EXCLUSIVE:

“THE ROAD TO SUCCESS IS DOTTED WITH MANY TEMPTING PARKING PLACES...

...keep driving”

ROLLING RECESSION CONCEPT

• Belief in an ongoing economic recession characterized by a cyclic pattern.

• Sectors of the economy experience alternating periods of contraction and expansion.

• Sectors don't necessarily follow the same trends simultaneously; their movements are more sporadic and independent.

CONCLUSION

Consumers spent way too much and put a massive strain on the manufacturers of the world. Now, people aren’t spending like they used to.

Source Federal Reserve Bank of New York, The Yield Curve as a Leading Indicator

CONSUMER SENTIMENT

• Consumer confidence and consumer sentiment are actually short - hand for two monthly surveys from different sources.

• Each aims at judging the degree of confidence that Americans feel about their current financial status and their expectations of change for the better or worse in the near future.

• The media lacks understanding of our industry, leading to misleading coverage.

Source Survey of Consumers, University of Michigan

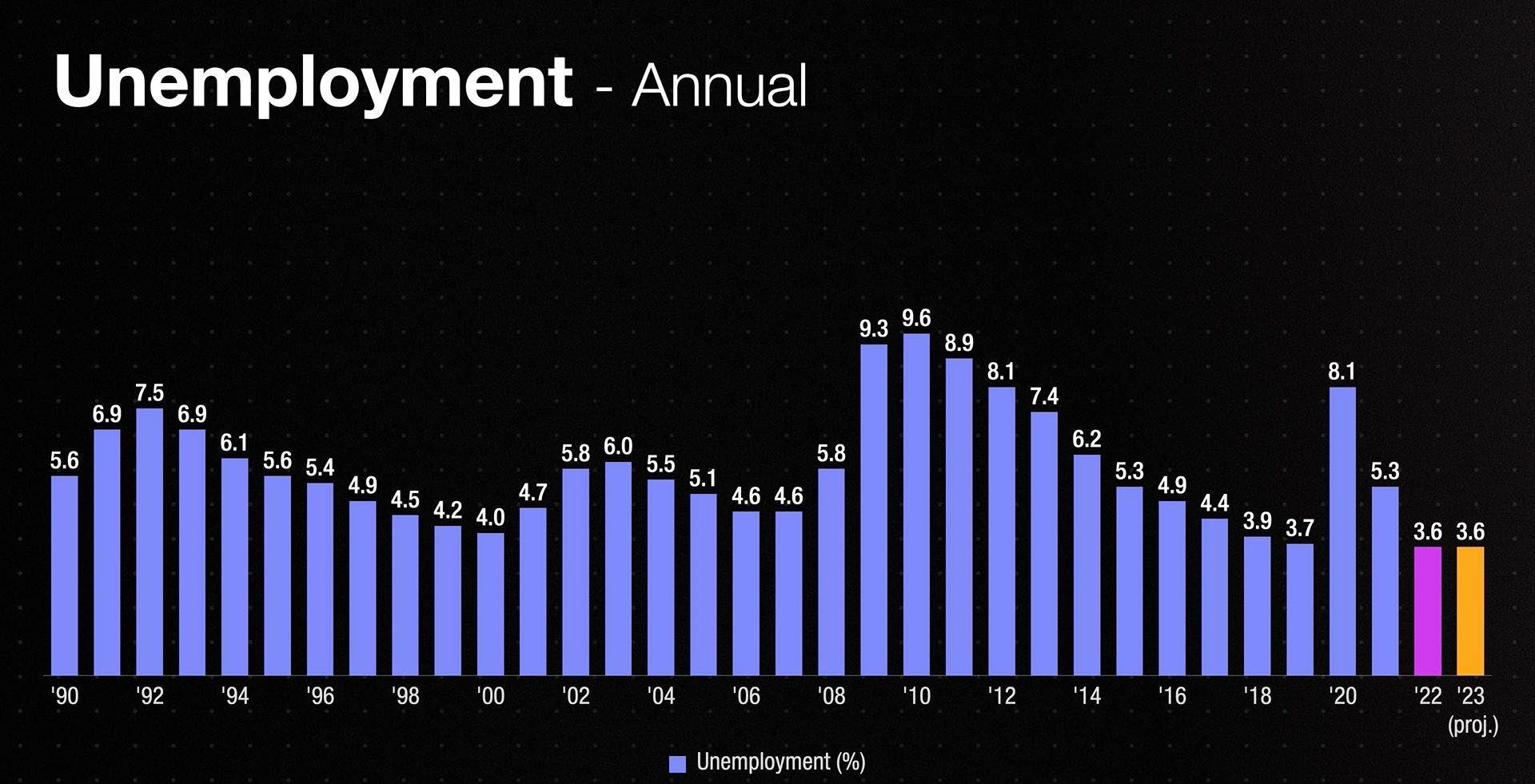

UNEMPLOYMENT NARRATIVE

• The disparity between job openings and unemployment has widened significantly compared to the preCOVID period due to a notable workforce exodus.

• At 3.6% projected in 2023, it will be the lowest unemployment percentage in the past 33 years.

Source U.S. Bureau of Labor Statistics

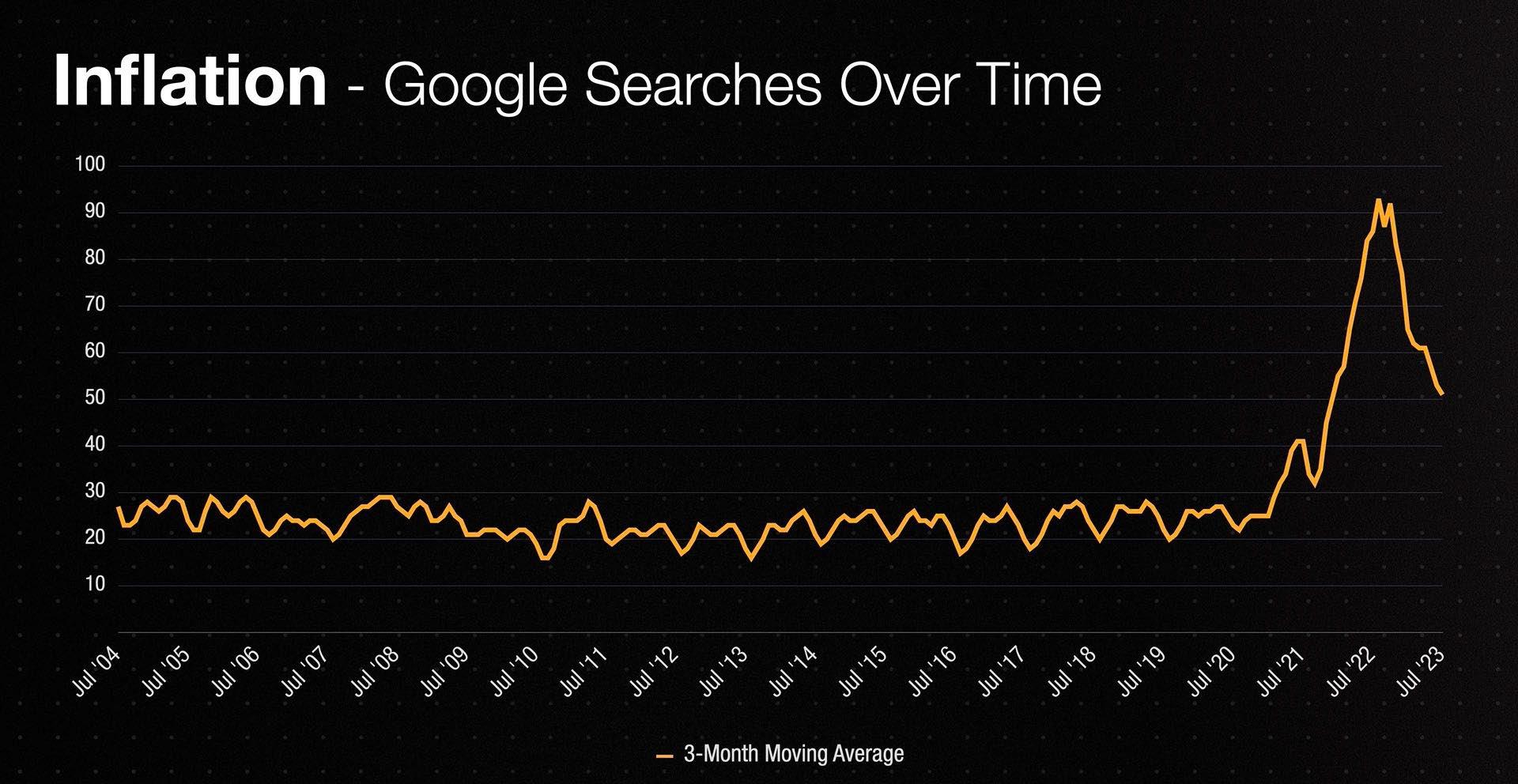

Inflation – Google

Searches

• In response to this situation, the government opted to raise interest rates, a strategy aligned with our approach.

• Notably, the occurrence of elevated Google searches for 'inflation' throughout the previous year underscores a heightened public interest in comprehending this economic phenomenon.

Source: Google Trends

HOME SALES

• This year the projected volume of US sales will drop to 4.3M which aligns with the baseline for the past 30 years.

• The last 3 years were an aberration and now it's just coming back to normalcy.

Source: National Association of REALTORS®

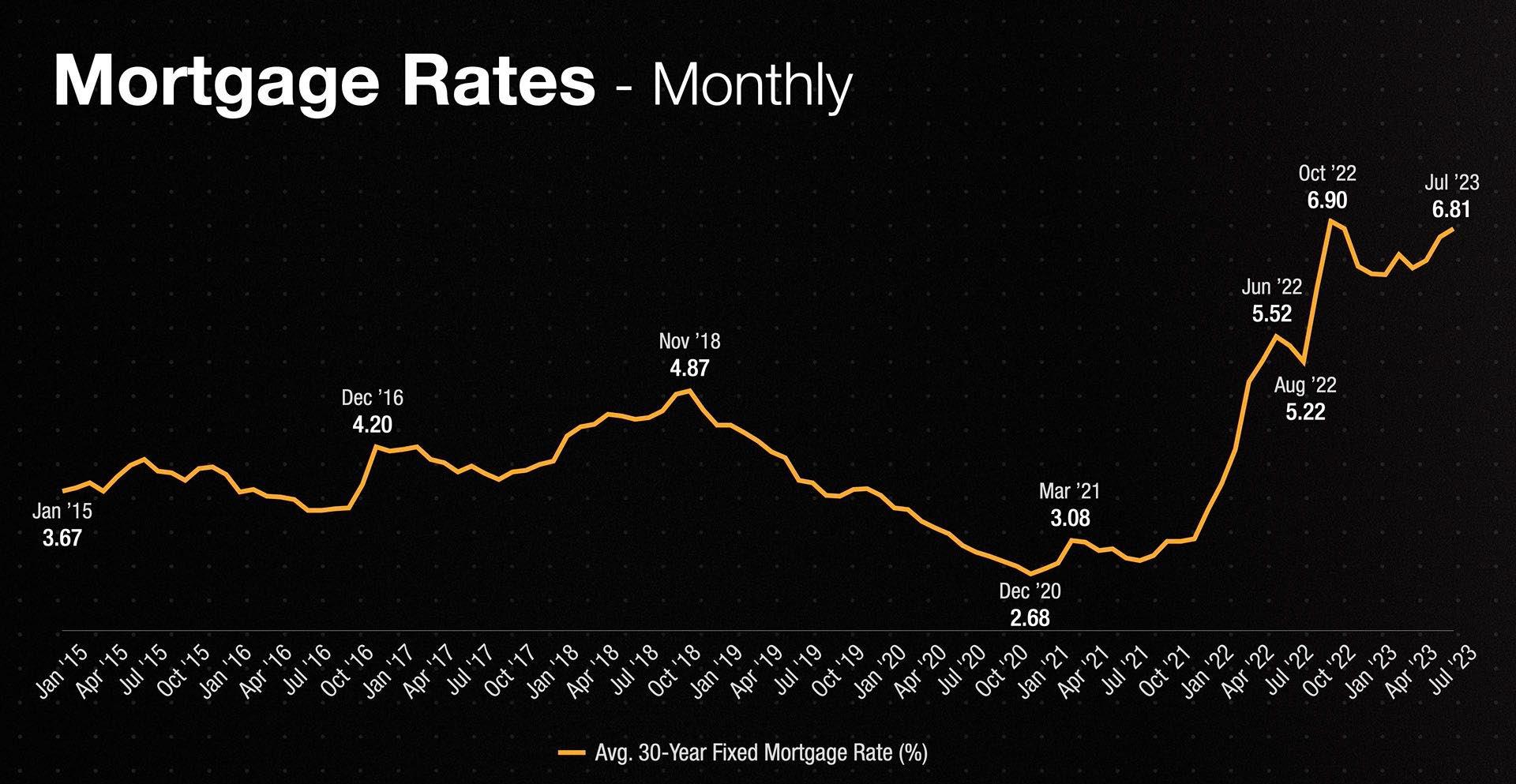

MORTGAGE RATES

• Gary Keller attributes the recent increase in mortgage rates to the rise in inflation and the subsequent actions taken by the government to control it, including raising interest rates to counter inflationary pressures.

• The historical average is 7.81%.

Source Freddie Mac

MORTGAGE RATES

Source Freddie Mac

• Consumer actions have directly impacted the borrowing costs associated with mortgages, leading to the observed rate hikes. KW RESEARCH

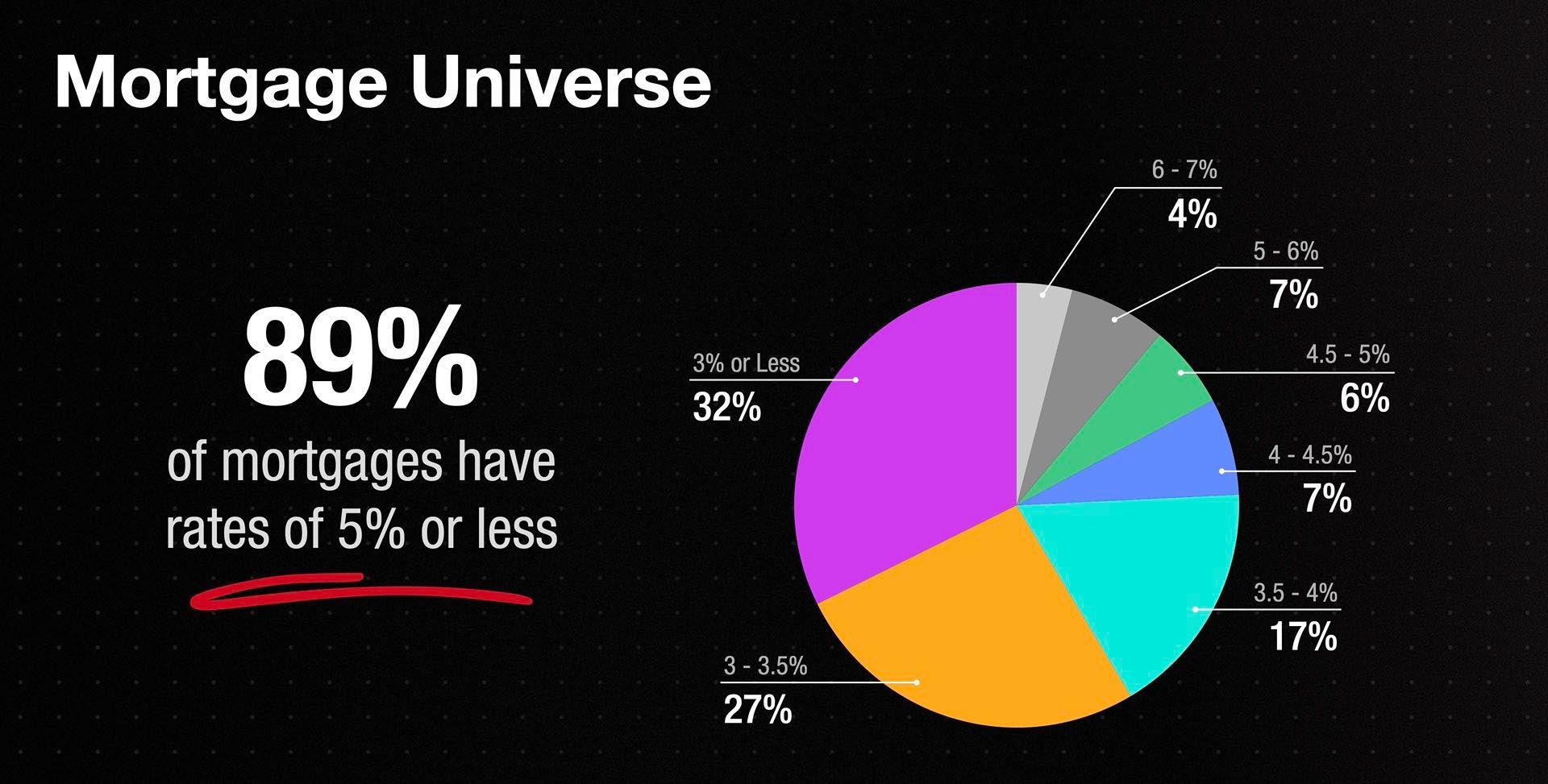

MORTGAGE RATES

• 89% of mortgages have less than 5% rate.

• High - wealth individuals can use low mortgage balances to borrow strategically against their properties, funding investments like expanding real estate portfolios, other assets, or business ventures.

HOMEOWNER EQUITY

• Currently in the US, 39% of homeowners own their home out right while 61% have mortgages.

• Now is the time to look at investment properties and/or second homes.

Source U.S. Census Bureau, OEDC, Corelogic