Perhaps it is the fact of writing this hot on the heels of our glitzy inaugural awards event, but it feels as if the positivity and festive cheer of the impending season might just be se ling in. It’s even snowing in some areas as I write, although my window is showing only the usual drizzle.

To continue the positivity, the Bank of England lowered the base rate again, which I’m sure gives us all the warm fuzzies even as the weather turns, and I am cautiously optimistic that the upcoming inflation data will continue these tentatively positive trends.

Even the ‘Halloween Horror’ Budget didn’t quite cause the chaos that was predicted in the lead up. Yes, there were some painful measures for property investors and landlords – and even more disappointing omissions, for those operating in the property finance market or looking to get on the housing ladder – but a er all is said and done, we’re pre y hard to spook these days.

There’s not much Rachel Reeves could have done to truly shake this industry up, bar jumping out from behind a bush shouting ‘Truss mini-Budget!’

Back to the real reason for my uncharacteristic positivity. The National Mortgage Awards –Second Charge took place on 14th November, bringing together the best and brightest in the sector to celebrate the achievements of everyone from underwriters through to industry champions. As our first here at The Intermediary,

the event set a great tone, and I look forward to many more in the future. Keep an eye out in next month’s magazine for a round-up of the night, and to see if you can spot yourself in the photos.

Much like the snowfall in my beloved London, I am still being realistic, and I won’t be pu ing my money on the thin dusting of positivity sticking around too long in a market plagued by bad news in recent years. For those keen to return to my regular scheduled ranting, I’m sure there will be something to complain about soon.

In the meantime, this issue takes a look at an area of interest for everyone, and one which is a constant source of excitement, even for those most cynical among us. This month, we take a special focus lens to tech across the mortgage market. This covers the entire gamut of the mortgage market, from initial lead generation, through client relationship management, to completion and even out towards the end of a borrower’s loan term.

That’s not to mention all the other elements of property finance, beyond single transactions, from the tech needed to revolutionise the UK’s housing delivery and meet Labour’s ambitious targets, to the latest in sustainable standard se ing. We take a look at everything, from the systems brokers use to enable their increasingly complex work, through to apps, AI, open property data sharing, and the future of digitalisation in mortgage lending. ●

Jessica Bird

@jess_jbird

www.theintermediary.co.uk www.uk.linkedin.com/company/the-intermediary @IntermediaryUK www.facebook.com/IntermediaryUK

Jessica Bird Managing Editor

Jessica O’Connor Senior Reporter

Marvin Onumonu Reporter

Zarah Choudhary Reporter editorial@theintermediary.co.uk

Stephen Watson BDM stephen@theintermediary.co.uk

Ryan Fowler Publisher

Felix Blakeston Associate Publisher

Helen Thorne Accounts nance@theintermediary.co.uk

Barbara Prada Designer

Bryan Hay Associate Editor Subscriptions subscriptions@theintermediary.co.uk

Ahmed Bawa | Alan Longhorn | Alex Michelin

Alex Upton | Amir Firdaus | Andrew Fisher

Aneisha Beveridge | Ashley Pearson | Averil Leimon

Christian Duncan | Christopher Tanner

David Hannah | David Lownds | Donna Francis

Gamze Bastug | Gemma Brown | Geo Hall

Georgi Demirev | Grant Hendry | I hikar Mohamed

James Gillam | James Woodfall | Jamie ompson

Jerry Mulle | Jodie Andrews | Joel Vinnicombe

Jon Hall | Jonathan Workman | Josh Skelding

Julia Brownley | Karl Wilkinson | Kate Davies

Laura omas | Lilla Dilliway | Lisa Martin

Madeleine Birtles | Maria Harris | Mark Blackwell

Martese Carton | Matthew Parden | Melanie Spencer

Nathan Reilly | Neil Leitch | Neil Wyatt | Nick Hale

Paul Adams | Paul Glynn | Rebecca Salt

Richard Pike | Robin Johnson | Sam Leonard-Williams

Simon Martin | Simon Webb | Sonya Matharu

Stephanie Charman | Stephen Cowdell | Steve

Carruthers | Steve Goodall | Steve Richmond

Tim Bowen | Vic Jannels | Will Calito | Yann Murciano

© 2024 The Intermediary

Cover illustration by Barbara Prada Cartoons by Giles Pilbrow Printed by Pensord Press

TECHNOLOGY FOCUS

Feature 6

FROM PAPER TO PIXELS

Jessica Bird considers how technology is shaping the working lives of modern brokers

Opinion 16

Insights into mortgage sector tech from 360 Lifecycle, Ohpen, MSO, and more

REGULARS

Rapid reaction 56

The industry re ects on the impact of this Government’s rst Budget

Broker business 84

A look at the practical realities of being a broker, from resilience to the monthly case clinic

Local focus 90

This month The Intermediary takes a look at the housing market in Manchester

On the move 94

An eye on the revolving doors of the mortgage market: the latest industry job moves

SECTORS

The Interview 20

PARAGON

Jonathan Workman looks back at the rm’s digital transformation journey

Pro le 28

PRECISE

Jon Hall discusses the lender’s brand refresh and the launch of a new app

Q&A 34

MORTGAGE BRAIN

Neil Wyatt on tech that works now, and plans for the future

PURE RETIREMENT

Gemma Brown on the challenges and opportunities facing business development managers

Jessica Bird

Despite a brief period of fearmongering around being replaced by ‘robo-advice’, the ripples of which still show in the debate around artificial intelligence (AI), few would deny that mortgage advice is a deeply human process.

This is particularly true in the specialist sectors. Nevertheless, tech touches and improves every element of modern life, and it would be an outlier – and an oddity – to find a broker that didn’t rely in some way on digital processes.

While larger budgets and greater resources mean that tech innovation is often perceived to be the preserve of the lender side of the market, there is plenty of movement and disruption happening that can directly affect and improve the working lives of the brokers that choose to engage with it.

Whether self-employed, part of a larger firm, appointed representative (AR) or directly authorised (DA), and in whatever part of the property market, there is simply no world in which technology is not playing an increasingly important role.

Nevertheless, the fact remains that brokers face a turbulent rate environment, increasingly complex customer requirements, ever more nuanced products, and major world events coming round the corner at an alarming rate. Add to this the proliferation – and cost – of the numerous different tech options out there, and the picture could be quite daunting.

When presented with the idea of broker tech, there will be those that bemoan the loss of face-to-face client contact, or cling to their paper forms. However, David Smith, commercial director at 360 Lifecycle, notes that “if you’re a modern broker, you probably can’t run your business without technology.”

Just as they use their mobile to connect with clients, send emails or use a digital calendar, technology is truly already a fact of life. As anyone who has progressed through from a Nokia 3210 to an iPhone will know, progress is inevitable, and those who do not accept that are left missing out.

Simply put, Smith says, brokers should not be filling out a fact-find manually, when there are so many easy options and data resources out there to make their lives simpler.

He adds: “People’s lives and credit histories are complicated, especially post-Covid. Meanwhile, products are dropped and changed left, right and centre. That all makes the job really hard for brokers.”

Ifthikar Mohamed, founder of MortgagX, agrees that the market is reaching a point of no return, where brokers will have to use tech to be able to effectively analyse customer data.

Stelios Constantinidis, head of data science and research at MPowered, says: “There’s no reason why this process isn’t as simple and as fast

as getting car insurance, which is a oneclick process.”

It is not just brokers affected by this, as gone are the days of bank branches and paper forms. Constantinidis warns that “customers demand greater tech enablement.”

Adrian Richardson, broker and founder of Mortgage Wallet, agrees, adding that this demand goes further, with the younger generations expecting to be able to transact through apps.

Richardson adds: “The broker demographic is that little bit older than in some other industries. That, in turn, might make them less inclined to go with it. But what are all the lenders doing? They’re building apps to keep up with the customer base.”

Mohamed says: “Today, people are used to life being easy. We like to pick up information in 20 seconds. So, if you give somebody an application form that takes two hours to fill out, they don’t like it, particularly if you tell them they have to log in on a PC, when they have a phone. Borrowers will do it if they don’t have a choice, but it’s not ‘sci-fi’ to be able to do it via an app like ours.”

From sourcing to client communication, there are many systems available to help the modern broker. Sometimes, though, it is as simple as using the right calendar. For Jonathan Fowler, founder and managing director at Fowler Smith Mortgages & Protection, “it is always about tasksetting.” He uses a system that allows for project management, automated reminders and team collaboration in order to keep his brokerage running smoothly. For others, it might be as simple as investigating the features on offer via familiar systems like Outlook.

Fowler says: “AI could be a huge help in the day-to-day, because every broker – even day one in their career – can essentially have a personal assistant to remind them to do something.”

Systems like ChatGPT, meanwhile, can help with everything from marketing copy ideas to creating code for websites, which otherwise might cost too much for a small firm to handle. More than just enabling brokers’ businesses, Fowler says, this puts brokers – no matter their size or status – “on a level playing field.”

The advent of app and platform-based mortgage broking is not just about pandering to the needs

“I just can’t see the need to upgrade my legacy system”

of the ‘TikTok generation’, but freeing up work that both need not have human input, and where human fallibility could even be a problem.

Smith says there is no need for a human to check binary data like dates, and adds: “Regulatory requirements mean that you’ve got to do various checks, and I would suggest that if you are using paper for these, then you should learn how to do it digitally, because it’s safer.”

In addition to speeding the process up, using a platform or app allows for the kind of digital record that is becoming increasingly important as the regulatory environment evolves.

Christopher Evans and Lee Flavin, co-founders of Mortgage Metrics, launched their business – which allows brokers to log their cases and receive notifications when the rates drop – in the aftermath of the mini-Budget, when rates were “out of control.” One piece of positive feedback they have received is the help with Consumer Duty, allowing brokers to show that they are getting the best deal for a client, without the need for constant monitoring of PDFs and spreadsheets.

Networks increasingly insist that members disclose whether they conduct ongoing rate monitoring, meaning those that do not may want to start, to avoid negative comparisons.

Tim Bowen is CEO at Mutual Vision

The future of technology in the mutual sector, including cooperative nancial services, is likely to be shaped by several key trends and challenges, including digital transformation, increased adoption of digital platforms for customer engagement and processing, a focus on mobile apps, and online services to enhance accessibility, utilising big data and AI for underwriting, risk assessment, and personalised customer service.

Advanced analytics can improve decision-making and streamline operations. Technology will enable mutuals to o er more tailored products and services based on member preferences and behaviours.

Mutuals will be able to leverage technology to support environmental, social, and governance (ESG) initiatives, aligning with members’ values and societal expectations.

MV Nebula will provide many bene ts for mortgage brokers as processes are streamlined with the automation of many tasks. The creation of a seamless end-to-end application journey through access to third-party integrations means MV Nebula can and will drive mortgage e ciencies. Improving the application experience for lenders, brokers and borrowers, while providing increased insights.

By providing a next generation end-to-end platform for lenders, it will empower mortgage brokers to work more e ciently, enhance their service o erings, and adapt to the evolving needs of their clients.

All of this adds time and effort to a broker’s day, further increasing the case for investing in tech.

Fraud and security are also constant concerns. While some might be wary of new tech in its ability to fend off fraudsters, there are considerable advancements being made.

Richardson, for example, cites Mortgage Wallet’s “military grade encryption” and secure, cloud-based system that leaves ownership of client data firmly with the broker. While the platform itself is does not claim to be a compliance tool, this security and transparency can form part of a broker’s overall approach.

MQube offers a content creation tool that allows brokers to create blog posts for their own websites, engaging with customers while

checking they fit with Financial Conduct Authority (FCA) regulations, allowing for a sense of security where previously they might have hesitated.

AI, in forms that are available mass-market, can be used to summarise and transcribe meetings, form key action points, and analyse customer behaviour data to point to where better support might be needed.

However, while tech aims to make brokers’ lives simpler, there is still some way to go. Fowler points to the great benefit of sourcing and criteria search systems, but says these still leave something to be desired in terms of accuracy, particularly if they depend on lenders that might be slow to update the product information.

He says: “These systems are incredible to at least get a very, very good idea of where you’re going to go. But there’s still a manual element involved to make sure that you’re going to the right lender, which I think is a great thing.

“We can never solely rely on tech, in my opinion. We’ve still got to have that human element.”

The tech available in the market at the moment all tends toward one key goal: freeing up time to spend with the client.

Constantinidis says: “Brokers get to spend more time listening, finding out about the the customer’s situation, rather than doing all the admin of the fact-find.”

Smith agrees: “There is so much data already out there that fact-finds should come preloaded, and brokers should be focusing on the soft facts – goals, aspirations, the stuff that isn’t already in the system.

“Instead, they dedicate more time to navigating criteria, assessing affordability, and sourcing solutions – essential tasks in today’s increasingly complex lives.”

Not only does using the right tech allow brokers to free up their time, it also helps them demonstrate their value to customers. Saving borrowers money by rate monitoring with programmes like Mortgage Metrics, for example, could build long-term loyalty without an added administrative burden.

Flavin points out that with programmes like this which provide a service that runs in the background, while otherwise “the broker’s business is their own to run,” are key to supporting those relationships.

Meanwhile, Mortgage Wallet – an app which supports the relationship with the broker and the client throughout the lifetime of their loan – can create key touchpoints and establish the same level of communication as the broker might p

“If AI is so smart, won’t it take all the time o and make ME do all the work?”

previously have conducted face-to-face, or even more, building trust with clients remotely.

Whatever form their technology comes in, whether simple email reminders and digital calendars, through to AI assistants and apps that take the customer through every element of the deal, the fact remains that brokers are increasingly time-poor. Most need to take on more clients to continue strengthening their business, but clients’ needs – from rst-time buyers to seasoned investors – are becoming more complex. Brokers must cut down on admin, as well as streamlining the processes that do not have a direct return on investment (ROI).

When it comes to rate monitoring, for example, there is little opportunity to make additional money, despite the work being done to catch a lower rate. With a monitoring service, brokers can strip out the additional work, and if they decide to, they can include this as a value-add service, even with a fee, to recoup the cost.

Meanwhile, apps like MortgagX can use the same information brokers already access, cutting hours out of the application process, and using a ChatGPT-style tool, for example, to help create suitability letters. Mohamed explains that the system was created following his own experience as a broker, which helps him to “know the frustrations brokers face,” allowing them more

time to spend on the things that matter.

This might include marketing, for example. Constantinidis notes that many brokers, selfemployed or otherwise, face a challenge when it comes to the time it takes to craft good marketing material. With large language models (LLMs), brokers can create rst drafts, making more out of their limited time and resources.

From CRMs to AI assistants, lead generation to rate monitoring, and even all-encompassing apps for the entire mortgage journey, many would say the market is well-stocked with solutions for whatever a broker needs.

However, there is still much to improve, and technology is always evolving. Much of this will be simply improving the systems already in place. Indeed, Constantinidis says, “in ve years time we’d hope that time consuming admin will be a thing of the past for brokers, if lenders embrace AI and tech.”

Nevertheless, the challenges currently faced by brokers are unlikely to disappear.

Flavin says: “It has been two years since the mini-Budget, and every couple of weeks there’s a di erent story around mortgage rates. This rate monitoring process, which mortgage brokers have quite rightly adopted, will run and run.

“There’s no signs that regular rate changes will stop, now that there’s so much of a margin for lenders to be able to consistently tweak them in any variation they like, or any timeframe.

“Brokers who have committed to monitoring rates for their clients have set a service standard, and at what point do they say ‘we aren’t doing that any more’?”

Even at times when rates are increasing, Evans adds, brokers have to be circumspect, preparing for a market in which they fall again.

While tech will continue to evolve within this ‘new normal’, there are also spaces where greater innovation is needed. For example, Smith points out that while 360 Lifecycle, and others, can do ID veri cation electronically, at the moment there is no option to passport this through the process, resulting in multiple costs to the borrower, sometimes even if di erent parties in the process use the same service provider.

“The future for 360 Lifecycle is entirely con gurable,” he adds.

“Every rm likes to do things slightly di erent to try and get an edge on the market, or serve their section of customers the best way. That takes enormous exibility, naturally, and right now, technology is not exible. In fact, fact- nds are pretty rigid, but rms are continually and increasingly asking us for exibility. p

Dean Spasov is CEO and co-founder of finbryte

An AI assistant can analyse all the information provided by the borrower and helps advisers make the right decisions quickly. Anything that the assistant deems important or helpful, it brings up to the attention of the loan o cer in the form of ‘insights’. These could be simple things, such as reminding you that the borrower has a birthday coming up, agging missing documentation, or more substantial ndings such as identifying discrepancies in submitted information or alerting you to limited-time promotional terms from speci c lenders.

Our AI assistant also facilitates work ow by suggesting next steps for each application, and if given approval, executing those actions on behalf of the loan o cer. That means that at the request of the loan o cer, the assistant can execute a range of actions, such as requesting documents or information from the borrower, sending them emails explaining what is expected of them, summarising and comparing loan products, and more.

When deciding what to do, the AI assistant has access to a range of text documents explaining the speci c business processes of a given mortgage brokerage. Since language models can digest and analyse text just as well as people, this means that the brokerage can always change the desired behaviour and knowledge of the AI assistant by simply updating the text documents in its knowledge base.

Having access to this trove of information has the added bene t of allowing the assistant to act as an interactive encyclopaedia of your business rules and data, answering any questions or queries that a given loan o cer might have. We are also working on a feature that will allow the AI assistant to read and analyse documents provided by the borrower directly, helping you extract structured information from them and acting as a rst-pass check on their contents.

“Having configurability and flexibility is key. The most flexible piece of technology you’ll ever use? Paper. We want to deliver the flexibility of a blank piece of paper you can write anything on.”

For those brokers still unwilling to adapt, while there will likely always be space in the market, the fact is that there will come a time when –much like online and mobile banking – these apps and platforms are ubiquitous.

Mohamed says: “There’s a type of broker who’s reluctant, because they’ve been filing papers for the last 40 years, and like that way of doing things, and some who are simply still on the

fence. But people will realise that it’s changing their life, taking away all the manual stuff, and eventually it’s going to change the whole marketplace. We might be pioneers in this space, but it’s only a matter of time.

He adds: “In the future, the mortgage journey will be much, much faster, with offers coming to borrowers on day one. Obviously that’s a dream right now, but at the same time, there are some banks that issue mortgage offers on day one, so it should be the case, and I don’t think that day is far away, considering how we can analyse clients’ data now.”

In the next year, he adds, brokers will be much more likely to use AI assistants, adding, “this is not sci-fi, this is something we’ve done.”

As machine learning develops, Mohamed notes that it will take on a greater ability to emulate the common-sense and logic needed to underwrite deals. In the meantime, at the very least, he says, “the future is open banking,” and brokers should work to ensure their clients are comfortable using it.

With all this talk of advancement, an old fear rears its ugly head – that brokers will be pushed out, or their role diminished. However, with all the systems currently available – and indeed all the developments seemingly in the pipeline, one thing remains core: leaving the business in the hands of the broker.

Constantinidis says: “In the future, [brokering] will be perhaps 0% admin and much more time advising, advising, listening. This part will never go away. No matter how much AI changes the process, what will stay the same is the fact that this is a really big decision for a person deciding to get a mortgage.”

Instead of eliminating jobs, the idea is to boost productivity, using AI to make processes more efficient, rather than make decisions.

“People will always buy from people,” says Richardson. “I’m not looking to take away the human element, I’m trying to encourage that and embrace that, providing touch-points during the application and post-completion.

“Some people who aren’t as tech-enabled might see the idea of an app, especially one that’s allowing for progress tracking, as taking away those touch-points for the broker, because they’re not getting on the phone, but where our engagement with email was running at about 34%, engagement with the app is 84%-plus.”

Reaching borrowers instantly and easily means being able to maintain these positive touch-points with less legwork, in an era where phone calls are not the desired method of

communication for many, and emails can be missed or forgotten.

Richardson adds: “A lot of the tech that’s out there comes from an automation perspective, and it’s taking the human element away from some of the advice. I like that human element – that’s the nice bit about my job, if I’m honest. Don’t take that away from me, otherwise I won’t want to do it any more.

“I get that there’s room in the market for greater automation, but we don’t necessarily have to completely change everything – just streamline it a little bit. We’re all about interaction. We’re all about the human element.”

Mohamed says that, rather than remove that human touch, AI is more about doing the things that “brokers hate,” such as the endless analysing of bank statements.

He also adds that, while most brokers will have to adapt eventually, there will always be a borrower who “likes walking into a bank and depositing their cash,” and are happy to stick with the older ways, particularly in sectors like equity release, meaning “there will always be space” for those brokers, albeit a diminishing one.

It is not just the endless drive to greater productivity that is benefitted by higher automation, removing administration, and reaching borrowers better.

Constantinidis says: “We speak to our brokers about how much time they spend daily speaking to lenders, and how it impacts their mental health. Our experience is that these things can become stressful, particularly if there’s any risk of disgruntled clients at the end of it, because they’re not getting answers quickly enough.

“Mental health is such a big theme at the moment, and while we may not be able to transform that completely, the tech does reduce the hassle for brokers. It can support the wellbeing journey.”

This includes getting rid of exasperating phone calls to chase lenders and onerous forms or the need to rekey data.

In turn, Evans says: “Brokers don’t get paid any more when they rewrite applications. They’ve got a juggling act to perform to keep their business profitable and do the right thing for their clients, as well as finding time to attract new clients.”

Flavin adds: “The time saving is the biggest thing for most brokers, who spend sometimes hours a day manually monitoring rates. Now, they’ve got time to write more business, and there’s the cost saving, but also if they choose, they can promote it as a unique selling point, and have a better work-life balance.”

This might mean there is space to do more business, or focus on the much more enjoyable aspects of advice, or, if the broker chooses, play more golf or spend time with family.

For Richardson, it is technology’s ability to help a broker do their job well that is the real stress reduction, from streamlining the barrage of calls or emails, finding easier ways to keep clients happy and engaged, to never worrying about missing a mortgage renewal.

While the proliferation of available tech for brokers is something to be marvelled at, one thing that comes up time and again as an issue in this market is the need for greater investment in joined-up systems.

Smith points out that lenders, for their part, are spending tens of millions on developing their own systems, but that it is “incredibly inefficient to be spending that amount of capital on processes and it really not changing for brokers or customers much.”

Indeed, Mohamed notes that some £21bn was spent on AI architecture by banks last year –which could rise to £260bn by 2025. This does not, however, mean it is being invested in the right places. For example, Wyatt says: “What’s important to remember is, whatever element of tech you’re harnessing as a broker, it’s only as good as the data.”

Without market investment in ensuring strong, connected data sources, tech support for brokers can only go so far. Richardson adds: “One of the ways that we need to move forward with tech is to address the biggest problem I find in this industry: that people don’t talk to each other.”

Through the efforts of the Open Property Data Association (OPDA) and other industry stakeholders, a greater level of information sharing and communication may be on the horizon. In the meantime, from smart calendars to mobile apps, and even AI assistance, the modern broker has more tools at their disposal than ever.

To conclude, a word from ChatGPT: “With AI-driven tools, brokers can quickly analyse a client’s financial situation, recommend the best mortgage products, and automate routine tasks. AI algorithms can also assess market trends, helping brokers offer more informed advice. AI-powered chatbots can provide 24/7 customer support, answering questions and guiding clients through the application process. By reducing administrative burdens, AI allows brokers to focus more on relationship-building and personalised service, ultimately improving client satisfaction and driving business growth.” ●

In life or business, there is absolutely no escaping the transformational power of new technology. Whether it’s in how we communicate, consume information or entertainment, or how we work, new tech has helped increase capabilities, drive efficiencies and ultimately deliver a far be er user experience.

While the mortgage market is certainly no stranger to innovation, there’s still room for improvement and an opportunity to evolve the user experience. There are countless examples of where innovators have challenged convention and opted for disruption, helping to change the landscape and deliver an experience that is be er aligned to the needs of all users.

A great example of this is online music platform Napster. It was launched in 1999 by two American students as a peer-to-peer file sharing service, allowing users to share and download music across the internet. Previously, downloading songs from the early internet had been hugely challenging. But through its very simple interface, users were now able to access music, whether new releases, exclusive records or songs from up-and-coming artists from across the world.

Napster was a disruptor in the truest sense of the word, fundamentally changing the way people consume music and how an entire industry operates – albeit with clear legal and ethical ramifications. Inevitably, copyright claims and legal challenges followed, and Napster was forced to shut down.

However, the cat was already out of the bag. Napster offered users a be er experience and was a clear forerunner

to the streaming platforms that dominate music today, such as Spotify.

In fact, Daniel Ek, co-founder and CEO of Spotify, was directly influenced by Napster. Speaking with The New Yorker in 2014, Ek said: “It came back to me constantly that Napster was such an amazing consumer experience, and I wanted to see if it could be a viable business.”

Safe to say he was right, with Spotify now boasting a market cap of more than $75bn.

There are similar stories in countless other industries, where technology has advanced the user experience and changed the game. I would argue, though, that in this market –particularly when comes to applying for a mortgage – we are still waiting to see that Napster-style moment.

Think about it. The process of applying for a mortgage has remained relatively unchanged – it is still transactional, o en disjointed, and can be hugely ambiguous. Plus, it can o en be geared towards one element of the market, without considering the frustrations, challenges and overall experience of all the parties involved.

Much like Napster, we must step away from existing processes or legacy systems and start fresh with our full focus on the user experience.

While the broker experience has long been a priority – and rightly so – we must also broaden our horizons and think about the experiences of all those that play a critical role in the mortgage process, such as underwriters, case managers, surveyors and solicitors.

We must also consider customers, without being too one dimensional. A er all, a customer could be a first-time buyer, they could be

remortgaging, in later life or a buy-to-let (BTL) landlord. All may desire the same personal and painless homebuying experience, but their needs and requirements will all be slightly different.

There are positive signs of progress with the use of behavioural science emerging in the mortgage market. This is an important component in understanding human behaviour –studying how people interact and why they make certain decisions.

With this powerful insight, technology providers can then eliminate pitfalls or frustrations in the design and enhance the customer journey from the outset.

By looking at exactly want the user needs and what they want to achieve, the right technology can then be put in place to actually achieve those goals. The opportunity is there for the mortgage industry to have its very own Napster moment, creating a frictionless, user-centric experience that transforms the process of applying for a mortgage for every person and party involved.

This is certainly the ethos of Mortgage Hub, which was designed from scratch with the user experience at its core. Whether it is deploying behavioural science throughout the build, or through ongoing consultation with all the parties involved, we are able to address the clear frustrations faced throughout the application process and help to reimagine the entire mortgage journey for all. ●

Mortgage advisers today face one of the most challenging markets in recent memory. They’re expected to meet ever growing regulatory demands while navigating a rapidly changing landscape, caused by volatile interest rates and a turbulent property market.

Add to the mix increased pressure from lenders to retain existing customers through product transfers, and a surge of large firms with healthy advertising and technology budgets entering the race to win new business, and the challenge for advisers has arguably never been greater.

It’s not all doom and gloom. Yes, there are challenges, and the mortgage market is rapidly changing, but for advisers who embrace technology, there are tools that can help streamline processes and free up valuable time.

Great technology can automate large parts of the administrative load and provide insights to augment the capabilities of an adviser.

However, while technology holds promise, it is not a magic wand, and it will never replace the nuanced, human role advisers play in guiding clients through life’s biggest financial decisions.

We’re o en asked if artificial intelligence (AI) is the answer to advisers’ problems. The answer is both yes and no. AI has increasingly been, and will continue to be, a buzzword in the industry, but it’s no silver bullet.

AI certainly has its strengths. It can process vast amounts of information in seconds, giving advisers the ability to analyse transaction histories, summarise credit information, and

surface relevant data at the click of a bu on.

This means advisers no longer have to spend hours creating customer notes and follow-up tasks. Instead, AI can organise these summaries, making it easy to retrieve and review important client details.

Consumer Duty places high expectations on advisers to act in customers’ best interests, especially for vulnerable clients. AI can create bite-sized summaries from prior meetings, flagging important details about the client’s unique needs, health conditions, or financial vulnerabilities. This helps advisers quickly get up to speed before reconnecting, making sure they’re informed about any potential considerations for the upcoming review.

By freeing up time spent on admin, AI gives advisers the capacity to refocus on what they do best: building and maintaining relationships, a racting new customers, and acting as a voice of reason in a crowded market. It also enables them to offer a more holistic approach, supporting clients with additional services, such as insurance, that add value during extended client relationships.

However, AI is only as good as the data it uses. Low-quality, fragmented data will lead to poor insights and diminish AI’s effectiveness. Many advisers rely on multiple tools that don’t seamlessly connect, creating a patchwork of data silos. This fragmentation limits AI’s ability to provide accurate insights and meaningful support, or worse, potentially provides incorrect or misleading information.

In contrast, a centralised customer relationship management (CRM) system is a solid foundation for successful AI integration. Advisers with unified systems will have the ability to harness AI’s real

SAM LEONARD-WILLIAMS is director at Twenty7tec

By freeing up time spent on admin, AI gives advisers the capacity to refocus on what they do best: building and maintaining relationships, attracting new customers, and acting as a voice of reason”

potential, ensuring that it’s built on comprehensive, high-quality data that truly reflects their client base.

As AI continues to evolve, more solutions will undoubtedly enter the mortgage space. Some of these will flourish, and others may fade.

Ultimately, advisers need technology that supports their unique needs, rather than dictating how they work. AI can help make them more efficient, but the best technology will still be the one that empowers advisers to do what they do best: understand, advise, and guide their clients through complex financial decisions.

For those who embrace AI as part of a holistic technology strategy, the future is bright. Those who choose to rely solely on traditional methods may find it harder to compete.

By blending AI with human insight and judgement, advisers can deliver the tailored, empathic service that clients will always value. ●

The second half of this year has seen a substantial increase in market opportunities for businesses like ours that offer core banking, loan and savings servicing solutions.

We have seen enquiries from banks, building societies, business process outsourcers (BPOs), specialists and equity release. But what has caused this upli in institutions looking at transformation programmes now?

The core banking and account servicing sectors have never been the ‘darlings’ of the so ware industry, with the flashing lights and beautiful user interfaces (UIs) of origination platforms being the business development and marketeers’ dreams when it comes to encouraging customer acquisition.

Today, however, far more focus is being given to account servicing technology, with new entrants coming to market with more impressive UIs – with questionable functionality behind them in some cases! This – combined with existing players not keeping up with modern day requirements of automation, funding, and other key areas of account servicing – means that lenders that use this type of technology are beginning to consider re-platforming to new servicing platforms. Let’s look at a few reasons why.

There is a mix of new entrants and established brands in the servicing technology space, with some origination so ware houses ‘playing’ at servicing with no real depth of knowledge, experience or functionality, while other more ‘pedigree’ so ware houses are now able to back up years of servicing loan

and savings accounts experience with fantastic end-user experiences.

In the majority of cases, gone are the days of requirements for mainframe solutions which, although scalable and hugely reliable, are costly, hard to maintain, and in many lenders are so highly integrated that they will almost be impossible to migrate away from.

Companies like us have invested heavily in developing a true cloud native so ware-as-a-service core banking and account servicing product for lending and savings. This means that with the right technology, you can service all of your brands, different loans and savings products from a single deployment.

There are no multiple deployments required per brand or product. This creates a large cost saving from traditional platforms as multiple deployments generally come with multiple costs, both in terms of set-up, run-costs and licensing.

Advancement in this technology continues to gather pace. The use of application programming interfaces (APIs) is growing, and businesses like us have invested heavily to provide a suite of APIs to clients to enable the seamless transfer of data between the varied systems and solutions that may make up a client’s IT stack.

This is particularly relevant when a client is looking for best-ofbreed solutions for differing parts of transformation programmes, a key component of which is o en origination platforms.

By offering an originations API to clients, they can choose whatever platform they require, and we know that as long as the data is returned as specified in our API, we can service the loan or savings account compliantly

moving forward. Other APIs that should be standard when looking at servicing suppliers include data warehouses, general ledger, customer relationship management (CRM), promotion of data to mobile phones and self-serve portals.

At Phoebus, we have developed a migrations API that automates the migration process. This technology is tested against client loan or savings book data through several dry-runs to ensure success, but we are now able to commence migration on a Saturday morning and complete it ready for when users come into work on the Monday. This has been successfully achieved on loan books ranging from a few thousand to a few hundred thousand accounts.

All data available from when records began are migrated including open and closed accounts, notes and images. This stops the requirement of having to maintain multiple systems of record post migration. This is a game changer and completely derisks what has always seen as a high risk part of an implementation.

There is no doubt that the mention of large-scale transformation programmes usually encourages a few deep draws of breath around the boardroom table, but technology has advanced hugely, and in working with suppliers that have long-term experience and supply modern, efficient technologies, all institutions can now take advantage of the benefits transformation programmes can bring. Selecting the right partner with the right experience, technology and testimonials is key. ●

Jessica Bird speaks with Jonathan Workman, transformation director at Paragon Bank, about the lender’s tech evolution

For the past three years, Jonathan Workman has been transformation director for the mortgages business at Paragon Bank. In that time, he has led the lender on a journey of technological and digital change, launching a pilot of its new platform in September following years of hard work.

Workman’s background stems from operations, underwriting and originations, and spans 24 years in the mortgage business. More recently, this has included change management and delivering technology-based programmes to improve the way rms do business on a broader scale.

“I’ve moved from being responsible for the origination of the loan and interacting with brokers, into transformation,” he says.

At Paragon, this focus on change and adaptability meant working with systems that have been in place since the buy-to-let (BTL)

Paragon Bank

lending business was established. Changing this, as anyone who has been through the process of updating any type of legacy system, is no mean feat.

e Intermediary sat down with Workman to discuss how Paragon handled such a seismic shi , and the importance of adaptability, while keeping the core tenets of the business at heart.

When Workman arrived at the rm, Paragon Bank had already started to consider an overhaul of its systems.

He says: “ e tech has served the business well, but sta were increasingly working very hard to work around the system and deliver the service we’ve built a reputation for.

“We’ve been very successful over the years, but you do start becoming constrained by things you can’t do, or things you have to work hard to do manually.”

First, before any development could start, Workman and his team sat down to consider what it was that they were trying to achieve, and primarily, how to de ne the strategy of the business as a specialist, complex BTL lender catering for landlords with large portfolios and complicated structures. is would fundamentally shape what Paragon wanted to deliver via its refreshed systems.

“ ere was a long list of requirements, looking ahead and scanning the market,” Workman says, adding that this laid the foundations for two years of work building the right system.

At the time of speaking, the system was four weeks into its pilot launch, allowing for decisions in principle (DIPs) and application submissions to be made via the platform.

In that time – and based on feedback from a select panel of brokers – there have been two follow-up releases in order to make improvements, with more planned ahead of the full launch in early 2025 e next phase, Workman explains, is to extend the system beyond the o er and through the process to completion, to allow for a seamless journey start to nish.

It took years to get from inception to launch, and Workman says that the temptation with these systems might be to try and deliver sooner, but that it is worth taking the time to get it right.

Product complexity has increased, as has the importance of having tailored solutions. You’re not having one-size- ts-all, and it’s important to ensure we can deliver things in a transparent and quick way”

“One of the temptations was to deliver in modules, so we could get this out piecemeal, which would t with how we ran the project on an Agile basis,” he explains.

“We considered doing it so we could deliver things to market quicker and build on that. But actually we stepped back from that, because we wanted to avoid rework as much as possible, bolting things together and having to go back over them to make them work.

“We also wanted to deliver something that would make the impact to our customers, brokers and sta from day one, rather than losing it as we went along.

“It was important to stand up the infrastructure, build the journey and make sure it owed from start to nish right away.”

Workman says one of the key challenges was making sure all the pieces worked together, both broker-facing and internal processes. e journey was tested throughout the development process, including check-ins with brokers beyond the initial consultation.

is also took in the fact that, when taking a longer time to develop a programme, it is important to keep track of the ways in which tech – and broker needs and expectations –might have changed over that time.

Over the coming months, the continued development of the platform will take into account this added information and feedback from brokers – though at week four, Workman says the response has been almost entirely positive – as well as focusing on bringing in more volume while ensuring the platform continues to perform.

From Workman’s perspective, the role of a transformation director is to “be a bridge

between the business requirements, the broker and customer requirements, and the technology teams.”

Workman’s role includes leading one team that spans across the business, which includes tech experts, business people, analysts and change functions in order to deliver a sweeping update that works practically.

is means leveraging expertise that “goes beyond pure IT,” and focusing on four pillars: needs, strategy, requirements and delivery.

Workman says: “It’s about understanding what the key elements of our proposition are, making sure that we build on that and bring in tech to support what we currently do, and to make sure we don’t throw everything out.”

He adds: “It’s not just handing over a system to our colleagues and to brokers, but it’s also making sure we understand how we’re going to use that system and make the most of it.”

In addition to the need to update systems to continue delivering a strong service, Workman explains that the nature of the market in which Paragon operates also drove the need for modernisation.

“Product complexity has increased, as has the importance of having tailored solutions,” he says. “You’re not having one-size- ts-all, and it’s important to ensure we can deliver things in a transparent and quick way.”

In addition, Paragon wanted to address evolving regulatory requirements, which is harder to do when working with a system that is nearly 30 years old.

Part of the work to bridge the needs of all parties included extensive discussion with brokers about what they liked about working with Paragon, as well as the pain-points and areas for improvement.

Fundamentally, what emerged was a need to take “all of the legwork out of the system,” ease the administrative and manual burden, automate, and allow for access to data upfront as much as possible.

Before starting the work on designing a new system, Paragon did consider taking a preexisting solution “o the shelf,” according to Workman.

“It would have been very tempting,” he explains. “But we were holding up what was important to us, and one of those things was that we wanted to have some advantages over our competitors, and not something that was easily copied.

“ at’s how we came to the decision to build our own platform.” →

Creating something bespoke also allowed Paragon to prioritise its other needs. For example, beyond just a core banking platform, the rm wanted to be able to integrate with its choice of the best services on the market, adding and switching as its own evolution called for it. is includes integrating with Companies House, for example.

Building a system internally, while a mammoth task, also meant Paragon was not beholden to the pipeline of an external business, and would not have to “queue” behind other lender customers when the time came to update, develop or troubleshoot.

Workman says: “It means we’re masters of our own timeline, and we could develop a system which suited our business, customers and brokers.”

When it came to the design, Paragon wanted a system that “treated every application on its own merits and could be tailored accordingly.”

To this end, Workman says: “ e application is dynamic, with tailored questions case-bycase, so that the ow of the application means we’re asking the right questions, and we don’t ask the same questions twice.”

“We had to be very clear on what the desired outcomes and design principles were, so that the system could be held up against that,” he adds.

e other important element was that this was an “internal and external” system, integrated to allow for brokers to submit applications on the same system that underwriters pick the case up on, with no transposing.

“ e data is the same, and we access the same services,” he explains.

Previously, while brokers could submit applications online, Paragon had a more standardised form, and there were limitations to what the broker could submit before it would revert to a paper application.

Workman says: “We’ve solved that. We’re making sure that every application a broker submits will be a digital experience from start to nish, and there’s no drop-o from that.

at’s one of the rst things we’ve resolved –some of the basic pain-points from before.” is means being able to handle more than two applicants, for example, or large numbers of properties on the same application.

As it stands, the system is already integrating with more than 12 application programming interfaces (APIs), drawing in data from sources across the property ecosystem, such

as Hometrack, including climate and Energy Performance Certi cate (EPC) data. e system not only accesses, but validates that data “as much as we can, as early as we can.”

Workman adds: “ is means we can give a surer decision upfront, based around the applicant’s pro le, a ordability and property information. It also means we have what we need in order to underwrite the decision and take it through to o er.

“We are trying to cut down on to-ing and froing between us and the broker, getting as much of that data as we possibly can up front, to cut down on the time it will take to get to o er and allow us to have more con dence in the decision that’s been given upfront.”

For example, as the vast majority of applicants are under a limited company structure, one of the rst things Paragon sought to do was pre-populate data from resources already available, using the company number.

“For us, that means we can trust it, and that it’s validated, and it’s all automated,” says Workman. “It can then give a very clear picture to the underwriter.”

While automation and easy access to data are key to the proposition, this strengthens rather than chipping away at the role of the underwriter, Workman explains.

“An underwriter will still get to understand the case, engage with the broker and the complexities, and look to see how we can make the case work,” he says.

“We’ll enable the underwriter to get to that understanding of the case quicker and better.

“ at might mean we’re more con dent in lending up to our risk appetite as we have fewer questions or concerns about a case, but it could also mean that we’re quicker at saying ‘no this isn’t for us’ where a case doesn’t t our risk appetite, rather than protracting that process.

“It won’t change our well-established risk appetite, but it will help us be quicker at understanding where a case lands.”

Being an older, more established business working with legacy systems can be both an advantage and a burden when it comes to developing refreshed, new tech.

Workman says: “If you’re a rm starting from day one, you haven’t got a pipeline or backbook, or other customer segments to consider – you’re starting from scratch – that might be more appealing.

“But what we’ve got that has helped us, is a lot of experience and knowledge within the business. is means we know where things

We had to be very clear on what the desired outcomes and design principles were, so that the system could be held up against that”

have been tried in the past, and we have a real understanding of what’s important to Paragon.” is might mean having a tried and tested credit appetite, an understanding the kind of nuanced data that needs to get to the underwriter’s desk, or in Paragon’s case, a circumspect approach to tech such as automated valuation models (AVMs). e bank has chosen not to lean on AVMs, keeping its in-house survey team, but the system does pull in AVM data upfront to gain a greater early understanding of the property.

“We use a combination of Paragon’s experience and the new data and technology that is available,” Workman says.

“Bringing that experience into the design has absolutely helped us when building our own system.”

at said, this does not mean that dealing with legacy books and application pipelines during the process of this overhaul has not been a signi cant challenge.

Workman does not point to a future in which arti cial intelligence (AI) and technology take over from the role of the human being, particularly in the specialist market.

However, he points to the system’s use of some AI in order to “present the case to the underwriter in a clear way, so that they don’t have to trawl through multiple sources and pages of paperwork.”

is allows the system to help a human gain a good understanding of the case, and most critically, “draw their attention to where it is needed.”

For example, the system accesses data from trusted sources, such as Experian, Equifax or Companies House, for example, but of course there are still places where the application necessitates documentation such as bank statements and payslips. At this stage, the platform uses so ware called Digilytics,

which “extracts the data in an intelligent way, analyses and categorises it, and presents it to the underwriter.”

is brings in elements of machine learning to perform some of the more administrative checks that the underwriter would have done previously, while still deferring to human common-sense and expertise.

Looking back at all the work done over the past several years, and ahead at what more Paragon plans to do down the line, Workman sees “massive opportunity” for innovation and adoption of tech in the specialist market, despite the fact that this complex sector o en demands human input.

In fact, it is because of this very complexity that the industry must look to a future of greater automation and innovation in order to “get to grips” with cases much more e ectively.

For Paragon, the immediate future means bringing in a customer portal alongside the broker one, as well as expanding its platform to be able to track accounts and di erent properties, using returning customer data to ease the process, and generally continuing to push for a smoother journey and greater con dence for the customer, broker and internal teams.

Post-o er, this means allowing the borrower to access their case, track its progress through to completion, and once funds are released, track their mortgage and ensure their product continues to be right for them. Some of these capabilities, Workman says, are already built, ready to be further developed as time goes on.

“ e bottom line is that upfront the customer has more con dence about whether we will or won’t do the deal,” Workman adds.

“ e broker can speak more con dently about the decision we’ve given and what we’ll need from the customer, and we can be clearer upfront as to our requirements.”

is con dence and ease of process – as well as the ability to view multiple properties and multiple applications for one borrower –is particularly important as the BTL market becomes ever more complex, and landlords increasingly professionalised.

Giving underwriters – as well as borrowers – a more streamlined, e cient overview of the various elements of a portfolio feeds once again into the focus on creating con dence throughout the transaction.

Workman concludes: “A key thing for us is that this is not just technology. It’s technology, and data, and people – making the most of each of those three elements, and doing things di erently in a way that will pay back later.” ●

Across the property sector, landlords, lenders, tech providers and tenants are awaiting the final form of the Renters’ Rights Bill, which is set to be the biggest change to the private rented sector (PRS) in decades, and could become law by next summer.

It includes new rights for tenants, more rules for landlords, eviction reform, changes to rent increases and a switch to open-ended tenancies.

If you haven’t started prepping for the impact of the Bill yet, this is your reminder. This legislation will push property professionals to increase their reliance on digital tools, so the best way to prepare is to review your information systems, platforms and processes – because digitisation now will pay off in just a few months.

Compliance isn’t sexy, but it’s what the Renters’ Rights Bill is founded on. The new Private Rented Sector Database is a major part of the Bill. Landlords and their representatives will need to add the required property and landlord data to the database to demonstrate their compliance.

While the database may help people understand the rules, the Government is clear on its other use: enforcement. The cost of non-compliance could be fines of up to £40,000 and repayment of up to 24 months of rent.

With the high levels of potential fines your friendly local trading standards office can levy on landlords and property professionals, you can see why having easy, digital access to that key compliance information will be critical under the new regime. It’ll also make your lives easier if you’re helping landlords manage that compliance burden.

Paperwork isn’t the only area where digitisation will be critical under the Renters’ Rights Bill.

Currently, if a tenant racks up arrears, landlords and agents can use a Section 21 eviction under the Housing Act 1988. This allows the tenant to be evicted without being given a reason, and in most cases, this avoids a long and drawn-out court process. However, Section 21 won’t be an option under the Renters’ Rights Bill. Instead, landlords must go to court to prove arrears under Section 8 of the Housing Act. Records of bank statements, compliant payment reminders, tenant correspondence, and accumulated debts will be critical.

Gathering all this data from other sources will take an age – or you could leverage PropTech to have it all digitised and accessible with a few clicks of a mouse.

It’ll also pay to go digital when it comes time to increase the rent. The only way to do this under the Bill will be to issue a Section 13 notice. If the tenant thinks the rent increase is unfair, they can challenge it at a tribunal. Convincing tenants that the rent increase is fair is where technology will help. You could spend time trawling Rightmove, Zoopla and On the Market looking for comparables, or simply gather rental price data from your own agency and other sources in a few clicks using the right PropTech.

They will need to be convincing, as waiting for a tribunal decision could delay any rent increase for months. This delay could get even worse once the Bill passes, as I’ve warned elsewhere that the tribunal system doesn’t have the capacity to handle the potential influx of new cases.

Greater digitisation or higher

Digitisation isn’t the only option in dealing with the Renters’ Rights Bill. You could increase your headcount to cope with the additional compliance burdens and up your fees to cover the new overheads.

STEVE RICHMOND is general manager at Reapit UK&I

However, the April increases in employer National Insurance Contribution (NIC) and the minimum wage, coupled with the new Employment Rights Bill means hiring new staff could have a big impact on your bo om line. The alternative is to upskill and enhance your existing team with the right tools.

According to a survey by KPMG, 65% of investment in digital IT and PropTech is driven by a need for improved efficiencies.

If your competition is making that investment and you’re not, you run the risk of being le behind. It could leave your business vulnerable to being swallowed up by more agile players, or unable to compete, as landlords seek suppliers that can deliver the data assurances essential to compliance in this brave new world.

But the best PropTech won’t just make your team more efficient, it will also make your business more scalable, allowing your team to take on more work with less stress.

We’ve focused a lot on the issues the industry will face without digitisation, but let’s end on a high. Having data is one thing, but being able to analyse it will give you an advantage over the competition.

Identifying market trends from your data will help you to advise landlords looking to expand on the best yields and spot potential listings before they even come to market, which will reinforce your reputation as the expert in your area. A er all, no ma er how digital the rental sector becomes, who a landlord trusts with their investment will come down to the personal relationship between a property professional and investor. ●

In our recent research into homebuyers, 30% said a be er understanding of the process beforehand would have relieved stress during the mortgage application process, as well as fewer delays in the process (37%) and less paperwork (36%). 15% also called for be er online tools.

Half (48%) said that the feeling they most associate with the mortgage process is anxiety. Although all age groups had some level of stress regarding the application process, there is a stark generational divide, with 38% of homeowning 24 to 35-year-olds wishing they had chosen to rent for longer.

You have to ask yourself, how is it that selling a house today takes on average 22 weeks from exchange to completion? Archaic legacy systems are part of the problem, but lenders have also had a lot of demand-side issues to resolve.

This year marks two decades since M-Day in 2004. In the intervening years we have seen the rise and then abolition of self-certification and discount rate sub-prime mortgages, an evolution in repayment standards for interest-only loans, and a wholesale review of income assessments in favour of affordability checks under the Mortgage Market Review.

The Mortgage Credit Directive added another layer to consumer protection regulation. Then there was – and still is – general data protection regulation (GDPR), and prudential and capital requirement regulations changes under the Basel regime.

This was followed by the launch of Open Banking and the demise of the Financial Services Authority – in its place the triumvirate of the Prudential Regulation Authority (PRA), Financial Conduct Authority (FCA) and

Competition and Markets Authority (CMA). Consumer Duty has since taken Principle 6, treating customers fairly, into a whole new realm.

Listed like that, it should prompt us to take a step back to realise just how seismic the speed and scale of change has been. But we should also consider why a lender’s ability to accommodate this value of change has impacted operational efficiency.

Wholesale re-engineering of processing systems and ge ing rid of legacy tech issues is daunting. It comes with massive operational and reputational risks. The logistics are o en so mind-bending as to result in the best-laid plans ending in unsatisfactory solutions unable to adapt to a constantly evolving environment.

For the largest lenders, the case for investing in the right people to develop systems that work commercially and comply with regulation is more compelling. For medium and smallersized (SME) lenders, it can rule itself out before even ge ing started.

The danger, then, is that compromises are made to cut costs. According to the Corporate Governance Institute, a culture of following the rules only because you have to is bad news. Its experts say: “Tick-box cultures are warning signs in the world of good standards and compliance. They foster bureaucracy and suck away the motivation for high performance, even if the rules causing it were brought in with good intentions.”

As with all other retail financial services providers, lenders can all too easily be lured into the trap of ticking boxes. Especially when margins are tight and there is li le room to go

JERRY MULLE is UK managing director at Ohpen

further should they want to. But that can result in consumer detriment and a failure to comply with the spirit of the regulation.

There’s a lesson in this. Lenders are made to lend. They understand borrowers, credit risk, asset risk, the cost of finance and funding models. The functionality required to implement that expertise is something else. In a highly regulated world, IT is where strategic partners can really add value, and the thinking that sits behind it is pivotal.

Like our customers, our market is constantly changing and evolving. Regulation must keep pace, and as such, so must the systems that support good customer outcomes. For the most part, firms recognise that controlled innovation from within holds the key. But this doesn’t have to mean a huge investment into bespoke technology development and permanent headcount to enable a firm to cope. On the contrary, success relies on a system’s ability to flex and adapt. New platforms offer agility and robustness, and adopting a new commercial model can make leading edge technology accessible.

O en, the biggest challenge with this approach is internal buy-in and adoption. Learned culture and skills take years to embed; asking a workforce to start that journey again can be daunting. Hard as change might be, however, it is vital for organisations that wish to survive and prosper.

Our research confirmed what we believed to be the borrower experience at the sharp end. With right partner, new markets can be quickly available, and pivoting can be achieved more easily. ●

In today’s fast-paced mortgage industry, time is of the essence, and every opportunity to streamline processes is vital for client satisfaction and business success. One of the most impactful advancements in the mortgage process is the integration of conveyancing solutions via customer relationship management (CRM) systems.

Integrations with a carefully selected panels of law firms can help combat one of the biggest pinchpoints in the mortgage process, conveyancing-related delays.

According to research from the HomeOwners Alliance, 43% of homeowners reported that delays were a major frustration in their homebuying journey, and a significant number of respondents (78%) felt the process could be improved, primarily through quicker, be er quality service.

When conveyancing is integrated within a CRM, brokers can work in tandem with law firms to reduce these delays and streamline processes without stepping outside of multiple systems and their workflows. Automated updates, reminders, and real-time tracking mean that everyone involved in the transaction, from buyers through to mortgage lenders, can stay on top of the process – whether it’s a relatively straightforward residential transaction or in one of more specialist areas, such as bridging or commercial.

While the research also showed that seven in 10 homeowners were satisfied with their conveyancer, service levels were suggested to have deteriorated over the past five years, leaving ample room for improvement.

More than three-quarters of recent homebuyers believe that communication and transparency are key areas where the process could be be er, with calls for more frequent updates, clearer explanations of the legal process, and app notifications.

Integrating conveyancing into a CRM directly addresses these concerns, with updates readily available so that clients no longer feel in the dark about where they stand in the process.

The data from integrated conveyancing solutions can also provide invaluable insights for users, enabling them to access key data such as average completion times for various transaction types. This information empowers brokers to make informed recommendations, while also helping them set realistic expectations for clients. Additionally, it allows them to identify trends that may help prevent delays in future transactions, ultimately streamlining the homebuying process for everyone involved.

is

At OMS, we partner with firms known for their ability to adapt to the fast-changing market. These partnerships go beyond service delivery; they foster closer collaboration between brokers and law firms.

By integrating conveyancing solutions, we provide clients with a faster, more seamless, and less stressful experience. In a market where customer expectations are at an all-time high, this added value can distinguish brokers from their competition.

The Government’s increased focus on speeding up the conveyancing process reflects this urgent need for modernisation. HM Land Registry’s digitisation of local authority search data and the introduction of the Open Property Data Association’s (OPDA) framework to standardise and provide key conveyancing information digitally certainly represent some positive steps in the right direction.

As digitalisation becomes an even more integral part of the mortgage process, staying ahead with modern solutions like CRM-integrated conveyancing not only improves client outcomes but future-proofs brokers’ businesses.

This is especially critical in today’s turbulent lending environment, where efficiency and adaptability are essential for success. In a world where customer expectations are higher than ever, delivering this kind of value can set brokers apart from the competition. ●

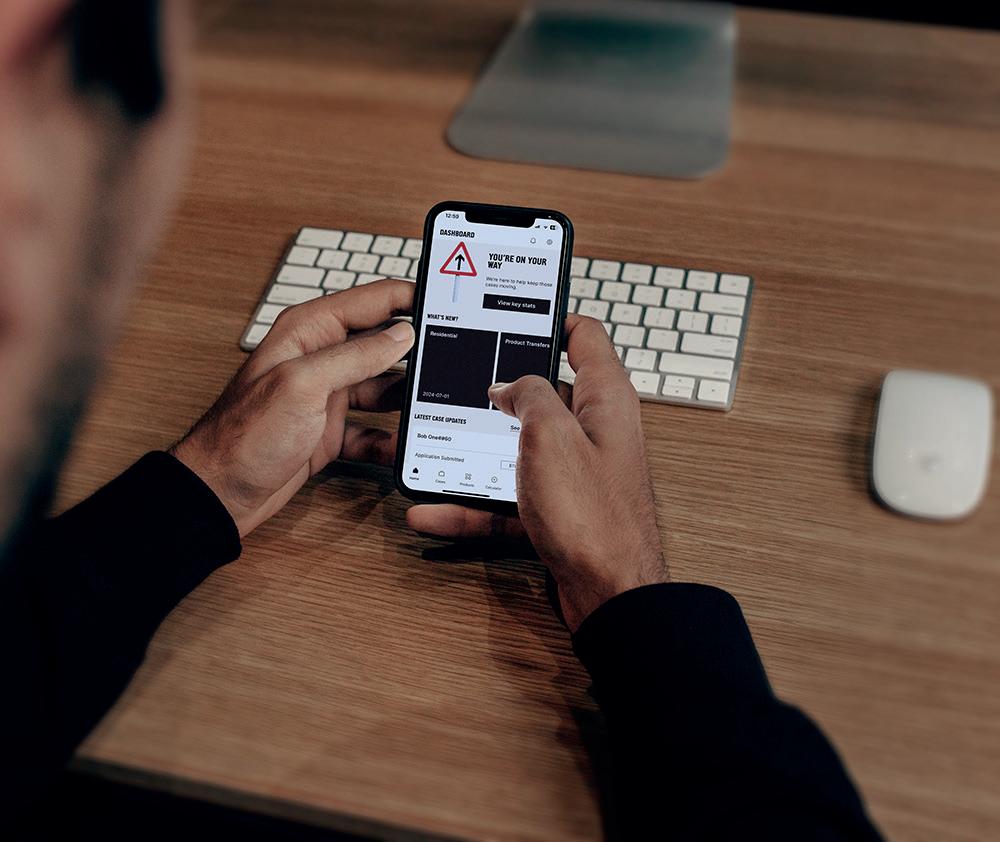

The Intermediary speaks with Jon Hall, group managing director, mortgages and savings at OSB Group, about the Precise brand refresh and the launch of its new app

In March 2024, Precise Mortgages unveiled its new brand identity, as well as a redesign of its broker and customer websites. Now known simply as Precise, the lender went on to launch a mobile app for brokers within the specialist finance market.

e Intermediary sat down with Jon Hall, group managing director, mortgages and savings at parent company OSB Group, to discuss returning to fundamentals and planning for the future.

Rather than simply a fresh logo and eye-catching ad campaign, the Precise brand refresh was a return to and rejuvenation of the fundamentals that made up an already well-established brand.

Hall says: “I tend to approach our brand from four dimensions: leading intermediary relationships; communicating at our best; lending and saving clearly; and excellence and experience. That last one can be the hardest one to hit.

“When I joined, I looked at all of those elements, and one of the things that jumped out at me was that Precise is a very iconic lending brand, but we’d lost a little bit of what the essence of it was. That essence is: no faff, straight to the point, getting the results, being straightforward to deal with, in communications and in our product range.

“We’d lost sight of a lot of that as we’d gone through the integration of the various businesses, and it was an opportunity to bring that back to life, and make sure the brand was true to those principles that were already part of the DNA.”

This meant extensive discussion with intermediaries and internal teams to ensure this messaging was brought through in the brand strategy. It was also not simply a case of launching a brand refresh and leaving it at that.

for Intermediaries and InterBay in one go, rather than having to repeat steps, making things “a lot more straightforward for intermediaries.”

In addition, Precise updated the tools available to brokers via its website, including calculators, criteria and product searching, and site navigation.

The final part of this initial wave of advancement and updating was the launch of the “first of it’s kind intermediary lending app in the UK.”

“All of those things work together to deliver the true experience we wanted the Precise brand to deliver for intermediaries,” Hall says.

Not only was this a broad-reaching, holistic project during development, but Hall adds that this was never meant to be a “one and done,” but a project in which OSB Group will “invest and deliver as we go” over the years.

When it came to launching the app, one of the first considerations was “easy accessibility,” from being available through different app stores and easy registration with pre-existing data from the lender’s portal, through to using the latest biometric Face ID technology.

According to Hall, the foundation of the plan for the app was for it to be “a virtual assistant for our intermediaries – there was no point it being a flat place with basic messaging.”

Hall says: “It’s the period after bringing it to market that’s particularly critical.”

This means it was timed to coincide

It was important that the Precise brand refresh was not brought in in isolation. Instead, it had to be aligned with OSB Group’s wider technological development journey. This means it was timed to coincide with a website refresh, including developments which allow brokers to register across Precise, Kent Reliance

He adds: “We understand that the point at which we are handling the client is critical, and an intermediary is trusting us with their client. It’s really important that we keep the intermediary engaged with how their client’s interaction with us is progressing.”

The app includes instant case updates and push notifications, among various other functions that Hall says are designed to help the broker continue to feel in control and be “on the front foot” with their own clients.

JON HALL

The app also aims to emulate the new brand identity. Hall says: “It’s fun, engaging, light, direct, with no faff communication – we’re not filling someone’s phone with notifications that aren’t relevant to

He engaged with how their client’s interaction with notifications that them.”

While much of the brand refresh focused on a return to core values, this was also a project focused on the current and future needs of both the business and its intermediary partners.

Hall adds that brokers are looking for straightforward products that are easily understandable and accessible, which are elements that have remained true all the way through, but that the business keeps in mind that “borrowers’ and intermediaries’ needs evolve all the time.” For example, the post-Covid world, as well as the cost-of-living crisis and inflation, have all created challenges that call for different support for borrowers, and different information for brokers.