculum activities within the school.

PAGE 6, Monday, January 9, 2023 THE TRIBUNE

PAGE B1

FROM

Please Forward your resume and introduction letter by email to hrbahamas2014@gmail.com

‘Don’t be led like sheep to the digital slaughter’

Government, are refusing to accept cash payments. This is illegal. Bahamian cash in The Bahamas is legal tender. If you are conducting legal business in The Bahamas, you must accept cash as payment. The Government of The Bahamas and its agencies must desist from this behaviour.

“Forcing citizens into a cashless system where they can be digitally monitored and controlled without reference to the people is undemocratic..... Do not be led like sheep to the digital slaughter. There is no payment system as reliable as cash. It works when the power is off and the Internet is down. You can maintain your privacy..... Make cashless an option, not a mandate.”

Mr Bowe’s words are likely to strike a chord with many Bahamians, especially those who believe the Central Bank and commercial banking industry are moving too fast in pushing persons to online, mobile and other forms of digital payments without the necessary education and infrastructure reliability to back it.

John Rolle, the Central Bank’s governor, has said the regulator does not envisage the complete elimination of cash as a transaction and payment mechanism. Nevertheless, the Central Bank wants to reduce and discourage its use in a bid to improve security around the holding of cash as well as increase the finality of payments.

Mr Bowe, an engineer with multiple business interests including Advanced Technical Enterprises, an insurance agency/brokerage and a family farm, told Tribune Business yesterday that The Bahamas needed to walk before it can run when it comes to digital banking. Before going electronic, he argued that the country needs to fix the difficulties encountered with opening a bank account as well as deteriorating customer service across the industry.

“We have a lot of people in The Bahamas and the world who are unbanked,” Mr Bowe said. “They don’t have a bank account. I don’t know why anybody would think that’s reasonable? Why can’t they open a bank account within 15 to 20 minutes? Maybe we need things to open in

the financial sector where competition comes in and service goes up and costs go down.

“I’m happy I’m a shareholder in a bank because they pay an awesome dividend. Financial performance is improved, but service is getting worse. It’s just poor. You can’t leave this bank to go to the next bank because service is poor universally.”

Mr Bowe continued: “We have digital access right now. I wanted to buy chicken feed for the farm. It costs $56 for two bags. I had a debit card and it wouldn’t process. I go to a restaurant with my wife and others I know, and we have a wonderful time. They take my debit card and it doesn’t work.

“This has happened to me several times. I don’t want to carry cash around, but I’ve been bitten so often that I take cash out of the bank before I go. Canada has been digital for a while now. They function well there. They don’t have the situation that we have. Things work, and work all the time. And they still accept cash.

“The US will never be out of cash. There’s a large group of people in the

US who will not go digital because of freedom concerns. This thing about going digital globally, it’s not possible, it will not happen and nobody should be trying to force it on our people when they cannot deal with it. It doesn’t make sense.”

The Bahamas’ digital banking woes, and those of the wider Caribbean, were brought into sharp relief last month when Royal Bank of Canada’s (RBC) online platform went down. Businesses were unable to make or receive payments, and conduct transactions vital to the smooth functioning of business, after they were “locked out” of their accounts for up to three days.

“Business has not been conducted for three days now due to RBC Online Banking being out of order,” one irate businessman, speaking on condition of anonymity, said. “This is the equivalent to Bahamas Power & Light (BPL) being out of fuel for three days, and the generator can’t run. It’s an absolute catastrophe. Please let us know why this is happening when everything now is done now online.”

Another business owner, also speaking on condition of anonymity, shared a screen shot detailing an “unexpected outage” and saying: “RBC Caribbean Digital App is currently unable to launch. We will investigate the issue and try to resolve it as soon as possible.”

They added: “It’s crazy, and I can’t get any answer. We just cannot access our online accounts. I can’t pay my bills and am not sure how I am going to pay my staff tomorrow [today]. You cannot pay anybody. I am going to have to write my staff a cheque if this goes on like this. It’s been going on for three days.

“I cannot get into my account, I cannot pay anybody, I can’t see if I’ve been paid by anybody. If I go to the bank and get a ledger, they say they’ve been working on it around the clock but this is the third day. I see on Facebook that there are a million people complaining they cannot get access to their account.

“People are complaining that they can’t pay anybody. Some people have tried to sign in and been locked out of their account. It spins and you get this ‘unexpected outage’, or something that appears to be wrong. I got in and paid one bill yesterday, and then it spins and spins and kicks you out.”

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

Monitor operations to ensure compliance with safety or security policies or regulations. Observe individuals’ activities to gather information or compile evidence.

Operate surveillance equipment to detect suspicious or illegal activities.

• Discuss performance, complaints, or violations with supervisors.

Monitor establishment activities to ensure adherence to all gaming regulations and company policies and procedures.

Observe gaming operations for irregular activities such as cheating or theft by employees or patrons, using audio and video equipment.

Report all violations and suspicious behaviors to supervisors, verbally or in writing.

Act as oversight or security agents for management or customers. .

• Be prepared to work within a shift system

Retain and file audio and video records of gaming activities in the event that the records need to be used for investigations.

• Perform other related duties as assigned by Management.

SANDILANDS REHABILITATION CENTRE

The Public Hospitals Authority (PHA) invites applications from suitably qualified persons for the post of Assistant Director Quality & Patient Safety, Sandilands Rehabilitation Centre (SRC)

POSITION SUMMARY:

The Assistant Director, Quality & Patient Safety is responsible for overseeing all functions of the Quality & Safety Department within the Sandilands Rehabilitation Centre (SRC).

KEY ACCOUNTABILITIES FOR THIS ROLE INCLUDE BUT ARE NOT LIMITED TO

THE FOLLOWING:

• Implements, maintains, and monitor facility wide performance improvement and patient safety initiatives;

• Assess potential compensable events and patient complaints for investigation and review with notification to Director of Quality & Patient Safety; Participates in select committees related to assessment of patient care and environmental care;

• Coordinates the acquisition and release of records and information to the Director of Quality & Patient Safety;

• Works with clinical and facilities Heads of Department to develop policies and procedures for review and approval by the Quality Council; Provides Executive Management and Director with monthly, quarterly, and annual reports on incidents, claims and recommendations for quality and patient safety initiatives for review by the Board;

• Plans, develops, and presents educational material to administration, medical staff, nursing personnel, allied health and other health care workers on topics related to quality, patient safety and risk management;

• Conducts and evaluates concurrent and retrospective audit of patient medical records to include nursing, physician and other disciplines providing patient care aimed at ensuring compliance with approved standards of practice, policies, and procedures;

• Develops and implements educational programs to reduce or eliminate potential safety hazards throughout the facility.

EDUCATION/EXPERIENCE:

• Master’s Degree in Health Care Administration, Business Administration or Risk Management or possesses a minimum of fifteen (15) years sub-specialty in healthcare equivalent;

• Proficient knowledge of Occupational Health & Safety Administration, Centre for Disease Control, Patient and Life Safety and local health care regulations;

• Proficient use of Microsoft and database management including spreadsheets, graphics, and statistical analysis;

• Eight (8) years’ experience in infection control, risk, and safety management principles.

COMPETENCY REQUIREMENTS:

• Must possess experience with the organizational quality improvement program;

• Excellent communication skills (oral and written); analytical and conceptualized thinking skills; Excellent interpersonal skills.

The Assistant Director, Quality & Patient Safety will report to the Director, Quality & Patient Services, and the Hospital Administrator.

Letter of application and curriculum vitae should be submitted to the Director of Human Resources, Corporate Office, Public Hospitals Authority, Third and West Terraces, Centreville; or email to jobs@phabahamas.org no later than 19th January 2022.

THE TRIBUNE Monday, January 9, 2023, PAGE 7

FROM PAGE B1

Jarol Investments Limited is seeking to fill the following position: Surveillance Officers (Nassau)

Interested persons must require surveillance experience, certification, training, communication skills, attention to detail, ability to work independently and should apply at Jarol Investments Limited Head Office, Prince Charles Drive (Across from Restview) between the hours of 9am to 5pm. Or send your CV to careers@chancesgames.com Subject: Surveillance Officer – Your Name

PUBLIC HOSPITALS AUTHORITY ADVERTISEMENT

VACANCY ASSISTANT DIRECTOR, QUALITY & PATIENT SAFETY

REDEVELOPED PI MARINA TOUTS FUELLING INNOVATION

PARADISE Island’s Hurricane Hole marina says the ability it offers vessels to refuel where they are docked provides a competitive advantage over rivals.

Sterling Global Financial, the Hurricane Hole Superyacht Marina’s developer, said in a statement that it has installed a two-inch fuel line that is connected to ten sump boxes around the facility. Each acts as a fuel distribution point for visiting yachts, with trucks able to fill the line at a centralised pump and filter station.

David Kosoy, Sterling’s executive chairman and founder, said: “The new Hurricane Hole Superyacht Marina has the distinction of being an outstanding Bahamas marina, and this amenity only bolsters its premier status. In-slip fuelling offers unparalleled convenience and yet another reason why Hurricane Hole is the only place to be for yachts of all sizes.”

The Hurricane Hole Superyacht Marina was officially opened on November 25 last year by Prime Minister Philip Davis KC. The renovated marina features a poolside bar and grill, a pharmacy, wine and liquor store, gym and Captain’s lounge, in-house concierge and onsite Customs and Immigration clearance.

Three restaurants are set to open soon, while a gourmet grocery store, medical clinic and wellness centre will also open in early 2023.

Bahamian crowdfunder targeting help for Haiti

FROM

share what we have learned in our crowdfunding initiative since it is the only successful one in over 40m inhabitants of CARICOM.”

Mr Rahming identified other initiatives that ArawakX will be pursuing, including countries being able to list international US dollardenominated bonds and a solution for Haiti’s financial and economic woes. “The fact is that when international bonds are traded there are only a few major banks and brokers determining the price,” he added.

“I believe that better prices are possible through a regional exchange. This will lower the cost of borrowing and allow a lower investment threshold for retail investors, while saving local governments hundreds of millions of dollars. We have presented unofficially to some high-ranking members of the UN on the solution to Haiti, and they are in the midst of evaluating our proposals.

“CARICOM has many possible innovative initiatives that deserve more than just lip service,” Mr Rahming added. “The solution involves rebuilding Haiti using its diaspora and through businesses

listed on ArawakX. We have also begun to talk with a national leader of another CARICOM country, who recognises the enormity of our initiatives, to expand the local economies and deliver economic development felt by average citizens.

“We will reveal more of these initiatives in the coming months, and look forward to working with the governments of the region while deepening our ties to the US. When I was in Business School studying finance and economics, I had the opportunity to work with and help build the modern Chicago Mercantile Exchange. I saw the power of an exchange to increase the size of the US economy.

“I also kept the personal networks that can help CARICOM do the same thing here. It is undeniable that America-style capital markets work to provide real world economic growth. We are very happy to be providing an opportunity for our CARICOM customers to finally have access to the ArawakX platform, which will enable them to grow their investment portfolios, businesses and economies.”

Reinforces company goals and vision to all direct reports and continually implements this strategy into overall communications.

• Supervises, directly and/or indirectly, all Security/Surveillance team members including: selection, training, work direction, safety, communication, counseling, disciplining, performance evaluations and records.

Oversight and training for emergency response procedures such matters as fires, bomb threats, power outages, and other serious matters or emergencies.

• Directs and monitors the security and safety of customers, employees, facilities, and grounds. Reviews security/surveillance investigations concerning all incidents and issues taking place on property and makes necessary reports and notifies the Assistant COO.

• Checks all security/surveillance reports for accuracy and completeness and ensure timeliness.

• Ensure compliance with department and Company policies and procedures.

• Create and update weekly department schedule.

• Continually evaluate Team Members for alertness, appearance, and proper performance of duties.

• Observes, supervises and instructs shift officers in the performance of their duties.

Determines personnel requirements and makes assignments at the beginning of each shift.

• Ensure effective onboarding and training for Security/Surveillance Officers. Provide security and protection for customers, team members, property and assets.

• Reacts promptly to disturbances where Security/Surveillance is required.

• Maintain a high level of confidentiality

• Be familiar with all Chances web shops throughout the Bahamas.

• Takes appropriate action, when required, of individuals suspected of illegal activities.

• Perform related duties as assigned by management.

PAGE 8, Monday, January 9, 2023 THE TRIBUNE

PAGE B2

Interested persons must require surveillance experience, certification, training, communication skills, attention to detail, ability to work independently and should apply at Jarol Investments Limited Head Office, Prince Charles Drive (Across from Restview) between the hours of 9am to 5pm. Or send your CV to careers@chancesgames.com Subject: Assistant Security Manager – Your Name

Jarol Investments Limited is seeking to fill the following position: Assistant Security Manager (Nassau)

FTX’s Bahamian liquidators to to control $46m Tether assets

potential buyers “utilising the services or one or more brokers”.

Tribune Business understands that the liquidators - Brian Simms KC, the senior Lennox Paton partner, and PricewaterhouseCoopers (PwC) accountant duo, Kevin Cambridge and Peter Greaves - are satisfied that the agreement with John Ray and his Chapter 11 team places them in a much stronger position than previously following a near two-month battle over who will control FTX’s liquidation, restructuring and sell-off.

The deal states that the two sides have a “shared goal” of maximising asset recoveries for the benefit of FTX’s creditors and investors, as well as “avoiding redundant work, minimising expense and respecting the sovereignty of different legal systems”. Parallel legal proceedings related to FTX’s winding-up will thus continue before both the Bahamian Supreme Court and Delaware federal bankruptcy court.

The agreement effectively marks out both sides’ territory, with the

Bahamian provisional liquidators responsible for the locally-domiciled subsidiary, FTX Digital Markets, and Mr Ray and his team looking after the entities in Chapter 11 bankruptcy protection in Delaware minus FTX Property Holdings, the company that holds all the local real estate purchases.

“The parties agree that FTX Digital Markets shall be primarily responsible for recovering value from the assets and property in the name of FTX Digital Markets, including without limitation all real and personal property and bank and security accounts in the name of FTX Digital Markets regardless of where located,” the two sides’ agreement stated.

FTX Digital Markets is the entity under Supreme Court-supervised liquidation in The Bahamas, and the agreement also makes the joint provisional liquidators responsible for “the approximately $45m of US Tether coins currently frozen in The Bahamas”.

Tether is a stablecoin, with its value pegged one:one with the US dollar, thus making it a critical recovery source that can help finance the liquidation’s costs.

Christina Rolle, the Securities Commission’s executive director, previously revealed that these assets, which she valued at $46m, had been frozen at the regulator’s request. While initially wanting these transferred to the Securities Commission’s care, she said it as agreed that Tether could instead “maintain a freeze over” the tokens until their ownership was resolved given the existence of the Chapter 11 proceedings.

As for the Bahamian real estate investments, the “co-operation agreement” stipulates: “The parties agree that the value in the

properties owned by FTX Property Holdings will be realised over time in one or more arm’s length marketing processes utilising the services of one or more mutually acceptable brokers in a manner and on a timeframe designed to maximise the recovery.”

This, the agreement said, could be effected by a Supreme Court liquidation process running concurrently with the Chapter 11 proceedings or some other “mutually acceptable arrangement”. It added: “The joint provisional liquidators.... shall take the lead in managing the properties, determining the appropriate strategy for the monetisation of the properties, identifying buyers and conducting the marketing process.” This, though, all has to be approved by Mr Ray and his team.

Mr Simms, describing FTX Property Holdings as an International Business Company (IBC), said in previous court filings that its sole purpose had been to “purchase and hold properties on the island of New Providence in The Bahamas as offices for the benefit of FTX Digital Markets and dwellings for employees of FTX Digital Markets”.

He added: “FTX Property Holdings conducted no business other than the purchase and ownership of real property. Immediately following our appointment, the joint provisional liquidators began investigating all aspects of FTX Digital Markets’ business, including its business dealings with FTX Property Holdings. As part of this investigation, we have identified 35 properties owned by FTX Property Holdings, all located on the island of New Providence in The Bahamas.”

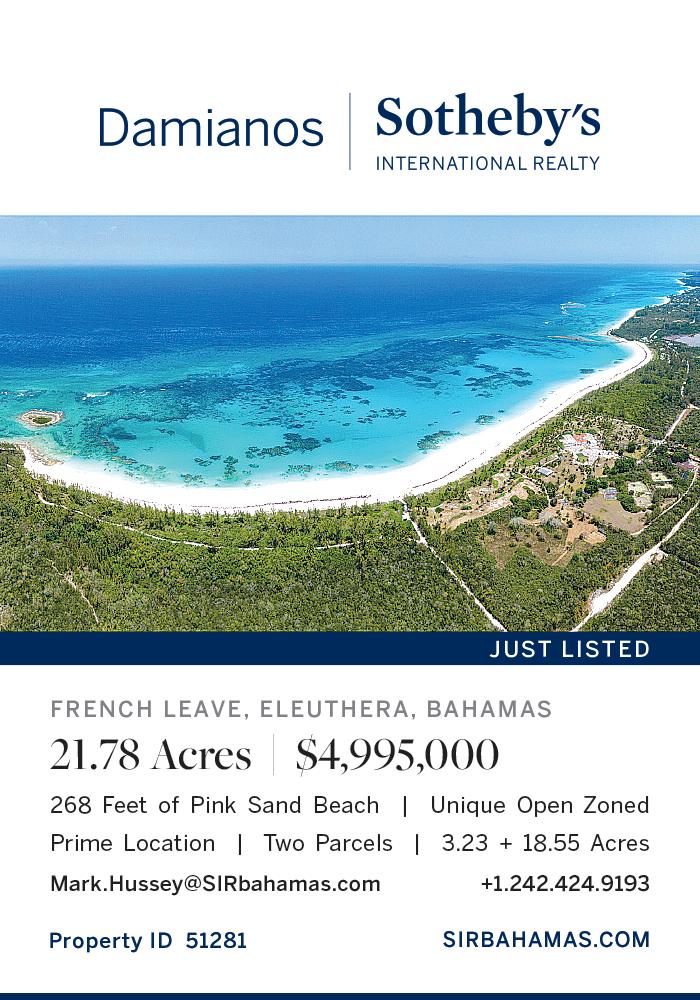

These included no less than 16 properties at Albany, 15 of which were condominiums, valued between $4.75m and $30m. A further seven units were acquired in the GoldWynn project at Goodman’s Bay, which is scheduled to open in early 2023, valued between $563,520 and $1.449m.

Another four units, varying in value from $975,000 to $1.54m, were purchased in the One Cable Beach project developed by Jason Kinsale’s Aristo Development. Some $26.34m was spent on acquiring multiple units at the Veridian Corporate Centre developed by Sebas Bastian, with further

outlays of $17.435m, $9m and $1.8m on property at Ocean Terrace, Old Fort Bay and Pineapple House respectively.

“We would like to thank all of the joint provisional liquidators of FTX Digital Markets for constructive meetings this week in Miami and all their work on behalf of their estate,” said Mr Ray in their joint Friday statement. “There are some issues where we do not yet have a meeting of the minds, but we resolved many of the outstanding matters and have a path forward to resolve the rest.”

“Our meetings stressed our shared objective to find the best solution for customers and creditors of the FTX.com platform,” said Mr Simms. “Each jurisdiction has different tools available to accomplish that objective and we look forward to working collaboratively to optimize outcomes for all of our respective stakeholders.” The co-operation agreement has to be approved by both the Bahamian Supreme Court and Delaware court.

THE TRIBUNE Monday, January 9, 2023, PAGE 9

FROM PAGE B1

BRIAN SIMMS KC

be reinstated by end-June 2020, that did not occur because the Gaming Board moved to appeal Justice Charles’ verdict on May 7 that year.

All sides agreed that the reinstatement Order, as well as compensation for wrongful/unfair dismissal, would be stayed pending the outcome of any Court of Appeal ruling. The Gaming Board, though, ultimately withdrew its appeal on December 15, 2020 - a move that Justice Charles said neither she nor the Supreme Court were made aware of.

In her latest verdict, she noted that the matter went quiet “for nearly two years” despite suggestions that both sides had held negotiations to resolve all issues. It was only revived on July 8, 2022, when the Gaming Board filed a summons requesting that damages be assessed. This triggered two filings on behalf of the 17 former employees. One,

from the Munroe & Associates on behalf of 12 of the group, asked the Supreme Court to set a date for their reinstatement.

The other five, represented by Obie Ferguson KC, sought a Committal Order against the Gaming Board’s officers and directors for allegedly disobeying the Supreme Court’s Order. However, Justice Charles said all parties subsequently determined that the key issue to be resolved was whether the reinstatement of the 17 to their former jobs was “practical” and the date when this was to take effect.

“Succinctly put, the Munroe plaintiffs and the Ferguson plaintiffs assert that, in the judgment delivered on February 17, 2020, the court ordered the reinstatement of the plaintiffs to take place on or before June 30, 2020. Since the reinstatement has not taken place on that date, or, at all the plaintiffs ask the court to fix a date for that to happen, which they assert

ought to be December 15, 2020 (the day when the Gaming Board withdrew its appeal),” Justice Charles said.

“On the other hand, the Gaming Board asserts that, because the plaintiffs were made redundant and because of the lengthy passage of time, reinstatement is impractical.” It added that the February 2020 ruling, which said the workers were “entitled to reinstatement, which should take place no later than June 30, 2020, and/or damages for wrongful and/ or unfair dismissal”, meant there were other options besides reinstatement.

Justice Charles, weighing up the arguments, said her initial ruling stipulated that if the Gaming Board could not find positions for those employees it could “immediately embark upon the process of dismissing them.

She added: “Even at the date of the delivery of the judgment in February 2020, the court was concerned with the passage of time.

“The plaintiffs were terminated for redundancy in October 2017 through to February 2018, a period of nearly two years. It was for that very reason that the court did not give the Gaming Board too much time – a little over four months - to either find suitable positions to place the plaintiffs or immediately embark upon the process of dismissing them.

“I therefore disagree with [the] interpretation that the court ordered the Gaming Board to reinstate the plaintiffs per se. Further, had the plaintiffs approached the court in December 2020 when the appeal was withdrawn, the plaintiffs might have had a better case for reinstatement,” Justice Charles continued.

“It is now more than fourand-a-half years since the plaintiffs were made redundant. The practicability of reinstatement after such a long period becomes grimmer and grimmer as each day passes. It was therefore incumbent on the plaintiffs,

who brought this case, to approach the court much earlier to request a new date for reinstatement.”

The Gaming Board argued that some employees “have not approached the court with clean hands, as some of them were gainfully employed between the periods February 17, 2020, to June 30, 2020, and would have continued their employment with other employers for periods extending far beyond these dates and up to today”.

It produced their National Insurance Board (NIB) contributions as evidence to back this assertion, while accusing four former staff - Georgette Dorsett-Johnson, Mazell Hinzey, Claudette Capron (now deceased) and Jennifer Russell - of seeking to “unjustly enrich” themselves by claiming reinstatement despite having opted for retirement and received their respective pensions.

“All things considered, had the plaintiffs pursued

this matter with alacrity, the court might have been able to fix another date for reinstatement shortly after the appeal was withdrawn and dismissed,” Justice Charles ruled.

“It is not a good and sufficient reason to say that they were the ones spearheading the discussions between the parties. Simply put, an application should have been made to the court sooner even as negotiations were ongoing. It is now too late for the plaintiffs, who were made redundant more than four-and-a-half years ago to be reinstated.”

Munroe & Associates represented Jean Minus; Marva Heastie; Barbara Adderley; Antonique Brown; Jennifer Russell; Genese Musgrove; Meresha Walkes; Jacqueline Duncombe; Nickia McPhee; Mazell Hinzey; Tenielle Mackey; and Inga Brown. Mr Ferguson acted for Kayla Ward; Georgette Johnson; Dwaynel Archer; Hope Miller; and Latoya Knowles.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

PUBLIC NOTICE

INTENT TO CHANGE NAME BY

DEED POLL