We’re here to speed things up, not slow things down. Our 100% online application is stripped back to the essentials, offering speed of service, saving time for everyone.

£ for £ remortgages assessed at pay rate helping with affordability, even on short-term fixed rates.

Quick, consistent decisions with instant DIPs and desktop valuations for remortgages on standard properties that meet eligibility.

All underpinned by clear criteria so you know where you stand with simple processes for portfolio landlords, no extra forms just a few additional questions to fully understand your application.

01978 80 33 33

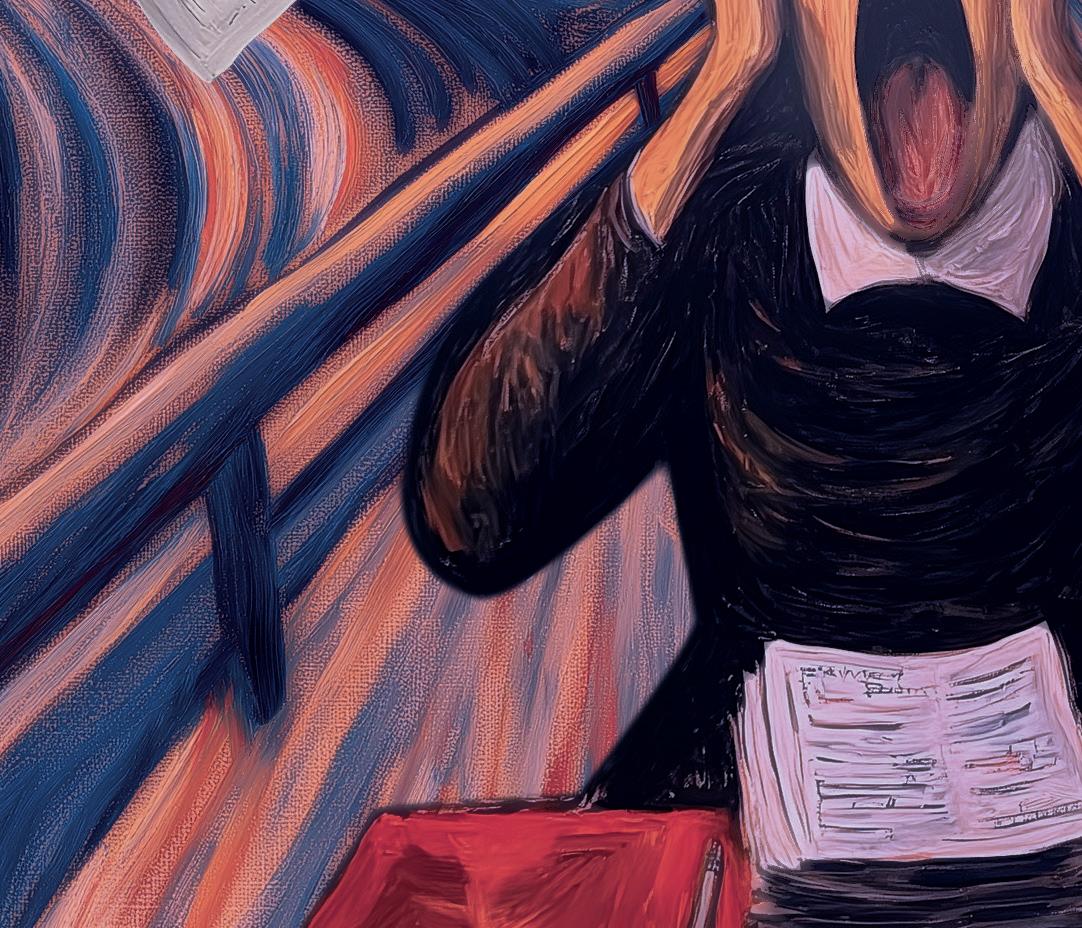

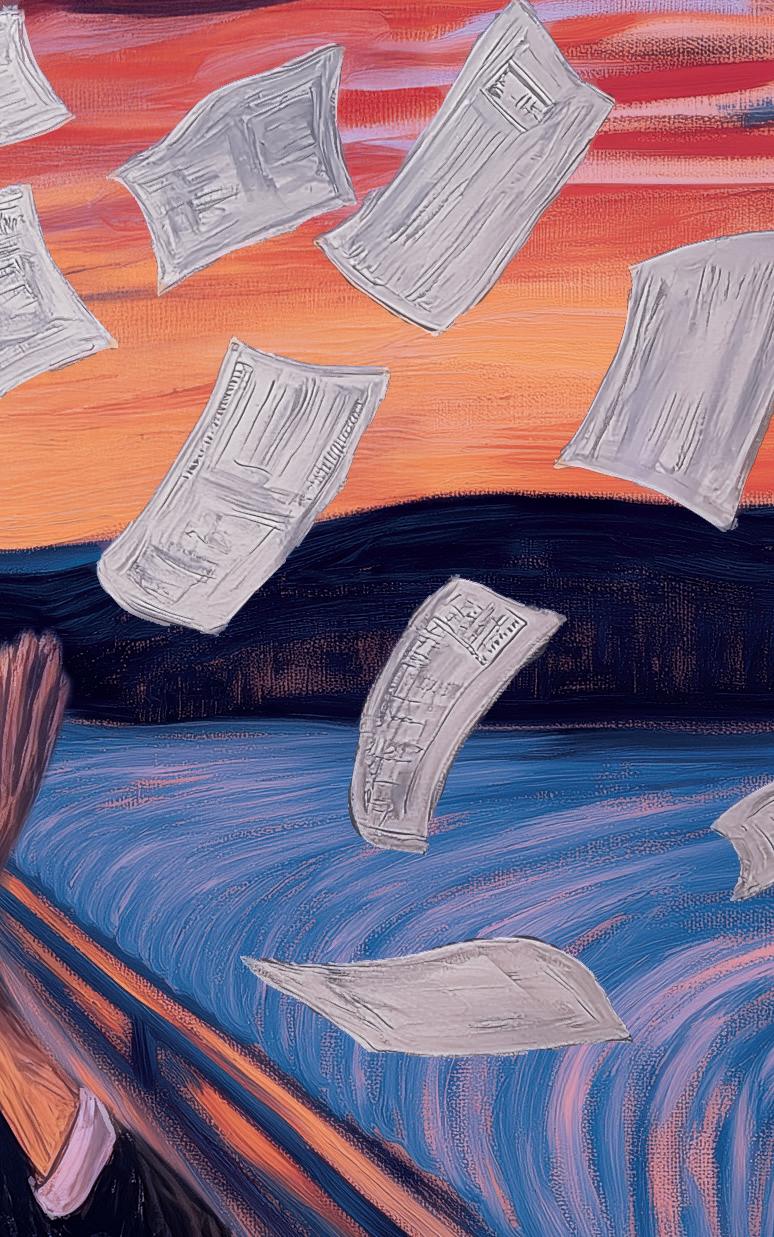

Having toyed with us for a few weeks, the sun has finally decided to make a proper show of it, and the past week or so has felt decidedly more optimistic as a result – both in general and in mortgage market terms. There’s nothing quite like the first burst of British summer sun to make everything seem a li le less bleak.

Perhaps this is why the market seems like it has hit into its stride. Mortgage pricing remains higher than many might find ideal, but lenders have been making rate cuts in anticipation of future base rate reductions.

Meanwhile, higher loan-to-values (LTVs) are improving the options for first-time buyers, and some lenders are making changes to enhance buy-to-let (BTL) affordability.

On the specialist side of the market, second charge and bridging loans continue to see growth, while product innovation continues apace across the board.

As is always the case in the UK, though, there’s the threat of rain behind every sunny day. Affordability remains tight as raised living costs remain, swap rates are volatile, and BTL landlords are facing tough decisions – as ever – when it comes to remaining viable in an increasingly restrictive environment, which is only going to become more difficult with upcoming reforms.

The substantial rate drops hoped for by many prospective buyers are continuing to prove a fantasy. And of course, no one will be unaware

of the mounting international instability that, at the very least, will affect investment prospects in this market.

Just like any forecast, it’s hard to get a good picture of whether the outlook is bright or grey, and it’s worth planning for both.

Nowhere else is this more evident than in the ma er of the Financial Conduct Authority’s (FCA) current regulatory consultation.

Some are looking ahead with optimism to the rationalisation and streamlining of certain regulatory requirements, which they believe will open up creativity and innovation across the market. Others, meanwhile, are concerned by the potential opening for execution-only transactions, and what this might mean for the broker, the prevalence of advice, and indeed for customer outcomes as a result.

That’s the subject of our feature this month, where Marvin Onumonu talks to the experts about what to expect for this market’s regulatory future, how its past has shaped mortgage advice over the years, and how businesses of all types can prepare for what’s to come. It’s a topic that echoes throughout this month’s issue, as the experts clamour to have their say.

You can also read about everything from tech advancement to remortgage market pa erns, succession planning to conveyancing costs, and more, in order to bring you what you need to be prepared, whatever the weather. ●

Jessica Bird

@jess_jbird

www.theintermediary.co.uk www.uk.linkedin.com/company/the-intermediary @IntermediaryUK www.facebook.com/IntermediaryUK

Jessica Bird Managing Editor

Jessica O’Connor Deputy Editor

Marvin Onumonu Reporter

Brian West Sales Director (Interim)

brian@theintermediary.co.uk

Ryan Fowler Publisher

Felix Blakeston Associate Publisher

Helen Thorne Accounts

nance@theintermediary.co.uk

Orson McAleer Designer

Bryan Hay Associate Editor Subscriptions subscriptions@theintermediary.co.uk

Agnes Zhang | Ahmed Bawa | Ahmed Michla

Alan Longhorn | Alasdair McDonald | Andrew Smart

Angus MacNee | Anna Lewis | Ashley Pearson

Averil Leimon | Caroline Payne | Claire Askham

Clare Beardmore | Dave Harris | David Castling

David Whittaker | Donna Hopton | Eddie Lau

Gavin Diamond | Greg Went | Hamza Behzad

Harpal Singh | I hikar Mohamed | James O’Reilly

Jerry Mulle | Jim Baker | Jim Boyd | Joe Pepper

Joel Bailey-Wilson | John Phillips | Jonathan Fowler

Jonathan Rubins | Karen Noye | Katherine Pinnell

Kathy Bowes | Kirsty Dudek | Louis Mason

Louisa Ritchie | Louise Pengelly | Luke Williams

Matthew Wasley | Neil Leitch | Nicholas Mendes

Nick Chadbourne | Paresh Raja | Pete Dupree eter Stimson | Rob McCoy | Robert Sadle

Stephanie Dunkley | Steve Goodall | Steven Bailey

Tanya Elmaz | Tim Parkes

© 2025 The Intermediary

by Giles Pilbrow

by Pensord Press

Feature 26

CHARTING A COURSE

Marvin Onumonu asks how regulation is shaping the lending landscape

Broker business 68

A look at the practical realities of being a broker, from wellbeing and succession planning to the monthly case clinic

Local focus 86

This month The Intermediary takes a look at the housing market in Gloucester

On the

90

An eye on the revolving doors of the mortgage market: the latest industry job moves SECTORS

PARAGON

Andrew Smart talks bold tech transformation and the need for certainty, speed, and a human touch

META MORTGAGES

Joel Bailey-Wilson on the realitiees of running a brokerage in the modern market

LEGAL & GENERAL MORTGAGE CLUB

Clare Beardmore discusses the lessons learned in three decades since the club’s launch

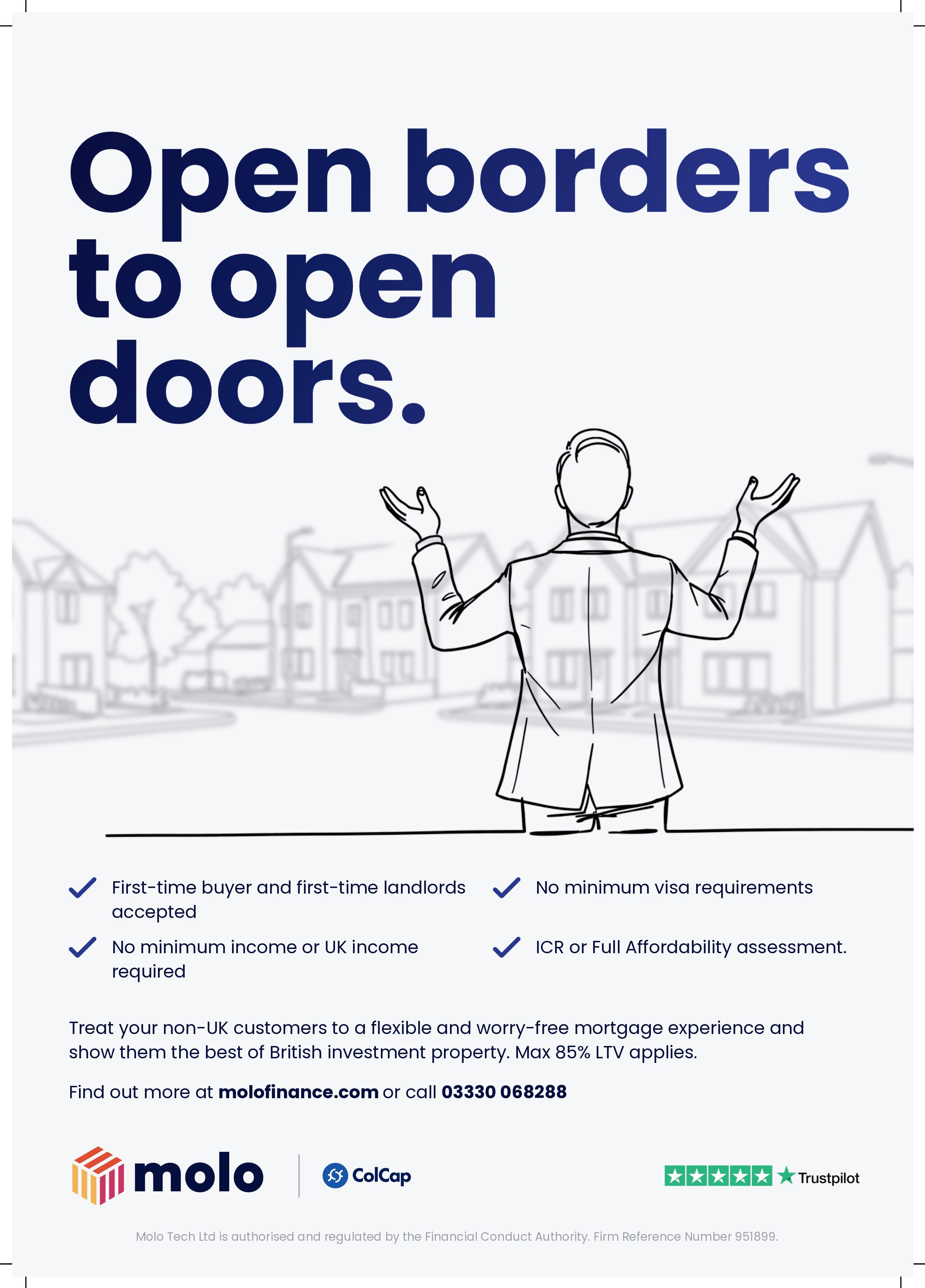

MOLO 48

LIVEMORE 62

Agnes Zhang and Steven Bailey discuss the challenges and opportunities for BDMs

As the industry continues to anticipate the Bank of England’s next move, much of the conversation around mortgage lending remains dominated by one question: when will rates fall?

But while rate cuts will inevitably make headlines, pinning hopes of recovery on interest rate changes is both risky and short-sighted.

The real opportunity lies in taking action now. Lenders must build longterm resilience into their offerings, while brokers must continue to help clients make informed decisions based on personal circumstances, not economic forecasts.

The cost of hesitation

We’re seeing more would-be borrowers holding off, waiting for the ‘perfect’ rate, a sharper drop in inflation or a more stable outlook. But this delay comes at a cost.

House prices in many areas continue to climb – the most recent official figures from the Government show that average UK house prices increased by 6.4% in the 12 months to March 2025, reaching £271,000.

When rates eventually fall, demand is likely to spike, potentially driving prices even higher. For brokers, the message is clear: pausing on the sidelines can cost clients more in the long run. Timing the market may feel safe, but it often leads to missed opportunities. Brokers play a key role in helping buyers weigh up the bigger picture.

This is also where lenders must step up. Rather than waiting for rate cuts to do the heavy lifting, now is the time to offer innovative solutions that meet evolving borrower needs. Intermediaries need options that

reflect realities their clients face today, not assumptions about where the market might be tomorrow.

For example, we recently reduced our stress rates across both residential and buy-to-let (BTL) applications, with the lowest now at 6.25% and 5.70% respectively. Earlier this year, there were further sweeping criteria changes, the biggest of which sees that the society now accepts 100% of second income, and recognises child maintenance payments.

We also engaged the market ahead of the significant Stamp Duty changes that took effect in April by introducing a residential cashback product that helped prospective homebuyers –especially first-time buyers – get up to £5,000 in cashback to soften the immediate impact.

These changes are designed to support borrowers who might otherwise struggle to pass affordability checks, particularly those with complex income streams or nonstandard employment. It’s a clear example of how lenders can take meaningful steps today to widen access and empower brokers, to better serve a diverse client base.

Today’s borrowers are more financially aware and digitally informed than ever, but that doesn’t mean they’re confident. Many are navigating complex situations, from irregular income to rising rental costs, and are unsure how to align their personal circumstances with what lenders expect.

That’s where brokers add tremendous value, not just as product matchmakers, but as longterm advisers. When clients are overwhelmed by economic noise, brokers are the ones who can reframe

GREG WENT is chief lending o cer (interim) at Nottingham Building

the conversation around readiness, affordability and lifestyle fit.

That is why a steady, informed voice matters more than ever. Lenders should be supporting intermediaries with clear product criteria, transparency around decision-making and tools that help make those conversations easier. It’s not just about better deals; it’s about better guidance.

Don’t miss the window

One insight we’ve seen in today’s market is that higher interest environments often present more leverage for buyers. When demand is cooler, clients may have room to negotiate, secure seller incentives or avoid bidding wars – all of which can result in savings that far outweigh small changes in the interest rate.

This won’t last forever. When base rates do start to fall, competition will intensify. Buyers who move now – with the right financial plan and the right advice – may find themselves in a stronger position than those who wait.

There’s no doubt that confidence has been shaken in the past few years. But brokers and lenders have the power to rebuild it – not through guesswork or hype but by offering pragmatic support, long-term thinking and real solutions.

Brokers who guide clients with clarity, and the lenders that equip them with flexible, responsible products, will lead the market forward. The best lending strategy doesn’t wait for perfect conditions. It takes action and supports customers where they are, right now. ●

This commentary was written on the morning of the Chancellor’s Spending Review before any formal announcements. Events may have moved on by the time of publication, but the pressures and challenges outlined still sit at the heart of the UK’s economic outlook.

The UK economy is showing signs of stabilising. After months of patchy data and political noise, we’re beginning to see a more coherent –albeit cautious – narrative emerge. The International Monetary Fund (IMF) has nudged its 2025 growth forecast for the UK up to 1.2%, with 1.4% expected the following year. That’s a positive development, but the message from the IMF is also clear: without a step-change in productivity, longer-term prospects remain underwhelming.

Government ministers have welcomed the update. The Chancellor pointed to strong early-year growth and international support for her economic plan. But look beyond the top-line figures, and a more fragile picture comes into focus.

Since the Autumn Budget, more than 270,000 jobs have been lost, marking the steepest drop in employment since the early stages of the pandemic. The rise in National Insurance Contributions (NICs) for employers has been widely cited as a contributing factor, particularly in sectors like hospitality and retail. For businesses already managing higher borrowing costs and shaky consumer confidence, this additional overhead has been difficult to absorb.

Unemployment has now risen to 4.6%, the highest in nearly four years. Although questions remain around the quality of the Office for

National Statistics’ (ONS) labour force data, the direction of travel is clear. Redundancies are up, vacancies are down, and confidence is fragile.

The Bank of England has responded by starting to loosen monetary policy. The Bank Rate now sits at 4.25% after four cuts, with more expected before the year is out. Inflation is falling back, and forecasts suggest it may drop below 3% in early 2026, which should give the Bank more flexibility to support growth.

That said, for borrowers, the benefits of rate cuts have been limited so far. While some expected mortgage rates to fall in step with the Bank Rate, the reality has been more subdued. Most lenders had already priced in expected cuts.

Swap rates are higher than they were this time last month, reflecting wider market caution and ongoing geopolitical uncertainty, particularly from the US. As a result, the expected wave of cheaper mortgage deals has yet to materialise. The housing market has, unsurprisingly, remained flat. Transaction volumes are subdued, and while prices have held up better than many anticipated, overall activity remains well below typical levels.

With buyers still constrained by affordability, especially in the South and major cities, it’s difficult to see momentum returning in the shortterm unless there’s a material shift in rates or employment confidence.

The Spending Review may go some way to clarifying the Government’s position. Departments are awaiting their budgets through to 2029, and the pressure to invest in public services without spooking the markets is acute. Defence and healthcare are expected to receive priority, but with borrowing already elevated, further tax changes are hard to rule out.

NICHOLAS MENDES is mortgage technical manager at John Charcol

This is where politics and economics begin to rub up against one another. The Chancellor has built her fiscal stance around discipline and credibility, but critics argue it risks suppressing the very growth she aims to support. Talk of a ‘double debt mountain’ – both formal borrowing and hidden liabilities – is becoming more prominent in policy circles, and investors will be watching closely.

For now, sterling remains relatively strong, up around 8% against the dollar this year. But much of that has more to do with US uncertainty than UK strength. The pound’s position may prove fragile if growth falters or if international investors lose faith in the UK’s ability to balance growth with control.

Real wage growth has provided a degree of short-term support to households, and consumer spending has proven more resilient than expected. But with job losses mounting and pay growth beginning to slow, that buffer may not last. Wages are now rising at 5.2% annually, down from previous months, and further softening seems likely.

In many ways, the next six months could be decisive. If the Bank can continue to ease rates, if the Government can avoid overcorrection on tax, and if business sentiment stabilises, we could see a more durable recovery emerge. But that’s still a big ‘if’.

At present, this remains a recovery that feels vulnerable – moving forward, yes, but without much margin for error. ●

Since the Bank of England began to raise the base rate in December 2021, the remortgage market has been at a disadvantage to product transfers. Higher monthly repayments as mortgage rates jumped from sub-2% to over 5% coincided with inflation topping 10%, a cost-of-living crisis and sky-high energy bills.

However, over the past 10 months, the base rate has been coming back down. This has already prompted much speculation about whether we could see a spike in remortgage activity, with customers more likely to switch lender to benefit from one of the highly competitive rates on the market at the moment.

There is a potential challenge in the way of this, in the Financial Conduct Authority’s (FCA) view – as its Mortgage Rule Review (MRR) consultation paper published in May shows. Out of 1.6 million borrowers who remortgaged in 2024, some 83% stayed with their existing lender and 17% remortgaged to a different provider – broadly consistent since the regulator began collecting data on product transfers in 2021.

The likelihood is that remortgage volumes should climb this year, but growth is also likely to be hampered by the need for borrowers to go through a full affordability underwrite if they are to switch lenders. The question of convenience is an important one, particularly in an environment where rates are coming back down.

The MRR proposes to address this by simplifying the affordability rules for a like-for-like remortgage – even where the borrower is switching lender. Its reasoning relies, in part, on the growing role that data plays in risk assessment within lenders.

The FCA paper says: “There is significant momentum to digitise the home-buying process, speeding up conveyancing and HM Land Registry processes. Alongside existing, swift tools – such as automated valuations, credit file and HM Revenue and Customs checks – and potential efficiency and innovation that can be delivered through Open Banking, we want to explore options to streamline affordability testing requirements where the customer is remortgaging to a cheaper deal on similar terms.”

Yet it goes on to highlight the existing Modified Affordability Assessment (MAA) rules, which give lenders the flexibility to carry out a modified affordability assessment where the consumer has a current mortgage, is up to date with payments, does not want to borrow more, and is looking to switch to a new mortgage deal on their current property.

Some further stipulations apply, but they are perhaps not as onerous for lenders as one specific consideration which has hampered uptake. The FCA’s regulatory data indicates that “to date this option has not been widely adopted, supporting approximately 2,655 transactions.”

The proposal is to amend the MAA to permit lenders to enter into a new mortgage contract where it is more affordable than either a customer’s current mortgage, or a new mortgage product that is available to that customer from their current lender.

The FCA paper says: “As with the current MAA, this would be optional for lenders to use and depend on their risk appetite. However, we believe widening the scope of when a firm can use the MAA could increase the commerciality of this option and the number of customers who could get a better deal by changing lenders.”

This may alleviate some of the challenges, but it does not deal with the capital risk assessment – and that is the consideration I’m referring to.

If the FCA’s proposals go ahead, we must consider what a swifter remortgage market looks like and how it interacts with understanding collateral – assuming previous credit underwriting of individuals suffices. We must be sure that our automated valuations evolve to deliver decisions based on all the data points that can impact value over a given period.

There are structural risks which homeowners may choose not to disclose under a product switch: cracks in walls may suggest subsidence or structural movement, for example.

Climate risk associated with flooding or drought – leading to the potential for subsidence – could shift significantly over a decade.

Energy efficiency, regulatory compliance with net zero rules due to come into play for residential homeowners – how do these things affect the capital risk sitting on lenders’ balance sheets? Not to mention structural alterations, extensions or unauthorised building works that could make a property unmortgageable.

The potential loosening of credit criteria brings the role of property data to the fore. Many lenders will require a robust mix of digital data sources and ongoing physical inspections to maintain an accurate view of risk exposure and, therefore, appetite to take on new loans. ●

There was a school of thought – sensible in theory, wrong in practice – that the recent Stamp Duty threshold changes would trigger a noticeable drop-off in transaction volumes. Less urgency to act due to those greater costs, resulting in demand and activity dropping off. It sounded plausible,

looked logical, but certainly from our perspective, it hasn’t happened.

The market’s still ticking along, buyers are still buying, movers are still moving, and that persistent hum of conveyancing activity hasn’t softened. If anything, the opposite. Which means one thing: conveyancers are under just as much pressure as they were pre-change, and probably always will be. The shortage, for example, of ‘bums on seats’ in the sector doesn’t look like it’s going to be filled.

So, what happens next? My view is that conveyancing fees will go up – they already are, and they should.

SINGH is CEO at conveybuddy

Why? Well, for a start, I’m not sure there’s another part of the homebuying journey where the service demanded is so high and yet the price paid is still stuck somewhere in 2016.

We sold our previous business eight years ago, and I can tell you with absolute certainty that conveyancing fees haven’t shifted much since then. Meanwhile, inflation has increased massively – so have house prices, and pretty much everything else associated with the market.

Yet we still hear complaints when a law firm asks for £100 more on a case. Madness. It’s part of the reason why, for so long, firms have been locked in a race to the bottom. Lower fees. Bigger caseloads. More strain. Worse service.

But something’s changing. The smarter firms – the ones that understand their value – are putting their prices up. Not because they want to be greedy, but because they know what it costs to deliver a good service. They know that without good service, clients suffer, and brokers are left picking up the pieces.

Let’s be honest, those cost pressures are real. The recent increase in National Insurance (NI) contributions has hit many firms square in the face. Overheads have gone up across the board, from payroll to professional indemnity insurance. Firms have to

spend more just to stand still.

In an industry where margins were already thin, something’s got to give. Either the service dips, or the price goes up. And rightly, many are choosing the latter.

The right people

It’s not just about keeping the lights on. It’s about holding on to the people who actually do the work. As mentioned, good conveyancers – actual qualified, experienced fee-earners – are increasingly hard to find.

In places like Manchester, Leeds, and Cardiff, where multiple large firms compete for a limited talent pool, staff retention is a full-time job in itself. If a firm can’t afford to pay competitively, it’ll lose people. When that happens, it loses service standards, too.

The challenge isn’t just getting people in the door – it’s keeping them. Good people know their worth. They’re not going to stay in roles where the workload is brutal and the salary hasn’t moved in five years. Firms that want to deliver great service need to pay enough to keep their teams stable. Fundamentally, that has to be paid for with increased

fees. Think about it. What do your clients want? It’s likely they want clarity, speed, and confidence. What do you want? Happy clients who come back again and refer their friends. Neither of those things is helped by conveyancing being done on the cheap.

When a firm earns £100 more per case, that gives them room to breathe. Caseloads drop. Phones get answered. Enquiries get dealt with. Pipelines move quicker. Completion dates hold. Suddenly, everyone’s blood pressure is lower, and you’re not fielding angry calls from clients.

If you’re thinking, ‘But hang on, won’t my client care about paying more?’, then let me be blunt: most clients are not au fait with what conveyancing should cost. They’re not comparing a £750 quote to a £950 quote and demanding answers. They’re just trusting you to steer them to someone who gets the job done. So, if you tell them this slightly pricier option means better service and fewer delays, they’ll nod and say, ‘Thanks, that’s exactly what I need’.

Now, here’s the bit that’s often overlooked or misunderstood. Just because a quote is high doesn’t mean the firm’s getting paid well. We’ve seen quotes from other panel managers that are £300 more than ours, yet the law firm earns less because of commissions. We pay one

Too many still chase the cheapest deal and pass on the cost in other ways – hidden fees, unclear quotes, poor service”

of our firms a significant amount more than one of our competitors, and yet somehow our total quote is still cheaper. It will not take a genius to work out why.

As a panel manager, we’re not taking the Michael when it comes to our panel fee. We believe in paying our firms properly, while keeping things fair for the client.

Which, of course, makes your choice of panel manager more important than ever. Are they paying their firms properly? Are they squeezing them dry? Are they using their margins to add value or just extract more?

The sad truth is that too many still chase the cheapest deal and pass on the cost in other ways – hidden fees, unclear quotes, poor service.

You want transparency. You want integrity. You want to know that when fees go up, they’re going to the right place. At conveybuddy, we make sure that happens. We’re not perfect, but we’re proud of the way we support our panel, our brokers and, ultimately, our clients.

Cheap rarely means cheerful in the service industry. Conveyancing is no different. So let’s stop pretending that a race to the bottom helps anyone.

The best firms know what they’re worth. The best brokers understand the value of good service.

Together, we can help clients get what they really need: a smooth, successful move from start to finish ●

May saw the Financial Conduct Authority (FCA) publish its Mortgage Rule Review (MRR) consultation paper, which aims to give consumers “more choice” in how they deal with their mortgage.

A central focus is making the process of switching lender at remortgage easier, faster and with a lower threshold for underwriting and the consequent paperwork it entails.

At the end of a fixed term, many borrowers now use firms’ internal product transfer or ‘rate switch’ product. According to the regulator, out of 1.6 million who remortgaged in 2024, some 83% stayed with their existing lender and 17% remortgaged to a different provider.

The paper notes: “There are several barriers or transaction costs, both in time and money, that make external remortgaging less attractive, even if cheaper options are available.

“Customers may make a conscious choice to stay with their current lender because of these. These barriers can include conveyancing, valuations, engaging with a mortgage adviser and affordability assessments. By contrast, these don’t apply when completing an internal product transfer, and an affordability assessment is only required where the change is material to affordability.”

This recognises an unintended consequence of the existing regulatory regime. Essentially, consumers are disincentivised from shopping around and may end up paying more than is necessary for their mortgage.

The proposed amendments have a positive logic behind them, though we wait to see the final detail before assessing how they work in practice.

The FCA is definitely on the same page as much of the industry when it comes to the way that data use and digitalisation is changing what is possible for the customer journey.

The paper acknowledges that there is “significant momentum to digitise the home-buying process,” including speeding up conveyancing and HM Land Registry processes.

Alongside existing tools such as automated valuations, credit file and HMRC checks, and the potential efficiency and innovation that can be delivered through Open Banking, the regulator wants to explore “options to streamline affordability testing requirements where the customer is remortgaging to a cheaper deal on similar terms.”

This has implications for affordability, but for lenders there is also property risk that has to be considered. Where a lender engages a customer in a straightforward product transfer, its understanding of the capital value, title and property condition – within whatever bounds deemed necessary at the point of origination – is as complete as it can be.

In the event that a borrower transfers via a similar product switch, on the same or similar terms, the new lender will be relying – at least partly – on the existing one’s underwriting. The affordability assessment, under the FCA proposals, will be based on payment history – the more robust, the lower the implied risk, is the theory. Where payments are lower following a switch, logic should dictate that the borrower can pay.

Relying on another lender’s assessment is separate from this. Just as a borrower’s financial

AHMED MICHLA is head of business development at Cotality

circumstances may have changed since their last assessment, so may have the property’s condition and value.

Flood risk is dynamic, with new areas becoming exposed each year. Title assessment, including rights of way and boundaries, as well as land search results, can be cursory all the way through to comprehensive.

Permitted development rights (PDR) allow for material changes to a property’s construction, without the need for a change to be recorded. Trees grow, bamboo, Japanese knotweed and other organic threats to a property’s structural resilience change quickly.

Lenders will need new sources of risk data to support their lending decisions. As the consultation paper highlights, this data is increasingly available in a format that becomes useable and meaningful at both an individual property level and for a mortgage book. But this is only one side of the coin when it comes to accessing true value from these sources. Lenders must have systems and technology capable of integrating with new data streams and pulling a sufficient number of elements out of a far wider data pool.

Data is only as good as the tools to make use of it – and the reality is that much of the mortgage industry’s systems are not set up for this new world yet. A wholesale system replacement across the entire market is a daunting prospect, yet if lenders are to facilitate the proposed changes, newer systems must be put in place to protect lenders’ risk exposure. ●

Many of us know that sinking feeling when you spot a parking ticket on your windscreen. It’s a frustration that millions experience each year. In fact, research from Confused.com at the end of 2024 revealed that a staggering 16 million parking fines were issued in the UK between 2022 and 2024.

It’s obviously an infuriating experience, particularly if you didn’t think you were doing anything wrong, or thought you’d followed the rules correctly. However, that parking fine can be far more than just a nuisance –it can have an enormous impact on the recipient’s finances.

Should a fine go unpaid, it can escalate into a County Court Judgment (CCJ). These stay on a person’s credit file for six years and can have a longlasting influence on the driver’s ability to access finances, particularly a prime mortgage product.

Brokers we have spoken with in recent months have highlighted that clients who would otherwise have a great credit score are instead paying the price for a simple oversight.

It just serves to highlight the need for lenders to step up on supporting those who only just miss the mark for prime, by offering a product such as near prime.

The past few years have been marked by sustained financial pressure for UK households, with rising outgoings on everything from energy bills to Council Tax. This increase in costs has resulted in some households missing the odd payment.

In many cases, the credit issues in question are minor, just a temporary

issue which has now been resolved. Yet the long-term consequences can be disproportionately severe.

The only way to do that, however, is to introduce products and criteria that genuinely meet the needs of these near prime borrowers.

For example, when we increased the maximum level of unsatisfied registered defaults last year, from £1,000 to £2,500, it was because it had become clear that a higher cap was necessary to support more near prime borrowers.

This was also the driving factor in our recent move to raise the maximum loan-to-value (LTV) available on our near prime products to 90%. It’s about ensuring that those with more modest deposits can still access the funding they need.

As lenders, it’s crucial to work closely with brokers, and use their insights to pinpoint where improvements can be made to make the process easier. Obviously lenders must be responsible, but where flexibility and more understanding criteria can be introduced, it will make a significant difference to the options at the disposal of brokers and their clients.

The increase in activity we have seen for near prime in recent months has been striking. The number of applications in April was up by 28% on the previous month, which itself had set a new record high.

Compared with a year ago, applications nearly tripled, while there was also substantial growth seen in the value of applications.

This growth not only demonstrates how our improvements have resonated with brokers, but it also highlights the level of need for this sort of flexible lending by a mainstream lender, rather than relying entirely

DAVID CASTLING is head of intermediary distribution at Atom bank

The past few years have been marked by sustained financial pressure for UK households...from energy bills to Council Tax”

on the specialists that cannot support borrowers as and when they regain prime status.

The escalation of a simple parking fine into a CCJ may sound disproportionate, but it illustrates a broader truth: minor credit events can significantly restrict mortgage options. In such cases, intermediaries play a critical role in ensuring that clients are not automatically excluded from homeownership, and that their borrowing journey can progress.

It is essential that brokers have a clear understanding of which lenders are equipped to support near prime borrowers – not only at the point of need, but over the life of the mortgage. We not only proactively monitor a customer’s circumstances, but automatically offer them a prime rate at maturity, if they are eligible. Lenders and brokers should always think about the long term, alongside the immediate need.

With the right support, today’s near prime borrower can become tomorrow’s prime customer. ●

In today’s marketplace, straightforward mortgage cases are increasingly rare. Buyers and brokers alike are navigating a tougher economic climate, with affordability a major concern, lending criteria remaining narrow for those outside prime profiles, and the rising cost of living continuing to apply pressure.

The pressures on UK consumers are both well-documented and intensifying. According to The Money Charity’s April 2025 statistics, households are seeing steep increases across essential bills:

The Energy Price Cap rose by £111 in April, bringing average energy bills to £1,849.

Water bills in England and Wales surged by 26%, with the highest average reaching £703.

Council Tax increased by 5% to 9.99% depending on the region, further straining monthly budgets.

Additional hikes in broadband, phone, transport fares, and other utilities have compounded this pressure.

Further data from the Insolvency Service illustrates the growing financial fragility:

In April 2025, 10,012 individuals entered insolvency in England and Wales. This was 8% higher than in March 2025 and 4% higher than in April 2024.

The individual insolvencies consisted of 589 bankruptcies, 3,837 debt relief orders (DROs) and 5,586 individual voluntary arrangements (IVAs). DRO numbers in April 2025 remained similar to the record high levels seen over the past 12 months. The number of IVAs registered in April 2025 was similar to the average monthly number seen in 2024.

Bankruptcy remained at about half of pre-2020 levels, 11% lower than in April 2024.

In the 12 months ending 30 April 2025, one in 417 adults in England and Wales entered insolvency, at a rate of 24.0 per 10,000 adults. This is higher than the rate of 21.6 per 10,000 adults (one in 463) who entered insolvency in the 12 months ending 30 April 2024.

There were 7,273 Breathing Space registrations in April 2025. This is 5% lower than in April 2024.

Adding to these challenges, inflation jumped to 3.5% in April, from 2.6% in March, driven by household cost increases and employer cost passthroughs linked to recent National Insurance and minimum wage hikes.

Core inflation climbed to 3.8%, highlighting a sustained squeeze on disposable incomes.

While two interest rate cuts had been expected this year, April’s inflation reading has cast doubt, with some economists now predicting only one cut, adding further uncertainty to mortgage affordability.

For me, these numbers tell a clear story. More households are struggling to stay afloat, and for many, a single missed payment or unexpected cost can trigger wider financial distress. Traditional lending models o en don’t cater to those with impaired credit profiles, even when past issues were caused by temporary or uncontrollable events.

Recognising this, a growing number of lenders are stepping up with innovative solutions that not only offer access to credit, but also support financial recovery. One such solution is our Credit Restore mortgage,

CLAIRE ASKHAM is head of mortgage sales at Buckinghamshire Building Society

Traditional lending models often don’t cater to those with impaired credit pro les, even when past issues were caused by temporary or uncontrollable events”

tailored for clients with historical credit challenges. We’ve recently increased the maximum loan-to-value (LTV) on this product from 70% to 75% to offer even greater flexibility and opportunity. This, alongside other specialist products in the market, provides much-needed breathing space, and a much-needed pathway to financial stability.

As an industry, it remains vital to deliver responsible options which allow borrowers to repair their credit profiles over time, without being unnecessarily excluded from homeownership or viable refinancing opportunities. For brokers, these options allow them to expand their advisory toolkit, enabling them to service the needs of clients who might otherwise be le behind.

Rebuilding credit shouldn’t be an uphill ba le fought alone. With the right products, advice, and support, more people can move from financial recovery to long-term resilience, and take meaningful steps toward securing their future in the homes they need and deserve. ●

We are witnessing a real moment of change in the UK remortgage landscape. For the first time in over two years, more than half of all borrowers selected 5-year fixedratemortgage products.

This signifies a shift away from opportunism and toward intentionality. Borrowers are choosing long-term certainty, even when economic forecasts point to rate reductions in the not-too-distant future. That decision speaks volumes about where borrower sentiment is heading.

It’s a sign that borrowers are moving away from relying on market shifts and instead prioritising financial stability. They’re prioritising certainty over speculation. That’s a big shift from the rate-chasing behaviour that defined much of the post-pandemic remortgage market.

It’s also a strong signal of how recent economic instability has shaped consumer thinking. The past few years have brought inflation spikes, global energy shocks, and household budget squeezes. Against that backdrop, it’s no surprise that homeowners are re-evaluating their appetite for risk.

Even though base rate cuts are still on the cards for 2025, many borrowers seem to believe those cuts will be slower or smaller than anticipated. Rather than holding out in the hope of better rates, they’re opting to secure what’s on offer now, especially as many lenders are pricing 5-year deals competitively to attract market share.

There’s another, more urgent dynamic at play, too. A wave of

borrowers is now emerging from low, sub-2% fixed deals agreed during the pandemic. With those rates expiring, the alternative is jumping to standard variable rates (SVRs) that can be three or four-times higher.

That kind of payment shock isn’t something borrowers are willing to accept lightly. Many are choosing to remortgage ahead of time, locking in a deal before their current term ends.

The result? We’re seeing a more proactive, engaged borrower base that’s focused on long-term affordability and peace of mind.

At LMS, we’ve seen increased activity in remortgage instructions and completions as borrowers take action earlier in the cycle. The message is clear: consumers are planning ahead, and they’re looking for solutions that help them do so with confidence.

What does this behavioural shift mean for the market? First, it puts a spotlight on the importance of clear, flexible product design. Borrowers don’t just want a low rate, they want to understand what that rate means for them now and down the line. They want transparency, not complexity.

Lenders that can offer products that support long-term financial resilience and explain them in simple, relatable terms will have the edge. That means offering real clarity on repayment expectations, exit fees, and how products might respond to changes in the base rate.

It also reinforces the value of strong partnerships between lenders and intermediaries. As the market becomes more nuanced, borrowers are turning to advisers not just for access to deals, but for trusted guidance. They need someone to help them

NICK CHADBOURNE is CEO at LMS

navigate the options and align their mortgage strategy with their broader financial goals.

Explaining the implications of a 5-year fix versus a 2-year option, exploring what overpayment flexibility might look like, and helping clients stresstest different rate scenarios are all part of delivering value.

With product proliferation only likely to increase in a competitive lending environment, tailored advice will be a key differentiator. Borrowers are more cautious, but they’re also more engaged. That opens the door to more meaningful, long-term adviserclient relationships.

What we’re really seeing is a new kind of borrower behaviour emerging that’s cautious, measured, and futurefocused. That’s a healthy development. It suggests that UK households are becoming more financially resilient, and more prepared to make decisions that protect them against volatility.

For the wider market, it’s a sign that the post-pandemic recalibration is still very much underway. As more borrowers come off low-rate deals, we can expect remortgage activity to stay strong into Q3 and beyond. The appetite is there, but so is the demand for clarity, guidance, and longterm value.

The takeaway is simple: the long game is back. In an environment shaped by uncertainty, borrowers are choosing stability, and the market must adapt to meet them there. ●

England and Wales may share a border –and a legal heritage – but increasingly they’re speaking in different dialects of the law. For conveyancing firms, that means becoming fluent in two evolving legal systems, each with its own terminology, processes, and expectations.

Recent shifts in Welsh legislation – most notably the replacement of Stamp Duty Land Tax (SDLT) with Land Transaction Tax (LTT), and the forthcoming Building Safety Bill –illustrate how the two jurisdictions are setting their own legislative agendas.

For firms operating across both nations, this divergence brings new operational, compliance, and advisory challenges.

Since 2018, property transactions in Wales have followed a different linguistic path, with LTT replacing SDLT. This wasn’t just a semantic switch, it signalled Wales’ intention to write its own tax code, shaped by its specific housing and economic goals.

For conveyancing firms, this has required more than a simple translation. Processes had to be adapted to ensure that transactions are interpreted correctly within each tax framework. Letters, documents and digital systems have all been reworked to align with the nuances of LTT, ensuring clients receive accurate, context-specific advice.

Planning law offers another clear example of legal divergence. While England operates under the long-established Town and Country Planning Act 1990, Wales

has developed its own legislative framework through the Planning (Wales) Act 2015. This introduces unique provisions tailored to Welsh priorities, such as a stronger focus on sustainability and strategic coordination.

The terminology itself has shifted, too. In England, local authorities refer to ‘Local Plans’ to guide development. In Wales, however, it’s ‘Local Development Plans’ (LDPs) – documents that place a greater emphasis on community involvement and long-term environmental impact.

For conveyancing professionals, fluency in both systems means understanding not just the different words, but the different planning philosophies underpinning them.

While England implemented its Building Safety Act in 2022, with the Building Safety Levy intended to be introduced in 2025, Wales is preparing to publish its own version: a legislative equivalent written in a different dialect.

Though the subject matter may be shared, the legal expressions will diverge – reflecting Wales’s own regulatory priorities and approach to safety in the built environment.

For firms like Movera, keeping up with this evolving bilingual legal system requires close monitoring of legislative updates and an agile approach to internal processes.

Just as fluency requires attention to subtle shifts in tone and meaning, so too does effective legal compliance in two jurisdictions.

For clients navigating property transactions in Wales or moving between the two nations, the divergence in law can be confusing – especially when the language

KATHERINE PINNELL is head of legal and technical services at Movera

of regulation looks familiar but behaves differently.

Firms must act as interpreters, guiding clients through the correct processes and translating legal differences into clear, actionable advice.

Some clients may discover opportunities within Wales’s distinct legal landscape, while others may require extra support to understand the implications.

In both cases, conveyancing firms must be equipped to offer culturally –and legally – fluent services.

The flexibility afforded to Welsh policymakers has enabled laws to be tailored to national priorities. However, for businesses operating cross-border, it introduces complexity.

Navigating two legal dialects requires careful coordination, with separate systems in place to ensure transactions remain compliant – something Movera has already embedded into its operations.

The Welsh Government has signalled that further legal divergence is on the horizon. For firms, this means continuing to develop a strong command of both jurisdictions’ legal languages – understanding not just the vocabulary, but the intent behind the legislation.

Movera is investing in training, systems, and regulatory awareness to ensure it can continue to operate confidently across borders.

As the legal dialects of England and Wales grow more distinct, firms that can switch seamlessly between them will be best placed to serve clients with clarity and confidence. ●

Jessica Bird speaks with Clare Beardmore, director of distribution and Mortgage Club, mortgage services at L&G, about the lessons learned in three decades since the club’s launch

Clare Beardmore stepped foot into Leek Building Society at the age of 20, and went from serving at the counter to leaving two decades years later as head of sales. At Legal & General (L&G), Beardmore describes her role as director of distribution and Mortgage Club as being a “champion of advice,” leading the effort to “make a difference” in a market that is not just about financial transactions, but getting people into their dream homes.

This year, L&G’s Mortgage Club business celebrates its 30-year anniversary. The Intermediary sat down with Beardmore to hear about the changes and challenges, and understand what might be coming in the next 30 years.

L&G’s Mortgage Club business reached this “super milestone” by “thinking passionately about mortgages and advice,” Beardmore explains, adding: “What has been very clear over the years is that L&G is a strong source of safety and security that can really support difficult situations.”

and advisers and get their viewpoints. You can support bringing new lenders into the market, giving them a platform, which ultimately changes the landscape, opening up criteria and bringing better competition.

“If we’ve got a strong housing market then absolutely it’s good for the country, and with our market share we get a good picture of what’s going on out there. With that insight, we can challenge positively, we can point things in the right direction.”

In the time that L&G’s Mortgage Club business has been active, the market has seen the relationships between brokers, lenders and the end customer shift. Beardmore says navigating this changing relationship is “what we do well” – influencing the advice and lender markets to “challenge the status quo.”

“We can highlight what’s going well with lenders, but we also know what’s making advisers unhappy, like dual pricing or reduced proc fees for product transfers,” she explains.

“We’ve got a unique position from which to drive conversation and debate, while considering all the parties in the equation.”

Over the past 30 years, there has been no lack of foundation-shaking events through which the club has had to prove steady, from the Global Financial Crisis to Covid-19 and Brexit.

“It’s at times like that, that L&G sits perfectly, able to listen to lenders and brokers, and really support the market,” says Beardmore.

Overall, Beardmore believes that L&G’s Mortgage Club business has “made a difference in the industry” in its first three decades, acting for advisers and lenders, including supporting businesses with the tools to reopen after Covid-19. As a result of this journey, a quarter of all mortgages in the UK market now pass through the club’s proverbial doors. This puts it in a strong position to continue supporting, growing and improving the market.

Beardmore says: “As director, that’s one of my overriding impressions – what a significant role we’ve got. It’s unique that we can talk to lenders

The Mortgage Club also has a role acting as “the combined voice of the adviser when it comes to things like regulatory consultations.” On the other side of this, it provides roadshows and continued professional development (CPD) opportunities for advisers themselves.

For Beardmore, while the past 30 years have seen many changes, especially in how advice is delivered, there is something fundamental that underpins this market.

She says: “I’ve been speaking to a lot of advisers, especially over the past few weeks since the release of the CP25/11, and what shines through is that human interaction and empathy are what makes the difference in our industry.

“Whether a person is looking for a tailored mortgage or a suitable protection product, it is that thoughtful and specialist advice that can

make the difference. I’ve heard so many stories about customers who went it alone and made a less than ideal decision. Whenever an adviser stepped in, the outcome was far more positive.”

To this end, while tech – and particularly artificial intelligence (AI) – has a key role to play, it is unlikely to replace the adviser. Indeed, this would be a “massive shame” to Beardmore: “Has AI got a heart? Absolutely not, and in this industry that’s what’s needed.”

She adds: “If you combine transformation, technology and people together, you get the ideal combination. But on its own, how does AI drive a market forward? How does it spot new opportunities and chances to innovate?”

Nevertheless, Beardmore is still clear that the tech journey is an important one to get right: “We’re passionate supporters of tech, if done in the right way.”

In the early days, with the club’s unique selling point (USP) of payment on advance, Beardmore points to the use of yellow stickers and carbon paper forms as the height of advancement. Now, Ignite and Club Hub provide brokers with fingertip access to affordability, criteria, product and property resources. L&G, Beardmore says, is more than willing to “keep up with the pace of change.”

This pace was, of course, accelerated by Covid-19, which pushed the market further down the path to automated valuation models (AVMs), electronic ID verification, and in a more general sense, the drive for decisions to happen earlier in the homebuying journey.

Beardmore says: “The earlier a decision can be made, the better. Advisers and customers want that certainty. I don’t think we’re there yet. Everybody thought that the golden bullet would be API connectivity, but adoption is a challenge.

“There’s a nervousness in the industry around the ‘robots taking over’, but you can see that things are beginning to evolve. People are beginning to adapt their plans. Advice is human, but technology can get rid of the grind.”

Part of the club’s role is helping understand how to bring in new innovation as well as improve the use of data, always with the goal being for the customer to receive the best service and advice.

“We give brokers access to research tools, and we expect lenders to keep them up to date,” Beardmore explains. “That ultimately drives better consumer outcomes, so we play a crucial part.”

While the correct implementation of AI is at the forefront of the tech conversation, Beardmore boils this down further, suggesting that a key question is how this sector uses data to “drive the market forward.”

“We know that people’s lifestyles are changing, there are more self-employed people, more people

facing financial difficulties,” she says. “How do you use data to create new opportunities? Then, from a surveying perspective, how do you use data to really support decisioning as early as possible in the journey?”

Beardmore says more than anything, the coming decades will be shaped by the next generation of customers. Indeed, with Gen Z not far off the first-time buyer mark, the future might come along sooner than many realise.

Firms will have to consider how future borrowers want to interact and conduct the mortgage journey, while still ensuring they benefit from that all-important human advice.

Beardmore also points to changing attitudes to debt in retirement, which will shape the later life market and its relationship with more ‘mainstream’ residential lending as people take on longer terms.

Meanwhile, the next cohort will likely spark more of a focus on green and sustainable products and buildings, which begs the question: is the market ready to offer innovative ideas that are attractive to Gen Z?

“From a lender perspective, Gen Z are different,” Beardmore says. “They are big advocates of a ‘side hustle’ and being both employed and selfemployed. The customer that we serve now is very different from when I bought my first house. We absolutely should know what they want.

“We’re moving into a new era and we have to make sure the new customer is being catered to, while not forgetting that people live longer and work longer. The makeup of the population should drive what we do, the products that are offered, and how advice is given.”

This might sound like far too much change and nuance for advisers to keep track of, particularly while they must also provide an empathic helping hand to borrowers, keep on top of regulation and compliance, and manage the daily work of running a business.

This, Beardmore says, is where clubs can make all the difference, providing education resources, technological services like L&G’s Referral Pro, the ability to “earn while you learn” about new markets and product sets, access to third-parties and CRMs, and on top of it all, thought leadership from different perspectives.

For the immediate future, the club is developing the learning and development piece in particular, continuing to underpin the value of advice , and fundamentally working to get people into homes.

Beardmore concludes: “It’s not just a payment route, it’s wider support. We’ve got to evolve, and the pace of change is only going to get quicker.”

There has been a lot of noise around 100% mortgages in recent weeks due to the emergence of two new entrants in this market. Is this the start of the return of higher loan-to-value (LTV) lending, or is it the case that it’s never really been away? “The reports of my death are greatly exaggerated,” to quote Mark Twain.

Let’s peek behind the curtain to see what’s going on, and whether 100% lending is really back, or whether it’s still a product in search of a market.

A large part of the interest in 100% mortgages seems, at least in part, to stem from the association with 100% loans and the financial crisis of 2007-8.

Having been at the heart of the Global Financial Crisis – at Lehman Bros at the time, in fact – most the issues stemming from the mortgage market weren’t from 100% mortgages per se, but broadly from lax lending decisions and a lack of adequate capital underpinning the loans.

While the now infamous Northern Rock Together mortgage – “Infamy, infamy, they’ve all got it in for me,” Kenneth Williams – let people borrow up to 125%, ‘only’ 95% of it was in the form of a mortgage, with the remainder coming in the form of a personal loan.

Since this point in time, as lenders and brokers are no doubt fully aware, the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) have put in place a large number of measures to (a empt) to prevent the events of the Global Financial Crisis reoccurring.

Chief among these is the adoption by banks and lenders of countercyclical capital buffers, or put simply,

the need to hold an awful lot more capital against loans in the ‘good times’, against possible events in the ‘bad times’! In practical terms, this means that lenders are now having hold significantly higher levels of capital against higher LTV loans. In short, this makes lending at higher LTV not only more challenging, but significantly more expensive.

From a very practical point of view, the default probability of a 100% mortgage customer rises significantly over and above a customer who is pu ing down a deposit of even 10%, quite simply as they have ‘no skin in the game’. On top of this, the loss severity, should the worst occur, is obviously and quite simply likely to be a sum significantly greater than zero, especially when you build in arrears and likely losses on the property.

The above, in practical terms, will mean two things when lenders look to develop products. First, lending criteria that is restricted to only those clients with the best credit profiles and higher incomes to limit risk of credit or payment default. Second, rates that reflect the additional capital that has to be deployed against the loan.

On the first point, the challenge or contradiction here is that high credit or high income customers are usually not the sort of customers who typically need 100% mortgages.

The other challenge with 100% mortgages is around the borrowing requirement. Many, or indeed arguably most first-time buyers (FTBs) in the South, are looking for a stretch on income multiples above 4.5-times. As well as the deposit itself stretching the customer’s purchasing power, lenders will look favourably on most FTBs with a deposit – the larger

PETER STIMSON is managing director of mortgages at MPowered Mortgages

The challenge or contradiction here is that high credit or high income customers are usually not the sort of customers who typically need a 100% mortgage”

the be er! – given the decrease in risk, loss severity and capital requirements detailed above. This is generally not the case on 100% loans.

In summary, a 100% mortgage is more expensive, will mean generally lower borrowing outcomes and a smaller property budget, and will be restricted to a smaller customer cohort by virtue of credit and income.

Does that mean that they don’t have a place? No, of course not. Not everyone has access to ‘bank of mum and dad’ or the means to save for a deposit, and for some they will be absolutely the right choice. I just don’t see that, considering where lenders and the market are now, it’s ever going to be more than a niche product. These products are too challenging and expensive to fund, and there are other, be er options out there for many customers, such as Joint Borrower Sole Proprietor mortgages or family springboard mortgages and lend a hand options. ●

The mortgage market has had a ji ery start to the second quarter.

A er the surge in completions at the end of March, driven by the Stamp Duty changes, the latest Money and Credit data from the Bank of England reveals just how sharply activity has fallen away.

April saw net mortgage borrowing swing from a robust £13bn in March to -£0.8bn – a drop of £13.7bn in a single month. Gross lending halved to £16.9bn, while repayments also dropped, but not by enough to offset the collapse in new activity. It’s the steepest monthly fall in gross lending since June 2021.

While it’s tempting to read this as a market in retreat, advisers will know it’s more a case of pausing to catch its breath.

Much of March’s momentum was artificially inflated by the rush to beat the Stamp Duty deadline. Buyers, brokers and lenders alike had a clear incentive to get deals over the line before thresholds reset. What we’re seeing now is the natural hangover from that sprint finish.

Approvals data tells the real story. House purchase approvals fell again in April, down to 60,500. That’s the fourth consecutive monthly decline, and while not catastrophic, it’s an unmistakable signal that demand is so ening. Remortgaging approvals, meanwhile, ticked up slightly to 35,300, but these figures only include remortgages with a different lender, and overall refinancing activity remains subdued.

This ties in closely with the Financial Conduct Authority’s (FCA) lending data for Q1, which captured the peak of the pre-April rush. Those figures showed gross advances rising

12.8% on the quarter to £77.6bn – the highest since Q4 2022. It’s also a 50% increase on the same period last year, but as with the Bank’s March figures, this shouldn’t be mistaken for a true return to form. It was a blip caused by a policy deadline, not the start of a sustained recovery.

In truth, Q2 looks set to be defined by ‘wait-and-see’ behaviour. With no clear timeline for rate cuts, plenty of would-be borrowers are holding back. The effective interest rate on new mortgages nudged down slightly in April to 4.49%, but this is still high by recent standards, and affordability remains a constraint.

For existing borrowers, the average rate on the outstanding stock of mortgages edged up again to 3.86%. The refinance window that many borrowers are entering now is tighter than they expected when they took out their deals, particularly if they fixed at rock-bo om rates a few years ago.

The FCA data did show one trend that merits close a ention: the share of new advances with loan-to-values (LTVs) over 90% rose to 6.7%, the highest level since the financial crisis.

That might reflect lenders trying to tempt first-time buyers back into the market, or buyers stretching to access it. Either way, it’s a sign that risk appetites are shi ing again. Advisers must be vigilant when helping clients structure deals. It’s one thing to get a high LTV mortgage agreed, but another to ensure it’s sustainable. What we’re not yet seeing, reassuringly, is a spike in distress. New arrears cases fell slightly, and the total value of balances in arrears dropped by 2.9% on the quarter, even if they remain higher than a year ago. But this is a lagging indicator, and the

KAREN NOYE is mortgage expert at Quilter

broader economic picture remains fragile. According to early PAYE estimates for May, payrolled employee numbers fell by 274,000 compared to last year. If that trend continues, lender affordability models will tighten, and some borrowers may find the window to refinance narrower than they expect.

For advisers, this is a moment to step in and help clients tune out the noise. It’s tempting for borrowers to try and time the market – holding out for rate cuts or hoping for a sudden improvement in affordability. But the reality is that any improvements will likely be incremental.

Market conditions are more stable than they were a year ago, but they’re not exactly benign. Clients still need careful budgeting and clear advice to avoid overextending themselves.

The broader lesson from April’s data is that policy shocks – like a sudden change in Stamp Duty – can dramatically warp short-term activity. But when the dust se les, structural challenges remain. High house prices, squeezed budgets, and cautious lenders all point to a subdued market over the summer. That doesn’t mean there’s no business to be done, but it does mean that advisers will need to work harder to help clients find value, particularly those coming off fixed rates or looking to move in a flat market.

The headline figures may bounce up and down, but the fundamentals are clear: affordability remains tight, rate uncertainty persists, and borrowers need guidance more than ever.

Advisers who can keep their clients calm and well-informed in this environment will be doing them a greater service than simply securing a headline rate. ●

With news of the Government’s funding for affordable housing and the retirement of the Help to Buy scheme, there is more a ention than ever on ways to best help first-time buyers into home ownership.

Shared Ownership remains one of the most accessible options for those with smaller deposits, particularly in the current economic climate, but it hasn’t been without its challenges. That’s why the recent introduction of the Shared Ownership Code, led by the Shared Ownership Council, represents a potentially significant step in the right direction.

The Code sets out voluntary standards for housing providers, aiming to address long-standing issues that have undermined trust in the model. These include service charges, lease extension policies, and clarity around defect periods, all historical issues that have affected customer outcomes. While the Code won’t solve everything overnight, it does begin to put clearer protections in place for consumers and improves consistency in how Shared Ownership is applied.

Importantly, the Code responds to criticisms raised in last year’s Government report, which highlighted how inconsistent practices, and a lack of transparency were impacting buyers.

In some cases, residents found themselves facing rising service charges or unclear repair obligations, while others were unaware of how staircasing – gradually buying more of their home – could help them reach full ownership. Most significantly, Government data shows that fewer than 3% of all customers with Shared Ownership reached their ultimate goal of full ownership.

At West Brom Building Society, we have long supported Shared Ownership as part of a diverse housing market. It’s not a product that is suitable for everyone, but for the right customer, in the right circumstances, it can offer a pathway to homeownership that might otherwise be out of reach.

But it must be delivered fairly, transparently and consistently. The new Code is designed to raise standards and rebuild confidence, among consumers, the housing sector and the intermediary community.

When customers understand what they’re signing up for, feel confident in their housing provider, and are supported to staircase towards full ownership, more people stand a chance of achieving their goal of homeownership. That’s the model we should all be striving for.

Shared Ownership helps chip away at the affordability challenge by reducing the initial deposit and purchase amount. Buyers only need a deposit for the share they are buying, not the full property value.

In an economic climate where many renters are struggling to save due to rising living costs and rental prices, this smaller upfront cost can make a real difference.

Recent research by West Brom Building Society found that 45% of private renters have not yet been able to start saving for a house deposit. Many are constrained by high rents, increased living costs and a lack of affordable alternatives. Shared Ownership, if delivered properly, can help open a door that would otherwise remain closed.

The success of Shared Ownership isn’t just about affordability, it’s also about ensuring those homes are made available. If the Government is to meet its housing targets over the next five years, Shared Ownership can play a

ALASDAIR MCDONALD is head of intermediaries at West Brom Building Society

Many [prospective buyers] are constrained by high rents, increased living costs and a lack of a ordable alternatives”

key role in increasing the volume of affordable new homes and broadening access to those homes.

Intermediaries have a vital part to play in this. Shared Ownership is still unfamiliar territory for many buyers, and some customers don’t realise they can staircase to full ownership – or worry it’s like renting with strings a ached. The intermediary community can help demystify the model, explain the protections offered by the Code, and reassure clients that the goal of full homeownership remains achievable.

The Code won’t fix every challenge overnight, and it is still voluntary, but its adoption by more providers signals a growing commitment to raising the bar. With more support and more transparency, Shared Ownership can fulfil its potential as a viable and sustainable model for homeownership, especially for those who might otherwise be priced out. Shared Ownership, with the right regulation and clearer protections is evolving. It’s not perfect, and it won’t be suitable for every customer. But thanks to the Code, the sector is taking steps to build confidence and raise standards. With the right advice, provider and product, Shared Ownership can offer a clear path to homeownership for those who need it most. ●

by Marvin Onumonu

As the mortgage sector moves through the middle of the 2020s, regulation remains a defining force. The Financial Conduct Authority’s (FCA) consultation paper CP25/11 may have closed, but it continues to fuel speculation and debate among lenders, brokers and key players across the market.

For some, the proposals signal a long-awaited opportunity to streamline lending processes and increase flexibility; for others, they raise concerns about weakening the consumer protection safeguards established over the past decade.

Against this backdrop, the sector is reflecting on its regulatory journey and considering the direction of advice, compliance, and innovation in the years ahead.

In the aftermath of the Global Financial Crisis, mortgage lending was reshaped by a wave of strict regulation. The Mortgage Market Review (MMR), introduced in 2014, established robust affordability checks and made regulated advice central to most transactions. Industry leaders widely consider this a turning point for responsible lending and consumer protection.

Clare Beardmore, director of distribution and Mortgage Club, mortgage services at L&G,

reflects: “One of the biggest changes to our market was MMR. That was the time that we decided as an industry that advice was best for the end consumer.”

In the years following these reforms, firms invested in new processes, compliance teams, and technology, striving to meet the rising expectations of the FCA and restore trust in the market.

Today, advice is the market’s default, providing reassurance for both consumers and firms.

Beardmore adds: “The FCA talks about how 97% of transactions are now advised. That’s a huge change. Only 3% of the time people do not get advice and recommendations on their mortgage, and that's great because it's not just about the product, it's about the term, it's about the repayment method.”

The introduction of Consumer Duty in 2023 shifted the focus further, from merely following rules to delivering positive customer outcomes. The regulator now expects evidence that borrowers genuinely benefit from products and services, requiring not just compliance, but a deeper sense of ethical responsibility and proactive care.

Katrina Hutchins, principal, mortgage policy at UK Finance, says: “What we see is Consumer

Duty as the guardrails to these choices. So, where they're choosing to adopt the new rules, they'll need to consider their Consumer Duty obligations to ensure customers receive a good outcome.”

However, while regulation has delivered greater stability and protection, it has also introduced friction – slowing processes, increasing costs, and sometimes making it harder for consumers to secure deals quickly. This tension is now at the heart of the debate about the future shape of regulation.

The FCA’s publication of CP25/11 in May 2025 marked a significant bid to simplify responsible lending and advice rules, making it easier for consumers to switch mortgages or change their terms.

Central to the proposals is the removal of the rule obliging lenders to recommend advice, paving the way for greater use of execution-only sales and faster processes for those who feel confident making their own choices.

Harpal Singh, CEO at conveybuddy, says: “On the face of it, the language was framed around improving consumer access, removing friction, streamlining the process. But make no mistake: the proposals point directly to wanting to increase execution-only mortgage sales and an attempt to remove advice from those cases where it deems it unnecessary and expensive.”

For the regulator, this is not a retreat from Consumer Duty, but a realignment with its fiveyear strategy, which aims to foster innovation and competitiveness. The FCA argues that excessive guidance and bureaucracy can hinder both consumers and firms, and that a streamlined marketplace will benefit those who are digitally confident, while keeping support in place for those who need more help.

However, the short consultation period – less than a month – sparked concern across the industry about the potential consequences of such rapid change. Many felt the window for feedback was too narrow, given the scale of the proposed reforms.

Faizan Haq, senior policy manager at the Finance & Leasing Association (FLA), recognises both the aims and the practical demands of new regulatory moves. He says: “Both lenders and intermediaries are working hard to meet new regulatory expectations from the FCA. Recent consultations, including the MMR and the next steps on Consumer Duty, reflect a growing focus on customer outcomes and fair value.

“These are welcome aims that align with the industry's commitment to responsible lending.

However, some of these changes do require careful planning and system updates which firms have had to prepare for.”

Hutchins highlights the importance of engaging with trade bodies and staying informed on FCA plans: “It’s really important for those mortgage lenders and intermediaries to engage with their relevant trade body, to stay up to date with FCA plans and to understand their expectations around any new rules [...] there’s a great opportunity to help shape those rules by responding to consultations.”

Industry groups, advisers and networks have expressed a range of views, with some welcoming the opportunity for greater efficiency, but many warning of the risk that consumer interests could be undermined if advice becomes less accessible or if protections are weakened. Some respondents have also highlighted the challenge of ensuring that firms are given enough time to adapt to any changes and to update their systems, processes and staff training accordingly.

Across the market, people have raised concerns about the potential risks to their roles, as well as to consumer outcomes. Since 2015, advice has been the norm in the vast majority of new mortgage sales, reflecting the value both advisers and consumers place on professional guidance in a complex market.

Mortgage advisers now deliver far more than just rate comparison – they provide guidance on protection, insurance, and long-term financial stability, building relationships based on trust.

The consultation’s emphasis on ‘flexibility’ and ‘removing friction’ has ignited fears of a return to execution-only models and a widening of the advice gap. Singh warns that these proposals could have a “seismic impact” on advisers, undermining both mortgage advice income and long-term client relationships: “It’s the lenders who stand to gain from more direct business, fewer broker commissions paid, and a tighter grip on the customer journey.”

While execution-only may seem “frictionless,” Singh describes it as “risk-laden,” particularly for those lacking the knowledge or confidence to choose suitable deals. He also notes that most brokers don’t charge fees and often deliver greater value through advice.

Kate Davies, executive director at the Intermediary Mortgage Lenders Association (IMLA), stresses the importance of clear advice triggers: “Of course borrowers should be able to engage with their lender to ask questions and clarify certain aspects about their current mortgage product – but where this leads to a

discussion about changing the product, the advice trigger needs to be pulled.”

On the other hand, some in the industry see potential benefits. Haq observes that many firms are adapting with clearer customer journeys and stronger internal processes.

Michael Shand, managing principal at Capco, describes the FCA’s review as a positive step for consumers with simple needs: “The FCA’s review into mortgage rules is a welcome step, making it simpler for many customers to switch to better mortgage deals.