‘$400m opportunity’ to double cruise spend

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

NASSAU has a “$400m opportunity” to double gross cruise passenger spending if it can fully capitalise on the “springboard” provided by the 900,000 visitor increase forecast for 2023, its port chief argued yesterday.

Michael Maura, Nassau Cruise Port’s chief executive, told Tribune Business the Bahamian capital can increase the arrivals impact from preCOVID’s $380m high to

close to $800m per annum if cruise passenger spending expands by $100 per person to fall into line with the Caribbean’s top performers.

Conceding that “getting those people off the ship and giving them more

things to do” will be critical to achieving this ambition, he disclosed that Nassau’s cruise passenger arrivals for the 2022 fourth quarter had beaten 2019’s pre-pandemic performance - and in what was a record

tourism year for The Bahamas - by almost 13,000. Suggesting that this signals the cruise industry’s post-COVID recovery is complete, Mr Maura explained that his “$400m opportunity” estimate was derived from the 4.1m passengers forecast to arrive at Nassau Cruise Port in 2023 spending that extra $100 each. He added that 2022’s fourth quarter performance had surpassed pre-pandemic

SEE PAGE B4

COVID non-factor: Winter tourism season up 10-15%

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FORWARD bookings for The Bahamas’ peak winter tourism season are 10-15 percent ahead of 2022 numbers, a leading hotelier disclosed yesterday, with the industry “satisfied” there will be no return to past COVID restrictions.

Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) president, told Tribune Business that “all the indicators for 2023” point to

the

Pointing out that there are multiple “buffers” protecting The Bahamas against Chinese COVID cases, he revealed that average daily room rates (ADR), average per capita tourism spend and length of visitor stay were all “beginning to get to double digit increases” in percentage terms compared to prior year benchmarks.

Mr Sands also told this newspaper that post-pandemic pent-up tourism demand remains higher than many in The Bahamas anticipated, with January - typically a month

when business tapers off slightly from the Christmas/New Year highs - also proving “stronger than normal”.

And, despite China’s COVID outbreak in China reviving memories of what happened in 2020 and 2021 for some, the BHTA chief voiced optimism that there will be no global case explosion that resulted in the lockdowns, border closures and travel restrictions that marred those two years. He added that the “paramount

SEE PAGE B8

‘Settle down’ before tax crackdown tie-in

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government should allow the corporate real estate market to “settle down” before seeking to tie Business Licence renewals to property tax compliance by commercial landlords, a prominent realtor argued yesterday.

Donald Martinborough, Bahamas Realty’s chief executive, told Tribune Business the latest tax enforcement crackdown

was “a bit aggressive” given that many building owners were still getting over 2022’s skyrocketing real property tax bills that increased by up to 400-500 percent in some cases.

While applauding the Davis administration’s intent to ensure all taxpayers pay their fair share, he explained his main concern was the “timing” of such a move and said he would have preferred that the market be allowed to

Gov’t defends $233m borrowing against ‘pure arrogance’ charge

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government yesterday defended itself from Opposition accusations of “pure arrogance” after it confirmed the law will be changed retroactively to facilitate its borrowing of $233m in IMF special drawing rights (SDRs).

The Ministry of Finance, in a statement, pledged that the necessary reforms to the Central Bank Act will be brought before Parliament for its approval “shortly” as Free National Movement (FNM) leaders demanded that someone be held responsible and

punished for a transaction they asserted has no lawful basis at present.

The ministry, effectively confirming the allegations, said: “While the use of the SDRs creates a liability to the Central Bank, it is only because the Central Bank Act in its current form does not accommodate the use of the SDRs in the manner prescribed by the IMF (International Monetary Fund).....

“The prospective amendments to the Central Bank Act, which will be brought to Parliament shortly, will codify the terms established in the governing

business@tribunemedia.net THURSDAY, JANUARY 5, 2023

SEE

PAGE B4

SEE PAGE B9

industry surpassing its pre-COVID record year of 2019 as it continues to monitor the surge in COVID cases in China.

• Port chief: Nassau can drive visitor impact to $800m • 2022 fourth quarter arrivals beat pre-COVID by 13k • And 900k rise for 2023 to give yields ‘springboard’

ROBERT SANDS

$5.85 $5.86 $5.83 $5.21

MICHAEL MAURA

POTENTIAL AND CHALLENGE AS BAHAMAS NEARS 50

This past year was one for recovery and reflection.

The COVID-19 pandemic, alongside widespread predictions of a US and wider global recession, supply chain disruptions and other socio-economic tragedies, has marred potential development opportunities for world leaders, consumers, entrepreneurs and businesses. The same sentiments are likely shared by many Bahamian families and businesses. As we approach our 50th independence celebration, we should take time to reflect on what the past three years have taught us as a nation. These events were not a test of endurance. Instead, they

were an eye opener for how unprepared we are to survive beyond the short-term aftermath of unforeseen disasters or events. The pandemic forced governments to step up, and step out, of their comfort zone to deliver sustainable, safe and disruptive solutions to health challenges that the world had not seen for 100 years. Now that our eyes have been opened to the need to diversify and plan for the unforeseen, what will our government do better to improve the current state of the country? Will we continue to aim for progress, yet revert to doing the same things we have always done?

Reality Check Since 2020, there has been no mention of using the National Development Plan (NDP) to kickstart the reforms needed across our islands to spur economic growth. There has also not been a shift in policy circles regarding the bureaucracy and red tape that still plague the ease of doing business, plus health care and crime. This signals that we may not have learnt the importance of planning for the future. But, to kickstart 2023 on a positive note, we trust that our government has a lot of innovation in store for us this year. In the meantime, this article will focus on key issues

that continue to hold back national development.

Northern Bahamas Grand Bahamians would agree the island has seen better days. Yet it appears that, since 2004, when its prolonged downturn began, the island’s ‘magic city’ reputation has been permanently blemished as residents continue to leave in search of better economic opportunities and standards of living. Successive governments have tried to give Grand Bahama the tools for success, such as new infrastructure, foreign direct investment and even diversifying its economy, but nothing has truly produced measurable

outcomes. The main reason is because hardly any promises and plans for Grand Bahama come to fruition. What is causing this? It could be the relationship between the Government and the Grand Bahama Port Authority (GBPA), or it could be a loss of interest in developing the island further. Maybe our governments have decided it is time to pump the brakes on Grand Bahama and focus on other Family Islands that are thriving. Whatever their thinking, the island remains in a depressed state.

However, there are many Family Islands, such as the Abacos, that have compensated for Grand Bahama’s reduced economic contribution. Abaco was for some time referred to as the nation’s second capital. Increased airlift and marina traffic, along with the construction of multimillion-dollar second home properties, all played a role in the island’s booming economy. However, Hurricane Dorian changed Abaco’s economic outlook. The island’s airport was destroyed, families were traumatised, and decades of home home ownership and businesses were gone in less than a day. Thankfully, successive governments together with aid from several international organisations provided relief in response to this devastation.

Yet, three years after the passing of this Category Five storm, residents still have questions on when things will fully get back to normal. One concern is whether Abaco will suffer the same fate as Grand Bahama. The latter island was a booming second city with much to offer prior to Hurricane Frances in 2004 but, somehow, it never fully recovered from this blow. We hope the Government continues to work aggressively towards rebuilding Abaco this year to prevent one more island from spiralling downward.

Central Bahamas Exuma and Eleuthera Eleuthera and Exuma are islands that have the potential to become economic centres for The Bahamas. Both islands have luxury real estate offerings, established hotel brands, skilled human capital and reliable infrastructure. The islands are also a hotspot for the growing second home and vacation rental market.

With so many parts that combine for the success of these two islands, it goes without saying that a plan is needed to ensure this continues. The Government should be prepared to further invest itself while managing future private sector investments more effectively. For example, better healthcare facilities are needed for both islands to ensure that residents and visitors do not incur expensive air travel to access medical services. Given the increasing airlift demand for both islands, this could encourage visitors or residents to visit more often.

What is also needed for these islands are better airports, with construction work having already begun in Exuma.

Hubert edwards by

Southern Bahamas

Mayaguana holds significant potential for The Bahamas given its ideal geographic location and land mass. It is a great blank state for investment. The investment group connected to this island was the Boston-based I-Group, which proposed a $1.8bn development in 2006. The then-government entered into a Heads of Agreement with Mayaguana Island Developers (MID), a joint venture entity owned 50/50 by the Government through the Hotel Corporation of The Bahamas (HCB) and the I-Group. A $7m airport development was proposed for the island. However, this has yet to start. There was also a potential project called “Port Mayaguana”. Given the island’s geographical location, it would be ideal for a transshipment hub since it sits in a major shipping lane. Minimal dredging is required since there is easy access to deep waters. The proposed port would be located at the southern part of Betsy Bay. Since we are not clear on the direction for developing this island, the government should provide an update to Bahamians on the status of long overdue projects and its relationship with the I-Group.

The National Development Plan

In 2023, we need to dust off the National Development Plan since it remains the most effective tool that will guide our leaders and policymakers by giving them the direction needed to usher in new growth for all islands. It promotes sustainable, well-researched solutions that each island can benefit from. Common issues faced among all islands are the ease of doing business, education, healthcare, transportation, tourism and investments. The National Development Plan has already outlined how these issues can be addressed.

Conclusion In closing, there is still a lot of work to do. Our nation has accomplished a lot over the past five decades yet it has not progressed in many areas. We are focused on resilience and endurance when we should really be focused on shifting the paradigm and becoming disruptors. Our current situation from a socio-economic standpoint could use improvement if only we would begin to step out of our comfort zone. As we head towards 50 years-old, let’s celebrate by putting the best interests of the Bahamian people first.

PAGE 2, Thursday, January 5, 2023 THE TRIBUNE

GOLDWYNN’S $100M EASTERN EXPANSION

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

GOLDWYNN’S developer yesterday said it no longer plans to acquire additional Goodman’s Bay real estate to its immediate west and will instead move eastwards with its $100m second phase expansion this year.

Randy Hart, the Wynn Group’s vice-president, told Tribune Business that ambitions to acquire the La Playa property and another land parcel to GoldWynn’s west

have been scrapped but the project will continue to develop moving east.

He added: “We have an understanding with the Government, and Baha Mar as well, to undertake some improvements to the Goodman’s Bay park generally. There is a committee that was formed for that purpose, which we sit on, and are just awaiting further direction from government to execute the plan.

“We’re not the only developer in Nassau, and we certainly hope that if there is a development to the west of us that is done

TOWING FARE INCREASE COULD HEIGHTEN RISKS

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

AUTOMOTIVE repair shops yesterday voiced concern that the 67 percent, or two-thirds increase, in standard towing fees could prompt Bahamians to take more risky measures to move broken down vehicles.

Primrose Johnson, owner/ operator of Johnson’s Autobody Repair & Paint, told Tribune Business that many may opt to save money by asking their friends to give them a tow rather than hire the services of a trained wrecker or tow truck driver.

Explaining that her company normally locates a tow truck for customers, then tells them how much it costs and lets them decide if they want to use its services, she added that the $40 increase in standard fees - from $60 to $100 - may also deter clients from bringing vehicles to the shop.

“It’s more convenient for a wrecker to pick up the car from the boat or the house, but a customer may go now and get one of their friends with a rope to pull the car. That’s dangerous,” she said. “Everything has gone up. Even the materials to fix cars have gone up. We run specials and things like that but it’s really hard.

“What’s really putting a lot of pressure on us is these mechanics who operate from their homes, and the shops end up losing money. We still have to end up paying Business License fees and VAT and all of that while they pay nothing.” So-called “bush mechanics” undercut established repair shops by up to 50 percent on the standard rate of auto repairs.

The Towing and Salvage Association, in a statement issued on Tuesday, said its members have had little choice but to increase rates that have remained unchanged for at least two decades in some cases due to the rising costs of doing business in an inflationary environment.

A flatbed truck will start at $150, up from the $100 per call, representing a 50 percent increase. Regular tows will now start at $100, compared to the previous $60, while recoveries start at $150 in addition to the towing fee. Derelict car removals will begin at $100, and unlocking vehicle doors at $80. Finally, the service of towing vehicle from no parking zones will cost $100.

Another repair shop, speaking under the condition of anonymity, said: “The thing with us is that normally when a tow truck tows a car here we would pay the $100 fee. So it’s not a big increase to us, but I do see it as a big increase on the general public.”

“This will hinder us getting business in, but if a customer gets into an accident, especially if it’s a prior customer, we will pay the cost of the tow truck regardless. Towing always came out of our pocket, so it wouldn’t affects us in that regard with getting customers to come in. Also, we can still also submit that towing fee to the insurance company and get reimbursed. So it will have a little effect, but nothing major.”

Jeff Major, owner/operator of Jeff’s Auto Repair, said: “One thing I tell everybody, a carton of eggs was $4 and now it’s $8. So the same money they get from towing the trucks he needs to go to the store and buy those eggs.”

appropriately. There are planning issues involving the Goodman’s Bay park and the neighbourhood in general that we would want to see addressed, and that all the stakeholders are contributing equally and fairly towards the improvements that are required to this area.

“So those are issues that I hope will be addressed in due course. Right now, as far as we know, there’s still a for sale sign out in front of the property next door. So whatever happens on the western side of us will unfold over

quite a long period of time,” Mr Hart continued.

“There’s also the La Playa property next door to us owned by the National Insurance Board (NIB) that still has a question mark over it as well. It remains derelict to this day and we’d certainly like to see some improvement and beautification of that property.”

As for GoldWynn’s phase two development, Mr Hart said: “We have received all of the preliminary approvals for the second phase of GoldWynn, which would include a smaller scale that is at a commensurate level

of the quality of the building next door, on the eastern side of the property. We’re expecting to start that early in 2023. That would be a roughly another $100m investment.”

Phase one is 95 percent sold, with the first 25 tenants already moving in as of this week. The GoldWynn hotel will be finished next month and is already receiving strong bookings. “The building is divided into two sections. There’s the residential wing and the condo hotel, where the condo hotel owners have been permitted

WEST BAY STREET DEVELOPMENT’S RENTAL RATES 20% ABOVE TARGET

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A RESIDENTIAL West Bay Street development was yesterday said to be more than 95 percent sold with rental rates some 20 percent higher than projected.

Randy Hart, president of Villanova Bahamas, told Tribune Business that the

project’s second phase will be completed by April this year. Phase three is under construction now and will be completed in June, the first phase having been finished in November 2021

“The first phase is fully occupied. There are homeowners occupying certain units, and there are also other owners leasing their units, either long-term or short-term, but mostly longterm,” Mr Hart said.

“The market for the rentals has proven to be higher and even more robust than we had initially anticipated. The owners are receiving rents in excess of our initial projections - about, I would say, at least 15 percent to 20 percent higher than initially projected. We’re basically working on a waiting list basis for the rentals.”

The average cost for a rental unit was initially $2,800, but homeowners are now earning on average

to move in to the units that we have,” Mr Hart added.

“We won’t be accepting paying guests until the first the first week of February, at which time we will have the official opening of the hotel component. This will include all the resort amenities; the spa, the restaurant, the beach bar, the cafe, the fitness club and everything else.”

All first phase units were said to be “basically ready for occupancy”, with just the last fittings and furnishings remaining before February’s grand opening.

between $3,400 and $3,600 a month. Demand has spiked for housing in western New Providence, “with proximity to Cable Beach, down town and Paradise Island” among the elements sought-after by buyers.

Villanova’s buyers were said to be split evenly between expatriates and Bahamians, with just two units remaining to be sold. Villanova’s initial development cost was pegged at $14m. It has survived the COVID-19 pandemic after launching in December 2019. Most units are priced under $400,000, which place them within reach of the middle and upper middle class Bahamians.

Atlantis unveils five-day food and wine festival

ATLANTIS yesterday confirmed the Nassau Paradise Island Wine & Food Festival, which will be held over five days between Wednesday, March 15, and Sunday, March 19.

The Paradise Island mega resort, in a statement, said the festival will showcase top chefs, master sommeliers, mixologists and TV personalities including Tony Abou-Ganim, Alex Guarnaschelli, JJ Johnson, Aarón Sánchez, Alon Shaya, Michael White and Andrew Zimmern.

Grammy Award-winning artist, Wyclef Jean, will also perform at Jerk Jam on March 18. Duff Goldman and DJ Kim Lee, from Netflix’s Bling Empire, will host the festival’s closing night Sugar & Spice after party at The Cove pool.

Atlantis said the festival aims to highlight Th Bahamas as a growing culinary

and entertainment hub, while generating awareness for Atlantis Blue Project Foundation. This is a non-profit founded in 2005 to protect and preserve marine wildlife, and associated endangered habitats, throughout The Bahamas and Caribbean seas.

Following the previous Taste of Paradise Food & Wine Festival, the newlynamed Nassau Paradise Island Wine & Food Festival will be expanded to include local and regional chefs and restaurants, music

performances and exclusive dinners.

While participating in events with visiting celebrity chefs, Atlantis said guests will be able to enjoy Bahamian dining favourites such as Sip Sip, McKenzie’s Conch Shack, Bimini Road, Sun & Ice gelato and ice cream by Bahamian chef Wayne Moncur, locally produced beers, and Paradise Rum, Atlantis’ signature rum produced by John Watling’s Nassau distillery.

Guests will also experience new restaurants and bars, including Paranza from Michelin-starred chef Michael White; Café Martinique by chef Adrian Delcourt, and The Dilly Club, the new offshoot of Bon Vivants Bar & Café.

The complete line-up of festival events, live entertainment and appearances can be found online at npiwff.org or atlantisbahamas.com. Tickets are available for purchase now at npiwff.org.

THE TRIBUNE Thursday, January 5, 2023, PAGE 3

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

‘$400m opportunity’ to double cruise spend

FROM

comparatives despite losing seven vessel calls to Tropical Storm Nicole.

“When we talk about getting more persons off the ship, and when we look regionally at the historical spend by cruise passengers in each destination, Nassau has traditionally been half of what the top spending destinations of St Maarten and St Thomas are,” Mr Maura told this newspaper. “Those passengers spend about $100 more there than they have in Nassau.

“With four million cruise passenger arrivals, and $100 in extra spending each, that’s $400m per year of new opportunity on top of the $380m they have already been spending with us. We have an opportunity to double the gross spending amount from the cruise sector coming to Nassau, going from $380m to around $800m by getting

those people off the ship and giving them more to do. “That’s what this new waterfront development [cruise port] in Nassau is all about, and why the Government is encouraged to support the development of these heritage sites throughout New Providence because these visitors really want to get to know us and understand our 500year culture and history.”

The $300m transformation of Nassau Cruise Port, which will feature an amphitheatre, Junkanoo museum, retail, food and beverage, arts and crafts and other amenities that create a Bahamian ‘sense of place’, is intended to be the catalyst that drives more passengers off their vessels when in port as well as sparking other downtown Bay Street businesses, plus the likes of tour and excursion providers, to enhance their product offerings and drive greater visitor spend.

Mr Maura, meanwhile, said the platform to drive increased economic benefits for Bahamians was in place with cruise passenger numbers forecast to increase by 27.6 percent year-over-year in 2023. “Nassau Cruise Port finished the year with 3.313m passengers arriving on 1,140 ships,” he revealed of 2022, the first full year of post-COVID recovery for the cruise industry.

“Cruise traffic in 2019 to Nassau broke all previous records, with 3.85m passengers arriving on 1,206 ships, making it an exciting target for 2023. Comparisons to vessel and passenger counts reveal that 2022 had 5.5 percent fewer vessel calls than 2019, but 1 percent more than in 2018, while passenger volumes were 17 percent and 11 percent under 2019 and 2018, respectively.

“January 2022 began with vessel occupancy of 45 percent or the month’s ships

averaging 1,148 passengers. By June 2022, vessel occupancy had climbed to 102 percent with ships averaging 3.312 passengers per call.” While increasing per capita cruise passenger spend will take some time, and not be accomplished in one year, Mr Maura said cruise ship berthings for 2023 are “solid”.

The 4.1m passengers forecast to arrive at Prince George’s Wharf in 2023 will exceed 2019’s performance by some 6.5 percent, while vessel calls are ahead by 3.6 percent or close to 50. “Our confirmed bookings are well ahead of 2019, and 2019 has been the benchmark as the record year that The Bahamas and Nassau enjoyed for most vessel calls and passengers ever having landed in the capital,” Mr Maura told this newspaper.

“And the 2022 fourth quarter marked the end of the recovery with total passenger volumes of 989,285

‘Settle down’ before tax crackdown tie-in

“stabilise” following the multiple challenges to last year’s revaluations.

Meanwhile, Mark A Turnquest, a consultant and president of the 242 Small Business Association Resource Centre, voiced concerns that the Government’s plans to “garnish” or take a lien over rental income paid to delinquent taxpayers will introduce “chaotic” complications into the relationship between commercial landlords and their business tenants.

While not objecting to the Department of Inland Revenue collecting taxes that are due and owing, he argued that it needed to develop a better mechanism for doing so as opposed to inserting itself into the landlord-tenant relationship. Mr Turnquest said he was particularly concerned whether, if the Government took all or a portion of rental payments to satisfy real property tax arrears, the landlord could then deem their tenants to be in breach of the lease agreements.

Both men spoke out after Tribune Business revealed that Bahamian companies will have their 2023 Business Licence renewals withheld if they fail to comply with the

Government’s crackdown on tax dodging commercial property landlords.

The Davis administration is now demanding that all businesses provide the real property tax assessment number for the building from which they operate even if they are merely tenants, while warning that failure to do so could delay or impact the processing of Business Licence renewal submissions that are due within 27 days at January’s end.

Mr Martinborough, though, questioned what would happen in the case of a property he was familiar with which had received two separate real property tax bills with different assessment numbers. “When we contacted the Department of Inland Revenue’s real property tax unit, they said they would have to research that and go out there and go through it with management to sort it out,” he recalled.

“We said: ‘There’s nothing to sort out. We pay our taxes, and we’ve received two bills with different assessment numbers for the same property’.” Mr Martinborough argued that it would have been better to delay linking Business Licence renewals to real property tax compliance by commercial landlords due

to the upheaval created by last year’s revaluations that produced huge tax hikes and multiple challenges by aggrieved taxpayers.

“There was a lot of push back and rightly so,” he said, noting that the Department of Inland Revenue had made the necessary adjustments to commercial property valuations for 2023. Taxpayers who successfully challenged their 2022 valuations have received “a rebate or credit” on their latest bills

“We want to make sure their correct,” Mr Martinborough said of the 2023 valuations, “but then to be hit with this. I just think it’s unfair when we are going through all these adjustments. Do it when the system is stable. It’s just that the timing is not great. I understand the intent but the timing is bad, although I could see it coming. My objection is that they should have slowed it down.

“It’s a good thing that business people and landlords pay their taxes. The concept of this is good. But last year was a tough year, when many of the valuations were out of left field. They adjusted it, great, but they have to let things settle down and to tie it to Business Licences at this time is a bit aggressive.”

The Bahamas Realty said the move also had to be assessed against the backdrop of multiple economic and inflationary pressures. “I’ve never seen inflation so bad in so many areas. Where does it stop?” he asked. “Increases of 30-40 percent are on a lot of things, and it does take its toll on the middle class. I’m worried about the long-term effect of all these things. There comes a point when the straw breaks the camel’s back and people can’t pay these things.”

The joint objective of the Ministry of Finance and Department of Inland Revenue is two-fold - to boost both Business Licence and real property tax revenue. By better matching business tenants to their commercial landlords, the tax authorities’ goal is to detect those among the latter who lack the necessary Business Licence for the activities they are conducting and thus clamp down on such tax dodging.

While companies have been assured that their landlord’s existing real property tax arrears will not impact Business Licence renewals, the strategy is also designed to provide the Department of Inland Revenue with information enabling it to

compared with 986,641 [in 2019]. It provided us with a passenger count around 13,000 higher than in 2019. It is definitely the springboard for what we will see in 2023. Our passenger forecasts for 2023 are over 4.1m and vessel calls are approximately 1,250, which will materially exceed 2019 for both counts.”

Mr Maura said the 2022 fourth quarter beat 2019 comparatives despite Nassau Cruise Port suffering the loss of seven potential vessel calls due to Tropical Storm Nicole. He added that the numbers being generated “bring a lot of confidence to the cruise industry itself, which has climbed what must have felt like a vertical cliff after coming to a standstill due to the pandemic.”

The Nassau Cruise Port chief described the sector as akin to “a hibernating bear that just woke up” given its rapid ascent from a total

“garnish” the tenant’s rental payments and thereby use these to pay-off debt owed to the Public Treasury by the building’s owner.

The move will impact hundreds, if not thousands, of Bahamian companies who lease - rather than own - the premises from which they operate. Retailers, restaurants and office-based businesses are just a few sectors that typically rent their locations.

Given that corporate tenants do not necessarily possess their building’s real property tax assessment number, since such information will typically be held by their landlord, several raised concerns over what happens to Business Licence renewals in the event that the latter proves uncooperative in providing it.

Mr Turnquest, who yesterday revealed that virtually all his small business clients and members lease their premises, voiced particular concern over the Government’s plans to “garnish” rental income paid by tenants to settle their landlord’s real property tax debts.

“It’s difficult for small businesses to be put in that position,” he argued. “If we cannot get our Business Licences then what happens? We will be closed down. I don’t feel as if that’s a good position for the small businesses to be in. If the landlord has not paid their

shutdown over the past 18 months. And, besides increased cruise passenger spending, Mr Maura said 2023’s forecast arrivals also represent “four million individual opportunities” that The Bahamas must seek to convert into highyielding stopover visitors that take their next vacation in this country at a resort.

“From our perspective as a tourism destination, a tourism country, when we have 4m people come to visit on an annul basis that’s 4m individual opportunities to encourage those visitors to return, but the next time they return to fly into Nassau through Lynden Pindling International Airport (LPIA) and stay in one of our resorts,” Mr Maura said. “That is when we will see visitor spending increase substantially above what the typical cruise passenger spends.”

property taxes, that is going to be very complicated.

“I have no problem with the Government getting their taxes, but they’re introducing another layer of work for us small businesses. What system will be put in place for us? I hope the Government has an alternative mechanism in place to receive their tax money. That is now another burden on small businesses. There are severe legal ramifications.”

Mr Turnquest queried whether, if the Government “garnished” or seized a tenant’s rental payments to settle their landlord’s real property tax arrears, the latter could treat this as a breach of the tenancy agreement and terminate it for cause. “Our members feel we should not be put in that awkward position where we have to pay a portion of the rent to the Government,” he said.

“That’s going to have all kinds of legal and accounting ramifications because you will have to redo the lease agreement again. We are fighting for our livelihoods with inflation, crime and other negative impacts to our business. We don’t need any further negative things. This is going to cause chaotic conditions for our members and my clients as 99 percent of then have lease agreements.”

PAGE 4, Thursday, January 5, 2023 THE TRIBUNE

PAGE B1

FROM PAGE B1

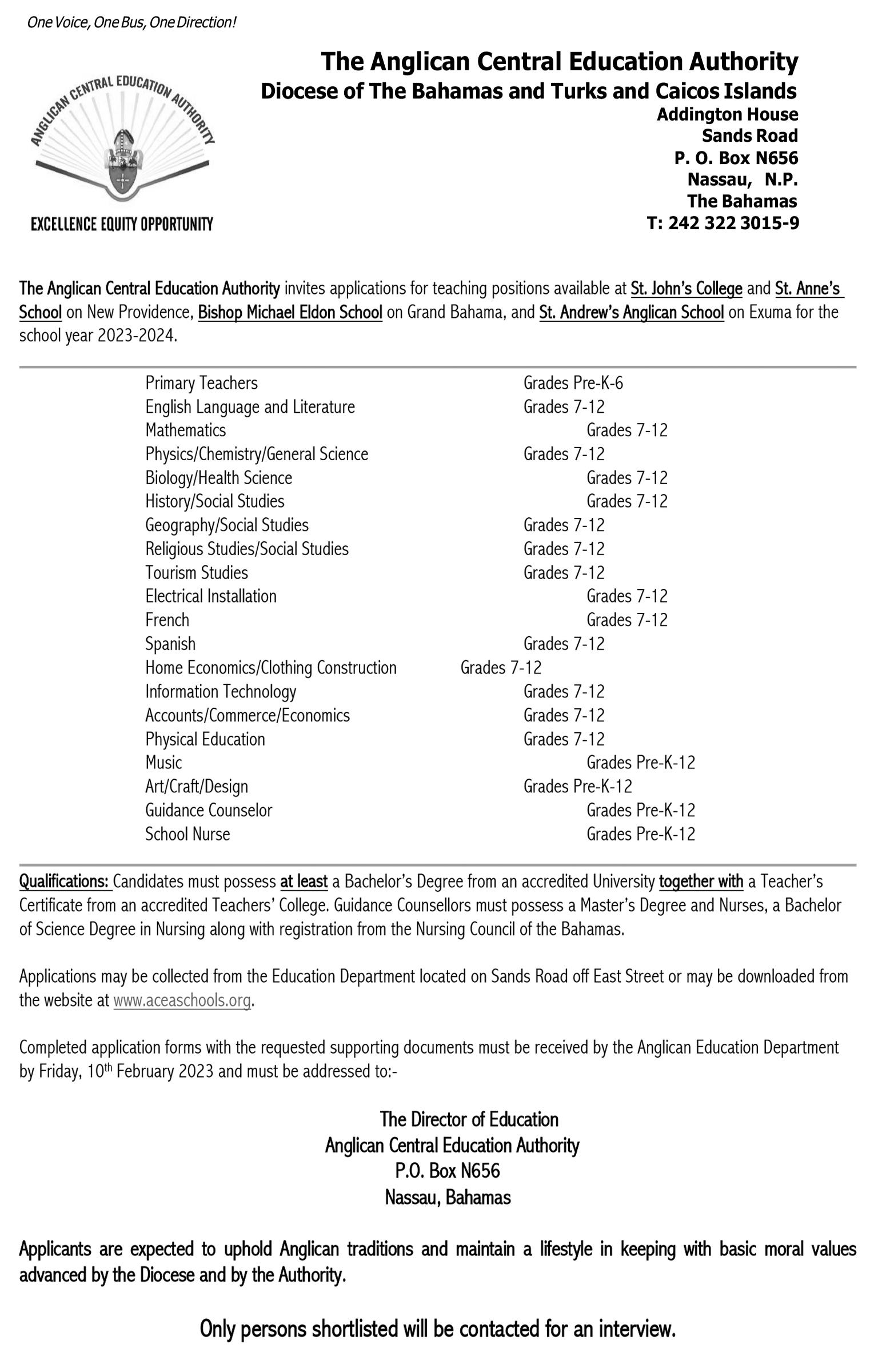

PM to set out Gov’ts vision at Business Outlook event

THE PRIME Minister will set out the Government’s vision for this nation’s development in 2023 and beyond when he gives the keynote address at this year’s Bahamas Business Outlook conference on January 19.

Philip Davis KC will give a presentation entitled Forward, upward, onward, together: A bold vision for the next 50 years’ during the event, which will be held at Baha Mar via a hybrid of in-person and virtual attendance.

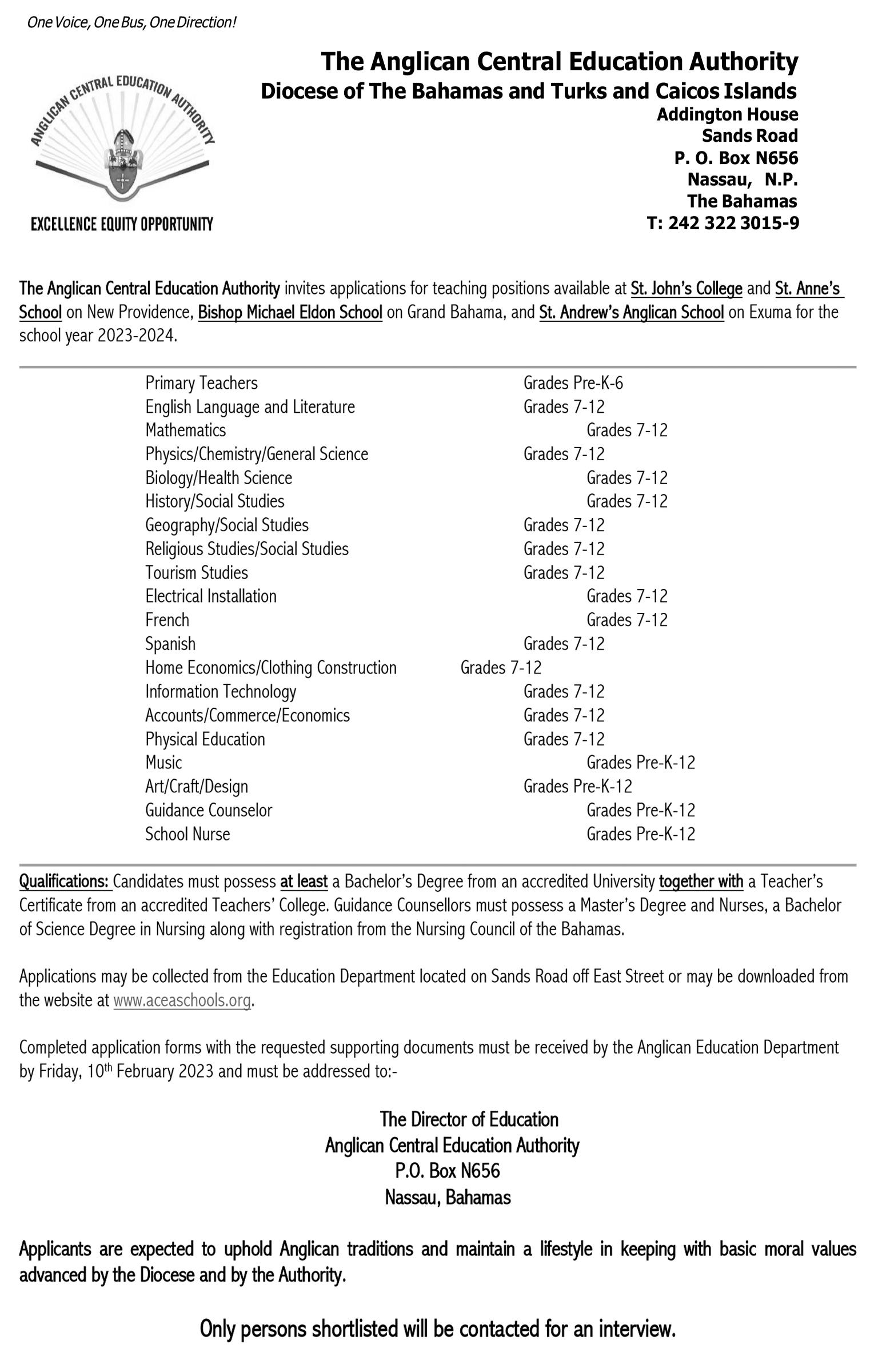

Joan Albury, president of TCL Group, founder and chief organiser of the Bahamas Business Outlook series, said in a statement: “We have planned this year’s Bahamas Business Outlook, the lead in our series of forums, as a grand event with a novel and timely slate of topics and dynamic group of speakers who head key projects and institutions.

“We are most grateful that Prime Minister Davis has confirmed his attendance and presentation, thus continuing the much-anticipated tradition of the nation’s prime minister leading as keynote at Bahamas Business Outlook. I’m giving our potential audience a heads up; we have deliberately

put at the end of our agenda a panel presentation, comprising leaders who will highlight the latest developments which offer tremendous opportunities for partnerships, spin-offs and employment.”

Echoing the 2023 Bahamas Business Outlook theme, the programme will be divided into four segments: Forward: ‘Moving ahead with purpose and speed’; Onward: ‘Prioritising the sustainable revolution’; Upward: ‘Soaring to economic advancement and diversification; and Together: ‘Facilitating stakeholder engagement for success’.

Led by moderators K Karlos Mackey, chief executive, MoneyMaxx; Ria Christina, host, You and Your Money; and Davrielle Gardiner, Bahamas@ Sunrise host, the other speakers and their presentations are as follows. ‘The Road to 50’, George Smith, special advisor, 50th anniversary events; ‘Staying Connected’, John Gomez, chief operations officer, Cable Bahamas; ‘Rising Above, Going Beyond: Doing Business in The Bahamas’, Christel SandsFeaste, partner, Higgs & Johnson; ‘The Energy Revolution’, Toni B. Seymour, chief operations officer,

Bahamas Power & Light; ‘The Future of banking in The Bahamas’, Roger Archer, vice-president and district head for Caribbean North, Scotiabank; ‘Creative industries: A potential income generation power base, Neko Meicholas and Patricia Glinton-Meicholas, principals, Guanima Press; ‘Tourism & Hospitality Education 2.0’; Erik Rolland, president and chief executive, University of The Bahamas; ‘Enriching the future of the world with leading emerging technology; Robert Sweeting, Fli Drone; ‘Applied skills of artistic expression in business communication and success’, Dion Cunningham, pianist and educator; ‘Aligning healthcare and hospitality’, Dennis Deveaux, chief financial officer, Doctors Hospital Health System; ‘Environmental economics for sustainable (national) development’, Karen Panton, executive director, Bahamas Protected Areas Fund; and ‘Dialogue, diversity, inclusion: Bahamians learning to live and prosper together’, Haldane Chase, professor, University of The Bahamas.

The panel that will address ‘Public-Private Partnership in motion’ are Michael Maura Jr, chief

executive and director, Nassau Cruise Port; Dr Charles Diggiss, president, Doctors Hospital Health Systems; and Khrystle Rutherford-Ferguson, chairman, the Bahamas Chamber of Commerce and Employers’ Confederation (BCCEC).

“Not only are we celebrating our country’s 50th anniversary of independence, but we’re also expressing our gratitude for 32 years of Bahamas Business Outlook, which is a signal achievement. We are talking about visioning and planning the way

Xmas business spikes for Go’vt worker lender

A CONSUMER credit provider says the recent Christmas holiday was its second busiest quarter behind only the summer vacation and back-to-school season in 2022.

Ruthie Knowles, general manager for Easy PayDay, which provides consumer credit for government employees, said in a statement: “It was our second busiest quarter with our parking lot overflowing, and extra work hours added to fulfill our service delivery promise of one-hour approval and disbursement.”

Easy PayDay, a Bahamian-owned company, has been servicing government employees since 2015. Loans are approved and fulfilled in an hour, either online or in person at its University Drive location.

“Currently, we lend up to $30,000 to permanent government employees,”

explained Mrs Knowles. “Our business trend presently depicts approximately one-third as new business. Top-ups and consolidation loans are the most popular for existing customers. On average, loan requests and fulfillments are usually between $5,000 and $10,000.”

The general manager said loan repayments are managed through the Government’s payroll system, and the Easy Payday instant emergency or short-term loans for public sector employees has meant double-digit growth each year with thousands of loans being written annually.

“We hear every type of emergency that needs an instant loan to manage the situation, and sometimes they are for tragic reasons. Our staff know when to deliver compassion with their customer service,” Mrs Knowles said.

ahead with optimism. Celebratory inputs will include the String City Violinists of The Bahamas to present the national anthem and opening prayer, and Vivian Moultrie, composer of the national motto, as luncheon speaker,” Mrs Albury said.

“Towards the end of 2022, Forbes magazine, one of the major media players in the world of finance, offered this statement as part of its outlook on 2023: ‘With a downturn in the near future, executives must prepare their companies to weather the storm and to come back stronger once it subsides’.

“So TCL is doing its part by offering Bahamians and others interested in Bahamas business development a forum for balanced information, professional opinions and expert advice. We must indeed face this new year looking honestly and fully at such views but, equally, our country must forge boldly ahead with openness to new ideas, novel strategies and in faith for an increasingly brighter future”.

Persons interested in tuning in can register at tclevents.com or call TCL Group at 322-1000.

EASY PayDay Loans general manager, Ruthie Knowles, said this past Christmas season was its second busiest quarter in 2022 with staff working extra hours to fulfill the company’s promise of a one-hour credit approval and disbursement. L to R: Felanique Capron, accounts officer, and Mrs Knowles.

“It’s all about the service. We can turn around a loan in less than an hour; traditional lending institutions can’t do that. Times have changed and credit facilities are changing, too. We’re proof that there is a real need for more versatile and flexible money lending options. Currently we service only government employees but, due to the high number of non-government employee inquiries for loans, we are considering extending credit to the private sector.”

THE TRIBUNE Thursday, January 5, 2023, PAGE 5

PHILIP DAVIS KC

importance” of protecting both lives and livelihoods would be factored into any future decisions or actions by The Bahamas.

The Government earlier this week stated it has no plans at present to impose testing restrictions on Chinese travellers, and Mr Sands said: “Based on our conversations with the Ministry of Health and Ministry of Tourism, there is the utmost sensitivity with this particular matter.

“Obviously the health of citizens and tourists is of paramount importance to The Bahamas, but there’s also the paramount importance of sustaining the economy that is continuing to rebound robustly. Therefore, I think decisions will be made that encompass all those considerations.”

Asked whether the hotel and tourism industries harboured any fears about

falling back into COVID restrictions and protocols, Mr Sands replied: “We are satisfied at this point in time, and we don’t anticipate us going back to this time period.”

He pointed out that The Bahamas attracts relatively flew Chinese visitors and tourists and, in the absence of direct commercial flights between the two countries, any travellers heading this way will have to interconnect through multiple gateways where COVID testing restrictions have already been imposed.

The BHTA president said this had created “a buffer” between The Bahamas and China’s COVID surge that should help to protect this nation, although the industry is “continuing to monitor the situation”. And 90 percent of The Bahamas’ visitor base continues to come from the US and Canada rather than Asia or the Far East.

Buoyed by a Christmas/ New Year performance that “met or exceeded persons’ expectations”, Mr Sands told Tribune Business: “If the demand in the last quarter, and certainly in the last month or two, is any indication and we certainly don’t see that abating..... The forward bookings for the first quarter of 2023 are much further ahead than the advance bookings for the same period last year.

“I would say they are anywhere from 10-15 percent ahead. I am reasonably satisfied that all the indications for 2023 would put us ahead of our best year in 2019. That’s a combination of cruise and stopover visitors. We’re seeing an increase in average room rate, we’re seeing an increase in average spend, we’re seeing an increase in length of stay.

“All the barometers are trending in the right direction. Without looking, I would say they’re running

Amazon, Salesforce jettison jobs in latest tech worker purge

By MICHAEL LIEDTKE AND MICHELLE CHAPMAN AP Business Writers

E-COMMERCE giant Amazon and business software maker Salesforce are the latest U.S. technology

companies to announce major job cuts as they prune payrolls that rapidly expanded during the pandemic lockdown.

Amazon said Wednesday that it will be cutting about 18,000 positions. It’s the largest set of layoffs in the

Seattle-based company’s history, although just a fraction of its 1.5 million global workforce.

“Amazon has weathered uncertain and difficult economies in the past, and we will continue to do so,” CEO Andy Jassy said

in the high single digits [ahead of 2022] and beginning to get into the double digits.” The 2023 first quarter includes the peak winter tourism season, and the run-up to Easter which this year falls on April 9, and is typically the period when Bahamian resorts make the bulk of their annual profits that carry them through the quieter periods later in the year.

Describing the tourism industry’s outlook as “exceptionally strong”, Mr Sands added that the postCOVID recovery’s speed and strength had exceeded the sector’s expectations. “I think we’re seeing it start with the first quarter out of January. January is stronger than normal,” he added. “What I also think is that pent-up demand has not begun to subside at the rate we thought it might do. It continues to remain strong.

“It’s also evidenced by the fact the equity of The

in a note to employees that the company made public. “These changes will help us pursue our longterm opportunities with a stronger cost structure.”

He said the layoffs will mostly impact the company’s brick-and-mortar stores, which include Amazon Fresh and Amazon Go, and its PXT organizations, which handle human resources and other functions.

Bahamas’ brand continues to be extremely strong because we are seeing growth from all over. We’re also seeing the emergence of Family Islands that here-to-before were not considered to be at the forefront of tourism; certainly Andros, while Eleuthera is gaining attention, and San Salvador with the re-opening of Club Med. We’re not only seeing growth in New Providence but are seeing it in the Family Islands.”

Mr Sands said The Bahamas was also experiencing the ongoing revival of its group business, long considered as the market segment that will recover last from COVID because it takes time to build. He added that the industry was also confident that this nation has sufficient airlift capacity to meet present tourist demand.

“We’re beginning to see new gateways develop,” the BHTA chief confirmed.

Salesforce, meanwhile, said it is laying off about 8,000 employees, or 10% of its workforce.

The cuts announced Wednesday are by far the largest in the 23-year history of a San Francisco company founded by former Oracle executive Marc Benioff. Benioff pioneered the method of leasing software services to internet-connected devices — a concept now known as “cloud computing.”

“At the moment demand can be met, but we continue to work on growth from other gateways to expand that opportunity. All the signs are pointing upwards. What is important is that the Government initiatives in terms of Family Island airport development and renovation continue with the growth we have.”

Mr Sands shrugged off fears that continued inflationary pressures, as well as a predicted US and global recession, would impact 2023 prospects for the Bahamian economy and its tourism industry. “I think The Bahamas market tends to be on the mid to upper class tourists, which are less susceptible to the headwinds of inflation in the US. I don’t see that as an issue that will retard our growth in tourism,” he added.

Salesforce workers who lose their jobs will receive nearly five months of pay, health insurance, career resources, and other benefits, according to the company. Amazon said it is also offering a separation payment, transitional health insurance benefits, and job placement support.

Investments Limited is seeking to fill the following position: Surveillance Officers (Nassau)

• Monitor operations to ensure compliance with safety or security policies or regulations. Observe individuals’ activities to gather information or compile evidence.

Operate surveillance equipment to detect suspicious or illegal activities.

• Discuss performance, complaints, or violations with supervisors. Monitor establishment activities to ensure adherence to all gaming regulations and company policies and procedures.

Observe gaming operations for irregular activities such as cheating or theft by employees or patrons, using audio and video equipment. Report all violations and suspicious behaviors to supervisors, verbally or in writing.

• Act as oversight or security agents for management or customers. . Be prepared to work within a shift system

• Retain and file audio and video records of gaming activities in the event that the records need to be used for investigations.

• Perform other related duties as assigned by Management.

In November, Jassy told staff that layoffs were coming due to the economic landscape and the company’s rapid hiring in the last several years. Wednesday’s announcement included earlier job cuts that had not been numbered. The company had also offered voluntary buyouts and has been cutting costs in other areas of its sprawling business.

The layoffs are being made on the heels of a shake-up in Salesforce’s top ranks. Benioff’s handpicked co-CEO Bret Taylor, who also was Twitter’s chairman at the time of its tortuous $44 billion sale to billionaire Elon Musk, left Salesforce. Then, Slack co-founder Stewart Butterfield left. Salesforce bought Slack two years ago for nearly $28 billion.

Benioff, now the sole chief executive at Salesforce, told employees in a letter that he blamed himself for the layoffs after continuing to hire aggressively into the pandemic, with millions of Americans working from home and demand for the company’s technology surging. “As our revenue accelerated through the pandemic, we hired too many people leading into this economic downturn we’re now facing, and I take responsibility for that,” Benioff wrote.

COMMERCIAL BUILDING FOR SALE

Three-storey Commercial Building located on the Northern side of Delancey Street, approximately 135 feet East of Nassau Street, on the Island of New Providence, The Bahamas. The building is situated on 8,791 square feet of land and has a gross floor space of approximately 5,208 square feet.

The ground floor of the building consists of a retail shop and office space with an entry porch, and a bathroom. Both upper and attic levels comprise a large open office space and two (2) bathrooms. The property has asphalt surfaced parking, and concrete block and chain link fencing boundary enclosures.

All offers must be in writing in a sealed envelope marked “Commercial Building” and addressed to the Receiver, along with a copy via email to james.gomez@ecovis.bs.

The closing date for submission is January 31, 2023.

James B. Gomez Receiver

ECOVIS bahamas Serenity House, East Bay Street Nassau, The Bahamas

PAGE 8, Thursday, January 5, 2023 THE TRIBUNE

COVID

Winter

10-15% FROM PAGE B1

non-factor:

tourism season up

Interested persons must require surveillance experience, certification, training, communication skills, attention to detail, ability to work independently and should apply at Jarol Investments Limited Head Office, Prince Charles Drive (Across from Restview) between the hours of 9am to 5pm. Or send your CV to careers@chancesgames.com

Surveillance Officer – Your Name

Jarol

Subject:

Gov’t defends $233m borrowing against ‘pure arrogance’ charge

Memorandum of Understanding (MOU). It will also modernise the Act and facilitate the proper classification of this transaction as contemplated by the IMF.”

The MoU was signed with the Central Bank to facilitate the $233m borrowing.

The Ministry of Finance reiterated that the SDR transaction was a prudent move to source low-cost foreign currency financing and thus save Bahamian taxpayers millions of dollars in associated debt servicing costs at a time when the Government would otherwise have to pay close to double digit interest rates on the international capital markets.

However, Michael Pintard, the Opposition’s leader, yesterday argued that the real issue was whether the borrowing was legal as opposed to being low-cost financing. “There have to be consequences,” he told Tribune Business ‘We keep highlighting where they are breaking the law. We want it on the record that this cannot be the Government continues to admit to a litany of breaches of the law with no consequences, no one held responsible, no policymaker, no civil servant.”

Accusing the Government of “acting with impunity”, he added: “These are decisions involving hundreds of millions of dollars they are making that can have an adverse impact on our fiscal position. They continue to make mistakes with no consequences at all. It’s not a question of borrowing from the Central Bank at low-cost. The issue is whether it’s lawful

for them to do so. The law guards against them behaving in that manner.”

Mr Pintard urged the Prime Minister to confirm “whether or not he signed off on this” in his capacity as minister of finance.

The FNM had previously argued the IMF SDR transaction potentially breaches Section 21 of the Central Bank Act, which sets limits on how much the monetary policy regulator can lend or advance to the Government.

However, the party yesterday asserted that it also violates Section 68 (1) of the Debt Management Act, which stipulates that any public official found to have borrowed money from the Central Bank outside of what is allowed in the Central Bank Act commits an offence of financial misconduct.

Kwasi Thompson, the Opposition’s finance spokesman, yesterday described the Ministry of Finance statement as a

“non-response” that further confirmed the FNM’s charges that the Government had entered into a financial borrowing arrangement that is not supported by law.

“There is no legal basis on which they can get this loan from the Central Bank,” the former minister of state for finance told Tribune Business. “It was confirmed in the MoU that there is a commitment to change the law, which is an admission that in order to proceed with this transaction the law must been changed but they have not yet done so.”

Mr Thompson went further in a release, accusing the Government of “pure arrogance” in its approach to the IMF SDR loan.

“There is no excuse for the Davis administration to have broken the law with a promise to fix the willful breach after the fact,” he said. “The primary responsibility of any government is to uphold the law of the

land.... The Opposition is dismayed that the Government would so brazenly break the law

“We also question why the Government would draw down on this facility with only a Memorandum of Understanding, which in most cases is not legally binding. Is this how the Government of the Bahamas functions? Where is the loan agreement and what are the terms of the facility? There is absolutely no legal basis for the Government to have agreed to this loan or to receive the money. It is against the law to do so.”

Simon Wilson, the Ministry of Finance’s financial secretary, previously told this newspaper the MoU would provide the Government with access to cheap foreign currency financing that as an estimated 700 basis points below prevailing market rates.

Based on the $233m valuation presently assigned to the SDRs, he argued

that this seven percentage point differential could generate close to $20m in annual interest savings for hard-pressed Bahamian taxpayers compared to the likely rates if the Government had to borrow in the international capital markets.

Mr Wilson also argued that the Government’s SDR borrowing was also aligned with the IMF’s stated reason for issuing them, which was use for “fiscal purposes”. This is partially backed by the Central Bank’s August 2021 release, which says: “Countries can decide whether policy buffers would be used to increase the flexibility of fiscal and monetary policies, including for pandemicrelated deficit financing, debt management operations, promoting external debt sustainability, financial stability or balance of payments needs.”

“I think we have to remember now that when the SDRs were issued, the

IMF’s viewpoint was that it was primarily for fiscal purposes,” the financial secretary said. “The Central Bank at the time said to put it in the reserves. But it’s unlikely the IMF will reduce the amount of SDRs issued. It’s a perpetual source of financing. It will be there for a long period of time.

“It makes sense, when you look at the cost of financing domestically and internationally, to use the SDRs for their intended purpose. The savings will be significant.” Compared to the international markets, Mr Wilson said the variable 2.88 percent interest rate attached to the SDRs - as measured over the Christmas week - would likely result in a “seven percentage point saving”.

Based on that saving, and the $233m value presently assigned to the SDRs, Tribune Business calculated a $16.31m annual interest bill savings for Bahamian taxpayers if the full amount is drawn down. “To me, that’s a significant savings,” Mr Wilson asserted. “Why not do it?”

The IMF SDR move thus continues the Davis administration’s strategy of finding creative ways to access low-cost foreign currency debt financing while avoiding the international capital markets. It started with the $206.5m Goldman Sachs repurchase or ‘repo’ deal last year, using funds accumulated to repay future debt maturities, and maintained this with a subsequent $385m bond - of which some $200m was guaranteed by the InterAmerican Development Bank (IDB).

THE TRIBUNE Thursday, January 5, 2023, PAGE 9

FROM PAGE B1

MICHAEL PINTARD

Reinforces company goals and vision to all direct reports and continually implements this strategy into overall communications.

Supervises, directly and/or indirectly, all Security/Surveillance team members including: selection, training, work direction, safety, communication, counseling, disciplining, performance evaluations and records. Oversight and training for emergency response procedures such matters as fires, bomb threats, power outages, and other serious matters or emergencies.

Directs and monitors the security and safety of customers, employees, facilities, and grounds. Reviews

property

reports

KWASI THOMPSON

•

•

security/surveillance investigations concerning all incidents and issues taking place on

and makes necessary

and notifies the Assistant COO.

reports for accuracy and completeness

• Checks all security/surveillance

and ensure timeliness.

with department and Company policies and

• Ensure compliance

procedures.

department schedule.

• Create and update weekly

for alertness, appearance,

duties.

• Continually evaluate Team Members

and proper performance of

• Observes, supervises and instructs shift officers in the performance of their duties. Determines personnel requirements and makes assignments at the beginning of each shift.

• Ensure effective onboarding and training for Security/Surveillance Officers. Provide security and protection for customers, team members, property and assets.

• Reacts promptly to disturbances where Security/Surveillance is required. • Maintain a high level of confidentiality • Be familiar with all Chances web shops throughout the Bahamas.

• Takes appropriate action, when required, of individuals suspected of illegal activities.

Interested persons must require surveillance experience, certification, training, communication skills, attention to detail, ability to work independently and should apply at Jarol Investments Limited Head Office, Prince Charles Drive (Across from Restview) between the hours of 9am to 5pm. Or send your CV to careers@chancesgames.com Subject: Assistant Security Manager – Your Name

• Perform related duties as assigned by management.

to fill the following

Security Manager

Jarol Investments Limited is seeking

position: Assistant

(Nassau)

Asia shares up as sentiments boosted by Fed minutes, US jobs

By YURI KAGEYAMA AP Business Writer

ASIAN shares are mostly higher following a rally on Wall Street as investors assessed minutes from the Federal Reserve’s latest meeting of policymakers and welcomed encouraging data on U.S. jobs.

Worries over China’s economic slowdown were weighing on regional sentiment.

Japan’s benchmark Nikkei 225 rose 0.9% in morning trading to 25,943.93. Australia’s S&P/ASX 200 edged up 0.1% to 7,068.60. South Korea’s Kospi added 0.6% to 2,268.29. Hong Kong’s Hang Seng jumped 2.3% to 21,274.44, while the Shanghai Composite gained 0.6% to 3,143.63.

“Despite the positive close in Wall Street, the fade of earlier gains and muted moves in the U.S. equity futures this morning are driving more measured upside in the Asia session,” Yeap Jun Rong, a market

analyst at IG, said in a report.

The government will release its weekly unemployment report on Thursday and its closely watched monthly employment report, for December, on Friday. Strong jobs numbers are seen as an indication of inflationary pressures that support further interest rate increases by the Federal Reserve.

Widespread COVID-19 cases in China have added to gloom over a long-term slump in its property sector and over the impact of pandemic restrictions that were only recently loosened as the virus gained ground in the worst nationwide outbreak so far.

“Retail sales in general should be weaker in December compared to the prior month,” said Robert Carnell, regional head of research Asia-Pacific at ING. He said demand might bounce back during the Lunar New Year later in the month.

“After the long holiday, there could be even

more daily COVID cases, and then another quiet month for retail. The road to recovery may not be smooth for retailers,” he said.

On Wall Street, major indexes rallied following a government report showing

that job openings increased more than expected in November. Stocks then shed some of their gains after the minutes from the Fed meeting last month underscored how the central bank remains

determined to keep rates high to crush inflation.

The S&P 500 rose 0.8% to 3,852.97, with more than 80% of shares notching gains. The Dow Jones Industrial Average rose 0.4% to 33,269.77, and the Nasdaq composite added 0.7% to 10,458.76. Small company stocks outpaced the broader market, lifting the Russell 2000 index 1.2% to 1,772.54.

Banks, companies that rely on consumer spending and communications stocks accounted for a big share of the rally. Citigroup rose 2.6%, Starbucks added 3.6% and Netflix gained 4.9%.

The Fed raised its key short-term interest rate last month for the seventh time in 2022 and signaled more hikes to come. The increase was smaller than those from the previous four meetings, reflecting signs that inflation, while still high, has been easing.

The minutes from the mid-December meeting show Fed officials remained determined to keep rates high, taking little comfort

from inflation’s decline from a peak of 9.1% in June to 7.1% in November.

The Fed’s benchmark lending rate stands at a range of 4.25% to 4.5%, up from close to zero following seven increases last year. It has forecast that the rate will reach a range of 5% to 5.25% by the end of 2023 and it isn’t calling for a rate cut before 2024.

Layoffs have been mounting in the technology sector, which is dealing with falling demand as inflation squeezes consumers.

Investors cheered several companies that reduced staff as they face weaker demand. Cloud computing software company Salesforce rose 3.6% after it announced it was laying off about 10% of its workforce. Video hosing platform Vimeo rose 4% after reportedly notifying workers about job cuts.

In energy trading, benchmark U.S. crude rose 85 cents to $73.79 a barrel in electronic trading on the New York Mercantile Exchange. It dropped $4.09 on Wednesday. Brent crude, the international pricing standard, rose 77 cents to $78.61 a barrel. U.S. crude oil settled 5.3% lower on Wall Street.

In currency trading, the U.S. dollar fell to 131.87 Japanese yen from 132.56 yen. The euro cost $1.0620, up slightly from $1.0610.

PAGE 10, Thursday, January 5, 2023 THE TRIBUNE

BUSINESSMEN walk by monitors showing Tokyo’s Nikkei 225 index at a securities firm in Tokyo, Thursday, Jan. 5, 2023. Asian shares are mostly higher following a rally on Wall Street as investors assessed minutes from the Federal Reserve’s latest meeting of policymakers and welcomed encouraging data on U.S. jobs.

CALL 502-2394 TO ADVERTISE TODAY! WEDNESDAY, 4 JANUARY 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2645.120.070.000.060.00 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0040.03 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00

2.462.31Bahamas First Holdings Limited BFH 2.46 2.460.00

2.852.25Bank of Bahamas BOB

6.306.00Bahamas Property Fund BPF

9.808.78Bahamas Waste BWL

4.502.82Cable Bahamas CAB

Brewery CBB

Bank CBL

Holdings CHL

FirstCaribbean Bank CIB

3.251.99Consolidated Water BDRs CWCB

11.2810.05Doctor's Hospital DHS

11.679.16Emera Incorporated EMAB

11.5010.06Famguard FAM

18.3014.50Fidelity Bank (Bahamas) Limited FBB

4.003.55Focol FCL

11.509.85Finco FIN

16.2515.50J. S. Johnson JSJ

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00

1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00

1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00

1.001.00Colina Holdings Class A CHLA 1.00

10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00

1.001.00Focol Class B FCLB 1.00 1.000.00

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 93.7093.70BGRS FX BGR121138 BSBGR1211386 93.7093.700.00 100.0089.08BGRS FX BGR127149 BSBGR1271497 89.7289.720.00 94.8093.36BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.71100.01BGRS FL BGRS70023 BSBGRS700238 100.71100.710.00 91.9191.91BGRS FX BGR127139 BSBGR1271398 100.00100.000.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359 100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375 100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331 100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.582.11 2.583.48%3.87% 4.883.30 4.884.49%5.32% 2.261.68 2.262.74%3.02% 205.22164.74 190.45-6.40%-6.95% 212.41116.70 169.68-20.12%-15.15% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91%

16.279.88

N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75% MARKET REPORT 31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 30-Nov-2022 30-Nov-2022 6.95% 4.50% 30-Sep-2022 31-Oct-2022 4.50% 6.25% 31-Dec-2021 30-Nov-2022 30-Nov-2022 31-Oct-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 31-Oct-2022 31-Oct-2022 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 25-Nov-2022 22-Sep-2033 23-Feb-2038 26-Jul-2037 26-Jul-2035 17-Jan-2040 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 30-Sep-2025 30-Sep-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 5.24% 4.81% 5.35% 5.14% 5.60% 15-Jan-2049 5.50% 15-Jul-2039 15-Jun-2040 4.53% 5.00% 29-Jul-2023 15-Jan-2039 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 5.35% 5.00% (242)323-2330 (242) 323-2320 www.bisxbahamas.com

Photo:Hiro Komae/AP

0.0000.020N/M0.72%

0.1400.08017.63.25%

2.61 2.610.00 0.0700.000N/M0.00%

6.30 6.300.00 1.7600.000N/M0.00%

9.75 9.750.00 0.3690.26026.42.67%

4.50 4.500.00 -0.4380.000-10.3 0.00% 10.657.50Commonwealth

10.25 10.250.00 0.1400.00073.20.00% 3.652.54Commonwealth

3.58 3.580.0020,0000.1840.12019.53.35% 8.547.00Colina

8.53 8.530.00 0.4490.22019.02.58% 17.5012.00CIBC

15.99 15.990.00 0.7220.72022.14.50%

2.91 2.87 (0.04) 0.1020.43428.115.12%

10.50 10.500.00 0.4670.06022.50.57%

9.40 9.530.13 0.6460.32814.83.44%

11.22 11.220.00 0.7280.24015.42.14%

18.10 18.100.00 1000.8160.54022.22.98%

3.98 3.980.00 0.2030.12019.63.02%

11.00 11.000.00 0.9390.20011.71.82%

15.76 15.760.00 0.6310.61025.03.87%

1.000.00 0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

1.000.00 0.0000.0000.0006.25%

0.0000.0000.0007.00%

0.0000.0000.0006.50%

1.030.93 0.93-8.94%-9.55% 9.376.41 10.107.82%9.00% 11.837.62 13.4413.58%15.81% 7.545.66 7.712.57%2.83% 16.648.65 13.25-20.10%-19.25% 12.8410.54 12.03-4.50%-4.64% 10.779.57 10.59-0.55%-1.61%

16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20

By DAMIAN J. TROISE AND ALEX VEIGA AP Business Writers

STOCKS on Wall Street closed broadly higher Wednesday after wavering for much of the day as investors weighed the minutes from the Federal Reserve’s latest meeting of policymakers and welcomed encouraging data on job openings.

The major indexes rallied following a government report showing that job openings increased more than expected in November. Stocks then shed some of their gains after the minutes from the Fed meeting last month underscored how the central bank remains determined to keep rates high to crush inflation.

The S&P 500 rose 0.8% after having been down 0.2% in the early going. The Dow Jones Industrial Average rose 0.4% and the Nasdaq composite added 0.7%. Small company stocks outpaced the broader market, lifting the Russell 2000 index 1.2% higher.

MINUTES, STRONG JOB DATA

The Fed raised its key short-term interest rate last month for the seventh time in 2022 and signaled more hikes to come. Still, the increase was smaller than those announced after its previous four meetings, reflecting signs that inflation, while still high, has been showing signs of easing.

The minutes from the mid-December meeting show that Fed officials remained determined to keep rates high and have taken little comfort from inflation’s decline from a peak of 9.1% in June to 7.1% in November.

Stocks marched higher prior to the 2 p.m. Eastern release of the Fed minutes after the government reported that the number of job openings in November was higher than expected. While that could maintain pressure on the Fed to keep interest rates high to fight inflation, the resilience in the labor market also bolsters hopes on Wall Street that the economy can avoid sliding into a protracted recession.

“I think the market is trying to figure out if the recession indeed comes, will it be a bad one,” said Jeffrey Roach, chief economist for LPL Financial. “I think investors are right, that if we do fall into a recession, it’s not going to be a deep and prolonged recession.”

The latest update on job openings is the first set of employment data that Wall Street will get this week. The government will release its weekly unemployment report on Thursday and its closely watched monthly employment report, for December, on Friday.

The strong jobs market helped insulate a weakening economy from slipping into a recession in 2022. The Fed, though, is trying to lower inflation with its rate increases and that also means it needs to cool employment.

The minutes from the central bank’s last policy meeting shows Fed officials suggested that a continuing streak of robust hiring could keep inflation elevated and was a key reason why they expected to raise

interest rates this year more than they had previously forecast.

The Fed’s benchmark lending rate stands at a range of 4.25% to 4.5%, up from close to zero following seven increases last year. It forecast that the rate will reach a range of 5% to 5.25% by the end of 2023 and it isn’t calling for a rate cut before 2024.

Crude oil prices fell and Treasury yields ended lower Wednesday.

The yield on the 10-year Treasury, which influences mortgage rates, fell to 3.68% from 3.75% late Tuesday. The yield on the two-year Treasury, which tends to track expectations for Fed action, slipped to 4.34% from 4.38%.

Banks, companies that rely on consumer spending and communications stocks accounted for a big share of the rally. Citigroup rose 2.6%, Starbucks added 3.6% and Netflix gained 4.9%.

Energy stocks fell as the price of U.S. crude oil settled 5.3% lower. Chevron fell 1.1%.

TRADERS work on

More than 80% of the stocks in the S&P 500 notched gains. The benchmark index rose 28.83 points to 3,852.97. The Dow added 133.40 points to close at 33,269.77. The Nasdaq rose 71.78 points to 10,458.76. The Russell 2000 gained 21.81 points to close at 1,772.54.

The latest updates for the job market comes amid more layoffs within the technology sector, which has been dealing with falling demand as inflation squeezes consumers.

Investors cheered several companies that decided to

make cuts to their workforces as they face weaker demand. Cloud computing software company Salesforce rose 3.6% after it announced it is laying off about 10% of its workforce. Video hosing platform Vimeo rose 4% after reportedly notifying workers about job cuts.

Coinbase jumped 12.2% following the announcement of a $100 million settlement with New York State over what regulators called failures in the cryptocurrency trading platform’s systems for spotting possible criminal activity.

Monday Tuesday Wednesday

2.8 12:11 a.m. -0.2

p.m. 2.0 1:11 p.m. 0.0 7:20 a.m. 2.8 12:52 a.m. -0.2

7:33 p.m. 2.0 1:51 p.m. 0.0

7:58 a.m. 2.8 1:32 a.m. -0.1

8:12 p.m. 2.0 2:29 p.m. 0.0

8:36 a.m. 2.8 2:11 a.m. -0.1 8:51 p.m. 2.1 3:06 p.m. 0.0

9:12 a.m. 2.7 2:50 a.m. 0.0 9:31 p.m. 2.1 3:42 p.m. 0.1

9:49 a.m. 2.7 3:29 a.m. 0.1 10:10 p.m. 2.1 4:18 p.m. 0.1 10:25 a.m. 2.6 4:10 a.m. 0.2 10:51 p.m. 2.1 4:54 p.m. 0.1

THE TRIBUNE Thursday, January 5, 2023, PAGE 11

END

MEETING

STOCKS

HIGHER AFTER FED

the floor at the New York Stock Exchange in New York, Friday, July 1, 2022. Wall Street expects companies to face a reckoning with the realities of hot inflation, a slowing economy and rising interest rates in the latest round of earnings results. Analysts are forecasting an earnings contraction of about 3.5% for the fourth quarter, according to FactSet. That estimate, as of the end of last year, is an about-face from forecasts back in September of 3.5% growth and a sharp reversal from 8.5% growth forecasts in June.