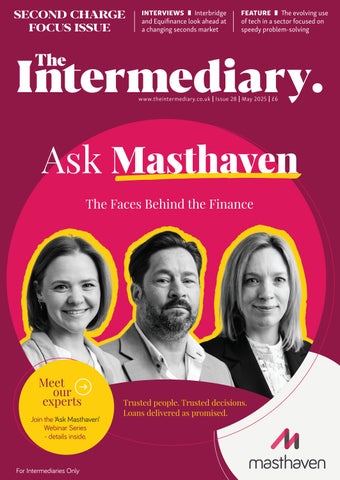

Ask Masthaven

The Faces Behind the Finance

Join Shelley and Paul for second charge & specialist remortgages (including unencumbered), Claire and Jim for bridging, and Claire with EJ for development finance - all offering real-time support on even your most complex client scenarios.

Trusted people. Trusted decisions. Loans delivered as promised.

Register now for our ‘Ask Masthaven’ webinar series - a live Q&A with the leaders in bridging, development finance and mortgages & secured loans

We’re here to speed things up, not slow things down. Our 100% online application is stripped back to the essentials, offering speed of service, saving time for everyone. Plus, we’re waiving valuation and application fees during our initial launch phase.

£ for £ remortgages assessed at pay rate helping with affordability, even on short-term fixed rates.

Quick, consistent decisions with instant DIPs and desktop valuations for remortgages on standard properties that meet eligibility.

All underpinned by clear criteria so you know where you stand with simple processes for portfolio landlords, no extra forms just a few additional questions to fully understand your application.

80 33 33

Much has happened since the last time The Intermediary dedicated a Focus Issue to the second charge mortgage market.Chief among the developments from our perspective, of course, was the success of our inaugural National Mortgage Awards –Second Charge.

We are now deep in the process of organising the next event, and November 2024’s glamorous evening feels like a lifetime ago.

The reason we chose to launch an awards event, in an industry where there are some well-established events that make for stiff competition, was in large part because we saw that there was a group crying out for it.

More o en than not, second charge market players get a somewhat cursory look-in – a few categories, at best – as part of a wider picture. This is pre y starkly symbolic of the way this sector has been viewed in recent years. It feeds into a prevailing misconception that this is a niche product, with only a few uses in in circumstances that make it absolutely necessary.

The message of the Second Charge Focus Issue, then, has not changed hugely since last year. Between this, the awards, and all our other content focused on this market, we are still shouting about this product’s many uses, and the fact that, whether or not it’s right for every client – spoiler alert, it won’t be, and that’s fine – brokers must consider all the options for their clients to ensure the best outcomes.

This time last year we were speaking to new entrant Interbridge about plans for taking the scene by storm, while hearing from other market experts and established lending leaders, who gave us a pre y uniform picture of steady growth that nonetheless felt like it could have been more meteoric had people understood the real value of this product.

At the time, we had a lot of discussion around market conditions being perfect for seconds to come into their own, but receptiveness among clients and first charge brokers potentially muting the sector’s success.

This year, while the old debate around ge ing more ‘whole of market’ players to engage meaningfully with seconds continues, the conversation does feel generally more positive.

New entrants are seeing smashing success, while established lenders and distributors are speaking with a greater sense of optimism about progress and growth in 2025.

Indeed, according to Pepper Money’s analysis of Bank of England and FLA data, this is the fastest growing segment in the post-pandemic property market.

It seems that those who might have dismissed this product before are coming around. Perhaps all the talk – and the celebration – of this market’s recent successes is having an impact. Considering this sector’s potential for further growth, it’s worth keeping an eye on. ●

Jessica Bird

@jess_jbird

www.theintermediary.co.uk www.uk.linkedin.com/company/the-intermediary @IntermediaryUK www.facebook.com/IntermediaryUK

Jessica Bird Managing Editor

Jessica O’Connor Deputy Editor

Marvin Onumonu ......................... Reporter

Stephen Watson BDM

stephen@theintermediary.co.uk

Brian West Sales Director (Interim) brian@theintermediary.co.uk

Ryan Fowler Publisher

Felix Blakeston Associate Publisher

Helen Thorne .............................. Accounts nance@theintermediary.co.uk

Orson McAleer Designer

Bryan Hay Associate Editor Subscriptions subscriptions@theintermediary.co.uk

Aimee-Jo Shutt | Alex Upton | Alistair Nimmo

Anil Mistry | Ashley Pearson | Averil Leimon

Carly Wiggins | Caroline Mirakian

Claire Askham | Craig Hall | Dale Townsend

Dave Harris | David Wylie | Donna Francis

Emma Green | Greg Went | Iain Kirkpatrick

I hikar Mohamed | James Gillam | Jason Berry

Jerry Mulle | Jess Trueman | Joe Defrie

Jonny Jones | Laura Sneddon | Laura omas

Lee Chiswell | Liam Billings | Lisa Hodgson

Lorna Shah | Maria Harris | Mark Blackwell

Martese Carton | Matt Tristram

Matthew Cumber | Michelle Walsh

Phil Jeynes | Ravneet Sokhi | Richard Keen

Richard Sexton | Rob McCoy | Rob Stanton

Roz Cawood | Steve Goodall

Tony Bunting | Wes Regis

© 2025 The Intermediary

by Fergus Boylan

by Pensord Press

SECOND CHARGE

FOCUS ISSUE

Feature 6

FASTER, SMARTER, SIMPLER

Bill Lumley asks how tech advancements are shaping the second charge industry

Opinion 14

The latest from Together, UTB, Loans Watehouse, Pure Panel Management and more

REGULARS

Broker Business 64

A look at the practical realities of being a broker, from mental health to the monthly case clinic

Local focus 82

This month The Intermediary takes a look at the housing market in Leicester

On the move 86

An eye on the revolving doors of the mortgage market: the latest industry job moves

INTERVIEWS & PROFILES

The Interview 30

INTERBRIDGE

Jonny Jones looks back at a year of success in the second charge market

Q&A 20, 58

EQUIFINANCE

Laura Thomas on communication, demand, and the changing world of second charge mortgages

LONDON’S SURVEYORS

Tony Bunting discusses the changing valuations market

Pro le 74

METLIFE

Phil Jeynes on product innovation and the road ahead for the business

Liam Billings and Carly Wiggins discuss the challenges and opportunities for BDMs

The second charge mortgage market is experiencing a thorough technological revolution that is reshaping the way borrowers access home equity, and how brokers manage applications.

With lending in this sector reaching £1.6bn in 2024 – a 12% year-on-year increase, according to Bank of England and Finance & Leasing Association (FLA) data – digital platforms, automation, and analytics are driving unprecedented efficiency and accessibility.

Second charge mortgages have surged in popularity as homeowners seek alternatives to remortgaging. This is particularly the case for those locked into low-rate fixed mortgages secured before the 2022 interest rate hikes.

An estimated 40,000 households will opt for second charges in 2025, building even further on the £6.5bn in equity that has been accessed since the pandemic.

Technology is a driving force behind this market movement, enhancing efficiency,

accessibility and appeal across the second charge market.

The second charge process, once bogged down by manual paperwork and lengthy approvals, is being transformed by digital platforms and automation.

Automation in underwriting, for example, leverages artificial intelligence (AI) to analyse credit profiles, property data and financial histories in real time, slashing approval times from weeks to days.

Lenders such as Together, in one example, use proprietary technology to integrate credit bureau data, ensuring swift, accurate decisions.

Shelley Stern, director of mortgages at Masthaven, highlights this shift: “We’re working towards rolling out a new system that will fully automate the application process, something we see as critical in today’s market, as intermediaries are under more pressure than ever to act quickly.

“When a deal is time-sensitive, waiting days for a decision just isn’t good enough for their clients.”

Certainty, speed and clarity are no longer ‘niceto-haves’, but are expected by modern borrowers and the brokers that serve them.

Stern says: “By streamlining the process end-to-end, we’re giving brokers faster access to the answers they need, without sacrificing the depth or quality of decision-making we’re known for. It’s about removing the friction, not the thinking.

“This approach has already started delivering results, as last year we introduced biometric ID checks and electronic signatures for our offer documents.

“That one change made a big difference, not just in turnaround times, but in how we protect both our customers and our business. It tightened our internal controls, strengthened fraud prevention and contributed to a noticeable rise in same-day application, offer and completion.”

Norton Broker Services has embraced similar technologies to modernise its approach to second charge mortgages.

Eddie Lau, broker account manager at Norton Broker Services, explains: “We work with many lenders who accept [automated valuation models (AVMs)] even on higher [loan-to-value (LTV)] cases, allowing for faster and more cost-effective property assessments.”

By using AVMs instead of physical valuations, Norton accelerates underwriting, while e-signatures for conveyancing documents enable completions in as few as 12 working days, even for complex cases.

Lau says: “The move to digital conveyancing with e-signatures has been a massive step forward. It’s not just about speed. It’s about giving borrowers and brokers a smoother, more reliable experience.

“We’ve seen turnaround times drop significantly, which is critical when clients need funds urgently.”

Norton has found that, through partnerships with lenders using integrated broker platforms, it has often been able to eliminate manual forms, reducing errors and speeding up application processing.

One Mortgage System (OMS) works hard to take a leading role when it comes to “seamless connectivity,” according to CEO Dale Jannels, integrating more than 14 application programming interfaces (APIs) with second charge lenders.

Jannels says: “OMS has significantly enhanced the second charge mortgage journey by leveraging digital platforms and advanced automation.

“These APIs enable both real-time quick quotes and end-to-end full applications, eliminating the need for manual rekeying and reducing time to offer.”

He adds: “For second charge mortgages, where speed can make or break a deal, our technology ensures that brokers can move quickly without sacrificing accuracy or compliance.

“Our integrations mean brokers can access a wide range of lenders in one place, saving time and improving outcomes.”

Selina Finance’s Broker Portal and APIs also aim to streamline applications.

Henry Vaughan, VP of growth at Selina Finance, says: “Our focus has always been on making life easier for brokers. We’ve built a smooth, modern process that removes unnecessary admin and speeds things up from the start.

“There’s no need for documents upfront, and smart APIs work behind the scenes to automate key steps.

“Credit file checks, valuations and affordability assessments all happen instantly, which means brokers can move quicker and get early clarity on each case.”

Vaughan adds: “We understand that brokers have different ways of working.

“That’s why we’ve developed flexible APIs that allow quotes to be generated directly from a broker’s [customer relationship management (CRM) system].

“This cuts out double-keying, reduces errors and makes the whole process far more efficient.”

Analytics and machine learning are able to revolutionise risk assessment, enabling bespoke rates for diverse borrowers.

Unlike rigid credit score models, these technologies analyse nuanced data, making lending inclusive, according to Lau, who explains: “Norton partners with lenders that do not rely solely on automated credit scoring, and technology plays a vital role in this.

“By using such lenders, we can quickly identify and route applications from borrowers with adverse credit histories to suitable providers.

“This helps ensure that applicants who may not meet rigid prime lending criteria are still considered for appropriate lending solutions.”

He adds: “For borrowers burdened by highinterest credit card debt, Norton’s technology recommends second charge products that offer lower interest rates and longer repayment terms.

“Intelligent sourcing tools help match applicants with suitable products in real time, allowing borrowers to reduce monthly outgoings and restructure debt more sustainably.”

p

OMS’ credit search also works to support complex cases. Jannels says: “A key example is our credit search process, which occurs at the outset of the application.

“This gives brokers immediate access to a borrower’s full credit profile, enabling them to make faster, more informed sourcing decisions tailored to the client’s circumstances.

“This is especially valuable for clients with credit blips. By embedding this early in the journey, OMS reduces friction, improves sourcing accuracy and helps the broker get to a ‘right first time’ solution which ultimately benefits the borrower.”

Selina Finance targets self-employed and nonprime borrowers, a growing segment for whom second charge options can be vital.

Vaughan notes: “It’s clear the market is growing. We’ve used this opportunity to focus on segments that are often underserved, particularly self-employed borrowers and contractors. Our lending policy is designed to flex around non-

standard income, and we continue to adapt as customer needs change.”

API-driven pre-underwriting checks provide clarity, avoiding wasted effort.

Vaughan says: “Early eligibility is still one of the biggest pain points for brokers, so we’ve tackled that head-on.

“By running pre-underwriting checks on credit files and property details, we can provide reliable decisions in principle [DIPs] much earlier in the process.

“This gives brokers more confidence and avoids wasted effort down the line.”

Technology ensures compliance with Financial Conduct Authority (FCA) regulations, including Consumer Duty, as well as General Data Protection Regulation (GDPR) and anti-money laundering (AML) standards.

Stern says: “Our systems balance speed with the depth or quality of decision-making we’re p

“I told you to only call on me for emergencies, Gordon. You just need a second charge.”

◆ The second charge market expanded by nearly a third (31%) in 2020, showing its use in facing the immediate impact of the pandemic. (Source: Pepper Money analysis of Bank of England and FLA data)

◆ New second charge lending fell 10% year-on-year to £106m; the number of new agreements also dropped 10% to 2,406. For the three months to February 2023, agreements were down 2% year-on-year to 6,807.

(Source: FLA)

◆ Searches for second charge mortgages on broker platforms rose 14% year-on-year compared to 2022, indicating rising consumer interest.

(Source: Knowledge Bank)

◆ January saw market growth of 29% compared to January 2023. Lending grew 17% year-on-year in H1, making second charge the fastest-growing segment of the secured loans market. (Source: Pepper Money)

◆ Across the year, growth in the seconds market surpassed the previous year’s performance by 25%; the value of new second charge lending hit £130m, up 35% year-on-year. (Source: Bank of England, FLA)

◆

£3.2bn was accessed via second charge mortgages from Q1 2022 to Q2 2024, 27% higher than pre-pandemic levels. (Source: Pepper Money)

◆ Around 40,000 households are expected to use homeowner loans in 2025. (Source: Pepper Money)

◆ In March 2025, new business volumes rose 18% yearon-year; in the 12 months to March, there were were 37,053 new agreements (£1.82bn) – a 19% increase in volume and 27% increase in value compared to the 12 months to March 2024. (Source: FLA)

Jannels observes that any future developments must keep the customer’s needs and demands front of mind: “By actively listening to customer feedback, OMS continually develops tools that cater to underserved segments, particularly borrowers facing complex lending scenarios.”

Mobile apps, chatbots and biometric ID verification are all part of the tapestry of enhancing borrower experience. Stern reports that these have boosted same-day completions for Masthaven already.

Norton’s digital ID tools, meanwhile, resonate with the expectations of the next generation of clients, who expect seamless digital experiences that mirror the experience already being provided in other industries.

Lau notes: “Where digital ID verification tools are used by Norton, the speed and reliability of borrower onboarding has significantly improved. By allowing applicants to verify their identity

securely from any device, often using facial recognition or document scanning, borrowers no longer need to post physical documents or attend face-to-face meetings.

“This has been a huge win for younger homeowners and the self-employed, who want speed and convenience.”

OMS’ mobile interfaces and webchat are also part of the work being done to support accessibility moving forward.

Jannels explains: “Technologies like digital identity verification, webchat functionality and mobile-friendly applications play a crucial role in streamlining the application process, reducing manual intervention and supporting faster decision-making.

“Uptake has been especially strong among younger homeowners and the self-employed, who tend to be more tech-savvy and value speed and accessibility.

“I haven’t had this much free time in years!”

Real progress has been made in the second charge market to streamline and improve the borrower experience.

Vaughan says: “One of the biggest changes has been the introduction of advanced ID verification. Customers can now confirm who they are quickly and securely, without uploading documents or waiting for manual checks. We also adopted DocuSign early on, so there’s no need for paper forms or back-and-forths in the post.”

Tech-driven lenders push others to innovate, increasing competition and strengthening the market in the long run. Through all of this, though, cybersecurity is critical.

Lau says: “At Norton, maintaining borrower trust is not only a compliance obligation – it’s a core part of the company’s ethos.

“With technical safeguards, regulatory compliance and secure partnerships, we’re building a digital environment where borrowers can engage with confidence.”

OMS also takes cybersecurity and data privacy extremely seriously, being ISO 27001 certified, with a multi-layered security framework, continuous monitoring and penetration testing every six months.

For what has been a lesser known product, ensuring watertight compliance and security is key to building trust and reliability among borrowers and brokers.

Vaughan says: “Being a digital-first lender means security and privacy are essential. We’ve built robust protections into our tech stack, including encryption, multi-factor authentication and access controls.

“We also have clear policies in place for GDPR, covering everything from data consent to how long we retain customer information.”

Jannels adds: “In a climate where cyber threats are evolving, a proactive approach to security ensures that both borrower data and business operations remain protected – reinforcing confidence in the digital mortgage process.”

Robust cybersecurity and compliance, as well as streamlined applications and decision-making, set a high standardin this market, but challenges do persist.

Lau explains: “The challenge is keeping up with regulatory changes whilst pushing for innovation, but our tech gives us the flexibility to adapt quickly.”

Vaughan adds: “As we continue to refine our platform, we’re sticking to a secure-by-design approach, making sure every tool we launch is built with privacy and compliance in mind.”

FIONA HOYLE IS DIRECTOR OF CONSUMER AND MORTGAGE FINANCE AND INCLUSION AT THE FLA

The past five years have seen the use of technology reshaping how the second change mortgage market operates and supports its growth.

New portals are making case tracking simpler and more collaborative, and the use of API-powered property valuations have improved e ciency.

Digital ID checks – incorporating AI to verify documents –and the extensive use of electronic signatures are improving the customer experience.

Borrowers increasingly want to interact with lenders and brokers in ways that suit their preferences – whether that’s through apps, websites or via a phone call.

The sector has a strong focus on using technology to deliver good customer outcomes.

There is clearly a confidence in tech among those in the second charge market, but there is little evidence that this will become an automated market any time soon.

In fact, much of the tech advancement available in seconds centres on freeing up time to tackle the elements that need a human touch.

Vaughan says: “Brokers can quote and submit cases to Selina without ever leaving their existing systems. It’s about fitting into the broker’s day-today, not the other way round.”

Stern says: “While technology helps streamline the journey, we know it can’t answer everything. Lending isn’t one-size-fits-all – especially for selfemployed clients, or those with complex credit histories. The tech is there to speed things up. The people are there to get it done right.”

With attention so strongly focused on highlevel technological developments in every corner of the property finance market, from handling client information to making brokers’ lives easier, there is little doubt that the second charge mortgage market is poised for significant growth. ●

Imagine this: one of your customers, a landlord with a large portfolio, is looking to raise the finances needed to bring a property up to Energy Performance Certificate (EPC) standard. What product do you recommend to them?

The go-to for many brokers might be a standard remortgage, but there’s a lesser-known alternative that could serve this customer be er: a second charge buy-to-let (BTL) mortgage.

Second charge BTL loans are not offered by all lenders, and so are o en overlooked. However, they present a compelling option for landlords looking to unlock equity in their existing properties without disturbing the terms of their current mortgage.

For clients who have favourable interest rates or terms on their first charge, a second charge allows them to retain those benefits while securing the funds they need.

In a challenging and ever-changing market, landlords are navigating increasing regulation, rising taxation, tighter profit margins, and unpredictable interest rates. Yet many are not retreating – they are evolving.

Research we conducted revealed that, although around one in 10 landlords are planning to reduce the size of their portfolios this year, nearly 30% are actively planning to expand or diversify. This shows that the appetite for growth remains strong, even amid market pressures. For landlords with ambitions to grow or diversify their portfolios, traditional financing methods don’t always provide the flexibility or speed required.

Second charge BTL mortgages are increasingly filling that gap, offering a solution that aligns with the evolving needs of property investors. Whether it’s funding refurbishments,

upgrading properties to meet new regulations, or consolidating debt to ease cashflow, these loans provide landlords with the agility they need to act quickly and strategically.

One of the key advantages of second charge BTL mortgages is the speed at which they can o en be processed. Compared to remortgaging, second charge applications o en move faster due to more responsive underwriting and fewer hurdles.

They also offer flexibility and can be purpose-built to meet a wide range of financial objectives – from property improvements and EPC upgrades to business expansion, debt consolidation, or even providing a deposit for the purchase of additional properties.

They are particularly valuable when the funds are to be used for specific improvements, such as bringing a property up to EPC standards – a requirement that’s becoming more critical as legislation tightens.

The flexibility of repayment terms, whether short-term or longterm, also makes them accessible to landlords at various stages of their property journey.

Those newer to the market, who may be facing cashflow constraints or are reluctant to refinance their main mortgage, can still access the finance they need without affecting their existing financing arrangements.

At Together, we have already seen many customers finding success through the product. We recently helped a landlord unlock equity across their portfolio with a £879,000 second charge BTL mortgage, secured against 26 properties in a £3.5m portfolio. This

enabled them to move swi ly on a new opportunity that arose, without affecting their existing loans or refinance each property individually.

Some lenders, like Together, also offer cross-charging, where one loan can be secured against multiple properties, providing even greater flexibility for portfolio landlords.

Despite these benefits, awareness of second charge BTL mortgages remains limited. Many landlords simply don’t know they exist or understand how they can be used. This is where brokers play a vital role; it’s up to industry professionals to guide their clients through the available options, bringing alternative lending solutions to their a ention and ensuring customers have the right information to make informed decisions.

As demand for flexible financing continues to grow, brokers who understand and champion second charge BTL will be positioned to thrive. These brokers are not just facilitating transactions, they’re building long-term relationships, solving complex challenges, and enabling clients to achieve their goals with greater confidence and speed.

Second charge BTL mortgages are no longer the niche product they used to be – they are a strategic financial tool.

As landlords navigate the evershi ing market, brokers have the opportunity to lead with knowledge and solutions that go beyond the conventional.

Awareness, education and access to specialist lenders can make the world of difference in achieving the right outcomes for your customers. ●

SECOND

Just how important is speed in terms of the quality of service we offer? A first reaction might be that it is of paramount importance, and overshadows other considerations. However, I would argue that speed is interpreted in different ways by all of us – whether as customer, adviser, or lender – and that we need to take this into account in the advice process.

As lenders and advisers, we tend to think that it is all about the time taken to complete the mortgage process, but that represents only one interpretation – although a large one, admi edly.

Another factor to remember is that the longer the production line, the greater the chance of delays. While first charge lenders in particular are under pressure currently because of the property purchase miniboom, local authority, valuation and conveyancing backlogs are also adding to the problem. It is easy to see how the house purchase market can stall, but where does that leave homeowners who want to raise capital?

With the welcome news of increasing volumes of second charge mortgages last month – as the market recorded the highest annual total since 2009 – and that every month of 2024 had shown an increase in business volumes the highest monthly level of new business since the start of the lockdown, it is worth considering how much influence the need for fast resolutions has had on those numbers?

With first charge mortgage providers struggling to cope, it is reasonable to suggest that advisers relying on fast remortgages are likely to be disappointed at present. Therefore, what I want to do is connect with open-minded advisers

who follow the guidelines of informing customers that a second charge mortgage can provide an alternative to a remortgage.

I am not going to list the many examples of where a second charge mortgage is a more appropriate choice for capital raisers, but instead just concentrate on meeting a customer’s need for a fast resolution.

The main issue that needs assessing is exactly how pressed the customer is to receive the capital required.

In other words, is the deadline realistic for them and for the lender? Next, whatever the funding solution being considered, does it come with conditions which increase cost unnecessarily?

A good example here would be the choice of a remortgage which involves an early repayment charge (ERC) to be paid. Are the customers prepared to pay that price just to get the money they require, or could they wait for the ERC period to end and put off the transaction until then? If the la er, and the answer is no, then if they do not want to pay the ERC along with the costs of remortgaging, a second charge mortgage should be a serious consideration.

It is worth mentioning that under Consumer Duty, the regulator is more likely to question decisions where there is ambiguity over the

LAURA THOMAS is regional sales manager at Equi nance

It is reasonable to suggest that advisers relying on fast remortgages are likely to be disappointed”

recommendation of a remortgage, and advisers need to be sure that they have clear evidence that clients are be er off having a remortgage recommended over a second charge.

Speed must be interpreted on different levels. How quickly must the customer have the money? Can the lender meet that deadline? Then, must the customer pay a financial penalty for taking a particular course of action?

In the cases referenced above there were be er choices, especially if the capital was needed immediately. However, if the customers had been in a position to wait for the ERC to end, then the need for speed was not really the issue it seemed to be, and both a remortgage and a second charge loan are valid alternatives.

Perhaps cases like this serve as a reminder that there is no such thing as a ‘one case fits all’ lending scenario when offering advice. So, the need for speed must be properly understood and applied to the path recommended to the customer. ●

Trusted people. Trusted decisions. Loans delivered as promised.

With decades of experience, our team understands what brokers like you value most: certainty, flexibility, and personalised service as standard.

That’s why we’re hosting a series of webinars to provide valuable market insight and answer your questions on our range of specialist lending solutions.

Join Shelley and Paul for second charge & specialist remortgages (including unencumbered), Claire and Jim for bridging, and Claire with EJ for development finance - all offering real-time support on even your most complex client scenarios.

Re-mortgage or Secured Loan? The Great Debate

Date: Wednesday 2nd July 2025 | Time: 12pm

Date: Tuesday 8th July 2025 | Time: 12pm

Date: Tuesday 15th July 2025 | Time: 12pm

Register now for our ‘Ask Masthaven’ webinar series - a live Q&A with the leaders in bridging, development finance and mortgages & secured loans

The second charge mortgage market has evolved dramatically in recent years. Once considered a niche lending solution, it is increasingly becoming a mainstream option for a growing number of homeowners – and crucially, a more diverse range of borrowers.

Traditionally, second charge mortgages were favoured by homeowners aged 40 and above – typically with well-established careers and significant equity in their properties. These borrowers used second charges primarily for home improvements, debt consolidation, or major one-off expenses like funding school fees or buying a second property. Today, that landscape is changing – and fast.

The cost-of-living crisis, rising property values, and a broader cultural shi in financial a itudes have combined to bring a new generation of borrowers into the second charge space.

According to the Finance & Leasing Association (FLA), total second charge lending over the last 12 months reached nearly £1.784bn across 36,519 agreements.

In fact, March this year was the second biggest month in second charge lending since the Credit Crunch, which evidences the buoyancy in the market and lender appetite to support customers.

Notably, around 68% of lending was for debt consolidation, 24% for home improvements, and 8% for other purposes, including tax bills, education, or starting a business.

The average loan size stands at around £48,000 – up only slightly from previous years – suggesting that while borrower demographics are changing, responsible lending

remains a priority. Around 50% of loans remain under 70% loan-tovalue (LTV), with only around 26% exceeding 80% LTV, indicating a continued emphasis on sensible, equity-based lending decisions.

So, what’s behind the surge in younger and more varied applicants?

1.Increased nancial awareness

Millennials and Gen Z are showing a greater awareness of financial tools and products. Armed with knowledge from digital platforms, they’re seeking out flexible, cost-effective borrowing solutions – and second charges increasingly fit the bill.

2.Changing attitudes towards debt

There has been a cultural shi in how younger generations view debt. It’s no longer simply a burden; it’s a strategic tool. With second charge products o en offering lower rates than unsecured credit, many are using them to consolidate debt efficiently and take control of their finances.

3.Greater diversity in homeownership

The profile of the UK homeowner is no longer uniform. More culturally and socioeconomically diverse than ever, today’s borrowers expect tailored, flexible lending solutions. Second charge products, with their adaptability and evolving underwriting criteria, are beginning to reflect this demand.

4.Economic pressures and lifestyle goals

The cost-of-living crisis, stagnant wage growth, and rising interest rates

have driven homeowners to seek alternative forms of finance. Whether it’s to fund energy-efficient upgrades, cover unexpected expenses, or start a business, second charges are offering a quick and flexible finance option.

While it would be premature to suggest we’re heading back to the peak lending volumes of 2008, the signs are encouraging. The second charge market has shown steady growth over the past couple of years, and this upward trend looks set to continue –particularly as younger homeowners become more comfortable with using home equity to reach their goals. Looking ahead, several factors could continue to support market expansion:

Increased homeownership among younger adults, offering a broader base for second charge lending. Growing demand for financial flexibility, especially as consumers seek alternatives to unsecured debt. Rising property values, giving homeowners more equity to tap into.

More progressive a itudes toward borrowing, especially for personal investment purposes like education or entrepreneurship.

Favourable economic conditions, including stable employment and improving tech-enabled access to credit.

Keeping pace

To remain competitive – and relevant – lenders are responding with meaningful product innovations that reflect the changing face of their customer base.

1.Digitally-driven application journeys

Modern borrowers expect speed and convenience. Digital portals and automated decisioning are now standard among many lenders, streamlining the process and improving both the broker and borrower experience.

2.Flexible loan structures

From variable terms to overpayment allowances, lenders are increasingly offering flexible repayment solutions that cater for the needs of borrowers with fluctuating incomes or nontraditional financial backgrounds.

3.Smarter underwriting and pricing models

Many lenders are looking beyond standard credit scoring, adopting more holistic approaches that consider individual borrower circumstances –helping those with complex income streams or thin credit files access appropriate funding.

4.Green nancing options

As eco-consciousness grows, several lenders have launched products that incentivise green home improvements. Lower interest rates for energy-efficient

upgrades are appealing to younger, environmentally aware homeowners and align with broader environmental, social and corporate governance (ESG) goals across the industry.

The second charge mortgage market is in the midst of a transformation. No longer confined to older, equity-rich borrowers, it’s rapidly opening up to younger, more diverse homeowners with a broader range of financial goals.

As lenders continue to innovate and respond to evolving borrower needs, the future for second charges looks bright.

For brokers, this presents a significant opportunity. Understanding the nuances of this

The second charge mortgage market is [...] rapidly opening up to younger, more diverse homeowners”

shi ing demographic – and staying informed about the latest product developments – will be key to supporting clients effectively and unlocking the full potential of the second charge market. ●

The Intermediary speaks with Laura Thomas, regional sales manager for the North at Equifinance, about communication, market demand, and regional second charge trends

Please can you introduce yourself for the readers?

I have 30 years in financial services – often not believed, but I started at the Bank of Scotland at the grand age of 15! I have seen the many ups and downs of the lending and broking rollercoaster over these years, having worked in the commercial, secured and unsecured sectors. However, secured lending has always been my favourite!

Having started with Equifinance in 2019, the business has grown and drastically in the past six years. Proudly an independent lender, Equifinance has gone from being a small lender in the secured lending sector to a prominent player.

It has been an exciting and rewarding journey that shows no signs of slowing down!

Can you walk us through the typical application process, highlighting any unique aspects?

Equifinance has always worked on a business-tobusiness (B2B) model, so all business is introduced via our broker partners. This allows the broker to do what they do best and allows us focus on the underwriting and servicing, which we do best.

Equifinance is proud to have always been well known for its flexibility, ‘can-do’ approach and applying common sense to lending decisions. We have a name in the market for applying a ‘manual’ underwriting approach, taking into consideration client’s circumstances, as we are well aware one size does not fit all.

Some may find this approach old fashioned, as it is far from a digital perspective; however, we see this as going the extra mile to understand clients’ circumstances. This sets us apart from other lenders in the market, it is often one of the biggest positives our brokers provide feedback to us on.

What are your typical second charge loan terms? Are there any notable exclusions or restrictions?

As the name suggests, Equifinance can only apply second charge on an owner-occupied residential property. Our loan must follow a regulated first charge lender and any other charge on the land registry must be cleared, with the exception of boilers or solar panels. Equifinance can consider differing income and employment types, various credit profiles and offer an array of loan amounts, loan-to-values (LTVs) and rates to cover as many client circumstances as possible.

We are well-known for our service level agreements (SLAs), as they have always been our biggest unique selling point (USP) over the years, when perhaps our rates were not as competitive as they are now. We have been careful to never allow this USP to slip as we’ve grown.

Lenders are trusted by brokers to take their cases from submission to completion as smoothly and efficiently as they can. We believe it is our responsibility to provide the best possible service and communication throughout the process so that brokers can provide customers an efficient and smooth journey with constant updates.

Equifinance is constantly appraising and reviewing its second charge offering. Internally, product development is a team effort with risk, finance, underwriting and sales all involved in the creation and updating of products.

Essential to this work is the feedback our brokers partners provide, so that we not only

remain competitive in the market but also offer products and terms that will be a good fit for their clients.

emerging trends do you foresee in the second charge mortgage market?

The balance of power between broker and lender goes up and down and always has done – this makes for a healthy market.

With interest rate changes, twinned with the cost-of-living crisis over the past few years, I have never seen the margin on rates so close between the first and second charge market.

For that reason, the market is buoyant, and with new entries into the lender market, including high street names like Admiral, along with Consumer Duty obligations, second charge loans are becoming more and more recommended and utilised, when this was an industry that was often seen as the ‘poor relation’ to firsts.

What do you consider the most important factors in building strong relationships with brokers?

Brokers are my customers, so my relationship with them is of paramount importance. I feel lucky to have broker relationships that have evolved into personal friendships, but that’s often how it goes as a remote sales manager – you can spend more time at brokers’ offices than your own, so relationships flourish.

Brokers rely on me to be honest, transparent and to add value to their business. I do this through providing trustworthy support, always being on hand to help and always, always answering my phone! I’m renowned for always answering or calling straight back. Such a simple habit to adopt, but it means a great deal to brokers.

How do you tailor your approach to meet the unique needs and challenges of brokers in the North?

I love working in the North! The warmth and banter in the brokers’ offices I visit mean I never have a dull – or quiet! – day. I would take working from a broker’s office to working from home any day of the week. The biggest challenge is adapting what I call a ‘bread roll’ around the regions; this can be a contentious subject!

Are there trends or opportunities specifi c to the second charge mortgage space in the North?

The North boasts a number of second charge brokers, all with vast experience in the market. What is helpful is that most brokers and lenders know each other in the North, and there is genuine respect in the market for each other –broker to broker, lender to lender and everyone else in between.

What key market movements or changes within the business are you looking forward to this year?

On a personal level, Equifinance has invested heavily in a new broker portal which will revolutionise the way we work.

I cannot wait to launch this into the market as it will implement a number of efficiencies for their teams.

On a wider level, following a successful securitisation last year, I am excited about Equifinance continuing to build its loan book and work towards the next securitisation.

The plans for Equifinance are always positive, with a commitment to achieving goals as a team. I feel very lucky to be a part of their journey. ●

The second charge mortgage industry is a sleeping giant. A large number of mortgage advisers are missing a trick by ignoring its considerable merits. In doing so, they are not only doing themselves a disservice, but more importantly, their clients.

I’ve been directly involved in second charge mortgages for over 25 years. I’ve seen good and bad times, brokers and lenders come and go, and a number of challenges brought and overcome. As such, I feel well placed to use that experience to draw some conclusions on where the industry finds itself today.

Data published by the Finance & Leasing Association (FLA) shows that the industry continues to grow. Comparing March 2024 to March 2025 shows an increase in wri en agreements from 2,894 to 3,428, an 18% increase. A decent percentage, but when I look back 20 years, I was working for Loans.co.uk when we regularly wrote 2,000 second charge mortgages a month. That was just our company. I suspect the industry wrote five-times the business it writes today.

So why is this? Well, 20 years ago, second charge brokers got their business directly from their own advertising; direct mail, TV, and the internet were the main channels. Today, while some business is generated online, a lot more is generated through referrals from mortgage brokers who specialise in first charge mortgages.

Unfortunately, far too many choose to ignore or dismiss second charge products. This is despite them claiming to cover the whole of the market, of which the second charge mortgage is actually a crucial part.

There are many reasons why I suspect mortgage brokers discount second

charge mortgages. These include ignorance, a misconception of associated fees and charges, of rates, and of process. Some don’t take the time to understand the benefits to their clients. Some don’t understand the focus on Consumer Duty and compliance that lives within our business, that we are as qualified as they are, and that our passion for ensuring correct customer outcomes runs as deep as theirs.

Yet second charge mortgages can provide great solution to a customer’s capital raising needs.

Just like two high street lenders might have different ways of compliantly assessing affordability, the second charge industry focuses more on actual affordability and less on an arbitrary loan-to-income (LTI) calculation. This can mean that a customer may pass affordability calculations on a second charge, where they may not on a first charge.

Some second charge lenders may be more comfortable with a near prime application, or one with multiple and complex income, or where debt consolidation is the primary purpose of borrowing.

Customers need help. As their mortgage adviser, if you are not able to provide it, their need doesn’t go away. So, your customer may go online and find a second charge mortgage broker through an aggregator website or suchlike, and just like that, you’ve lost them. They’ve gone to someone who has taken time to understand the market and provide a solution. You’ve lost income from this transaction, and potentially future ones as well if they don’t come back to you.

The recent entry of two major lenders into the second charge mortgage market is a clear indication of the sector’s growing significance within the broader mortgage landscape. Their arrival not only demonstrates

JOE DEFRIES is managing director at e Loan Partnership

increasing confidence in the stability and profitability of second charge lending, but also signals that this onceniche area is becoming a mainstream financial solution for borrowers.

As more homeowners look for flexible ways to access equity without remortgaging, the presence of these heavyweight lenders confirms that the second charge market is not only expanding, but firmly establishing itself as a permanent fixture in the mortgage world.

Given the Financial Conduct Authority’s (FCA) regulation of second charge mortgages, and the second charge mortgage industry’s positive embracing of that regulation, it is important to take the time to educate yourself around how, in the right circumstances, a second charge mortgage could be a great solution for your customer.

At The Loan Partnership, we are proud of the education we have delivered to hundreds of mortgage advisers through our partnerships with clubs and networks, and our outreach to the directly authorised (DA) market. If you’d like to learn more, or have a customer who you think might benefit, why not give me a call? I’d be delighted to be able to tell you if a second charge mortgage could be an option for your client.

In time, I live in hope that if first charge mortgage brokers who call themselves ‘whole of market’ do not consider a second charge alongside the first charge option – and select the right one for their customer – the regulator will intervene to make sure customers do indeed get the right outcome each and every time. Only then will we truly see the awakening of the sleeping giant. ●

I’ve seen this headline written by second charge brokers many, many times – so why is this different? The answer is simple, the market is different. The landscape for mortgage brokers, the need to use second charges, and the increased use of product transfers have all changed the game.

The fact is, secured loans are becoming increasingly vital for the modern mortgage broker. That’s why Loans Warehouse’s services are more in demand by brokers than ever.

In February 2025, second charge new business reached £156m – up 20% year-on-year. Over the three months to February, lending totalled £431m –a 27% annual increase. Across the 12 months to February 2025, the market hit £1.78bn – up 26% on the previous year. Looking ahead, lending volumes are confidently predicted to exceed £2bn in 2025.

New lenders with strong brand recognition have entered the market, and major acquisitions are reshaping the landscape. ClearScore has acquired Aro, while TotallyMoney was recently

purchased by Intelligent Lending Group – the parent company of second charge broker Ocean Finance.

These deals are expected to boost the mainstream visibility of secured loans, with potential TV advertising campaigns on the horizon. This added exposure will help educate consumers about their options, and is likely to drive demand even higher.

According to UK Finance forecasts, product transfers are set to increase by 13% this year, totalling £254bn.

Given the average UK mortgage size of £206,384, this equates to around 1.23 million customers refinancing – many of whom won’t be raising additional funds through traditional remortgaging.

With higher interest rates and tighter affordability criteria, many borrowers are reluctant to disturb competitive first charge rates secured during the historically low interest period.

Instead, they turn to second charge loans to raise capital without affecting their existing mortgage terms. This shift is transforming second charge lending from a niche

MATT TRISTRAM is MD at Loans Warehouse

product into a mainstream financial solution. Secured loans will become an essential solution for these clients. If brokers and networks don’t offer them, customers will naturally seek alternatives through comparison sites like MoneySuperMarket and Money.co.uk, losing out on potential revenue and creating competition for themselves.

A combination of economic pressures and consumer needs is driving this increased demand:

£1.78bn

£431m

£156m

Cost-of-living pressures: Rising household costs are pushing homeowners to consolidate unsecured debts into a single, lower-rate secured loan, freeing up monthly cashflow.

Home improvement boom: With moving costs remaining high and housing stock limited, more homeowners are borrowing to improve rather than relocate. The second charge market has seen notable increases in loans for home renovations, extensions, and energy efficiency upgrades.

Self-employed and complex borrowers: Traditional remortgage routes are often closed to selfemployed clients or those with complex incomes. Second charge lenders offer more flexible underwriting, opening crucial doors for these customers.

Interest rate environment: Many homeowners are still on historically lower fixed rates; remortgaging means sacrificing these deals, making second charge loans the preferable option for additional borrowing.

According to the Finance & Leasing Association (FLA), around 60% of second charge loans are used for debt consolidation, while 25% fund

home improvements — evidence of the product’s relevance across diverse financial needs.

Loans Warehouse has positioned itself as one of the UK’s leading second charge brokers, consistently outperforming market growth.

In 2024, the business reported a 35% increase in second charge completions, outpacing the overall market rise of 26%.

Notably, Loans Warehouse has developed strong partnerships with key lenders, providing brokers with access to exclusive rates and faster processing times.

Digital innovation has also been central to second charge lending success. Investment in streamlined technology platforms has reduced average application times by 20%, while maintaining industry-leading customer satisfaction scores, which currently stand at five out of five on Trustpilot.

In fact, Loans Warehouse was recently awarded ‘Best Quality Packager’ at the National Mortgage Awards – Second Charge, testament to its reputation for service excellence.

Another major driver has been the broker support proposition. Loans Warehouse provides bespoke training and marketing support to networks and directly authorised (DA) firms, ensuring brokers are not only aware of second charge opportunities, but confident in advising on them.

The biggest networks and brokers are aware the second charge market is no longer an optional extra for brokers – it’s an essential part of the advice process. Brokers who fail to engage with this market risk falling behind as competitors and direct-to-consumer platforms step in to fill the gap.

By partnering with a specialist like Loans Warehouse, brokers can meet their clients’ needs across the full mortgage journey: from initial purchase to remortgage, second charge, and beyond.

With demand set to grow even further in 2025 and beyond, there has never been a better time for brokers to embrace the opportunity. ●

HEADLINE SPONSOR

THE UNDERGLOBE, NEW GLOBE WALK, BANKSIDE, LONDON 23RD OCTOBER, 2025

BROUGHT TO YOU BY

WHY ATTEND?

Join us on ursday, 23rd October 2025 for an unforgettable evening as we honour the standout performers of our industry at the National Mortgage Awards – Second Charge. is prestigious event recognises the outstanding dedication, innovation, and expertise across the sector – from brokers and lenders to trailblazing individuals.

Celebrate the success stories that shape the second charge mortgage landscape

Connect with leading industry professionals and decision-makers

Be inspired by the achievements of peers and pioneers alike

Enjoy an evening of recognition, celebration, and networking in the heart of London

JAMES GILLAM is managing director at Pure Panel Management

Uncertain economic conditions and a higher interest rate environment have significantly increased demand for second charges over the past few years. Affordability challenges, combined with access to cheaper long-term fixedrate products, have been key drivers, as borrowers explore alternative ways to raise capital without remortgaging.

The Finance & Leasing Association (FLA) found in March 2025 that new business volumes in this sector grew by an impressive 18%, continuing the upward trend observed throughout most of the previous year. As we move further into 2025, demand is expected to remain robust.

This surge in demand was celebrated at the National Mortgage Awards – Second Charges, hosted by The Intermediary back in November. It was fantastic to see the importance of second charges within the industry taking centre stage.

Debt consolidation remains the most common reason borrowers turn to second charge mortgages. According to FLA data, 58% of transactions in March 2025 were used for this, followed by a combination of debt consolidation and home improvements (22.6%). Nevertheless, second charge mortgages are incredibly versatile. Borrowers also use these products to fund home extensions, purchase additional properties, provide financial assistance to family members, or even expand their businesses.

This flexibility makes second charge mortgages a valuable tool for brokers working with clients seeking tailored financial solutions.

One of the standout features is the speed at which funds can be released. The process is o en completed within a week or two, making it an a ractive option for borrowers who need fast access to funds.

Clients with time-sensitive financial needs can benefit greatly from the swi turnaround times, and brokers can provide efficient solutions without the lengthy processes o en associated with traditional remortgaging.

Obtaining a quick and accurate valuation report is a crucial part of the second charge process. This is important in the specialist lending market, where borrowers o en have complex financial arrangements or a history of adverse credit.

Working with an experienced provider can make all the difference –a deep understanding of the valuation process and a panel of qualified valuers who can deliver reliable reports within tight deadlines. This expertise helps brokers secure the information required to move transactions forward without unnecessary delays.

An experienced provider does more than just source valuers. They can check access details, liaise with applicants, and follow up at every stage of the application process to ensure deadlines are met.

In cases where post-valuation queries arise, they act as intermediaries between the broker, lender, and valuer, ensuring that issues are resolved promptly. This can make a significant difference in meeting clients’ expectations and closing deals on time.

By handling the complexities of the second charge process, providers can allow brokers to focus on

generating new business in areas where they excel. By delivering a seamless experience, brokers can enhance client retention and satisfaction, strengthening long-term relationships.

For brokers unfamiliar with the second charge market, partnering with experts can also save valuable time and resources. Providers can help navigate the intricacies of the sector, offering guidance on how to best position these products for clients and unlocking new earning opportunities.

In the current economic climate, it is crucial for brokers to stay informed about the advantages of second charge mortgages. Understanding the product’s versatility, speed, and flexibility can help brokers be er meet the needs of borrowers seeking alternative solutions.

As demand continues to rise, brokers have a unique opportunity to capitalise on this growth.

Whether it’s helping clients consolidate debt, fund home improvements, or raise capital for other purposes, second charge mortgages are an invaluable tool in today’s financial landscape.

By staying informed, partnering with experienced providers, and delivering tailored solutions, brokers can not only meet their clients’ needs, but also position themselves for success in a dynamic and expanding sector.

In 2025, second charge mortgages are set to remain a key player in the specialist lending market, and brokers who embrace this trend will be wellplaced to thrive. ●

The Intermediary speaks with Liam Billings, business development manager (BDM) at Central Trust

How and why did you become a BDM?

My journey into the nancial services industry began many years ago, when I started working as a mortgage broker. I built strong relationships within the sector and gained invaluable experience helping clients navigate the complexities of mortgage lending. However, I had never worked for a lender before, and I saw becoming a BDM as the perfect opportunity to take on a new challenge while remaining within the industry I love.

I have always enjoyed a role that involves direct interaction with people, and the transition allowed me to continue working closely

with brokers while expanding my expertise from a di erent perspective. e ability to support brokers in nding solutions for their clients, while also contributing to the strategic growth of a lender, was incredibly appealing. Being a BDM enables me to merge my technical knowledge with relationshipbuilding skills, making the role both dynamic and rewarding.

When I made the decision to transition into a BDM role, I wanted to join a company that would o er me the right support. From my very rst interactions with Central Trust,

I knew this was the right place for me. During the application process, I had the pleasure of speaking with Andrew Turner, group chairman, and Debbie Burton, chief executive, both of whom le a lasting impression. eir enthusiasm for the company reassured me that Central Trust would provide a great working environment. Since joining, it has become even more apparent how driven and forward-thinking the company is. Central Trust has a clear vision for the future and a focus on teamwork, which creates a supportive and collaborative culture. Everyone here works towards a common goal –ensuring that we provide brokers and their clients with the best possible products and service.

One thing is our commitment to continuous improvement. We are always looking for ways to enhance our products and services to better serve brokers and their clients. Our dedication to putting the customer rst is at the heart of everything we do, ensuring that we always operate with integrity and go the extra mile. Another standout factor is our longevity and resilience. Central Trust has been lending since 1988, and during that time, we have remained steadfast. While many lenders have withdrawn from the market during uncertain times, we have maintained our commitment to providing lending solutions, o ering stability to brokers and borrowers alike.

e nancial landscape is always evolving, and one of the biggest challenges is the competitive nature of the market. High street lenders are broadening their o erings and expanding their criteria, making it more di cult for specialist lenders to di erentiate themselves.

A crucial part of my role is demonstrating where we can add value. is means ensuring brokers fully understand our unique selling points (USPs), such as our exible lending criteria. Helping brokers to identify the right opportunities for their clients is an ongoing challenge, but also a rewarding part of the job.

One of the most rewarding aspects of the role is the ability to build strong, lasting relationships with brokers across the country. Every day presents a new opportunity to meet new people, understand their

challenges, and work together to nd solutions that help their clients secure the right nancial products. Beyond relationship-building, the role also provides the opportunity to contribute to the company’s growth by feeding back insights from brokers. By identifying gaps in the market and areas for improvement, I can play a part in shaping the future of our lending propositions. is not only bene ts the business, but also strengthens our o ering, creating a positive cycle of development and improvement.

Collaboration is key to ensuring the best outcomes for borrowers. I make it a priority to be available to brokers, o ering guidance and support whenever they need it. is includes helping brokers understand our criteria and working with our underwriting team to ensure a smooth process.

One of the most valuable things I can do is help brokers package their cases correctly from the outset. By ensuring that all necessary information is provided upfront, we can speed up the decision-making process and improve customer experiences. I also keep brokers informed about any changes to our products so that they can o er their clients the most up-to-date advice. By providing a high level of service and maintaining strong communication, I help brokers deliver the best possible outcomes for their clients.

e mortgage market is more complex than ever, and my biggest piece of advice for potential borrowers is to seek professional

advice from an experienced mortgage adviser. With interest rates uctuating and lenders regularly updating their criteria, it is essential to have someone who can navigate the options and help borrowers make informed decisions.

Finally, I would encourage borrowers to think long-term. While short-term a ordability is crucial, considering future nancial stability is just as important. Ensuring that mortgage payments remain manageable in the long run can provide peace of mind and prevent nancial di culties further down the line.

is something outside of work that people might like to know about you?

When I was younger, I entered a competition run by Manchester City football club to name their new mascot. My brother and I submitted ideas. He went with ‘Cheater Chester’, and I – with the help of my dad – suggested ‘Moonchester’.

My suggestion was chosen and remains the o cial mascot to this day, which is my claim to fame. Although people don’t believe me at rst, I am always happy to pull out the proof! ● Central Trust Established in 1988 Products

Jessica O’Connor speaks with Jonny Jones, CEO at Interbridge Mortgages, about record-breaking growth, tech-led innovation, and why automation should never come at the expense of a human interaction

When e Intermediary rst sat down with Jonny Jones in 2024, Interbridge Mortgages was the newest name in second charge lending, promising to bring a fresh, streamlined approach to the market. Just launched and brimming with ambition, the lender was positioning itself as a responsive, tech-forward partner to intermediaries – aiming to cut through complexity with clarity and exibility.

Over 12 months later, Interbridge has not only lived up to that early vision, but helped rede ne expectations in the rapidly evolving second charge sector.

With a paperless application journey and a product range tailored for borrower needs,

Interbridge has made a signi cant impact on the second charge space. is success has not happened in isolation.

e wider second charge mortgage market has seen remarkable growth, as the second half of 2024 marked a 17% rise in total lending value, according the Finance & Leasing Association (FLA), with volumes not seen since before the Global Financial Crisis in 2008.

As more consumers seek alternatives to traditional remortgaging – driven by rate sensitivity and a need for exibility – second charge loans have become one of the fastestgrowing sectors of the UK mortgage market. In that context, Interbridge’s entry could hardly have been better timed.

In this special follow-up, e Intermediary reconnects with Jones to re ect on Interbridge’s rst year, unpack how the business has navigated opportunity and challenge alike, and explore what is next – both for the lender and the second charge market it now helps to shape.

Interbridge Mortgages has completed its rst year in the market with momentum. From day one, the goal was clear: bring quality products, top-tier service, and a smoother journey to the second charge mortgage market – and the reception has been overwhelmingly positive.

Jones says: “We’ve been received extremely well by brokers.

“We’ve got a very experienced team, and many people had established relationships with brokers already.

“Brokers knew that when we came to market, we would bring a high level of service and very high-quality products to their customers.” at trust has translated into real business. In just 12 months, Interbridge Mortgages has originated over £260m in loans – a gure that comfortably outpaced expectations, both internal and external.

Nevertheless, volume is not its only marker of success. For Interbridge, service has been just as important as scale, and arguably even more central to its identity.

“It’s relatively easy for a lender to deliver volumes and do that in a shabby or loose way,” Jones notes.

“But we believe that our service is, if not the best, then close to the best in the market.”

Since launch, Interbridge has received more than 375 Trustpilot reviews, averaging a nearperfect 4.9 rating.

Jones says: “None of our customers have given us a one- or two-star rating, which again is a real testament to the quality of the team that we have.”

He also points to the company’s broader ambition to improve the second charge journey itself, making the process less clunky, less frustrating, and crucially, more modern.

“When we set the business up, one of the things that we said we wanted to do was to modernise the second charge journey and make it much less unpleasant to take out a mortgage,” he says. “I think [there is] evidence that we’ve delivered on that.”

Speed has been another standout feature of Interbridge’s approach – one that has made a tangible di erence for borrowers. From the outset, the lender has prioritised e ciency in the second charge journey, stripping out delays and pushing the boundaries of what fast service can really look like.

Jones explains: “Fairly quickly a er launch we managed to do something that, if you’d asked me two years ago, I would have said was completely impossible – which is same-day payouts. A customer that applies for a loan on a Monday and gets the money on a Monday. at’s now becoming increasingly common.”

In a market where rst charge mortgages can still take months to complete, Interbridge’s ability to cut turnaround time has been a key di erentiator. is is the result of a deliberate focus on making the customer journey more e cient from start to nish.

Jones says: “ e steps that we’ve taken to make the journey more e cient mean that customers can get their money very, very quickly.”

Since launch, Interbridge has averaged a cycle time of around three weeks from application to completion – a signi cant improvement on industry standards just a few years ago.

Jones says: “I’m hugely pleased with our cycle times since launch, something that is dramatically shorter than the industry average a couple of years back.

“It’s probably come down from about ve weeks to about three weeks now.”

Jones is quick to acknowledge that Interbridge is not alone in chasing faster

processing times, and in fact, sees this as a positive sign for seconds more broadly.

He notes: “I think in some ways we’ve been a catalyst for that change. is is a great time to be a second charge mortgage customer because you’ve got a few lenders who are competing on quality of service with very fast turnaround times and a very e cient process.”

It is clear that Interbridge did not just enter the second charge market – it set out to positively disrupt it. From launch, the lender aimed to bring a fresh perspective to a sector o en bogged down by outdated processes.

Jones notes: “We came in with a lot of stu that was best in class.

“We did redesign some elements of the journey to make it more e cient.”

E ciency was not just a buzzword; it translates into practical changes that have removed friction from the borrower experience. One of the most notable innovations is a shi in how applications were handled.

Jones explains: “Something that sounds like a small innovation, but was actually quite important to the customer journey, is that we got rid of written application forms.

“Instead, we replaced that with a declaration where the customer veri ed if things were correct at the end of the journey rather than the beginning.”

What might seem like a small tweak had a major impact. Previously, customers o en lled out multiple versions of application forms as they adjusted their needs or changed their minds, thus leading to confusion and delays. By consolidating this into a single, streamlined declaration at the end, Interbridge made the process more straightforward.

e introduction of e-signatures also played a crucial role. While Interbridge was not the rst to bring them to market, their adoption shaved o signi cant time from the mortgage process. More importantly, it aimed to tackle a common and frustrating pain point in traditional lending: the logistics of signing documents in person.

Jones continues: “If you’re trying to apply for a mortgage the traditional way, by signing a piece of paper, the mortgage deed has to be witnessed, and you can’t get a family member to witness it.

“Now, put yourself in the position of somebody trying to sort their mortgage over the weekend. You’re around your family, who can’t witness the signature. →

“You think, ‘I’ll take it into work on Monday’ – then you forget. Tuesday, you’re working from home again. Before you know it, a week has elapsed just because you’re trying to nd a witness.”

By moving that step online, and allowing witnesses to sign digitally via email, Interbridge removed a seemingly small hurdle that too o en caused major delays. It is this kind of practical innovation that, according to Jones, “makes a huge di erence.”

If Interbridge set out to make the second charge journey less laborious, it has done so not by reinventing the wheel, but by quietly, and e ectively, tightening the individual bolts that make up the process. As Jones says: “None of this was groundbreaking, but it’s about incremental improvements.”

From increased automation and e-signatures to smarter modelling and automated valuations, Interbridge has taken small steps toward one big goal: making the second charge process faster and more tech-based.

“We’ve really been looking at 1,000 ways to improve the process,” he explains. “You get rid of each of those little things and then you make quite a substantial change. at’s how we then get to the reductions in the times.”

Much of the magic lies behind the scenes, in back-end systems designed to discreetly support the mortgage journey.

Jones explains: “It’s about increasing the ways in which our systems interact with broker systems to reduce manual entry and delays and errors in that area.

“Tech is really important. Brokers want quick responses, and they get a quick response most easily when it is a system talking to a system.” is integration has become vital in a sector where intermediaries are increasingly tech-savvy, Jones adds: “Many second charge intermediaries are quite large and quite sophisticated.

“Rather than doing the old-fashioned thing of manually nding out whether their customer will be accepted by di erent lenders, their systems all talk automatically through [application programming interfaces (APIs)] and inquire directly.”

Jones continues: “A broker will gather information and submit it to us simply by pressing a button on their own system. We’ll go away and do an automated valuation, we’ll do a credit search, we’ll do fraud checks – we assess all of that and bring it together to give an individual price for each customer.”

However, while technology may be at the heart of Interbridge’s streamlined second charge journey, it has never been a case of automation at the expense of human service. In fact, maintaining a personal touch has been just as important as building smart systems. Jones is clear that the two must go hand in hand.

He says: “What we’ve been really careful to do is to make sure that we’re not the kind of business where we do our automated systems and you can’t get hold of a human, where you try and speak to someone and you get an [arti cial intelligence (AI)] chatbot that thinks you’re asking about the price of butter.”

It is a scenario all too familiar to anyone who has found themselves stuck in an endless loop of automated prompts.

Interbridge, in contrast, has made human responsiveness a pillar of its proposition.

“We always answer the phone, and we always answer the phone in a few seconds,” Jones says. “We look at our phone statistics very carefully. You just don’t have any meaningful queues for either customers or brokers when they want to get hold of us.” at accessibility becomes particularly important when cases fall outside the standard mould, which, in the case of second charge lending, is all too o en.

Jones explains: “We know that not all cases are identical. Sometimes brokers will be looking at cases where maybe the income is a little bit complex, or they can’t quite see how di erent types of income might t within our packaging guides.

“ ere’s always someone who will answer the phone straight away and give guidance.

“It’s all about that interaction of a rapid human response with a really thought-through way of getting rid of the pain points in the automated journey.”

While AI is a hot topic across industries around the world, Jones believes that when it comes to mortgages, balance is key.

“In the mortgage market people actually want to deal with humans,” he says.

“So, what we want to do is use AI solutions in places where brokers and customers don’t, need to interact with it, focusing on back-end changes rather than front-end changes.”

While the human touch remains a key di erentiator, the pace of technological change, and the need to keep up with it, is shaping the second charge market just as profoundly. For Interbridge, that means staying

on the front foot as both opportunity and competition accelerate.

“ e market is growing really fast,” says Jones. “If you look across all lenders, including ones that aren’t members of the trade association, in quarter one this year it’s about 30% up on quarter one last year, and about 50% up on quarter one two years ago.”

It is a trajectory of consistent growth – one with several forces behind it.

Jones explains: “ e speed at which customers can access money from this product has improved, and there’s no doubt that’s driving completions.